895aeb34e74a4364dea3b22074d90412.ppt

- Количество слайдов: 54

End of ECON 151 – PRINCIPLES OF MACROECONOMICS Chapter 10 Chapter 12: Consumption, Real GDP, and the Multiplier Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved. 1 1

End of ECON 151 – PRINCIPLES OF MACROECONOMICS Chapter 10 Chapter 12: Consumption, Real GDP, and the Multiplier Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved. 1 1

Some Simplifying Assumptions in a Keynesian Model n To simplify the income determination model 1. Businesses pay no indirect taxes (sales tax) 2. Businesses distribute all profits to shareholders 3. There is no depreciation 4. The economy is closed; no foreign trade 12 -2

Some Simplifying Assumptions in a Keynesian Model n To simplify the income determination model 1. Businesses pay no indirect taxes (sales tax) 2. Businesses distribute all profits to shareholders 3. There is no depreciation 4. The economy is closed; no foreign trade 12 -2

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Real Disposable Income ¨ Real GDP minus net taxes, or after-tax real income n Consumption ¨ Spending on new goods and services out of a household’s current income ¨ Whatever is not consumed is saved. ¨ Consumption includes such things as buying food and going to a concert. 12 -3

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Real Disposable Income ¨ Real GDP minus net taxes, or after-tax real income n Consumption ¨ Spending on new goods and services out of a household’s current income ¨ Whatever is not consumed is saved. ¨ Consumption includes such things as buying food and going to a concert. 12 -3

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Saving ¨ ¨ Whatever is not consumed is, by definition, saved. ¨ Saving is an action measured over time (a flow). ¨ n The act of not consuming all of one’s current income Savings are a stock, an accumulation resulting from the act of saving in the past. Dissaving ¨ Negative saving; a situation in which spending exceeds income 12 -4

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Saving ¨ ¨ Whatever is not consumed is, by definition, saved. ¨ Saving is an action measured over time (a flow). ¨ n The act of not consuming all of one’s current income Savings are a stock, an accumulation resulting from the act of saving in the past. Dissaving ¨ Negative saving; a situation in which spending exceeds income 12 -4

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Consumption plus saving equals disposable income. n Saving equals disposable income minus consumption. 12 -5

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Consumption plus saving equals disposable income. n Saving equals disposable income minus consumption. 12 -5

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Consumption Goods ¨ Goods bought by households to use up, such as food and movies n Capital Goods ¨ Producer durables; nonconsumable goods that firms use to make other goods 12 -6

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Consumption Goods ¨ Goods bought by households to use up, such as food and movies n Capital Goods ¨ Producer durables; nonconsumable goods that firms use to make other goods 12 -6

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Investment ¨ Spending by businesses on things such as machines and buildings, which can be used to produce goods and services in the future ¨ The investment part of real GDP is the portion that will be used in the process of producing goods in the future. 12 -7

Some Simplifying Assumptions in a Keynesian Model (cont'd) n Investment ¨ Spending by businesses on things such as machines and buildings, which can be used to produce goods and services in the future ¨ The investment part of real GDP is the portion that will be used in the process of producing goods in the future. 12 -7

Spending on Human Capital: Investment or Consumption? n Economists define human capital as the accumulation of investments and training in education. n From this perspective, educational expenses should be regarded as a form of investment spending. n Nevertheless, in official U. S. government statistics, household spending on education is classified as consumption. 12 -8

Spending on Human Capital: Investment or Consumption? n Economists define human capital as the accumulation of investments and training in education. n From this perspective, educational expenses should be regarded as a form of investment spending. n Nevertheless, in official U. S. government statistics, household spending on education is classified as consumption. 12 -8

Determinants of Planned Consumption and Planned Saving n In the classical model, the supply of saving was determined by the rate of interest. ¨ The higher the rate, the more people wanted to save, the less they wanted to consume. n Keynes argued that real saving and consumption decisions depend primarily on a household’s real disposable income. 12 -9

Determinants of Planned Consumption and Planned Saving n In the classical model, the supply of saving was determined by the rate of interest. ¨ The higher the rate, the more people wanted to save, the less they wanted to consume. n Keynes argued that real saving and consumption decisions depend primarily on a household’s real disposable income. 12 -9

Determinants of Planned Consumption and Planned Saving (cont'd) Keynes was concerned with changes in AD as reflected in planned expenditures. n His initial focus was on Consumption. n AD = C + I + G + X 12 -10

Determinants of Planned Consumption and Planned Saving (cont'd) Keynes was concerned with changes in AD as reflected in planned expenditures. n His initial focus was on Consumption. n AD = C + I + G + X 12 -10

Determinants of Planned Consumption and Planned Saving (cont'd) n Consumption Function ¨ The relationship between amount consumed and disposable income ¨A consumption function tells us how much people plan to consume at various levels of disposable income. 12 -11

Determinants of Planned Consumption and Planned Saving (cont'd) n Consumption Function ¨ The relationship between amount consumed and disposable income ¨A consumption function tells us how much people plan to consume at various levels of disposable income. 12 -11

Determinants of Planned Consumption and Planned Saving (cont'd) n Dissaving ¨ Negative saving; a situation in which spending exceeds income ¨ Dissaving can occur when a household is able to borrow or use up existing assets. 12 -12

