c8d2e77ad00e254a54b393ae2f30ea5f.ppt

- Количество слайдов: 11

Electronic Commerce updates Presented by Brendan Kee Electronic Commerce Service Delivery Australian Taxation Office November 2014

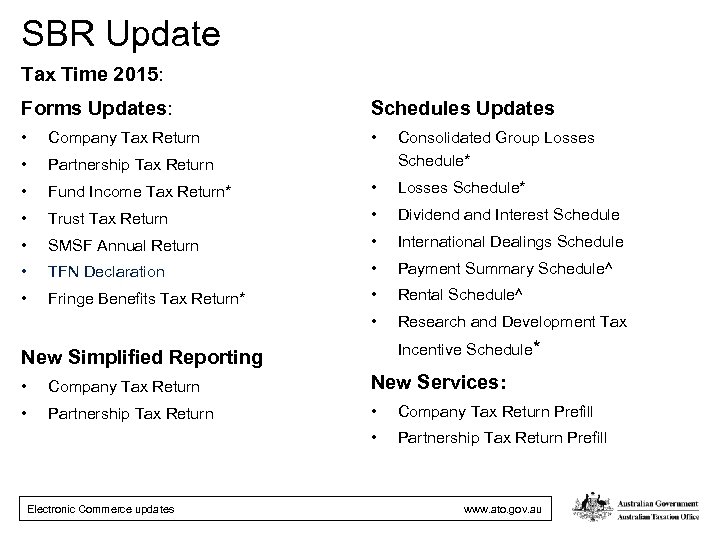

SBR Update Tax Time 2015: Forms Updates: Schedules Updates • Company Tax Return • • Partnership Tax Return Consolidated Group Losses Schedule* • Fund Income Tax Return* • Losses Schedule* • Trust Tax Return • Dividend and Interest Schedule • SMSF Annual Return • International Dealings Schedule • TFN Declaration • Payment Summary Schedule^ • Fringe Benefits Tax Return* • Rental Schedule^ • Research and Development Tax Incentive Schedule* New Simplified Reporting • Company Tax Return New Services: • Partnership Tax Return • Company Tax Return Prefill • Partnership Tax Return Prefill Electronic Commerce updates www. ato. gov. au

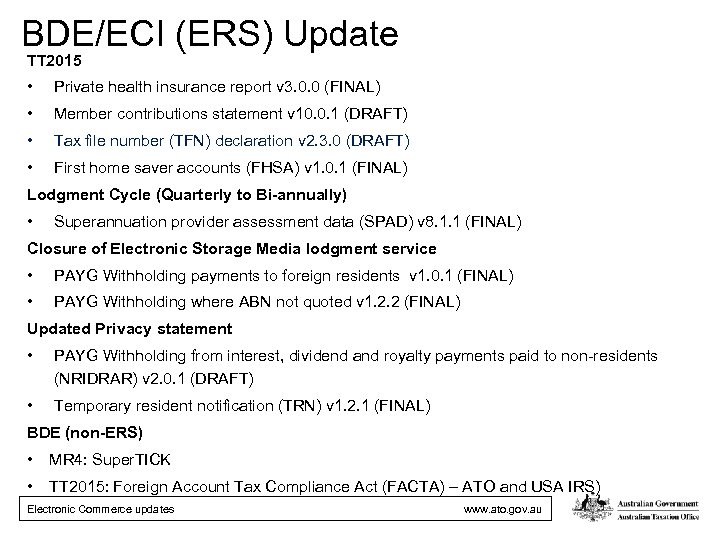

BDE/ECI (ERS) Update TT 2015 • Private health insurance report v 3. 0. 0 (FINAL) • Member contributions statement v 10. 0. 1 (DRAFT) • Tax file number (TFN) declaration v 2. 3. 0 (DRAFT) • First home saver accounts (FHSA) v 1. 0. 1 (FINAL) Lodgment Cycle (Quarterly to Bi-annually) • Superannuation provider assessment data (SPAD) v 8. 1. 1 (FINAL) Closure of Electronic Storage Media lodgment service • PAYG Withholding payments to foreign residents v 1. 0. 1 (FINAL) • PAYG Withholding where ABN not quoted v 1. 2. 2 (FINAL) Updated Privacy statement • PAYG Withholding from interest, dividend and royalty payments paid to non-residents (NRIDRAR) v 2. 0. 1 (DRAFT) • Temporary resident notification (TRN) v 1. 2. 1 (FINAL) BDE (non-ERS) • MR 4: Super. TICK • TT 2015: Foreign Account Tax Compliance Act (FACTA) – ATO and USA IRS) Electronic Commerce updates www. ato. gov. au

