dfba541619b18eb51a982f2c1d98cdf6.ppt

- Количество слайдов: 23

EIB financing for energy efficiency Anton Rop, Vice-President European Investment Bank ICPE Conference Ljubljana, 24 October 2012 3/16/2018 1

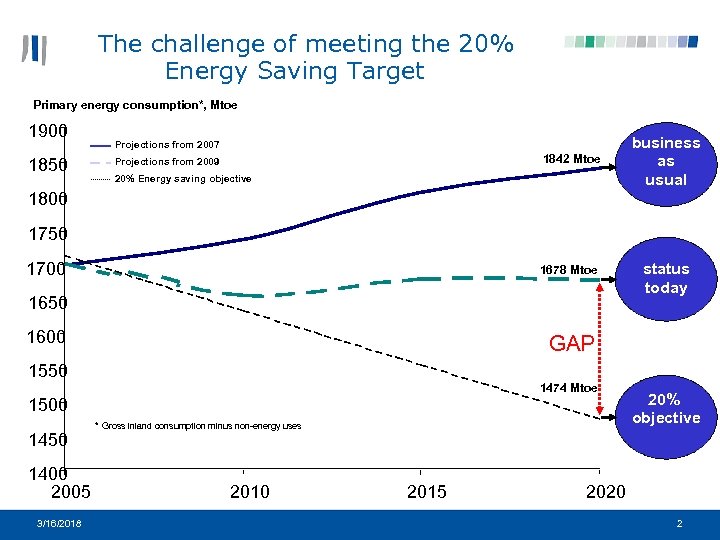

The challenge of meeting the 20% Energy Saving Target Primary energy consumption*, Mtoe 1900 1850 Projections from 2007 1842 Mtoe Projections from 2009 20% Energy saving objective business as usual 1800 1750 1700 1678 Mtoe 1650 1600 status today GAP 1550 1474 Mtoe 1500 1450 1400 2005 3/16/2018 * Gross inland consumption minus non-energy uses 2010 2015 20% objective 2020 2

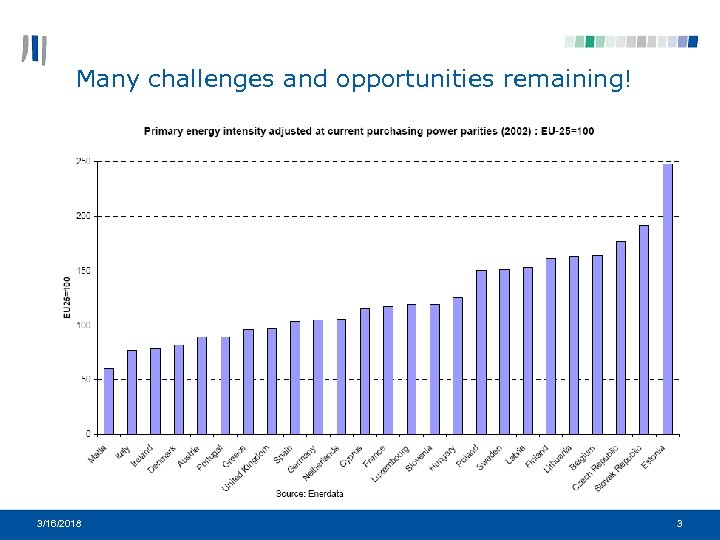

Many challenges and opportunities remaining! 3/16/2018 3

The European Investment Bank (EIB) – European priority objectives Within the Union: Cohesion and convergence Small and medium-sized enterprises (SMEs) Environmental sustainability Knowledge Economy Trans-European Networks (TENs) Sustainable, competitive and secure energy 3/16/2018 4

EIB in supporting the EU energy policy Five priority lending areas: - Renewable energy - Energy efficiency - RDI in energy - Diversification and security of internal supply (incl. TEN-E) - External energy security and economic development EIB Energy Policy Document (currently being updated. ) EIB has substantial experience in energy technologies Broad range of financial products Technical Assistance available for project preparation 3/16/2018 5

