e9c69e1580ca39d906e541cb4e22ca1a.ppt

- Количество слайдов: 37

EMPIRE LIFE INVESTMENTS READY…SET…GO! 2014 RRSP Season FOR DEALER/ADVISOR USE ONLY|

EMPIRE LIFE INVESTMENTS READY…SET…GO! 2014 RRSP Season FOR DEALER/ADVISOR USE ONLY|

AGENDA READY… Why Partner With Empire Life Investments? Investment Team and Approach …SET… Our Products and Services …GO! RRSP Season Solutions RRSP Season Opportunities FOR DEALER/ADVISOR USE ONLY| 2

AGENDA READY… Why Partner With Empire Life Investments? Investment Team and Approach …SET… Our Products and Services …GO! RRSP Season Solutions RRSP Season Opportunities FOR DEALER/ADVISOR USE ONLY| 2

READY… WHY PARTNER WITH EMPIRE LIFE INVESTMENTS? FOR DEALER/ADVISOR USE ONLY| 3

READY… WHY PARTNER WITH EMPIRE LIFE INVESTMENTS? FOR DEALER/ADVISOR USE ONLY| 3

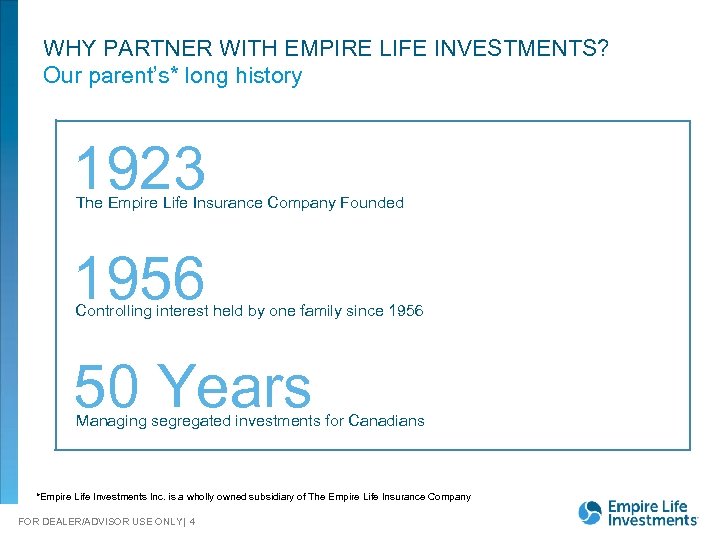

WHY PARTNER WITH EMPIRE LIFE INVESTMENTS? Our parent’s* long history 1923 The Empire Life Insurance Company Founded 1956 Controlling interest held by one family since 1956 50 Years Managing segregated investments for Canadians *Empire Life Investments Inc. is a wholly owned subsidiary of The Empire Life Insurance Company FOR DEALER/ADVISOR USE ONLY| 4

WHY PARTNER WITH EMPIRE LIFE INVESTMENTS? Our parent’s* long history 1923 The Empire Life Insurance Company Founded 1956 Controlling interest held by one family since 1956 50 Years Managing segregated investments for Canadians *Empire Life Investments Inc. is a wholly owned subsidiary of The Empire Life Insurance Company FOR DEALER/ADVISOR USE ONLY| 4

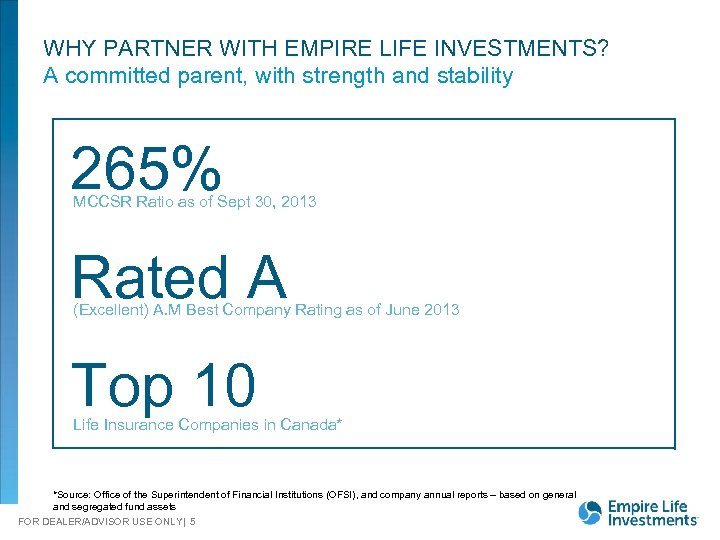

WHY PARTNER WITH EMPIRE LIFE INVESTMENTS? A committed parent, with strength and stability 265% MCCSR Ratio as of Sept 30, 2013 Rated A (Excellent) A. M Best Company Rating as of June 2013 Top 10 Life Insurance Companies in Canada* *Source: Office of the Superintendent of Financial Institutions (OFSI), and company annual reports – based on general and segregated fund assets FOR DEALER/ADVISOR USE ONLY| 5

WHY PARTNER WITH EMPIRE LIFE INVESTMENTS? A committed parent, with strength and stability 265% MCCSR Ratio as of Sept 30, 2013 Rated A (Excellent) A. M Best Company Rating as of June 2013 Top 10 Life Insurance Companies in Canada* *Source: Office of the Superintendent of Financial Institutions (OFSI), and company annual reports – based on general and segregated fund assets FOR DEALER/ADVISOR USE ONLY| 5

