15383d75f6e68c5caee97f1cf0928ee8.ppt

- Количество слайдов: 68

Elan Corporation plc. Advancing science, changing lives Lucette Blé Maëlle Dandjinou Jennifer Dao Phan Fania Meghira 1

Elan Corporation plc. Advancing science, changing lives Lucette Blé Maëlle Dandjinou Jennifer Dao Phan Fania Meghira 1

Safe Harbor This is an independent study performed by students from the Faculté des Sciences Pharmaceutiques of Lille. The opinions expressed are our own and not necessarily those of Elan Corporation plc. 2

Safe Harbor This is an independent study performed by students from the Faculté des Sciences Pharmaceutiques of Lille. The opinions expressed are our own and not necessarily those of Elan Corporation plc. 2

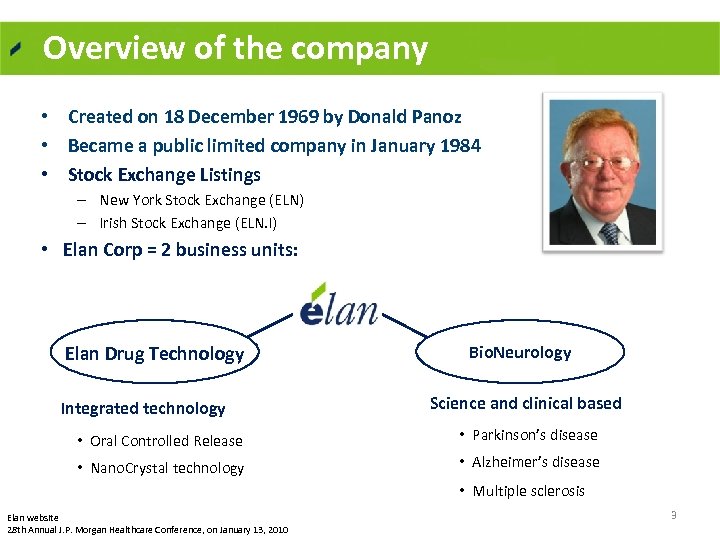

Overview of the company • Created on 18 December 1969 by Donald Panoz • Became a public limited company in January 1984 • Stock Exchange Listings – New York Stock Exchange (ELN) – Irish Stock Exchange (ELN. I) • Elan Corp = 2 business units: Elan Drug Technology Integrated technology Bio. Neurology Bio. Pharmaceuticals Science and clinical based • Oral Controlled Release • Parkinson’s disease • Nano. Crystal technology • Alzheimer’s disease • Multiple sclerosis Elan website 28 th Annual J. P. Morgan Healthcare Conference, on January 13, 2010 3

Overview of the company • Created on 18 December 1969 by Donald Panoz • Became a public limited company in January 1984 • Stock Exchange Listings – New York Stock Exchange (ELN) – Irish Stock Exchange (ELN. I) • Elan Corp = 2 business units: Elan Drug Technology Integrated technology Bio. Neurology Bio. Pharmaceuticals Science and clinical based • Oral Controlled Release • Parkinson’s disease • Nano. Crystal technology • Alzheimer’s disease • Multiple sclerosis Elan website 28 th Annual J. P. Morgan Healthcare Conference, on January 13, 2010 3

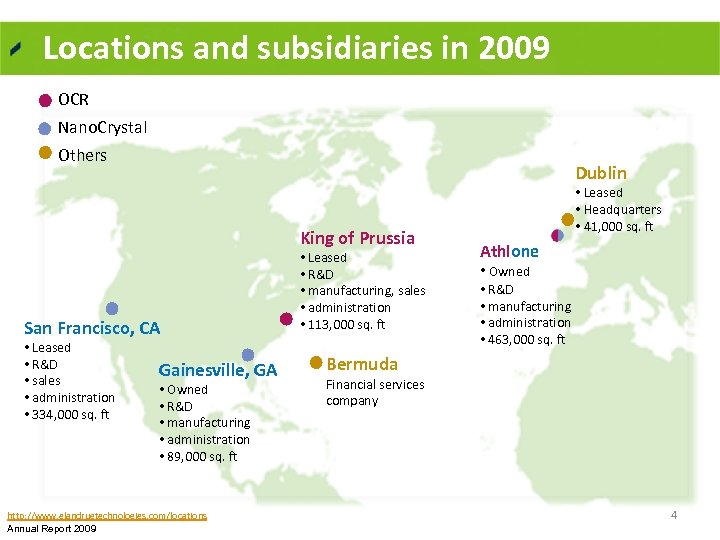

Locations and subsidiaries in 2009 OCR Nano. Crystal Others Dublin King of Prussia San Francisco, CA • Leased • R&D • sales • administration • 334, 000 sq. ft Gainesville, GA • Owned • R&D • manufacturing • administration • 89, 000 sq. ft http: //www. elandrugtechnologies. com/locations Annual Report 2009 • Leased • R&D • manufacturing, sales • administration • 113, 000 sq. ft • Leased • Headquarters • 41, 000 sq. ft Athlone • Owned • R&D • manufacturing • administration • 463, 000 sq. ft Bermuda Financial services company 4

Locations and subsidiaries in 2009 OCR Nano. Crystal Others Dublin King of Prussia San Francisco, CA • Leased • R&D • sales • administration • 334, 000 sq. ft Gainesville, GA • Owned • R&D • manufacturing • administration • 89, 000 sq. ft http: //www. elandrugtechnologies. com/locations Annual Report 2009 • Leased • R&D • manufacturing, sales • administration • 113, 000 sq. ft • Leased • Headquarters • 41, 000 sq. ft Athlone • Owned • R&D • manufacturing • administration • 463, 000 sq. ft Bermuda Financial services company 4

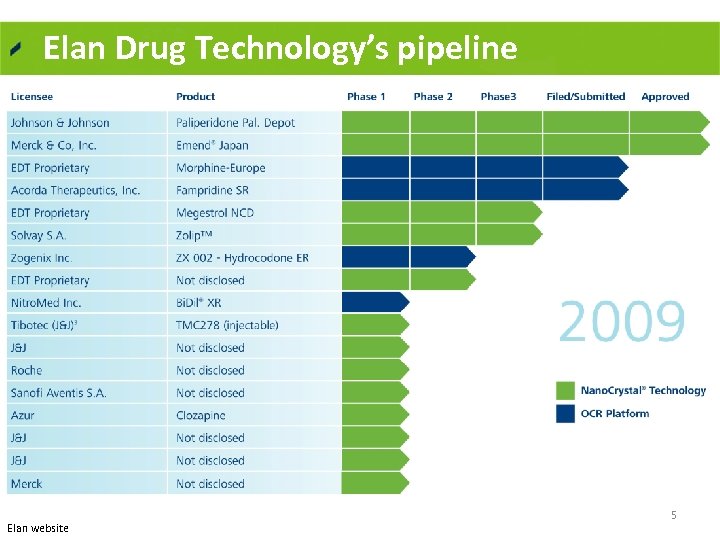

Elan Drug Technology’s pipeline Elan website 5

Elan Drug Technology’s pipeline Elan website 5

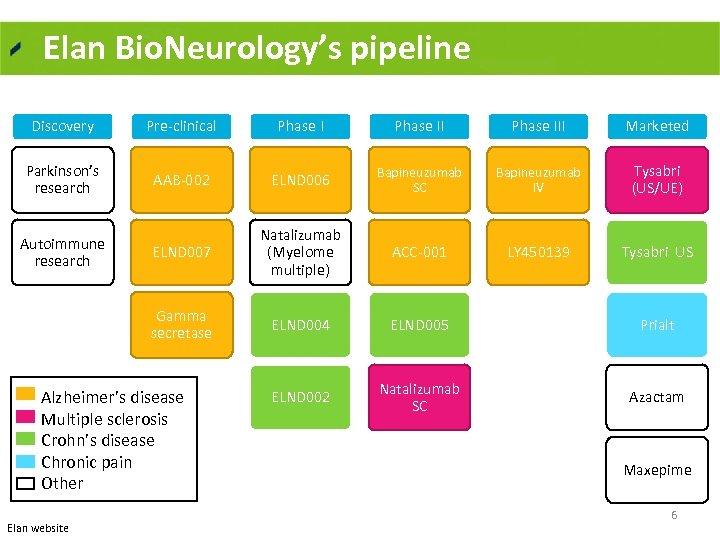

Elan Bio. Neurology’s pipeline Discovery Pre clinical Phase III Marketed Parkinson’s research AAB 002 ELND 006 Bapineuzumab SC Bapineuzumab IV Tysabri (US/UE) ELND 007 Natalizumab (Myelome multiple) ACC 001 LY 450139 Tysabri US Gamma secretase ELND 004 ELND 005 Prialt ELND 002 Natalizumab SC Azactam Autoimmune research Alzheimer’s disease Multiple sclerosis Crohn’s disease Chronic pain Other Elan website Maxepime 6

Elan Bio. Neurology’s pipeline Discovery Pre clinical Phase III Marketed Parkinson’s research AAB 002 ELND 006 Bapineuzumab SC Bapineuzumab IV Tysabri (US/UE) ELND 007 Natalizumab (Myelome multiple) ACC 001 LY 450139 Tysabri US Gamma secretase ELND 004 ELND 005 Prialt ELND 002 Natalizumab SC Azactam Autoimmune research Alzheimer’s disease Multiple sclerosis Crohn’s disease Chronic pain Other Elan website Maxepime 6

Elan Drug Technology v History with Donald Panoz v Nano. Crystal and Oral Controlled Release v Yesterday : Tricor, Skelaxin, Ritalin, Verelan v Today : Ampyra, Invega Sustenna, Zypadhera v Tomorrow ?

Elan Drug Technology v History with Donald Panoz v Nano. Crystal and Oral Controlled Release v Yesterday : Tricor, Skelaxin, Ritalin, Verelan v Today : Ampyra, Invega Sustenna, Zypadhera v Tomorrow ?

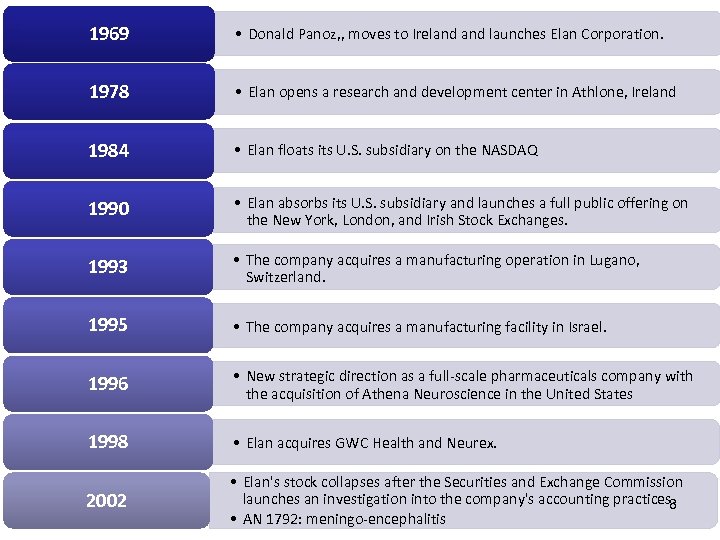

1969 • Donald Panoz, , moves to Ireland launches Elan Corporation. 1978 • Elan opens a research and development center in Athlone, Ireland 1984 • Elan floats its U. S. subsidiary on the NASDAQ 1990 • Elan absorbs its U. S. subsidiary and launches a full public offering on the New York, London, and Irish Stock Exchanges. 1993 • The company acquires a manufacturing operation in Lugano, Switzerland. 1995 • The company acquires a manufacturing facility in Israel. 1996 • New strategic direction as a full scale pharmaceuticals company with the acquisition of Athena Neuroscience in the United States 1998 • Elan acquires GWC Health and Neurex. 2002 • Elan's stock collapses after the Securities and Exchange Commission launches an investigation into the company's accounting practices. 8 • AN 1792: meningo encephalitis

1969 • Donald Panoz, , moves to Ireland launches Elan Corporation. 1978 • Elan opens a research and development center in Athlone, Ireland 1984 • Elan floats its U. S. subsidiary on the NASDAQ 1990 • Elan absorbs its U. S. subsidiary and launches a full public offering on the New York, London, and Irish Stock Exchanges. 1993 • The company acquires a manufacturing operation in Lugano, Switzerland. 1995 • The company acquires a manufacturing facility in Israel. 1996 • New strategic direction as a full scale pharmaceuticals company with the acquisition of Athena Neuroscience in the United States 1998 • Elan acquires GWC Health and Neurex. 2002 • Elan's stock collapses after the Securities and Exchange Commission launches an investigation into the company's accounting practices. 8 • AN 1792: meningo encephalitis

Business Overview Expertise in drug formulation, development, scale-up & manufacture • More than 30 products launched in 100+ countries • 15 products in clinical development • Extensive product development, scale-up and manufacturing capabilities in US and EU World’s leading drug delivery company • 40 years of innovation and expertise in drug delivery • Most successful drug delivery provider in US in recent times – 11 products launched since 2001 Robust drug delivery portfolio in the industry 9

Business Overview Expertise in drug formulation, development, scale-up & manufacture • More than 30 products launched in 100+ countries • 15 products in clinical development • Extensive product development, scale-up and manufacturing capabilities in US and EU World’s leading drug delivery company • 40 years of innovation and expertise in drug delivery • Most successful drug delivery provider in US in recent times – 11 products launched since 2001 Robust drug delivery portfolio in the industry 9

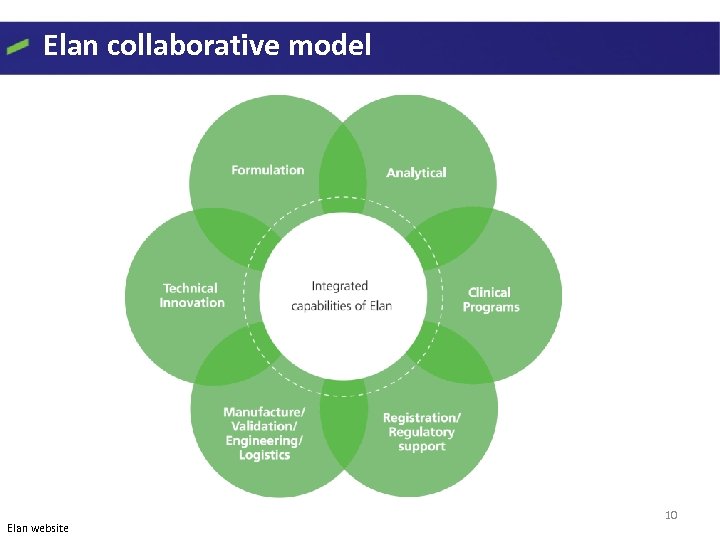

Elan collaborative model Elan website 10

Elan collaborative model Elan website 10

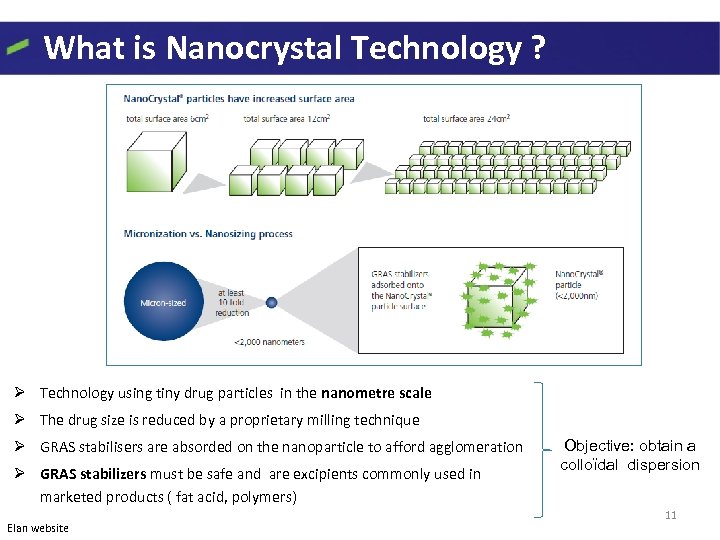

What is Nanocrystal Technology ? Ø Technology using tiny drug particles in the nanometre scale Ø The drug size is reduced by a proprietary milling technique Ø GRAS stabilisers are absorded on the nanoparticle to afford agglomeration Ø GRAS stabilizers must be safe and are excipients commonly used in marketed products ( fat acid, polymers) Elan website Objective: obtain a colloïdal dispersion 11

