31cdb21840f05bfaddfdbc1cb94c3237.ppt

- Количество слайдов: 58

Economics of the Firm Cost Analysis

Economics of the Firm Cost Analysis

Primary Managerial Objective: Minimize costs for a given production level (potentially subject to on or more constraints) Example: PG&E would like to meet the daily electricity demands of its 5. 1 Million customers for the lowest possible cost Or Maximize production levels while operating within a given budget Example: George Steinbrenner and would like to maximize the production of the NY Yankees while staying within the salary cap

Primary Managerial Objective: Minimize costs for a given production level (potentially subject to on or more constraints) Example: PG&E would like to meet the daily electricity demands of its 5. 1 Million customers for the lowest possible cost Or Maximize production levels while operating within a given budget Example: George Steinbrenner and would like to maximize the production of the NY Yankees while staying within the salary cap

Note: Economic Costs vs. Accounting Costs Example: You decide to open a lemonade stand. You spend $100 building the stand $50 on supplies. After your first day (you worked 8 hours), you have collected $200 in revenues Profit (Accounting): $200 - $50 - $100 Economic profit accounts for the opportunity cost of your time and money. Suppose that you have a bank account that earns 5% interest annually and that you could have worked at the local grocery for $8/hr Profit (Economic): $200 - $50 - $100 - $150(5%/365) - $8*8 Lost Interest Value of your time

Note: Economic Costs vs. Accounting Costs Example: You decide to open a lemonade stand. You spend $100 building the stand $50 on supplies. After your first day (you worked 8 hours), you have collected $200 in revenues Profit (Accounting): $200 - $50 - $100 Economic profit accounts for the opportunity cost of your time and money. Suppose that you have a bank account that earns 5% interest annually and that you could have worked at the local grocery for $8/hr Profit (Economic): $200 - $50 - $100 - $150(5%/365) - $8*8 Lost Interest Value of your time

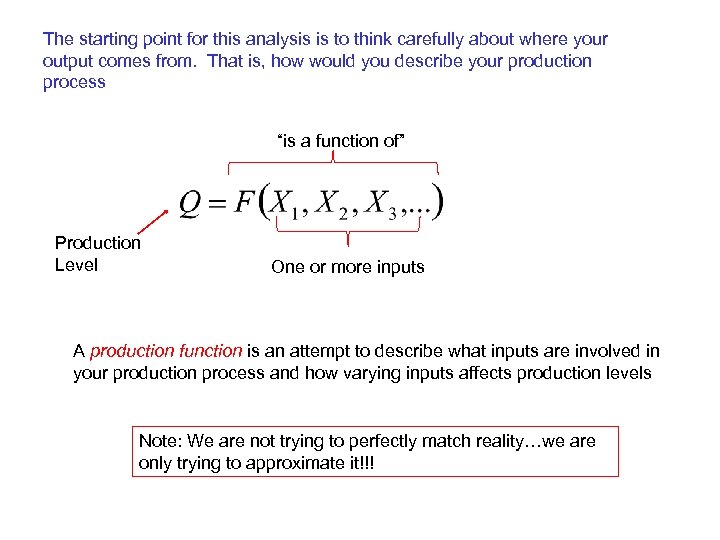

The starting point for this analysis is to think carefully about where your output comes from. That is, how would you describe your production process “is a function of” Production Level One or more inputs A production function is an attempt to describe what inputs are involved in your production process and how varying inputs affects production levels Note: We are not trying to perfectly match reality…we are only trying to approximate it!!!

The starting point for this analysis is to think carefully about where your output comes from. That is, how would you describe your production process “is a function of” Production Level One or more inputs A production function is an attempt to describe what inputs are involved in your production process and how varying inputs affects production levels Note: We are not trying to perfectly match reality…we are only trying to approximate it!!!

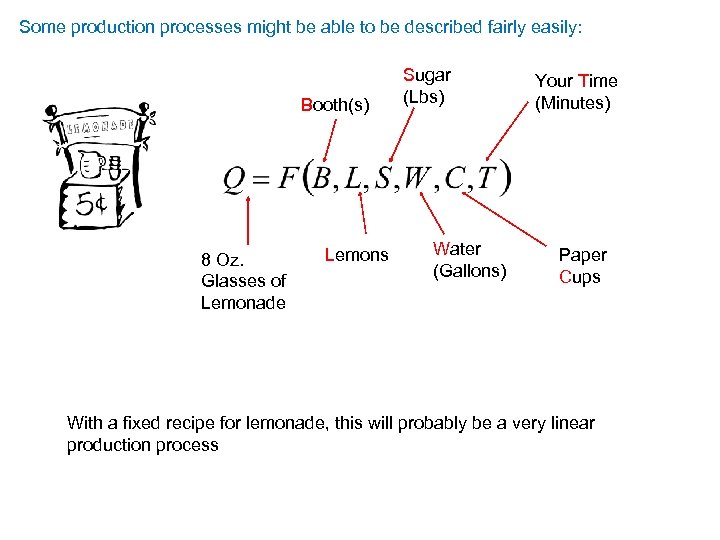

Some production processes might be able to be described fairly easily: Booth(s) 8 Oz. Glasses of Lemonade Lemons Sugar (Lbs) Water (Gallons) Your Time (Minutes) Paper Cups With a fixed recipe for lemonade, this will probably be a very linear production process

Some production processes might be able to be described fairly easily: Booth(s) 8 Oz. Glasses of Lemonade Lemons Sugar (Lbs) Water (Gallons) Your Time (Minutes) Paper Cups With a fixed recipe for lemonade, this will probably be a very linear production process

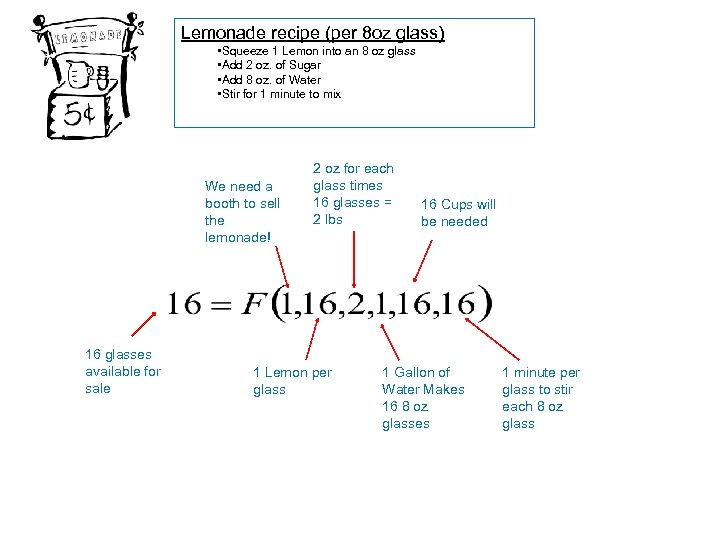

Lemonade recipe (per 8 oz glass) • Squeeze 1 Lemon into an 8 oz glass • Add 2 oz. of Sugar • Add 8 oz. of Water • Stir for 1 minute to mix We need a booth to sell the lemonade! 16 glasses available for sale 2 oz for each glass times 16 glasses = 2 lbs 1 Lemon per glass 16 Cups will be needed 1 Gallon of Water Makes 16 8 oz glasses 1 minute per glass to stir each 8 oz glass

Lemonade recipe (per 8 oz glass) • Squeeze 1 Lemon into an 8 oz glass • Add 2 oz. of Sugar • Add 8 oz. of Water • Stir for 1 minute to mix We need a booth to sell the lemonade! 16 glasses available for sale 2 oz for each glass times 16 glasses = 2 lbs 1 Lemon per glass 16 Cups will be needed 1 Gallon of Water Makes 16 8 oz glasses 1 minute per glass to stir each 8 oz glass

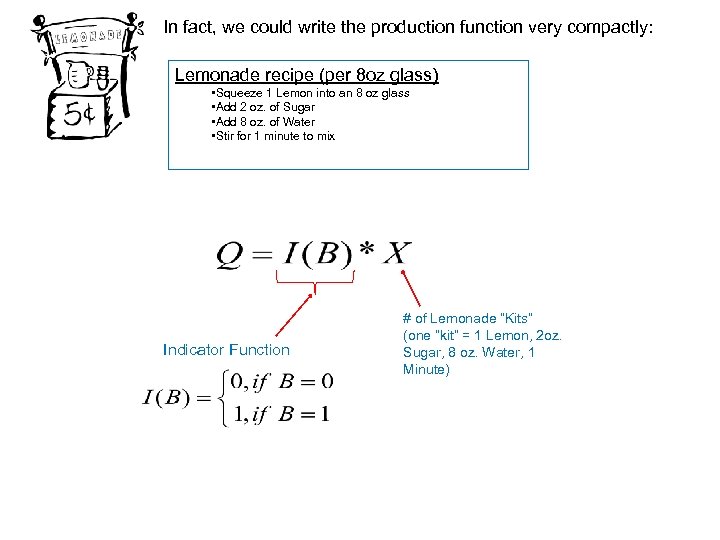

In fact, we could write the production function very compactly: Lemonade recipe (per 8 oz glass) • Squeeze 1 Lemon into an 8 oz glass • Add 2 oz. of Sugar • Add 8 oz. of Water • Stir for 1 minute to mix Indicator Function # of Lemonade “Kits” (one “kit” = 1 Lemon, 2 oz. Sugar, 8 oz. Water, 1 Minute)

In fact, we could write the production function very compactly: Lemonade recipe (per 8 oz glass) • Squeeze 1 Lemon into an 8 oz glass • Add 2 oz. of Sugar • Add 8 oz. of Water • Stir for 1 minute to mix Indicator Function # of Lemonade “Kits” (one “kit” = 1 Lemon, 2 oz. Sugar, 8 oz. Water, 1 Minute)

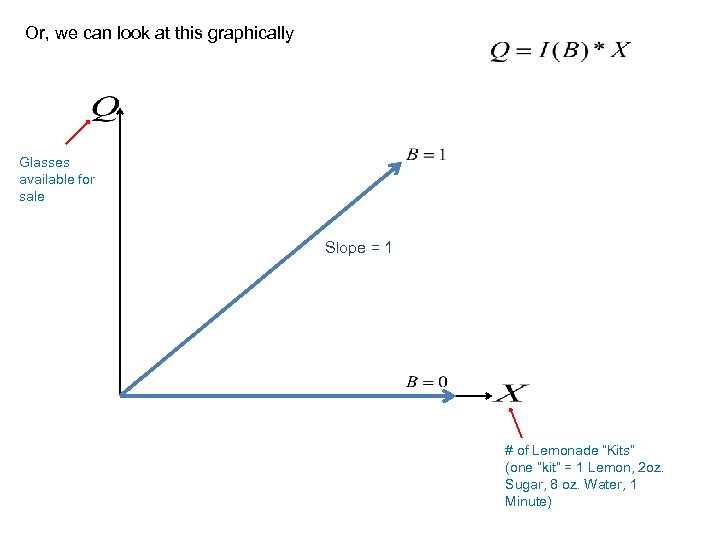

Or, we can look at this graphically Glasses available for sale Slope = 1 # of Lemonade “Kits” (one “kit” = 1 Lemon, 2 oz. Sugar, 8 oz. Water, 1 Minute)

Or, we can look at this graphically Glasses available for sale Slope = 1 # of Lemonade “Kits” (one “kit” = 1 Lemon, 2 oz. Sugar, 8 oz. Water, 1 Minute)

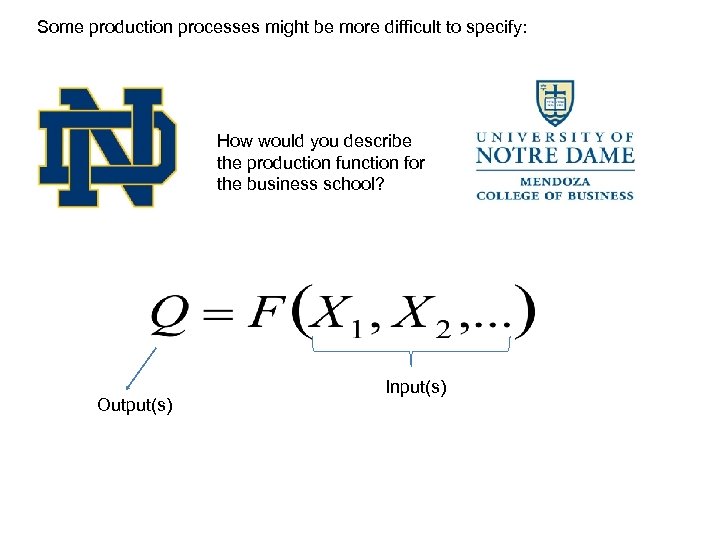

Some production processes might be more difficult to specify: How would you describe the production function for the business school? Output(s) Input(s)

