1606a9b1d726197f4d9b34bf54813f00.ppt

- Количество слайдов: 26

Electronic Commerce Financial Intermediaries and Electronic Payments

Electronic Commerce Financial Intermediaries and Electronic Payments

Topics n n n Electronic Fund Transfer Digital cash Virtual bank Certification authority (CA) Web capitalist

Topics n n n Electronic Fund Transfer Digital cash Virtual bank Certification authority (CA) Web capitalist

Types of financial intermediaries n n just one example of intermediaries for digital products, a middleman who facilitates transactions between potential traders. n n match buyers with sellers: broker; buy goods from sellers and sell them to buyers: retailer; buy goods and sell them after modifications transformer; sell transaction-related information only: information brokerage

Types of financial intermediaries n n just one example of intermediaries for digital products, a middleman who facilitates transactions between potential traders. n n match buyers with sellers: broker; buy goods from sellers and sell them to buyers: retailer; buy goods and sell them after modifications transformer; sell transaction-related information only: information brokerage

Broker n n n The more buyers and sellers there are, the more marketable a commodity becomes since there will be a higher probability of finding a match in a larger pool of traders. Exchange markets of commodity trading markets or stock exchanges Commercial banks and a large group of financial institutions dealing with payment clearing services (between creditors and debtors)

Broker n n n The more buyers and sellers there are, the more marketable a commodity becomes since there will be a higher probability of finding a match in a larger pool of traders. Exchange markets of commodity trading markets or stock exchanges Commercial banks and a large group of financial institutions dealing with payment clearing services (between creditors and debtors)

Retailer n n the intermediary who concerned with the ultimate buyers of the goods since his profits originate from the spread between the bid (of the buyers) and ask (of the sellers) prices in the market. Dealers: purchase goods and resell them

Retailer n n the intermediary who concerned with the ultimate buyers of the goods since his profits originate from the spread between the bid (of the buyers) and ask (of the sellers) prices in the market. Dealers: purchase goods and resell them

Transformer n n (value-added retailer) Beyond brokering and distribution Example: a mutual fund manager who sells a share of its fund of combined products from different producers; a bank receives deposits from savers and makes loans to borrowers.

Transformer n n (value-added retailer) Beyond brokering and distribution Example: a mutual fund manager who sells a share of its fund of combined products from different producers; a bank receives deposits from savers and makes loans to borrowers.

Transactional Efficiencies n Broken down into three distinctive market interaction processes of n n search, negotiation, and settlement An online market not only provides a meeting place for sellers and buyers but also performs other economic roles such as price setting, payment and delivery.

Transactional Efficiencies n Broken down into three distinctive market interaction processes of n n search, negotiation, and settlement An online market not only provides a meeting place for sellers and buyers but also performs other economic roles such as price setting, payment and delivery.

Internet Initial public offerings (IPOs) n n The motive for companies to offer IPOs is to raise capital for their business projects. The first Internet IPOs, Spring Street Brewing Company n n A microbrewery in New York, offered the first Internet IPO, raising $1. 6 million from 3, 500 shareholders without using Wall Street underwriters. Its offerings were open to all potential buyers without the need to rely on brokers or to pay commissions. Both the firm and individual investors can trade capital assets at a lower cost. Internet investment and brokerage firm to promote Internet IPOs and subsequent public trading of stocks in secondary markets. n n n Wit Capital Corporation Internet Capital Exchange (http: //www. inetcapital. com) and Web IPO - Capital Formation Group (http: //www. webipo. com).

Internet Initial public offerings (IPOs) n n The motive for companies to offer IPOs is to raise capital for their business projects. The first Internet IPOs, Spring Street Brewing Company n n A microbrewery in New York, offered the first Internet IPO, raising $1. 6 million from 3, 500 shareholders without using Wall Street underwriters. Its offerings were open to all potential buyers without the need to rely on brokers or to pay commissions. Both the firm and individual investors can trade capital assets at a lower cost. Internet investment and brokerage firm to promote Internet IPOs and subsequent public trading of stocks in secondary markets. n n n Wit Capital Corporation Internet Capital Exchange (http: //www. inetcapital. com) and Web IPO - Capital Formation Group (http: //www. webipo. com).

