14faa1cec6e6ab0125c6cc0ce5c1b68c.ppt

- Количество слайдов: 40

Empowering Cooperatives through Information & Communication Technology: Connectivity & Accessibility Cresente C. Paez President & CEO National Confederation of Cooperatives (NATCCO) - Philippines

Empowering Cooperatives through Information & Communication Technology: Connectivity & Accessibility Cresente C. Paez President & CEO National Confederation of Cooperatives (NATCCO) - Philippines

About NATCCO… n n n The biggest and strongest national federation of cooperatives in the country in terms of geographical reach, membership, financial capacity and array of services. Core financial functions focused on treasury, deposit -taking, credit-granting, money transfer and cash management services Non-financial services include accounting software, website development, training & consulting on microfinance, ICT specialization (it@coops), and professionalization of cooperatives.

About NATCCO… n n n The biggest and strongest national federation of cooperatives in the country in terms of geographical reach, membership, financial capacity and array of services. Core financial functions focused on treasury, deposit -taking, credit-granting, money transfer and cash management services Non-financial services include accounting software, website development, training & consulting on microfinance, ICT specialization (it@coops), and professionalization of cooperatives.

About NATCCO… n n We are a national financial solutions cooperative, servicing the needs of 1. 2 million individuals through our local cooperatives. Our solutions conform international financial intermediation standards; and the highest degree in responding to the needs of the communities we serve.

About NATCCO… n n We are a national financial solutions cooperative, servicing the needs of 1. 2 million individuals through our local cooperatives. Our solutions conform international financial intermediation standards; and the highest degree in responding to the needs of the communities we serve.

…. NATCCO throughout the country has embraced this financial solution for: Liquidity pool management n Wholesale lending n Cash management services Investment in hi-impact, high growth enterprises n Development of information technology (IT) n Microfinance Innovations Capability building through training & consulting n n n

…. NATCCO throughout the country has embraced this financial solution for: Liquidity pool management n Wholesale lending n Cash management services Investment in hi-impact, high growth enterprises n Development of information technology (IT) n Microfinance Innovations Capability building through training & consulting n n n

n The NATCCO NETWORK q q 1. 2 million members 589 co-ops with 354 branches Php 60 billion (US$1. 5 billion) 6, 000 Employees

n The NATCCO NETWORK q q 1. 2 million members 589 co-ops with 354 branches Php 60 billion (US$1. 5 billion) 6, 000 Employees

n The NATCCO Central (As of Dec. 31, 2007) q q q q US$17 million (P 683 million) assets US$1 million (P 40. 4 million) – shares of co-ops US$9. 2 million (P 369 million) – deposits US$5. 3 million (P 212 million) – borrowings US$7. 9 million (P 317 million) – loans disbursed PAR – 0. 6% US$0. 17 million (P 7 million) - Net Surplus 87 employees

n The NATCCO Central (As of Dec. 31, 2007) q q q q US$17 million (P 683 million) assets US$1 million (P 40. 4 million) – shares of co-ops US$9. 2 million (P 369 million) – deposits US$5. 3 million (P 212 million) – borrowings US$7. 9 million (P 317 million) – loans disbursed PAR – 0. 6% US$0. 17 million (P 7 million) - Net Surplus 87 employees

