b89ec2371efab406640d683603e13bd8.ppt

- Количество слайдов: 24

Electronic Payment Systems

Electronic Payment Systems

Outline • Types of money – Fiduciary v. scriptural – Token v. notational • Types of payment systems • Cash • Credit cards – SSL (TLS) protocol • Intermediaries – Pay. Pal • Smart cards • Electronic Bill Presentment 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Outline • Types of money – Fiduciary v. scriptural – Token v. notational • Types of payment systems • Cash • Credit cards – SSL (TLS) protocol • Intermediaries – Pay. Pal • Smart cards • Electronic Bill Presentment 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Types of Money: Fiduciary vs. Scriptural • Fiduciary money (fiat money, legal tender) – Issued by a central (government) bank – Has real “discharging power” (to discharge debts) – Cannot be refused • Scriptural money (not legal tender) – Money not issued by central bank – Examples: bank accounts, travelers checks, gift certificates, scrips – Discharging power based on trust in issuer – Can be refused

Types of Money: Fiduciary vs. Scriptural • Fiduciary money (fiat money, legal tender) – Issued by a central (government) bank – Has real “discharging power” (to discharge debts) – Cannot be refused • Scriptural money (not legal tender) – Money not issued by central bank – Examples: bank accounts, travelers checks, gift certificates, scrips – Discharging power based on trust in issuer – Can be refused

Types of Money: Token vs. Notational • Token money (value represented by physical article) – Represented by a physical article (e. g. cash, gift certificate, traveler’s check) – Can be lost • Notational money (value held in account balance) – – Examples: bank accounts, frequent flyer miles Transferred by order Requires clearance (determining net effect of multiple orders) Requires settlement (payment in fiduciary money) • Hybrid money – Check, telephone card (carries promise of future service)

Types of Money: Token vs. Notational • Token money (value represented by physical article) – Represented by a physical article (e. g. cash, gift certificate, traveler’s check) – Can be lost • Notational money (value held in account balance) – – Examples: bank accounts, frequent flyer miles Transferred by order Requires clearance (determining net effect of multiple orders) Requires settlement (payment in fiduciary money) • Hybrid money – Check, telephone card (carries promise of future service)