Internet Digital Exchange Markets n n Individual investors can buy and sell without involving a broker through private online trading houses Internet-based linkage to proprietary online brokerage services n n Datek Securities Corp. , which provides access to NASDAQ's computerized Small Order Execution System or NYSE's Super. DOT system Internet brokerages n n e. Schwab of Charles Schwab (http: // www. schwab. com) E*Trade online brokerage of E*Trade Group

Internet Digital Exchange Markets n n Individual investors can buy and sell without involving a broker through private online trading houses Internet-based linkage to proprietary online brokerage services n n Datek Securities Corp. , which provides access to NASDAQ's computerized Small Order Execution System or NYSE's Super. DOT system Internet brokerages n n e. Schwab of Charles Schwab (http: // www. schwab. com) E*Trade online brokerage of E*Trade Group

Transformational functions n Maturity transformation n n Volume transformation n n accept short-term deposits and make loans on a long-term basis can thus accommodate lenders and borrowers with different maturity preferences. match the different needs of lenders and borrowers in terms of volume. Electronic commerce effects n n home-banking by software producers such as Intuit (http: //www. intuit. com) will have a significant effect in diverting the customer base of traditional banks in a way of more creative and flexible in developing and providing new financial services Sony Bank Inc. Paypal. com Ezpay. com

Transformational functions n Maturity transformation n n Volume transformation n n accept short-term deposits and make loans on a long-term basis can thus accommodate lenders and borrowers with different maturity preferences. match the different needs of lenders and borrowers in terms of volume. Electronic commerce effects n n home-banking by software producers such as Intuit (http: //www. intuit. com) will have a significant effect in diverting the customer base of traditional banks in a way of more creative and flexible in developing and providing new financial services Sony Bank Inc. Paypal. com Ezpay. com

Information brokerage n n Agents with functions of collecting, evaluating and monitoring may or may not be tied to actual trading of digital financial instruments. Example, stockbrokers, on top of their brokerage functions, often make buy and sell recommendations to their customers based on their own information and analysis. Publishers of financial newspapers and newsletters, financial cable networks, and online specialized business information services Financial intermediation sector alone accounts for over 20. 5% of the GDP in US steadily from 2002 to 2005.

Information brokerage n n Agents with functions of collecting, evaluating and monitoring may or may not be tied to actual trading of digital financial instruments. Example, stockbrokers, on top of their brokerage functions, often make buy and sell recommendations to their customers based on their own information and analysis. Publishers of financial newspapers and newsletters, financial cable networks, and online specialized business information services Financial intermediation sector alone accounts for over 20. 5% of the GDP in US steadily from 2002 to 2005.

Information brokerage n n Information Uncertainty and Risk Information trading n n Merrill Lynch & Co. Securities Exchange Commission's Electronic Data Gathering, Analysis, and Retrieval, EDGAR (http: //www. sec. gov/edgarhp. htm) Certification and Assurance n n Identifying Certificates: e. g. , a leading provider of digital IDs as Veri. Sign, Inc. Authorizing Certificates: verify attributes of a person other than the identity. (password, age, city, address, email, etc. ) Transactional Certificates: digital signature attached to transaction Time-Stamping Services: unforgeable time stamp (Cryptographic hash value)

Information brokerage n n Information Uncertainty and Risk Information trading n n Merrill Lynch & Co. Securities Exchange Commission's Electronic Data Gathering, Analysis, and Retrieval, EDGAR (http: //www. sec. gov/edgarhp. htm) Certification and Assurance n n Identifying Certificates: e. g. , a leading provider of digital IDs as Veri. Sign, Inc. Authorizing Certificates: verify attributes of a person other than the identity. (password, age, city, address, email, etc. ) Transactional Certificates: digital signature attached to transaction Time-Stamping Services: unforgeable time stamp (Cryptographic hash value)

Payment patterns n 80% of all retail purchases are paid for by cash in the U. S. And 96% of all business-to-business transactions are completed using paper checks.

Payment patterns n 80% of all retail purchases are paid for by cash in the U. S. And 96% of all business-to-business transactions are completed using paper checks.

Types of Electronic Payment Systems n n Anonymous Internet Mercantile Protocols by AT&T Bell Labs (http: //www. bell-labscom) Conditional Access for Europe (CAFE) for the European community Secure Electronic Transaction (SET) promoted by Master. Card (http: //www. mastercard. com) and Visa (http: //www. visa. com) Some open standards are being offered including Cyber. Cash, Digicash, Mondex, Net. Bill and Net. Cheque

Types of Electronic Payment Systems n n Anonymous Internet Mercantile Protocols by AT&T Bell Labs (http: //www. bell-labscom) Conditional Access for Europe (CAFE) for the European community Secure Electronic Transaction (SET) promoted by Master. Card (http: //www. mastercard. com) and Visa (http: //www. visa. com) Some open standards are being offered including Cyber. Cash, Digicash, Mondex, Net. Bill and Net. Cheque

