492e3300b678b13aea4fc7c125be02e1.ppt

- Количество слайдов: 17

Emissions Trading – What Can Tax Teach Us? Matthew P. Haskins Confederation of Swedish Enterprise International Tax Conference 15 June 2009 Pw. C Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009

Emissions Trading – What Can Tax Teach Us? Matthew P. Haskins Confederation of Swedish Enterprise International Tax Conference 15 June 2009 Pw. C Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009

Overview • Carbon trading vs. carbon taxes • US legislative developments • Tax issues arising from emissions trading • “Hybrid” approaches to emissions trading and the importance of applying tax analysis to emissions trading and corporate carbon strategy Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 1

Overview • Carbon trading vs. carbon taxes • US legislative developments • Tax issues arising from emissions trading • “Hybrid” approaches to emissions trading and the importance of applying tax analysis to emissions trading and corporate carbon strategy Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 1

Carbon Trading vs. Carbon Taxes • Carbon trading and carbon taxes both achieve the policy goal of establishing a carbon price that drives investment and consumption decisions • Many economists and policymakers prefer the relative simplicity and transparency of a carbon tax over cap and trade systems - “Even some early devotees of a system of tradable emissions permits believe that it will not work for carbon dioxide, by definition a planetary problem. A straightforward tax on each ton of carbon dioxide emitted by any source, they say, would provide more a more predictable price and a simpler system to police. ” - New York Times (17 May 2009), citing inter alia, Al Gore Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 2

Carbon Trading vs. Carbon Taxes • Carbon trading and carbon taxes both achieve the policy goal of establishing a carbon price that drives investment and consumption decisions • Many economists and policymakers prefer the relative simplicity and transparency of a carbon tax over cap and trade systems - “Even some early devotees of a system of tradable emissions permits believe that it will not work for carbon dioxide, by definition a planetary problem. A straightforward tax on each ton of carbon dioxide emitted by any source, they say, would provide more a more predictable price and a simpler system to police. ” - New York Times (17 May 2009), citing inter alia, Al Gore Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 2

Carbon Trading vs. Carbon Taxes Advantages of Carbon Taxes • Reduced price volatility • Lower transactions and administrative costs of trading systems • Less complex and quicker to implement than trading systems - Example: British Columbia (Canada) introduced, adopted, and implemented a carbon tax in just six months. • Absence of free allocations lessens distortions of domestic competition • Ability to border adjust, consistent with WTO precedent • Potential for “green shift” reductions in other taxes Advantages of Carbon Trading • US political considerations favor enactment of cap and trade - Ability to allocate allowances to ease transition - Significant business support from US Climate Action Partnership (“US-CAP”) - Avoiding the “T” word • International Cooperation - Difficult under either approach - Head start on trading systems (EUETS) may hold the promise of eventual inter-linkage Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 3

Carbon Trading vs. Carbon Taxes Advantages of Carbon Taxes • Reduced price volatility • Lower transactions and administrative costs of trading systems • Less complex and quicker to implement than trading systems - Example: British Columbia (Canada) introduced, adopted, and implemented a carbon tax in just six months. • Absence of free allocations lessens distortions of domestic competition • Ability to border adjust, consistent with WTO precedent • Potential for “green shift” reductions in other taxes Advantages of Carbon Trading • US political considerations favor enactment of cap and trade - Ability to allocate allowances to ease transition - Significant business support from US Climate Action Partnership (“US-CAP”) - Avoiding the “T” word • International Cooperation - Difficult under either approach - Head start on trading systems (EUETS) may hold the promise of eventual inter-linkage Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 3

US Legislative Developments • While several carbon tax proposals have been introduced, Congress is more likely to act on a cap and trade bill • US Environmental Protection Agency finding that greenhouse gases are a “dangerous pollutant” may drive legislative action - If Congress does not act, EPA has asserted authority to implement GHG controls by regulation • Waxman-Markey bill (H. R. 2454) is the likely template for Congressional action - Reported out of committee on 21 May 2009 - Speaker Pelosi wants full House vote by 29 June 2009, but note that eight different House committees have asserted jurisdiction over this bill Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 4

