8a11369e62004b556802cd4ef4e5f0be.ppt

- Количество слайдов: 28

Electronic Banking ACH or ICL? In-House vs. Out-Source Payment Processing Utility Payment Conference

Electronic Banking ACH or ICL? • Arizona Public Service (APS) is Arizona’s largest and oldest utility, serving since 1886 • More than 1. 1 million customers in 11 of the state’s 15 counties, about 35, 000 sq miles • – – – Current Payment Processing Distribution: 55% Electronically 35% US Mail 10% Business Offices

Electronic Banking ACH or ICL? In-House or Out-Source? Our Considerations: – Current system was 13 years old – Mailed-in payments dropped from 72% to 38% of total payment volume between 1990 to 2008, but still significant – Replace armored car pickup with electronic banking – Leverage technology to process more than payments; anticipating continued payment volume decrease – Centralize data input to better utilized skilled customer service representatives to address customer needs

Electronic Banking ACH or ICL? Options Banks - JP Morgan Chase - Wachovia - Bank of America - Wells Fargo Non-Banks - CDS Global - Regulus Group - First Data Corp In-House Banc. Tec (Unisys) Wausau Financial Systems J & B Software

Electronic Banking ACH or ICL? Quantitative Results Outsourcers: – Competitive process pricing for: • singles • clean payments – Less competitive pricing for: • non-clean payments (white mail, checks only) • exception payments (research, correspondence) • non-payment transactions

Electronic Banking ACH or ICL? Quantitative Results In-House: – Over an 8 year period projected payment processing costs were competitive – Advantage is gained in managing exception transactions

Electronic Banking ACH or ICL? Qualitative Results Out-Source Advantages – As volume decreases over time so would costs – Technology remains current – Built-in Disaster Recovery

Electronic Banking ACH or ICL? Qualitative Results In-House Advantages – Maintain control of customer data – Same day exception processing (Customer PR) – Timely exception transaction processing – Reduce costs by leveraging technology for nonpayment transactions

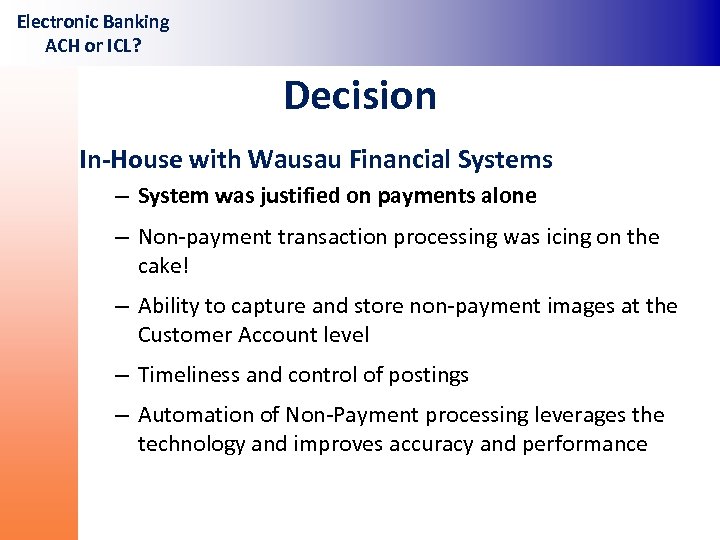

Electronic Banking ACH or ICL? Decision In-House with Wausau Financial Systems – System was justified on payments alone – Non-payment transaction processing was icing on the cake! – Ability to capture and store non-payment images at the Customer Account level – Timeliness and control of postings – Automation of Non-Payment processing leverages the technology and improves accuracy and performance

Electronic Banking ACH or ICL? Banking Options Automated Clearing House (ACH) Vs. Image Cash Letter (Check 21)

