708622cf8b61a28ae3beca548cdbc9a6.ppt

- Количество слайдов: 32

Egypt Open for Business By Dr. Hany Barakat Ministry of Trade & Industry Egypt 2008

• Introduction • Principles • Values • Key Reform Objectives § Sustainable economic growth § Deregulation as a driver for success § Public-private partnership as a vehicle for growth § Investor-friendly business environment § Stable political conditions § Reliable and transparent operating legal environment

Macro-economic Fundamentals

Real Economy · GDP growth rate increased to 6 % and expected to reach over 7% in 2007 · GOE introduced significant changes in the past 36 months increasing the ability of the economy to withstand exogenous shocks · Inflation down by approx. 13 percentage points between 2003/2004 and 2005/2006 · Stable exchange rate

External position · C/A posted its fourth surplus in a row reaching $2. 9 Bn in 2005/2006 · Key current inflows: hydrocarbons, Suez Canal, tourism, Exports , private remittances and FDI · C/A balance reached 3% of GDP in 2005/2006 · Current Account Surpluses & capital inflows (2006) led to a significant rise in CBE reserves.

FDI Surge · Non-oil FDI tripled to USD 1. 3 Bn bringing total FDI in June 2006 to USD 6 B. · In 2005/2006, newly established companies reached 6236 with an issued capital amounting to EGP 19. 3 B, representing a leap from 1434 established in 2002/2003 with only EGP 3. 8 B in issued capital · Issued capital from foreign sources doubled in 2005 · Issued capital from Egyptian sources was twice as much as capital from foreign sources · 68% of total issued capital was in the industrial and finance and services sectors in 2006

• Privatization · Reform of the public sector has been the hallmark of the new Govt. · Cumulative Privatization proceeds over the period July 2005 - 2006 reached LE 20 B representing 55 deals · This value is approximately equivalent to the total privatization proceeds between the years 1995 -2000

Banking Sector Reform · A plan has been initiated to restructure the six main Public Banks in Egypt. · Privatizing State owned Banks and Divesting Public Shares in Joint Venture Banks · Bank of Alexandria was totally acquired by Sao Paolo · 10 major transactions over a period of 12 months

Stock Market · Market cap rose to 83% of GDP in April 2006 up from 50% in January 2005. · Reshaping of the organizational structure of the CMA and introduction of corporate governance department · Issuance of the executive regulation of the securitization law.

Stock Market Strong Earnings Reports § Attractive valuations in absolute terms § Attractive valuations in comparison with other emerging markets Ø Average price earnings ratio of most of the actively traded securities is 14 -16 times 2005 earnings. § Strong fundamental economic backdrop Ø Strong earnings reports Ø Active Mergers and Acquisitions Market § Attractive dividend yields Ø Many companies offer yields in excess of 10%

Mergers & Acquisitions · A 4 -fold increase in M&A transactions between 2004 and 2006 Ø 15 M&A Major transactions in the financial sector in 2006 Ø 22 M&A Major transactions in the Industrial sector in 2006

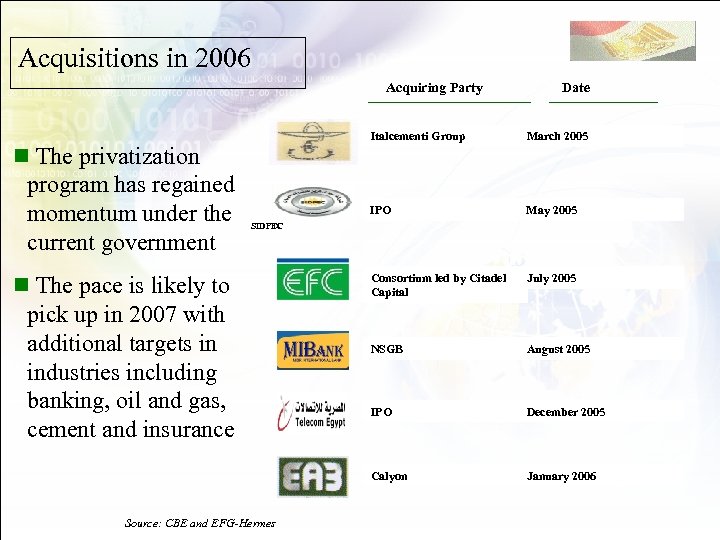

Acquisitions in 2006 Acquiring Party Date Italcementi Group IPO program has regained momentum under the current government May 2005 Consortium led by Citadel Capital July 2005 NSGB August 2005 IPO December 2005 Calyon n The privatization March 2005 January 2006 SIDPEC n The pace is likely to pick up in 2007 with additional targets in industries including banking, oil and gas, cement and insurance Source: CBE and EFG-Hermes