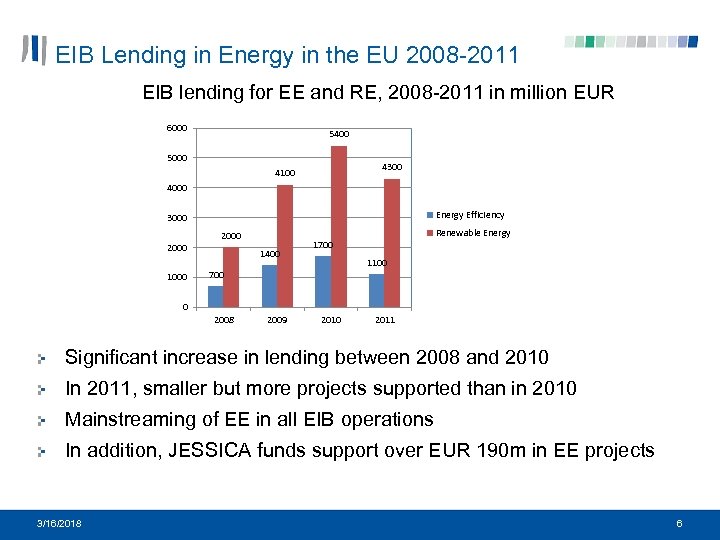

EIB Lending in Energy in the EU 2008 -2011 EIB lending for EE and RE, 2008 -2011 in million EUR 6000 5400 5000 4300 4100 4000 Energy Efficiency 3000 2000 1400 Renewable Energy 1700 1100 700 0 2008 2009 2010 2011 Significant increase in lending between 2008 and 2010 In 2011, smaller but more projects supported than in 2010 Mainstreaming of EE in all EIB operations In addition, JESSICA funds support over EUR 190 m in EE projects 3/16/2018 6

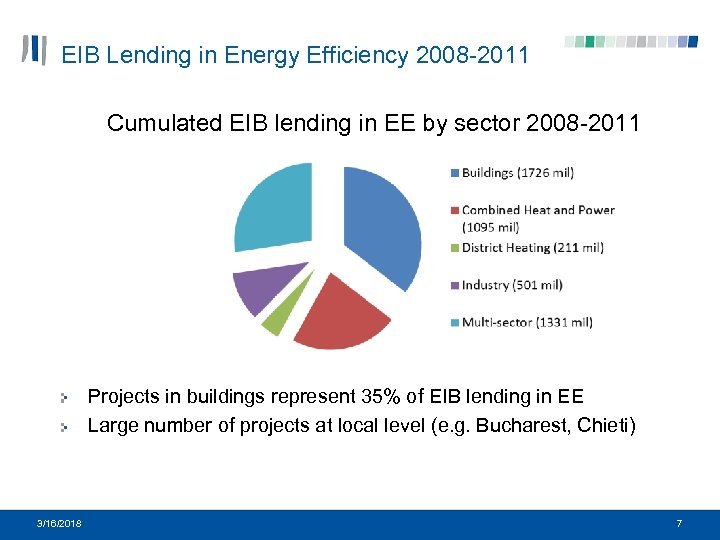

EIB Lending in Energy Efficiency 2008 -2011 Cumulated EIB lending in EE by sector 2008 -2011 Projects in buildings represent 35% of EIB lending in EE Large number of projects at local level (e. g. Bucharest, Chieti) 3/16/2018 7

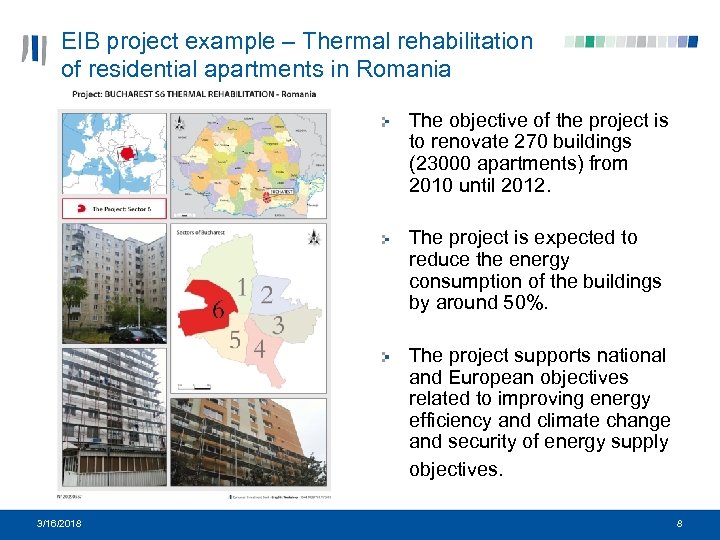

EIB project example – Thermal rehabilitation of residential apartments in Romania The objective of the project is to renovate 270 buildings (23000 apartments) from 2010 until 2012. The project is expected to reduce the energy consumption of the buildings by around 50%. The project supports national and European objectives related to improving energy efficiency and climate change and security of energy supply objectives. 3/16/2018 8

