79bea53bd9efbab182f765277baf8ab1.ppt

- Количество слайдов: 38

Enabling Transformational Change in Health using Oracle e. Business Suite Presented by: Angela Morley Director Supply Chain, Waikato District Health Board Joint Business Solution Lead, NOS Programme 1

Presenter: Angela Morley Director Supply Chain for Waikato District Health Board Joint Business Solution Lead for the 20 DHBs Oracle project. Program Manager 7 years transforming Supply Chain. 2

Waikato DHB Employs or Contracts 6, 500+ people • • A tertiary hospital Secondary hospital Three rural hospitals Wide range of community-based and health promotion services. Tertiary services to a population of more than 846, 600 • Includes neurosurgery and other highly complex surgery, specialised medical procedures and specialist trauma services 3

NZ Health Strategy 2016 The cost of providing health services through the current model is unsustainable in the long term 4

Health Landscape In 2014, 90% of New Zealanders reported they are in good, very good or excellent health, the highest percentage reported by any OECD country. For those aged over 75 years, the figure is 87%. Our health system supports: 12. 6 million GP visits 2. 8 million practice nurse visit Dispensing 65 million pharmaceutical items 24 million laboratory tests 1 million emergency department visits per year 5

Health Landscape Main Concerns: Unsustainable in the long term • Treasury 7% of GDP now, to about 11% of GDP in 2060. Need new and sustainable ways to deliver services & investing resources • That will provide the best outcomes possible for people’s health and wider wellbeing. • A much more systematic, scaled and long-term approach–Primary health organisation Systematic, Scaled & Long Term Approach • To implementing key systems and cultural changes… will influence clinician and patient behaviours and choices towards a more sustainable and equitable health system. ’ The cost of providing health services through the current model is unsustainable in the long term. The Treasury estimates that, if nothing were to change in the way we fund and deliver services, government health spending would rise from about 7% of GDP now, to about 11% of GDP in 2060. It is essential that we find new and sustainable ways to deliver services, investing resources in a way that will provide the best outcomes possible for people’s health and wider wellbeing. ‘… a much more systematic, scaled and long-term approach to implementing key systems and cultural changes… will influence clinician and patient behaviours and choices towards a more sustainable and equitable health system. ’ –Primary health organisation 6

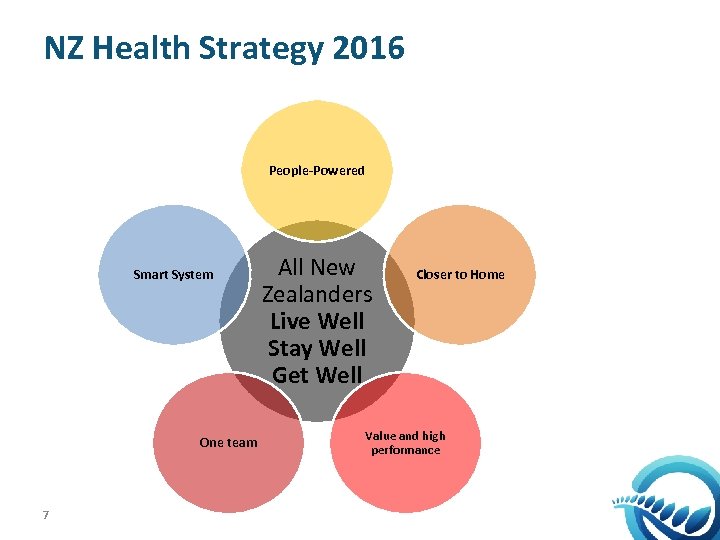

NZ Health Strategy 2016 People-Powered Smart System One team 7 All New Zealanders Live Well Stay Well Get Well Closer to Home Value and high performance

NZ Health Strategy 2016 (continued…) “Our system needs to become a learning system, by seeking improvements and innovations, monitoring and evaluating what we are doing, and sharing and standardising better ways of doing things when this is appropriate. Key tools to help make this shift to a learning system are data and technology. ” 8

District Health Boards Have a critical role in ensuring all New Zealanders live well, stay well and get well 9

District Health Boards (DHBs) DHBs are significant businesses $11 Billion Per Year Spend • Of taxpayers money Employing over 60, 000 New Zealanders Did you know? Every day, tens of thousands of people are involved in some way with the New Zealand health system – as health professionals, service providers or members of the public 10

