961b12d1b18d0c6594816d46a0a2dae2.ppt

- Количество слайдов: 53

Elida Local Schools Financial Summit III Report to Stakeholders Fiscal Year 2007 -2008 Joel L. Parker, CPA

Elida Local Schools Financial Summit III Report to Stakeholders Fiscal Year 2007 -2008 Joel L. Parker, CPA

Summit Team n n n n n n Lynn Metzger, Metzger Financial Services Bruce Opperman, WLIO Phillip Morton, Elida Visionaries Matt Huffman, State Representative Dennis Swick, Mayor of Elida Paul Basinger, Township Trustee Pat Schymanski, Elida Visionaries Peter Kesler, Ohio Foam Corporation Cliff Barber, General Dynamics David Anderson, The State Bank Max Stover, First Federal Bank Steve Boroff, Superior Federal Credit Union Steve Romey, Attorney Beth Jokinen, The Lima News Mike Ford, Delphos Herald Becky Foust, EEA Sally Ulrich, Elida Board Member Brenda Stocker, Elida Board Vice President Don Diglia, Elida Superintendent Joel Parker, Elida Treasurer Faith Cummings, Elida NCLB Director Jo Ellen Miller, Elida Information Director

Summit Team n n n n n n Lynn Metzger, Metzger Financial Services Bruce Opperman, WLIO Phillip Morton, Elida Visionaries Matt Huffman, State Representative Dennis Swick, Mayor of Elida Paul Basinger, Township Trustee Pat Schymanski, Elida Visionaries Peter Kesler, Ohio Foam Corporation Cliff Barber, General Dynamics David Anderson, The State Bank Max Stover, First Federal Bank Steve Boroff, Superior Federal Credit Union Steve Romey, Attorney Beth Jokinen, The Lima News Mike Ford, Delphos Herald Becky Foust, EEA Sally Ulrich, Elida Board Member Brenda Stocker, Elida Board Vice President Don Diglia, Elida Superintendent Joel Parker, Elida Treasurer Faith Cummings, Elida NCLB Director Jo Ellen Miller, Elida Information Director

Goals n n n n Review data on high school project Review the financial condition of Elida Local Schools Expand the knowledge base on school funding issues Review data for future financial planning Exchange ideas on “best practices” Encourage dialogue on future economic trends Have summit representative report to the Board of Education on current condition

Goals n n n n Review data on high school project Review the financial condition of Elida Local Schools Expand the knowledge base on school funding issues Review data for future financial planning Exchange ideas on “best practices” Encourage dialogue on future economic trends Have summit representative report to the Board of Education on current condition

THERE IS NO BUSINESS LIKE PUBLIC SCHOOL BUSINESS n n n Ohio Revised Code No Child Left Behind Unfunded mandates-HB 1 De. Rolph case Collective Bargaining Tax structure n. State Budget n. Levies/Bond Issues n. Phantom Revenue n. Voters n. Raw product - 100% accepted n. Emotional Issues

THERE IS NO BUSINESS LIKE PUBLIC SCHOOL BUSINESS n n n Ohio Revised Code No Child Left Behind Unfunded mandates-HB 1 De. Rolph case Collective Bargaining Tax structure n. State Budget n. Levies/Bond Issues n. Phantom Revenue n. Voters n. Raw product - 100% accepted n. Emotional Issues

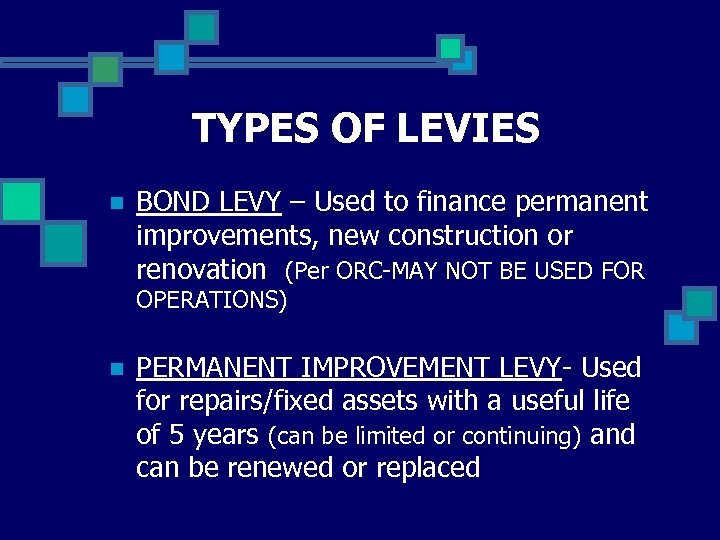

TYPES OF LEVIES n BOND LEVY – Used to finance permanent improvements, new construction or renovation (Per ORC-MAY NOT BE USED FOR OPERATIONS) n PERMANENT IMPROVEMENT LEVY- Used for repairs/fixed assets with a useful life of 5 years (can be limited or continuing) and can be renewed or replaced

TYPES OF LEVIES n BOND LEVY – Used to finance permanent improvements, new construction or renovation (Per ORC-MAY NOT BE USED FOR OPERATIONS) n PERMANENT IMPROVEMENT LEVY- Used for repairs/fixed assets with a useful life of 5 years (can be limited or continuing) and can be renewed or replaced

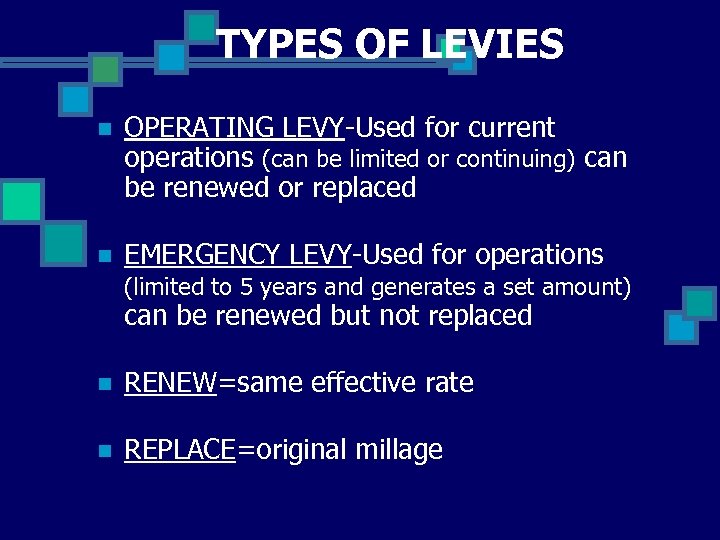

TYPES OF LEVIES n OPERATING LEVY-Used for current operations (can be limited or continuing) can be renewed or replaced n EMERGENCY LEVY-Used for operations (limited to 5 years and generates a set amount) can be renewed but not replaced n RENEW=same effective rate n REPLACE=original millage

TYPES OF LEVIES n OPERATING LEVY-Used for current operations (can be limited or continuing) can be renewed or replaced n EMERGENCY LEVY-Used for operations (limited to 5 years and generates a set amount) can be renewed but not replaced n RENEW=same effective rate n REPLACE=original millage

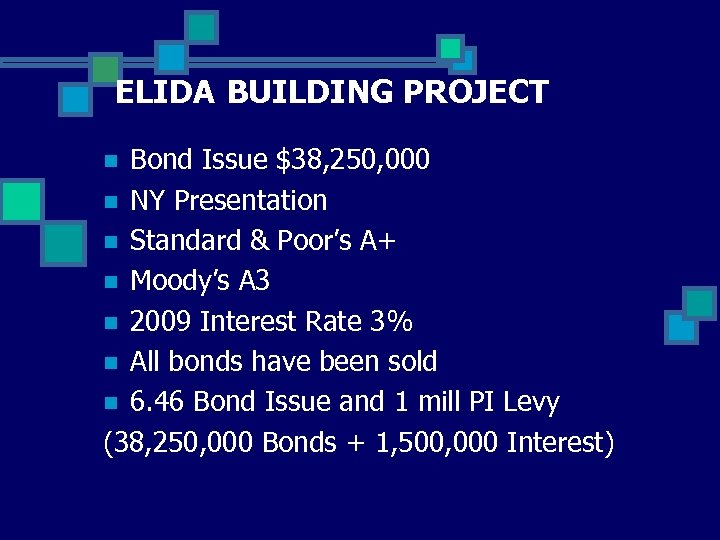

ELIDA BUILDING PROJECT Bond Issue $38, 250, 000 n NY Presentation n Standard & Poor’s A+ n Moody’s A 3 n 2009 Interest Rate 3% n All bonds have been sold n 6. 46 Bond Issue and 1 mill PI Levy (38, 250, 000 Bonds + 1, 500, 000 Interest) n

