Economist. com 13 — 1 The European

- Размер: 1.9 Mегабайта

- Количество слайдов: 46

Описание презентации Economist. com 13 — 1 The European по слайдам

Economist. com 13 — 1 The European Commission warned that Spain and Slovenia must deal quickly with the imbalances in their economies. Spain’s banking system has already been bailed out; Slovenia is expected to become the next euro-zone country to ask for a rescue. The IMF and multilateral banks agreed to another bail-out for Jamaica , following the indebted island’s bond restructuring. In return for $2 billion in loans the government has frozen public-sector wages and promised tax reforms. Barack Obama unveiled a budget for the 2014 fiscal year. It included a proposal to reduce Social Security payments, but also contained more spending on infrastructure and higher taxes on the rich. The cumulative deficit was forecast at $5. 3 trillion over the next decade.

Economist. com 13 — 1 The European Commission warned that Spain and Slovenia must deal quickly with the imbalances in their economies. Spain’s banking system has already been bailed out; Slovenia is expected to become the next euro-zone country to ask for a rescue. The IMF and multilateral banks agreed to another bail-out for Jamaica , following the indebted island’s bond restructuring. In return for $2 billion in loans the government has frozen public-sector wages and promised tax reforms. Barack Obama unveiled a budget for the 2014 fiscal year. It included a proposal to reduce Social Security payments, but also contained more spending on infrastructure and higher taxes on the rich. The cumulative deficit was forecast at $5. 3 trillion over the next decade.

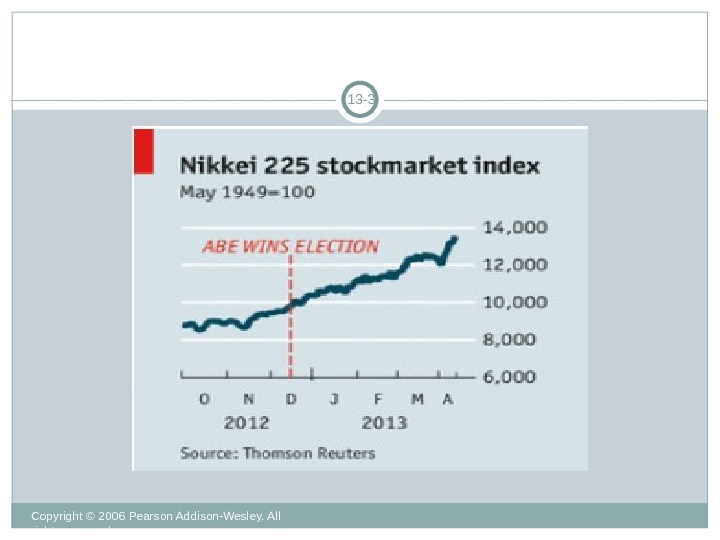

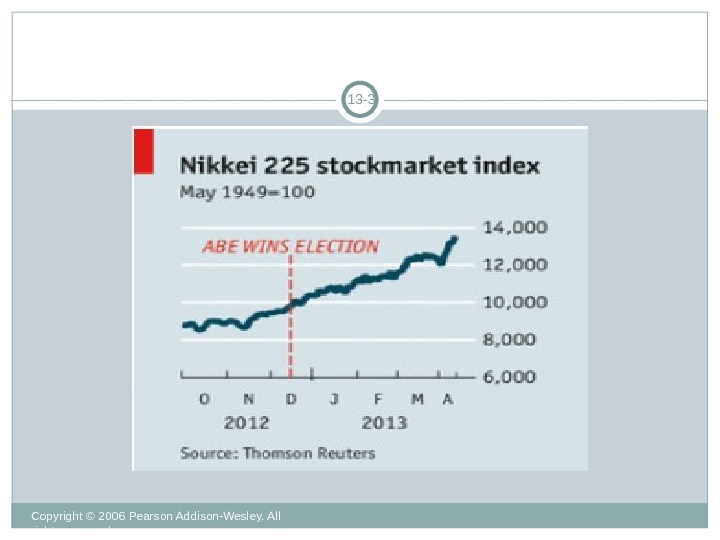

13 — 2 The Bank of Japan conducted its first bond-buying operations after announcing a radical easing of monetary policy. Markets reacted positively to the Bo. J’s decision to double Japan’s monetary base. The Nikkei rose to its highest point since mid-2008 (it is up by 30% since January). The yen, which has steadily depreciated since the new government signaled its intent to address the currency’s strength, slid to its lowest level against the dollar in four years. China received the first downgrade of its sovereign debt since 1999. Fitch cut its rating on China’s local-currency debt by one notch, citing unsustainable levels of debt on the part of local governments, companies and consumers. China’s foreign-exchange reserves jumped by $130 billion in the first quarter, to $3. 4 trillion. Surging capital inflows will fuel fears of a credit bubble. The minutes from the latest meeting of the Federal Reserve’s policy committee revealed that central bankers were prepared to slow down quantitative easing some time this year if the labor market kept improving.

13 — 2 The Bank of Japan conducted its first bond-buying operations after announcing a radical easing of monetary policy. Markets reacted positively to the Bo. J’s decision to double Japan’s monetary base. The Nikkei rose to its highest point since mid-2008 (it is up by 30% since January). The yen, which has steadily depreciated since the new government signaled its intent to address the currency’s strength, slid to its lowest level against the dollar in four years. China received the first downgrade of its sovereign debt since 1999. Fitch cut its rating on China’s local-currency debt by one notch, citing unsustainable levels of debt on the part of local governments, companies and consumers. China’s foreign-exchange reserves jumped by $130 billion in the first quarter, to $3. 4 trillion. Surging capital inflows will fuel fears of a credit bubble. The minutes from the latest meeting of the Federal Reserve’s policy committee revealed that central bankers were prepared to slow down quantitative easing some time this year if the labor market kept improving.

Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 —

Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 —

13 — 4 Luxembourg decided to relax its rules on banking secrecy and allow banks to share account details of suspected tax cheats with American and European authorities, starting in 2015. In a breakthrough for anti-corruption campaigners the European Union agreed to introduce stringent transparency rules for oil, gas, mining and timber companies, in areas such as details of payments to foreign governments. There are no exemptions for projects that take place in countries with confidentiality laws on contracts. Shell said it had “always supported” a global code, though the oil association to which it belongs in America is suing the government there over similar rules. Google’s competitors filed a complaint with European regulators about the dominance of the Android platform on smartphones. Fair. Search, which represents Microsoft and others, described Android as a “Trojan horse” that was part of Google’s strategy to “dominate mobile markets”. It is another potential antitrust headache for Google; the EU will soon report on its two-year investigation into the firm’s search business.

13 — 4 Luxembourg decided to relax its rules on banking secrecy and allow banks to share account details of suspected tax cheats with American and European authorities, starting in 2015. In a breakthrough for anti-corruption campaigners the European Union agreed to introduce stringent transparency rules for oil, gas, mining and timber companies, in areas such as details of payments to foreign governments. There are no exemptions for projects that take place in countries with confidentiality laws on contracts. Shell said it had “always supported” a global code, though the oil association to which it belongs in America is suing the government there over similar rules. Google’s competitors filed a complaint with European regulators about the dominance of the Android platform on smartphones. Fair. Search, which represents Microsoft and others, described Android as a “Trojan horse” that was part of Google’s strategy to “dominate mobile markets”. It is another potential antitrust headache for Google; the EU will soon report on its two-year investigation into the firm’s search business.