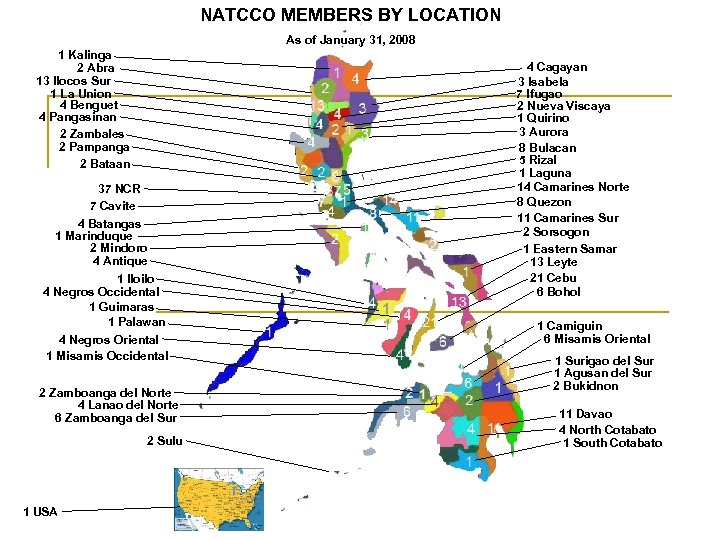

NATCCO MEMBERS BY LOCATION As of January 31, 2008 1 Kalinga 2 Abra 13 Ilocos Sur 1 La Union 4 Benguet 4 Pangasinan 2 Zambales 2 Pampanga 2 Bataan 37 NCR 7 Cavite 4 Batangas 1 Marinduque 2 Mindoro 4 Antique 1 Iloilo 4 Negros Occidental 1 Guimaras 1 Palawan 4 Negros Oriental 1 Misamis Occidental 2 Zamboanga del Norte 4 Lanao del Norte 6 Zamboanga del Sur 2 Sulu 1 USA 4 Cagayan 3 Isabela 7 Ifugao 2 Nueva Viscaya 1 Quirino 3 Aurora 8 Bulacan 5 Rizal 1 Laguna 14 Camarines Norte 8 Quezon 11 Camarines Sur 2 Sorsogon 1 Eastern Samar 13 Leyte 21 Cebu 6 Bohol 1 Camiguin 6 Misamis Oriental 1 Surigao del Sur 1 Agusan del Sur 2 Bukidnon 11 Davao 4 North Cotabato 1 South Cotabato

NATCCO MEMBERS BY LOCATION As of January 31, 2008 1 Kalinga 2 Abra 13 Ilocos Sur 1 La Union 4 Benguet 4 Pangasinan 2 Zambales 2 Pampanga 2 Bataan 37 NCR 7 Cavite 4 Batangas 1 Marinduque 2 Mindoro 4 Antique 1 Iloilo 4 Negros Occidental 1 Guimaras 1 Palawan 4 Negros Oriental 1 Misamis Occidental 2 Zamboanga del Norte 4 Lanao del Norte 6 Zamboanga del Sur 2 Sulu 1 USA 4 Cagayan 3 Isabela 7 Ifugao 2 Nueva Viscaya 1 Quirino 3 Aurora 8 Bulacan 5 Rizal 1 Laguna 14 Camarines Norte 8 Quezon 11 Camarines Sur 2 Sorsogon 1 Eastern Samar 13 Leyte 21 Cebu 6 Bohol 1 Camiguin 6 Misamis Oriental 1 Surigao del Sur 1 Agusan del Sur 2 Bukidnon 11 Davao 4 North Cotabato 1 South Cotabato

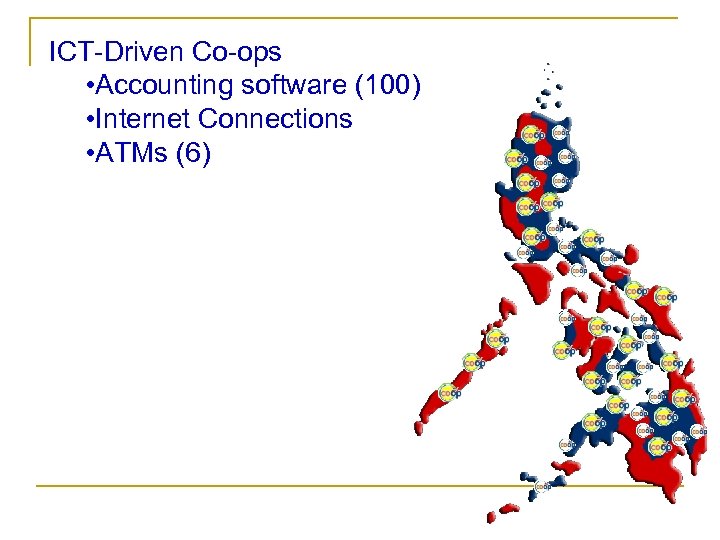

ICT-Driven Co-ops • Accounting software (100) • Internet Connections • ATMs (6)