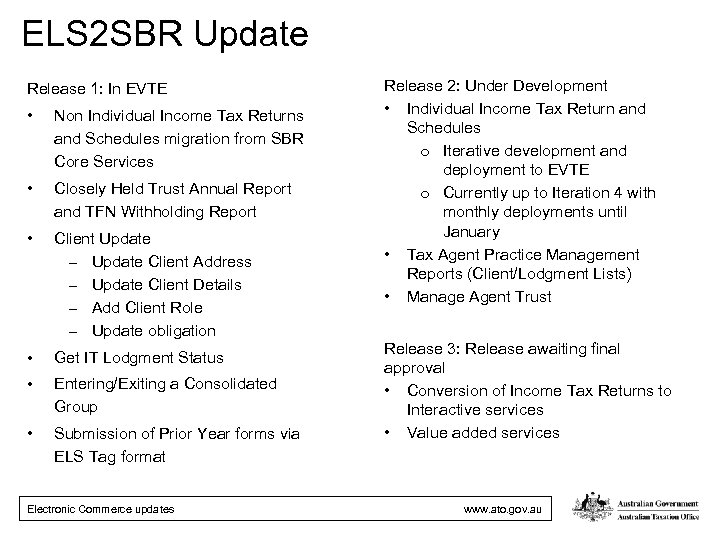

ELS 2 SBR Update Release 1: In EVTE • Non Individual Income Tax Returns and Schedules migration from SBR Core Services • Closely Held Trust Annual Report and TFN Withholding Report • Client Update – Update Client Address – Update Client Details – Add Client Role – Update obligation • Get IT Lodgment Status • Entering/Exiting a Consolidated Group • Submission of Prior Year forms via ELS Tag format Electronic Commerce updates Release 2: Under Development • Individual Income Tax Return and Schedules o Iterative development and deployment to EVTE o Currently up to Iteration 4 with monthly deployments until January • Tax Agent Practice Management Reports (Client/Lodgment Lists) • Manage Agent Trust Release 3: Release awaiting final approval • Conversion of Income Tax Returns to Interactive services • Value added services www. ato. gov. au

SBR eb. MS 3 Update Superstream • Fund Validation Services – Update Fund Product Details - Notify the ATO of changes to details for a superannuation provider’s products. – List Fund Products - Enables employers and superannuation providers to obtain a list of all of the provider’s products. – Get Fund Product Details - enables employers and superannuation providers to obtain details of a superannuation product • Super. TICK service migration • Electronic Portability Form Electronic Commerce updates www. ato. gov. au

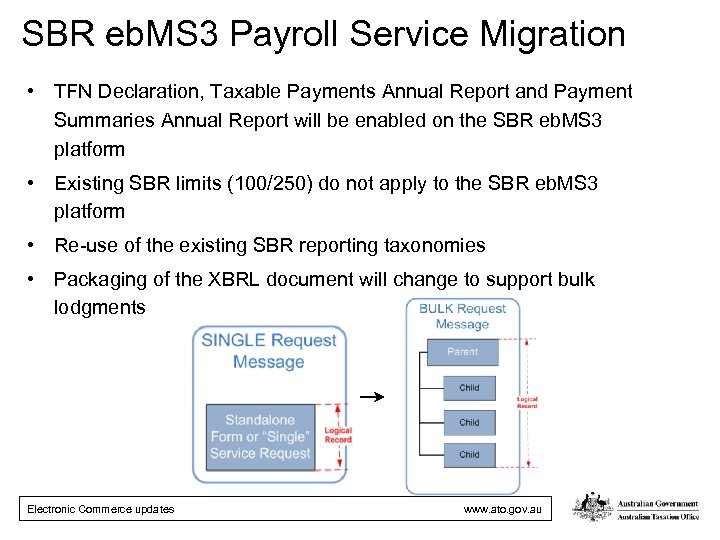

SBR eb. MS 3 Payroll Service Migration • TFN Declaration, Taxable Payments Annual Report and Payment Summaries Annual Report will be enabled on the SBR eb. MS 3 platform • Existing SBR limits (100/250) do not apply to the SBR eb. MS 3 platform • Re-use of the existing SBR reporting taxonomies • Packaging of the XBRL document will change to support bulk lodgments Electronic Commerce updates www. ato. gov. au