13 — 5 HTC , a Taiwanese smartphone-maker, saw its net profit fall by 98% in the first quarter, to $2. 8 m, as sales slumped. By contrast, China’s Huawei reported a 32% rise in annual profit, to 15. 4 billion yuan ($2. 5 billion), partly because of the growth of its domestic smartphone business. It is forecasting that revenues will rise by an average of 10% a year over the next five years. Sales of personal computers fell by 14% in the first quarter compared with the same period last year, according to International Data Corporation, a market research firm. It was the sharpest drop in PC sales since IDC began recording the data in 1994. It explained much of the sharp fall on the slump in popularity of notebooks, as people switch to tablets and smartphones. «Too big to fail» banks are «more dangerous than ever» to the U. S. and world economies and must be reined in, the International Monetary Fund chief said. She said the world was now developing a «three-speed» global economy, which she defined as «those countries that are doing well, those that are on the mend and those that still have some distance to travel. «

13 — 5 HTC , a Taiwanese smartphone-maker, saw its net profit fall by 98% in the first quarter, to $2. 8 m, as sales slumped. By contrast, China’s Huawei reported a 32% rise in annual profit, to 15. 4 billion yuan ($2. 5 billion), partly because of the growth of its domestic smartphone business. It is forecasting that revenues will rise by an average of 10% a year over the next five years. Sales of personal computers fell by 14% in the first quarter compared with the same period last year, according to International Data Corporation, a market research firm. It was the sharpest drop in PC sales since IDC began recording the data in 1994. It explained much of the sharp fall on the slump in popularity of notebooks, as people switch to tablets and smartphones. «Too big to fail» banks are «more dangerous than ever» to the U. S. and world economies and must be reined in, the International Monetary Fund chief said. She said the world was now developing a «three-speed» global economy, which she defined as «those countries that are doing well, those that are on the mend and those that still have some distance to travel. «

13 —

13 —

THE FOREIGN EXCHANGE MARKETChapter

THE FOREIGN EXCHANGE MARKETChapter

Chapter Preview Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 — 8 We develop a modern view of exchange rate determination that explains recent behavior in the foreign exchange market. Topics include: Foreign Exchange Market Exchange Rates in the Long Run Exchange Rates in the Short Run Explaining Changes in Exchange Rates

Chapter Preview Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 — 8 We develop a modern view of exchange rate determination that explains recent behavior in the foreign exchange market. Topics include: Foreign Exchange Market Exchange Rates in the Long Run Exchange Rates in the Short Run Explaining Changes in Exchange Rates

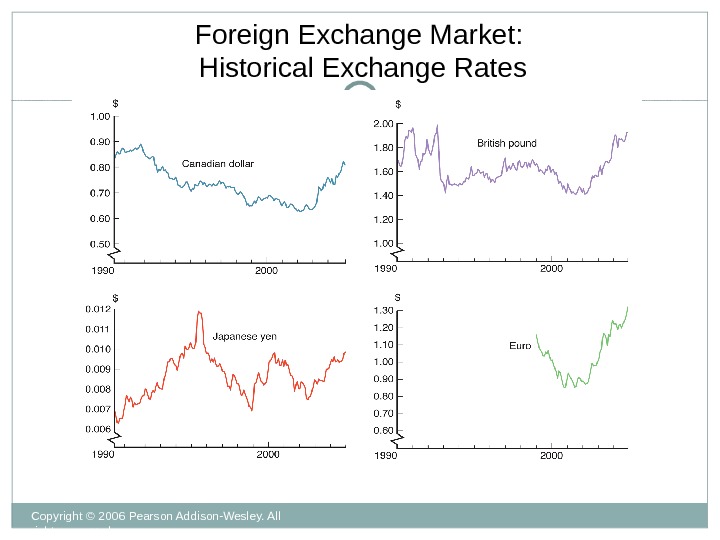

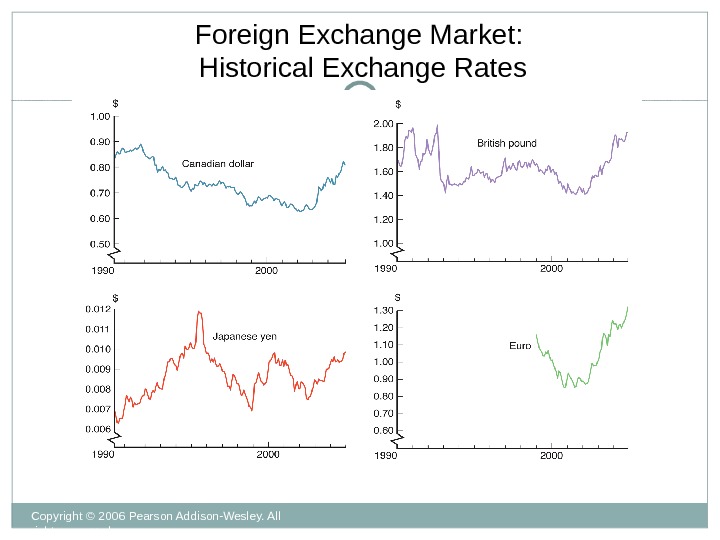

Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 — 9 Foreign Exchange Market: Historical Exchange Rates

Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 — 9 Foreign Exchange Market: Historical Exchange Rates

The Foreign Exchange Market 13 — 10 Definitions 1. Spot exchange rate 2. Forward exchange rate 3. Appreciation when a currency increases in value. 4. Depreciation

The Foreign Exchange Market 13 — 10 Definitions 1. Spot exchange rate 2. Forward exchange rate 3. Appreciation when a currency increases in value. 4. Depreciation

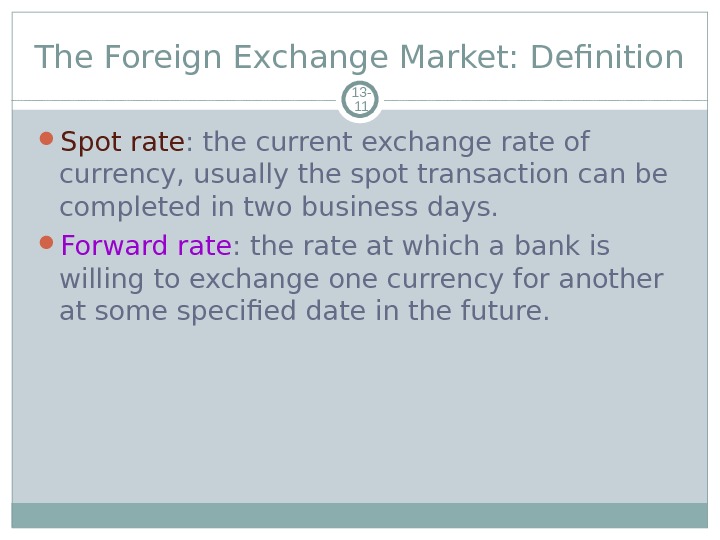

The Foreign Exchange Market: Definition 13 — 11 Spot rate : the current exchange rate of currency, usually the spot transaction can be completed in two business days. Forward rate : the rate at which a bank is willing to exchange one currency for another at some specified date in the future.

The Foreign Exchange Market: Definition 13 — 11 Spot rate : the current exchange rate of currency, usually the spot transaction can be completed in two business days. Forward rate : the rate at which a bank is willing to exchange one currency for another at some specified date in the future.

Foreign Exchange Market: Why Are Exchange Rates Important? 13 — 12 When the currency of your country appreciates relative to another country, your country’s goods prices abroad and foreign goods prices in your country. 1. Makes domestic businesses less competitive 2. Benefits domestic consumers (you)

Foreign Exchange Market: Why Are Exchange Rates Important? 13 — 12 When the currency of your country appreciates relative to another country, your country’s goods prices abroad and foreign goods prices in your country. 1. Makes domestic businesses less competitive 2. Benefits domestic consumers (you)

Foreign Exchange Market: How is Foreign Exchange Traded? 13 — 13 FX traded in over-the-counter market 1. Most trades involve buying and selling bank deposits denominated in different currencies. 2. Trades in the foreign exchange market involve transactions in excess of $1 million. 3. Typical consumers buy foreign currencies from retail dealers, such as American Express.

Foreign Exchange Market: How is Foreign Exchange Traded? 13 — 13 FX traded in over-the-counter market 1. Most trades involve buying and selling bank deposits denominated in different currencies. 2. Trades in the foreign exchange market involve transactions in excess of $1 million. 3. Typical consumers buy foreign currencies from retail dealers, such as American Express.

Exchange Rates in the Long Run 13 — 14 Exchange rates are determined in markets by the interaction of supply and demand. An important concept that drives the forces of supply and demand is the Law of One Price or PPP (Purchasing Power Parity). PPP states that exchange rates between any two currencies will adjust to reflect changes in the price levels of the two countries. It (Theory of PPP) suggest that if one country’s price level rises relative to another’s, its currency should depreciate.

Exchange Rates in the Long Run 13 — 14 Exchange rates are determined in markets by the interaction of supply and demand. An important concept that drives the forces of supply and demand is the Law of One Price or PPP (Purchasing Power Parity). PPP states that exchange rates between any two currencies will adjust to reflect changes in the price levels of the two countries. It (Theory of PPP) suggest that if one country’s price level rises relative to another’s, its currency should depreciate.