What is Nanocrystal Technology ? Ø Technology using tiny drug particles in the nanometre scale Ø The drug size is reduced by a proprietary milling technique Ø GRAS stabilisers are absorded on the nanoparticle to afford agglomeration Ø GRAS stabilizers must be safe and are excipients commonly used in marketed products ( fat acid, polymers) Elan website Objective: obtain a colloïdal dispersion 11

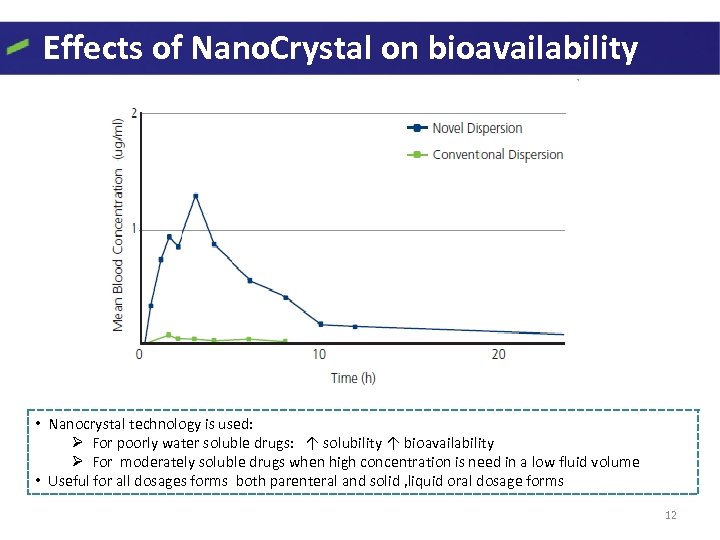

Effects of Nano. Crystal on bioavailability • Nanocrystal technology is used: Ø For poorly water soluble drugs: ↑ solubility ↑ bioavailability Ø For moderately soluble drugs when high concentration is need in a low fluid volume • Useful for all dosages forms both parenteral and solid , liquid oral dosage forms 12

Effects of Nano. Crystal on bioavailability • Nanocrystal technology is used: Ø For poorly water soluble drugs: ↑ solubility ↑ bioavailability Ø For moderately soluble drugs when high concentration is need in a low fluid volume • Useful for all dosages forms both parenteral and solid , liquid oral dosage forms 12

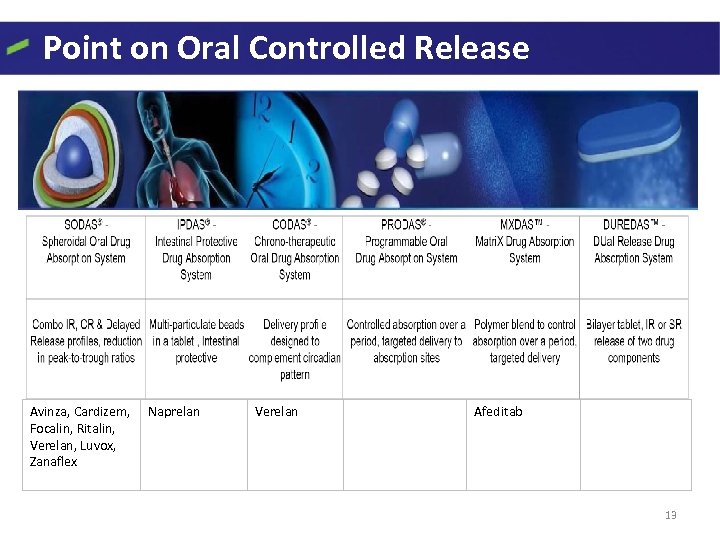

Point on Oral Controlled Release Avinza, Cardizem, Focalin, Ritalin, Verelan, Luvox, Zanaflex Naprelan Verelan Afeditab 13

Point on Oral Controlled Release Avinza, Cardizem, Focalin, Ritalin, Verelan, Luvox, Zanaflex Naprelan Verelan Afeditab 13

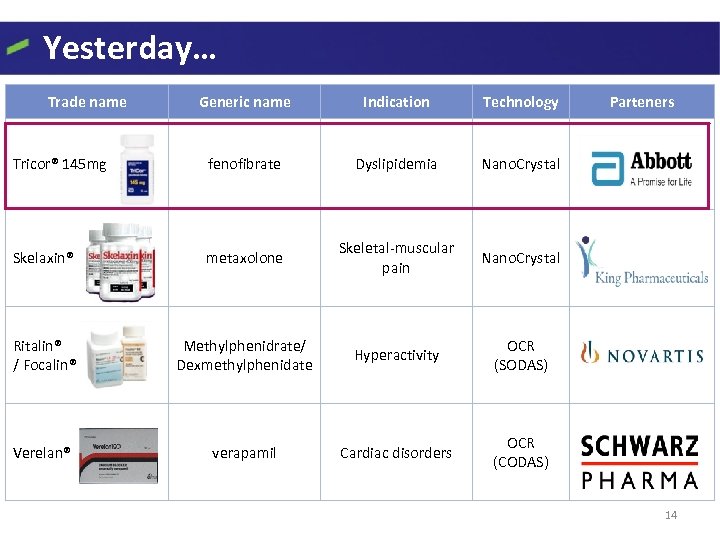

Yesterday… Trade name Generic name Indication Technology Tricor® 145 mg fenofibrate Dyslipidemia Nano. Crystal Skelaxin® metaxolone Skeletal muscular pain Nano. Crystal Ritalin® / Focalin® Methylphenidrate/ Dexmethylphenidate Hyperactivity OCR (SODAS) Verelan® verapamil Cardiac disorders Parteners OCR (CODAS) 14

Yesterday… Trade name Generic name Indication Technology Tricor® 145 mg fenofibrate Dyslipidemia Nano. Crystal Skelaxin® metaxolone Skeletal muscular pain Nano. Crystal Ritalin® / Focalin® Methylphenidrate/ Dexmethylphenidate Hyperactivity OCR (SODAS) Verelan® verapamil Cardiac disorders Parteners OCR (CODAS) 14

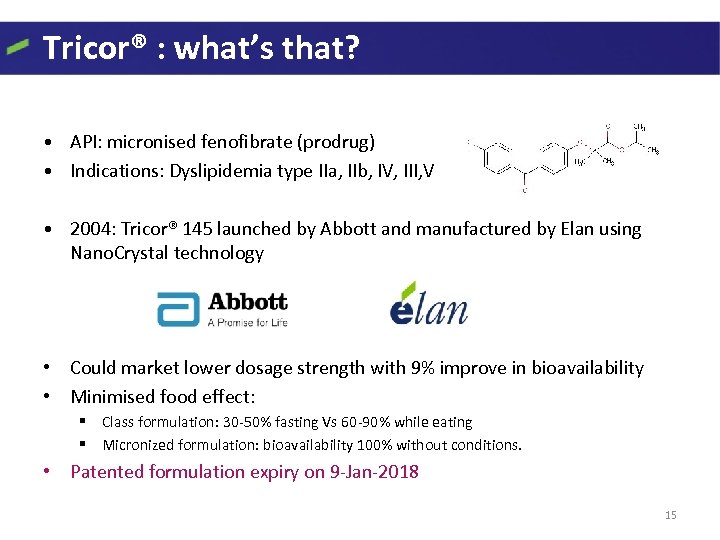

Tricor® : what’s that? • API: micronised fenofibrate (prodrug) • Indications: Dyslipidemia type IIa, IIb, IV, III, V • 2004: Tricor® 145 launched by Abbott and manufactured by Elan using Nano. Crystal technology • Could market lower dosage strength with 9% improve in bioavailability • Minimised food effect: § Class formulation: 30 50% fasting Vs 60 90% while eating § Micronized formulation: bioavailability 100% without conditions. • Patented formulation expiry on 9 Jan 2018 15

Tricor® : what’s that? • API: micronised fenofibrate (prodrug) • Indications: Dyslipidemia type IIa, IIb, IV, III, V • 2004: Tricor® 145 launched by Abbott and manufactured by Elan using Nano. Crystal technology • Could market lower dosage strength with 9% improve in bioavailability • Minimised food effect: § Class formulation: 30 50% fasting Vs 60 90% while eating § Micronized formulation: bioavailability 100% without conditions. • Patented formulation expiry on 9 Jan 2018 15

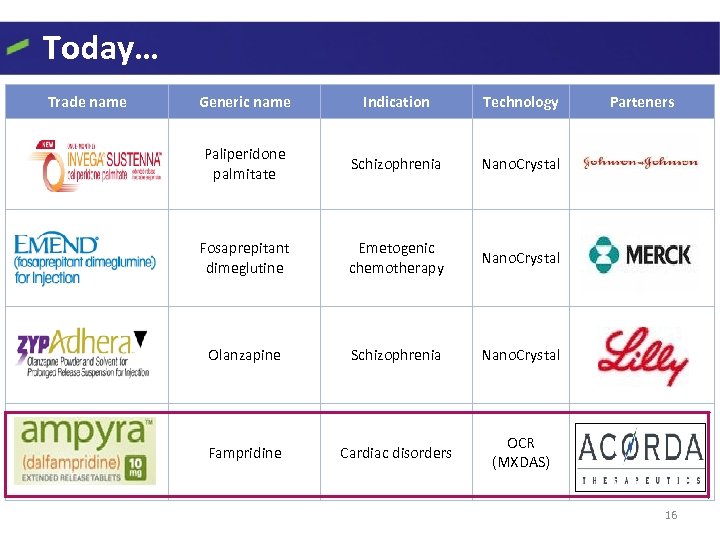

Today… Trade name Generic name Indication Technology Paliperidone palmitate Schizophrenia Nano. Crystal Fosaprepitant dimeglutine Emetogenic chemotherapy Nano. Crystal Olanzapine Schizophrenia Nano. Crystal Fampridine Cardiac disorders Parteners OCR (MXDAS) 16

Today… Trade name Generic name Indication Technology Paliperidone palmitate Schizophrenia Nano. Crystal Fosaprepitant dimeglutine Emetogenic chemotherapy Nano. Crystal Olanzapine Schizophrenia Nano. Crystal Fampridine Cardiac disorders Parteners OCR (MXDAS) 16

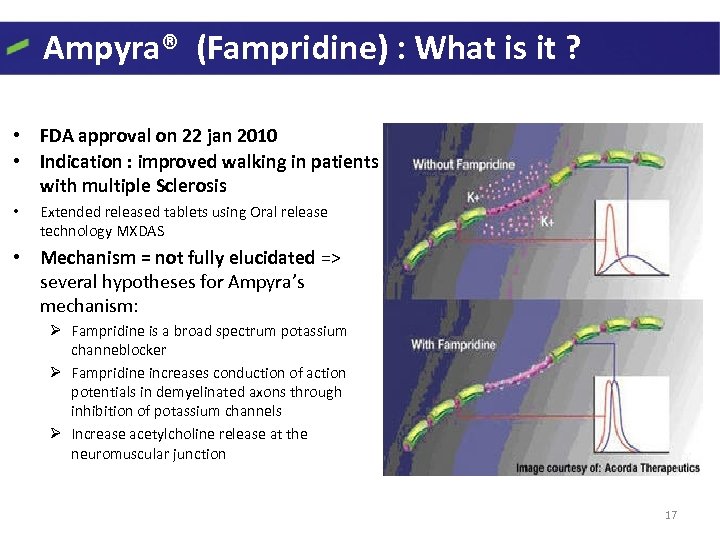

Ampyra® (Fampridine) : What is it ? • FDA approval on 22 jan 2010 • Indication : improved walking in patients with multiple Sclerosis • Extended released tablets using Oral release technology MXDAS • Mechanism = not fully elucidated => ® several hypotheses for Ampyra’s mechanism: Ø Fampridine is a broad spectrum potassium channeblocker Ø Fampridine increases conduction of action potentials in demyelinated axons through inhibition of potassium channels Ø Increase acetylcholine release at the neuromuscular junction 17

Ampyra® (Fampridine) : What is it ? • FDA approval on 22 jan 2010 • Indication : improved walking in patients with multiple Sclerosis • Extended released tablets using Oral release technology MXDAS • Mechanism = not fully elucidated => ® several hypotheses for Ampyra’s mechanism: Ø Fampridine is a broad spectrum potassium channeblocker Ø Fampridine increases conduction of action potentials in demyelinated axons through inhibition of potassium channels Ø Increase acetylcholine release at the neuromuscular junction 17

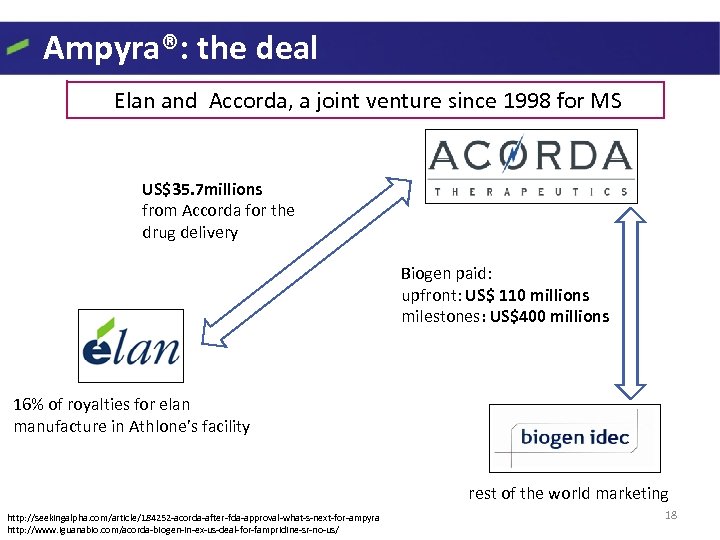

Ampyra®: the deal Elan and Accorda, a joint venture since 1998 for MS US$35. 7 millions from Accorda for the drug delivery Biogen paid: upfront: US$ 110 millions milestones: US$400 millions 16% of royalties for elan manufacture in Athlone’s facility http: //seekingalpha. com/article/184252 acorda after fda approval what s next for ampyra http: //www. iguanabio. com/acorda biogen in ex us deal for fampridine sr no us/ rest of the world marketing 18