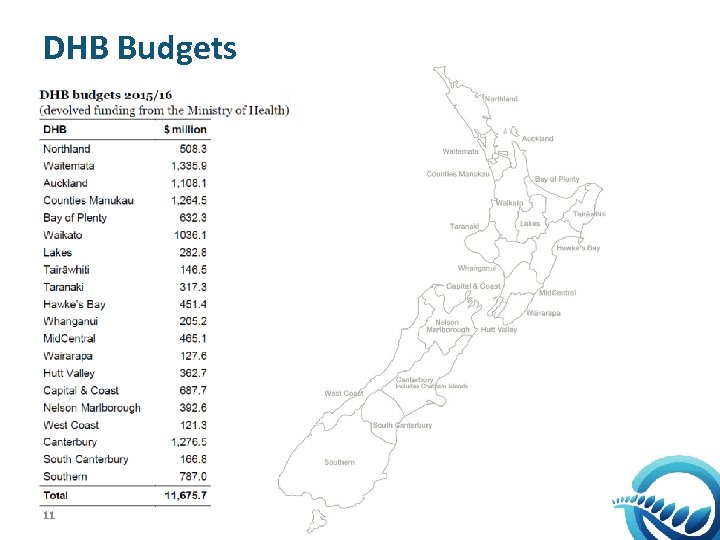

DHB Budgets 11

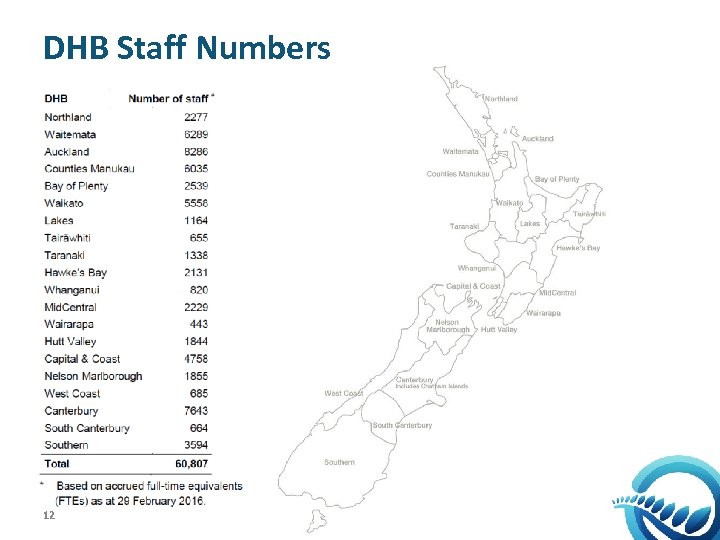

DHB Staff Numbers 12

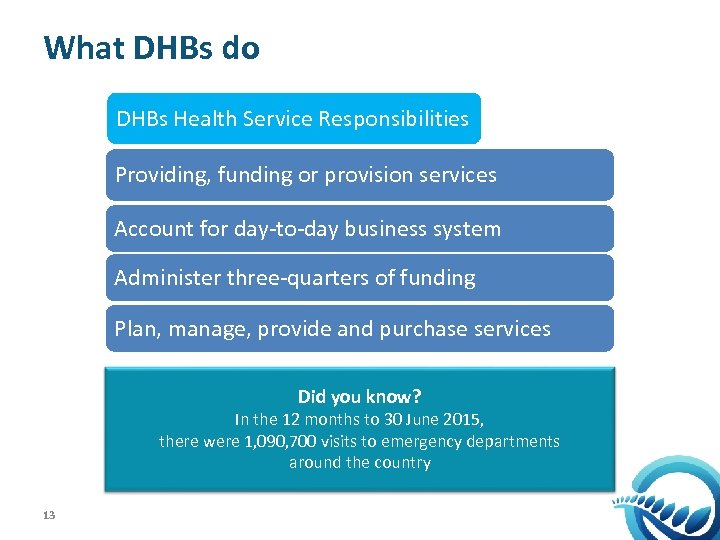

What DHBs do DHBs Health Service Responsibilities Providing, funding or provision services Account for day-to-day business system Administer three-quarters of funding Plan, manage, provide and purchase services Did you know? In the 12 months to 30 June 2015, there were 1, 090, 700 visits to emergency departments around the country 13

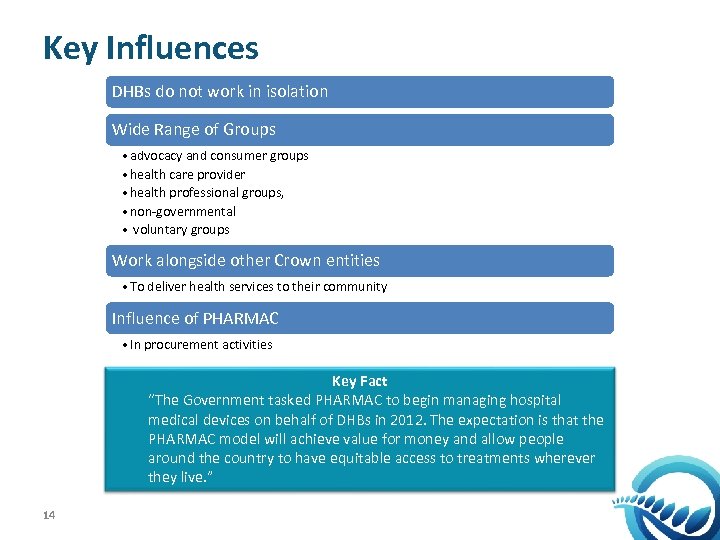

Key Influences DHBs do not work in isolation Wide Range of Groups • advocacy and consumer groups • health care provider • health professional groups, • non-governmental • voluntary groups Work alongside other Crown entities • To deliver health services to their community Influence of PHARMAC • In procurement activities Key Fact “The Government tasked PHARMAC to begin managing hospital medical devices on behalf of DHBs in 2012. The expectation is that the PHARMAC model will achieve value for money and allow people around the country to have equitable access to treatments wherever they live. ” 14