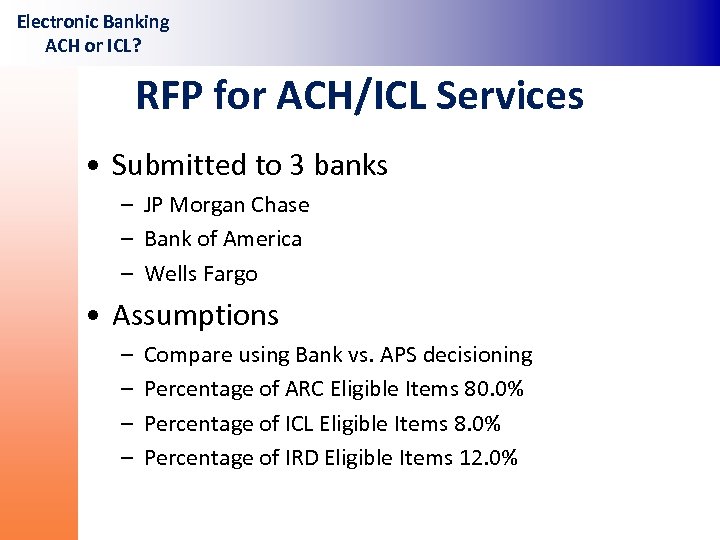

Electronic Banking ACH or ICL? RFP for ACH/ICL Services • Submitted to 3 banks – JP Morgan Chase – Bank of America – Wells Fargo • Assumptions – – Compare using Bank vs. APS decisioning Percentage of ARC Eligible Items 80. 0% Percentage of ICL Eligible Items 8. 0% Percentage of IRD Eligible Items 12. 0%

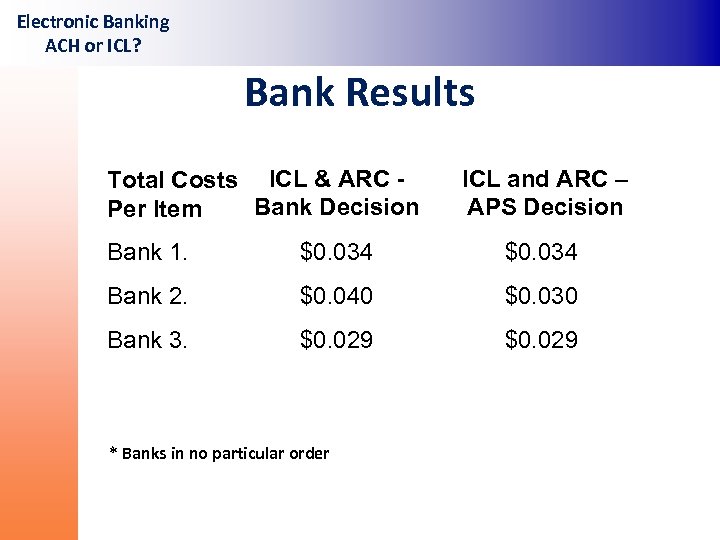

Electronic Banking ACH or ICL? Bank Results Total Costs ICL & ARC Bank Decision Per Item ICL and ARC – APS Decision Bank 1. $0. 034 Bank 2. $0. 040 $0. 030 Bank 3. $0. 029 * Banks in no particular order

Electronic Banking ACH or ICL? Bank Decision • APS will perform decisioning to control costs • We chose all 3 banks to: – Maintain our relationship with each Bank – Keep competitive pricing in play – Overall projected annual savings $57, 000

Electronic Banking ACH or ICL? Major Project Initiatives • Configuration & changes of WFS System to our needs • Testing with each Bank for ICL and ACH files • Enhancements to APS Customer System for multiple payment files and non-payment transactions • Leverage new B 2 B processes

Electronic Banking ACH or ICL? Payment Transactions • • Single Check, Single Stub Multiple Checks, Single Stub Single Check, Multiple Stubs Multiple Checks, Multiple Stubs Checks Without Payment Stubs Accounts Receivable Lists Money Orders Process bank NSF Files and systematically reverse payments

Electronic Banking ACH or ICL? Payment Transactions • All payments are compared to Hot Files for: – Cash Only Id and Rejection – Pending Shut Off Orders – ARC Opt-Out (Process as Image)