ICT-Driven Co-ops • Accounting software (100) • Internet Connections • ATMs (6)

Why Information & Communication Technology? n n n Competitiveness is the key that drove NATCCO to go into ICT as a tool to deliver more competitive products and services to cooperatives and its members 2003, initially implemented ICT within the organization, giving birth to: q Local Area Network q Internet & Email q NATCCO Website q ICT Trainings

Why Information & Communication Technology? n n n Competitiveness is the key that drove NATCCO to go into ICT as a tool to deliver more competitive products and services to cooperatives and its members 2003, initially implemented ICT within the organization, giving birth to: q Local Area Network q Internet & Email q NATCCO Website q ICT Trainings

Specific Developmental Problems that ICT should Address in the Cooperatives… n Automated financial transactions & accounting q q q Volume of transactions: shift from manualization to automation The issue of accuracy, efficiency, speed, analysis, and MIS (generation of reports) Data generation (network wide) The issue of different system providers (i. e. outsourced, in-house) and their continuity. Expensive to develop and maintain by one local co-op

Specific Developmental Problems that ICT should Address in the Cooperatives… n Automated financial transactions & accounting q q q Volume of transactions: shift from manualization to automation The issue of accuracy, efficiency, speed, analysis, and MIS (generation of reports) Data generation (network wide) The issue of different system providers (i. e. outsourced, in-house) and their continuity. Expensive to develop and maintain by one local co-op

Specific problems… n The inconvenience of transactions “over the counter” q q q Crowding of customers during peak hours. Offices are closed before 8: 00 a. m. and after 5: 00 p. m. and during Saturdays & Sundays Proximity: Long distances to travel

Specific problems… n The inconvenience of transactions “over the counter” q q q Crowding of customers during peak hours. Offices are closed before 8: 00 a. m. and after 5: 00 p. m. and during Saturdays & Sundays Proximity: Long distances to travel

Specific problems… n Money Transfer q q No access to payout centers in rural areas (money sent from other places) Bank-to-bank transfer: requirement to open a bank account and pay expensive remittance fee

Specific problems… n Money Transfer q q No access to payout centers in rural areas (money sent from other places) Bank-to-bank transfer: requirement to open a bank account and pay expensive remittance fee

e. Koop. Banker - Coop Banking System

e. Koop. Banker - Coop Banking System

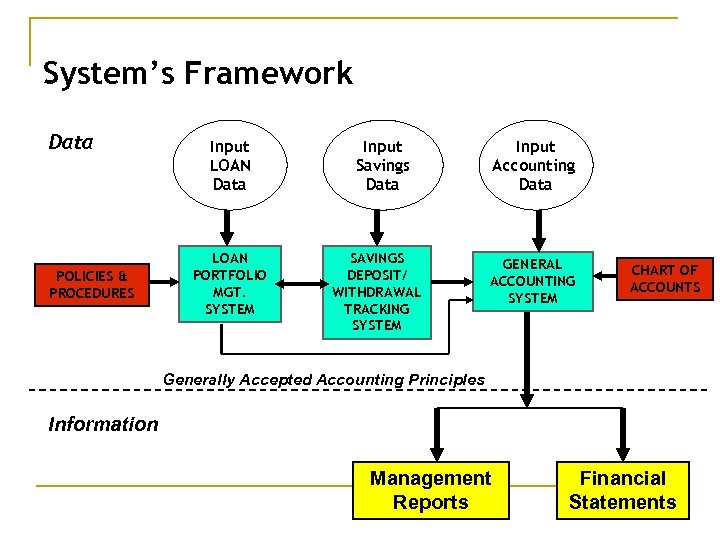

System’s Framework Data POLICIES & PROCEDURES Input LOAN Data LOAN PORTFOLIO MGT. SYSTEM Input Savings Data SAVINGS DEPOSIT/ WITHDRAWAL TRACKING SYSTEM Input Accounting Data GENERAL ACCOUNTING SYSTEM CHART OF ACCOUNTS Generally Accepted Accounting Principles Information Management Reports Financial Statements

