96399609e7e6afc076dfb25444ab215d.ppt

- Количество слайдов: 45

Economics/Market Review The Lull Before the Storm Daryl Montgomery June 18, 2015 Copyright 2015, All Rights Reserved

The contents of this presentation are not intended as a recommendation to buy or sell any security and are for educational purposes only The New York Investing meetup is not affiliated with the New York Life Insurance Co.

US Economic Recovery Hits Some Rough Patches

Stock Market – What Could Go Wrong?

Political News: If Elected, Trump Has Already Selected 1 st Dog

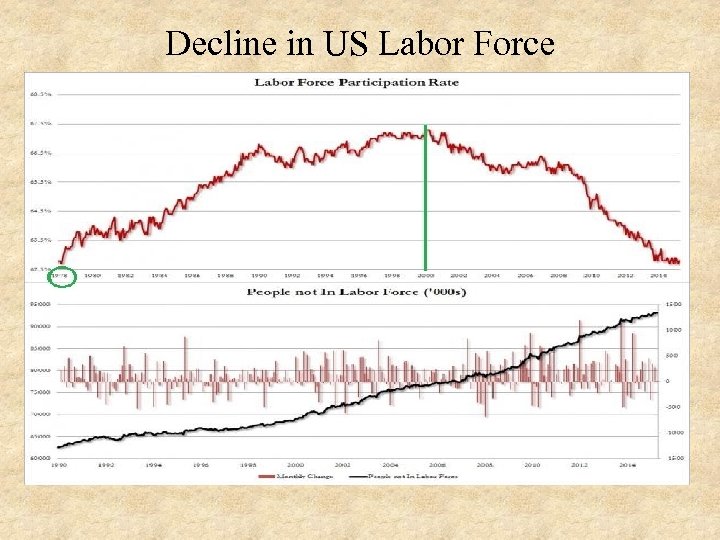

U. S. Roundup • Q 1 GDP came in at MINUS 0. 7% (doublyseasonally adjusted considered for stats) • Jobs 280 K in May, even though other econ indicator looking bad. Not in Labor Force hit record in April. • Retail sales up 1. 2%, mostly on higher gas prices (not adjusted for inflation). • Industrial Production down since Nov. US manufacturing technically in recession (MW) • Obamacare will cost taxpayers $50 K per enrollee.