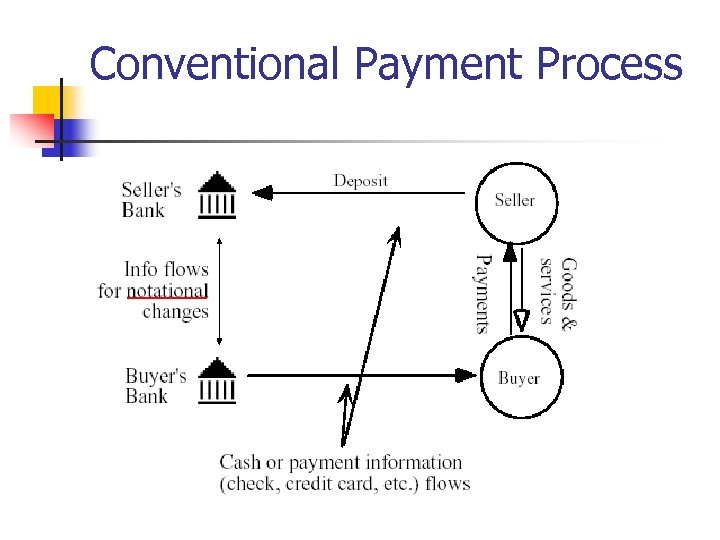

Conventional Payment Process

Conventional Payment Process

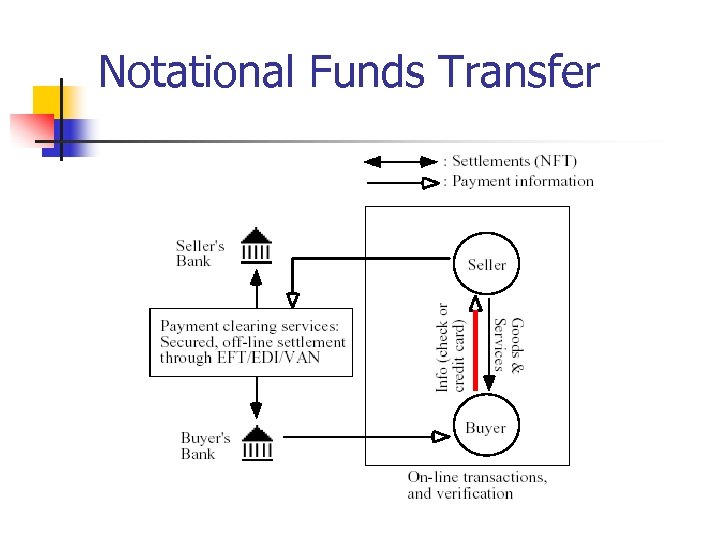

Notational Funds Transfer

Notational Funds Transfer

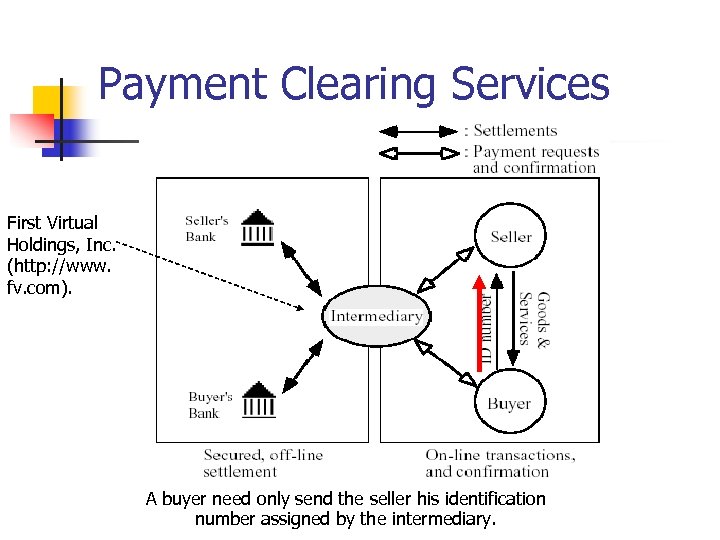

Payment Clearing Services First Virtual Holdings, Inc. (http: //www. fv. com). A buyer need only send the seller his identification number assigned by the intermediary.

Payment Clearing Services First Virtual Holdings, Inc. (http: //www. fv. com). A buyer need only send the seller his identification number assigned by the intermediary.