US Legislative Developments • While several carbon tax proposals have been introduced, Congress is more likely to act on a cap and trade bill • US Environmental Protection Agency finding that greenhouse gases are a “dangerous pollutant” may drive legislative action - If Congress does not act, EPA has asserted authority to implement GHG controls by regulation • Waxman-Markey bill (H. R. 2454) is the likely template for Congressional action - Reported out of committee on 21 May 2009 - Speaker Pelosi wants full House vote by 29 June 2009, but note that eight different House committees have asserted jurisdiction over this bill Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 4

Waxman-Markey • Reduction Path - GHG emissions reductions from 2005 levels: 3% by 2012, 17% by 2020, and 83% by 2050 • Scope of System – significantly broader than the EU-ETS - Intended to cover 85% of GHG emissions 7, 400 facilities required to submit allowances Entities that emit less than 25, 000 tons/year of CO 2 -equivalent are exempt Renewable biomass fuels are exempt • Most Allowances Allocated - About 85% of allowances allocated free of charge through 2026 with most significant allocations to electric utilities (35% of total) and natural gas distributors (9%) - After 2026, system would gradually shift to an auction-dominated approach with revenues returned to public via per capita “climate change dividend” payments Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 5

Waxman-Markey • Reduction Path - GHG emissions reductions from 2005 levels: 3% by 2012, 17% by 2020, and 83% by 2050 • Scope of System – significantly broader than the EU-ETS - Intended to cover 85% of GHG emissions 7, 400 facilities required to submit allowances Entities that emit less than 25, 000 tons/year of CO 2 -equivalent are exempt Renewable biomass fuels are exempt • Most Allowances Allocated - About 85% of allowances allocated free of charge through 2026 with most significant allocations to electric utilities (35% of total) and natural gas distributors (9%) - After 2026, system would gradually shift to an auction-dominated approach with revenues returned to public via per capita “climate change dividend” payments Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 5

Waxman-Markey (continued) • Banking, Borrowing, Offsets, and Reserves - Unlimited banking - Borrowing permitted one year ahead - Both domestic and international offsets (e. g. , CERs) are permitted up to 2 billion tons/year, split evenly between domestic and international • “Exchange rate” – 5 international offset tons required for every 4 tons of emissions being offset - EPA would certify qualifying international emissions allowances for US use - “Strategic reserve” of allowances established, and EPA granted authority to auction such allowances if prices rise faster than expected - Auction reserve price of $10/ton, rising at CPI plus 5% • Trade and Competitiveness Issues - EPA to give allocations of allowances to certain trade-affected, energy-intensive industries (e. g. , aluminum) - By 2022, President must determine whether to continue these allocations or impose a border adjustment requirement on imports • National renewable portfolio standard requiring utilities to meet 20% of their demand with renewable energy by 2020 Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 6

Waxman-Markey (continued) • Banking, Borrowing, Offsets, and Reserves - Unlimited banking - Borrowing permitted one year ahead - Both domestic and international offsets (e. g. , CERs) are permitted up to 2 billion tons/year, split evenly between domestic and international • “Exchange rate” – 5 international offset tons required for every 4 tons of emissions being offset - EPA would certify qualifying international emissions allowances for US use - “Strategic reserve” of allowances established, and EPA granted authority to auction such allowances if prices rise faster than expected - Auction reserve price of $10/ton, rising at CPI plus 5% • Trade and Competitiveness Issues - EPA to give allocations of allowances to certain trade-affected, energy-intensive industries (e. g. , aluminum) - By 2022, President must determine whether to continue these allocations or impose a border adjustment requirement on imports • National renewable portfolio standard requiring utilities to meet 20% of their demand with renewable energy by 2020 Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 6