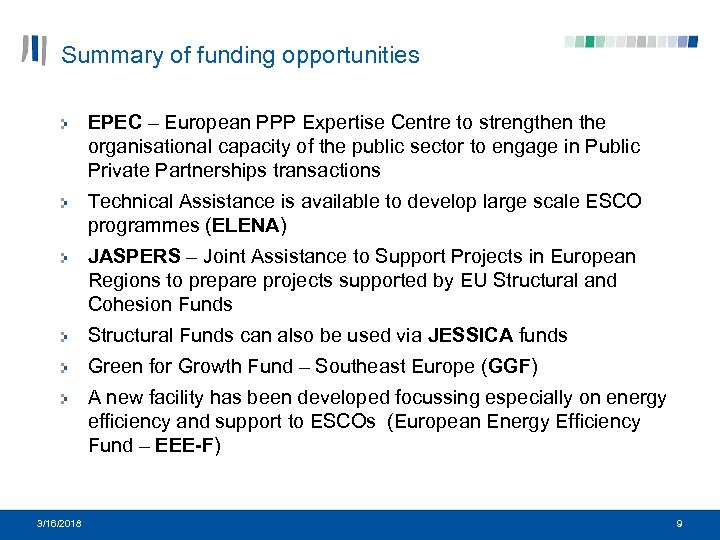

Summary of funding opportunities EPEC – European PPP Expertise Centre to strengthen the organisational capacity of the public sector to engage in Public Private Partnerships transactions Technical Assistance is available to develop large scale ESCO programmes (ELENA) JASPERS – Joint Assistance to Support Projects in European Regions to prepare projects supported by EU Structural and Cohesion Funds Structural Funds can also be used via JESSICA funds Green for Growth Fund – Southeast Europe (GGF) A new facility has been developed focussing especially on energy efficiency and support to ESCOs (European Energy Efficiency Fund – EEE-F) 3/16/2018 9

PPPs and Investment in Energy Efficiency & Renewables Major challenges in achieving the EU 20% target for EE PPPs : opportunities for leveraging public funding & risk transfer PPPs and Energy Performance contracting models Public sector requirement for long-term contract delivery Need for integration of the build and operating phase Proper maintenance and life cycle maintenance is key Significant opportunities for combining Energy Efficiency with RE PPPs provide for a variety of innovative funding models 3/16/2018 10

European Investment Bank Provision of Technical assistance European Local ENergy Assistance -- ELENA EC-EIB cooperation to support local and regional authorities to reach 20 -20 -20 targets; Grant facility: managed by EIB; funded by EU budget (CIP/IEE programme). Application to Energy Efficiency; local renewables; clean transport. Market replication focus; Minimum investment leverage required Budget 2009 - 2011: EUR 49 m (allocations can be made until end 2013) Envisaged budget 2012: EUR 22 m

Example: RE: FIT, London Proposal Retrofitting of public buildings owned by several London Boroughs, Colleges, Universities and Hospitals Planned investment: EUR 115 m Expected results: 4. 69 GWh energy/year saved Main TA feature: Project Development Unit, performance-based to ensure value for money Current results (after 1 year of operation) 14 mini competitions for ESCOs launched Over EUR 12 m invested in 150 buildings 3/16/2018 12

Example: Electrobus, Barcelona Proposal Bus fleet renewal: retrofitting 220 existing buses into hybrid buses and integrating electric and hybrid vehicles Planned investment: EUR 164 m Expected results: 61. 4 GWh of energy savings and a reduction of 16 400 CO 2 -eq [t] by the end of the three year project period Main TA features: Technological studies on electric and hybrid buses Support in the definition of tailored financial instruments to finance the bus fleet renewal Current results (after 15 months of operation): TA on track First investments scheduled for end 2012 3/16/2018 13

