a150eb328b2dbaf9e54db9cb32c0beca.ppt

- Количество слайдов: 186

Electronic Commerce: Business Models, Strategies, Investment and Implementation in the Network Economics August, 2008 Minder Chen, Ph. D. Associate Professor of Management Information Systems E-Mail: minder. chen@csuci. edu or minderchen@hotmail. com Web site: http: //faculty. csuci. edu/minder. chen/

Reference • 1. 2. 3. 4. 5. 6. 7. 8. EC Books Net Ready, by Amir Hartman and John Sifonis, Mc. GRaw-Hill, 2000. Now or Never, by Mary Modahl, Harper Business, 2000 Designing Systems for Internet Commerce by G. Winfield Treese, Lawrence C. Stewart (May 1998) Addison-Wesley Pub Co; ISBN: 0201571676 Net Results: Web Marketing that Works by Rick E. Bruner (Editor), Cybernautics, Usweb Corporation Hayden Books; ISBN: 1568304145 E-Business : Roadmap for Success by Ravi Kalakota, Marcia Robinson, Don Tapscott (June 1999) Addison-Wesley Pub Co (C); ISBN: 0201604809 Customers. Com: How to Create a Profitable Business Strategy for the Internet and Beyond by Patricia B. Seybold (Contributor), R. T. Marshak, Ronni Marshak 1 Ed edition (November 1998) Times Books; ISBN: 0812930371 Net Success : 24 Leaders in Web Commerce Show You How to Put the Web to Work for Your Business by Christina Ford Haylock, Len Muscarella, Ron Schultz, Steve Case (May 1999) Adams Media Corporation; ISBN: 1580621147 Creating the Virtual Store: Taking Your Web Site from Browsing to Buying, by Magdalena Yesil, Published by John Wiley & Sons, November 1, 1996 © Minder Chen, 1996 -2008 EC(I) - 2

Course Description This course provides an overview of Electronic Commerce and Electronic Business based on new E-conomy (network economics) and unique characteristics of underlying web technologies. Topics covered include: electronic commerce overview, network economics, EC models and strategies, EC case studies, e-business components such as Enterprise Resource Planning and Customer Relationship Management from a reengineering process viewpoint; Internet and web technologies including web technologies, electronic payment systems, and Internet security. Critical success factors for building a successful EC will be discussed. © Minder Chen, 1996 -2008 EC(I) - 3

Seminar Leader Dr. Minder Chen received a B. S. in Electrical Engineering from National Taiwan University in 1977, an M. B. A. from National Chiao Tung University in 1983, and a Ph. D. in Management Information Systems from the University of Arizona in 1988. He is currently Associate Professor of Management Information Systems and Decision Science and served as the Director of Technology Program (an Executive Master Program in Information Technology Management) in the School of Management at George Mason University. He has taught Executive MBA and undergraduate level courses in electronic commerce, as well as Business Process Reengineering and Change Management; Technology Assessment, Evaluation, & Investment; Global Information Technology Management at the Executive Technology Management master program. He is the President of Advanced Information Technology Consulting (U. S. A), a consulting firm specialized in business engineering, electronic commerce, and emerging technologies. He is also one of the founder and Chief Technology Officer of KITE ECommerce Training and Consulting Inc. (Taiwan). His primary research interests are electronic commerce, computer-aided instruction, collaborative and organizational learning, information engineering and business reengineering, computer-aided software engineering, client/server computing, collaboration technologies (groupware), and objectoriented systems development methodology. He has published papers in Journal of Management Information Systems, Database, Journal of Organizational Computing, Expert Systems with Applications, IEEE Transactions on Knowledge and Data Engineering, IEEE Transactions on Systems, Man, and Cybernetics, Journal of Small Group Research, and IEEE Software. © Minder Chen, 1996 -2008 EC(I) - 4

Continued. . . He has been involved in studying methods and tools for business process reengineering and software reuse for DOD's Corporate Information Management Office. He has also worked with governments and private-sector businesses, such as Fairfax County Government, US Court, Industrial Technology Research Institute, DOD Center for Information Management, American Management Systems, and Wizdom Systems Inc. in their information engineering, client/server migration, and business reengineering efforts by providing them with training and consulting services. He has given presentations and one- to three-day business reengineering and electronic commerce and other advanced IT seminars in U. S. , China (for Everbright Group), Taiwan (via National Taiwan University and Corporate Synergy Development Center), Singapore, and Hong Kong. Dr. Chen is also a well-known expert in systems development methodology, integrated CASE tools, and groupware. He has provided training courses such as HTML, DHTML, XML, Java. Script, Web Site Development and User Interface Design, IIS, ASP, Cold. Fusion, electronic commerce, CASE tools, Information Strategy Planning, Information Engineering methodology, client/server computing using Power. Builder and Visual Basic for many firms, such as AT&T, Logicon, PSINet, KForce. com, TRW Inc. , BDM, BTG, Lockheed Martin, International Monetary Funds, Computer Sciences Corporation, and Marriot Hotel. He is the co-guest-editor of the March 1992 IEEE Software special issue on Integrated CASE, a CASE minitrack coordinator of Hawaii International Conference on Systems Sciences for several years, a program committee member of Methods and Tools for Business Engineering 1995 Conference, an international program committee member of 1995 Pan Pacific Conference on Information Systems. © Minder Chen, 1996 -2008 EC(I) - 5

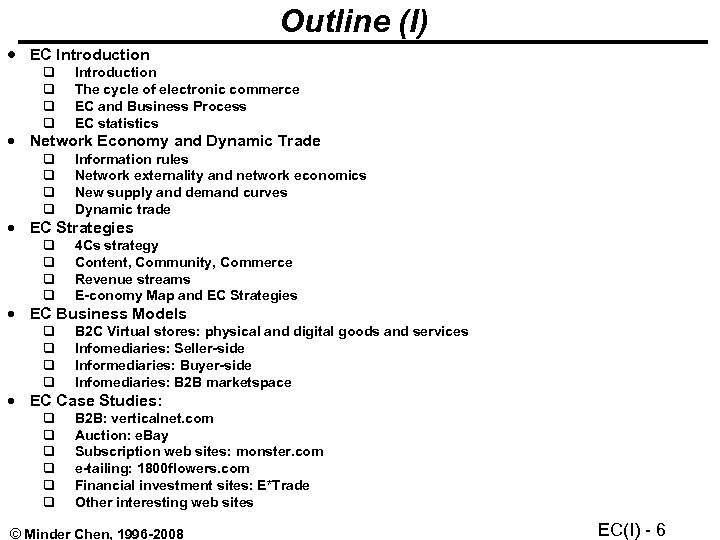

Outline (I) EC Introduction The cycle of electronic commerce EC and Business Process EC statistics Information rules Network externality and network economics New supply and demand curves Dynamic trade 4 Cs strategy Content, Community, Commerce Revenue streams E-conomy Map and EC Strategies B 2 C Virtual stores: physical and digital goods and services Infomediaries: Seller-side Informediaries: Buyer-side Infomediaries: B 2 B marketspace B 2 B: verticalnet. com Auction: e. Bay Subscription web sites: monster. com e-tailing: 1800 flowers. com Financial investment sites: E*Trade Other interesting web sites Network Economy and Dynamic Trade EC Strategies EC Business Models EC Case Studies: © Minder Chen, 1996 -2008 EC(I) - 6

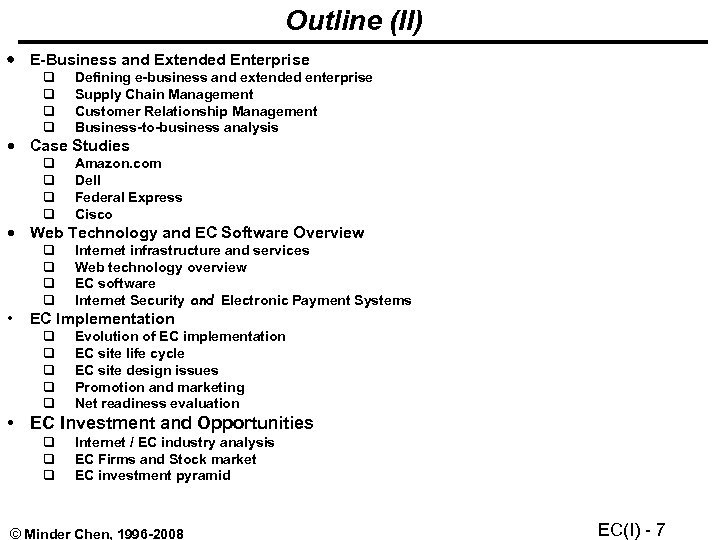

Outline (II) E-Business and Extended Enterprise Defining e-business and extended enterprise Supply Chain Management Customer Relationship Management Business-to-business analysis Amazon. com Dell Federal Express Cisco Internet infrastructure and services Web technology overview EC software Internet Security and Electronic Payment Systems Case Studies Web Technology and EC Software Overview • EC Implementation Evolution of EC implementation EC site life cycle EC site design issues Promotion and marketing Net readiness evaluation • EC Investment and Opportunities Internet / EC industry analysis EC Firms and Stock market EC investment pyramid © Minder Chen, 1996 -2008 EC(I) - 7

EC Introduction • Introduction • The cycle of electronic commerce • EC and business process • EC statistics © Minder Chen, 1996 -2008 EC(I) - 8

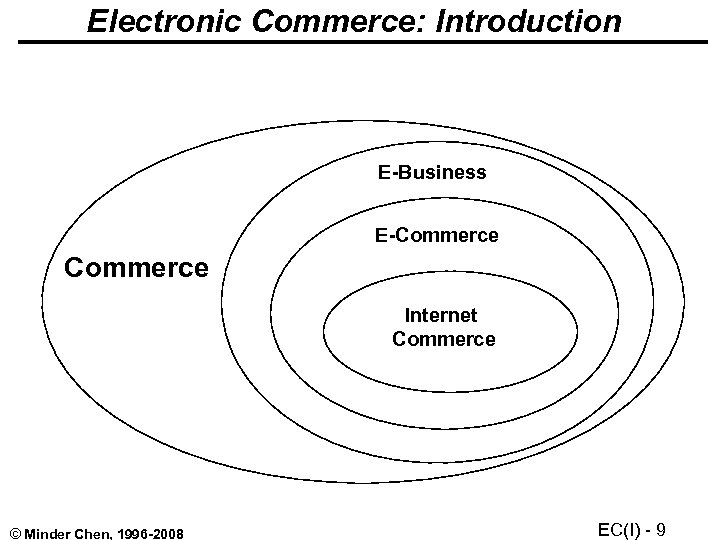

Electronic Commerce: Introduction E-Business E-Commerce Internet Commerce © Minder Chen, 1996 -2008 EC(I) - 9

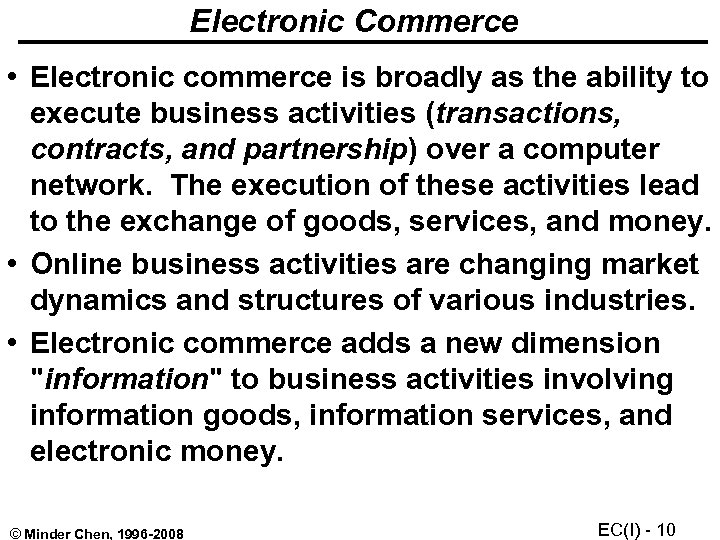

Electronic Commerce • Electronic commerce is broadly as the ability to execute business activities (transactions, contracts, and partnership) over a computer network. The execution of these activities lead to the exchange of goods, services, and money. • Online business activities are changing market dynamics and structures of various industries. • Electronic commerce adds a new dimension "information" to business activities involving information goods, information services, and electronic money. © Minder Chen, 1996 -2008 EC(I) - 10

Market Relationships © Minder Chen, 1996 -2008 EC(I) - 11

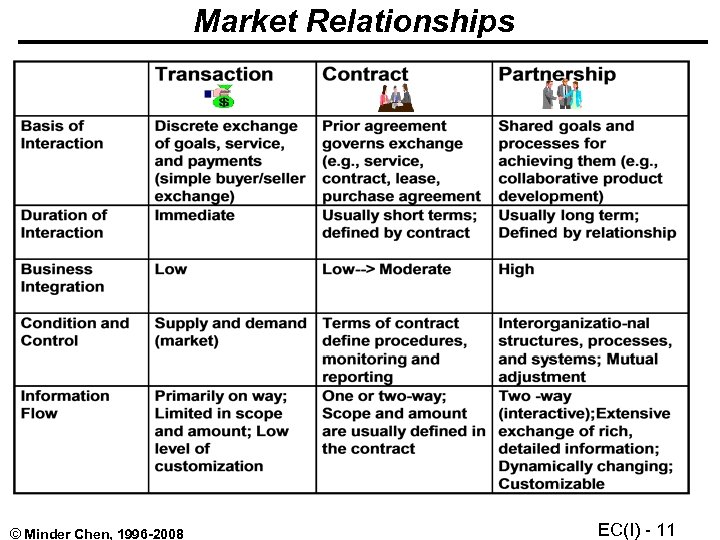

Travelocity Microsoft expedia Priceline. com

![The Low-Friction Market "[The Internet] will carry us into a new world of low The Low-Friction Market "[The Internet] will carry us into a new world of low](https://present5.com/presentation/a150eb328b2dbaf9e54db9cb32c0beca/image-13.jpg)

The Low-Friction Market "[The Internet] will carry us into a new world of low friction, lowoverhead capitalism, in which market information will be plentiful and transaction costs low. " -- Bill Gates, The Road Ahead "Where there is a friction, there is opportunity!" -- Net Ready. © Minder Chen, 1996 -2008 EC(I) - 13

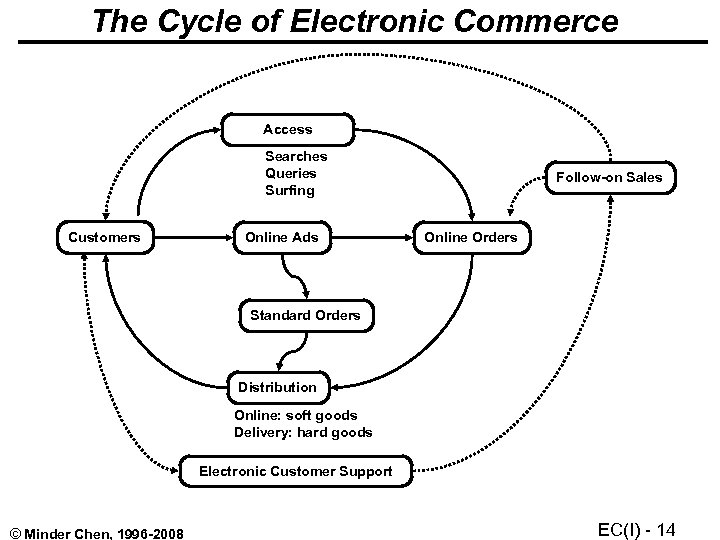

The Cycle of Electronic Commerce Access Searches Queries Surfing Customers Online Ads Follow-on Sales Online Orders Standard Orders Distribution Online: soft goods Delivery: hard goods Electronic Customer Support © Minder Chen, 1996 -2008 EC(I) - 14

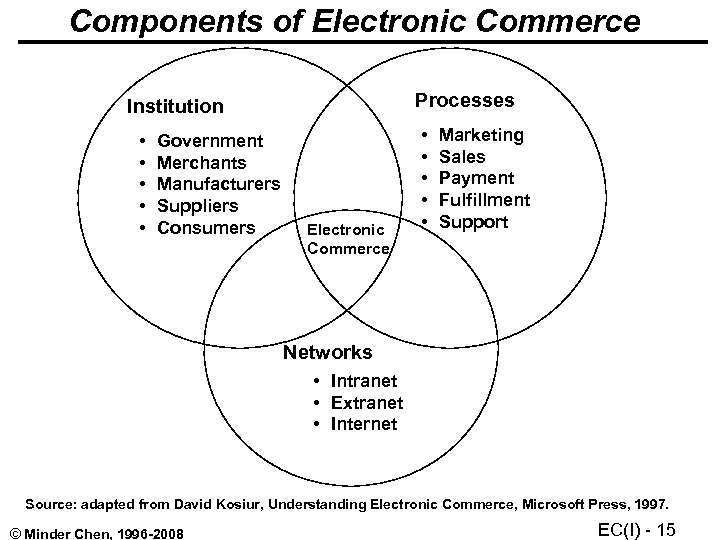

Components of Electronic Commerce Processes Institution • • • Government Merchants Manufacturers Suppliers Consumers Electronic Commerce • • • Marketing Sales Payment Fulfillment Support Networks • Intranet • Extranet • Internet Source: adapted from David Kosiur, Understanding Electronic Commerce, Microsoft Press, 1997. © Minder Chen, 1996 -2008 EC(I) - 15

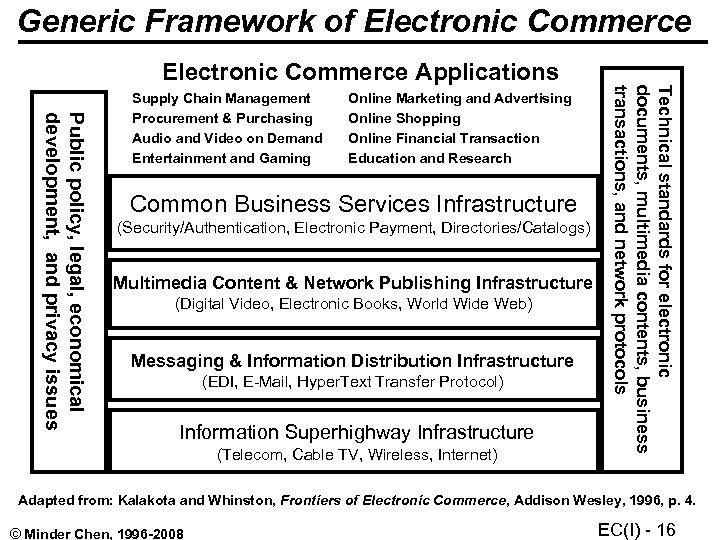

Generic Framework of Electronic Commerce Applications Technical standards for electronic documents, multimedia contents, business transactions, and network protocols Public policy, legal, economical development, and privacy issues Supply Chain Management Procurement & Purchasing Audio and Video on Demand Entertainment and Gaming Online Marketing and Advertising Online Shopping Online Financial Transaction Education and Research Common Business Services Infrastructure (Security/Authentication, Electronic Payment, Directories/Catalogs) Multimedia Content & Network Publishing Infrastructure (Digital Video, Electronic Books, World Wide Web) Messaging & Information Distribution Infrastructure (EDI, E-Mail, Hyper. Text Transfer Protocol) Information Superhighway Infrastructure (Telecom, Cable TV, Wireless, Internet) Adapted from: Kalakota and Whinston, Frontiers of Electronic Commerce, Addison Wesley, 1996, p. 4. © Minder Chen, 1996 -2008 EC(I) - 16

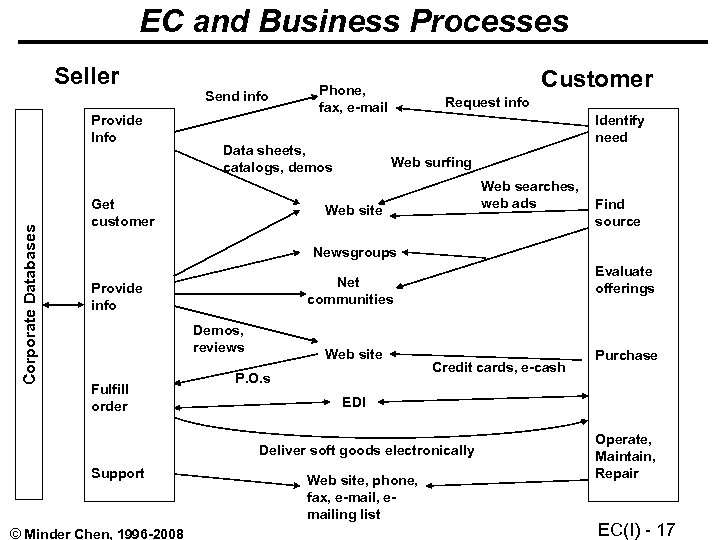

EC and Business Processes Seller Corporate Databases Provide Info Send info Data sheets, catalogs, demos Get customer Customer Phone, fax, e-mail Request info Identify need Web surfing Web searches, web ads Find source Web site Newsgroups Provide info Demos, reviews Fulfill order Evaluate offerings Net communities Web site P. O. s Credit cards, e-cash EDI Deliver soft goods electronically Support © Minder Chen, 1996 -2008 Purchase Web site, phone, fax, e-mail, emailing list Operate, Maintain, Repair EC(I) - 17

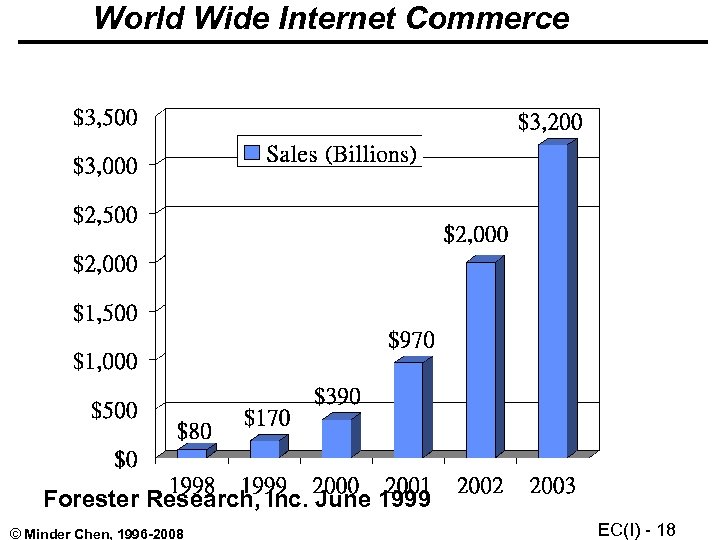

World Wide Internet Commerce Forester Research, Inc. June 1999 © Minder Chen, 1996 -2008 EC(I) - 18