ELIDA BUILDING PROJECT Bond Issue $38, 250, 000 n NY Presentation n Standard & Poor’s A+ n Moody’s A 3 n 2009 Interest Rate 3% n All bonds have been sold n 6. 46 Bond Issue and 1 mill PI Levy (38, 250, 000 Bonds + 1, 500, 000 Interest) n

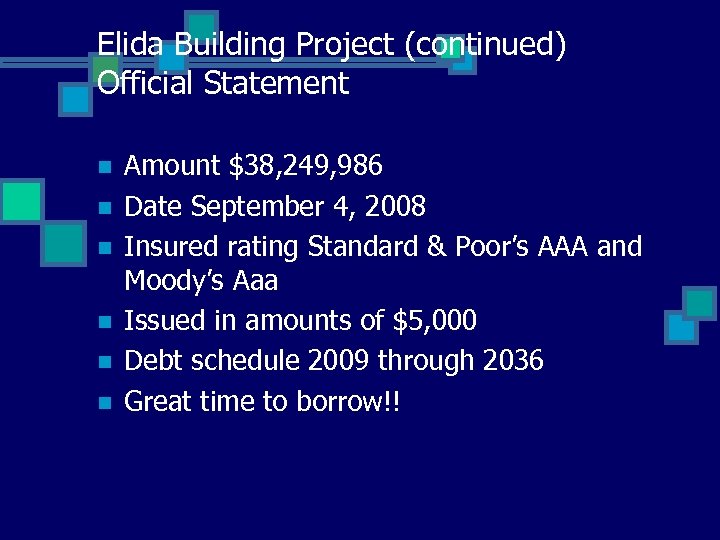

Elida Building Project (continued) Official Statement n n n Amount $38, 249, 986 Date September 4, 2008 Insured rating Standard & Poor’s AAA and Moody’s Aaa Issued in amounts of $5, 000 Debt schedule 2009 through 2036 Great time to borrow!!

Elida Building Project (continued) Official Statement n n n Amount $38, 249, 986 Date September 4, 2008 Insured rating Standard & Poor’s AAA and Moody’s Aaa Issued in amounts of $5, 000 Debt schedule 2009 through 2036 Great time to borrow!!

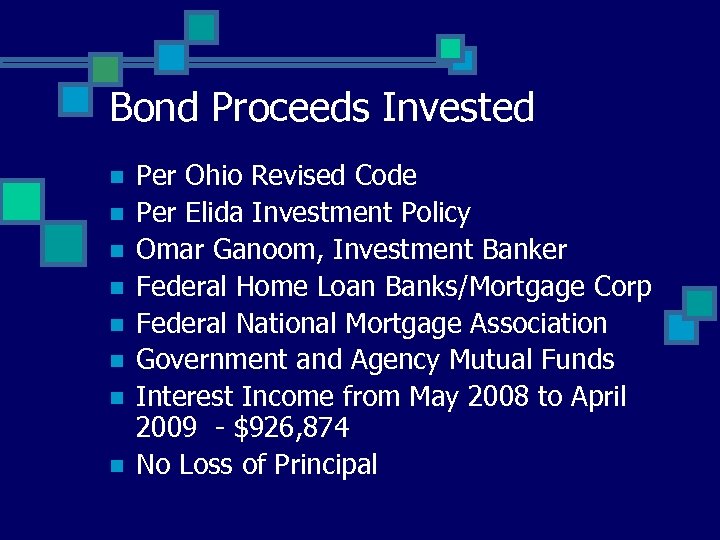

Bond Proceeds Invested n n n n Per Ohio Revised Code Per Elida Investment Policy Omar Ganoom, Investment Banker Federal Home Loan Banks/Mortgage Corp Federal National Mortgage Association Government and Agency Mutual Funds Interest Income from May 2008 to April 2009 - $926, 874 No Loss of Principal

Bond Proceeds Invested n n n n Per Ohio Revised Code Per Elida Investment Policy Omar Ganoom, Investment Banker Federal Home Loan Banks/Mortgage Corp Federal National Mortgage Association Government and Agency Mutual Funds Interest Income from May 2008 to April 2009 - $926, 874 No Loss of Principal

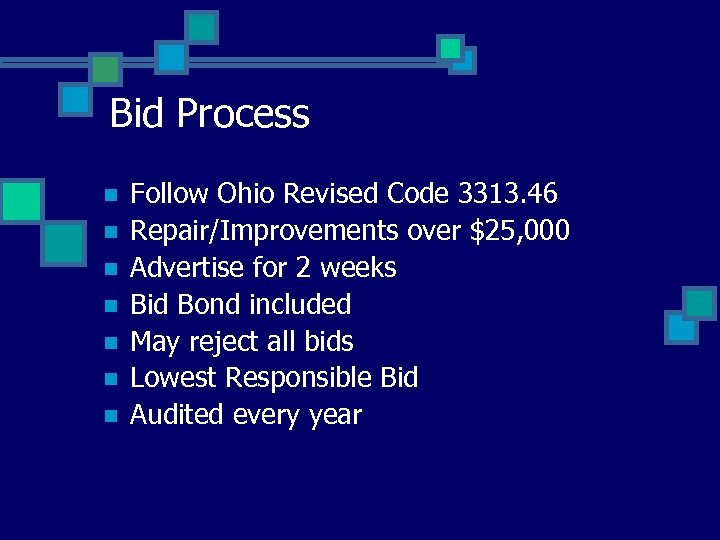

Bid Process n n n n Follow Ohio Revised Code 3313. 46 Repair/Improvements over $25, 000 Advertise for 2 weeks Bid Bond included May reject all bids Lowest Responsible Bid Audited every year

Bid Process n n n n Follow Ohio Revised Code 3313. 46 Repair/Improvements over $25, 000 Advertise for 2 weeks Bid Bond included May reject all bids Lowest Responsible Bid Audited every year

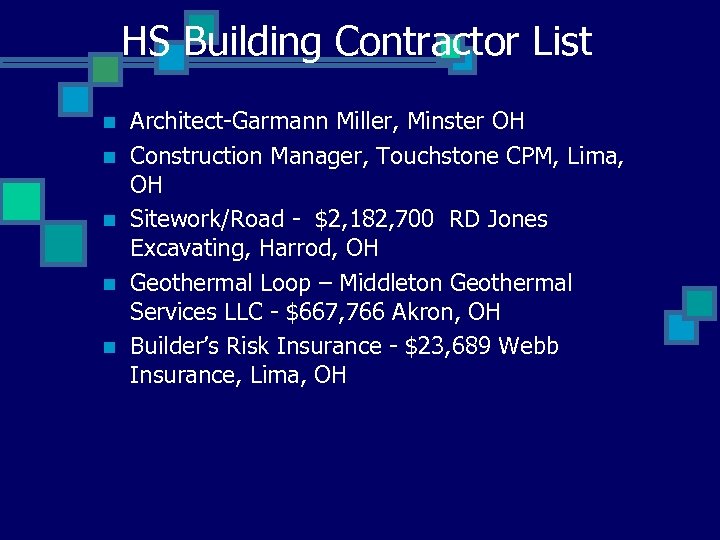

HS Building Contractor List n n n Architect-Garmann Miller, Minster OH Construction Manager, Touchstone CPM, Lima, OH Sitework/Road - $2, 182, 700 RD Jones Excavating, Harrod, OH Geothermal Loop – Middleton Geothermal Services LLC - $667, 766 Akron, OH Builder’s Risk Insurance - $23, 689 Webb Insurance, Lima, OH