Ampyra®: the deal Elan and Accorda, a joint venture since 1998 for MS US$35. 7 millions from Accorda for the drug delivery Biogen paid: upfront: US$ 110 millions milestones: US$400 millions 16% of royalties for elan manufacture in Athlone’s facility http: //seekingalpha. com/article/184252 acorda after fda approval what s next for ampyra http: //www. iguanabio. com/acorda biogen in ex us deal for fampridine sr no us/ rest of the world marketing 18

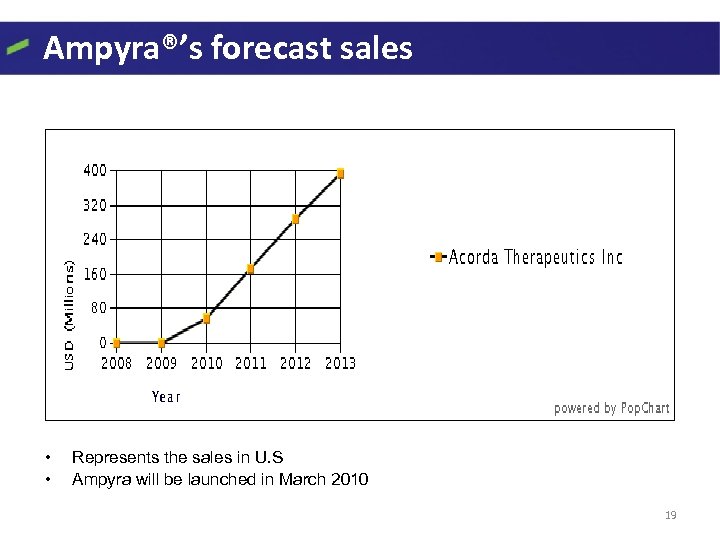

Ampyra®’s forecast sales • • Represents the sales in U. S Ampyra will be launched in March 2010 19

Ampyra®’s forecast sales • • Represents the sales in U. S Ampyra will be launched in March 2010 19

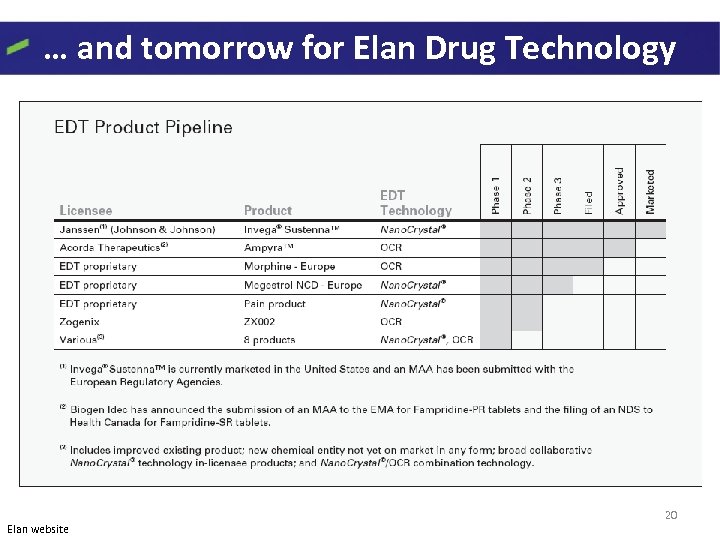

… and tomorrow for Elan Drug Technology Elan website 20

… and tomorrow for Elan Drug Technology Elan website 20

Elan Bio. Neurology § Yesterday : Azactam®/Maxipime®, Prialt® § Today : Tysabri ® § Tomorrow : • Alzheimer Immunotherapy Program • Research in Parkinson’s disease 21

Elan Bio. Neurology § Yesterday : Azactam®/Maxipime®, Prialt® § Today : Tysabri ® § Tomorrow : • Alzheimer Immunotherapy Program • Research in Parkinson’s disease 21

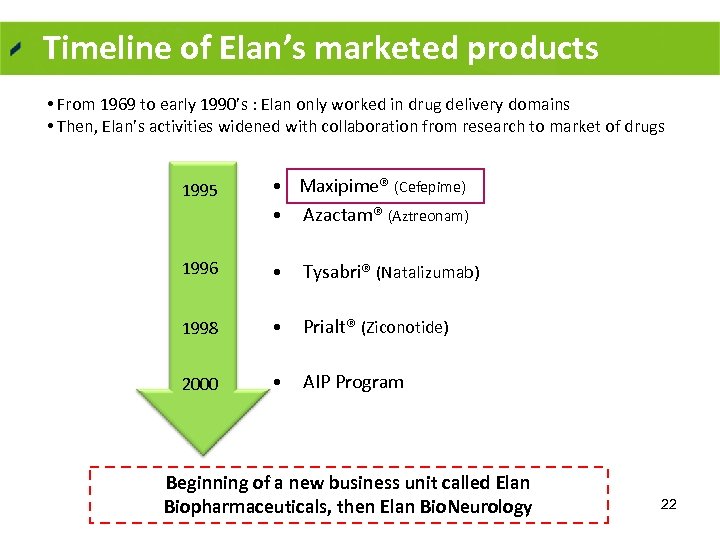

Timeline of Elan’s marketed products • From 1969 to early 1990’s : Elan only worked in drug delivery domains • Then, Elan’s activities widened with collaboration from research to market of drugs 1995 • Maxipime® (Cefepime) • Azactam® (Aztreonam) 1996 • Tysabri® (Natalizumab) 1998 • Prialt® (Ziconotide) 2000 • AIP Program Beginning of a new business unit called Elan Biopharmaceuticals, then Elan Bio. Neurology 22

Timeline of Elan’s marketed products • From 1969 to early 1990’s : Elan only worked in drug delivery domains • Then, Elan’s activities widened with collaboration from research to market of drugs 1995 • Maxipime® (Cefepime) • Azactam® (Aztreonam) 1996 • Tysabri® (Natalizumab) 1998 • Prialt® (Ziconotide) 2000 • AIP Program Beginning of a new business unit called Elan Biopharmaceuticals, then Elan Bio. Neurology 22

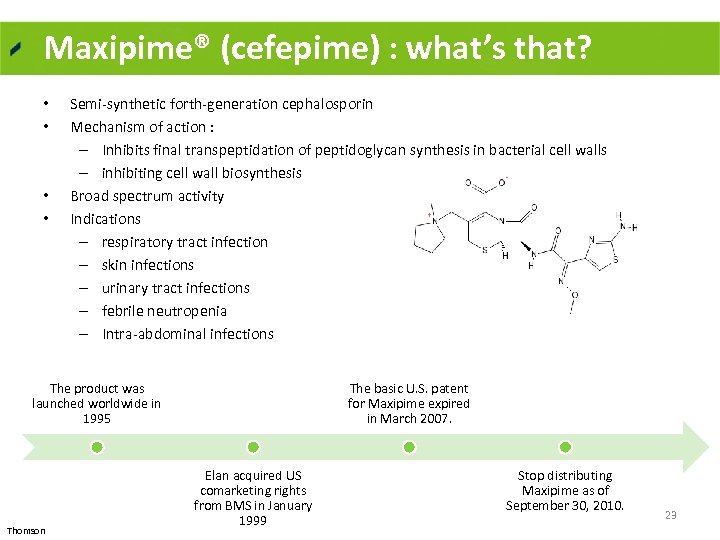

Maxipime® (cefepime) : what’s that? • • Semi synthetic forth generation cephalosporin Mechanism of action : – Inhibits final transpeptidation of peptidoglycan synthesis in bacterial cell walls – inhibiting cell wall biosynthesis Broad spectrum activity Indications – respiratory tract infection – skin infections – urinary tract infections – febrile neutropenia – Intra abdominal infections The product was launched worldwide in 1995 Thomson The basic U. S. patent for Maxipime expired in March 2007. Elan acquired US comarketing rights from BMS in January 1999 Stop distributing Maxipime as of September 30, 2010. 23

Maxipime® (cefepime) : what’s that? • • Semi synthetic forth generation cephalosporin Mechanism of action : – Inhibits final transpeptidation of peptidoglycan synthesis in bacterial cell walls – inhibiting cell wall biosynthesis Broad spectrum activity Indications – respiratory tract infection – skin infections – urinary tract infections – febrile neutropenia – Intra abdominal infections The product was launched worldwide in 1995 Thomson The basic U. S. patent for Maxipime expired in March 2007. Elan acquired US comarketing rights from BMS in January 1999 Stop distributing Maxipime as of September 30, 2010. 23

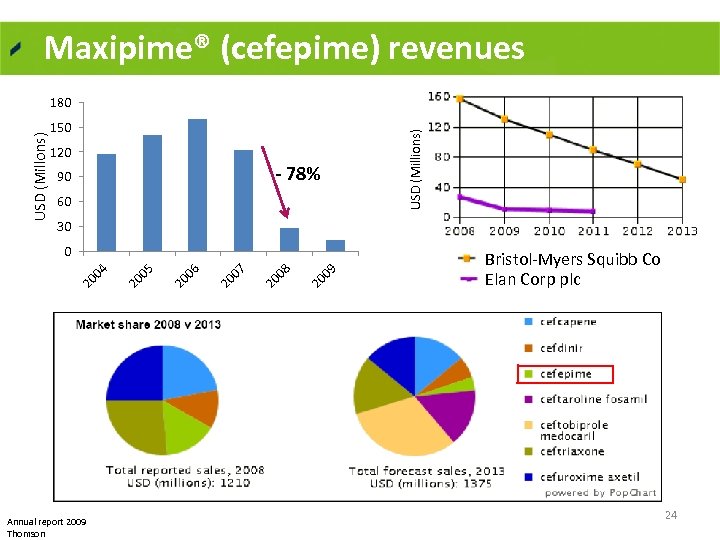

Maxipime® (cefepime) revenues 150 120 - 78% 90 60 USD (Millions) USD (Millons) 180 30 Annual report 2009 Thomson 09 20 08 20 07 20 06 20 05 20 20 04 0 Bristol Myers Squibb Co Elan Corp plc 24

Maxipime® (cefepime) revenues 150 120 - 78% 90 60 USD (Millions) USD (Millons) 180 30 Annual report 2009 Thomson 09 20 08 20 07 20 06 20 05 20 20 04 0 Bristol Myers Squibb Co Elan Corp plc 24

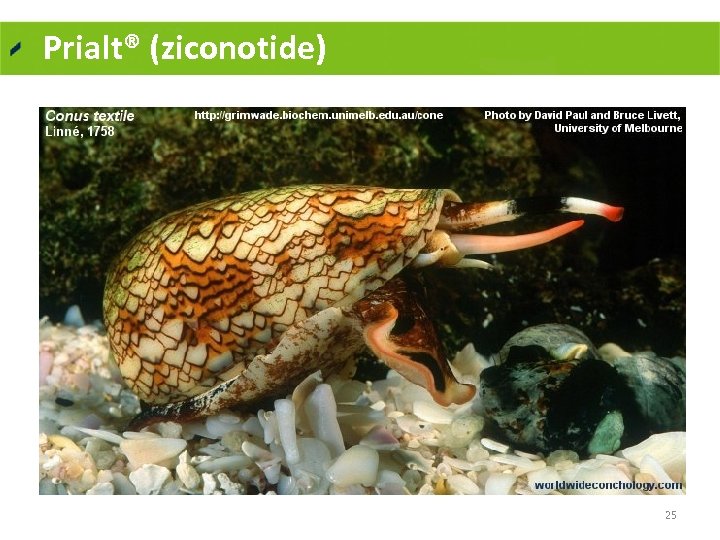

Prialt® (ziconotide) 25

Prialt® (ziconotide) 25

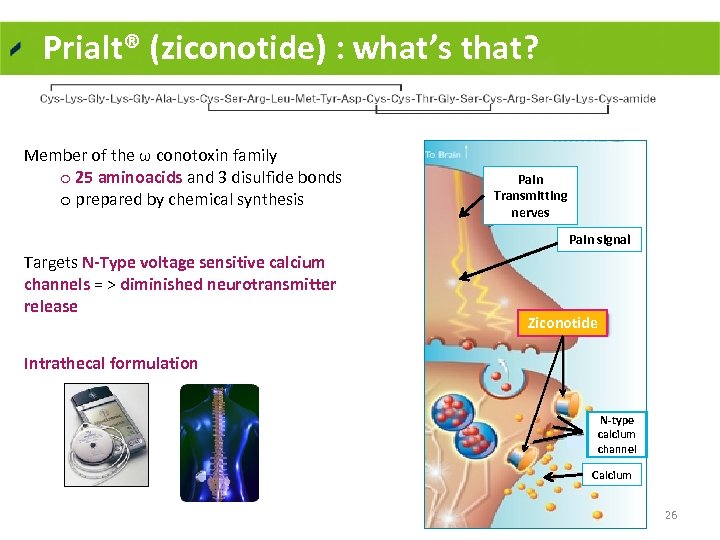

Prialt® (ziconotide) : what’s that? Member of the ω conotoxin family o 25 aminoacids and 3 disulfide bonds o prepared by chemical synthesis Pain Transmitting nerves Pain signal Targets N-Type voltage sensitive calcium channels = > diminished neurotransmitter release Ziconotide Intrathecal formulation N-type calcium channel Calcium 26

Prialt® (ziconotide) : what’s that? Member of the ω conotoxin family o 25 aminoacids and 3 disulfide bonds o prepared by chemical synthesis Pain Transmitting nerves Pain signal Targets N-Type voltage sensitive calcium channels = > diminished neurotransmitter release Ziconotide Intrathecal formulation N-type calcium channel Calcium 26

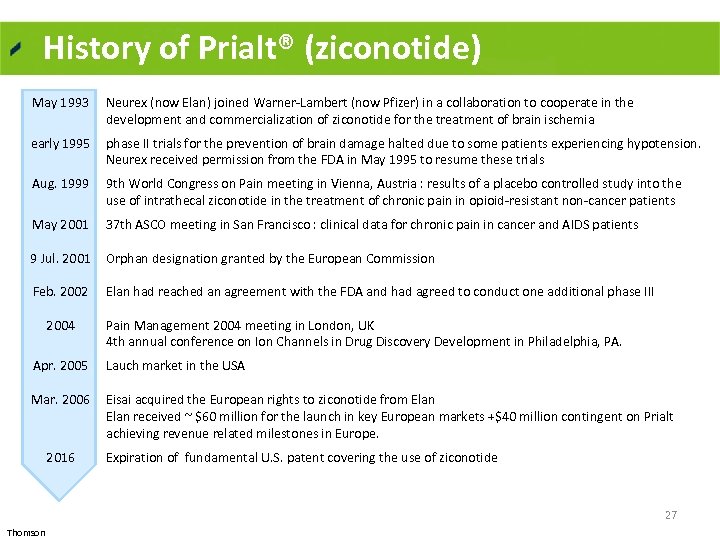

History of Prialt® (ziconotide) May 1993 Neurex (now Elan) joined Warner Lambert (now Pfizer) in a collaboration to cooperate in the development and commercialization of ziconotide for the treatment of brain ischemia early 1995 phase II trials for the prevention of brain damage halted due to some patients experiencing hypotension. Neurex received permission from the FDA in May 1995 to resume these trials Aug. 1999 9 th World Congress on Pain meeting in Vienna, Austria : results of a placebo controlled study into the use of intrathecal ziconotide in the treatment of chronic pain in opioid resistant non cancer patients May 2001 37 th ASCO meeting in San Francisco : clinical data for chronic pain in cancer and AIDS patients 9 Jul. 2001 Orphan designation granted by the European Commission Feb. 2002 Elan had reached an agreement with the FDA and had agreed to conduct one additional phase III 2004 Pain Management 2004 meeting in London, UK 4 th annual conference on Ion Channels in Drug Discovery Development in Philadelphia, PA. Apr. 2005 Lauch market in the USA Mar. 2006 Eisai acquired the European rights to ziconotide from Elan received ~ $60 million for the launch in key European markets +$40 million contingent on Prialt achieving revenue related milestones in Europe. 2016 Expiration of fundamental U. S. patent covering the use of ziconotide 27 Thomson