Decline in US Labor Force

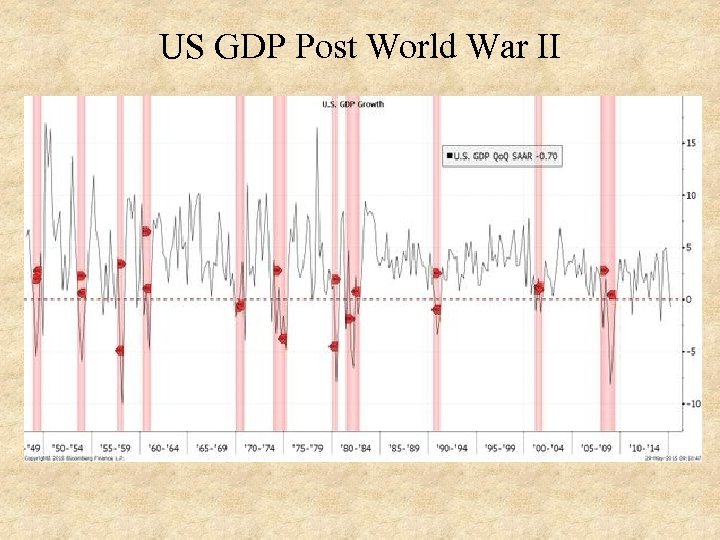

US GDP Post World War II

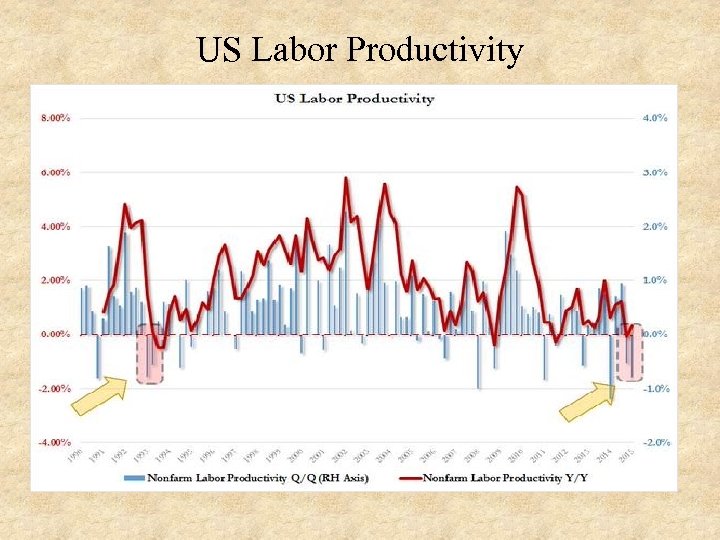

US Labor Productivity

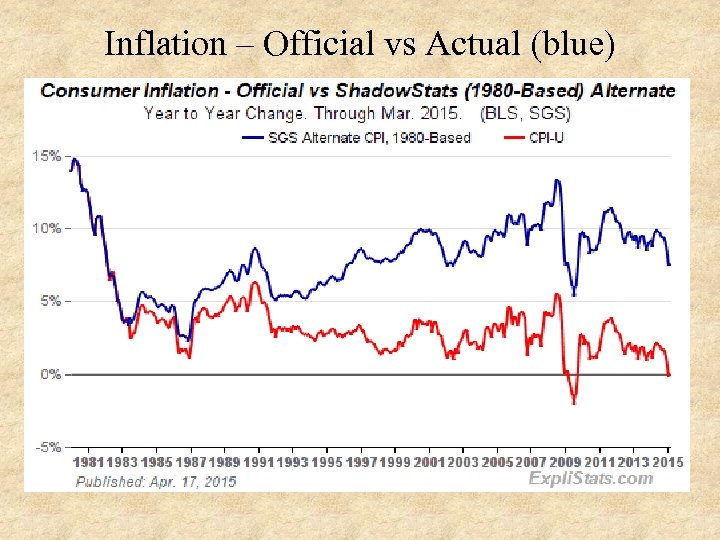

Inflation – Official vs Actual (blue)

Fiscal State of U. S. - Mostly Unchanged • National Debt: $18. 3 trillion State & Local Debt: $3. 1 trillion GDP: $17. 8 trillion[calculation changed] Debt/GDP Ratio: 103% (120% Fed+State) • Unfunded Liabilities: $ 96 trillion Total National Assets: $116 trillion • Debt doesn’t include Federal Reserve, Fannie Mae + Freddie Mac and FHA obligations • Total US Debt: $ 61. 1 trillion* • Student Loans: $1. 4 trillion • Federal Budget Deficit -2014 $0. 483 trillion (CBO described as “modest”) • 2014 Trade Deficit $737 billion. • Historically average interest rates would bankrupt U. S.

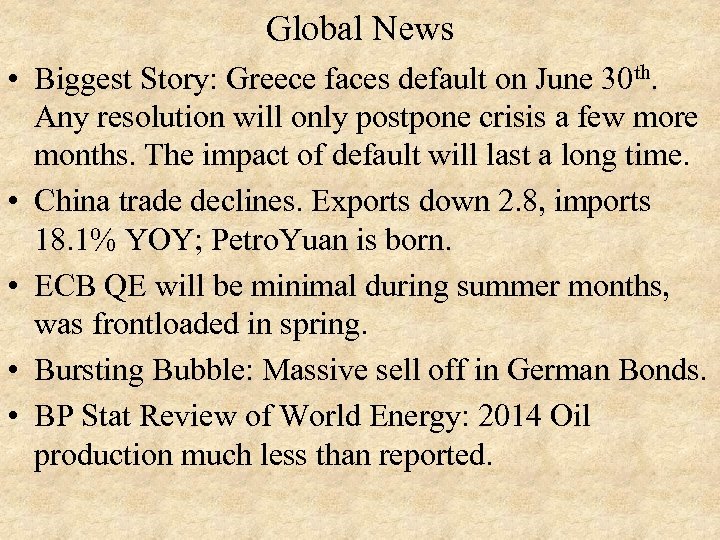

Global News • Biggest Story: Greece faces default on June 30 th. Any resolution will only postpone crisis a few more months. The impact of default will last a long time. • China trade declines. Exports down 2. 8, imports 18. 1% YOY; Petro. Yuan is born. • ECB QE will be minimal during summer months, was frontloaded in spring. • Bursting Bubble: Massive sell off in German Bonds. • BP Stat Review of World Energy: 2014 Oil production much less than reported.

Who Knows if Greece Will Default?