Exchange Rates in the Long Run: Law of One Price The Law of One Price states that the price of an identical good will be the same (if measured in a common currency) throughout the world, regardless of which country produces it. Example: American steel $100 per ton, Japanese steel 10, 000 yen per ton A everything is the same Computer: sell in US $1, 000 but in KZ Tg 100, 000. If FX=Tg 125/$, then buy in KZ for $800 and then sell in US for $1, 000.

Exchange Rates in the Long Run: Law of One Price The Law of One Price states that the price of an identical good will be the same (if measured in a common currency) throughout the world, regardless of which country produces it. Example: American steel $100 per ton, Japanese steel 10, 000 yen per ton A everything is the same Computer: sell in US $1, 000 but in KZ Tg 100, 000. If FX=Tg 125/$, then buy in KZ for $800 and then sell in US for $1, 000.

Exchange Rates in the Long Run: Law of One Price 13 — 16 (ratio) Law of one price If E = 100 Yen/$, then a 10% rise in the yen price of Japanese steel results in a 10% appreciation of the dollar. If E = 50 yen/$ then price are: American Steel. Japanese Steel In U. S. $100$200 In Japan 5000 yen 10, 000 yen If E = 100 yen/$ then price are: American Steel. Japanese Steel In U. S. $100 In Japan 10, 000 yen

Exchange Rates in the Long Run: Law of One Price 13 — 16 (ratio) Law of one price If E = 100 Yen/$, then a 10% rise in the yen price of Japanese steel results in a 10% appreciation of the dollar. If E = 50 yen/$ then price are: American Steel. Japanese Steel In U. S. $100$200 In Japan 5000 yen 10, 000 yen If E = 100 yen/$ then price are: American Steel. Japanese Steel In U. S. $100 In Japan 10, 000 yen

Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) The theory of PPP states that exchange rates between two currencies will adjust to reflect changes in price levels. Or, the relative price level between two countries will determine the exchange rate. PPP Domestic price level 10%, domestic currency 10% Application of law of one price to price levels Works in long run , not short run

Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) The theory of PPP states that exchange rates between two currencies will adjust to reflect changes in price levels. Or, the relative price level between two countries will determine the exchange rate. PPP Domestic price level 10%, domestic currency 10% Application of law of one price to price levels Works in long run , not short run

Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) 13 — 18 Problems with PPP 1. PPP assumes that all goods are identical in both countries, but all goods are not identical in both countries (i. e. , Toyota versus Chevy) 2. Many goods and services are not traded (e. g. , haircuts, land, etc. )

Exchange Rates in the Long Run: Theory of Purchasing Power Parity (PPP) 13 — 18 Problems with PPP 1. PPP assumes that all goods are identical in both countries, but all goods are not identical in both countries (i. e. , Toyota versus Chevy) 2. Many goods and services are not traded (e. g. , haircuts, land, etc. )

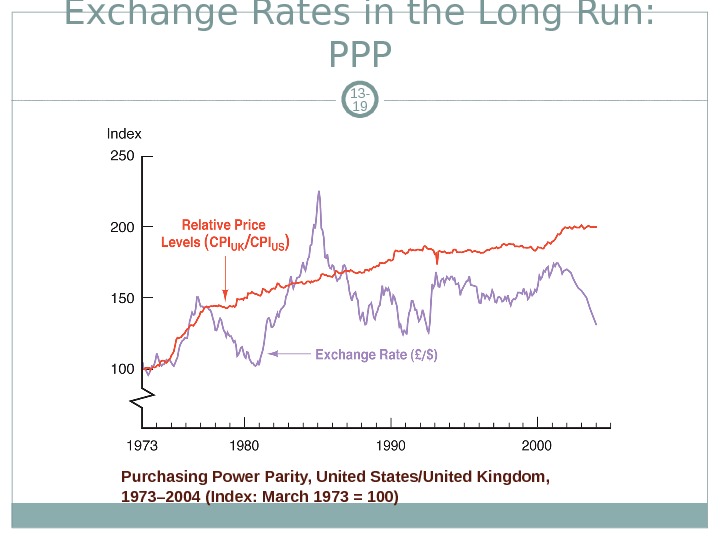

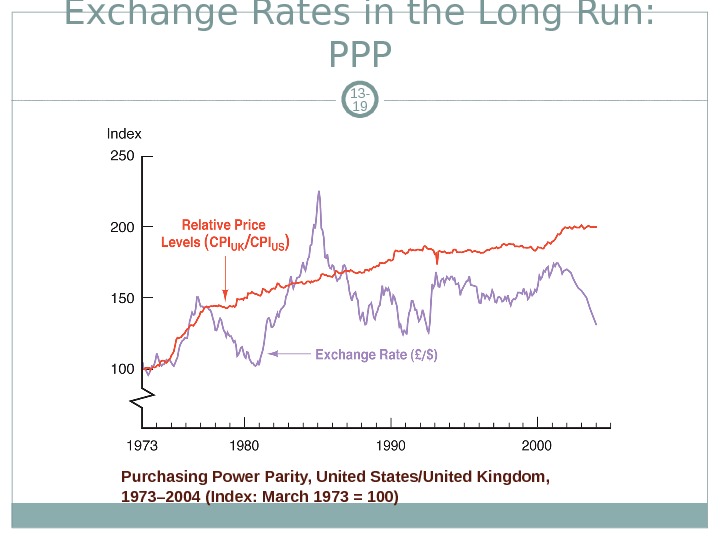

Exchange Rates in the Long Run: PPP 13 — 19 Purchasing Power Parity, United States/United Kingdom, 1973– 2004 (Index: March 1973 = 100)

Exchange Rates in the Long Run: PPP 13 — 19 Purchasing Power Parity, United States/United Kingdom, 1973– 2004 (Index: March 1973 = 100)

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run Basic Principle: If a factor increases demand for domestic goods relative to foreign goods, the exchange rate The four major factors are relative price levels , tariffs and quotas , preferences for domestic vs. foreign goods and productivity.

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run Basic Principle: If a factor increases demand for domestic goods relative to foreign goods, the exchange rate The four major factors are relative price levels , tariffs and quotas , preferences for domestic vs. foreign goods and productivity.

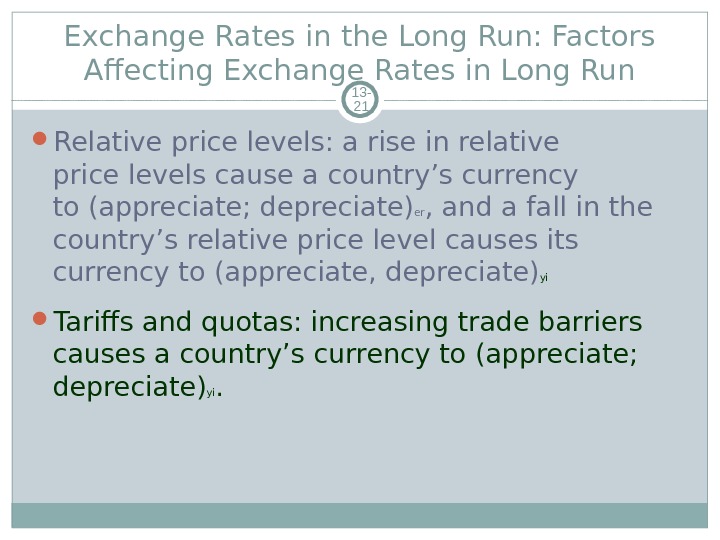

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run 13 — 21 Relative price levels: a rise in relative price levels cause a country’s currency to (appreciate; depreciate) er , and a fall in the country’s relative price level causes its currency to (appreciate, depreciate) yi Tariffs and quotas: increasing trade barriers causes a country’s currency to (appreciate; depreciate) yi.

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run 13 — 21 Relative price levels: a rise in relative price levels cause a country’s currency to (appreciate; depreciate) er , and a fall in the country’s relative price level causes its currency to (appreciate, depreciate) yi Tariffs and quotas: increasing trade barriers causes a country’s currency to (appreciate; depreciate) yi.