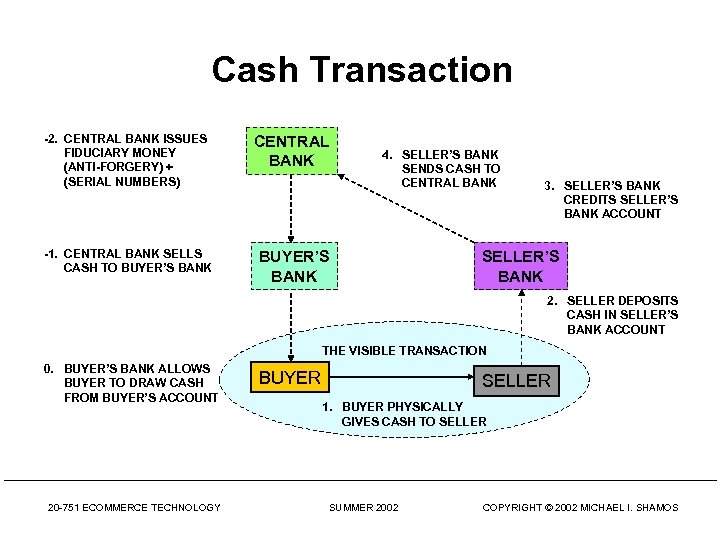

Cash Transaction -2. CENTRAL BANK ISSUES FIDUCIARY MONEY (ANTI-FORGERY) + (SERIAL NUMBERS) CENTRAL BANK -1. CENTRAL BANK SELLS CASH TO BUYER’S BANK 4. SELLER’S BANK SENDS CASH TO CENTRAL BANK 3. SELLER’S BANK CREDITS SELLER’S BANK ACCOUNT SELLER’S BANK 2. SELLER DEPOSITS CASH IN SELLER’S BANK ACCOUNT THE VISIBLE TRANSACTION 0. BUYER’S BANK ALLOWS BUYER TO DRAW CASH FROM BUYER’S ACCOUNT 20 -751 ECOMMERCE TECHNOLOGY BUYER SELLER 1. BUYER PHYSICALLY GIVES CASH TO SELLER SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Cash Transaction -2. CENTRAL BANK ISSUES FIDUCIARY MONEY (ANTI-FORGERY) + (SERIAL NUMBERS) CENTRAL BANK -1. CENTRAL BANK SELLS CASH TO BUYER’S BANK 4. SELLER’S BANK SENDS CASH TO CENTRAL BANK 3. SELLER’S BANK CREDITS SELLER’S BANK ACCOUNT SELLER’S BANK 2. SELLER DEPOSITS CASH IN SELLER’S BANK ACCOUNT THE VISIBLE TRANSACTION 0. BUYER’S BANK ALLOWS BUYER TO DRAW CASH FROM BUYER’S ACCOUNT 20 -751 ECOMMERCE TECHNOLOGY BUYER SELLER 1. BUYER PHYSICALLY GIVES CASH TO SELLER SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

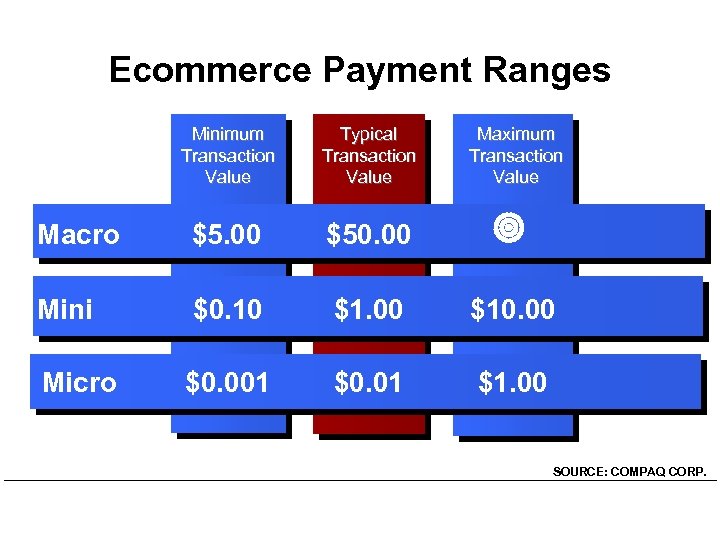

Ecommerce Payment Ranges Minimum Transaction Value Typical Transaction Value Maximum Transaction Value Macro $5. 00 $50. 00 Mini $0. 10 $1. 00 $10. 00 Micro $0. 001 $0. 01 $1. 00 SOURCE: COMPAQ CORP.

Ecommerce Payment Ranges Minimum Transaction Value Typical Transaction Value Maximum Transaction Value Macro $5. 00 $50. 00 Mini $0. 10 $1. 00 $10. 00 Micro $0. 001 $0. 01 $1. 00 SOURCE: COMPAQ CORP.