History of Prialt® (ziconotide) May 1993 Neurex (now Elan) joined Warner Lambert (now Pfizer) in a collaboration to cooperate in the development and commercialization of ziconotide for the treatment of brain ischemia early 1995 phase II trials for the prevention of brain damage halted due to some patients experiencing hypotension. Neurex received permission from the FDA in May 1995 to resume these trials Aug. 1999 9 th World Congress on Pain meeting in Vienna, Austria : results of a placebo controlled study into the use of intrathecal ziconotide in the treatment of chronic pain in opioid resistant non cancer patients May 2001 37 th ASCO meeting in San Francisco : clinical data for chronic pain in cancer and AIDS patients 9 Jul. 2001 Orphan designation granted by the European Commission Feb. 2002 Elan had reached an agreement with the FDA and had agreed to conduct one additional phase III 2004 Pain Management 2004 meeting in London, UK 4 th annual conference on Ion Channels in Drug Discovery Development in Philadelphia, PA. Apr. 2005 Lauch market in the USA Mar. 2006 Eisai acquired the European rights to ziconotide from Elan received ~ $60 million for the launch in key European markets +$40 million contingent on Prialt achieving revenue related milestones in Europe. 2016 Expiration of fundamental U. S. patent covering the use of ziconotide 27 Thomson

Tysabri® (natalizumab) 28

Tysabri® (natalizumab) 28

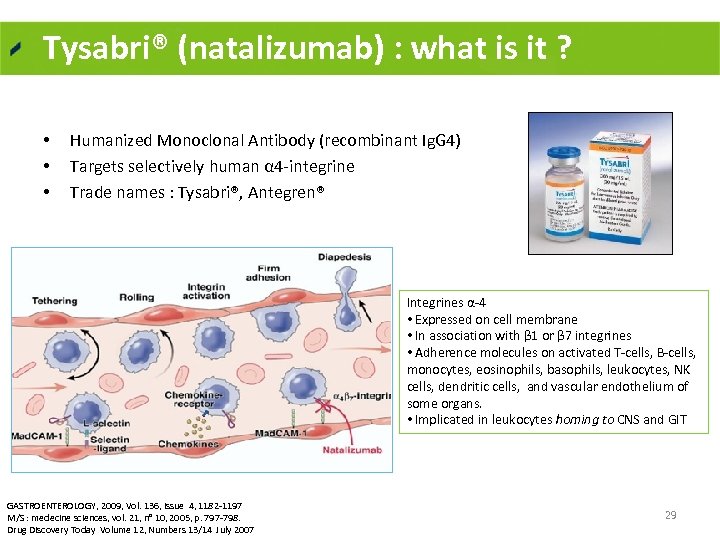

Tysabri® (natalizumab) : what is it ? • • • Humanized Monoclonal Antibody (recombinant Ig. G 4) Targets selectively human α 4 integrine Trade names : Tysabri®, Antegren® Integrines α 4 • Expressed on cell membrane • In association with β 1 or β 7 integrines • Adherence molecules on activated T cells, B cells, monocytes, eosinophils, basophils, leukocytes, NK cells, dendritic cells, and vascular endothelium of some organs. • Implicated in leukocytes homing to CNS and GIT GASTROENTEROLOGY, 2009, Vol. 136, Issue 4, 1182 1197 M/S : medecine sciences, vol. 21, n° 10, 2005, p. 797 798. Drug Discovery Today Volume 12, Numbers 13/14 July 2007 29

Tysabri® (natalizumab) : what is it ? • • • Humanized Monoclonal Antibody (recombinant Ig. G 4) Targets selectively human α 4 integrine Trade names : Tysabri®, Antegren® Integrines α 4 • Expressed on cell membrane • In association with β 1 or β 7 integrines • Adherence molecules on activated T cells, B cells, monocytes, eosinophils, basophils, leukocytes, NK cells, dendritic cells, and vascular endothelium of some organs. • Implicated in leukocytes homing to CNS and GIT GASTROENTEROLOGY, 2009, Vol. 136, Issue 4, 1182 1197 M/S : medecine sciences, vol. 21, n° 10, 2005, p. 797 798. Drug Discovery Today Volume 12, Numbers 13/14 July 2007 29

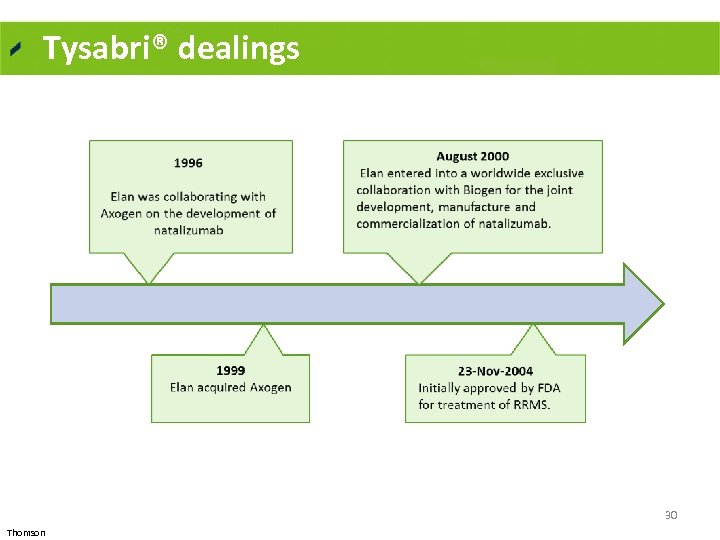

Tysabri® dealings 30 Thomson

Tysabri® dealings 30 Thomson

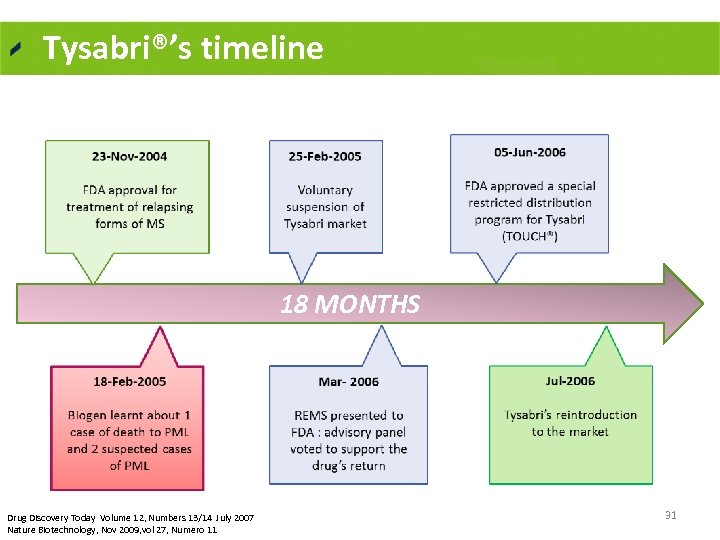

Tysabri®’s timeline 18 MONTHS Drug Discovery Today Volume 12, Numbers 13/14 July 2007 Nature Biotechnology, Nov 2009, vol 27, Numero 11 31

Tysabri®’s timeline 18 MONTHS Drug Discovery Today Volume 12, Numbers 13/14 July 2007 Nature Biotechnology, Nov 2009, vol 27, Numero 11 31

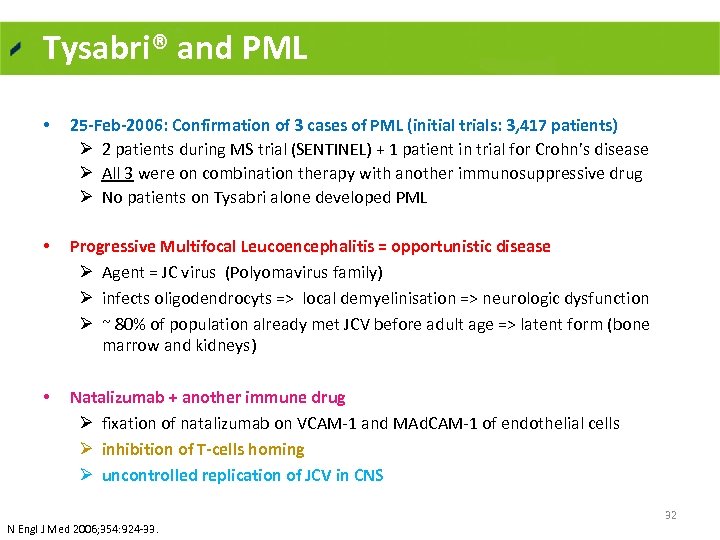

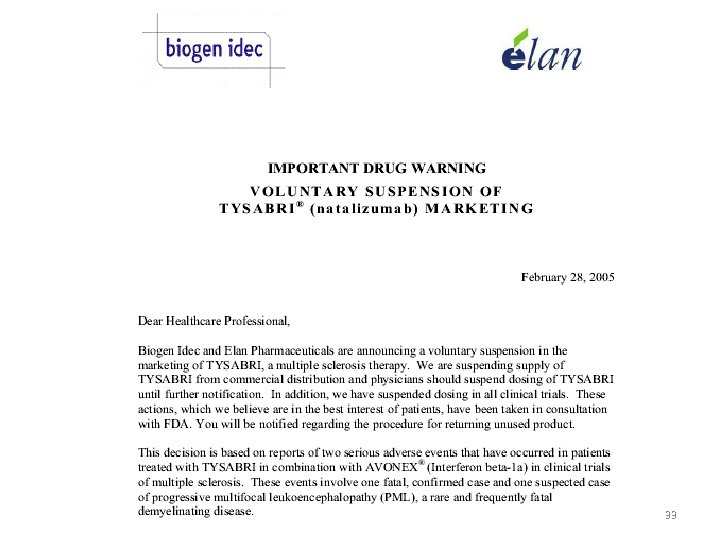

Tysabri® and PML • 25 -Feb-2006: Confirmation of 3 cases of PML (initial trials: 3, 417 patients) Ø 2 patients during MS trial (SENTINEL) + 1 patient in trial for Crohn’s disease Ø All 3 were on combination therapy with another immunosuppressive drug Ø No patients on Tysabri alone developed PML • Progressive Multifocal Leucoencephalitis = opportunistic disease Ø Agent = JC virus (Polyomavirus family) Ø infects oligodendrocyts => local demyelinisation => neurologic dysfunction Ø ~ 80% of population already met JCV before adult age => latent form (bone marrow and kidneys) • Natalizumab + another immune drug Ø fixation of natalizumab on VCAM 1 and MAd. CAM 1 of endothelial cells Ø inhibition of T-cells homing Ø uncontrolled replication of JCV in CNS N Engl J Med 2006; 354: 924 33. 32

Tysabri® and PML • 25 -Feb-2006: Confirmation of 3 cases of PML (initial trials: 3, 417 patients) Ø 2 patients during MS trial (SENTINEL) + 1 patient in trial for Crohn’s disease Ø All 3 were on combination therapy with another immunosuppressive drug Ø No patients on Tysabri alone developed PML • Progressive Multifocal Leucoencephalitis = opportunistic disease Ø Agent = JC virus (Polyomavirus family) Ø infects oligodendrocyts => local demyelinisation => neurologic dysfunction Ø ~ 80% of population already met JCV before adult age => latent form (bone marrow and kidneys) • Natalizumab + another immune drug Ø fixation of natalizumab on VCAM 1 and MAd. CAM 1 of endothelial cells Ø inhibition of T-cells homing Ø uncontrolled replication of JCV in CNS N Engl J Med 2006; 354: 924 33. 32

33

33

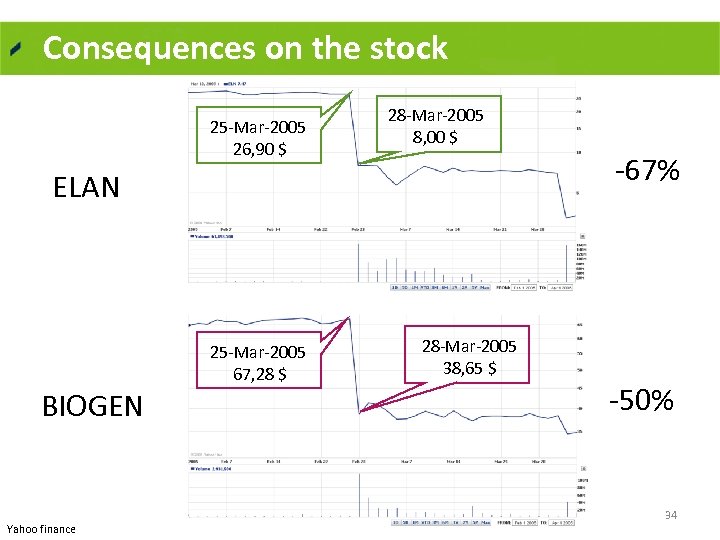

Consequences on the stock 25 Mar 2005 26, 90 $ 28 Mar 2005 8, 00 $ 67% ELAN 25 Mar 2005 67, 28 $ BIOGEN Yahoo finance 28 Mar 2005 38, 65 $ 50% 34

Consequences on the stock 25 Mar 2005 26, 90 $ 28 Mar 2005 8, 00 $ 67% ELAN 25 Mar 2005 67, 28 $ BIOGEN Yahoo finance 28 Mar 2005 38, 65 $ 50% 34

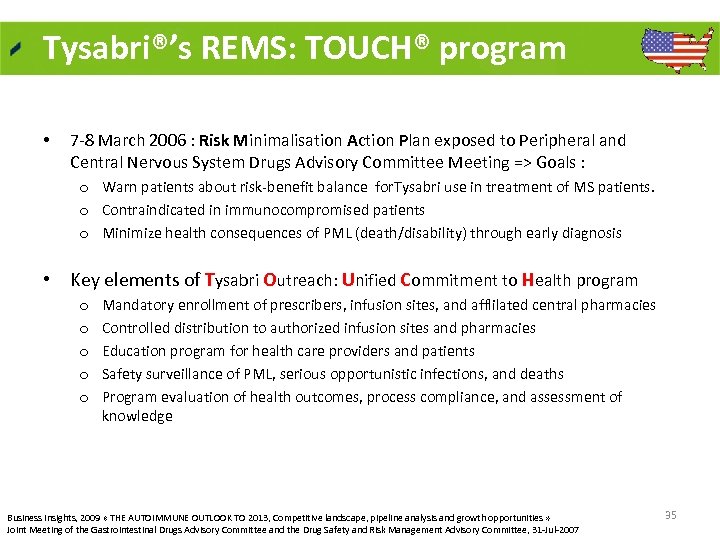

Tysabri®’s REMS: TOUCH® program • 7 8 March 2006 : Risk Minimalisation Action Plan exposed to Peripheral and Central Nervous System Drugs Advisory Committee Meeting => Goals : o Warn patients about risk benefit balance for. Tysabri use in treatment of MS patients. o Contraindicated in immunocompromised patients o Minimize health consequences of PML (death/disability) through early diagnosis • Key elements of Tysabri Outreach: Unified Commitment to Health program o o o Mandatory enrollment of prescribers, infusion sites, and afflilated central pharmacies Controlled distribution to authorized infusion sites and pharmacies Education program for health care providers and patients Safety surveillance of PML, serious opportunistic infections, and deaths Program evaluation of health outcomes, process compliance, and assessment of knowledge Business Insights, 2009 « THE AUTOIMMUNE OUTLOOK TO 2013, Competitive landscape, pipeline analysis and growth opportunities » Joint Meeting of the Gastrointestinal Drugs Advisory Committee and the Drug Safety and Risk Management Advisory Committee, 31 Jul 2007 35