Electronic Banking ACH or ICL? Non-Payment Transactions • Sure. Pay, SHARE Pledges & E 3 Low Income Enrollment – from Bill Stub (marksense detection) – from Application form (full page scans) • Undeliverable Refund Checks and Bill Statements • Change of Address (marksense detection) • On-Demand Images for CIS at Customer Account level • Systematic Customer Account Note Updates

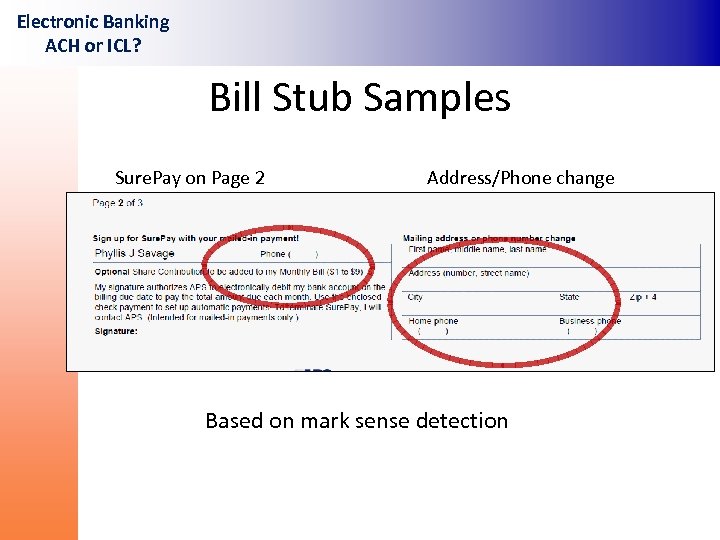

Electronic Banking ACH or ICL? Bill Stub Samples Sure. Pay on Page 2 Address/Phone change Based on mark sense detection

