a52db45ad6801ae927526e106d7a3f26.ppt

- Количество слайдов: 35

Effective Marginal Costing: Know Your Resource Needs Larry R. White, CGFM, CMA, CFM, CPA Executive Director, Resource Consumption Accounting Institute CAPT, USCG (Retired)

Effective Marginal Costing: Know Your Resource Needs Larry R. White, CGFM, CMA, CFM, CPA Executive Director, Resource Consumption Accounting Institute CAPT, USCG (Retired)

Agenda ü What exactly is Marginal Costing? • Why is Marginal Costing important? • How is Marginal Costing done?

Agenda ü What exactly is Marginal Costing? • Why is Marginal Costing important? • How is Marginal Costing done?

Quiz • What is Marginal Costing? • Does it have any other names? • Where or When do you use it? • What do you remember about it from Cost Accounting or Microeconomics?

Quiz • What is Marginal Costing? • Does it have any other names? • Where or When do you use it? • What do you remember about it from Cost Accounting or Microeconomics?

What is Marginal Costing? • Wikipedia: – Marginal Cost is the change in total cost that arises when the quantity produced changes by one unit. – Marginal Costing (under Cost Accounting): This method is used particularly for short-term decisionmaking. Its principal tenets are: – Revenue (per product) - variable costs (per product) = contribution (per product) – Total contribution - total fixed costs = total profit or total loss) • Thus, it does not attempt to allocate fixed costs in an arbitrary manner to different products.

What is Marginal Costing? • Wikipedia: – Marginal Cost is the change in total cost that arises when the quantity produced changes by one unit. – Marginal Costing (under Cost Accounting): This method is used particularly for short-term decisionmaking. Its principal tenets are: – Revenue (per product) - variable costs (per product) = contribution (per product) – Total contribution - total fixed costs = total profit or total loss) • Thus, it does not attempt to allocate fixed costs in an arbitrary manner to different products.

A Closer Look • What resource use (and costs) will change if output changes? • What you need to know: – Relationships within a process: What resources in the value chain contribute to creating the output? – Characteristics of the resources used: • Which resources will need beefed up or reduced? • What resource quantities have fixed and proportional relationships with the change in output? – Costs associated with the resource changes.

A Closer Look • What resource use (and costs) will change if output changes? • What you need to know: – Relationships within a process: What resources in the value chain contribute to creating the output? – Characteristics of the resources used: • Which resources will need beefed up or reduced? • What resource quantities have fixed and proportional relationships with the change in output? – Costs associated with the resource changes.

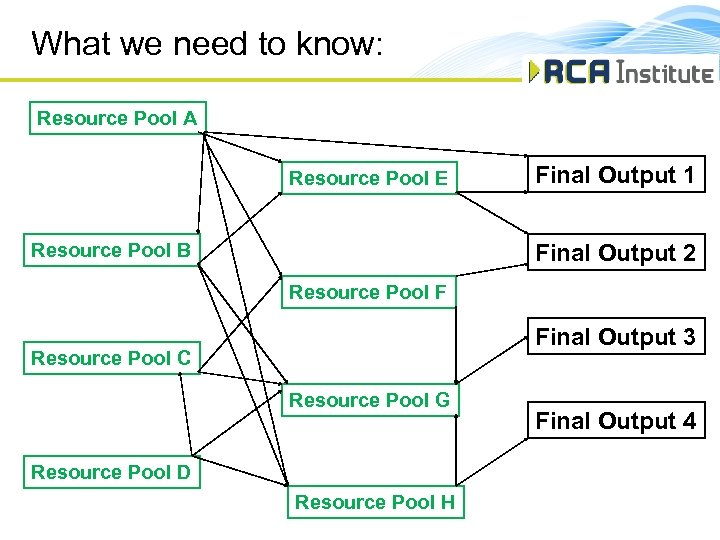

What we need to know: Resource Pool A Resource Pool E Resource Pool B Final Output 1 Final Output 2 Resource Pool F Final Output 3 Resource Pool C Resource Pool G Resource Pool D Resource Pool H Final Output 4

What we need to know: Resource Pool A Resource Pool E Resource Pool B Final Output 1 Final Output 2 Resource Pool F Final Output 3 Resource Pool C Resource Pool G Resource Pool D Resource Pool H Final Output 4

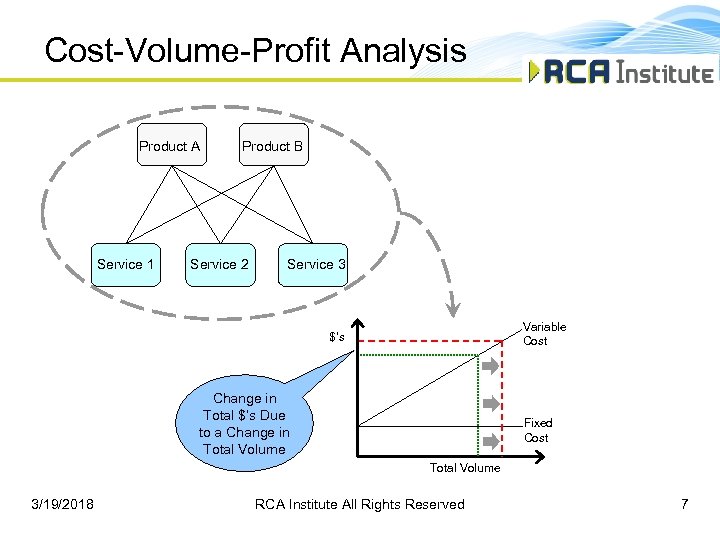

Cost-Volume-Profit Analysis Product A Service 1 Product B Service 2 Service 3 Variable Cost $’s Change in Total $’s Due to a Change in Total Volume Fixed Cost Total Volume 3/19/2018 RCA Institute All Rights Reserved 7

Cost-Volume-Profit Analysis Product A Service 1 Product B Service 2 Service 3 Variable Cost $’s Change in Total $’s Due to a Change in Total Volume Fixed Cost Total Volume 3/19/2018 RCA Institute All Rights Reserved 7

