8d32ddb411dde29affc4c3a7deceb8b8.ppt

- Количество слайдов: 90

Empty Rates – Avoidance and Evasion IRRV East Midlands Association October 2013 Gordon Heath BSc IRRV (Hons) IRRV National Council Member Honorary Member of the Rating Surveyors Association

Empty Rates – Avoidance and Evasion IRRV East Midlands Association October 2013 Gordon Heath BSc IRRV (Hons) IRRV National Council Member Honorary Member of the Rating Surveyors Association

Empty Rate Avoidance or Evasion • Tax Avoidance – the lawful avoidance or reduction of tax by arranging one’s affairs in order to minimise the amount of tax payable • Aggressive Tax Avoidance – the lawful exploitation of tax loopholes in order to minimise the amount of tax payable • Tax Evasion – the unlawful and potentially criminal evasion of payment of tax that is legally due. This may involve lying or the criminal offence of fraud by false representation under the Fraud Act 2006 ss 1 -2 Gordon Heath Ltd 2

Empty Rate Avoidance or Evasion • Tax Avoidance – the lawful avoidance or reduction of tax by arranging one’s affairs in order to minimise the amount of tax payable • Aggressive Tax Avoidance – the lawful exploitation of tax loopholes in order to minimise the amount of tax payable • Tax Evasion – the unlawful and potentially criminal evasion of payment of tax that is legally due. This may involve lying or the criminal offence of fraud by false representation under the Fraud Act 2006 ss 1 -2 Gordon Heath Ltd 2

The Right to Minimise Tax Liability • The Westminster Principle • Inland Revenue Commissioners V Duke of Westminster 1936 (H. of Lords) • Payments to domestic employees by deed of covenant that amounted to remuneration • House of Lords refused to disregard the character of the deeds merely because the same result could be brought about in another manner • Principle applies to any form of direct taxation Gordon Heath Ltd 3

The Right to Minimise Tax Liability • The Westminster Principle • Inland Revenue Commissioners V Duke of Westminster 1936 (H. of Lords) • Payments to domestic employees by deed of covenant that amounted to remuneration • House of Lords refused to disregard the character of the deeds merely because the same result could be brought about in another manner • Principle applies to any form of direct taxation Gordon Heath Ltd 3

The Right to Minimise Tax Liability • Lord Tomlin “Every man is entitled if he can to order his affairs so as that the tax attaching under the appropriate Acts is less than it otherwise would be. If he succeeds in ordering them so as to secure this result, then, however unappreciative the Commissioners of the Inland Revenue or his fellow taxpayers may be of his ingenuity, he cannot be compelled to pay an increased tax. ” • Lord Atkin “It has to be recognised that the subject whether poor and humble or wealthy and noble has the legal right to dispose of his capital and income as to attract upon himself the least amount of tax” • BUT this case only involved a single avoidance step Gordon Heath Ltd 4

The Right to Minimise Tax Liability • Lord Tomlin “Every man is entitled if he can to order his affairs so as that the tax attaching under the appropriate Acts is less than it otherwise would be. If he succeeds in ordering them so as to secure this result, then, however unappreciative the Commissioners of the Inland Revenue or his fellow taxpayers may be of his ingenuity, he cannot be compelled to pay an increased tax. ” • Lord Atkin “It has to be recognised that the subject whether poor and humble or wealthy and noble has the legal right to dispose of his capital and income as to attract upon himself the least amount of tax” • BUT this case only involved a single avoidance step Gordon Heath Ltd 4

The Right to Minimise Tax Liability • The Ramsay Principle • W. T. Ramsay Ltd v Inland Revenue Commissioners 1982 (H. of Lords) • Company made a large capital gain and entered into a series of self cancelling transactions to generate an artificial capital loss and avoid CGT • Where a transaction has pre-arranged artificial steps which serve no commercial purpose other than to save tax, then the proper approach is to tax the effect of the transaction as a whole – referred to as the Ramsay Principle • BUT it is limited to a series of self cancelling financial steps Gordon Heath Ltd 5

The Right to Minimise Tax Liability • The Ramsay Principle • W. T. Ramsay Ltd v Inland Revenue Commissioners 1982 (H. of Lords) • Company made a large capital gain and entered into a series of self cancelling transactions to generate an artificial capital loss and avoid CGT • Where a transaction has pre-arranged artificial steps which serve no commercial purpose other than to save tax, then the proper approach is to tax the effect of the transaction as a whole – referred to as the Ramsay Principle • BUT it is limited to a series of self cancelling financial steps Gordon Heath Ltd 5

The Right to Minimise Tax Liability • Furniss (Inspector of Taxes) v Dawson D. E. R. , Furniss v Dawson G. E. , Murdoch v Dawson R. S. 1984 (H. of Lords) • Selling family company shares – a pre-arranged plan to exchange shares for shares in a newly formed investment company that immediately sold the family shares at an agreed price. • CGT exemption applies to company amalgamation and there was no gain or loss by investment company • Steps inserted in a preordained series of transactions with no commercial purpose other than tax avoidance should be disregarded for tax purposes, notwithstanding that the inserted step had a business effect • Significant extension to Ramsay Principle • Now applies to a linear series of financial transactions Gordon Heath Ltd 6

The Right to Minimise Tax Liability • Furniss (Inspector of Taxes) v Dawson D. E. R. , Furniss v Dawson G. E. , Murdoch v Dawson R. S. 1984 (H. of Lords) • Selling family company shares – a pre-arranged plan to exchange shares for shares in a newly formed investment company that immediately sold the family shares at an agreed price. • CGT exemption applies to company amalgamation and there was no gain or loss by investment company • Steps inserted in a preordained series of transactions with no commercial purpose other than tax avoidance should be disregarded for tax purposes, notwithstanding that the inserted step had a business effect • Significant extension to Ramsay Principle • Now applies to a linear series of financial transactions Gordon Heath Ltd 6

Rateable Occupation • John Laing & Son Ltd v Kingswood Area Assessment Committee 1949 (Court of Appeal) • London County Council v Wilkins 1956 (House of Lords) • Four elements of occupation 1. it must be actual 2. it must be exclusive to the occupier 3. it must be of some benefit to the occupier 4. it must not be for too transient a period • SI 2008/386 reg. 5 prescribes that no further rate free period applies if occupation is less than 6 weeks Gordon Heath Ltd 7

Rateable Occupation • John Laing & Son Ltd v Kingswood Area Assessment Committee 1949 (Court of Appeal) • London County Council v Wilkins 1956 (House of Lords) • Four elements of occupation 1. it must be actual 2. it must be exclusive to the occupier 3. it must be of some benefit to the occupier 4. it must not be for too transient a period • SI 2008/386 reg. 5 prescribes that no further rate free period applies if occupation is less than 6 weeks Gordon Heath Ltd 7

Rateable Occupation • Rateable occupation is a question of fact • Further periods of relief are allowed • There is nothing in the regulations that prevents a ratepayer from repeatedly occupying for 6 week periods to claim repeated empty periods • Key test is probably beneficial occupation • My question “Ignoring the empty rate saving, would the ratepayer be prepared to pay a rent to obtain that benefit from the occupation? ” Gordon Heath Ltd 8

Rateable Occupation • Rateable occupation is a question of fact • Further periods of relief are allowed • There is nothing in the regulations that prevents a ratepayer from repeatedly occupying for 6 week periods to claim repeated empty periods • Key test is probably beneficial occupation • My question “Ignoring the empty rate saving, would the ratepayer be prepared to pay a rent to obtain that benefit from the occupation? ” Gordon Heath Ltd 8

De Minimis Occupation • • • There is no “de minimis” rule in the legislation Wirral BC v Lane 1979 Empty House undergoing building works - No overnight stays Most goods removed but use of telephone Cumming-Bruce LJ “the magistrates ……. . decided to apply the maxim de minimis non curat lex to these valuable chattels. ” • “on the facts found by the magistrates, they could have very well come to the opposite conclusion” • “I am not prepared to hold as a matter of law that the magistrates were not entitled thus to relegate these objects to a lowly grade of value or importance” Gordon Heath Ltd 9

De Minimis Occupation • • • There is no “de minimis” rule in the legislation Wirral BC v Lane 1979 Empty House undergoing building works - No overnight stays Most goods removed but use of telephone Cumming-Bruce LJ “the magistrates ……. . decided to apply the maxim de minimis non curat lex to these valuable chattels. ” • “on the facts found by the magistrates, they could have very well come to the opposite conclusion” • “I am not prepared to hold as a matter of law that the magistrates were not entitled thus to relegate these objects to a lowly grade of value or importance” Gordon Heath Ltd 9

Plant, Machinery and Equipment • LGFA 1988 s 65(5) - “Plant, machinery and equipment…. which was used…. or is intended for use…” can be ignored • Sheafbank Property Trust PLC v Sheffield MDC 1988 • A disused sports ground and premises was held to be unoccupied because it only contained plant, machinery and equipment that were last used on the premises • Items included a snooker table, music facilities, tables, chairs, the bar and associated equipment, freezer, dishwasher, kitchen items, TV, refrigerator, settee, grass cutting equipment Gordon Heath Ltd 10

Plant, Machinery and Equipment • LGFA 1988 s 65(5) - “Plant, machinery and equipment…. which was used…. or is intended for use…” can be ignored • Sheafbank Property Trust PLC v Sheffield MDC 1988 • A disused sports ground and premises was held to be unoccupied because it only contained plant, machinery and equipment that were last used on the premises • Items included a snooker table, music facilities, tables, chairs, the bar and associated equipment, freezer, dishwasher, kitchen items, TV, refrigerator, settee, grass cutting equipment Gordon Heath Ltd 10