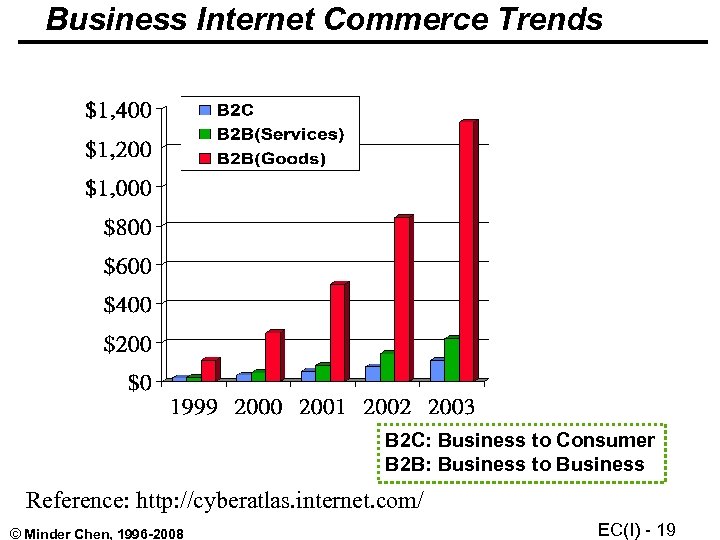

Business Internet Commerce Trends B 2 C: Business to Consumer B 2 B: Business to Business Reference: http: //cyberatlas. internet. com/ © Minder Chen, 1996 -2008 EC(I) - 19

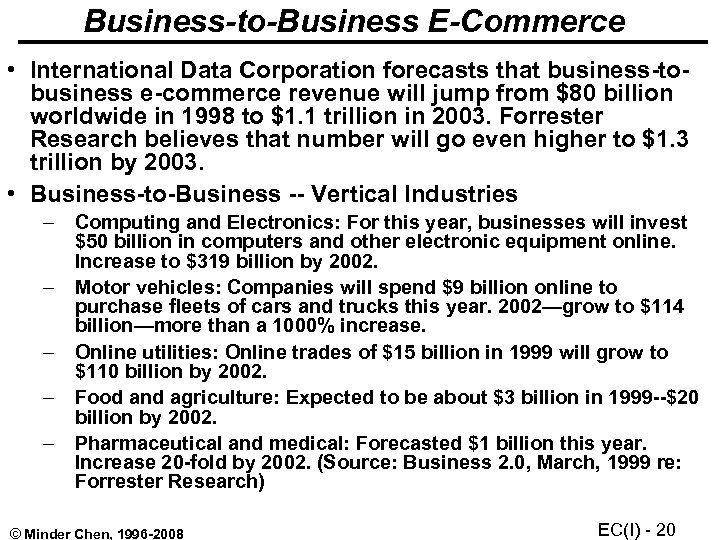

Business-to-Business E-Commerce • International Data Corporation forecasts that business-tobusiness e-commerce revenue will jump from $80 billion worldwide in 1998 to $1. 1 trillion in 2003. Forrester Research believes that number will go even higher to $1. 3 trillion by 2003. • Business-to-Business -- Vertical Industries – Computing and Electronics: For this year, businesses will invest $50 billion in computers and other electronic equipment online. Increase to $319 billion by 2002. – Motor vehicles: Companies will spend $9 billion online to purchase fleets of cars and trucks this year. 2002—grow to $114 billion—more than a 1000% increase. – Online utilities: Online trades of $15 billion in 1999 will grow to $110 billion by 2002. – Food and agriculture: Expected to be about $3 billion in 1999 --$20 billion by 2002. – Pharmaceutical and medical: Forecasted $1 billion this year. Increase 20 -fold by 2002. (Source: Business 2. 0, March, 1999 re: Forrester Research) © Minder Chen, 1996 -2008 EC(I) - 20

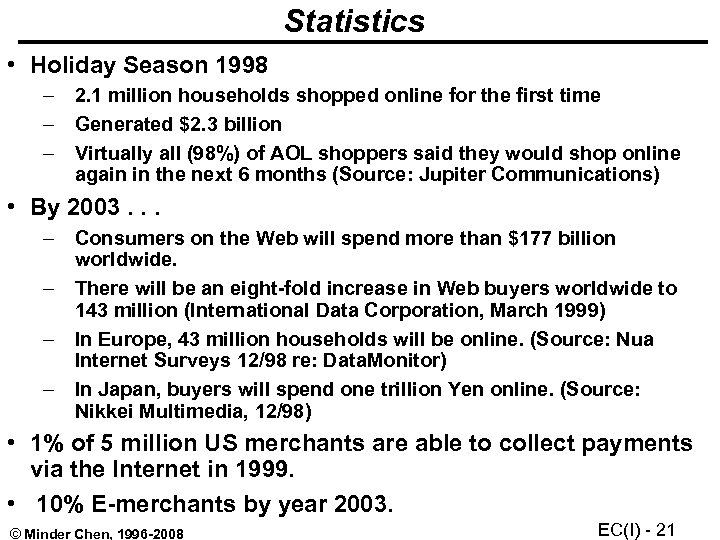

Statistics • Holiday Season 1998 – 2. 1 million households shopped online for the first time – Generated $2. 3 billion – Virtually all (98%) of AOL shoppers said they would shop online again in the next 6 months (Source: Jupiter Communications) • By 2003. . . – Consumers on the Web will spend more than $177 billion worldwide. – There will be an eight-fold increase in Web buyers worldwide to 143 million (International Data Corporation, March 1999) – In Europe, 43 million households will be online. (Source: Nua Internet Surveys 12/98 re: Data. Monitor) – In Japan, buyers will spend one trillion Yen online. (Source: Nikkei Multimedia, 12/98) • 1% of 5 million US merchants are able to collect payments via the Internet in 1999. • 10% E-merchants by year 2003. © Minder Chen, 1996 -2008 EC(I) - 21

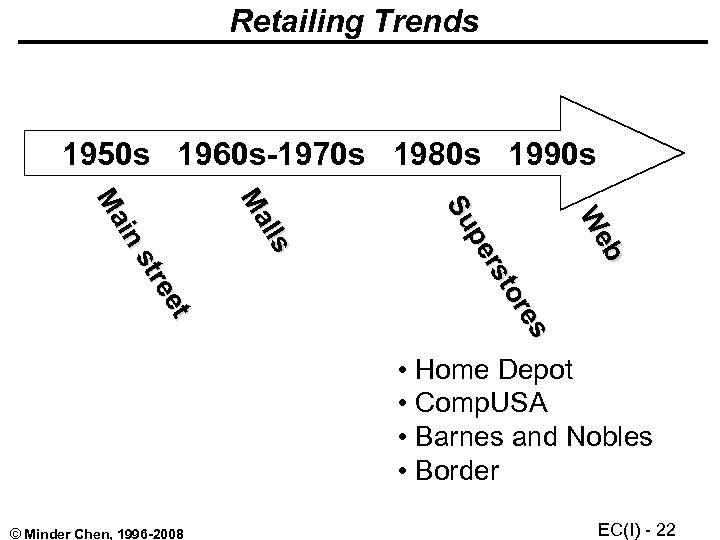

Retailing Trends 1950 s 1960 s-1970 s 1980 s 1990 s b eb We W es es or tor rst rs pe pe Su Su s lllls Ma Ma t et ee tre str n s iin Ma Ma • Home Depot • Comp. USA • Barnes and Nobles • Border © Minder Chen, 1996 -2008 EC(I) - 22

AOL Findings • Buy brands • Seek convenience • Are increasingly time-starving • Are not solely motivated by price • Require simplicity © Minder Chen, 1996 -2008 EC(I) - 23

Network Economy and Dynamic Trade • Information rules • Network externality and network economics • New supply and demand curves • Dynamic trade © Minder Chen, 1996 -2008 EC(I) - 24

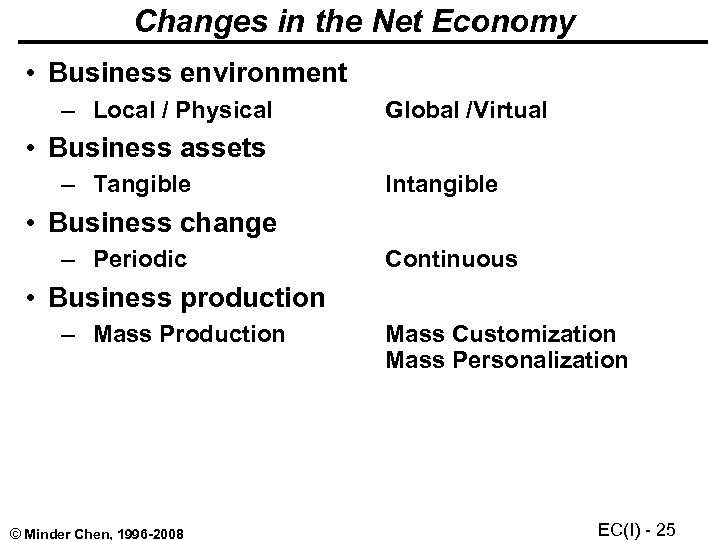

Changes in the Net Economy • Business environment – Local / Physical Global /Virtual • Business assets – Tangible Intangible • Business change – Periodic Continuous • Business production – Mass Production © Minder Chen, 1996 -2008 Mass Customization Mass Personalization EC(I) - 25

Net Economy • 1940 s - 1980 s – Manufacturing to information economy – Local - regional - national - multinational – Tangible brick-and-mortar assets: offices, shops, service centers, and warehouse • 1990 s - 21 st Century – Net economy: » Information & Knowledge » Communication and interactions – Global and virtual – Business Focus: Information, channel, flow, customer loyalty, reliable service, relationship – Intangible assets: Knowledge, experiences, relationships © Minder Chen, 1996 -2008 EC(I) - 26

Internet Economy Driving Forces • • • Changing customer demands Globalization Internet ubiquity New technology New marketplace and intermediacies © Minder Chen, 1996 -2008 EC(I) - 27

Network and Information Economy • Information is costly to produce but cheap to reproduce. – Price information according to its value not its cost. • Managing intellectual property. – Maximize the value of your intellectual property, not the terms and conditions that maximize the protection. • Information as an “experience good” – Consumers must experience it to value it. – Brand trust building is critical. • The economics of attention – A wealth of information creates a poverty of attention. Source: Information Rules © Minder Chen, 1996 -2008 EC(I) - 28

Characteristic of Information Economy © Minder Chen, 1996 -2008 EC(I) - 29

Information Commodity Market • • Competition among sellers of commodity information pushes prices to zero. Personalize your product and personalize your pricing Know your customer Differentiate your prices when possible Use promotion to measure demands Network effects lead to demand side economies of scale and positive feedback. Information has its greatest value when it is fresh. © Minder Chen, 1996 -2008 EC(I) - 30

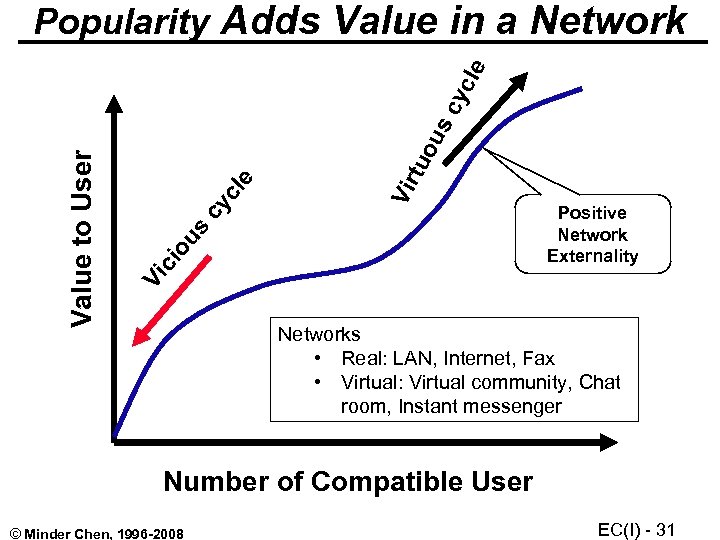

tuo Vir cy cl e ci ou s Positive Network Externality Vi Value to User us c yc le Popularity Adds Value in a Networks • Real: LAN, Internet, Fax • Virtual: Virtual community, Chat room, Instant messenger Number of Compatible User © Minder Chen, 1996 -2008 EC(I) - 31

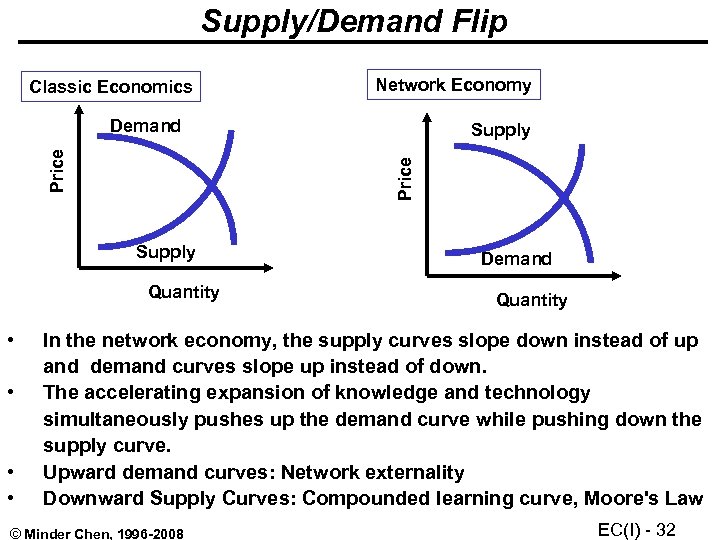

Supply/Demand Flip Classic Economics Network Economy Supply Quantity • • Supply Price Demand Quantity In the network economy, the supply curves slope down instead of up and demand curves slope up instead of down. The accelerating expansion of knowledge and technology simultaneously pushes up the demand curve while pushing down the supply curve. Upward demand curves: Network externality Downward Supply Curves: Compounded learning curve, Moore's Law © Minder Chen, 1996 -2008 EC(I) - 32

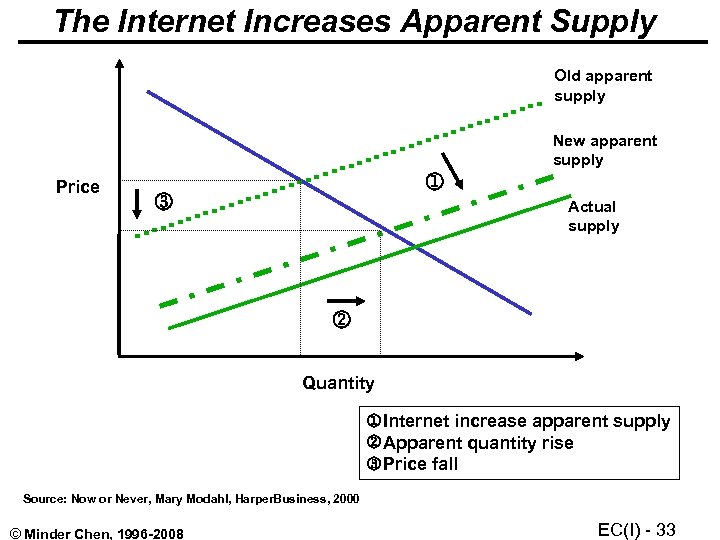

The Internet Increases Apparent Supply Old apparent supply New apparent supply Price Actual supply Quantity Internet increase apparent supply Apparent quantity rise Price fall Source: Now or Never, Mary Modahl, Harper. Business, 2000 © Minder Chen, 1996 -2008 EC(I) - 33

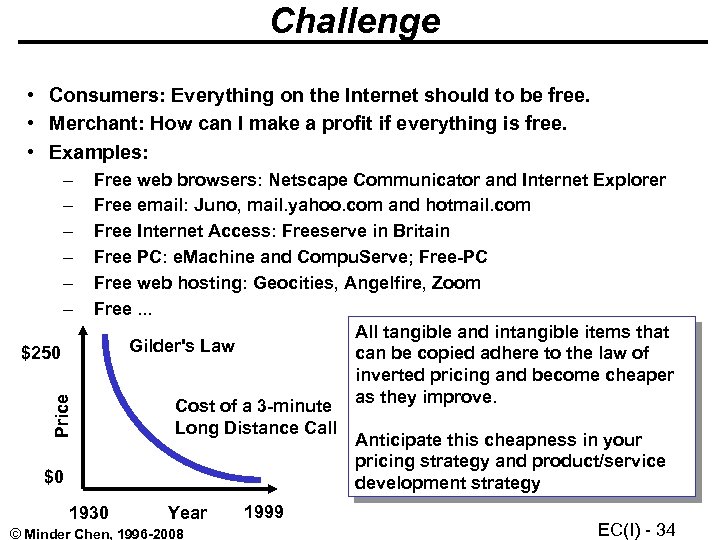

Challenge • Consumers: Everything on the Internet should to be free. • Merchant: How can I make a profit if everything is free. • Examples: – – – Price $250 $0 Free web browsers: Netscape Communicator and Internet Explorer Free email: Juno, mail. yahoo. com and hotmail. com Free Internet Access: Freeserve in Britain Free PC: e. Machine and Compu. Serve; Free-PC Free web hosting: Geocities, Angelfire, Zoom Free. . . All tangible and intangible items that Gilder's Law can be copied adhere to the law of inverted pricing and become cheaper as they improve. Cost of a 3 -minute Long Distance Call Anticipate this cheapness in your pricing strategy and product/service development strategy 1930 Year © Minder Chen, 1996 -2008 1999 EC(I) - 34

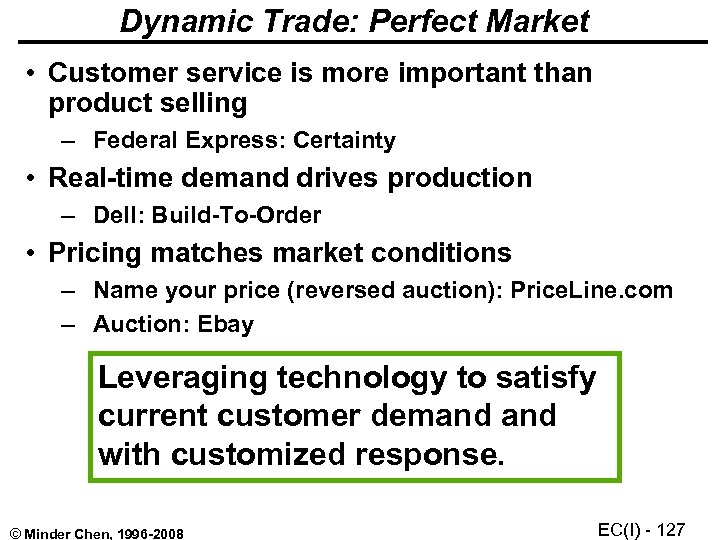

Dynamic Trade: Perfect Market • Customer service is more important than product selling – Federal Express: Certainty • Real-time demand drives production – Dell: Build-To-Order • Pricing matches market conditions – Name your price (reversed auction): Price. Line. com – Auction: Ebay Leveraging technology to satisfy current customer demand with customized response. © Minder Chen, 1996 -2008 EC(I) - 35

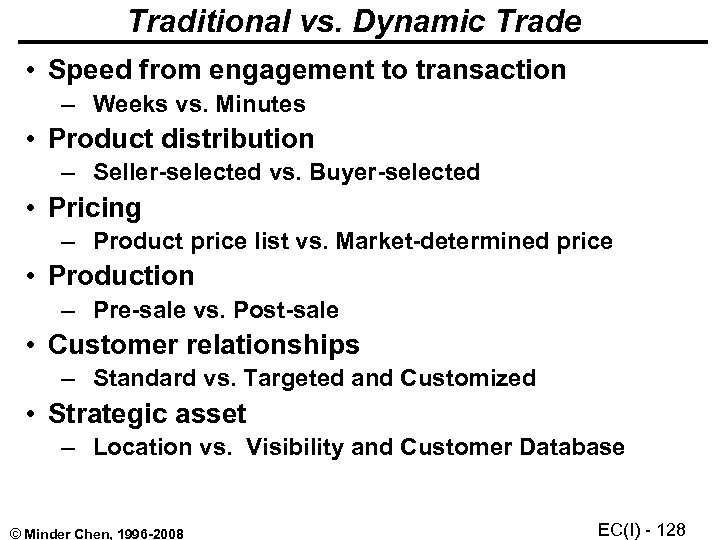

Traditional vs. Dynamic Trade • Speed from engagement to transaction – Weeks vs. Minutes • Product distribution – Seller-selected vs. Buyer-selected • Pricing – Product price list vs. Market-determined price • Production – Pre-sale vs. Post-sale (Dell’s BTO) • Customer relationships – Standard vs. Targeted and Customized • Strategic asset – Location vs. Visibility and Customer Database © Minder Chen, 1996 -2008 EC(I) - 36

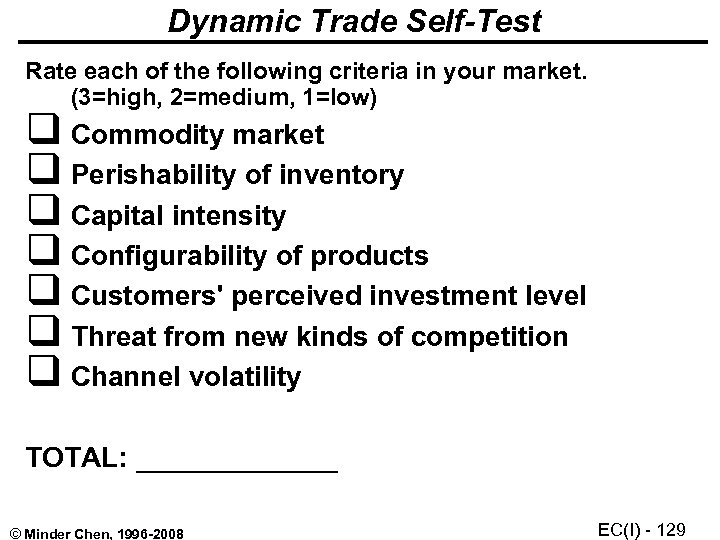

Dynamic Trade Self-Test Rate each of the following criteria in your market. (3=high, 2=medium, 1=low) Commodity market Perishability of inventory Capital intensity Configurability of products Customers' perceived investment level Threat from new kinds of competition Channel volatility TOTAL: _______ © Minder Chen, 1996 -2008 EC(I) - 37

Electronic Commerce: Strategies and Business Models © Minder Chen, 1996 -2008 EC(I) - 38