German Bund Selloff - Yield

Stocks, Commodities, Currencies, Bonds

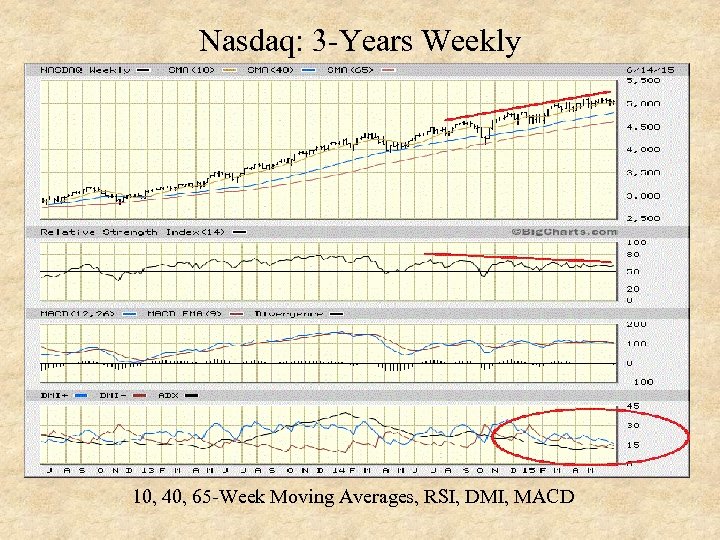

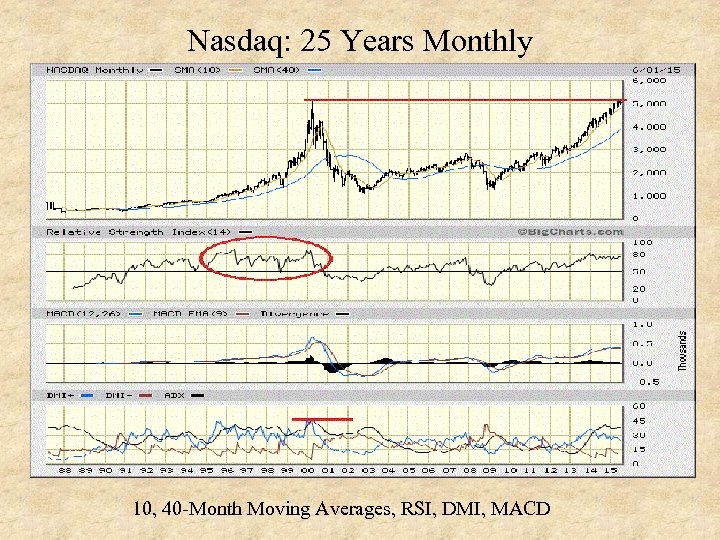

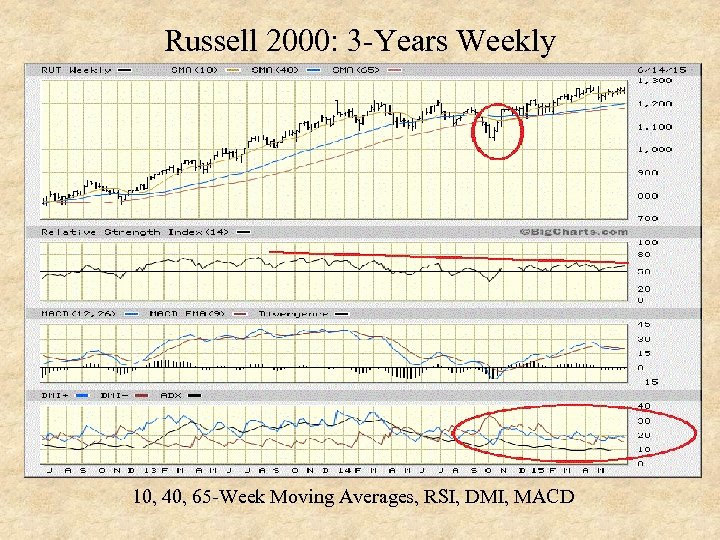

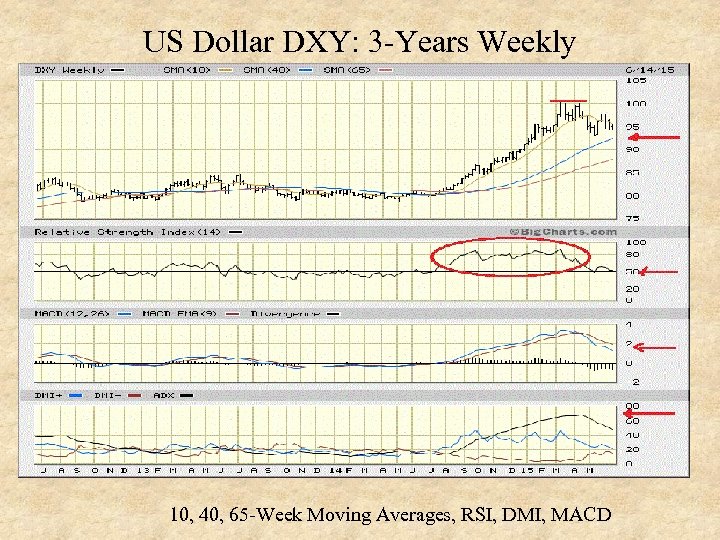

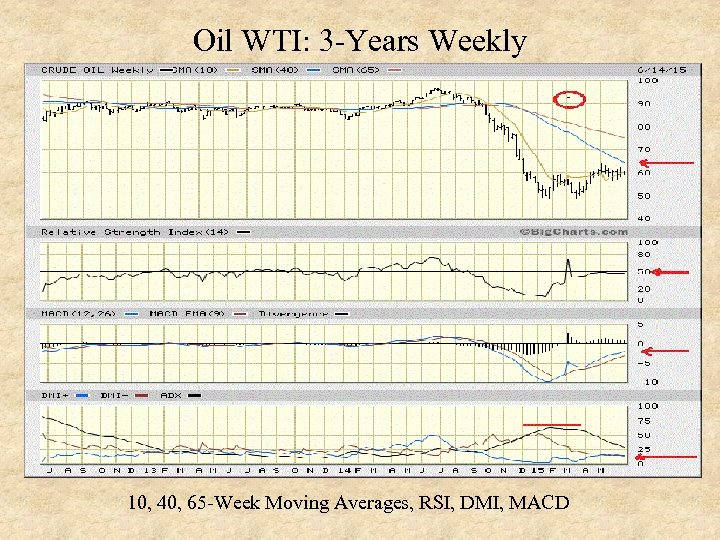

Market Summary • US stocks moving sideways. European stocks selling off. • Massive global sell off in bonds. Since March, there has been a large drop in bond long positions by big money. • Nasdaq has touched all-time high. • Dollar seems to have peaked. • Only cheap assets are commodities. • Oil has a confirmed double bottom.

