85bb1435b79055f747dd5111002a3695.ppt

- Количество слайдов: 12

Employee Financial Participation Schemes in European Enterprises Presentation to Workshop on Financial Participation in Europe, 11 th ILERA Regional Congress, Milano Andrew Pendleton University of Durham, United Kingdom September 9 th 2016

Employee Financial Participation Schemes in European Enterprises Presentation to Workshop on Financial Participation in Europe, 11 th ILERA Regional Congress, Milano Andrew Pendleton University of Durham, United Kingdom September 9 th 2016

FP activity in Europe • Periodic promotion of FP at EU-level since early 1990 s – Pepper Reports (1991, 1996, 2005, 2009) – European Commission Communication (2002) – Expert groups at EU level (2004) – Economic and Social Committee Opinion (2010) – European Parliament hearing (2012) – Green Paper on Company Law and Corporate Governance (2012) • Reflected in periodic interest in Member States, sometimes resulting in legislation • Series of studies on FP across Europe – European Foundation studies on incidence, correlates, participation, and views of key actors in 2000 s. 2016 study on reward (Corral et. al) – Growing availability of cross-national data, such as ECS, EWCS

FP activity in Europe • Periodic promotion of FP at EU-level since early 1990 s – Pepper Reports (1991, 1996, 2005, 2009) – European Commission Communication (2002) – Expert groups at EU level (2004) – Economic and Social Committee Opinion (2010) – European Parliament hearing (2012) – Green Paper on Company Law and Corporate Governance (2012) • Reflected in periodic interest in Member States, sometimes resulting in legislation • Series of studies on FP across Europe – European Foundation studies on incidence, correlates, participation, and views of key actors in 2000 s. 2016 study on reward (Corral et. al) – Growing availability of cross-national data, such as ECS, EWCS

Policy objectives • Harmonisation of interests, leading to greater productivity and innovation • Promotion of flexibility • Security for employees through wealth and income distribution • Improved corporate governance – constraining short-termism (post GFC rationale) Key observations 1) EU policies combine business agenda with European traditions of social solidarity (Lisbon Agenda) 2) Practices and policy objectives vary considerably between Member states

Policy objectives • Harmonisation of interests, leading to greater productivity and innovation • Promotion of flexibility • Security for employees through wealth and income distribution • Improved corporate governance – constraining short-termism (post GFC rationale) Key observations 1) EU policies combine business agenda with European traditions of social solidarity (Lisbon Agenda) 2) Practices and policy objectives vary considerably between Member states

Policy features • EU principles emphasise – – – Voluntary nature of schemes (but see France) Open to all employees Clarity and transparency Regularity Avoidance of unreasonable risk No substitute for pay • TUs (ETUC) also emphasise - embed in broader system of participation - introduction subject to consultation and agreement of worker reps/Tus • Employers (eg. Business Europe) emphasise voluntarism and nonprescriptivity

Policy features • EU principles emphasise – – – Voluntary nature of schemes (but see France) Open to all employees Clarity and transparency Regularity Avoidance of unreasonable risk No substitute for pay • TUs (ETUC) also emphasise - embed in broader system of participation - introduction subject to consultation and agreement of worker reps/Tus • Employers (eg. Business Europe) emphasise voluntarism and nonprescriptivity

What do governments do? Considerable diversity in policy and practice across EU Members. q France – harmonisation of capital and labour + link to savings plans. Cautious link to pensions. PS + ESO. Some compulsion q Germany – wealth formation and redistribution. Traditional focus on PS q UK – enhancement of company productivity by harmonisation of interests on company terms. Periodic anti-union/employment rights agenda. Focus on ESO q Italy – links to measures to enhance wage and bargaining flexibility. Governance arrangements limit ESO. TU differences

What do governments do? Considerable diversity in policy and practice across EU Members. q France – harmonisation of capital and labour + link to savings plans. Cautious link to pensions. PS + ESO. Some compulsion q Germany – wealth formation and redistribution. Traditional focus on PS q UK – enhancement of company productivity by harmonisation of interests on company terms. Periodic anti-union/employment rights agenda. Focus on ESO q Italy – links to measures to enhance wage and bargaining flexibility. Governance arrangements limit ESO. TU differences