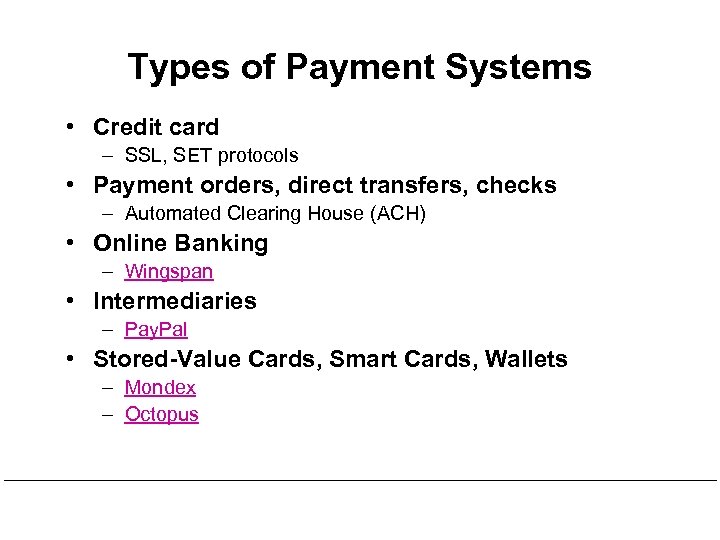

Types of Payment Systems • Credit card – SSL, SET protocols • Payment orders, direct transfers, checks – Automated Clearing House (ACH) • Online Banking – Wingspan • Intermediaries – Pay. Pal • Stored-Value Cards, Smart Cards, Wallets – Mondex – Octopus

Types of Payment Systems • Credit card – SSL, SET protocols • Payment orders, direct transfers, checks – Automated Clearing House (ACH) • Online Banking – Wingspan • Intermediaries – Pay. Pal • Stored-Value Cards, Smart Cards, Wallets – Mondex – Octopus

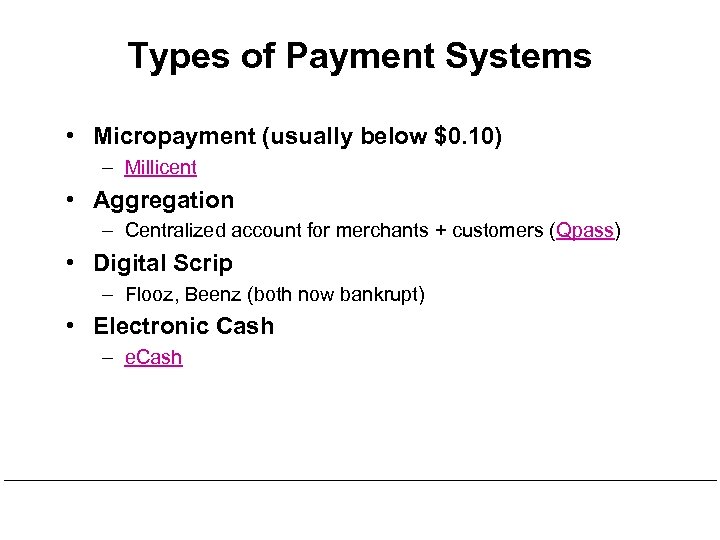

Types of Payment Systems • Micropayment (usually below $0. 10) – Millicent • Aggregation – Centralized account for merchants + customers (Qpass) • Digital Scrip – Flooz, Beenz (both now bankrupt) • Electronic Cash – e. Cash

Types of Payment Systems • Micropayment (usually below $0. 10) – Millicent • Aggregation – Centralized account for merchants + customers (Qpass) • Digital Scrip – Flooz, Beenz (both now bankrupt) • Electronic Cash – e. Cash

