5d4668d6f0de110eb06b2ee82aae1e4f.ppt

- Количество слайдов: 21

EDGE Meeting June 29 th 2016 © 2015 United World Line. Confidential & Proprietary. 1

EDGE Meeting June 29 th 2016 © 2015 United World Line. Confidential & Proprietary. 1

GLOBAL CARRIER LANDSCAPE TODAY The Big Three US National Lines • International Freight Skills transitioned offshore. • Reduced US Merchant Marine. • US has abandoned all direct participation as a global carrier. © 2015 United World Line. Confidential & Proprietary. 2

GLOBAL CARRIER LANDSCAPE TODAY The Big Three US National Lines • International Freight Skills transitioned offshore. • Reduced US Merchant Marine. • US has abandoned all direct participation as a global carrier. © 2015 United World Line. Confidential & Proprietary. 2

MAJOR OCEAN CARRIERS Carrier 1 Maersk 2 MSC 3 CMA-CGM 4 Hapag-Lloyd 5 Evergreen 6 COSCO 7 China Shipping 8 Hamburg Sud 9 Hanjin Shipping • • Ownership Denmark Swiss France Germany Taiwan PR China Germany Korea Founded 1928 1970 1978 1970 1968 1961 1997 1871 1977 Vessels 600 480 470 175 150 130 148 112 101 TEU 3. 0 m 2. 6 m 1. 8 m 940 k 930 k 850 k 700 k 650 k 630 k Share 14. 7% 13. 3% 8. 8% 4. 6% 4. 2% 3. 4% 3. 2% Factoid Makes up 14% of Denmarks GDP Italian founder moved to Switzerland for tax reasons In December 2015 purchased Singapore based NOL/APL (500 k ctrs) Recently acquired Chilean CSAV, in merger talks with UASC More vessels on order, will soon pass Hapag-Lloyd Merger with China Shipping will catapult to them to #4 carrier Owned by Chinese government, as is #6 COSCO Seoul-based chaebol that also operates Korean Air and Czech Airlines Current Top 5 carriers are all either private or family-owned (Maersk, though public, is majority family owned) Lack of discipline and accountability Chaotic pricing environment. Illogical business decisions based on ego, national pride and force of habit US is now completely reliant on this global network of foreign entities, many of which receive bailouts, preferred status and subsidies from their national governments. © 2015 United World Line. Confidential & Proprietary. 3

MAJOR OCEAN CARRIERS Carrier 1 Maersk 2 MSC 3 CMA-CGM 4 Hapag-Lloyd 5 Evergreen 6 COSCO 7 China Shipping 8 Hamburg Sud 9 Hanjin Shipping • • Ownership Denmark Swiss France Germany Taiwan PR China Germany Korea Founded 1928 1970 1978 1970 1968 1961 1997 1871 1977 Vessels 600 480 470 175 150 130 148 112 101 TEU 3. 0 m 2. 6 m 1. 8 m 940 k 930 k 850 k 700 k 650 k 630 k Share 14. 7% 13. 3% 8. 8% 4. 6% 4. 2% 3. 4% 3. 2% Factoid Makes up 14% of Denmarks GDP Italian founder moved to Switzerland for tax reasons In December 2015 purchased Singapore based NOL/APL (500 k ctrs) Recently acquired Chilean CSAV, in merger talks with UASC More vessels on order, will soon pass Hapag-Lloyd Merger with China Shipping will catapult to them to #4 carrier Owned by Chinese government, as is #6 COSCO Seoul-based chaebol that also operates Korean Air and Czech Airlines Current Top 5 carriers are all either private or family-owned (Maersk, though public, is majority family owned) Lack of discipline and accountability Chaotic pricing environment. Illogical business decisions based on ego, national pride and force of habit US is now completely reliant on this global network of foreign entities, many of which receive bailouts, preferred status and subsidies from their national governments. © 2015 United World Line. Confidential & Proprietary. 3