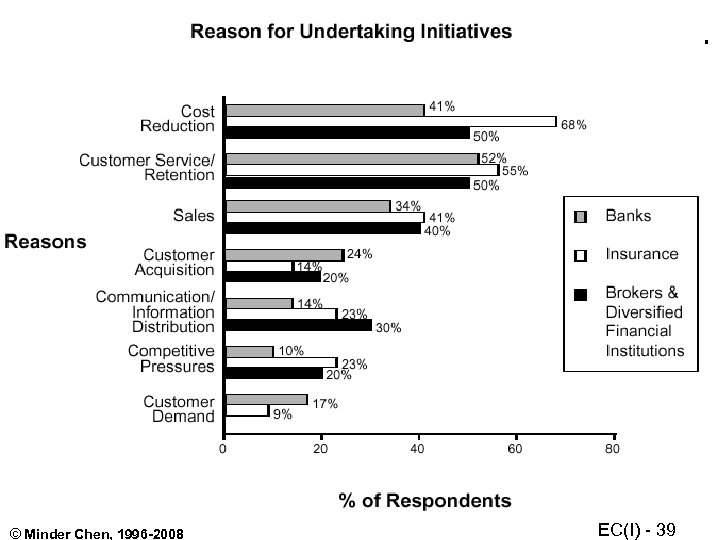

© Minder Chen, 1996 -2008 EC(I) - 39

Moving Your Business Online • Companies are motivated by either fear or greed to move to their businesses to the net. • To. com your company is becoming an imperative. • They have to obsolete their current business models and work very hard to search a new business model. Your competitor is just one-click away © Minder Chen, 1996 -2008 EC(I) - 40

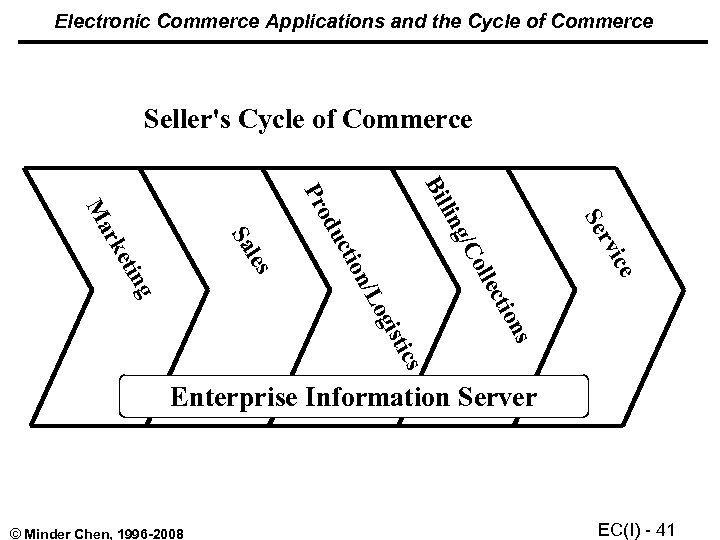

Electronic Commerce Applications and the Cycle of Commerce Seller's Cycle of Commerce Bil ce rvi Se s s tic gis /Lo ng ion ect oll les Sa eti ion uct od g/C lin Pr rk Ma Enterprise Information Server © Minder Chen, 1996 -2008 EC(I) - 41

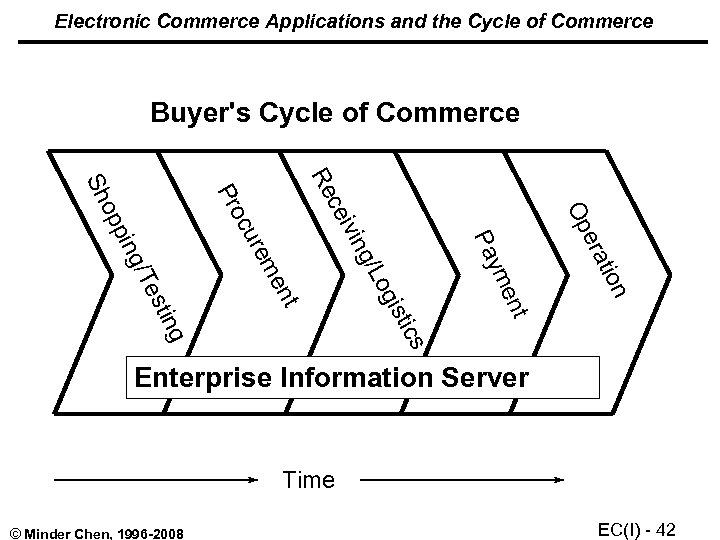

Electronic Commerce Applications and the Cycle of Commerce Buyer's Cycle of Commerce Re ion t era Op ent ym Pa cs isti og g/L ivin ce t ing est en rem g/T pin op cu Pro Sh Enterprise Information Server Time © Minder Chen, 1996 -2008 EC(I) - 42

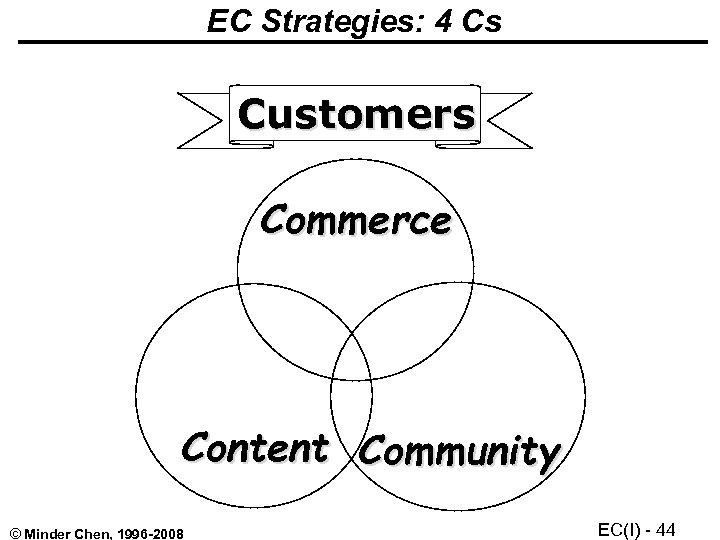

EC Strategies • • 4 Cs strategy Content, Community, Commerce Revenue streams E-conomy Map © Minder Chen, 1996 -2008 EC(I) - 43

EC Strategies: 4 Cs Customers Commerce Content Community © Minder Chen, 1996 -2008 EC(I) - 44

Customers • Obsess over your customers • Remember that the Web is an infant – What do you have to offer that the physical world cannot in order to attract customers? • If you make one customer unhappy, he won't tell five friends -- he'll tell 5, 000 on newsgroups, list servers, and so on. – "Word of mouth" factor gets amplified on the Net • The shifts of balance of power away from business and toward customer. - Jeff Bezos © Minder Chen, 1996 -2008 EC(I) - 45

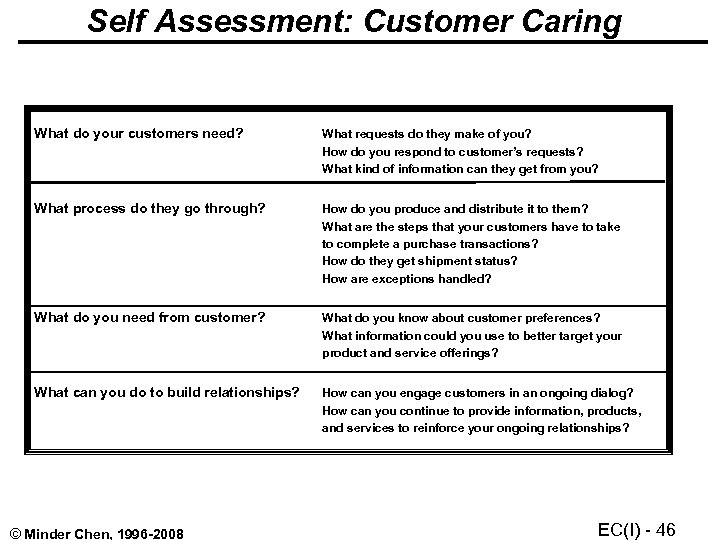

Self Assessment: Customer Caring What do your customers need? What requests do they make of you? How do you respond to customer’s requests? What kind of information can they get from you? What process do they go through? How do you produce and distribute it to them? What are the steps that your customers have to take to complete a purchase transactions? How do they get shipment status? How are exceptions handled? What do you need from customer? What do you know about customer preferences? What information could you use to better target your product and service offerings? What can you do to build relationships? How can you engage customers in an ongoing dialog? How can you continue to provide information, products, and services to reinforce your ongoing relationships? © Minder Chen, 1996 -2008 EC(I) - 46

• Consumers are increasingly engaged in an active and explicit dialogue with companies. • The role of the consumer is being transformed from passive buyer to active participant in co-creating value • The market is no longer a "target, " but must be recognized as an ecosystem. It's a forum for value creation and extraction, and the company is part of an enhanced network--one that includes its suppliers and partners, and its customers. The network's fulfillment goes beyond business-to-business or business-toconsumer relationships to a consumer-to-business-tobusiness relationship. • Consumer Centricity at http: //www. informationweek. com/781/prahalad. © Minder Chen, 1996 -2008 EC(I) - 47

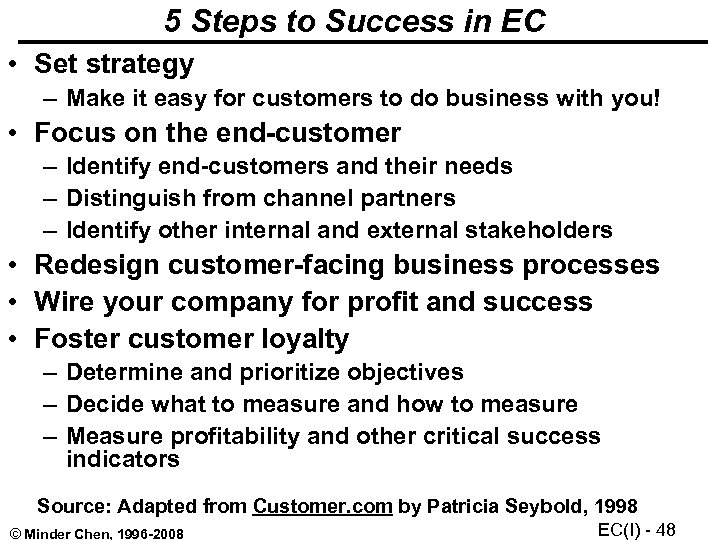

5 Steps to Success in EC • Set strategy – Make it easy for customers to do business with you! • Focus on the end-customer – Identify end-customers and their needs – Distinguish from channel partners – Identify other internal and external stakeholders • Redesign customer-facing business processes • Wire your company for profit and success • Foster customer loyalty – Determine and prioritize objectives – Decide what to measure and how to measure – Measure profitability and other critical success indicators Source: Adapted from Customer. com by Patricia Seybold, 1998 © Minder Chen, 1996 -2008 EC(I) - 48

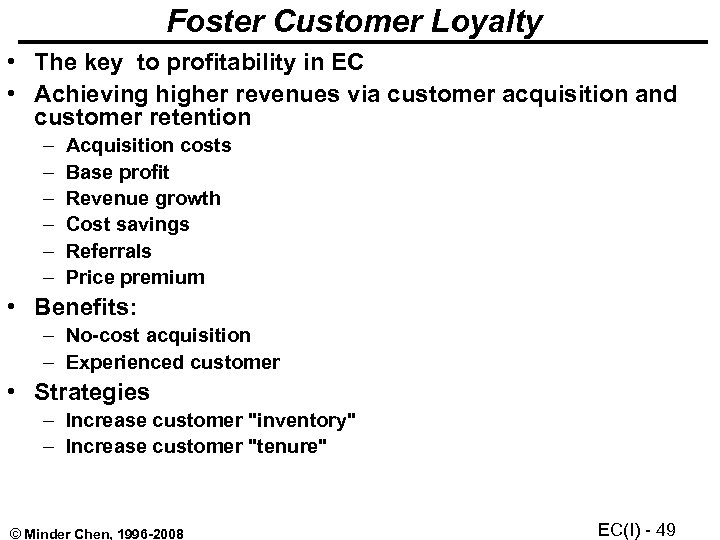

Foster Customer Loyalty • The key to profitability in EC • Achieving higher revenues via customer acquisition and customer retention – – – Acquisition costs Base profit Revenue growth Cost savings Referrals Price premium • Benefits: – No-cost acquisition – Experienced customer • Strategies – Increase customer "inventory" – Increase customer "tenure" © Minder Chen, 1996 -2008 EC(I) - 49

8 Critical Success Factors • Target the right customers • Own customer's total experience • Streamline business processes that impact the customer • Provide a 360 -degree view of relationships with your customers • Let customers help themselves • Help customers do their jobs • Deliver personalized services • Foster community © Minder Chen, 1996 -2008 EC(I) - 50

Target the Right Customers • Know who your customers and prospects are • Find out which customers are profitable • Decide which customers you want to attract (or keep from losing) • Decide which customers influence key purchases • Find out which customers generate referrals • Don't confuse customers, partners, and stakeholders © Minder Chen, 1996 -2008 EC(I) - 51

Own the Customer's Total Experience • • Deliver a consist and branded experience Focus on saving customer time and irritation Offer a peace of mind Work with partner to deliver consistent service and quality • Respect the customer individuality • Give customers control over their experience © Minder Chen, 1996 -2008 EC(I) - 52

Streamline Business Processes That Impacts the Customers • Start identify the end customer • Streamline the process from the end customer's point of view • Streamline the process for key stakeholders • Continuously improve the process based on customer feedback • Give everyone involved a clear view of the process © Minder Chen, 1996 -2008 EC(I) - 53

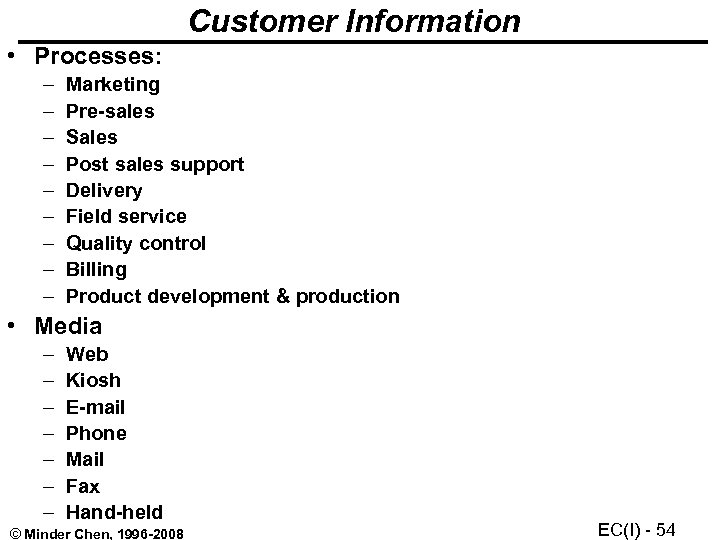

Customer Information • Processes: – – – – – Marketing Pre-sales Sales Post sales support Delivery Field service Quality control Billing Product development & production • Media – – – – Web Kiosh E-mail Phone Mail Fax Hand-held © Minder Chen, 1996 -2008 EC(I) - 54

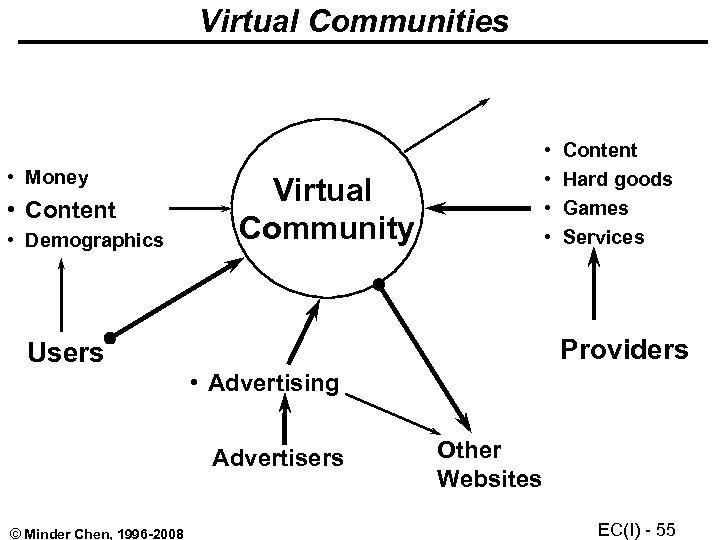

Virtual Communities • Money • Content • Demographics • • Virtual Community Content Hard goods Games Services Providers Users • Advertising Advertisers © Minder Chen, 1996 -2008 Other Websites EC(I) - 55

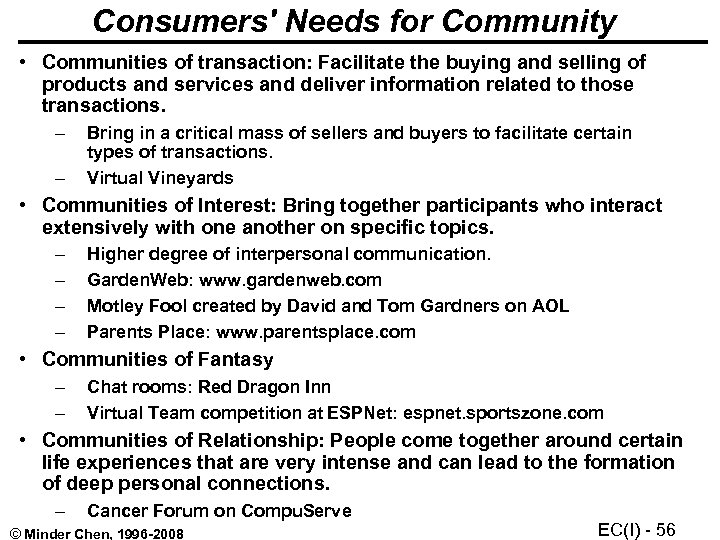

Consumers' Needs for Community • Communities of transaction: Facilitate the buying and selling of products and services and deliver information related to those transactions. – – Bring in a critical mass of sellers and buyers to facilitate certain types of transactions. Virtual Vineyards • Communities of Interest: Bring together participants who interact extensively with one another on specific topics. – – Higher degree of interpersonal communication. Garden. Web: www. gardenweb. com Motley Fool created by David and Tom Gardners on AOL Parents Place: www. parentsplace. com • Communities of Fantasy – – Chat rooms: Red Dragon Inn Virtual Team competition at ESPNet: espnet. sportszone. com • Communities of Relationship: People come together around certain life experiences that are very intense and can lead to the formation of deep personal connections. – Cancer Forum on Compu. Serve © Minder Chen, 1996 -2008 EC(I) - 56

www. parentsoup. com © Minder Chen, 1996 -2008 EC(I) - 57

Geocities: www. geocities. com • This collection of themes cyberhoods is populated by a half-million "homesteaders" who get free home pages. © Minder Chen, 1996 -2008 EC(I) - 58

The Well: www. well. com © Minder Chen, 1996 -2008 EC(I) - 59

Talk City: www. talkcity. com • Live. World Production Inc. hopes to create a clean, welllighted place to chat on the Web. © Minder Chen, 1996 -2008 EC(I) - 60

Major Portals • • AOL/Netscape Yahoo Excite MSN Lycos Info. Seek/GO: Disney's go. com Snap Alta. Vista © Minder Chen, 1996 -2008 EC(I) - 61

Revenue Streams • Advertising / Sponsorship • Transaction • Subscription / Listing Fee • Value-added services © Minder Chen, 1996 -2008 EC(I) - 62

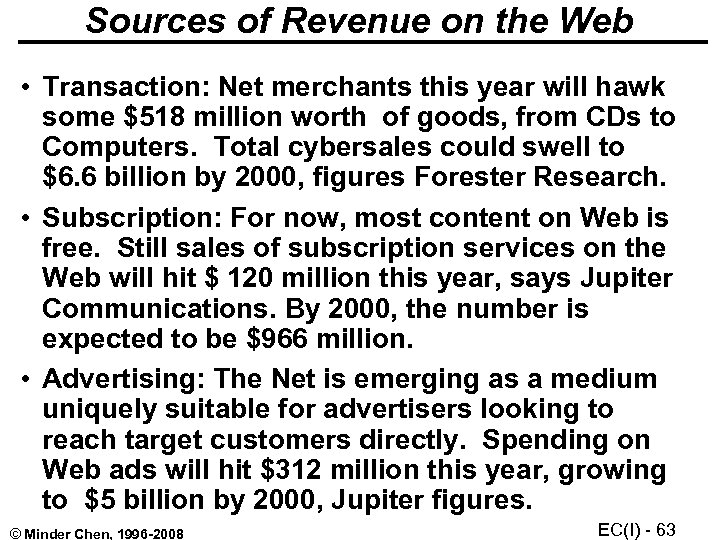

Sources of Revenue on the Web • Transaction: Net merchants this year will hawk some $518 million worth of goods, from CDs to Computers. Total cybersales could swell to $6. 6 billion by 2000, figures Forester Research. • Subscription: For now, most content on Web is free. Still sales of subscription services on the Web will hit $ 120 million this year, says Jupiter Communications. By 2000, the number is expected to be $966 million. • Advertising: The Net is emerging as a medium uniquely suitable for advertisers looking to reach target customers directly. Spending on Web ads will hit $312 million this year, growing to $5 billion by 2000, Jupiter figures. © Minder Chen, 1996 -2008 EC(I) - 63

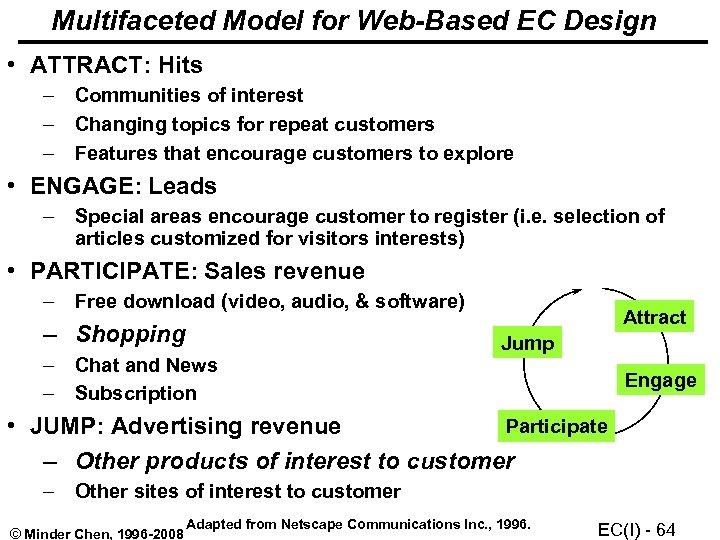

Multifaceted Model for Web-Based EC Design • ATTRACT: Hits – Communities of interest – Changing topics for repeat customers – Features that encourage customers to explore • ENGAGE: Leads – Special areas encourage customer to register (i. e. selection of articles customized for visitors interests) • PARTICIPATE: Sales revenue – Free download (video, audio, & software) – Shopping – Chat and News – Subscription Attract Jump Engage Participate • JUMP: Advertising revenue – Other products of interest to customer – Other sites of interest to customer © Minder Chen, 1996 -2008 Adapted from Netscape Communications Inc. , 1996. EC(I) - 64

