6fcfc9c2d10bdbae70ccb811b90a8f0e.ppt

- Количество слайдов: 20

End of an Era? Searching for a new ‘normal’ in the housing market Peter Williams, Director, CCHPR, Cambridge

End of an Era? Searching for a new ‘normal’ in the housing market Peter Williams, Director, CCHPR, Cambridge

My presentation • Build on the previous presentations –the economy and regulation • Together they paint a picture of constraint and caution. • My presentation – – – – The changing housing market The underlying drivers of change Unpacking change and its consequences Projections of the future Implications Conclusions

My presentation • Build on the previous presentations –the economy and regulation • Together they paint a picture of constraint and caution. • My presentation – – – – The changing housing market The underlying drivers of change Unpacking change and its consequences Projections of the future Implications Conclusions

The Changing Housing Market • Change predates the financial crisis • Fall in mortgages for house purchase from 2002 – 1. 4 m down to 0. 5 m in 2011 • and home ownership (numbers peaked in England in 2005 at 14. 8 m, now 14. 5 m; in percentage terms 2003, 71% to 66% now) • Masked by the rise in BTL but it has continued • Don’t forget – 50. 7 % of households were owners in 1971 (E&W) when there were also 467 Building Societies! • 14% of GB HO stock from RTB – without it much lower

The Changing Housing Market • Change predates the financial crisis • Fall in mortgages for house purchase from 2002 – 1. 4 m down to 0. 5 m in 2011 • and home ownership (numbers peaked in England in 2005 at 14. 8 m, now 14. 5 m; in percentage terms 2003, 71% to 66% now) • Masked by the rise in BTL but it has continued • Don’t forget – 50. 7 % of households were owners in 1971 (E&W) when there were also 467 Building Societies! • 14% of GB HO stock from RTB – without it much lower

The underlying drivers • Rising wages, low interest rates, plentiful and easier credit and undersupply of homes • Favourable tax regime and mixed performance by other assets • Supported rising HPI and sustained confidence/demand • Going forward - wage restraint, rising interest rates and tighter credit supply/higher cost • But continued undersupply and still stretched affordability • Pent up demand of over 1. 4 million would be buyers • Could go in either direction in medium to long term

The underlying drivers • Rising wages, low interest rates, plentiful and easier credit and undersupply of homes • Favourable tax regime and mixed performance by other assets • Supported rising HPI and sustained confidence/demand • Going forward - wage restraint, rising interest rates and tighter credit supply/higher cost • But continued undersupply and still stretched affordability • Pent up demand of over 1. 4 million would be buyers • Could go in either direction in medium to long term

Unpacking change • A few graphs • But the story is as follows; – Need to distinguish outright from mortgaged home ownership –two different trajectories – The feed through from RTB sales to home ownership – esp outright – The decline of council housing and the rise of private renting – The differences between parts of England – Change has differential impacts - by household type and income – Going forward to 2025 and depending upon the economic trajectory we see further development of the shifts

Unpacking change • A few graphs • But the story is as follows; – Need to distinguish outright from mortgaged home ownership –two different trajectories – The feed through from RTB sales to home ownership – esp outright – The decline of council housing and the rise of private renting – The differences between parts of England – Change has differential impacts - by household type and income – Going forward to 2025 and depending upon the economic trajectory we see further development of the shifts