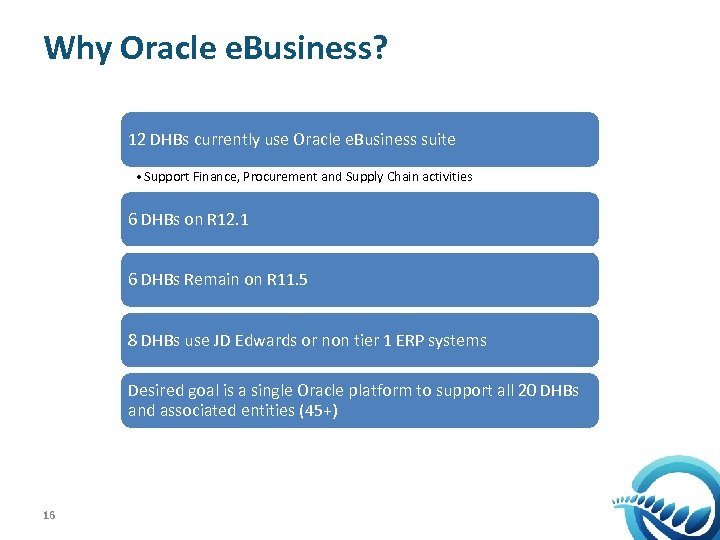

Oracle e. Business in Health 12 of the 20 DHBs currently use Oracle e. Business to support Finance, Procurement and Supply Chain activities 15

Why Oracle e. Business? 12 DHBs currently use Oracle e. Business suite • Support Finance, Procurement and Supply Chain activities 6 DHBs on R 12. 1 6 DHBs Remain on R 11. 5 8 DHBs use JD Edwards or non tier 1 ERP systems Desired goal is a single Oracle platform to support all 20 DHBs and associated entities (45+) 16

Desired Goal Single Oracle platform to support all 20 DHBs and associated entities (45+) 17

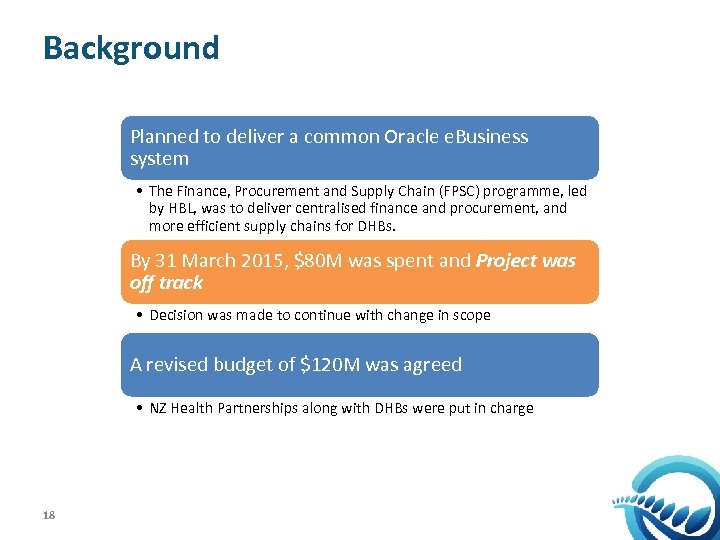

Background Planned to deliver a common Oracle e. Business system • The Finance, Procurement and Supply Chain (FPSC) programme, led by HBL, was to deliver centralised finance and procurement, and more efficient supply chains for DHBs. By 31 March 2015, $80 M was spent and Project was off track • Decision was made to continue with change in scope A revised budget of $120 M was agreed • NZ Health Partnerships along with DHBs were put in charge 18

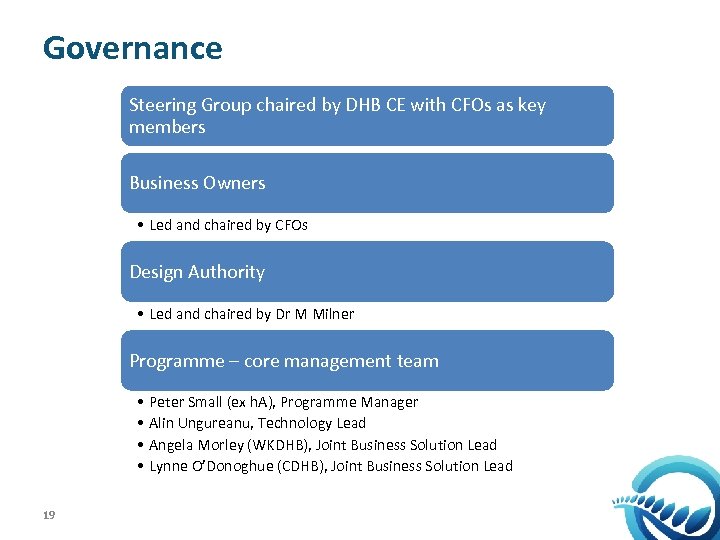

Governance Steering Group chaired by DHB CE with CFOs as key members Business Owners • Led and chaired by CFOs Design Authority • Led and chaired by Dr M Milner Programme – core management team • • 19 Peter Small (ex h. A), Programme Manager Alin Ungureanu, Technology Lead Angela Morley (WKDHB), Joint Business Solution Lead Lynne O’Donoghue (CDHB), Joint Business Solution Lead