Determinants of Planned Consumption and Planned Saving (cont'd) n Dissaving ¨ Negative saving; a situation in which spending exceeds income ¨ Dissaving can occur when a household is able to borrow or use up existing assets. 12 -12

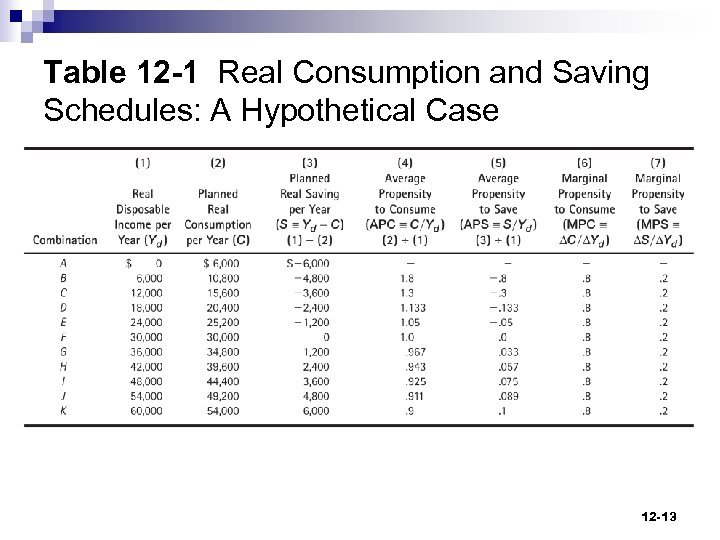

Table 12 -1 Real Consumption and Saving Schedules: A Hypothetical Case 12 -13

Table 12 -1 Real Consumption and Saving Schedules: A Hypothetical Case 12 -13

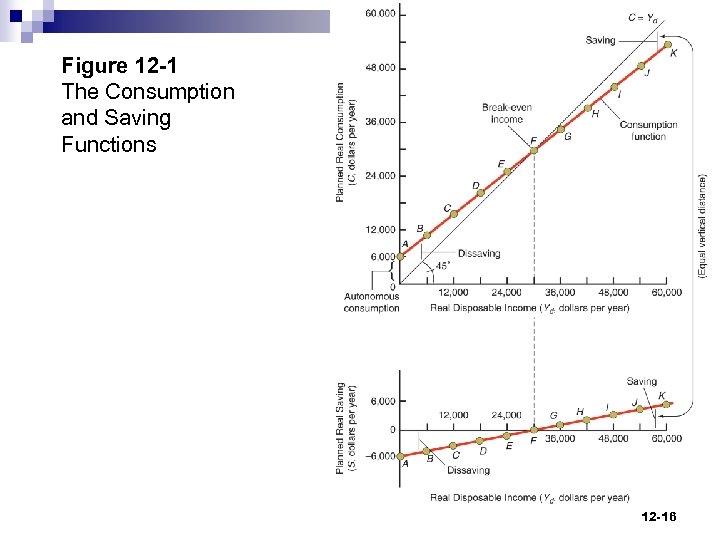

Determinants of Planned Consumption and Planned Saving (cont'd) n 45 -Degree Reference Line ¨ The line along which planned real expenditures equal real GDP per year ¨ On the following graph, DPI is labeled as YD. However, under the Keynesian simplifying assumptions, when all components of AD are reflected, the label becomes Y for real GDP. 12 -14

Determinants of Planned Consumption and Planned Saving (cont'd) n 45 -Degree Reference Line ¨ The line along which planned real expenditures equal real GDP per year ¨ On the following graph, DPI is labeled as YD. However, under the Keynesian simplifying assumptions, when all components of AD are reflected, the label becomes Y for real GDP. 12 -14

Determinants of Planned Consumption and Planned Saving (cont'd) n Autonomous Consumption ¨ The part of consumption that is independent of the level of disposable income ¨ Changes in autonomous consumption shift the consumption function. 12 -15

Determinants of Planned Consumption and Planned Saving (cont'd) n Autonomous Consumption ¨ The part of consumption that is independent of the level of disposable income ¨ Changes in autonomous consumption shift the consumption function. 12 -15