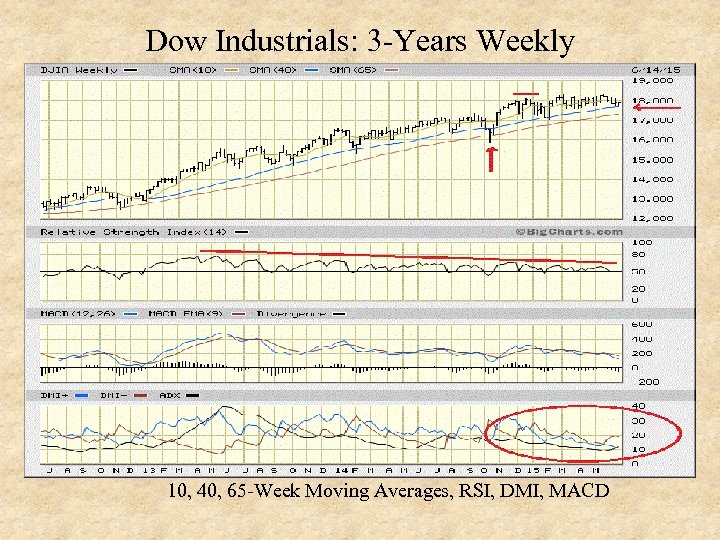

Dow Industrials: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

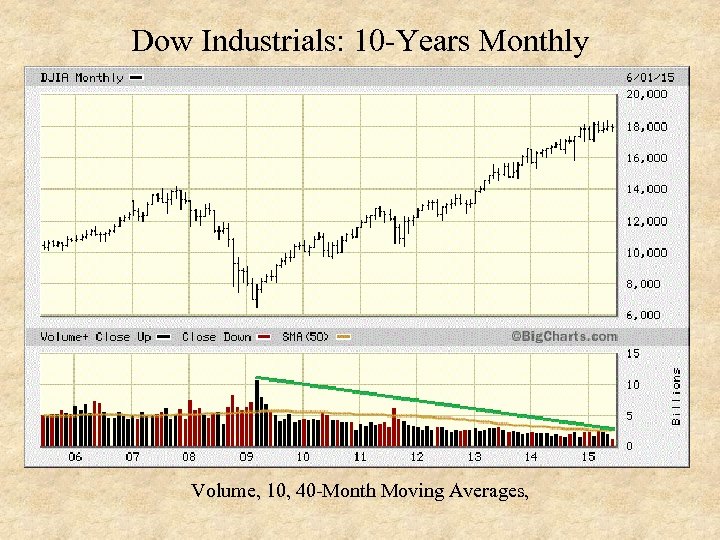

Dow Industrials: 10 -Years Monthly Volume, 10, 40 -Month Moving Averages,

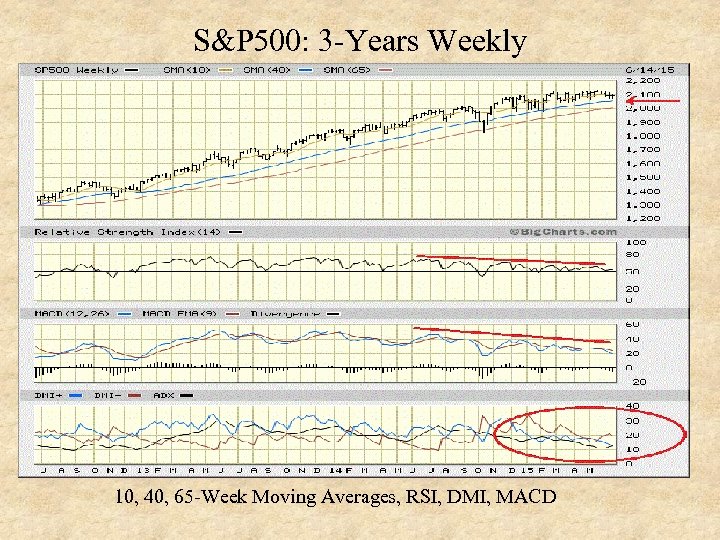

S&P 500: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

Nasdaq: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

Nasdaq: 25 Years Monthly 10, 40 -Month Moving Averages, RSI, DMI, MACD

