24dbcd96c791072b6a0314fb135efa5c.ppt

- Количество слайдов: 99

ECONOMICS why should we study it?

ECONOMICS why should we study it?

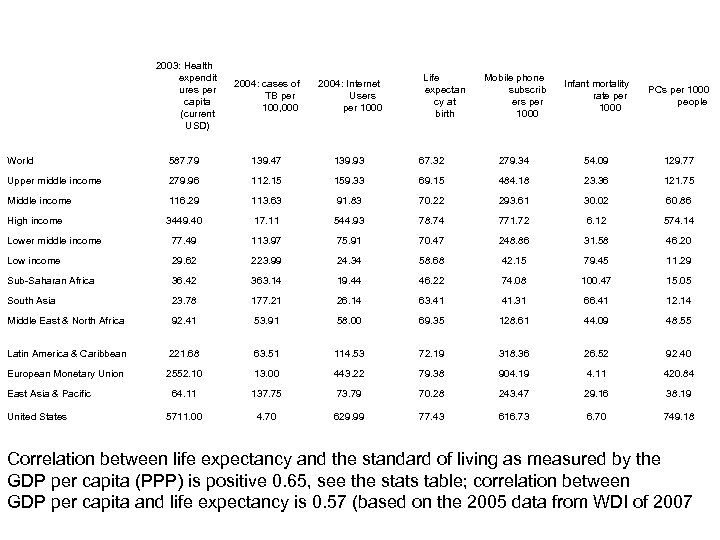

Economic development = quality of life Life expectancy is strongly correlated with economic activity (GDP per capita, based on PPP) Using WDI data for 2004, the correlation coefficient between the life expectancy at birth and the GDP per capita, PPP method: 0. 63 The statistical relationship can be approximated by the following expression (click here for the source file): This suggests that $1319 in GDP per capita translate into 1 year difference in expected lifespan

Economic development = quality of life Life expectancy is strongly correlated with economic activity (GDP per capita, based on PPP) Using WDI data for 2004, the correlation coefficient between the life expectancy at birth and the GDP per capita, PPP method: 0. 63 The statistical relationship can be approximated by the following expression (click here for the source file): This suggests that $1319 in GDP per capita translate into 1 year difference in expected lifespan

Economics • Defining Economics – Social Science – Unlimited Wants – Scarce Resources • Efficiency – What to Produce (allocative efficiency) – How to Produce (productive efficiency) – For Whom to Produce (allocative efficiency)

Economics • Defining Economics – Social Science – Unlimited Wants – Scarce Resources • Efficiency – What to Produce (allocative efficiency) – How to Produce (productive efficiency) – For Whom to Produce (allocative efficiency)

Economic Resources • Agricultural Economy (Feudalism) – Labor • Immigration, population growth – Land • Inclusive of natural resources • Industrialization (Capitalism) – Capital • Encouragement of saving and capital formation (IRA) • Advanced Industrialization and Post Industrial – Human Capital • Subsidized education – Entrepreneurship • Establishing favorable business environment

Economic Resources • Agricultural Economy (Feudalism) – Labor • Immigration, population growth – Land • Inclusive of natural resources • Industrialization (Capitalism) – Capital • Encouragement of saving and capital formation (IRA) • Advanced Industrialization and Post Industrial – Human Capital • Subsidized education – Entrepreneurship • Establishing favorable business environment

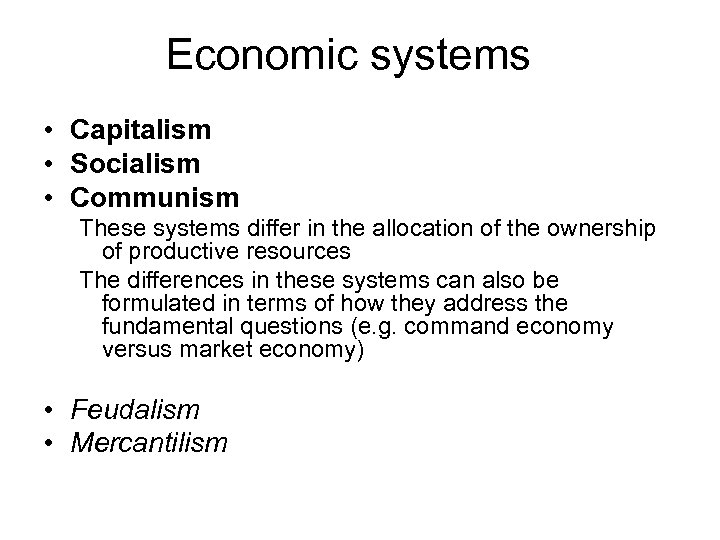

Economic systems • Capitalism • Socialism • Communism These systems differ in the allocation of the ownership of productive resources The differences in these systems can also be formulated in terms of how they address the fundamental questions (e. g. command economy versus market economy) • Feudalism • Mercantilism

Economic systems • Capitalism • Socialism • Communism These systems differ in the allocation of the ownership of productive resources The differences in these systems can also be formulated in terms of how they address the fundamental questions (e. g. command economy versus market economy) • Feudalism • Mercantilism

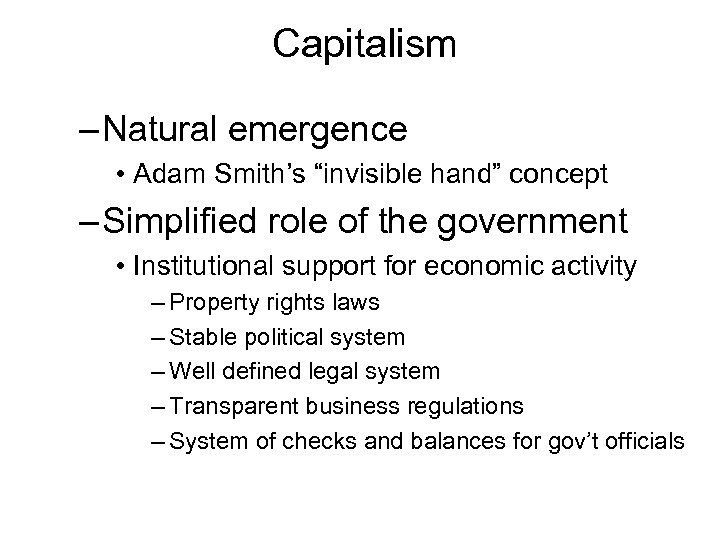

Capitalism – Natural emergence • Adam Smith’s “invisible hand” concept – Simplified role of the government • Institutional support for economic activity – Property rights laws – Stable political system – Well defined legal system – Transparent business regulations – System of checks and balances for gov’t officials

Capitalism – Natural emergence • Adam Smith’s “invisible hand” concept – Simplified role of the government • Institutional support for economic activity – Property rights laws – Stable political system – Well defined legal system – Transparent business regulations – System of checks and balances for gov’t officials

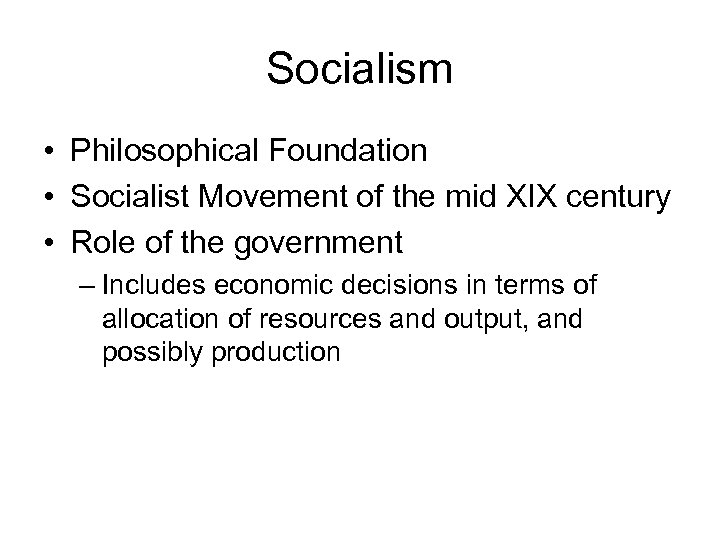

Socialism • Philosophical Foundation • Socialist Movement of the mid XIX century • Role of the government – Includes economic decisions in terms of allocation of resources and output, and possibly production

Socialism • Philosophical Foundation • Socialist Movement of the mid XIX century • Role of the government – Includes economic decisions in terms of allocation of resources and output, and possibly production

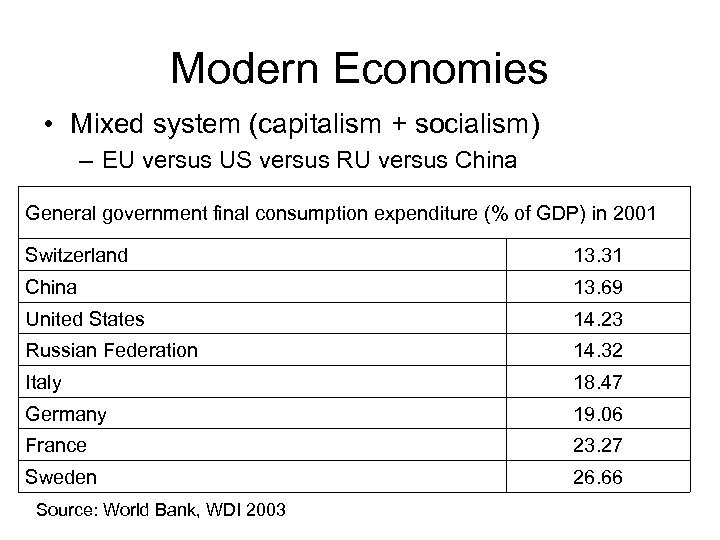

Modern Economies • Mixed system (capitalism + socialism) – EU versus US versus RU versus China General government final consumption expenditure (% of GDP) in 2001 Switzerland 13. 31 China 13. 69 United States 14. 23 Russian Federation 14. 32 Italy 18. 47 Germany 19. 06 France 23. 27 Sweden 26. 66 Source: World Bank, WDI 2003

Modern Economies • Mixed system (capitalism + socialism) – EU versus US versus RU versus China General government final consumption expenditure (% of GDP) in 2001 Switzerland 13. 31 China 13. 69 United States 14. 23 Russian Federation 14. 32 Italy 18. 47 Germany 19. 06 France 23. 27 Sweden 26. 66 Source: World Bank, WDI 2003

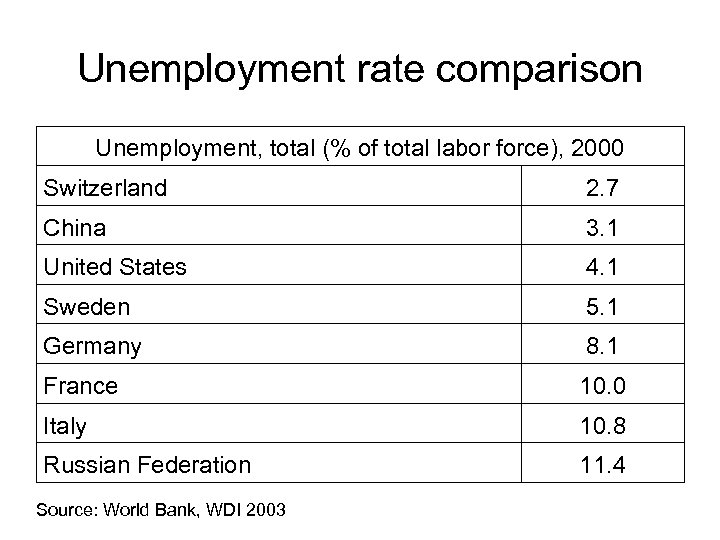

Unemployment rate comparison Unemployment, total (% of total labor force), 2000 Switzerland 2. 7 China 3. 1 United States 4. 1 Sweden 5. 1 Germany 8. 1 France 10. 0 Italy 10. 8 Russian Federation 11. 4 Source: World Bank, WDI 2003

Unemployment rate comparison Unemployment, total (% of total labor force), 2000 Switzerland 2. 7 China 3. 1 United States 4. 1 Sweden 5. 1 Germany 8. 1 France 10. 0 Italy 10. 8 Russian Federation 11. 4 Source: World Bank, WDI 2003

The Concept of Cost in Economics • Every undertaken activity has a foregone sacrifice associated with it • Opportunity Cost – The value of the next BEST (highest valued) alternative (the value of the sacrifice that would have become the next choice) – E. g. opportunity cost of this class – E. g. Opportunity cost of the Colander’s book (relative price) – E. g. Opportunity cost of physical capital

The Concept of Cost in Economics • Every undertaken activity has a foregone sacrifice associated with it • Opportunity Cost – The value of the next BEST (highest valued) alternative (the value of the sacrifice that would have become the next choice) – E. g. opportunity cost of this class – E. g. Opportunity cost of the Colander’s book (relative price) – E. g. Opportunity cost of physical capital

The world of trade-offs • Budget Constraint and Relative Price • Production Possibilities Frontier

The world of trade-offs • Budget Constraint and Relative Price • Production Possibilities Frontier

Gains from Trade • Specialization and increased output • Two-country two-product world • Absolute advantage principle – Why specialize in the production of something that is cheaper to purchase from abroad? • Comparative advantage principle – Specialize in the production of those products in which you have the lowest relative (opportunity) cost of production • Shape of PPF and lack of complete specialization • US trade data available on BEA website at: http: //www. bea. gov/bea/di/home/trade. htm

Gains from Trade • Specialization and increased output • Two-country two-product world • Absolute advantage principle – Why specialize in the production of something that is cheaper to purchase from abroad? • Comparative advantage principle – Specialize in the production of those products in which you have the lowest relative (opportunity) cost of production • Shape of PPF and lack of complete specialization • US trade data available on BEA website at: http: //www. bea. gov/bea/di/home/trade. htm

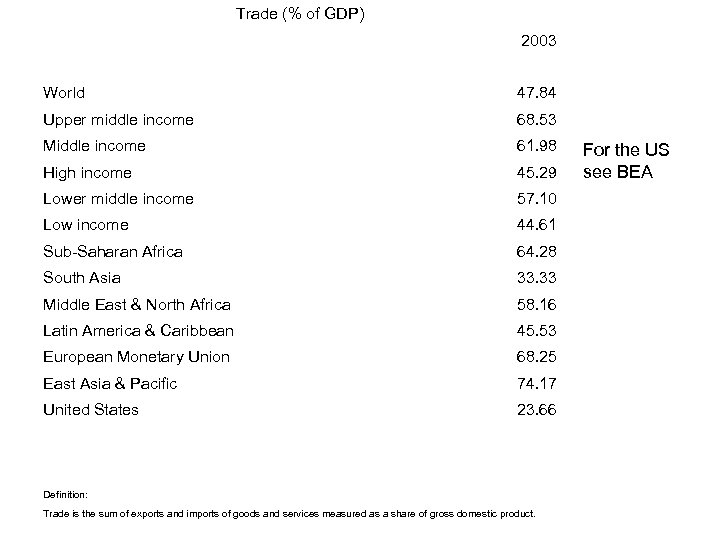

Trade (% of GDP) 2003 World 47. 84 Upper middle income 68. 53 Middle income 61. 98 High income 45. 29 Lower middle income 57. 10 Low income 44. 61 Sub-Saharan Africa 64. 28 South Asia 33. 33 Middle East & North Africa 58. 16 Latin America & Caribbean 45. 53 European Monetary Union 68. 25 East Asia & Pacific 74. 17 United States 23. 66 Definition: Trade is the sum of exports and imports of goods and services measured as a share of gross domestic product. For the US see BEA