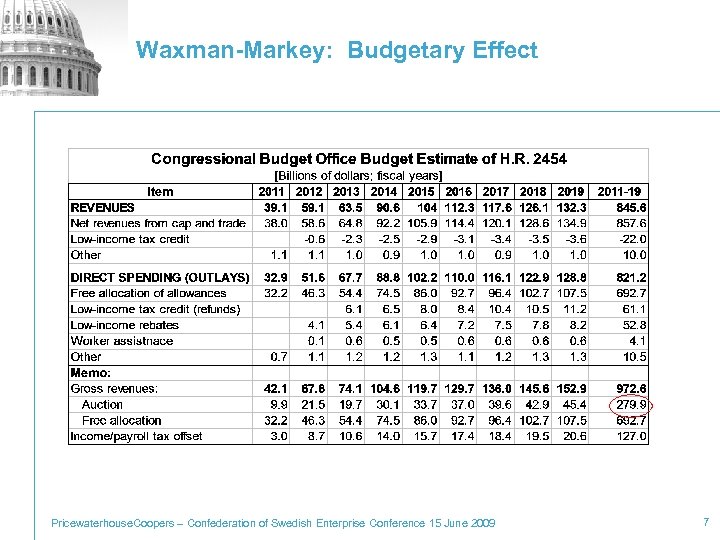

Waxman-Markey: Budgetary Effect Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 7

Waxman-Markey: Budgetary Effect Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 7

Tax Issues Arising From Emissions Trading: An End-User’s Perspective • Does receipt of a freely allocated allowance create taxable income? - US precedents from our Acid Rain Program say “no, ” but with no analysis - The Australian Tax Office proposed to treat such receipts as taxable but has since backed off • What sort of asset is an emissions allowance? Intangible? Commodity? Something new? - US private guidance calls it an “operating intangible” - This cures some issues (no passive income under US CFC rules) but creates others • Does a company that voluntarily buys carbon credits to offset its emissions get a current deduction for the expense? • Should carbon credits be treated as inventory? • Does differing characterization across jurisdictions present double-tax risk that is unaddressed by treaties? Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 8

Tax Issues Arising From Emissions Trading: An End-User’s Perspective • Does receipt of a freely allocated allowance create taxable income? - US precedents from our Acid Rain Program say “no, ” but with no analysis - The Australian Tax Office proposed to treat such receipts as taxable but has since backed off • What sort of asset is an emissions allowance? Intangible? Commodity? Something new? - US private guidance calls it an “operating intangible” - This cures some issues (no passive income under US CFC rules) but creates others • Does a company that voluntarily buys carbon credits to offset its emissions get a current deduction for the expense? • Should carbon credits be treated as inventory? • Does differing characterization across jurisdictions present double-tax risk that is unaddressed by treaties? Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 8

Tax Issues Arising From Emissions Trading: A Financial Intermediary’s Perspective • Can investors trade in emissions allowances without creating a taxable permanent establishment? - UK guidance extends its investment manager exemption to carbon trading - US guidance on its trading safe harbor is unclear; under current law, a favorable answer would require IRS to treat allowances as “commodities” • What does it mean to become a “dealer” in emissions allowances? • Should emissions allowances be characterized the same way for traders as they are for end users? - Differing treatment may facilitate favorable rules for traders that provide depth and liquidity to emissions trading markets - But differences in treatment also may facilitate tax arbitrage Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 9

Tax Issues Arising From Emissions Trading: A Financial Intermediary’s Perspective • Can investors trade in emissions allowances without creating a taxable permanent establishment? - UK guidance extends its investment manager exemption to carbon trading - US guidance on its trading safe harbor is unclear; under current law, a favorable answer would require IRS to treat allowances as “commodities” • What does it mean to become a “dealer” in emissions allowances? • Should emissions allowances be characterized the same way for traders as they are for end users? - Differing treatment may facilitate favorable rules for traders that provide depth and liquidity to emissions trading markets - But differences in treatment also may facilitate tax arbitrage Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 9