READY… INVESTMENT TEAM & APPROACH FOR DEALER/ADVISOR USE ONLY| 6

READY… INVESTMENT TEAM & APPROACH FOR DEALER/ADVISOR USE ONLY| 6

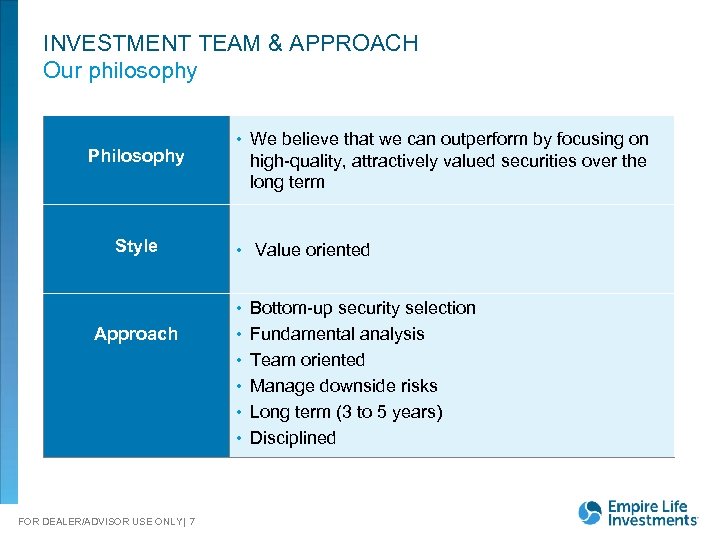

INVESTMENT TEAM & APPROACH Our philosophy Philosophy Style • We believe that we can outperform by focusing on high-quality, attractively valued securities over the long term • Value oriented • Bottom-up security selection Approach • Fundamental analysis • Team oriented • Manage downside risks • Long term (3 to 5 years) • Disciplined FOR DEALER/ADVISOR USE ONLY| 7

INVESTMENT TEAM & APPROACH Our philosophy Philosophy Style • We believe that we can outperform by focusing on high-quality, attractively valued securities over the long term • Value oriented • Bottom-up security selection Approach • Fundamental analysis • Team oriented • Manage downside risks • Long term (3 to 5 years) • Disciplined FOR DEALER/ADVISOR USE ONLY| 7

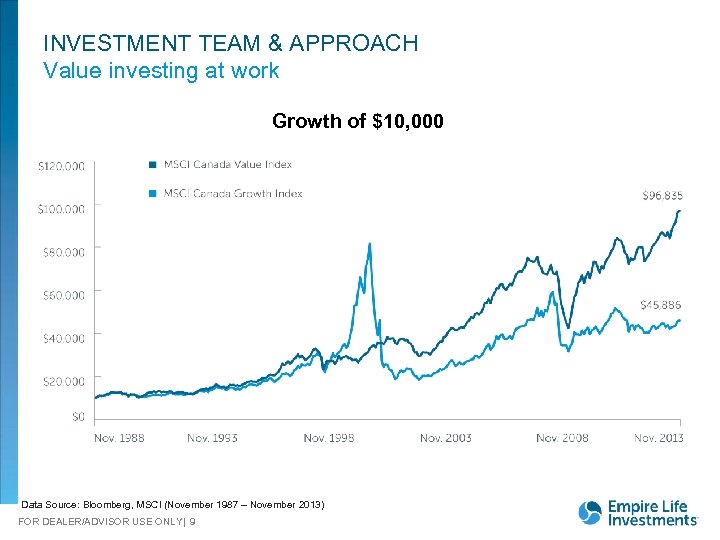

INVESTMENT TEAM & APPROACH Value investing at work Growth of $10, 000 Data Source: Bloomberg, MSCI (November 1987 – November 2013) FOR DEALER/ADVISOR USE ONLY| 9

INVESTMENT TEAM & APPROACH Value investing at work Growth of $10, 000 Data Source: Bloomberg, MSCI (November 1987 – November 2013) FOR DEALER/ADVISOR USE ONLY| 9

…SET… OUR PRODUCTS & SERVICES FOR DEALER/ADVISOR USE ONLY| 11

…SET… OUR PRODUCTS & SERVICES FOR DEALER/ADVISOR USE ONLY| 11

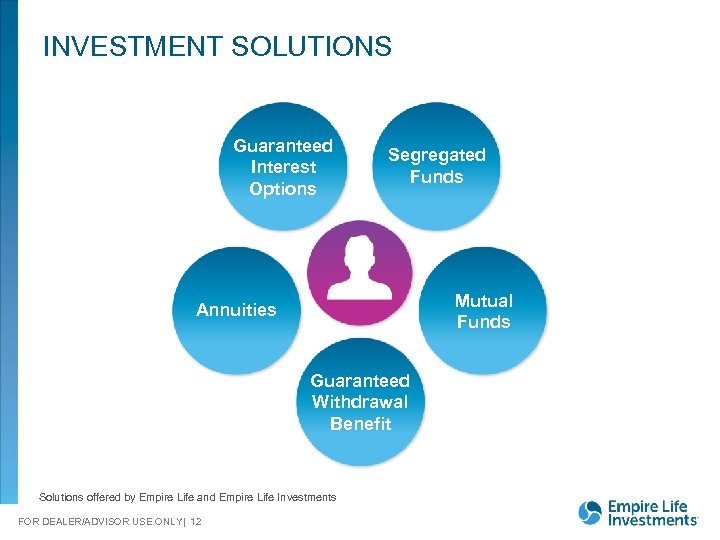

INVESTMENT SOLUTIONS Guaranteed Interest Options Segregated Funds Mutual Funds Annuities Guaranteed Withdrawal Benefit Solutions offered by Empire Life and Empire Life Investments FOR DEALER/ADVISOR USE ONLY| 12

INVESTMENT SOLUTIONS Guaranteed Interest Options Segregated Funds Mutual Funds Annuities Guaranteed Withdrawal Benefit Solutions offered by Empire Life and Empire Life Investments FOR DEALER/ADVISOR USE ONLY| 12