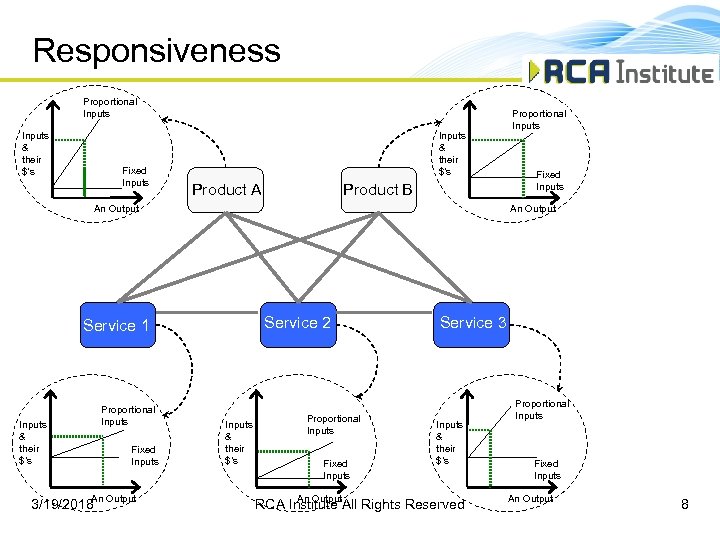

Responsiveness Proportional Inputs & their $’s Fixed Inputs & their $’s Product A Product B An Output Inputs & their $’s Fixed Inputs An Output 3/19/2018 Fixed Inputs An Output Service 2 Service 1 Proportional Inputs & their $’s Proportional Inputs Fixed Inputs An Output Service 3 Inputs & their $’s RCA Institute All Rights Reserved Proportional Inputs Fixed Inputs An Output 8

Responsiveness Proportional Inputs & their $’s Fixed Inputs & their $’s Product A Product B An Output Inputs & their $’s Fixed Inputs An Output 3/19/2018 Fixed Inputs An Output Service 2 Service 1 Proportional Inputs & their $’s Proportional Inputs Fixed Inputs An Output Service 3 Inputs & their $’s RCA Institute All Rights Reserved Proportional Inputs Fixed Inputs An Output 8

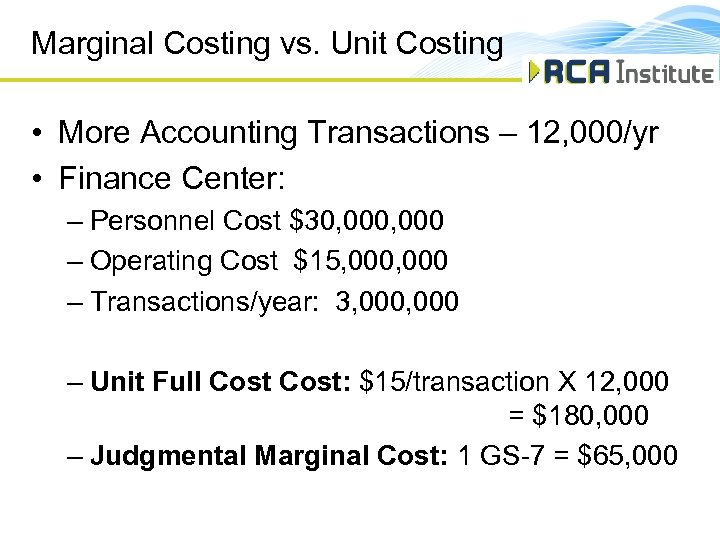

Marginal Costing vs. Unit Costing • More Accounting Transactions – 12, 000/yr • Finance Center: – Personnel Cost $30, 000 – Operating Cost $15, 000 – Transactions/year: 3, 000 – Unit Full Cost: $15/transaction X 12, 000 = $180, 000 – Judgmental Marginal Cost: 1 GS-7 = $65, 000

Marginal Costing vs. Unit Costing • More Accounting Transactions – 12, 000/yr • Finance Center: – Personnel Cost $30, 000 – Operating Cost $15, 000 – Transactions/year: 3, 000 – Unit Full Cost: $15/transaction X 12, 000 = $180, 000 – Judgmental Marginal Cost: 1 GS-7 = $65, 000

Agenda ü What exactly is Marginal Costing? ü Why is Marginal Costing important? • How is Marginal Costing done?

Agenda ü What exactly is Marginal Costing? ü Why is Marginal Costing important? • How is Marginal Costing done?

Importance of Marginal Costing • Budgets are incremental or decremental. • Full Cost is nearly always a gross overstatement. • Only way to achieve transparency and internal management alignment around financial impacts.

Importance of Marginal Costing • Budgets are incremental or decremental. • Full Cost is nearly always a gross overstatement. • Only way to achieve transparency and internal management alignment around financial impacts.

Full Cost • Full Cost is the correct figure for very few actions • Worse you can calculate full cost easily • And……know next to nothing about your processes or resources. – Finance Center Transaction Example.

Full Cost • Full Cost is the correct figure for very few actions • Worse you can calculate full cost easily • And……know next to nothing about your processes or resources. – Finance Center Transaction Example.

Example • Fact set: City Council is requiring fire inspections every 18 mths rather than every 3 years. • Current Fire Inspection Staff: 1 Supervisor, 3 Inspectors, 1 Clerk, . 75 FTE Hearing Officer/Judge, 1 FTE Billing and Collection at City Treasurer • What else do you need to know? – Space, Current Capacity (including non fire inspection work), equipment (computers, vehicles), training, hearing workload………

Example • Fact set: City Council is requiring fire inspections every 18 mths rather than every 3 years. • Current Fire Inspection Staff: 1 Supervisor, 3 Inspectors, 1 Clerk, . 75 FTE Hearing Officer/Judge, 1 FTE Billing and Collection at City Treasurer • What else do you need to know? – Space, Current Capacity (including non fire inspection work), equipment (computers, vehicles), training, hearing workload………

Agenda ü What exactly is Marginal Costing? ü Why is Marginal Costing important? ü How is Marginal Costing done?