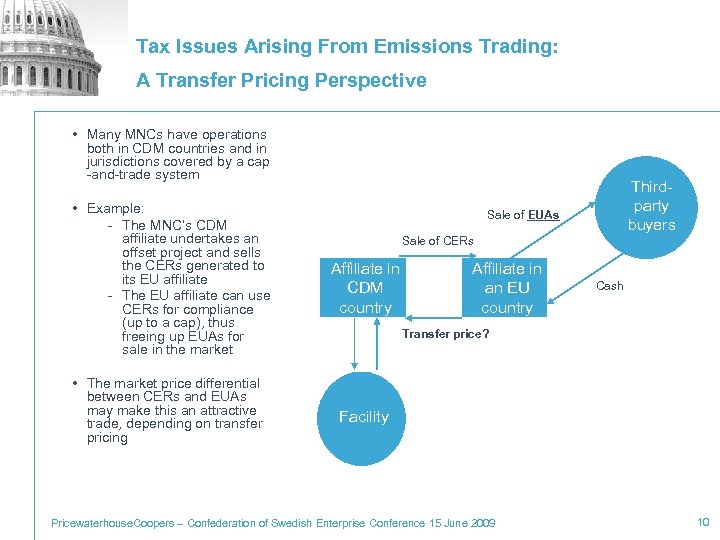

Tax Issues Arising From Emissions Trading: A Transfer Pricing Perspective • Many MNCs have operations both in CDM countries and in jurisdictions covered by a cap -and-trade system • Example: - The MNC’s CDM affiliate undertakes an offset project and sells the CERs generated to its EU affiliate - The EU affiliate can use CERs for compliance (up to a cap), thus freeing up EUAs for sale in the market • The market price differential between CERs and EUAs may make this an attractive trade, depending on transfer pricing Thirdparty buyers Sale of EUAs Sale of CERs Affiliate in CDM country Affiliate in an EU country Cash Transfer price? Facility Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 10

Tax Issues Arising From Emissions Trading: A Transfer Pricing Perspective • Many MNCs have operations both in CDM countries and in jurisdictions covered by a cap -and-trade system • Example: - The MNC’s CDM affiliate undertakes an offset project and sells the CERs generated to its EU affiliate - The EU affiliate can use CERs for compliance (up to a cap), thus freeing up EUAs for sale in the market • The market price differential between CERs and EUAs may make this an attractive trade, depending on transfer pricing Thirdparty buyers Sale of EUAs Sale of CERs Affiliate in CDM country Affiliate in an EU country Cash Transfer price? Facility Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 10

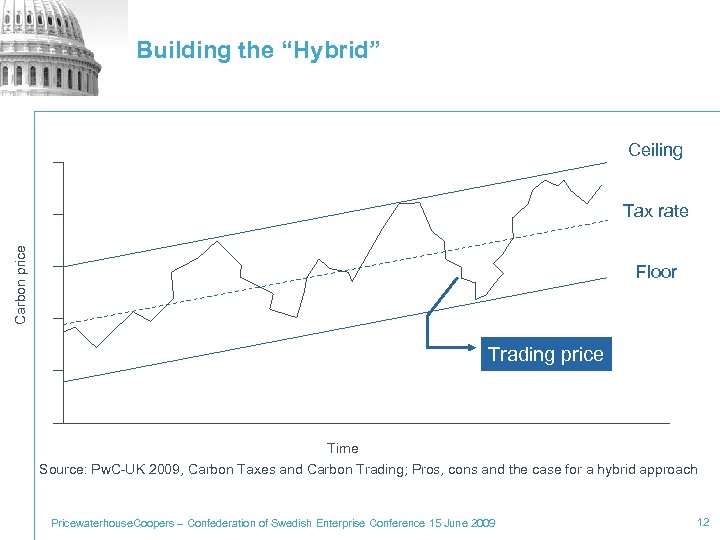

Hybrid Approaches and the Importance of Tax Analysis • Many of the price-certainty advantages of a carbon tax can be replicated (or nearly so) in a carbon trading system - Reserve auction prices set a floor on the market - Setting a penalty tax level or releasing additional allowances at a price ceiling - Banking and borrowing also contribute to price stability • US legislators appear to recognize this and have built several of these features into the Waxman-Markey draft • “Technical” tax issues also are important – but underdeveloped - Senate Finance Committee hearing scheduled for 16 June 2009 Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 11

Hybrid Approaches and the Importance of Tax Analysis • Many of the price-certainty advantages of a carbon tax can be replicated (or nearly so) in a carbon trading system - Reserve auction prices set a floor on the market - Setting a penalty tax level or releasing additional allowances at a price ceiling - Banking and borrowing also contribute to price stability • US legislators appear to recognize this and have built several of these features into the Waxman-Markey draft • “Technical” tax issues also are important – but underdeveloped - Senate Finance Committee hearing scheduled for 16 June 2009 Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 11