OUR PRODUCTS & SERVICES Class and Elite: Segregated Funds Choice Full range of asset classes Includes Portfolio Funds, our managed program Funds with up to 100% equity exposure Flexibility Two levels of guarantees: 75%/100% or 100%/100%* Growth 2 client-initiated resets per year take advantage of higher market values* Competitive and inclusive MERs Easy for clients to understand No extra fees for resets *There must be at least 10 years to the Maturity Date of the policy, 15 years if 100% MBG. No resets are permitted after December 31 st of the year the Annuitant turns 80 years old. FOR DEALER/ADVISOR USE ONLY| 13

OUR PRODUCTS & SERVICES Class and Elite: Segregated Funds Choice Full range of asset classes Includes Portfolio Funds, our managed program Funds with up to 100% equity exposure Flexibility Two levels of guarantees: 75%/100% or 100%/100%* Growth 2 client-initiated resets per year take advantage of higher market values* Competitive and inclusive MERs Easy for clients to understand No extra fees for resets *There must be at least 10 years to the Maturity Date of the policy, 15 years if 100% MBG. No resets are permitted after December 31 st of the year the Annuitant turns 80 years old. FOR DEALER/ADVISOR USE ONLY| 13

OUR PRODUCTS & SERVICES Elite and Elite XL Investment Programs Consolidated investment program Hold segregated funds and interest investments in one policy Segregated funds Guaranteed Interest Options Treasury Interest Options FOR DEALER/ADVISOR USE ONLY| 14

OUR PRODUCTS & SERVICES Elite and Elite XL Investment Programs Consolidated investment program Hold segregated funds and interest investments in one policy Segregated funds Guaranteed Interest Options Treasury Interest Options FOR DEALER/ADVISOR USE ONLY| 14

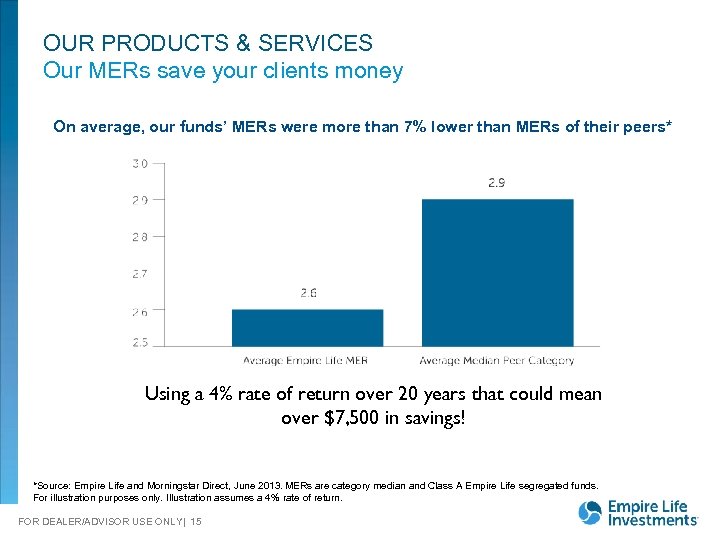

OUR PRODUCTS & SERVICES Our MERs save your clients money On average, our funds’ MERs were more than 7% lower than MERs of their peers* Using a 4% rate of return over 20 years that could mean over $7, 500 in savings! *Source: Empire Life and Morningstar Direct, June 2013. MERs are category median and Class A Empire Life segregated funds. For illustration purposes only. Illustration assumes a 4% rate of return. FOR DEALER/ADVISOR USE ONLY| 15

OUR PRODUCTS & SERVICES Our MERs save your clients money On average, our funds’ MERs were more than 7% lower than MERs of their peers* Using a 4% rate of return over 20 years that could mean over $7, 500 in savings! *Source: Empire Life and Morningstar Direct, June 2013. MERs are category median and Class A Empire Life segregated funds. For illustration purposes only. Illustration assumes a 4% rate of return. FOR DEALER/ADVISOR USE ONLY| 15

OUR PRODUCTS & SERVICES Class Plus 2: Guaranteed Retirement Income For Life. TM 5% annual Income Base Bonus Builds income potential. 1 Client-friendly Automatic Income Reset increases automatically to next LWA tier. Retirement Income Privileges allow stop and start income payments. Excess Withdrawal Alert safeguards clients’ guaranteed income. Competitive fees. Potential for higher growth 3 of the 12 investment options offering 80% equity exposure. 1 Income Base Bonus is a notional amount added to the Income Base at the end of each calendar year if no withdrawals are made for that year. FOR DEALER/ADVISOR USE ONLY| 16

OUR PRODUCTS & SERVICES Class Plus 2: Guaranteed Retirement Income For Life. TM 5% annual Income Base Bonus Builds income potential. 1 Client-friendly Automatic Income Reset increases automatically to next LWA tier. Retirement Income Privileges allow stop and start income payments. Excess Withdrawal Alert safeguards clients’ guaranteed income. Competitive fees. Potential for higher growth 3 of the 12 investment options offering 80% equity exposure. 1 Income Base Bonus is a notional amount added to the Income Base at the end of each calendar year if no withdrawals are made for that year. FOR DEALER/ADVISOR USE ONLY| 16

OUR PRODUCTS & SERVICES Mutual Funds* Simplicity 10 mutual funds Includes Emblem Portfolios, our managed program Funds with up to 100% equity exposure Flexibility Available in series T, 6% and 8% tax-efficient cash flow options Competitive MERs Competitive management fees and advisor compensation *Mutual funds are offered by Empire Life Investments Inc. FOR DEALER/ADVISOR USE ONLY| 17

OUR PRODUCTS & SERVICES Mutual Funds* Simplicity 10 mutual funds Includes Emblem Portfolios, our managed program Funds with up to 100% equity exposure Flexibility Available in series T, 6% and 8% tax-efficient cash flow options Competitive MERs Competitive management fees and advisor compensation *Mutual funds are offered by Empire Life Investments Inc. FOR DEALER/ADVISOR USE ONLY| 17

