d58dd0f949e8e9f061b522d2cc468970.ppt

- Количество слайдов: 81

EDD Performance against 2015/16 Annual Performance Plan (APP) for the 1 st Quarter 2015/16 Presentation to the Portfolio Committee Economic Development 1 September 2015 1

EDD Performance against 2015/16 Annual Performance Plan (APP) for the 1 st Quarter 2015/16 Presentation to the Portfolio Committee Economic Development 1 September 2015 1

Background On the 24 th March 2015 the Ministry presented the conceptual framework of the Strategic Plan and Annual Performance Plan for 2015/16 to the Economic Development Portfolio Committee, providing the context in which we operate and an overview of the Department’s programmes and strategic objectives. On the 14 th April 2015 the Ministry presented the details of the Department’s KPIs and products or outputs including: • 3 programmes to organise the Department around • 6 strategic objectives to provide direction • 23 KPIs to give effect to the strategic objectives • 164 products / outputs from the KPIs. Today we will report on work performed in Q 1 according to the Department’s Strategic Plan and Annual Performance Plan. 2

Background On the 24 th March 2015 the Ministry presented the conceptual framework of the Strategic Plan and Annual Performance Plan for 2015/16 to the Economic Development Portfolio Committee, providing the context in which we operate and an overview of the Department’s programmes and strategic objectives. On the 14 th April 2015 the Ministry presented the details of the Department’s KPIs and products or outputs including: • 3 programmes to organise the Department around • 6 strategic objectives to provide direction • 23 KPIs to give effect to the strategic objectives • 164 products / outputs from the KPIs. Today we will report on work performed in Q 1 according to the Department’s Strategic Plan and Annual Performance Plan. 2

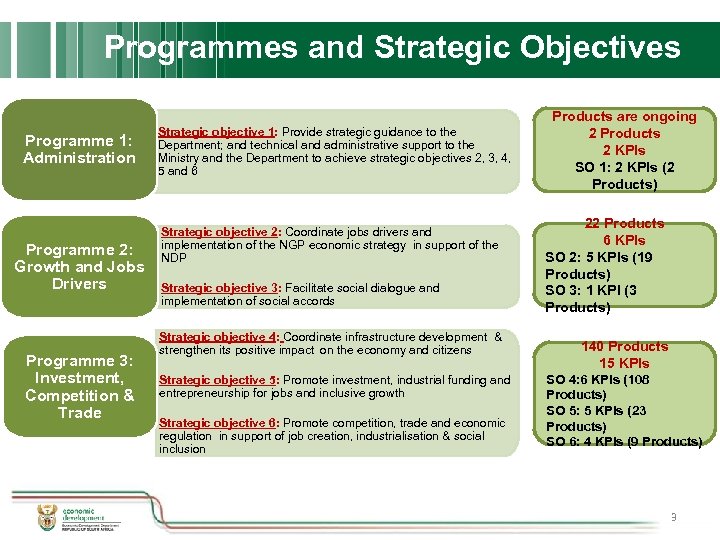

Programmes and Strategic Objectives Programme 1: Administration Programme 2: Growth and Jobs Drivers Programme 3: Investment, Competition & Trade Strategic objective 1: Provide strategic guidance to the Department; and technical and administrative support to the Ministry and the Department to achieve strategic objectives 2, 3, 4, 5 and 6 Strategic objective 2: Coordinate jobs drivers and implementation of the NGP economic strategy in support of the NDP Strategic objective 3: Facilitate social dialogue and implementation of social accords Strategic objective 4: Coordinate infrastructure development & strengthen its positive impact on the economy and citizens Strategic objective 5: Promote investment, industrial funding and entrepreneurship for jobs and inclusive growth Strategic objective 6: Promote competition, trade and economic regulation in support of job creation, industrialisation & social inclusion Products are ongoing 2 Products 2 KPIs SO 1: 2 KPIs (2 Products) 22 Products 6 KPIs SO 2: 5 KPIs (19 Products) SO 3: 1 KPI (3 Products) 140 Products 15 KPIs SO 4: 6 KPIs (108 Products) SO 5: 5 KPIs (23 Products) SO 6: 4 KPIs (9 Products) 3

Programmes and Strategic Objectives Programme 1: Administration Programme 2: Growth and Jobs Drivers Programme 3: Investment, Competition & Trade Strategic objective 1: Provide strategic guidance to the Department; and technical and administrative support to the Ministry and the Department to achieve strategic objectives 2, 3, 4, 5 and 6 Strategic objective 2: Coordinate jobs drivers and implementation of the NGP economic strategy in support of the NDP Strategic objective 3: Facilitate social dialogue and implementation of social accords Strategic objective 4: Coordinate infrastructure development & strengthen its positive impact on the economy and citizens Strategic objective 5: Promote investment, industrial funding and entrepreneurship for jobs and inclusive growth Strategic objective 6: Promote competition, trade and economic regulation in support of job creation, industrialisation & social inclusion Products are ongoing 2 Products 2 KPIs SO 1: 2 KPIs (2 Products) 22 Products 6 KPIs SO 2: 5 KPIs (19 Products) SO 3: 1 KPI (3 Products) 140 Products 15 KPIs SO 4: 6 KPIs (108 Products) SO 5: 5 KPIs (23 Products) SO 6: 4 KPIs (9 Products) 3

Programme 1: Administration Strategic Objective 1: Provide strategic guidance to the Department; and technical and administrative support to the Ministry and the Department to achieve strategic objectives 2, 3, 4, 5 and 6 Key Performance Indicators 1. Unqualified audit report 2. Measured improvement in support services to Strategic Objectives 2, 3, 4, 5 & 6 and the Ministry, as quantified by users 4

Programme 1: Administration Strategic Objective 1: Provide strategic guidance to the Department; and technical and administrative support to the Ministry and the Department to achieve strategic objectives 2, 3, 4, 5 and 6 Key Performance Indicators 1. Unqualified audit report 2. Measured improvement in support services to Strategic Objectives 2, 3, 4, 5 & 6 and the Ministry, as quantified by users 4

Key Performance Indicator Unqualified audit report KPI 1 Work completed towards an unqualified audit: Respond to AG queries EDD completed the following work in relation to the preparation for the 2014/15 final audit by the Auditor-General (AG): • physical verification of movable assets; • year-end reconciliations, closed the financial systems and prepared the annual financial statements; • Compiled evidence files in support of the performance information; • convened an Audit Committee meeting to consider the annual financial statements and performance information for submission to the AG; • engaged with the Auditor-General at Ministerial level to receive feedback and to advise on measures to ensure sound management in the department; • convened meetings to monitor progress on the implementation of corrective measures to address the Auditor-General’s queries and findings; • the Acting DG engaged with ITAC implementing corrective measures to address the audit findings of the previous financial year. 5

Key Performance Indicator Unqualified audit report KPI 1 Work completed towards an unqualified audit: Respond to AG queries EDD completed the following work in relation to the preparation for the 2014/15 final audit by the Auditor-General (AG): • physical verification of movable assets; • year-end reconciliations, closed the financial systems and prepared the annual financial statements; • Compiled evidence files in support of the performance information; • convened an Audit Committee meeting to consider the annual financial statements and performance information for submission to the AG; • engaged with the Auditor-General at Ministerial level to receive feedback and to advise on measures to ensure sound management in the department; • convened meetings to monitor progress on the implementation of corrective measures to address the Auditor-General’s queries and findings; • the Acting DG engaged with ITAC implementing corrective measures to address the audit findings of the previous financial year. 5

Key Performance Indicator Measured improvement in support services to Strategic Objectives 2, 3, 4, 5 & 6 and the Ministry, as quantified by users KPI 2 Work completed: Pilot survey completed • EDD conducted a pilot survey to identify the quality and effectiveness of support services in the department and to implement interventions to improve service delivery. The survey covered Finance, HR, SCM, Communications, IT and Facilities Management. • As a result of the pilot survey, the DG began to implement the following: • Measures to ensure speedy responses; • Training and communication of policies and procedures has been developed; • Review of systems to remove unnecessary bureaucratic delays. • This process will continue throughout the year to ensure the results are embedded. • In the 2 nd quarter, these interventions will be assessed by focus groups. • In the 3 rd quarter the Survey will be redesigned or amended where necessary, incorporating the learnings from the previous quarter. • In the 4 th quarter the Survey will be repeated, results analysed and tabled with the Minister. A baseline will be developed for targets for the following financial year. 6

Key Performance Indicator Measured improvement in support services to Strategic Objectives 2, 3, 4, 5 & 6 and the Ministry, as quantified by users KPI 2 Work completed: Pilot survey completed • EDD conducted a pilot survey to identify the quality and effectiveness of support services in the department and to implement interventions to improve service delivery. The survey covered Finance, HR, SCM, Communications, IT and Facilities Management. • As a result of the pilot survey, the DG began to implement the following: • Measures to ensure speedy responses; • Training and communication of policies and procedures has been developed; • Review of systems to remove unnecessary bureaucratic delays. • This process will continue throughout the year to ensure the results are embedded. • In the 2 nd quarter, these interventions will be assessed by focus groups. • In the 3 rd quarter the Survey will be redesigned or amended where necessary, incorporating the learnings from the previous quarter. • In the 4 th quarter the Survey will be repeated, results analysed and tabled with the Minister. A baseline will be developed for targets for the following financial year. 6

Programme 2: Growth path and social dialogue Strategic Objective 2: Coordinate jobs drivers and implementation of the NGP economic strategy in support of the NDP Key Performance Indicator 3. Integrate NGP framework in macro - and micro economic policy and infrastructure initiatives, including through selective impact assessments and updating the operational sections of the NGP where necessary, as part of strengthening implementation of the NGP 4. Strategic support for jobs drivers of the NGP, monitor implementation across the state, address blockages as required and identify new opportunities and risks as they arise as part of strengthening implementation of the NGP 5. Support the development of the green economy and jobs through implementing the Green Economy Accord 7. Number of spatial, local and provincial initiatives to promote employment, empowerment and development 7

Programme 2: Growth path and social dialogue Strategic Objective 2: Coordinate jobs drivers and implementation of the NGP economic strategy in support of the NDP Key Performance Indicator 3. Integrate NGP framework in macro - and micro economic policy and infrastructure initiatives, including through selective impact assessments and updating the operational sections of the NGP where necessary, as part of strengthening implementation of the NGP 4. Strategic support for jobs drivers of the NGP, monitor implementation across the state, address blockages as required and identify new opportunities and risks as they arise as part of strengthening implementation of the NGP 5. Support the development of the green economy and jobs through implementing the Green Economy Accord 7. Number of spatial, local and provincial initiatives to promote employment, empowerment and development 7

Key Performance Indicator Integrate NGP framework in macro - and micro economic policy and infrastructure initiatives, including through selective impact assessments and updating the operational sections of the NGP where necessary, as part of strengthening implementation of the NGP KPI 3 Work completed: Report on employment The Department conducted a detailed analysis of employment trends since the adoption of the NGP in October 2010, assessing progress for each of the Jobs Drivers identified in the strategy. The findings assist in directing the work of the state to prioritise the 9 -point plan announced during the 2015 State of the Nation Address. 8

Key Performance Indicator Integrate NGP framework in macro - and micro economic policy and infrastructure initiatives, including through selective impact assessments and updating the operational sections of the NGP where necessary, as part of strengthening implementation of the NGP KPI 3 Work completed: Report on employment The Department conducted a detailed analysis of employment trends since the adoption of the NGP in October 2010, assessing progress for each of the Jobs Drivers identified in the strategy. The findings assist in directing the work of the state to prioritise the 9 -point plan announced during the 2015 State of the Nation Address. 8

