98f81429e6ec9f1681b5278bed13b00e.ppt

- Количество слайдов: 8

ELECTRONIC PAYMENTS 101: AN INTRODUCTION TO ELECTRONIC PAYMENTS Kontrol Confidential

ELECTRONIC PAYMENTS 101: AN INTRODUCTION TO ELECTRONIC PAYMENTS Kontrol Confidential

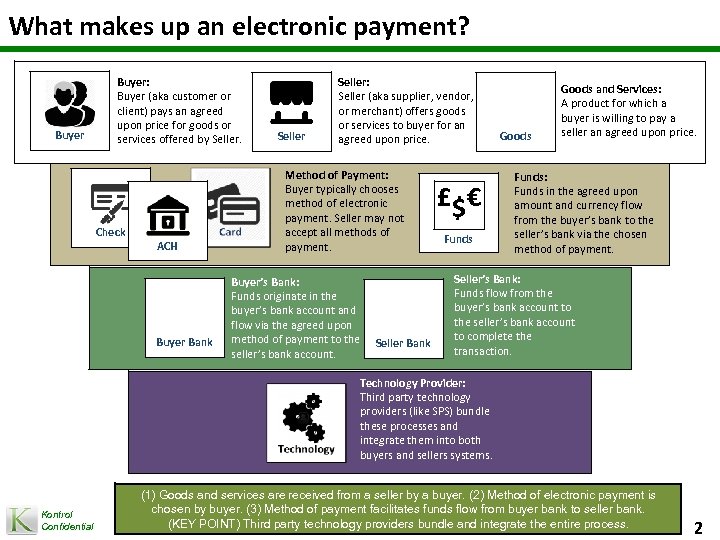

What makes up an electronic payment? Buyer: Buyer (aka customer or client) pays an agreed upon price for goods or services offered by Seller. Check ACH Buyer Bank Seller: Seller (aka supplier, vendor, or merchant) offers goods or services to buyer for an agreed upon price. Method of Payment: Buyer typically chooses method of electronic payment. Seller may not accept all methods of payment. Buyer’s Bank: Funds originate in the buyer’s bank account and flow via the agreed upon method of payment to the seller’s bank account. Seller Bank £ $€ Funds Goods and Services: A product for which a buyer is willing to pay a seller an agreed upon price. Funds: Funds in the agreed upon amount and currency flow from the buyer’s bank to the seller’s bank via the chosen method of payment. Seller’s Bank: Funds flow from the buyer’s bank account to the seller’s bank account to complete the transaction. Technology Provider: Third party technology providers (like SPS) bundle these processes and integrate them into both buyers and sellers systems. Kontrol Confidential (1) Goods and services are received from a seller by a buyer. (2) Method of electronic payment is chosen by buyer. (3) Method of payment facilitates funds flow from buyer bank to seller bank. (KEY POINT) Third party technology providers bundle and integrate the entire process. 2

What makes up an electronic payment? Buyer: Buyer (aka customer or client) pays an agreed upon price for goods or services offered by Seller. Check ACH Buyer Bank Seller: Seller (aka supplier, vendor, or merchant) offers goods or services to buyer for an agreed upon price. Method of Payment: Buyer typically chooses method of electronic payment. Seller may not accept all methods of payment. Buyer’s Bank: Funds originate in the buyer’s bank account and flow via the agreed upon method of payment to the seller’s bank account. Seller Bank £ $€ Funds Goods and Services: A product for which a buyer is willing to pay a seller an agreed upon price. Funds: Funds in the agreed upon amount and currency flow from the buyer’s bank to the seller’s bank via the chosen method of payment. Seller’s Bank: Funds flow from the buyer’s bank account to the seller’s bank account to complete the transaction. Technology Provider: Third party technology providers (like SPS) bundle these processes and integrate them into both buyers and sellers systems. Kontrol Confidential (1) Goods and services are received from a seller by a buyer. (2) Method of electronic payment is chosen by buyer. (3) Method of payment facilitates funds flow from buyer bank to seller bank. (KEY POINT) Third party technology providers bundle and integrate the entire process. 2