System’s Framework Data POLICIES & PROCEDURES Input LOAN Data LOAN PORTFOLIO MGT. SYSTEM Input Savings Data SAVINGS DEPOSIT/ WITHDRAWAL TRACKING SYSTEM Input Accounting Data GENERAL ACCOUNTING SYSTEM CHART OF ACCOUNTS Generally Accepted Accounting Principles Information Management Reports Financial Statements

Technical Features ü Window-Based ü Available on both stand-alone & network versions ü Developed using Visual Basic 6. 0 ü With Microsoft Database Engine (MSDE) or Microsoft SQL Server as its Back-end Database Manager ü Crystal Report enables migration to MS Word, Excel & other file formats

Technical Features ü Window-Based ü Available on both stand-alone & network versions ü Developed using Visual Basic 6. 0 ü With Microsoft Database Engine (MSDE) or Microsoft SQL Server as its Back-end Database Manager ü Crystal Report enables migration to MS Word, Excel & other file formats

e. Koop. Banker - Coop Banking System n Automating the operations of the cooperative q q q n n n Loan portfolio management Savings tracking General accounting Standardization Streamline the operations Member Satisfaction

e. Koop. Banker - Coop Banking System n Automating the operations of the cooperative q q q n n n Loan portfolio management Savings tracking General accounting Standardization Streamline the operations Member Satisfaction

Hindrances n n n n Acceptance End-User Resistance to change Fear of layoffs due to computerization Investment Cost False expectations on automation Lack of knowledge in the complexity and impact of automation Low staff competency Inability to meet automation requirements (time, human & resources)

Hindrances n n n n Acceptance End-User Resistance to change Fear of layoffs due to computerization Investment Cost False expectations on automation Lack of knowledge in the complexity and impact of automation Low staff competency Inability to meet automation requirements (time, human & resources)

Strategies used and Significant Accomplishments… n Strategies Used q q n One standard accounting software for the network To own vs. to outsource: Buy an existing software and enhance Accomplishments: q q Currently installed in 96 cooperatives with 118 branches On-going migration of the system to open-source and web-based application

Strategies used and Significant Accomplishments… n Strategies Used q q n One standard accounting software for the network To own vs. to outsource: Buy an existing software and enhance Accomplishments: q q Currently installed in 96 cooperatives with 118 branches On-going migration of the system to open-source and web-based application

Growth for the e. Koop. Banker n n n n Migration to open-source system Web-base application Inter-branch capabilities Data warehousing Online member transaction SMS transactions ATM Integration

Growth for the e. Koop. Banker n n n n Migration to open-source system Web-base application Inter-branch capabilities Data warehousing Online member transaction SMS transactions ATM Integration

ATM & Cash Cards n Strategies Used q q q n ATM & Cash Cards – to outsource the system For the ATM – to join the ATM network as a nonbank For the Cash Card – co-branding with a bank Accomplishments q q Installed and functional ATMs (Quezon City, Dumaguete, Tacloban & Iligan) For the Cash Card - NATCCO entered into partnership with Chinatrust Bank.

ATM & Cash Cards n Strategies Used q q q n ATM & Cash Cards – to outsource the system For the ATM – to join the ATM network as a nonbank For the Cash Card – co-branding with a bank Accomplishments q q Installed and functional ATMs (Quezon City, Dumaguete, Tacloban & Iligan) For the Cash Card - NATCCO entered into partnership with Chinatrust Bank.

ATM n n NATCCO as the Settlement Bank for cooperatives thru Central Fund Cardholders can transact to any ATM network nationwide q n n n Availability of cash anytime, anywhere Loan disbursement Attract membership Security

ATM n n NATCCO as the Settlement Bank for cooperatives thru Central Fund Cardholders can transact to any ATM network nationwide q n n n Availability of cash anytime, anywhere Loan disbursement Attract membership Security