Russell 2000: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

US Dollar DXY: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

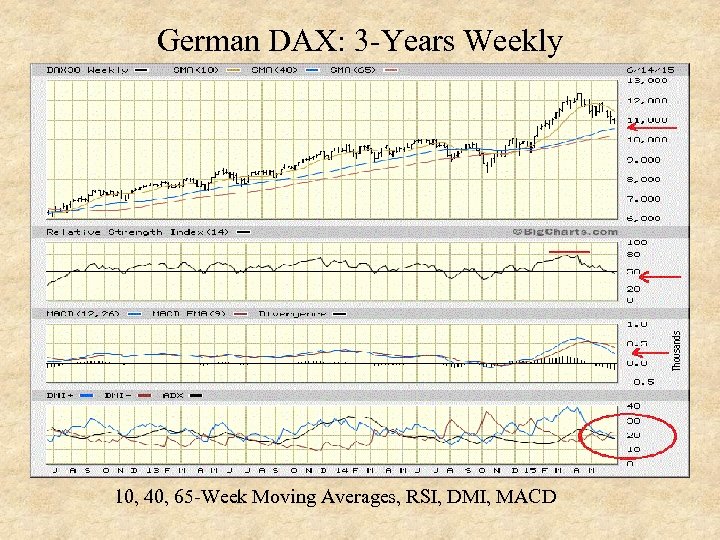

German DAX: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

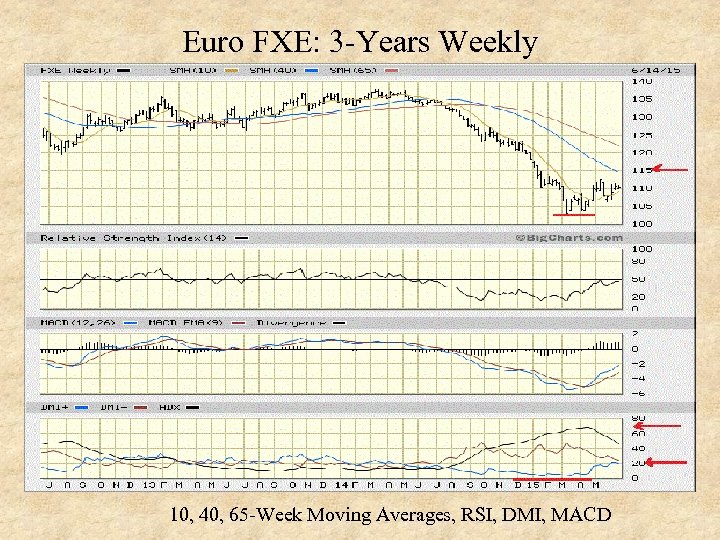

Euro FXE: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

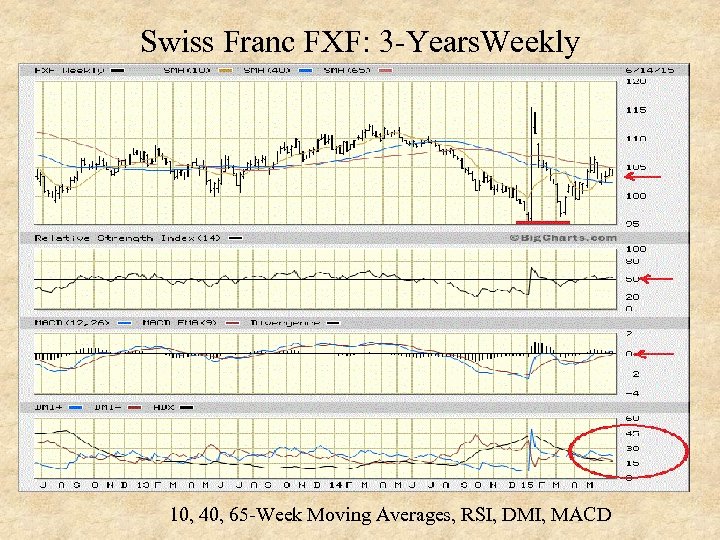

Swiss Franc FXF: 3 -Years. Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

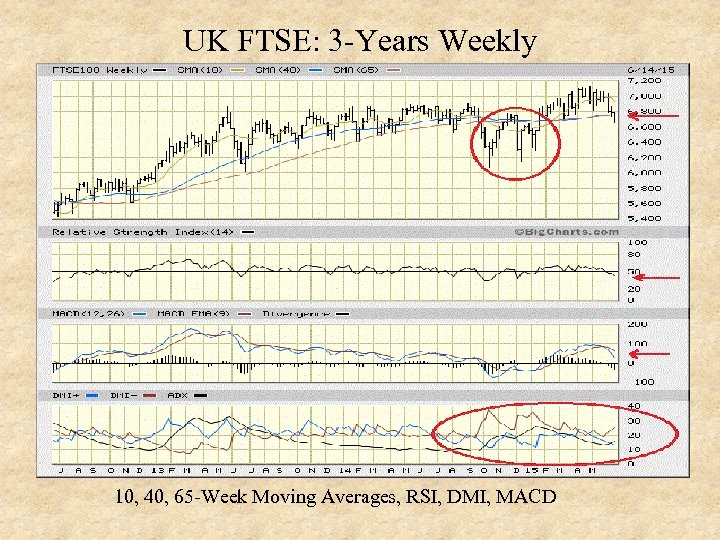