DHBs are leading the way Key roles are held by DHB people Project resource primarily from DHBs Supporting the health strategy principles • • • 20 One Team People Powered Closer to Home Smart System Value and High Performance

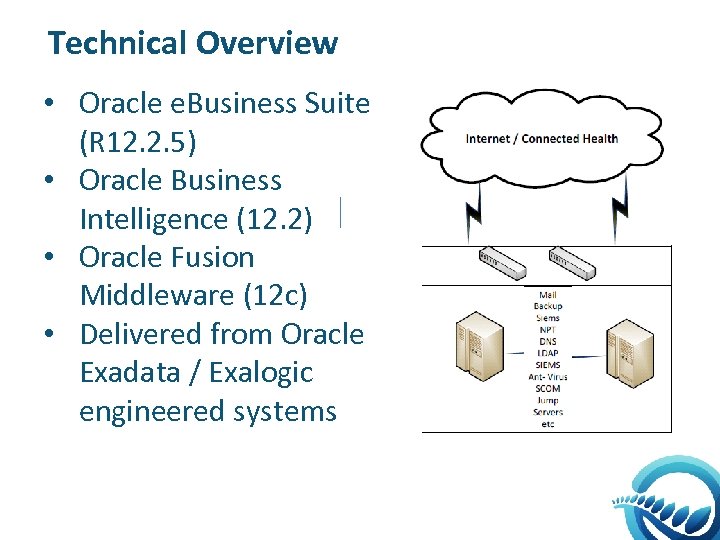

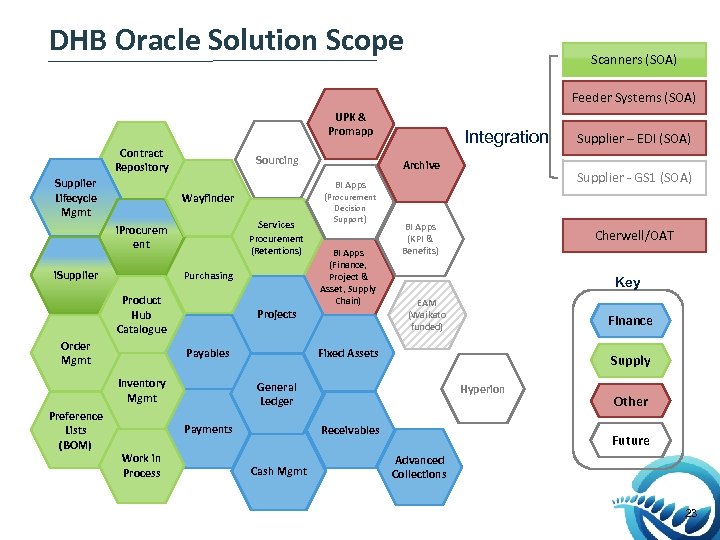

Technical Overview • Oracle e. Business Suite (R 12. 2. 5) • Oracle Business Intelligence (12. 2) • Oracle Fusion Middleware (12 c) • Delivered from Oracle Exadata / Exalogic engineered systems

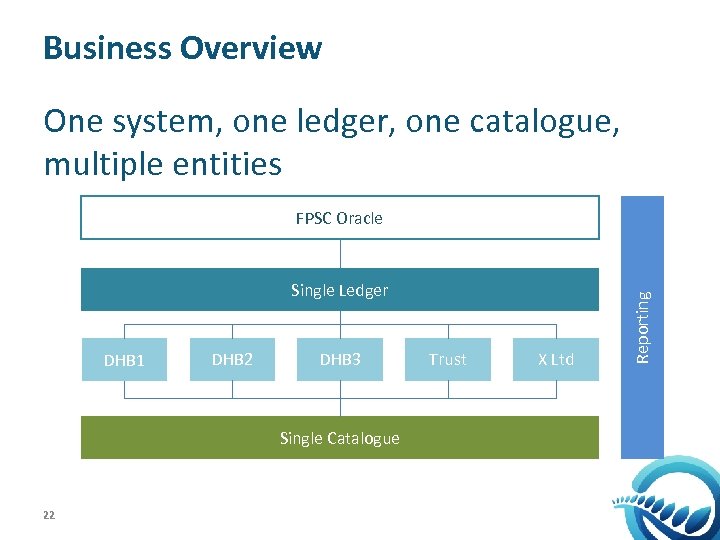

Business Overview One system, one ledger, one catalogue, multiple entities Single Ledger DHB 1 DHB 2 DHB 3 Single Catalogue 22 Trust X Ltd Reporting FPSC Oracle