Some production processes might be more difficult to specify: How would you describe the production function for the business school? Output(s) Input(s)

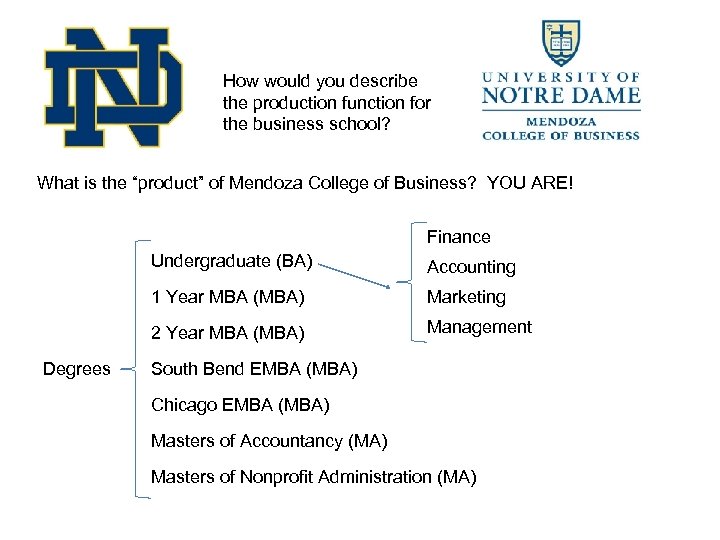

How would you describe the production function for the business school? What is the “product” of Mendoza College of Business? YOU ARE! Finance Undergraduate (BA) 1 Year MBA (MBA) Marketing 2 Year MBA (MBA) Degrees Accounting Management South Bend EMBA (MBA) Chicago EMBA (MBA) Masters of Accountancy (MA) Masters of Nonprofit Administration (MA)

How would you describe the production function for the business school? What is the “product” of Mendoza College of Business? YOU ARE! Finance Undergraduate (BA) 1 Year MBA (MBA) Marketing 2 Year MBA (MBA) Degrees Accounting Management South Bend EMBA (MBA) Chicago EMBA (MBA) Masters of Accountancy (MA) Masters of Nonprofit Administration (MA)

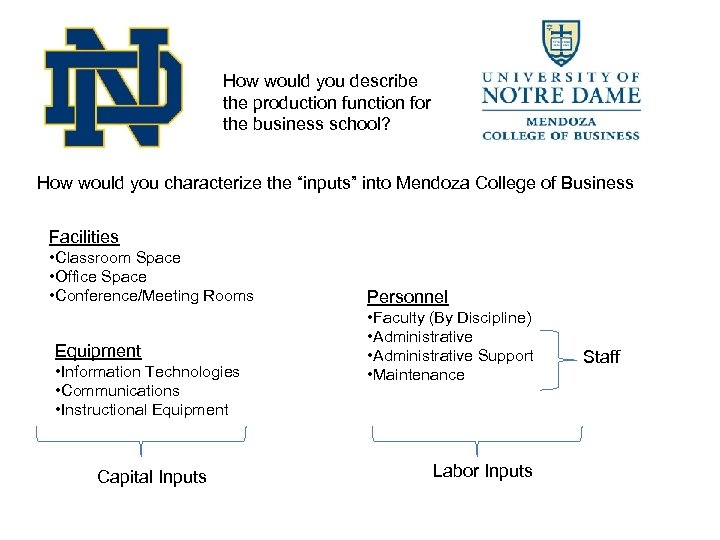

How would you describe the production function for the business school? How would you characterize the “inputs” into Mendoza College of Business Facilities • Classroom Space • Office Space • Conference/Meeting Rooms Equipment • Information Technologies • Communications • Instructional Equipment Capital Inputs Personnel • Faculty (By Discipline) • Administrative Support • Maintenance Labor Inputs Staff

How would you describe the production function for the business school? How would you characterize the “inputs” into Mendoza College of Business Facilities • Classroom Space • Office Space • Conference/Meeting Rooms Equipment • Information Technologies • Communications • Instructional Equipment Capital Inputs Personnel • Faculty (By Discipline) • Administrative Support • Maintenance Labor Inputs Staff

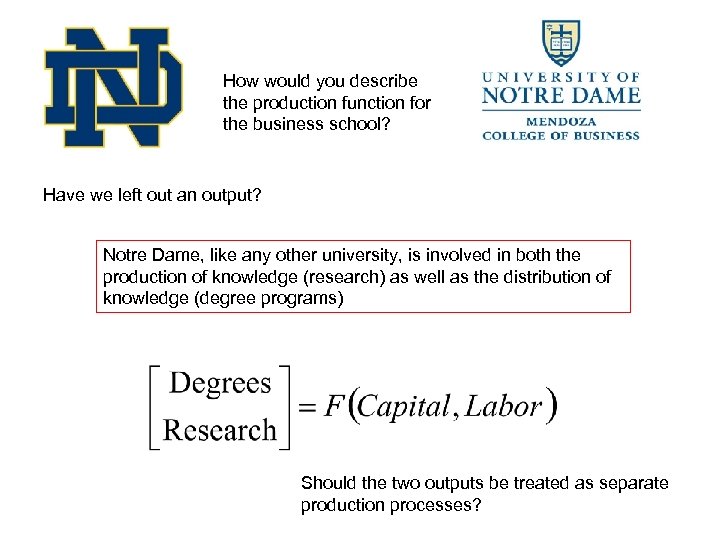

How would you describe the production function for the business school? Have we left out an output? Notre Dame, like any other university, is involved in both the production of knowledge (research) as well as the distribution of knowledge (degree programs) Should the two outputs be treated as separate production processes?

How would you describe the production function for the business school? Have we left out an output? Notre Dame, like any other university, is involved in both the production of knowledge (research) as well as the distribution of knowledge (degree programs) Should the two outputs be treated as separate production processes?

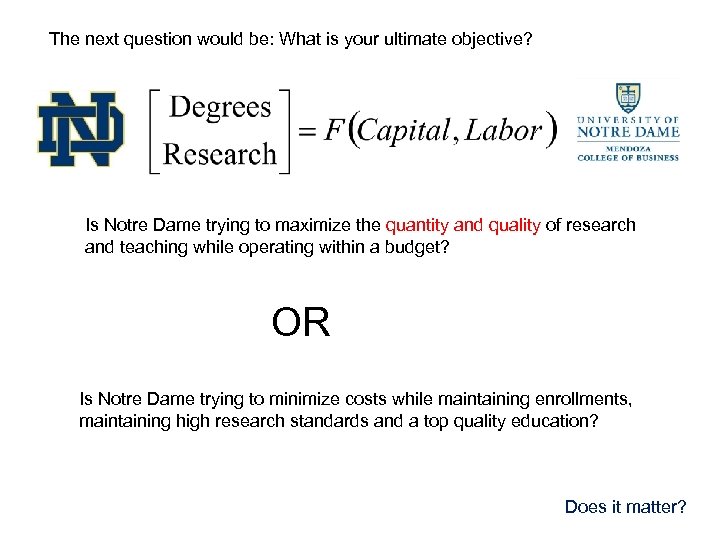

The next question would be: What is your ultimate objective? Is Notre Dame trying to maximize the quantity and quality of research and teaching while operating within a budget? OR Is Notre Dame trying to minimize costs while maintaining enrollments, maintaining high research standards and a top quality education? Does it matter?

The next question would be: What is your ultimate objective? Is Notre Dame trying to maximize the quantity and quality of research and teaching while operating within a budget? OR Is Notre Dame trying to minimize costs while maintaining enrollments, maintaining high research standards and a top quality education? Does it matter?

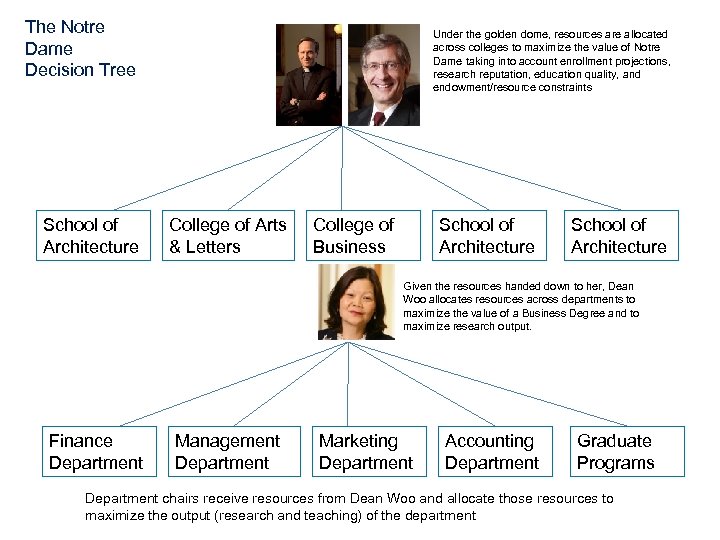

The Notre Dame Decision Tree School of Architecture Under the golden dome, resources are allocated across colleges to maximize the value of Notre Dame taking into account enrollment projections, research reputation, education quality, and endowment/resource constraints College of Arts & Letters College of Business School of Architecture Given the resources handed down to her, Dean Woo allocates resources across departments to maximize the value of a Business Degree and to maximize research output. Finance Department Management Department Marketing Department Accounting Department Graduate Programs Department chairs receive resources from Dean Woo and allocate those resources to maximize the output (research and teaching) of the department

The Notre Dame Decision Tree School of Architecture Under the golden dome, resources are allocated across colleges to maximize the value of Notre Dame taking into account enrollment projections, research reputation, education quality, and endowment/resource constraints College of Arts & Letters College of Business School of Architecture Given the resources handed down to her, Dean Woo allocates resources across departments to maximize the value of a Business Degree and to maximize research output. Finance Department Management Department Marketing Department Accounting Department Graduate Programs Department chairs receive resources from Dean Woo and allocate those resources to maximize the output (research and teaching) of the department

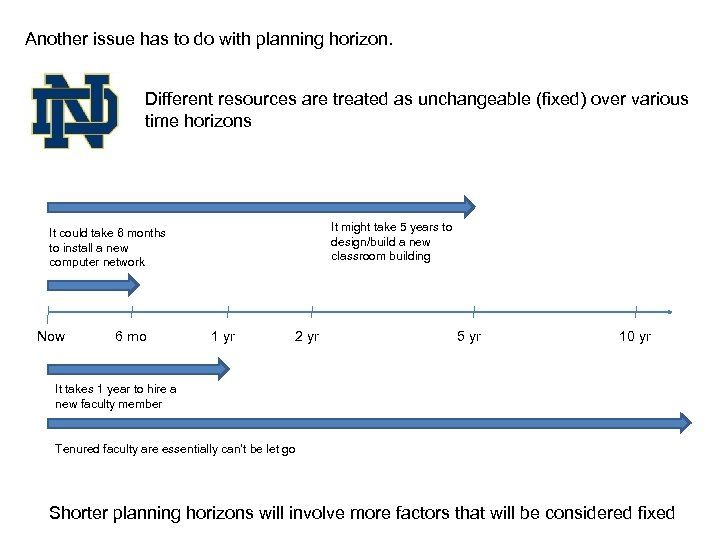

Another issue has to do with planning horizon. Different resources are treated as unchangeable (fixed) over various time horizons It might take 5 years to design/build a new classroom building It could take 6 months to install a new computer network Now 6 mo 1 yr 2 yr 5 yr 10 yr It takes 1 year to hire a new faculty member Tenured faculty are essentially can’t be let go Shorter planning horizons will involve more factors that will be considered fixed

Another issue has to do with planning horizon. Different resources are treated as unchangeable (fixed) over various time horizons It might take 5 years to design/build a new classroom building It could take 6 months to install a new computer network Now 6 mo 1 yr 2 yr 5 yr 10 yr It takes 1 year to hire a new faculty member Tenured faculty are essentially can’t be let go Shorter planning horizons will involve more factors that will be considered fixed