HS Building Contractor List n n n Architect-Garmann Miller, Minster OH Construction Manager, Touchstone CPM, Lima, OH Sitework/Road - $2, 182, 700 RD Jones Excavating, Harrod, OH Geothermal Loop – Middleton Geothermal Services LLC - $667, 766 Akron, OH Builder’s Risk Insurance - $23, 689 Webb Insurance, Lima, OH

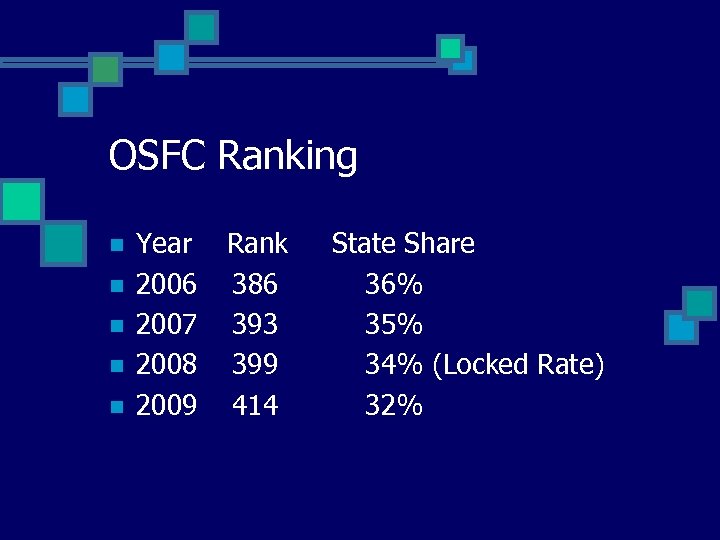

OSFC Ranking n n n Year 2006 2007 2008 2009 Rank 386 393 399 414 State Share 36% 35% 34% (Locked Rate) 32%

OSFC Ranking n n n Year 2006 2007 2008 2009 Rank 386 393 399 414 State Share 36% 35% 34% (Locked Rate) 32%

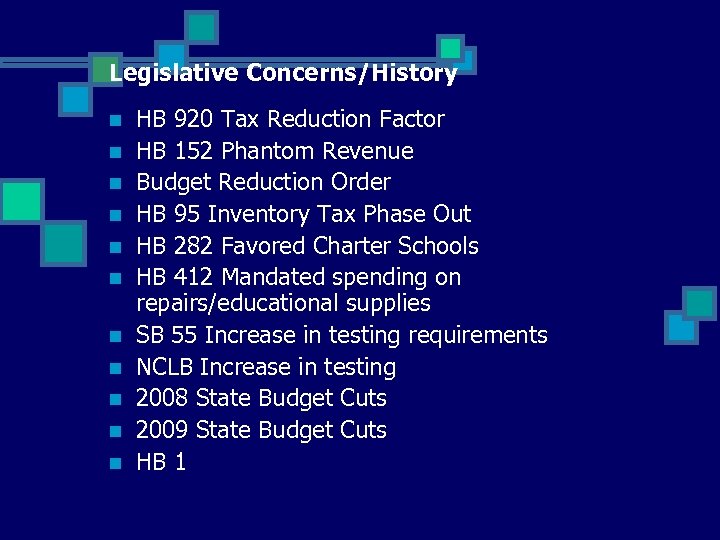

Legislative Concerns/History n n n HB 920 Tax Reduction Factor HB 152 Phantom Revenue Budget Reduction Order HB 95 Inventory Tax Phase Out HB 282 Favored Charter Schools HB 412 Mandated spending on repairs/educational supplies SB 55 Increase in testing requirements NCLB Increase in testing 2008 State Budget Cuts 2009 State Budget Cuts HB 1

Legislative Concerns/History n n n HB 920 Tax Reduction Factor HB 152 Phantom Revenue Budget Reduction Order HB 95 Inventory Tax Phase Out HB 282 Favored Charter Schools HB 412 Mandated spending on repairs/educational supplies SB 55 Increase in testing requirements NCLB Increase in testing 2008 State Budget Cuts 2009 State Budget Cuts HB 1

HOW MANY CLIENTS? n n n Students Tax payers Boosters Parents Business partners Local officials

HOW MANY CLIENTS? n n n Students Tax payers Boosters Parents Business partners Local officials

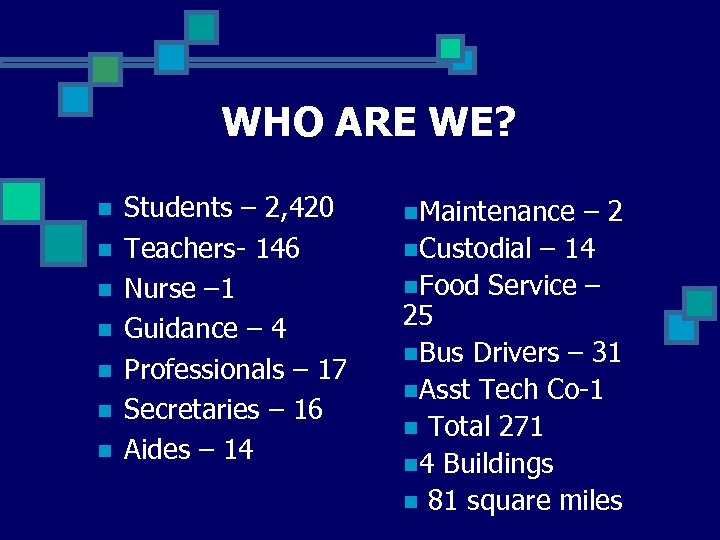

WHO ARE WE? n n n n Students – 2, 420 Teachers- 146 Nurse – 1 Guidance – 4 Professionals – 17 Secretaries – 16 Aides – 14 n. Maintenance – 2 n. Custodial – 14 n. Food Service – 25 n. Bus Drivers – 31 n. Asst Tech Co-1 n Total 271 n 4 Buildings n 81 square miles

WHO ARE WE? n n n n Students – 2, 420 Teachers- 146 Nurse – 1 Guidance – 4 Professionals – 17 Secretaries – 16 Aides – 14 n. Maintenance – 2 n. Custodial – 14 n. Food Service – 25 n. Bus Drivers – 31 n. Asst Tech Co-1 n Total 271 n 4 Buildings n 81 square miles

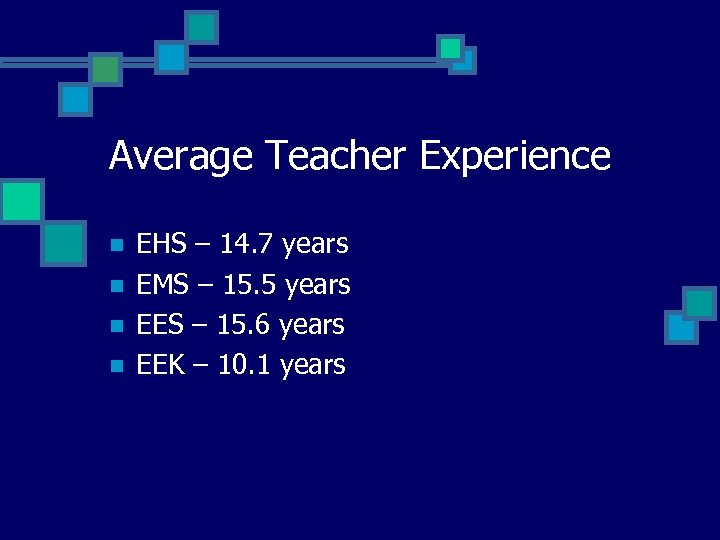

Average Teacher Experience n n EHS – 14. 7 years EMS – 15. 5 years EES – 15. 6 years EEK – 10. 1 years

Average Teacher Experience n n EHS – 14. 7 years EMS – 15. 5 years EES – 15. 6 years EEK – 10. 1 years