Tysabri®’s REMS: TOUCH® program • 7 8 March 2006 : Risk Minimalisation Action Plan exposed to Peripheral and Central Nervous System Drugs Advisory Committee Meeting => Goals : o Warn patients about risk benefit balance for. Tysabri use in treatment of MS patients. o Contraindicated in immunocompromised patients o Minimize health consequences of PML (death/disability) through early diagnosis • Key elements of Tysabri Outreach: Unified Commitment to Health program o o o Mandatory enrollment of prescribers, infusion sites, and afflilated central pharmacies Controlled distribution to authorized infusion sites and pharmacies Education program for health care providers and patients Safety surveillance of PML, serious opportunistic infections, and deaths Program evaluation of health outcomes, process compliance, and assessment of knowledge Business Insights, 2009 « THE AUTOIMMUNE OUTLOOK TO 2013, Competitive landscape, pipeline analysis and growth opportunities » Joint Meeting of the Gastrointestinal Drugs Advisory Committee and the Drug Safety and Risk Management Advisory Committee, 31 Jul 2007 35

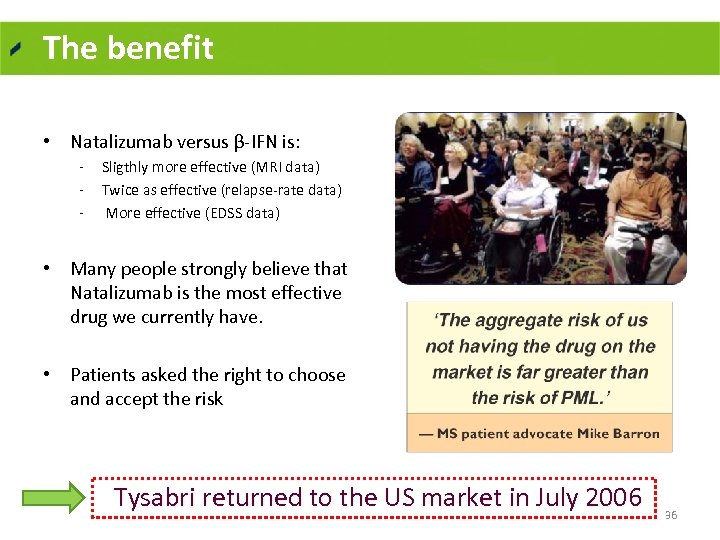

The benefit • Natalizumab versus β IFN is: Sligthly more effective (MRI data) Twice as effective (relapse rate data) More effective (EDSS data) • Many people strongly believe that Natalizumab is the most effective drug we currently have. • Patients asked the right to choose and accept the risk Tysabri returned to the US market in July 2006 36

The benefit • Natalizumab versus β IFN is: Sligthly more effective (MRI data) Twice as effective (relapse rate data) More effective (EDSS data) • Many people strongly believe that Natalizumab is the most effective drug we currently have. • Patients asked the right to choose and accept the risk Tysabri returned to the US market in July 2006 36

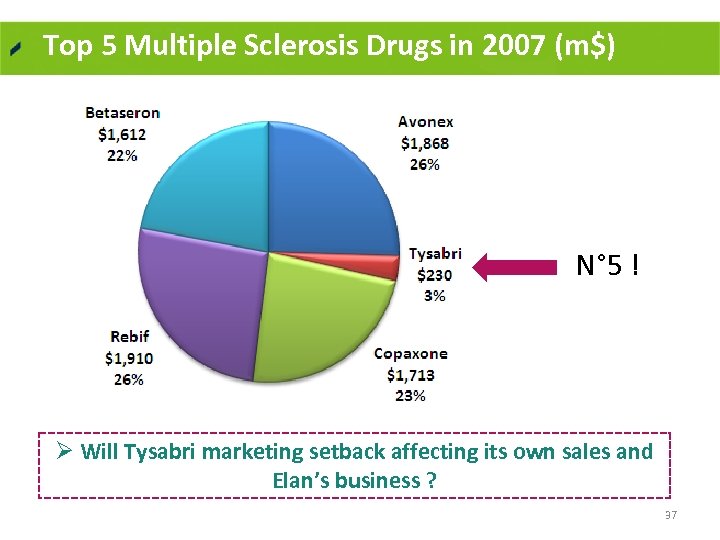

Top 5 Multiple Sclerosis Drugs in 2007 (m$) N° 5 ! Ø Will Tysabri marketing setback affecting its own sales and Elan’s business ? 37

Top 5 Multiple Sclerosis Drugs in 2007 (m$) N° 5 ! Ø Will Tysabri marketing setback affecting its own sales and Elan’s business ? 37

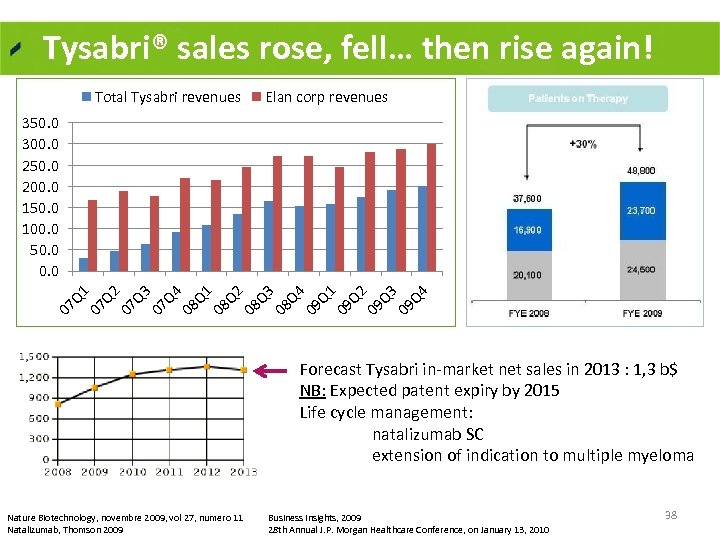

Tysabri® sales rose, fell… then rise again! Total Tysabri revenues Elan corp revenues 07 Q 1 07 Q 2 07 Q 3 07 Q 4 08 Q 1 08 Q 2 08 Q 3 08 Q 4 09 Q 1 09 Q 2 09 Q 3 09 Q 4 350. 0 300. 0 250. 0 200. 0 150. 0 100. 0 50. 0 Forecast Tysabri in market net sales in 2013 : 1, 3 b$ NB: Expected patent expiry by 2015 Life cycle management: natalizumab SC extension of indication to multiple myeloma Nature Biotechnology, novembre 2009, vol 27, numero 11 Business Insights, 2009 Natalizumab, Thomson 2009 28 th Annual J. P. Morgan Healthcare Conference, on January 13, 2010 38

Tysabri® sales rose, fell… then rise again! Total Tysabri revenues Elan corp revenues 07 Q 1 07 Q 2 07 Q 3 07 Q 4 08 Q 1 08 Q 2 08 Q 3 08 Q 4 09 Q 1 09 Q 2 09 Q 3 09 Q 4 350. 0 300. 0 250. 0 200. 0 150. 0 100. 0 50. 0 Forecast Tysabri in market net sales in 2013 : 1, 3 b$ NB: Expected patent expiry by 2015 Life cycle management: natalizumab SC extension of indication to multiple myeloma Nature Biotechnology, novembre 2009, vol 27, numero 11 Business Insights, 2009 Natalizumab, Thomson 2009 28 th Annual J. P. Morgan Healthcare Conference, on January 13, 2010 38

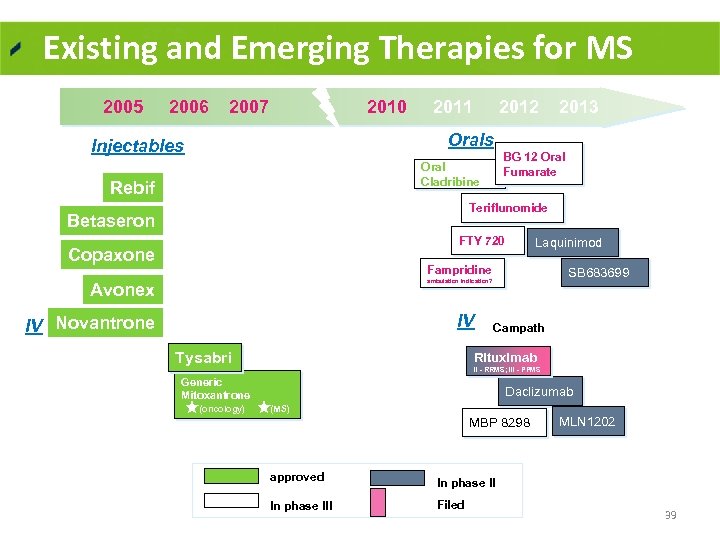

Existing and Emerging Therapies for MS 2005 2006 2007 2010 2011 2012 2013 Orals Injectables BG 12 Oral Fumarate Oral Cladribine Rebif Teriflunomide Betaseron FTY 720 Copaxone Laquinimod Fampridine SB 683699 ambulation indication? Avonex IV IV Novantrone Tysabri Campath Rituximab II - RRMS; III - PPMS Generic Mitoxantrone (oncology) Daclizumab (MS) MBP 8298 approved In phase III Filed MLN 1202 39

Existing and Emerging Therapies for MS 2005 2006 2007 2010 2011 2012 2013 Orals Injectables BG 12 Oral Fumarate Oral Cladribine Rebif Teriflunomide Betaseron FTY 720 Copaxone Laquinimod Fampridine SB 683699 ambulation indication? Avonex IV IV Novantrone Tysabri Campath Rituximab II - RRMS; III - PPMS Generic Mitoxantrone (oncology) Daclizumab (MS) MBP 8298 approved In phase III Filed MLN 1202 39

Alzheimer’s disease 40

Alzheimer’s disease 40

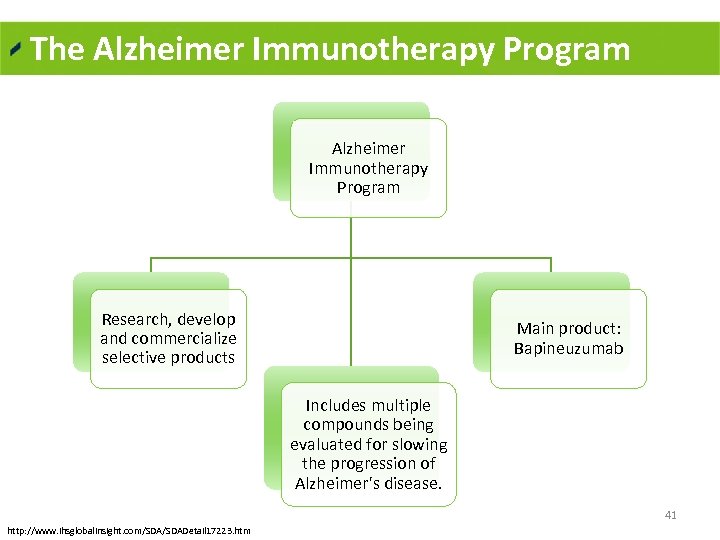

The Alzheimer Immunotherapy Program Research, develop and commercialize selective products Main product: Bapineuzumab Includes multiple compounds being evaluated for slowing the progression of Alzheimer's disease. 41 http: //www. ihsglobalinsight. com/SDADetail 17223. htm

The Alzheimer Immunotherapy Program Research, develop and commercialize selective products Main product: Bapineuzumab Includes multiple compounds being evaluated for slowing the progression of Alzheimer's disease. 41 http: //www. ihsglobalinsight. com/SDADetail 17223. htm

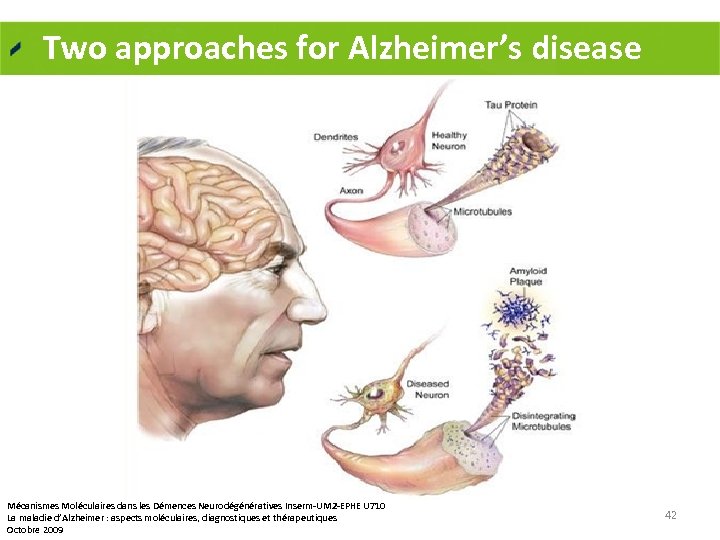

Two approaches for Alzheimer’s disease Mécanismes Moléculaires dans les Démences Neurodégénératives Inserm-UM 2 -EPHE U 710 La maladie d’Alzheimer : aspects moléculaires, diagnostiques et thérapeutiques Octobre 2009 42

Two approaches for Alzheimer’s disease Mécanismes Moléculaires dans les Démences Neurodégénératives Inserm-UM 2 -EPHE U 710 La maladie d’Alzheimer : aspects moléculaires, diagnostiques et thérapeutiques Octobre 2009 42

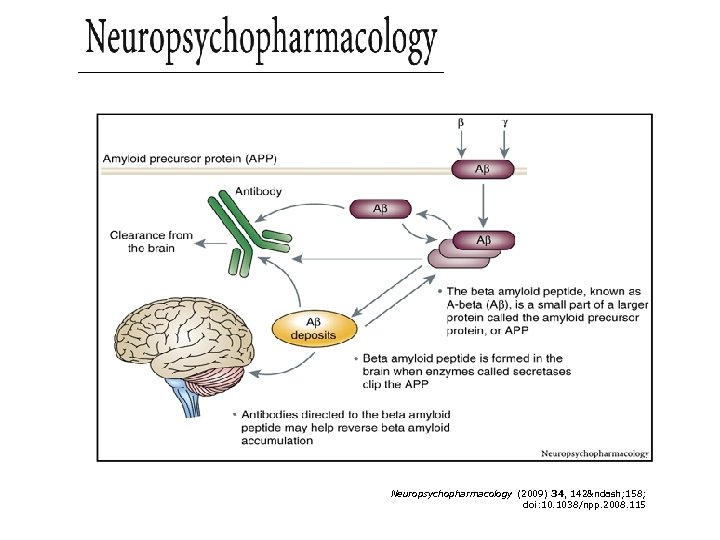

Figure 6 Neuropsychopharmacology (2009) 34, 142– 158; doi: 10. 1038/npp. 2008. 115