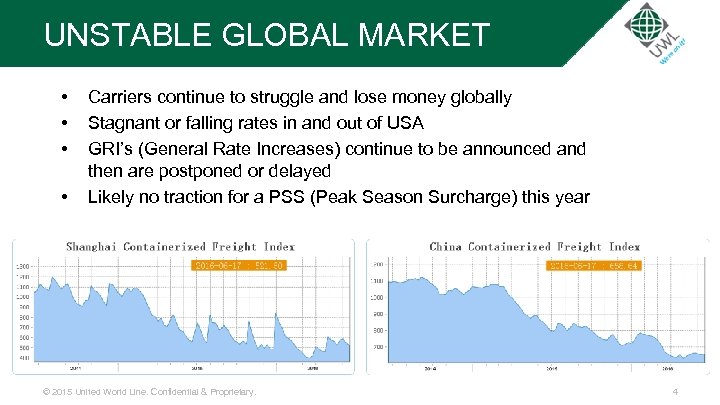

UNSTABLE GLOBAL MARKET • • Carriers continue to struggle and lose money globally Stagnant or falling rates in and out of USA GRI’s (General Rate Increases) continue to be announced and then are postponed or delayed Likely no traction for a PSS (Peak Season Surcharge) this year © 2015 United World Line. Confidential & Proprietary. 4

UNSTABLE GLOBAL MARKET • • Carriers continue to struggle and lose money globally Stagnant or falling rates in and out of USA GRI’s (General Rate Increases) continue to be announced and then are postponed or delayed Likely no traction for a PSS (Peak Season Surcharge) this year © 2015 United World Line. Confidential & Proprietary. 4

CARRIER ALLIANCES • • 13 of the 20 largest global carriers are now a part of an alliance encompassing the three major East-West trade lanes, the trans-Atlantic, the trans-Pacific and Asia-Europe and control 94% of global container capacity. – Ocean Alliance (39%) CMA CGM, COSCO, China Shipping, Evergreen Line, OOCL – THE Alliance (39%) Hanjin, Hapag-Lloyd, “K” Line, MOL, NYK Line, Yang Ming Line – 2 M (16%) Maersk & MSC Through the alliances, carriers gain access to the economies of scale achieved through larger ships and a more controlled environment. The pacts are operational, forbidding joint marketing and sales. If small players are driven out of the market, a small number of mega-carriers will achieve the power to exert price leadership in the market. © 2015 United World Line. Confidential & Proprietary. 5

CARRIER ALLIANCES • • 13 of the 20 largest global carriers are now a part of an alliance encompassing the three major East-West trade lanes, the trans-Atlantic, the trans-Pacific and Asia-Europe and control 94% of global container capacity. – Ocean Alliance (39%) CMA CGM, COSCO, China Shipping, Evergreen Line, OOCL – THE Alliance (39%) Hanjin, Hapag-Lloyd, “K” Line, MOL, NYK Line, Yang Ming Line – 2 M (16%) Maersk & MSC Through the alliances, carriers gain access to the economies of scale achieved through larger ships and a more controlled environment. The pacts are operational, forbidding joint marketing and sales. If small players are driven out of the market, a small number of mega-carriers will achieve the power to exert price leadership in the market. © 2015 United World Line. Confidential & Proprietary. 5

POSSIBILITIES • • • What can turn the tide? – A huge increase in demand (unlikely) – Carriers can cut capacity (more likely, but still questionable) Increase in vessel orders (capacity) would counter any efforts to shrink market players and would keep rates low in long-term. It doesn’t appear that we’ll have any large swings in freight rates in the near to mid-term Rumors that the big boys are intentionally keeping rates low in order to drive bankruptcies or consolidations. Seems we’re very close to a highly commoditized market with fewer providers and lower service levels and options. – This would play out in the carriers’ favor Long-term market where carriers can demand very high rates with little-to-no competition to keep rates in check. © 2015 United World Line. Confidential & Proprietary. 6