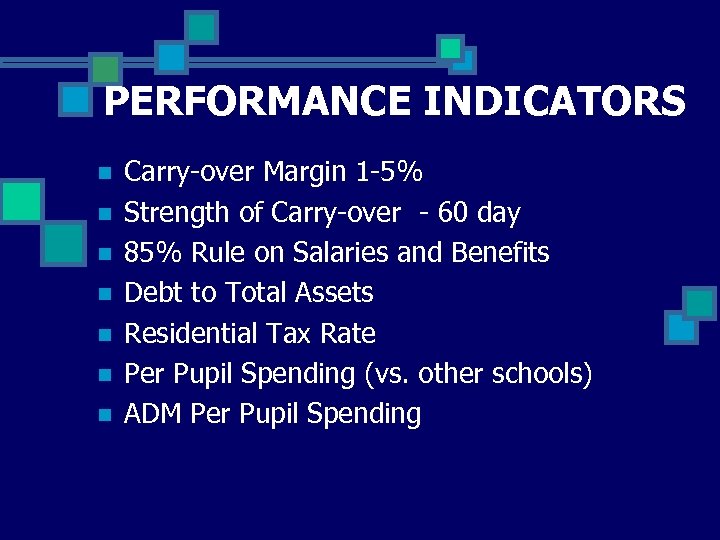

PERFORMANCE INDICATORS n n n n Carry-over Margin 1 -5% Strength of Carry-over - 60 day 85% Rule on Salaries and Benefits Debt to Total Assets Residential Tax Rate Per Pupil Spending (vs. other schools) ADM Per Pupil Spending

PERFORMANCE INDICATORS n n n n Carry-over Margin 1 -5% Strength of Carry-over - 60 day 85% Rule on Salaries and Benefits Debt to Total Assets Residential Tax Rate Per Pupil Spending (vs. other schools) ADM Per Pupil Spending

AUDIT LIST n n n Annual Financial Audit by Auditor of State ADM Audit by ODE(every 5 years) Staffing Audit by ODE(5 years ago) Curriculum Review by ODE Annual Facility Inspection (Jared’s Law)

AUDIT LIST n n n Annual Financial Audit by Auditor of State ADM Audit by ODE(every 5 years) Staffing Audit by ODE(5 years ago) Curriculum Review by ODE Annual Facility Inspection (Jared’s Law)

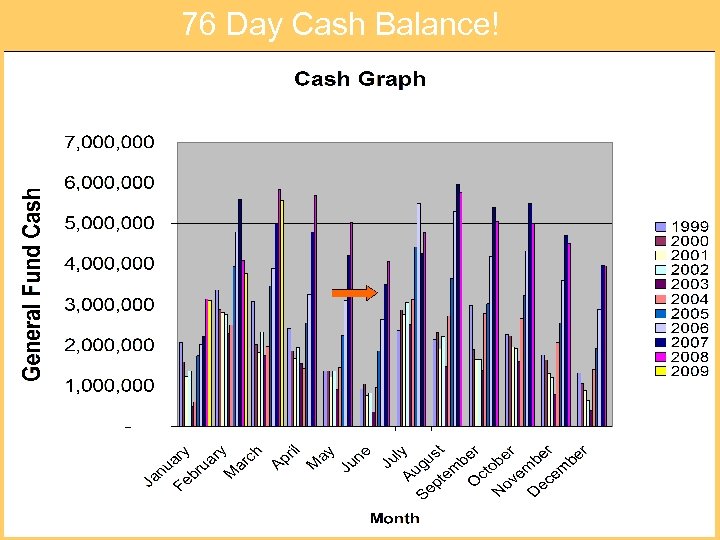

76 Day Cash Balance! 60 DAY CASH BALANCE ALMOST A REALITY

76 Day Cash Balance! 60 DAY CASH BALANCE ALMOST A REALITY

June 30 Carry-Over *Gaining Strength* n n n n n 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 $ 936, 422 $1, 048, 819 $ 758, 675 $ 821, 146 $ 360, 933 $ 967, 429 $1, 865, 900 $2, 645, 703 $3, 496, 376 $4, 071, 288 21 days 23 days 17 days 18 days 21 days 39 days 53 days 68 days 76 days

June 30 Carry-Over *Gaining Strength* n n n n n 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 $ 936, 422 $1, 048, 819 $ 758, 675 $ 821, 146 $ 360, 933 $ 967, 429 $1, 865, 900 $2, 645, 703 $3, 496, 376 $4, 071, 288 21 days 23 days 17 days 18 days 21 days 39 days 53 days 68 days 76 days

WHAT CHANGED? n n n Staff cuts Administrative cuts $239, 155 Administrative Wages-0% increase 2 yrs Streamlined food service Moved staff to PPO insurance plan Moved to pay to participate Passed a levy in 2005 to bring back specific programs Reduce bus fuel consumption Think long term Savings on Retire/Rehire Sharing on health premiums

WHAT CHANGED? n n n Staff cuts Administrative cuts $239, 155 Administrative Wages-0% increase 2 yrs Streamlined food service Moved staff to PPO insurance plan Moved to pay to participate Passed a levy in 2005 to bring back specific programs Reduce bus fuel consumption Think long term Savings on Retire/Rehire Sharing on health premiums

Health Insurance n n n 1/1/09 Medical Rate Increase 15% 1/1/09 Dental Rate Increase 20% 1/1/09 New Plan MDHP Developed Meeting this year to introduce HDHP plan Continue discussions on spousal coordination of benefits What are you doing/seeing? ? ?

Health Insurance n n n 1/1/09 Medical Rate Increase 15% 1/1/09 Dental Rate Increase 20% 1/1/09 New Plan MDHP Developed Meeting this year to introduce HDHP plan Continue discussions on spousal coordination of benefits What are you doing/seeing? ? ?

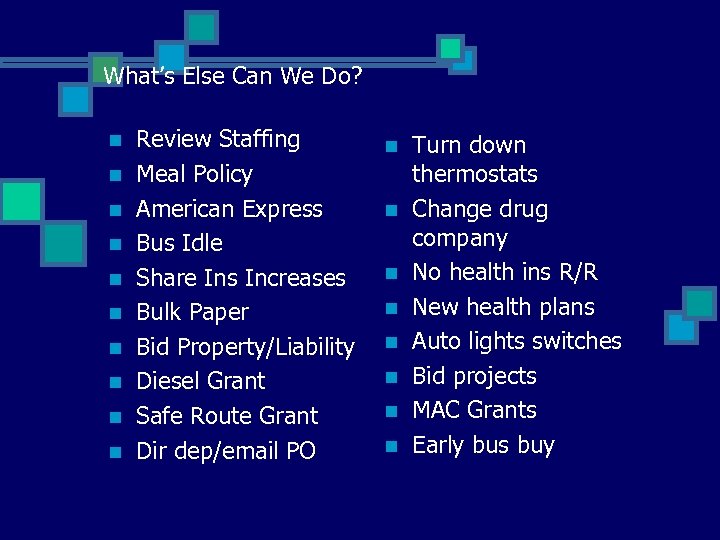

What’s Else Can We Do? n n n n n Review Staffing Meal Policy American Express Bus Idle Share Ins Increases Bulk Paper Bid Property/Liability Diesel Grant Safe Route Grant Dir dep/email PO n n n n Turn down thermostats Change drug company No health ins R/R New health plans Auto lights switches Bid projects MAC Grants Early bus buy

What’s Else Can We Do? n n n n n Review Staffing Meal Policy American Express Bus Idle Share Ins Increases Bulk Paper Bid Property/Liability Diesel Grant Safe Route Grant Dir dep/email PO n n n n Turn down thermostats Change drug company No health ins R/R New health plans Auto lights switches Bid projects MAC Grants Early bus buy