Trade (% of GDP) 2003 World 47. 84 Upper middle income 68. 53 Middle income 61. 98 High income 45. 29 Lower middle income 57. 10 Low income 44. 61 Sub-Saharan Africa 64. 28 South Asia 33. 33 Middle East & North Africa 58. 16 Latin America & Caribbean 45. 53 European Monetary Union 68. 25 East Asia & Pacific 74. 17 United States 23. 66 Definition: Trade is the sum of exports and imports of goods and services measured as a share of gross domestic product. For the US see BEA

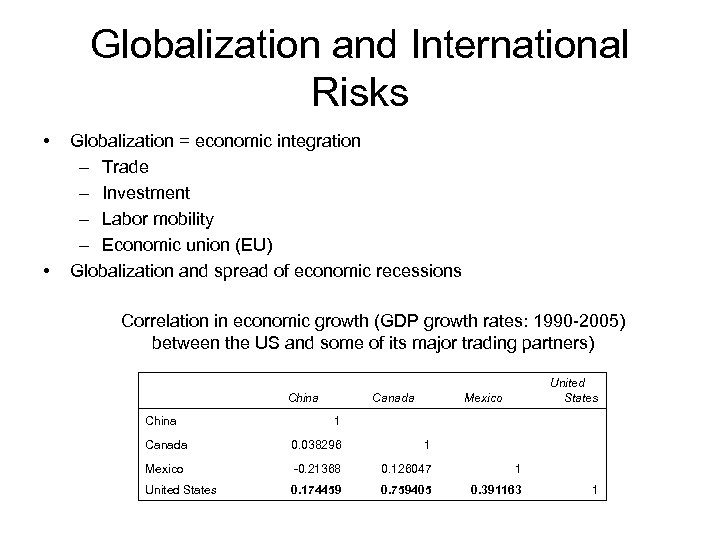

Globalization and International Risks • • Globalization = economic integration – Trade – Investment – Labor mobility – Economic union (EU) Globalization and spread of economic recessions Correlation in economic growth (GDP growth rates: 1990 -2005) between the US and some of its major trading partners) China Canada United States Mexico 1 Canada 0. 038296 1 Mexico -0. 21368 0. 126047 1 United States 0. 174459 0. 759405 0. 391163 1

Globalization and International Risks • • Globalization = economic integration – Trade – Investment – Labor mobility – Economic union (EU) Globalization and spread of economic recessions Correlation in economic growth (GDP growth rates: 1990 -2005) between the US and some of its major trading partners) China Canada United States Mexico 1 Canada 0. 038296 1 Mexico -0. 21368 0. 126047 1 United States 0. 174459 0. 759405 0. 391163 1

Markets • Defining a market – Product definition (and competition) – Geographical boundaries (internet, shipping cost reduction – globalization and outsourcing) • Market forces: Buyers (demand) versus Sellers (supply) – Price and quantity as the outcome

Markets • Defining a market – Product definition (and competition) – Geographical boundaries (internet, shipping cost reduction – globalization and outsourcing) • Market forces: Buyers (demand) versus Sellers (supply) – Price and quantity as the outcome

demand • Quantity = f (price, other factors) • Price and the Law of Demand • Other factors – Income (normal versus inferior) – Related in consumption goods • Substitutes • Complements – Expectations about the future – OTHER FACTORS ………

demand • Quantity = f (price, other factors) • Price and the Law of Demand • Other factors – Income (normal versus inferior) – Related in consumption goods • Substitutes • Complements – Expectations about the future – OTHER FACTORS ………

supply • Quantity = f ( price, other factors) • Price and the Law of Supply • Other factors – Costs of Production (MC, and price as MB) – Goods related in production • Substitutes: (agricultural products) – Note, identical to costs of production since is based on opportunity cost concept • Complements: (like gold and silver) – Producer expectations of future prices • Other factors…

supply • Quantity = f ( price, other factors) • Price and the Law of Supply • Other factors – Costs of Production (MC, and price as MB) – Goods related in production • Substitutes: (agricultural products) – Note, identical to costs of production since is based on opportunity cost concept • Complements: (like gold and silver) – Producer expectations of future prices • Other factors…

Market equilibrium • Qs = Qd • Shortage and surplus as unstable states and the stability property of the equilibrium • Market efficiency • Shifts in demand supply • Is the equilibrium really efficient? – Productive and allocative efficiency

Market equilibrium • Qs = Qd • Shortage and surplus as unstable states and the stability property of the equilibrium • Market efficiency • Shifts in demand supply • Is the equilibrium really efficient? – Productive and allocative efficiency

Market example: For. Ex • How can the US run a trade deficit consistently? Or, differently put, can one live on credit forever?

Market example: For. Ex • How can the US run a trade deficit consistently? Or, differently put, can one live on credit forever?

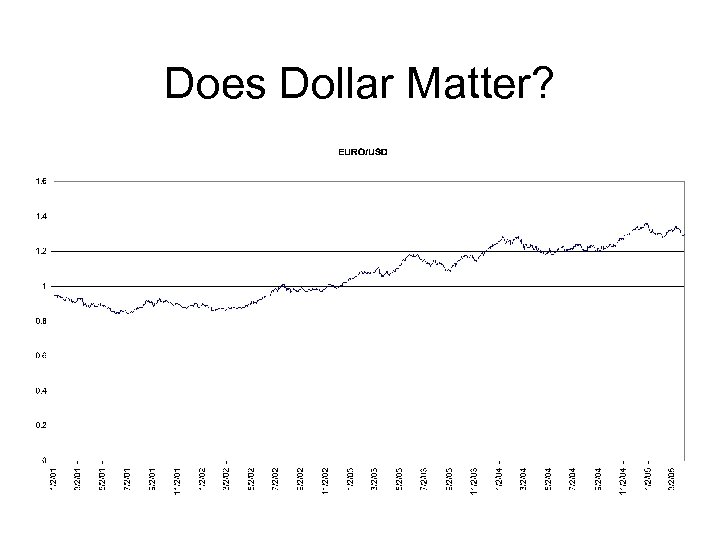

Does Dollar Matter?

Does Dollar Matter?

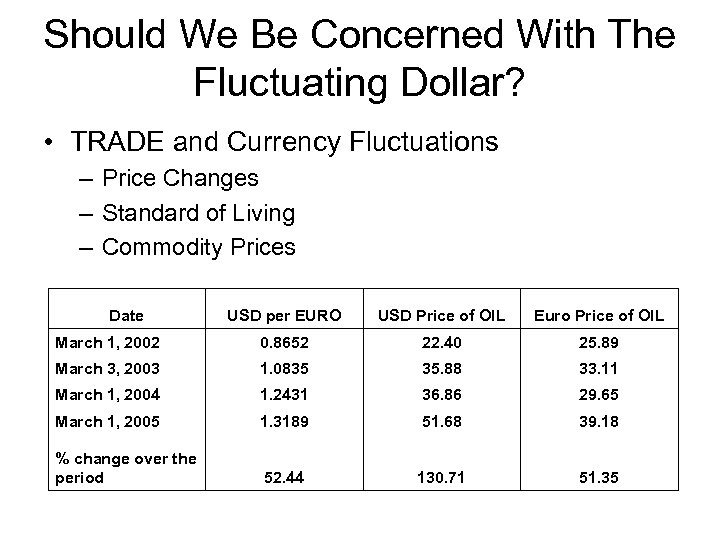

Should We Be Concerned With The Fluctuating Dollar? • TRADE and Currency Fluctuations – Price Changes – Standard of Living – Commodity Prices Date USD per EURO USD Price of OIL Euro Price of OIL March 1, 2002 0. 8652 22. 40 25. 89 March 3, 2003 1. 0835 35. 88 33. 11 March 1, 2004 1. 2431 36. 86 29. 65 March 1, 2005 1. 3189 51. 68 39. 18 % change over the period 52. 44 130. 71 51. 35

Should We Be Concerned With The Fluctuating Dollar? • TRADE and Currency Fluctuations – Price Changes – Standard of Living – Commodity Prices Date USD per EURO USD Price of OIL Euro Price of OIL March 1, 2002 0. 8652 22. 40 25. 89 March 3, 2003 1. 0835 35. 88 33. 11 March 1, 2004 1. 2431 36. 86 29. 65 March 1, 2005 1. 3189 51. 68 39. 18 % change over the period 52. 44 130. 71 51. 35

The For. Ex market • Supply of the USD – Imports to the US • Goods (trade) • Services (tourism) – US investment abroad • Foreign Financial Markets • Direct investment abroad – Central Banks – Speculation • Demand for the USD – US Exports • Goods • Services (tourism) – Foreign Investment into US • US Financial markets • Direct investment – Central Banks – Speculation

The For. Ex market • Supply of the USD – Imports to the US • Goods (trade) • Services (tourism) – US investment abroad • Foreign Financial Markets • Direct investment abroad – Central Banks – Speculation • Demand for the USD – US Exports • Goods • Services (tourism) – Foreign Investment into US • US Financial markets • Direct investment – Central Banks – Speculation

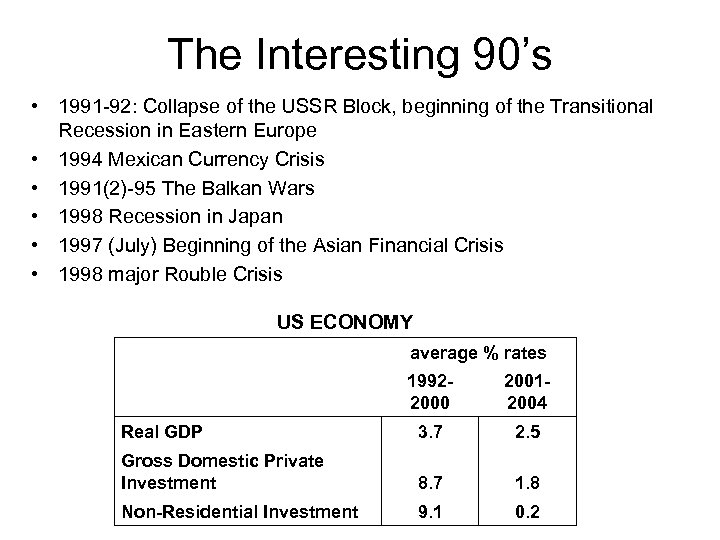

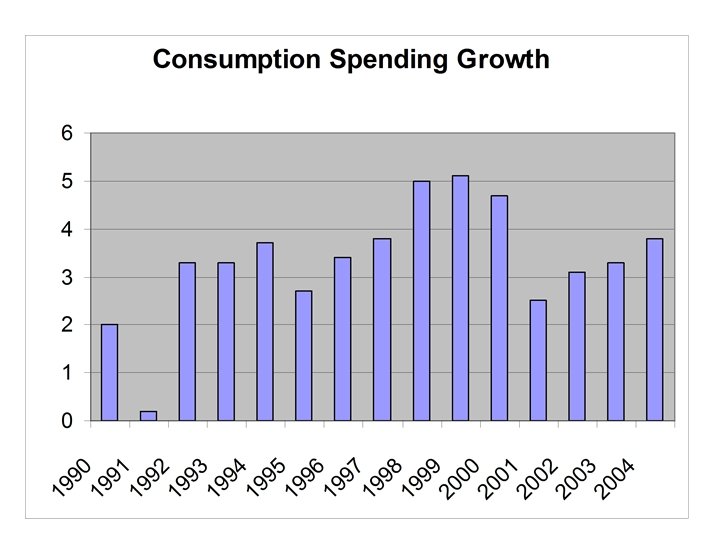

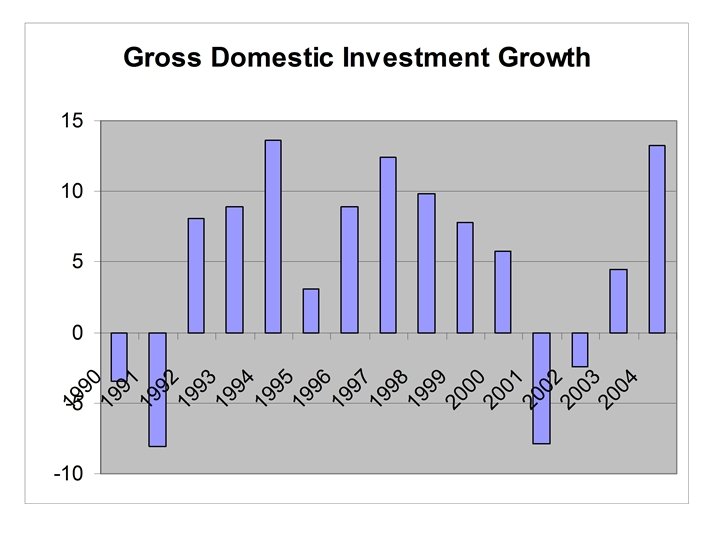

The Interesting 90’s • 1991 -92: Collapse of the USSR Block, beginning of the Transitional Recession in Eastern Europe • 1994 Mexican Currency Crisis • 1991(2)-95 The Balkan Wars • 1998 Recession in Japan • 1997 (July) Beginning of the Asian Financial Crisis • 1998 major Rouble Crisis US ECONOMY average % rates 19922000 20012004 Real GDP 3. 7 2. 5 Gross Domestic Private Investment 8. 7 1. 8 Non-Residential Investment 9. 1 0. 2

The Interesting 90’s • 1991 -92: Collapse of the USSR Block, beginning of the Transitional Recession in Eastern Europe • 1994 Mexican Currency Crisis • 1991(2)-95 The Balkan Wars • 1998 Recession in Japan • 1997 (July) Beginning of the Asian Financial Crisis • 1998 major Rouble Crisis US ECONOMY average % rates 19922000 20012004 Real GDP 3. 7 2. 5 Gross Domestic Private Investment 8. 7 1. 8 Non-Residential Investment 9. 1 0. 2

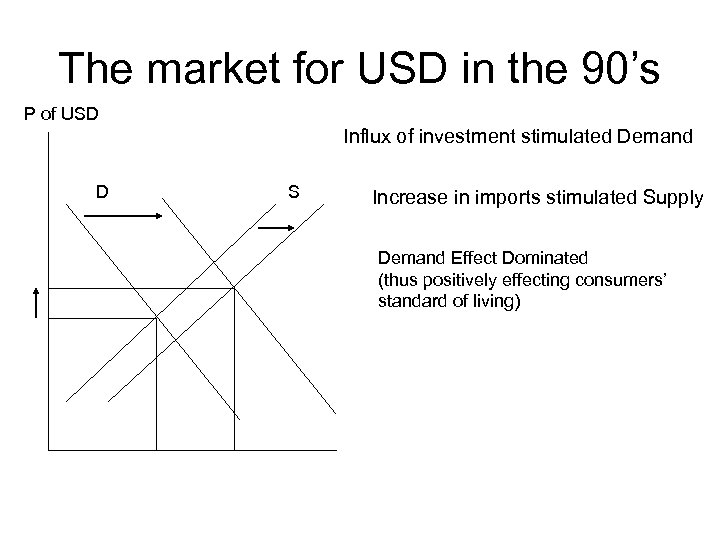

The market for USD in the 90’s P of USD Influx of investment stimulated Demand D S Increase in imports stimulated Supply Demand Effect Dominated (thus positively effecting consumers’ standard of living)

The market for USD in the 90’s P of USD Influx of investment stimulated Demand D S Increase in imports stimulated Supply Demand Effect Dominated (thus positively effecting consumers’ standard of living)