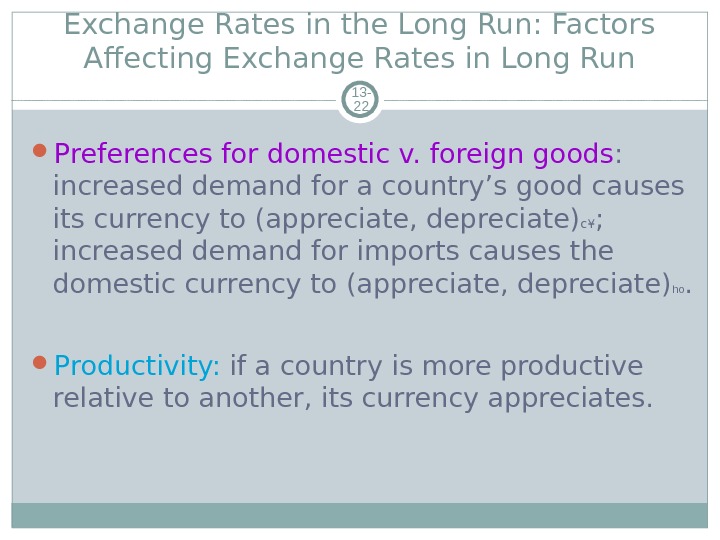

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run 13 — 22 Preferences for domestic v. foreign goods : increased demand for a country’s good causes its currency to (appreciate, depreciate) c ¥ ; increased demand for imports causes the domestic currency to (appreciate, depreciate) ho. Productivity: if a country is more productive relative to another, its currency appreciates.

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run 13 — 22 Preferences for domestic v. foreign goods : increased demand for a country’s good causes its currency to (appreciate, depreciate) c ¥ ; increased demand for imports causes the domestic currency to (appreciate, depreciate) ho. Productivity: if a country is more productive relative to another, its currency appreciates.

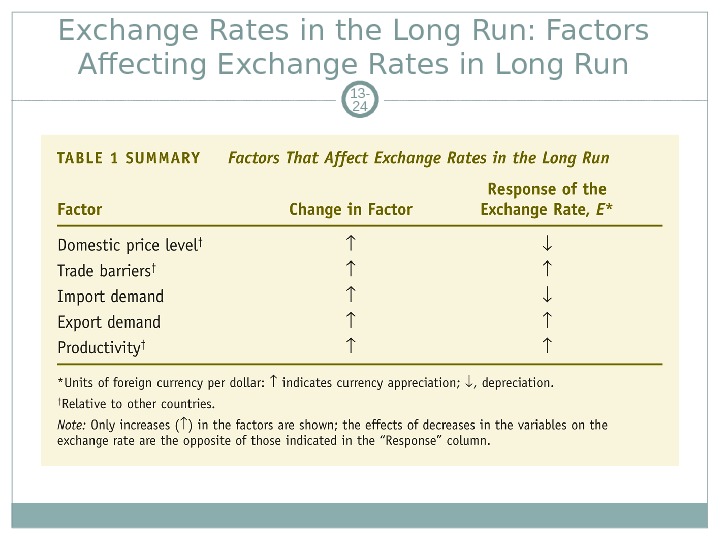

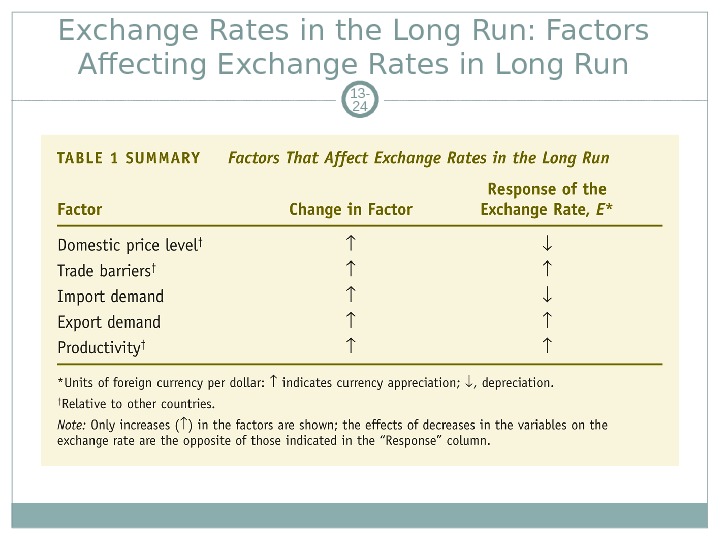

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run 13 — 23 The following table summarizes these relationships. By convention, we are quoting, for example, the exchange rate, E , as units of foreign currency / 1 US dollar. For KZ, Tg 147/$ is a direct quotation.

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run 13 — 23 The following table summarizes these relationships. By convention, we are quoting, for example, the exchange rate, E , as units of foreign currency / 1 US dollar. For KZ, Tg 147/$ is a direct quotation.

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run 13 —

Exchange Rates in the Long Run: Factors Affecting Exchange Rates in Long Run 13 —

Exchange Rates in the Short Run 13 — 25 In the short run , it is key to recognize that an exchange rate is nothing more than the price of domestic bank deposits in terms of foreign bank deposits.

Exchange Rates in the Short Run 13 — 25 In the short run , it is key to recognize that an exchange rate is nothing more than the price of domestic bank deposits in terms of foreign bank deposits.

Exchange Rates in the Short Run: Expected Returns on Domestic and Foreign Deposits We will illustrate this with a simple example Francois the Foreigner can deposit excess Euros locally, or he can convert them to U. S. dollars and deposit them in a U. S. bank. The difference in expected returns depends on two things: local interest rates and expected future (forward) exchange rates.

Exchange Rates in the Short Run: Expected Returns on Domestic and Foreign Deposits We will illustrate this with a simple example Francois the Foreigner can deposit excess Euros locally, or he can convert them to U. S. dollars and deposit them in a U. S. bank. The difference in expected returns depends on two things: local interest rates and expected future (forward) exchange rates.

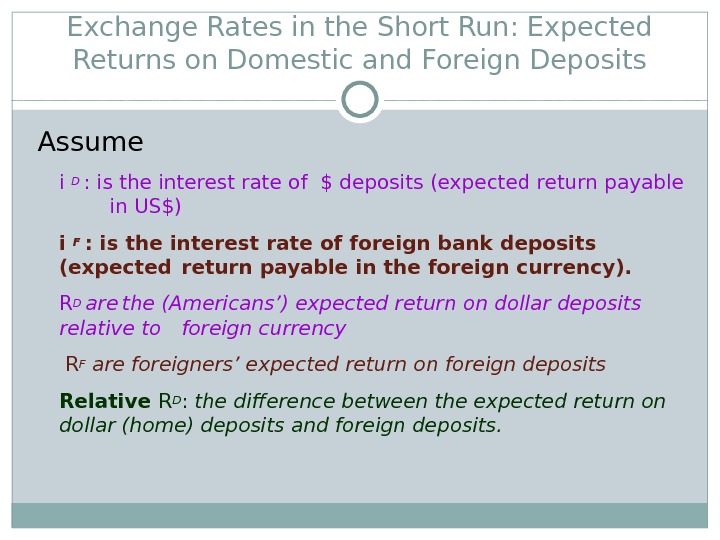

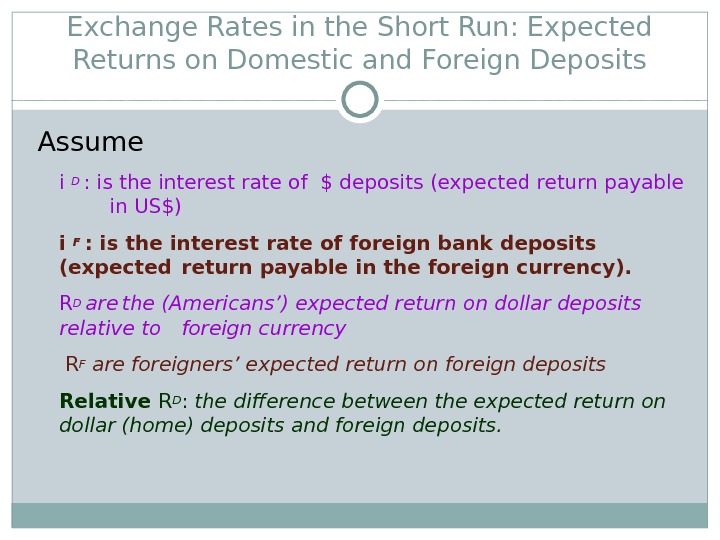

Exchange Rates in the Short Run: Expected Returns on Domestic and Foreign Deposits Assume i D : is the interest rate of $ deposits (expected return payable in US$) i F : is the interest rate of foreign bank deposits (expected return payable in the foreign currency). R D are the (Americans’) expected return on dollar deposits relative to foreign currency R F are foreigners’ expected return on foreign deposits Relative R D : the difference between the expected return on dollar (home) deposits and foreign deposits.