The Makro Case • Makro Properties Ltd and Makro Self Service Wholesalers Ltd v Nuneaton and Bedworth BC 2012 • Decision given on 29 June 2012 • Appeal by case stated against liability order granted in the Magistrates’ Court on 14 April 2011 • Former cash and carry warehouse used for temporary storage • Rowleys Green, Coventry • 0. 2% of floor space of 140, 000 sq. ft. • Storing 16 pallets of documents • Between November 2009 and January 2010 • Sufficient to trigger a further 6 months rate free period Gordon Heath Ltd 11

The Makro Case • Makro Properties Ltd and Makro Self Service Wholesalers Ltd v Nuneaton and Bedworth BC 2012 • Decision given on 29 June 2012 • Appeal by case stated against liability order granted in the Magistrates’ Court on 14 April 2011 • Former cash and carry warehouse used for temporary storage • Rowleys Green, Coventry • 0. 2% of floor space of 140, 000 sq. ft. • Storing 16 pallets of documents • Between November 2009 and January 2010 • Sufficient to trigger a further 6 months rate free period Gordon Heath Ltd 11

The Makro Case • Two questions for the opinion of the High Court • Whether on the facts found by the court about the level, purpose and benefit to the ratepayer of the storage occurring on the hereditament, the court was correct to decide that the hereditament was not in rateable occupation between 25 November 2009 and 12 January 2010 and after 23 July 2010. • In the event that the court was not correct so to decide, whether the court was correct to consider (a) that rateable occupation would continue throughout the period 12 January 2010 to 23 July 2010 and (b) that the occupier would be Makro Properties Limited Gordon Heath Ltd 12

The Makro Case • Two questions for the opinion of the High Court • Whether on the facts found by the court about the level, purpose and benefit to the ratepayer of the storage occurring on the hereditament, the court was correct to decide that the hereditament was not in rateable occupation between 25 November 2009 and 12 January 2010 and after 23 July 2010. • In the event that the court was not correct so to decide, whether the court was correct to consider (a) that rateable occupation would continue throughout the period 12 January 2010 to 23 July 2010 and (b) that the occupier would be Makro Properties Limited Gordon Heath Ltd 12

The Makro Case • Makro Properties Ltd (MPL) was the freeholder • Makro Self Service Wholesalers Ltd (MSSWL) held a lease until 31 December 2009 • Both part of the Makro Group Ltd • MSSWL occupied as a self service warehouse until 1 June 2009 when it was cleared and vacated • MSSWL stored 16 pallets of company paperwork which it was obliged by law to retain, between 25 November 2009 and 12 January 2010 • Occupied 0. 2% of over 13, 000 sq. metres (140, 000 sq. feet) Gordon Heath Ltd 13

The Makro Case • Makro Properties Ltd (MPL) was the freeholder • Makro Self Service Wholesalers Ltd (MSSWL) held a lease until 31 December 2009 • Both part of the Makro Group Ltd • MSSWL occupied as a self service warehouse until 1 June 2009 when it was cleared and vacated • MSSWL stored 16 pallets of company paperwork which it was obliged by law to retain, between 25 November 2009 and 12 January 2010 • Occupied 0. 2% of over 13, 000 sq. metres (140, 000 sq. feet) Gordon Heath Ltd 13

The Makro Case • After the surrender of the lease there was an informal intra-group permission but no written agreement • Premises empty between 12 January and 23 July 2010 • Intention to sell but a reserve plan to reoccupy to a minor degree for a short period • 40 pallets of MSSWL paperwork were delivered on 23 July 2010 • 17 pallets removed on 17 August 2010 • Up to 60 pallets delivered on 21 September 2010 • Rates were paid for the periods of occupation Gordon Heath Ltd 14

The Makro Case • After the surrender of the lease there was an informal intra-group permission but no written agreement • Premises empty between 12 January and 23 July 2010 • Intention to sell but a reserve plan to reoccupy to a minor degree for a short period • 40 pallets of MSSWL paperwork were delivered on 23 July 2010 • 17 pallets removed on 17 August 2010 • Up to 60 pallets delivered on 21 September 2010 • Rates were paid for the periods of occupation Gordon Heath Ltd 14

The Makro Case • The billing authority charged empty rates from 1 December 2009 and obtained liability orders. • The District Judge in the Magistrates’ Court accepted that only part needed to be used and that the determining factor was whether the goods were of value • The High Court referred extensively to the case law • District Judge accepted that the goods were of value but considered “de minimis” and decided 0. 2% did not amount to actual occupation • Concluded that there was no benefit other than avoiding empty rate and applied the principle in Furniss v Dawson that the steps had no business value other than avoiding empty rate Gordon Heath Ltd 15

The Makro Case • The billing authority charged empty rates from 1 December 2009 and obtained liability orders. • The District Judge in the Magistrates’ Court accepted that only part needed to be used and that the determining factor was whether the goods were of value • The High Court referred extensively to the case law • District Judge accepted that the goods were of value but considered “de minimis” and decided 0. 2% did not amount to actual occupation • Concluded that there was no benefit other than avoiding empty rate and applied the principle in Furniss v Dawson that the steps had no business value other than avoiding empty rate Gordon Heath Ltd 15

The Makro Case • On appeal the Council submitted that the intention found in this case was to give a “semblance” of occupation • Mr Glover QC (for Makro) observed that the state of mind may more properly be described as motivation rather than intention • Judge Jarman did not accept the Council’s submission finding that it “necessarily included an intention to occupy and not just give a semblance of occupation” • Judge Jarman went on to dismiss the district judge’s reliance on Furniss v Dawson which concerned financial transactions, stating “that principle in my judgement is of no assistance in considering the question of intention in this case” Gordon Heath Ltd 16

The Makro Case • On appeal the Council submitted that the intention found in this case was to give a “semblance” of occupation • Mr Glover QC (for Makro) observed that the state of mind may more properly be described as motivation rather than intention • Judge Jarman did not accept the Council’s submission finding that it “necessarily included an intention to occupy and not just give a semblance of occupation” • Judge Jarman went on to dismiss the district judge’s reliance on Furniss v Dawson which concerned financial transactions, stating “that principle in my judgement is of no assistance in considering the question of intention in this case” Gordon Heath Ltd 16

The Makro Case • The district judge had accepted there was actual occupation, but argued that it was “de minimis” • Judge Jarman examined this in some detail • Judge Jarman considered that the proper approach was to consider both use and intention • In this case, there was an intention to occupy and the storage of 16 pallets of documents which are required by law to be stored cannot be said to be trifling Gordon Heath Ltd 17

The Makro Case • The district judge had accepted there was actual occupation, but argued that it was “de minimis” • Judge Jarman examined this in some detail • Judge Jarman considered that the proper approach was to consider both use and intention • In this case, there was an intention to occupy and the storage of 16 pallets of documents which are required by law to be stored cannot be said to be trifling Gordon Heath Ltd 17

The Makro Case • Actual occupation does not amount to rateable occupation unless it is also beneficial • Abandoned goods do not amount to rateable occupation (LCC v Hackney BC [1928] 2 KB 588) • Goods of small value to the ratepayer has been held to amount to beneficial occupation (Appleton v Westminster Corporation [1910] AC 7) Gordon Heath Ltd 18

The Makro Case • Actual occupation does not amount to rateable occupation unless it is also beneficial • Abandoned goods do not amount to rateable occupation (LCC v Hackney BC [1928] 2 KB 588) • Goods of small value to the ratepayer has been held to amount to beneficial occupation (Appleton v Westminster Corporation [1910] AC 7) Gordon Heath Ltd 18

The Makro Case • Judge Jarman said that by relying on Furniss v Dawson, the district judge misdirected himself by disregarding the steps taken to occupy the warehouse • The district judge found that the documentation stored was of benefit which MSSWL were bound by law to retain • Judge Jarman concluded “it cannot be properly said that the storage was of no practical benefit” • He emphasised the point by stating “The fact that this storage could have been continued at other venues does not render storage at the warehouse of no practical benefit” Gordon Heath Ltd 19

The Makro Case • Judge Jarman said that by relying on Furniss v Dawson, the district judge misdirected himself by disregarding the steps taken to occupy the warehouse • The district judge found that the documentation stored was of benefit which MSSWL were bound by law to retain • Judge Jarman concluded “it cannot be properly said that the storage was of no practical benefit” • He emphasised the point by stating “The fact that this storage could have been continued at other venues does not render storage at the warehouse of no practical benefit” Gordon Heath Ltd 19

The Makro Case • Judge Jarman found that the first question in the case stated must be answered in the negative • There should have been a finding that there was rateable occupation while the pallets were stored on the premises Gordon Heath Ltd 20

The Makro Case • Judge Jarman found that the first question in the case stated must be answered in the negative • There should have been a finding that there was rateable occupation while the pallets were stored on the premises Gordon Heath Ltd 20

The Makro Case • The district judge found that if there was occupation, then it continued between January and July 2010 • The Council tried to support this conclusion on the basis that it had been used for storage and that it remained ready for use Gordon Heath Ltd 21

The Makro Case • The district judge found that if there was occupation, then it continued between January and July 2010 • The Council tried to support this conclusion on the basis that it had been used for storage and that it remained ready for use Gordon Heath Ltd 21

The Makro Case • Mr Glover QC (for Makro) argued that when MSSWL removed the goods on 12 January 2010, there was nothing to show that MPL resumed occupation or intended to let space • The intention was that it would not be occupied before July • The intention to re-occupy in July, if the property was not sold, does not amount to an intention to occupy between January and July. Gordon Heath Ltd 22

The Makro Case • Mr Glover QC (for Makro) argued that when MSSWL removed the goods on 12 January 2010, there was nothing to show that MPL resumed occupation or intended to let space • The intention was that it would not be occupied before July • The intention to re-occupy in July, if the property was not sold, does not amount to an intention to occupy between January and July. Gordon Heath Ltd 22