POSSIBILITIES • • • What can turn the tide? – A huge increase in demand (unlikely) – Carriers can cut capacity (more likely, but still questionable) Increase in vessel orders (capacity) would counter any efforts to shrink market players and would keep rates low in long-term. It doesn’t appear that we’ll have any large swings in freight rates in the near to mid-term Rumors that the big boys are intentionally keeping rates low in order to drive bankruptcies or consolidations. Seems we’re very close to a highly commoditized market with fewer providers and lower service levels and options. – This would play out in the carriers’ favor Long-term market where carriers can demand very high rates with little-to-no competition to keep rates in check. © 2015 United World Line. Confidential & Proprietary. 6

DISCUSSION • • • Carrier consolidation within countries; Governments increasingly unwilling to support multiple “quasi-national” carriers. – Germany – Japan – China (just happened) – Korea (underway) Consolidation across borders (happening already) – December 2015: CMA purchases Singapore NOL/APL – Hapag-Lloyd: Recently acquired CSAV, merger approved with UASC. Smaller and less attractive carriers will be allowed to go bankrupt. The handful of carriers left standing will drive rates to unprecedented levels. No nation or private entity will be left with the resources or motivation to re-enter the carrier market. Could higher rates drive more re-shoring of manufacturing closer to their global markets? © 2015 United World Line. Confidential & Proprietary. 7

DISCUSSION • • • Carrier consolidation within countries; Governments increasingly unwilling to support multiple “quasi-national” carriers. – Germany – Japan – China (just happened) – Korea (underway) Consolidation across borders (happening already) – December 2015: CMA purchases Singapore NOL/APL – Hapag-Lloyd: Recently acquired CSAV, merger approved with UASC. Smaller and less attractive carriers will be allowed to go bankrupt. The handful of carriers left standing will drive rates to unprecedented levels. No nation or private entity will be left with the resources or motivation to re-enter the carrier market. Could higher rates drive more re-shoring of manufacturing closer to their global markets? © 2015 United World Line. Confidential & Proprietary. 7

WORLD SHIPPING GROUP © 2015 United World Line. Confidential & Proprietary. 8

WORLD SHIPPING GROUP © 2015 United World Line. Confidential & Proprietary. 8

WORLD SHIPPING GROUP • The company dates back to 1960 and the opening of the St. Lawrence Seaway - handling vessels in the Great Lakes. • Company playing a lead role through the evolution of containerization in the Mid-West, from liner agency to now - a global organization. • We have grown to become one of the largest international logistics companies in the Cleveland area, revenues of $500 m and 1150 staff. Local Service - Global Reach © 2015 United World Line. Confidential & Proprietary. 9

WORLD SHIPPING GROUP • The company dates back to 1960 and the opening of the St. Lawrence Seaway - handling vessels in the Great Lakes. • Company playing a lead role through the evolution of containerization in the Mid-West, from liner agency to now - a global organization. • We have grown to become one of the largest international logistics companies in the Cleveland area, revenues of $500 m and 1150 staff. Local Service - Global Reach © 2015 United World Line. Confidential & Proprietary. 9

WORLD SHIPPING GROUP - EVOLUTION © 2015 United World Line. Confidential & Proprietary. 10

WORLD SHIPPING GROUP - EVOLUTION © 2015 United World Line. Confidential & Proprietary. 10

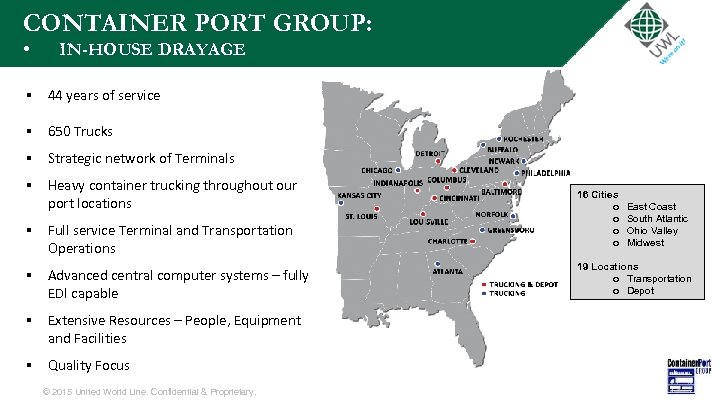

CONTAINER PORT GROUP: • IN-HOUSE DRAYAGE § 44 years of service § 650 Trucks § Strategic network of Terminals § Heavy container trucking throughout our port locations § Full service Terminal and Transportation Operations § Advanced central computer systems – fully EDI capable 16 Cities o o East Coast South Atlantic Ohio Valley Midwest 19 Locations o Transportation o Depot § Extensive Resources – People, Equipment and Facilities § Quality Focus © 2015 United World Line. Confidential & Proprietary. 11