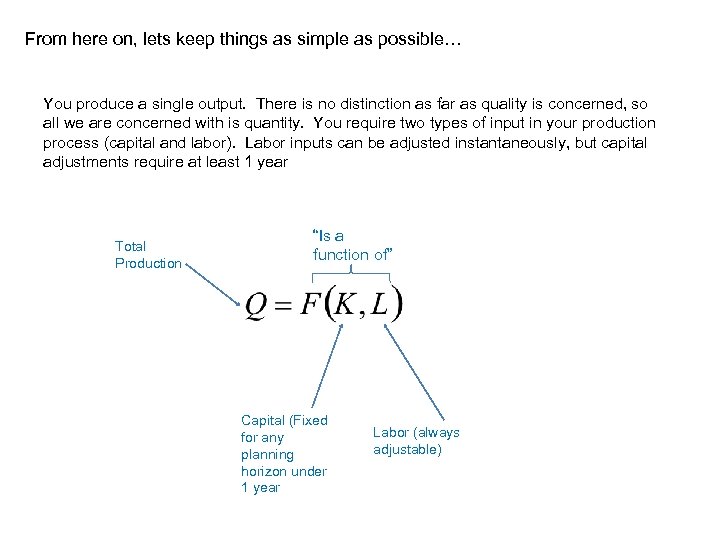

From here on, lets keep things as simple as possible… You produce a single output. There is no distinction as far as quality is concerned, so all we are concerned with is quantity. You require two types of input in your production process (capital and labor). Labor inputs can be adjusted instantaneously, but capital adjustments require at least 1 year Total Production “Is a function of” Capital (Fixed for any planning horizon under 1 year Labor (always adjustable)

From here on, lets keep things as simple as possible… You produce a single output. There is no distinction as far as quality is concerned, so all we are concerned with is quantity. You require two types of input in your production process (capital and labor). Labor inputs can be adjusted instantaneously, but capital adjustments require at least 1 year Total Production “Is a function of” Capital (Fixed for any planning horizon under 1 year Labor (always adjustable)

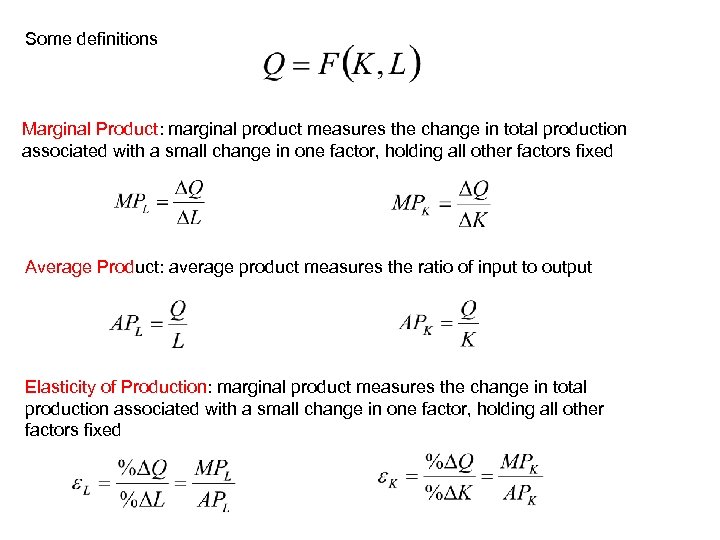

Some definitions Marginal Product: marginal product measures the change in total production associated with a small change in one factor, holding all other factors fixed Average Product: average product measures the ratio of input to output Elasticity of Production: marginal product measures the change in total production associated with a small change in one factor, holding all other factors fixed

Some definitions Marginal Product: marginal product measures the change in total production associated with a small change in one factor, holding all other factors fixed Average Product: average product measures the ratio of input to output Elasticity of Production: marginal product measures the change in total production associated with a small change in one factor, holding all other factors fixed

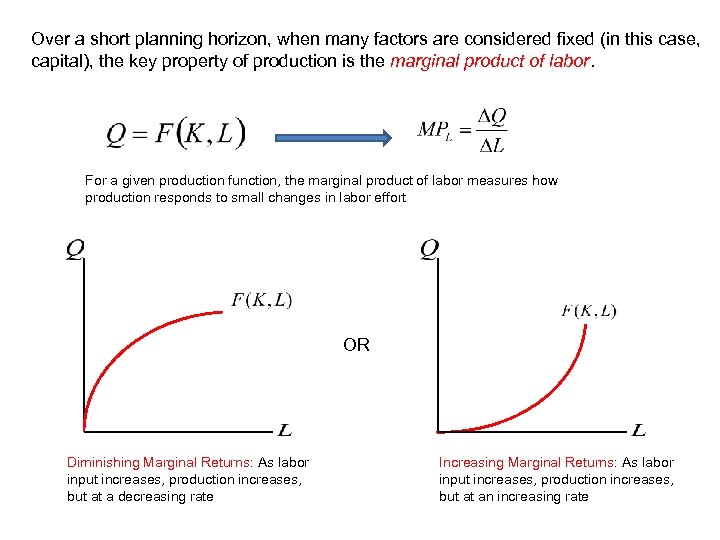

Over a short planning horizon, when many factors are considered fixed (in this case, capital), the key property of production is the marginal product of labor. For a given production function, the marginal product of labor measures how production responds to small changes in labor effort OR Diminishing Marginal Returns: As labor input increases, production increases, but at a decreasing rate Increasing Marginal Returns: As labor input increases, production increases, but at an increasing rate

Over a short planning horizon, when many factors are considered fixed (in this case, capital), the key property of production is the marginal product of labor. For a given production function, the marginal product of labor measures how production responds to small changes in labor effort OR Diminishing Marginal Returns: As labor input increases, production increases, but at a decreasing rate Increasing Marginal Returns: As labor input increases, production increases, but at an increasing rate

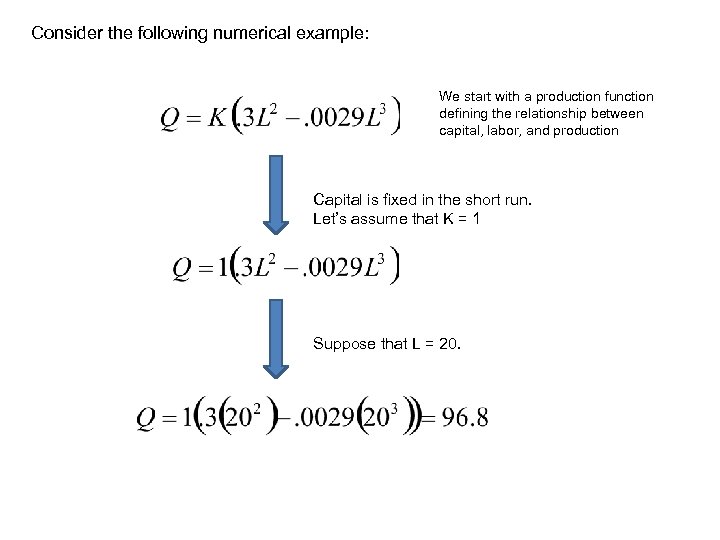

Consider the following numerical example: We start with a production function defining the relationship between capital, labor, and production Capital is fixed in the short run. Let’s assume that K = 1 Suppose that L = 20.

Consider the following numerical example: We start with a production function defining the relationship between capital, labor, and production Capital is fixed in the short run. Let’s assume that K = 1 Suppose that L = 20.

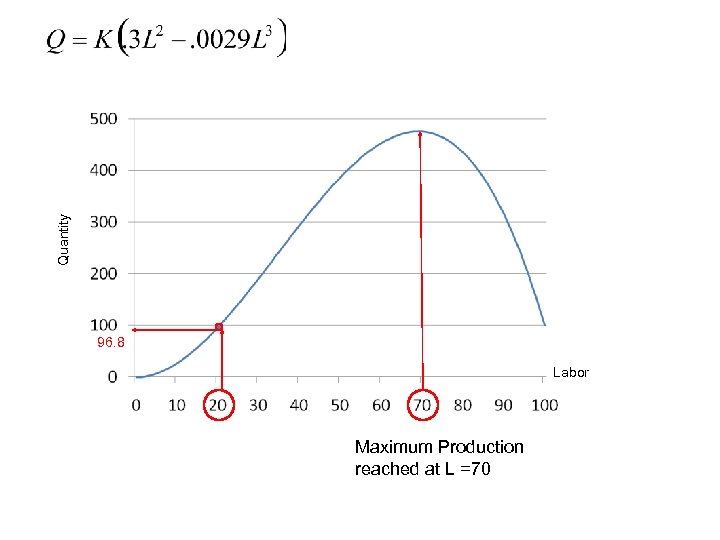

Quantity 96. 8 Labor Maximum Production reached at L =70

Quantity 96. 8 Labor Maximum Production reached at L =70

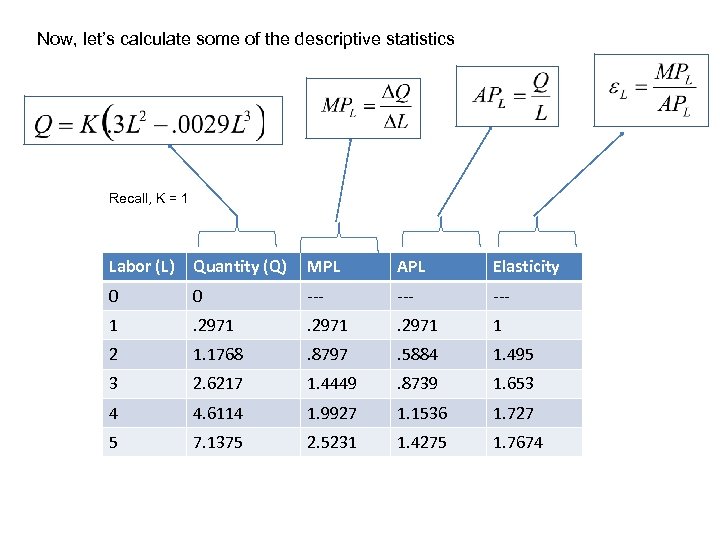

Now, let’s calculate some of the descriptive statistics Recall, K = 1 Labor (L) Quantity (Q) MPL APL Elasticity 0 0 --- --- 1 . 2971 1 2 1. 1768 . 8797 . 5884 1. 495 3 2. 6217 1. 4449 . 8739 1. 653 4 4. 6114 1. 9927 1. 1536 1. 727 5 7. 1375 2. 5231 1. 4275 1. 7674

Now, let’s calculate some of the descriptive statistics Recall, K = 1 Labor (L) Quantity (Q) MPL APL Elasticity 0 0 --- --- 1 . 2971 1 2 1. 1768 . 8797 . 5884 1. 495 3 2. 6217 1. 4449 . 8739 1. 653 4 4. 6114 1. 9927 1. 1536 1. 727 5 7. 1375 2. 5231 1. 4275 1. 7674

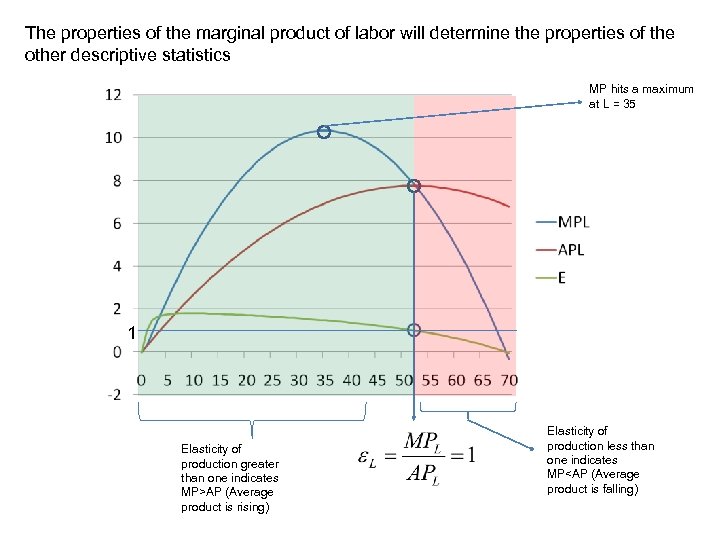

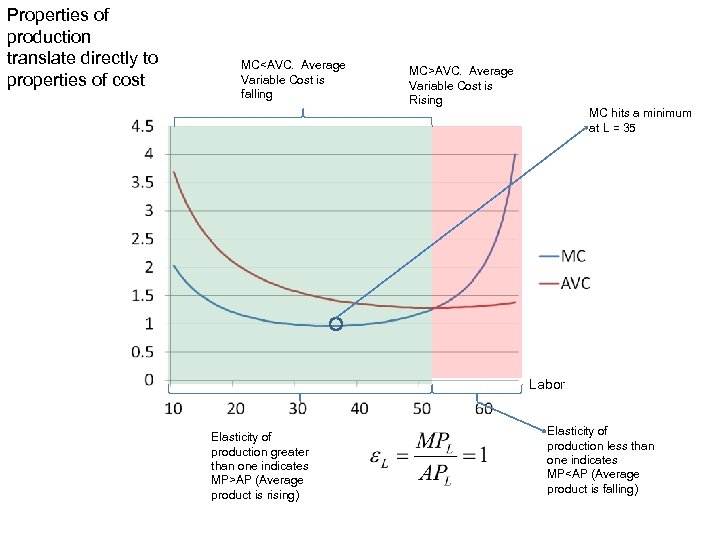

The properties of the marginal product of labor will determine the properties of the other descriptive statistics MP hits a maximum at L = 35 1 Elasticity of production greater than one indicates MP>AP (Average product is rising) Elasticity of production less than one indicates MP