The Makro Case • Judge Jarman preferred Mr Glover’s arguments • The second question in the case stated must also be answered in the negative because there was no intention amounting to occupation or use from January to July 2010 • It follows that the liability orders must be quashed • The Council submitted that such an outcome means that a scheme to avoid paying rates for six months has succeeded and that could not have been foreseen when the 2008 reforms were made Gordon Heath Ltd 23

The Makro Case • Judge Jarman preferred Mr Glover’s arguments • The second question in the case stated must also be answered in the negative because there was no intention amounting to occupation or use from January to July 2010 • It follows that the liability orders must be quashed • The Council submitted that such an outcome means that a scheme to avoid paying rates for six months has succeeded and that could not have been foreseen when the 2008 reforms were made Gordon Heath Ltd 23

The Makro Case • Judge Jarman said “Insofar as that may be relevant I cannot accept the latter submission. It has been recognised for a considerable amount of time that ratepayers or potential ratepayers can and do organise their affairs as to avoid paying rates. In Gage, Alverstone CJ dealt with this question and stated that if the ratepayer thought that she would not be within the charging act by going out of possession, she was quite entitled to do so. In my judgement the same applies to going in and then out of occupation. It has often been emphasised that the court is not a court of morals, but of law. If the outcome of this case is seen as unacceptable then it is for the legislature to determine whether further reform is needed” Gordon Heath Ltd 24

The Makro Case • Judge Jarman said “Insofar as that may be relevant I cannot accept the latter submission. It has been recognised for a considerable amount of time that ratepayers or potential ratepayers can and do organise their affairs as to avoid paying rates. In Gage, Alverstone CJ dealt with this question and stated that if the ratepayer thought that she would not be within the charging act by going out of possession, she was quite entitled to do so. In my judgement the same applies to going in and then out of occupation. It has often been emphasised that the court is not a court of morals, but of law. If the outcome of this case is seen as unacceptable then it is for the legislature to determine whether further reform is needed” Gordon Heath Ltd 24

The Makro Case – My Conclusions • Actual occupation is established if there is a clear intention to use the premises, however small that the actual use might be. By contrast a slight use without any intention to occupy does not amount to rateable occupation. The latter would include chattels of little value as in Wirral v Lane 1979 or abandoned goods • Beneficial occupation requires the use of the premises to provide some benefit, however small, to the ratepayer. The fact that the goods could be stored by the ratepayer elsewhere does not render the storage to be of no practical benefit Gordon Heath Ltd 25

The Makro Case – My Conclusions • Actual occupation is established if there is a clear intention to use the premises, however small that the actual use might be. By contrast a slight use without any intention to occupy does not amount to rateable occupation. The latter would include chattels of little value as in Wirral v Lane 1979 or abandoned goods • Beneficial occupation requires the use of the premises to provide some benefit, however small, to the ratepayer. The fact that the goods could be stored by the ratepayer elsewhere does not render the storage to be of no practical benefit Gordon Heath Ltd 25

The Makro Case – My Conclusions • Exclusive occupation was not an issue in this case except insofar as MSSWL continued to occupy after the end of the lease. However as MPL took no steps to occupy, there was no competing occupation, although the judgement did consider the degree of control exercised by MPL • Transience was not an issue because the nature of the hereditament was not transient Gordon Heath Ltd 26

The Makro Case – My Conclusions • Exclusive occupation was not an issue in this case except insofar as MSSWL continued to occupy after the end of the lease. However as MPL took no steps to occupy, there was no competing occupation, although the judgement did consider the degree of control exercised by MPL • Transience was not an issue because the nature of the hereditament was not transient Gordon Heath Ltd 26

The Makro Case – My Conclusions • The principles established in Furniss v Dawson [1984] STC 153 concerning a series of financial transactions are of no assistance in deciding whether a hereditament is occupied • See my article in March 2012 Valuer for more information on this Gordon Heath Ltd 27

The Makro Case – My Conclusions • The principles established in Furniss v Dawson [1984] STC 153 concerning a series of financial transactions are of no assistance in deciding whether a hereditament is occupied • See my article in March 2012 Valuer for more information on this Gordon Heath Ltd 27

Chiltern Case – Storage Boxes • Chiltern District Council v Principled Partnership Ltd and Heathcote Distribution Ltd 2012 • Magistrates’ Court – NOT a legal precedent • Decision date 22 November 2012 • 19 separate office units at Chiltern Court, Ashridge Road, Chesham • Empty rate 9 Sept. to 5 Nov. 2011 • Total rates £ 10, 680 • Council billed empty rate for the period • Ratepayers maintain they were occupied by storage boxes Gordon Heath Ltd 28

Chiltern Case – Storage Boxes • Chiltern District Council v Principled Partnership Ltd and Heathcote Distribution Ltd 2012 • Magistrates’ Court – NOT a legal precedent • Decision date 22 November 2012 • 19 separate office units at Chiltern Court, Ashridge Road, Chesham • Empty rate 9 Sept. to 5 Nov. 2011 • Total rates £ 10, 680 • Council billed empty rate for the period • Ratepayers maintain they were occupied by storage boxes Gordon Heath Ltd 28

Chiltern Case – Storage Boxes • Ratepayers provide short term storage facilities for companies • Principle aim is to provide 6 week occupation of vacant premises in order to mitigate landlord’s rate liabilities • Less than 10% of their income is derived from storage itself • Most income derived from landlords • Entitles to use premises and therefore liable • Inspection by Council concluded that some boxes were empty and the rest contained items of no value – sham business – no meaningful occupation Gordon Heath Ltd 29

Chiltern Case – Storage Boxes • Ratepayers provide short term storage facilities for companies • Principle aim is to provide 6 week occupation of vacant premises in order to mitigate landlord’s rate liabilities • Less than 10% of their income is derived from storage itself • Most income derived from landlords • Entitles to use premises and therefore liable • Inspection by Council concluded that some boxes were empty and the rest contained items of no value – sham business – no meaningful occupation Gordon Heath Ltd 29

Chiltern Case – Storage Boxes • Ratepayers maintain that they are a legitimate business providing bona fide storage solutions for companies requiring storage • All the units contained storage boxes provided by Atlas Supply Solutions Ltd – believed it to be confidential material • Revenue from Atlas offset against transport costs • Boxes contained items of value to clients of Atlas • District Judge “benefit must derive to the occupier and not from the abatement of tax due” Gordon Heath Ltd 30

Chiltern Case – Storage Boxes • Ratepayers maintain that they are a legitimate business providing bona fide storage solutions for companies requiring storage • All the units contained storage boxes provided by Atlas Supply Solutions Ltd – believed it to be confidential material • Revenue from Atlas offset against transport costs • Boxes contained items of value to clients of Atlas • District Judge “benefit must derive to the occupier and not from the abatement of tax due” Gordon Heath Ltd 30

Chiltern Case – Storage Boxes • Not practical for the Council to inspect all the boxes individually • Council only found some empty boxes and only inspected the contents of one box • Evidence of ratepayers was largely un-contradicted • Ratepayers did not hide the fact that their income was derived from the landlords • Beneficial occupation – valid storage facilities on behalf of Atlas • Not a sham company • Very few boxes examined by Council • Liability Order for empty rate refused – premises occupied • Costs awarded against the Council £ 30, 000 Gordon Heath Ltd 31

Chiltern Case – Storage Boxes • Not practical for the Council to inspect all the boxes individually • Council only found some empty boxes and only inspected the contents of one box • Evidence of ratepayers was largely un-contradicted • Ratepayers did not hide the fact that their income was derived from the landlords • Beneficial occupation – valid storage facilities on behalf of Atlas • Not a sham company • Very few boxes examined by Council • Liability Order for empty rate refused – premises occupied • Costs awarded against the Council £ 30, 000 Gordon Heath Ltd 31

Sunderland Blue Tooth Case • • • Sunderland City Council v Stirling Investment Properties LLP 2013 Decision dated 24 May 2013 Stirling - freeholders of Unit G 7, Phoenix Towers Business Park 1, 500 m 2 unit formerly part of a furniture warehouse Used by Complete Mobile Marketing Ltd (CMML) from 20/5/2011 to 1 July 2011 inclusive for blue tooth broadcasting Lease for 43 days for blue tooth marketing and advertising services - could be terminated at any time CMML billed and paid rates for 43 days Blue tooth box was 100 x 50 mm Stirling liable for any rates from 2 July 2011 Gordon Heath Ltd 32

Sunderland Blue Tooth Case • • • Sunderland City Council v Stirling Investment Properties LLP 2013 Decision dated 24 May 2013 Stirling - freeholders of Unit G 7, Phoenix Towers Business Park 1, 500 m 2 unit formerly part of a furniture warehouse Used by Complete Mobile Marketing Ltd (CMML) from 20/5/2011 to 1 July 2011 inclusive for blue tooth broadcasting Lease for 43 days for blue tooth marketing and advertising services - could be terminated at any time CMML billed and paid rates for 43 days Blue tooth box was 100 x 50 mm Stirling liable for any rates from 2 July 2011 Gordon Heath Ltd 32

Sunderland Blue Tooth Case • Stirling billed from 2 July 2011 • Stirling claimed entitlement to 6 months rate free period • Application for a liability order dismissed • Two questions for the High Court: 1. Whether I erred in law in finding that the presence of the blue tooth apparatus constituted occupation of the hereditament? 2. Whether I erred in law in finding that the presence of the apparatus amounted to rateable occupation of the hereditament notwithstanding that it had been placed there for the purposes of advertising and not for warehousing? Gordon Heath Ltd 33

Sunderland Blue Tooth Case • Stirling billed from 2 July 2011 • Stirling claimed entitlement to 6 months rate free period • Application for a liability order dismissed • Two questions for the High Court: 1. Whether I erred in law in finding that the presence of the blue tooth apparatus constituted occupation of the hereditament? 2. Whether I erred in law in finding that the presence of the apparatus amounted to rateable occupation of the hereditament notwithstanding that it had been placed there for the purposes of advertising and not for warehousing? Gordon Heath Ltd 33