Figure 12 -1 The Consumption and Saving Functions 12 -16

Figure 12 -1 The Consumption and Saving Functions 12 -16

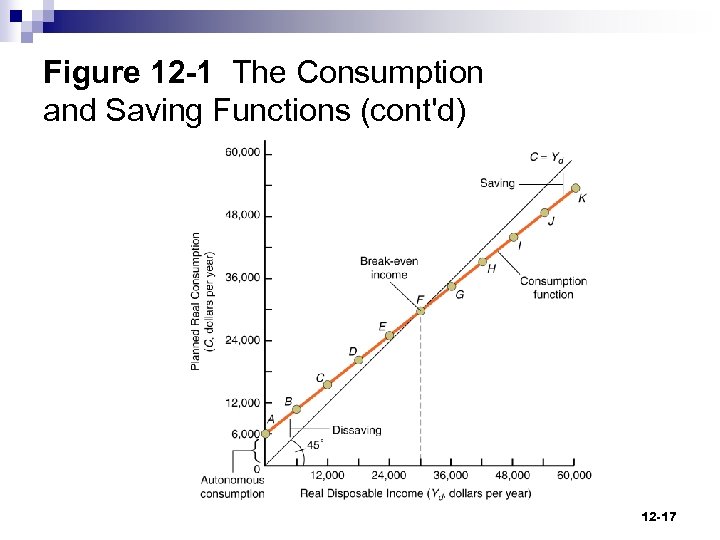

Figure 12 -1 The Consumption and Saving Functions (cont'd) 12 -17

Figure 12 -1 The Consumption and Saving Functions (cont'd) 12 -17

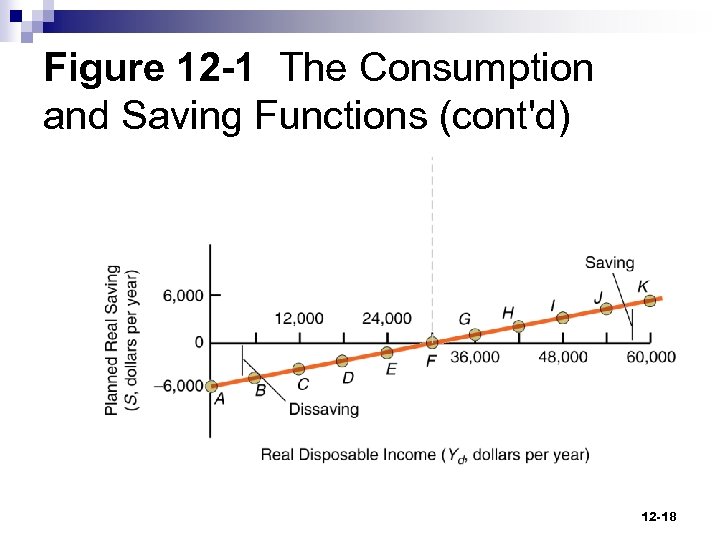

Figure 12 -1 The Consumption and Saving Functions (cont'd) 12 -18

Figure 12 -1 The Consumption and Saving Functions (cont'd) 12 -18

Determinants of Planned Consumption and Planned Saving (cont'd) n Average Propensity to Consume (APC) ¨ Real consumption divided by real disposable income ¨ The proportion of total disposable income that is consumed Real consumption APC = Real disposable income 12 -19

Determinants of Planned Consumption and Planned Saving (cont'd) n Average Propensity to Consume (APC) ¨ Real consumption divided by real disposable income ¨ The proportion of total disposable income that is consumed Real consumption APC = Real disposable income 12 -19

Determinants of Planned Consumption and Planned Saving (cont'd) n Average Propensity to Save (APS) ¨ Real saving divided by real disposable income (DI) ¨ Saved proportion of real DI Real saving APS = Real disposable income 12 -20

Determinants of Planned Consumption and Planned Saving (cont'd) n Average Propensity to Save (APS) ¨ Real saving divided by real disposable income (DI) ¨ Saved proportion of real DI Real saving APS = Real disposable income 12 -20

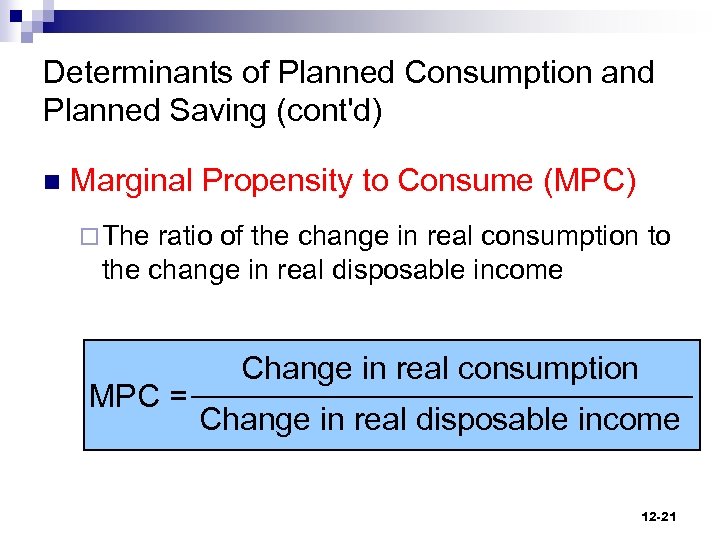

Determinants of Planned Consumption and Planned Saving (cont'd) n Marginal Propensity to Consume (MPC) ¨ The ratio of the change in real consumption to the change in real disposable income MPC = Change in real consumption Change in real disposable income 12 -21

Determinants of Planned Consumption and Planned Saving (cont'd) n Marginal Propensity to Consume (MPC) ¨ The ratio of the change in real consumption to the change in real disposable income MPC = Change in real consumption Change in real disposable income 12 -21

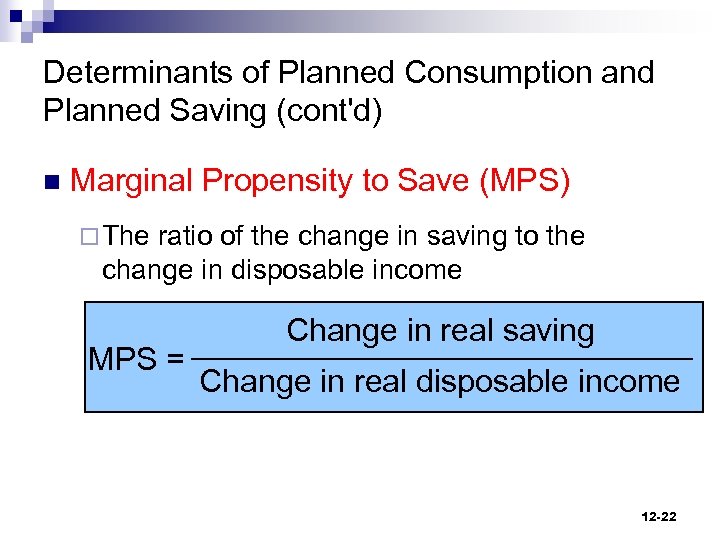

Determinants of Planned Consumption and Planned Saving (cont'd) n Marginal Propensity to Save (MPS) ¨ The ratio of the change in saving to the change in disposable income MPS = Change in real saving Change in real disposable income 12 -22