UK FTSE: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

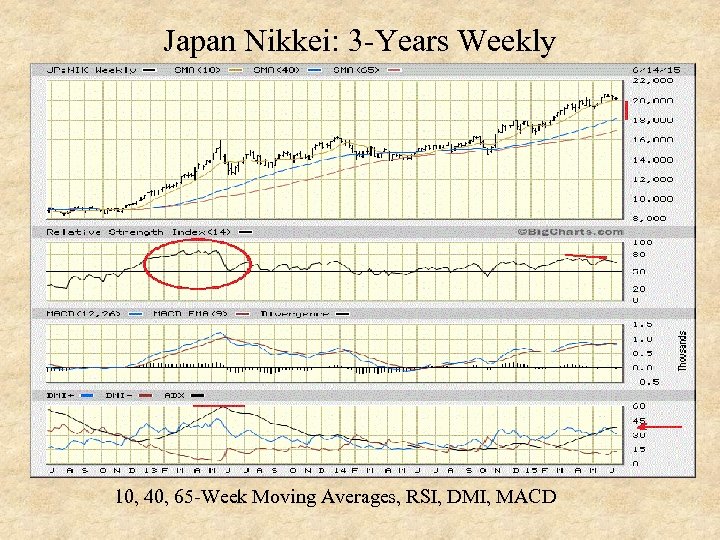

Japan Nikkei: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

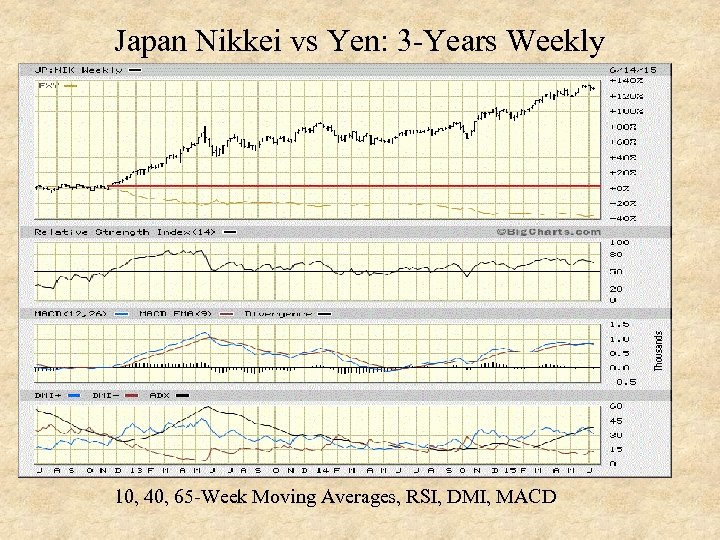

Japan Nikkei vs Yen: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

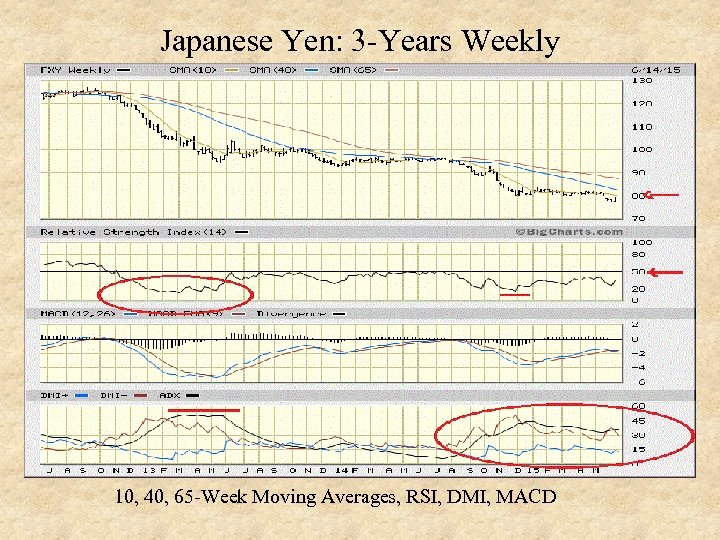

Japanese Yen: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

China Shanghai Composite: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