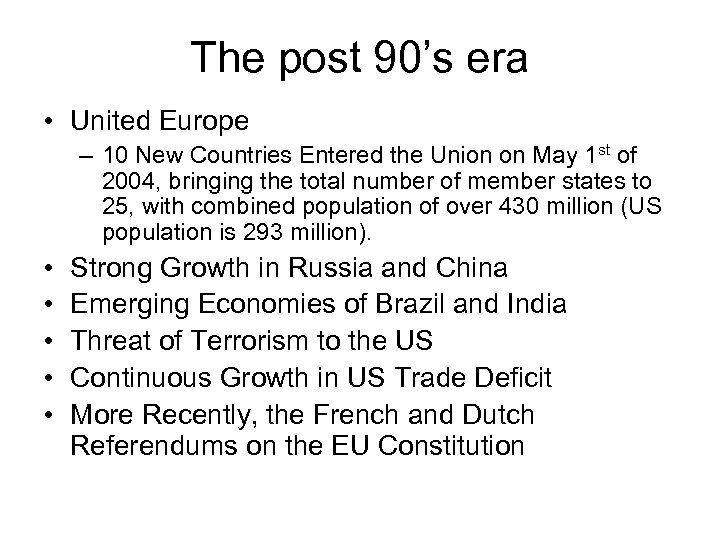

The post 90’s era • United Europe – 10 New Countries Entered the Union on May 1 st of 2004, bringing the total number of member states to 25, with combined population of over 430 million (US population is 293 million). • • • Strong Growth in Russia and China Emerging Economies of Brazil and India Threat of Terrorism to the US Continuous Growth in US Trade Deficit More Recently, the French and Dutch Referendums on the EU Constitution

The post 90’s era • United Europe – 10 New Countries Entered the Union on May 1 st of 2004, bringing the total number of member states to 25, with combined population of over 430 million (US population is 293 million). • • • Strong Growth in Russia and China Emerging Economies of Brazil and India Threat of Terrorism to the US Continuous Growth in US Trade Deficit More Recently, the French and Dutch Referendums on the EU Constitution

The BIG picture • • Rise in Imports Increase in Supply Depreciation Rise in Exports Increase in Demand Appreciation Influx of Investment Increase in Demand Appreciation Outflow of Investment Increase in Supply Depreciation • BALANCE OF PAYMENTS – An Economy’s International Balance Sheet (www. bea. gov)

The BIG picture • • Rise in Imports Increase in Supply Depreciation Rise in Exports Increase in Demand Appreciation Influx of Investment Increase in Demand Appreciation Outflow of Investment Increase in Supply Depreciation • BALANCE OF PAYMENTS – An Economy’s International Balance Sheet (www. bea. gov)

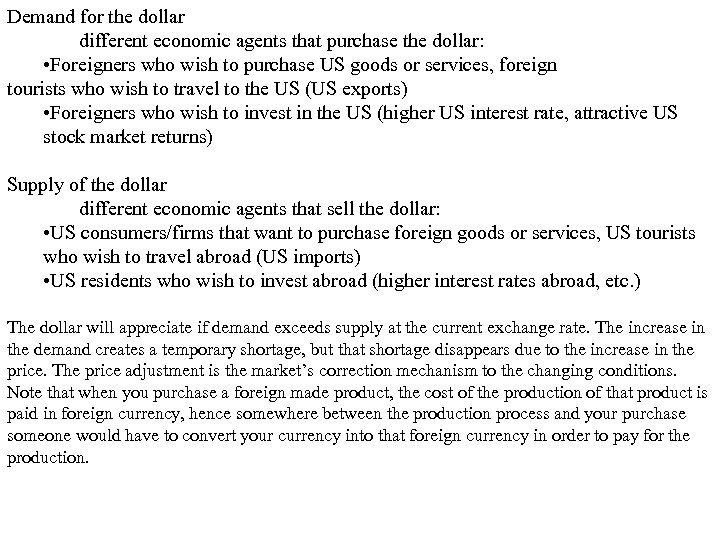

Demand for the dollar different economic agents that purchase the dollar: • Foreigners who wish to purchase US goods or services, foreign tourists who wish to travel to the US (US exports) • Foreigners who wish to invest in the US (higher US interest rate, attractive US stock market returns) Supply of the dollar different economic agents that sell the dollar: • US consumers/firms that want to purchase foreign goods or services, US tourists who wish to travel abroad (US imports) • US residents who wish to invest abroad (higher interest rates abroad, etc. ) The dollar will appreciate if demand exceeds supply at the current exchange rate. The increase in the demand creates a temporary shortage, but that shortage disappears due to the increase in the price. The price adjustment is the market’s correction mechanism to the changing conditions. Note that when you purchase a foreign made product, the cost of the production of that product is paid in foreign currency, hence somewhere between the production process and your purchase someone would have to convert your currency into that foreign currency in order to pay for the production.

Demand for the dollar different economic agents that purchase the dollar: • Foreigners who wish to purchase US goods or services, foreign tourists who wish to travel to the US (US exports) • Foreigners who wish to invest in the US (higher US interest rate, attractive US stock market returns) Supply of the dollar different economic agents that sell the dollar: • US consumers/firms that want to purchase foreign goods or services, US tourists who wish to travel abroad (US imports) • US residents who wish to invest abroad (higher interest rates abroad, etc. ) The dollar will appreciate if demand exceeds supply at the current exchange rate. The increase in the demand creates a temporary shortage, but that shortage disappears due to the increase in the price. The price adjustment is the market’s correction mechanism to the changing conditions. Note that when you purchase a foreign made product, the cost of the production of that product is paid in foreign currency, hence somewhere between the production process and your purchase someone would have to convert your currency into that foreign currency in order to pay for the production.

Measuring Economic Activity • OUTPUT • EMPLOYMENT • INFLATION

Measuring Economic Activity • OUTPUT • EMPLOYMENT • INFLATION

• Gross Domestic Product the total market value of all final goods and services produced by factors of production located within a nation’s borders over a period of time (usually one year) • Gross National Product the total market value of all final goods and services produced by factors of production owned by a nation over a period of time (usually one year)

• Gross Domestic Product the total market value of all final goods and services produced by factors of production located within a nation’s borders over a period of time (usually one year) • Gross National Product the total market value of all final goods and services produced by factors of production owned by a nation over a period of time (usually one year)

Output • Measuring production – – Time period Final goods and services (value added) Market prices Defining an economy (geographical boundaries versus resource ownership) • Gross Domestic Product • Gross National Product • www. bea. gov Table 1. 7. 5 http: //www. bea. gov/bea/dn/nipaweb/Table. View. asp? Selected. Table=43&First. Year=2003&Last. Year=2005&Freq=Qtr

Output • Measuring production – – Time period Final goods and services (value added) Market prices Defining an economy (geographical boundaries versus resource ownership) • Gross Domestic Product • Gross National Product • www. bea. gov Table 1. 7. 5 http: //www. bea. gov/bea/dn/nipaweb/Table. View. asp? Selected. Table=43&First. Year=2003&Last. Year=2005&Freq=Qtr

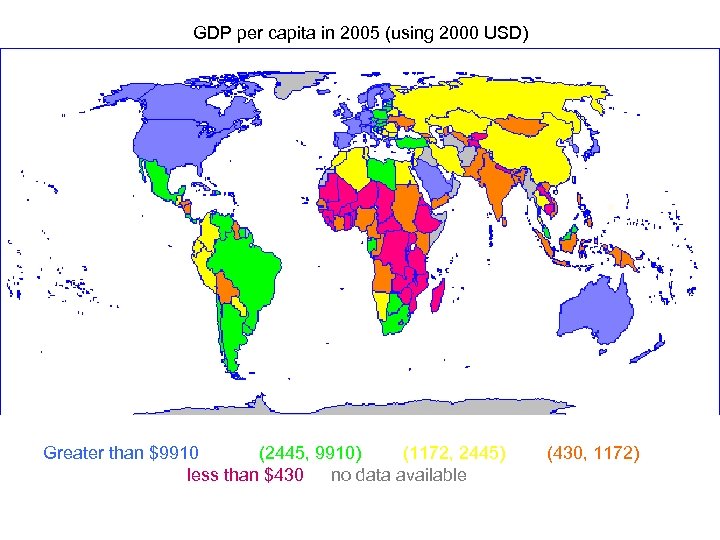

GDP per capita in 2005 (using 2000 USD) Greater than $9910 (2445, 9910) (1172, 2445) less than $430 no data available (430, 1172)

GDP per capita in 2005 (using 2000 USD) Greater than $9910 (2445, 9910) (1172, 2445) less than $430 no data available (430, 1172)

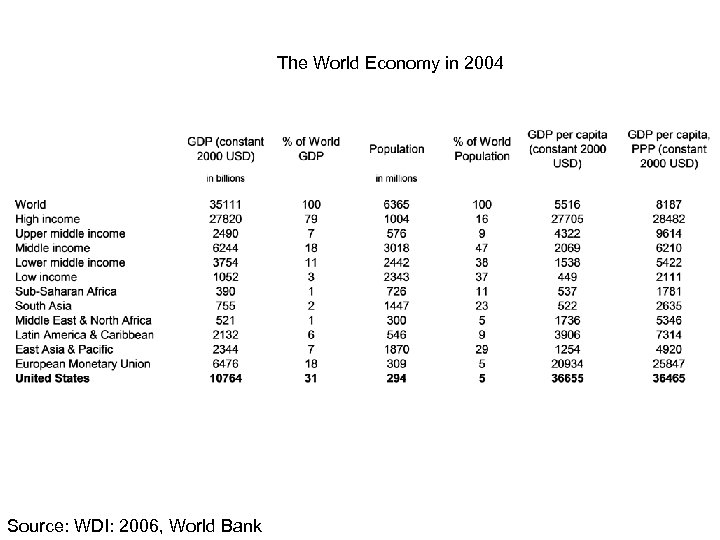

The World Economy in 2004 Source: WDI: 2006, World Bank

The World Economy in 2004 Source: WDI: 2006, World Bank

2003: Health expendit ures per capita (current USD) 2004: cases of TB per 100, 000 2004: Internet Users per 1000 World 587. 79 139. 47 139. 93 Upper middle income 279. 96 112. 15 Middle income 116. 29 High income Mobile phone subscrib ers per 1000 Infant mortality rate per 1000 PCs per 1000 people 67. 32 279. 34 54. 09 129. 77 159. 33 69. 15 484. 18 23. 36 121. 75 113. 63 91. 83 70. 22 293. 61 30. 02 60. 86 3449. 40 17. 11 544. 93 78. 74 771. 72 6. 12 574. 14 Lower middle income 77. 49 113. 97 75. 91 70. 47 248. 86 31. 58 46. 20 Low income 29. 62 223. 99 24. 34 58. 68 42. 15 79. 45 11. 29 Sub-Saharan Africa 36. 42 363. 14 19. 44 46. 22 74. 08 100. 47 15. 05 South Asia 23. 78 177. 21 26. 14 63. 41 41. 31 66. 41 12. 14 Middle East & North Africa 92. 41 53. 91 58. 00 69. 35 128. 61 44. 09 48. 55 Latin America & Caribbean 221. 68 63. 51 114. 53 72. 19 318. 36 26. 52 92. 40 European Monetary Union 2552. 10 13. 00 443. 22 79. 38 904. 19 4. 11 420. 84 64. 11 137. 75 73. 79 70. 28 243. 47 29. 16 38. 19 5711. 00 4. 70 629. 99 77. 43 616. 73 6. 70 749. 18 East Asia & Pacific United States Life expectan cy at birth Correlation between life expectancy and the standard of living as measured by the GDP per capita (PPP) is positive 0. 65, see the stats table; correlation between GDP per capita and life expectancy is 0. 57 (based on the 2005 data from WDI of 2007

2003: Health expendit ures per capita (current USD) 2004: cases of TB per 100, 000 2004: Internet Users per 1000 World 587. 79 139. 47 139. 93 Upper middle income 279. 96 112. 15 Middle income 116. 29 High income Mobile phone subscrib ers per 1000 Infant mortality rate per 1000 PCs per 1000 people 67. 32 279. 34 54. 09 129. 77 159. 33 69. 15 484. 18 23. 36 121. 75 113. 63 91. 83 70. 22 293. 61 30. 02 60. 86 3449. 40 17. 11 544. 93 78. 74 771. 72 6. 12 574. 14 Lower middle income 77. 49 113. 97 75. 91 70. 47 248. 86 31. 58 46. 20 Low income 29. 62 223. 99 24. 34 58. 68 42. 15 79. 45 11. 29 Sub-Saharan Africa 36. 42 363. 14 19. 44 46. 22 74. 08 100. 47 15. 05 South Asia 23. 78 177. 21 26. 14 63. 41 41. 31 66. 41 12. 14 Middle East & North Africa 92. 41 53. 91 58. 00 69. 35 128. 61 44. 09 48. 55 Latin America & Caribbean 221. 68 63. 51 114. 53 72. 19 318. 36 26. 52 92. 40 European Monetary Union 2552. 10 13. 00 443. 22 79. 38 904. 19 4. 11 420. 84 64. 11 137. 75 73. 79 70. 28 243. 47 29. 16 38. 19 5711. 00 4. 70 629. 99 77. 43 616. 73 6. 70 749. 18 East Asia & Pacific United States Life expectan cy at birth Correlation between life expectancy and the standard of living as measured by the GDP per capita (PPP) is positive 0. 65, see the stats table; correlation between GDP per capita and life expectancy is 0. 57 (based on the 2005 data from WDI of 2007

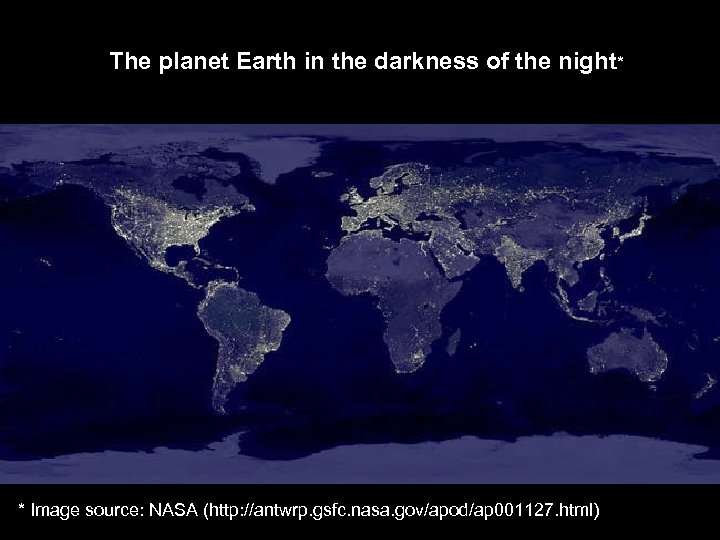

The planet Earth in the darkness of the night* * Image source: NASA (http: //antwrp. gsfc. nasa. gov/apod/ap 001127. html)

The planet Earth in the darkness of the night* * Image source: NASA (http: //antwrp. gsfc. nasa. gov/apod/ap 001127. html)

Issues in GDP computation/comparison • Survey of economic activity – Self-employed/small businesses • Market prices and the government sector • Illegal activities – Underground economy (“shadow” sector) – Tax compliance – Defining legal vs illegal • Labor force participation/wages – Household vs market setting

Issues in GDP computation/comparison • Survey of economic activity – Self-employed/small businesses • Market prices and the government sector • Illegal activities – Underground economy (“shadow” sector) – Tax compliance – Defining legal vs illegal • Labor force participation/wages – Household vs market setting