DHB Oracle Solution Scope Scanners (SOA) Feeder Systems (SOA) UPK & Promapp Contract Repository Supplier Lifecycle Mgmt Sourcing Archive (Procurement Wayfinder i. Supplier Services Procurement (Retentions) Purchasing Product Hub Catalogue Order Mgmt Projects Payables Inventory Mgmt Decision Support) BI Apps (Finance, Project & Asset, Supply Chain) BI Apps (KPI & Benefits) Cherwell/OAT Key EAM (Waikato funded) Finance Fixed Assets Supply General Ledger Payments Work in Process Supplier – EDI (SOA) Supplier - GS 1 (SOA) BI Apps i. Procurem ent Preference Lists (BOM) Integration Hyperion Receivables Cash Mgmt Other Future Advanced Collections 23

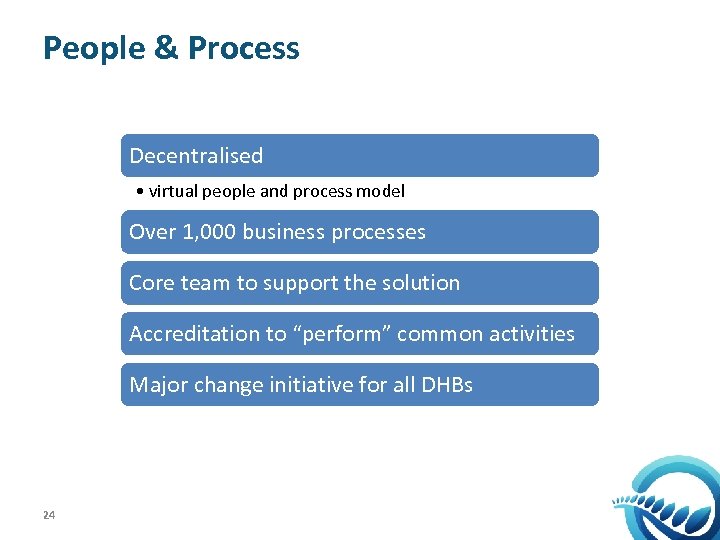

People & Process Decentralised • virtual people and process model Over 1, 000 business processes Core team to support the solution Accreditation to “perform” common activities Major change initiative for all DHBs 24

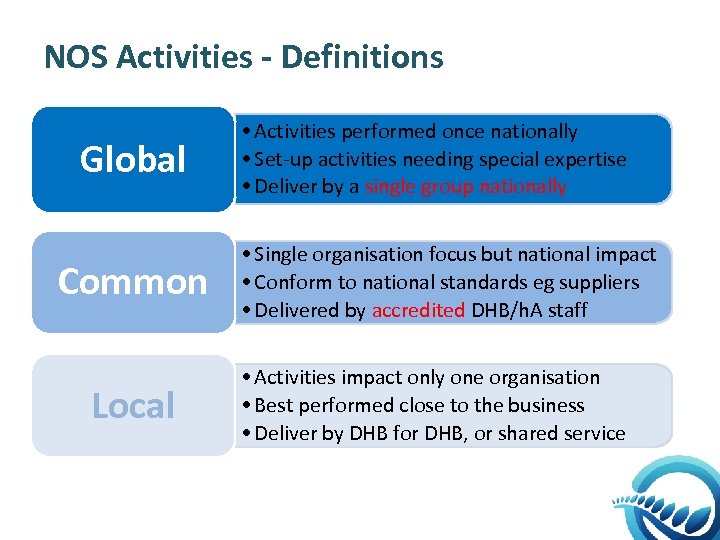

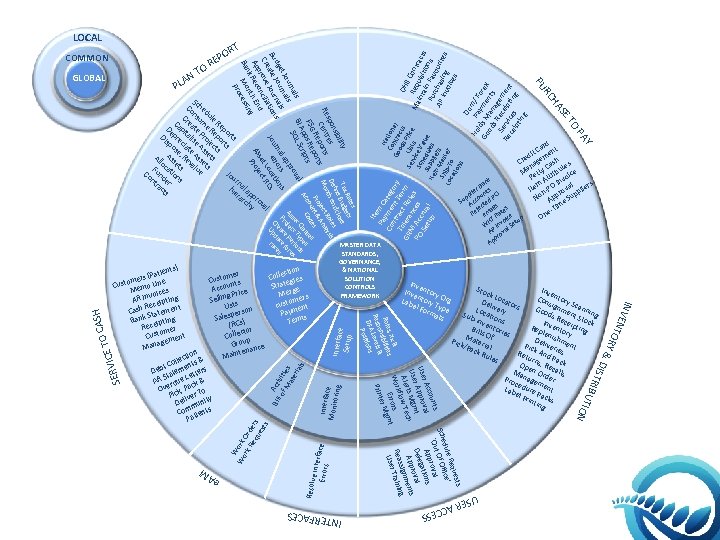

NOS Activities - Definitions Global Common Local • Activities performed once nationally • Set-up activities needing special expertise • Deliver by a single group nationally • Single organisation focus but national impact • Conform to national standards eg suppliers • Delivered by accredited DHB/h. A staff • Activities impact only one organisation • Best performed close to the business • Deliver by DHB for DHB, or shared service