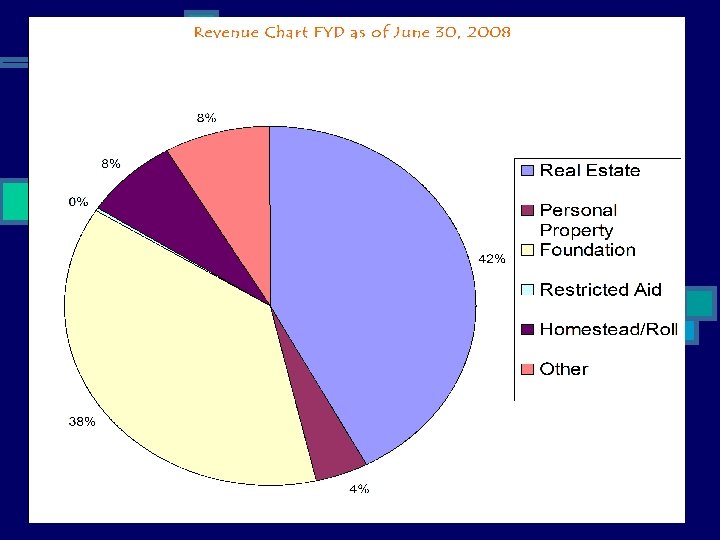

General Fund

General Fund

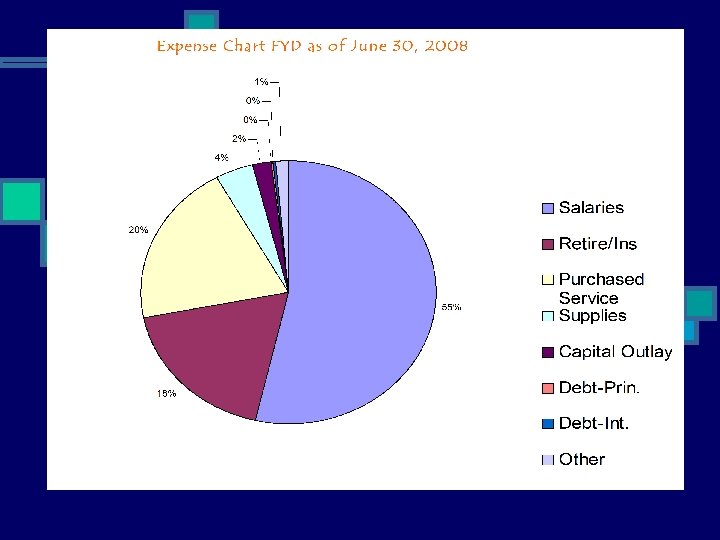

General Fund Expenditures

General Fund Expenditures

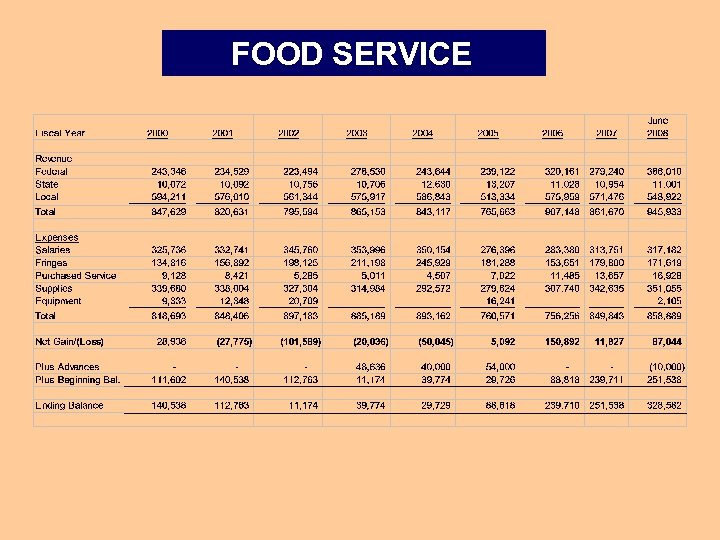

FOOD SERVICE

FOOD SERVICE

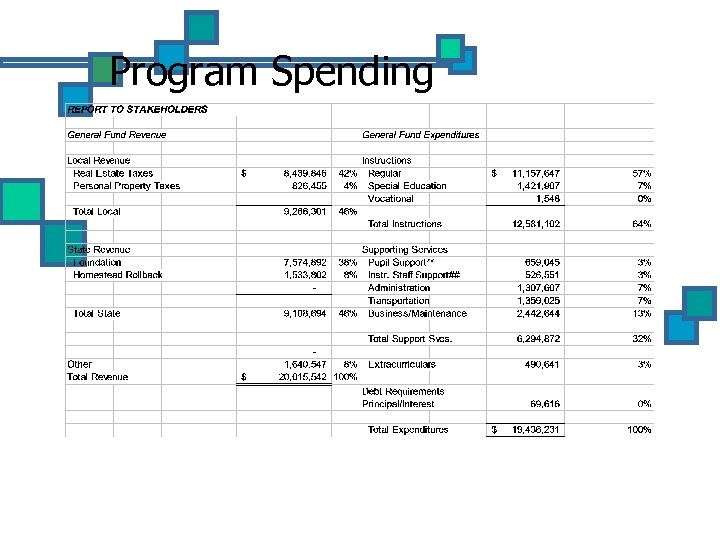

Program Spending

Program Spending

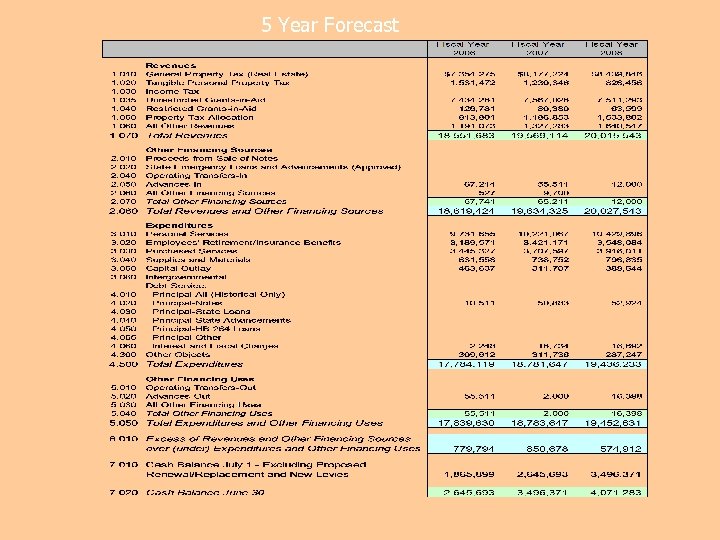

5 Year Forecast

5 Year Forecast

AUDIT REPORT n n n Performed every year Cost to taxpayers $16, 000 Cash basis (saves taxpayers $10, 000$13, 000 each year) Tests are performed on accounts payable, payroll, compliance with ORC, fund raising, athletics, food service, grants, etc. Clean opinion No adjustments

AUDIT REPORT n n n Performed every year Cost to taxpayers $16, 000 Cash basis (saves taxpayers $10, 000$13, 000 each year) Tests are performed on accounts payable, payroll, compliance with ORC, fund raising, athletics, food service, grants, etc. Clean opinion No adjustments

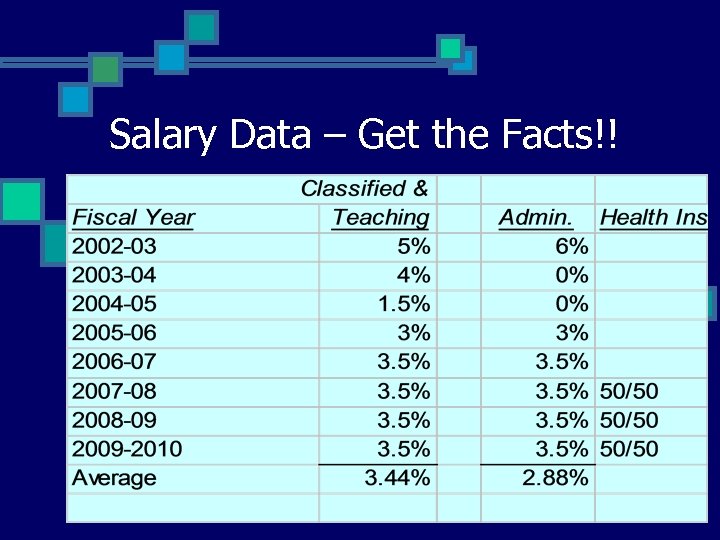

Salary Data – Get the Facts!!

Salary Data – Get the Facts!!