Sunderland Blue Tooth Case • Sunderland argued that the blue tooth equipment was “de minimis” and that it was not occupation as a warehouse • Wilkie JJ concluded that although the rent was nominal, the rates were not and this surmounted the “de minimis” hurdle • Wilkie JJ also concluded that there is nothing in the legislation which limits the ability of a local authority to levy rates to occupation for a purpose which is identical to the description of the hereditament in the rating list. The issue of any apparent disconnect between the nature of the occupation of an hereditament and its description in the rating list is a matter for the valuation officer. • Appeal dismissed – CMML were in occupation and a further 6 months rate free applies Gordon Heath Ltd 34

Sunderland Blue Tooth Case • Sunderland argued that the blue tooth equipment was “de minimis” and that it was not occupation as a warehouse • Wilkie JJ concluded that although the rent was nominal, the rates were not and this surmounted the “de minimis” hurdle • Wilkie JJ also concluded that there is nothing in the legislation which limits the ability of a local authority to levy rates to occupation for a purpose which is identical to the description of the hereditament in the rating list. The issue of any apparent disconnect between the nature of the occupation of an hereditament and its description in the rating list is a matter for the valuation officer. • Appeal dismissed – CMML were in occupation and a further 6 months rate free applies Gordon Heath Ltd 34

Letting to a Charity • Letting to a charity only works if they occupy or intend to occupy it for charitable purposes (of that charity or that charity and others) • If there is no intention for the charity to use it for a charitable purpose, the charity will be liable for 100% charge • If it is occupied, it must be wholly or mainly used for charitable purposes to qualify for mandatory relief Gordon Heath Ltd 35

Letting to a Charity • Letting to a charity only works if they occupy or intend to occupy it for charitable purposes (of that charity or that charity and others) • If there is no intention for the charity to use it for a charitable purpose, the charity will be liable for 100% charge • If it is occupied, it must be wholly or mainly used for charitable purposes to qualify for mandatory relief Gordon Heath Ltd 35

Letting to a Charity – Edinburgh Case • English Speaking Union Scottish Branches Educational Fund v City of Edinburgh Council 2009 • Judicial review of refusal of mandatory relief • Tenants of whole building - 8 floors • Only used the ground floor • Ratepayer - wholly used for charitable purposes • Council - only partially used • Council’s argument is consistent with the ordinary meaning of the language used in the legislation Gordon Heath Ltd 36

Letting to a Charity – Edinburgh Case • English Speaking Union Scottish Branches Educational Fund v City of Edinburgh Council 2009 • Judicial review of refusal of mandatory relief • Tenants of whole building - 8 floors • Only used the ground floor • Ratepayer - wholly used for charitable purposes • Council - only partially used • Council’s argument is consistent with the ordinary meaning of the language used in the legislation Gordon Heath Ltd 36

Letting to a Charity – Kenya Aid Case • • • Kenya Aid Programme v Sheffield City Council 2013 EWHC 54 (Admin) Appeal by case stated against liability orders for full charge Linked Judicial Review Claim Units 1 and 2 Europa Way Sheffield Total rates in dispute – over £ 1. 6 M Ratepayer is Kenya Aid Programme (KAP) KAP are a registered charity – not in dispute KAP in rateable occupation – not in dispute Main issue – are the premises wholly or mainly used for charitable purposes? Gordon Heath Ltd 37

Letting to a Charity – Kenya Aid Case • • • Kenya Aid Programme v Sheffield City Council 2013 EWHC 54 (Admin) Appeal by case stated against liability orders for full charge Linked Judicial Review Claim Units 1 and 2 Europa Way Sheffield Total rates in dispute – over £ 1. 6 M Ratepayer is Kenya Aid Programme (KAP) KAP are a registered charity – not in dispute KAP in rateable occupation – not in dispute Main issue – are the premises wholly or mainly used for charitable purposes? Gordon Heath Ltd 37

Letting to a Charity – Kenya Aid Case • Both premises used for furniture storage • Furniture spaced out – more efficient approach to storage would compress the space to less than half the available space • KAP also occupy various similar properties in the North East, the North and the North West • The amount of furniture shipped to Kenya was small • Low frequency of shipment • KAP dependant on donations from Landlord to pay rates • District Judge followed the approach in the Edinburgh case and decided that the premises were not wholly or mainly used for charitable purposes Gordon Heath Ltd 38

Letting to a Charity – Kenya Aid Case • Both premises used for furniture storage • Furniture spaced out – more efficient approach to storage would compress the space to less than half the available space • KAP also occupy various similar properties in the North East, the North and the North West • The amount of furniture shipped to Kenya was small • Low frequency of shipment • KAP dependant on donations from Landlord to pay rates • District Judge followed the approach in the Edinburgh case and decided that the premises were not wholly or mainly used for charitable purposes Gordon Heath Ltd 38

Letting to a Charity – Kenya Aid Case • In Glasgow Corporation v Johnstone [1965] AC 621 Lord Reid confined the analysis to the charitable purposes of the use made of the premises, not the extent of the use • In Kenya Aid case, Treacy LJ took the view that the Glasgow case did not prevent the court from applying the approach in the Edinburgh case • It was right to consider the extent of use of the premises • BUT the District Judge also took account of the inefficiency of the furniture storage and the necessity to occupy both premises • These were irrelevant and should not have been taken into account, in the light of the Glasgow case Gordon Heath Ltd 39

Letting to a Charity – Kenya Aid Case • In Glasgow Corporation v Johnstone [1965] AC 621 Lord Reid confined the analysis to the charitable purposes of the use made of the premises, not the extent of the use • In Kenya Aid case, Treacy LJ took the view that the Glasgow case did not prevent the court from applying the approach in the Edinburgh case • It was right to consider the extent of use of the premises • BUT the District Judge also took account of the inefficiency of the furniture storage and the necessity to occupy both premises • These were irrelevant and should not have been taken into account, in the light of the Glasgow case Gordon Heath Ltd 39

Letting to a Charity – Kenya Aid Case • District Judge also took into account the “mutual advantages to the charity and the landlord” • Treacy LJ said that if this referred to tax avoidance, it was not a matter to which weight should have been attached – Makro case referred to Gage v Wren [1903] 67 JP 32 in which Alverstone CJ stated that “if the ratepayer thought that she would not be within the charging act by going out of possession, she was quite entitled to do so” • Alternatively if this referred to the use of the premises for fundraising, that would not be charitable in accordance with Oxfam v City of Birmingham District Council [1976] 1 AC 126 Gordon Heath Ltd 40

Letting to a Charity – Kenya Aid Case • District Judge also took into account the “mutual advantages to the charity and the landlord” • Treacy LJ said that if this referred to tax avoidance, it was not a matter to which weight should have been attached – Makro case referred to Gage v Wren [1903] 67 JP 32 in which Alverstone CJ stated that “if the ratepayer thought that she would not be within the charging act by going out of possession, she was quite entitled to do so” • Alternatively if this referred to the use of the premises for fundraising, that would not be charitable in accordance with Oxfam v City of Birmingham District Council [1976] 1 AC 126 Gordon Heath Ltd 40

Letting to a Charity – Kenya Aid Case • Treacy LJ – District Judge was right to take account of the extent of the use of the premises in line with the Edinburgh case • However District Judge also took account of irrelevant factors or factors that were not analysed sufficiently • Hence District Judge’s decision was flawed because he took account of the efficiency of the storage and the need to occupy both premises contrary to the Glasgow case • Appeal allowed and remitted back to the District Judge for further consideration • The related application for Judicial Review was dismissed • High Court decision on a case stated is final • District Judge reconsidered the case and found that it was not wholly or mainly used for charitable purposes • Under investigation by the Charity Commission Gordon Heath Ltd 41

Letting to a Charity – Kenya Aid Case • Treacy LJ – District Judge was right to take account of the extent of the use of the premises in line with the Edinburgh case • However District Judge also took account of irrelevant factors or factors that were not analysed sufficiently • Hence District Judge’s decision was flawed because he took account of the efficiency of the storage and the need to occupy both premises contrary to the Glasgow case • Appeal allowed and remitted back to the District Judge for further consideration • The related application for Judicial Review was dismissed • High Court decision on a case stated is final • District Judge reconsidered the case and found that it was not wholly or mainly used for charitable purposes • Under investigation by the Charity Commission Gordon Heath Ltd 41

Letting to a Charity – Preston Case • • Preston City Council v Oyston Angel Charity 2012 QBD Appeal by case stated from Preston Magistrates’ Court Oyston Mill owned by Denwis Ltd Oyston Angel Charity (formerly Oyston Angel Trust) - the “Trust” set up in 2005 • Objects are “social relief, rehabilitation and the promotion of the welfare” of offenders, former offenders, disabled including addiction and persons under social or economic deprivation • Registered as a charity 30 August 2011 • Previously accepted as a charity for tax purposes Gordon Heath Ltd 42

Letting to a Charity – Preston Case • • Preston City Council v Oyston Angel Charity 2012 QBD Appeal by case stated from Preston Magistrates’ Court Oyston Mill owned by Denwis Ltd Oyston Angel Charity (formerly Oyston Angel Trust) - the “Trust” set up in 2005 • Objects are “social relief, rehabilitation and the promotion of the welfare” of offenders, former offenders, disabled including addiction and persons under social or economic deprivation • Registered as a charity 30 August 2011 • Previously accepted as a charity for tax purposes Gordon Heath Ltd 42

Letting to a Charity – Preston Case • i. iii. iv. • • 30. 03. 2011 – Denwis Ltd granted a licence to the Trust subject to: The Trust had the right to occupy and use the units Permitted use for charitable purposes only Trust could sublet but only for charitable services Trust to pay all rates, if any Units below RV £ 2, 600 were excluded No dispute that as licensee, Trust liable for rates Gordon Heath Ltd 43