Agenda ü What exactly is Marginal Costing? ü Why is Marginal Costing important? ü How is Marginal Costing done?

Calculating Marginal Costs • How are marginal costs calculated? • Ad hoc Analysis – Advantages/Disadvantages • Policy Based Formulas – Advantages/Disadvantages • Directly fm Management Accounting Information – Advantages/Disadvantages

Calculating Marginal Costs • How are marginal costs calculated? • Ad hoc Analysis – Advantages/Disadvantages • Policy Based Formulas – Advantages/Disadvantages • Directly fm Management Accounting Information – Advantages/Disadvantages

Calculating Marginal Costs • What you need to know: – Process Flow – Resources in the process – How resources interact/support each other Characteristics of the resource • Fixed and proportional relationship to outputs (intermediate and/or final) – Costs to overlay the resource flows.

Calculating Marginal Costs • What you need to know: – Process Flow – Resources in the process – How resources interact/support each other Characteristics of the resource • Fixed and proportional relationship to outputs (intermediate and/or final) – Costs to overlay the resource flows.

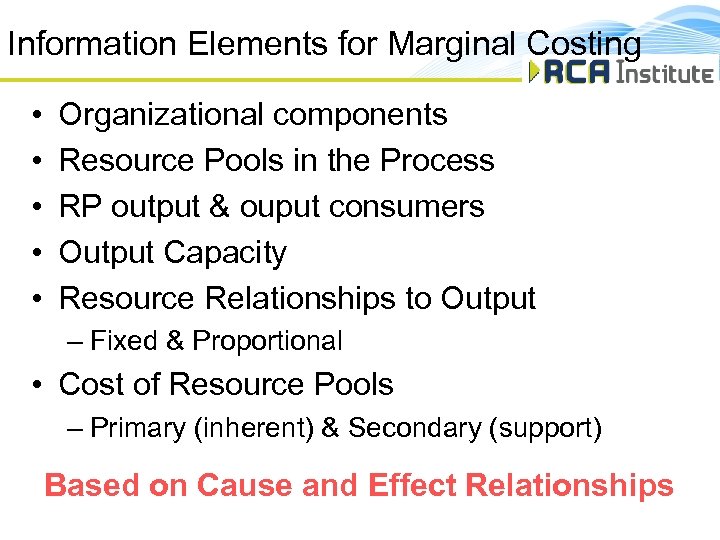

Information Elements for Marginal Costing • • • Organizational components Resource Pools in the Process RP output & ouput consumers Output Capacity Resource Relationships to Output – Fixed & Proportional • Cost of Resource Pools – Primary (inherent) & Secondary (support) Based on Cause and Effect Relationships

Information Elements for Marginal Costing • • • Organizational components Resource Pools in the Process RP output & ouput consumers Output Capacity Resource Relationships to Output – Fixed & Proportional • Cost of Resource Pools – Primary (inherent) & Secondary (support) Based on Cause and Effect Relationships

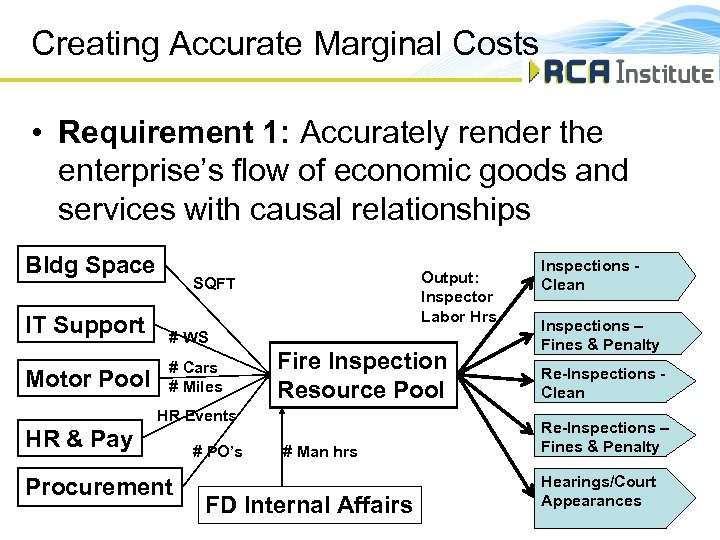

Creating Accurate Marginal Costs • Requirement 1: Accurately render the enterprise’s flow of economic goods and services with causal relationships Bldg Space IT Support Motor Pool Output: Inspector Labor Hrs SQFT # WS # Cars # Miles Fire Inspection Resource Pool HR Events HR & Pay Procurement # PO’s # Man hrs FD Internal Affairs Inspections Clean Inspections – Fines & Penalty Re-Inspections Clean Re-Inspections – Fines & Penalty Hearings/Court Appearances

Creating Accurate Marginal Costs • Requirement 1: Accurately render the enterprise’s flow of economic goods and services with causal relationships Bldg Space IT Support Motor Pool Output: Inspector Labor Hrs SQFT # WS # Cars # Miles Fire Inspection Resource Pool HR Events HR & Pay Procurement # PO’s # Man hrs FD Internal Affairs Inspections Clean Inspections – Fines & Penalty Re-Inspections Clean Re-Inspections – Fines & Penalty Hearings/Court Appearances

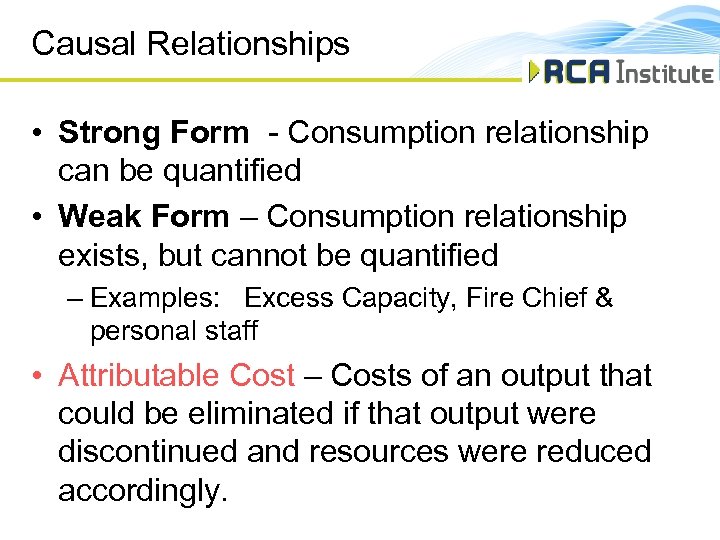

Causal Relationships • Strong Form - Consumption relationship can be quantified • Weak Form – Consumption relationship exists, but cannot be quantified – Examples: Excess Capacity, Fire Chief & personal staff • Attributable Cost – Costs of an output that could be eliminated if that output were discontinued and resources were reduced accordingly.