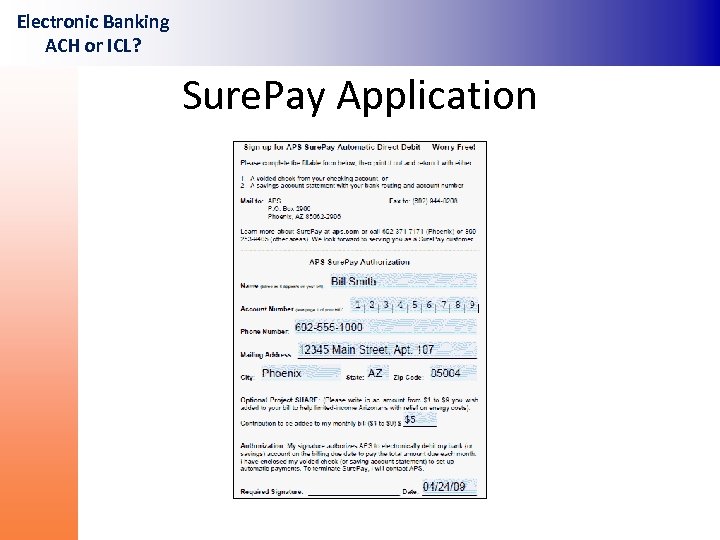

Electronic Banking ACH or ICL? Sure. Pay Application

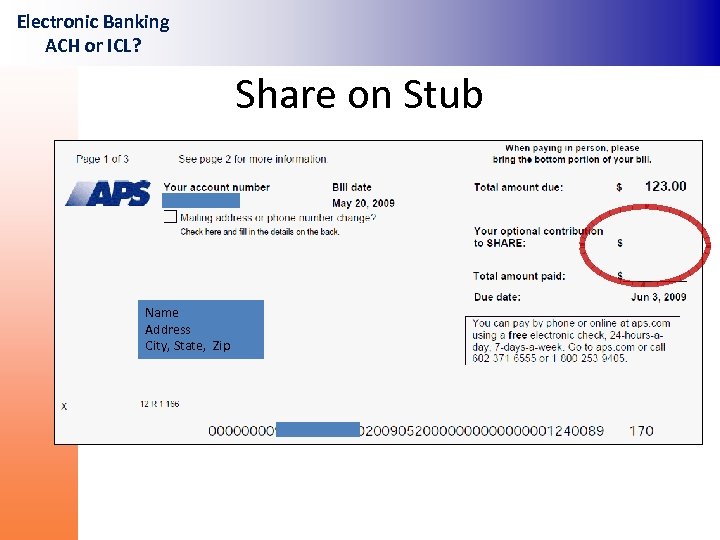

Electronic Banking ACH or ICL? Share on Stub Name Address City, State, Zip

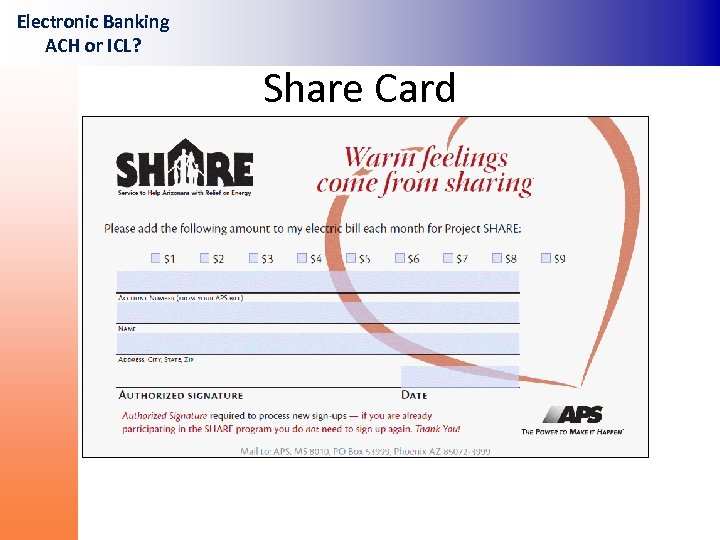

Electronic Banking ACH or ICL? Share Card

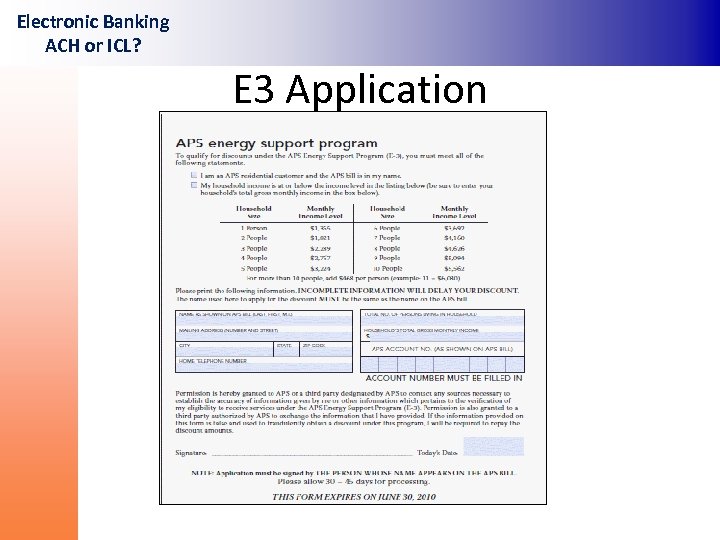

Electronic Banking ACH or ICL? E 3 Application

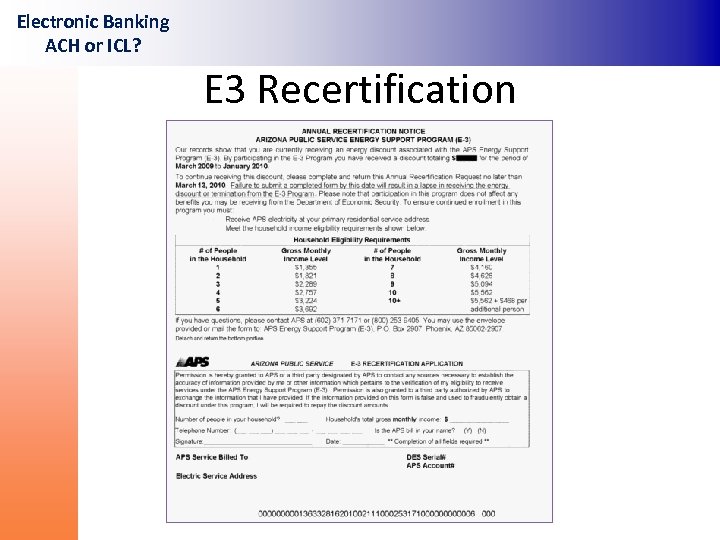

Electronic Banking ACH or ICL? E 3 Recertification

Electronic Banking ACH or ICL? Lessons Learned • Bank Validation Process takes time – ACH and ICL are different groups within each bank • “To thine own system be true” • Test, and Test some more – Include all interfaces – Include all jobs, even if you think they do not apply