Figure 6 Neuropsychopharmacology (2009) 34, 142– 158; doi: 10. 1038/npp. 2008. 115

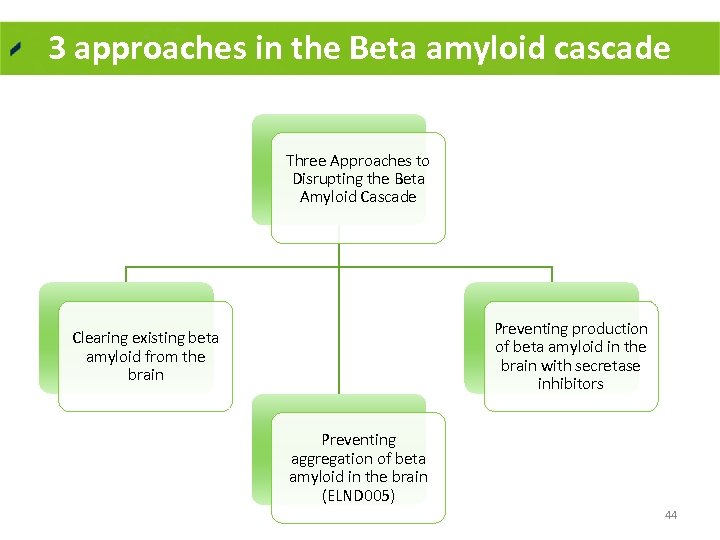

3 approaches in the Beta amyloid cascade Three Approaches to Disrupting the Beta Amyloid Cascade Preventing production of beta amyloid in the brain with secretase inhibitors Clearing existing beta amyloid from the brain Preventing aggregation of beta amyloid in the brain (ELND 005) 44

3 approaches in the Beta amyloid cascade Three Approaches to Disrupting the Beta Amyloid Cascade Preventing production of beta amyloid in the brain with secretase inhibitors Clearing existing beta amyloid from the brain Preventing aggregation of beta amyloid in the brain (ELND 005) 44

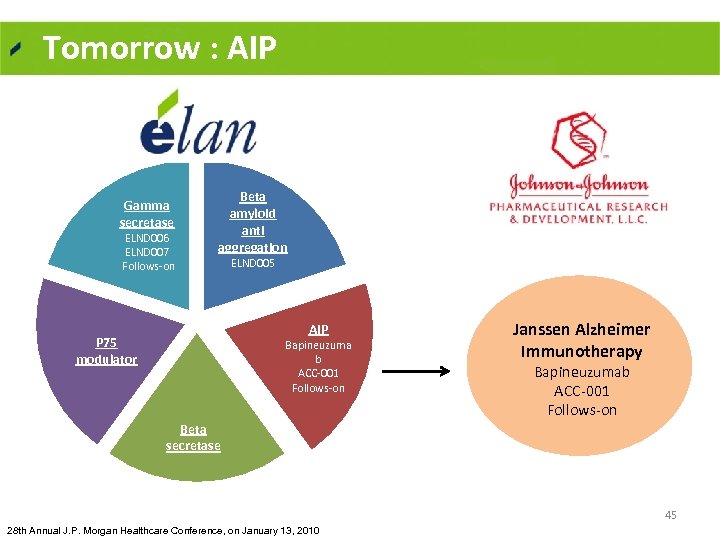

Tomorrow : AIP Gamma secretase ELND 006 ELND 007 Follows on Beta amyloid anti aggregation ELND 005 AIP P 75 modulator Bapineuzuma b ACC 001 Follows on Janssen Alzheimer Immunotherapy Bapineuzumab ACC 001 Follows on Beta secretase 45 28 th Annual J. P. Morgan Healthcare Conference, on January 13, 2010

Tomorrow : AIP Gamma secretase ELND 006 ELND 007 Follows on Beta amyloid anti aggregation ELND 005 AIP P 75 modulator Bapineuzuma b ACC 001 Follows on Janssen Alzheimer Immunotherapy Bapineuzumab ACC 001 Follows on Beta secretase 45 28 th Annual J. P. Morgan Healthcare Conference, on January 13, 2010

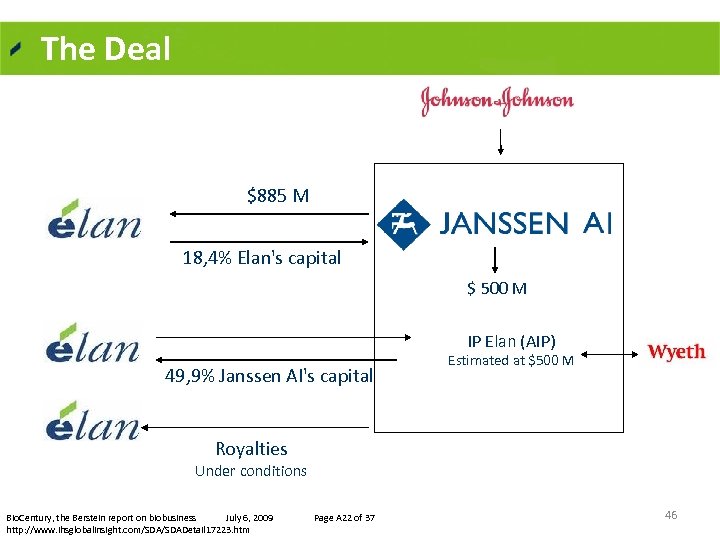

The Deal $885 M 18, 4% Elan's capital $ 500 M IP Elan (AIP) 49, 9% Janssen AI's capital Estimated at $500 M Royalties Under conditions Bio. Century, the Berstein report on biobusiness July 6, 2009 Page A 22 of 37 http: //www. ihsglobalinsight. com/SDADetail 17223. htm 46

The Deal $885 M 18, 4% Elan's capital $ 500 M IP Elan (AIP) 49, 9% Janssen AI's capital Estimated at $500 M Royalties Under conditions Bio. Century, the Berstein report on biobusiness July 6, 2009 Page A 22 of 37 http: //www. ihsglobalinsight. com/SDADetail 17223. htm 46

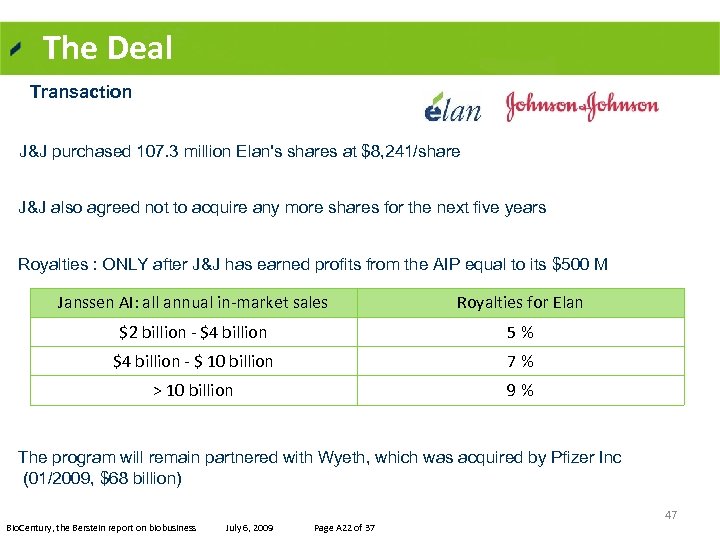

The Deal Transaction J&J purchased 107. 3 million Elan's shares at $8, 241/share J&J also agreed not to acquire any more shares for the next five years Royalties : ONLY after J&J has earned profits from the AIP equal to its $500 M Janssen AI: all annual in market sales Royalties for Elan $2 billion $4 billion 5 % $4 billion $ 10 billion 7 % > 10 billion 9 % The program will remain partnered with Wyeth, which was acquired by Pfizer Inc (01/2009, $68 billion) Bio. Century, the Berstein report on biobusiness July 6, 2009 Page A 22 of 37 47

The Deal Transaction J&J purchased 107. 3 million Elan's shares at $8, 241/share J&J also agreed not to acquire any more shares for the next five years Royalties : ONLY after J&J has earned profits from the AIP equal to its $500 M Janssen AI: all annual in market sales Royalties for Elan $2 billion $4 billion 5 % $4 billion $ 10 billion 7 % > 10 billion 9 % The program will remain partnered with Wyeth, which was acquired by Pfizer Inc (01/2009, $68 billion) Bio. Century, the Berstein report on biobusiness July 6, 2009 Page A 22 of 37 47

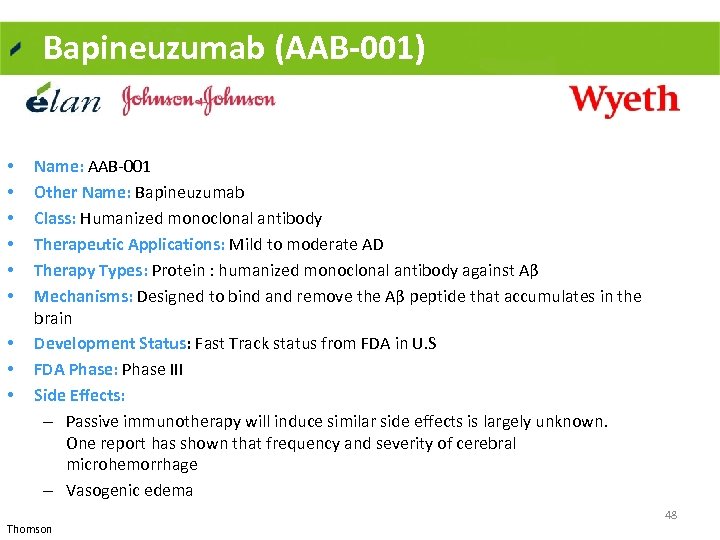

Bapineuzumab (AAB-001) • • • Name: AAB 001 Other Name: Bapineuzumab Class: Humanized monoclonal antibody Therapeutic Applications: Mild to moderate AD Therapy Types: Protein : humanized monoclonal antibody against Aβ Mechanisms: Designed to bind and remove the Aβ peptide that accumulates in the brain Development Status: Fast Track status from FDA in U. S FDA Phase: Phase III Side Effects: – Passive immunotherapy will induce similar side effects is largely unknown. One report has shown that frequency and severity of cerebral microhemorrhage – Vasogenic edema Thomson 48

Bapineuzumab (AAB-001) • • • Name: AAB 001 Other Name: Bapineuzumab Class: Humanized monoclonal antibody Therapeutic Applications: Mild to moderate AD Therapy Types: Protein : humanized monoclonal antibody against Aβ Mechanisms: Designed to bind and remove the Aβ peptide that accumulates in the brain Development Status: Fast Track status from FDA in U. S FDA Phase: Phase III Side Effects: – Passive immunotherapy will induce similar side effects is largely unknown. One report has shown that frequency and severity of cerebral microhemorrhage – Vasogenic edema Thomson 48

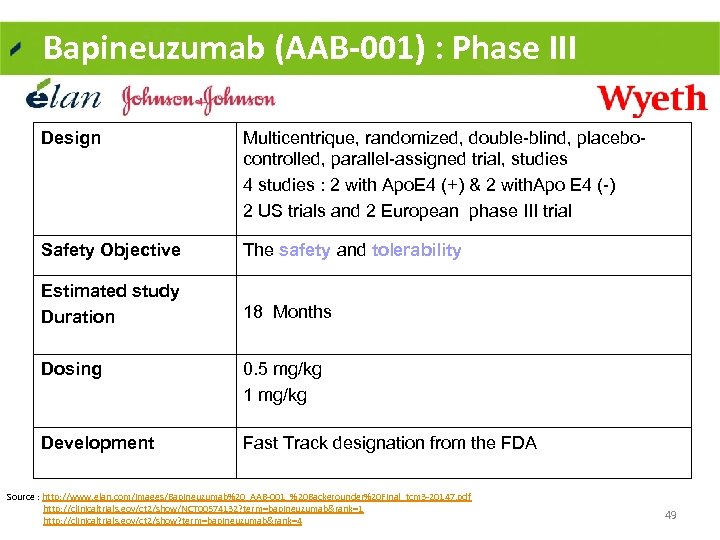

Bapineuzumab (AAB-001) : Phase III Design Multicentrique, randomized, double-blind, placebocontrolled, parallel-assigned trial, studies 4 studies : 2 with Apo. E 4 (+) & 2 with. Apo E 4 (-) 2 US trials and 2 European phase III trial Safety Objective The safety and tolerability Estimated study Duration 18 Months Dosing 0. 5 mg/kg 1 mg/kg Development Fast Track designation from the FDA Source : http: //www. elan. com/Images/Bapineuzumab%20_AAB 001_%20 Backgrounder%20 Final_tcm 3 20147. pdf http: //clinicaltrials. gov/ct 2/show/NCT 00574132? term=bapineuzumab&rank=1 http: //clinicaltrials. gov/ct 2/show? term=bapineuzumab&rank=4 49

Bapineuzumab (AAB-001) : Phase III Design Multicentrique, randomized, double-blind, placebocontrolled, parallel-assigned trial, studies 4 studies : 2 with Apo. E 4 (+) & 2 with. Apo E 4 (-) 2 US trials and 2 European phase III trial Safety Objective The safety and tolerability Estimated study Duration 18 Months Dosing 0. 5 mg/kg 1 mg/kg Development Fast Track designation from the FDA Source : http: //www. elan. com/Images/Bapineuzumab%20_AAB 001_%20 Backgrounder%20 Final_tcm 3 20147. pdf http: //clinicaltrials. gov/ct 2/show/NCT 00574132? term=bapineuzumab&rank=1 http: //clinicaltrials. gov/ct 2/show? term=bapineuzumab&rank=4 49

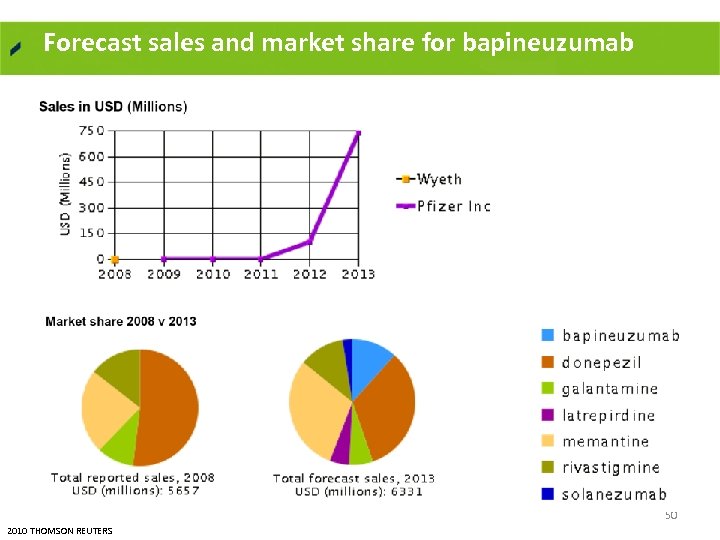

Forecast sales and market share for bapineuzumab 50 2010 THOMSON REUTERS

Forecast sales and market share for bapineuzumab 50 2010 THOMSON REUTERS

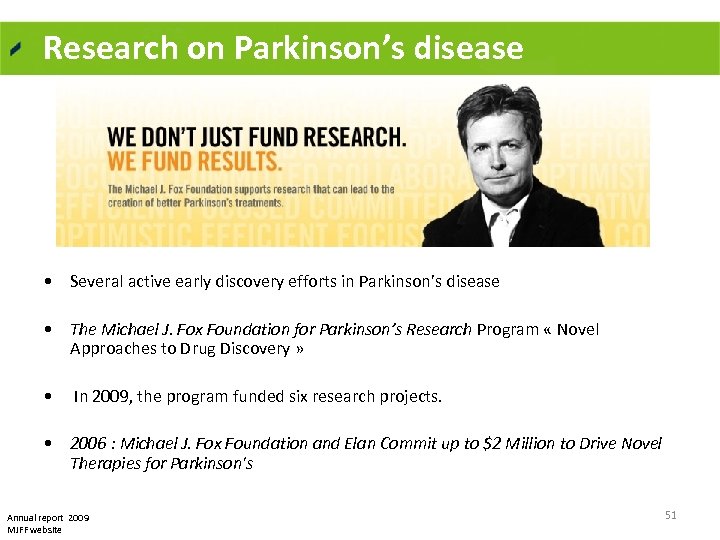

Research on Parkinson’s disease • Several active early discovery efforts in Parkinson’s disease • The Michael J. Fox Foundation for Parkinson’s Research Program « Novel Approaches to Drug Discovery » • In 2009, the program funded six research projects. • 2006 : Michael J. Fox Foundation and Elan Commit up to $2 Million to Drive Novel Therapies for Parkinson's Annual report 2009 MJFF website 51