Causal Relationships • Strong Form - Consumption relationship can be quantified • Weak Form – Consumption relationship exists, but cannot be quantified – Examples: Excess Capacity, Fire Chief & personal staff • Attributable Cost – Costs of an output that could be eliminated if that output were discontinued and resources were reduced accordingly.

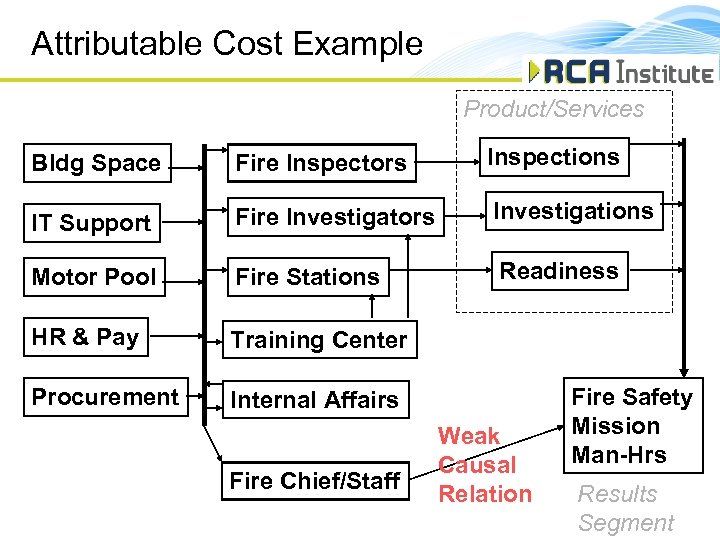

Attributable Cost Example Product/Services Bldg Space Fire Inspectors Inspections IT Support Fire Investigators Investigations Motor Pool Fire Stations Readiness HR & Pay Training Center Procurement Internal Affairs Fire Chief/Staff Weak Causal Relation Fire Safety Mission Man-Hrs Results Segment

Attributable Cost Example Product/Services Bldg Space Fire Inspectors Inspections IT Support Fire Investigators Investigations Motor Pool Fire Stations Readiness HR & Pay Training Center Procurement Internal Affairs Fire Chief/Staff Weak Causal Relation Fire Safety Mission Man-Hrs Results Segment

Creating Accurate Marginal Costs • Requirement 2: Link the quantitative flow of goods and services to their monetary implications.

Creating Accurate Marginal Costs • Requirement 2: Link the quantitative flow of goods and services to their monetary implications.

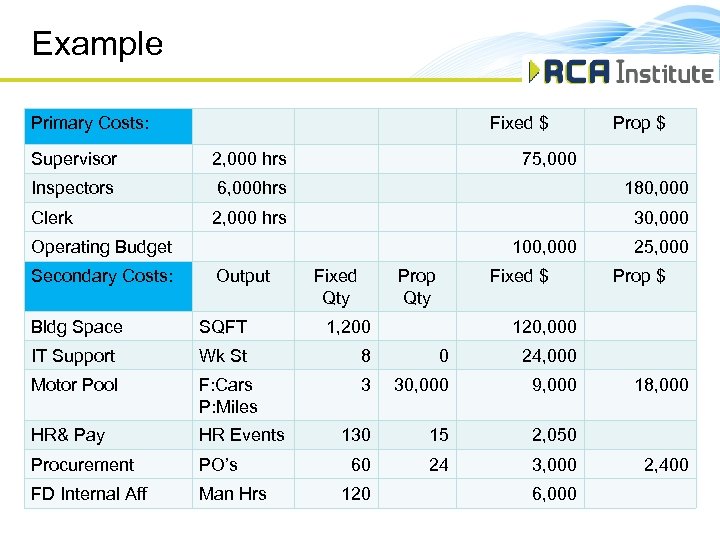

Example Primary Costs: Fixed $ Prop $ Supervisor 2, 000 hrs 75, 000 Inspectors 6, 000 hrs 180, 000 Clerk 2, 000 hrs 30, 000 Operating Budget Secondary Costs: 100, 000 Output Fixed Qty Prop Qty Fixed $ Bldg Space SQFT 1, 200 IT Support Wk St 8 0 F: Cars P: Miles 3 30, 000 9, 000 HR& Pay HR Events 130 15 2, 050 Procurement PO’s 60 24 3, 000 FD Internal Aff Man Hrs Prop $ 24, 000 Motor Pool 25, 000 120, 000 6, 000 18, 000 2, 400

Example Primary Costs: Fixed $ Prop $ Supervisor 2, 000 hrs 75, 000 Inspectors 6, 000 hrs 180, 000 Clerk 2, 000 hrs 30, 000 Operating Budget Secondary Costs: 100, 000 Output Fixed Qty Prop Qty Fixed $ Bldg Space SQFT 1, 200 IT Support Wk St 8 0 F: Cars P: Miles 3 30, 000 9, 000 HR& Pay HR Events 130 15 2, 050 Procurement PO’s 60 24 3, 000 FD Internal Aff Man Hrs Prop $ 24, 000 Motor Pool 25, 000 120, 000 6, 000 18, 000 2, 400