OUR PRODUCTS & SERVICES Empire for Life™ Loyalty Program Eligibility Empire Life Mutual Funds, Empire Life Class or Class Plus 2 Segregated Funds Loyalty pays A management fee distribution equal to 5% on December 31 st of the year in which the investor reaches the 10 -year anniversary and every year thereafter. * *Class/Class Plus 2 segregated funds and Elite/Elite XL contracts are issued by The Empire Life Insurance Company. The Empire for Life. TM Loyalty Program management fee re-imbursement is distributed in the form of additional units. Investors must own the units on the distribution date in order to receive the management fee re-imbursement. FOR DEALER/ADVISOR USE ONLY| 18

OUR PRODUCTS & SERVICES Empire for Life™ Loyalty Program Eligibility Empire Life Mutual Funds, Empire Life Class or Class Plus 2 Segregated Funds Loyalty pays A management fee distribution equal to 5% on December 31 st of the year in which the investor reaches the 10 -year anniversary and every year thereafter. * *Class/Class Plus 2 segregated funds and Elite/Elite XL contracts are issued by The Empire Life Insurance Company. The Empire for Life. TM Loyalty Program management fee re-imbursement is distributed in the form of additional units. Investors must own the units on the distribution date in order to receive the management fee re-imbursement. FOR DEALER/ADVISOR USE ONLY| 18

…GO! RRSP SOLUTIONS FOR DEALER/ADVISOR USE ONLY| 19

…GO! RRSP SOLUTIONS FOR DEALER/ADVISOR USE ONLY| 19

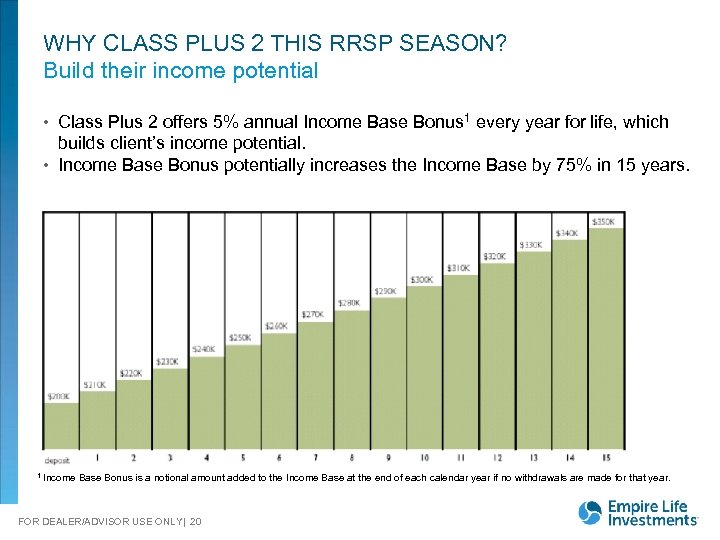

WHY CLASS PLUS 2 THIS RRSP SEASON? Build their income potential • Class Plus 2 offers 5% annual Income Base Bonus 1 every year for life, which builds client’s income potential. • Income Base Bonus potentially increases the Income Base by 75% in 15 years. 1 Income Base Bonus is a notional amount added to the Income Base at the end of each calendar year if no withdrawals are made for that year. FOR DEALER/ADVISOR USE ONLY| 20

WHY CLASS PLUS 2 THIS RRSP SEASON? Build their income potential • Class Plus 2 offers 5% annual Income Base Bonus 1 every year for life, which builds client’s income potential. • Income Base Bonus potentially increases the Income Base by 75% in 15 years. 1 Income Base Bonus is a notional amount added to the Income Base at the end of each calendar year if no withdrawals are made for that year. FOR DEALER/ADVISOR USE ONLY| 20

Investor Needs and Challenges 43800 2 people X 3 meals X 365 days X 20 years $438, 000 FOR DEALER/ADVISOR USE ONLY| 21

Investor Needs and Challenges 43800 2 people X 3 meals X 365 days X 20 years $438, 000 FOR DEALER/ADVISOR USE ONLY| 21

Why your clients need income • The peak of the baby boom is age 50 • With the annual 5% Income Base Bonus, a one-time investment would increase by 75% in 15 years. • $250, 286 deposit is increased to $438, 000 for the purpose of guaranteeing income for life. Use Empire Class Plus 2 for all your income needs As you age, income is generally preferred relative to growth. FOR DEALER/ADVISOR USE ONLY| 22

Why your clients need income • The peak of the baby boom is age 50 • With the annual 5% Income Base Bonus, a one-time investment would increase by 75% in 15 years. • $250, 286 deposit is increased to $438, 000 for the purpose of guaranteeing income for life. Use Empire Class Plus 2 for all your income needs As you age, income is generally preferred relative to growth. FOR DEALER/ADVISOR USE ONLY| 22