Building the “Hybrid” Ceiling Carbon price Tax rate Floor Trading price Time Source: Pw. C-UK 2009, Carbon Taxes and Carbon Trading; Pros, cons and the case for a hybrid approach Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 12

Building the “Hybrid” Ceiling Carbon price Tax rate Floor Trading price Time Source: Pw. C-UK 2009, Carbon Taxes and Carbon Trading; Pros, cons and the case for a hybrid approach Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 12

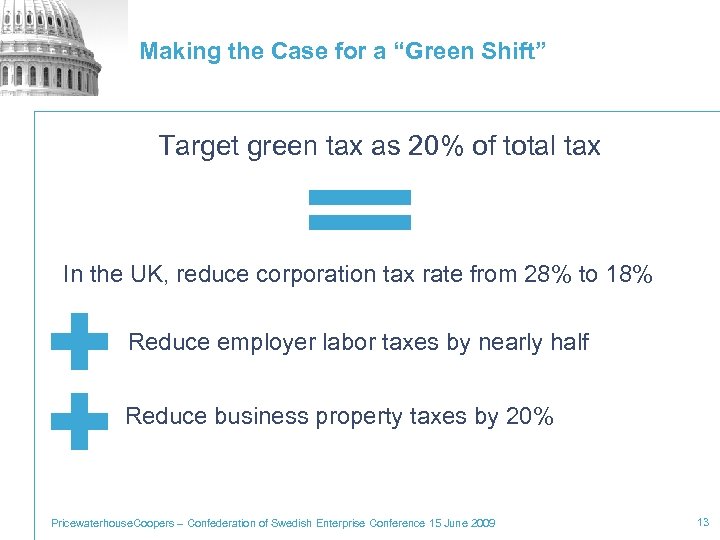

Making the Case for a “Green Shift” Target green tax as 20% of total tax In the UK, reduce corporation tax rate from 28% to 18% Reduce employer labor taxes by nearly half Reduce business property taxes by 20% Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 13

Making the Case for a “Green Shift” Target green tax as 20% of total tax In the UK, reduce corporation tax rate from 28% to 18% Reduce employer labor taxes by nearly half Reduce business property taxes by 20% Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 13

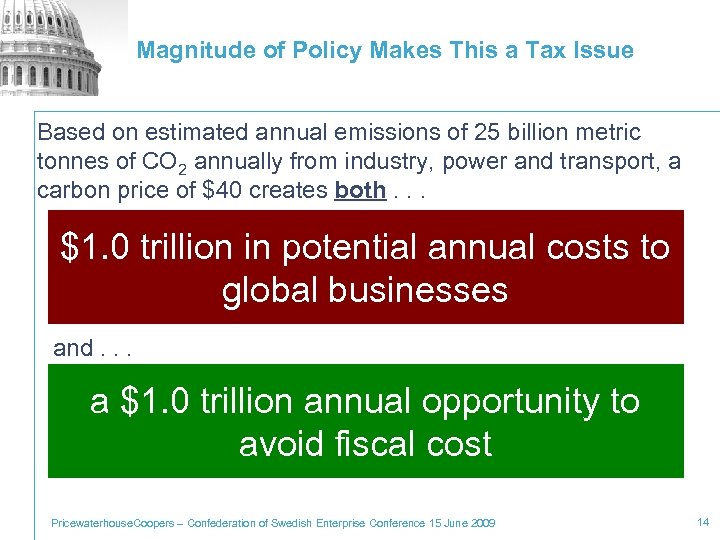

Magnitude of Policy Makes This a Tax Issue Based on estimated annual emissions of 25 billion metric tonnes of CO 2 annually from industry, power and transport, a carbon price of $40 creates both. . . $1. 0 trillion in potential annual costs to global businesses and. . . a $1. 0 trillion annual opportunity to avoid fiscal cost Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 14

Magnitude of Policy Makes This a Tax Issue Based on estimated annual emissions of 25 billion metric tonnes of CO 2 annually from industry, power and transport, a carbon price of $40 creates both. . . $1. 0 trillion in potential annual costs to global businesses and. . . a $1. 0 trillion annual opportunity to avoid fiscal cost Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 14