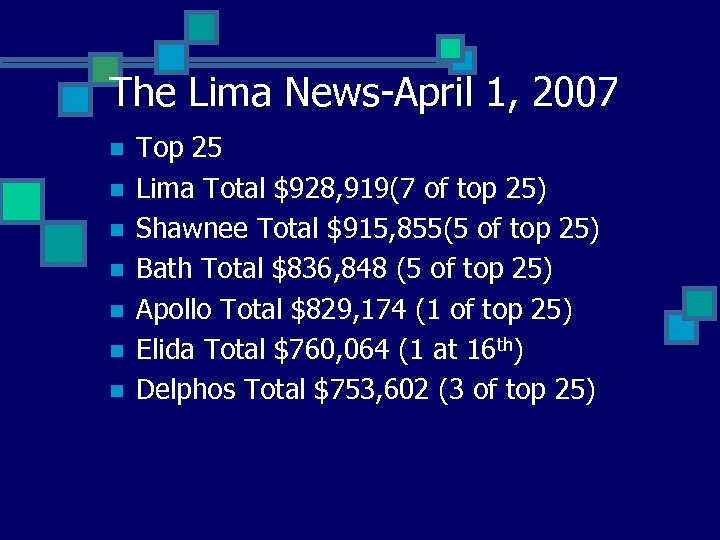

The Lima News-April 1, 2007 n n n n Top 25 Lima Total $928, 919(7 of top 25) Shawnee Total $915, 855(5 of top 25) Bath Total $836, 848 (5 of top 25) Apollo Total $829, 174 (1 of top 25) Elida Total $760, 064 (1 at 16 th) Delphos Total $753, 602 (3 of top 25)

The Lima News-April 1, 2007 n n n n Top 25 Lima Total $928, 919(7 of top 25) Shawnee Total $915, 855(5 of top 25) Bath Total $836, 848 (5 of top 25) Apollo Total $829, 174 (1 of top 25) Elida Total $760, 064 (1 at 16 th) Delphos Total $753, 602 (3 of top 25)

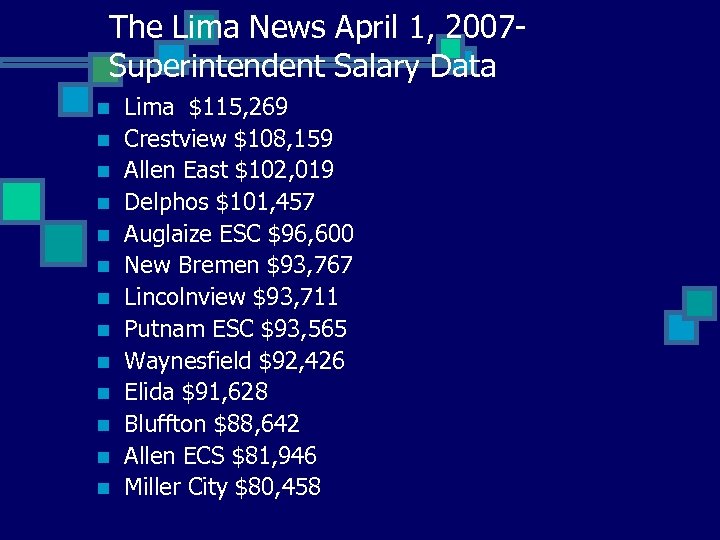

The Lima News April 1, 2007 Superintendent Salary Data n n n n Lima $115, 269 Crestview $108, 159 Allen East $102, 019 Delphos $101, 457 Auglaize ESC $96, 600 New Bremen $93, 767 Lincolnview $93, 711 Putnam ESC $93, 565 Waynesfield $92, 426 Elida $91, 628 Bluffton $88, 642 Allen ECS $81, 946 Miller City $80, 458

The Lima News April 1, 2007 Superintendent Salary Data n n n n Lima $115, 269 Crestview $108, 159 Allen East $102, 019 Delphos $101, 457 Auglaize ESC $96, 600 New Bremen $93, 767 Lincolnview $93, 711 Putnam ESC $93, 565 Waynesfield $92, 426 Elida $91, 628 Bluffton $88, 642 Allen ECS $81, 946 Miller City $80, 458

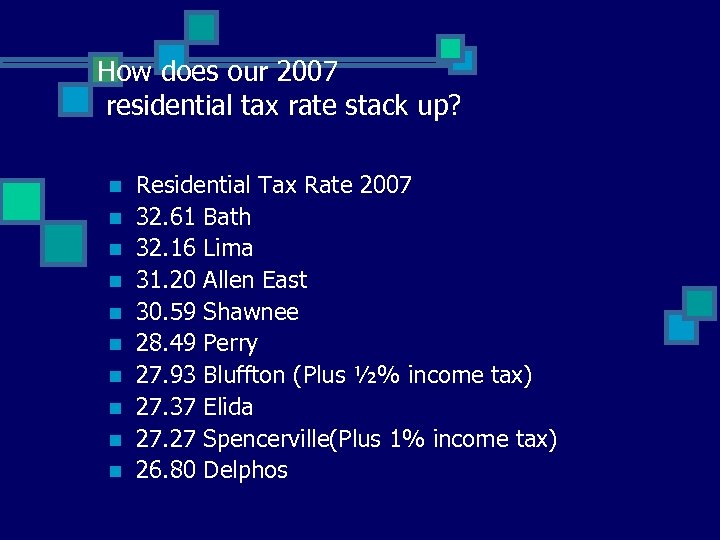

How does our 2007 residential tax rate stack up? n n n n n Residential Tax Rate 2007 32. 61 Bath 32. 16 Lima 31. 20 Allen East 30. 59 Shawnee 28. 49 Perry 27. 93 Bluffton (Plus ½% income tax) 27. 37 Elida 27. 27 Spencerville(Plus 1% income tax) 26. 80 Delphos

How does our 2007 residential tax rate stack up? n n n n n Residential Tax Rate 2007 32. 61 Bath 32. 16 Lima 31. 20 Allen East 30. 59 Shawnee 28. 49 Perry 27. 93 Bluffton (Plus ½% income tax) 27. 37 Elida 27. 27 Spencerville(Plus 1% income tax) 26. 80 Delphos

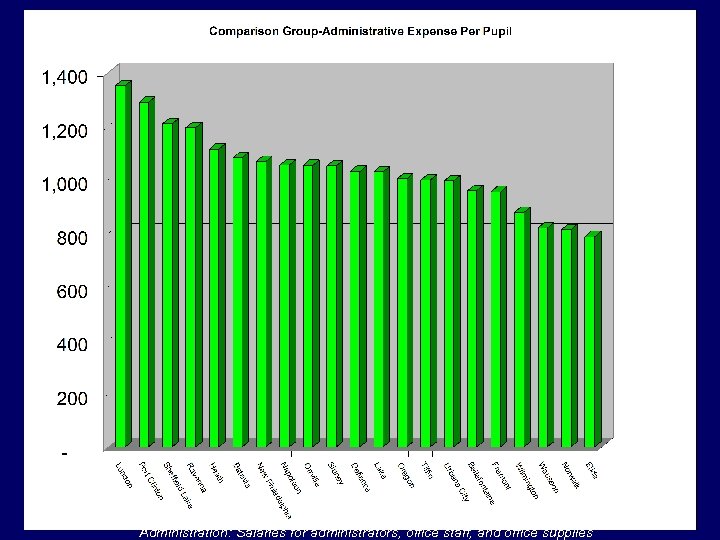

ADMINISTRATIVE EXPENSES Administration: Salaries for administrators, office staff, and office supplies

ADMINISTRATIVE EXPENSES Administration: Salaries for administrators, office staff, and office supplies

STATE FUNDING FLAWS n n n n Over-reliant on property taxes No inflationary growth on property taxes Phantom Revenue Unfunded mandates System too complicated Many man hours on levies(2000, 2003, 2004, 2005, 2006, 2007, 2008) Schools get viewed as “Big Government Waste” One of the few ways voters can express frustration with taxes

STATE FUNDING FLAWS n n n n Over-reliant on property taxes No inflationary growth on property taxes Phantom Revenue Unfunded mandates System too complicated Many man hours on levies(2000, 2003, 2004, 2005, 2006, 2007, 2008) Schools get viewed as “Big Government Waste” One of the few ways voters can express frustration with taxes