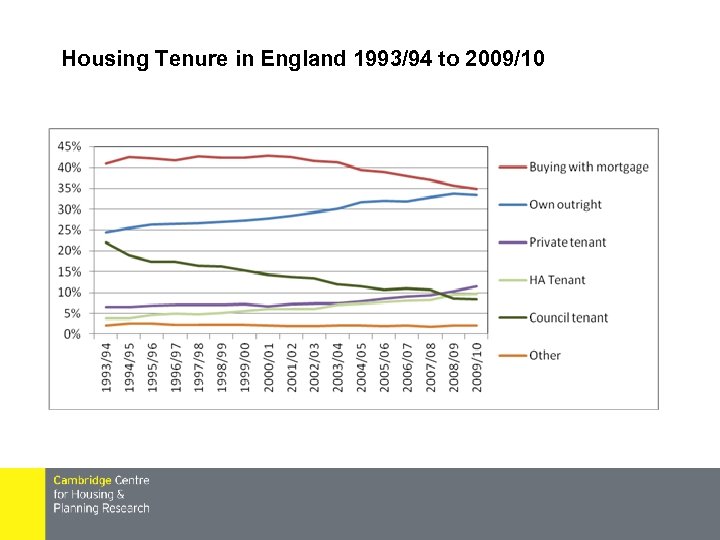

Housing Tenure in England 1993/94 to 2009/10

Housing Tenure in England 1993/94 to 2009/10

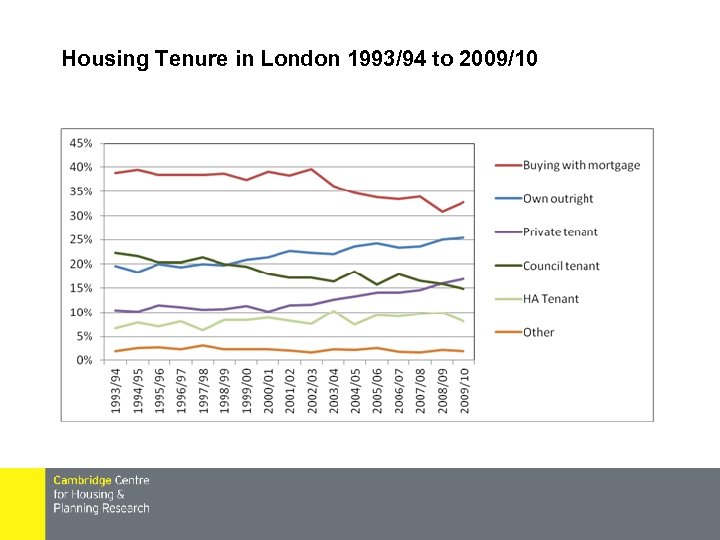

Housing Tenure in London 1993/94 to 2009/10

Housing Tenure in London 1993/94 to 2009/10

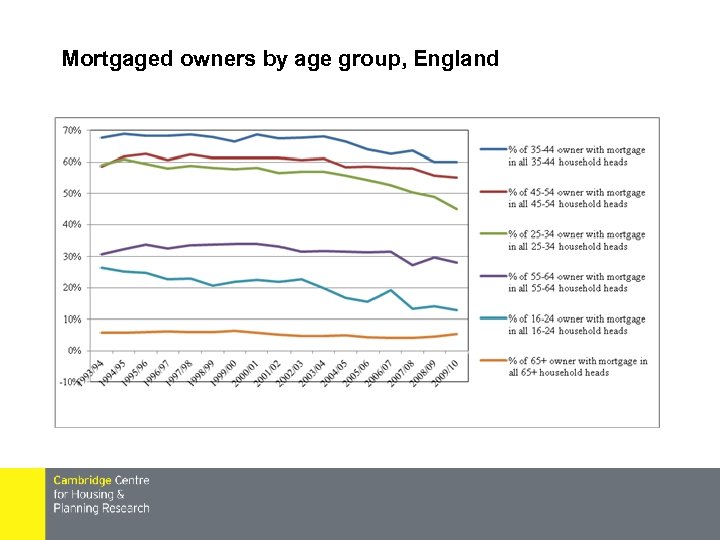

Mortgaged owners by age group, England

Mortgaged owners by age group, England

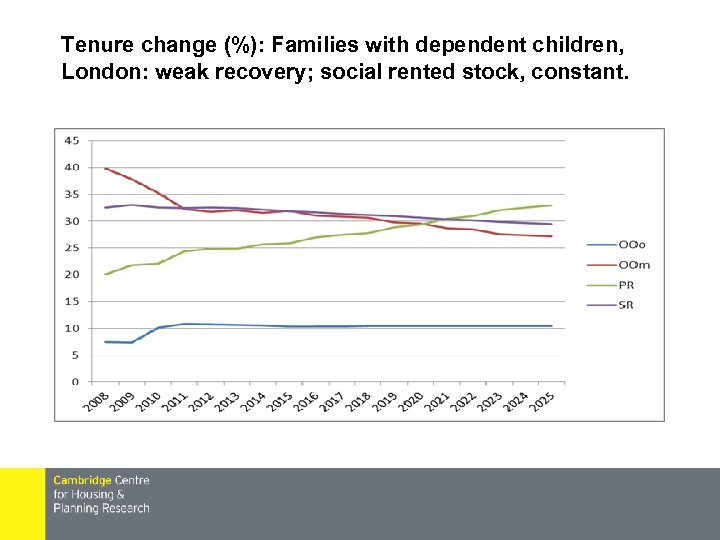

Projecting forward to 2025 • Projected forward using 3 different economic scenarios –weak, cautious and robust economic growth • Four variables –mortgage interest rates, LTVs to FTBs, real income growth and housing completions • Clearly all turns on assumptions! • A key one is what happens to the social housing sector – constant in number, 50, 000 pa decline and demand into PRS and same decline but splitting demand into PRS and OO. • Implicit assumption households will be allowed to form • Preliminary results!