Measures to Improve Business Climate

Legal and Structural Reforms § New Customs Law § New Tax Law § Mortgage Law § Securitization Law § An amendment on the Corporate Law to allow the adoption of Employee Stock Option (ESP) Plans § Established the Investor Protection Fund (IPF) against non-commercial risk § Issuance of Codes of Ethics and Conduct for the Brokerage and Fund Management Activities

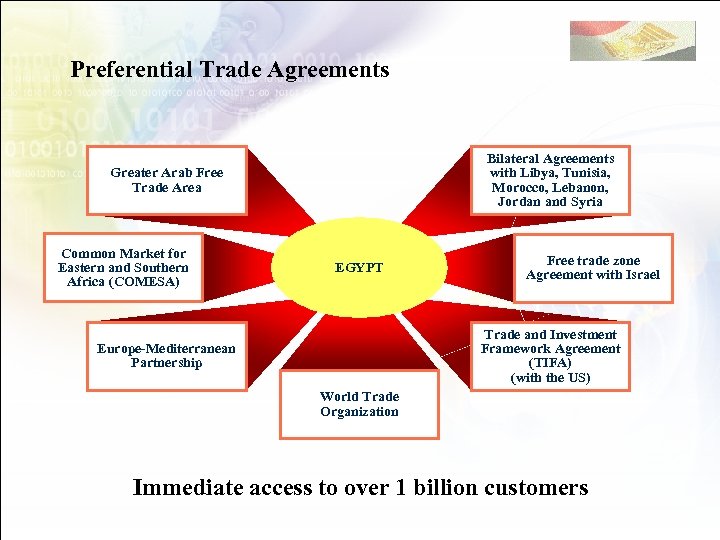

Preferential Trade Agreements Bilateral Agreements with Libya, Tunisia, Morocco, Lebanon, Jordan and Syria Greater Arab Free Trade Area Common Market for Eastern and Southern Africa (COMESA) EGYPT Free trade zone Agreement with Israel Trade and Investment Framework Agreement (TIFA) (with the US) Europe-Mediterranean Partnership World Trade Organization Immediate access to over 1 billion customers

Incentive Schemes Inland • Low infrastructure cost • Project contracts exempted from stamp duties and fees for five years from the date of registry in the commercial register (Bank loan agreements, Mortgages) • Free land in Upper (South) Egypt • 20% Tax rate on industrial projects • 0 - 5% customs duties on imported machinery Free Zones • • • Corporate income tax exemption Low infrastructure cost No customs duty (except for sales into Egypt) No Sales tax Mere 1%annual duty on the value added of the project

Incentive Schemes § Qualified Industrial Zones (QIZ) Agreement with the United States and Israel in December 2004 & other FT agreements · Special Economic Zones (SEZ) – The tax rate on all activities within these zones is 10% – First Zone Created under the new law: The North West Suez Special Economic Zone. The Red Sea port of Ain Sokhna East Port Said located on the Mediterranean Sea.

Simplification Procedures Establishing a ‘One-Stop-Shop’ at the General Authority for Investment Promotion (GAFI) · The one Stop Shop started operating in Cairo head office in 2004, Opened in Alexandria in 2005 Three other governorates (Assiut, Giza and Ismailia). · Reduction of some administrative start up and operational barriers

Investor Protection & Transparency • Implementation of the executive regulations of Intellectual Property Rights Law passed in 2002 • Issuance of Antitrust Law (August 2005) • Set up Competition Council to ensure the prohibition of anticompetition practices • Institute of Directors (IOD) was established with the aim of strengthening corporate governance practices • Issuance of the Corporate Governance Best Practice Code in Aug 2005

Investor Protection & Transparency • Restructure of the Ministerial Committee for Dispute Settlement • Specialized Economic Courts (in Progress) • A new budget classification system compliant with IMF has been adopted to improve transparency on budget reporting

Egypt Fortune Global 500 (2006)

Egypt And the list goes on…. .

Industrial profile § Strategic Vision &Targets

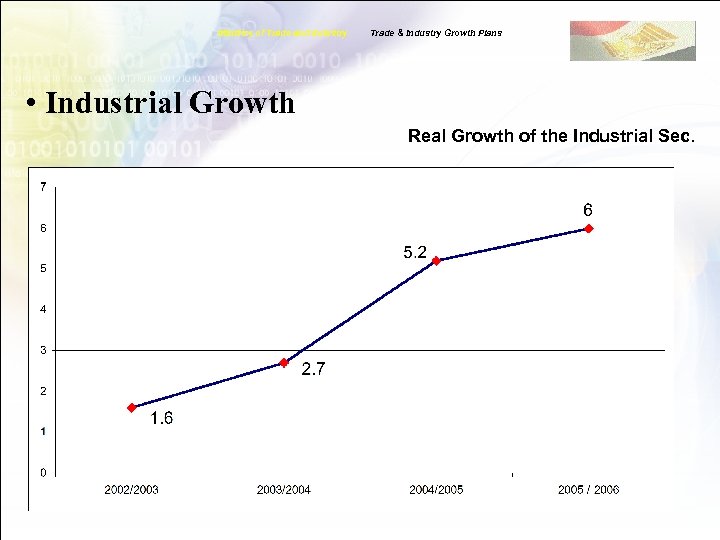

Ministry of Trade and Industry Trade & Industry Growth Plans • Industrial Growth Real Growth of the Industrial Sec.