CLASS PLUS 2 MARKETING SUPPORT FOR DEALER/ADVISOR USE ONLY| 23

CLASS PLUS 2 MARKETING SUPPORT FOR DEALER/ADVISOR USE ONLY| 23

…GO! RRSP SEASON OPPORTUNITIES FOR DEALER/ADVISOR USE ONLY| 30

…GO! RRSP SEASON OPPORTUNITIES FOR DEALER/ADVISOR USE ONLY| 30

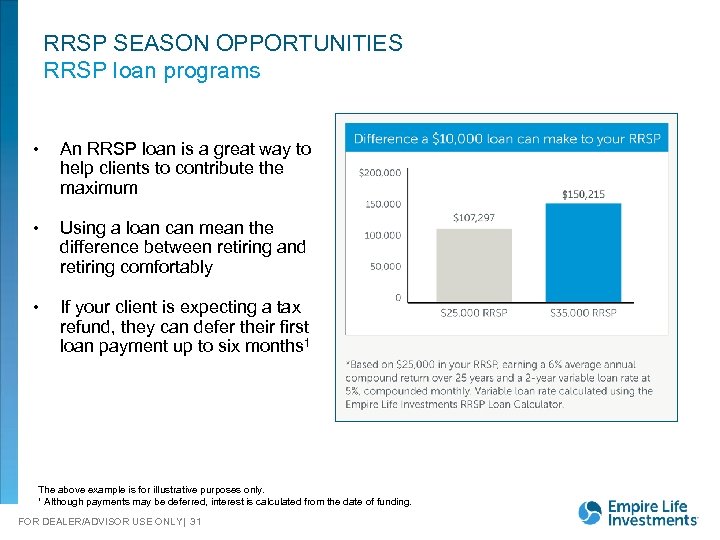

RRSP SEASON OPPORTUNITIES RRSP loan programs • An RRSP loan is a great way to help clients to contribute the maximum • Using a loan can mean the difference between retiring and retiring comfortably • If your client is expecting a tax refund, they can defer their first loan payment up to six months 1 The above example is for illustrative purposes only. ¹ Although payments may be deferred, interest is calculated from the date of funding. FOR DEALER/ADVISOR USE ONLY| 31

RRSP SEASON OPPORTUNITIES RRSP loan programs • An RRSP loan is a great way to help clients to contribute the maximum • Using a loan can mean the difference between retiring and retiring comfortably • If your client is expecting a tax refund, they can defer their first loan payment up to six months 1 The above example is for illustrative purposes only. ¹ Although payments may be deferred, interest is calculated from the date of funding. FOR DEALER/ADVISOR USE ONLY| 31

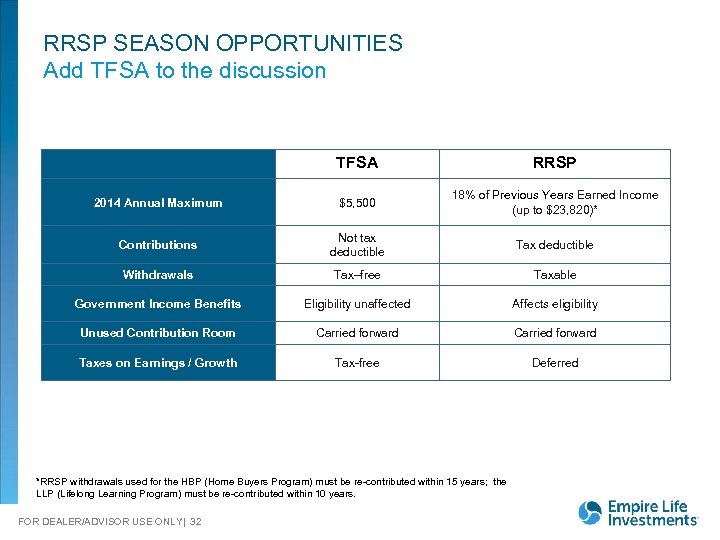

RRSP SEASON OPPORTUNITIES Add TFSA to the discussion TFSA RRSP 2014 Annual Maximum $5, 500 18% of Previous Years Earned Income (up to $23, 820)* Contributions Not tax deductible Tax deductible Withdrawals Tax–free Taxable Government Income Benefits Eligibility unaffected Affects eligibility Unused Contribution Room Carried forward Taxes on Earnings / Growth Tax-free Deferred *RRSP withdrawals used for the HBP (Home Buyers Program) must be re-contributed within 15 years; the LLP (Lifelong Learning Program) must be re-contributed within 10 years. FOR DEALER/ADVISOR USE ONLY| 32

RRSP SEASON OPPORTUNITIES Add TFSA to the discussion TFSA RRSP 2014 Annual Maximum $5, 500 18% of Previous Years Earned Income (up to $23, 820)* Contributions Not tax deductible Tax deductible Withdrawals Tax–free Taxable Government Income Benefits Eligibility unaffected Affects eligibility Unused Contribution Room Carried forward Taxes on Earnings / Growth Tax-free Deferred *RRSP withdrawals used for the HBP (Home Buyers Program) must be re-contributed within 15 years; the LLP (Lifelong Learning Program) must be re-contributed within 10 years. FOR DEALER/ADVISOR USE ONLY| 32

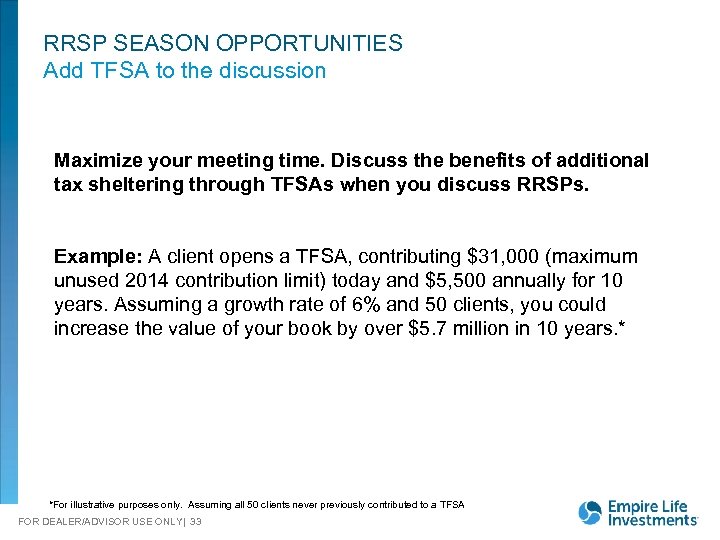

RRSP SEASON OPPORTUNITIES Add TFSA to the discussion Maximize your meeting time. Discuss the benefits of additional tax sheltering through TFSAs when you discuss RRSPs. Example: A client opens a TFSA, contributing $31, 000 (maximum unused 2014 contribution limit) today and $5, 500 annually for 10 years. Assuming a growth rate of 6% and 50 clients, you could increase the value of your book by over $5. 7 million in 10 years. * *For illustrative purposes only. Assuming all 50 clients never previously contributed to a TFSA FOR DEALER/ADVISOR USE ONLY| 33