Jobs context - From 1994 to 2008, the economy grew at a faster rate than the preceding 15 years. - The 2008/09 global economic crisis which started in the US, rapidly spread through the transmission belts of weaker global demand, contraction of credit to the real economy and business confidence, affecting particularly countries with high trade to GDP ratios, like SA - The impact on jobs was sudden and significant: about one million jobs were lost - The response of government to this was two-fold: - Short-term interventions based on a social accord signed in 2009, covering funds for companies and workers in distress; and - Development of a new growth path addresses structural constrains and to deepen the jobs impact of economic growth 9

Jobs context - From 1994 to 2008, the economy grew at a faster rate than the preceding 15 years. - The 2008/09 global economic crisis which started in the US, rapidly spread through the transmission belts of weaker global demand, contraction of credit to the real economy and business confidence, affecting particularly countries with high trade to GDP ratios, like SA - The impact on jobs was sudden and significant: about one million jobs were lost - The response of government to this was two-fold: - Short-term interventions based on a social accord signed in 2009, covering funds for companies and workers in distress; and - Development of a new growth path addresses structural constrains and to deepen the jobs impact of economic growth 9

CASE STUDY – JOBS GROWTH • Cabinet adopted the NGP’s focus on jobs drivers in October 2010. • This is the economic strategy to give effect to the vision of the National Development Plan to create 11 million new jobs by 2030. • The NGP prioritised job creation through the alignment of policies across the state to support key jobs drivers • The analysis draws primarily on the Quarterly Labour Force Survey for overall jobs data • The data shows robust jobs growth over the period • This perception of limited jobs growth may arise from – The fact that joblessness is still high – Concerns about the economic slowdown given the end of the commodity boom, energy shortages and a conflictual labour relations environment • We need to develop a more evidence-based discussion 10

CASE STUDY – JOBS GROWTH • Cabinet adopted the NGP’s focus on jobs drivers in October 2010. • This is the economic strategy to give effect to the vision of the National Development Plan to create 11 million new jobs by 2030. • The NGP prioritised job creation through the alignment of policies across the state to support key jobs drivers • The analysis draws primarily on the Quarterly Labour Force Survey for overall jobs data • The data shows robust jobs growth over the period • This perception of limited jobs growth may arise from – The fact that joblessness is still high – Concerns about the economic slowdown given the end of the commodity boom, energy shortages and a conflictual labour relations environment • We need to develop a more evidence-based discussion 10

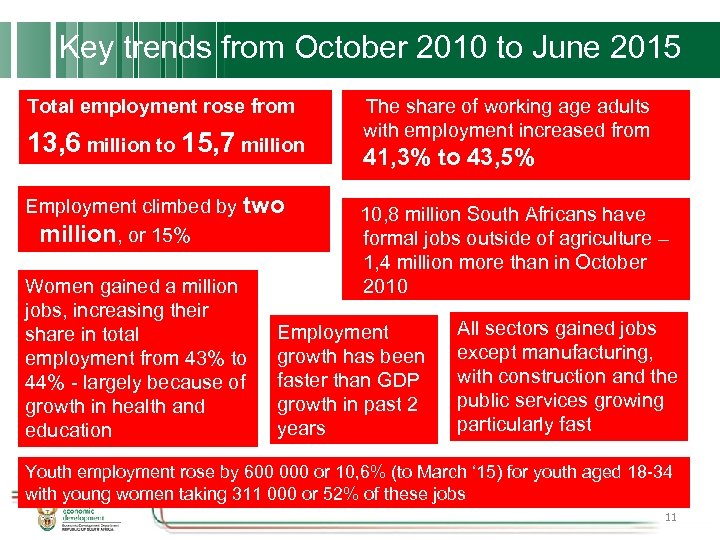

Key trends from October 2010 to June 2015 Total employment rose from 13, 6 million to 15, 7 million Employment climbed by two million, or 15% Women gained a million jobs, increasing their share in total employment from 43% to 44% - largely because of growth in health and education The share of working age adults with employment increased from 41, 3% to 43, 5% 10, 8 million South Africans have formal jobs outside of agriculture – 1, 4 million more than in October 2010 Employment growth has been faster than GDP growth in past 2 years All sectors gained jobs except manufacturing, with construction and the public services growing particularly fast Youth employment rose by 600 000 or 10, 6% (to March ‘ 15) for youth aged 18 -34 with young women taking 311 000 or 52% of these jobs 11

Key trends from October 2010 to June 2015 Total employment rose from 13, 6 million to 15, 7 million Employment climbed by two million, or 15% Women gained a million jobs, increasing their share in total employment from 43% to 44% - largely because of growth in health and education The share of working age adults with employment increased from 41, 3% to 43, 5% 10, 8 million South Africans have formal jobs outside of agriculture – 1, 4 million more than in October 2010 Employment growth has been faster than GDP growth in past 2 years All sectors gained jobs except manufacturing, with construction and the public services growing particularly fast Youth employment rose by 600 000 or 10, 6% (to March ‘ 15) for youth aged 18 -34 with young women taking 311 000 or 52% of these jobs 11

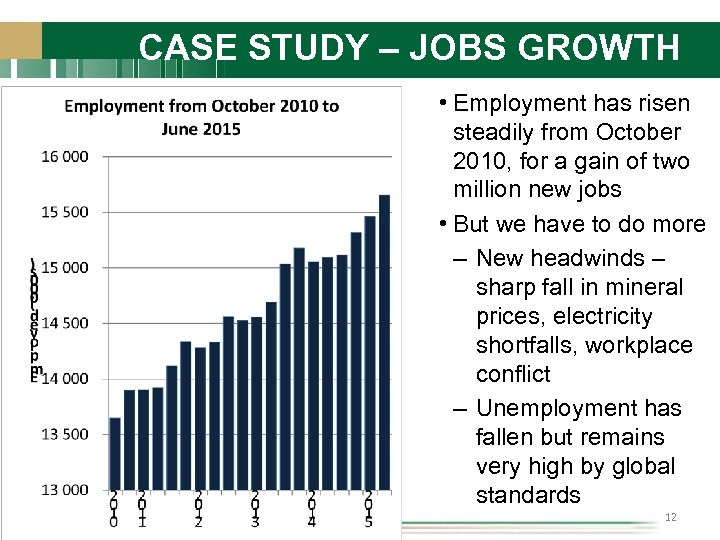

CASE STUDY – JOBS GROWTH • Employment has risen steadily from October 2010, for a gain of two million new jobs • But we have to do more – New headwinds – sharp fall in mineral prices, electricity shortfalls, workplace conflict – Unemployment has fallen but remains very high by global standards 12

CASE STUDY – JOBS GROWTH • Employment has risen steadily from October 2010, for a gain of two million new jobs • But we have to do more – New headwinds – sharp fall in mineral prices, electricity shortfalls, workplace conflict – Unemployment has fallen but remains very high by global standards 12

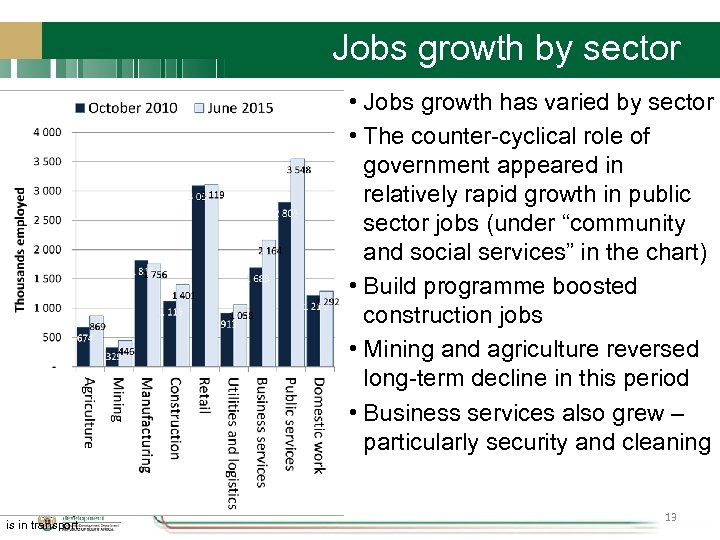

Jobs growth by sector • Jobs growth has varied by sector • The counter-cyclical role of government appeared in relatively rapid growth in public sector jobs (under “community and social services” in the chart) • Build programme boosted construction jobs • Mining and agriculture reversed long-term decline in this period • Business services also grew – particularly security and cleaning Utilities and logistics includes transport, electricity, gas, water and telecommunications. Most of the employment in this sector is in transport. 13

Jobs growth by sector • Jobs growth has varied by sector • The counter-cyclical role of government appeared in relatively rapid growth in public sector jobs (under “community and social services” in the chart) • Build programme boosted construction jobs • Mining and agriculture reversed long-term decline in this period • Business services also grew – particularly security and cleaning Utilities and logistics includes transport, electricity, gas, water and telecommunications. Most of the employment in this sector is in transport. 13

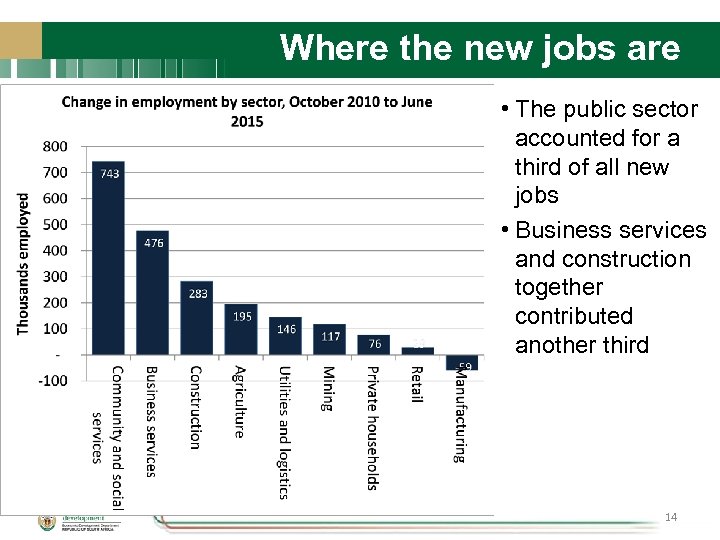

Where the new jobs are • The public sector accounted for a third of all new jobs • Business services and construction together contributed another third 14

Where the new jobs are • The public sector accounted for a third of all new jobs • Business services and construction together contributed another third 14