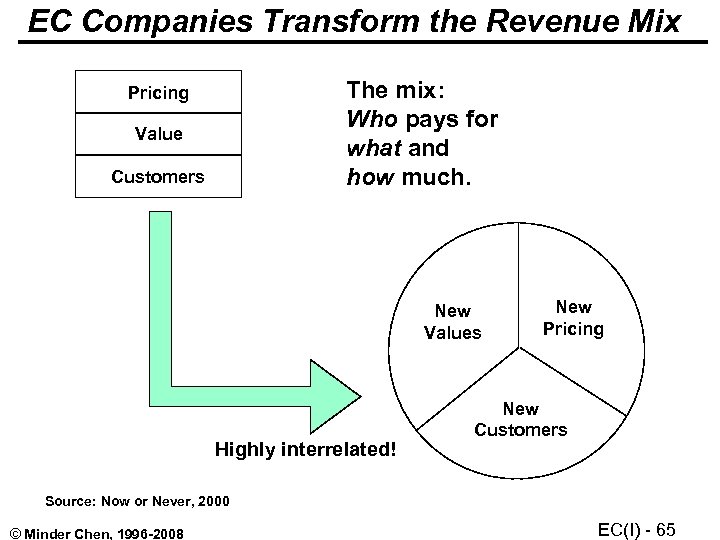

EC Companies Transform the Revenue Mix The mix: Who pays for what and how much. Pricing Value Customers New Values Highly interrelated! New Pricing New Customers Source: Now or Never, 2000 © Minder Chen, 1996 -2008 EC(I) - 65

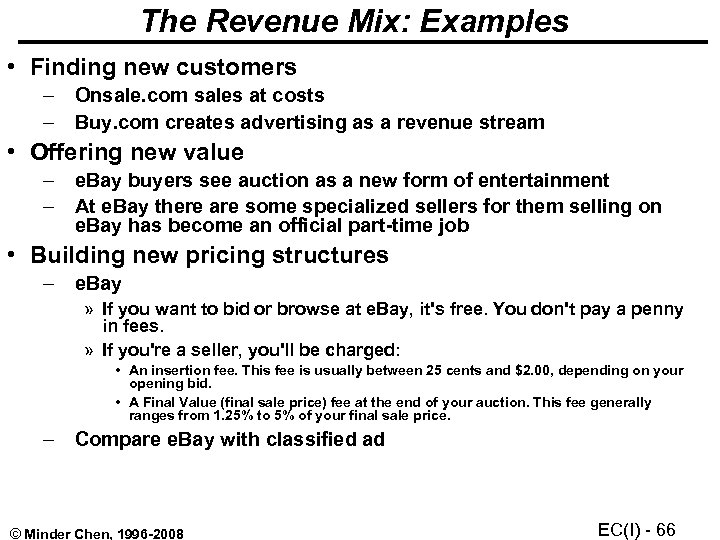

The Revenue Mix: Examples • Finding new customers – Onsale. com sales at costs – Buy. com creates advertising as a revenue stream • Offering new value – e. Bay buyers see auction as a new form of entertainment – At e. Bay there are some specialized sellers for them selling on e. Bay has become an official part-time job • Building new pricing structures – e. Bay » If you want to bid or browse at e. Bay, it's free. You don't pay a penny in fees. » If you're a seller, you'll be charged: • An insertion fee. This fee is usually between 25 cents and $2. 00, depending on your opening bid. • A Final Value (final sale price) fee at the end of your auction. This fee generally ranges from 1. 25% to 5% of your final sale price. – Compare e. Bay with classified ad © Minder Chen, 1996 -2008 EC(I) - 66

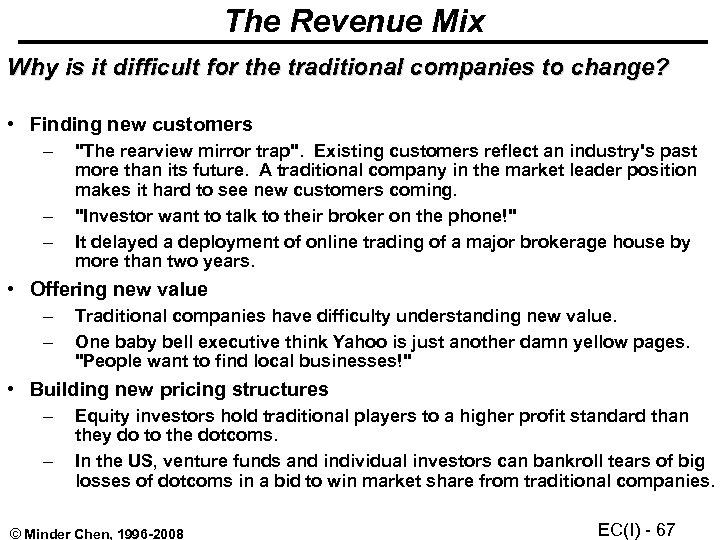

The Revenue Mix Why is it difficult for the traditional companies to change? • Finding new customers – – – "The rearview mirror trap". Existing customers reflect an industry's past more than its future. A traditional company in the market leader position makes it hard to see new customers coming. "Investor want to talk to their broker on the phone!" It delayed a deployment of online trading of a major brokerage house by more than two years. • Offering new value – – Traditional companies have difficulty understanding new value. One baby bell executive think Yahoo is just another damn yellow pages. "People want to find local businesses!" • Building new pricing structures – – Equity investors hold traditional players to a higher profit standard than they do to the dotcoms. In the US, venture funds and individual investors can bankroll tears of big losses of dotcoms in a bid to win market share from traditional companies. © Minder Chen, 1996 -2008 EC(I) - 67

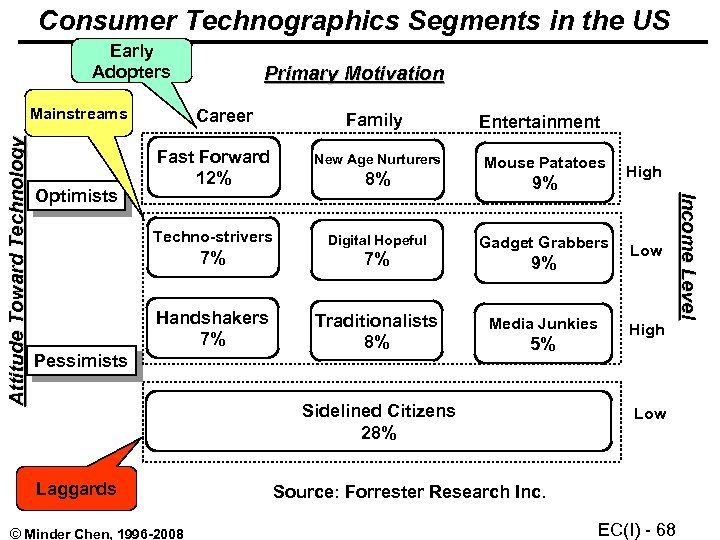

Consumer Technographics Segments in the US Early Adopters Career Family New Age Nurturers Techno-strivers Optimists Fast Forward 12% Digital Hopeful 7% Handshakers 7% Pessimists 8% 7% Traditionalists 8% Entertainment Mouse Patatoes 9% Gadget Grabbers 9% Media Junkies 5% Sidelined Citizens 28% Laggards © Minder Chen, 1996 -2008 High Low Source: Forrester Research Inc. EC(I) - 68 Income Level Attitude Toward Technology Mainstreams Primary Motivation

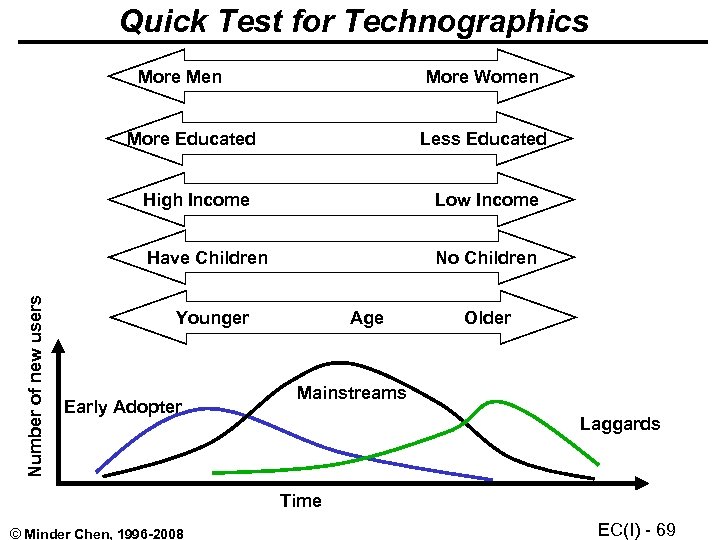

Quick Test for Technographics More Men More Women More Educated Less Educated High Income Low Income Number of new users Have Children Younger Early Adopter No Children Age Older Mainstreams Laggards Time © Minder Chen, 1996 -2008 EC(I) - 69

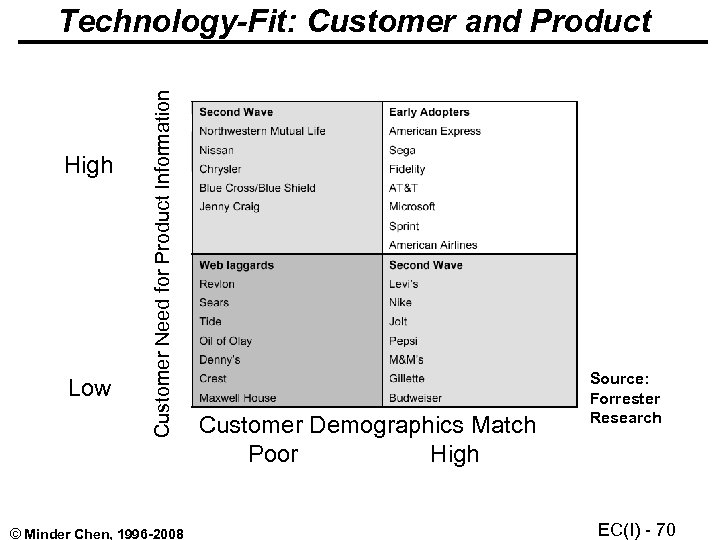

High Low Customer Need for Product Information Technology-Fit: Customer and Product © Minder Chen, 1996 -2008 Second Wave Earlier Adopter Jenny Craig Chrysler AA Fed. Exp Microsoft Web Laggards Second Wave Tide Denny's Nike Pepsi Customer Demographics Match Poor High Source: Forrester Research EC(I) - 70

EC Development Process • Competitive and capability analysis • Knowledge building and market evaluation • EC Business model design and feature identification • EC technical architecture design • Application development and deployment • Continuous performance evaluation and innovation © Minder Chen, 1996 -2008 EC(I) - 71

Opening Online Business • • • Identify a need and a niche Determine what you have to offer Set your business goals Design your EC architecture Assemble your EC teams Build your web site Set up a system to handle sales Provide customer services Advertise your online business (online and offline) • Evaluate your performance and moving on © Minder Chen, 1996 -2008 EC(I) - 72

Keys to Long Term Success • • • Fast deployment Evolutionary implementation First mover advantages Promotion, promotion Customer focus and services Interaction with customers Integrating emerging technologies Redefining and redesigning business models Comprehensive database and data warehouse design • Integrating back office operations with the virtual store fronts © Minder Chen, 1996 -2008 EC(I) - 73

Selling Points of Virtual Stores • "The Internet is going to become a channel of distribution. " -- The president of a major U. S. advertising agency • Another firm advertise its virtual store as "The parking is easy, there are no checkout lines, we are open 24 hours a day, and we deliver right to your door. " • The trend toward point-of-sale moving into the home is accelerating. © Minder Chen, 1996 -2008 EC(I) - 74

Benefits to the Merchants • Increased sales of existing products to generate additional revenues • Use the web to target their offers to a niche market • "The store is always open!" • Establish better relationships with customers. • Low cost information distribution • Increased speed to market • Expanded delivery channels • Global exposure and reach © Minder Chen, 1996 -2008 EC(I) - 75

Benefits to the Consumers • Convenience • Informative • Value presented upfront: Demo and free download • No long wait times • Easy flow and navigation • Search capabilities • Engaging presentation • Constant updates • Easy to buy © Minder Chen, 1996 -2008 EC(I) - 76

Five Strategies for. com-ming Your Business 1. Check Your DNA – Is the Net part of who you are as an enterprise? Or is it something foreign to you? – Are you ready to embrace the Net economy? – Do you have people on your team who have experience in this area? People who get it? More important, do you have people on your team who are passionate about the Net? Or are they expecting business as usual? Do you have the right people on the right projects? – Think about connections outside your enterprise-are you working with customers, partners and suppliers to help you retool your business. Are you learning from them and are they learning from you? Are you identifying key areas where you can make your interactions more productive and successful? © Minder Chen, 1996 -2008 EC(I) - 77

2. Think Portal – Think in terms of "portal". It's not about the site per se, it's about the community you create. – It's about building and maintaining services that build customer and partner loyalty and make your employees more efficient in providing service to your customers and partners. – Examples: automobiles/enthusiasts, airlines/travel agents, insurance/health care, agricultural/food and nutrition. – Find and create that home on the Web, and leverage it for competitive advantage. 3. Think Services – It's not enough anymore just to put information on a Web site. – Today you need to be offering services. What those services are will be up to you, but that's where users are finding value in the Net Economy. – Examples: Insurance, auto buying, auctioning, customer support, supply chain management, etc. – Services equal customer loyalty and retention. © Minder Chen, 1996 -2008 EC(I) - 78

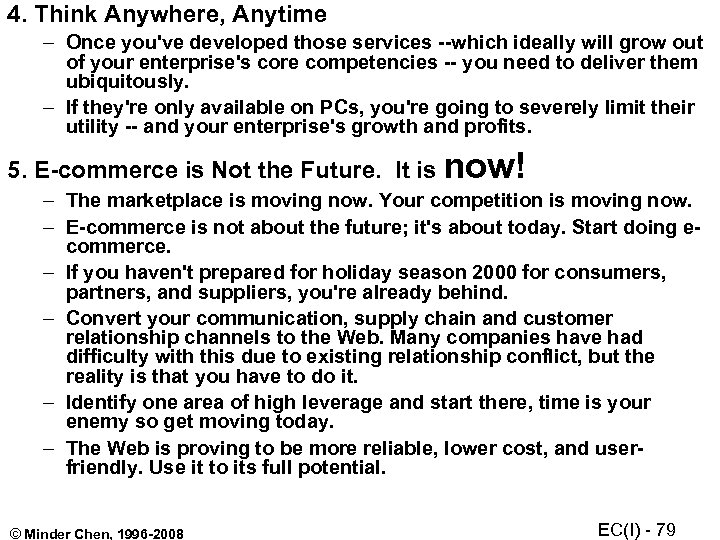

4. Think Anywhere, Anytime – Once you've developed those services --which ideally will grow out of your enterprise's core competencies -- you need to deliver them ubiquitously. – If they're only available on PCs, you're going to severely limit their utility -- and your enterprise's growth and profits. 5. E-commerce is Not the Future. It is now! – The marketplace is moving now. Your competition is moving now. – E-commerce is not about the future; it's about today. Start doing ecommerce. – If you haven't prepared for holiday season 2000 for consumers, partners, and suppliers, you're already behind. – Convert your communication, supply chain and customer relationship channels to the Web. Many companies have had difficulty with this due to existing relationship conflict, but the reality is that you have to do it. – Identify one area of high leverage and start there, time is your enemy so get moving today. – The Web is proving to be more reliable, lower cost, and userfriendly. Use it to its full potential. © Minder Chen, 1996 -2008 EC(I) - 79

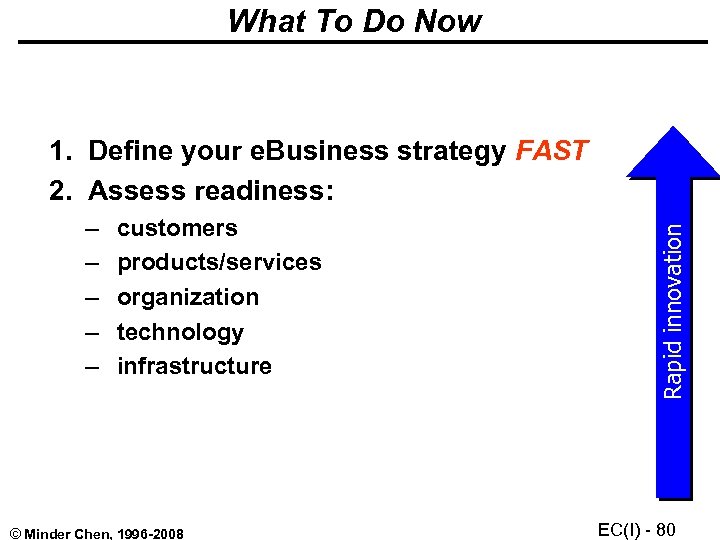

What To Do Now – – – customers products/services organization technology infrastructure © Minder Chen, 1996 -2008 Rapid innovation 1. Define your e. Business strategy FAST 2. Assess readiness: EC(I) - 80

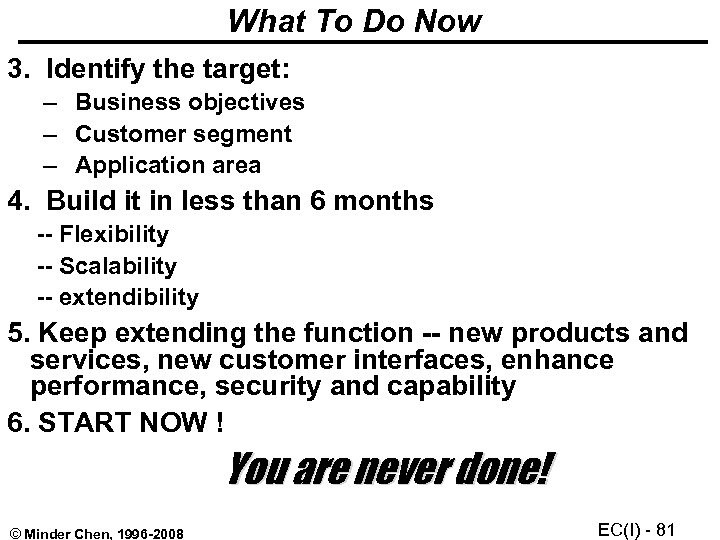

What To Do Now 3. Identify the target: – Business objectives – Customer segment – Application area 4. Build it in less than 6 months -- Flexibility -- Scalability -- extendibility 5. Keep extending the function -- new products and services, new customer interfaces, enhance performance, security and capability 6. START NOW ! You are never done! © Minder Chen, 1996 -2008 EC(I) - 81

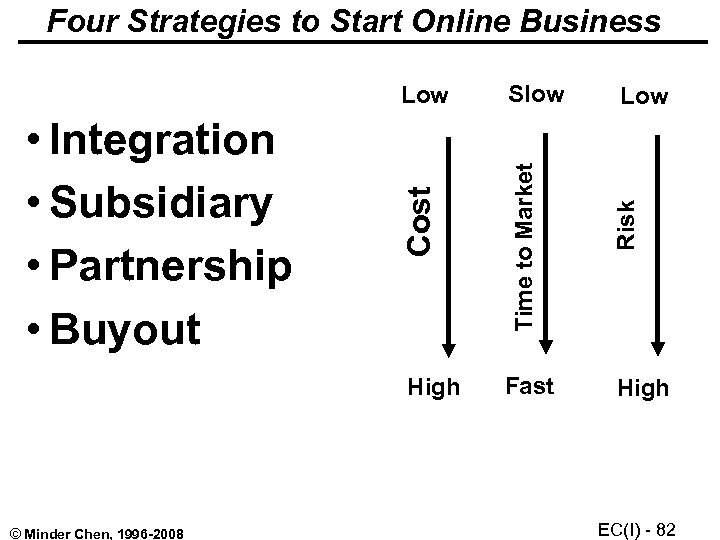

Four Strategies to Start Online Business High © Minder Chen, 1996 -2008 Fast Low Risk Slow Time to Market • Integration • Subsidiary • Partnership • Buyout Cost Low High EC(I) - 82

Brick and Mortar © Minder Chen, 1996 -2008 EC(I) - 83

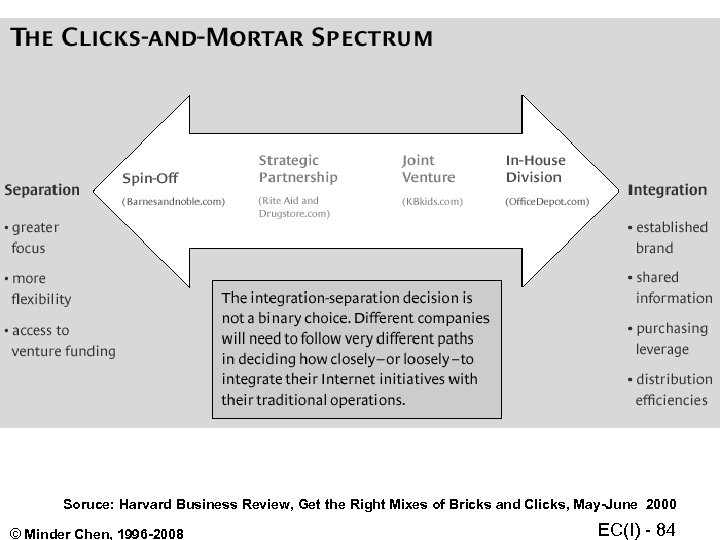

Soruce: Harvard Business Review, Get the Right Mixes of Bricks and Clicks, May-June 2000 © Minder Chen, 1996 -2008 EC(I) - 84