The properties of the marginal product of labor will determine the properties of the other descriptive statistics MP hits a maximum at L = 35 1 Elasticity of production greater than one indicates MP>AP (Average product is rising) Elasticity of production less than one indicates MP

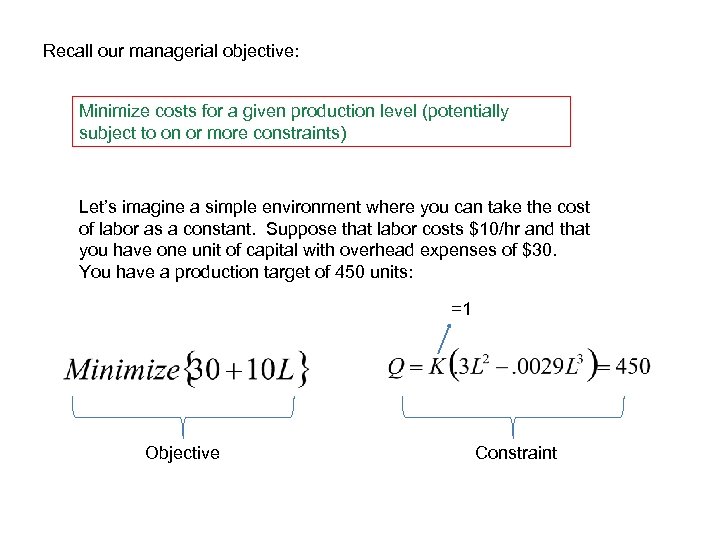

Recall our managerial objective: Minimize costs for a given production level (potentially subject to on or more constraints) Let’s imagine a simple environment where you can take the cost of labor as a constant. Suppose that labor costs $10/hr and that you have one unit of capital with overhead expenses of $30. You have a production target of 450 units: =1 Objective Constraint

Recall our managerial objective: Minimize costs for a given production level (potentially subject to on or more constraints) Let’s imagine a simple environment where you can take the cost of labor as a constant. Suppose that labor costs $10/hr and that you have one unit of capital with overhead expenses of $30. You have a production target of 450 units: =1 Objective Constraint

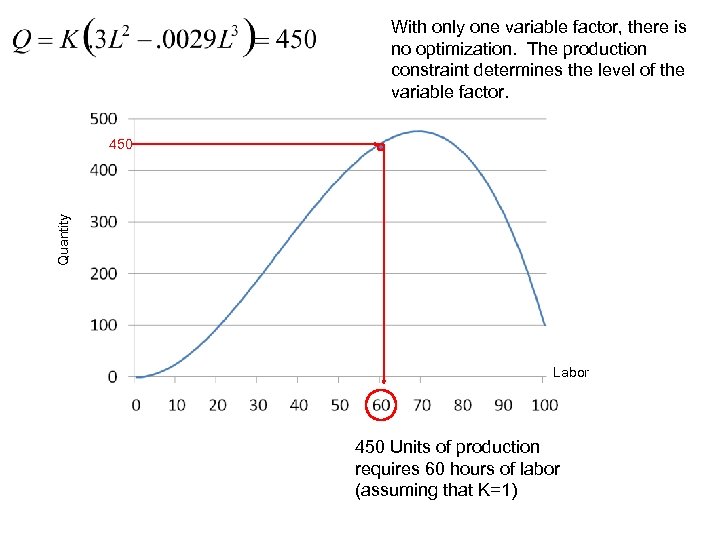

With only one variable factor, there is no optimization. The production constraint determines the level of the variable factor. Quantity 450 Labor 450 Units of production requires 60 hours of labor (assuming that K=1)

With only one variable factor, there is no optimization. The production constraint determines the level of the variable factor. Quantity 450 Labor 450 Units of production requires 60 hours of labor (assuming that K=1)

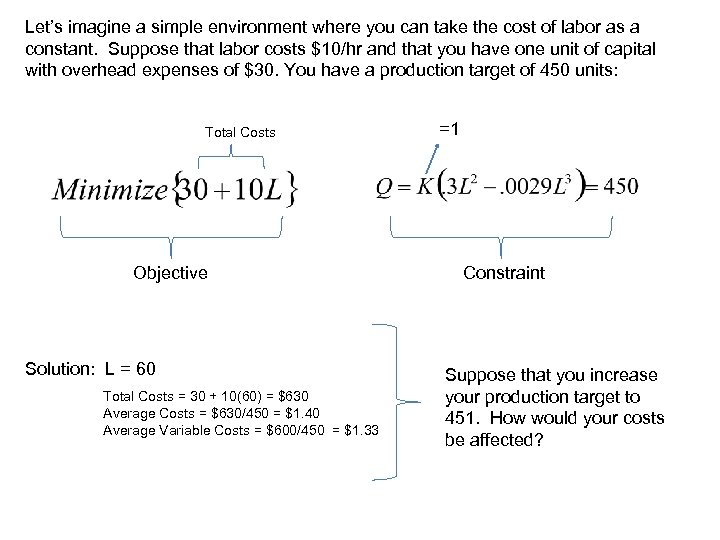

Let’s imagine a simple environment where you can take the cost of labor as a constant. Suppose that labor costs $10/hr and that you have one unit of capital with overhead expenses of $30. You have a production target of 450 units: Total Costs Objective Solution: L = 60 Total Costs = 30 + 10(60) = $630 Average Costs = $630/450 = $1. 40 Average Variable Costs = $600/450 = $1. 33 =1 Constraint Suppose that you increase your production target to 451. How would your costs be affected?

Let’s imagine a simple environment where you can take the cost of labor as a constant. Suppose that labor costs $10/hr and that you have one unit of capital with overhead expenses of $30. You have a production target of 450 units: Total Costs Objective Solution: L = 60 Total Costs = 30 + 10(60) = $630 Average Costs = $630/450 = $1. 40 Average Variable Costs = $600/450 = $1. 33 =1 Constraint Suppose that you increase your production target to 451. How would your costs be affected?

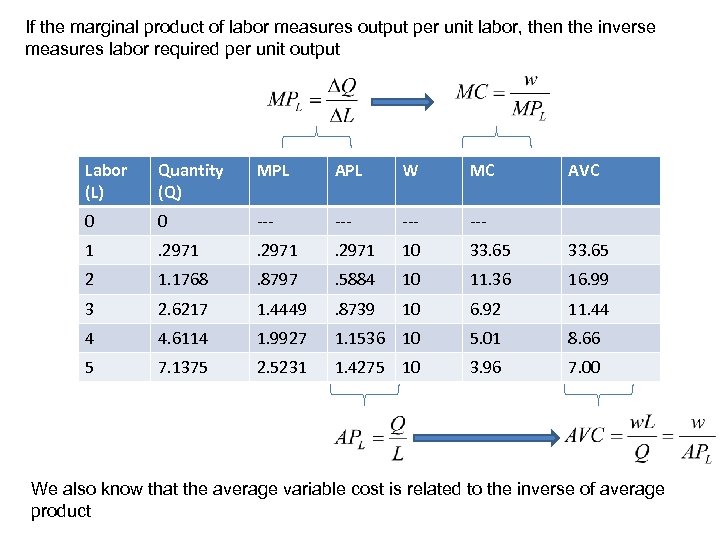

If the marginal product of labor measures output per unit labor, then the inverse measures labor required per unit output Labor (L) Quantity (Q) MPL APL W MC AVC 0 0 --- --- 1 . 2971 10 33. 65 2 1. 1768 . 8797 . 5884 10 11. 36 16. 99 3 2. 6217 1. 4449 . 8739 10 6. 92 11. 44 4 4. 6114 1. 9927 1. 1536 10 5. 01 8. 66 5 7. 1375 2. 5231 1. 4275 10 3. 96 7. 00 We also know that the average variable cost is related to the inverse of average product

If the marginal product of labor measures output per unit labor, then the inverse measures labor required per unit output Labor (L) Quantity (Q) MPL APL W MC AVC 0 0 --- --- 1 . 2971 10 33. 65 2 1. 1768 . 8797 . 5884 10 11. 36 16. 99 3 2. 6217 1. 4449 . 8739 10 6. 92 11. 44 4 4. 6114 1. 9927 1. 1536 10 5. 01 8. 66 5 7. 1375 2. 5231 1. 4275 10 3. 96 7. 00 We also know that the average variable cost is related to the inverse of average product

Properties of production translate directly to properties of cost MC

Properties of production translate directly to properties of cost MC

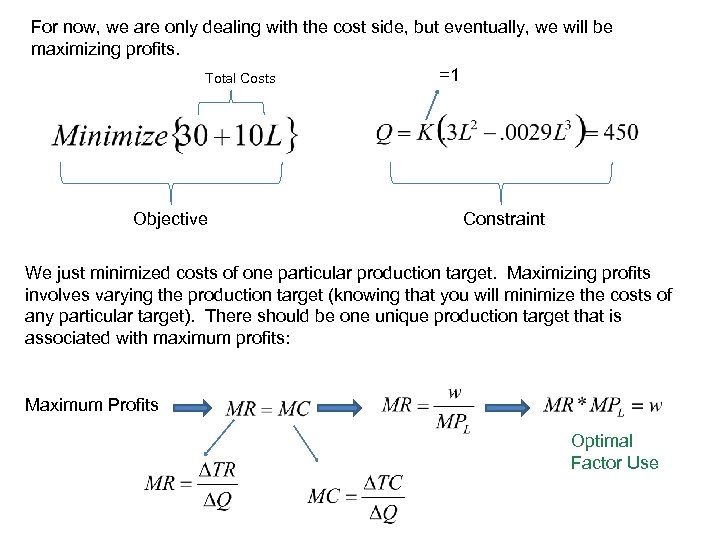

For now, we are only dealing with the cost side, but eventually, we will be maximizing profits. =1 Total Costs Objective Constraint We just minimized costs of one particular production target. Maximizing profits involves varying the production target (knowing that you will minimize the costs of any particular target). There should be one unique production target that is associated with maximum profits: Maximum Profits Optimal Factor Use

For now, we are only dealing with the cost side, but eventually, we will be maximizing profits. =1 Total Costs Objective Constraint We just minimized costs of one particular production target. Maximizing profits involves varying the production target (knowing that you will minimize the costs of any particular target). There should be one unique production target that is associated with maximum profits: Maximum Profits Optimal Factor Use

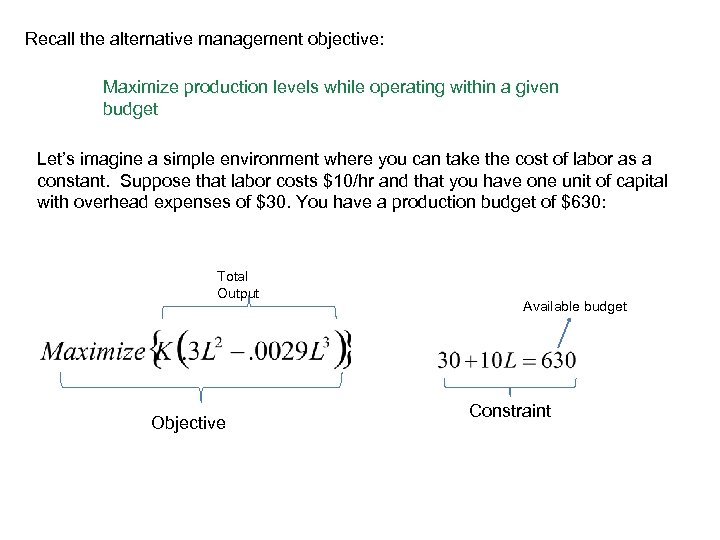

Recall the alternative management objective: Maximize production levels while operating within a given budget Let’s imagine a simple environment where you can take the cost of labor as a constant. Suppose that labor costs $10/hr and that you have one unit of capital with overhead expenses of $30. You have a production budget of $630: Total Output Objective Available budget Constraint