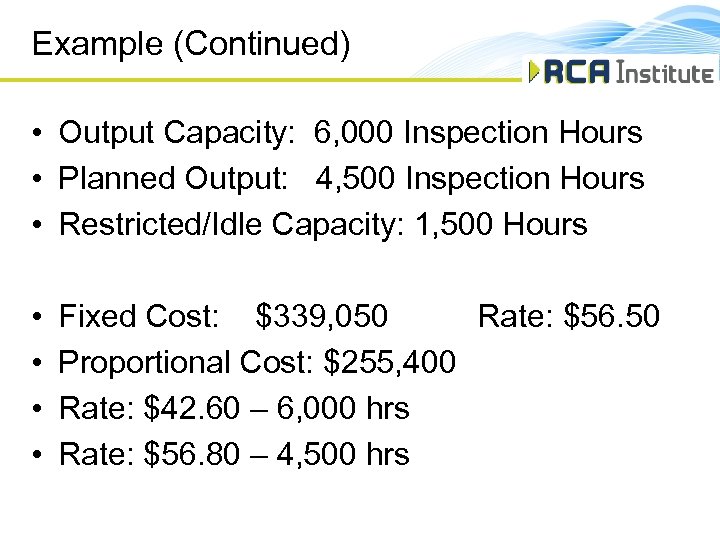

Example (Continued) • Output Capacity: 6, 000 Inspection Hours • Planned Output: 4, 500 Inspection Hours • Restricted/Idle Capacity: 1, 500 Hours • • Fixed Cost: $339, 050 Rate: $56. 50 Proportional Cost: $255, 400 Rate: $42. 60 – 6, 000 hrs Rate: $56. 80 – 4, 500 hrs

Example (Continued) • Output Capacity: 6, 000 Inspection Hours • Planned Output: 4, 500 Inspection Hours • Restricted/Idle Capacity: 1, 500 Hours • • Fixed Cost: $339, 050 Rate: $56. 50 Proportional Cost: $255, 400 Rate: $42. 60 – 6, 000 hrs Rate: $56. 80 – 4, 500 hrs

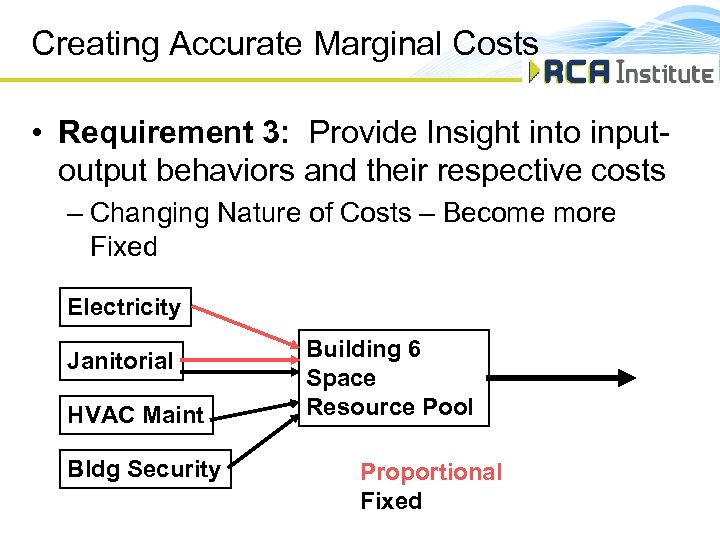

Creating Accurate Marginal Costs • Requirement 3: Provide Insight into inputoutput behaviors and their respective costs – Changing Nature of Costs – Become more Fixed Electricity Janitorial HVAC Maint Bldg Security Building 6 Space Resource Pool Proportional Fixed

Creating Accurate Marginal Costs • Requirement 3: Provide Insight into inputoutput behaviors and their respective costs – Changing Nature of Costs – Become more Fixed Electricity Janitorial HVAC Maint Bldg Security Building 6 Space Resource Pool Proportional Fixed

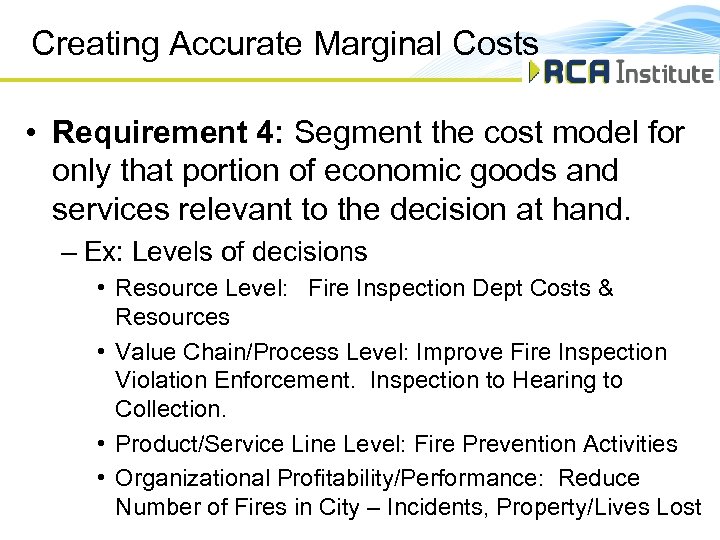

Creating Accurate Marginal Costs • Requirement 4: Segment the cost model for only that portion of economic goods and services relevant to the decision at hand. – Ex: Levels of decisions • Resource Level: Fire Inspection Dept Costs & Resources • Value Chain/Process Level: Improve Fire Inspection Violation Enforcement. Inspection to Hearing to Collection. • Product/Service Line Level: Fire Prevention Activities • Organizational Profitability/Performance: Reduce Number of Fires in City – Incidents, Property/Lives Lost

Creating Accurate Marginal Costs • Requirement 4: Segment the cost model for only that portion of economic goods and services relevant to the decision at hand. – Ex: Levels of decisions • Resource Level: Fire Inspection Dept Costs & Resources • Value Chain/Process Level: Improve Fire Inspection Violation Enforcement. Inspection to Hearing to Collection. • Product/Service Line Level: Fire Prevention Activities • Organizational Profitability/Performance: Reduce Number of Fires in City – Incidents, Property/Lives Lost