Projecting forward to 2025 • Projected forward using 3 different economic scenarios –weak, cautious and robust economic growth • Four variables –mortgage interest rates, LTVs to FTBs, real income growth and housing completions • Clearly all turns on assumptions! • A key one is what happens to the social housing sector – constant in number, 50, 000 pa decline and demand into PRS and same decline but splitting demand into PRS and OO. • Implicit assumption households will be allowed to form • Preliminary results!

Projections • Looked at a range of scenarios by household type, income, tenure, for England, Ro. E and London • What is very evident is the potential scale of the transformation – we can debate how probable • The key point is getting below the headlines – when looked at in detail –big impact –group expectations changed completely • Owning to renting, social renting to private renting – loss of control • 6 months AST –limited control, unregulated market –big impact upon families

Projections • Looked at a range of scenarios by household type, income, tenure, for England, Ro. E and London • What is very evident is the potential scale of the transformation – we can debate how probable • The key point is getting below the headlines – when looked at in detail –big impact –group expectations changed completely • Owning to renting, social renting to private renting – loss of control • 6 months AST –limited control, unregulated market –big impact upon families

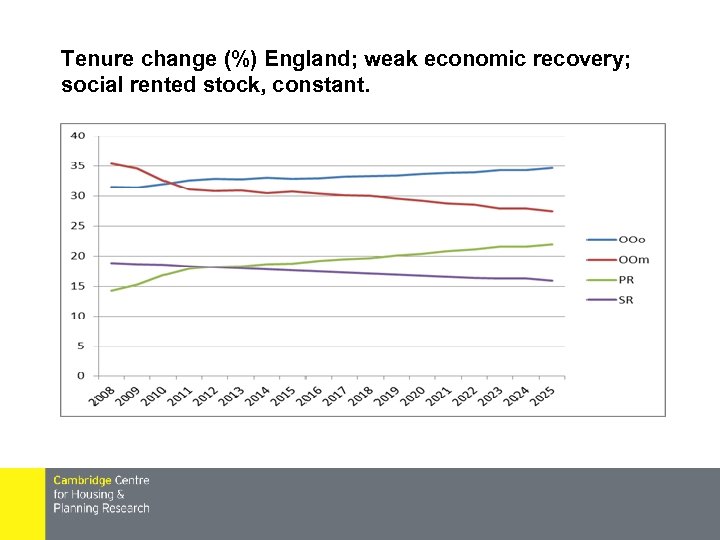

Tenure change (%) England; weak economic recovery; social rented stock, constant.

Tenure change (%) England; weak economic recovery; social rented stock, constant.

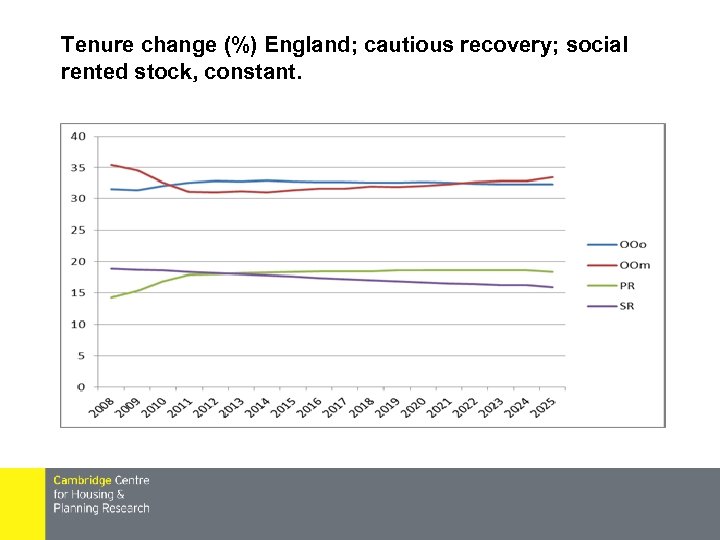

Tenure change (%) England; cautious recovery; social rented stock, constant.

Tenure change (%) England; cautious recovery; social rented stock, constant.

Tenure change (%): Families with dependent children, London: weak recovery; social rented stock, constant.

Tenure change (%): Families with dependent children, London: weak recovery; social rented stock, constant.