Recall the alternative management objective: Maximize production levels while operating within a given budget Let’s imagine a simple environment where you can take the cost of labor as a constant. Suppose that labor costs $10/hr and that you have one unit of capital with overhead expenses of $30. You have a production budget of $630: Total Output Objective Available budget Constraint

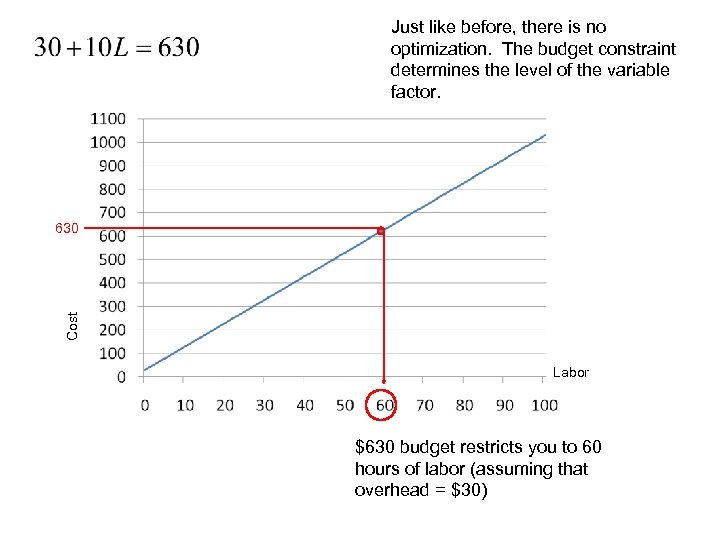

Just like before, there is no optimization. The budget constraint determines the level of the variable factor. Cost 630 Labor $630 budget restricts you to 60 hours of labor (assuming that overhead = $30)

Just like before, there is no optimization. The budget constraint determines the level of the variable factor. Cost 630 Labor $630 budget restricts you to 60 hours of labor (assuming that overhead = $30)

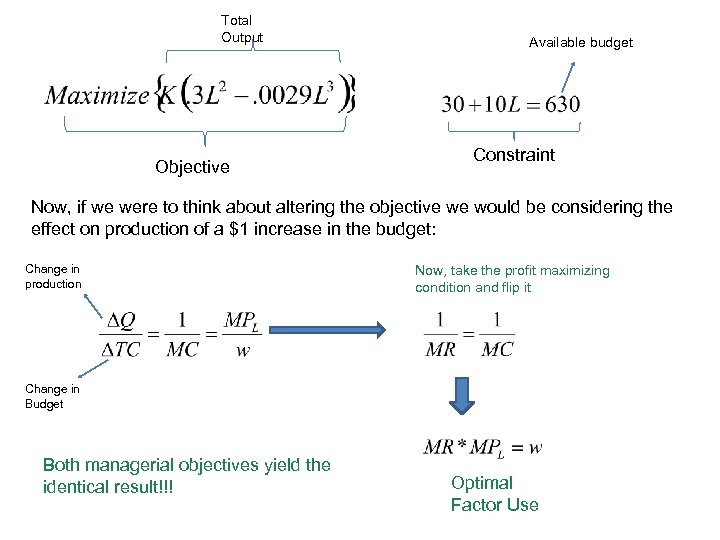

Total Output Objective Available budget Constraint Now, if we were to think about altering the objective we would be considering the effect on production of a $1 increase in the budget: Change in production Now, take the profit maximizing condition and flip it Change in Budget Both managerial objectives yield the identical result!!! Optimal Factor Use

Total Output Objective Available budget Constraint Now, if we were to think about altering the objective we would be considering the effect on production of a $1 increase in the budget: Change in production Now, take the profit maximizing condition and flip it Change in Budget Both managerial objectives yield the identical result!!! Optimal Factor Use

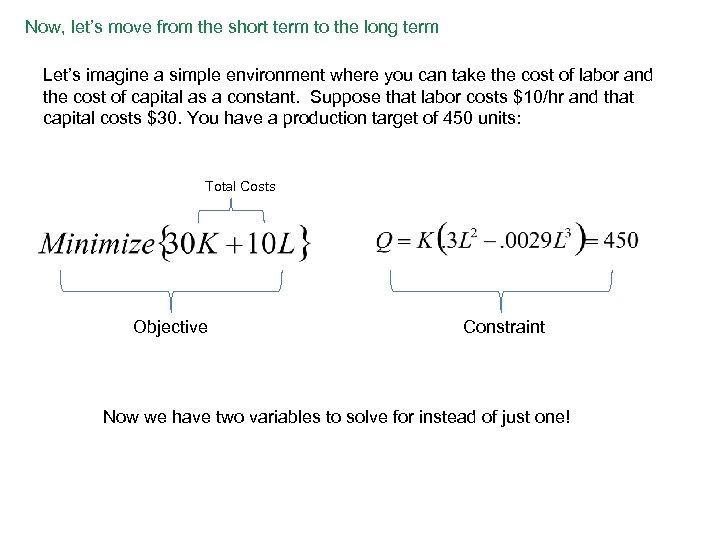

Now, let’s move from the short term to the long term Let’s imagine a simple environment where you can take the cost of labor and the cost of capital as a constant. Suppose that labor costs $10/hr and that capital costs $30. You have a production target of 450 units: Total Costs Objective Constraint Now we have two variables to solve for instead of just one!

Now, let’s move from the short term to the long term Let’s imagine a simple environment where you can take the cost of labor and the cost of capital as a constant. Suppose that labor costs $10/hr and that capital costs $30. You have a production target of 450 units: Total Costs Objective Constraint Now we have two variables to solve for instead of just one!

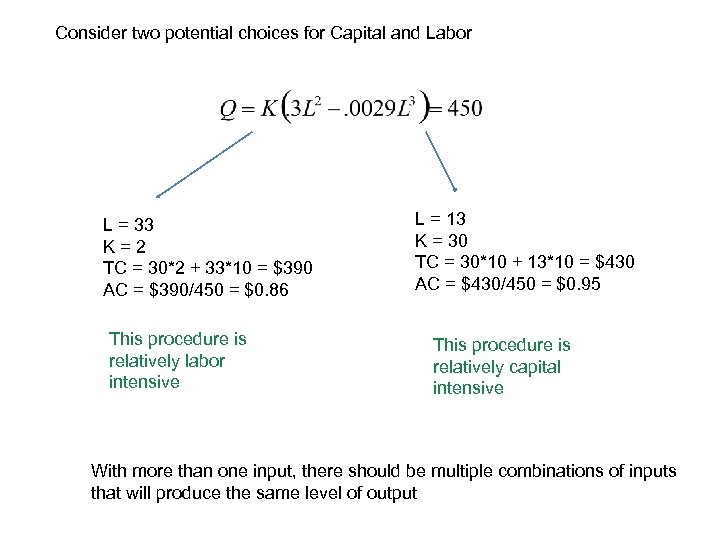

Consider two potential choices for Capital and Labor L = 33 K=2 TC = 30*2 + 33*10 = $390 AC = $390/450 = $0. 86 This procedure is relatively labor intensive L = 13 K = 30 TC = 30*10 + 13*10 = $430 AC = $430/450 = $0. 95 This procedure is relatively capital intensive With more than one input, there should be multiple combinations of inputs that will produce the same level of output

Consider two potential choices for Capital and Labor L = 33 K=2 TC = 30*2 + 33*10 = $390 AC = $390/450 = $0. 86 This procedure is relatively labor intensive L = 13 K = 30 TC = 30*10 + 13*10 = $430 AC = $430/450 = $0. 95 This procedure is relatively capital intensive With more than one input, there should be multiple combinations of inputs that will produce the same level of output

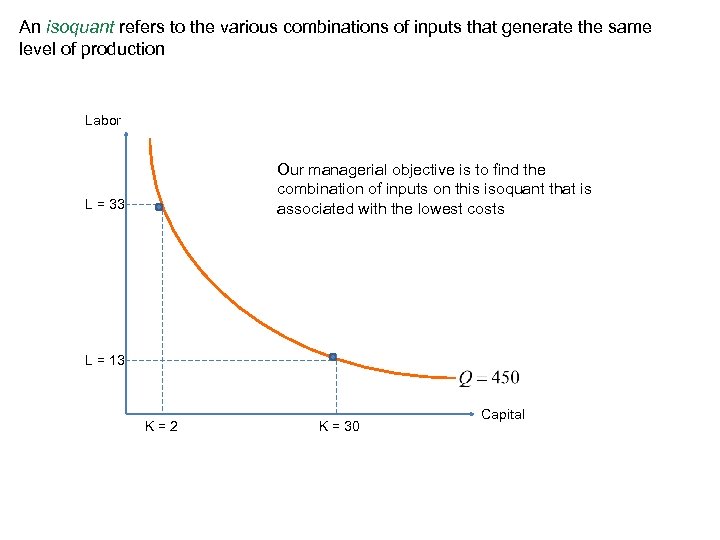

An isoquant refers to the various combinations of inputs that generate the same level of production Labor Our managerial objective is to find the combination of inputs on this isoquant that is associated with the lowest costs L = 33 L = 13 K=2 K = 30 Capital

An isoquant refers to the various combinations of inputs that generate the same level of production Labor Our managerial objective is to find the combination of inputs on this isoquant that is associated with the lowest costs L = 33 L = 13 K=2 K = 30 Capital

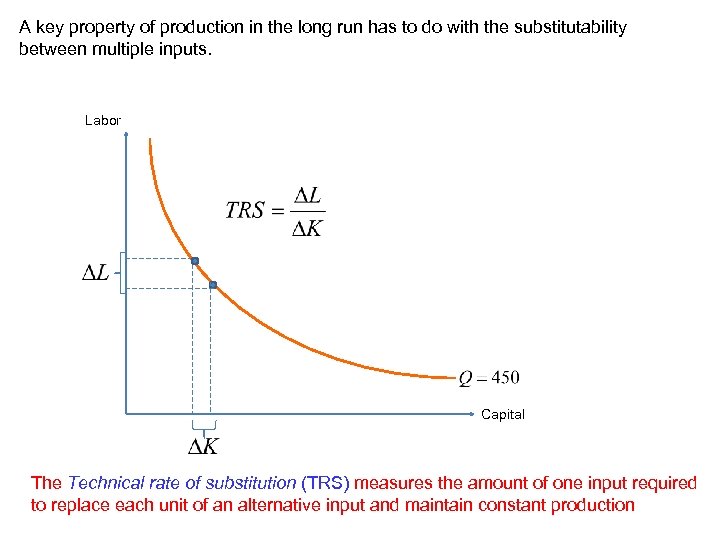

A key property of production in the long run has to do with the substitutability between multiple inputs. Labor Capital The Technical rate of substitution (TRS) measures the amount of one input required to replace each unit of an alternative input and maintain constant production

A key property of production in the long run has to do with the substitutability between multiple inputs. Labor Capital The Technical rate of substitution (TRS) measures the amount of one input required to replace each unit of an alternative input and maintain constant production

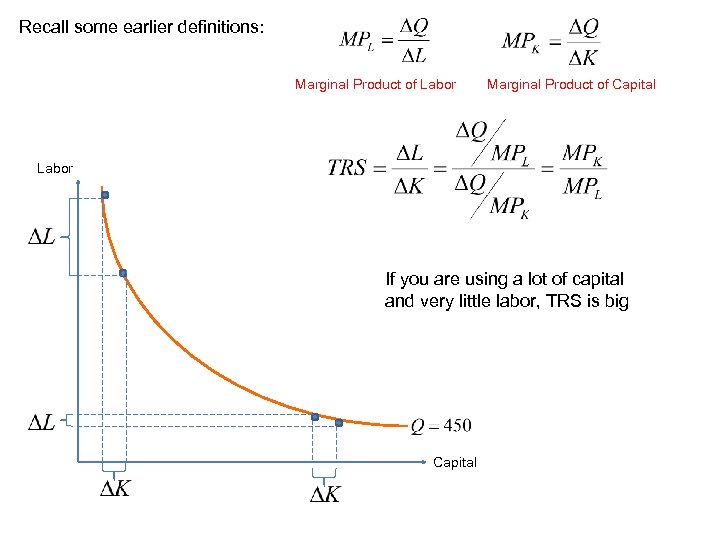

Recall some earlier definitions: Marginal Product of Labor Marginal Product of Capital Labor If you are using a lot of capital and very little labor, TRS is big Capital