Determinants of Planned Consumption and Planned Saving (cont'd) n Marginal Propensity to Save (MPS) ¨ The ratio of the change in saving to the change in disposable income MPS = Change in real saving Change in real disposable income 12 -22

Determinants of Planned Consumption and Planned Saving (cont'd) n Some relationships ¨ Average propensity to consume and average propensity to save must sum to 100% of total income. (APC + APS = 1) ¨ Marginal propensity to consume and marginal propensity to save must sum to 100% of the change in income. (MPC + MPS = 1) 12 -23

Determinants of Planned Consumption and Planned Saving (cont'd) n Some relationships ¨ Average propensity to consume and average propensity to save must sum to 100% of total income. (APC + APS = 1) ¨ Marginal propensity to consume and marginal propensity to save must sum to 100% of the change in income. (MPC + MPS = 1) 12 -23

Determinants of Planned Consumption and Planned Saving (cont'd) n Causes of shifts in the consumption function ¨A change besides real disposable income will cause the consumption function to shift. ¨ Non-income n Population n determinants of consumption Wealth 12 -24

Determinants of Planned Consumption and Planned Saving (cont'd) n Causes of shifts in the consumption function ¨A change besides real disposable income will cause the consumption function to shift. ¨ Non-income n Population n determinants of consumption Wealth 12 -24

Determinants of Planned Consumption and Planned Saving (cont'd) n Wealth ¨ The stock of assets owned by a person, household, firm or nation ¨ For a household, wealth can consist of a house, cars, personal belongings, stocks, bonds, bank accounts, and cash. 12 -25

Determinants of Planned Consumption and Planned Saving (cont'd) n Wealth ¨ The stock of assets owned by a person, household, firm or nation ¨ For a household, wealth can consist of a house, cars, personal belongings, stocks, bonds, bank accounts, and cash. 12 -25

Determinants of Investment n Investment, you will remember, consists of expenditures on new buildings and equipment. ¨ Gross private domestic investment has been volatile. ¨ Consider the planned investment function, and shifts in the function. 12 -26

Determinants of Investment n Investment, you will remember, consists of expenditures on new buildings and equipment. ¨ Gross private domestic investment has been volatile. ¨ Consider the planned investment function, and shifts in the function. 12 -26

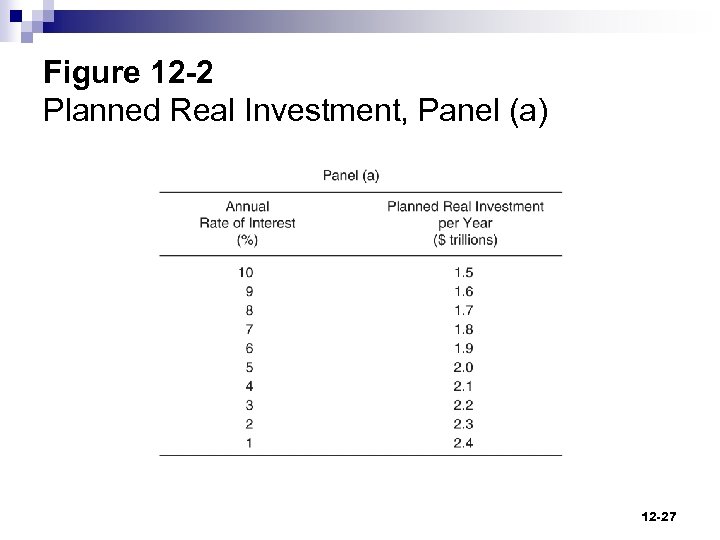

Figure 12 -2 Planned Real Investment, Panel (a) 12 -27

Figure 12 -2 Planned Real Investment, Panel (a) 12 -27

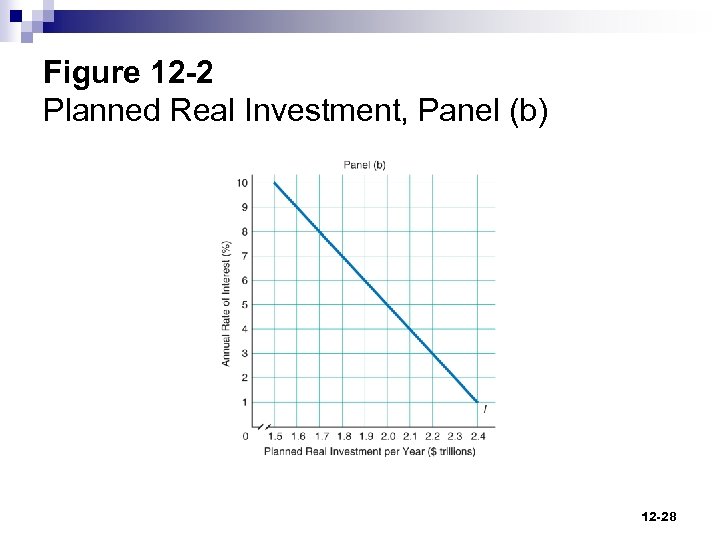

Figure 12 -2 Planned Real Investment, Panel (b) 12 -28

Figure 12 -2 Planned Real Investment, Panel (b) 12 -28

Determining Equilibrium Real GDP (cont'd) n Adding the investment function AD = C + I + G + X 12 -29