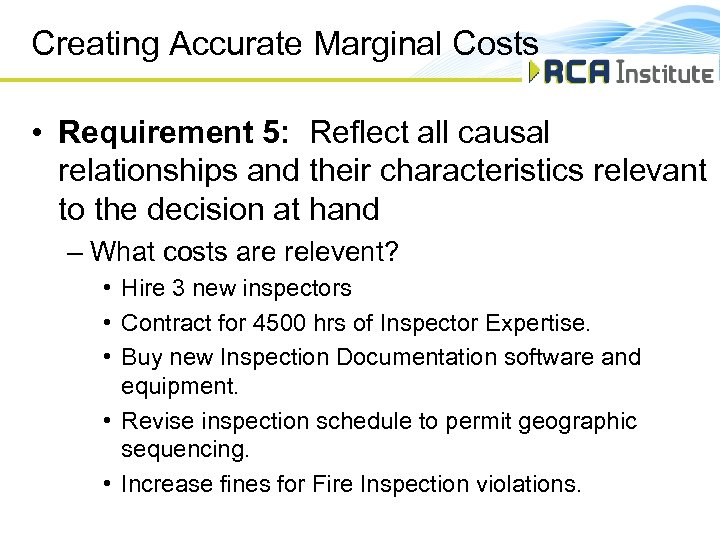

Creating Accurate Marginal Costs • Requirement 5: Reflect all causal relationships and their characteristics relevant to the decision at hand – What costs are relevent? • Hire 3 new inspectors • Contract for 4500 hrs of Inspector Expertise. • Buy new Inspection Documentation software and equipment. • Revise inspection schedule to permit geographic sequencing. • Increase fines for Fire Inspection violations.

Creating Accurate Marginal Costs • Requirement 5: Reflect all causal relationships and their characteristics relevant to the decision at hand – What costs are relevent? • Hire 3 new inspectors • Contract for 4500 hrs of Inspector Expertise. • Buy new Inspection Documentation software and equipment. • Revise inspection schedule to permit geographic sequencing. • Increase fines for Fire Inspection violations.

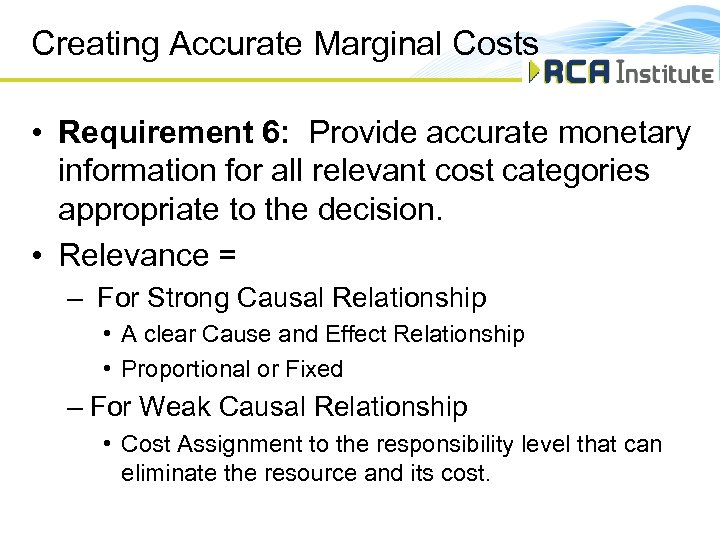

Creating Accurate Marginal Costs • Requirement 6: Provide accurate monetary information for all relevant cost categories appropriate to the decision. • Relevance = – For Strong Causal Relationship • A clear Cause and Effect Relationship • Proportional or Fixed – For Weak Causal Relationship • Cost Assignment to the responsibility level that can eliminate the resource and its cost.

Creating Accurate Marginal Costs • Requirement 6: Provide accurate monetary information for all relevant cost categories appropriate to the decision. • Relevance = – For Strong Causal Relationship • A clear Cause and Effect Relationship • Proportional or Fixed – For Weak Causal Relationship • Cost Assignment to the responsibility level that can eliminate the resource and its cost.

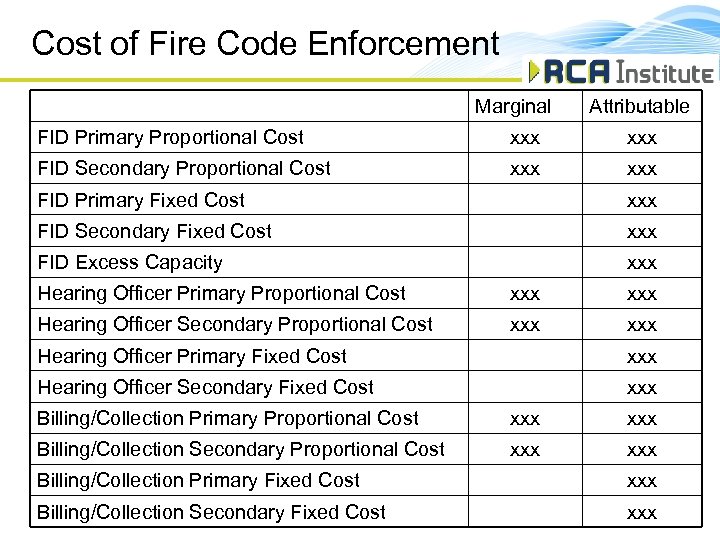

Cost of Fire Code Enforcement Marginal Attributable FID Primary Proportional Cost xxx FID Secondary Proportional Cost xxx FID Primary Fixed Cost xxx FID Secondary Fixed Cost xxx FID Excess Capacity xxx Hearing Officer Primary Proportional Cost xxx Hearing Officer Secondary Proportional Cost xxx Hearing Officer Primary Fixed Cost xxx Hearing Officer Secondary Fixed Cost xxx Billing/Collection Primary Proportional Cost xxx Billing/Collection Secondary Proportional Cost xxx Billing/Collection Primary Fixed Cost xxx Billing/Collection Secondary Fixed Cost xxx