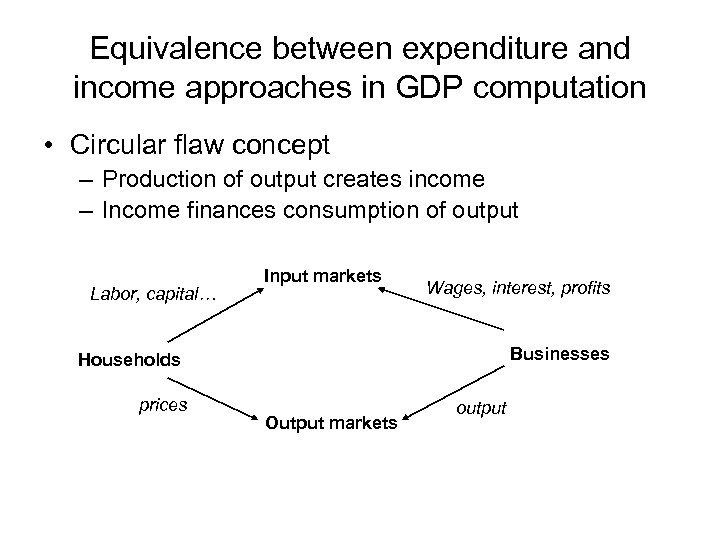

Equivalence between expenditure and income approaches in GDP computation • Circular flaw concept – Production of output creates income – Income finances consumption of output Labor, capital… Input markets Wages, interest, profits Businesses Households prices Output markets output

Equivalence between expenditure and income approaches in GDP computation • Circular flaw concept – Production of output creates income – Income finances consumption of output Labor, capital… Input markets Wages, interest, profits Businesses Households prices Output markets output

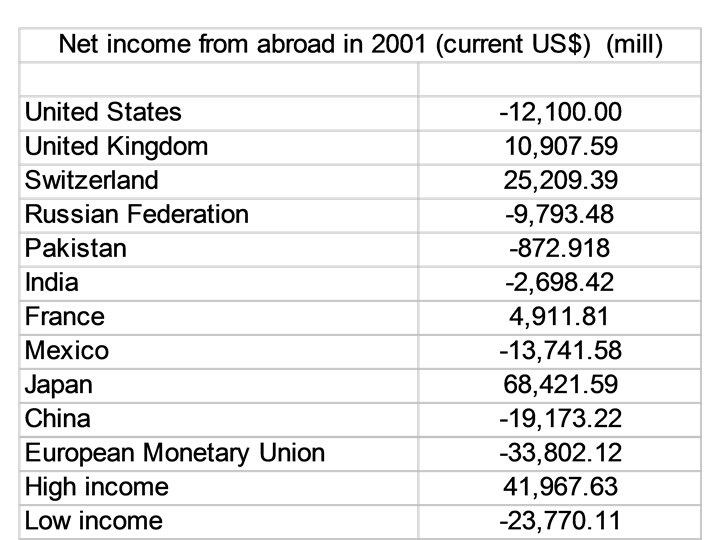

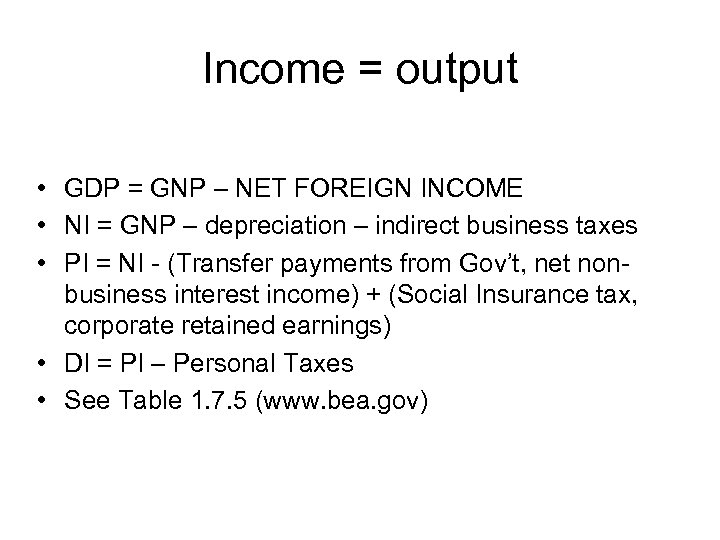

Income = output • GDP = GNP – NET FOREIGN INCOME • NI = GNP – depreciation – indirect business taxes • PI = NI - (Transfer payments from Gov’t, net nonbusiness interest income) + (Social Insurance tax, corporate retained earnings) • DI = PI – Personal Taxes • See Table 1. 7. 5 (www. bea. gov)

Income = output • GDP = GNP – NET FOREIGN INCOME • NI = GNP – depreciation – indirect business taxes • PI = NI - (Transfer payments from Gov’t, net nonbusiness interest income) + (Social Insurance tax, corporate retained earnings) • DI = PI – Personal Taxes • See Table 1. 7. 5 (www. bea. gov)

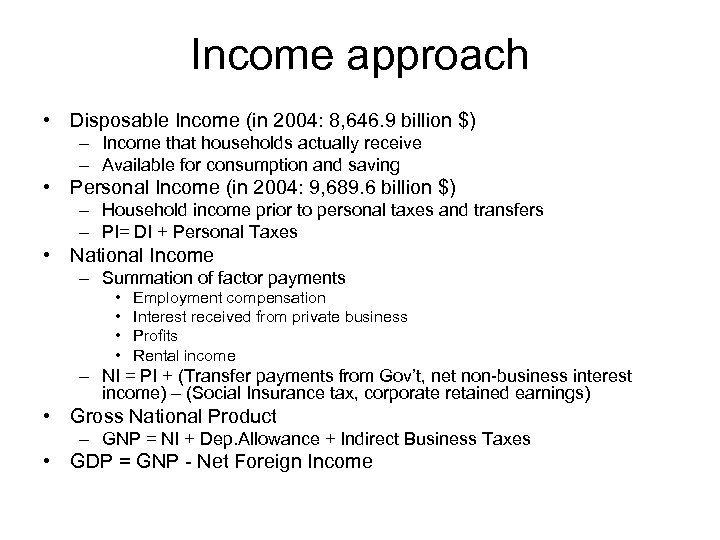

Income approach • Disposable Income (in 2004: 8, 646. 9 billion $) – Income that households actually receive – Available for consumption and saving • Personal Income (in 2004: 9, 689. 6 billion $) – Household income prior to personal taxes and transfers – PI= DI + Personal Taxes • National Income – Summation of factor payments • • Employment compensation Interest received from private business Profits Rental income – NI = PI + (Transfer payments from Gov’t, net non-business interest income) – (Social Insurance tax, corporate retained earnings) • Gross National Product – GNP = NI + Dep. Allowance + Indirect Business Taxes • GDP = GNP - Net Foreign Income

Income approach • Disposable Income (in 2004: 8, 646. 9 billion $) – Income that households actually receive – Available for consumption and saving • Personal Income (in 2004: 9, 689. 6 billion $) – Household income prior to personal taxes and transfers – PI= DI + Personal Taxes • National Income – Summation of factor payments • • Employment compensation Interest received from private business Profits Rental income – NI = PI + (Transfer payments from Gov’t, net non-business interest income) – (Social Insurance tax, corporate retained earnings) • Gross National Product – GNP = NI + Dep. Allowance + Indirect Business Taxes • GDP = GNP - Net Foreign Income

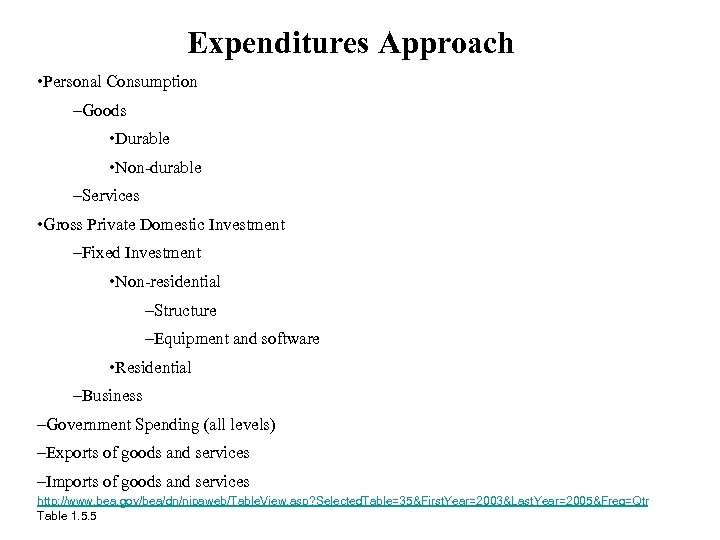

Expenditures Approach • Personal Consumption –Goods • Durable • Non-durable –Services • Gross Private Domestic Investment –Fixed Investment • Non-residential –Structure –Equipment and software • Residential –Business –Government Spending (all levels) –Exports of goods and services –Imports of goods and services http: //www. bea. gov/bea/dn/nipaweb/Table. View. asp? Selected. Table=35&First. Year=2003&Last. Year=2005&Freq=Qtr Table 1. 5. 5

Expenditures Approach • Personal Consumption –Goods • Durable • Non-durable –Services • Gross Private Domestic Investment –Fixed Investment • Non-residential –Structure –Equipment and software • Residential –Business –Government Spending (all levels) –Exports of goods and services –Imports of goods and services http: //www. bea. gov/bea/dn/nipaweb/Table. View. asp? Selected. Table=35&First. Year=2003&Last. Year=2005&Freq=Qtr Table 1. 5. 5

employment • Labor force – Labor force participation rate • Unemployment – Unemployment rate BLS www. bls. gov US statistics Industry data: ftp: //ftp. bls. gov/pub/suppl/empsit. ceseeb 3. txt • Categorizing unemployment – – Cyclical Structural Seasonal Frictional

employment • Labor force – Labor force participation rate • Unemployment – Unemployment rate BLS www. bls. gov US statistics Industry data: ftp: //ftp. bls. gov/pub/suppl/empsit. ceseeb 3. txt • Categorizing unemployment – – Cyclical Structural Seasonal Frictional

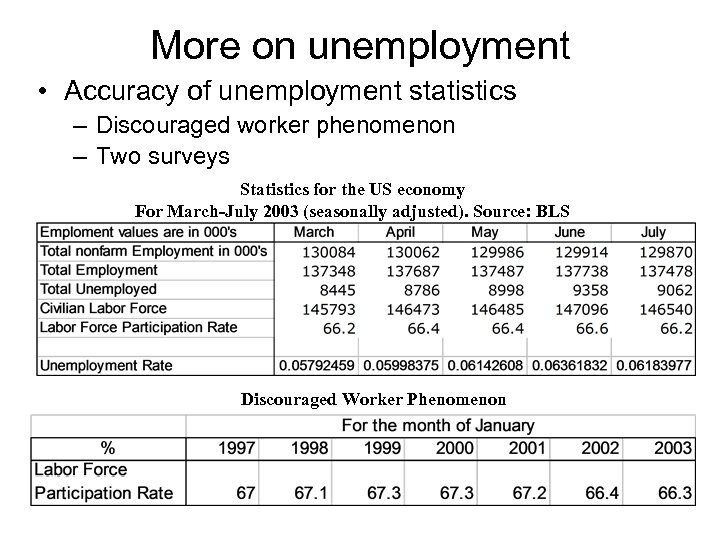

More on unemployment • Accuracy of unemployment statistics – Discouraged worker phenomenon – Two surveys Statistics for the US economy For March-July 2003 (seasonally adjusted). Source: BLS Discouraged Worker Phenomenon

More on unemployment • Accuracy of unemployment statistics – Discouraged worker phenomenon – Two surveys Statistics for the US economy For March-July 2003 (seasonally adjusted). Source: BLS Discouraged Worker Phenomenon

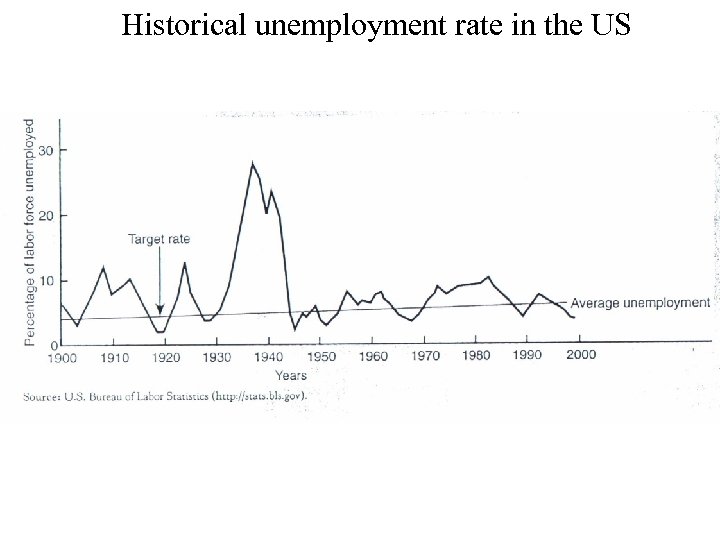

Historical unemployment rate in the US

Historical unemployment rate in the US

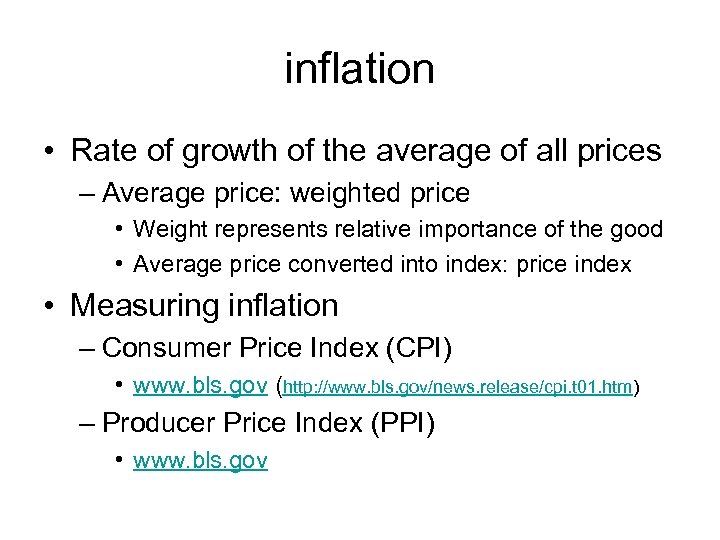

inflation • Rate of growth of the average of all prices – Average price: weighted price • Weight represents relative importance of the good • Average price converted into index: price index • Measuring inflation – Consumer Price Index (CPI) • www. bls. gov (http: //www. bls. gov/news. release/cpi. t 01. htm) – Producer Price Index (PPI) • www. bls. gov

inflation • Rate of growth of the average of all prices – Average price: weighted price • Weight represents relative importance of the good • Average price converted into index: price index • Measuring inflation – Consumer Price Index (CPI) • www. bls. gov (http: //www. bls. gov/news. release/cpi. t 01. htm) – Producer Price Index (PPI) • www. bls. gov

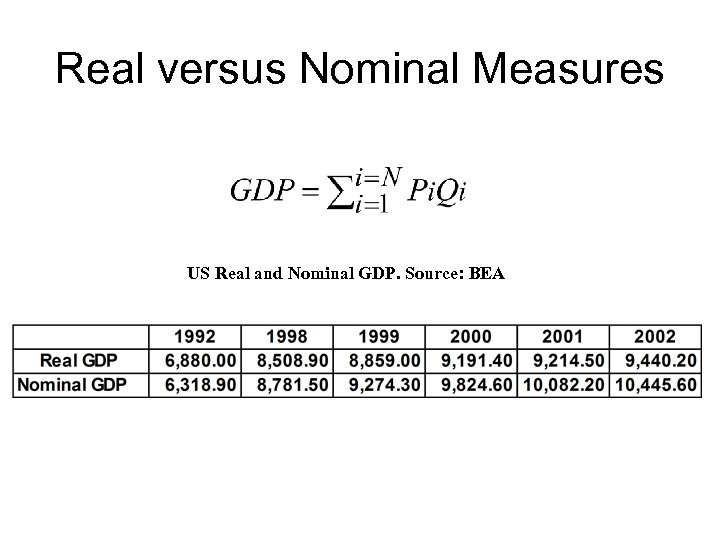

Real versus Nominal Measures US Real and Nominal GDP. Source: BEA

Real versus Nominal Measures US Real and Nominal GDP. Source: BEA

Costs of (unanticipated) Inflation • • • Menu Cost Redistribution of Wealth Changes in Standard of Living Inflation and relative prices High inflation tends to be more volatile Increased Uncertainty in Forward Looking Financial Arraignments • Impact on the Exchange Rate (Purchasing Price Parity for internationally traded goods)