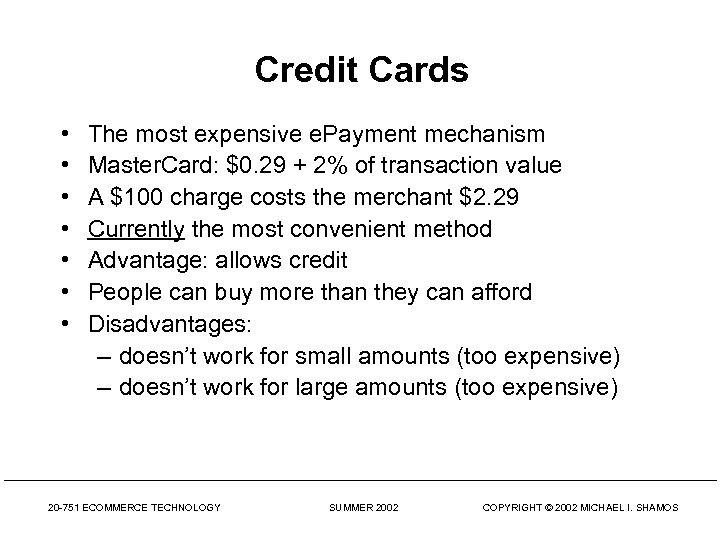

Credit Cards • • The most expensive e. Payment mechanism Master. Card: $0. 29 + 2% of transaction value A $100 charge costs the merchant $2. 29 Currently the most convenient method Advantage: allows credit People can buy more than they can afford Disadvantages: – doesn’t work for small amounts (too expensive) – doesn’t work for large amounts (too expensive) 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Credit Cards • • The most expensive e. Payment mechanism Master. Card: $0. 29 + 2% of transaction value A $100 charge costs the merchant $2. 29 Currently the most convenient method Advantage: allows credit People can buy more than they can afford Disadvantages: – doesn’t work for small amounts (too expensive) – doesn’t work for large amounts (too expensive) 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

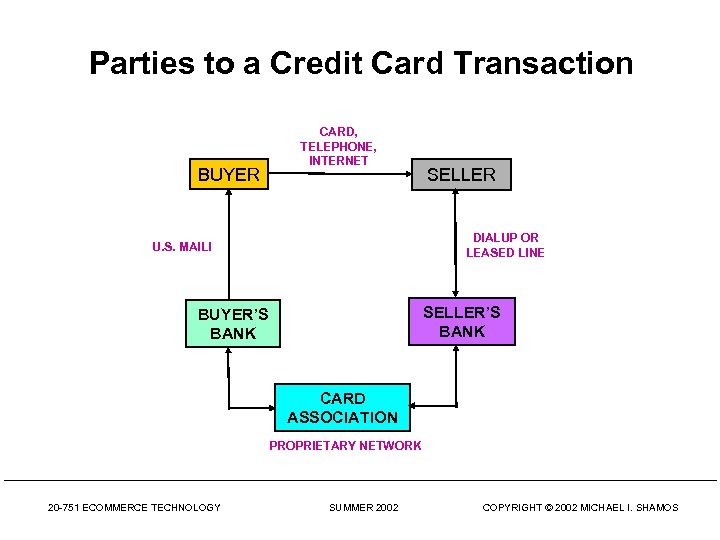

Parties to a Credit Card Transaction BUYER CARD, TELEPHONE, INTERNET SELLER DIALUP OR LEASED LINE U. S. MAIL! SELLER’S BANK BUYER’S BANK CARD ASSOCIATION PROPRIETARY NETWORK 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Parties to a Credit Card Transaction BUYER CARD, TELEPHONE, INTERNET SELLER DIALUP OR LEASED LINE U. S. MAIL! SELLER’S BANK BUYER’S BANK CARD ASSOCIATION PROPRIETARY NETWORK 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Secure Sockets Layer (SSL) if it has one 20 -751 ECOMMERCE TECHNOLOGY SOURCE: WEB SECURITY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Secure Sockets Layer (SSL) if it has one 20 -751 ECOMMERCE TECHNOLOGY SOURCE: WEB SECURITY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Pay. Pal • Pay anyone, anywhere via email • Draws funds from user’s bank account, places credit hold on credit card for guarantee • 16 million users – Bank of America has 3. 3. million • • Accounts insured up to $100, 000 Based on automated clearinghouse Withdraw funds anytime, or send to someone else Mobile payments (WAP)

Pay. Pal • Pay anyone, anywhere via email • Draws funds from user’s bank account, places credit hold on credit card for guarantee • 16 million users – Bank of America has 3. 3. million • • Accounts insured up to $100, 000 Based on automated clearinghouse Withdraw funds anytime, or send to someone else Mobile payments (WAP)