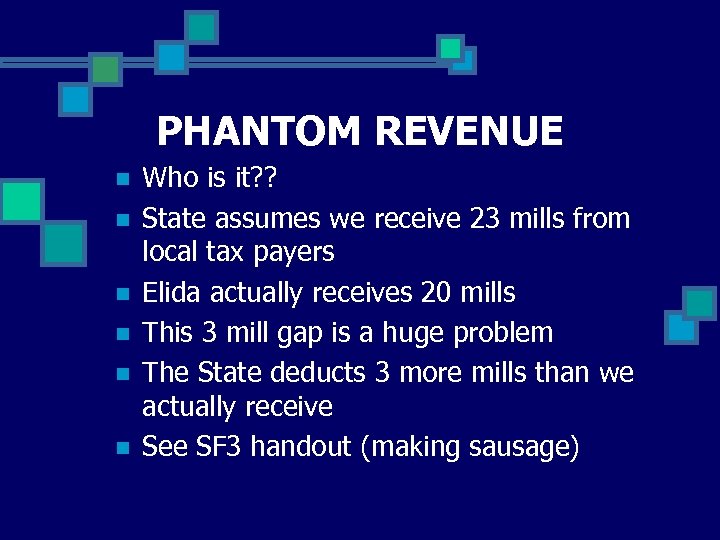

PHANTOM REVENUE n n n Who is it? ? State assumes we receive 23 mills from local tax payers Elida actually receives 20 mills This 3 mill gap is a huge problem The State deducts 3 more mills than we actually receive See SF 3 handout (making sausage)

PHANTOM REVENUE n n n Who is it? ? State assumes we receive 23 mills from local tax payers Elida actually receives 20 mills This 3 mill gap is a huge problem The State deducts 3 more mills than we actually receive See SF 3 handout (making sausage)

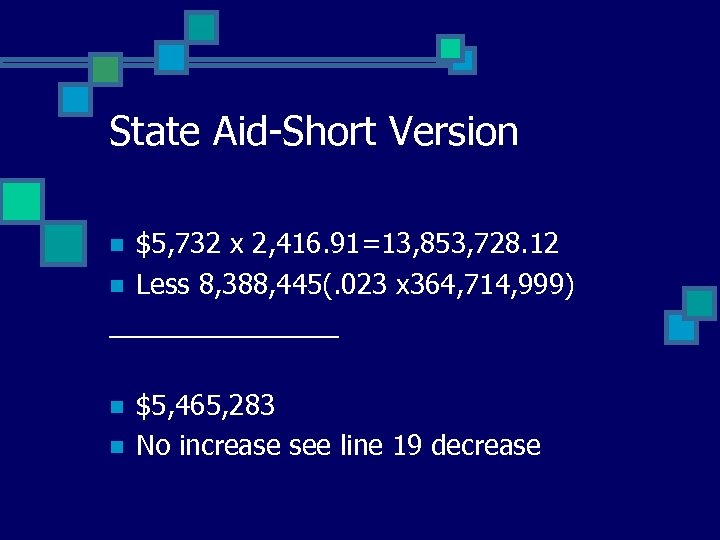

State Aid-Short Version $5, 732 x 2, 416. 91=13, 853, 728. 12 n Less 8, 388, 445(. 023 x 364, 714, 999) ________ n n n $5, 465, 283 No increase see line 19 decrease

State Aid-Short Version $5, 732 x 2, 416. 91=13, 853, 728. 12 n Less 8, 388, 445(. 023 x 364, 714, 999) ________ n n n $5, 465, 283 No increase see line 19 decrease

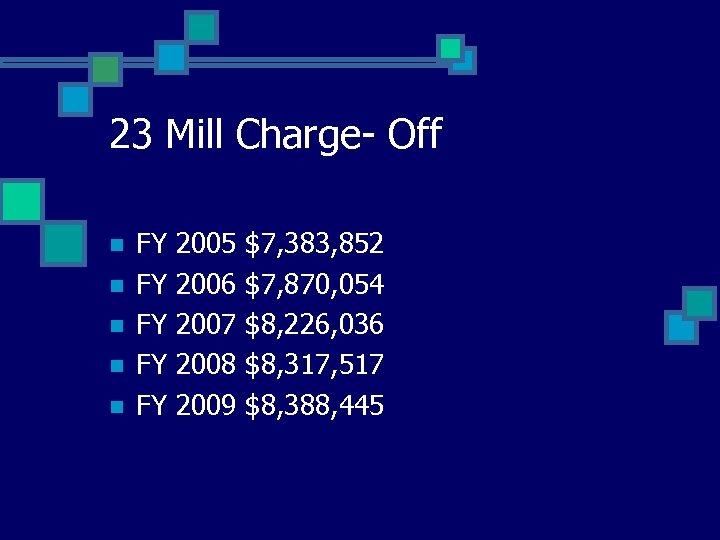

23 Mill Charge- Off n n n FY FY FY 2005 2006 2007 2008 2009 $7, 383, 852 $7, 870, 054 $8, 226, 036 $8, 317, 517 $8, 388, 445

23 Mill Charge- Off n n n FY FY FY 2005 2006 2007 2008 2009 $7, 383, 852 $7, 870, 054 $8, 226, 036 $8, 317, 517 $8, 388, 445

State Aid FY FY FY 2006 2007 2008 2009 2010 2011 $7, 520, 508 $7, 504, 941 $7, 502, 152 $7, 352, 109

State Aid FY FY FY 2006 2007 2008 2009 2010 2011 $7, 520, 508 $7, 504, 941 $7, 502, 152 $7, 352, 109

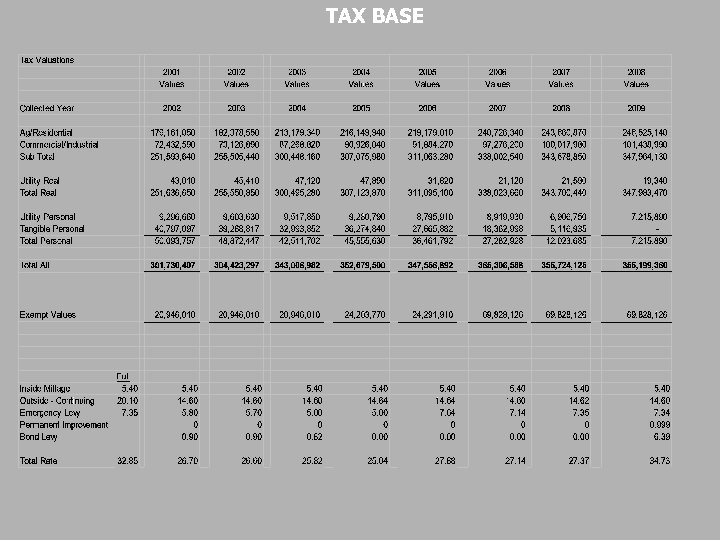

TAX BASE

TAX BASE

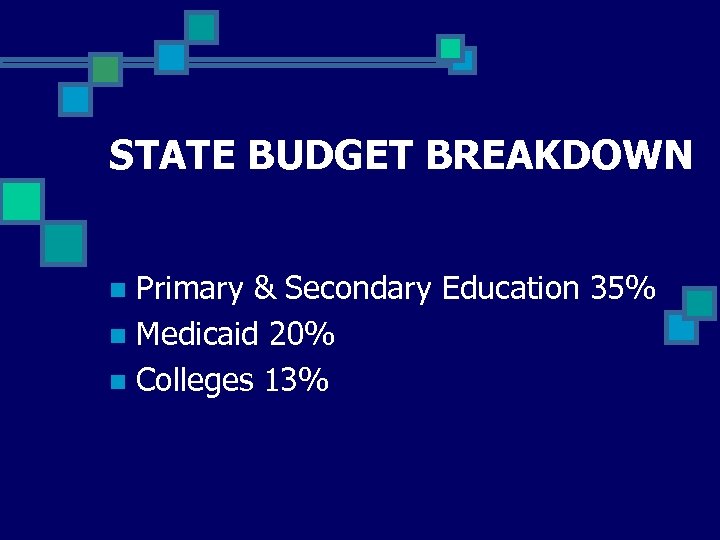

STATE BUDGET BREAKDOWN Primary & Secondary Education 35% n Medicaid 20% n Colleges 13% n