Exchange Rates in the Short Run: Expected Returns on Domestic and Foreign Deposits Assume i D : is the interest rate of $ deposits (expected return payable in US$) i F : is the interest rate of foreign bank deposits (expected return payable in the foreign currency). R D are the (Americans’) expected return on dollar deposits relative to foreign currency R F are foreigners’ expected return on foreign deposits Relative R D : the difference between the expected return on dollar (home) deposits and foreign deposits.

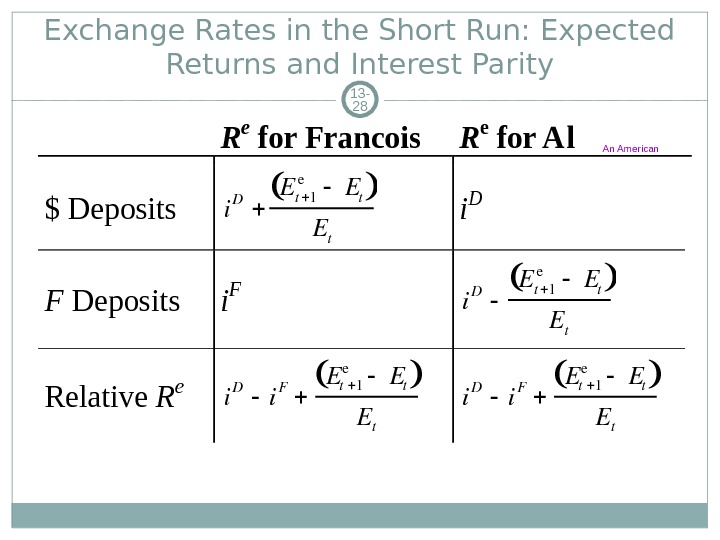

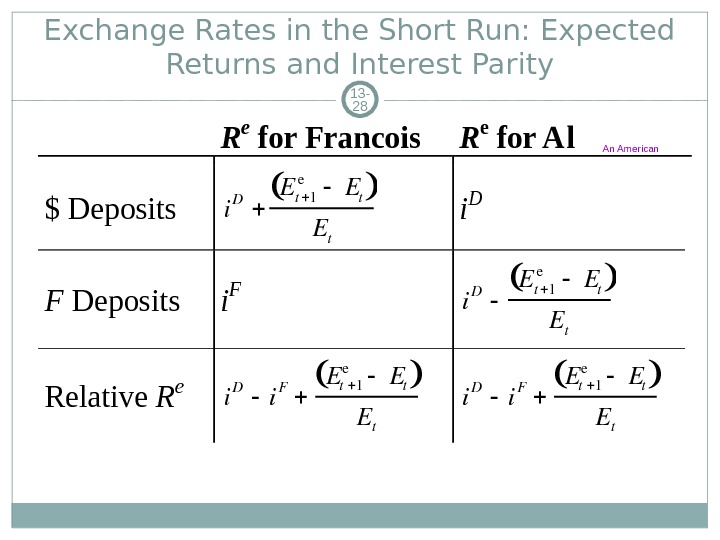

Exchange Rates in the Short Run: Expected Returns and Interest Parity 13 — 28 R e for Francois. R e for Al $ Depositsi D Et 1 e Et Et i D F Depositsi F i D Et 1 e Et Et Relative R e i D i F Et 1 e Et Et An American

Exchange Rates in the Short Run: Expected Returns and Interest Parity 13 — 28 R e for Francois. R e for Al $ Depositsi D Et 1 e Et Et i D F Depositsi F i D Et 1 e Et Et Relative R e i D i F Et 1 e Et Et An American

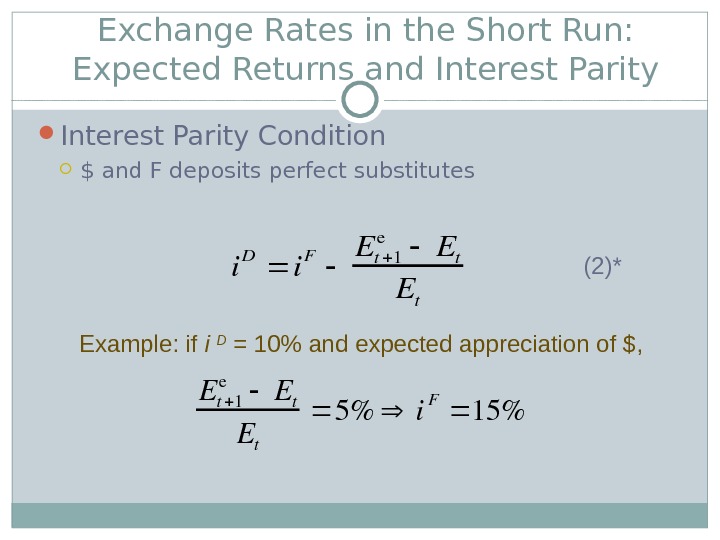

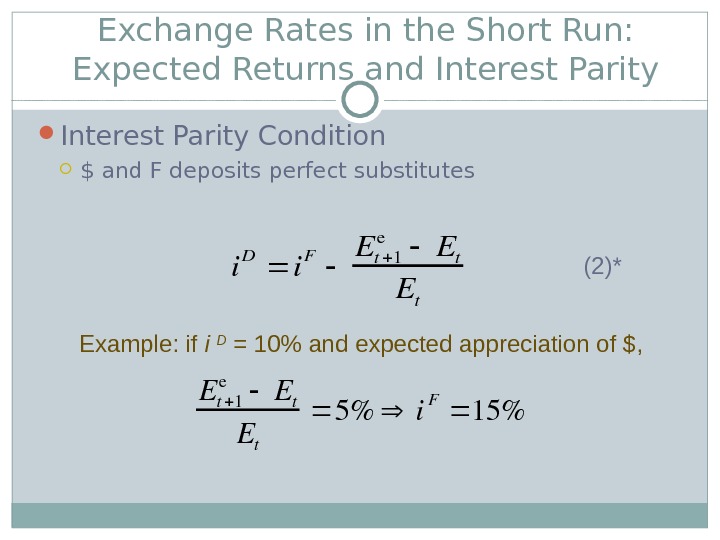

Exchange Rates in the Short Run: Expected Returns and Interest Parity Condition $ and F deposits perfect substitutesi D i F Et 1 e Et Et E t 1 e E t 5 % i F 15 %Example: if i D = 10% and expected appreciation of $, (2)*

Exchange Rates in the Short Run: Expected Returns and Interest Parity Condition $ and F deposits perfect substitutesi D i F Et 1 e Et Et E t 1 e E t 5 % i F 15 %Example: if i D = 10% and expected appreciation of $, (2)*

Exchange Rates in the Short Run: Expected Returns and Interest Parity 13 — 30 To determine the equilibrium condition, we must first determine the expected return in terms of dollars on foreign deposits, RF. Next, we must determine the expected return in terms of dollars on dollar deposits, R D.

Exchange Rates in the Short Run: Expected Returns and Interest Parity 13 — 30 To determine the equilibrium condition, we must first determine the expected return in terms of dollars on foreign deposits, RF. Next, we must determine the expected return in terms of dollars on dollar deposits, R D.