Costs of (unanticipated) Inflation • • • Menu Cost Redistribution of Wealth Changes in Standard of Living Inflation and relative prices High inflation tends to be more volatile Increased Uncertainty in Forward Looking Financial Arraignments • Impact on the Exchange Rate (Purchasing Price Parity for internationally traded goods)

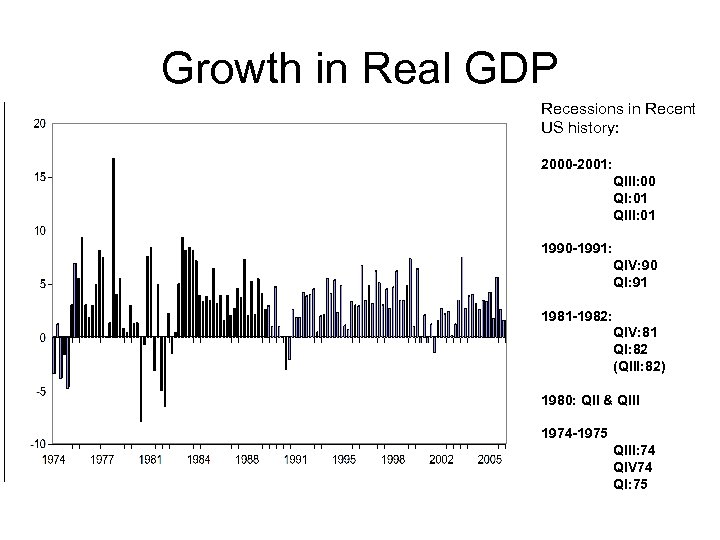

Growth in Real GDP Recessions in Recent US history: 2000 -2001: QIII: 00 QI: 01 QIII: 01 1990 -1991: QIV: 90 QI: 91 1981 -1982: QIV: 81 QI: 82 (QIII: 82) 1980: QII & QIII 1974 -1975 QIII: 74 QIV 74 QI: 75

Growth in Real GDP Recessions in Recent US history: 2000 -2001: QIII: 00 QI: 01 QIII: 01 1990 -1991: QIV: 90 QI: 91 1981 -1982: QIV: 81 QI: 82 (QIII: 82) 1980: QII & QIII 1974 -1975 QIII: 74 QIV 74 QI: 75

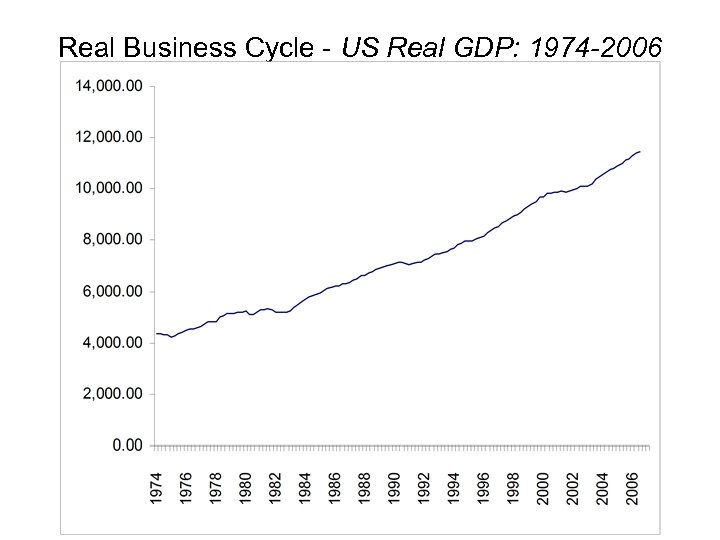

Real Business Cycle - US Real GDP: 1974 -2006

Real Business Cycle - US Real GDP: 1974 -2006

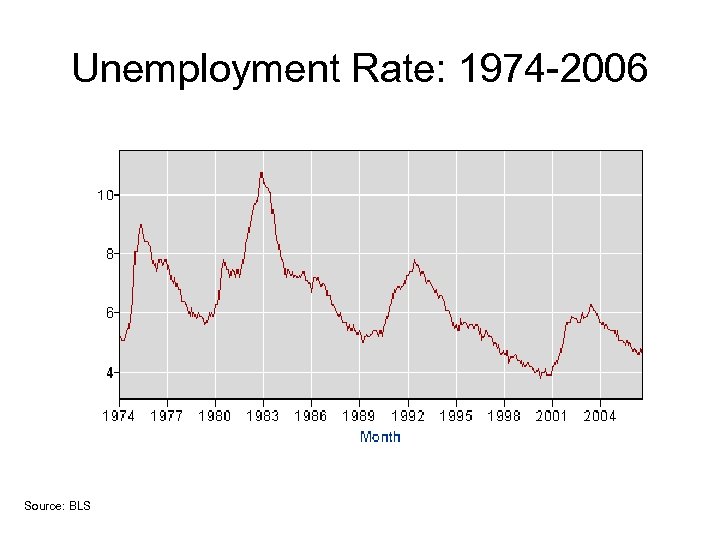

Unemployment Rate: 1974 -2006 Source: BLS

Unemployment Rate: 1974 -2006 Source: BLS

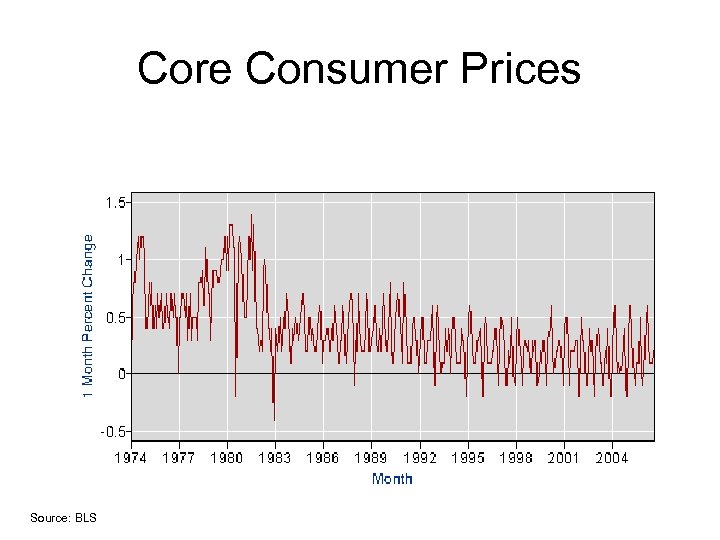

Core Consumer Prices Source: BLS

Core Consumer Prices Source: BLS

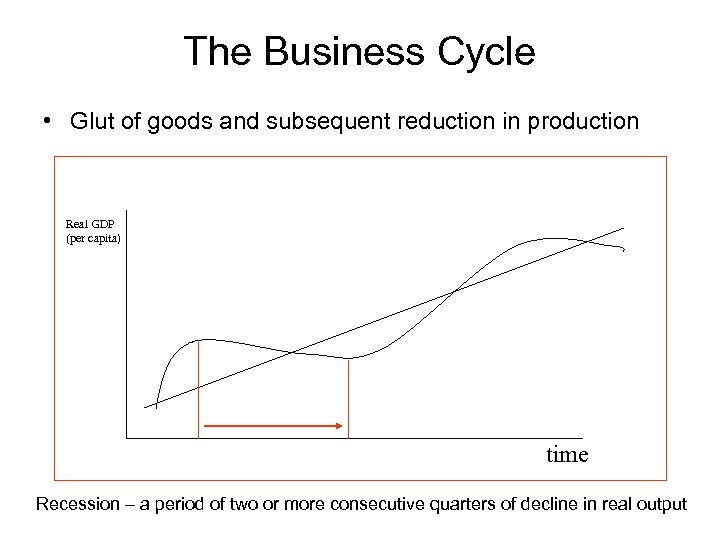

The Business Cycle • Glut of goods and subsequent reduction in production Real GDP (per capita) time Recession – a period of two or more consecutive quarters of decline in real output

The Business Cycle • Glut of goods and subsequent reduction in production Real GDP (per capita) time Recession – a period of two or more consecutive quarters of decline in real output

Business Cycle • Relationship between Output, Employment, and Inflation – Causes of inflation • Natural unemployment • Other sources: monetary policy, currency depreciation, decreases in the supply of resources [oil] …. – Business Inventories and start of recession – Deflation in the costs of production • Foreign economy effect • Change in confidence

Business Cycle • Relationship between Output, Employment, and Inflation – Causes of inflation • Natural unemployment • Other sources: monetary policy, currency depreciation, decreases in the supply of resources [oil] …. – Business Inventories and start of recession – Deflation in the costs of production • Foreign economy effect • Change in confidence

This slide merely provides you with some definitions and a basic discussion (for your reading) business cycle, unemployment and inflation • • Inflation and unemployment are related. Inflation will decline, and even deflation may begin when unemployment rate is above the natural rate of unemployment. In fact, the natural rate of unemployment is defined as the rate of unemployment at which the inflation rate remains constant. Another way of defining the natural rate of unemployment is to simply tie it to the level of real GDP. Natural rate of unemployment is the rate of unemployment that occurs when the real GDP is at its long term trend. Note that at the start of a recession the unemployment rate may still be above the natural rate of unemployment and hence the rate of inflation may continue to increase. Similarly, early in the recovery, unemployment rate remains higher than the natural rate of unemployment which may further reduce inflation. Inflation is dependent on unemployment. If unemployment is high then there is little pressure on prices to go up, but if unemployment is low, then people can bid up prices because they have disposable incomes. There are some additional factors that can change inflation, including currency fluctuations, but that topic will be covered later in the semester when we get to the international finance section.

This slide merely provides you with some definitions and a basic discussion (for your reading) business cycle, unemployment and inflation • • Inflation and unemployment are related. Inflation will decline, and even deflation may begin when unemployment rate is above the natural rate of unemployment. In fact, the natural rate of unemployment is defined as the rate of unemployment at which the inflation rate remains constant. Another way of defining the natural rate of unemployment is to simply tie it to the level of real GDP. Natural rate of unemployment is the rate of unemployment that occurs when the real GDP is at its long term trend. Note that at the start of a recession the unemployment rate may still be above the natural rate of unemployment and hence the rate of inflation may continue to increase. Similarly, early in the recovery, unemployment rate remains higher than the natural rate of unemployment which may further reduce inflation. Inflation is dependent on unemployment. If unemployment is high then there is little pressure on prices to go up, but if unemployment is low, then people can bid up prices because they have disposable incomes. There are some additional factors that can change inflation, including currency fluctuations, but that topic will be covered later in the semester when we get to the international finance section.

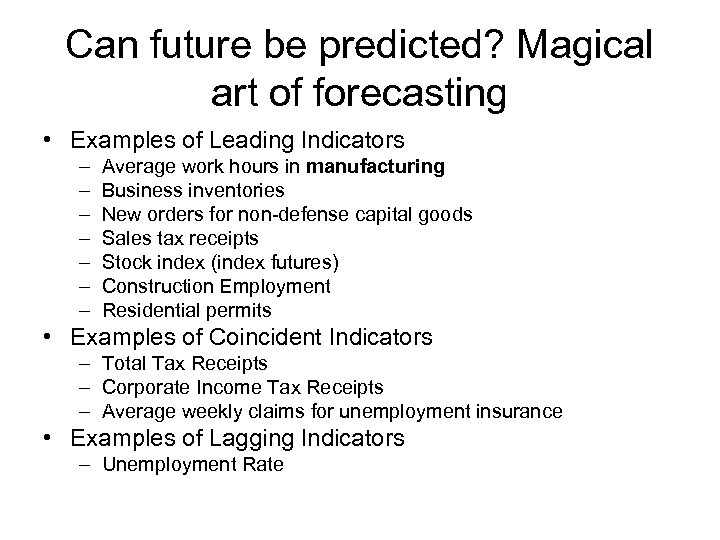

Can future be predicted? Magical art of forecasting • Examples of Leading Indicators – – – – Average work hours in manufacturing Business inventories New orders for non-defense capital goods Sales tax receipts Stock index (index futures) Construction Employment Residential permits • Examples of Coincident Indicators – Total Tax Receipts – Corporate Income Tax Receipts – Average weekly claims for unemployment insurance • Examples of Lagging Indicators – Unemployment Rate

Can future be predicted? Magical art of forecasting • Examples of Leading Indicators – – – – Average work hours in manufacturing Business inventories New orders for non-defense capital goods Sales tax receipts Stock index (index futures) Construction Employment Residential permits • Examples of Coincident Indicators – Total Tax Receipts – Corporate Income Tax Receipts – Average weekly claims for unemployment insurance • Examples of Lagging Indicators – Unemployment Rate

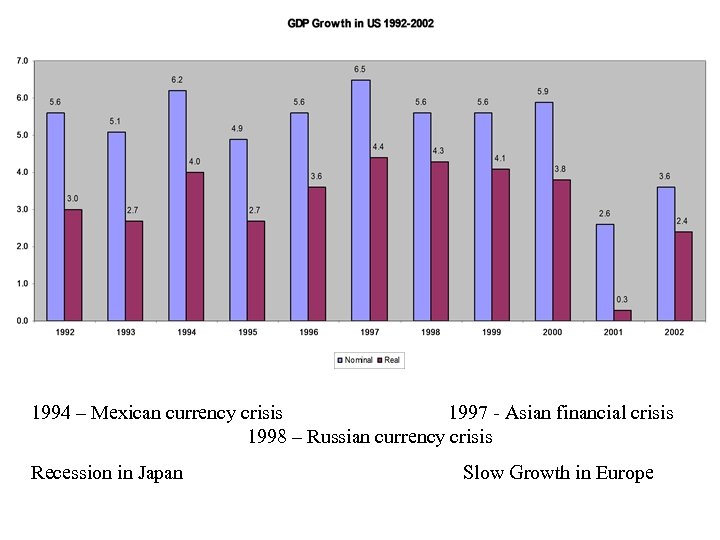

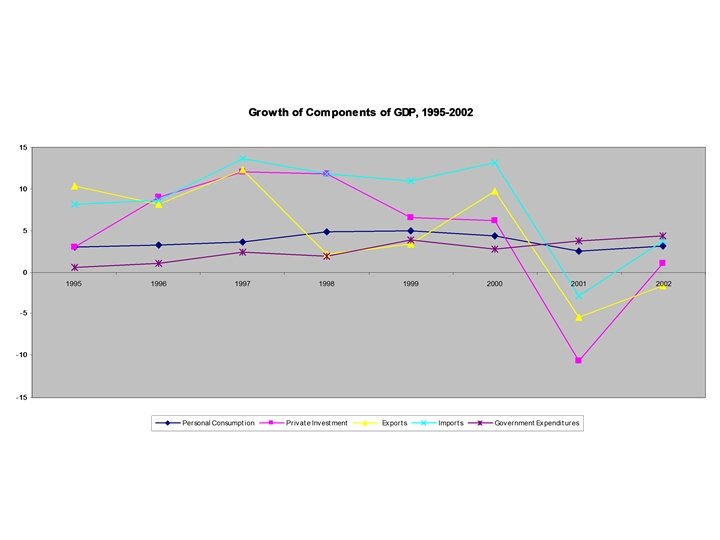

1994 – Mexican currency crisis 1997 - Asian financial crisis 1998 – Russian currency crisis Recession in Japan Slow Growth in Europe