RRSP SEASON OPPORTUNITIES Add TFSA to the discussion Maximize your meeting time. Discuss the benefits of additional tax sheltering through TFSAs when you discuss RRSPs. Example: A client opens a TFSA, contributing $31, 000 (maximum unused 2014 contribution limit) today and $5, 500 annually for 10 years. Assuming a growth rate of 6% and 50 clients, you could increase the value of your book by over $5. 7 million in 10 years. * *For illustrative purposes only. Assuming all 50 clients never previously contributed to a TFSA FOR DEALER/ADVISOR USE ONLY| 33

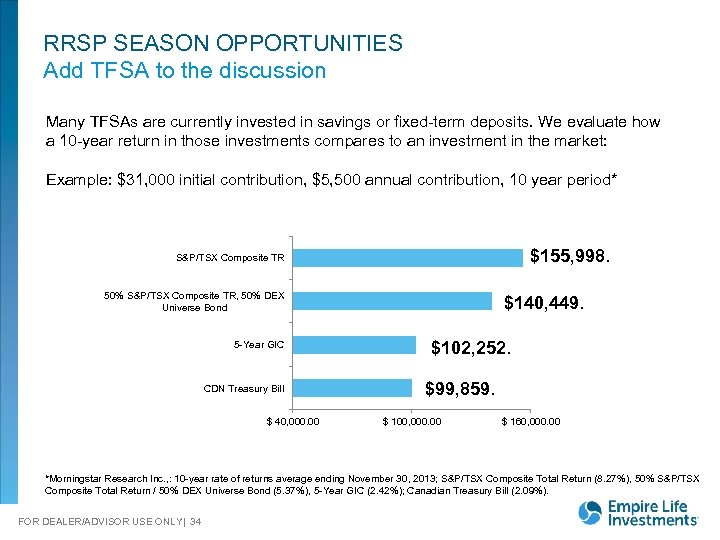

RRSP SEASON OPPORTUNITIES Add TFSA to the discussion Many TFSAs are currently invested in savings or fixed-term deposits. We evaluate how a 10 -year return in those investments compares to an investment in the market: Example: $31, 000 initial contribution, $5, 500 annual contribution, 10 year period* $155, 998. S&P/TSX Composite TR 50% S&P/TSX Composite TR, 50% DEX Universe Bond 5 -Year GIC CDN Treasury Bill $ 40, 000. 00 $140, 449. $102, 252. $99, 859. $ 100, 000. 00 $ 160, 000. 00 *Morningstar Research Inc. , : 10 -year rate of returns average ending November 30, 2013; S&P/TSX Composite Total Return (8. 27%), 50% S&P/TSX Composite Total Return / 50% DEX Universe Bond (5. 37%), 5 -Year GIC (2. 42%); Canadian Treasury Bill (2. 09%). FOR DEALER/ADVISOR USE ONLY| 34

RRSP SEASON OPPORTUNITIES Add TFSA to the discussion Many TFSAs are currently invested in savings or fixed-term deposits. We evaluate how a 10 -year return in those investments compares to an investment in the market: Example: $31, 000 initial contribution, $5, 500 annual contribution, 10 year period* $155, 998. S&P/TSX Composite TR 50% S&P/TSX Composite TR, 50% DEX Universe Bond 5 -Year GIC CDN Treasury Bill $ 40, 000. 00 $140, 449. $102, 252. $99, 859. $ 100, 000. 00 $ 160, 000. 00 *Morningstar Research Inc. , : 10 -year rate of returns average ending November 30, 2013; S&P/TSX Composite Total Return (8. 27%), 50% S&P/TSX Composite Total Return / 50% DEX Universe Bond (5. 37%), 5 -Year GIC (2. 42%); Canadian Treasury Bill (2. 09%). FOR DEALER/ADVISOR USE ONLY| 34

RRSP SEASON OPPORTUNITIES TFSA Marketing Support Segregated Funds FOR DEALER/ADVISOR USE ONLY| 35 Mutual Funds

RRSP SEASON OPPORTUNITIES TFSA Marketing Support Segregated Funds FOR DEALER/ADVISOR USE ONLY| 35 Mutual Funds

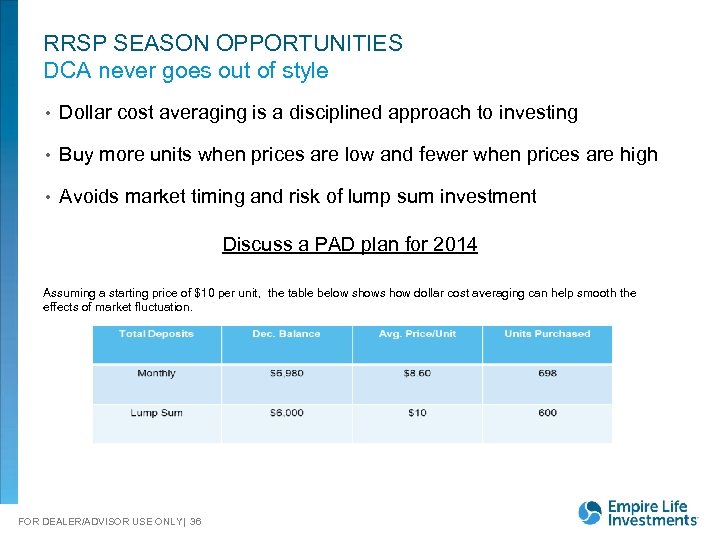

RRSP SEASON OPPORTUNITIES DCA never goes out of style • Dollar cost averaging is a disciplined approach to investing • Buy more units when prices are low and fewer when prices are high • Avoids market timing and risk of lump sum investment Discuss a PAD plan for 2014 Assuming a starting price of $10 per unit, the table below shows how dollar cost averaging can help smooth the effects of market fluctuation. FOR DEALER/ADVISOR USE ONLY| 36