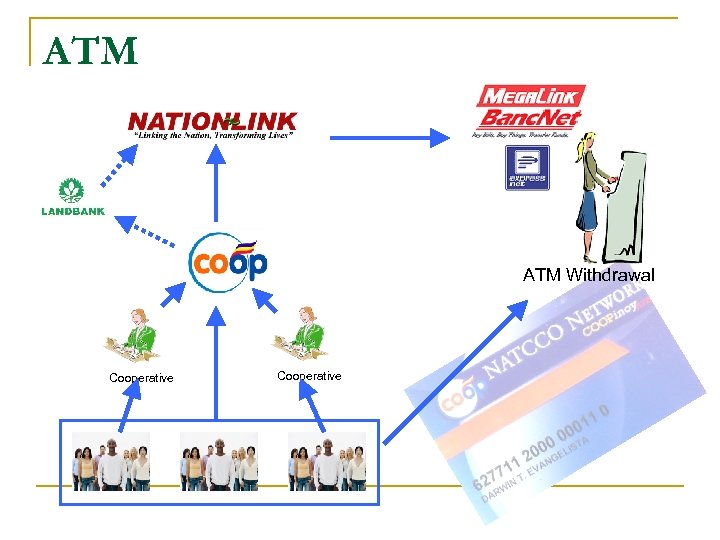

ATM Withdrawal Cooperative

ATM Withdrawal Cooperative

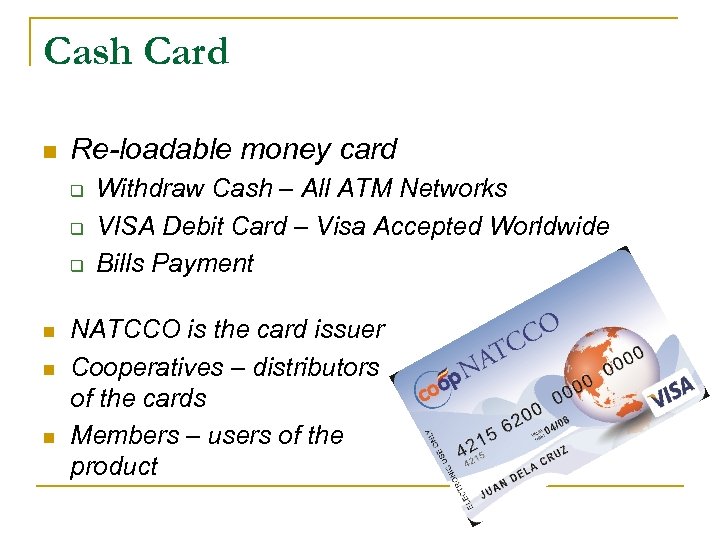

Cash Card n Re-loadable money card q q q n n n Withdraw Cash – All ATM Networks VISA Debit Card – Visa Accepted Worldwide Bills Payment NATCCO is the card issuer Cooperatives – distributors of the cards Members – users of the product

Cash Card n Re-loadable money card q q q n n n Withdraw Cash – All ATM Networks VISA Debit Card – Visa Accepted Worldwide Bills Payment NATCCO is the card issuer Cooperatives – distributors of the cards Members – users of the product

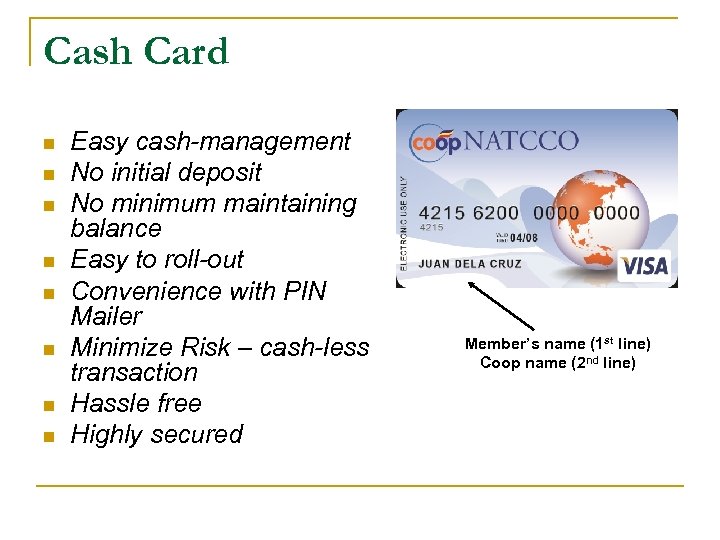

Cash Card n n n n Easy cash-management No initial deposit No minimum maintaining balance Easy to roll-out Convenience with PIN Mailer Minimize Risk – cash-less transaction Hassle free Highly secured Member’s name (1 st line) Coop name (2 nd line)