Letting to a Charity – Preston Case • i. iii. iv. • • 30. 03. 2011 – Denwis Ltd granted a licence to the Trust subject to: The Trust had the right to occupy and use the units Permitted use for charitable purposes only Trust could sublet but only for charitable services Trust to pay all rates, if any Units below RV £ 2, 600 were excluded No dispute that as licensee, Trust liable for rates Gordon Heath Ltd 43

Letting to a Charity – Preston Case • All 8 units unoccupied for over 6 months • One unit now sub-licensed to Methodist Action Northwest Ltd as a charity shop • Application for 8 liability orders for 2011 -12 • Magistrates – Trust did not intend to occupy themselves, but when next in use each unit would be wholly or mainly used for charitable purposes – hence units zero rated while empty • Liability orders refused – Preston appealed by case stated Gordon Heath Ltd 44

Letting to a Charity – Preston Case • All 8 units unoccupied for over 6 months • One unit now sub-licensed to Methodist Action Northwest Ltd as a charity shop • Application for 8 liability orders for 2011 -12 • Magistrates – Trust did not intend to occupy themselves, but when next in use each unit would be wholly or mainly used for charitable purposes – hence units zero rated while empty • Liability orders refused – Preston appealed by case stated Gordon Heath Ltd 44

Letting to a Charity – Preston Case • Local Government Finance Act 1988 s 45 A(2) provides that empty properties are zero rated where a) The ratepayer is a charity, and b) It appears that when next in use the hereditament will be wholly or mainly used for charitable purposes (whether of that charity or of that and other charities) • Preston contended that it must be next used by that charity • Trust submitted that it was not necessary to show that the owning charity would occupy Gordon Heath Ltd 45

Letting to a Charity – Preston Case • Local Government Finance Act 1988 s 45 A(2) provides that empty properties are zero rated where a) The ratepayer is a charity, and b) It appears that when next in use the hereditament will be wholly or mainly used for charitable purposes (whether of that charity or of that and other charities) • Preston contended that it must be next used by that charity • Trust submitted that it was not necessary to show that the owning charity would occupy Gordon Heath Ltd 45

Letting to a Charity – Preston Case • Trust also contended that the words “whether of that charity or of that and other charities” meant “whether of that charity or other charities” • The issue of the purposes of the charity occupying the charity shop was not considered • The only issue was whether it had to appear that the owning charity would next occupy and use the property • The Magistrates accepted the Trusts arguments Gordon Heath Ltd 46

Letting to a Charity – Preston Case • Trust also contended that the words “whether of that charity or of that and other charities” meant “whether of that charity or other charities” • The issue of the purposes of the charity occupying the charity shop was not considered • The only issue was whether it had to appear that the owning charity would next occupy and use the property • The Magistrates accepted the Trusts arguments Gordon Heath Ltd 46

Letting to a Charity – Preston Case • Appeal by case stated posed the question “Whether the justices were right to conclude that the [Trust] had established that the [Trust] was under section 45 A(2) of the Local Government Act 1988 exempted from liability for each of the applications for liability orders on the basis that the occupier/or user of each of the premises the subject of the said application would be charities other than the [Trust]. ” Gordon Heath Ltd 47

Letting to a Charity – Preston Case • Appeal by case stated posed the question “Whether the justices were right to conclude that the [Trust] had established that the [Trust] was under section 45 A(2) of the Local Government Act 1988 exempted from liability for each of the applications for liability orders on the basis that the occupier/or user of each of the premises the subject of the said application would be charities other than the [Trust]. ” Gordon Heath Ltd 47

Letting to a Charity – Preston Case • Judge concluded that Preston’s arguments would require the addition of the words “by that charity” after “wholly or mainly used” • The words mean “used for the charitable objects of the owning charity, accompanied or not by other charitable purposes” • “The requirement for it to appear additionally that, when the property is next used, the currently-owning charity will occupy and use the property cannot be read in” Gordon Heath Ltd 48

Letting to a Charity – Preston Case • Judge concluded that Preston’s arguments would require the addition of the words “by that charity” after “wholly or mainly used” • The words mean “used for the charitable objects of the owning charity, accompanied or not by other charitable purposes” • “The requirement for it to appear additionally that, when the property is next used, the currently-owning charity will occupy and use the property cannot be read in” Gordon Heath Ltd 48

Letting to a Charity – Preston Case • Hence the answer to the question posed is “Yes” the magistrates were correct • “I stress that answer is based upon the issues that were before the magistrates, before whom the possibility of charities sought as sub-licensees having charitable purposes entirely different from the wide charitable objects of the Trust was not in issue” • Appeal dismissed Gordon Heath Ltd 49

Letting to a Charity – Preston Case • Hence the answer to the question posed is “Yes” the magistrates were correct • “I stress that answer is based upon the issues that were before the magistrates, before whom the possibility of charities sought as sub-licensees having charitable purposes entirely different from the wide charitable objects of the Trust was not in issue” • Appeal dismissed Gordon Heath Ltd 49

Letting to a Charity – Bluetooth • Public Safety Charitable Trust v Milton Keynes Council, PSCT v South Cambridgeshire District Council, Cheshire West and Chester Borough Council v PSCT • [2013] EWHC 1237 (Admin) • CO/8616/2012 • Decision given on 14 May 2013 • Billing Authorities won all 3 cases and costs were awarded • “Wholly or mainly used for charitable purposes” refers to the amount of actual use and not the purpose of the use • Wi-fi hereditament in Cheshire case referred to all 13 • Wi-fi might work for 6 weeks • Wi-fi does not work for charitable status Gordon Heath Ltd 50

Letting to a Charity – Bluetooth • Public Safety Charitable Trust v Milton Keynes Council, PSCT v South Cambridgeshire District Council, Cheshire West and Chester Borough Council v PSCT • [2013] EWHC 1237 (Admin) • CO/8616/2012 • Decision given on 14 May 2013 • Billing Authorities won all 3 cases and costs were awarded • “Wholly or mainly used for charitable purposes” refers to the amount of actual use and not the purpose of the use • Wi-fi hereditament in Cheshire case referred to all 13 • Wi-fi might work for 6 weeks • Wi-fi does not work for charitable status Gordon Heath Ltd 50

Letting to a Charity – Bluetooth • Chester and West Cheshire Council v Public Safety Charitable Trust 2012 • Substantial office in Chester • 4 floors, RV £ 52, 500 • Landlord – Tameside MBC • Vacant since 2010 • PSCT had a leasehold agreement from December 2010 • Installed 13 Bluetooth transmitters Gordon Heath Ltd 51

Letting to a Charity – Bluetooth • Chester and West Cheshire Council v Public Safety Charitable Trust 2012 • Substantial office in Chester • 4 floors, RV £ 52, 500 • Landlord – Tameside MBC • Vacant since 2010 • PSCT had a leasehold agreement from December 2010 • Installed 13 Bluetooth transmitters Gordon Heath Ltd 51

Letting to a Charity – Bluetooth • • • Lease for 1 year to December 2011 Rent of £ 1 per annum Reverse premium of £ 7, 607. 25 payable by landlord to PSCT Terminable at 7 days notice Second lease for 1 year to December 2012 PSCT has a contractural arrangement with Commercial Links to install and maintain Bluetooth equipment Gordon Heath Ltd 52

Letting to a Charity – Bluetooth • • • Lease for 1 year to December 2011 Rent of £ 1 per annum Reverse premium of £ 7, 607. 25 payable by landlord to PSCT Terminable at 7 days notice Second lease for 1 year to December 2012 PSCT has a contractural arrangement with Commercial Links to install and maintain Bluetooth equipment Gordon Heath Ltd 52

Letting to a Charity – Bluetooth • • PSCT applied for charitable relief in February 2011 PSCT is a registered charity formed in 2010 PSCT is non-profit making Charitable objects to promote the efficiency of the police and prevention and solution of crime Mandatory and discretionary relief granted About 60 similar applications by PSCT received June 2011 – Council removed discretionary relief August 2011 – removed mandatory relief Gordon Heath Ltd 53

Letting to a Charity – Bluetooth • • PSCT applied for charitable relief in February 2011 PSCT is a registered charity formed in 2010 PSCT is non-profit making Charitable objects to promote the efficiency of the police and prevention and solution of crime Mandatory and discretionary relief granted About 60 similar applications by PSCT received June 2011 – Council removed discretionary relief August 2011 – removed mandatory relief Gordon Heath Ltd 53

Letting to a Charity – Bluetooth • September 2011 – Council contacted VOA • November 2011 - VOA created a new hereditament from 12 December 2010 for a “Wi. Fi site at 1 Heritage Court” RV £ 100 • Council granted mandatory relief on Wi. Fi hereditament – accepting the charitable occupation • New demands for empty rate on offices and liability orders sought • It does not appear to the Council that when next in use it will be used for a charitable purpose Gordon Heath Ltd 54

Letting to a Charity – Bluetooth • September 2011 – Council contacted VOA • November 2011 - VOA created a new hereditament from 12 December 2010 for a “Wi. Fi site at 1 Heritage Court” RV £ 100 • Council granted mandatory relief on Wi. Fi hereditament – accepting the charitable occupation • New demands for empty rate on offices and liability orders sought • It does not appear to the Council that when next in use it will be used for a charitable purpose Gordon Heath Ltd 54

Letting to a Charity – Bluetooth • 13 Bluetooth boxes monitored remotely • Communication Links visit the property no more than once a month to check and reposition equipment • Need access throughout the building • Each box needs an electricity supply • There is one “Wi. Fi hereditament” within the building but 12 other transmitters within the office building Gordon Heath Ltd 55