Recall some earlier definitions: Marginal Product of Labor Marginal Product of Capital Labor If you are using a lot of capital and very little labor, TRS is big Capital

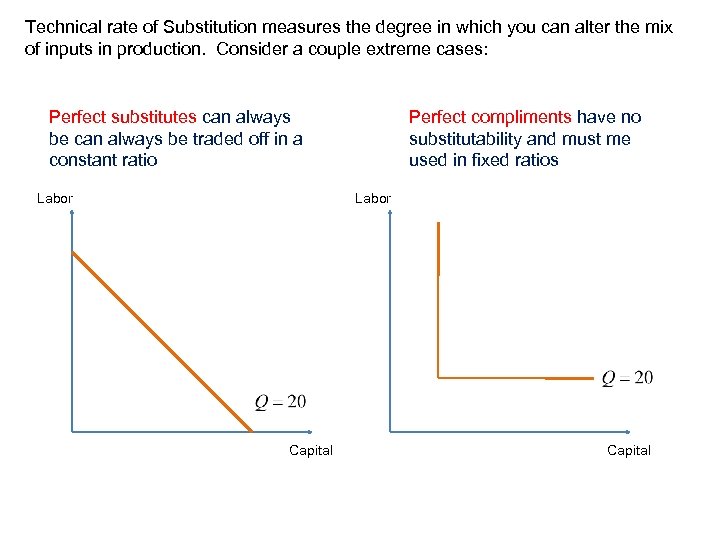

Technical rate of Substitution measures the degree in which you can alter the mix of inputs in production. Consider a couple extreme cases: Perfect substitutes can always be traded off in a constant ratio Labor Perfect compliments have no substitutability and must me used in fixed ratios Labor Capital

Technical rate of Substitution measures the degree in which you can alter the mix of inputs in production. Consider a couple extreme cases: Perfect substitutes can always be traded off in a constant ratio Labor Perfect compliments have no substitutability and must me used in fixed ratios Labor Capital

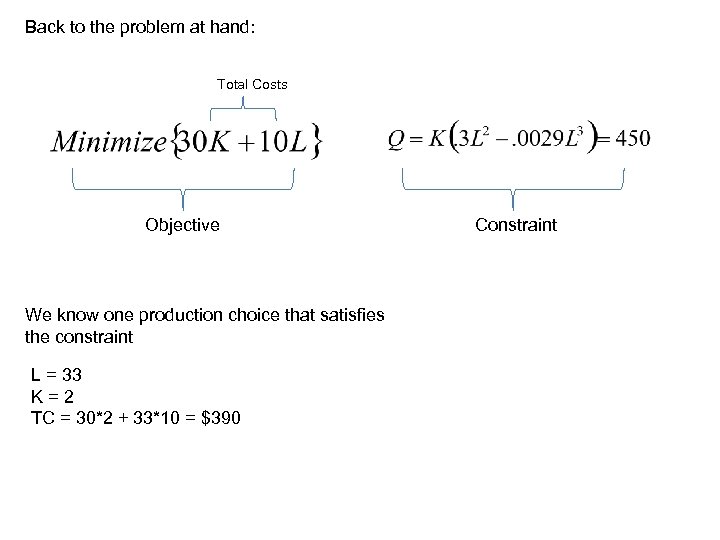

Back to the problem at hand: Total Costs Objective We know one production choice that satisfies the constraint L = 33 K=2 TC = 30*2 + 33*10 = $390 Constraint

Back to the problem at hand: Total Costs Objective We know one production choice that satisfies the constraint L = 33 K=2 TC = 30*2 + 33*10 = $390 Constraint

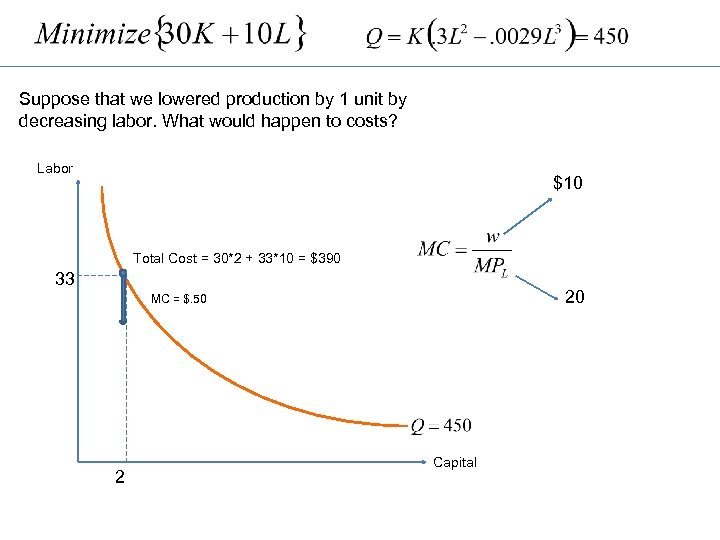

Suppose that we lowered production by 1 unit by decreasing labor. What would happen to costs? Labor $10 Total Cost = 30*2 + 33*10 = $390 33 20 MC = $. 50 2 Capital

Suppose that we lowered production by 1 unit by decreasing labor. What would happen to costs? Labor $10 Total Cost = 30*2 + 33*10 = $390 33 20 MC = $. 50 2 Capital

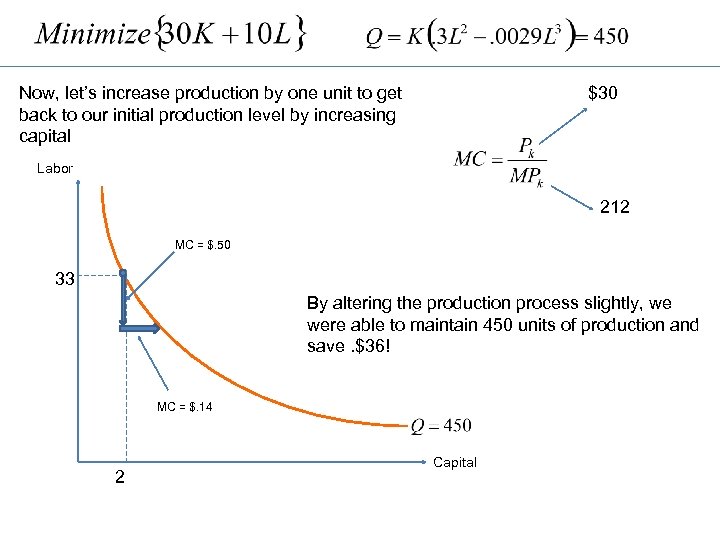

Now, let’s increase production by one unit to get back to our initial production level by increasing capital $30 Labor 212 MC = $. 50 33 By altering the production process slightly, we were able to maintain 450 units of production and save. $36! MC = $. 14 2 Capital

Now, let’s increase production by one unit to get back to our initial production level by increasing capital $30 Labor 212 MC = $. 50 33 By altering the production process slightly, we were able to maintain 450 units of production and save. $36! MC = $. 14 2 Capital

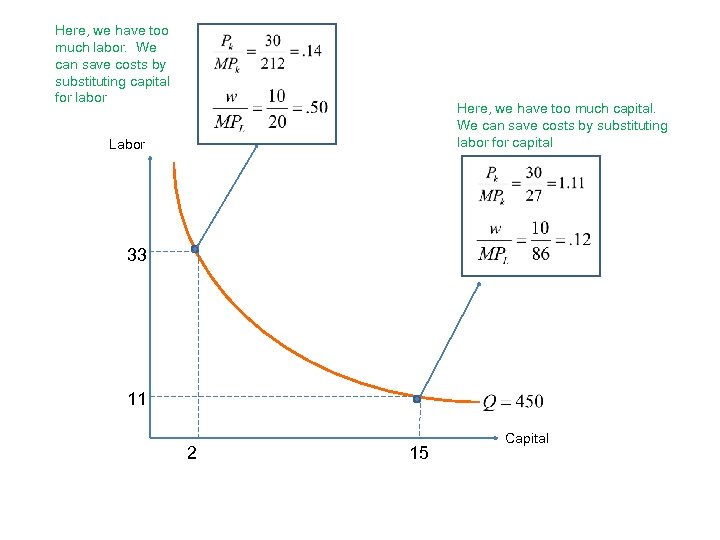

Here, we have too much labor. We can save costs by substituting capital for labor Here, we have too much capital. We can save costs by substituting labor for capital Labor 33 11 2 15 Capital

Here, we have too much labor. We can save costs by substituting capital for labor Here, we have too much capital. We can save costs by substituting labor for capital Labor 33 11 2 15 Capital

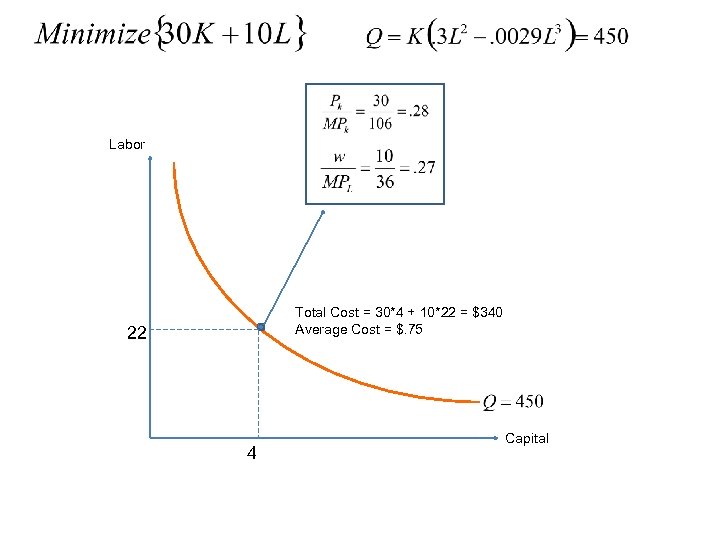

Labor Total Cost = 30*4 + 10*22 = $340 Average Cost = $. 75 22 4 Capital

Labor Total Cost = 30*4 + 10*22 = $340 Average Cost = $. 75 22 4 Capital

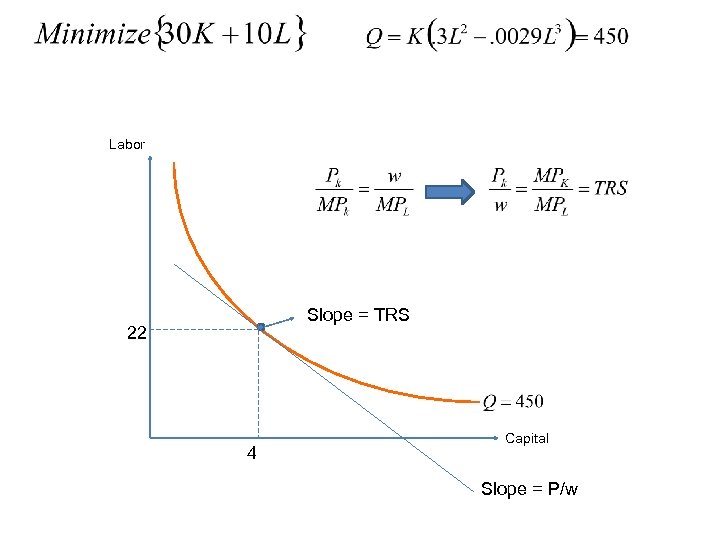

Labor Slope = TRS 22 4 Capital Slope = P/w

Labor Slope = TRS 22 4 Capital Slope = P/w

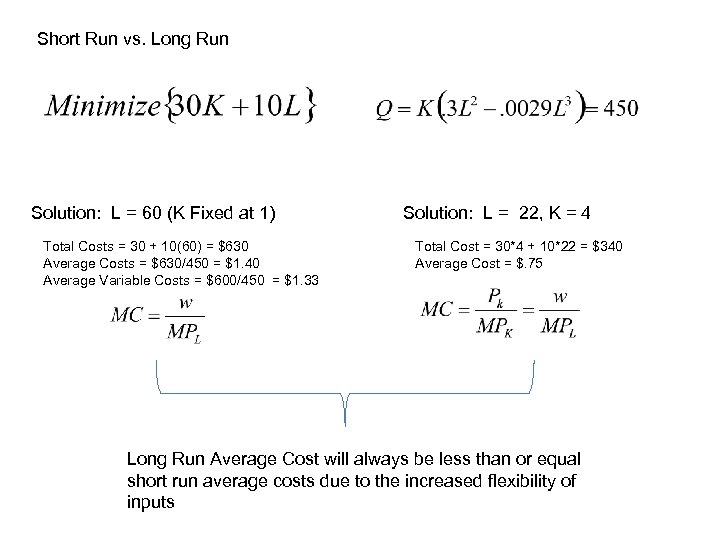

Short Run vs. Long Run Solution: L = 60 (K Fixed at 1) Total Costs = 30 + 10(60) = $630 Average Costs = $630/450 = $1. 40 Average Variable Costs = $600/450 = $1. 33 Solution: L = 22, K = 4 Total Cost = 30*4 + 10*22 = $340 Average Cost = $. 75 Long Run Average Cost will always be less than or equal short run average costs due to the increased flexibility of inputs