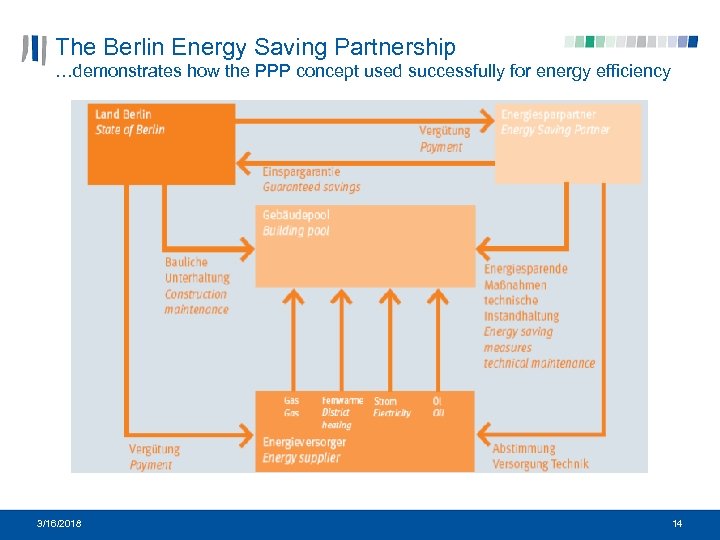

The Berlin Energy Saving Partnership …demonstrates how the PPP concept used successfully for energy efficiency Source : Berliner Energieagentur Gmbh 3/16/2018 14

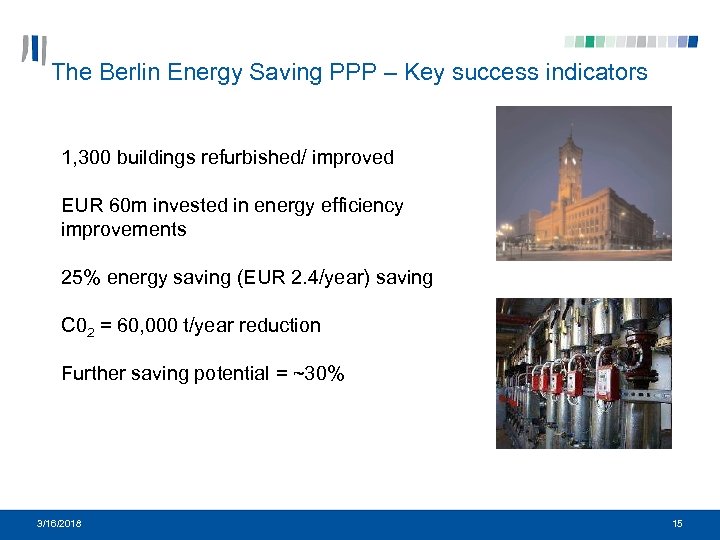

The Berlin Energy Saving PPP – Key success indicators 1, 300 buildings refurbished/ improved EUR 60 m invested in energy efficiency improvements 25% energy saving (EUR 2. 4/year) saving C 02 = 60, 000 t/year reduction Further saving potential = ~30% refurbished/ improved 3/16/2018 Quelle : Berliner Energieagentur Gmbh 15