RRSP SEASON OPPORTUNITIES DCA never goes out of style • Dollar cost averaging is a disciplined approach to investing • Buy more units when prices are low and fewer when prices are high • Avoids market timing and risk of lump sum investment Discuss a PAD plan for 2014 Assuming a starting price of $10 per unit, the table below shows how dollar cost averaging can help smooth the effects of market fluctuation. FOR DEALER/ADVISOR USE ONLY| 36

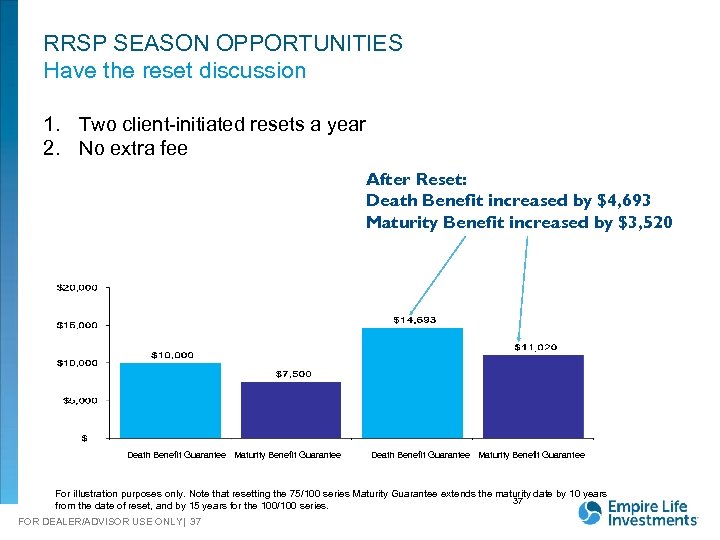

RRSP SEASON OPPORTUNITIES Have the reset discussion 1. Two client-initiated resets a year 2. No extra fee After Reset: Death Benefit increased by $4, 693 Maturity Benefit increased by $3, 520 Death Benefit Guarantee Maturity Benefit Guarantee For illustration purposes only. Note that resetting the 75/100 series Maturity Guarantee extends the maturity date by 10 years 37 from the date of reset, and by 15 years for the 100/100 series. FOR DEALER/ADVISOR USE ONLY| 37

RRSP SEASON OPPORTUNITIES Have the reset discussion 1. Two client-initiated resets a year 2. No extra fee After Reset: Death Benefit increased by $4, 693 Maturity Benefit increased by $3, 520 Death Benefit Guarantee Maturity Benefit Guarantee For illustration purposes only. Note that resetting the 75/100 series Maturity Guarantee extends the maturity date by 10 years 37 from the date of reset, and by 15 years for the 100/100 series. FOR DEALER/ADVISOR USE ONLY| 37

RRSP SEASON OPPORTUNITIES New: Lifetime Withdrawal Amounts & Life Income Funds Option to access to full LWA & Life Income Funds • Applicable if LWA exceeds legislated LIF maximum, which disallows withdrawal of full LWA. • Strict requirements must be met to qualify for this election • It is irrevocable • Class Plus/Class Plus 2 features remain intact. FOR DEALER/ADVISOR USE ONLY| 38

RRSP SEASON OPPORTUNITIES New: Lifetime Withdrawal Amounts & Life Income Funds Option to access to full LWA & Life Income Funds • Applicable if LWA exceeds legislated LIF maximum, which disallows withdrawal of full LWA. • Strict requirements must be met to qualify for this election • It is irrevocable • Class Plus/Class Plus 2 features remain intact. FOR DEALER/ADVISOR USE ONLY| 38

RRSP SEASON OPPORTUNITIES New: Annuity Settlement Option Situation Insurance products give peace-of-mind associated with the proceeds Sudden transfer of wealth may not be desirable for some beneficiaries Solution Gradual wealth transfer through innovative combination of payment and annuity Clients have flexibility and control over how death benefit proceeds paid out How it works All Empire Life insurance and investment contracts-inforce and new applications Choice of either a) 100% annuity option OR b) Partial upfront payment with the balance paid via Life or Term Certain annuity Benefits Maintain influence with family and retain assets Estate planning opportunity - include in sales process and annual reviews Client peace of mind FOR DEALER/ADVISOR USE ONLY| 39

RRSP SEASON OPPORTUNITIES New: Annuity Settlement Option Situation Insurance products give peace-of-mind associated with the proceeds Sudden transfer of wealth may not be desirable for some beneficiaries Solution Gradual wealth transfer through innovative combination of payment and annuity Clients have flexibility and control over how death benefit proceeds paid out How it works All Empire Life insurance and investment contracts-inforce and new applications Choice of either a) 100% annuity option OR b) Partial upfront payment with the balance paid via Life or Term Certain annuity Benefits Maintain influence with family and retain assets Estate planning opportunity - include in sales process and annual reviews Client peace of mind FOR DEALER/ADVISOR USE ONLY| 39