1994 – Mexican currency crisis 1997 - Asian financial crisis 1998 – Russian currency crisis Recession in Japan Slow Growth in Europe

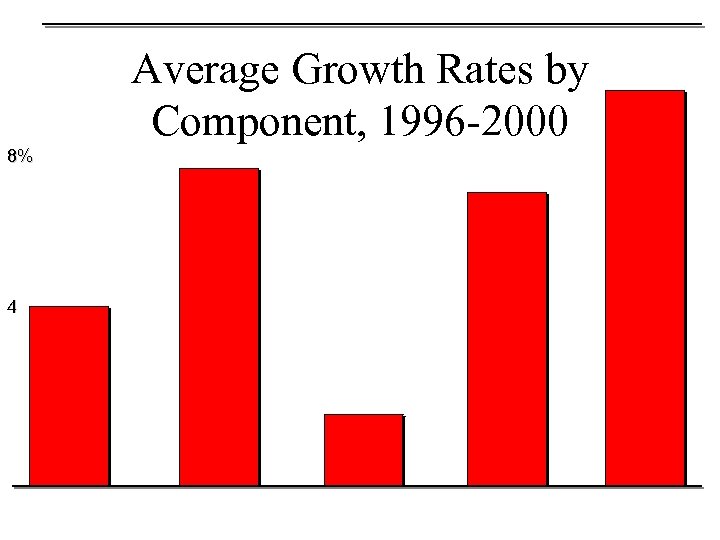

Average Growth Rates by Component, 1996 -2000 8% 4

Average Growth Rates by Component, 1996 -2000 8% 4

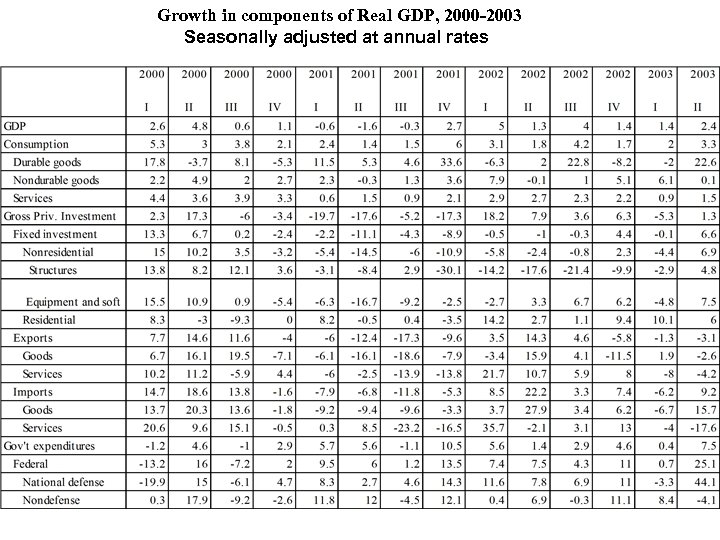

Growth in components of Real GDP, 2000 -2003 Seasonally adjusted at annual rates

Growth in components of Real GDP, 2000 -2003 Seasonally adjusted at annual rates

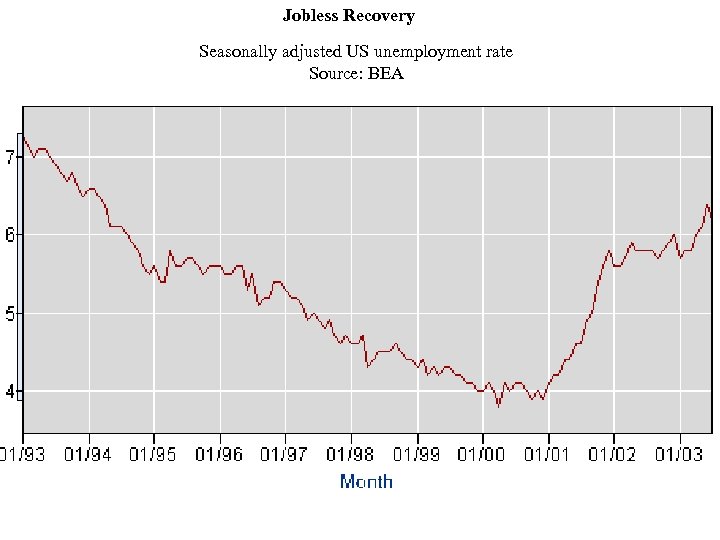

Jobless Recovery Seasonally adjusted US unemployment rate Source: BEA

Jobless Recovery Seasonally adjusted US unemployment rate Source: BEA

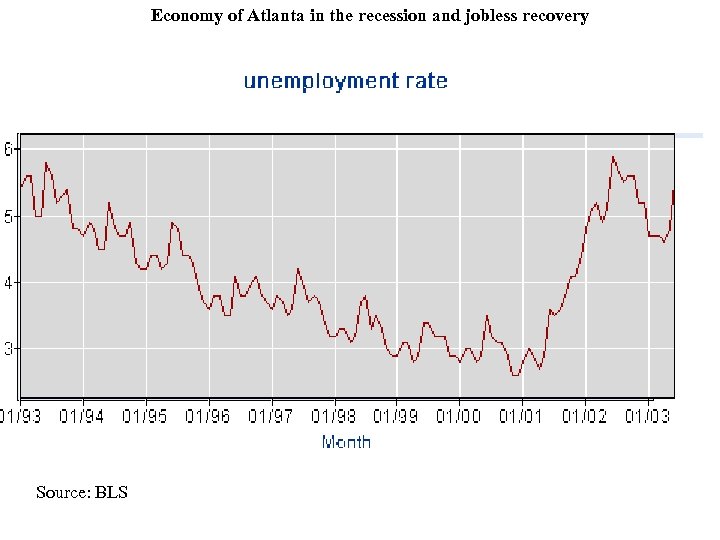

Economy of Atlanta in the recession and jobless recovery Source: BLS

Economy of Atlanta in the recession and jobless recovery Source: BLS

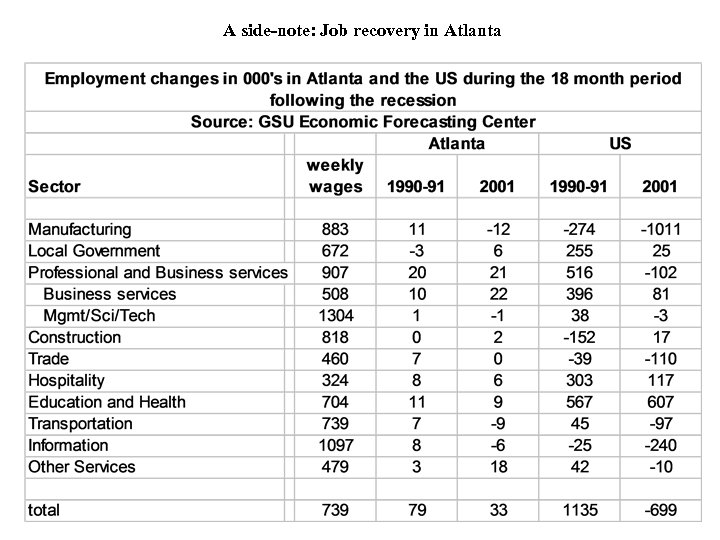

A side-note: Job recovery in Atlanta

A side-note: Job recovery in Atlanta

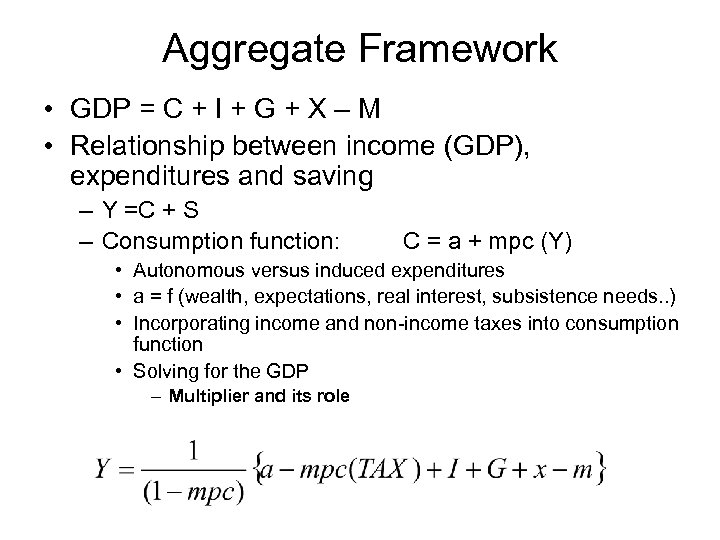

Aggregate Framework • GDP = C + I + G + X – M • Relationship between income (GDP), expenditures and saving – Y =C + S – Consumption function: C = a + mpc (Y) • Autonomous versus induced expenditures • a = f (wealth, expectations, real interest, subsistence needs. . ) • Incorporating income and non-income taxes into consumption function • Solving for the GDP – Multiplier and its role

Aggregate Framework • GDP = C + I + G + X – M • Relationship between income (GDP), expenditures and saving – Y =C + S – Consumption function: C = a + mpc (Y) • Autonomous versus induced expenditures • a = f (wealth, expectations, real interest, subsistence needs. . ) • Incorporating income and non-income taxes into consumption function • Solving for the GDP – Multiplier and its role

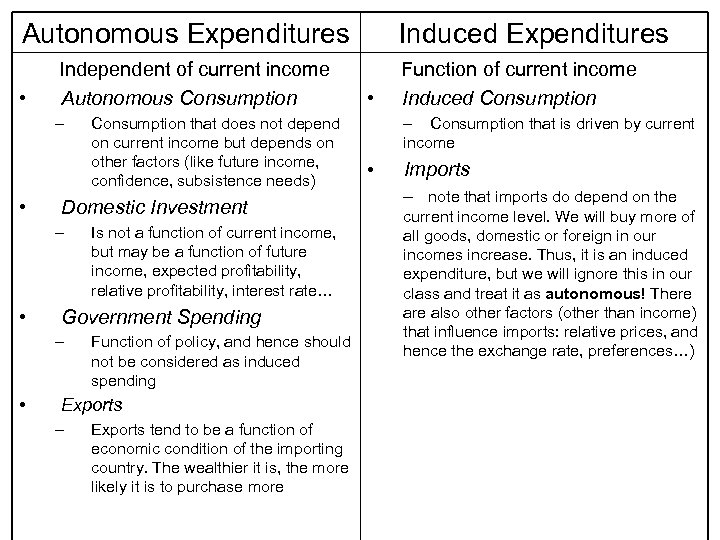

Autonomous Expenditures • Independent of current income Autonomous Consumption – • Domestic Investment – • Is not a function of current income, but may be a function of future income, expected profitability, relative profitability, interest rate… Government Spending – • Consumption that does not depend on current income but depends on other factors (like future income, confidence, subsistence needs) Function of policy, and hence should not be considered as induced spending Exports – Exports tend to be a function of economic condition of the importing country. The wealthier it is, the more likely it is to purchase more Induced Expenditures Function of current income • Induced Consumption – Consumption that is driven by current income • Imports – note that imports do depend on the current income level. We will buy more of all goods, domestic or foreign in our incomes increase. Thus, it is an induced expenditure, but we will ignore this in our class and treat it as autonomous! There also other factors (other than income) that influence imports: relative prices, and hence the exchange rate, preferences…)

Autonomous Expenditures • Independent of current income Autonomous Consumption – • Domestic Investment – • Is not a function of current income, but may be a function of future income, expected profitability, relative profitability, interest rate… Government Spending – • Consumption that does not depend on current income but depends on other factors (like future income, confidence, subsistence needs) Function of policy, and hence should not be considered as induced spending Exports – Exports tend to be a function of economic condition of the importing country. The wealthier it is, the more likely it is to purchase more Induced Expenditures Function of current income • Induced Consumption – Consumption that is driven by current income • Imports – note that imports do depend on the current income level. We will buy more of all goods, domestic or foreign in our incomes increase. Thus, it is an induced expenditure, but we will ignore this in our class and treat it as autonomous! There also other factors (other than income) that influence imports: relative prices, and hence the exchange rate, preferences…)

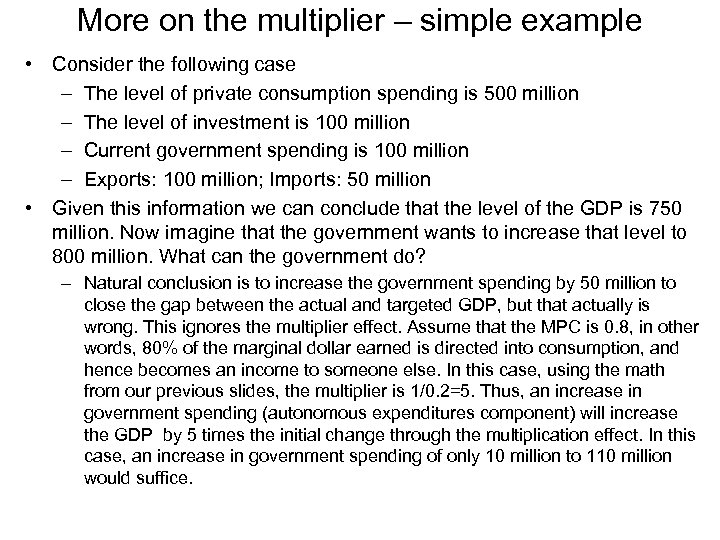

More on the multiplier – simple example • Consider the following case – The level of private consumption spending is 500 million – The level of investment is 100 million – Current government spending is 100 million – Exports: 100 million; Imports: 50 million • Given this information we can conclude that the level of the GDP is 750 million. Now imagine that the government wants to increase that level to 800 million. What can the government do? – Natural conclusion is to increase the government spending by 50 million to close the gap between the actual and targeted GDP, but that actually is wrong. This ignores the multiplier effect. Assume that the MPC is 0. 8, in other words, 80% of the marginal dollar earned is directed into consumption, and hence becomes an income to someone else. In this case, using the math from our previous slides, the multiplier is 1/0. 2=5. Thus, an increase in government spending (autonomous expenditures component) will increase the GDP by 5 times the initial change through the multiplication effect. In this case, an increase in government spending of only 10 million to 110 million would suffice.

More on the multiplier – simple example • Consider the following case – The level of private consumption spending is 500 million – The level of investment is 100 million – Current government spending is 100 million – Exports: 100 million; Imports: 50 million • Given this information we can conclude that the level of the GDP is 750 million. Now imagine that the government wants to increase that level to 800 million. What can the government do? – Natural conclusion is to increase the government spending by 50 million to close the gap between the actual and targeted GDP, but that actually is wrong. This ignores the multiplier effect. Assume that the MPC is 0. 8, in other words, 80% of the marginal dollar earned is directed into consumption, and hence becomes an income to someone else. In this case, using the math from our previous slides, the multiplier is 1/0. 2=5. Thus, an increase in government spending (autonomous expenditures component) will increase the GDP by 5 times the initial change through the multiplication effect. In this case, an increase in government spending of only 10 million to 110 million would suffice.