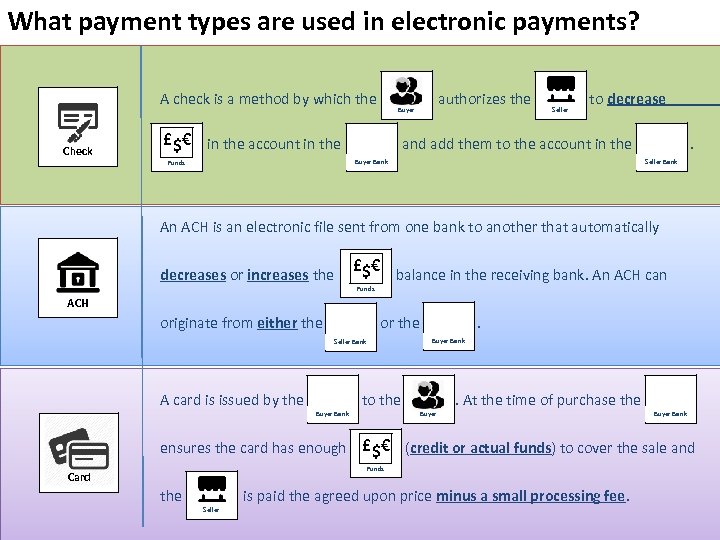

What payment types are used in electronic payments? A check is a method by which the Check authorizes the Buyer £ $€ in the account in the Seller to decrease and add them to the account in the Seller Bank Buyer Bank Funds . An ACH is an electronic file sent from one bank to another that automatically £ $€ balance in the receiving bank. An ACH can decreases or increases the Funds ACH originate from either the or the Seller Bank A card is issued by the . Buyer Bank to the . At the time of purchase the Buyer Bank ensures the card has enough £ $€ (credit or actual funds) to cover the sale and Funds Card the Kontrol Confidential is paid the agreed upon price minus a small processing fee. Seller

What payment types are used in electronic payments? A check is a method by which the Check authorizes the Buyer £ $€ in the account in the Seller to decrease and add them to the account in the Seller Bank Buyer Bank Funds . An ACH is an electronic file sent from one bank to another that automatically £ $€ balance in the receiving bank. An ACH can decreases or increases the Funds ACH originate from either the or the Seller Bank A card is issued by the . Buyer Bank to the . At the time of purchase the Buyer Bank ensures the card has enough £ $€ (credit or actual funds) to cover the sale and Funds Card the Kontrol Confidential is paid the agreed upon price minus a small processing fee. Seller

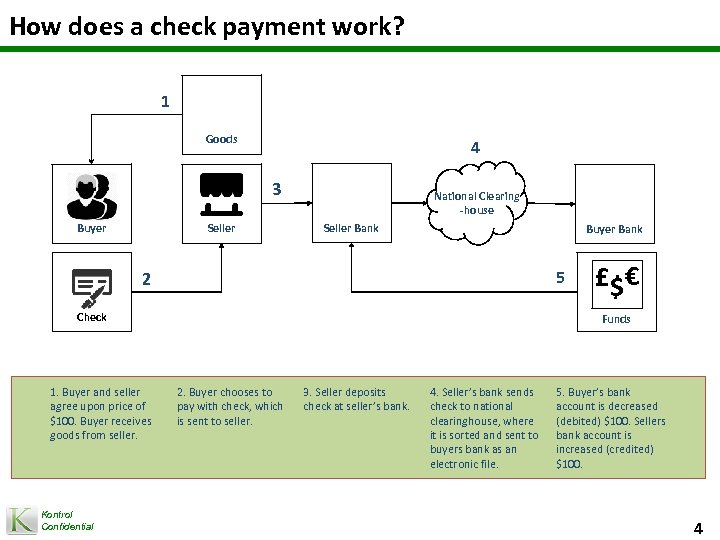

How does a check payment work? 1 Goods 4 3 Buyer Seller National Clearing -house Seller Bank Buyer Bank 5 2 Check 1. Buyer and seller agree upon price of $100. Buyer receives goods from seller. Kontrol Confidential £ $€ Funds 2. Buyer chooses to pay with check, which is sent to seller. 3. Seller deposits check at seller’s bank. 4. Seller’s bank sends check to national clearinghouse, where it is sorted and sent to buyers bank as an electronic file. 5. Buyer’s bank account is decreased (debited) $100. Sellers bank account is increased (credited) $100. 4

How does a check payment work? 1 Goods 4 3 Buyer Seller National Clearing -house Seller Bank Buyer Bank 5 2 Check 1. Buyer and seller agree upon price of $100. Buyer receives goods from seller. Kontrol Confidential £ $€ Funds 2. Buyer chooses to pay with check, which is sent to seller. 3. Seller deposits check at seller’s bank. 4. Seller’s bank sends check to national clearinghouse, where it is sorted and sent to buyers bank as an electronic file. 5. Buyer’s bank account is decreased (debited) $100. Sellers bank account is increased (credited) $100. 4