Letting to a Charity – Bluetooth • 13 Bluetooth boxes monitored remotely • Communication Links visit the property no more than once a month to check and reposition equipment • Need access throughout the building • Each box needs an electricity supply • There is one “Wi. Fi hereditament” within the building but 12 other transmitters within the office building Gordon Heath Ltd 55

Letting to a Charity – Bluetooth • • • Meets the 4 ingredients of occupation of the offices PSCT is a registered charity Council accepts the use is charitable Is it “wholly or mainly” used for a charitable purpose? Different from the Edinburgh case because regular access is required to the whole building • Liability order refused and the Magistrates’ Court found that PSCT are entitled to mandatory relief and should ask the Council to reconsider discretionary relief • Appeal to the High Court that hereditament is not “wholly or mainly” used for charitable purposes • High Court found that it was not “wholly or mainly” used for charitable purposes Gordon Heath Ltd 56

Letting to a Charity – Bluetooth • • • Meets the 4 ingredients of occupation of the offices PSCT is a registered charity Council accepts the use is charitable Is it “wholly or mainly” used for a charitable purpose? Different from the Edinburgh case because regular access is required to the whole building • Liability order refused and the Magistrates’ Court found that PSCT are entitled to mandatory relief and should ask the Council to reconsider discretionary relief • Appeal to the High Court that hereditament is not “wholly or mainly” used for charitable purposes • High Court found that it was not “wholly or mainly” used for charitable purposes Gordon Heath Ltd 56

Letting to a Charity – Bluetooth • South Cambridgeshire case billing authority refused mandatory relief – separate wi-fi hereditament • Milton Keynes case – billing authority refuse mandatory relief – no separate wi-fi hereditament • PSCT lost all 3 cases • PSCT under investigation by Charity Commission since October 2011 • PSCT subject to formal enquiry by Charity Commission since May 2013 • PSCT wound up in the High Court in July 2013 Gordon Heath Ltd 57

Letting to a Charity – Bluetooth • South Cambridgeshire case billing authority refused mandatory relief – separate wi-fi hereditament • Milton Keynes case – billing authority refuse mandatory relief – no separate wi-fi hereditament • PSCT lost all 3 cases • PSCT under investigation by Charity Commission since October 2011 • PSCT subject to formal enquiry by Charity Commission since May 2013 • PSCT wound up in the High Court in July 2013 Gordon Heath Ltd 57

Charity – Africa Relief Trust • Africa Relief Trust under investigation by Charity Commission since October 2011 • Concerns regarding its business rates relief arrangements • Formal inquiry by Charity Commission since 12 July 2013 • The purpose of the inquiry is to examine regulatory concerns including whether the charity trustees have properly discharged their trustees duties when making decisions to enter into tenancy agreements and occupy those properties to further their charitable purposes and whether any benefit to the landlord or other parties is incidental to that • The Commission has issued alerts to charities warning them of the risks associated with business rates relief Gordon Heath Ltd 58

Charity – Africa Relief Trust • Africa Relief Trust under investigation by Charity Commission since October 2011 • Concerns regarding its business rates relief arrangements • Formal inquiry by Charity Commission since 12 July 2013 • The purpose of the inquiry is to examine regulatory concerns including whether the charity trustees have properly discharged their trustees duties when making decisions to enter into tenancy agreements and occupy those properties to further their charitable purposes and whether any benefit to the landlord or other parties is incidental to that • The Commission has issued alerts to charities warning them of the risks associated with business rates relief Gordon Heath Ltd 58

Letting to a Company in Liquidation • Insolvency Service guidance – dear IP March 2012 Issue 53 chapter 26, Companies Investigation Branch • www. insolvencydirect. bis. gov. uk/insolvencyprofessionandlegislation/ dearip/dearipmill/chapter 26. htm#3 • On 29 July 2011 The Insolvency Service’s Company Investigations successfully applied for the winding up of 13 companies • Failed to appoint a liquidator • Set up for holding leases and the landlord claimed an exemption from NNDR • The court found that such a scheme was contrary to the public interest Gordon Heath Ltd 59

Letting to a Company in Liquidation • Insolvency Service guidance – dear IP March 2012 Issue 53 chapter 26, Companies Investigation Branch • www. insolvencydirect. bis. gov. uk/insolvencyprofessionandlegislation/ dearip/dearipmill/chapter 26. htm#3 • On 29 July 2011 The Insolvency Service’s Company Investigations successfully applied for the winding up of 13 companies • Failed to appoint a liquidator • Set up for holding leases and the landlord claimed an exemption from NNDR • The court found that such a scheme was contrary to the public interest Gordon Heath Ltd 59

Letting to a Company in Liquidation • “The Service now has reason to believe that a variation on this arrangement has emerged, allowing landlords to avoiding paying rates. A number of cases have been brought to The Service’s attention of instances where an insolvency practitioner has been appointed as liquidator of a company in a members voluntary liquidation, shortly after the company has entered into a lease, for premises it appears to have no legitimate use for. These instances have been characterised by features such as an extremely short period of time between the company entering into the lease and entering members voluntary liquidation, and peppercorn rents. ” Gordon Heath Ltd 60

Letting to a Company in Liquidation • “The Service now has reason to believe that a variation on this arrangement has emerged, allowing landlords to avoiding paying rates. A number of cases have been brought to The Service’s attention of instances where an insolvency practitioner has been appointed as liquidator of a company in a members voluntary liquidation, shortly after the company has entered into a lease, for premises it appears to have no legitimate use for. These instances have been characterised by features such as an extremely short period of time between the company entering into the lease and entering members voluntary liquidation, and peppercorn rents. ” Gordon Heath Ltd 60

Letting to a Company in Liquidation • “In light of the court’s decision to wind up the 13 companies on the grounds the arrangement was held to be contrary to the public interest, The Service is of the opinion that in cases where a practitioner takes an appointment in a members voluntary liquidation, in which the main aim of the arrangement is to facilitate the non-payment of rates, such an arrangement would also be contrary to the public interest. ” Gordon Heath Ltd 61

Letting to a Company in Liquidation • “In light of the court’s decision to wind up the 13 companies on the grounds the arrangement was held to be contrary to the public interest, The Service is of the opinion that in cases where a practitioner takes an appointment in a members voluntary liquidation, in which the main aim of the arrangement is to facilitate the non-payment of rates, such an arrangement would also be contrary to the public interest. ” Gordon Heath Ltd 61

Letting to a Company in Liquidation • “As such, if The Service is made aware of practitioners participating in these types of arrangements, it will consider reporting the matter to his/her Recognised Professional Body. ” • Any enquiries regarding this article should be directed towards Gareth Allen, Intelligence & Enforcement Services, 4 th Floor, 21 Bloomsbury Street, London WC 1 B 3 QW telephone: 020 7291 689? e-mail: gareth. allen@insolvency. gsi. gov. uk Gordon Heath Ltd 62

Letting to a Company in Liquidation • “As such, if The Service is made aware of practitioners participating in these types of arrangements, it will consider reporting the matter to his/her Recognised Professional Body. ” • Any enquiries regarding this article should be directed towards Gareth Allen, Intelligence & Enforcement Services, 4 th Floor, 21 Bloomsbury Street, London WC 1 B 3 QW telephone: 020 7291 689? e-mail: gareth. allen@insolvency. gsi. gov. uk Gordon Heath Ltd 62

Conclusions • • Empty rate avoidance is legal – Westminster principle The Ramsay Principle/Furniss case is a “red herring” De minimis occupation can be ignored unless it is beneficial Actual and Beneficial Occupation are the key issues Blue tooth occupation – can be rateable occupation if beneficial Blue tooth occupation by charities – not entitled to mandatory relief Inspecting occupation by boxes is difficult but vital Government is looking at avoidance Gordon Heath Ltd 63

Conclusions • • Empty rate avoidance is legal – Westminster principle The Ramsay Principle/Furniss case is a “red herring” De minimis occupation can be ignored unless it is beneficial Actual and Beneficial Occupation are the key issues Blue tooth occupation – can be rateable occupation if beneficial Blue tooth occupation by charities – not entitled to mandatory relief Inspecting occupation by boxes is difficult but vital Government is looking at avoidance Gordon Heath Ltd 63

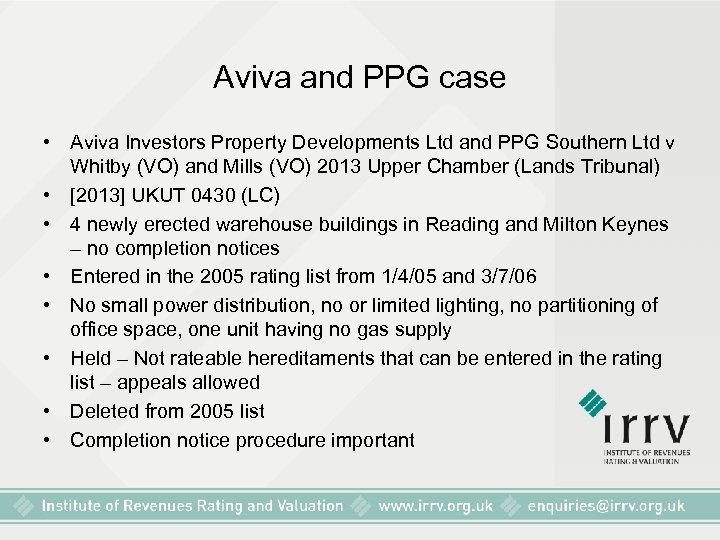

New Build Empty Property • Announced by Chancellor in the Autumn Statement on 5 December 2012 • All newly built commercial property in England completed between 1 October 2013 and 30 September 2016 to be exempt from empty rates for the first 18 months, up to state aid limits • Purpose – stimulate construction