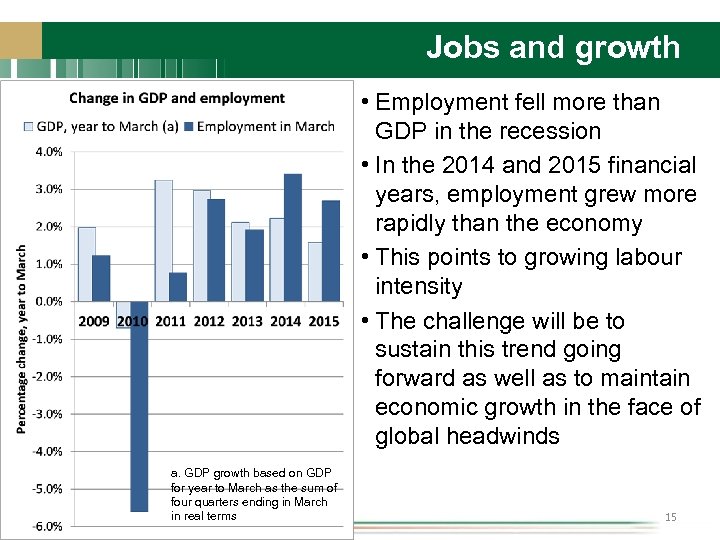

Jobs and growth • Employment fell more than GDP in the recession • In the 2014 and 2015 financial years, employment grew more rapidly than the economy • This points to growing labour intensity • The challenge will be to sustain this trend going forward as well as to maintain economic growth in the face of global headwinds a. GDP growth based on GDP for year to March as the sum of four quarters ending in March in real terms 15

Jobs and growth • Employment fell more than GDP in the recession • In the 2014 and 2015 financial years, employment grew more rapidly than the economy • This points to growing labour intensity • The challenge will be to sustain this trend going forward as well as to maintain economic growth in the face of global headwinds a. GDP growth based on GDP for year to March as the sum of four quarters ending in March in real terms 15

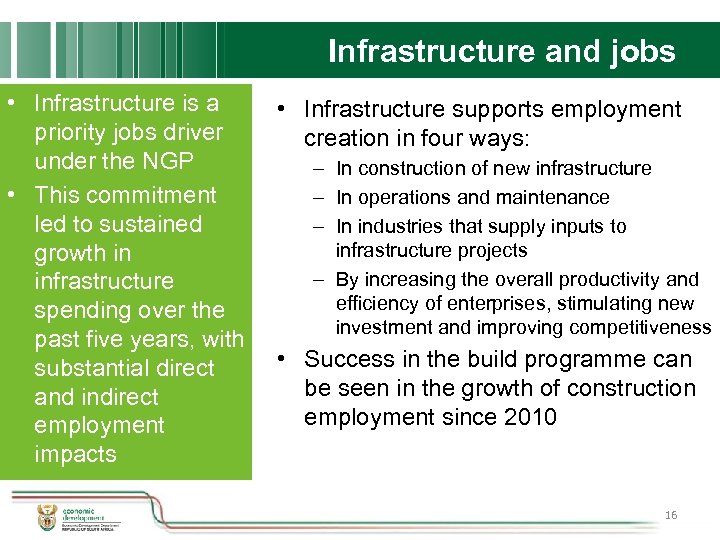

Infrastructure and jobs • Infrastructure is a priority jobs driver under the NGP • This commitment led to sustained growth in infrastructure spending over the past five years, with substantial direct and indirect employment impacts • Infrastructure supports employment creation in four ways: – In construction of new infrastructure – In operations and maintenance – In industries that supply inputs to infrastructure projects – By increasing the overall productivity and efficiency of enterprises, stimulating new investment and improving competitiveness • Success in the build programme can be seen in the growth of construction employment since 2010 16

Infrastructure and jobs • Infrastructure is a priority jobs driver under the NGP • This commitment led to sustained growth in infrastructure spending over the past five years, with substantial direct and indirect employment impacts • Infrastructure supports employment creation in four ways: – In construction of new infrastructure – In operations and maintenance – In industries that supply inputs to infrastructure projects – By increasing the overall productivity and efficiency of enterprises, stimulating new investment and improving competitiveness • Success in the build programme can be seen in the growth of construction employment since 2010 16

Construction jobs • • • Construction covers housing and other infrastructure. From the Global Financial Crisis in 2008/9, most construction growth occurred in non-housing infrastructure. In terms of jobs, it was one of the fastest growing sectors From October 2010 to June 2015, construction jobs rose by 283 000 or 25%, compared to 15% growth in jobs in the rest of the economy. In June 2015, construction accounted for 9% of total employment, up from 8% in 2010, but contributed 14% of all new jobs from October 2010 • The broad spatial impact of the build programme emerges from the rapid growth in employment in Limpopo and Mpumalanga as a result of the complex of power plants, coal mines and the related roads and water infrastructure. • From October 2010 to June 2015, total employment in Limpopo climbed by 357 000, or 38%, while Mpumalanga gained 209 000 new jobs, or 22%. • The share of adults with employment rose from 29% to 36% in Limpopo in this period, and from 39% to 43% in Mpumalanga. 17

Construction jobs • • • Construction covers housing and other infrastructure. From the Global Financial Crisis in 2008/9, most construction growth occurred in non-housing infrastructure. In terms of jobs, it was one of the fastest growing sectors From October 2010 to June 2015, construction jobs rose by 283 000 or 25%, compared to 15% growth in jobs in the rest of the economy. In June 2015, construction accounted for 9% of total employment, up from 8% in 2010, but contributed 14% of all new jobs from October 2010 • The broad spatial impact of the build programme emerges from the rapid growth in employment in Limpopo and Mpumalanga as a result of the complex of power plants, coal mines and the related roads and water infrastructure. • From October 2010 to June 2015, total employment in Limpopo climbed by 357 000, or 38%, while Mpumalanga gained 209 000 new jobs, or 22%. • The share of adults with employment rose from 29% to 36% in Limpopo in this period, and from 39% to 43% in Mpumalanga. 17

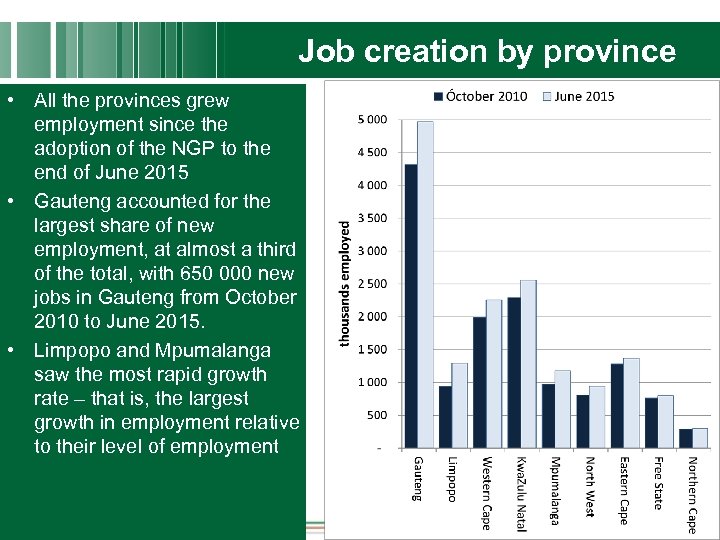

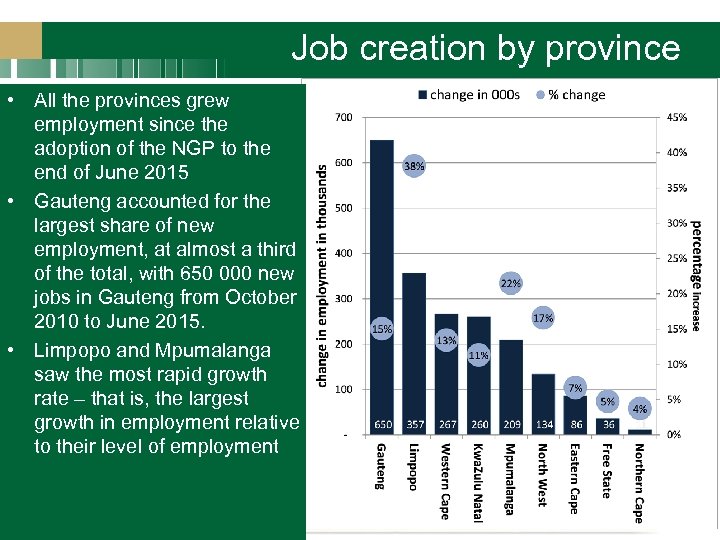

Job creation by province • All the provinces grew employment since the adoption of the NGP to the end of June 2015 • Gauteng accounted for the largest share of new employment, at almost a third of the total, with 650 000 new jobs in Gauteng from October 2010 to June 2015. • Limpopo and Mpumalanga saw the most rapid growth rate – that is, the largest growth in employment relative to their level of employment 2018/03/16 8: 48 AM 18

Job creation by province • All the provinces grew employment since the adoption of the NGP to the end of June 2015 • Gauteng accounted for the largest share of new employment, at almost a third of the total, with 650 000 new jobs in Gauteng from October 2010 to June 2015. • Limpopo and Mpumalanga saw the most rapid growth rate – that is, the largest growth in employment relative to their level of employment 2018/03/16 8: 48 AM 18

Job creation by province • All the provinces grew employment since the adoption of the NGP to the end of June 2015 • Gauteng accounted for the largest share of new employment, at almost a third of the total, with 650 000 new jobs in Gauteng from October 2010 to June 2015. • Limpopo and Mpumalanga saw the most rapid growth rate – that is, the largest growth in employment relative to their level of employment 19

Job creation by province • All the provinces grew employment since the adoption of the NGP to the end of June 2015 • Gauteng accounted for the largest share of new employment, at almost a third of the total, with 650 000 new jobs in Gauteng from October 2010 to June 2015. • Limpopo and Mpumalanga saw the most rapid growth rate – that is, the largest growth in employment relative to their level of employment 19

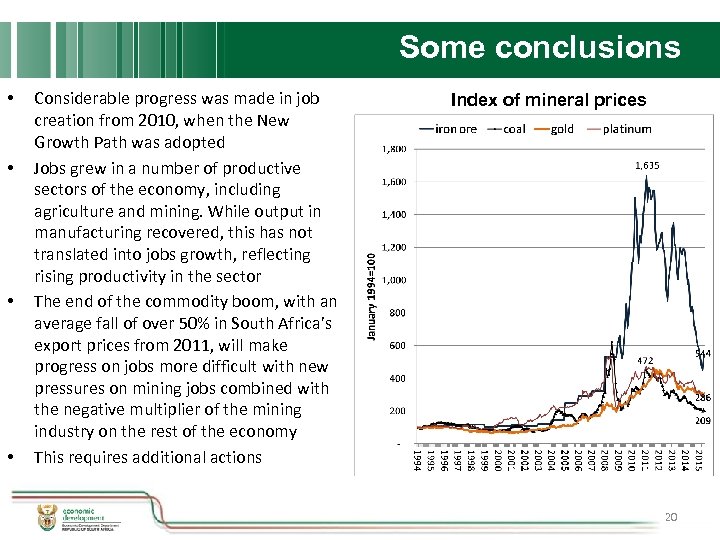

Some conclusions • • Considerable progress was made in job creation from 2010, when the New Growth Path was adopted Jobs grew in a number of productive sectors of the economy, including agriculture and mining. While output in manufacturing recovered, this has not translated into jobs growth, reflecting rising productivity in the sector The end of the commodity boom, with an average fall of over 50% in South Africa’s export prices from 2011, will make progress on jobs more difficult with new pressures on mining jobs combined with the negative multiplier of the mining industry on the rest of the economy This requires additional actions Index of mineral prices 20

Some conclusions • • Considerable progress was made in job creation from 2010, when the New Growth Path was adopted Jobs grew in a number of productive sectors of the economy, including agriculture and mining. While output in manufacturing recovered, this has not translated into jobs growth, reflecting rising productivity in the sector The end of the commodity boom, with an average fall of over 50% in South Africa’s export prices from 2011, will make progress on jobs more difficult with new pressures on mining jobs combined with the negative multiplier of the mining industry on the rest of the economy This requires additional actions Index of mineral prices 20