CONTAINER PORT GROUP: • IN-HOUSE DRAYAGE § 44 years of service § 650 Trucks § Strategic network of Terminals § Heavy container trucking throughout our port locations § Full service Terminal and Transportation Operations § Advanced central computer systems – fully EDI capable 16 Cities o o East Coast South Atlantic Ohio Valley Midwest 19 Locations o Transportation o Depot § Extensive Resources – People, Equipment and Facilities § Quality Focus © 2015 United World Line. Confidential & Proprietary. 11

OUR LANDSCAPE Global Tank Operations NVOCC Operator for Bulk Liquid Bulk Chemical Expertise Food Grade Fleet Reporting & Tracking Fleet Management M&R Services Growing USA Trucking company with 20 terminals in 16 markets nationwide Container Trucking – 650 Trucks Depot Operations M&R Services Container Sales © 2015 United World Line. Confidential & Proprietary. Logistics – 11 warehouses Hi-Speed Crossdocking Consolidation & Deconsolidation OTR / LTL Trucking Heavy Lift Capabilities Bulk Transloading Order Fulfillment NVOCC Operator Freight Forwarding Customs Broker Supply Chain Solutions Delivery Tracking Live Customer Service Integration with air, truck, rail, and warehouse logistics 12

OUR LANDSCAPE Global Tank Operations NVOCC Operator for Bulk Liquid Bulk Chemical Expertise Food Grade Fleet Reporting & Tracking Fleet Management M&R Services Growing USA Trucking company with 20 terminals in 16 markets nationwide Container Trucking – 650 Trucks Depot Operations M&R Services Container Sales © 2015 United World Line. Confidential & Proprietary. Logistics – 11 warehouses Hi-Speed Crossdocking Consolidation & Deconsolidation OTR / LTL Trucking Heavy Lift Capabilities Bulk Transloading Order Fulfillment NVOCC Operator Freight Forwarding Customs Broker Supply Chain Solutions Delivery Tracking Live Customer Service Integration with air, truck, rail, and warehouse logistics 12

ASSET BASED LOGISTICS COMPANY Full 3 PL Service Warehousing Cross Dock • • • Intermodal Truck / Rail Customs House Brokerage NVOCC & Freight Forwarding Air Freight & Expedited Services Information Technology Services Truck Brokerage UWL is a one stop shop for all the World Group companies providing Global 3 PL services. Current offerings touch all major service segments identified. Services globally using our own offices in Europe, Brazil, USA and agent networks. Many major fortune 2000 businesses use UWL’s 3 PL services today. Financially stable parent, and robust shipper base feeding new business. © 2015 United World Line. Confidential & Proprietary. 13

ASSET BASED LOGISTICS COMPANY Full 3 PL Service Warehousing Cross Dock • • • Intermodal Truck / Rail Customs House Brokerage NVOCC & Freight Forwarding Air Freight & Expedited Services Information Technology Services Truck Brokerage UWL is a one stop shop for all the World Group companies providing Global 3 PL services. Current offerings touch all major service segments identified. Services globally using our own offices in Europe, Brazil, USA and agent networks. Many major fortune 2000 businesses use UWL’s 3 PL services today. Financially stable parent, and robust shipper base feeding new business. © 2015 United World Line. Confidential & Proprietary. 13