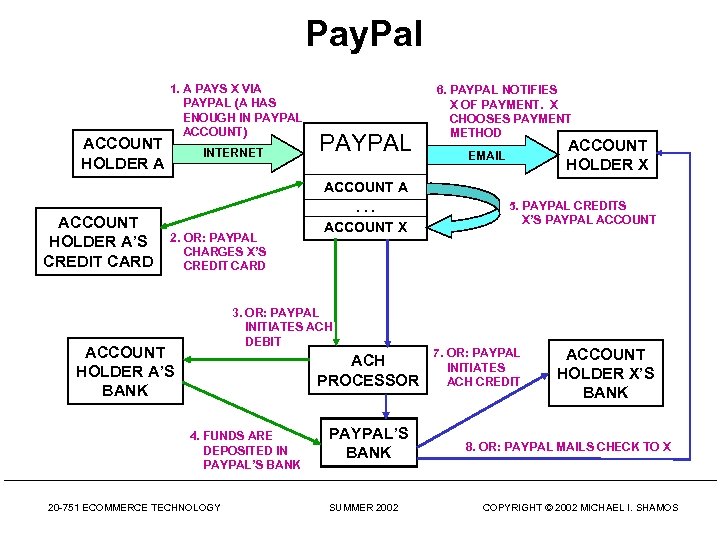

Pay. Pal ACCOUNT HOLDER A’S CREDIT CARD 1. A PAYS X VIA PAYPAL (A HAS ENOUGH IN PAYPAL ACCOUNT) INTERNET 2. OR: PAYPAL CHARGES X’S CREDIT CARD PAYPAL ACCOUNT A. . . ACCOUNT X 3. OR: PAYPAL INITIATES ACH DEBIT ACCOUNT HOLDER A’S BANK ACH PROCESSOR 4. FUNDS ARE DEPOSITED IN PAYPAL’S BANK 20 -751 ECOMMERCE TECHNOLOGY PAYPAL’S BANK SUMMER 2002 6. PAYPAL NOTIFIES X OF PAYMENT. X CHOOSES PAYMENT METHOD ACCOUNT HOLDER X EMAIL 5. PAYPAL CREDITS X’S PAYPAL ACCOUNT 7. OR: PAYPAL INITIATES ACH CREDIT ACCOUNT HOLDER X’S BANK 8. OR: PAYPAL MAILS CHECK TO X COPYRIGHT © 2002 MICHAEL I. SHAMOS

Pay. Pal ACCOUNT HOLDER A’S CREDIT CARD 1. A PAYS X VIA PAYPAL (A HAS ENOUGH IN PAYPAL ACCOUNT) INTERNET 2. OR: PAYPAL CHARGES X’S CREDIT CARD PAYPAL ACCOUNT A. . . ACCOUNT X 3. OR: PAYPAL INITIATES ACH DEBIT ACCOUNT HOLDER A’S BANK ACH PROCESSOR 4. FUNDS ARE DEPOSITED IN PAYPAL’S BANK 20 -751 ECOMMERCE TECHNOLOGY PAYPAL’S BANK SUMMER 2002 6. PAYPAL NOTIFIES X OF PAYMENT. X CHOOSES PAYMENT METHOD ACCOUNT HOLDER X EMAIL 5. PAYPAL CREDITS X’S PAYPAL ACCOUNT 7. OR: PAYPAL INITIATES ACH CREDIT ACCOUNT HOLDER X’S BANK 8. OR: PAYPAL MAILS CHECK TO X COPYRIGHT © 2002 MICHAEL I. SHAMOS