Nine-Point Plan The Nine-point Plan announced in SONA in February 2015 is a response to the new global conditions. They cover: – Agriculture and agro-processing – Manufacturing through higher impact Industrial Policy Action Plan – Advancing beneficiation through more local processing – Unlocking the potential of SMMEs, cooperatives, township and rural enterprises – Growing the oceans economy – Resolving the energy challenge – Reducing workplace conflict – Scaling-up private sector investment – Supporting infrastructure investment and innovation 21

Nine-Point Plan The Nine-point Plan announced in SONA in February 2015 is a response to the new global conditions. They cover: – Agriculture and agro-processing – Manufacturing through higher impact Industrial Policy Action Plan – Advancing beneficiation through more local processing – Unlocking the potential of SMMEs, cooperatives, township and rural enterprises – Growing the oceans economy – Resolving the energy challenge – Reducing workplace conflict – Scaling-up private sector investment – Supporting infrastructure investment and innovation 21

KPI 3 Work in progress but not completed: Amendments to the Competition Act In the first quarter EDD commenced work on the amendments to the Competition Act. This includes • Additional consultation with key internal stakeholders on the legislative amendments; • Addressing legal complexities related to options for Cabinet’s consideration; • Doing additional research where required. During the same period EDD did extensive work on the Criminal Matters Amendment Bill in partnership with the Department of Justice and the PICC. This is reported on in KPI 11. 22

KPI 3 Work in progress but not completed: Amendments to the Competition Act In the first quarter EDD commenced work on the amendments to the Competition Act. This includes • Additional consultation with key internal stakeholders on the legislative amendments; • Addressing legal complexities related to options for Cabinet’s consideration; • Doing additional research where required. During the same period EDD did extensive work on the Criminal Matters Amendment Bill in partnership with the Department of Justice and the PICC. This is reported on in KPI 11. 22

Key Performance Indicator Strategic support for jobs drivers of the NGP, monitor implementation across the state, address blockages as required and identify new opportunities and risks as they arise as part of strengthening implementation of the NGP KPI 4 Work completed: Contributions in IMCs, ESEID and War Room. During the quarter, significant work was done to support the integration of policy and jobs drivers through the work of the economic cluster and the inter -ministerial committees set up by Cabinet. These included: • Technical and policy contributions for Economic Sectors, Employment and Investment Development (ESEID); • Policy and implementation feedback for the IMC on Energy. 23

Key Performance Indicator Strategic support for jobs drivers of the NGP, monitor implementation across the state, address blockages as required and identify new opportunities and risks as they arise as part of strengthening implementation of the NGP KPI 4 Work completed: Contributions in IMCs, ESEID and War Room. During the quarter, significant work was done to support the integration of policy and jobs drivers through the work of the economic cluster and the inter -ministerial committees set up by Cabinet. These included: • Technical and policy contributions for Economic Sectors, Employment and Investment Development (ESEID); • Policy and implementation feedback for the IMC on Energy. 23

KPI 4 Steel Industry interventions (incl Q 2) • The end of the commodity super-cycle resulted in a glut of steel on global markets. The South African steel industry was seriously affected. • During the quarter, EDD undertook a range of efforts to address the circumstances of the industry. These included: • Meeting steel-makers to identify the extent of the economic challenges; • Liaising with regulators to expedite processes to evaluate the industry requests; • Appointing a panel of experts from the steel industry to provide advice and options to the Minister; • Engaging development finance institutions on short-term financing options; • Completing a competition probe into pricing by the dominant steel-mill • Liaising with other Ministers to enable a coordinated government response. 24

KPI 4 Steel Industry interventions (incl Q 2) • The end of the commodity super-cycle resulted in a glut of steel on global markets. The South African steel industry was seriously affected. • During the quarter, EDD undertook a range of efforts to address the circumstances of the industry. These included: • Meeting steel-makers to identify the extent of the economic challenges; • Liaising with regulators to expedite processes to evaluate the industry requests; • Appointing a panel of experts from the steel industry to provide advice and options to the Minister; • Engaging development finance institutions on short-term financing options; • Completing a competition probe into pricing by the dominant steel-mill • Liaising with other Ministers to enable a coordinated government response. 24

KPI 4 Update on soya plant in Mpumalanga • The Noble Soya plant became operational in December 2013, creating the continent’s largest and most advanced soya crushing plant • Between December 2013 to July 2015 the plant turnover was R 1. 2 billion • The plant employs 128 people, with an estimated 2 600 jobs sustained by commercial farmers. • With the company’s operations now stable, we are pursuing efforts to bring black small-holder farmers into its supply-chain • With the recent drought and poor prognosis for summer rainfall, Noble is looking at expanding its dry land cultivation in the Free State and North West provinces to spread its risk. 25

KPI 4 Update on soya plant in Mpumalanga • The Noble Soya plant became operational in December 2013, creating the continent’s largest and most advanced soya crushing plant • Between December 2013 to July 2015 the plant turnover was R 1. 2 billion • The plant employs 128 people, with an estimated 2 600 jobs sustained by commercial farmers. • With the company’s operations now stable, we are pursuing efforts to bring black small-holder farmers into its supply-chain • With the recent drought and poor prognosis for summer rainfall, Noble is looking at expanding its dry land cultivation in the Free State and North West provinces to spread its risk. 25

KPI 4 Work completed: African regional integration One of the jobs drivers in the NGP is African regional integration. Work on this was originally scheduled in the Strategic Plan for 2016/17. Following a number of attacks on foreign migrants during the quarter, a Cabinet-wide response included that EDD focus on research and advocacy on the importance of trade and investment across the continent, to provide context to the debate on migrants. The Minister put together a program including: • Research • Holding a stakeholder Symposium • Engaging workers and communities. Research findings: Examples • One out of every five Ford Ranger bakkies made in Roslyn Pretoria, is sold elsewhere on the continent. • The largest export market for manufactured plastic is Zimbabwe and for televisions is Zambia. • 244 000 direct jobs in South Africa are sustained by exports to the rest of the continent 26

KPI 4 Work completed: African regional integration One of the jobs drivers in the NGP is African regional integration. Work on this was originally scheduled in the Strategic Plan for 2016/17. Following a number of attacks on foreign migrants during the quarter, a Cabinet-wide response included that EDD focus on research and advocacy on the importance of trade and investment across the continent, to provide context to the debate on migrants. The Minister put together a program including: • Research • Holding a stakeholder Symposium • Engaging workers and communities. Research findings: Examples • One out of every five Ford Ranger bakkies made in Roslyn Pretoria, is sold elsewhere on the continent. • The largest export market for manufactured plastic is Zimbabwe and for televisions is Zambia. • 244 000 direct jobs in South Africa are sustained by exports to the rest of the continent 26

KPI 4 Case study: Africa Day Symposium – EDD with IDC and University of Johannesburg • Ministry hosted an Africa Day Symposium on African Integration and how South Africans benefit from our economic links with the rest of Africa. • Over 100 participants • Business and labour leaders from SA and the rest of the continent • Community members including youth, parliamentarians, academics and students attended. • Addressed African integration as a critical driver for shared economic prosperity and job creation. • Shared practical experiences, research, concerns and aspirations. OUTCOME: A SHARED COMMITMENT TO TELL THE AFRICAN STORY MORE CONSISTENTLY IN SOUTH AFRICA. 27

KPI 4 Case study: Africa Day Symposium – EDD with IDC and University of Johannesburg • Ministry hosted an Africa Day Symposium on African Integration and how South Africans benefit from our economic links with the rest of Africa. • Over 100 participants • Business and labour leaders from SA and the rest of the continent • Community members including youth, parliamentarians, academics and students attended. • Addressed African integration as a critical driver for shared economic prosperity and job creation. • Shared practical experiences, research, concerns and aspirations. OUTCOME: A SHARED COMMITMENT TO TELL THE AFRICAN STORY MORE CONSISTENTLY IN SOUTH AFRICA. 27

African economic development – Advocacy and community engagement Meetings were held with workers, communities and shop-stewards, to combat negative perceptions of the economic impact of greater economic integration 2018/03/16 28

African economic development – Advocacy and community engagement Meetings were held with workers, communities and shop-stewards, to combat negative perceptions of the economic impact of greater economic integration 2018/03/16 28

Key Performance Indicator Support the development of the green economy and jobs through implementing the Green Economy Accord KPI 5 Work completed: Support for Green Economy Accord The Green Economy Accord requires steps to be taken to reduce energy consumption by industry. • During the quarter, the Ministry engaged with stakeholders in the fashion manufacturing industry, culminating in a Fashion Industry Imbizo on energy and the green economy, held on 9 June 2015. • The Imbizo covered case studies of new technologies that reduce companies’ energy consumption and costs. • Eskom discussed its load-shedding schedules and what can be done to reduce the negative impact on industry. • The IDC highlighted the impact of funding energy-efficient technologies in the local industry. • A sock manufacturer provided feedback to industry representatives of the steps to be taken to retool for an energy-constrained environment whilst maintaining jobs, turnover and profitability. 29

Key Performance Indicator Support the development of the green economy and jobs through implementing the Green Economy Accord KPI 5 Work completed: Support for Green Economy Accord The Green Economy Accord requires steps to be taken to reduce energy consumption by industry. • During the quarter, the Ministry engaged with stakeholders in the fashion manufacturing industry, culminating in a Fashion Industry Imbizo on energy and the green economy, held on 9 June 2015. • The Imbizo covered case studies of new technologies that reduce companies’ energy consumption and costs. • Eskom discussed its load-shedding schedules and what can be done to reduce the negative impact on industry. • The IDC highlighted the impact of funding energy-efficient technologies in the local industry. • A sock manufacturer provided feedback to industry representatives of the steps to be taken to retool for an energy-constrained environment whilst maintaining jobs, turnover and profitability. 29

Green economy: case study A sock manufacturer GLENCAROL provided feedback to industry representatives on the steps they have taken to retool for an energyconstrained environment whilst maintaining jobs, turnover and profitability. • Power consumption reduced 950 000 kwhr to 650 000 kwhr, with annual savings of R 2, 5 million and 432 tons less coal used per annum • Business grew by 53% since 2007 when the company employed 497 people to current employment of 694 people • The company made a number of interventions: • Productivity support from the Production Incentive • Eskom funding to replace 1800 bulbs and fittings and space utilisation • New industrial air-conditioning and heat extraction services 30

Green economy: case study A sock manufacturer GLENCAROL provided feedback to industry representatives on the steps they have taken to retool for an energyconstrained environment whilst maintaining jobs, turnover and profitability. • Power consumption reduced 950 000 kwhr to 650 000 kwhr, with annual savings of R 2, 5 million and 432 tons less coal used per annum • Business grew by 53% since 2007 when the company employed 497 people to current employment of 694 people • The company made a number of interventions: • Productivity support from the Production Incentive • Eskom funding to replace 1800 bulbs and fittings and space utilisation • New industrial air-conditioning and heat extraction services 30

Key Performance Indicator Number of spatial, local and provincial initiatives to promote employment, empowerment and development KPI 7 Work completed: Min. Mec EDD convened a that culminated in a Min. Mec attended by Ministers and MECs, which covered: • Spatial development and the Special Economic Zones; • Promotion of the black industrialists programme; • Small business development initiatives; • A new framework for provincial economic development planning; • Use of innovative building technologies in the National Infrastructure Plan; • The extension of the Africa Growth and Opportunities Act (AGOA) by the United States. WORK COMPLETED: PROVINCIAL PLANS EDD worked with Limpopo, Mpumalanga and Free State and assessed their economic development plans. This work included: • Ensuring alignment of the provincial plans to national economic development goals and plans; • Identification of provincial priorities including key value chains and sectors. 31