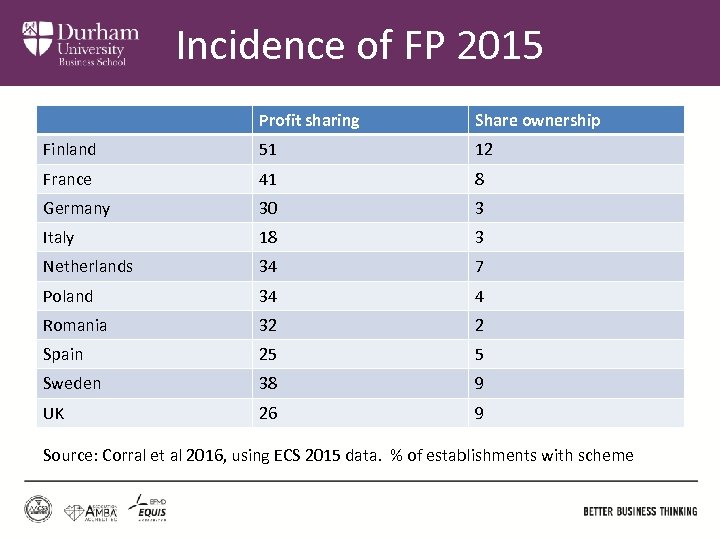

Incidence of FP 2015 Profit sharing Share ownership Finland 51 12 France 41 8 Germany 30 3 Italy 18 3 Netherlands 34 7 Poland 34 4 Romania 32 2 Spain 25 5 Sweden 38 9 UK 26 9 Source: Corral et al 2016, using ECS 2015 data. % of establishments with scheme

Incidence of FP 2015 Profit sharing Share ownership Finland 51 12 France 41 8 Germany 30 3 Italy 18 3 Netherlands 34 7 Poland 34 4 Romania 32 2 Spain 25 5 Sweden 38 9 UK 26 9 Source: Corral et al 2016, using ECS 2015 data. % of establishments with scheme

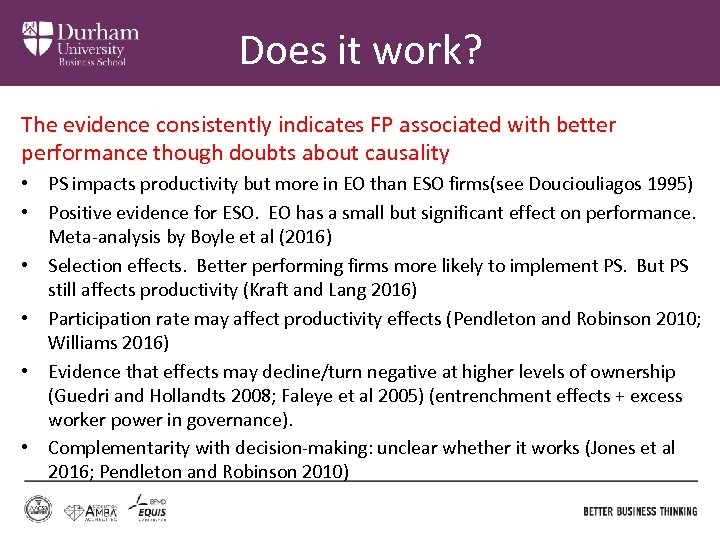

Does it work? The evidence consistently indicates FP associated with better performance though doubts about causality • PS impacts productivity but more in EO than ESO firms(see Douciouliagos 1995) • Positive evidence for ESO. EO has a small but significant effect on performance. Meta-analysis by Boyle et al (2016) • Selection effects. Better performing firms more likely to implement PS. But PS still affects productivity (Kraft and Lang 2016) • Participation rate may affect productivity effects (Pendleton and Robinson 2010; Williams 2016) • Evidence that effects may decline/turn negative at higher levels of ownership (Guedri and Hollandts 2008; Faleye et al 2005) (entrenchment effects + excess worker power in governance). • Complementarity with decision-making: unclear whether it works (Jones et al 2016; Pendleton and Robinson 2010)

Does it work? The evidence consistently indicates FP associated with better performance though doubts about causality • PS impacts productivity but more in EO than ESO firms(see Douciouliagos 1995) • Positive evidence for ESO. EO has a small but significant effect on performance. Meta-analysis by Boyle et al (2016) • Selection effects. Better performing firms more likely to implement PS. But PS still affects productivity (Kraft and Lang 2016) • Participation rate may affect productivity effects (Pendleton and Robinson 2010; Williams 2016) • Evidence that effects may decline/turn negative at higher levels of ownership (Guedri and Hollandts 2008; Faleye et al 2005) (entrenchment effects + excess worker power in governance). • Complementarity with decision-making: unclear whether it works (Jones et al 2016; Pendleton and Robinson 2010)