New Build Empty Property • Announced by Chancellor in the Autumn Statement on 5 December 2012 • All newly built commercial property in England completed between 1 October 2013 and 30 September 2016 to be exempt from empty rates for the first 18 months, up to state aid limits • Purpose – stimulate construction

New Build Empty Property • • Temporary measure No change to rules on empty rate exemptions Discretionary relief under s 47 LGFA 1988 Fully funded by central Government by a grant under s 31 LGA 2003 for relief granted in specified circumstances up to State Aid de minimis limits

New Build Empty Property • • Temporary measure No change to rules on empty rate exemptions Discretionary relief under s 47 LGFA 1988 Fully funded by central Government by a grant under s 31 LGA 2003 for relief granted in specified circumstances up to State Aid de minimis limits

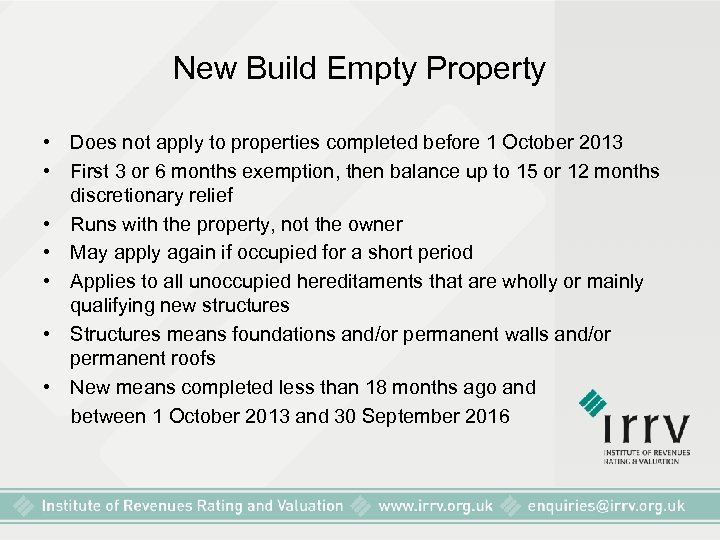

New Build Empty Property • Does not apply to properties completed before 1 October 2013 • First 3 or 6 months exemption, then balance up to 15 or 12 months discretionary relief • Runs with the property, not the owner • May apply again if occupied for a short period • Applies to all unoccupied hereditaments that are wholly or mainly qualifying new structures • Structures means foundations and/or permanent walls and/or permanent roofs • New means completed less than 18 months ago and between 1 October 2013 and 30 September 2016

New Build Empty Property • Does not apply to properties completed before 1 October 2013 • First 3 or 6 months exemption, then balance up to 15 or 12 months discretionary relief • Runs with the property, not the owner • May apply again if occupied for a short period • Applies to all unoccupied hereditaments that are wholly or mainly qualifying new structures • Structures means foundations and/or permanent walls and/or permanent roofs • New means completed less than 18 months ago and between 1 October 2013 and 30 September 2016

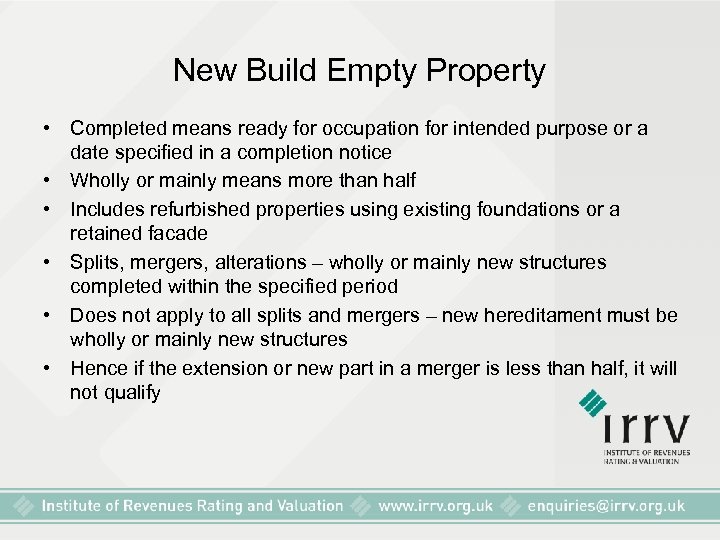

New Build Empty Property • Completed means ready for occupation for intended purpose or a date specified in a completion notice • Wholly or mainly means more than half • Includes refurbished properties using existing foundations or a retained facade • Splits, mergers, alterations – wholly or mainly new structures completed within the specified period • Does not apply to all splits and mergers – new hereditament must be wholly or mainly new structures • Hence if the extension or new part in a merger is less than half, it will not qualify

New Build Empty Property • Completed means ready for occupation for intended purpose or a date specified in a completion notice • Wholly or mainly means more than half • Includes refurbished properties using existing foundations or a retained facade • Splits, mergers, alterations – wholly or mainly new structures completed within the specified period • Does not apply to all splits and mergers – new hereditament must be wholly or mainly new structures • Hence if the extension or new part in a merger is less than half, it will not qualify

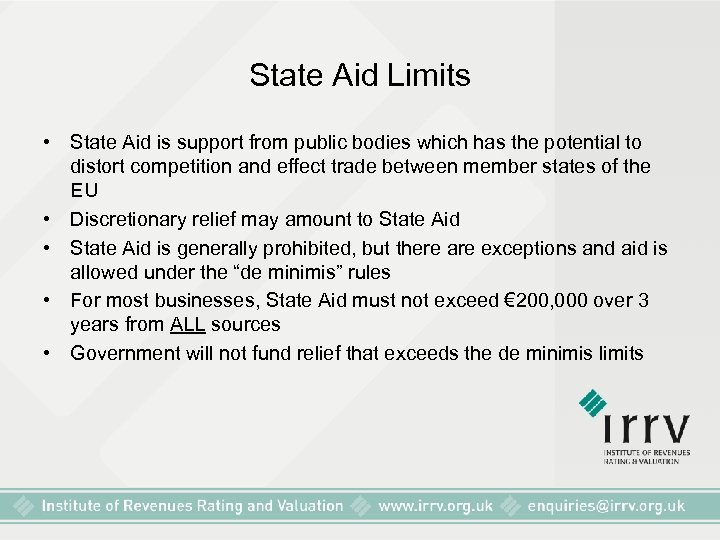

State Aid Limits • State Aid is support from public bodies which has the potential to distort competition and effect trade between member states of the EU • Discretionary relief may amount to State Aid • State Aid is generally prohibited, but there are exceptions and aid is allowed under the “de minimis” rules • For most businesses, State Aid must not exceed € 200, 000 over 3 years from ALL sources • Government will not fund relief that exceeds the de minimis limits

State Aid Limits • State Aid is support from public bodies which has the potential to distort competition and effect trade between member states of the EU • Discretionary relief may amount to State Aid • State Aid is generally prohibited, but there are exceptions and aid is allowed under the “de minimis” rules • For most businesses, State Aid must not exceed € 200, 000 over 3 years from ALL sources • Government will not fund relief that exceeds the de minimis limits

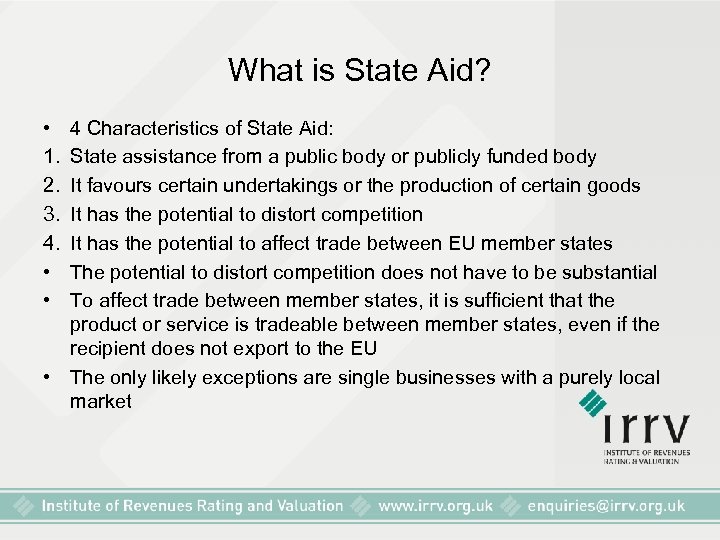

What is State Aid? • 1. 2. 3. 4. • • 4 Characteristics of State Aid: State assistance from a public body or publicly funded body It favours certain undertakings or the production of certain goods It has the potential to distort competition It has the potential to affect trade between EU member states The potential to distort competition does not have to be substantial To affect trade between member states, it is sufficient that the product or service is tradeable between member states, even if the recipient does not export to the EU • The only likely exceptions are single businesses with a purely local market

What is State Aid? • 1. 2. 3. 4. • • 4 Characteristics of State Aid: State assistance from a public body or publicly funded body It favours certain undertakings or the production of certain goods It has the potential to distort competition It has the potential to affect trade between EU member states The potential to distort competition does not have to be substantial To affect trade between member states, it is sufficient that the product or service is tradeable between member states, even if the recipient does not export to the EU • The only likely exceptions are single businesses with a purely local market

What is State Aid? • Member states must notify and seek approval from the European Commission before granting State Aid • The Commission must order the recovery of any aid that has not been properly notified and approved, even if it makes the company insolvent • Repayment is with interest • Exemptions apply to Community objectives • Aid must be notified and approved by the European Commission first • The General Block Exemption Regulation (GBER) applies to a whole range of aid measures that are less problematic in competition terms • The UK also has a number of different approved aid schemes in place that may be used by public authorities

What is State Aid? • Member states must notify and seek approval from the European Commission before granting State Aid • The Commission must order the recovery of any aid that has not been properly notified and approved, even if it makes the company insolvent • Repayment is with interest • Exemptions apply to Community objectives • Aid must be notified and approved by the European Commission first • The General Block Exemption Regulation (GBER) applies to a whole range of aid measures that are less problematic in competition terms • The UK also has a number of different approved aid schemes in place that may be used by public authorities