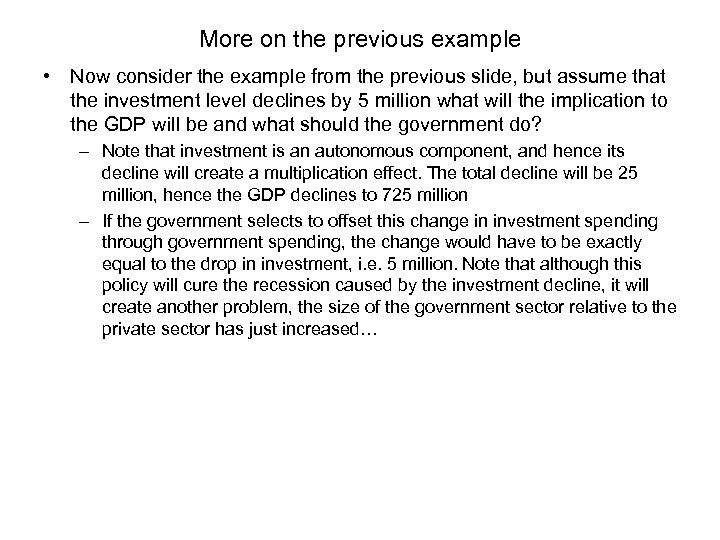

More on the previous example • Now consider the example from the previous slide, but assume that the investment level declines by 5 million what will the implication to the GDP will be and what should the government do? – Note that investment is an autonomous component, and hence its decline will create a multiplication effect. The total decline will be 25 million, hence the GDP declines to 725 million – If the government selects to offset this change in investment spending through government spending, the change would have to be exactly equal to the drop in investment, i. e. 5 million. Note that although this policy will cure the recession caused by the investment decline, it will create another problem, the size of the government sector relative to the private sector has just increased…

More on the previous example • Now consider the example from the previous slide, but assume that the investment level declines by 5 million what will the implication to the GDP will be and what should the government do? – Note that investment is an autonomous component, and hence its decline will create a multiplication effect. The total decline will be 25 million, hence the GDP declines to 725 million – If the government selects to offset this change in investment spending through government spending, the change would have to be exactly equal to the drop in investment, i. e. 5 million. Note that although this policy will cure the recession caused by the investment decline, it will create another problem, the size of the government sector relative to the private sector has just increased…

Further complication – note this slide will not appear on the exam • Now, let’s introduce income taxes…. • C = a + mpc (Y – t Y) – Here t represents the income tax rate, the rest of the function is the same • The new multiplier is: 1/(1 -mpc[1 -t]) – Note that income tax tends to reduce the multiplier effect as it increases the flow out of the consumption cycle. – Income taxes also present a second fiscal policy instrument: change in taxes • More complications can be introduced into the model, but as you can see their introduction does not complicate the math of the model

Further complication – note this slide will not appear on the exam • Now, let’s introduce income taxes…. • C = a + mpc (Y – t Y) – Here t represents the income tax rate, the rest of the function is the same • The new multiplier is: 1/(1 -mpc[1 -t]) – Note that income tax tends to reduce the multiplier effect as it increases the flow out of the consumption cycle. – Income taxes also present a second fiscal policy instrument: change in taxes • More complications can be introduced into the model, but as you can see their introduction does not complicate the math of the model

Multiplier • Dollar spent on domestic consumption becomes an income of domestic workers/capital owners… • Marginal propensity to consume – fraction of the next dollar earned that will be directed into consumption • Multiplier = 1 / marginal leakage rate from the consumption stream

Multiplier • Dollar spent on domestic consumption becomes an income of domestic workers/capital owners… • Marginal propensity to consume – fraction of the next dollar earned that will be directed into consumption • Multiplier = 1 / marginal leakage rate from the consumption stream

Extending the demand-supply framework to the economy as a whole: Aggregate Demand – Aggregate Supply Model “Through the so called wealth effect, recent stock market gains have tended to foster increases in aggregate demand beyond the increases in supply. It is this imbalance that contains the potential seeds of rising inflationary pressures that could undermine the current expansion. Our goal is to extend the expansion by containing its imbalances and avoiding the very recession that would complete the business cycle. ” -Alan Greenspan, January 13, 2000 Last two US recessions: Recession of 2001: Decline in the Aggregate Demand Recession of 2007 -2010: Decline in the Aggregate Demand

Extending the demand-supply framework to the economy as a whole: Aggregate Demand – Aggregate Supply Model “Through the so called wealth effect, recent stock market gains have tended to foster increases in aggregate demand beyond the increases in supply. It is this imbalance that contains the potential seeds of rising inflationary pressures that could undermine the current expansion. Our goal is to extend the expansion by containing its imbalances and avoiding the very recession that would complete the business cycle. ” -Alan Greenspan, January 13, 2000 Last two US recessions: Recession of 2001: Decline in the Aggregate Demand Recession of 2007 -2010: Decline in the Aggregate Demand

Stock Market and the Wealth Effect WFE - YTD Monthly How do such fluctuations in wealth effect the economy? Can the effects be modeled and understood?

Stock Market and the Wealth Effect WFE - YTD Monthly How do such fluctuations in wealth effect the economy? Can the effects be modeled and understood?

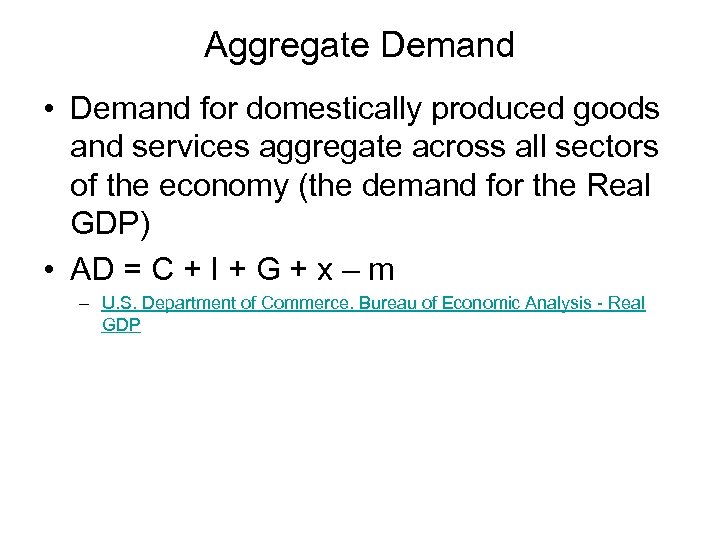

Aggregate Demand • Demand for domestically produced goods and services aggregate across all sectors of the economy (the demand for the Real GDP) • AD = C + I + G + x – m – U. S. Department of Commerce. Bureau of Economic Analysis - Real GDP

Aggregate Demand • Demand for domestically produced goods and services aggregate across all sectors of the economy (the demand for the Real GDP) • AD = C + I + G + x – m – U. S. Department of Commerce. Bureau of Economic Analysis - Real GDP

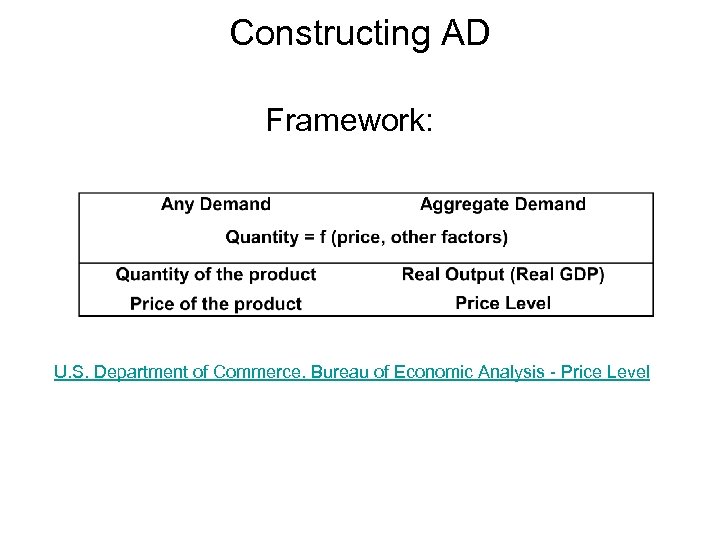

Constructing AD Framework: U. S. Department of Commerce. Bureau of Economic Analysis - Price Level

Constructing AD Framework: U. S. Department of Commerce. Bureau of Economic Analysis - Price Level

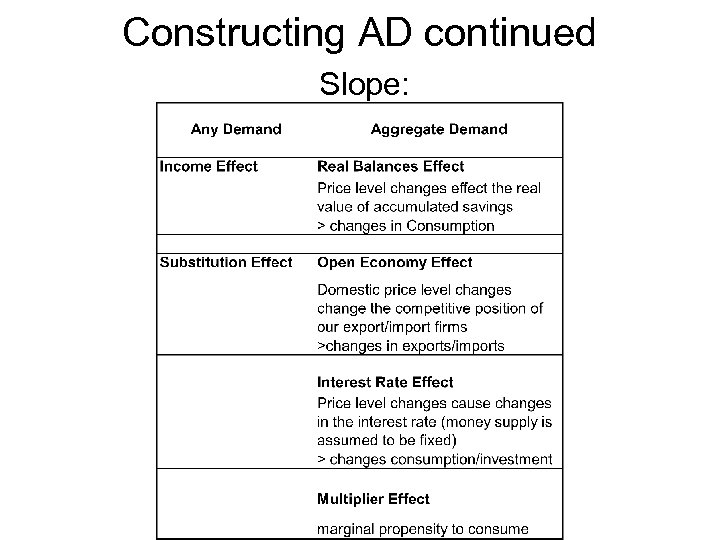

Constructing AD continued Slope:

Constructing AD continued Slope:

Determinants of AD factors that shift AD • Anything (other than the price level) that will cause changes in the expenditure components of the GDP

Determinants of AD factors that shift AD • Anything (other than the price level) that will cause changes in the expenditure components of the GDP

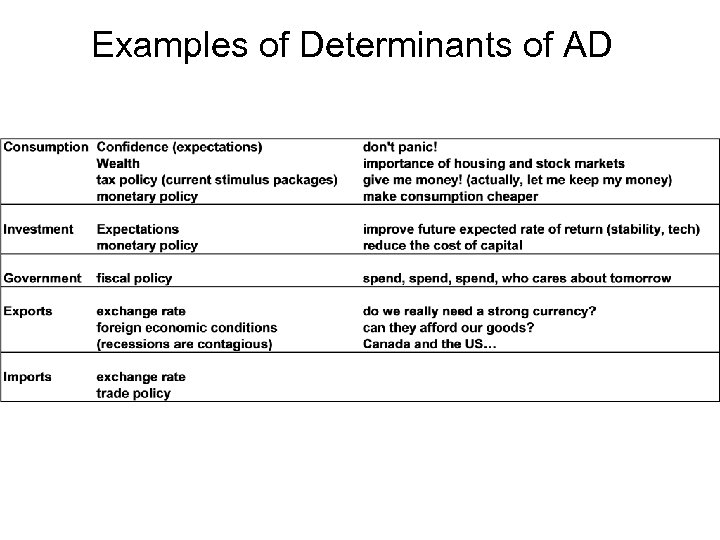

Examples of Determinants of AD

Examples of Determinants of AD

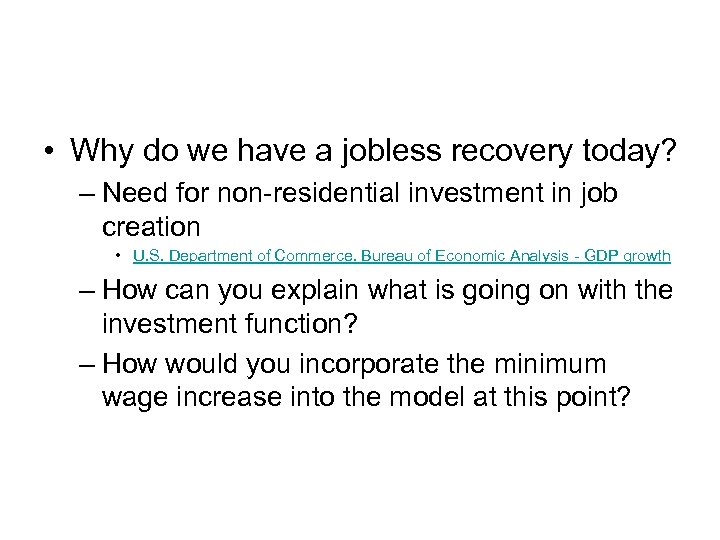

• Why do we have a jobless recovery today? – Need for non-residential investment in job creation • U. S. Department of Commerce. Bureau of Economic Analysis - GDP growth – How can you explain what is going on with the investment function? – How would you incorporate the minimum wage increase into the model at this point?

• Why do we have a jobless recovery today? – Need for non-residential investment in job creation • U. S. Department of Commerce. Bureau of Economic Analysis - GDP growth – How can you explain what is going on with the investment function? – How would you incorporate the minimum wage increase into the model at this point?

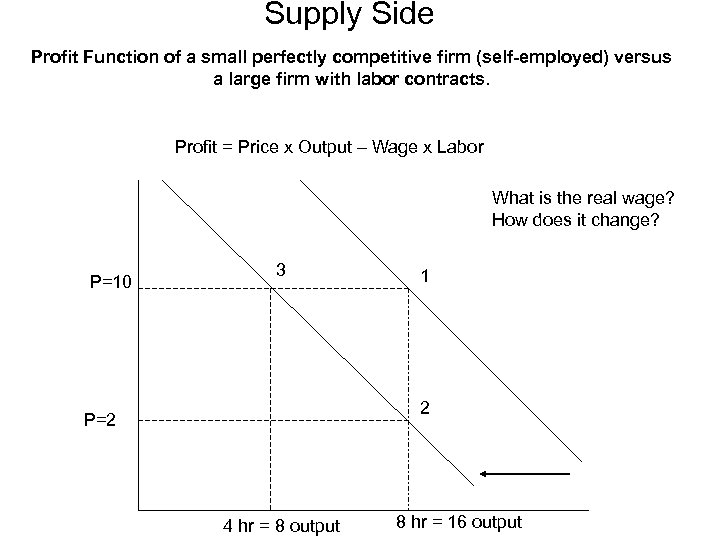

Supply Side Profit Function of a small perfectly competitive firm (self-employed) versus a large firm with labor contracts. Profit = Price x Output – Wage x Labor What is the real wage? How does it change? P=10 3 1 2 P=2 4 hr = 8 output 8 hr = 16 output

Supply Side Profit Function of a small perfectly competitive firm (self-employed) versus a large firm with labor contracts. Profit = Price x Output – Wage x Labor What is the real wage? How does it change? P=10 3 1 2 P=2 4 hr = 8 output 8 hr = 16 output

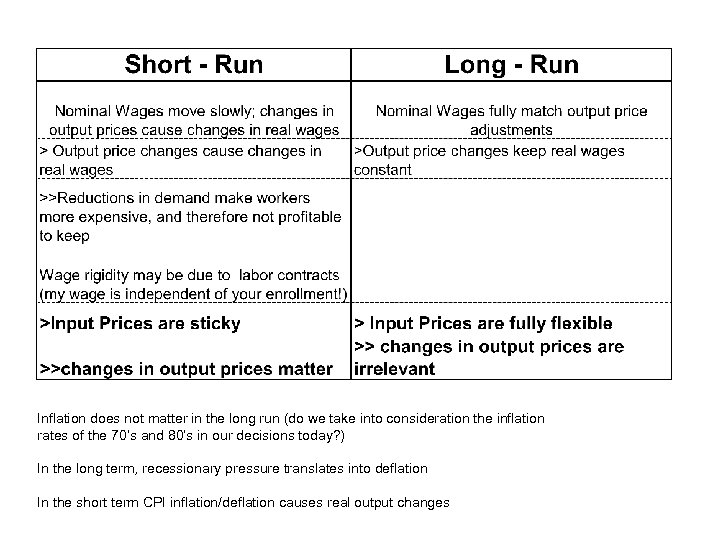

Inflation does not matter in the long run (do we take into consideration the inflation rates of the 70’s and 80’s in our decisions today? ) In the long term, recessionary pressure translates into deflation In the short term CPI inflation/deflation causes real output changes