STATE BUDGET BREAKDOWN Primary & Secondary Education 35% n Medicaid 20% n Colleges 13% n

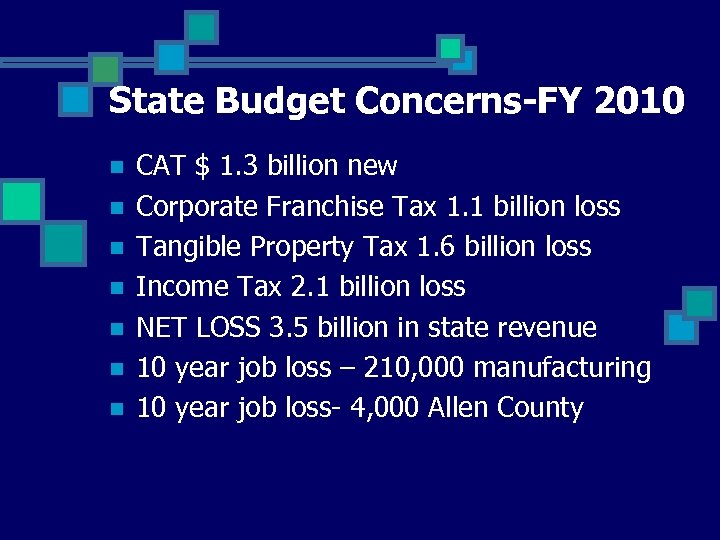

State Budget Concerns-FY 2010 n n n n CAT $ 1. 3 billion new Corporate Franchise Tax 1. 1 billion loss Tangible Property Tax 1. 6 billion loss Income Tax 2. 1 billion loss NET LOSS 3. 5 billion in state revenue 10 year job loss – 210, 000 manufacturing 10 year job loss- 4, 000 Allen County

State Budget Concerns-FY 2010 n n n n CAT $ 1. 3 billion new Corporate Franchise Tax 1. 1 billion loss Tangible Property Tax 1. 6 billion loss Income Tax 2. 1 billion loss NET LOSS 3. 5 billion in state revenue 10 year job loss – 210, 000 manufacturing 10 year job loss- 4, 000 Allen County

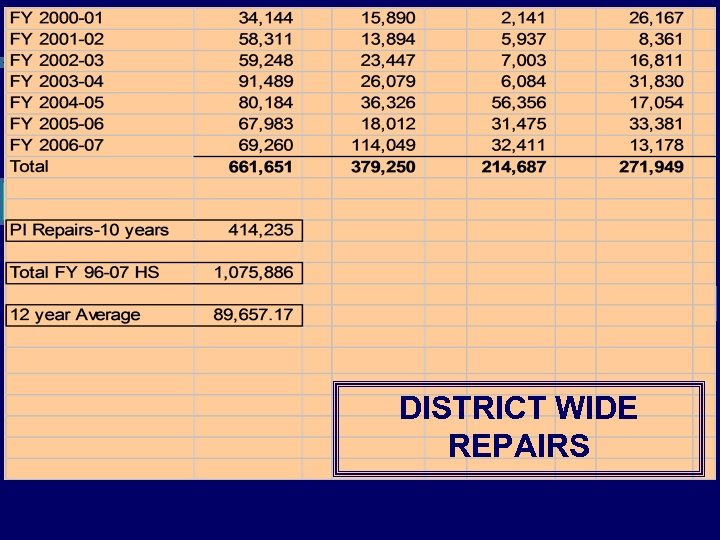

DISTRICT WIDE REPAIRS

DISTRICT WIDE REPAIRS

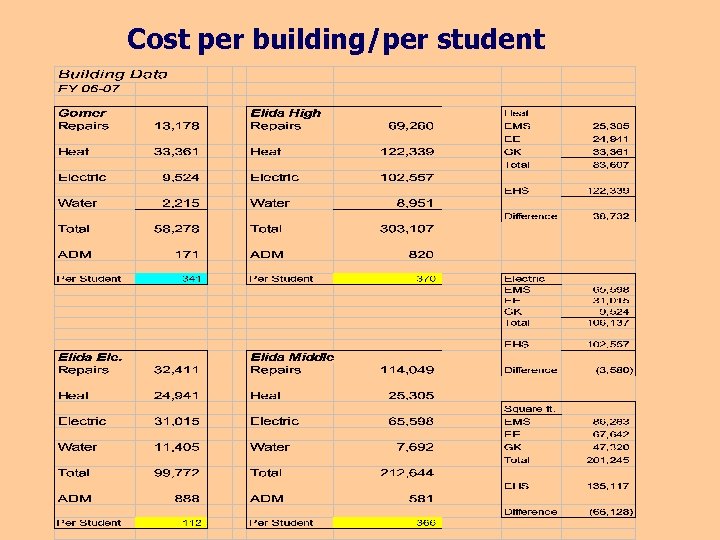

Cost per building/per student

Cost per building/per student

Levy Timeline-Future Dates n n n March 2008 Bond Issue & PI Fall 2009, 2010 Renew Emergency Levy Fall 2012, 2013 Renew PI Levy 2012 -2013 OSFC Issue 2014, 2015 Renew Emergency Levy

Levy Timeline-Future Dates n n n March 2008 Bond Issue & PI Fall 2009, 2010 Renew Emergency Levy Fall 2012, 2013 Renew PI Levy 2012 -2013 OSFC Issue 2014, 2015 Renew Emergency Levy

Funding the Future-Diversify Revenue Stream n n n Medina-1 st in state to pass Sales Tax for schools Income Tax-Earned income only Continue to communicate-always in levy mode

Funding the Future-Diversify Revenue Stream n n n Medina-1 st in state to pass Sales Tax for schools Income Tax-Earned income only Continue to communicate-always in levy mode

5 Year Goals n n n n n Evaluate HB 1 and unfunded mandates Continue to be lean Continue to monitor health insurance (Health Savings Accounts, Spousal language, Mandate Generic Drugs)…impact of state pool Enhance customer service Maintain 0 -2% profit margin Continue to review staffing needs Monitor new legislation Diversify revenue streams(conversation) Others ? ? (group discussion)

5 Year Goals n n n n n Evaluate HB 1 and unfunded mandates Continue to be lean Continue to monitor health insurance (Health Savings Accounts, Spousal language, Mandate Generic Drugs)…impact of state pool Enhance customer service Maintain 0 -2% profit margin Continue to review staffing needs Monitor new legislation Diversify revenue streams(conversation) Others ? ? (group discussion)

Items of Concern n n State Budget Cuts-HB 1 Health Care/BWC Increases Utility Increases Loss of tax valuation Special Education Increases Price of diesel Price of wheat and food supplies Loss on transportation Loss to ESC’s Fund All-day K Fund Pre-school program

Items of Concern n n State Budget Cuts-HB 1 Health Care/BWC Increases Utility Increases Loss of tax valuation Special Education Increases Price of diesel Price of wheat and food supplies Loss on transportation Loss to ESC’s Fund All-day K Fund Pre-school program

Building Timeline (Estimate) n n n March 4, 2008 Pass Bond Issue March 13, 2008 1 ST Meeting with Architect Early Spring 2009 – Complete Drawings Late Spring 2009 – Bid out project May 2009 – Break ground Summer 2011 – Move in!

Building Timeline (Estimate) n n n March 4, 2008 Pass Bond Issue March 13, 2008 1 ST Meeting with Architect Early Spring 2009 – Complete Drawings Late Spring 2009 – Bid out project May 2009 – Break ground Summer 2011 – Move in!

Meet the Team n n Architect – Garmann Miller, Minster Ohio Construction Management – Touchstone CPM, Lima Ohio Investment Banker – Omar Ganoom, Columbus, Ohio Construction Attorney – Bricker & Eckler, Columbus, Ohio

Meet the Team n n Architect – Garmann Miller, Minster Ohio Construction Management – Touchstone CPM, Lima Ohio Investment Banker – Omar Ganoom, Columbus, Ohio Construction Attorney – Bricker & Eckler, Columbus, Ohio