Smart Cards • Magnetic stripe – 140 bytes, cost $0. 20 -0. 75 • Memory cards – 1 -4 KB memory, no processor, cost $1. 00 -2. 50 • Optical memory cards – 4 megabytes read-only (CD-like), cost $7. 00 -12. 00 • Microprocessor cards – Imbedded microprocessor • (OLD) 8 -bit processor, 16 KB ROM, 512 bytes RAM • Equivalent power to IBM XT PC, cost $7. 00 -15. 00 • 32 -bit processors now available – Intelligent, active devices with defenses 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Smart Cards • Magnetic stripe – 140 bytes, cost $0. 20 -0. 75 • Memory cards – 1 -4 KB memory, no processor, cost $1. 00 -2. 50 • Optical memory cards – 4 megabytes read-only (CD-like), cost $7. 00 -12. 00 • Microprocessor cards – Imbedded microprocessor • (OLD) 8 -bit processor, 16 KB ROM, 512 bytes RAM • Equivalent power to IBM XT PC, cost $7. 00 -15. 00 • 32 -bit processors now available – Intelligent, active devices with defenses 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Smart Card Applications • Ticketless travel: Seoul bus system – 4 M cards, 1 B transactions since 1996 • • • Authentication, ID Medical records Ecash Store loyalty programs Personal profiles Government – Licenses • Mall parking. . . 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Smart Card Applications • Ticketless travel: Seoul bus system – 4 M cards, 1 B transactions since 1996 • • • Authentication, ID Medical records Ecash Store loyalty programs Personal profiles Government – Licenses • Mall parking. . . 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

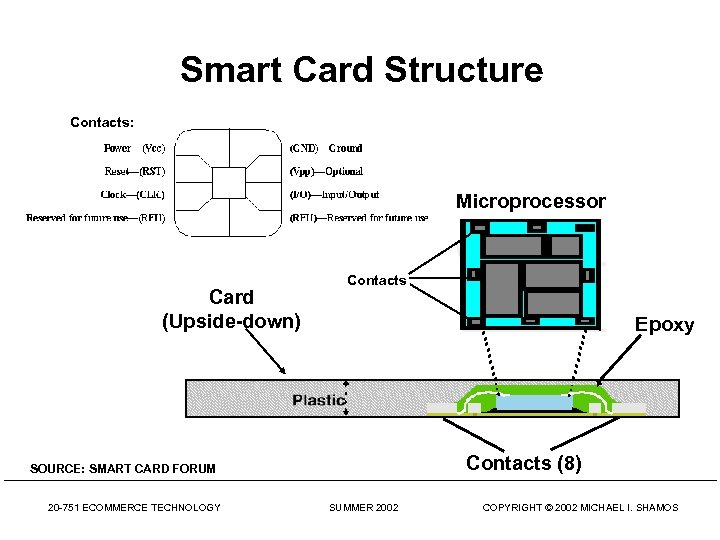

Smart Card Structure Contacts: Microprocessor Card (Upside-down) Contacts Epoxy Contacts (8) SOURCE: SMART CARD FORUM 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Smart Card Structure Contacts: Microprocessor Card (Upside-down) Contacts Epoxy Contacts (8) SOURCE: SMART CARD FORUM 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Mondex • • • Smart-card-based, stored-value card (SVC) Subsidiary of Master. Card Nat. West (National Westminister Bank, UK) et al. Secret chip-to-chip transfer protocol Value is not in strings alone; must be on Mondex card Loaded through ATM – ATM does not know transfer protocol; connects with secure device at bank • Spending at merchants having a Mondex value transfer terminal 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Mondex • • • Smart-card-based, stored-value card (SVC) Subsidiary of Master. Card Nat. West (National Westminister Bank, UK) et al. Secret chip-to-chip transfer protocol Value is not in strings alone; must be on Mondex card Loaded through ATM – ATM does not know transfer protocol; connects with secure device at bank • Spending at merchants having a Mondex value transfer terminal 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