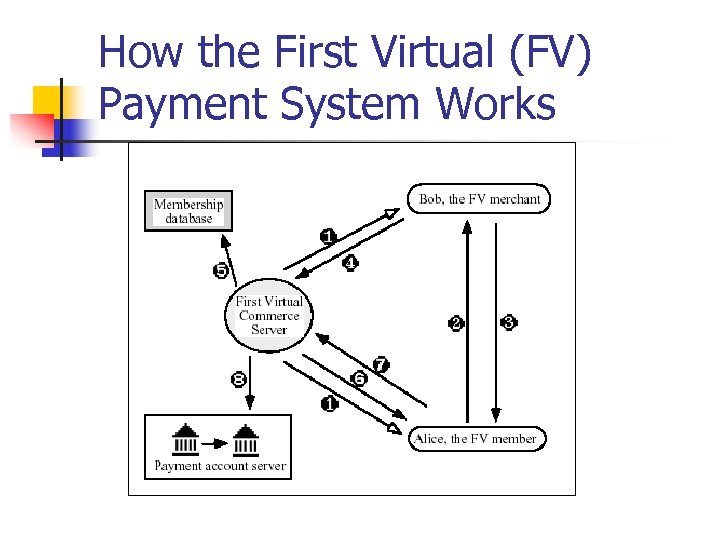

How the First Virtual (FV) Payment System Works

How the First Virtual (FV) Payment System Works

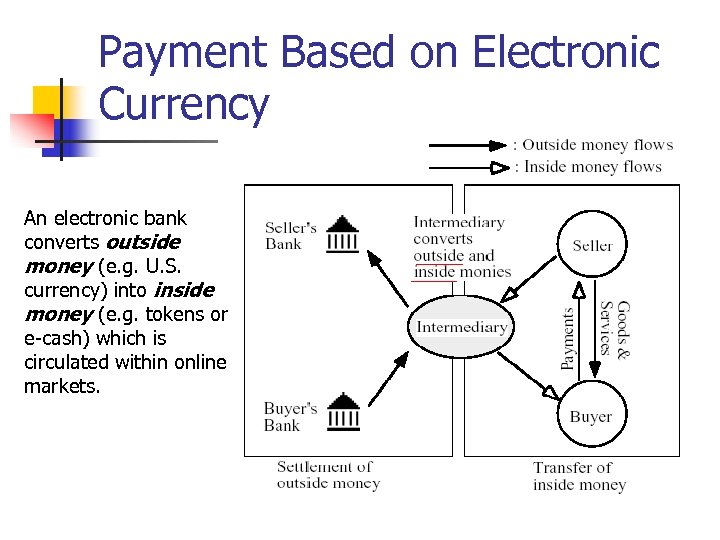

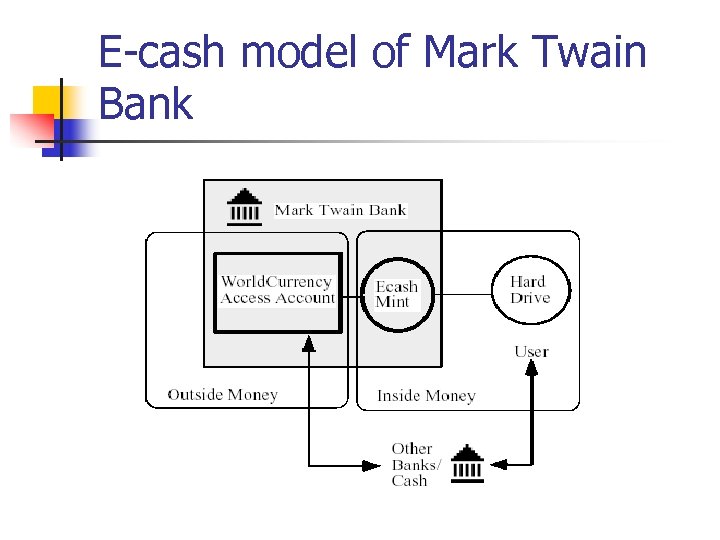

Payment Based on Electronic Currency An electronic bank converts outside money (e. g. U. S. currency) into inside money (e. g. tokens or e-cash) which is circulated within online markets.

Payment Based on Electronic Currency An electronic bank converts outside money (e. g. U. S. currency) into inside money (e. g. tokens or e-cash) which is circulated within online markets.