Short Run vs. Long Run Solution: L = 60 (K Fixed at 1) Total Costs = 30 + 10(60) = $630 Average Costs = $630/450 = $1. 40 Average Variable Costs = $600/450 = $1. 33 Solution: L = 22, K = 4 Total Cost = 30*4 + 10*22 = $340 Average Cost = $. 75 Long Run Average Cost will always be less than or equal short run average costs due to the increased flexibility of inputs

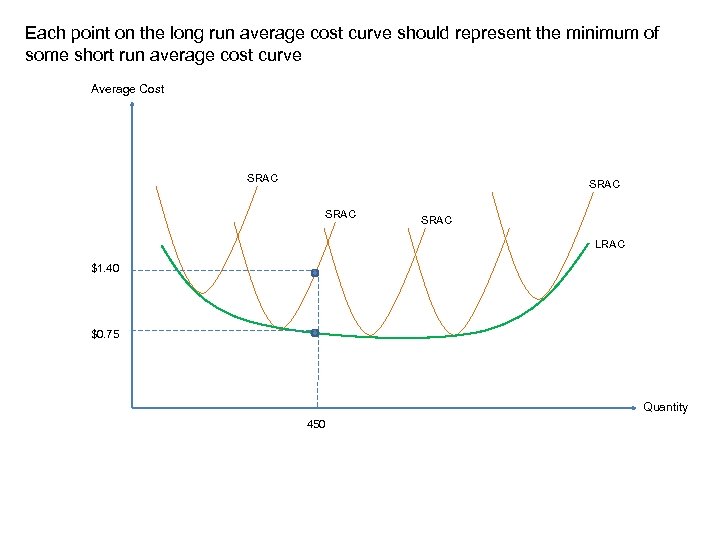

Each point on the long run average cost curve should represent the minimum of some short run average cost curve Average Cost SRAC LRAC $1. 40 $0. 75 Quantity 450

Each point on the long run average cost curve should represent the minimum of some short run average cost curve Average Cost SRAC LRAC $1. 40 $0. 75 Quantity 450

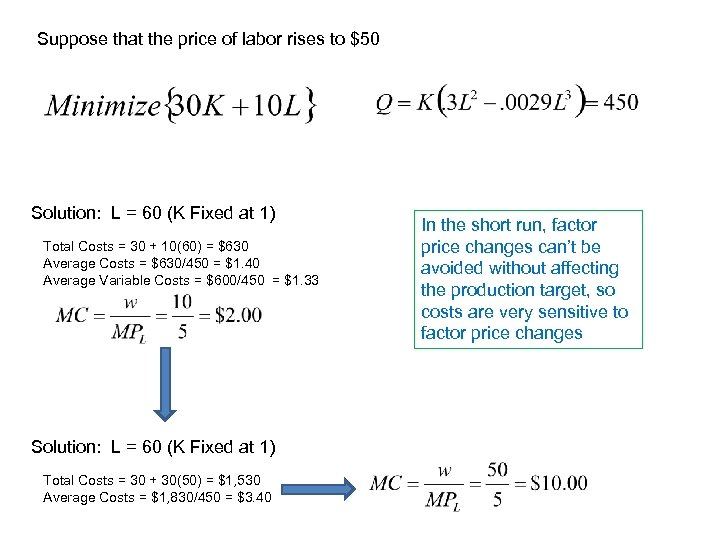

Suppose that the price of labor rises to $50 Solution: L = 60 (K Fixed at 1) Total Costs = 30 + 10(60) = $630 Average Costs = $630/450 = $1. 40 Average Variable Costs = $600/450 = $1. 33 Solution: L = 60 (K Fixed at 1) Total Costs = 30 + 30(50) = $1, 530 Average Costs = $1, 830/450 = $3. 40 In the short run, factor price changes can’t be avoided without affecting the production target, so costs are very sensitive to factor price changes

Suppose that the price of labor rises to $50 Solution: L = 60 (K Fixed at 1) Total Costs = 30 + 10(60) = $630 Average Costs = $630/450 = $1. 40 Average Variable Costs = $600/450 = $1. 33 Solution: L = 60 (K Fixed at 1) Total Costs = 30 + 30(50) = $1, 530 Average Costs = $1, 830/450 = $3. 40 In the short run, factor price changes can’t be avoided without affecting the production target, so costs are very sensitive to factor price changes

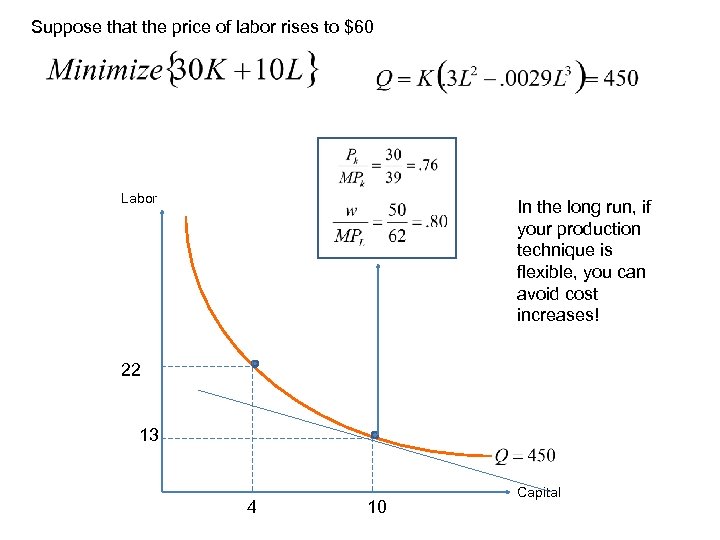

Suppose that the price of labor rises to $60 Labor In the long run, if your production technique is flexible, you can avoid cost increases! 22 13 4 10 Capital

Suppose that the price of labor rises to $60 Labor In the long run, if your production technique is flexible, you can avoid cost increases! 22 13 4 10 Capital

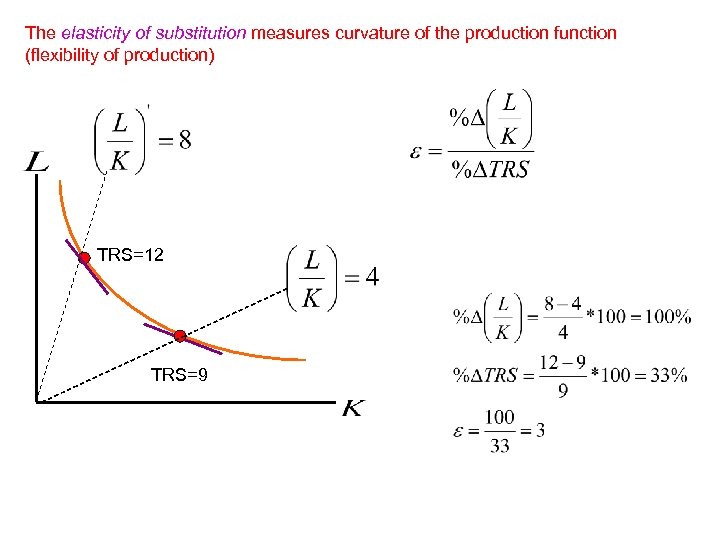

The elasticity of substitution measures curvature of the production function (flexibility of production) TRS=12 TRS=9

The elasticity of substitution measures curvature of the production function (flexibility of production) TRS=12 TRS=9

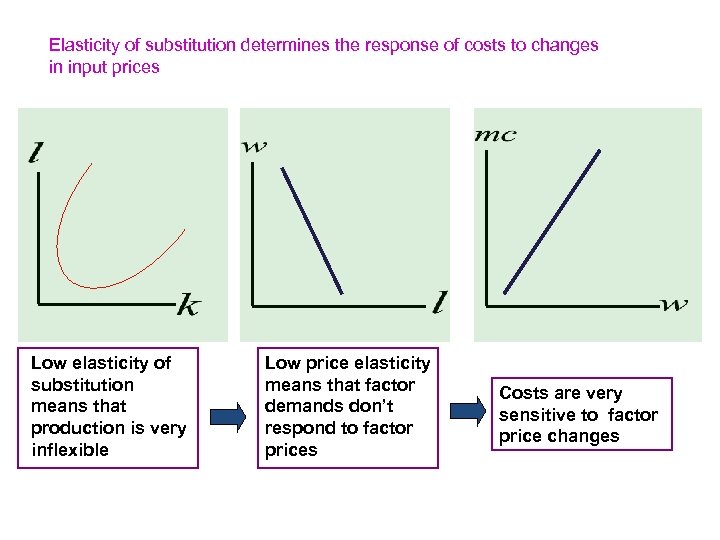

Elasticity of substitution determines the response of costs to changes in input prices Low elasticity of substitution means that production is very inflexible Low price elasticity means that factor demands don’t respond to factor prices Costs are very sensitive to factor price changes

Elasticity of substitution determines the response of costs to changes in input prices Low elasticity of substitution means that production is very inflexible Low price elasticity means that factor demands don’t respond to factor prices Costs are very sensitive to factor price changes

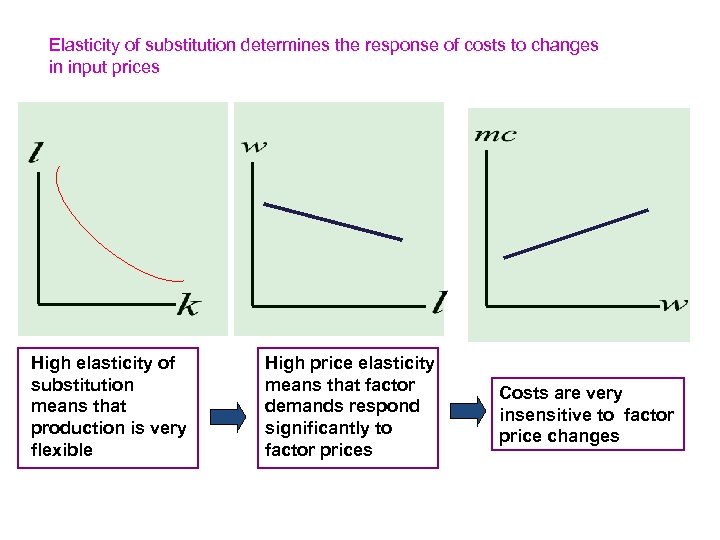

Elasticity of substitution determines the response of costs to changes in input prices High elasticity of substitution means that production is very flexible High price elasticity means that factor demands respond significantly to factor prices Costs are very insensitive to factor price changes

Elasticity of substitution determines the response of costs to changes in input prices High elasticity of substitution means that production is very flexible High price elasticity means that factor demands respond significantly to factor prices Costs are very insensitive to factor price changes

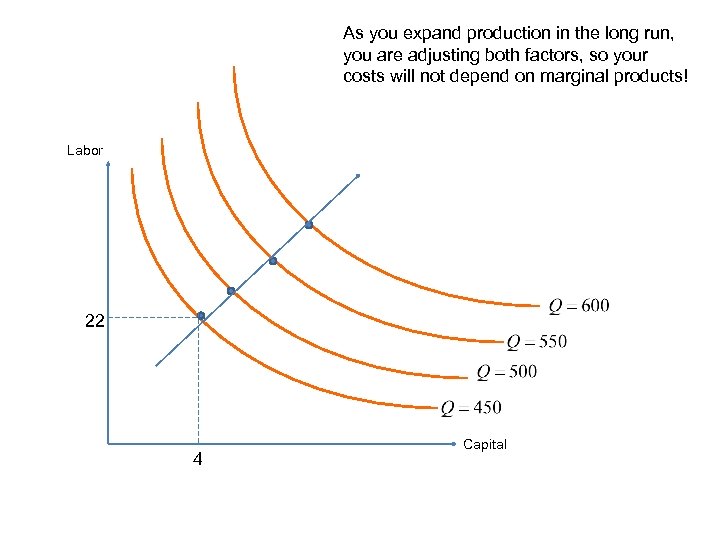

As you expand production in the long run, you are adjusting both factors, so your costs will not depend on marginal products! Labor 22 4 Capital