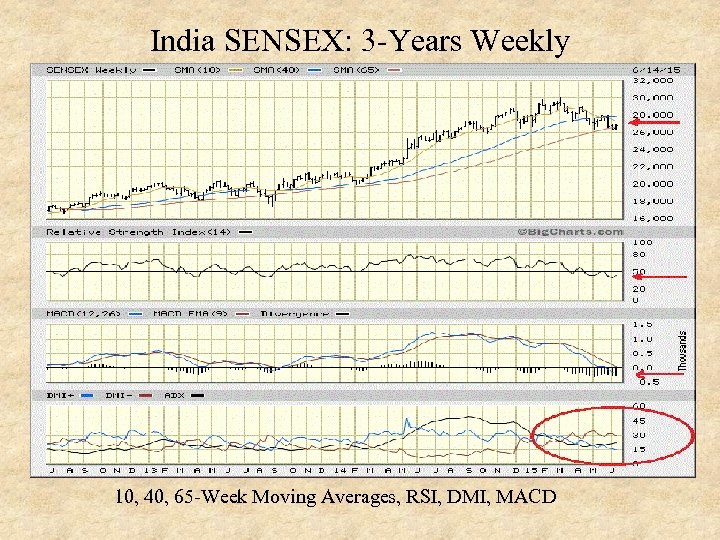

India SENSEX: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

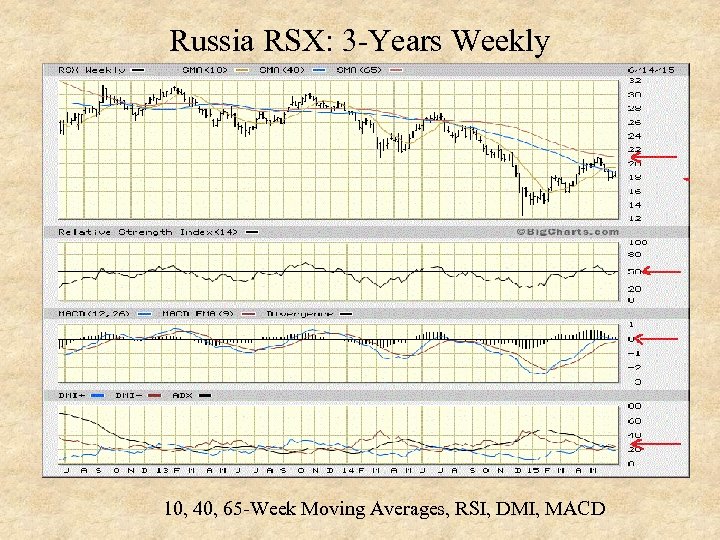

Russia RSX: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

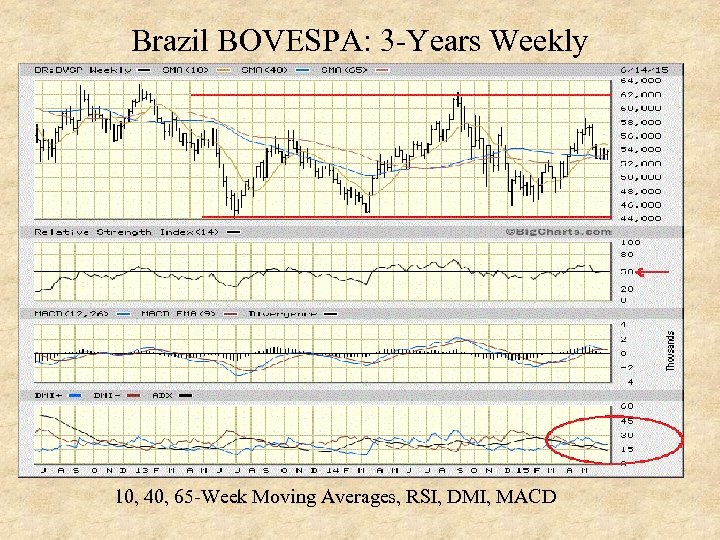

Brazil BOVESPA: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

Oil WTI: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

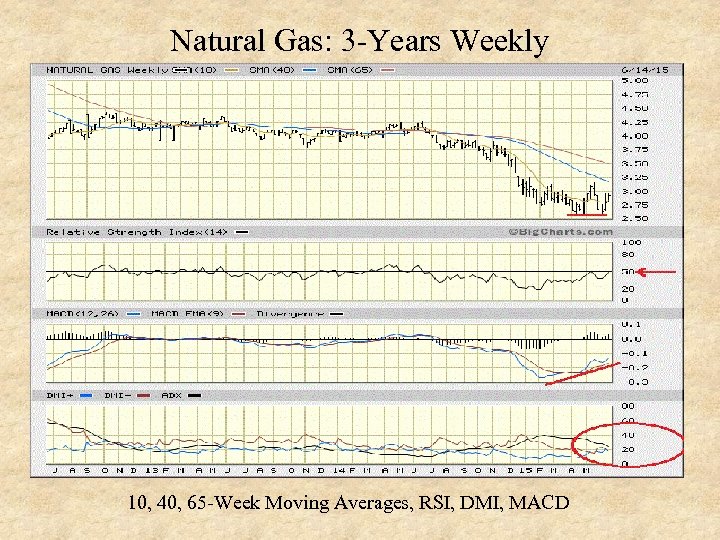