UWL GLOBAL COVERAGE © 2015 United World Line. Confidential & Proprietary. 14

UWL GLOBAL COVERAGE © 2015 United World Line. Confidential & Proprietary. 14

WORLD DISTRIBUTION SERVICES § § § We have In-house Dedicated Warehouse & Distribution Teams High Volume Distribution Cross-dock / Transload De-Consol / Consol Programs Racked Facilities Order Fulfillment Value Added Services Hazmat certified FDA certified US Customs Bonded C-TPAT Compliant © 2015 United World Line. Confidential & Proprietary. 11 markets nationally Over 2 million square feet § § § Norfolk, VA Newark, NJ Charleston, SC Savannah, GA Chicago, IL Baltimore, MD Columbus, OH Cincinnati, OH Cleveland, OH Houston, TX Los Angeles, CA 15

WORLD DISTRIBUTION SERVICES § § § We have In-house Dedicated Warehouse & Distribution Teams High Volume Distribution Cross-dock / Transload De-Consol / Consol Programs Racked Facilities Order Fulfillment Value Added Services Hazmat certified FDA certified US Customs Bonded C-TPAT Compliant © 2015 United World Line. Confidential & Proprietary. 11 markets nationally Over 2 million square feet § § § Norfolk, VA Newark, NJ Charleston, SC Savannah, GA Chicago, IL Baltimore, MD Columbus, OH Cincinnati, OH Cleveland, OH Houston, TX Los Angeles, CA 15

COMMERCIAL ISSUE TOPIC © 2015 United World Line. Confidential & Proprietary. 16

COMMERCIAL ISSUE TOPIC © 2015 United World Line. Confidential & Proprietary. 16

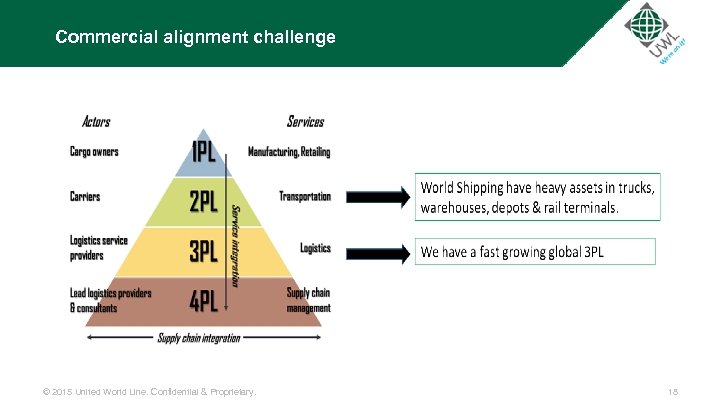

Commercial alignment challenge © 2015 United World Line. Confidential & Proprietary. 17

Commercial alignment challenge © 2015 United World Line. Confidential & Proprietary. 17

Commercial alignment challenge © 2015 United World Line. Confidential & Proprietary. 18

Commercial alignment challenge © 2015 United World Line. Confidential & Proprietary. 18

Commercial alignment challenge Current Scenario: We have four companies: • Newport • WDS and UWL – (one now) • CPG • All need independence due to the commercial complexity of our divisions all selling into our competitors. • Likely to be many years before this can be aligned differently. • Yet we also sell to the same companies and have relationships with clients that could use multiple services. • Longer term goal not to sell to competitors of the 3 PL. © 2015 United World Line. Confidential & Proprietary. 19

Commercial alignment challenge Current Scenario: We have four companies: • Newport • WDS and UWL – (one now) • CPG • All need independence due to the commercial complexity of our divisions all selling into our competitors. • Likely to be many years before this can be aligned differently. • Yet we also sell to the same companies and have relationships with clients that could use multiple services. • Longer term goal not to sell to competitors of the 3 PL. © 2015 United World Line. Confidential & Proprietary. 19

Commercial alignment challenge Who owns the customer? Reward systems? Not to overly incent, as conflicts with divisions core goals? © 2015 United World Line. Confidential & Proprietary. 20

Commercial alignment challenge Who owns the customer? Reward systems? Not to overly incent, as conflicts with divisions core goals? © 2015 United World Line. Confidential & Proprietary. 20

Thank you for your time! © 2015 United World Line. Confidential & Proprietary. 21

Thank you for your time! © 2015 United World Line. Confidential & Proprietary. 21