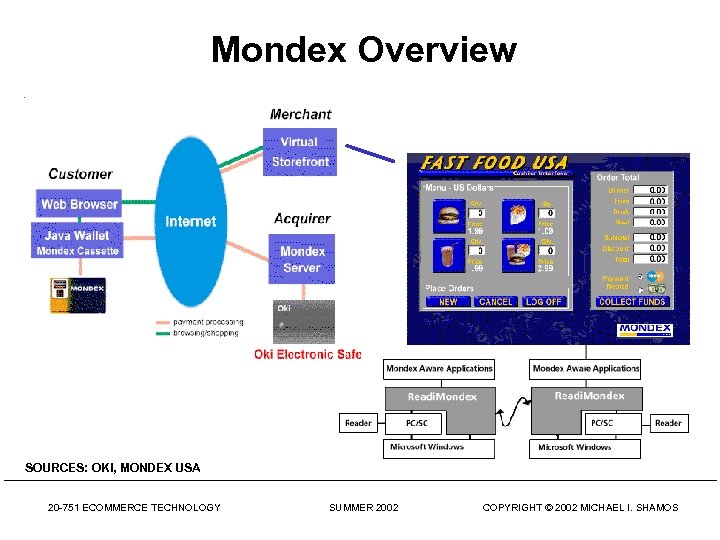

Mondex Overview SOURCES: OKI, MONDEX USA 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Mondex Overview SOURCES: OKI, MONDEX USA 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

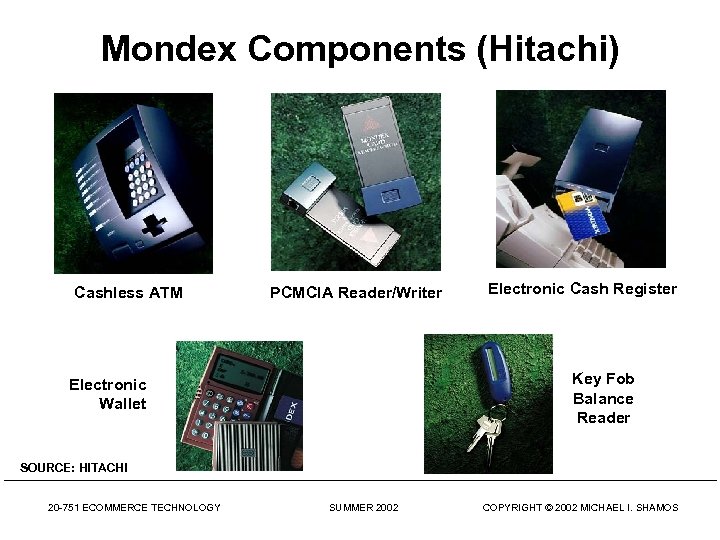

Mondex Components (Hitachi) Cashless ATM PCMCIA Reader/Writer Electronic Cash Register Key Fob Balance Reader Electronic Wallet SOURCE: HITACHI 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Mondex Components (Hitachi) Cashless ATM PCMCIA Reader/Writer Electronic Cash Register Key Fob Balance Reader Electronic Wallet SOURCE: HITACHI 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