Cash Card n n n n Easy cash-management No initial deposit No minimum maintaining balance Easy to roll-out Convenience with PIN Mailer Minimize Risk – cash-less transaction Hassle free Highly secured Member’s name (1 st line) Coop name (2 nd line)

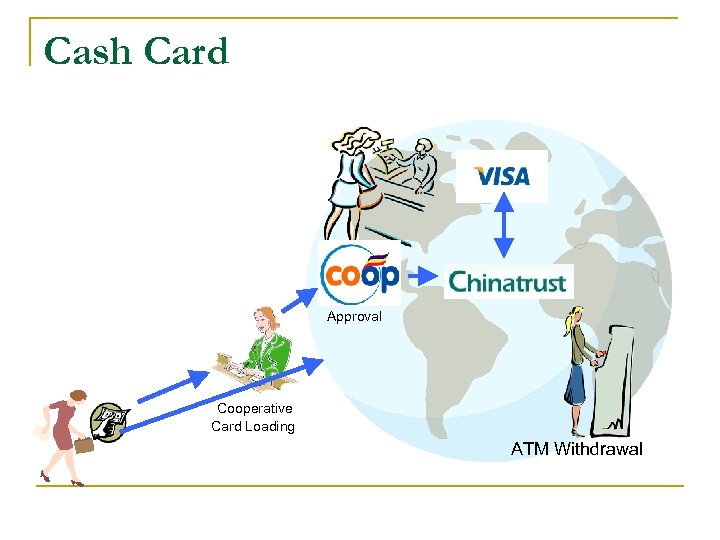

Cash Card POS Approval Cooperative Card Loading ATM Withdrawal

Cash Card POS Approval Cooperative Card Loading ATM Withdrawal

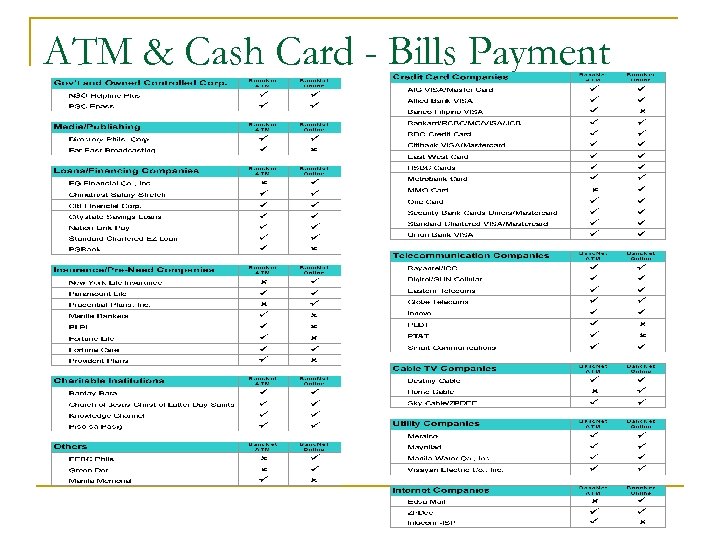

ATM & Cash Card - Bills Payment

ATM & Cash Card - Bills Payment

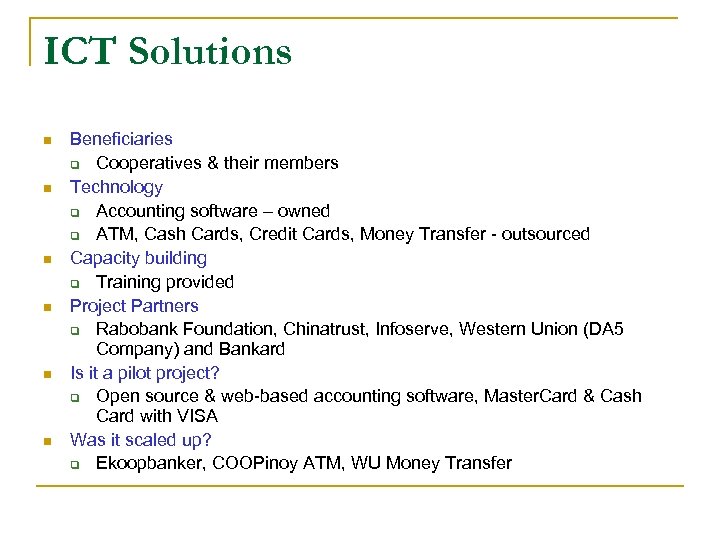

ICT Solutions n n n Beneficiaries q Cooperatives & their members Technology q Accounting software – owned q ATM, Cash Cards, Credit Cards, Money Transfer - outsourced Capacity building q Training provided Project Partners q Rabobank Foundation, Chinatrust, Infoserve, Western Union (DA 5 Company) and Bankard Is it a pilot project? q Open source & web-based accounting software, Master. Card & Cash Card with VISA Was it scaled up? q Ekoopbanker, COOPinoy ATM, WU Money Transfer

ICT Solutions n n n Beneficiaries q Cooperatives & their members Technology q Accounting software – owned q ATM, Cash Cards, Credit Cards, Money Transfer - outsourced Capacity building q Training provided Project Partners q Rabobank Foundation, Chinatrust, Infoserve, Western Union (DA 5 Company) and Bankard Is it a pilot project? q Open source & web-based accounting software, Master. Card & Cash Card with VISA Was it scaled up? q Ekoopbanker, COOPinoy ATM, WU Money Transfer

Website Development Connecting co-ops through virtual networking: LINKING WEBSITES

Website Development Connecting co-ops through virtual networking: LINKING WEBSITES