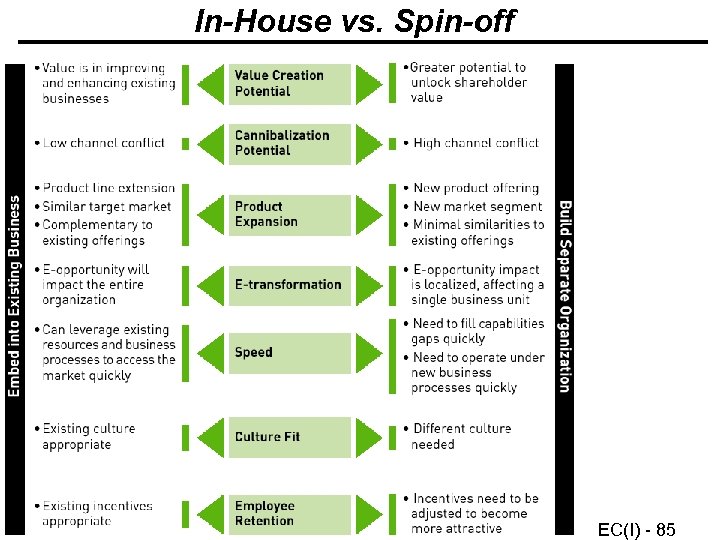

In-House vs. Spin-off © Minder Chen, 1996 -2008 EC(I) - 85

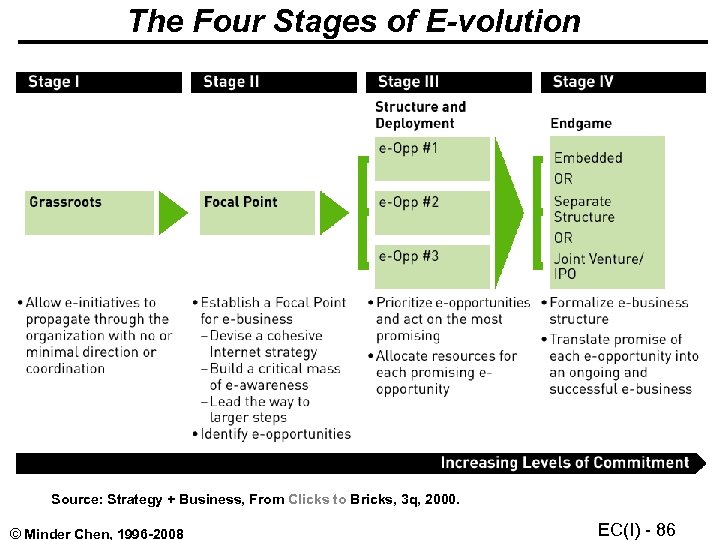

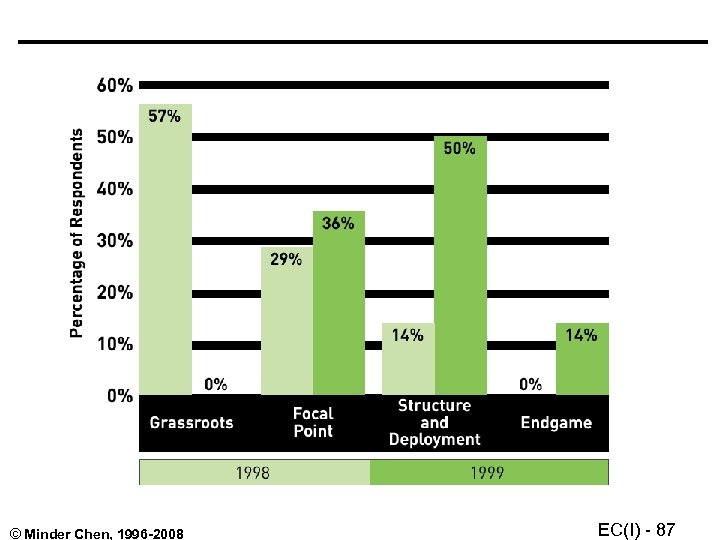

The Four Stages of E-volution Source: Strategy + Business, From Clicks to Bricks, 3 q, 2000. © Minder Chen, 1996 -2008 EC(I) - 86

© Minder Chen, 1996 -2008 EC(I) - 87

Becoming Virtual • Egghead to Egghead. com • Computer Literacy to Fatbrain. com • Romac International to KForce. com Kinder Toys is Moving to www. toydomain. com (Find us on the web after June 1 st) © Minder Chen, 1996 -2008 EC(I) - 88

Your 3 Biggest Problems/Opportunities • What should our strategy be? • How do we build it in 3 to 6 months? • How do we stay on the edge of innovation for life? © Minder Chen, 1996 -2008 EC(I) - 89

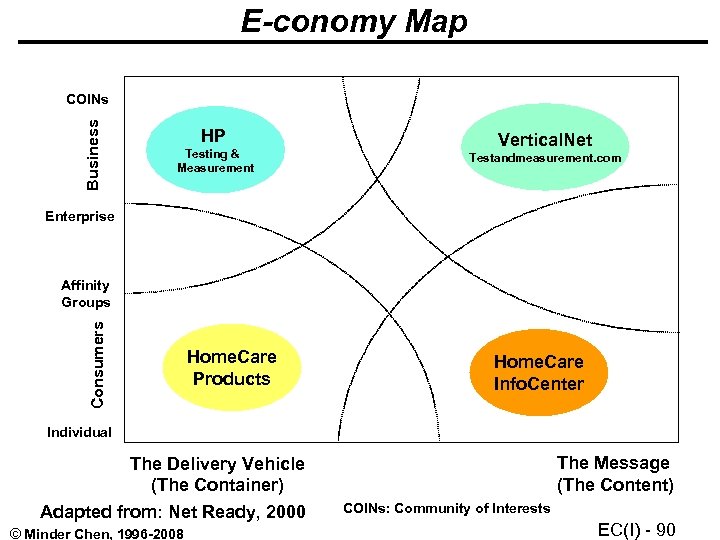

E-conomy Map Business COINs HP Testing & Measurement Vertical. Net Testandmeasurement. com Enterprise Consumers Affinity Groups Home. Care Products Home. Care Info. Center Individual The Delivery Vehicle (The Container) Adapted from: Net Ready, 2000 © Minder Chen, 1996 -2008 The Message (The Content) COINs: Community of Interests EC(I) - 90

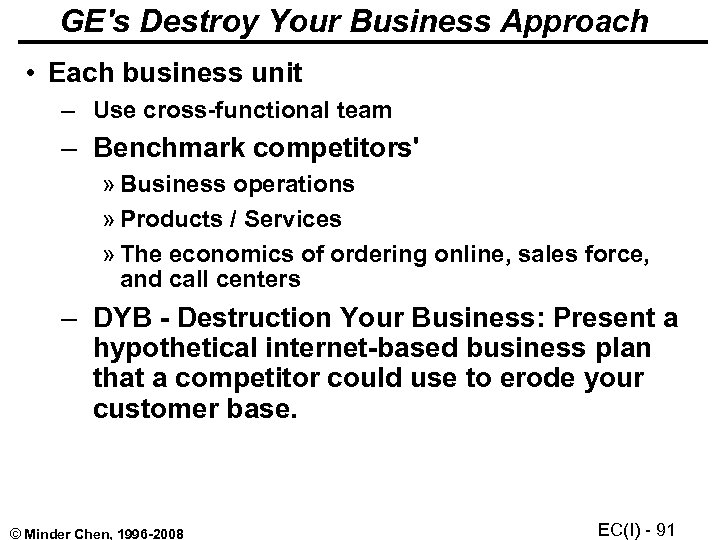

GE's Destroy Your Business Approach • Each business unit – Use cross-functional team – Benchmark competitors' » Business operations » Products / Services » The economics of ordering online, sales force, and call centers – DYB - Destruction Your Business: Present a hypothetical internet-based business plan that a competitor could use to erode your customer base. © Minder Chen, 1996 -2008 EC(I) - 91

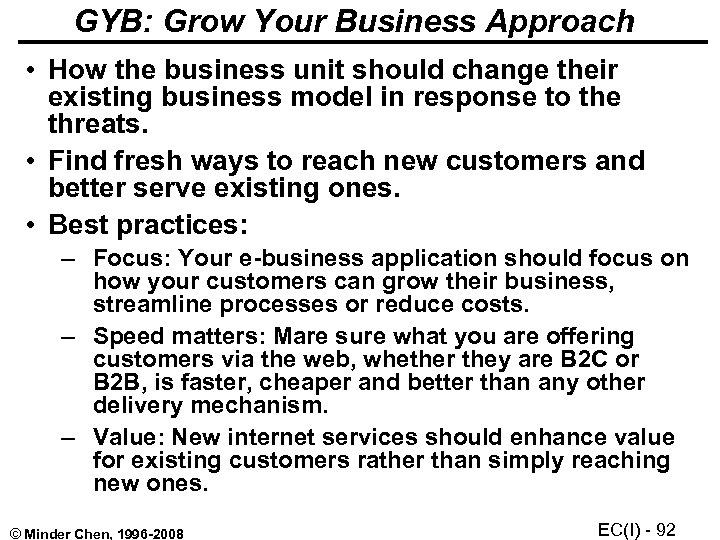

GYB: Grow Your Business Approach • How the business unit should change their existing business model in response to the threats. • Find fresh ways to reach new customers and better serve existing ones. • Best practices: – Focus: Your e-business application should focus on how your customers can grow their business, streamline processes or reduce costs. – Speed matters: Mare sure what you are offering customers via the web, whether they are B 2 C or B 2 B, is faster, cheaper and better than any other delivery mechanism. – Value: New internet services should enhance value for existing customers rather than simply reaching new ones. © Minder Chen, 1996 -2008 EC(I) - 92

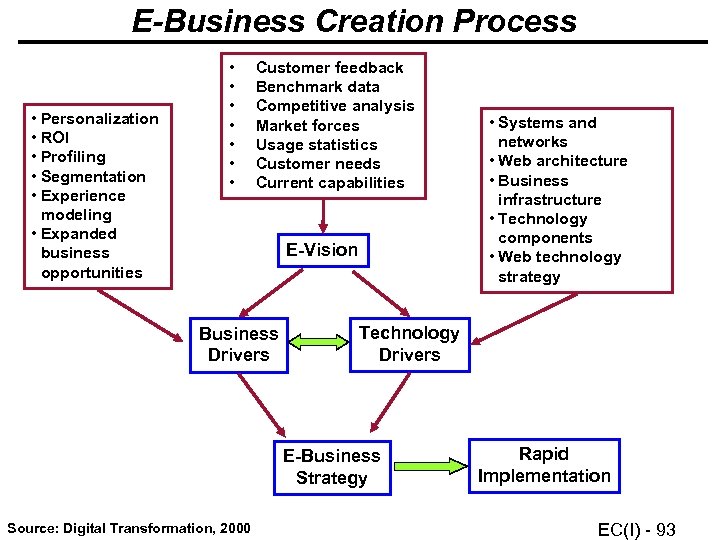

E-Business Creation Process • Personalization • ROI • Profiling • Segmentation • Experience modeling • Expanded business opportunities • • Customer feedback Benchmark data Competitive analysis Market forces Usage statistics Customer needs Current capabilities E-Vision Business Drivers Technology Drivers E-Business Strategy Source: Digital Transformation, 2000 © Minder Chen, 1996 -2008 • Systems and networks • Web architecture • Business infrastructure • Technology components • Web technology strategy Rapid Implementation EC(I) - 93

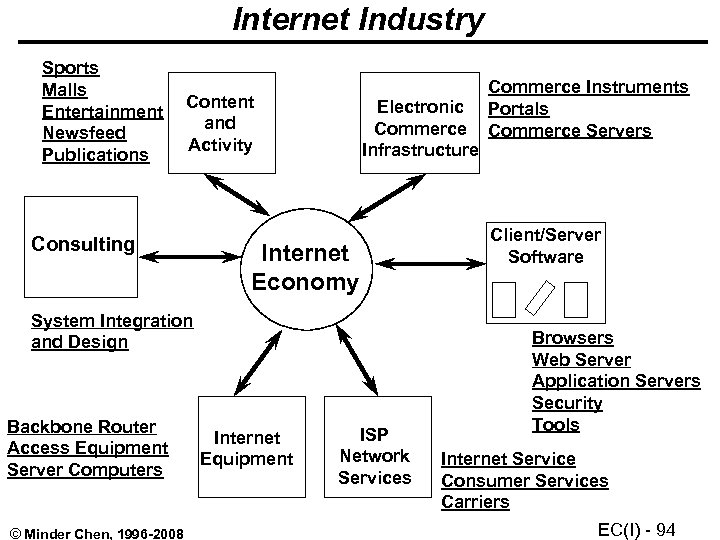

Internet Industry Sports Malls Entertainment Newsfeed Publications Content and Activity Consulting Electronic Commerce Infrastructure Internet Economy System Integration and Design Backbone Router Access Equipment Server Computers © Minder Chen, 1996 -2008 Internet Equipment ISP Network Services Commerce Instruments Portals Commerce Servers Client/Server Software Browsers Web Server Application Servers Security Tools Internet Service Consumer Services Carriers EC(I) - 94

EC Business Models • B 2 C Virtual stores: physical and digital goods and services • Infomediaries: Seller-side • Informediaries: Buyer-side • Infomediaries: B 2 B marketspace © Minder Chen, 1996 -2008 EC(I) - 95

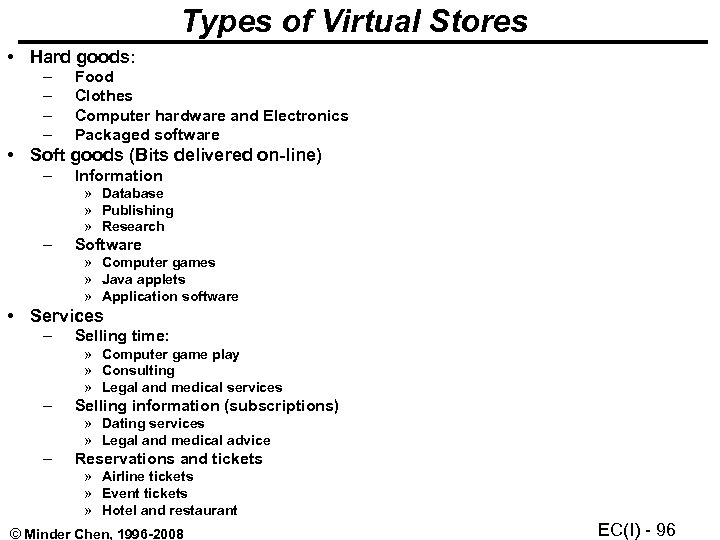

Types of Virtual Stores • Hard goods: – – Food Clothes Computer hardware and Electronics Packaged software • Soft goods (Bits delivered on-line) – Information » Database » Publishing » Research – Software » Computer games » Java applets » Application software • Services – Selling time: » Computer game play » Consulting » Legal and medical services – Selling information (subscriptions) » Dating services » Legal and medical advice – Reservations and tickets » Airline tickets » Event tickets » Hotel and restaurant © Minder Chen, 1996 -2008 EC(I) - 96

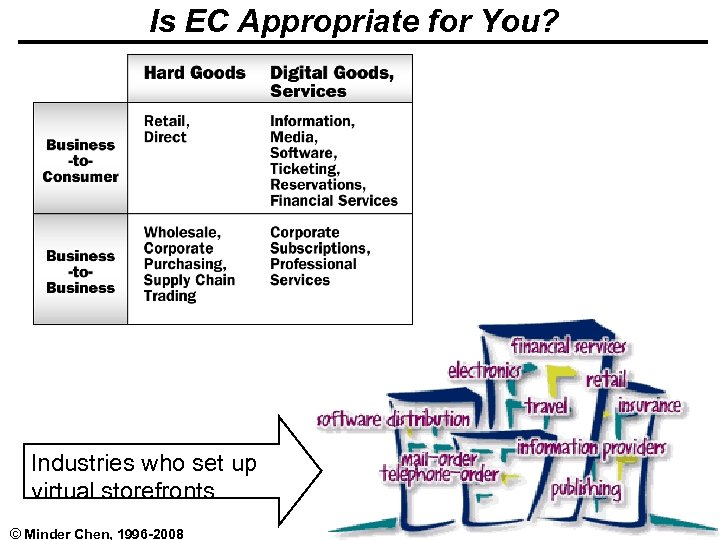

Is EC Appropriate for You? Industries who set up virtual storefronts © Minder Chen, 1996 -2008 EC(I) - 97

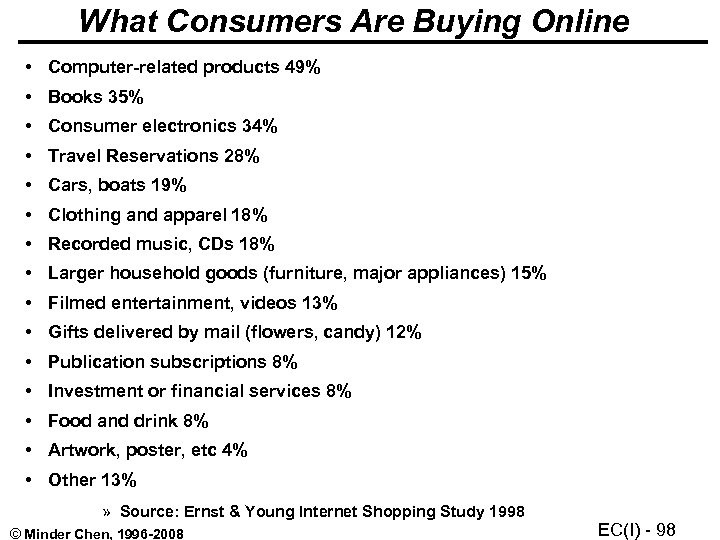

What Consumers Are Buying Online • Computer-related products 49% • Books 35% • Consumer electronics 34% • Travel Reservations 28% • Cars, boats 19% • Clothing and apparel 18% • Recorded music, CDs 18% • Larger household goods (furniture, major appliances) 15% • Filmed entertainment, videos 13% • Gifts delivered by mail (flowers, candy) 12% • Publication subscriptions 8% • Investment or financial services 8% • Food and drink 8% • Artwork, poster, etc 4% • Other 13% » Source: Ernst & Young Internet Shopping Study 1998 © Minder Chen, 1996 -2008 EC(I) - 98

Why? • The most affected industries: – – – Books Stock trading PCs Automobiles Travel • The least affected industries – – – Food Consumer durable goods Clothing Local services Banking and insurance © Minder Chen, 1996 -2008 Enterprise. com, 1998 EC(I) - 99

Three Business Models • Payment direction: – Buy-side – Sell-side – Marketplace: Business is being transacted with both suppliers and customers. • Trading parties: Most analysts predict the B 2 B model will have a more rapid adoption rate, but that the volume of transactions in the B 2 C model will, in the long run, greatly surpass that of B 2 B. – Business to Business – Business to Consumer • Type of product or service that is being provided. – Physical goods and services – Digital goods (contents) – Digital services © Minder Chen, 1996 -2008 EC(I) - 100

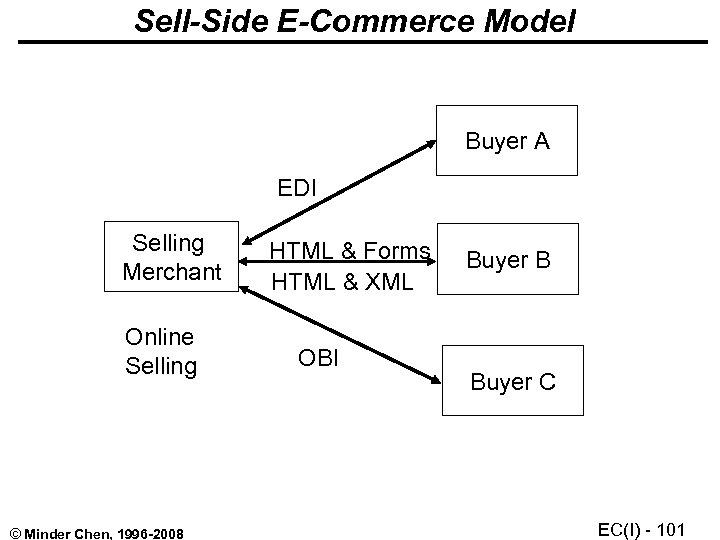

Sell-Side E-Commerce Model Buyer A EDI Selling Merchant Online Selling © Minder Chen, 1996 -2008 HTML & Forms HTML & XML OBI Buyer B Buyer C EC(I) - 101

Sell-Side Storefront • Primary model used in current business-toconsumer scenarios • Single seller, typically a distributor, constructs a Web storefront to sell to many consumers (i. e. Amazon. com) • Unless a single distributor can aggregate all the suppliers in a given industry, the buyer remains responsible for comparison shopping between stores • Expensive for buyer; does not meet the needs of corporate procurement organizations. © Minder Chen, 1996 -2008 EC(I) - 102

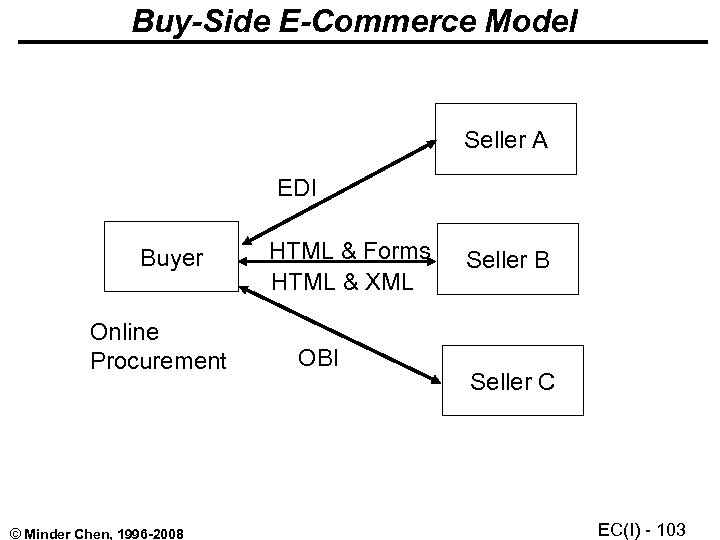

Buy-Side E-Commerce Model Seller A EDI Buyer Online Procurement © Minder Chen, 1996 -2008 HTML & Forms HTML & XML OBI Seller B Seller C EC(I) - 103

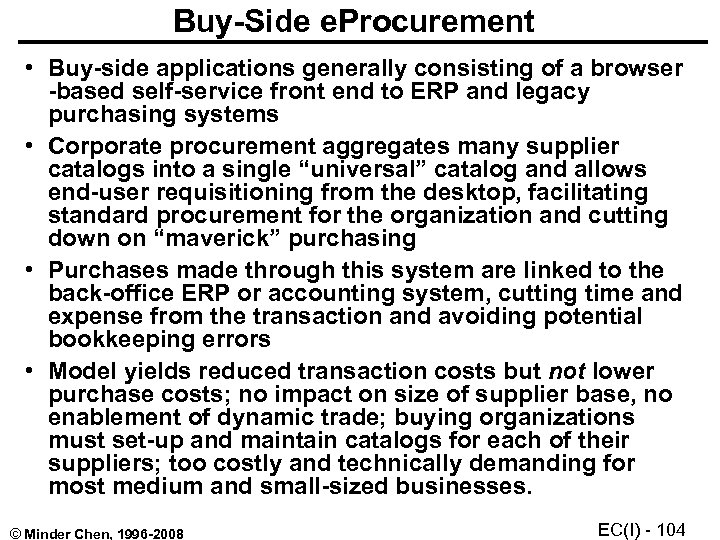

Buy-Side e. Procurement • Buy-side applications generally consisting of a browser -based self-service front end to ERP and legacy purchasing systems • Corporate procurement aggregates many supplier catalogs into a single “universal” catalog and allows end-user requisitioning from the desktop, facilitating standard procurement for the organization and cutting down on “maverick” purchasing • Purchases made through this system are linked to the back-office ERP or accounting system, cutting time and expense from the transaction and avoiding potential bookkeeping errors • Model yields reduced transaction costs but not lower purchase costs; no impact on size of supplier base, no enablement of dynamic trade; buying organizations must set-up and maintain catalogs for each of their suppliers; too costly and technically demanding for most medium and small-sized businesses. © Minder Chen, 1996 -2008 EC(I) - 104