Interfa ce Setup e Inte r Errors face Interfa c Monit e oring Bil Acti l o vit f M ies ate ria ls DH B C Ma Requ ontr a int ai isitio cts Pu n Fav ns rch ou AP Inv asing rites oic es rs S h Mas Loc ip-To ter at i on s Ite Pa m C Na Co yme ateg Co t io n ntr nt or Go ntra al ac Ter y T o d cts s GR olera t Ro m S e r L i st Pr i c e NI nc les vic s PO Acc es S c h e V a Se ru Su edul lue al tup Ite ppli es m e ESS W Wo ork rk Ord R e er qu s est s M e. A Resolv ION s uest Req e’ dule f ic Sche t Of Of l ‘Ou rova App tions ga l Dele rova App ments sign g Reas Trainin User C R AC S TRIB UT DIS Sto Inv ck L e oca Con ntory Del S s iver tors Goo ignme canni L ds R nt S ng Sub ocatio y -inv ns In ece tock e Rep vento ipting Bill ntorie l en s O s M ishmry D Pick ater f ial Pick eliveri ent /Pa ck R Ret And es ule Pa ur s Op ns, Re ck en M O calls Pro anage rder m ce Lab dure ent el P Pac rint ks ing INV EN ES INTERFAC H H W Inv l Se AP ova pr Ap TOR Y & CAS rd Ca nt dit eme Cre nag ash es t C Ma etty ribu ice P Att vo k an In l m rs r B Ite n-PO rova plie nts o pp Sup pp cou d PO N A e Su Ac te s im jec ail s e- T Re em Rate e On T oic tup Y Inv entory e Lab ntory Org el F Typ orm e ats nts cou al r Ac Use Approv t r Use ts Mgm h c Al e r w Te kflo Wor Errors gmt ter M Prin CE TO ERVI PA TO MASTER DATA STANDARDS, GOVERNANCE, & NATIONAL SOLUTION CONTROLS FRAMEWORK & s, Xx s Role sibilitie on & Resp Levels DFA sitions Po ) ients ction mer (Pat Colle gies mers ine Custo nts e u Custo emo L Strat ge Acco rice M es Mer rs nvoic ting P AR I eip Sell ts me custo ent Lis t Rec Cash tatemen rson a ym P pe S s Sales s) Bank eipting Term (RC r Rec mer cto Colle p Custo ment e Grou ce anag M tenan tion Main llec ts & t Co en Deb tatem etters S L AR rdue ck & ve , Pa o O ck Pi liver T ty De muni Com tients Pa SE t es t s e l HA RC Ra Sc Co hed ns ul C u e C re m R De api ate e R epo ta Pr ep rt Di pre lis o o s sp ci e jec rts os ate As ts e se Al Ass , Re Ass ts l o e t va e t ca s lu s e C Fun tio Jo on d e n s ur tra r n hi al a ct er p p s ar ro ch v y a PU A PL Tax Budg se ility c lo ine sib Def end oles sis p o n es nth t R aly Res Centr orts Mo jec An p ts Pr o t & Re por es s un FSG Re s c o C o d sse s Ac pps ript la pe s al t C Ty d BI A QL Sc ls ov se ct rio x S rna ls pr As oje Pe ore ap Jou Pr e a t e f s rna ls al rs et ns rn dg Jou na s Cr pda rate rro tio Bu ate Jour tion U Jou e Loca Cs t ct R Cre ve cilia se d pro on As Proje Ap Rec th En g n in nk Ba Mo cess Pro O N T GLOBAL Do Ho P m/ F a l Go ds M yme orex od an nts s a S Re gem Re ervic ceipt en ce es in t g ipt ing T OR P RE COMMON USE LOCAL