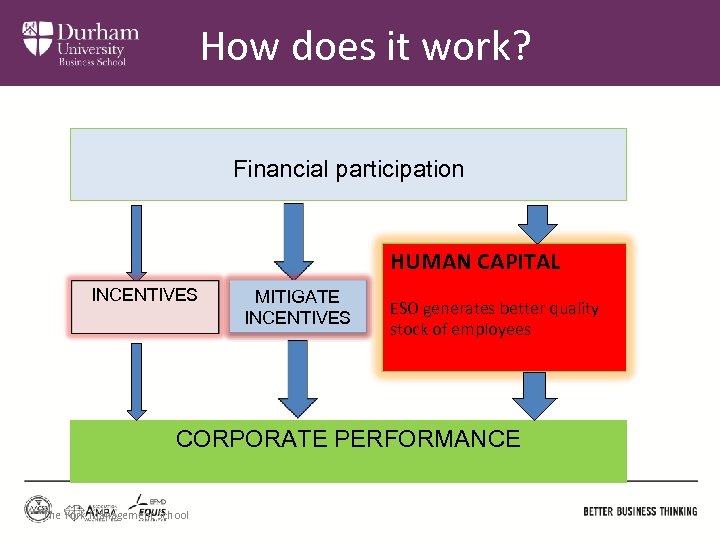

How does it work? Financial participation HUMAN CAPITAL INCENTIVES MITIGATE INCENTIVES ESO generates better quality stock of employees CORPORATE PERFORMANCE The York Management School

How does it work? Financial participation HUMAN CAPITAL INCENTIVES MITIGATE INCENTIVES ESO generates better quality stock of employees CORPORATE PERFORMANCE The York Management School

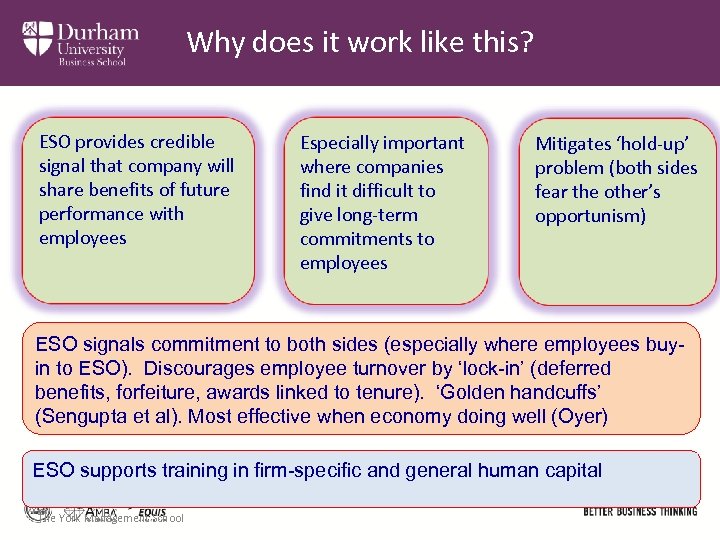

Why does it work like this? ESO provides credible signal that company will share benefits of future performance with employees Especially important where companies find it difficult to give long-term commitments to employees Mitigates ‘hold-up’ problem (both sides fear the other’s opportunism) ESO signals commitment to both sides (especially where employees buyin to ESO). Discourages employee turnover by ‘lock-in’ (deferred benefits, forfeiture, awards linked to tenure). ‘Golden handcuffs’ (Sengupta et al). Most effective when economy doing well (Oyer) ESO supports training in firm-specific and general human capital The York Management School

Why does it work like this? ESO provides credible signal that company will share benefits of future performance with employees Especially important where companies find it difficult to give long-term commitments to employees Mitigates ‘hold-up’ problem (both sides fear the other’s opportunism) ESO signals commitment to both sides (especially where employees buyin to ESO). Discourages employee turnover by ‘lock-in’ (deferred benefits, forfeiture, awards linked to tenure). ‘Golden handcuffs’ (Sengupta et al). Most effective when economy doing well (Oyer) ESO supports training in firm-specific and general human capital The York Management School