State Aid Exemptions • Less than € 200, 000 to any undertaking over any rolling three year period is considered to be de minimis • € 100, 000 in the road transport sector • This aid may be given without notification or approval but records of aid granted must be maintained • All the terms of the De Minimis Regulation must be followed – it is easy to make a mistake where undertakings are not independent but linked to other undertakings, such as a parent company

State Aid Exemptions • Less than € 200, 000 to any undertaking over any rolling three year period is considered to be de minimis • € 100, 000 in the road transport sector • This aid may be given without notification or approval but records of aid granted must be maintained • All the terms of the De Minimis Regulation must be followed – it is easy to make a mistake where undertakings are not independent but linked to other undertakings, such as a parent company

State Aid Exemptions The de minimis rule does not apply to: • Fishery and aquaculture sectors • Agriculture • Export related activities • Aid contingent on the use of domestic goods • Coal sector • Road freight transport sector • Undertakings in difficulties

State Aid Exemptions The de minimis rule does not apply to: • Fishery and aquaculture sectors • Agriculture • Export related activities • Aid contingent on the use of domestic goods • Coal sector • Road freight transport sector • Undertakings in difficulties

COMPLETION NOTICES • Still important despite 18 months relief for some • if an authority is aware that the remaining work to be carried out on a new building can be reasonably expected to be completed within three months, the authority shall serve a notice on the owner of the building unless the valuation officer (VO) directs otherwise in writing • if the building is complete then a notice may be served on the owner unless the VO directs otherwise in writing

COMPLETION NOTICES • Still important despite 18 months relief for some • if an authority is aware that the remaining work to be carried out on a new building can be reasonably expected to be completed within three months, the authority shall serve a notice on the owner of the building unless the valuation officer (VO) directs otherwise in writing • if the building is complete then a notice may be served on the owner unless the VO directs otherwise in writing

The Tewksbury Case • • • Porter (VO) v Trustees of Gladman Sipps Upper Tribunal (Lands Chamber) [2011] UKUT 204 (LC) 28 March 2011, London Re: Completion and inclusion in the list of 19 Office Units, Miller Court, Tewkesbury

The Tewksbury Case • • • Porter (VO) v Trustees of Gladman Sipps Upper Tribunal (Lands Chamber) [2011] UKUT 204 (LC) 28 March 2011, London Re: Completion and inclusion in the list of 19 Office Units, Miller Court, Tewkesbury

The Tewksbury Case • • • Gloucestershire VT deleted all 19 entries No completion notices served Speculative office development – 20 units 19 units empty on 1 May 2006 Plastered walls, suspended ceilings, lighting, air conditioning, raised floors with voids, WCs Some units had alarms, tea points, passenger lifts Power as far as the central core only External doors, double glazing, some fire doors No partitioning, data cabling or telephones Car Parking for each unit

The Tewksbury Case • • • Gloucestershire VT deleted all 19 entries No completion notices served Speculative office development – 20 units 19 units empty on 1 May 2006 Plastered walls, suspended ceilings, lighting, air conditioning, raised floors with voids, WCs Some units had alarms, tea points, passenger lifts Power as far as the central core only External doors, double glazing, some fire doors No partitioning, data cabling or telephones Car Parking for each unit

The Tewksbury Case • VO contended that the remaining work was minor or de minimis and cabling, tea points, etc. were tenant’s fit out • VO felt the properties were complete and were hereditaments • Ratepayer contended that the properties were not capable of occupation as offices without substantial work • VO Rating Manual – property not a hereditament when substantially complete but without tenant’s fit out • Completion notice required at that stage

The Tewksbury Case • VO contended that the remaining work was minor or de minimis and cabling, tea points, etc. were tenant’s fit out • VO felt the properties were complete and were hereditaments • Ratepayer contended that the properties were not capable of occupation as offices without substantial work • VO Rating Manual – property not a hereditament when substantially complete but without tenant’s fit out • Completion notice required at that stage

The Tewksbury Case • Decision – building is a hereditament if it is ready for occupation • Must be assessed in the light of the purpose for which it is designed to be occupied • No scope for rating a building that is very nearly ready for occupation without a completion notice first • Occupier would require more power points, tea points and some partitioning plus consequential fitting out • VT correct – Appeal dismissed

The Tewksbury Case • Decision – building is a hereditament if it is ready for occupation • Must be assessed in the light of the purpose for which it is designed to be occupied • No scope for rating a building that is very nearly ready for occupation without a completion notice first • Occupier would require more power points, tea points and some partitioning plus consequential fitting out • VT correct – Appeal dismissed

Prudential Assurance case • • • Prudential Assurance Co Ltd v a Valuation Officer 2011 VTE Surrey case – 24 May 2011 Before Prof. Zellick RE: 3 and 4 The Heights, Weybridge Validity of a completion notice can be challenged on a proposal in the VTE • Challenge must be timely

Prudential Assurance case • • • Prudential Assurance Co Ltd v a Valuation Officer 2011 VTE Surrey case – 24 May 2011 Before Prof. Zellick RE: 3 and 4 The Heights, Weybridge Validity of a completion notice can be challenged on a proposal in the VTE • Challenge must be timely

Prudential Assurance case • Proposals to delete on ground hereditaments improperly entered as not complete • Completion notices served but on developer not the owner • Subsequent agreement between owner and BA as to completion day

Prudential Assurance case • Proposals to delete on ground hereditaments improperly entered as not complete • Completion notices served but on developer not the owner • Subsequent agreement between owner and BA as to completion day

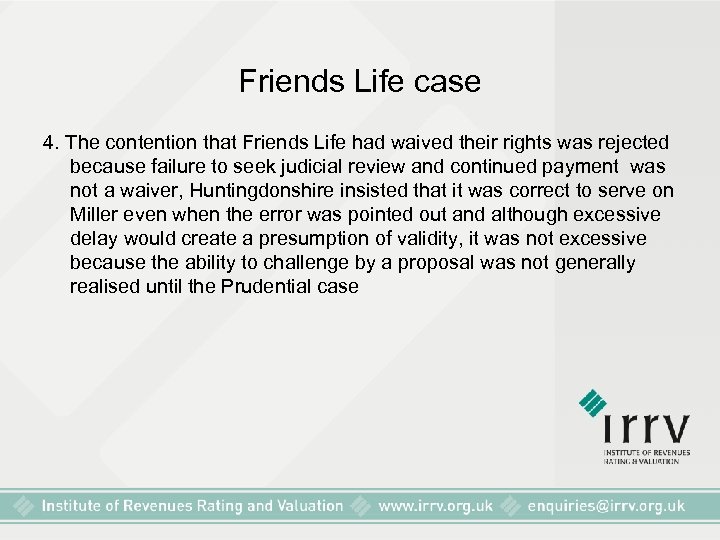

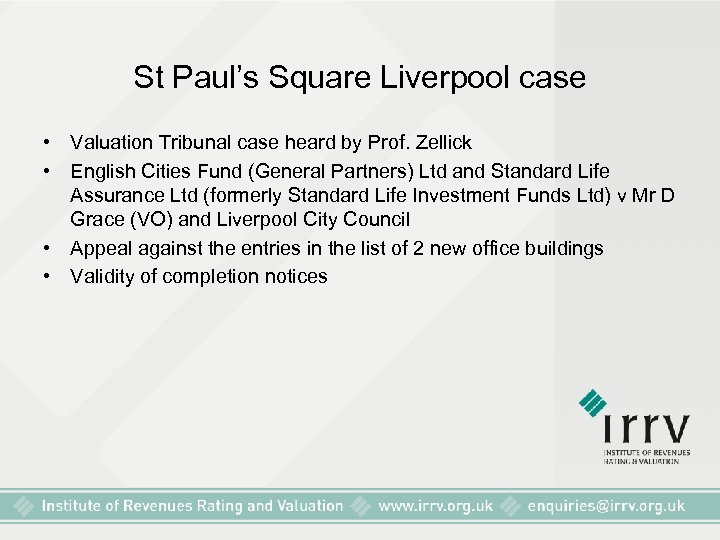

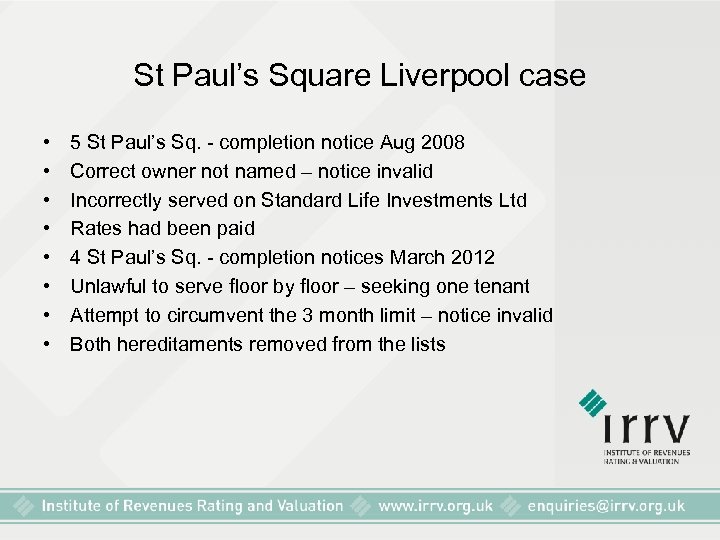

Prudential Assurance case • VO argued the VTE had no jurisdiction to consider whether or not the notice was valid as: • There is a statutory right of appeal for completion notices • VO in no position to defend validity of completion notice as he did not serve it • President rejected VO’s submissions • If no completion notice then properties not complete and entries unsound • BA could be added as a party • VTE did have jurisdiction