Cost of Fire Code Enforcement Marginal Attributable FID Primary Proportional Cost xxx FID Secondary Proportional Cost xxx FID Primary Fixed Cost xxx FID Secondary Fixed Cost xxx FID Excess Capacity xxx Hearing Officer Primary Proportional Cost xxx Hearing Officer Secondary Proportional Cost xxx Hearing Officer Primary Fixed Cost xxx Hearing Officer Secondary Fixed Cost xxx Billing/Collection Primary Proportional Cost xxx Billing/Collection Secondary Proportional Cost xxx Billing/Collection Primary Fixed Cost xxx Billing/Collection Secondary Fixed Cost xxx

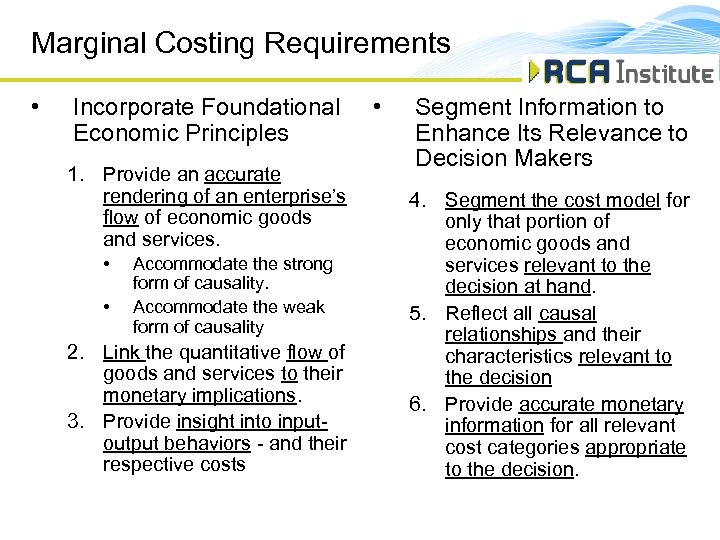

Marginal Costing Requirements • Incorporate Foundational Economic Principles 1. Provide an accurate rendering of an enterprise’s flow of economic goods and services. • • Accommodate the strong form of causality. Accommodate the weak form of causality 2. Link the quantitative flow of goods and services to their monetary implications. 3. Provide insight into inputoutput behaviors - and their respective costs • Segment Information to Enhance Its Relevance to Decision Makers 4. Segment the cost model for only that portion of economic goods and services relevant to the decision at hand. 5. Reflect all causal relationships and their characteristics relevant to the decision 6. Provide accurate monetary information for all relevant cost categories appropriate to the decision.

Marginal Costing Requirements • Incorporate Foundational Economic Principles 1. Provide an accurate rendering of an enterprise’s flow of economic goods and services. • • Accommodate the strong form of causality. Accommodate the weak form of causality 2. Link the quantitative flow of goods and services to their monetary implications. 3. Provide insight into inputoutput behaviors - and their respective costs • Segment Information to Enhance Its Relevance to Decision Makers 4. Segment the cost model for only that portion of economic goods and services relevant to the decision at hand. 5. Reflect all causal relationships and their characteristics relevant to the decision 6. Provide accurate monetary information for all relevant cost categories appropriate to the decision.

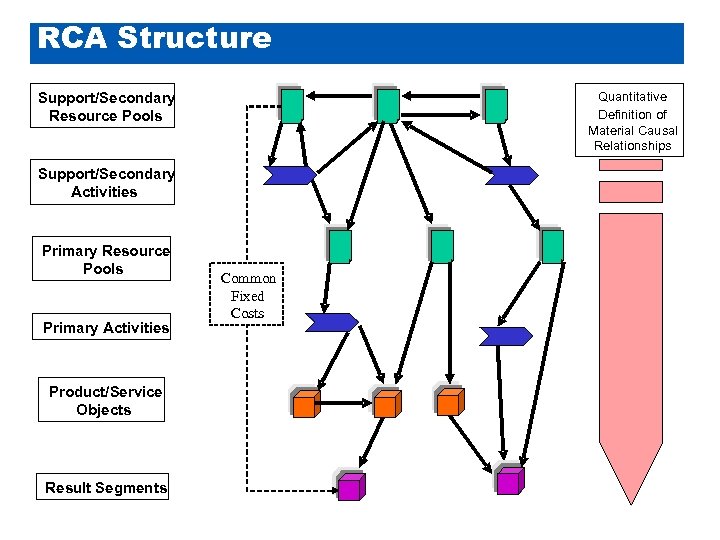

RCA Structure for Marginal Costing Quantitative Definition of Material Causal Relationships Support/Secondary Resource Pools Support/Secondary Activities Primary Resource Pools Primary Activities Product/Service Objects Result Segments Common Fixed Costs

RCA Structure for Marginal Costing Quantitative Definition of Material Causal Relationships Support/Secondary Resource Pools Support/Secondary Activities Primary Resource Pools Primary Activities Product/Service Objects Result Segments Common Fixed Costs