Inflation does not matter in the long run (do we take into consideration the inflation rates of the 70’s and 80’s in our decisions today? ) In the long term, recessionary pressure translates into deflation In the short term CPI inflation/deflation causes real output changes

Long-Run Aggregate Supply • Capacity Based – Full employment (cyclical = zero) • Long – Run Equilibrium – Corresponds to the expansion path in the business cycle • Shifts: – Economic development

Long-Run Aggregate Supply • Capacity Based – Full employment (cyclical = zero) • Long – Run Equilibrium – Corresponds to the expansion path in the business cycle • Shifts: – Economic development

Short-Run Aggregate Supply • Fixed input prices • Short – Run Equilibrium – Corresponds to the actual business cycle – We are always in the short run equilibrium • Shift factors – Changes in input costs – Changes in input productivities

Short-Run Aggregate Supply • Fixed input prices • Short – Run Equilibrium – Corresponds to the actual business cycle – We are always in the short run equilibrium • Shift factors – Changes in input costs – Changes in input productivities

Supply Driven Recession • The Oil Crisis of the 1970’s • Supply side threat with the rising oil prices in 2008 • Supply driven recessions are induced by rising input costs or reduced productivity • Consequences: – Stagflation • Correction – Time cures all • Will redistribute wealth: shares of output value will shift between the input suppliers – Rising price of fuel and Delta’s labor negotiations in 2007. – Government Stabilization Policy

Supply Driven Recession • The Oil Crisis of the 1970’s • Supply side threat with the rising oil prices in 2008 • Supply driven recessions are induced by rising input costs or reduced productivity • Consequences: – Stagflation • Correction – Time cures all • Will redistribute wealth: shares of output value will shift between the input suppliers – Rising price of fuel and Delta’s labor negotiations in 2007. – Government Stabilization Policy

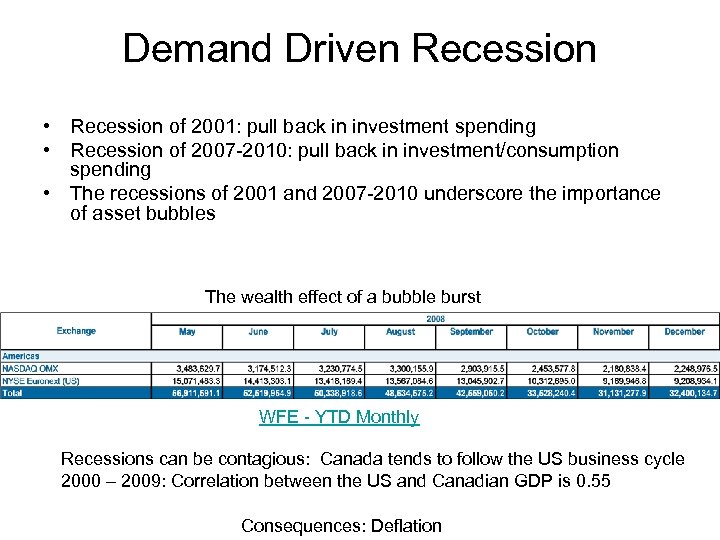

Demand Driven Recession • Recession of 2001: pull back in investment spending • Recession of 2007 -2010: pull back in investment/consumption spending • The recessions of 2001 and 2007 -2010 underscore the importance of asset bubbles The wealth effect of a bubble burst WFE - YTD Monthly Recessions can be contagious: Canada tends to follow the US business cycle 2000 – 2009: Correlation between the US and Canadian GDP is 0. 55 Consequences: Deflation

Demand Driven Recession • Recession of 2001: pull back in investment spending • Recession of 2007 -2010: pull back in investment/consumption spending • The recessions of 2001 and 2007 -2010 underscore the importance of asset bubbles The wealth effect of a bubble burst WFE - YTD Monthly Recessions can be contagious: Canada tends to follow the US business cycle 2000 – 2009: Correlation between the US and Canadian GDP is 0. 55 Consequences: Deflation

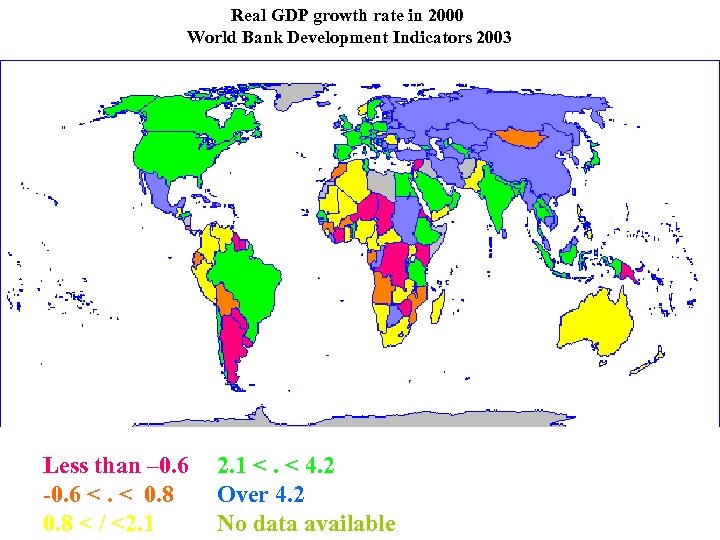

Real GDP growth rate in 2000 World Bank Development Indicators 2003 Less than – 0. 6 -0. 6 <. < 0. 8 < / <2. 1 <. < 4. 2 Over 4. 2 No data available

Real GDP growth rate in 2000 World Bank Development Indicators 2003 Less than – 0. 6 -0. 6 <. < 0. 8 < / <2. 1 <. < 4. 2 Over 4. 2 No data available

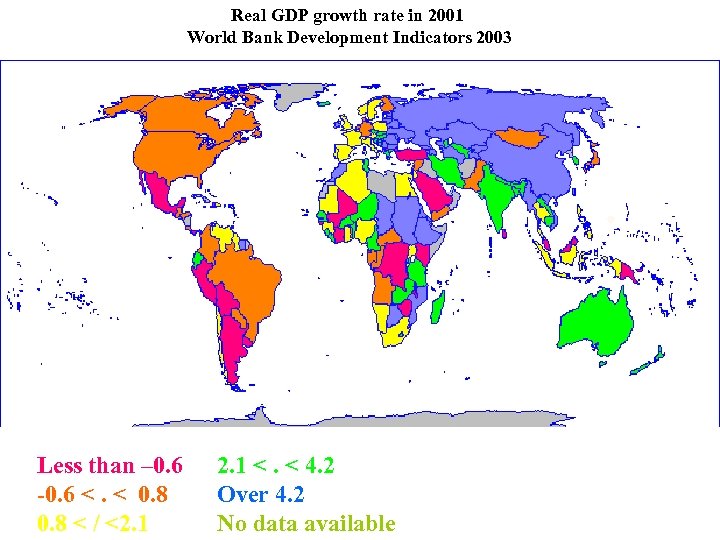

Real GDP growth rate in 2001 World Bank Development Indicators 2003 Less than – 0. 6 -0. 6 <. < 0. 8 < / <2. 1 <. < 4. 2 Over 4. 2 No data available

Real GDP growth rate in 2001 World Bank Development Indicators 2003 Less than – 0. 6 -0. 6 <. < 0. 8 < / <2. 1 <. < 4. 2 Over 4. 2 No data available

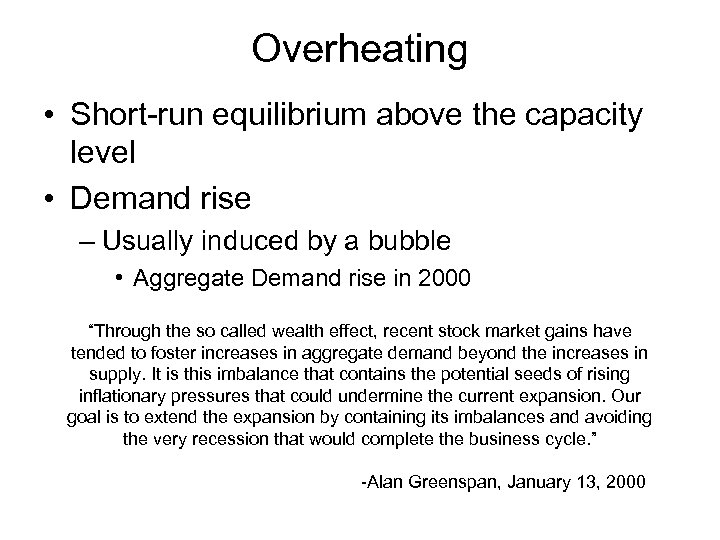

Overheating • Short-run equilibrium above the capacity level • Demand rise – Usually induced by a bubble • Aggregate Demand rise in 2000 “Through the so called wealth effect, recent stock market gains have tended to foster increases in aggregate demand beyond the increases in supply. It is this imbalance that contains the potential seeds of rising inflationary pressures that could undermine the current expansion. Our goal is to extend the expansion by containing its imbalances and avoiding the very recession that would complete the business cycle. ” -Alan Greenspan, January 13, 2000

Overheating • Short-run equilibrium above the capacity level • Demand rise – Usually induced by a bubble • Aggregate Demand rise in 2000 “Through the so called wealth effect, recent stock market gains have tended to foster increases in aggregate demand beyond the increases in supply. It is this imbalance that contains the potential seeds of rising inflationary pressures that could undermine the current expansion. Our goal is to extend the expansion by containing its imbalances and avoiding the very recession that would complete the business cycle. ” -Alan Greenspan, January 13, 2000

How will each of the following affect the AD-AS diagram? • • Stock market growth Fiscal expansionary policy Increase in taxes Capital investment

How will each of the following affect the AD-AS diagram? • • Stock market growth Fiscal expansionary policy Increase in taxes Capital investment

Classical View • The Invisible Hand logic • Flexible Economy – – Dominated by small firms Recessionary pressure translates into deflation Price mechanism as a corrective tool Rapid price adjustments • Say’s Law: Supply Creates Its Own Demand

Classical View • The Invisible Hand logic • Flexible Economy – – Dominated by small firms Recessionary pressure translates into deflation Price mechanism as a corrective tool Rapid price adjustments • Say’s Law: Supply Creates Its Own Demand

Keynesian Points • Price flexibility is too strong of an assumption – Non-flexible input prices in the short-run leading to output adjustments • Decline in Expenditures Components of the GDP (Aggregate Demand) – The Thrift Paradox – Consumption spending and other factors • Under-Production as an equilibrium in the shortrun

Keynesian Points • Price flexibility is too strong of an assumption – Non-flexible input prices in the short-run leading to output adjustments • Decline in Expenditures Components of the GDP (Aggregate Demand) – The Thrift Paradox – Consumption spending and other factors • Under-Production as an equilibrium in the shortrun

Aggregate Supply • Long-Run – Classical view – Capacity level – Long-term Growth • Short-Run – Fixed input prices – Relationship between the price level and the output: CPI and Q

Aggregate Supply • Long-Run – Classical view – Capacity level – Long-term Growth • Short-Run – Fixed input prices – Relationship between the price level and the output: CPI and Q

equilibrium • Long-Run and Short-Run • Demand Driven Recession – Deflationary pressure – Long-run input cost adjustment – Possible need for government intervention in the short -run • Supply Driven Recession – Input cost rise – Inflationary pressure • Eliminating Recession through Demand Side Policy

equilibrium • Long-Run and Short-Run • Demand Driven Recession – Deflationary pressure – Long-run input cost adjustment – Possible need for government intervention in the short -run • Supply Driven Recession – Input cost rise – Inflationary pressure • Eliminating Recession through Demand Side Policy

Fiscal Stabilization Policy • Instruments – Government Spending – Taxes – Transfers – Budget • Ability to be targeted – State level – Municipality level

Fiscal Stabilization Policy • Instruments – Government Spending – Taxes – Transfers – Budget • Ability to be targeted – State level – Municipality level

Drawbacks of Fiscal Expansion note that this is in chapter 30 • crowding-out effects [these refer to the replacement of one sector by another, in the case of expansionary fiscal policy, the public sector displaces the private sector] – direct [direct provision. GSU reduces the demand for Emory] – indirect [this works through the interest rate mechanism, expansionary fiscal policy results in government borrowing, the current tax cut and budget deficit is a perfect example of that, government borrowing may lead to an increase in the interest rates and hence higher costs for private sector investment] – open-economy effect [an increase in the interest rate due to government borrowing may cause an influx of foreign investment and therefore drive up the value of domestic currency] – Time lags (decision, recognition, effect) Ideally the second exam will be here

Drawbacks of Fiscal Expansion note that this is in chapter 30 • crowding-out effects [these refer to the replacement of one sector by another, in the case of expansionary fiscal policy, the public sector displaces the private sector] – direct [direct provision. GSU reduces the demand for Emory] – indirect [this works through the interest rate mechanism, expansionary fiscal policy results in government borrowing, the current tax cut and budget deficit is a perfect example of that, government borrowing may lead to an increase in the interest rates and hence higher costs for private sector investment] – open-economy effect [an increase in the interest rate due to government borrowing may cause an influx of foreign investment and therefore drive up the value of domestic currency] – Time lags (decision, recognition, effect) Ideally the second exam will be here

Monetary Side MONEY • Functions of money – Medium of exchange – Unit of account – Store of value • Measuring the supply of money (liquidity and transaction principles) – M 1 • Cash, checking accounts, traveler’s checks – M 2 • M 1+savings accounts, CD accounts, money market accounts

Monetary Side MONEY • Functions of money – Medium of exchange – Unit of account – Store of value • Measuring the supply of money (liquidity and transaction principles) – M 1 • Cash, checking accounts, traveler’s checks – M 2 • M 1+savings accounts, CD accounts, money market accounts

Money Creation by Banks • Creation of money balances by banks – Fractional reserve system and lending – Money multiplier • Potential • Actual • Regulatory institutions – Federal Reserve Bank – FDIC

Money Creation by Banks • Creation of money balances by banks – Fractional reserve system and lending – Money multiplier • Potential • Actual • Regulatory institutions – Federal Reserve Bank – FDIC

Monetary Policy • Federal Reserve Bank of the US (Central Bank) • Goal of the Policy – Influence consumption and investment spending – Change the exchange rate side effect more than a goal • Policy Instruments – Open Market Operations – Discount Rate – Reserve Requirements • Policy Operating Targets – Federal Funds Rate • Weaknesses of the Policy – Liquidity trap – Recognition/time lags

Monetary Policy • Federal Reserve Bank of the US (Central Bank) • Goal of the Policy – Influence consumption and investment spending – Change the exchange rate side effect more than a goal • Policy Instruments – Open Market Operations – Discount Rate – Reserve Requirements • Policy Operating Targets – Federal Funds Rate • Weaknesses of the Policy – Liquidity trap – Recognition/time lags

Economic Policy and the Exchange Rate Regime • Float – Monetary – Fiscal • Fixed – Monetary – Fiscal

Economic Policy and the Exchange Rate Regime • Float – Monetary – Fiscal • Fixed – Monetary – Fiscal

Currency Trade and Exchange Regime (History – optional) Floating Exchange Rate Regime – Currency Trade by Central Banks – (Forward looking instruments – optional) Fixed Exchange Rate Regime – Does Recent Dollar Depreciation Impact the Trade Deficit with CHINA? – Price Stabilization and Fixed Exchange Rate Regime – Risk to CB

Currency Trade and Exchange Regime (History – optional) Floating Exchange Rate Regime – Currency Trade by Central Banks – (Forward looking instruments – optional) Fixed Exchange Rate Regime – Does Recent Dollar Depreciation Impact the Trade Deficit with CHINA? – Price Stabilization and Fixed Exchange Rate Regime – Risk to CB