Determining Equilibrium Real GDP (cont'd) n Adding the investment function AD = C + I + G + X 12 -29

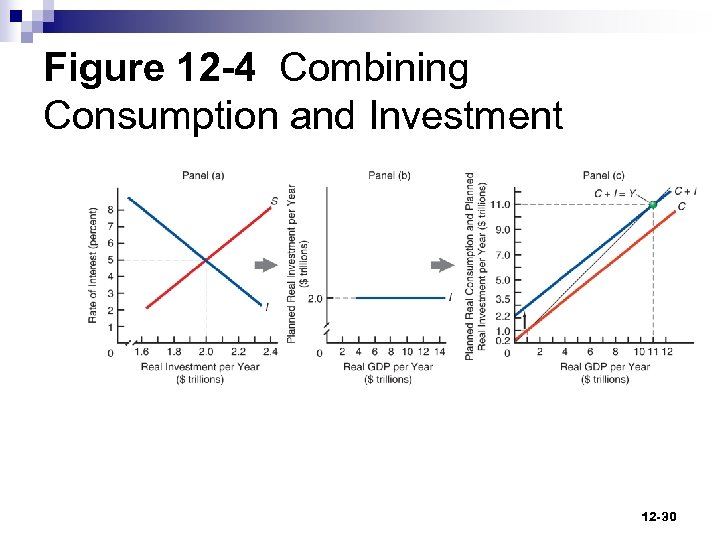

Figure 12 -4 Combining Consumption and Investment 12 -30

Figure 12 -4 Combining Consumption and Investment 12 -30

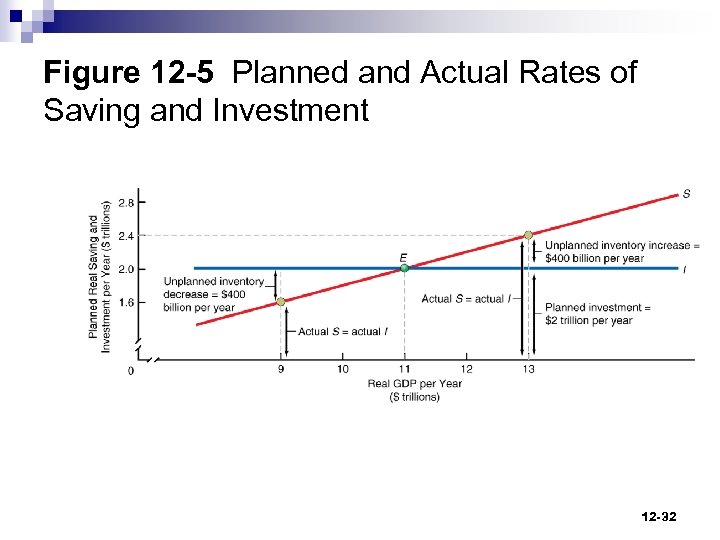

Determining Equilibrium Real GDP (cont'd) n Saving and investment: planned versus actual ¨ Only at equilibrium real GDP will planned saving equal actual saving. ¨ Planned investment equals actual investment. ¨ Hence planned saving is equal to planned investment. 12 -31

Determining Equilibrium Real GDP (cont'd) n Saving and investment: planned versus actual ¨ Only at equilibrium real GDP will planned saving equal actual saving. ¨ Planned investment equals actual investment. ¨ Hence planned saving is equal to planned investment. 12 -31

Figure 12 -5 Planned and Actual Rates of Saving and Investment 12 -32

Figure 12 -5 Planned and Actual Rates of Saving and Investment 12 -32

Determining Equilibrium Real GDP (cont'd) n Unplanned increases in business inventories ¨ Consumers purchase fewer goods and services than anticipated ¨ This n leaves firms with unsold products Unplanned decreases in business inventories ¨ Business will increase production of goods and services and increase employment 12 -33

Determining Equilibrium Real GDP (cont'd) n Unplanned increases in business inventories ¨ Consumers purchase fewer goods and services than anticipated ¨ This n leaves firms with unsold products Unplanned decreases in business inventories ¨ Business will increase production of goods and services and increase employment 12 -33

Keynesian Equilibrium with Government and the Foreign Sector Added n To this point we have ignored the role of government in our model. n We also left out the foreign sector of the economy in our model. n Let’s think about what happens when we add these elements. 12 -34

Keynesian Equilibrium with Government and the Foreign Sector Added n To this point we have ignored the role of government in our model. n We also left out the foreign sector of the economy in our model. n Let’s think about what happens when we add these elements. 12 -34

Keynesian Equilibrium with Government and the Foreign Sector Added (cont'd) n Government (G): C + I + G ¨ Federal, state, and local n Does not include transfer payments n Is autonomous n Lump-sum taxes = G n Lump-Sum Tax ¨A tax that does not depend on income or the circumstances of the taxpayer 12 -35