Key Performance Indicator Number of spatial, local and provincial initiatives to promote employment, empowerment and development KPI 7 Work completed: Min. Mec EDD convened a that culminated in a Min. Mec attended by Ministers and MECs, which covered: • Spatial development and the Special Economic Zones; • Promotion of the black industrialists programme; • Small business development initiatives; • A new framework for provincial economic development planning; • Use of innovative building technologies in the National Infrastructure Plan; • The extension of the Africa Growth and Opportunities Act (AGOA) by the United States. WORK COMPLETED: PROVINCIAL PLANS EDD worked with Limpopo, Mpumalanga and Free State and assessed their economic development plans. This work included: • Ensuring alignment of the provincial plans to national economic development goals and plans; • Identification of provincial priorities including key value chains and sectors. 31

Case study: Free State Case study: Limpopo Following engagement with the province, Limpopo will focus on: Analysis of the province demonstrates the following: • Productive sectors such as manufacturing, mining and • Plans to diversify the agriculture; economy from reliance on mining and agriculture into • Eliminating unnecessary manufacturing, tourism and regulatory burdens; infrastructure (transport); • Up-skilling the labour force; • Continued focus on • Expanding employment in beneficiation in mining and agriculture (horticulture, agriculture (i. e. agro meat production and forestry processing); value-chains focusing on • The need for more skills beneficiation); development in fields such • Reducing workplace conflict; as artisans and engineering. • Small business development. Case study: Mpumalanga Analysis of the province demonstrates the following: • Province has targeted jobs drivers and sectors identified to create jobs - agriculture and forestry, manufacturing, tourism and other high level services (e. g. ICT), mining and energy, green economy and infrastructure; • Strategic interventions include BBBEE, strategic procurement, skills development, reducing the cost of doing business, support to SMMEs and co-ops, and DFI funding; • Strengthened oversight and monitoring mechanisms will assist in improving implementation. Potential projects include: • Unblocking agro-processing • Support for economic Potential projects include: projects; revitalisation in mining • Linking provincial youth SMMEs to • Supporting the textile the retrofitting programme: regions (Waterberg and industry’s expansion plans establishment of energy bulb Sekhukhune) with a focus on through coordination and manufacturing plant (Mpumalanga). unblocking obstacles to support measures; • Support mining initiatives in development; Emalahleni Municipality through • Assisting the province in its • Promotion of the use of the Revitalization of Distressed development of its Innovative Building Mining Towns Programme Provincial Economic Strategy. Technologies in Lephalale. (Mpumalanga). A more detailed presentation on the insights and work can be prepared for the Portfolio Committee 32

Case study: Free State Case study: Limpopo Following engagement with the province, Limpopo will focus on: Analysis of the province demonstrates the following: • Productive sectors such as manufacturing, mining and • Plans to diversify the agriculture; economy from reliance on mining and agriculture into • Eliminating unnecessary manufacturing, tourism and regulatory burdens; infrastructure (transport); • Up-skilling the labour force; • Continued focus on • Expanding employment in beneficiation in mining and agriculture (horticulture, agriculture (i. e. agro meat production and forestry processing); value-chains focusing on • The need for more skills beneficiation); development in fields such • Reducing workplace conflict; as artisans and engineering. • Small business development. Case study: Mpumalanga Analysis of the province demonstrates the following: • Province has targeted jobs drivers and sectors identified to create jobs - agriculture and forestry, manufacturing, tourism and other high level services (e. g. ICT), mining and energy, green economy and infrastructure; • Strategic interventions include BBBEE, strategic procurement, skills development, reducing the cost of doing business, support to SMMEs and co-ops, and DFI funding; • Strengthened oversight and monitoring mechanisms will assist in improving implementation. Potential projects include: • Unblocking agro-processing • Support for economic Potential projects include: projects; revitalisation in mining • Linking provincial youth SMMEs to • Supporting the textile the retrofitting programme: regions (Waterberg and industry’s expansion plans establishment of energy bulb Sekhukhune) with a focus on through coordination and manufacturing plant (Mpumalanga). unblocking obstacles to support measures; • Support mining initiatives in development; Emalahleni Municipality through • Assisting the province in its • Promotion of the use of the Revitalization of Distressed development of its Innovative Building Mining Towns Programme Provincial Economic Strategy. Technologies in Lephalale. (Mpumalanga). A more detailed presentation on the insights and work can be prepared for the Portfolio Committee 32

Programme 2: Growth path and social dialogue Strategic Objective 3: Facilitate social dialogue and implementation of social accords Key Performance Indicator 8. Development and support programmes for more effective industrial relations and support for implementation of social accords 33

Programme 2: Growth path and social dialogue Strategic Objective 3: Facilitate social dialogue and implementation of social accords Key Performance Indicator 8. Development and support programmes for more effective industrial relations and support for implementation of social accords 33

Key Performance Indicator Development and support programmes for more effective industrial relations and support for implementation of social accords KPI 8 Work completed: More effective industrial relations EDD provided support at technical level and to the Minister during the social dialogue with business, labour and community representatives on a national minimum wage and on reducing industrial conflict. The dialogue process included an extensive exchange of information on international experiences on minimum wages, including in Brazil, Mauritius, Kenya, Germany, Malaysia and the United Kingdom. During the first quarter discussions were held on codes of conducts during and prior to industrial action. 34

Key Performance Indicator Development and support programmes for more effective industrial relations and support for implementation of social accords KPI 8 Work completed: More effective industrial relations EDD provided support at technical level and to the Minister during the social dialogue with business, labour and community representatives on a national minimum wage and on reducing industrial conflict. The dialogue process included an extensive exchange of information on international experiences on minimum wages, including in Brazil, Mauritius, Kenya, Germany, Malaysia and the United Kingdom. During the first quarter discussions were held on codes of conducts during and prior to industrial action. 34

KPI 8 On-going work: Monitoring the Youth Employment Accord • The Youth Employment Accord was signed with NEDLAC constituencies on 18 April 2013. • EDD monitors implementation and tables progress reports to Cabinet. • These cover actions in areas such as entrepreneurship and industrial funding, internships and skills development • A detailed report is being prepared, to be finalised during the current quarter of 2015 35

KPI 8 On-going work: Monitoring the Youth Employment Accord • The Youth Employment Accord was signed with NEDLAC constituencies on 18 April 2013. • EDD monitors implementation and tables progress reports to Cabinet. • These cover actions in areas such as entrepreneurship and industrial funding, internships and skills development • A detailed report is being prepared, to be finalised during the current quarter of 2015 35

Snippets on Youth Employment Accord Provisional data 377 000 increase in youth employment since signing of Accord [In the last 2 years sefa disbursed about R 568. 2 million to 26 714 youth owned enterprises. The IDC disbursed over R 149 million to youth owned enterprises. ] 28 000 young people were registered as artisans through the SETAs in the 2014/15 financial year, and over 14 300 completed their training Internships are important – for example in the last 2 years SAA provided internships to 153 young people and employed thereafter 83 were successfully 405 742 young people trained in EPWP from 2013/14 to 2014/15

Snippets on Youth Employment Accord Provisional data 377 000 increase in youth employment since signing of Accord [In the last 2 years sefa disbursed about R 568. 2 million to 26 714 youth owned enterprises. The IDC disbursed over R 149 million to youth owned enterprises. ] 28 000 young people were registered as artisans through the SETAs in the 2014/15 financial year, and over 14 300 completed their training Internships are important – for example in the last 2 years SAA provided internships to 153 young people and employed thereafter 83 were successfully 405 742 young people trained in EPWP from 2013/14 to 2014/15

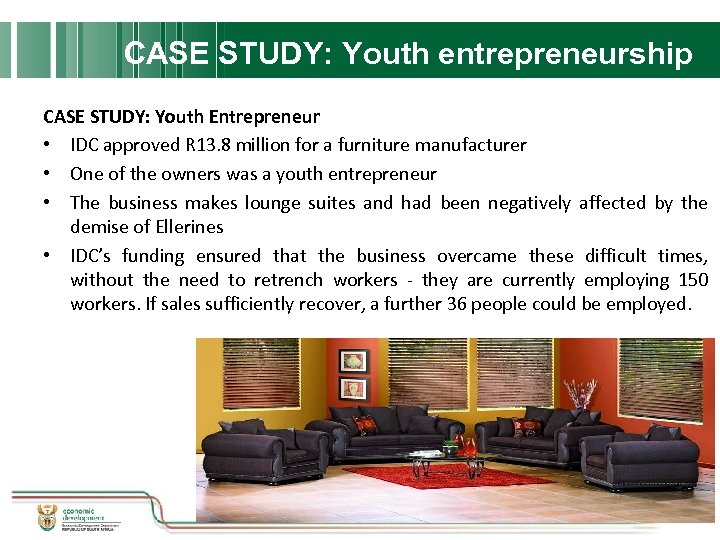

CASE STUDY: Youth entrepreneurship CASE STUDY: Youth Entrepreneur • IDC approved R 13. 8 million for a furniture manufacturer • One of the owners was a youth entrepreneur • The business makes lounge suites and had been negatively affected by the demise of Ellerines • IDC’s funding ensured that the business overcame these difficult times, without the need to retrench workers - they are currently employing 150 workers. If sales sufficiently recover, a further 36 people could be employed. 2018/03/16 37

CASE STUDY: Youth entrepreneurship CASE STUDY: Youth Entrepreneur • IDC approved R 13. 8 million for a furniture manufacturer • One of the owners was a youth entrepreneur • The business makes lounge suites and had been negatively affected by the demise of Ellerines • IDC’s funding ensured that the business overcame these difficult times, without the need to retrench workers - they are currently employing 150 workers. If sales sufficiently recover, a further 36 people could be employed. 2018/03/16 37

Programme 3: Investment, competition & trade Strategic Objective 4: Coordinate infrastructure development & strengthen its positive impact on the economy and citizens Key Performance Indicator 9. Number of quarterly Cabinet-level progress reports of infrastructure Strategic Integrated projects (SIPs) 10. Number of infrastructure projects unblocked, fast tracked or facilitated 11. Number of Cabinet and PICC strategic decisions on infrastructure implemented 12. Number of PICC meetings held and facilitated 13. Drive implementation of Strategic Integrated Project (SIP) 5 of the National Infrastructure Plan 14. Support programmes to drive localisation in the infrastructure programme, including through the PPPFA, and the local supplier development initiatives 38

Programme 3: Investment, competition & trade Strategic Objective 4: Coordinate infrastructure development & strengthen its positive impact on the economy and citizens Key Performance Indicator 9. Number of quarterly Cabinet-level progress reports of infrastructure Strategic Integrated projects (SIPs) 10. Number of infrastructure projects unblocked, fast tracked or facilitated 11. Number of Cabinet and PICC strategic decisions on infrastructure implemented 12. Number of PICC meetings held and facilitated 13. Drive implementation of Strategic Integrated Project (SIP) 5 of the National Infrastructure Plan 14. Support programmes to drive localisation in the infrastructure programme, including through the PPPFA, and the local supplier development initiatives 38