· Factories Built and Operated ( 2005 – 2006 ) : 610 –Number : Large ( >15 M ) : 110 Medium ( 5 – 15 M ) : 140 Small ( < 5 M ) : 360 –Total Investments : 10 B –Employment : 100 Thousand Direct Jobs

· Factories Under Construction –Number of Factories Under Construction : 1227 – Land Allocated for new factories ( 2005 – 2006 ) : 4. 8 M Sq meter for 496 factories Total Number of Factories Under Construction : 1723

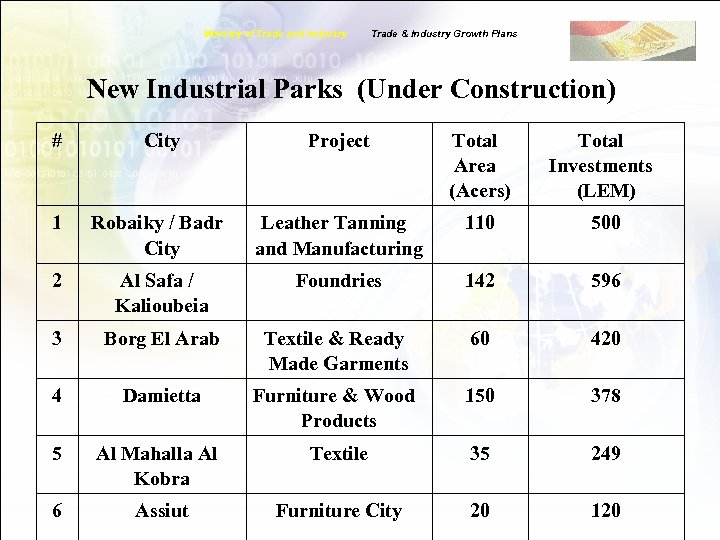

Ministry of Trade and Industry Trade & Industry Growth Plans New Industrial Parks (Under Construction) # City Project Total Area (Acers) Total Investments (LEM) 1 Robaiky / Badr City Leather Tanning and Manufacturing 110 500 2 Al Safa / Kalioubeia Foundries 142 596 3 Borg El Arab Textile & Ready Made Garments 60 420 4 Damietta Furniture & Wood Products 150 378 5 Al Mahalla Al Kobra Textile 35 249 6 Assiut Furniture City 20 120

Ministry of Trade and Industry • Exports Performance Trade & Industry Growth Plans

• Exports Performance · Total Exports (M$) : 2004/2005 : 6201 2005/2006 : 8826 · Growth : 42% · Sectorial Distribution

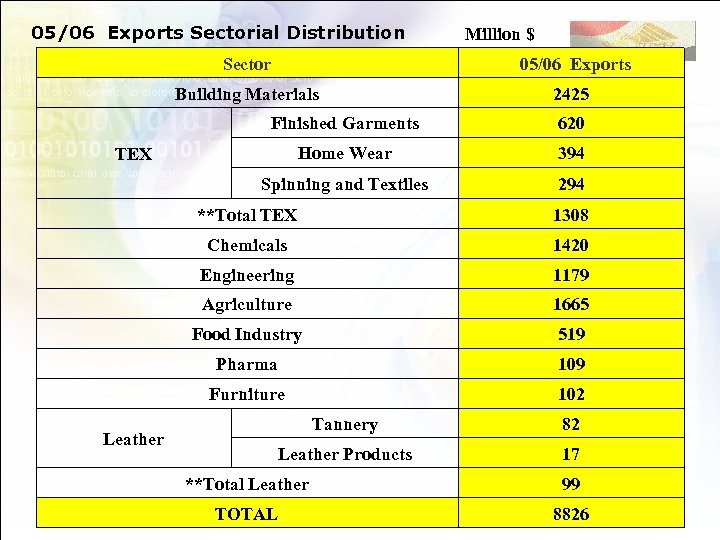

05/06 Exports Sectorial Distribution Million $ Sector 05/06 Exports Building Materials 2425 Finished Garments 620 Home Wear 394 Spinning and Textiles 294 TEX **Total TEX Chemicals 1420 Engineering 1179 Agriculture 1665 Food Industry 519 Pharma 109 Furniture Leather 1308 102 Tannery 82 Leather Products 17 **Total Leather 99 TOTAL 8826

· Strategic Thrusts –Industrial Zones –Human Resource Development –Industrial Modernization –Technology Transfer Centers –Exports Promotion –Development of Local Market

Egypt Open for Business

708622cf8b61a28ae3beca548cdbc9a6.ppt