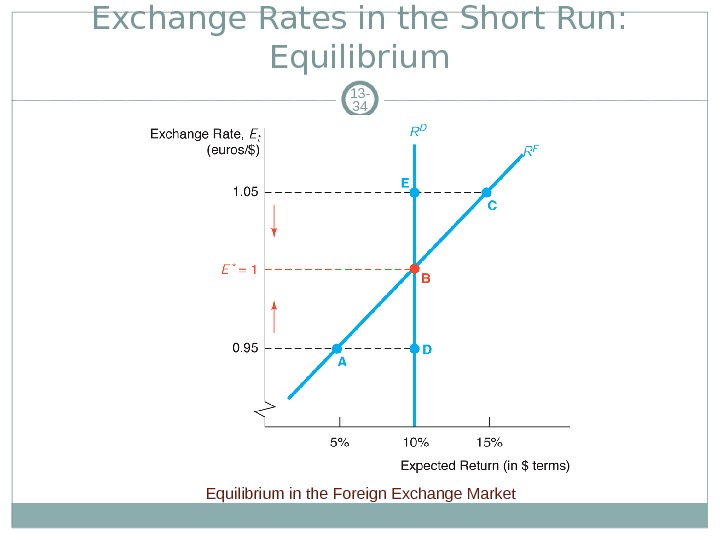

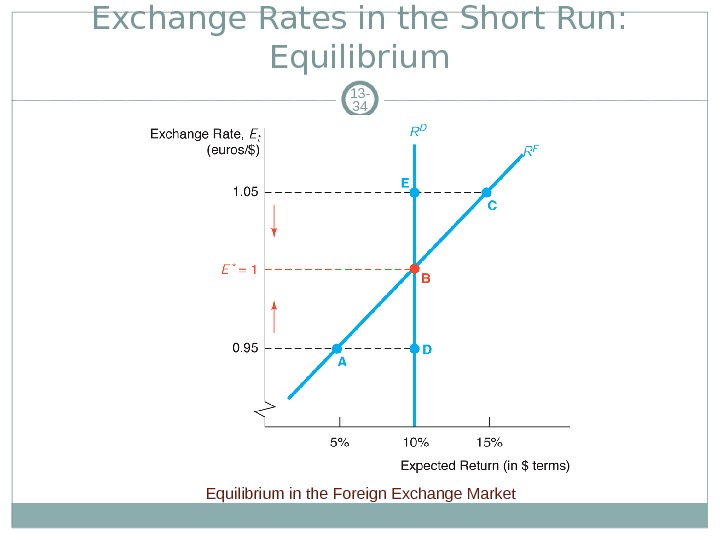

Exchange Rates in the Short Run: Deriving R F Curve R F curve connects these points and is upward sloping because when E t is higher, expected appreciation of F higher, R F Assume i. F = 10%, E e t+1 = 1 euro/$ Point A: E t = 0. 95 R F 0. 101. 00. 950. 0484. 8% B: E t = 1. 0 R F 0. 101. 01. 00. 10010. 0% C: E t = 1. 05 RF = 0. 10 – (1. 0 – 1. 05)/1. 05 = 0. 1 – (-0. 048) = 14. 8%

Exchange Rates in the Short Run: Deriving R F Curve R F curve connects these points and is upward sloping because when E t is higher, expected appreciation of F higher, R F Assume i. F = 10%, E e t+1 = 1 euro/$ Point A: E t = 0. 95 R F 0. 101. 00. 950. 0484. 8% B: E t = 1. 0 R F 0. 101. 01. 00. 10010. 0% C: E t = 1. 05 RF = 0. 10 – (1. 0 – 1. 05)/1. 05 = 0. 1 – (-0. 048) = 14. 8%

Exchange Rates in the Short Run: Deriving R D Curve 13 — 32 Deriving RD Curve Points B, D, E, R D = 10%, so curve is vertical

Exchange Rates in the Short Run: Deriving R D Curve 13 — 32 Deriving RD Curve Points B, D, E, R D = 10%, so curve is vertical

Exchange Rates in the Short Run: Equilibrium 13 — 33 Equilibrium RD = RF at E * If E t > E *, R F > RD , sell $, E t If E t < E *, R F < RD , buy $, E t The following figure illustrates this.

Exchange Rates in the Short Run: Equilibrium 13 — 33 Equilibrium RD = RF at E * If E t > E *, R F > RD , sell $, E t If E t < E *, R F < RD , buy $, E t The following figure illustrates this.

Exchange Rates in the Short Run: Equilibrium 13 — 34 Equilibrium in the Foreign Exchange Market

Exchange Rates in the Short Run: Equilibrium 13 — 34 Equilibrium in the Foreign Exchange Market

Explaining Changes in Exchange Rates 13 — 35 To understand how exchange rates shift in time, we need to understand the factors that shift expected returns for domestic and foreign deposits. We will examine these separately, as well as changes in the money supply and exchange rate overshooting.

Explaining Changes in Exchange Rates 13 — 35 To understand how exchange rates shift in time, we need to understand the factors that shift expected returns for domestic and foreign deposits. We will examine these separately, as well as changes in the money supply and exchange rate overshooting.

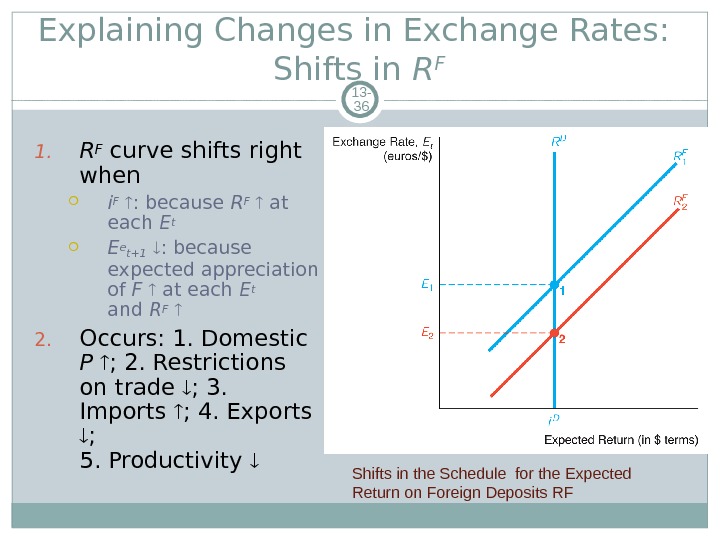

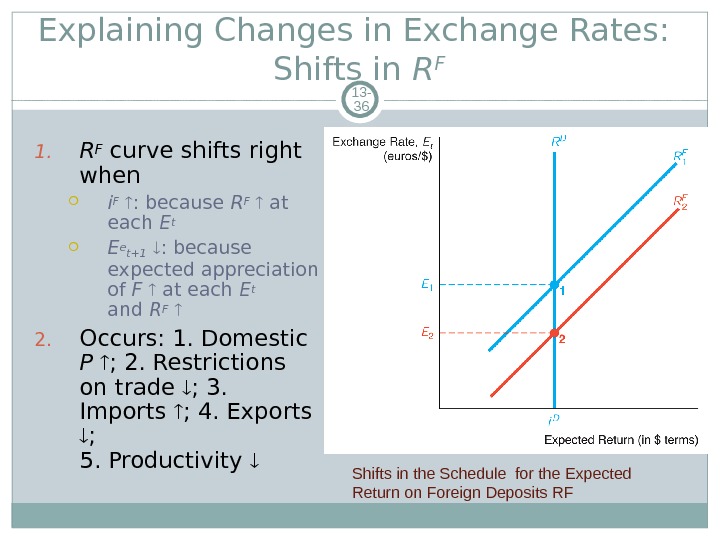

Explaining Changes in Exchange Rates: Shifts in R F 13 — 36 1. R F curve shifts right when i F : because R F at each E t E e t+1 : because expected appreciation of F at each E t and R F 2. Occurs: 1. Domestic P ; 2. Restrictions on trade ; 3. Imports ; 4. Exports ; 5. Productivity Shifts in the Schedule for the Expected Return on Foreign Deposits R

Explaining Changes in Exchange Rates: Shifts in R F 13 — 36 1. R F curve shifts right when i F : because R F at each E t E e t+1 : because expected appreciation of F at each E t and R F 2. Occurs: 1. Domestic P ; 2. Restrictions on trade ; 3. Imports ; 4. Exports ; 5. Productivity Shifts in the Schedule for the Expected Return on Foreign Deposits R