As you expand production in the long run, you are adjusting both factors, so your costs will not depend on marginal products! Labor 22 4 Capital

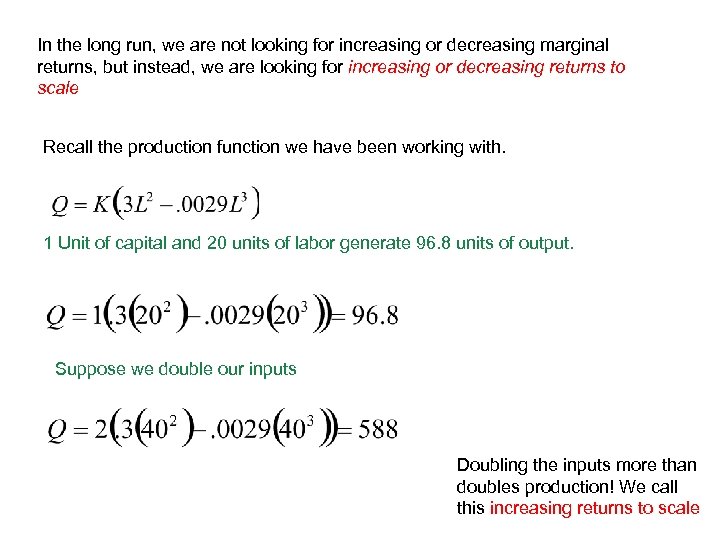

In the long run, we are not looking for increasing or decreasing marginal returns, but instead, we are looking for increasing or decreasing returns to scale Recall the production function we have been working with. 1 Unit of capital and 20 units of labor generate 96. 8 units of output. Suppose we double our inputs Doubling the inputs more than doubles production! We call this increasing returns to scale

In the long run, we are not looking for increasing or decreasing marginal returns, but instead, we are looking for increasing or decreasing returns to scale Recall the production function we have been working with. 1 Unit of capital and 20 units of labor generate 96. 8 units of output. Suppose we double our inputs Doubling the inputs more than doubles production! We call this increasing returns to scale

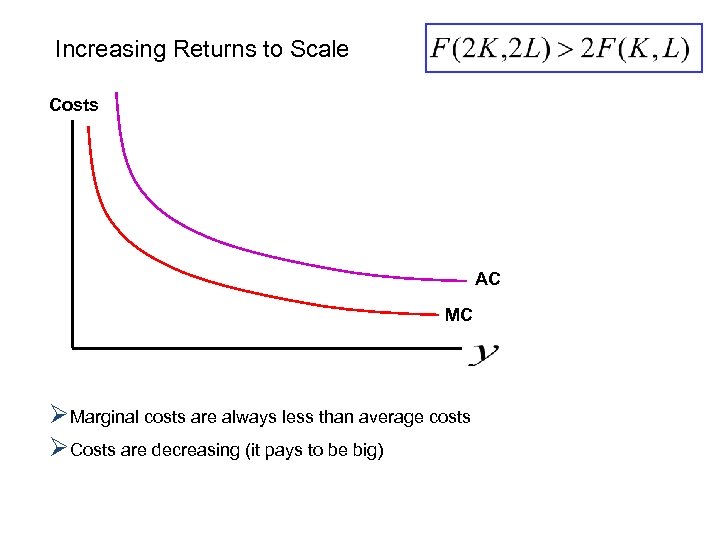

Increasing Returns to Scale Costs AC MC ØMarginal costs are always less than average costs ØCosts are decreasing (it pays to be big)

Increasing Returns to Scale Costs AC MC ØMarginal costs are always less than average costs ØCosts are decreasing (it pays to be big)

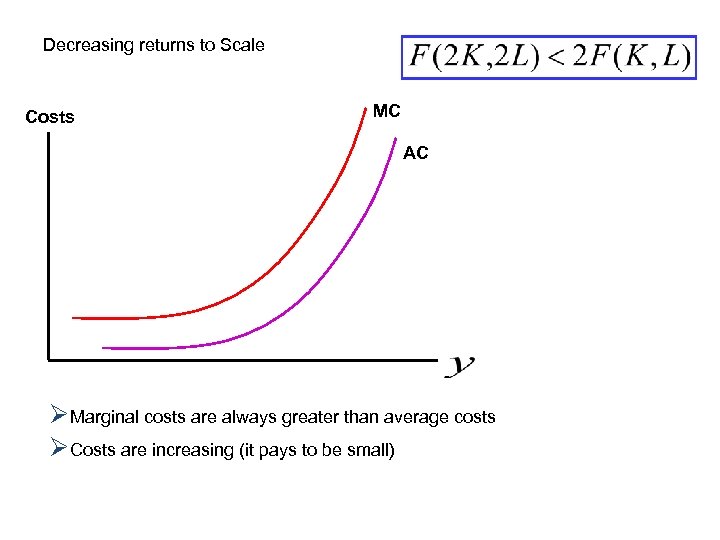

Decreasing returns to Scale Costs MC AC ØMarginal costs are always greater than average costs ØCosts are increasing (it pays to be small)

Decreasing returns to Scale Costs MC AC ØMarginal costs are always greater than average costs ØCosts are increasing (it pays to be small)

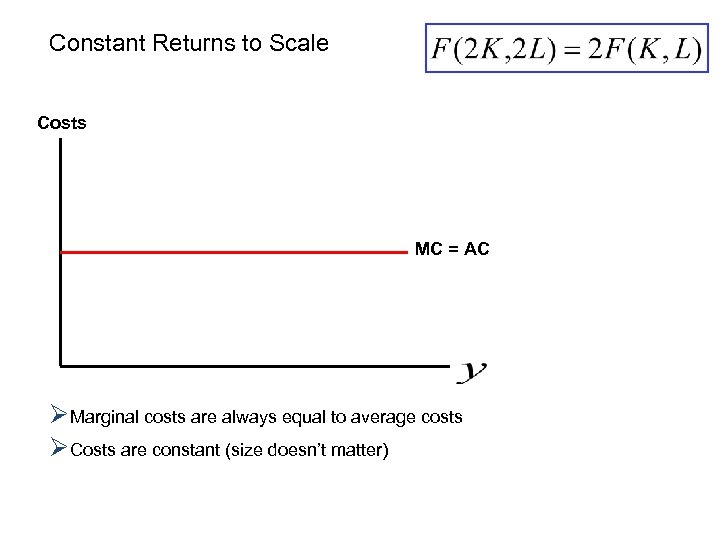

Constant Returns to Scale Costs MC = AC ØMarginal costs are always equal to average costs ØCosts are constant (size doesn’t matter)

Constant Returns to Scale Costs MC = AC ØMarginal costs are always equal to average costs ØCosts are constant (size doesn’t matter)

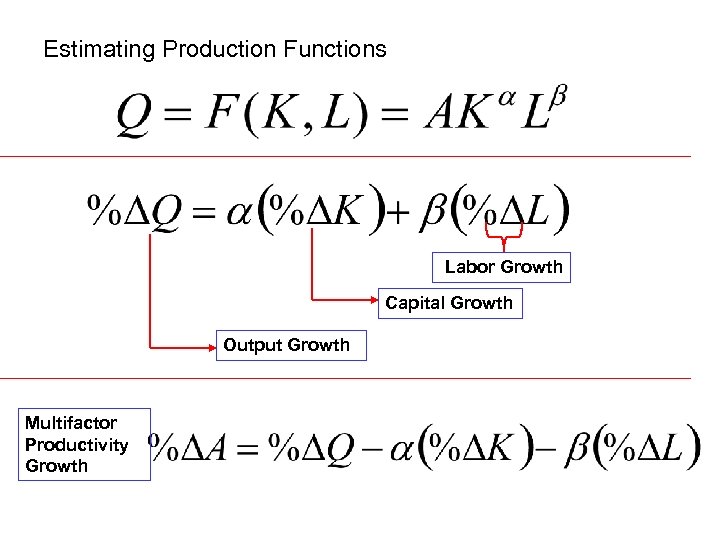

Estimating Production Functions Labor Growth Capital Growth Output Growth Multifactor Productivity Growth

Estimating Production Functions Labor Growth Capital Growth Output Growth Multifactor Productivity Growth

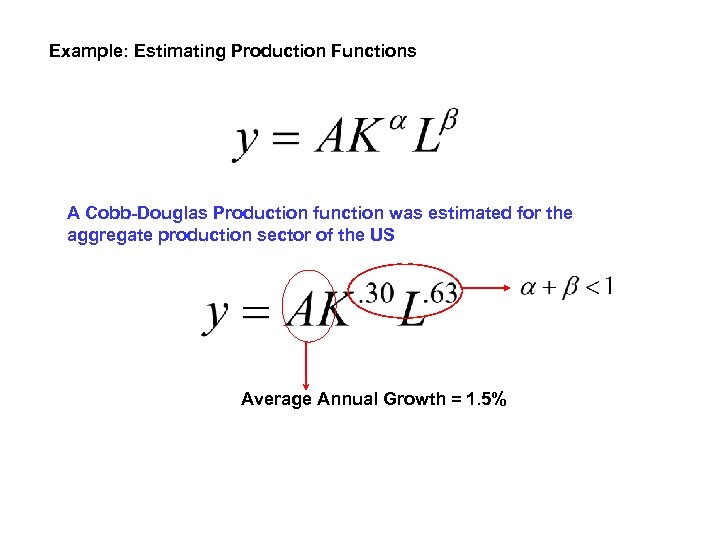

Example: Estimating Production Functions A Cobb-Douglas Production function was estimated for the aggregate production sector of the US Average Annual Growth = 1. 5%

Example: Estimating Production Functions A Cobb-Douglas Production function was estimated for the aggregate production sector of the US Average Annual Growth = 1. 5%

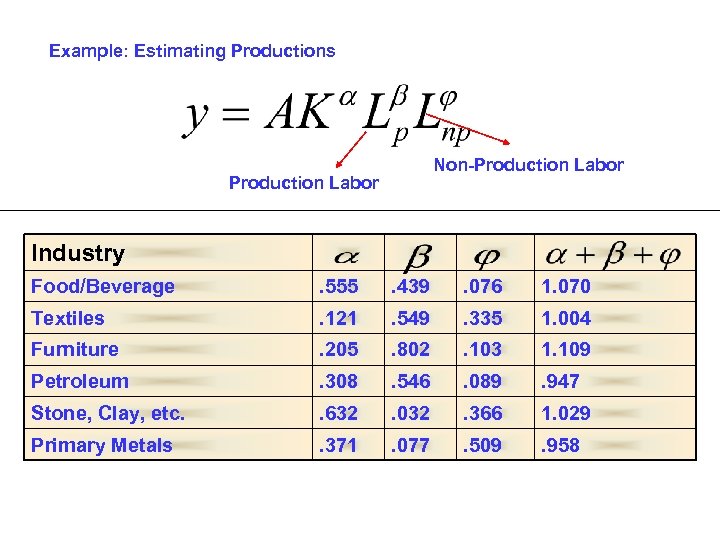

Example: Estimating Productions Non-Production Labor Industry Food/Beverage . 555 . 439 . 076 1. 070 Textiles . 121 . 549 . 335 1. 004 Furniture . 205 . 802 . 103 1. 109 Petroleum . 308 . 546 . 089 . 947 Stone, Clay, etc. . 632 . 032 . 366 1. 029 Primary Metals . 371 . 077 . 509 . 958

Example: Estimating Productions Non-Production Labor Industry Food/Beverage . 555 . 439 . 076 1. 070 Textiles . 121 . 549 . 335 1. 004 Furniture . 205 . 802 . 103 1. 109 Petroleum . 308 . 546 . 089 . 947 Stone, Clay, etc. . 632 . 032 . 366 1. 029 Primary Metals . 371 . 077 . 509 . 958