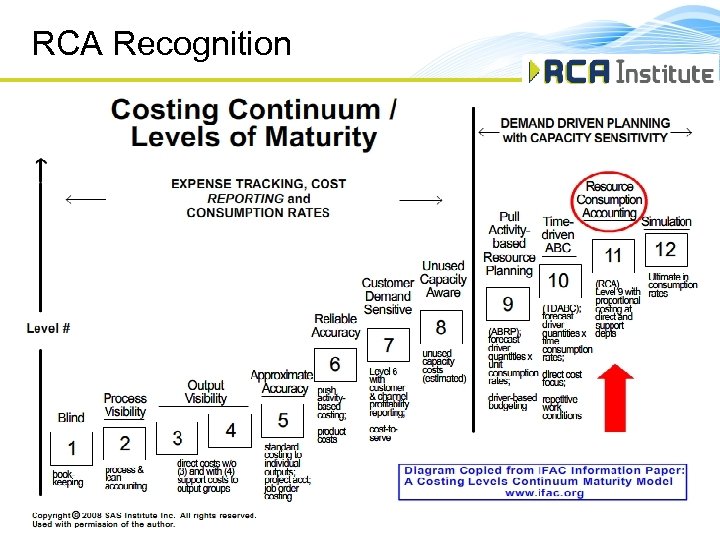

RCA Recognition

RCA Recognition

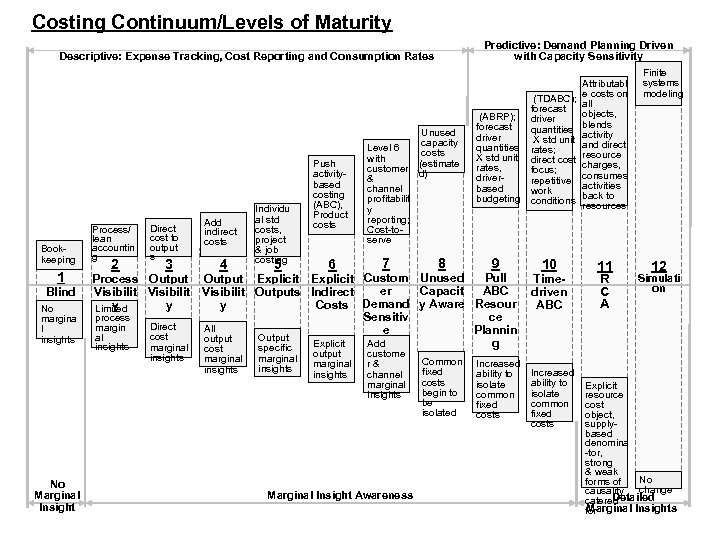

Costing Continuum/Levels of Maturity Predictive: Demand Planning Driven with Capacity Sensitivity Descriptive: Expense Tracking, Cost Reporting and Consumption Rates Bookkeeping Process/ lean accountin g Blind No margina l insights No Marginal Insight 3 4 insights 1 2 Direct cost to output s Add indirect costs marginal insights Push activitybased costing (ABC), Product costs Level 6 with customer & channel profitabilit y reporting; Cost-toserve 5 6 7 marginal insights output marginal insights custome r& channel marginal insights Individu al std costs, project & job costing Unused capacity costs (estimate d) (ABRP); forecast driver quantities X std unit rates, driverbased budgeting 8 9 Pull Process Output Explicit Custom Unused er Capacit ABC Visibilit Outputs Indirect y y y Costs Demand y Aware Resour Limited Sensitiv ce process Direct margin All e Plannin cost al Output output g Explicit Add insights marginal specific cost Marginal Insight Awareness Common fixed costs begin to be isolated Increased ability to isolate common fixed costs (TDABC); forecast driver quantities X std unit rates; direct cost focus; repetitive work conditions 10 Timedriven ABC Increased ability to isolate common fixed costs Attributabl e costs on all objects, blends activity and direct resource charges, consumes activities back to resources 11 R C A Finite systems modeling 12 Simulati on Explicit resource cost object, supplybased denomina -tor, strong & weak No forms of change causality Detailed catered Marginal Insights for

Costing Continuum/Levels of Maturity Predictive: Demand Planning Driven with Capacity Sensitivity Descriptive: Expense Tracking, Cost Reporting and Consumption Rates Bookkeeping Process/ lean accountin g Blind No margina l insights No Marginal Insight 3 4 insights 1 2 Direct cost to output s Add indirect costs marginal insights Push activitybased costing (ABC), Product costs Level 6 with customer & channel profitabilit y reporting; Cost-toserve 5 6 7 marginal insights output marginal insights custome r& channel marginal insights Individu al std costs, project & job costing Unused capacity costs (estimate d) (ABRP); forecast driver quantities X std unit rates, driverbased budgeting 8 9 Pull Process Output Explicit Custom Unused er Capacit ABC Visibilit Outputs Indirect y y y Costs Demand y Aware Resour Limited Sensitiv ce process Direct margin All e Plannin cost al Output output g Explicit Add insights marginal specific cost Marginal Insight Awareness Common fixed costs begin to be isolated Increased ability to isolate common fixed costs (TDABC); forecast driver quantities X std unit rates; direct cost focus; repetitive work conditions 10 Timedriven ABC Increased ability to isolate common fixed costs Attributabl e costs on all objects, blends activity and direct resource charges, consumes activities back to resources 11 R C A Finite systems modeling 12 Simulati on Explicit resource cost object, supplybased denomina -tor, strong & weak No forms of change causality Detailed catered Marginal Insights for

RCA Institute Objectives • Improve Management Accounting Knowledge and Practice – Focus on Decision Support for Enterprise Optimization • Build A Highly Structured and Disciplined RCA Community – Create Standard Body of Knowledge and Standards of Practice – Initial Objective is 150 -200 Highly Skilled Practitioners (The Tipping Point) – Provide A Professional Structure that Minimizes Risk to RCA Adopters

RCA Institute Objectives • Improve Management Accounting Knowledge and Practice – Focus on Decision Support for Enterprise Optimization • Build A Highly Structured and Disciplined RCA Community – Create Standard Body of Knowledge and Standards of Practice – Initial Objective is 150 -200 Highly Skilled Practitioners (The Tipping Point) – Provide A Professional Structure that Minimizes Risk to RCA Adopters

RCA Support & Quality Assurance • Institute Membership – Corporate & Individual • Certification – Specialist, Practitioner, Master – Software Products • Adopter Exploratory Workshops – Customized Workshops applying RCA to an organization • Implementation Review/Assurance – Support Adopting Organizations & Practitioner Expertise • Adopter Internal Use Reviews – Evaluations of An Organization’s Effectiveness Using and Maintaining RCA

RCA Support & Quality Assurance • Institute Membership – Corporate & Individual • Certification – Specialist, Practitioner, Master – Software Products • Adopter Exploratory Workshops – Customized Workshops applying RCA to an organization • Implementation Review/Assurance – Support Adopting Organizations & Practitioner Expertise • Adopter Internal Use Reviews – Evaluations of An Organization’s Effectiveness Using and Maintaining RCA

www. RCAInstitute. org lwhite@rcainstitute. org 757 288 6082

www. RCAInstitute. org lwhite@rcainstitute. org 757 288 6082