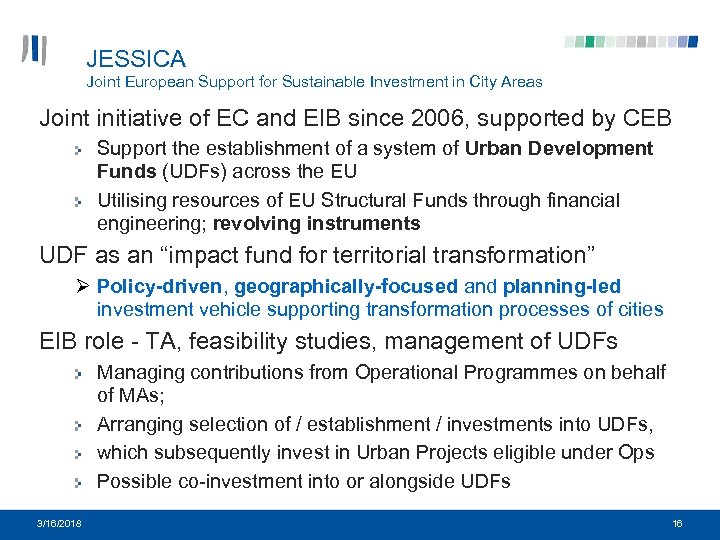

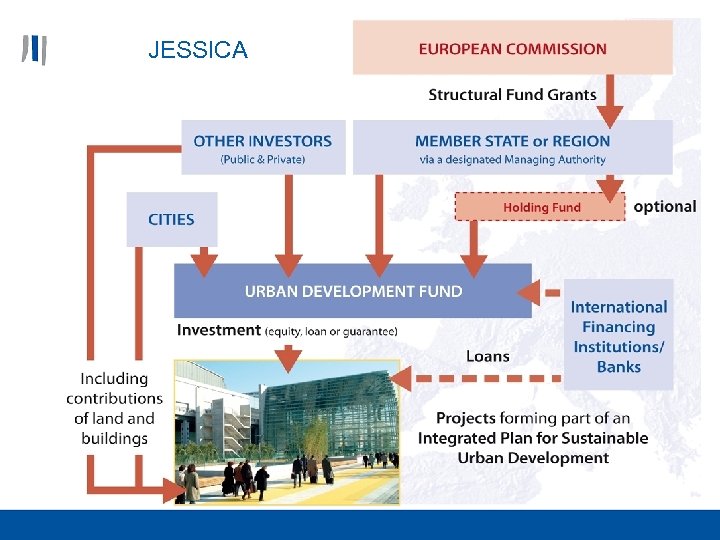

JESSICA Joint European Support for Sustainable Investment in City Areas Joint initiative of EC and EIB since 2006, supported by CEB Support the establishment of a system of Urban Development Funds (UDFs) across the EU Utilising resources of EU Structural Funds through financial engineering; revolving instruments UDF as an “impact fund for territorial transformation” Ø Policy-driven, geographically-focused and planning-led investment vehicle supporting transformation processes of cities EIB role - TA, feasibility studies, management of UDFs Managing contributions from Operational Programmes on behalf of MAs; Arranging selection of / establishment / investments into UDFs, which subsequently invest in Urban Projects eligible under Ops Possible co-investment into or alongside UDFs 3/16/2018 16

JESSICA A

Green for Growth Fund - Southeast Europe Investments in financial institutions Investments in non-financial institutions Investments in RE Projects • founded December, 2009 with committed capital of EUR 128 m • initiators: EIB & Kf. W; additional founding investors - EBRD, IFC, EC, BMZ; TA donors: EC, BMZ, Oe. EB • current committed capital: EUR 201 m (includes FMO and NIF) • target size: EUR 400 m within 4 years • Mission: Foster energy efficiency and renewable energy in Southeast Europe, including Turkey, and the European Neighborhood region, resulting in a reduction in energy consumption and/or CO 2 emissions of at least 20% 3/16/2018 18

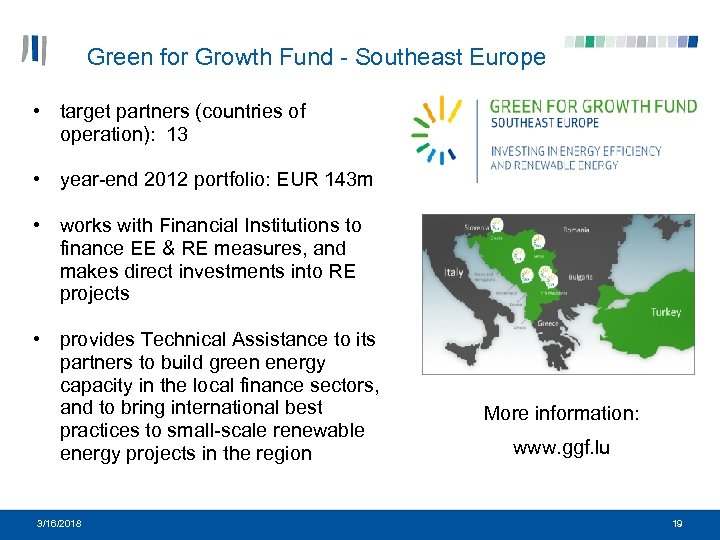

Green for Growth Fund - Southeast Europe • target partners (countries of operation): 13 • year-end 2012 portfolio: EUR 143 m • works with Financial Institutions to finance EE & RE measures, and makes direct investments into RE projects • provides Technical Assistance to its partners to build green energy capacity in the local finance sectors, and to bring international best practices to small-scale renewable energy projects in the region 3/16/2018 More information: www. ggf. lu 19

European Energy Efficiency Fund (EEEF) Objective — EEEF aims to provide market based financing for commercially viable public energy efficiency (EE) and renewable energy (RE) projects within the European Union What is EEEF? — It contributes with a layered risk/return structure to enhance EE and foster RE in the form of a targeted private public partnership, primarily through the provision of dedicated financing via direct finance and partnering with financial institutions Why EEEF? — … amendment of the European Energy Programme for Recovery Regulation (a) — … commitment of the EU member states to achieve the 20/20/20 goals, cutting GHG emissions by 20%, increasing RE usage by 20%, and cutting energy consumption through improved EE by 20% — … substantial potential for EE and small scale RE in the European public sector (a) Regulation (EU) No 1233/2010 of the European Parliament and of the Council amended the European Energy Program for Recovery Regulation (EC) No 663/2009 establishing a program to aid economic recovery by granting Community financial assistance to projects in the field of energy. Uncommitted funds will be used for the creation of the EEEF. 3/16/2018 20