Key Performance Indicator Number of quarterly Cabinet-level progress reports of infrastructure Strategic Integrated projects (SIPs) KPI 9 Work completed: Cabinet level reports 18 SIPs reports were developed for Cabinet. The Report noted that R 54, 8 billion was spent on infrastructure in the quarter to March 2015 by the public sector, excluding projects facilitated by the state through the renewable energy programme. Of this sum spent, the PICC tracked projects that spent R 36 billion over this period and provided Cabinet with reports that set out progress on construction and planning. The results were used by the PICC Council and the July 2015 Cabinet Lekgotla. Implementation of the projects and operational responsibility remains with the relevant line departments. 39

Key Performance Indicator Number of quarterly Cabinet-level progress reports of infrastructure Strategic Integrated projects (SIPs) KPI 9 Work completed: Cabinet level reports 18 SIPs reports were developed for Cabinet. The Report noted that R 54, 8 billion was spent on infrastructure in the quarter to March 2015 by the public sector, excluding projects facilitated by the state through the renewable energy programme. Of this sum spent, the PICC tracked projects that spent R 36 billion over this period and provided Cabinet with reports that set out progress on construction and planning. The results were used by the PICC Council and the July 2015 Cabinet Lekgotla. Implementation of the projects and operational responsibility remains with the relevant line departments. 39

Key Performance Indicator Number of infrastructure projects unblocked, fast tracked or facilitated KPI 10 Work completed: Unblocking infrastructure projects • Regulatory issues: EDD facilitated the unblocking of 1 Air Emissions Licence and 4 Environmental Impact Assessment's (EIAs) affecting five infrastructure projects, to ensure that they were issued on time so that projects could be implemented. • Financing: The Ministry engaged the private sector and financiers on behalf of the PICC on the national infrastructure rollout and the requirements and opportunities for financing of assets with a long-term investment horizon. This included a major policy engagement with ASISA, an association that manages more than R 4 trillion of investible funds. • Skills development: The Ministry engaged South African project managers from the public and private sectors on the needs of the National Infrastructure Plan and the skills required from developmentally-oriented managers. 40

Key Performance Indicator Number of infrastructure projects unblocked, fast tracked or facilitated KPI 10 Work completed: Unblocking infrastructure projects • Regulatory issues: EDD facilitated the unblocking of 1 Air Emissions Licence and 4 Environmental Impact Assessment's (EIAs) affecting five infrastructure projects, to ensure that they were issued on time so that projects could be implemented. • Financing: The Ministry engaged the private sector and financiers on behalf of the PICC on the national infrastructure rollout and the requirements and opportunities for financing of assets with a long-term investment horizon. This included a major policy engagement with ASISA, an association that manages more than R 4 trillion of investible funds. • Skills development: The Ministry engaged South African project managers from the public and private sectors on the needs of the National Infrastructure Plan and the skills required from developmentally-oriented managers. 40

KPI 10 Case study: Regulatory unblocking The following regulatory authorisations were unblocked to ensure they were issued on time so that projects could commence or continue: 1. AEL – Air emissions licence for Medupi unblocked 2. EIA – Construction Kusile Ash and Gypsum co-disposal facility & associated infrastructure 3. EIA – Mzimvubu Project: Construction of Roads Infrastructure 4. EIA – Mzimvubu Project: Ntabelanga-Laleni Conjunctive Scheme and associated infrastructure 5. EIA – Mzimvubu Project: Electricity Generation and Associated infrastructure 41

KPI 10 Case study: Regulatory unblocking The following regulatory authorisations were unblocked to ensure they were issued on time so that projects could commence or continue: 1. AEL – Air emissions licence for Medupi unblocked 2. EIA – Construction Kusile Ash and Gypsum co-disposal facility & associated infrastructure 3. EIA – Mzimvubu Project: Construction of Roads Infrastructure 4. EIA – Mzimvubu Project: Ntabelanga-Laleni Conjunctive Scheme and associated infrastructure 5. EIA – Mzimvubu Project: Electricity Generation and Associated infrastructure 41

CABLE AND METAL THEFT –Theft of copper and metal from public infrastructure causes serious economic harm and social disruption –This affects transport systems (rail cables and lines; road signs), energy (cables and metal from distribution systems), water (pipes, taps and metal from water treatment works), communications (copper cables), social infrastructure (clinics, schools, households) –The PICC approved a package of measures in December 2014 –Drafting of a Bill to address ways to strengthen action against metal and cable thieves commenced thereafter 42

CABLE AND METAL THEFT –Theft of copper and metal from public infrastructure causes serious economic harm and social disruption –This affects transport systems (rail cables and lines; road signs), energy (cables and metal from distribution systems), water (pipes, taps and metal from water treatment works), communications (copper cables), social infrastructure (clinics, schools, households) –The PICC approved a package of measures in December 2014 –Drafting of a Bill to address ways to strengthen action against metal and cable thieves commenced thereafter 42

Key Performance Indicator Number of Cabinet and PICC strategic decision on infrastructure implemented KPI 11 Work completed: Criminal Matters Amendment Bill EDD worked with lawyers, the NPA, PICC Secretariat, Security Cluster and the Department of Justice to identify proposed legislation to address cable and metal theft on the public infrastructure programme. This resulted in a Criminal Matters Amendment Bill. EDD worked with the Department of Justice to pilot the amendments through Cabinet in June 2015. 43

Key Performance Indicator Number of Cabinet and PICC strategic decision on infrastructure implemented KPI 11 Work completed: Criminal Matters Amendment Bill EDD worked with lawyers, the NPA, PICC Secretariat, Security Cluster and the Department of Justice to identify proposed legislation to address cable and metal theft on the public infrastructure programme. This resulted in a Criminal Matters Amendment Bill. EDD worked with the Department of Justice to pilot the amendments through Cabinet in June 2015. 43

Infrastructure: new Bill on cable theft The amendments: • Provide for changes to the laws pertaining to infrastructure-related offences such as cable theft and create a new offence for damage to essential infrastructure • Set out stricter provisions for the granting of bail • Introduces minimum sentencing periods for certain types of offences. • Aims to safeguard infrastructure and thus ensure that the country can meet its economic growth targets and increase employment 44

Infrastructure: new Bill on cable theft The amendments: • Provide for changes to the laws pertaining to infrastructure-related offences such as cable theft and create a new offence for damage to essential infrastructure • Set out stricter provisions for the granting of bail • Introduces minimum sentencing periods for certain types of offences. • Aims to safeguard infrastructure and thus ensure that the country can meet its economic growth targets and increase employment 44

Key Performance Indicator Number of PICC meetings held and facilitated KPI 12 Work completed: PICC meetings held and facilitated During the quarter, EDD provided technical, secretariat and coordinating support for the hosting of PICC structures, including one PICC Council meeting, seven PICC Secretariat meetings (attended by Ministers and Deputy Ministers) and SIP Coordinator meetings. These structures prepared and finalised the submissions discussed by Cabinet. 45

Key Performance Indicator Number of PICC meetings held and facilitated KPI 12 Work completed: PICC meetings held and facilitated During the quarter, EDD provided technical, secretariat and coordinating support for the hosting of PICC structures, including one PICC Council meeting, seven PICC Secretariat meetings (attended by Ministers and Deputy Ministers) and SIP Coordinator meetings. These structures prepared and finalised the submissions discussed by Cabinet. 45

Key Performance Indicator Drive implementation of Strategic Integrated Project (SIP) 5 of the National Infrastructure Plan KPI 13 Work completed: Drive implementation of SIP 5 aims to integrate development and integration between the Northern Cape and Saldanha and expand iron-ore mining, industrial beneficiation and export activities. During the quarter, the Minister convened a meeting with the technical team to receive an update at the start of the new financial year and guide the work on implementation. KPI 13 This included a critical review of investment opportunities identified by the project team, identifying needs of local communities to ensure that new investment benefit local economic development and what blockages need to be addressed. 46

Key Performance Indicator Drive implementation of Strategic Integrated Project (SIP) 5 of the National Infrastructure Plan KPI 13 Work completed: Drive implementation of SIP 5 aims to integrate development and integration between the Northern Cape and Saldanha and expand iron-ore mining, industrial beneficiation and export activities. During the quarter, the Minister convened a meeting with the technical team to receive an update at the start of the new financial year and guide the work on implementation. KPI 13 This included a critical review of investment opportunities identified by the project team, identifying needs of local communities to ensure that new investment benefit local economic development and what blockages need to be addressed. 46

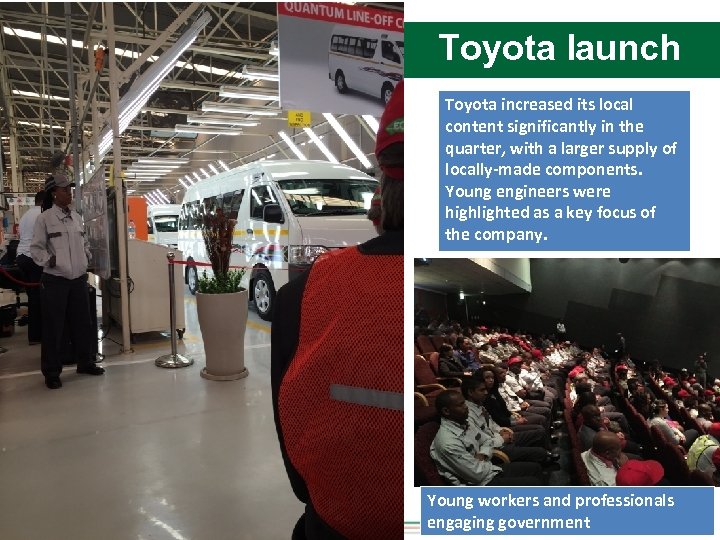

Key Performance Indicator Support programmes to drive localisation in the infrastructure programme, including through the PPPFA, and the local supplier development initiatives KPI 14 Case study: Minibus manufacturing in South Africa Jobs created: 720 in Toyota and suppliers through the new taxi production EDD played a key role in the development of a local manufacturing strategy for minibus taxis. During the quarter, the Minister – engaged with the management and workforce of Toyota SA – attended the launch of the new Quantum taxi which was produced with a significantly higher local content – discussed opportunities for black industrialists to be integrated in the auto supply-chain and – engaged young workers and professionals at Toyota’s plant in e. Thekwini during Youth Month 47

Key Performance Indicator Support programmes to drive localisation in the infrastructure programme, including through the PPPFA, and the local supplier development initiatives KPI 14 Case study: Minibus manufacturing in South Africa Jobs created: 720 in Toyota and suppliers through the new taxi production EDD played a key role in the development of a local manufacturing strategy for minibus taxis. During the quarter, the Minister – engaged with the management and workforce of Toyota SA – attended the launch of the new Quantum taxi which was produced with a significantly higher local content – discussed opportunities for black industrialists to be integrated in the auto supply-chain and – engaged young workers and professionals at Toyota’s plant in e. Thekwini during Youth Month 47

Toyota launch Toyota increased its local content significantly in the quarter, with a larger supply of locally-made components. Young engineers were highlighted as a key focus of the company. Young workers and professionals 48 engaging government

Toyota launch Toyota increased its local content significantly in the quarter, with a larger supply of locally-made components. Young engineers were highlighted as a key focus of the company. Young workers and professionals 48 engaging government