Digital Enabling Services (DES) • A new group have been formed in the ATO to deliver a number of SBR eb. MS 3 services which will be provided as retail and wholesale offerings. • This process will start with o Account list – Displays a list of client accounts, including account balance o Transaction list – Displays a list of client account transactions for a specific client account o Lodgment list - Displays client lodgment obligations, including due date for lodgments and payments, and received dates for. • Iterative deployment to EVTE starting this month and in production early 2015 Electronic Commerce updates www. ato. gov. au

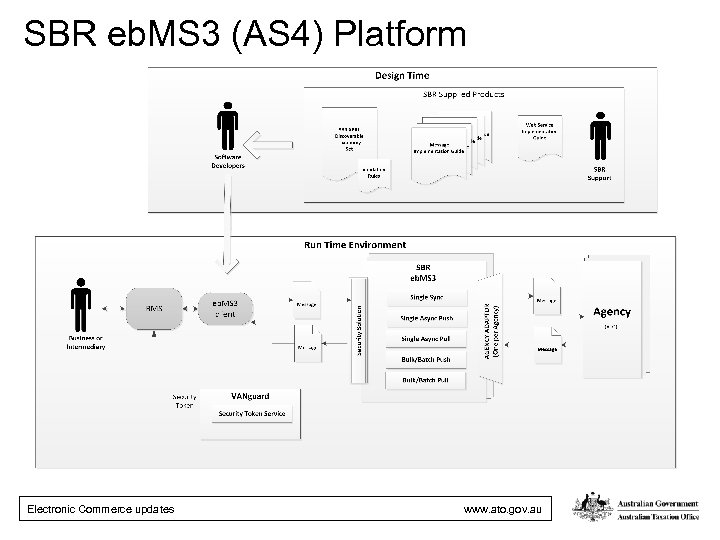

SBR eb. MS 3 (AS 4) Platform Electronic Commerce updates www. ato. gov. au

SBR eb. MS 3 (AS 4) Platform Integration • ATO SBR e. BMS 3 Web Service Implementation Guide (WIG) • SBR e. BMS 3 SDK developer guide • SBR e. BMS 3 embeddable(reference) client* • ABR AUSkey Manager (IM Client Keystore API) • ABR Security Token Manager API • SDK XBRL API Electronic Commerce updates www. ato. gov. au

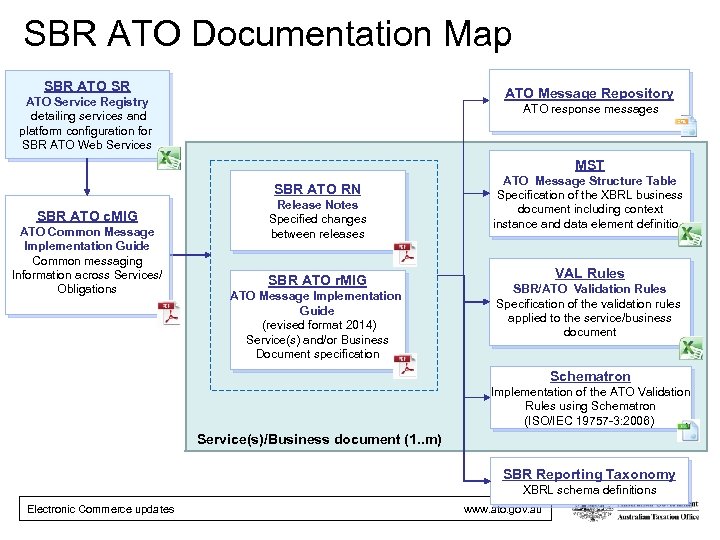

SBR ATO Documentation Map SBR ATO SR ATO Message Repository ATO Service Registry detailing services and platform configuration for SBR ATO Web Services ATO response messages MST SBR ATO RN . ATO Common Message SBR ATO c. MIG Implementation Guide Common messaging Information across Services/ Obligations Release Notes Specified changes between releases ATO Message Structure Table Specification of the XBRL business document including context instance and data element definitions ATO MIG package SBR ATO r. MIG ATO Message Implementation Guide (revised format 2014) Service(s) and/or Business Document specification VAL Rules SBR/ATO Validation Rules Specification of the validation rules applied to the service/business document Schematron Implementation of the ATO Validation Rules using Schematron (ISO/IEC 19757 -3: 2006) Service(s)/Business document (1. . m) SBR Reporting Taxonomy XBRL schema definitions Electronic Commerce updates www. ato. gov. au

Questions? Electronic Commerce updates www. ato. gov. au

c8d2e77ad00e254a54b393ae2f30ea5f.ppt