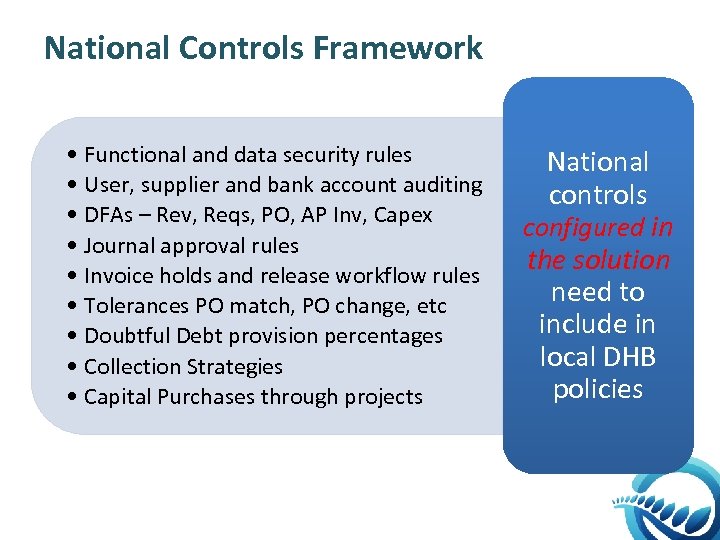

National Controls Framework • Functional and data security rules • User, supplier and bank account auditing • DFAs – Rev, Reqs, PO, AP Inv, Capex • Journal approval rules • Invoice holds and release workflow rules • Tolerances PO match, PO change, etc • Doubtful Debt provision percentages • Collection Strategies • Capital Purchases through projects National controls configured in the solution need to include in local DHB policies

Interested Stakeholders Patients • Ensure the right product is in the right place at the right time DHBs as an enabler • Of benefits to support priority initiatives PHARMAC • To support national procurement of medical devices Suppliers • To reduce end to end Supply Chain risk and cost of supply 28

Waikato DHB as an example (10% of sector) 2008 - ranked as having the worst DHB supply chain 2016 - leading the sector in supply chain efficiency and innovation Decision was made to invest in Oracle e. Business to support Supply Chain • Wayfinder (clinical focused portal) • Full Consignment tracking with RFID interface • e. AM to manage assets 29