Workers responsible for making the mini-bus taxi. 49

Workers responsible for making the mini-bus taxi. 49

Key Performance Indicator Support programmes to drive localisation in the infrastructure programme, including through the PPPFA, and the local supplier development initiatives KPI 14 Case study: Clothing manufacturing in South Africa. Employment opportunities in the clothing industry requires dedicated localisation initiatives. EDD worked with partner departments and DFI’s to reverse the loss of productive capacity and jobs in the clothing industry. During the quarter, the Minister: – engaged with Foschini and its local supplier, Prestige Clothing, as an example of a local manufacturer who is able to retain and expand market share through high levels of production efficiencies – visited the factory to track changes made to work organisation – engaged the management on productivity improvements made possible through the government incentive schemes; and – addressed workers at the company on their experiences of the workplace partnership 50

Key Performance Indicator Support programmes to drive localisation in the infrastructure programme, including through the PPPFA, and the local supplier development initiatives KPI 14 Case study: Clothing manufacturing in South Africa. Employment opportunities in the clothing industry requires dedicated localisation initiatives. EDD worked with partner departments and DFI’s to reverse the loss of productive capacity and jobs in the clothing industry. During the quarter, the Minister: – engaged with Foschini and its local supplier, Prestige Clothing, as an example of a local manufacturer who is able to retain and expand market share through high levels of production efficiencies – visited the factory to track changes made to work organisation – engaged the management on productivity improvements made possible through the government incentive schemes; and – addressed workers at the company on their experiences of the workplace partnership 50

Clothing company competitiveness Prestige Clothing - Converted manual cutting room to fully automated using government incentives - Trained staff in industrial skills - Replaced sewing equipment - Introduced modular manufacturing system - Improved employee benefits: food, facilities in canteen and education on garnishee orders The impact on productivity and employment was positive. The company was able to in-source work previously done off-shore. 51

Clothing company competitiveness Prestige Clothing - Converted manual cutting room to fully automated using government incentives - Trained staff in industrial skills - Replaced sewing equipment - Introduced modular manufacturing system - Improved employee benefits: food, facilities in canteen and education on garnishee orders The impact on productivity and employment was positive. The company was able to in-source work previously done off-shore. 51

Prestige Clothing factory visit 52

Prestige Clothing factory visit 52

Key Performance Indicator Support programmes to drive localisation in the infrastructure programme, including through the PPPFA, and the local supplier development initiatives KPI 14 Case study: Sheraton Manufacturing Home textile operation that has IDC investment. Company has improved its employment and operations. Shift from a manufacturing-only company to a design-intensive operation. 53

Key Performance Indicator Support programmes to drive localisation in the infrastructure programme, including through the PPPFA, and the local supplier development initiatives KPI 14 Case study: Sheraton Manufacturing Home textile operation that has IDC investment. Company has improved its employment and operations. Shift from a manufacturing-only company to a design-intensive operation. 53

Sheraton visit 54

Sheraton visit 54

Programme 3: Investment, competition & trade Strategic Objective 5: Promote investment, industrial funding and entrepreneurship for jobs and inclusive growth Key Performance Indicator 15. Number of investment initiatives facilitated, fast tracked or unblocked 16. Establish and monitor industrial funding targets for identified jobs drivers and for township economies 17. Reports on increase in industrial finance available from DFIs and departments and its impact on job creation 18. Strategic engagements with DFIs to improve efficiency/decrease turnaround times for project approvals 55

Programme 3: Investment, competition & trade Strategic Objective 5: Promote investment, industrial funding and entrepreneurship for jobs and inclusive growth Key Performance Indicator 15. Number of investment initiatives facilitated, fast tracked or unblocked 16. Establish and monitor industrial funding targets for identified jobs drivers and for township economies 17. Reports on increase in industrial finance available from DFIs and departments and its impact on job creation 18. Strategic engagements with DFIs to improve efficiency/decrease turnaround times for project approvals 55

Key Performance Indicator Number of investment initiatives facilitated, fast tracked or unblocked KPI 15 Work completed: Investment facilitated and unblocked During the quarter, both macro and micro investment initiatives were undertaken to boost investment. These included - A major engagement with foreign investors from the United Arab Emirates, led by the Minister and the UAE Minister of the Economy - Contributing to the finalisation of a draft Investment Bill to provide a legal framework foreign investment in South Africa - Discussions with individual foreign and domestic investors in industries such as tourism, steel, finance, chemical, ICT, infrastructure and business support services - Participating in the World Economic Forum Africa sessions, dealing with investment and promotion of new business opportunities - Unblocking five investment initiatives through support on areas such as energy supply, industrial support and finding market opportunities. 56

Key Performance Indicator Number of investment initiatives facilitated, fast tracked or unblocked KPI 15 Work completed: Investment facilitated and unblocked During the quarter, both macro and micro investment initiatives were undertaken to boost investment. These included - A major engagement with foreign investors from the United Arab Emirates, led by the Minister and the UAE Minister of the Economy - Contributing to the finalisation of a draft Investment Bill to provide a legal framework foreign investment in South Africa - Discussions with individual foreign and domestic investors in industries such as tourism, steel, finance, chemical, ICT, infrastructure and business support services - Participating in the World Economic Forum Africa sessions, dealing with investment and promotion of new business opportunities - Unblocking five investment initiatives through support on areas such as energy supply, industrial support and finding market opportunities. 56

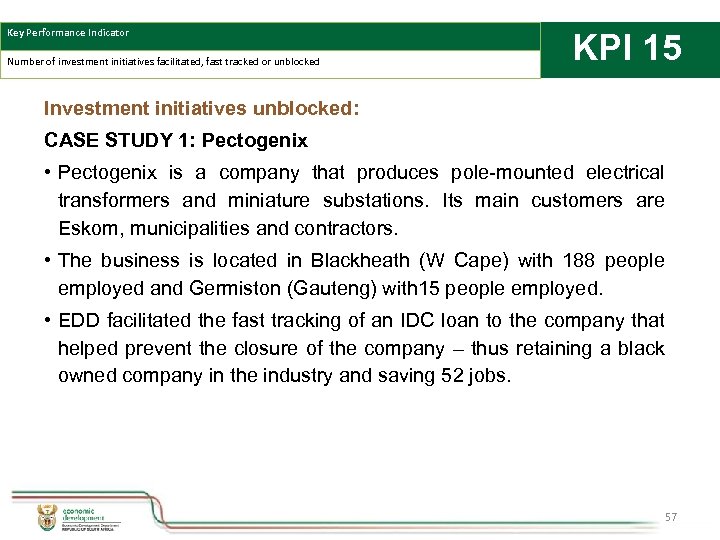

Key Performance Indicator Number of investment initiatives facilitated, fast tracked or unblocked KPI 15 Investment initiatives unblocked: CASE STUDY 1: Pectogenix • Pectogenix is a company that produces pole-mounted electrical transformers and miniature substations. Its main customers are Eskom, municipalities and contractors. • The business is located in Blackheath (W Cape) with 188 people employed and Germiston (Gauteng) with 15 people employed. • EDD facilitated the fast tracking of an IDC loan to the company that helped prevent the closure of the company – thus retaining a black owned company in the industry and saving 52 jobs. 57

Key Performance Indicator Number of investment initiatives facilitated, fast tracked or unblocked KPI 15 Investment initiatives unblocked: CASE STUDY 1: Pectogenix • Pectogenix is a company that produces pole-mounted electrical transformers and miniature substations. Its main customers are Eskom, municipalities and contractors. • The business is located in Blackheath (W Cape) with 188 people employed and Germiston (Gauteng) with 15 people employed. • EDD facilitated the fast tracking of an IDC loan to the company that helped prevent the closure of the company – thus retaining a black owned company in the industry and saving 52 jobs. 57

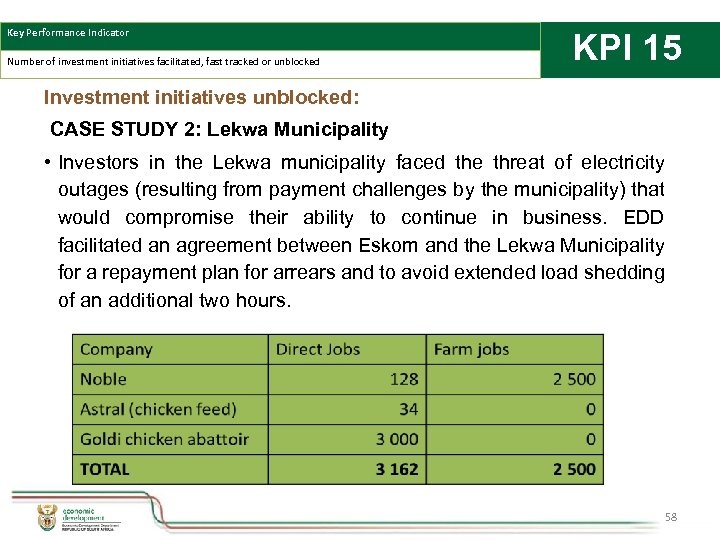

Key Performance Indicator Number of investment initiatives facilitated, fast tracked or unblocked KPI 15 Investment initiatives unblocked: CASE STUDY 2: Lekwa Municipality • Investors in the Lekwa municipality faced the threat of electricity outages (resulting from payment challenges by the municipality) that would compromise their ability to continue in business. EDD facilitated an agreement between Eskom and the Lekwa Municipality for a repayment plan for arrears and to avoid extended load shedding of an additional two hours. 58

Key Performance Indicator Number of investment initiatives facilitated, fast tracked or unblocked KPI 15 Investment initiatives unblocked: CASE STUDY 2: Lekwa Municipality • Investors in the Lekwa municipality faced the threat of electricity outages (resulting from payment challenges by the municipality) that would compromise their ability to continue in business. EDD facilitated an agreement between Eskom and the Lekwa Municipality for a repayment plan for arrears and to avoid extended load shedding of an additional two hours. 58

KPI 15 CASE STUDY 3: The Noodle Factory • A local black-owned noodle manufacturer was assisted by EDD to access funding and orders from Massmart, in accordance with the terms of the Supplier Development Fund mandated by the Competition Appeal Court when Walmart acquired the company, following representations by EDD. • Massmart was importing noodles as it was unable to find a domestic supplier. Following engagements with Walmart, EDD identified a black-owned company (The Noodle Factory) and facilitated funding from Massmart Supplier Development Fund. • The Fund approved grant funding of R 2, 5 million to enable the company to acquire capital equipment, replace a steam boiler and assist the client with the design and development of packaging for Massmart Home-Brands. • The funding will also enable The Noodle Factory to increase production to two shifts a day and employ an additional 45 people. • This second shift will supply Massmart and there is now potential to supply another major retailer with the equipment that the company has in place. 59

KPI 15 CASE STUDY 3: The Noodle Factory • A local black-owned noodle manufacturer was assisted by EDD to access funding and orders from Massmart, in accordance with the terms of the Supplier Development Fund mandated by the Competition Appeal Court when Walmart acquired the company, following representations by EDD. • Massmart was importing noodles as it was unable to find a domestic supplier. Following engagements with Walmart, EDD identified a black-owned company (The Noodle Factory) and facilitated funding from Massmart Supplier Development Fund. • The Fund approved grant funding of R 2, 5 million to enable the company to acquire capital equipment, replace a steam boiler and assist the client with the design and development of packaging for Massmart Home-Brands. • The funding will also enable The Noodle Factory to increase production to two shifts a day and employ an additional 45 people. • This second shift will supply Massmart and there is now potential to supply another major retailer with the equipment that the company has in place. 59