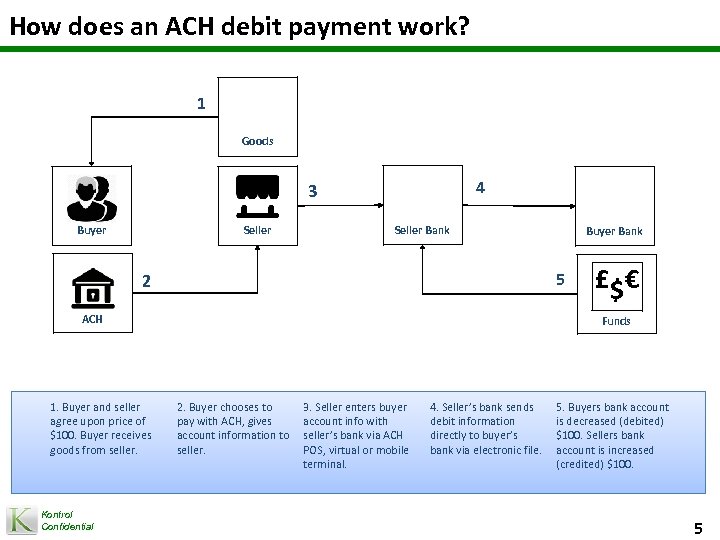

How does an ACH debit payment work? 1 Goods 4 3 Buyer Seller Bank 5 2 ACH 1. Buyer and seller agree upon price of $100. Buyer receives goods from seller. Kontrol Confidential Buyer Bank £ $€ Funds 2. Buyer chooses to pay with ACH, gives account information to seller. 3. Seller enters buyer account info with seller’s bank via ACH POS, virtual or mobile terminal. 4. Seller’s bank sends debit information directly to buyer’s bank via electronic file. 5. Buyers bank account is decreased (debited) $100. Sellers bank account is increased (credited) $100. 5

How does an ACH debit payment work? 1 Goods 4 3 Buyer Seller Bank 5 2 ACH 1. Buyer and seller agree upon price of $100. Buyer receives goods from seller. Kontrol Confidential Buyer Bank £ $€ Funds 2. Buyer chooses to pay with ACH, gives account information to seller. 3. Seller enters buyer account info with seller’s bank via ACH POS, virtual or mobile terminal. 4. Seller’s bank sends debit information directly to buyer’s bank via electronic file. 5. Buyers bank account is decreased (debited) $100. Sellers bank account is increased (credited) $100. 5

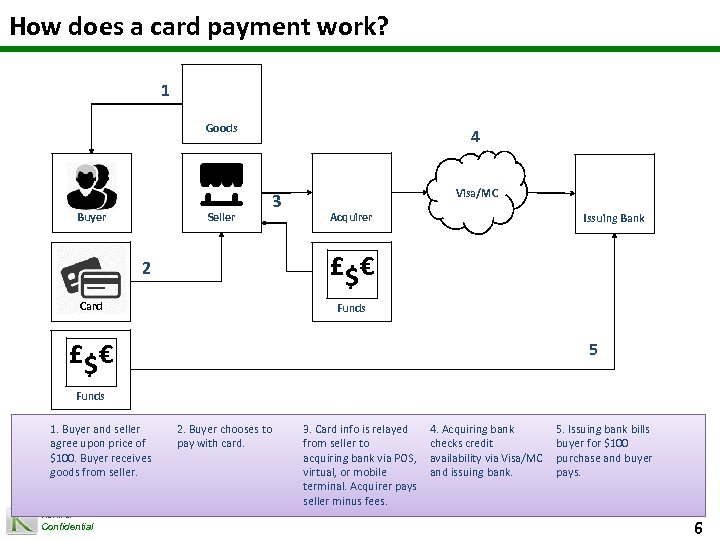

How does a card payment work? 1 Goods Buyer Seller 4 3 Visa/MC Acquirer Issuing Bank £ $€ 2 Card Funds £ $€ 5 Funds 1. Buyer and seller agree upon price of $100. Buyer receives goods from seller. Kontrol Confidential 2. Buyer chooses to pay with card. 3. Card info is relayed from seller to acquiring bank via POS, virtual, or mobile terminal. Acquirer pays seller minus fees. 4. Acquiring bank checks credit availability via Visa/MC and issuing bank. 5. Issuing bank bills buyer for $100 purchase and buyer pays. 6

How does a card payment work? 1 Goods Buyer Seller 4 3 Visa/MC Acquirer Issuing Bank £ $€ 2 Card Funds £ $€ 5 Funds 1. Buyer and seller agree upon price of $100. Buyer receives goods from seller. Kontrol Confidential 2. Buyer chooses to pay with card. 3. Card info is relayed from seller to acquiring bank via POS, virtual, or mobile terminal. Acquirer pays seller minus fees. 4. Acquiring bank checks credit availability via Visa/MC and issuing bank. 5. Issuing bank bills buyer for $100 purchase and buyer pays. 6