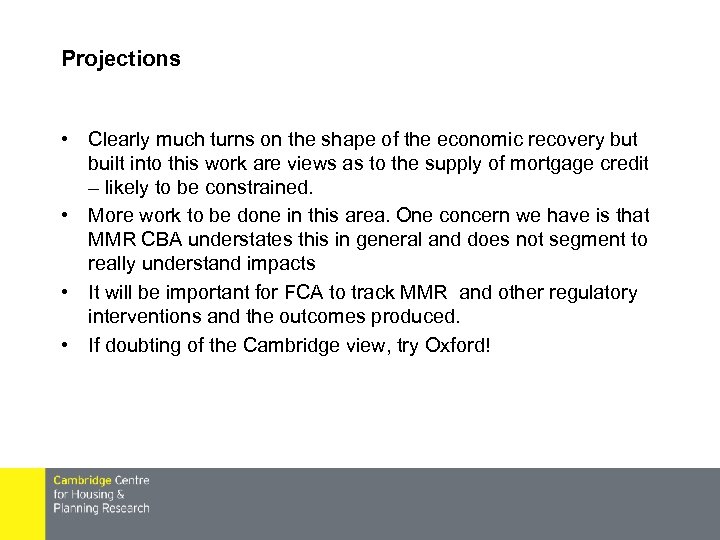

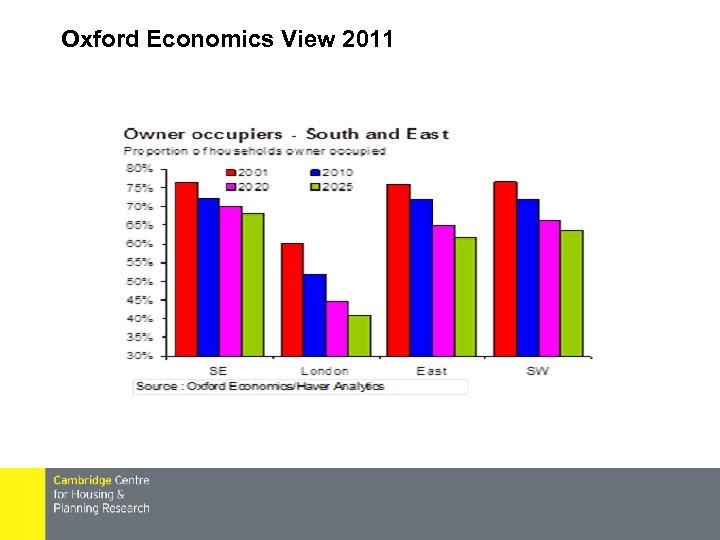

Projections • Clearly much turns on the shape of the economic recovery but built into this work are views as to the supply of mortgage credit – likely to be constrained. • More work to be done in this area. One concern we have is that MMR CBA understates this in general and does not segment to really understand impacts • It will be important for FCA to track MMR and other regulatory interventions and the outcomes produced. • If doubting of the Cambridge view, try Oxford!

Projections • Clearly much turns on the shape of the economic recovery but built into this work are views as to the supply of mortgage credit – likely to be constrained. • More work to be done in this area. One concern we have is that MMR CBA understates this in general and does not segment to really understand impacts • It will be important for FCA to track MMR and other regulatory interventions and the outcomes produced. • If doubting of the Cambridge view, try Oxford!

Oxford Economics View 2011

Oxford Economics View 2011

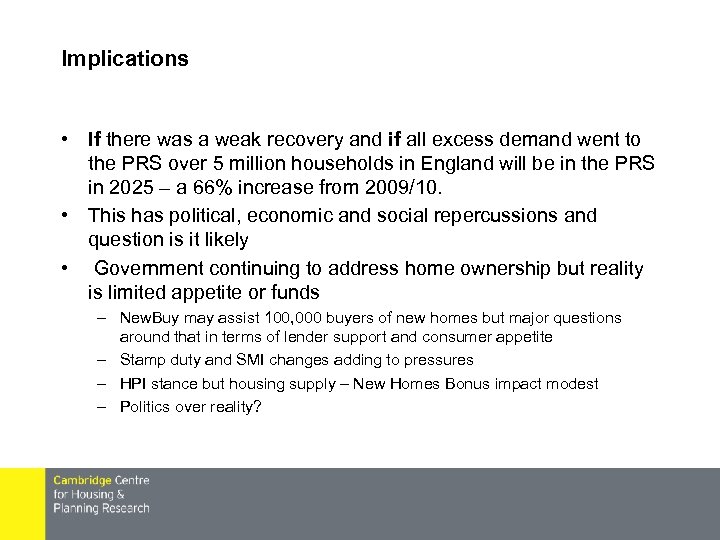

Implications • If there was a weak recovery and if all excess demand went to the PRS over 5 million households in England will be in the PRS in 2025 – a 66% increase from 2009/10. • This has political, economic and social repercussions and question is it likely • Government continuing to address home ownership but reality is limited appetite or funds – New. Buy may assist 100, 000 buyers of new homes but major questions around that in terms of lender support and consumer appetite – Stamp duty and SMI changes adding to pressures – HPI stance but housing supply – New Homes Bonus impact modest – Politics over reality?