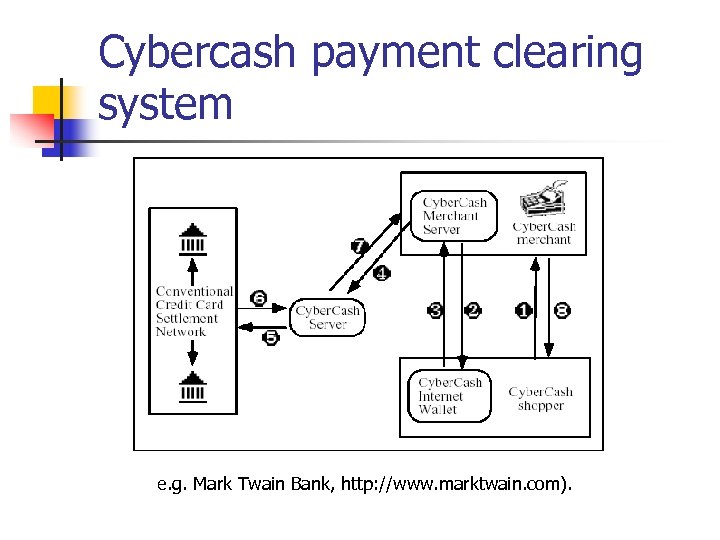

Cybercash payment clearing system e. g. Mark Twain Bank, http: //www. marktwain. com).

Cybercash payment clearing system e. g. Mark Twain Bank, http: //www. marktwain. com).

E-cash model of Mark Twain Bank

E-cash model of Mark Twain Bank

Money as a Medium of Exchange n n Meet the criteria of acceptability, availability, and convenience as a medium of exchange. Anything imperishable informational media issued by a trustable party n n n Anonymity in Transaction (for many strangers) Micro-payments in the Internet (for any purchasing) Transferability of Value (for extended orders)

Money as a Medium of Exchange n n Meet the criteria of acceptability, availability, and convenience as a medium of exchange. Anything imperishable informational media issued by a trustable party n n n Anonymity in Transaction (for many strangers) Micro-payments in the Internet (for any purchasing) Transferability of Value (for extended orders)

Desirable Properties of Digital Currency n n n n Monetary Value Convenience Security Authentication Non-refutability Accessibility and Reliability Anonymity

Desirable Properties of Digital Currency n n n n Monetary Value Convenience Security Authentication Non-refutability Accessibility and Reliability Anonymity

Technical Specifications of Digital Currencies n Digi. Cash (http: //www. digicash. com), is the forerunner of Internet payment systems based on online transactions. n n n Ecash uses public key encryption technologies to maintain the integrity of digital coins. Mondex is a smart card system which transfers stored balances based on off-line transactions. The Millicent system, self-described as a payahead, coupon system, uses vendor-specific digital scrips, which are akin to merchant-issued coupons.

Technical Specifications of Digital Currencies n Digi. Cash (http: //www. digicash. com), is the forerunner of Internet payment systems based on online transactions. n n n Ecash uses public key encryption technologies to maintain the integrity of digital coins. Mondex is a smart card system which transfers stored balances based on off-line transactions. The Millicent system, self-described as a payahead, coupon system, uses vendor-specific digital scrips, which are akin to merchant-issued coupons.

Monetary effects of digital currency n Money Stock = (Money Multiplier) × (Monetary Base), where Money Multiplier = (1+ CD)/(CD + RD) n n CD is the currency-deposit ratio, and RD is the reservedeposit ratio. E-cash systems essentially create new currencies, but their effect on the money supply depends on whether they are backed by the national currency. n n Withdraws $100 from her conventional bank for Ecash account, (lower down the deposit ratio and therefore increase money supply) If Ecash is backed by dollars or any outside money, it could reflow into deposit constrained by a reserve ratio. The same amount of cash balance is held with no effect on the money multiplier.

Monetary effects of digital currency n Money Stock = (Money Multiplier) × (Monetary Base), where Money Multiplier = (1+ CD)/(CD + RD) n n CD is the currency-deposit ratio, and RD is the reservedeposit ratio. E-cash systems essentially create new currencies, but their effect on the money supply depends on whether they are backed by the national currency. n n Withdraws $100 from her conventional bank for Ecash account, (lower down the deposit ratio and therefore increase money supply) If Ecash is backed by dollars or any outside money, it could reflow into deposit constrained by a reserve ratio. The same amount of cash balance is held with no effect on the money multiplier.

Regulatory Issues on digital currency n n n Possible reduction in government revenue due to private monies. Consumer protection and law enforcement issues such as money laundering that demand government attention. Reexamine existing laws which regulate who can issue private monies and accept money as deposits

Regulatory Issues on digital currency n n n Possible reduction in government revenue due to private monies. Consumer protection and law enforcement issues such as money laundering that demand government attention. Reexamine existing laws which regulate who can issue private monies and accept money as deposits