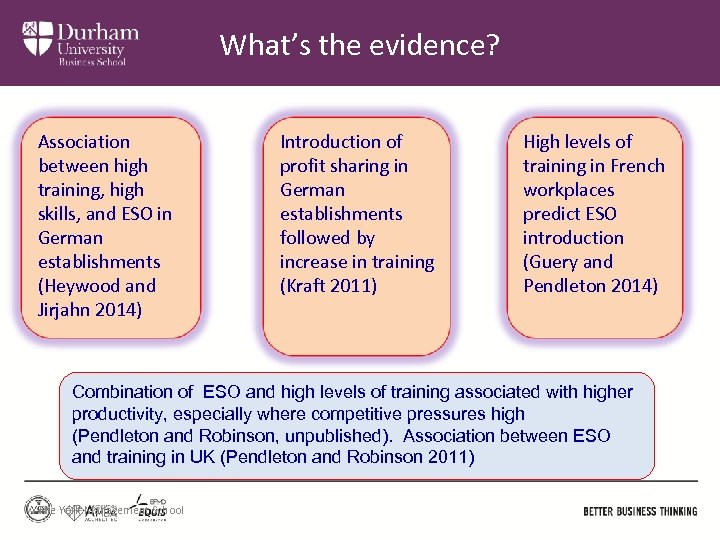

What’s the evidence? Association between high training, high skills, and ESO in German establishments (Heywood and Jirjahn 2014) Introduction of profit sharing in German establishments followed by increase in training (Kraft 2011) High levels of training in French workplaces predict ESO introduction (Guery and Pendleton 2014) Combination of ESO and high levels of training associated with higher productivity, especially where competitive pressures high (Pendleton and Robinson, unpublished). Association between ESO and training in UK (Pendleton and Robinson 2011) The York Management School

What’s the evidence? Association between high training, high skills, and ESO in German establishments (Heywood and Jirjahn 2014) Introduction of profit sharing in German establishments followed by increase in training (Kraft 2011) High levels of training in French workplaces predict ESO introduction (Guery and Pendleton 2014) Combination of ESO and high levels of training associated with higher productivity, especially where competitive pressures high (Pendleton and Robinson, unpublished). Association between ESO and training in UK (Pendleton and Robinson 2011) The York Management School

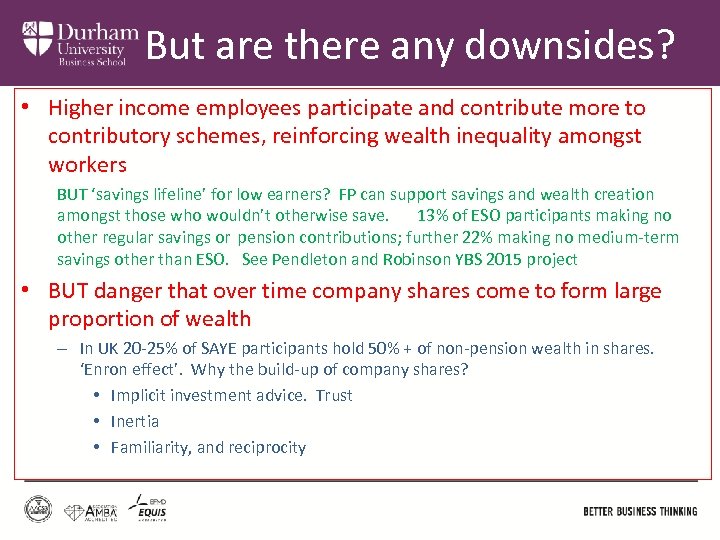

But are there any downsides? • Higher income employees participate and contribute more to contributory schemes, reinforcing wealth inequality amongst workers BUT ‘savings lifeline’ for low earners? FP can support savings and wealth creation amongst those who wouldn’t otherwise save. 13% of ESO participants making no other regular savings or pension contributions; further 22% making no medium-term savings other than ESO. See Pendleton and Robinson YBS 2015 project • BUT danger that over time company shares come to form large proportion of wealth – In UK 20 -25% of SAYE participants hold 50% + of non-pension wealth in shares. ‘Enron effect’. Why the build-up of company shares? • Implicit investment advice. Trust • Inertia • Familiarity, and reciprocity

But are there any downsides? • Higher income employees participate and contribute more to contributory schemes, reinforcing wealth inequality amongst workers BUT ‘savings lifeline’ for low earners? FP can support savings and wealth creation amongst those who wouldn’t otherwise save. 13% of ESO participants making no other regular savings or pension contributions; further 22% making no medium-term savings other than ESO. See Pendleton and Robinson YBS 2015 project • BUT danger that over time company shares come to form large proportion of wealth – In UK 20 -25% of SAYE participants hold 50% + of non-pension wealth in shares. ‘Enron effect’. Why the build-up of company shares? • Implicit investment advice. Trust • Inertia • Familiarity, and reciprocity

Conclusions • Diversity of policy objectives and national practices • FP works but not in the way that is often claimed • But there are dangers – we can’t ignore them Thank you for listening

Conclusions • Diversity of policy objectives and national practices • FP works but not in the way that is often claimed • But there are dangers – we can’t ignore them Thank you for listening