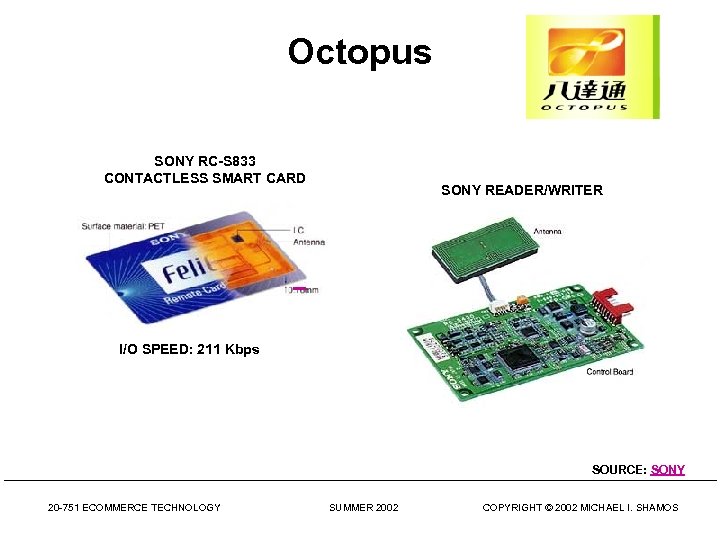

Octopus SONY RC-S 833 CONTACTLESS SMART CARD SONY READER/WRITER I/O SPEED: 211 Kbps SOURCE: SONY 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Octopus SONY RC-S 833 CONTACTLESS SMART CARD SONY READER/WRITER I/O SPEED: 211 Kbps SOURCE: SONY 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Financial Aggregation • Idea: allow access to all assets through a single portal • Citigroup • Electronic bill presentment – Check. Free demo, EIPP – Paytrust • Mobile – Vodaphone demo

Financial Aggregation • Idea: allow access to all assets through a single portal • Citigroup • Electronic bill presentment – Check. Free demo, EIPP – Paytrust • Mobile – Vodaphone demo

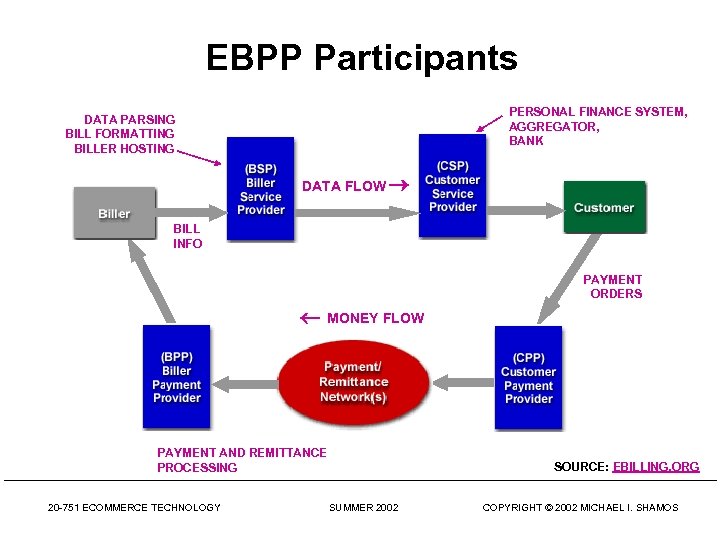

EBPP Participants PERSONAL FINANCE SYSTEM, AGGREGATOR, BANK DATA PARSING BILL FORMATTING BILLER HOSTING DATA FLOW BILL INFO PAYMENT ORDERS MONEY FLOW PAYMENT AND REMITTANCE PROCESSING 20 -751 ECOMMERCE TECHNOLOGY SOURCE: EBILLING. ORG SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

EBPP Participants PERSONAL FINANCE SYSTEM, AGGREGATOR, BANK DATA PARSING BILL FORMATTING BILLER HOSTING DATA FLOW BILL INFO PAYMENT ORDERS MONEY FLOW PAYMENT AND REMITTANCE PROCESSING 20 -751 ECOMMERCE TECHNOLOGY SOURCE: EBILLING. ORG SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Key Takeaways • epayment security accomplished with PKI • Pay. Pal is the fastest-growing technology in history • Rising use of smart cards – Face-to-face minipayments • • Little movement toward electronic cash Online banking retains customers Electronic bill presentment/payment add value Profound changes in money flow are afoot

Key Takeaways • epayment security accomplished with PKI • Pay. Pal is the fastest-growing technology in history • Rising use of smart cards – Face-to-face minipayments • • Little movement toward electronic cash Online banking retains customers Electronic bill presentment/payment add value Profound changes in money flow are afoot

Q&A 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Q&A 20 -751 ECOMMERCE TECHNOLOGY SUMMER 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS