5946a7ee2cc0474c7b28c59d1fa83b98.ppt

- Количество слайдов: 26

El Dorado: using the Netherlands to avoid tax in Greece Campaigning against mailbox companies Centre for Research on Multinational Corporations (SOMO) Re. INFORM info evening, Joe’s Garage, Amsterdam, 8. 12. 2013

El Dorado: using the Netherlands to avoid tax in Greece Campaigning against mailbox companies Centre for Research on Multinational Corporations (SOMO) Re. INFORM info evening, Joe’s Garage, Amsterdam, 8. 12. 2013

The focus of this presentation: 1. 2. 3. 4. 5. 6. Why bother with tax? Types of business taxation and tax avoidance El Dorado’s company structure and Dutch subsidiaries Tax justice campaigning Intervention possibilities in the Netherlands Follow-up

The focus of this presentation: 1. 2. 3. 4. 5. 6. Why bother with tax? Types of business taxation and tax avoidance El Dorado’s company structure and Dutch subsidiaries Tax justice campaigning Intervention possibilities in the Netherlands Follow-up

Why bother with tax? n Revenue > provide essential services and infrastructure n Redistribution > of wealth from rich to poor n Repricing > can stimulate e. g. ‘green’ economy and discourage ‘unsustainable’ economic activities n Representation > increases people’s say over politics n But: Ø Corporations and wealthy individuals avoid/evade tax Ø Corporation tax has decreased with neo-liberal reforms

Why bother with tax? n Revenue > provide essential services and infrastructure n Redistribution > of wealth from rich to poor n Repricing > can stimulate e. g. ‘green’ economy and discourage ‘unsustainable’ economic activities n Representation > increases people’s say over politics n But: Ø Corporations and wealthy individuals avoid/evade tax Ø Corporation tax has decreased with neo-liberal reforms

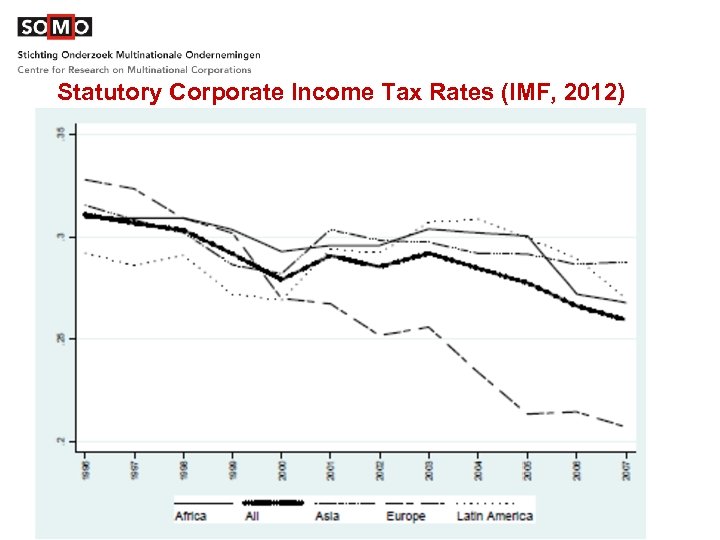

Statutory Corporate Income Tax Rates (IMF, 2012)

Statutory Corporate Income Tax Rates (IMF, 2012)

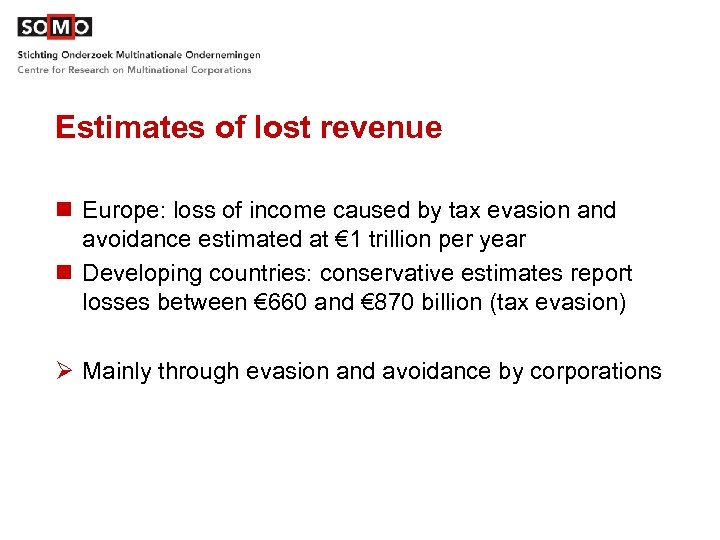

Estimates of lost revenue n Europe: loss of income caused by tax evasion and avoidance estimated at € 1 trillion per year n Developing countries: conservative estimates report losses between € 660 and € 870 billion (tax evasion) Ø Mainly through evasion and avoidance by corporations

Estimates of lost revenue n Europe: loss of income caused by tax evasion and avoidance estimated at € 1 trillion per year n Developing countries: conservative estimates report losses between € 660 and € 870 billion (tax evasion) Ø Mainly through evasion and avoidance by corporations

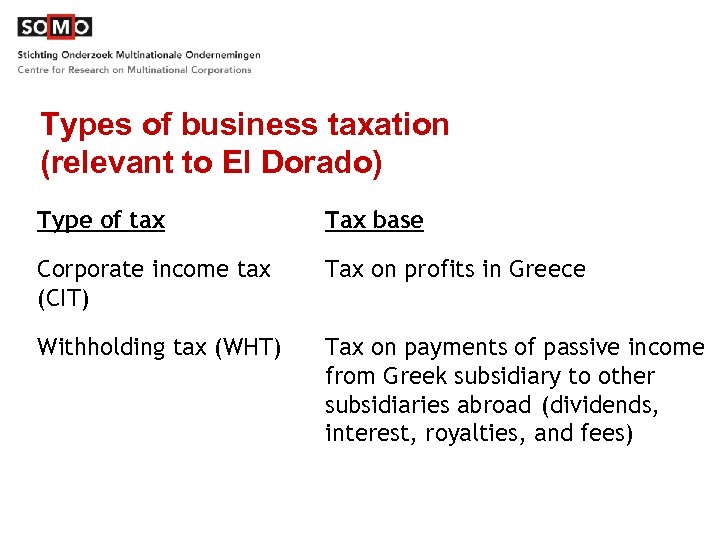

Types of business taxation (relevant to El Dorado) Type of tax Tax base Corporate income tax (CIT) Tax on profits in Greece Withholding tax (WHT) Tax on payments of passive income from Greek subsidiary to other subsidiaries abroad (dividends, interest, royalties, and fees)

Types of business taxation (relevant to El Dorado) Type of tax Tax base Corporate income tax (CIT) Tax on profits in Greece Withholding tax (WHT) Tax on payments of passive income from Greek subsidiary to other subsidiaries abroad (dividends, interest, royalties, and fees)

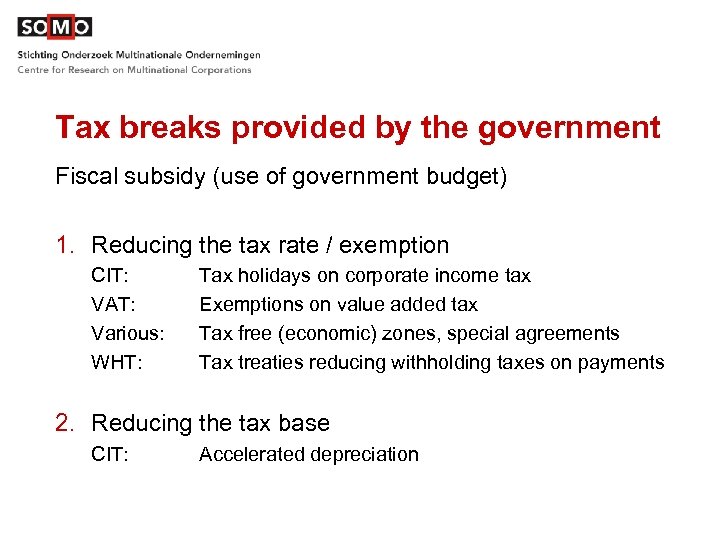

Tax breaks provided by the government Fiscal subsidy (use of government budget) 1. Reducing the tax rate / exemption CIT: VAT: Various: WHT: Tax holidays on corporate income tax Exemptions on value added tax Tax free (economic) zones, special agreements Tax treaties reducing withholding taxes on payments 2. Reducing the tax base CIT: Accelerated depreciation

Tax breaks provided by the government Fiscal subsidy (use of government budget) 1. Reducing the tax rate / exemption CIT: VAT: Various: WHT: Tax holidays on corporate income tax Exemptions on value added tax Tax free (economic) zones, special agreements Tax treaties reducing withholding taxes on payments 2. Reducing the tax base CIT: Accelerated depreciation

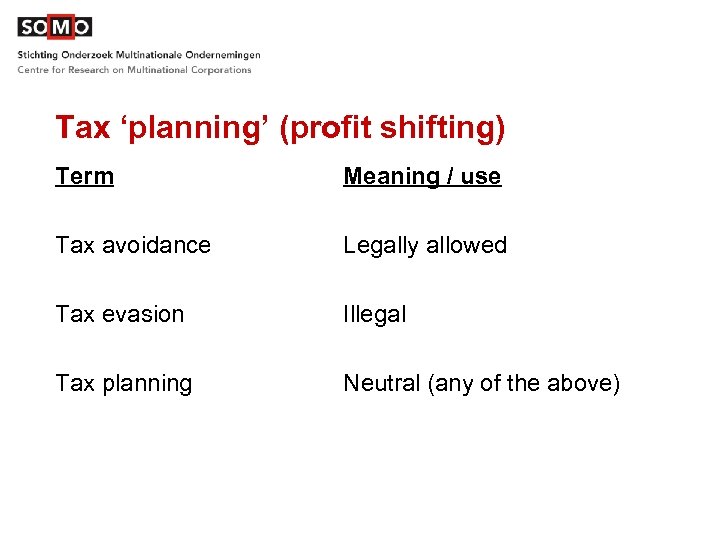

Tax ‘planning’ (profit shifting) Term Meaning / use Tax avoidance Legally allowed Tax evasion Illegal Tax planning Neutral (any of the above)

Tax ‘planning’ (profit shifting) Term Meaning / use Tax avoidance Legally allowed Tax evasion Illegal Tax planning Neutral (any of the above)

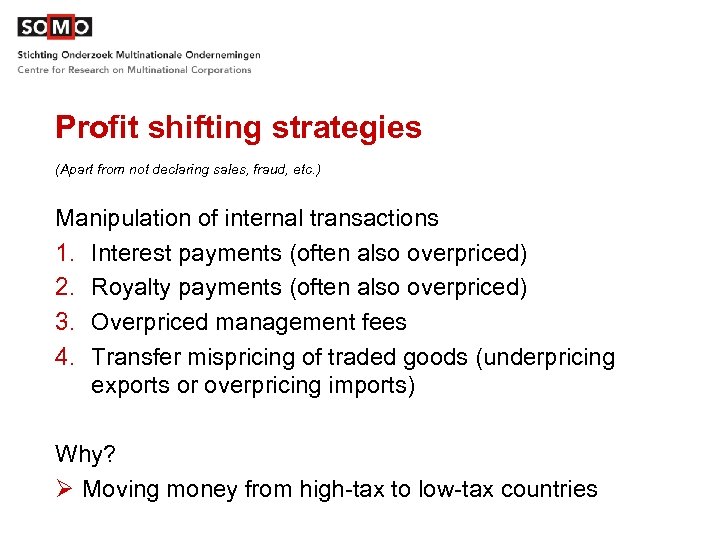

Profit shifting strategies (Apart from not declaring sales, fraud, etc. ) Manipulation of internal transactions 1. Interest payments (often also overpriced) 2. Royalty payments (often also overpriced) 3. Overpriced management fees 4. Transfer mispricing of traded goods (underpricing exports or overpricing imports) Why? Ø Moving money from high-tax to low-tax countries

Profit shifting strategies (Apart from not declaring sales, fraud, etc. ) Manipulation of internal transactions 1. Interest payments (often also overpriced) 2. Royalty payments (often also overpriced) 3. Overpriced management fees 4. Transfer mispricing of traded goods (underpricing exports or overpricing imports) Why? Ø Moving money from high-tax to low-tax countries

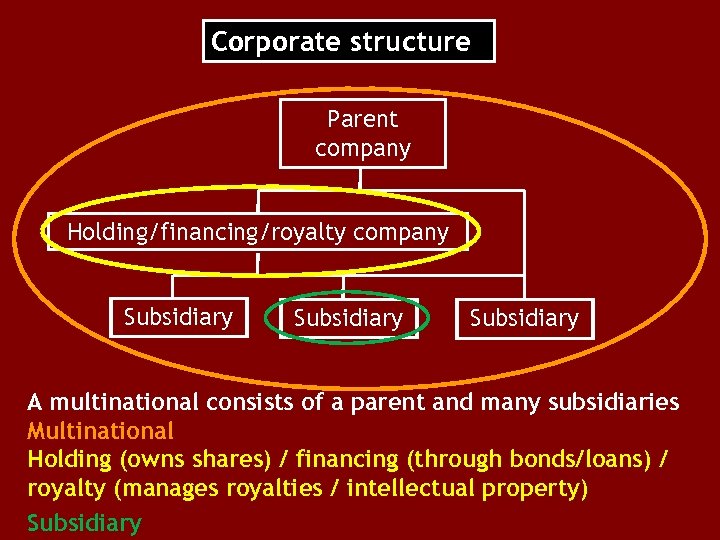

Corporate structure Parent company Holding/financing/royalty company Subsidiary A multinational consists of a parent and many subsidiaries Multinational Holding (owns shares) / financing (through bonds/loans) / royalty (manages royalties / intellectual property) Subsidiary

Corporate structure Parent company Holding/financing/royalty company Subsidiary A multinational consists of a parent and many subsidiaries Multinational Holding (owns shares) / financing (through bonds/loans) / royalty (manages royalties / intellectual property) Subsidiary

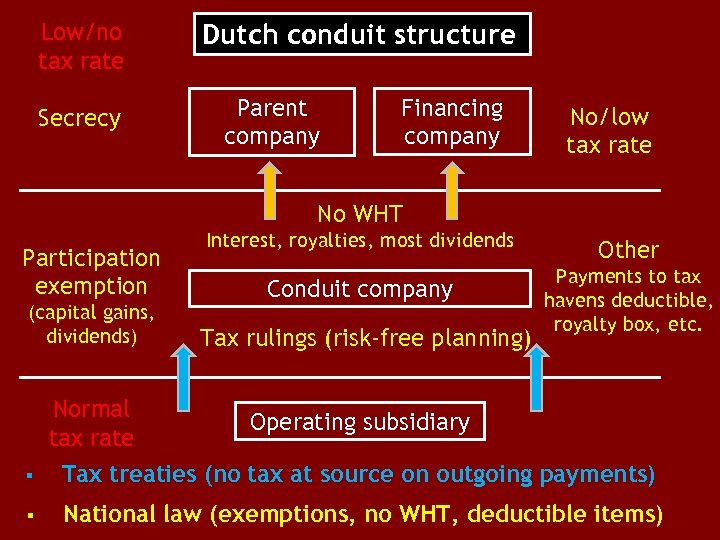

3 types of Dutch conduit companies 1. Financing companies (loans & interest) 2. Holding companies (capital & dividens) 3. Royalty companies (rights & royalties) Type of tax Tax base Corporate income tax (CIT) Tax on profits in Greece Withholding tax (WHT) Tax on payments of passive income from Greek subsidiary to other subsidiaries abroad (dividends, interest, royalties, and fees)

3 types of Dutch conduit companies 1. Financing companies (loans & interest) 2. Holding companies (capital & dividens) 3. Royalty companies (rights & royalties) Type of tax Tax base Corporate income tax (CIT) Tax on profits in Greece Withholding tax (WHT) Tax on payments of passive income from Greek subsidiary to other subsidiaries abroad (dividends, interest, royalties, and fees)

Low/no tax rate Secrecy Dutch conduit structure Parent company Financing company No/low tax rate No WHT Participation exemption (capital gains, dividends) Normal tax rate Interest, royalties, most dividends Other Conduit company Payments to tax havens deductible, royalty box, etc. Tax rulings (risk-free planning) Operating subsidiary § Tax treaties (no tax at source on outgoing payments) § National law (exemptions, no WHT, deductible items)

Low/no tax rate Secrecy Dutch conduit structure Parent company Financing company No/low tax rate No WHT Participation exemption (capital gains, dividends) Normal tax rate Interest, royalties, most dividends Other Conduit company Payments to tax havens deductible, royalty box, etc. Tax rulings (risk-free planning) Operating subsidiary § Tax treaties (no tax at source on outgoing payments) § National law (exemptions, no WHT, deductible items)

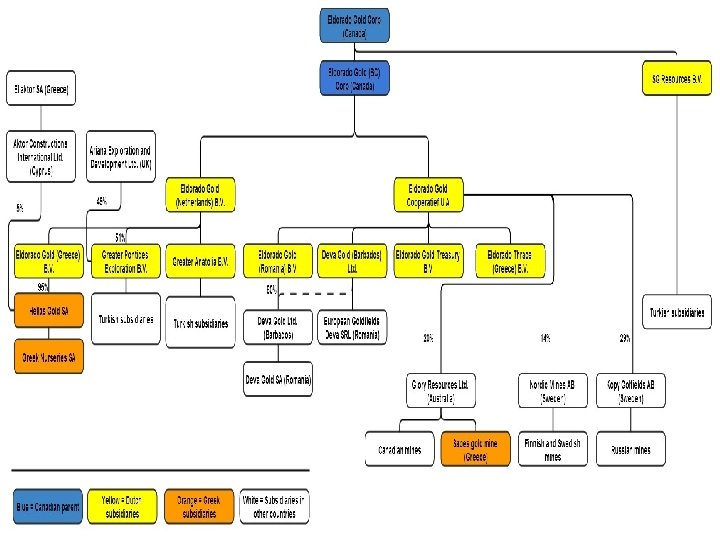

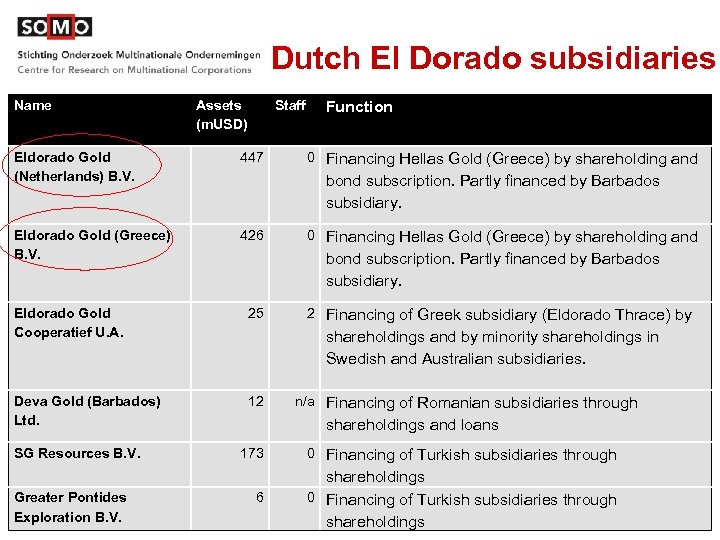

Dutch El Dorado subsidiaries Name Assets (m. USD) Staff Eldorado Gold (Netherlands) B. V. 447 Eldorado Gold (Greece) B. V. 426 0 Financing Hellas Gold (Greece) by shareholding and bond subscription. Partly financed by Barbados subsidiary. 25 Deva Gold (Barbados) Ltd. 12 Greater Pontides Exploration B. V. 0 Financing Hellas Gold (Greece) by shareholding and bond subscription. Partly financed by Barbados subsidiary. Eldorado Gold Cooperatief U. A. SG Resources B. V. Function 2 Financing of Greek subsidiary (Eldorado Thrace) by shareholdings and by minority shareholdings in Swedish and Australian subsidiaries. n/a Financing of Romanian subsidiaries through shareholdings and loans 173 0 Financing of Turkish subsidiaries through 6 shareholdings 0 Financing of Turkish subsidiaries through shareholdings

Dutch El Dorado subsidiaries Name Assets (m. USD) Staff Eldorado Gold (Netherlands) B. V. 447 Eldorado Gold (Greece) B. V. 426 0 Financing Hellas Gold (Greece) by shareholding and bond subscription. Partly financed by Barbados subsidiary. 25 Deva Gold (Barbados) Ltd. 12 Greater Pontides Exploration B. V. 0 Financing Hellas Gold (Greece) by shareholding and bond subscription. Partly financed by Barbados subsidiary. Eldorado Gold Cooperatief U. A. SG Resources B. V. Function 2 Financing of Greek subsidiary (Eldorado Thrace) by shareholdings and by minority shareholdings in Swedish and Australian subsidiaries. n/a Financing of Romanian subsidiaries through shareholdings and loans 173 0 Financing of Turkish subsidiaries through 6 shareholdings 0 Financing of Turkish subsidiaries through shareholdings

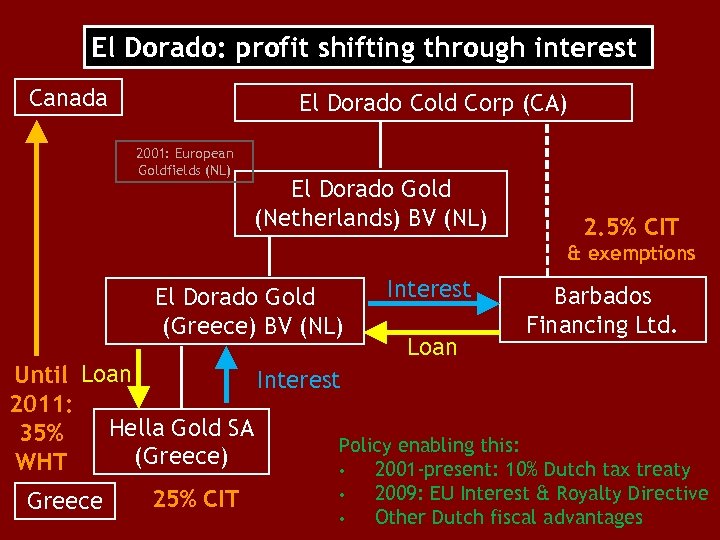

El Dorado: profit shifting through interest Canada El Dorado Cold Corp (CA) 2001: European Goldfields (NL) El Dorado Gold (Netherlands) BV (NL) 2. 5% CIT & exemptions El Dorado Gold (Greece) BV (NL) Interest Loan Barbados Financing Ltd. Until Loan Interest 2011: Hella Gold SA 35% Policy enabling this: (Greece) WHT • 2001 -present: 10% Dutch tax treaty Greece 25% CIT • • 2009: EU Interest & Royalty Directive Other Dutch fiscal advantages

El Dorado: profit shifting through interest Canada El Dorado Cold Corp (CA) 2001: European Goldfields (NL) El Dorado Gold (Netherlands) BV (NL) 2. 5% CIT & exemptions El Dorado Gold (Greece) BV (NL) Interest Loan Barbados Financing Ltd. Until Loan Interest 2011: Hella Gold SA 35% Policy enabling this: (Greece) WHT • 2001 -present: 10% Dutch tax treaty Greece 25% CIT • • 2009: EU Interest & Royalty Directive Other Dutch fiscal advantages

El Dorado’s gain - Greece’s loss n Withholding tax on all outgoing payments that Greece has missed since Hellas Gold SA has been paying interest to a Dutch company rather than a Canadian company. n Foregone CIT on the profits that have been artificially reduced by interest payments to NL for bond loans: (total amount of interest deducted from Greek taxable profits and eventually collected in Barbados. This multiplied by Greek CIT is a revenue loss. n In case a shareholding in Hellas Gold SA is sold, the sales profits can be received tax exempt in NL.

El Dorado’s gain - Greece’s loss n Withholding tax on all outgoing payments that Greece has missed since Hellas Gold SA has been paying interest to a Dutch company rather than a Canadian company. n Foregone CIT on the profits that have been artificially reduced by interest payments to NL for bond loans: (total amount of interest deducted from Greek taxable profits and eventually collected in Barbados. This multiplied by Greek CIT is a revenue loss. n In case a shareholding in Hellas Gold SA is sold, the sales profits can be received tax exempt in NL.

Conclusion n Mailboxes allow for tax avoidance and opportunity to stop policy choices in the public interest (BITs). Ø What to do about it?

Conclusion n Mailboxes allow for tax avoidance and opportunity to stop policy choices in the public interest (BITs). Ø What to do about it?

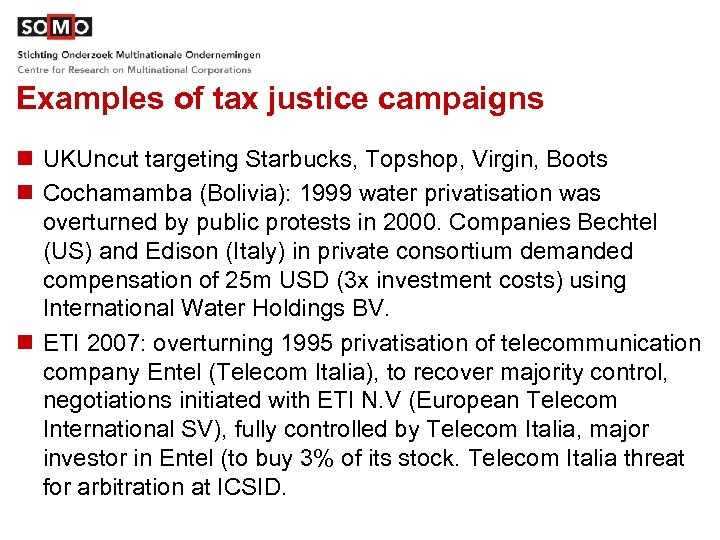

Examples of tax justice campaigns n UKUncut targeting Starbucks, Topshop, Virgin, Boots n Cochamamba (Bolivia): 1999 water privatisation was overturned by public protests in 2000. Companies Bechtel (US) and Edison (Italy) in private consortium demanded compensation of 25 m USD (3 x investment costs) using International Water Holdings BV. n ETI 2007: overturning 1995 privatisation of telecommunication company Entel (Telecom Italia), to recover majority control, negotiations initiated with ETI N. V (European Telecom International SV), fully controlled by Telecom Italia, major investor in Entel (to buy 3% of its stock. Telecom Italia threat for arbitration at ICSID.

Examples of tax justice campaigns n UKUncut targeting Starbucks, Topshop, Virgin, Boots n Cochamamba (Bolivia): 1999 water privatisation was overturned by public protests in 2000. Companies Bechtel (US) and Edison (Italy) in private consortium demanded compensation of 25 m USD (3 x investment costs) using International Water Holdings BV. n ETI 2007: overturning 1995 privatisation of telecommunication company Entel (Telecom Italia), to recover majority control, negotiations initiated with ETI N. V (European Telecom International SV), fully controlled by Telecom Italia, major investor in Entel (to buy 3% of its stock. Telecom Italia threat for arbitration at ICSID.

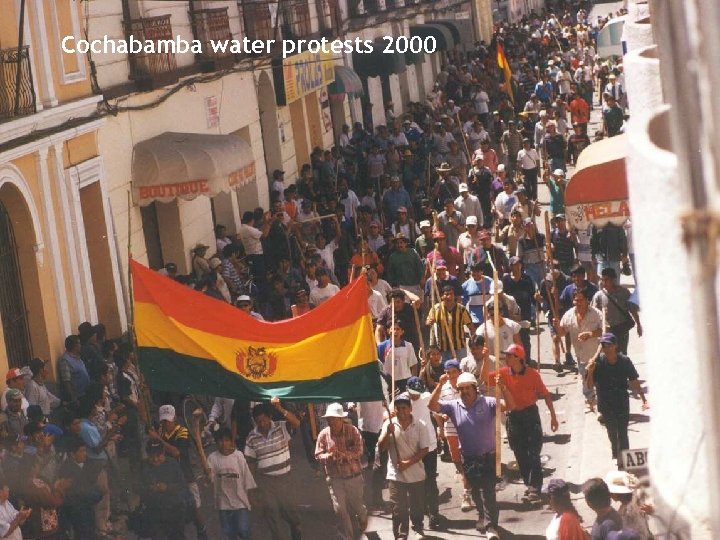

Cochabamba water protests 2000

Cochabamba water protests 2000

idarity action at Amsterdam trust offices

idarity action at Amsterdam trust offices

ETI solidarity action 2008

ETI solidarity action 2008

Follow up n n n n Set out campaign strategy Company research training Publication (naming and shaming) Media campaign (journalists and social media) Political parties and parliamentary questions Civil society networks Political targets: – Role of the Netherlands – Greek parliament – EU parliament

Follow up n n n n Set out campaign strategy Company research training Publication (naming and shaming) Media campaign (journalists and social media) Political parties and parliamentary questions Civil society networks Political targets: – Role of the Netherlands – Greek parliament – EU parliament

Follow up (2) n Identify indirect and direct state support – For example Export Development Canada; other export credit agencies and development banks (loans and subsidies) n Shareholders and investors campaign (Eerlijke Bankwijzer) n Dutch Business and Human Rights Agenda (extraterritorial obligations) n OECD complaint at National Contact Point (simultaneously in the Netherlands and Canada) – – Violations of disclosure principles Tax evasion Human rights violation Environmental law violations

Follow up (2) n Identify indirect and direct state support – For example Export Development Canada; other export credit agencies and development banks (loans and subsidies) n Shareholders and investors campaign (Eerlijke Bankwijzer) n Dutch Business and Human Rights Agenda (extraterritorial obligations) n OECD complaint at National Contact Point (simultaneously in the Netherlands and Canada) – – Violations of disclosure principles Tax evasion Human rights violation Environmental law violations

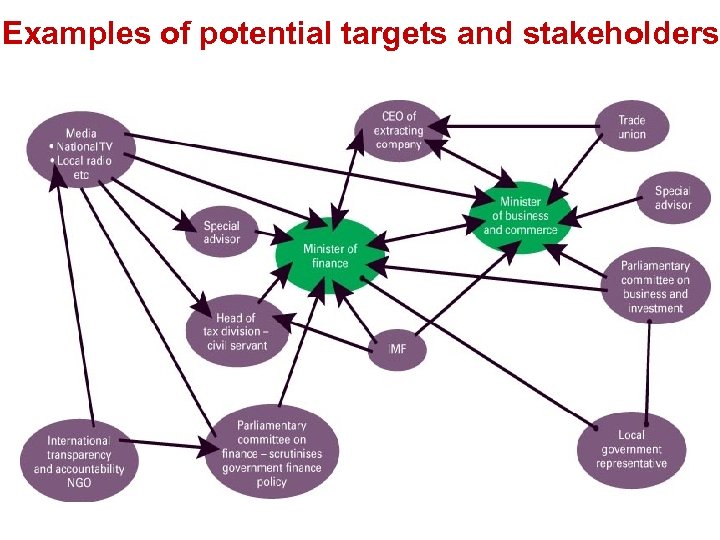

Examples of potential targets and stakeholders

Examples of potential targets and stakeholders

More info n Campaigning & research Tax Justice Toolkit for civil society groups (how to develop tax justice campaigns and research) http: //taxjusticetoolkit. org/ Activist Tax Toolkit developed by UK Citizens Online: http: //taxhaventoolkit. wordpress. com/ http: //globalinfo. nl news portal on globalisation, political-economy and actions n SOMO on tax and investment protection in the Netherlands http: //somo. nl/dossiers-en/economic-reform/trade-investment http: //somo. nl/themes-en/tax-justice n Dutch mailbox companies in Bolivia De Dutch Connection. Wateroorlog Cochabamba en de ING, http: //www. noticias. nl/de-dutchconnection The Story of a Dutch Letterbox which Could Cost Bolivia a Fortune, http: //archive. corporateeurope. org/bolivia-eti. html

More info n Campaigning & research Tax Justice Toolkit for civil society groups (how to develop tax justice campaigns and research) http: //taxjusticetoolkit. org/ Activist Tax Toolkit developed by UK Citizens Online: http: //taxhaventoolkit. wordpress. com/ http: //globalinfo. nl news portal on globalisation, political-economy and actions n SOMO on tax and investment protection in the Netherlands http: //somo. nl/dossiers-en/economic-reform/trade-investment http: //somo. nl/themes-en/tax-justice n Dutch mailbox companies in Bolivia De Dutch Connection. Wateroorlog Cochabamba en de ING, http: //www. noticias. nl/de-dutchconnection The Story of a Dutch Letterbox which Could Cost Bolivia a Fortune, http: //archive. corporateeurope. org/bolivia-eti. html