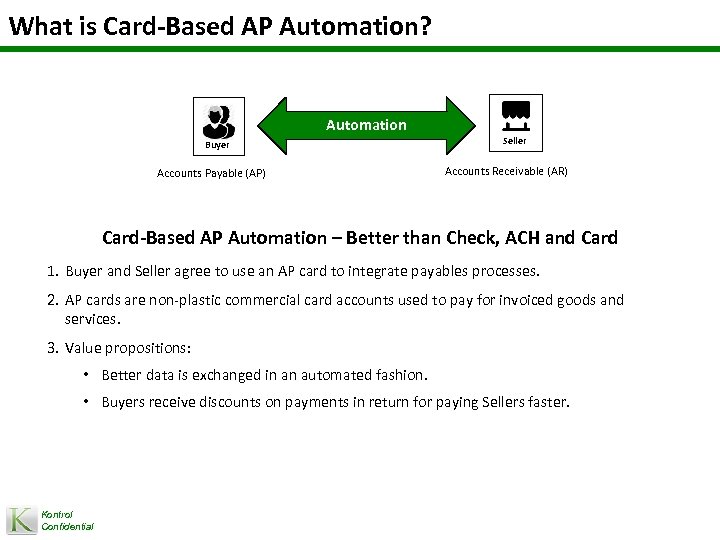

What is Card-Based AP Automation? Automation Buyer Accounts Payable (AP) Seller Accounts Receivable (AR) Card-Based AP Automation – Better than Check, ACH and Card 1. Buyer and Seller agree to use an AP card to integrate payables processes. 2. AP cards are non-plastic commercial card accounts used to pay for invoiced goods and services. 3. Value propositions: • Better data is exchanged in an automated fashion. • Buyers receive discounts on payments in return for paying Sellers faster. Kontrol Confidential

What is Card-Based AP Automation? Automation Buyer Accounts Payable (AP) Seller Accounts Receivable (AR) Card-Based AP Automation – Better than Check, ACH and Card 1. Buyer and Seller agree to use an AP card to integrate payables processes. 2. AP cards are non-plastic commercial card accounts used to pay for invoiced goods and services. 3. Value propositions: • Better data is exchanged in an automated fashion. • Buyers receive discounts on payments in return for paying Sellers faster. Kontrol Confidential

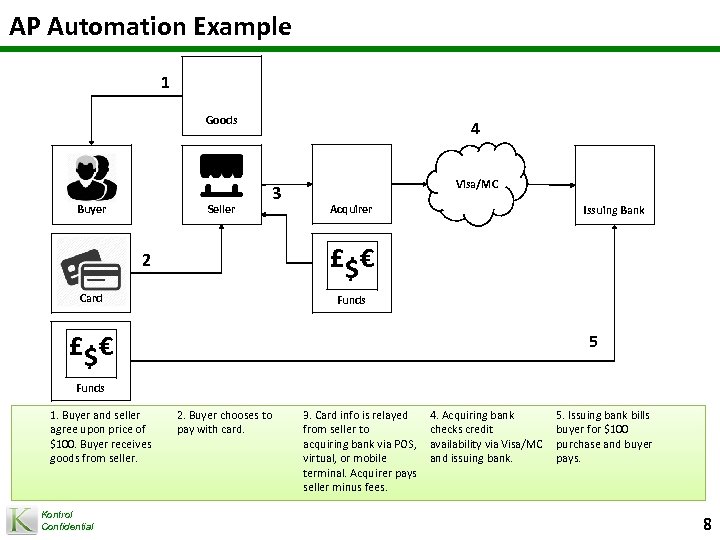

AP Automation Example 1 Goods Buyer Seller 4 3 Visa/MC Acquirer Issuing Bank £ $€ 2 Card Funds £ $€ 5 Funds 1. Buyer and seller agree upon price of $100. Buyer receives goods from seller. Kontrol Confidential 2. Buyer chooses to pay with card. 3. Card info is relayed from seller to acquiring bank via POS, virtual, or mobile terminal. Acquirer pays seller minus fees. 4. Acquiring bank checks credit availability via Visa/MC and issuing bank. 5. Issuing bank bills buyer for $100 purchase and buyer pays. 8

AP Automation Example 1 Goods Buyer Seller 4 3 Visa/MC Acquirer Issuing Bank £ $€ 2 Card Funds £ $€ 5 Funds 1. Buyer and seller agree upon price of $100. Buyer receives goods from seller. Kontrol Confidential 2. Buyer chooses to pay with card. 3. Card info is relayed from seller to acquiring bank via POS, virtual, or mobile terminal. Acquirer pays seller minus fees. 4. Acquiring bank checks credit availability via Visa/MC and issuing bank. 5. Issuing bank bills buyer for $100 purchase and buyer pays. 8