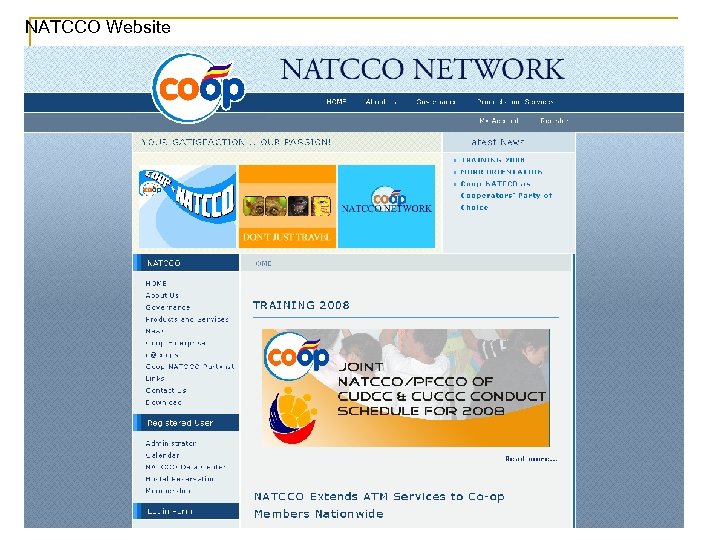

NATCCO Website

NATCCO Website

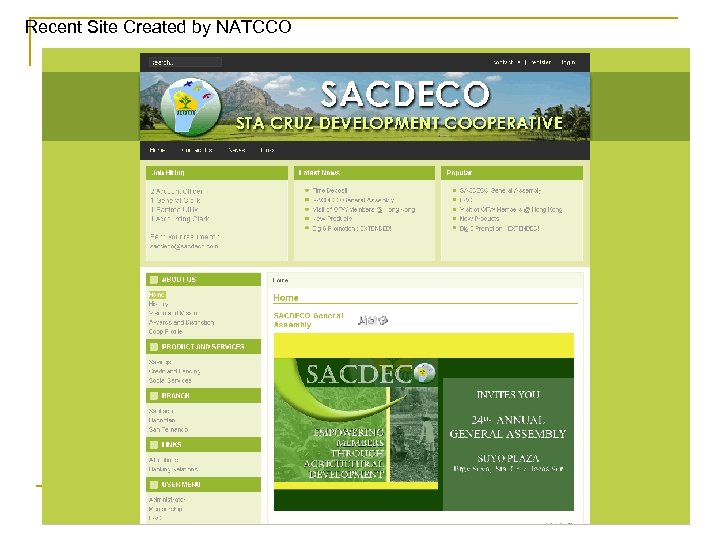

Recent Site Created by NATCCO

Recent Site Created by NATCCO

Recent Site Created by NATCCO

Recent Site Created by NATCCO

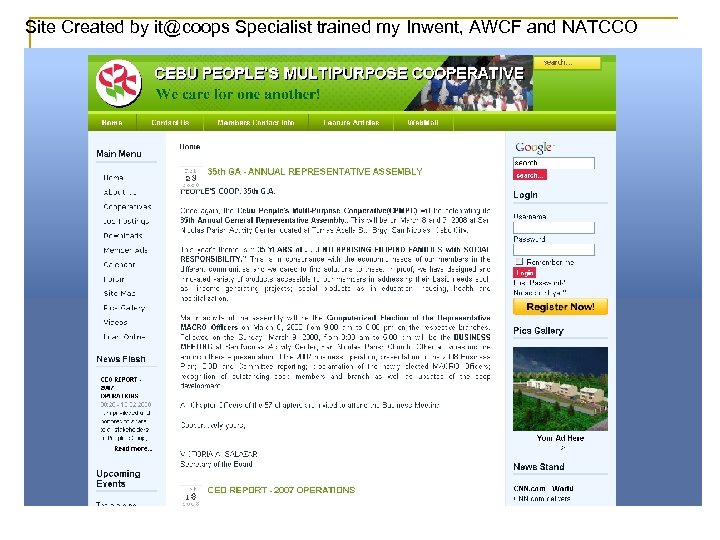

Site Created by it@coops Specialist trained my Inwent, AWCF and NATCCO

Site Created by it@coops Specialist trained my Inwent, AWCF and NATCCO

Site Created by it@coops Specialist trained by NATCCO in partnership with AWCF & INWent-Germany.

Site Created by it@coops Specialist trained by NATCCO in partnership with AWCF & INWent-Germany.

Major Challenges n Accounting Software (ekoopbanker) q q q n To be fully developed as OPEN SOURCE and WEB-BASED system Inter-branch and inter-coop transactions as one NATCCO network One system, One Standard, One software COOPinoy ATM q q Co-op as non-bank is mainstreamed in the banking system NATCCO to own a co-op ATM network

Major Challenges n Accounting Software (ekoopbanker) q q q n To be fully developed as OPEN SOURCE and WEB-BASED system Inter-branch and inter-coop transactions as one NATCCO network One system, One Standard, One software COOPinoy ATM q q Co-op as non-bank is mainstreamed in the banking system NATCCO to own a co-op ATM network

Major Challenges… n n Integration of internet and mobile phone banking to our accounting software Cash Cards & Credit Cards q n Targeting 100, 000 cardholders Money Transfer q q Increase from 300 to 1, 000 locations in the next 3 years Card-Based Technology Development: Card-tocard money transfer with bills payment functions

Major Challenges… n n Integration of internet and mobile phone banking to our accounting software Cash Cards & Credit Cards q n Targeting 100, 000 cardholders Money Transfer q q Increase from 300 to 1, 000 locations in the next 3 years Card-Based Technology Development: Card-tocard money transfer with bills payment functions

Key Learnings n n n Owning or developing a technology versus outsourcing is a “business decision” with reference to investment requirement, in-house capability, economy of scale, potential market impact and competition. Financial services delivered through ICT is a “value proposition” to win and keep your customers and members. Bottom line: Does ICT create superior value in local communities? It is not only ICT but also “innovation-driven” ICT.

Key Learnings n n n Owning or developing a technology versus outsourcing is a “business decision” with reference to investment requirement, in-house capability, economy of scale, potential market impact and competition. Financial services delivered through ICT is a “value proposition” to win and keep your customers and members. Bottom line: Does ICT create superior value in local communities? It is not only ICT but also “innovation-driven” ICT.

Key Learnings… ”ICT? ” “Do it Fast, Do it Right and Do it Cheap. ”

Key Learnings… ”ICT? ” “Do it Fast, Do it Right and Do it Cheap. ”

Thank you very much!

Thank you very much!