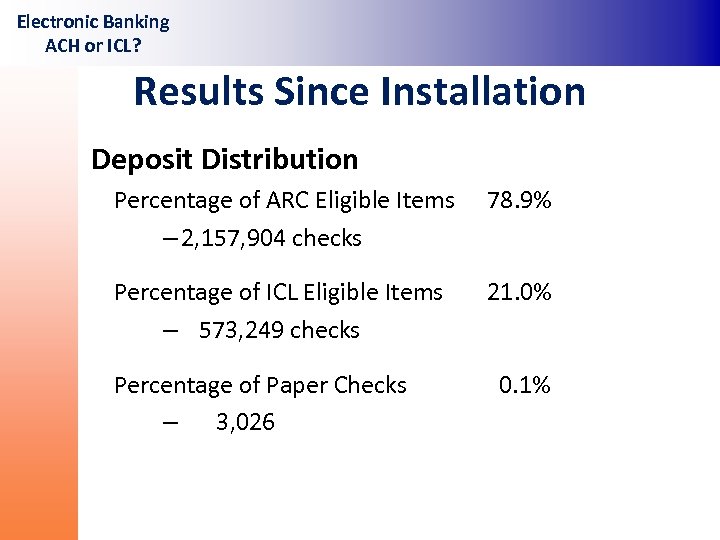

Electronic Banking ACH or ICL? Results Since Installation Deposit Distribution Percentage of ARC Eligible Items – 2, 157, 904 checks 78. 9% Percentage of ICL Eligible Items – 573, 249 checks 21. 0% Percentage of Paper Checks – 3, 026 0. 1%

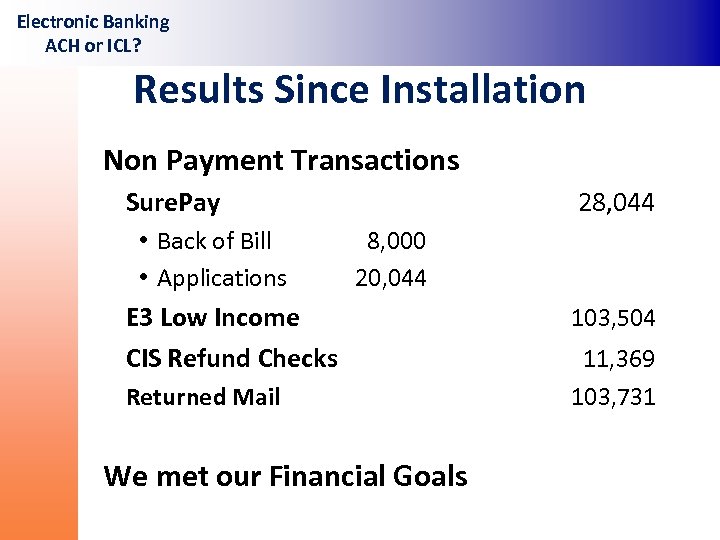

Electronic Banking ACH or ICL? Results Since Installation Non Payment Transactions Sure. Pay • Back of Bill • Applications 28, 044 8, 000 20, 044 E 3 Low Income CIS Refund Checks Returned Mail We met our Financial Goals 103, 504 11, 369 103, 731

Electronic Banking ACH or ICL? Q&A

William Dow Sr. Project Manager Arizona Public Service 602 -250 -2110 William. dow@aps. com

8a11369e62004b556802cd4ef4e5f0be.ppt