Implications • If there was a weak recovery and if all excess demand went to the PRS over 5 million households in England will be in the PRS in 2025 – a 66% increase from 2009/10. • This has political, economic and social repercussions and question is it likely • Government continuing to address home ownership but reality is limited appetite or funds – New. Buy may assist 100, 000 buyers of new homes but major questions around that in terms of lender support and consumer appetite – Stamp duty and SMI changes adding to pressures – HPI stance but housing supply – New Homes Bonus impact modest – Politics over reality?

Implications • Government has taken no view on tenure – outcome • Should we be concerned if home ownership is 60% not 72%? • Does it matter if more households rent – lenders on both sides of this? • Certainly sits uncomfortably with expectations and rising tensions between younger and older households – as evidenced by ‘Jilted’. • Impact on family formation, school achievement, business start ups and much more • More households rent in retirement,

Implications • Government has taken no view on tenure – outcome • Should we be concerned if home ownership is 60% not 72%? • Does it matter if more households rent – lenders on both sides of this? • Certainly sits uncomfortably with expectations and rising tensions between younger and older households – as evidenced by ‘Jilted’. • Impact on family formation, school achievement, business start ups and much more • More households rent in retirement,

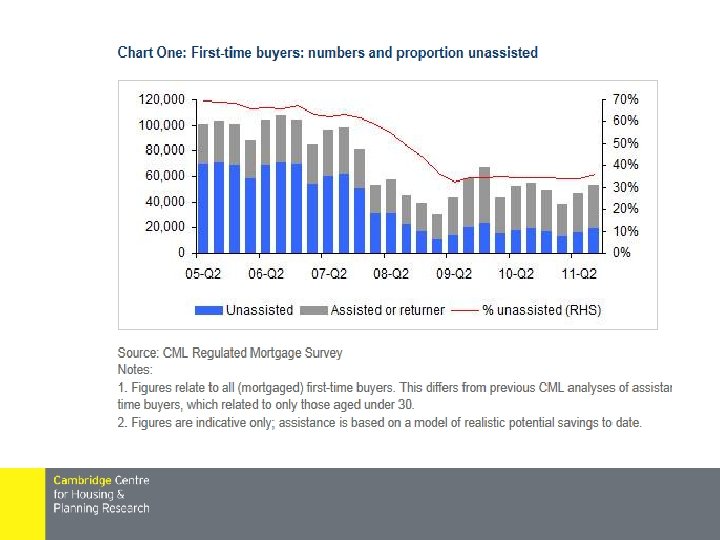

Implications • Does pose question about an unregulated PRS – in all senses! • Puts a premium on rent to buy type mechanisms? • And how we reshape access to ownership – and opens up debt financing to competition? • Places lenders at centre of an intense political battle? • The industry needs to give further collective thought to this • Certainly as next slide shows FTBs struggling!

Implications • Does pose question about an unregulated PRS – in all senses! • Puts a premium on rent to buy type mechanisms? • And how we reshape access to ownership – and opens up debt financing to competition? • Places lenders at centre of an intense political battle? • The industry needs to give further collective thought to this • Certainly as next slide shows FTBs struggling!

Conclusions • • • Sustained transformation has been underway Hard to see when you are in it –reflect in hindsight! Is it cyclical or structural –both? Does it matter – yes But England market still over priced – stressed affordability Real tensions going forward around prices, transactions and rates • Look back to Sir Enoch Hill, Chairman of the Halifax – Building societies, he said ‘stand for home ownership and the pride of possession that springs from it’ • So what are we going to do? What should government do? • Finding a new sustainable normal – could be quite different than where we have been?

Conclusions • • • Sustained transformation has been underway Hard to see when you are in it –reflect in hindsight! Is it cyclical or structural –both? Does it matter – yes But England market still over priced – stressed affordability Real tensions going forward around prices, transactions and rates • Look back to Sir Enoch Hill, Chairman of the Halifax – Building societies, he said ‘stand for home ownership and the pride of possession that springs from it’ • So what are we going to do? What should government do? • Finding a new sustainable normal – could be quite different than where we have been?