KPI 15 CASE STUDY 4: KN Link (Pty) Ltd (CMT for Colibri Towelling) Colibri is a local towel manufacturing company that experienced difficulties in the harsh economic conditions after the 2008/9 financial crisis, was placed in business rescue in 2011 and then shut its doors. – In 2012 the IDC took over the company and re-established manufacturing. It now employs 243 people. – EDD invited Colibri Towelling to display at the Economic Development Budget Vote in May 2015. – At the Budget Vote, EDD introduced Colibri to Mass. Mart and subsequently facilitated the engagement between the parties, which led to grant funding to expand the company’s capacity and secured orders from Game and competitor stores. 60

KPI 15 CASE STUDY 4: KN Link (Pty) Ltd (CMT for Colibri Towelling) Colibri is a local towel manufacturing company that experienced difficulties in the harsh economic conditions after the 2008/9 financial crisis, was placed in business rescue in 2011 and then shut its doors. – In 2012 the IDC took over the company and re-established manufacturing. It now employs 243 people. – EDD invited Colibri Towelling to display at the Economic Development Budget Vote in May 2015. – At the Budget Vote, EDD introduced Colibri to Mass. Mart and subsequently facilitated the engagement between the parties, which led to grant funding to expand the company’s capacity and secured orders from Game and competitor stores. 60

KPI 15 CASE STUDY 5: Langeberg & Ashton Foods EDD worked with Eskom, the Municipal Manager and Langeberg & Ashton Foods to mitigate the potential threat to the company and local economy as a result of load-shedding. An agreement was reached to exempt the factory from most loadshedding during the core canning season for the period covering the harvesting/ canning season from April to July 2015. The company retained 2, 000 seasonal workers during the canning season. EDD has worked with the company and other government departments to enable investment to expand its canned vegetable baked beans line that has created 80 additional seasonal jobs. 61

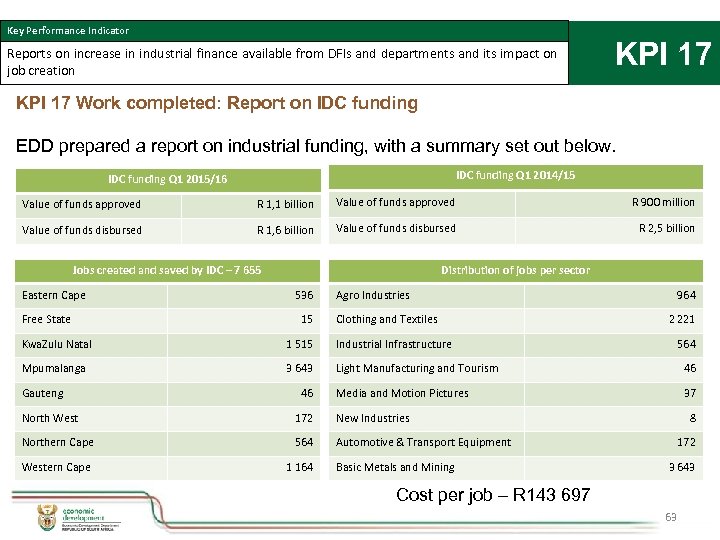

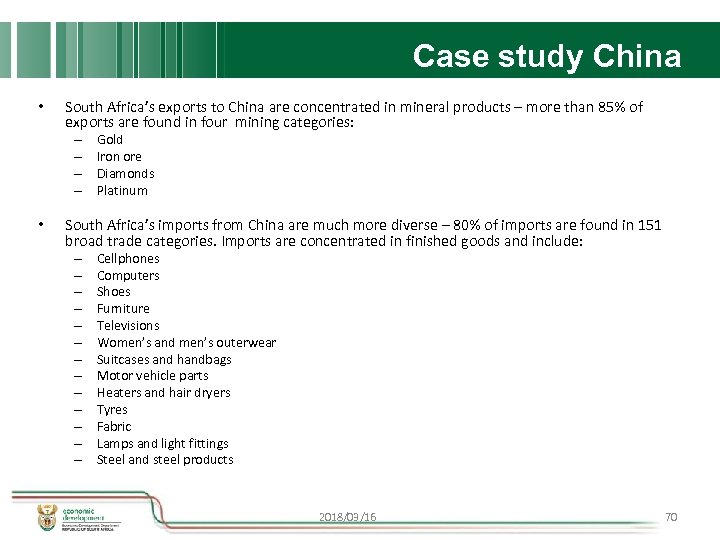

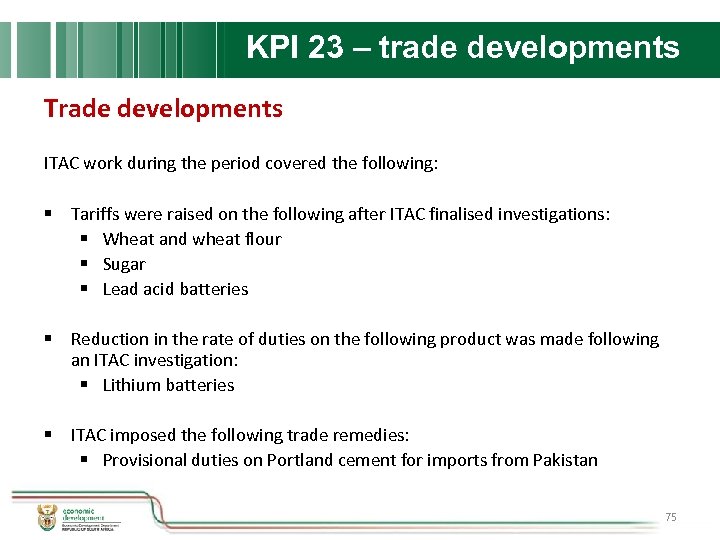

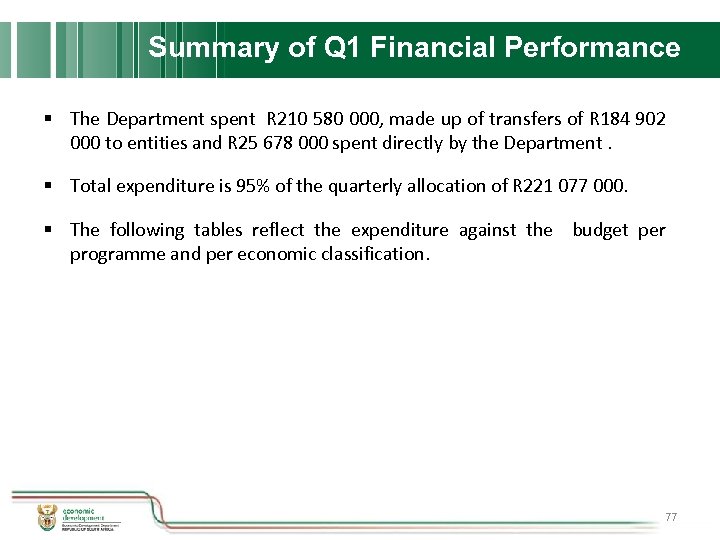

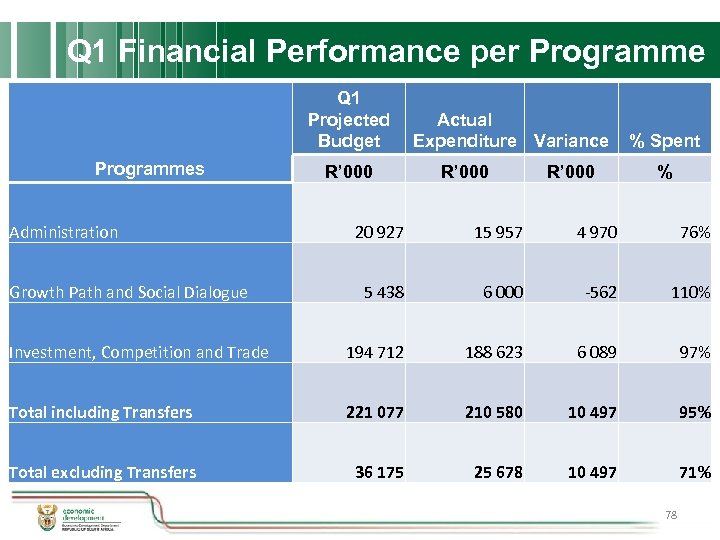

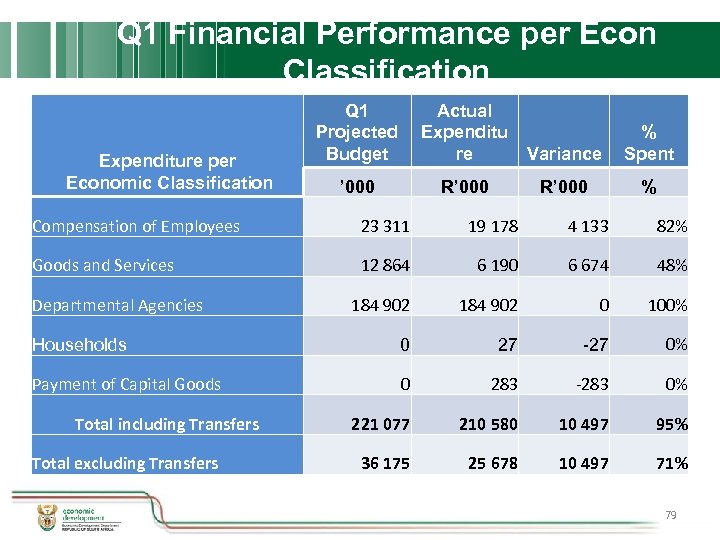

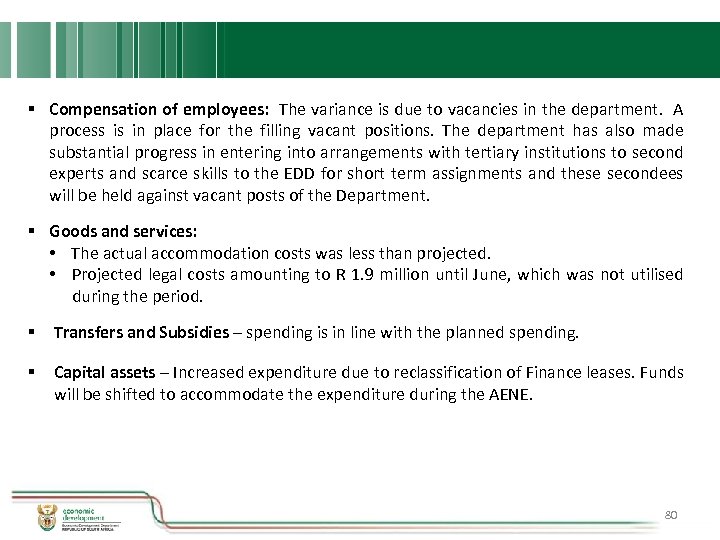

KPI 15 CASE STUDY 5: Langeberg & Ashton Foods EDD worked with Eskom, the Municipal Manager and Langeberg & Ashton Foods to mitigate the potential threat to the company and local economy as a result of load-shedding. An agreement was reached to exempt the factory from most loadshedding during the core canning season for the period covering the harvesting/ canning season from April to July 2015. The company retained 2, 000 seasonal workers during the canning season. EDD has worked with the company and other government departments to enable investment to expand its canned vegetable baked beans line that has created 80 additional seasonal jobs. 61