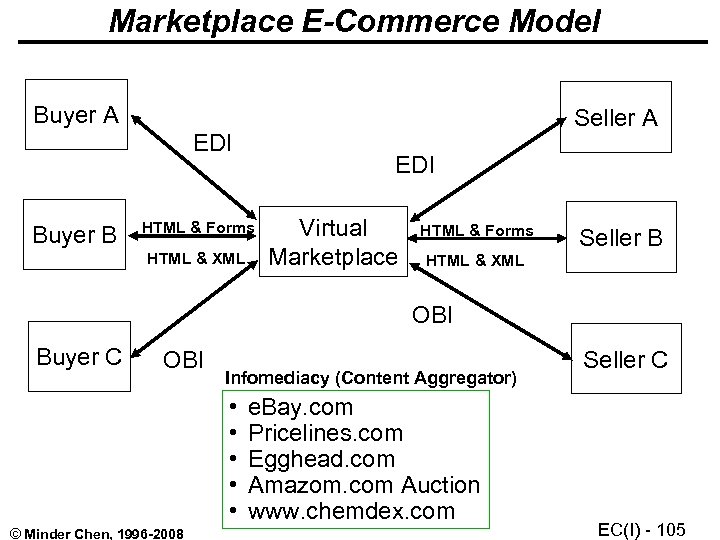

Marketplace E-Commerce Model Buyer A Seller A EDI Buyer B EDI HTML & Forms HTML & XML Virtual Marketplace HTML & Forms Seller B HTML & XML OBI Buyer C OBI Infomediacy (Content Aggregator) • • • © Minder Chen, 1996 -2008 e. Bay. com Pricelines. com Egghead. com Amazom. com Auction www. chemdex. com Seller C EC(I) - 105

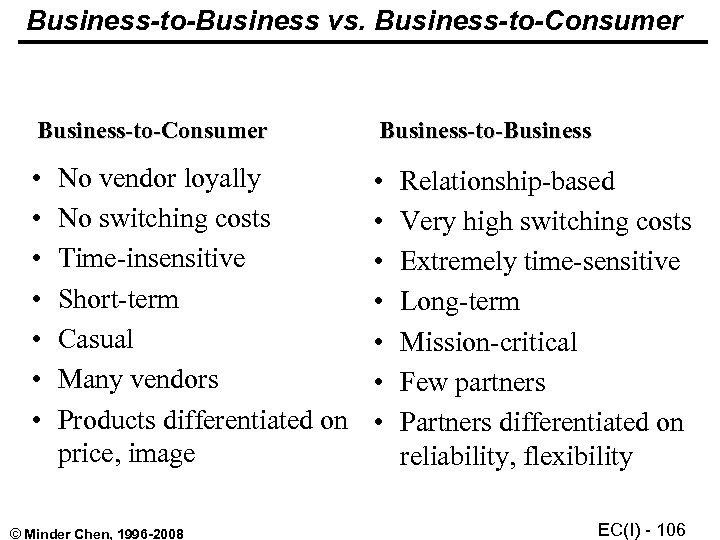

Business-to-Business vs. Business-to-Consumer Business-to-Business • • • • No vendor loyally No switching costs Time-insensitive Short-term Casual Many vendors Products differentiated on price, image © Minder Chen, 1996 -2008 Relationship-based Very high switching costs Extremely time-sensitive Long-term Mission-critical Few partners Partners differentiated on reliability, flexibility EC(I) - 106

B 2 B Marketplace • Latest evolution of B 2 B e. Commerce, enabling a many-to-many relationship between buyers and suppliers • Buyers and suppliers leverage economies of scale in their trading relationships and access a more “liquid” marketplace • Sellers find buyers for their goods, buyers find suppliers with goods to sell • Many-to-many liquidity allows the use of dynamic pricing models such as auctions and exchanges, further improving the economic efficiency of the market. • Web Site: http: //www. netmarketmakers. com/ © Minder Chen, 1996 -2008 EC(I) - 107

Direct-to-Customer (D-to-C) • Large, global, e-energized corporations (e. g. , Fortune 1000) begin to squeeze intermediary companies. • Stop & Shop [a large supermarket chain] is launch its own delivery service and is expected to end its partnership with Peapod [a dotcom delivery service]. -- The Boston Globe, April 2000 • June 20, 2000. Peapod announced online shopping and delivery services in Connecticut through grocery chain Stop & Shop is owned by Royal Ahold, which recently took a 51 percent interest in struggling Peapod. B-to-C © Minder Chen, 1996 -2008 B-to-B D-to-C EC(I) - 108

Channel Conflicts • Channel conflicts arise when a new venue for selling products - such as the Web for selling goods or services - threatens to cannibalize one or more existing conduits for selling goods within the same organization, such as a retailer or a manufacturer. • The company's internal e-commerce team had already recommended direct Web sales as a way to better manage its supply chain and interact more directly with customers… But when the team presented its proposals to the company's CEO, his response was terse: "We've done business with our distributors for 30 years, and I certainly don't want to sell around them. I don't even want to discuss it. " - Computer. World. com Quick Study © Minder Chen, 1996 -2008 EC(I) - 109

Case in Point • For example, about a year ago (1999), General Motors Corp. in Detroit attempted to buy back some car-dealer franchises as a possible step toward selling directly over the Web. Dealers protested so adamantly that both GM and Ford Motor Co. in Dearborn, Mich. , spent a lot of time at a recent industry convention reassuring dealers that the automakers wouldn't sell directly to consumers. And in a recent survey by Cambridge, Mass. -based Forrester Research Inc. of 50 consumer-goods manufacturers, 66% cited channel conflict as the No. 1 obstacle to selling online. © Minder Chen, 1996 -2008 EC(I) - 110

Channel Conflict: How About the Distributors • The concept of complete disintermediation - the elimination of the middleman - remains a theory. New intermediaries are emerging. • Cisco System has 2 billion dollars annual sales on the Web. • 70% of Cisco online business comes from VARs and distributors. • Distributors have to do lot of value-add and customer support to survive. • Fruit of Loom Inc. has 31 of its 55 distributors up on its extranet called Activewear Online. © Minder Chen, 1996 -2008 EC(I) - 111

Retailers and Manufacturers Co-exist on the Web • US retail sales revenues 1998: – Brick-and-mortar stores 93% – Catalog sales: 6% – E-commerce 1% • Cases: – Levi Strauss sells jeans at www. levis. com but won't allow retailers to sell them online. – Estee Lauder sells Clinique cosmetics at www. clinque. com but doesn't offer retail promotion. – Waterford sells a limited selection at www. waterford. com like chandeliers and corporate gifts. • Strategies: – Manufacturers want to maintain channels while stay in direct touch with their customers. – Provide online dealer locators. – Share customers information back and forth. © Minder Chen, 1996 -2008 EC(I) - 112

Extended E-conomy Business Models • E-buisness storefront • Informediary – – – Seller broker Buyer broker Transaction broker / Exchange COINs Portals • Trust intermediary • E-business enabler • Infrastructure providers / Communities of commerce Source: Net Ready, 2000 © Minder Chen, 1996 -2008 EC(I) - 113

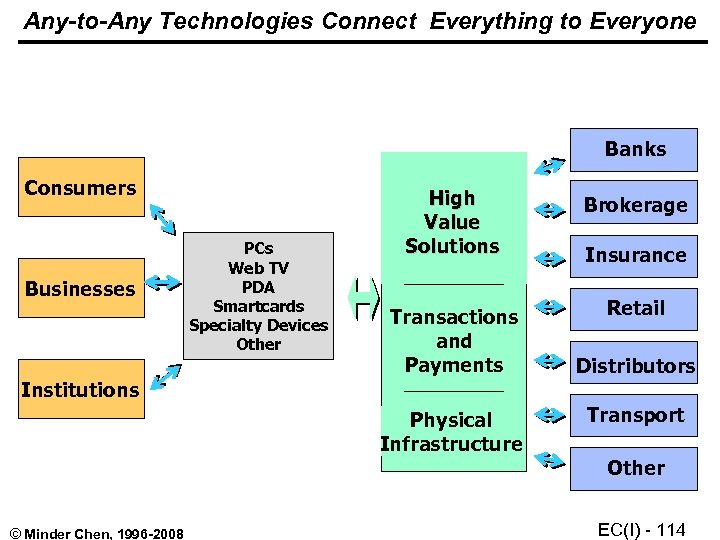

Any-to-Any Technologies Connect Everything to Everyone Banks Consumers Businesses PCs Web TV PDA Smartcards Specialty Devices Other High Value Solutions Brokerage Transactions and Payments Retail Institutions Physical Infrastructure © Minder Chen, 1996 -2008 Insurance Distributors Transport Other EC(I) - 114

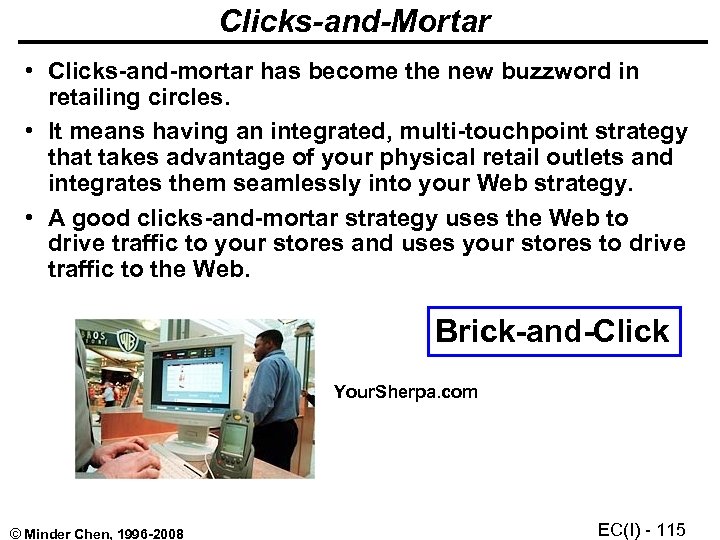

Clicks-and-Mortar • Clicks-and-mortar has become the new buzzword in retailing circles. • It means having an integrated, multi-touchpoint strategy that takes advantage of your physical retail outlets and integrates them seamlessly into your Web strategy. • A good clicks-and-mortar strategy uses the Web to drive traffic to your stores and uses your stores to drive traffic to the Web. Brick-and-Click Your. Sherpa. com © Minder Chen, 1996 -2008 EC(I) - 115

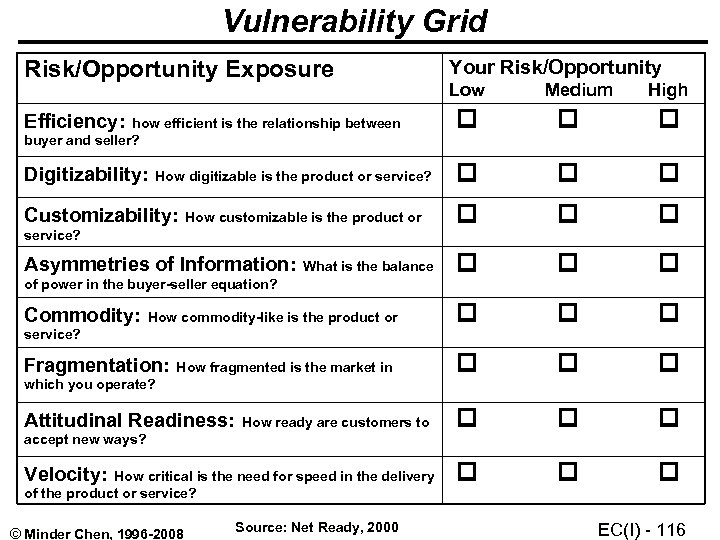

Vulnerability Grid Risk/Opportunity Exposure Your Risk/Opportunity Efficiency: how efficient is the relationship between Digitizability: How digitizable is the product or service? Customizability: How customizable is the product or Asymmetries of Information: What is the balance Commodity: How commodity-like is the product or Fragmentation: How fragmented is the market in Attitudinal Readiness: How ready are customers to Velocity: How critical is the need for speed in the delivery buyer and seller? service? of power in the buyer-seller equation? service? which you operate? accept new ways? of the product or service? © Minder Chen, 1996 -2008 Source: Net Ready, 2000 Low Medium High EC(I) - 116

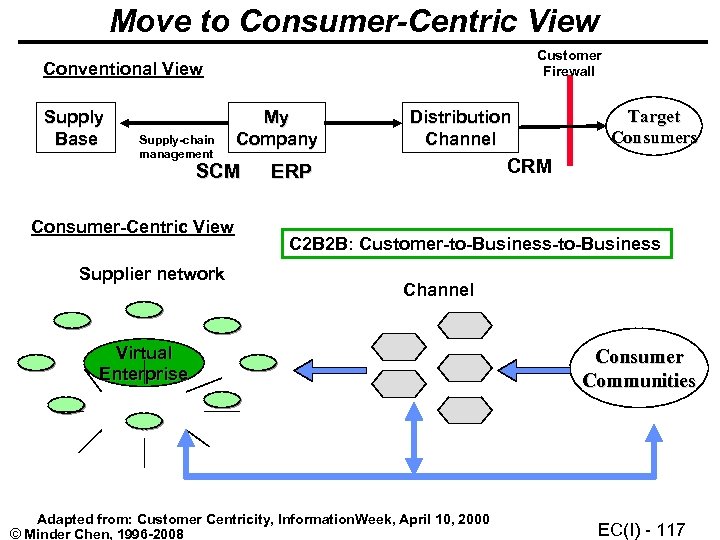

Move to Consumer-Centric View Customer Firewall Conventional View Supply Base Supply-chain management My Company SCM Consumer-Centric View Supplier network Distribution Channel Target Consumers CRM ERP C 2 B 2 B: Customer-to-Business Channel Virtual Enterprise Adapted from: Customer Centricity, Information. Week, April 10, 2000 © Minder Chen, 1996 -2008 Consumer Communities EC(I) - 117

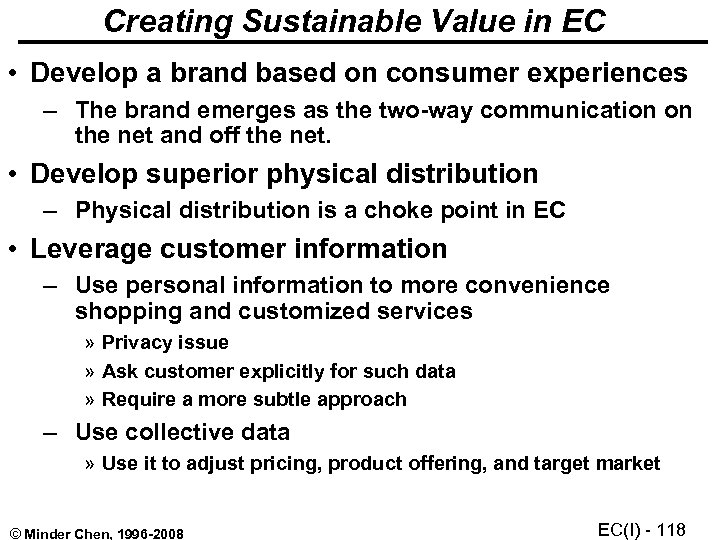

Creating Sustainable Value in EC • Develop a brand based on consumer experiences – The brand emerges as the two-way communication on the net and off the net. • Develop superior physical distribution – Physical distribution is a choke point in EC • Leverage customer information – Use personal information to more convenience shopping and customized services » Privacy issue » Ask customer explicitly for such data » Require a more subtle approach – Use collective data » Use it to adjust pricing, product offering, and target market © Minder Chen, 1996 -2008 EC(I) - 118

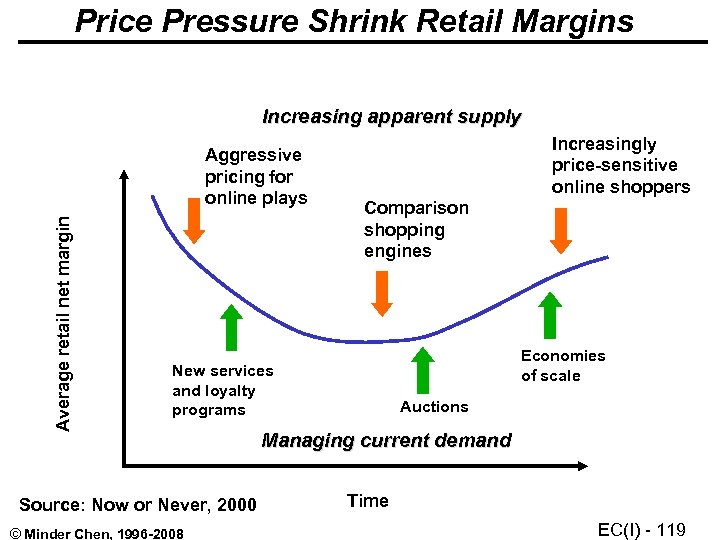

Price Pressure Shrink Retail Margins Increasing apparent supply Average retail net margin Aggressive pricing for online plays Increasingly price-sensitive online shoppers Comparison shopping engines Economies of scale New services and loyalty programs Source: Now or Never, 2000 © Minder Chen, 1996 -2008 Auctions Managing current demand Time EC(I) - 119

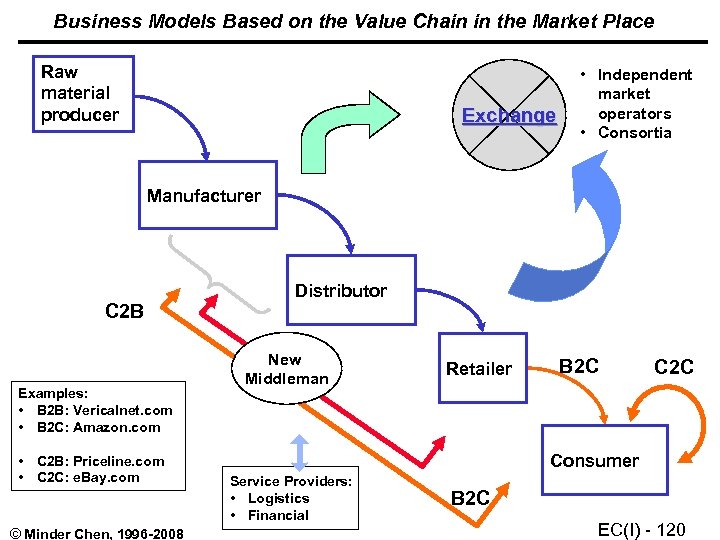

Business Models Based on the Value Chain in the Market Place Raw material producer Exchange • Independent market operators • Consortia Manufacturer C 2 B Examples: • B 2 B: Vericalnet. com • B 2 C: Amazon. com • C 2 B: Priceline. com • C 2 C: e. Bay. com © Minder Chen, 1996 -2008 Distributor New Middleman Retailer B 2 C Consumer Service Providers: • Logistics • Financial B 2 C EC(I) - 120

Business Models from a Strategic Viewpoint • "In the new economy, the unit of analysis for innovation is not a product or a technology-it's a business concept. …. To be an industry revolutionary, you must develop an instinctive capacity to think about business models in their entirety. " • Hamel's business concept that comprises four major components and several subcomponents: – – Core strategies Strategic resources Customer interfaces Value networks Source: Leading the Revolution by Gary Hamel © Minder Chen, 1996 -2008 EC(I) - 121

Business Concepts (I) • Core Strategy: It is the essence of how the firm chooses to compete. – Business Mission: This captures the overall 'objective' of the strategywhat the business model is designed to accomplish or deliver. – Product / Market Scope: This captures the essence of 'where' the firm competes-which customers, which geographies, and what product segments-and where, by implication, it doesn't compete. – Basis for Differentiation: This captures the essence of 'how' the firm competes and, in particular, how it competes 'differently' than its competitors. • Strategic Resources: These are unique firm-specific resources. – Core Competencies: This is what the firm 'knows. ' (skills and unique capabilities) – Strategic Assets: They are what the firm owns such as brands, patents, infrastructure, proprietary standards, customer data, and anything else that is both rare and valuable. – Core Processes: This is what people in the firm actually 'do. ' (activities) © Minder Chen, 1996 -2008 EC(I) - 122

Business Concepts (II) • Customer Interface – Fulfillment and Support: This refers to the way the firm 'goes to market, ' how it actually 'reaches' customers-which channels it uses, what kind of customer support it offers, and what level of service it provides. – Information and Insight: This refers to all the knowledge that is collected from and utilized on behalf of customers. – Relationship Dynamics: This refers to the nature of the 'interaction' between the producer and the customer. – Pricing Structure: This refers to the price choices depending on the traditions of your industry. • Value Network: It surrounds the firm, and which complements and amplifies the firm's own resources. – Suppliers – Partners – Coalitions © Minder Chen, 1996 -2008 EC(I) - 123

Bridge Components • These four major components are linked together by three 'bridge' components: – Configuration: Intermediating between a company's core strategy and its strategic resources is first bridge component. – Customer Benefits: Intermediating between the core strategy and the customer interface is second bridge component. – Company Boundaries: Intermediating between a company's strategic resources and its value network is third bridge component. © Minder Chen, 1996 -2008 EC(I) - 124