Keynesian Equilibrium with Government and the Foreign Sector Added (cont'd) n Government (G): C + I + G ¨ Federal, state, and local n Does not include transfer payments n Is autonomous n Lump-sum taxes = G n Lump-Sum Tax ¨A tax that does not depend on income or the circumstances of the taxpayer 12 -35

Keynesian Equilibrium with Government and the Foreign Sector Added (cont'd) n The Foreign Sector: C + I + G + X ¨ Net exports (X) equals exports minus imports ¨ Depends on international economic conditions ¨ Autonomous—independent of real national income 12 -36

Keynesian Equilibrium with Government and the Foreign Sector Added (cont'd) n The Foreign Sector: C + I + G + X ¨ Net exports (X) equals exports minus imports ¨ Depends on international economic conditions ¨ Autonomous—independent of real national income 12 -36

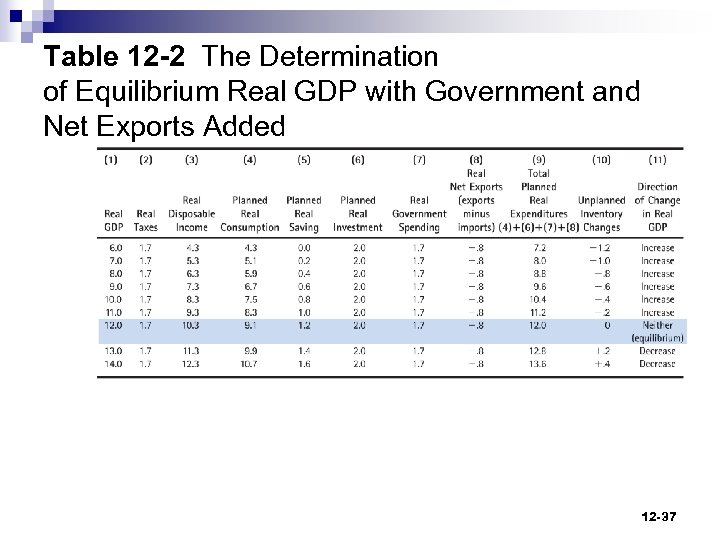

Table 12 -2 The Determination of Equilibrium Real GDP with Government and Net Exports Added 12 -37

Table 12 -2 The Determination of Equilibrium Real GDP with Government and Net Exports Added 12 -37

Keynesian Equilibrium with Government and the Foreign Sector Added (cont'd) n Determining the equilibrium level of GDP per year ¨ We are now in a position to determine the equilibrium level of real GDP per year. ¨ Remember that equilibrium always occurs when total planned real expenditures equal real GDP. 12 -38

Keynesian Equilibrium with Government and the Foreign Sector Added (cont'd) n Determining the equilibrium level of GDP per year ¨ We are now in a position to determine the equilibrium level of real GDP per year. ¨ Remember that equilibrium always occurs when total planned real expenditures equal real GDP. 12 -38

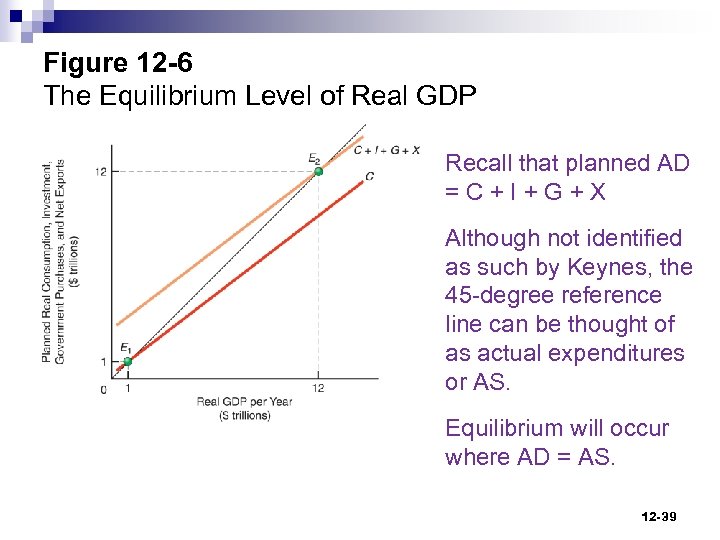

Figure 12 -6 The Equilibrium Level of Real GDP Recall that planned AD =C+I+G+X Although not identified as such by Keynes, the 45 -degree reference line can be thought of as actual expenditures or AS. Equilibrium will occur where AD = AS. 12 -39

Figure 12 -6 The Equilibrium Level of Real GDP Recall that planned AD =C+I+G+X Although not identified as such by Keynes, the 45 -degree reference line can be thought of as actual expenditures or AS. Equilibrium will occur where AD = AS. 12 -39

The Equilibrium Level of Real GDP n Observations ¨ If C+I+G+X=Y n ¨ If C+I+G+X>Y n n n ¨ If Equilibrium GDP Unplanned drop in inventories Businesses increase output Y returns to equilibrium C+I+G+X

The Equilibrium Level of Real GDP n Observations ¨ If C+I+G+X=Y n ¨ If C+I+G+X>Y n n n ¨ If Equilibrium GDP Unplanned drop in inventories Businesses increase output Y returns to equilibrium C+I+G+X