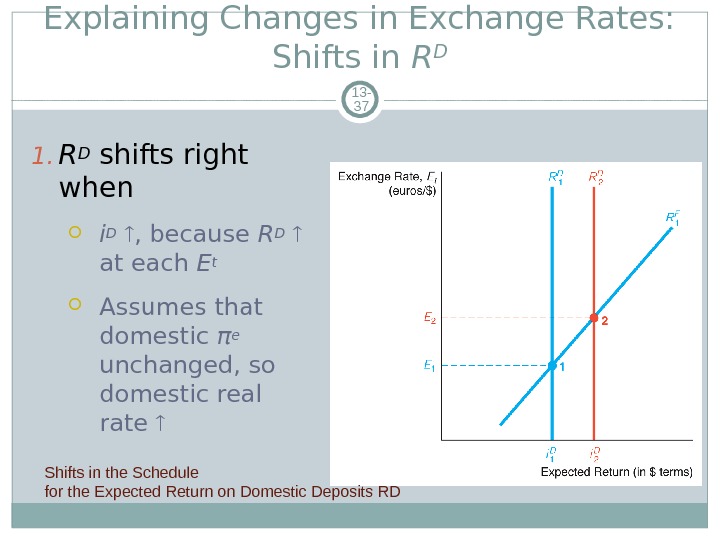

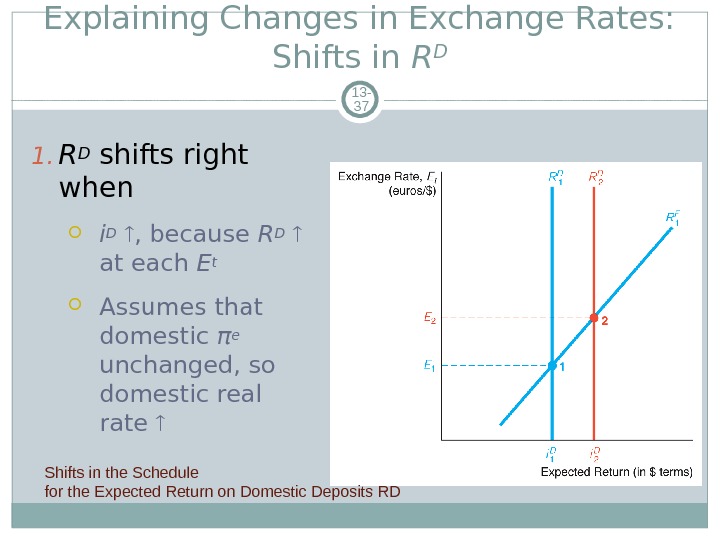

Explaining Changes in Exchange Rates: Shifts in R D 13 — 37 1. RD shifts right when i D , because RD at each E t Assumes that domestic π e unchanged, so domestic real rate Shifts in the Schedule for the Expected Return on Domestic Deposits R

Explaining Changes in Exchange Rates: Shifts in R D 13 — 37 1. RD shifts right when i D , because RD at each E t Assumes that domestic π e unchanged, so domestic real rate Shifts in the Schedule for the Expected Return on Domestic Deposits R

Explaining Changes in Exchange Rates: Factors that Shift R F and R D 13 —

Explaining Changes in Exchange Rates: Factors that Shift R F and R D 13 —

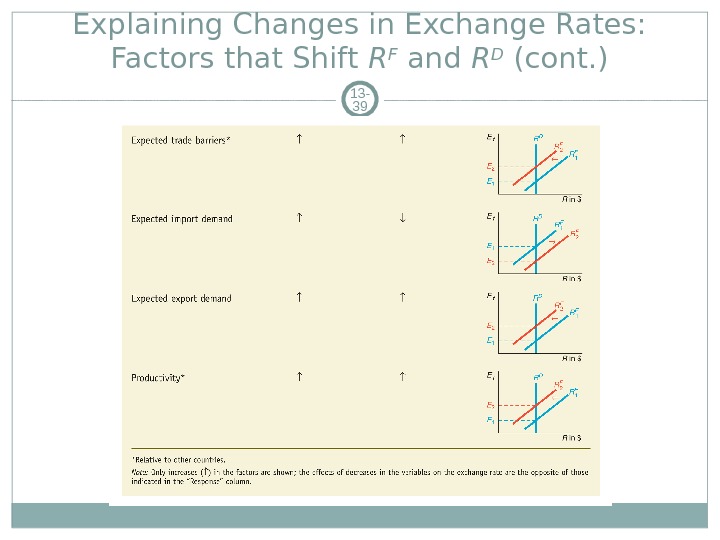

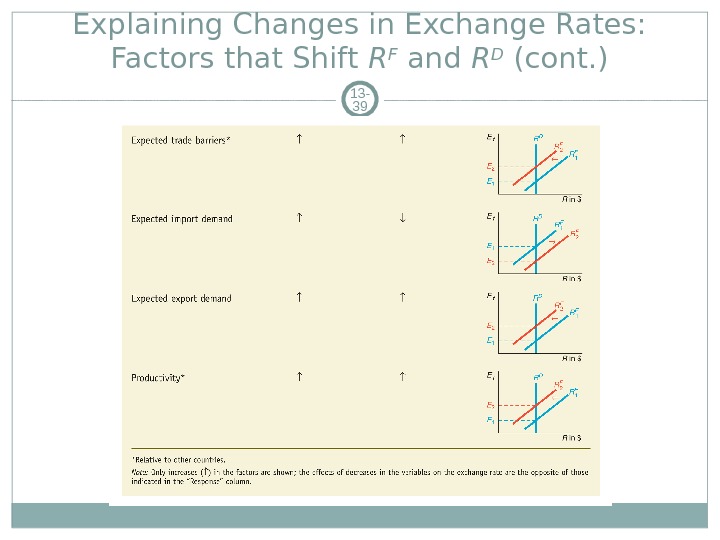

Explaining Changes in Exchange Rates: Factors that Shift R F and R D (cont. ) 13 —

Explaining Changes in Exchange Rates: Factors that Shift R F and R D (cont. ) 13 —

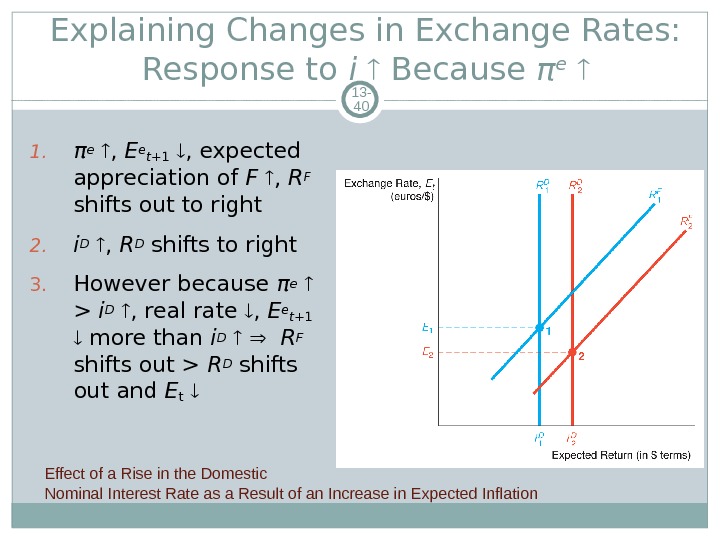

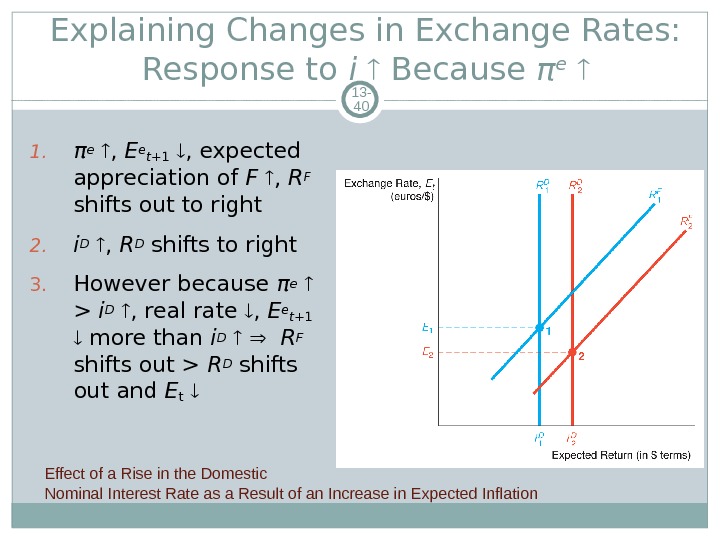

Explaining Changes in Exchange Rates: Response to i Because π e 13 — 40 1. π e , E e t +1 , expected appreciation of F , R F shifts out to right 2. i D , R D shifts to right 3. However because π e > i D , real rate , E e t +1 more than i D R F shifts out > R D shifts out and E t Effect of a Rise in the Domestic Nominal Interest Rate as a Result of an Increase in Expected Inflation

Explaining Changes in Exchange Rates: Response to i Because π e 13 — 40 1. π e , E e t +1 , expected appreciation of F , R F shifts out to right 2. i D , R D shifts to right 3. However because π e > i D , real rate , E e t +1 more than i D R F shifts out > R D shifts out and E t Effect of a Rise in the Domestic Nominal Interest Rate as a Result of an Increase in Expected Inflation