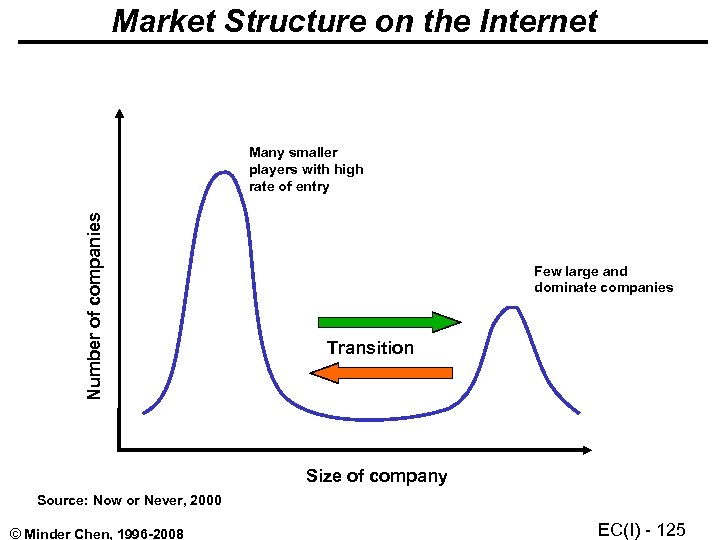

Market Structure on the Internet Number of companies Many smaller players with high rate of entry Few large and dominate companies Transition Size of company Source: Now or Never, 2000 © Minder Chen, 1996 -2008 EC(I) - 125

Three Top Three Concerns • Retailers – Conflict with investment in physical stores; – Technology issues; and – Lack of distribution and fulfillment network. • Manufacturers – – Products not appropriate for online sales; Potential risk to channel relationships; and Consumers won’t buy online Many manufacturers simply weren't capable of shipping a single box of Tide or a bottle of Advil. They had no experience in dealing directly with consumers. © Minder Chen, 1996 -2008 EC(I) - 126

Dynamic Trade: Perfect Market • Customer service is more important than product selling – Federal Express: Certainty • Real-time demand drives production – Dell: Build-To-Order • Pricing matches market conditions – Name your price (reversed auction): Price. Line. com – Auction: Ebay Leveraging technology to satisfy current customer demand with customized response. © Minder Chen, 1996 -2008 EC(I) - 127

Traditional vs. Dynamic Trade • Speed from engagement to transaction – Weeks vs. Minutes • Product distribution – Seller-selected vs. Buyer-selected • Pricing – Product price list vs. Market-determined price • Production – Pre-sale vs. Post-sale • Customer relationships – Standard vs. Targeted and Customized • Strategic asset – Location vs. Visibility and Customer Database © Minder Chen, 1996 -2008 EC(I) - 128

Dynamic Trade Self-Test Rate each of the following criteria in your market. (3=high, 2=medium, 1=low) Commodity market Perishability of inventory Capital intensity Configurability of products Customers' perceived investment level Threat from new kinds of competition Channel volatility TOTAL: _______ © Minder Chen, 1996 -2008 EC(I) - 129

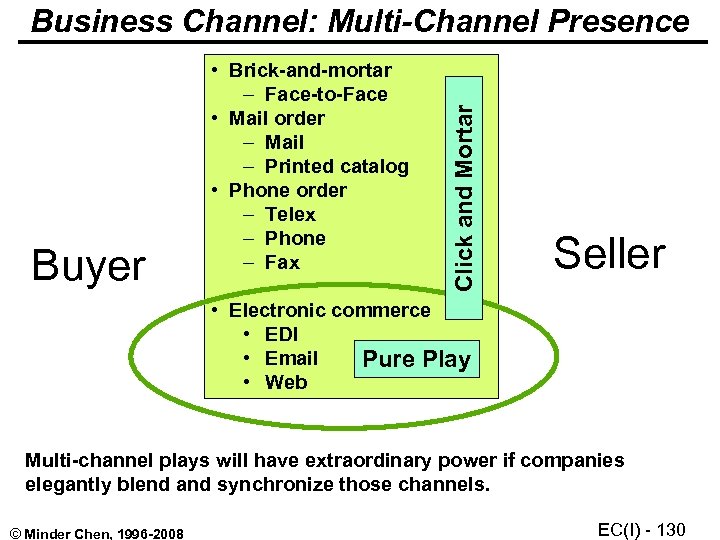

Buyer • Brick-and-mortar – Face-to-Face • Mail order – Mail – Printed catalog • Phone order – Telex – Phone – Fax Click and Mortar Business Channel: Multi-Channel Presence Seller • Electronic commerce • EDI • Email Pure Play • Web Multi-channel plays will have extraordinary power if companies elegantly blend and synchronize those channels. © Minder Chen, 1996 -2008 EC(I) - 130

Internet Companies? "Within five years, ALL companies will be Internet companies. " -- Andy Grove, Intel Chairman © Minder Chen, 1996 -2008 EC(I) - 131

Web Experiences for Consumers • A many-to-many rather a one-to-many experience • Fresh content • Access to detail information • Communities unbounded by space and time • The multimedia appeal of TV • A redefinition of privacy and identity • Hyper-impulsivity: The web permits a closer conjunction of desire, transaction, and payment than any other environment. © Minder Chen, 1996 -2008 EC(I) - 132

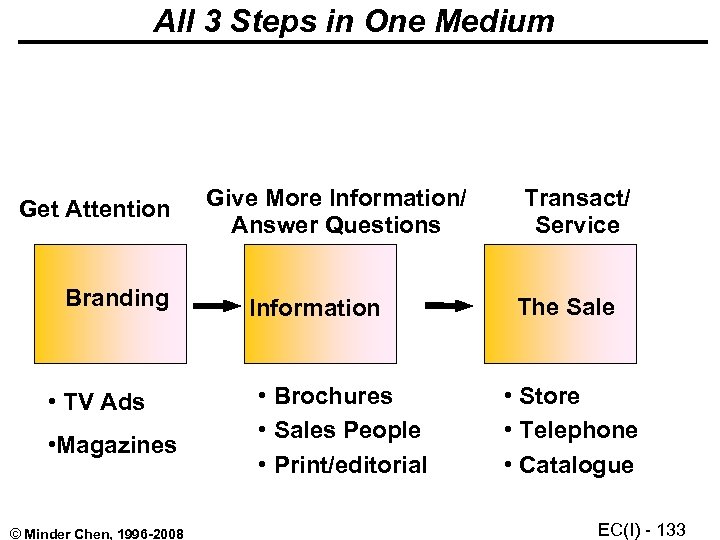

All 3 Steps in One Medium Get Attention Branding • TV Ads • Magazines © Minder Chen, 1996 -2008 Give More Information/ Answer Questions Information • Brochures • Sales People • Print/editorial Transact/ Service The Sale • Store • Telephone • Catalogue EC(I) - 133

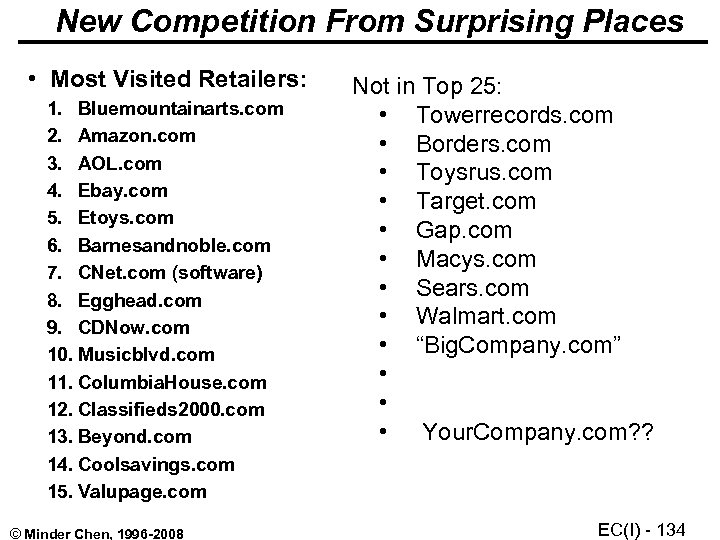

New Competition From Surprising Places • Most Visited Retailers: 1. Bluemountainarts. com 2. Amazon. com 3. AOL. com 4. Ebay. com 5. Etoys. com 6. Barnesandnoble. com 7. CNet. com (software) 8. Egghead. com 9. CDNow. com 10. Musicblvd. com 11. Columbia. House. com 12. Classifieds 2000. com 13. Beyond. com 14. Coolsavings. com 15. Valupage. com © Minder Chen, 1996 -2008 Not in Top 25: • Towerrecords. com • Borders. com • Toysrus. com • Target. com • Gap. com • Macys. com • Sears. com • Walmart. com • “Big. Company. com” • • • Your. Company. com? ? EC(I) - 134

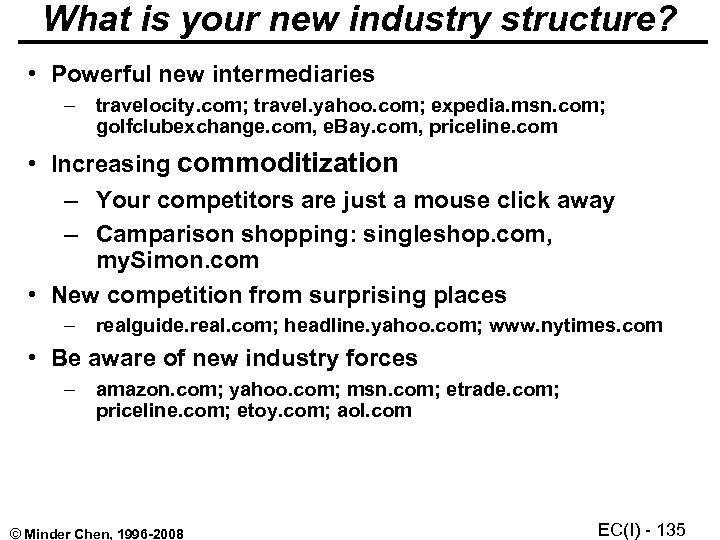

What is your new industry structure? • Powerful new intermediaries – travelocity. com; travel. yahoo. com; expedia. msn. com; golfclubexchange. com, e. Bay. com, priceline. com • Increasing commoditization – Your competitors are just a mouse click away – Camparison shopping: singleshop. com, my. Simon. com • New competition from surprising places – realguide. real. com; headline. yahoo. com; www. nytimes. com • Be aware of new industry forces – amazon. com; yahoo. com; msn. com; etrade. com; priceline. com; etoy. com; aol. com © Minder Chen, 1996 -2008 EC(I) - 135

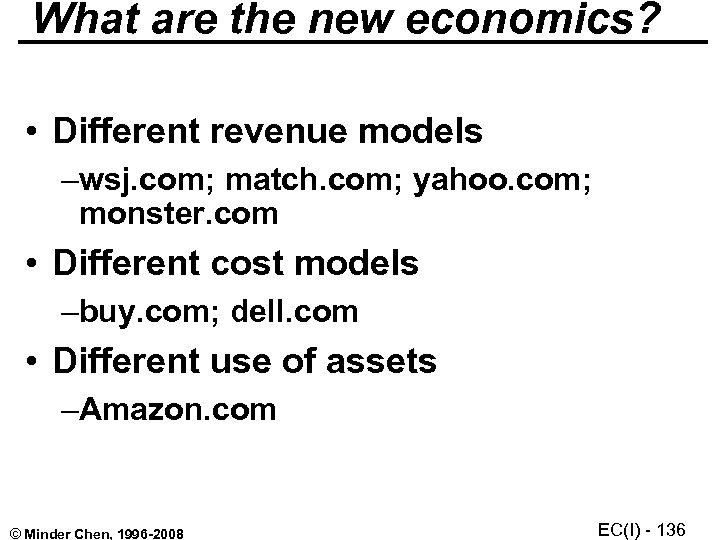

What are the new economics? • Different revenue models –wsj. com; match. com; yahoo. com; monster. com • Different cost models –buy. com; dell. com • Different use of assets –Amazon. com © Minder Chen, 1996 -2008 EC(I) - 136

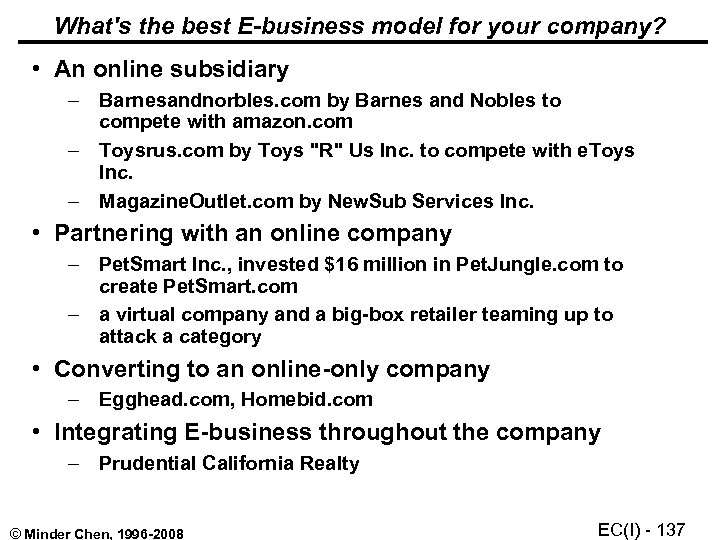

What's the best E-business model for your company? • An online subsidiary – Barnesandnorbles. com by Barnes and Nobles to compete with amazon. com – Toysrus. com by Toys "R" Us Inc. to compete with e. Toys Inc. – Magazine. Outlet. com by New. Sub Services Inc. • Partnering with an online company – Pet. Smart Inc. , invested $16 million in Pet. Jungle. com to create Pet. Smart. com – a virtual company and a big-box retailer teaming up to attack a category • Converting to an online-only company – Egghead. com, Homebid. com • Integrating E-business throughout the company – Prudential California Realty © Minder Chen, 1996 -2008 EC(I) - 137

EC: Case Studies • • • B 2 B: verticalnet. com Auction: e. Bay Subscription web sites: monster. com e-tailing: 1800 flowers. com Financial investment sites: E*Trade Other interesting web sites © Minder Chen, 1996 -2008 EC(I) - 138

www. verticalnet. com © Minder Chen, 1996 -2008 EC(I) - 139

Company Background and Capabilities • Own and operate 55 industry-specific Web sites designed as online B 2 B communities, known as vertical trade communities. • These vertical trade communities provide users with comprehensive sources of – – – Information (Content): from newswire and editorial services Interaction (Communities): email, chat rooms, bulletin board e-commerce: RFPs, RFQs • Additionally, Vertical. Net provides auctions, catalogs, bookstores, career services and other e-commerce capabilities horizontally across its communities with technologies from acquired and organic sites like Industry Deals. com, IT Career. Hub. com, Lab. X. com, and Professional Store. com. • Create values: – – – Individual advertising ($6, 000 - $25, 000) Hosting sites Build and design sites Sponsor forums with expert guests Negotiate a percentage of transaction at the online marketplace © Minder Chen, 1996 -2008 EC(I) - 140

© Minder Chen, 1996 -2008 EC(I) - 141

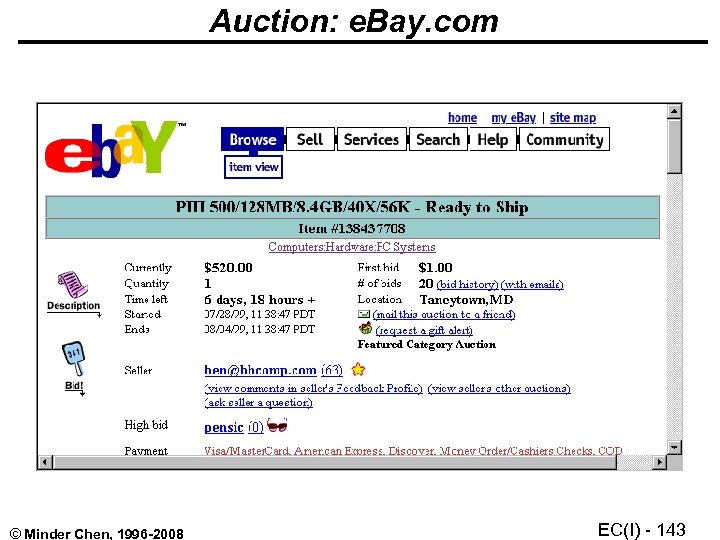

Auction: e. Bay. com © Minder Chen, 1996 -2008 EC(I) - 142

Auction: e. Bay. com © Minder Chen, 1996 -2008 EC(I) - 143

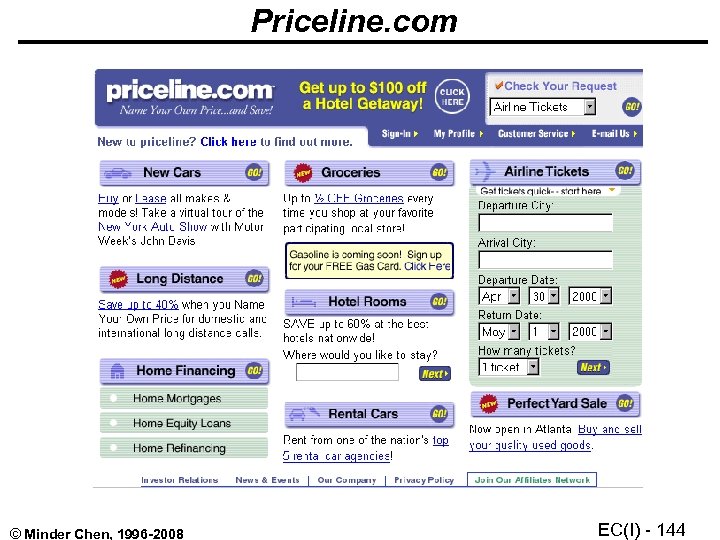

Priceline. com © Minder Chen, 1996 -2008 EC(I) - 144

• Jay Walker, 43, founder and Vice Chairman of priceline. com, has created a model for buying and selling that's so original, it's been patented. Walker calls his model "buyer-driven commerce, " and he's racing to build a big company around it. " – Fast Company • "It's not a traditional supply-and-demand market anymore. Priceline flips the power relationship on its head where the customer is telling you what he will pay. " – Interactive Week © Minder Chen, 1996 -2008 EC(I) - 145

Business Models • Priceline. com has pioneered a unique new type of e-commerce known as a "demand collection system" that enables consumers to use the Internet to save money on a wide range of products and services while enabling sellers to generate incremental revenue. • Using a simple and compelling consumer proposition--"name your price, " we collect consumer demand (in the form of individual customer offers guaranteed by a credit card) for a particular product or service at a price set by the customer and communicate that demand directly to participating sellers or to their private databases. • Consumers agree to hold their offers open for a specified period of time to enable priceline. com to fulfill their offers from inventory provided by participating sellers. Once fulfilled, offers generally cannot be canceled. • By requiring consumers to be flexible with respect to brands, sellers and/or product features, we enable sellers to generate incremental revenue without disrupting their existing distribution channels or retail pricing structures. © Minder Chen, 1996 -2008 EC(I) - 146

Problems? ! • As if making a profit from online retailing were not enough of a challenge, try making money online under a system where you give your customers essentially no service, no selection and no right to return unwanted items. • May sound crazy, but not too long ago, investors seemed to think it was a brilliant idea. • Critics say the company's troubles raising money reflect some fundamental problems with its reverse auction model, which invites consumers to set their own prices. But it also requires them to commit to the purchase before they know all the details. • "Consumers typically look for four things: choice, service, selection and low price, '' said Tom Courtney, an analyst with Banc of America Securities. "Priceline gives up everything but the price. '' • In hindsight, many critics say Priceline is more gimmick than solid business. Now that the novelty of the name-your-own-price model has started to wear thin, they are losing faith in its viability. • ``What I've seen is an intriguing model. You try it once and you feel a little uncomfortable with it. You may not get the route or the fare you wanted and at the end of the day you are not so sure about it, '' said Craig Palmer, president of e. Wanted, another Internet auction site. ``People come to Priceline, but they don't come back again and again. '' © Minder Chen, 1996 -2008 EC(I) - 147

E-Loan at eloan. com • IPO: 2 Billion Dollars Market Capitalization © Minder Chen, 1996 -2008 EC(I) - 148

Insweb. com © Minder Chen, 1996 -2008 EC(I) - 149

Singleshop. com Compare this with: my. Simon. com © Minder Chen, 1996 -2008 EC(I) - 150

Matching Games: The Marketplace Online Dating Service • $9, 000 subscription fee per year for recruiting firms • Free for job seekers © Minder Chen, 1996 -2008 EC(I) - 151

Internet Shopping Network: http: //www. internet. net • Operating online since April 1994. • Focus on computer products which fit the demographics pretty well. • Customer look for a narrow focus in an online store and expect expertise in that area. © Minder Chen, 1996 -2008 EC(I) - 152

Acquired by Cyberian Outpost • Kent, CT, & Sunnyvale, CA Nov. 2, 1998 - Cyberian Outpost, Inc. (NASDAQ: COOL), a leading Internet-only retailer of computer hardware, software, and peripherals for consumers worldwide, today announced it has acquired the Internet Shopping Network (ISN) Computer Superstore's customer base. Cyberian Outpost (http: //www. outpost. com/) will be the new online shopping destination for the Computer Superstore's more than 160, 000 customers. Prior to the acquisition, Cyberian Outpost had over 161, 000 customers. • In addition to selling the Computer Superstore's customer list, ISN has agreed to maintain, a direct link from the ISN Computer Superstore's homepage that will lead shoppers to the Cyberian Outpost homepage (http: //www. outpost. com/) for the next four months. Further, all existing URL's relating to the ISN Computer Superstore will re-direct users to Cyberian Outpost's homepage, extending Cyberian Outpost's market reach, these re-directed links will remain in place for one-year to cover residual bookmarks or links pointing to the ISN Computer Superstore. © Minder Chen, 1996 -2008 EC(I) - 153

Outpost. com © Minder Chen, 1996 -2008 EC(I) - 154

e. Toys. com © Minder Chen, 1996 -2008 EC(I) - 155

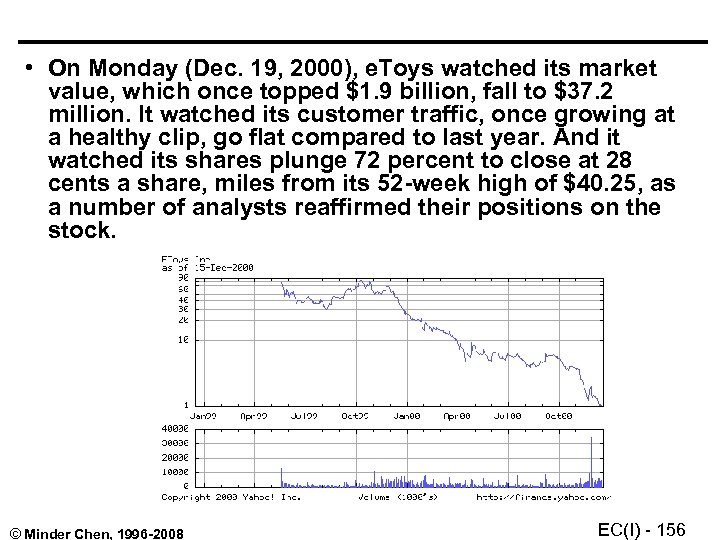

• On Monday (Dec. 19, 2000), e. Toys watched its market value, which once topped $1. 9 billion, fall to $37. 2 million. It watched its customer traffic, once growing at a healthy clip, go flat compared to last year. And it watched its shares plunge 72 percent to close at 28 cents a share, miles from its 52 -week high of $40. 25, as a number of analysts reaffirmed their positions on the stock. © Minder Chen, 1996 -2008 EC(I) - 156