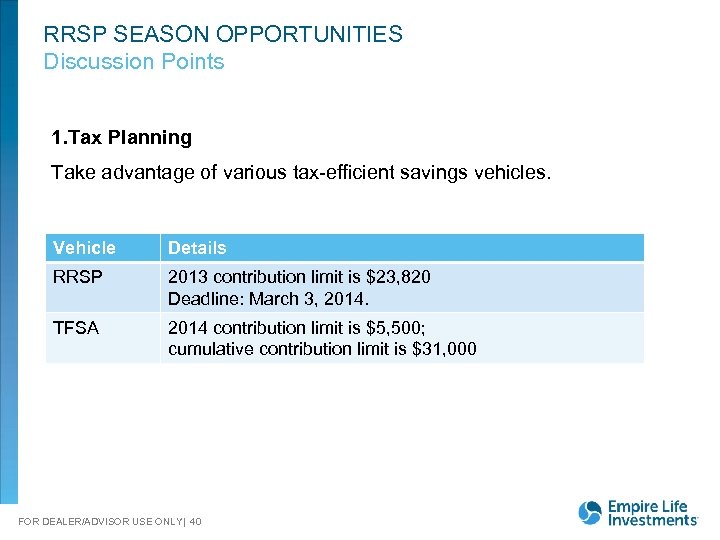

RRSP SEASON OPPORTUNITIES Discussion Points 1. Tax Planning Take advantage of various tax-efficient savings vehicles. Vehicle Details RRSP 2013 contribution limit is $23, 820 Deadline: March 3, 2014. TFSA 2014 contribution limit is $5, 500; cumulative contribution limit is $31, 000 FOR DEALER/ADVISOR USE ONLY| 40

RRSP SEASON OPPORTUNITIES Discussion Points 1. Tax Planning Take advantage of various tax-efficient savings vehicles. Vehicle Details RRSP 2013 contribution limit is $23, 820 Deadline: March 3, 2014. TFSA 2014 contribution limit is $5, 500; cumulative contribution limit is $31, 000 FOR DEALER/ADVISOR USE ONLY| 40

RRSP SEASON OPPORTUNITIES Discussion Points 2. Guaranteed Income Do your clients have a reliable retirement income source? • Possible solutions may be GWBs (Class Plus 2) or annuities (Empire Life Immediate Annuities), which provide guaranteed retirement income. • Check out Class Plus 2 -Guaranteed Retirement Income for Life and TM Empire Life Immediate Annuities FOR DEALER/ADVISOR USE ONLY| 41

RRSP SEASON OPPORTUNITIES Discussion Points 2. Guaranteed Income Do your clients have a reliable retirement income source? • Possible solutions may be GWBs (Class Plus 2) or annuities (Empire Life Immediate Annuities), which provide guaranteed retirement income. • Check out Class Plus 2 -Guaranteed Retirement Income for Life and TM Empire Life Immediate Annuities FOR DEALER/ADVISOR USE ONLY| 41

RRSP SEASON OPPORTUNITIES Discussion Points 3. Asset Allocation/Portfolio Rebalancing • Asset classes perform differently over time so a portfolio can drift from its target asset mix. • Does the current asset allocation reflect your client’s time horizon, risk tolerance, and investment goals? • A potential solution is a Portfolio program, which rebalances the asset mix to ensure it reflects the investor profile. FOR DEALER/ADVISOR USE ONLY| 42

RRSP SEASON OPPORTUNITIES Discussion Points 3. Asset Allocation/Portfolio Rebalancing • Asset classes perform differently over time so a portfolio can drift from its target asset mix. • Does the current asset allocation reflect your client’s time horizon, risk tolerance, and investment goals? • A potential solution is a Portfolio program, which rebalances the asset mix to ensure it reflects the investor profile. FOR DEALER/ADVISOR USE ONLY| 42

Social Media is here! Get the latest perspective from our Portfolio Managers! Join in the conversation! Located at www. empirelifeinvestments. ca FOR DEALER/ADVISOR USE ONLY| 43

Social Media is here! Get the latest perspective from our Portfolio Managers! Join in the conversation! Located at www. empirelifeinvestments. ca FOR DEALER/ADVISOR USE ONLY| 43

Thank You! We Appreciate Your Business www. empire. ca www. empirelifeinvestments. ca FOR DEALER/ADVISOR USE ONLY| 44

Thank You! We Appreciate Your Business www. empire. ca www. empirelifeinvestments. ca FOR DEALER/ADVISOR USE ONLY| 44

Disclaimer Empire Life Investments Inc. is the Manager of the Empire Life Mutual Funds (the “Funds”) and is the Portfolio Manager of the Empire Life segregated funds. Empire Life Investments is a wholly-owned subsidiary of The Empire Life Insurance Company. The units of the Funds are available only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such units. Nothing contained herein shall constitute, or shall be deemed to constitute, investment advice or a recommendation to buy or sell a specific security, by the Portfolios, Funds or their manager, Empire Life Investments Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information in this presentation is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. Empire Life Investments assumes no responsibility for any reliance made on or misuse or omissions of the information contained in this presentation. Please seek professional advice before making any decision Past performance is not a guarantee of future performance. Empire Class Segregated Funds, Class Plus 2 and Elite/Elite XL Investment Program contracts are issued by The Empire Life Insurance Company. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. ®/™ Trademarks of The Empire Life Insurance Company – used under license FOR DEALER/ADVISOR USE ONLY| 45

Disclaimer Empire Life Investments Inc. is the Manager of the Empire Life Mutual Funds (the “Funds”) and is the Portfolio Manager of the Empire Life segregated funds. Empire Life Investments is a wholly-owned subsidiary of The Empire Life Insurance Company. The units of the Funds are available only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such units. Nothing contained herein shall constitute, or shall be deemed to constitute, investment advice or a recommendation to buy or sell a specific security, by the Portfolios, Funds or their manager, Empire Life Investments Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The information in this presentation is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. Empire Life Investments assumes no responsibility for any reliance made on or misuse or omissions of the information contained in this presentation. Please seek professional advice before making any decision Past performance is not a guarantee of future performance. Empire Class Segregated Funds, Class Plus 2 and Elite/Elite XL Investment Program contracts are issued by The Empire Life Insurance Company. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. ®/™ Trademarks of The Empire Life Insurance Company – used under license FOR DEALER/ADVISOR USE ONLY| 45