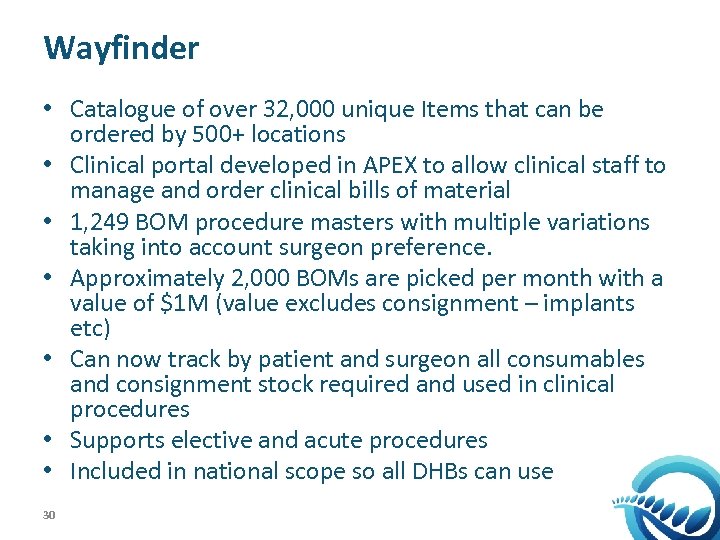

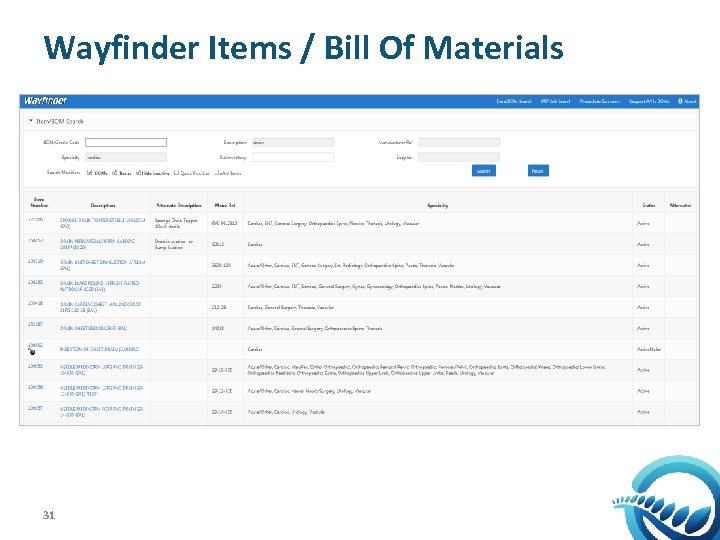

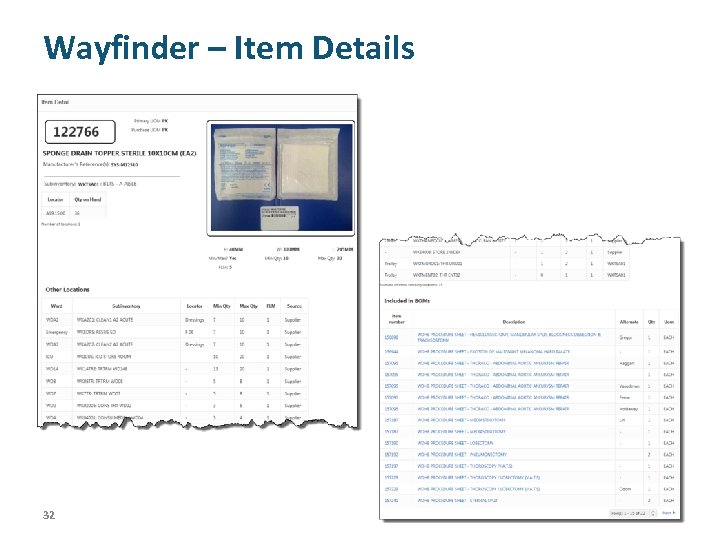

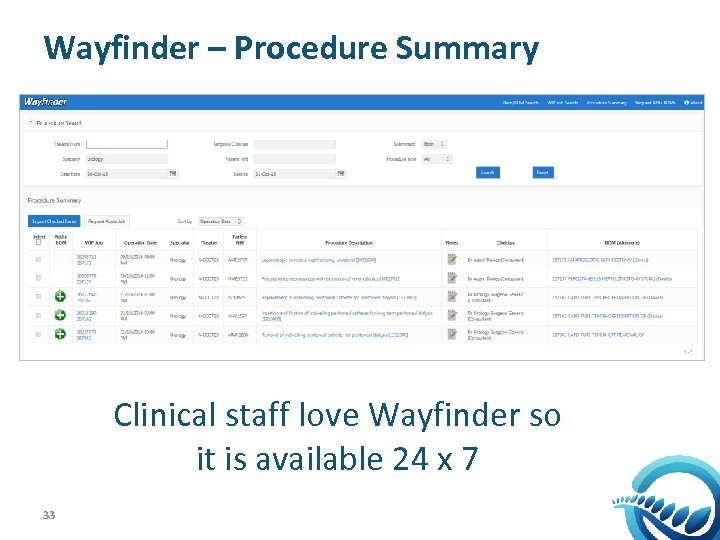

Wayfinder • Catalogue of over 32, 000 unique Items that can be ordered by 500+ locations • Clinical portal developed in APEX to allow clinical staff to manage and order clinical bills of material • 1, 249 BOM procedure masters with multiple variations taking into account surgeon preference. • Approximately 2, 000 BOMs are picked per month with a value of $1 M (value excludes consignment – implants etc) • Can now track by patient and surgeon all consumables and consignment stock required and used in clinical procedures • Supports elective and acute procedures • Included in national scope so all DHBs can use 30

Wayfinder Items / Bill Of Materials 31

Wayfinder – Item Details 32

Wayfinder – Procedure Summary • C Clinical staff love Wayfinder so it is available 24 x 7 33

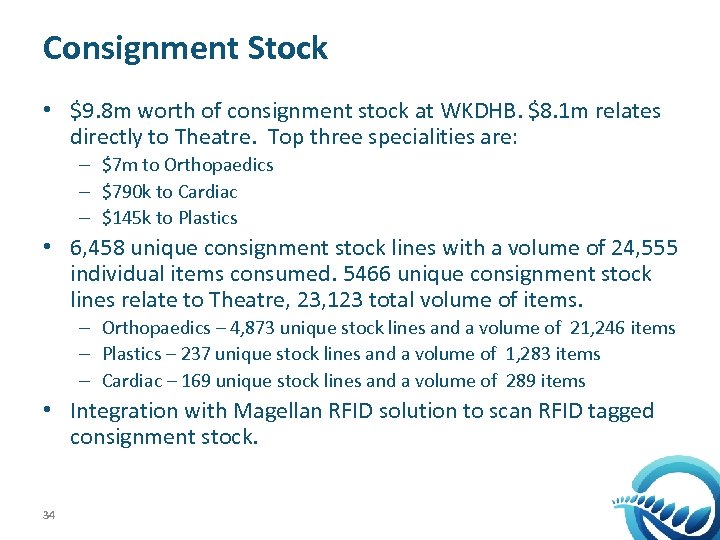

Consignment Stock • $9. 8 m worth of consignment stock at WKDHB. $8. 1 m relates directly to Theatre. Top three specialities are: – $7 m to Orthopaedics – $790 k to Cardiac – $145 k to Plastics • 6, 458 unique consignment stock lines with a volume of 24, 555 individual items consumed. 5466 unique consignment stock lines relate to Theatre, 23, 123 total volume of items. – Orthopaedics – 4, 873 unique stock lines and a volume of 21, 246 items – Plastics – 237 unique stock lines and a volume of 1, 283 items – Cardiac – 169 unique stock lines and a volume of 289 items • Integration with Magellan RFID solution to scan RFID tagged consignment stock. 34

Consignment Stock Benefits Was totally manual Now a transparent end to end solution • Using standard Oracle functionality Consumption advices sent to suppliers on use Purchase orders sent to suppliers based on min/max Full inventory control – easy to track usage Consignment stock holding Increased • By $1. 5 m in the past 12 months with • No increase in FTE required to manage Significant reduction in FTE required to manage RFID • tagged stock that is now scanned 35

Enterprise Asset Management (e. AM) First DHB to implement Oracle e. AM to manage asset maintenance Significant benefits delivered from standardisation Improved user experience – portal logging with visibility of status Included in national scope so any DHB can implement 36

Questions? 37

Thank you! 38

79bea53bd9efbab182f765277baf8ab1.ppt