The Multiplier n Multiplier ¨ The ratio of the change in the equilibrium level of real national income to the change in autonomous expenditures ¨ The number by which a change in autonomous real investment or autonomous real consumption is multiplied to get the change in equilibrium real GDP 12 -41

The Multiplier n Multiplier ¨ The ratio of the change in the equilibrium level of real national income to the change in autonomous expenditures ¨ The number by which a change in autonomous real investment or autonomous real consumption is multiplied to get the change in equilibrium real GDP 12 -41

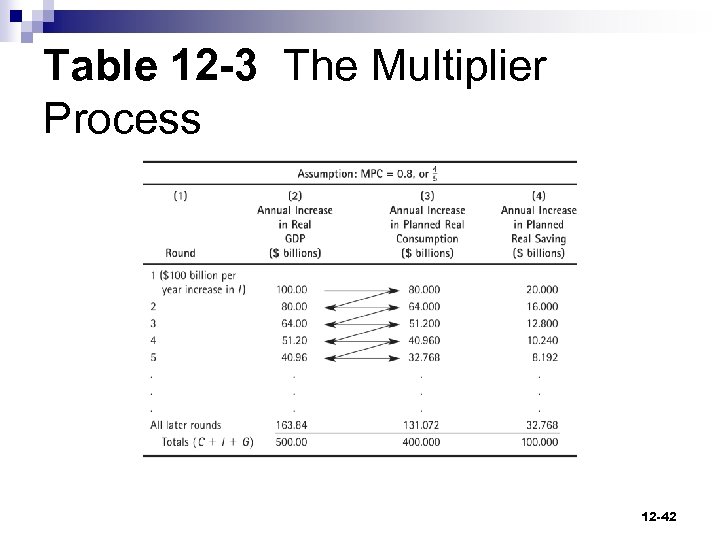

Table 12 -3 The Multiplier Process 12 -42

Table 12 -3 The Multiplier Process 12 -42

The Multiplier (cont'd) n The multiplier formula 1 1 Multiplier = = 1 - MPC MPS 12 -43

The Multiplier (cont'd) n The multiplier formula 1 1 Multiplier = = 1 - MPC MPS 12 -43

The Multiplier (cont'd) n By taking a few numerical examples, you can demonstrate to yourself an important property of the multiplier. ¨ The smaller the MPS, the larger the multiplier. ¨ The larger the MPC, the larger the multiplier. 12 -44

The Multiplier (cont'd) n By taking a few numerical examples, you can demonstrate to yourself an important property of the multiplier. ¨ The smaller the MPS, the larger the multiplier. ¨ The larger the MPC, the larger the multiplier. 12 -44

The Multiplier (cont'd) n Measuring the change in equilibrium income from a change in autonomous spending Change in equilibrium real GDP = Multiplier x Change in autonomous spending 12 -45

The Multiplier (cont'd) n Measuring the change in equilibrium income from a change in autonomous spending Change in equilibrium real GDP = Multiplier x Change in autonomous spending 12 -45

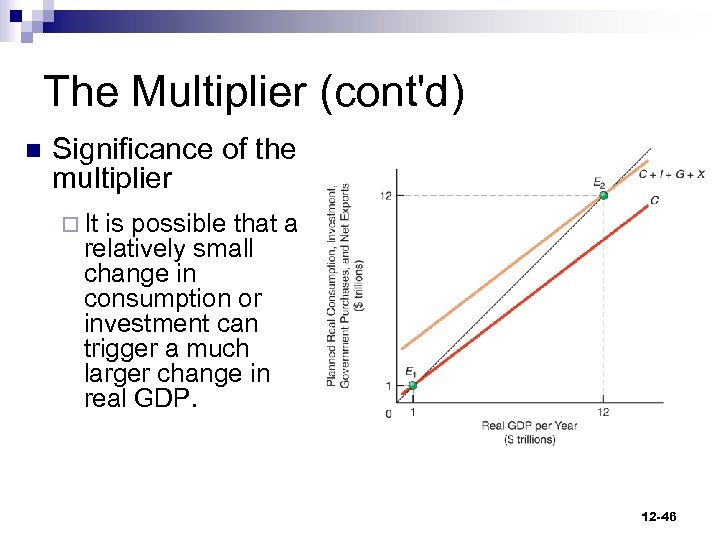

The Multiplier (cont'd) n Significance of the multiplier ¨ It is possible that a relatively small change in consumption or investment can trigger a much larger change in real GDP. 12 -46

The Multiplier (cont'd) n Significance of the multiplier ¨ It is possible that a relatively small change in consumption or investment can trigger a much larger change in real GDP. 12 -46