Research on Parkinson’s disease • Several active early discovery efforts in Parkinson’s disease • The Michael J. Fox Foundation for Parkinson’s Research Program « Novel Approaches to Drug Discovery » • In 2009, the program funded six research projects. • 2006 : Michael J. Fox Foundation and Elan Commit up to $2 Million to Drive Novel Therapies for Parkinson's Annual report 2009 MJFF website 51

Our opinion about Elan Corporation plc. • Financial Analysis • SWOT • Would we join Elan? 52

Our opinion about Elan Corporation plc. • Financial Analysis • SWOT • Would we join Elan? 52

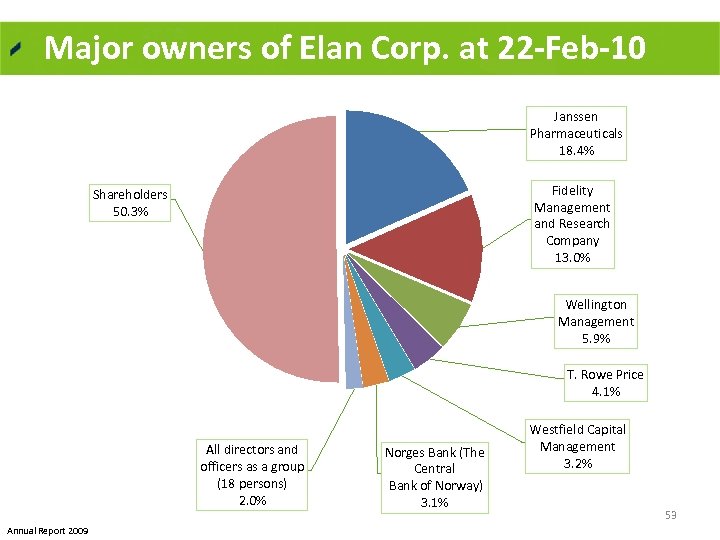

Major owners of Elan Corp. at 22 -Feb-10 Janssen Pharmaceuticals 18. 4% Fidelity Management and Research Company 13. 0% Shareholders 50. 3% Wellington Management 5. 9% T. Rowe Price 4. 1% All directors and officers as a group (18 persons) 2. 0% Annual Report 2009 Norges Bank (The Central Bank of Norway) 3. 1% Westfield Capital Management 3. 2% 53

Major owners of Elan Corp. at 22 -Feb-10 Janssen Pharmaceuticals 18. 4% Fidelity Management and Research Company 13. 0% Shareholders 50. 3% Wellington Management 5. 9% T. Rowe Price 4. 1% All directors and officers as a group (18 persons) 2. 0% Annual Report 2009 Norges Bank (The Central Bank of Norway) 3. 1% Westfield Capital Management 3. 2% 53

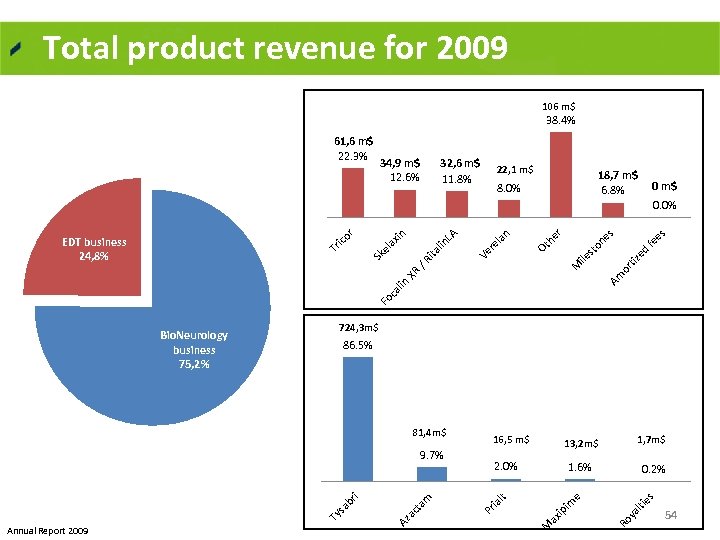

Total product revenue for 2009 106 m$ 38. 4% 61, 6 m$ 22. 3% 32, 6 m$ 11. 8% 34, 9 m$ 12. 6% 22, 1 m$ 18, 7 m$ 6. 8% 8. 0% 0 m$ es fe tiz ed Fo ca lin X Am or on e st ile M s r he Ot n la re lin ta R / Ri Ve LA in ax el Sk EDT business 24, 8% Tr ico r 0. 0% 724, 3 m$ 86. 5% 0. 2% es ya lti Ro ip i m e 1, 7 m$ 1. 6% 2. 0% lt am ac t 13, 2 m$ M ax Annual Report 2009 Az Ty sa br i 9. 7% 16, 5 m$ ia 81, 4 m$ Pr Bio. Neurology business 75, 2% 54

Total product revenue for 2009 106 m$ 38. 4% 61, 6 m$ 22. 3% 32, 6 m$ 11. 8% 34, 9 m$ 12. 6% 22, 1 m$ 18, 7 m$ 6. 8% 8. 0% 0 m$ es fe tiz ed Fo ca lin X Am or on e st ile M s r he Ot n la re lin ta R / Ri Ve LA in ax el Sk EDT business 24, 8% Tr ico r 0. 0% 724, 3 m$ 86. 5% 0. 2% es ya lti Ro ip i m e 1, 7 m$ 1. 6% 2. 0% lt am ac t 13, 2 m$ M ax Annual Report 2009 Az Ty sa br i 9. 7% 16, 5 m$ ia 81, 4 m$ Pr Bio. Neurology business 75, 2% 54

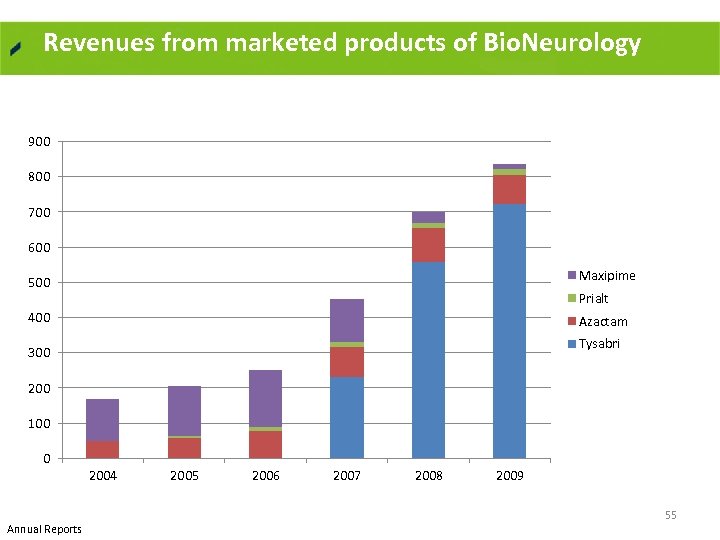

Revenues from marketed products of Bio. Neurology 900 800 700 600 500 Maxipime 400 Azactam Prialt Tysabri 300 200 100 0 2004 Annual Reports 2005 2006 2007 2008 2009 55

Revenues from marketed products of Bio. Neurology 900 800 700 600 500 Maxipime 400 Azactam Prialt Tysabri 300 200 100 0 2004 Annual Reports 2005 2006 2007 2008 2009 55

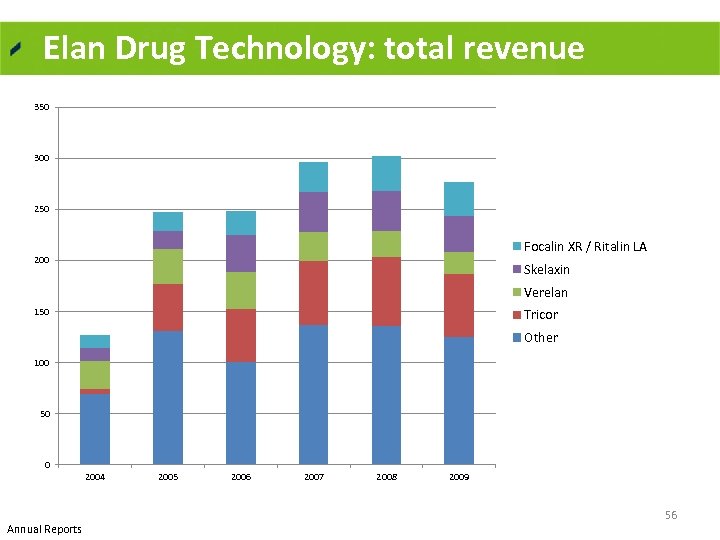

Elan Drug Technology: total revenue 350 300 250 Focalin XR / Ritalin LA 200 Skelaxin Verelan 150 Tricor Other 100 50 0 2004 Annual Reports 2005 2006 2007 2008 2009 56

Elan Drug Technology: total revenue 350 300 250 Focalin XR / Ritalin LA 200 Skelaxin Verelan 150 Tricor Other 100 50 0 2004 Annual Reports 2005 2006 2007 2008 2009 56

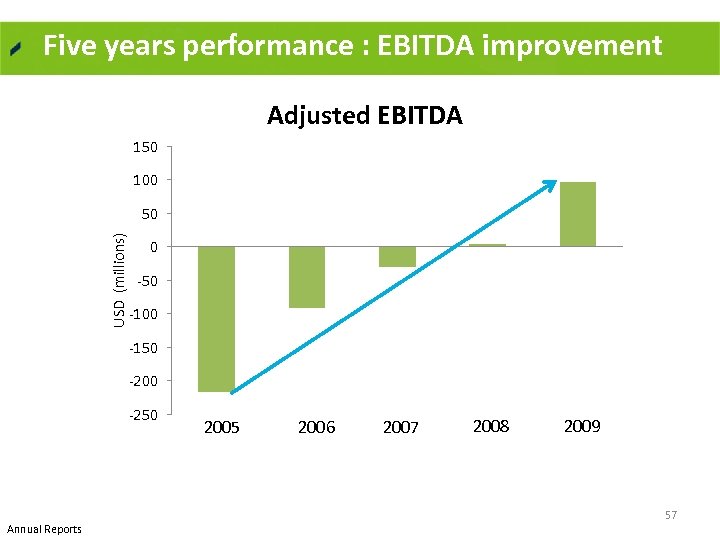

Five years performance : EBITDA improvement Adjusted EBITDA 150 100 USD (millions) 50 0 50 100 150 200 250 Annual Reports 2005 2006 2007 2008 2009 57

Five years performance : EBITDA improvement Adjusted EBITDA 150 100 USD (millions) 50 0 50 100 150 200 250 Annual Reports 2005 2006 2007 2008 2009 57

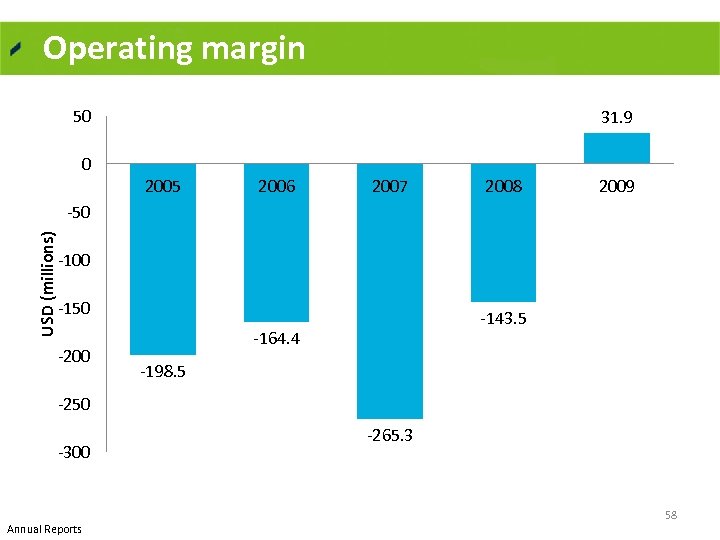

Operating margin 50 0 31. 9 2005 2006 2007 2008 2009 USD (millions) 50 100 150 200 143. 5 164. 4 198. 5 250 300 Annual Reports 265. 3 58

Operating margin 50 0 31. 9 2005 2006 2007 2008 2009 USD (millions) 50 100 150 200 143. 5 164. 4 198. 5 250 300 Annual Reports 265. 3 58

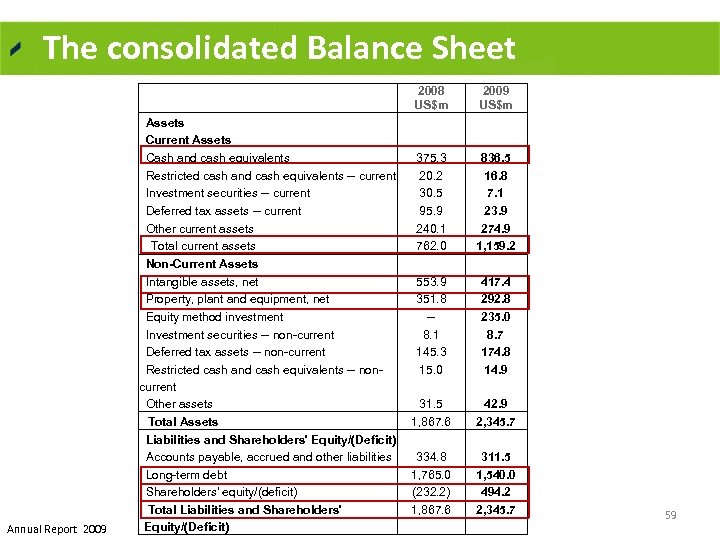

The consolidated Balance Sheet 2008 US$m Annual Report 2009 Assets Current Assets Cash and cash equivalents Restricted cash and cash equivalents -- current Investment securities -- current Deferred tax assets -- current Other current assets Total current assets Non-Current Assets Intangible assets, net Property, plant and equipment, net Equity method investment Investment securities -- non-current Deferred tax assets -- non-current Restricted cash and cash equivalents -- noncurrent Other assets Total Assets Liabilities and Shareholders' Equity/(Deficit) Accounts payable, accrued and other liabilities Long-term debt Shareholders' equity/(deficit) Total Liabilities and Shareholders' Equity/(Deficit) 2009 US$m 375. 3 20. 2 30. 5 95. 9 240. 1 762. 0 836. 5 16. 8 7. 1 23. 9 274. 9 1, 159. 2 553. 9 351. 8 -8. 1 145. 3 15. 0 417. 4 292. 8 235. 0 8. 7 174. 8 14. 9 31. 5 1, 867. 6 42. 9 2, 345. 7 334. 8 1, 765. 0 (232. 2) 1, 867. 6 311. 5 1, 540. 0 494. 2 2, 345. 7 59