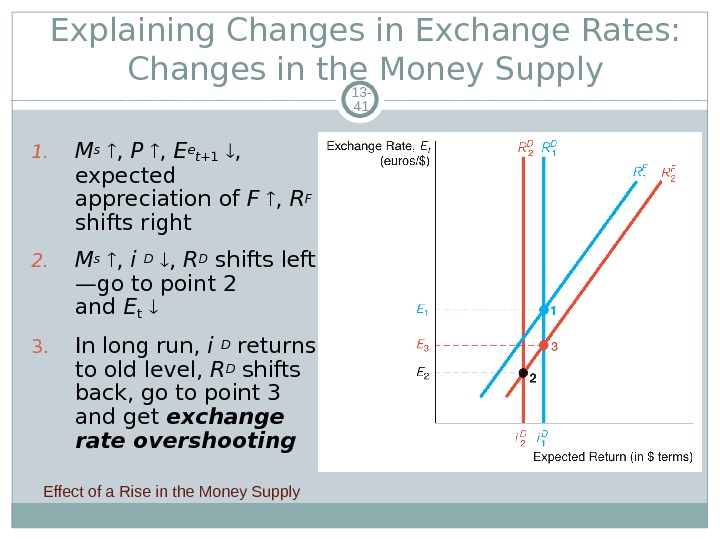

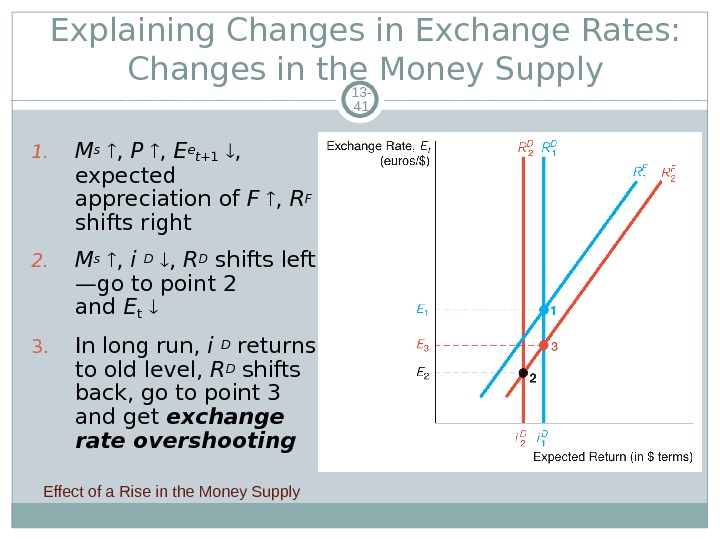

Explaining Changes in Exchange Rates: Changes in the Money Supply 13 — 41 1. M s , P , E e t +1 , expected appreciation of F , R F shifts right 2. M s , i D , R D shifts left —go to point 2 and E t 3. In long run, i D returns to old level, R D shifts back, go to point 3 and get exchange rate overshooting Effect of a Rise in the Money Supply

Explaining Changes in Exchange Rates: Changes in the Money Supply 13 — 41 1. M s , P , E e t +1 , expected appreciation of F , R F shifts right 2. M s , i D , R D shifts left —go to point 2 and E t 3. In long run, i D returns to old level, R D shifts back, go to point 3 and get exchange rate overshooting Effect of a Rise in the Money Supply

Case: Why are Exchange Rates So Volatile Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 — 42 Expectations of Eet+1 fluctuate Exchange rate overshooting

Case: Why are Exchange Rates So Volatile Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 — 42 Expectations of Eet+1 fluctuate Exchange rate overshooting

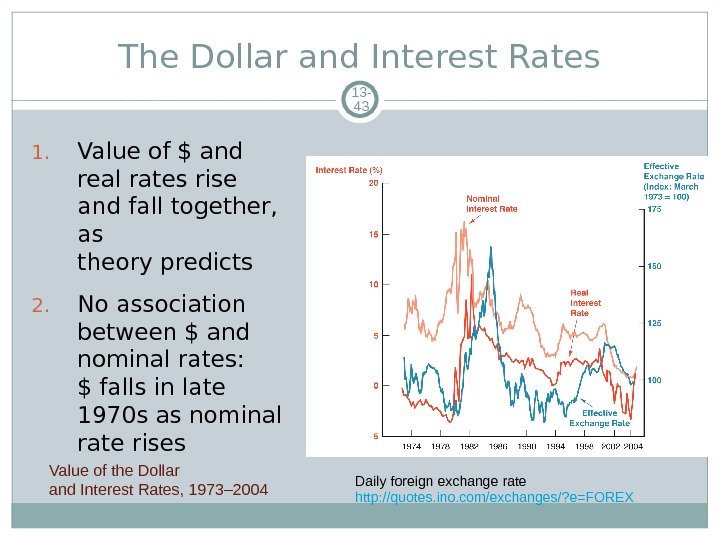

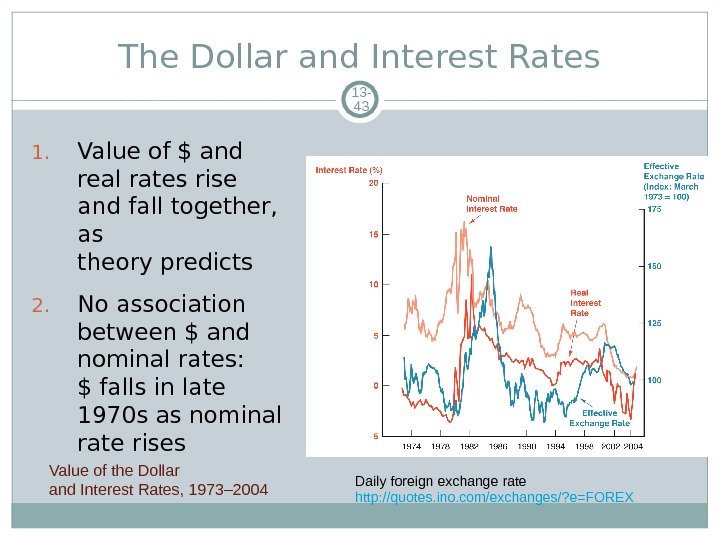

The Dollar and Interest Rates 13 — 43 1. Value of $ and real rates rise and fall together, as theory predicts 2. No association between $ and nominal rates: $ falls in late 1970 s as nominal rate rises Value of the Dollar and Interest Rates, 1973– 2004 Daily foreign exchange rate http: //quotes. ino. com/exchanges/? e=FOREX

The Dollar and Interest Rates 13 — 43 1. Value of $ and real rates rise and fall together, as theory predicts 2. No association between $ and nominal rates: $ falls in late 1970 s as nominal rate rises Value of the Dollar and Interest Rates, 1973– 2004 Daily foreign exchange rate http: //quotes. ino. com/exchanges/? e=FOREX

The Practicing Manger: Profiting from FX Forecasts Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 — 44 Forecasters look at factors discussed here FX forecasts affect financial institutions managers’ decisions If forecast yen appreciate, yen depreciate, Sell franc assets, buy euro assets Make more euros loans, less yen loans FX traders sell yen, buy euros

The Practicing Manger: Profiting from FX Forecasts Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13 — 44 Forecasters look at factors discussed here FX forecasts affect financial institutions managers’ decisions If forecast yen appreciate, yen depreciate, Sell franc assets, buy euro assets Make more euros loans, less yen loans FX traders sell yen, buy euros

Chapter Summary 13 — 45 Foreign Exchange Market: the market for deposits in one currency versus deposits in another. Exchange Rates in the Long Run: driven primarily by the law of one price as it affects the four factors discussed.

Chapter Summary 13 — 45 Foreign Exchange Market: the market for deposits in one currency versus deposits in another. Exchange Rates in the Long Run: driven primarily by the law of one price as it affects the four factors discussed.

Chapter Summary (cont. ) 13 — 46 Exchange Rates in the Short Run: short-run rates are determined by the demand for assets denominated in both domestic and foreign currencies. Explaining Changes in Exchange Rates: factors leading to shifts in the RF and RD schedules were explored.

Chapter Summary (cont. ) 13 — 46 Exchange Rates in the Short Run: short-run rates are determined by the demand for assets denominated in both domestic and foreign currencies. Explaining Changes in Exchange Rates: factors leading to shifts in the RF and RD schedules were explored.