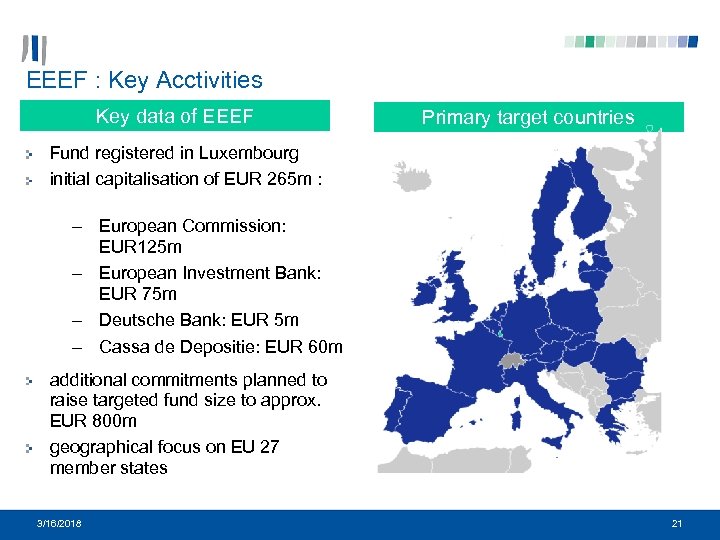

EEEF : Key Acctivities Key data of EEEF Primary target countries Fund registered in Luxembourg initial capitalisation of EUR 265 m : - European Commission: EUR 125 m - European Investment Bank: EUR 75 m - Deutsche Bank: EUR 5 m - Cassa de Depositie: EUR 60 m additional commitments planned to raise targeted fund size to approx. EUR 800 m geographical focus on EU 27 member states 3/16/2018 21

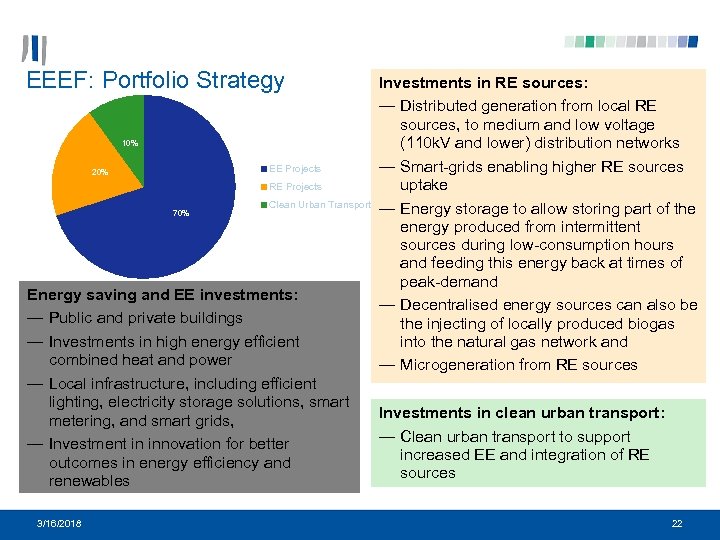

EEEF: Portfolio Strategy 10% EE Projects 20% RE Projects 70% Clean Urban Transport Energy saving and EE investments: — Public and private buildings — Investments in high energy efficient combined heat and power — Local infrastructure, including efficient lighting, electricity storage solutions, smart metering, and smart grids, — Investment in innovation for better outcomes in energy efficiency and renewables 3/16/2018 Investments in RE sources: — Distributed generation from local RE sources, to medium and low voltage (110 k. V and lower) distribution networks — Smart-grids enabling higher RE sources uptake — Energy storage to allow storing part of the energy produced from intermittent sources during low-consumption hours and feeding this energy back at times of peak-demand — Decentralised energy sources can also be the injecting of locally produced biogas into the natural gas network and — Microgeneration from RE sources Investments in clean urban transport: — Clean urban transport to support increased EE and integration of RE sources 22

For more information… http: //www. eib. org 3/16/2018 23

dfba541619b18eb51a982f2c1d98cdf6.ppt