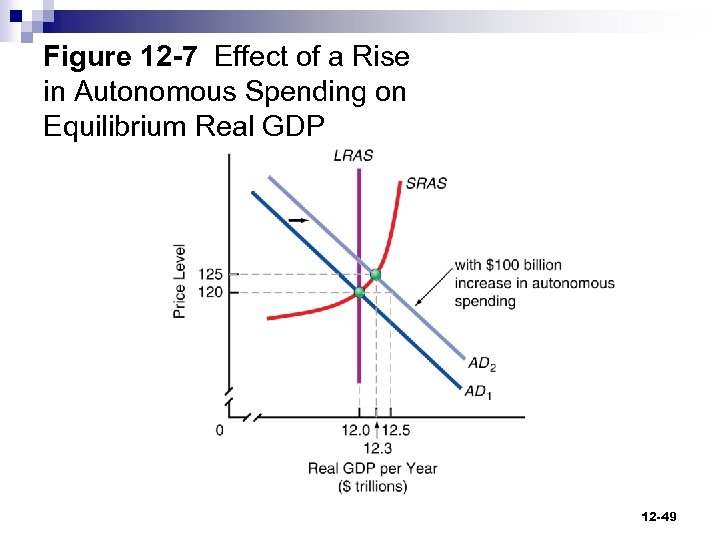

How a Change in Real Autonomous Spending Affects Real GDP When the Price Level Can Change n So far our examination of how changes in real autonomous spending affects equilibrium real GDP has considered a situation in which the price level remains unchanged. n Our equilibrium analysis has only considered how AD shifts in response to autonomous consumption, investment, government spending, net exports. 12 -47

How a Change in Real Autonomous Spending Affects Real GDP When the Price Level Can Change n So far our examination of how changes in real autonomous spending affects equilibrium real GDP has considered a situation in which the price level remains unchanged. n Our equilibrium analysis has only considered how AD shifts in response to autonomous consumption, investment, government spending, net exports. 12 -47

How a Change in Real Autonomous Spending Affects Real GDP When the Price Level Can Change (cont'd) n When we take into account the aggregate supply curve, we must also consider responses of the equilibrium price level to a multiplier-induced change in AD. 12 -48

How a Change in Real Autonomous Spending Affects Real GDP When the Price Level Can Change (cont'd) n When we take into account the aggregate supply curve, we must also consider responses of the equilibrium price level to a multiplier-induced change in AD. 12 -48

Figure 12 -7 Effect of a Rise in Autonomous Spending on Equilibrium Real GDP 12 -49

Figure 12 -7 Effect of a Rise in Autonomous Spending on Equilibrium Real GDP 12 -49

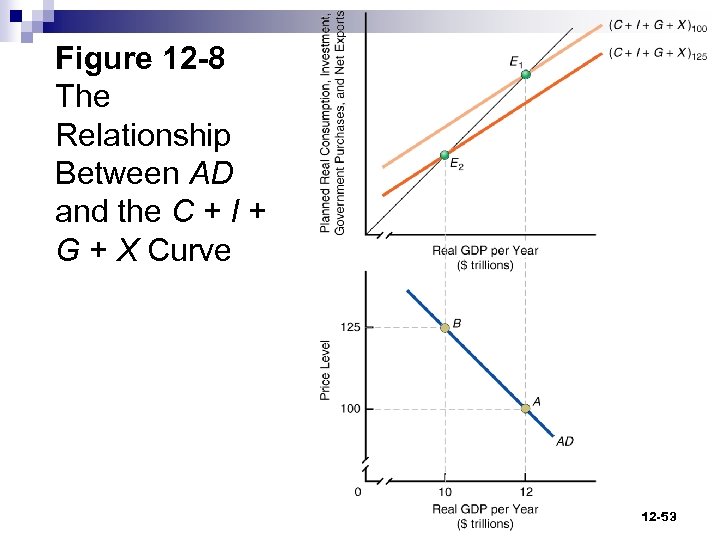

The Relationship Between Aggregate Demand the C + I + G + X Curve n There is clearly a relationship; aggregate demand consists of consumption, investment, government, and the foreign sector. 12 -50

The Relationship Between Aggregate Demand the C + I + G + X Curve n There is clearly a relationship; aggregate demand consists of consumption, investment, government, and the foreign sector. 12 -50

The Relationship Between Aggregate Demand the C + I + G + X Curve (cont'd) n There is a major difference ¨C + I + G + X curve drawn with price level constant ¨ AD curve drawn with the price level changing 12 -51

The Relationship Between Aggregate Demand the C + I + G + X Curve (cont'd) n There is a major difference ¨C + I + G + X curve drawn with price level constant ¨ AD curve drawn with the price level changing 12 -51

The Relationship Between Aggregate Demand the C + I + G + X Curve (cont'd) n n n To derive the aggregate demand curve from the C + I + G + X curve, we must now allow the price level to change. Since we know that at higher prices, real spending is diminished, we can show two C + I + G + X curves at different price levels. We can then plot the equilibrium outcomes of each as AD at the two price levels as reflected on the AS-AD model graph. 12 -52

The Relationship Between Aggregate Demand the C + I + G + X Curve (cont'd) n n n To derive the aggregate demand curve from the C + I + G + X curve, we must now allow the price level to change. Since we know that at higher prices, real spending is diminished, we can show two C + I + G + X curves at different price levels. We can then plot the equilibrium outcomes of each as AD at the two price levels as reflected on the AS-AD model graph. 12 -52

Figure 12 -8 The Relationship Between AD and the C + I + G + X Curve 12 -53

Figure 12 -8 The Relationship Between AD and the C + I + G + X Curve 12 -53

End of ECON 151 – PRINCIPLES OF MACROECONOMICS Chapter 10 Chapter 12: Consumption, Real GDP, and the Multiplier Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved. 54 54

End of ECON 151 – PRINCIPLES OF MACROECONOMICS Chapter 10 Chapter 12: Consumption, Real GDP, and the Multiplier Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved. 54 54