CDNow © Minder Chen, 1996 -2008 EC(I) - 157

CDNow Merged with Music Boulevard © Minder Chen, 1996 -2008 EC(I) - 158

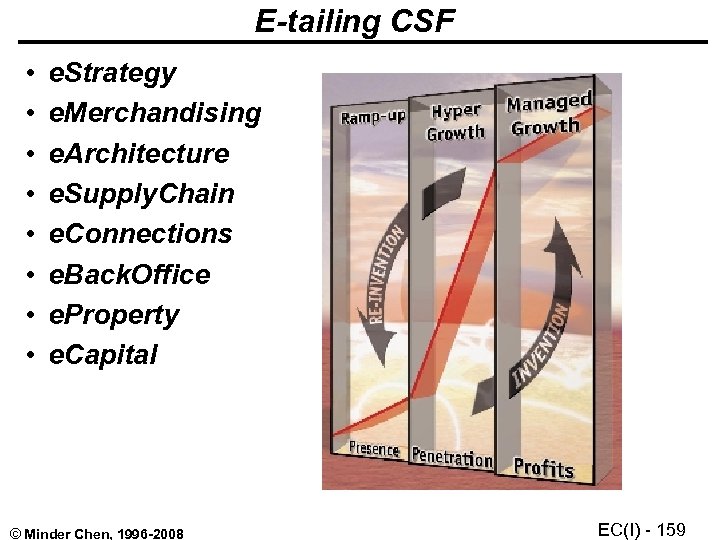

E-tailing CSF • • e. Strategy e. Merchandising e. Architecture e. Supply. Chain e. Connections e. Back. Office e. Property e. Capital © Minder Chen, 1996 -2008 EC(I) - 159

Time Warner's Path. Finder: http: : //pathfinder. com • Online Magazines: It was shut down in May 1999 © Minder Chen, 1996 -2008 EC(I) - 160

C|NET at cnet. com © Minder Chen, 1996 -2008 EC(I) - 161

espn. go. com • ESPN Sportszone © Minder Chen, 1996 -2008 EC(I) - 162

www. slate. com • Check out – http: //interactive. wsj. com/ – http: //www. salon. com © Minder Chen, 1996 -2008 EC(I) - 163

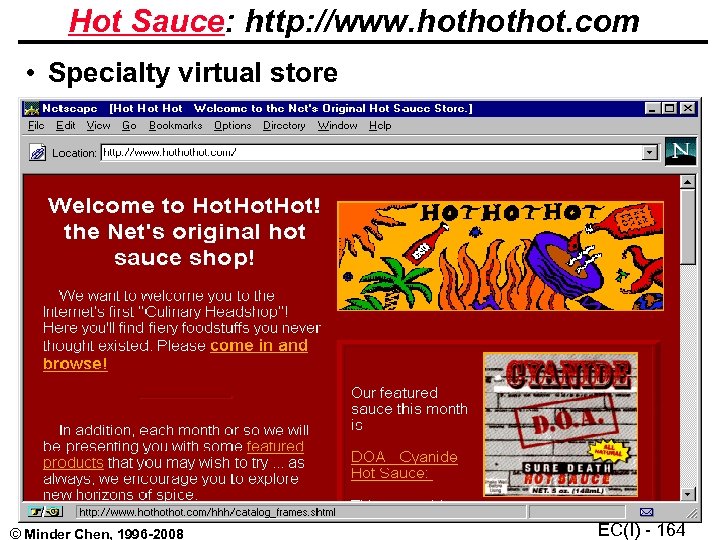

Hot Sauce: http: //www. hothothot. com • Specialty virtual store © Minder Chen, 1996 -2008 EC(I) - 164

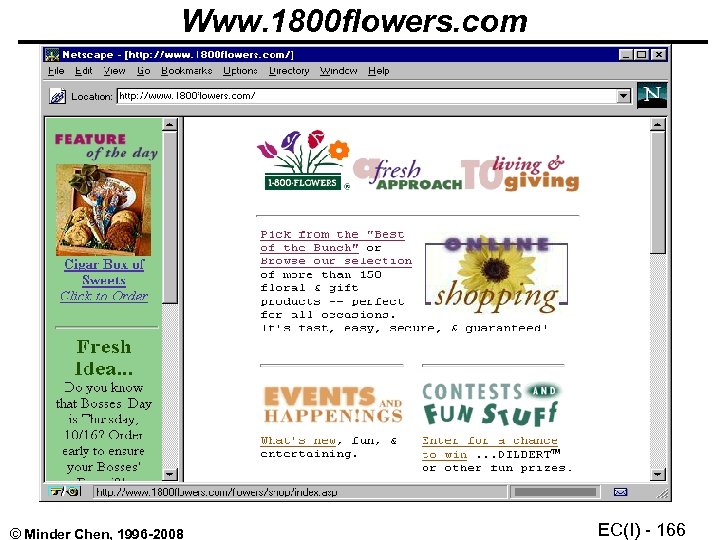

1 -800 -FLOWERS: Http: //www. 1800 flowers. com/ • A real world florist with more than 20 years of experience. • Went on live in April 1995. • Also maintain sites in American Online and Compu. Serve. • Online retailing $25 million (10% of company sales) in 1996. • Take advantage of proven retail marketing strategies: discounts, contests, and sweepstakes, grand opening promotions, etc. © Minder Chen, 1996 -2008 EC(I) - 165

Www. 1800 flowers. com © Minder Chen, 1996 -2008 EC(I) - 166

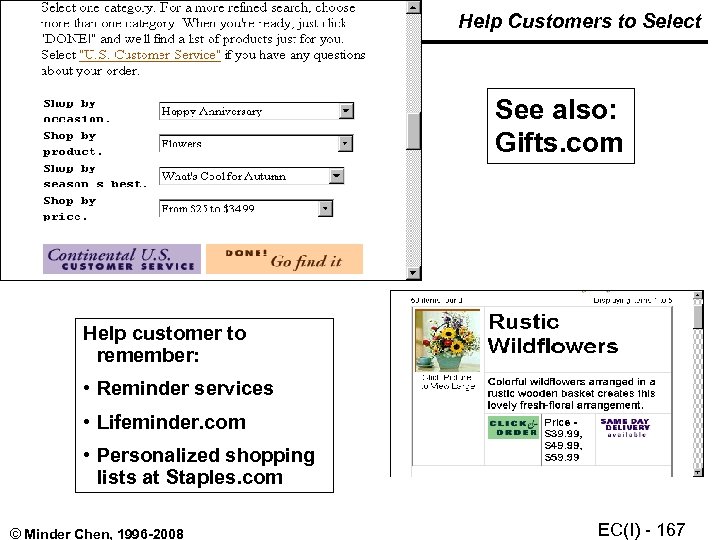

Help Customers to Select See also: Gifts. com Help customer to remember: • Reminder services • Lifeminder. com • Personalized shopping lists at Staples. com © Minder Chen, 1996 -2008 EC(I) - 167

Grocery Shopping: http: //www. peapod. com/ Homegrocer. com Net. Grocer. com Streamline Web. Van Priceline. com © Minder Chen, 1996 -2008 EC(I) - 168

Virtual Vineyard: virtualvin. com & wine. com © Minder Chen, 1996 -2008 EC(I) - 169

Landsend. com • • • Set up shop at AOL in 1992 Launch a web site in 1995 1% of sales in 1997 4. 5% of sales in 1998 Printing and mailing it 250 million catalogs each year counts for 43% of its operating cost. • 10% of all Internet apparel sales in 1998 © Minder Chen, 1996 -2008 EC(I) - 170

Interactive Application on the Net • Go to www. lendsend. com • Choose Oxford Express Link Check out http: //www. idreamsoftware. com/products/jio/appareldemo. htm EC(I) - 171 © Minder Chen, 1996 -2008

My Virtual Model • Online catalog Landsend. com plans to outshine the competition this holiday season with a more accurate virtual model derived from a body scan, the company announced Tuesday. In the months leading up to Christmas, a Lands' End mobile unit equipped with an automated Image Twin scanning booth will offer consumers in 14 U. S. and Canadian cities a chance to obtain precise body measurements, generating a virtual twin who will try clothing online. • Inside the mobile scanning unit, white light flashing on and off for more than 12 seconds digitally captures 200, 000 data points of a consumer's figure, creating a 3 -D mirror image. A consumer can start using the model online within two hours, after the information is transmitted wirelessly to an IBM server farm located in North Carolina, said C. Cammack Morton, chairman and founder of the North Carolina-based Image Twin. • The dressing-room tool, My Virtual Model, is an updated version of a virtual model generated solely from a questionnaire about height, dress size, body shape, and the like. The updated tool takes additional measurements for a more realistic result and as of next week, will offer a male virtual model. © Minder Chen, 1996 -2008 EC(I) - 172

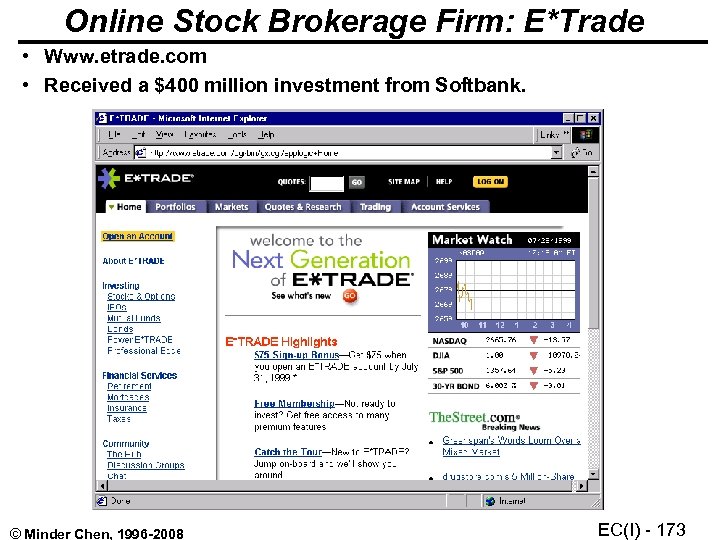

Online Stock Brokerage Firm: E*Trade • Www. etrade. com • Received a $400 million investment from Softbank. © Minder Chen, 1996 -2008 EC(I) - 173

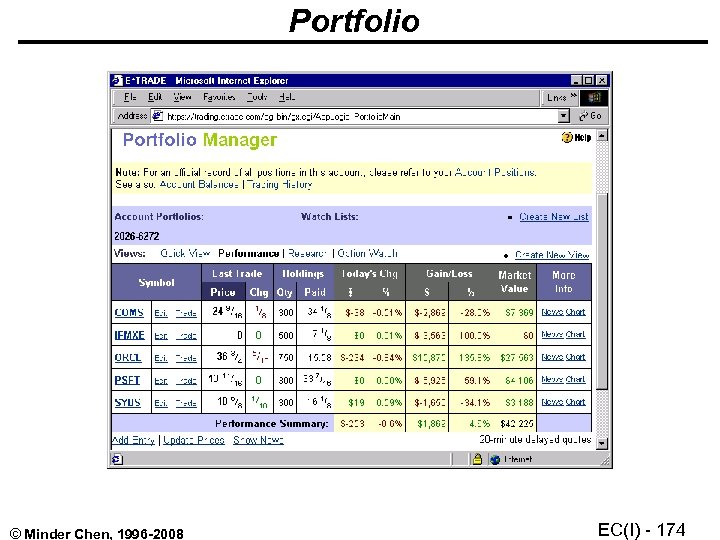

Portfolio © Minder Chen, 1996 -2008 EC(I) - 174

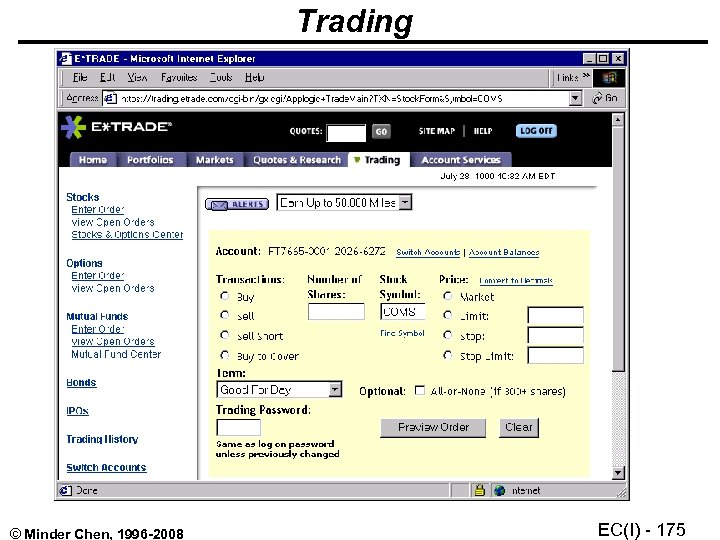

Trading © Minder Chen, 1996 -2008 EC(I) - 175

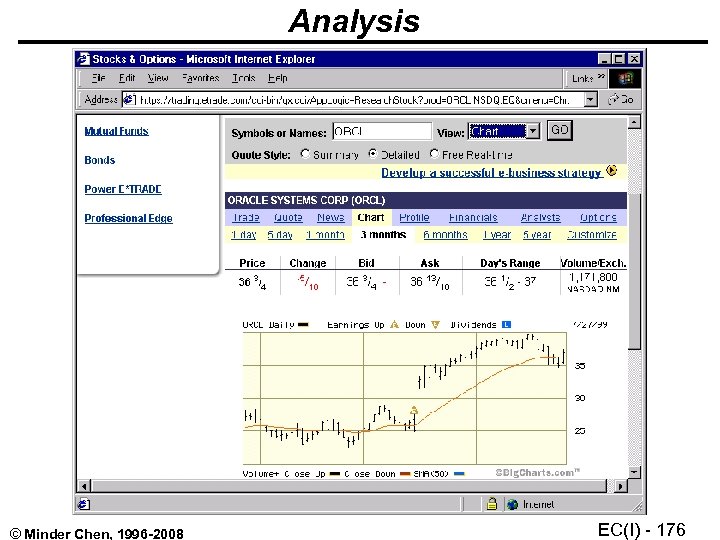

Analysis © Minder Chen, 1996 -2008 EC(I) - 176

E*Trade Investment Tools • E*TRADE has created a web-based trading system that is streamlined, efficient, and economical. As an account holder, you get free real-time market information, news and analysis and pay among the lowest commission rates and lowest margin rates in the industry. • One-Click Access to the Tools You Need: E*TRADE customers, get comprehensive online trading capabilities and a full set of investment and research tools such as free news, charts, in-depth company fundamentals, and online portfolio management. • Personal Market Page • E*TRADE offers a low and simple commission schedule. You pay only $14. 95 for listed market orders and $19. 95 for Nasdaq orders. For listed orders over 5, 000 shares, add 1 cent per share to the entire order. For options, you pay just $20 plus $1. 75 per contract, with a $29 minimum. © Minder Chen, 1996 -2008 EC(I) - 177

E*Trade Commission: A Comparison Online competitor © Minder Chen, 1996 -2008 EC(I) - 178

Updates • E*TRADE added 233, 000 new active accounts during first quarter 1999, an increase of 77% over the previous quarter. • In its second fiscal quarter, customer trades rose 63 percent in three months to approximately 70, 000 per day. • They ended the quarter with 909, 000 accounts and customer assets of $21. 1 billion – (Source: San Jose Mercury News, 4/21/99). • A day trader killed 9 people at Atlanta. – July 28, 1999. © Minder Chen, 1996 -2008 EC(I) - 179

E*TRADE Acquires Telebanc for $1. 8 Billion • • • Calling it the first pure-play Internet company to integrate banking and brokerage services, E*TRADE Group Inc. announced Tuesday it is acquiring Internet bank Telebanc Financial Corp. for approximately $1. 8 billion. Terms of the agreement call for Telebanc shareholders to receive 2. 1 shares of E*TRADE common stock for each share of Telebanc common stock. The merger is valued at roughly $1. 8 billion based on E*TRADE's closing price on Friday, May 28. Once the merger is finalized, Telebanc shareholders will own approximately 13 percent of E*TRADE's fully diluted common stock. The transaction will be accounted for as a pooling of interests and is slated to close sometime this fall upon regulatory and shareholder approval. The merger creates an Internet-based, FDIC-insured cash management account which the companies predict will change the future of personal financial services. Aimed at millions of Internet consumers, the online financial management resources of E*TRADE combined with online banking capabilities is expected to eliminate the need for multiple financial relationships. The merger also will offer online consumers for the first time, access to full-featured, FDIC-insured Internet cash management accounts, including ATM access through the national Cirrus network, online bill payment and investing services, enabling them to consolidate brokerage and banking accounts. By offering a central account, customers will be able to conduct a full range of transactions online, including buying mutual funds, CDs and fixed income securities, trading equities and paying bills. E*TRADE said through the integration of the companies services, a cost-effective, scalable business model will be achieved, while boosting E*TRADE's customer acquisitions and aggressively expanding its existing one millionplus customer account base. June 01, 1999 © Minder Chen, 1996 -2008 EC(I) - 180

© Minder Chen, 1996 -2008 EC(I) - 181

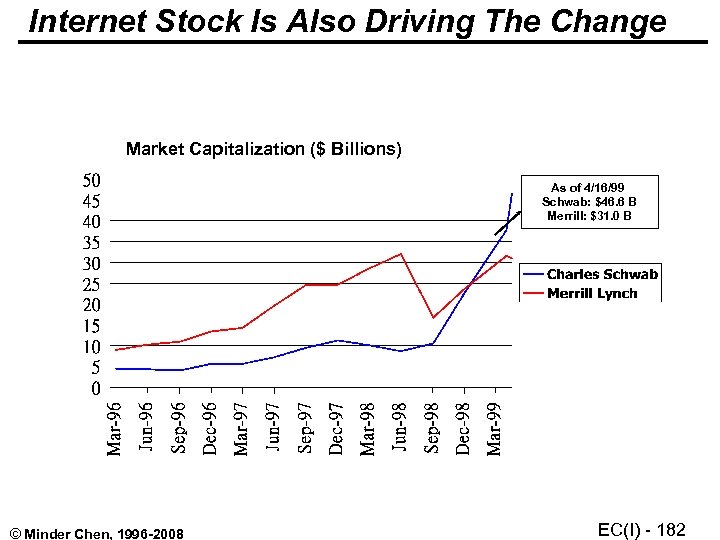

Internet Stock Is Also Driving The Change Market Capitalization ($ Billions) As of 4/16/99 Schwab: $46. 6 B Merrill: $31. 0 B © Minder Chen, 1996 -2008 EC(I) - 182

Merrill Lynch & CO. • Some 30 percent of chief executives and senior managers say the Internet is forcing them to revamp their strategies, according to a recent study by Booz, Allen & Hamilton and the Economist Intelligence Unit. • Take Merrill Lynch & Co. , the biggest U. S. broker, which after long resisting trading over the Internet, said on Tuesday it planned to roll out full-scale online trading. • "The undeniable fact that there is a segment of the marketplace that wants to access the market through technology and through online investing was indisputable, " Merrill Chairman David Komansky said. © Minder Chen, 1996 -2008 EC(I) - 183

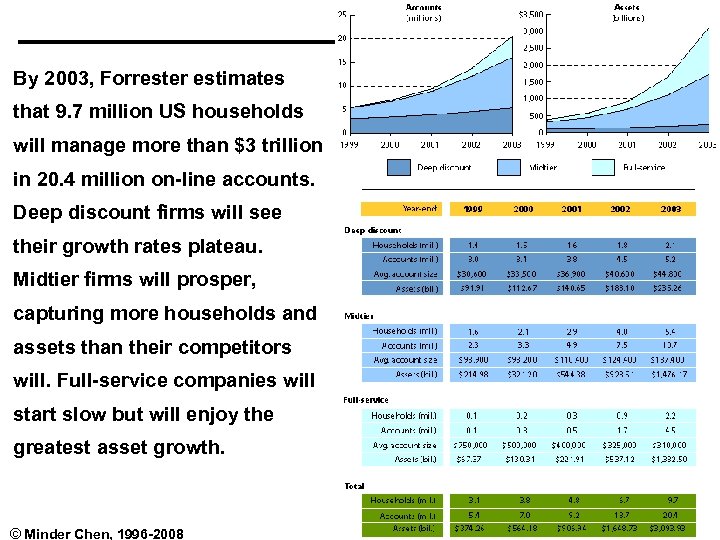

By 2003, Forrester estimates that 9. 7 million US households will manage more than $3 trillion in 20. 4 million on-line accounts. Deep discount firms will see their growth rates plateau. Midtier firms will prosper, capturing more households and assets than their competitors will. Full-service companies will start slow but will enjoy the greatest asset growth. © Minder Chen, 1996 -2008 EC(I) - 184

Motley Fool: www. fool. com • Competitor: Quote. yahoo. com, Street. com, Cbs. Marketwatch. com, Stock 247. com © Minder Chen, 1996 -2008 EC(I) - 185

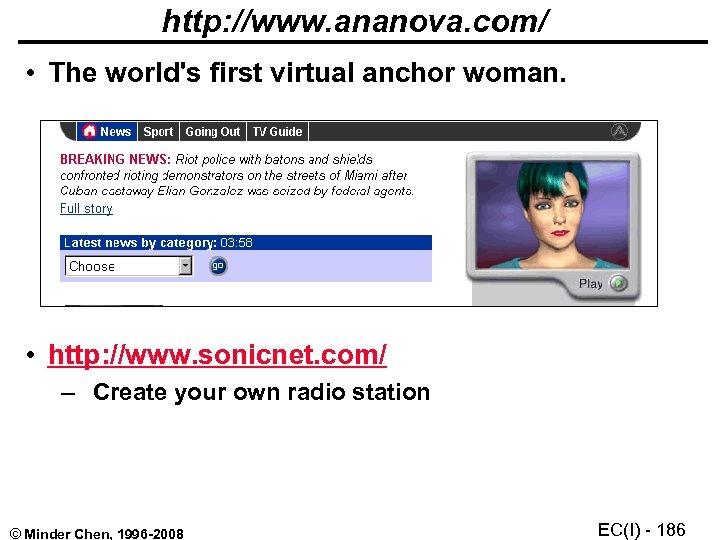

http: //www. ananova. com/ • The world's first virtual anchor woman. • http: //www. sonicnet. com/ – Create your own radio station © Minder Chen, 1996 -2008 EC(I) - 186

a150eb328b2dbaf9e54db9cb32c0beca.ppt