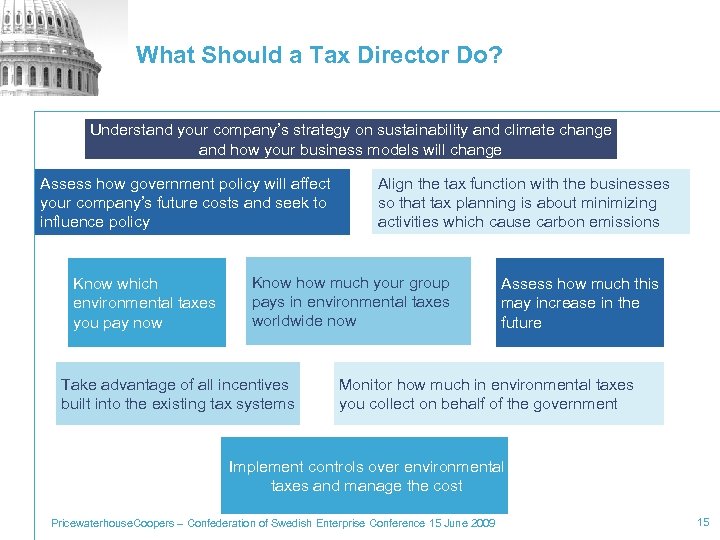

What Should a Tax Director Do? Understand your company’s strategy on sustainability and climate change and how your business models will change Assess how government policy will affect your company’s future costs and seek to influence policy Know which environmental taxes you pay now Align the tax function with the businesses so that tax planning is about minimizing activities which cause carbon emissions Know how much your group pays in environmental taxes worldwide now Take advantage of all incentives built into the existing tax systems Assess how much this may increase in the future Monitor how much in environmental taxes you collect on behalf of the government Implement controls over environmental taxes and manage the cost Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 15

What Should a Tax Director Do? Understand your company’s strategy on sustainability and climate change and how your business models will change Assess how government policy will affect your company’s future costs and seek to influence policy Know which environmental taxes you pay now Align the tax function with the businesses so that tax planning is about minimizing activities which cause carbon emissions Know how much your group pays in environmental taxes worldwide now Take advantage of all incentives built into the existing tax systems Assess how much this may increase in the future Monitor how much in environmental taxes you collect on behalf of the government Implement controls over environmental taxes and manage the cost Pricewaterhouse. Coopers – Confederation of Swedish Enterprise Conference 15 June 2009 15

Pw. C This document is provided by Pricewaterhouse. Coopers LLP for general guidance only, and does not constitute the provision of legal advice, accounting services, investment advice, written tax advice under Circular 230 or professional advice of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult with a professional adviser who has been provided with all pertinent facts relevant to your particular situation. The information is provided ‘as is’ with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties or performance, merchantability, and fitness for a particular purpose. NY-GR-05 -1332 -A © 2009 Pricewaterhouse. Coopers LLP. All rights reserved. “Pricewaterhouse. Coopers” refers to Pricewaterhouse. Coopers LLP Pricewaterhouse. Coopers SALT partnership) or, as the context requires, other member firms of Pricewaterhouse. Coopers International Limited, (a Delaware limited liability each of which is a separate and independent legal entity. 16 Date

Pw. C This document is provided by Pricewaterhouse. Coopers LLP for general guidance only, and does not constitute the provision of legal advice, accounting services, investment advice, written tax advice under Circular 230 or professional advice of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisers. Before making any decision or taking any action, you should consult with a professional adviser who has been provided with all pertinent facts relevant to your particular situation. The information is provided ‘as is’ with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties or performance, merchantability, and fitness for a particular purpose. NY-GR-05 -1332 -A © 2009 Pricewaterhouse. Coopers LLP. All rights reserved. “Pricewaterhouse. Coopers” refers to Pricewaterhouse. Coopers LLP Pricewaterhouse. Coopers SALT partnership) or, as the context requires, other member firms of Pricewaterhouse. Coopers International Limited, (a Delaware limited liability each of which is a separate and independent legal entity. 16 Date