The consolidated Balance Sheet 2008 US$m Annual Report 2009 Assets Current Assets Cash and cash equivalents Restricted cash and cash equivalents -- current Investment securities -- current Deferred tax assets -- current Other current assets Total current assets Non-Current Assets Intangible assets, net Property, plant and equipment, net Equity method investment Investment securities -- non-current Deferred tax assets -- non-current Restricted cash and cash equivalents -- noncurrent Other assets Total Assets Liabilities and Shareholders' Equity/(Deficit) Accounts payable, accrued and other liabilities Long-term debt Shareholders' equity/(deficit) Total Liabilities and Shareholders' Equity/(Deficit) 2009 US$m 375. 3 20. 2 30. 5 95. 9 240. 1 762. 0 836. 5 16. 8 7. 1 23. 9 274. 9 1, 159. 2 553. 9 351. 8 -8. 1 145. 3 15. 0 417. 4 292. 8 235. 0 8. 7 174. 8 14. 9 31. 5 1, 867. 6 42. 9 2, 345. 7 334. 8 1, 765. 0 (232. 2) 1, 867. 6 311. 5 1, 540. 0 494. 2 2, 345. 7 59

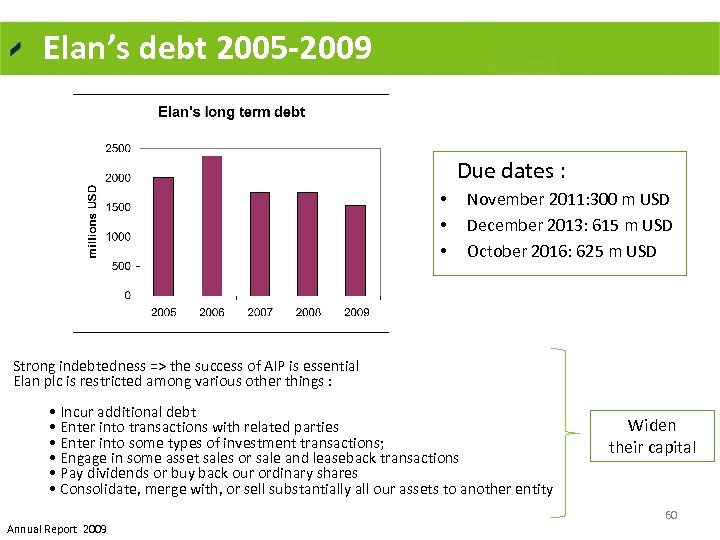

Elan’s debt 2005 -2009 Due dates : • • • November 2011: 300 m USD December 2013: 615 m USD October 2016: 625 m USD Strong indebtedness => the success of AIP is essential Elan plc is restricted among various other things : • Incur additional debt • Enter into transactions with related parties • Enter into some types of investment transactions; • Engage in some asset sales or sale and leaseback transactions • Pay dividends or buy back our ordinary shares • Consolidate, merge with, or sell substantially all our assets to another entity Annual Report 2009 Widen their capital 60

Elan’s debt 2005 -2009 Due dates : • • • November 2011: 300 m USD December 2013: 615 m USD October 2016: 625 m USD Strong indebtedness => the success of AIP is essential Elan plc is restricted among various other things : • Incur additional debt • Enter into transactions with related parties • Enter into some types of investment transactions; • Engage in some asset sales or sale and leaseback transactions • Pay dividends or buy back our ordinary shares • Consolidate, merge with, or sell substantially all our assets to another entity Annual Report 2009 Widen their capital 60

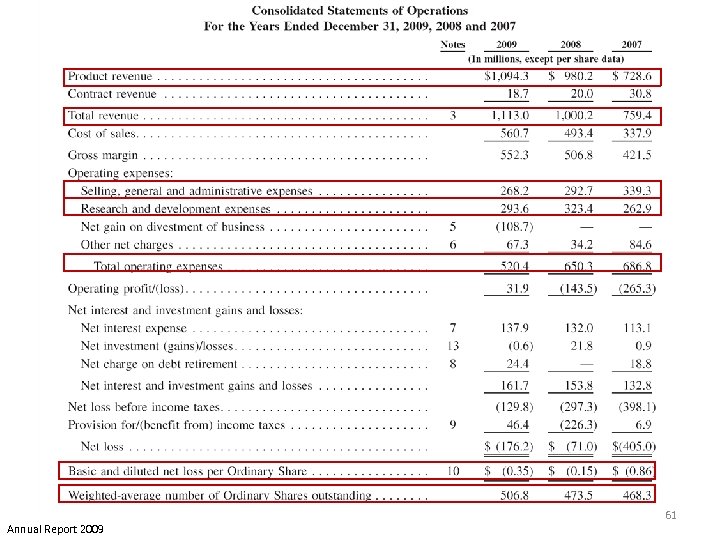

Annual Report 2009 61

Annual Report 2009 61

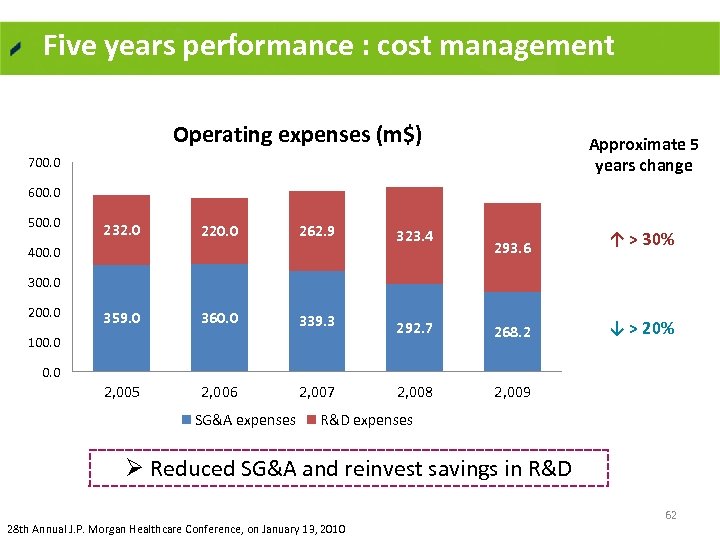

Five years performance : cost management Operating expenses (m$) Approximate 5 years change 700. 0 600. 0 500. 0 232. 0 220. 0 262. 9 323. 4 359. 0 360. 0 339. 3 2, 005 2, 006 2, 007 400. 0 293. 6 ↑ > 30% 292. 7 268. 2 ↓ > 20% 2, 008 2, 009 300. 0 200. 0 100. 0 SG&A expenses R&D expenses Ø Reduced SG&A and reinvest savings in R&D 28 th Annual J. P. Morgan Healthcare Conference, on January 13, 2010 62

Five years performance : cost management Operating expenses (m$) Approximate 5 years change 700. 0 600. 0 500. 0 232. 0 220. 0 262. 9 323. 4 359. 0 360. 0 339. 3 2, 005 2, 006 2, 007 400. 0 293. 6 ↑ > 30% 292. 7 268. 2 ↓ > 20% 2, 008 2, 009 300. 0 200. 0 100. 0 SG&A expenses R&D expenses Ø Reduced SG&A and reinvest savings in R&D 28 th Annual J. P. Morgan Healthcare Conference, on January 13, 2010 62

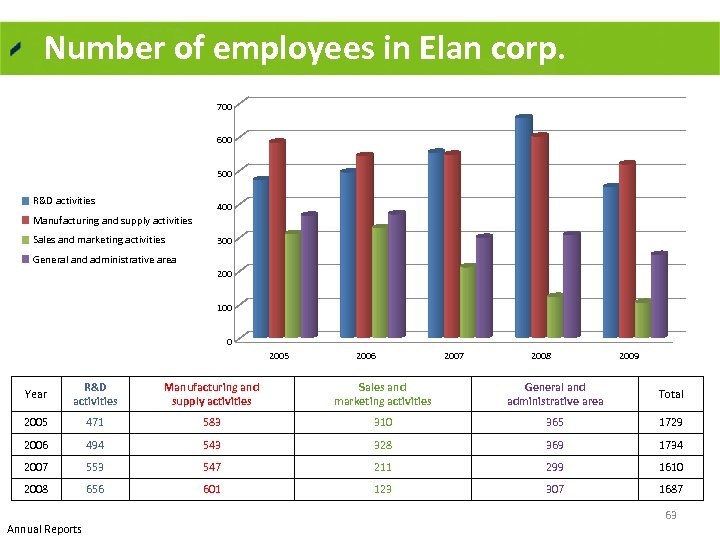

Number of employees in Elan corp. 700 600 500 R&D activities 400 Manufacturing and supply activities Sales and marketing activities 300 General and administrative area 200 100 0 2005 2006 2007 2008 2009 Year R&D activities Manufacturing and supply activities Sales and marketing activities General and administrative area Total 2005 471 583 310 365 1729 2006 494 543 328 369 1734 2007 553 547 211 299 1610 2008 656 601 123 307 1687 Annual Reports 63

Number of employees in Elan corp. 700 600 500 R&D activities 400 Manufacturing and supply activities Sales and marketing activities 300 General and administrative area 200 100 0 2005 2006 2007 2008 2009 Year R&D activities Manufacturing and supply activities Sales and marketing activities General and administrative area Total 2005 471 583 310 365 1729 2006 494 543 328 369 1734 2007 553 547 211 299 1610 2008 656 601 123 307 1687 Annual Reports 63

Elan’s lawsuits 2002 Elan vs Wolf Popper LLP 2009 Elan/J&J vs Biogen 2008 Elan vs Shareholders 64

Elan’s lawsuits 2002 Elan vs Wolf Popper LLP 2009 Elan/J&J vs Biogen 2008 Elan vs Shareholders 64

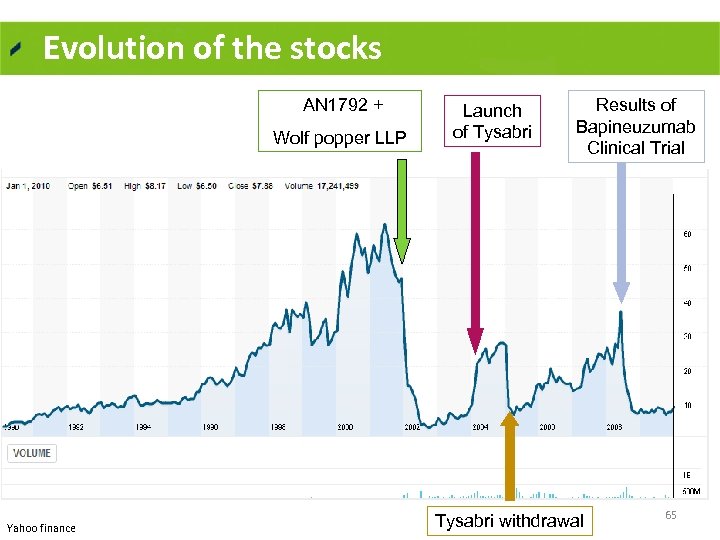

Evolution of the stocks AN 1792 + Wolf popper LLP Yahoo finance Launch of Tysabri Results of Bapineuzumab Clinical Trial Tysabri withdrawal 65

Evolution of the stocks AN 1792 + Wolf popper LLP Yahoo finance Launch of Tysabri Results of Bapineuzumab Clinical Trial Tysabri withdrawal 65

Strengths Weaknesses • Leadership position in drug delivery §Important endebtedness • Tysabri, its key product, sustaining the revenue growth • patent expiry and risk of generic competition • Strategic alliances bolstering the company’s business • Geographic concentration enhancing business risk • Tysabri marketing restricted indications affecting Elan’s business Elan Corp. Opportunities Threats • Focus on Alzheimer’s market, could be a source of revenues • Intense competition from Avonex, Rebif against • Benefits to accrue from growing incidences of neurological disorders • Patent expiries could affect company’s Revenues • Favorable demographic shift increasing Alzheimer drug market Tysabri in the MS drug market. • Legal proceedings could affect company’s Reputation • Reimbursement policies could affect company’s product sale 66

Strengths Weaknesses • Leadership position in drug delivery §Important endebtedness • Tysabri, its key product, sustaining the revenue growth • patent expiry and risk of generic competition • Strategic alliances bolstering the company’s business • Geographic concentration enhancing business risk • Tysabri marketing restricted indications affecting Elan’s business Elan Corp. Opportunities Threats • Focus on Alzheimer’s market, could be a source of revenues • Intense competition from Avonex, Rebif against • Benefits to accrue from growing incidences of neurological disorders • Patent expiries could affect company’s Revenues • Favorable demographic shift increasing Alzheimer drug market Tysabri in the MS drug market. • Legal proceedings could affect company’s Reputation • Reimbursement policies could affect company’s product sale 66

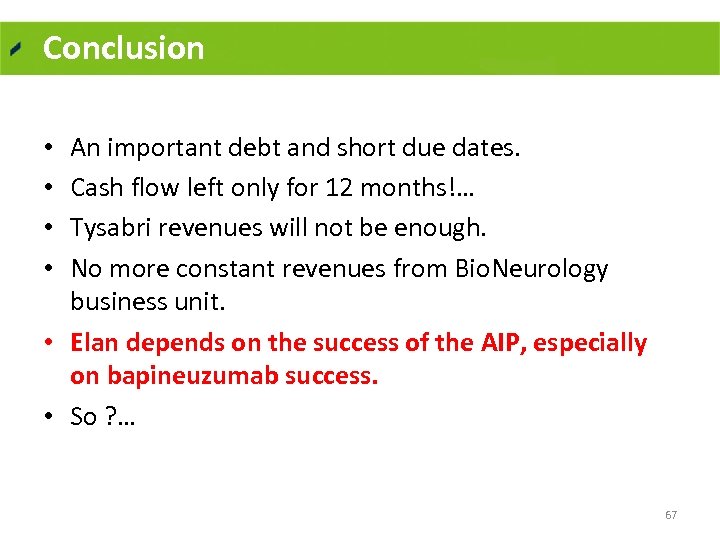

Conclusion An important debt and short due dates. Cash flow left only for 12 months!… Tysabri revenues will not be enough. No more constant revenues from Bio. Neurology business unit. • Elan depends on the success of the AIP, especially on bapineuzumab success. • So ? … • • 67

Conclusion An important debt and short due dates. Cash flow left only for 12 months!… Tysabri revenues will not be enough. No more constant revenues from Bio. Neurology business unit. • Elan depends on the success of the AIP, especially on bapineuzumab success. • So ? … • • 67

Thanks for your attention! Any question? 68

Thanks for your attention! Any question? 68