Natural Gas: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

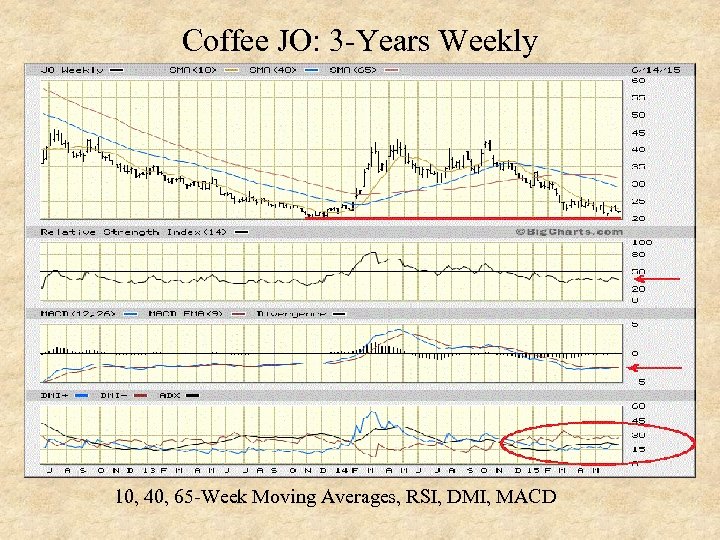

Coffee JO: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

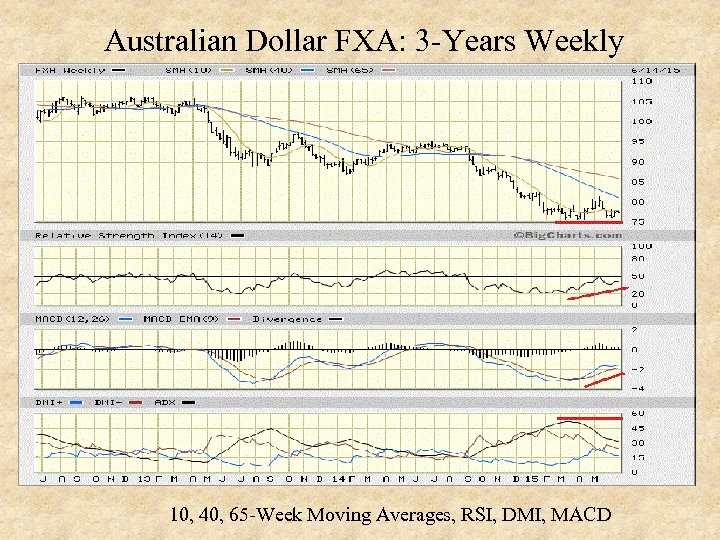

Australian Dollar FXA: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

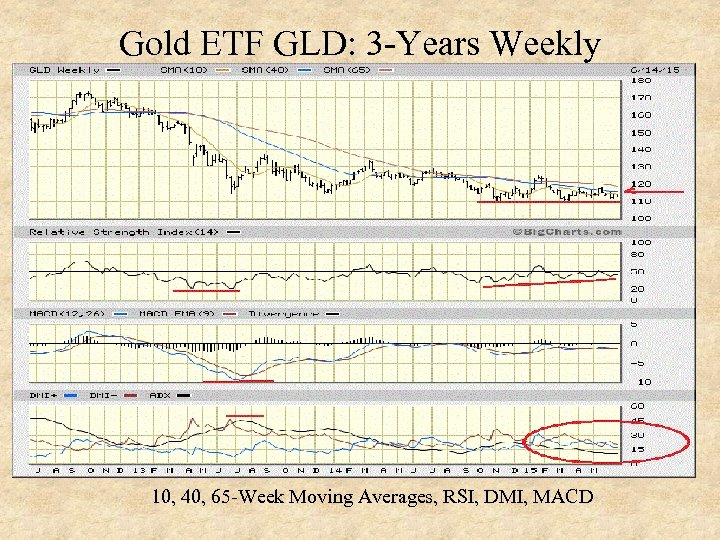

Gold ETF GLD: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

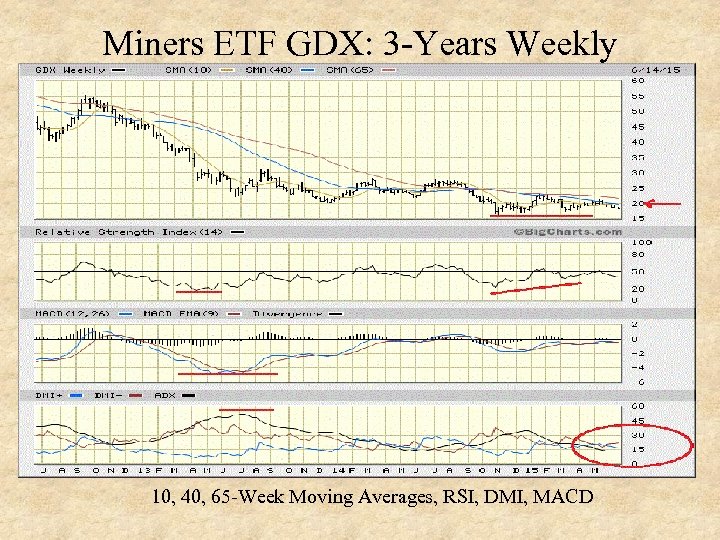

Miners ETF GDX: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

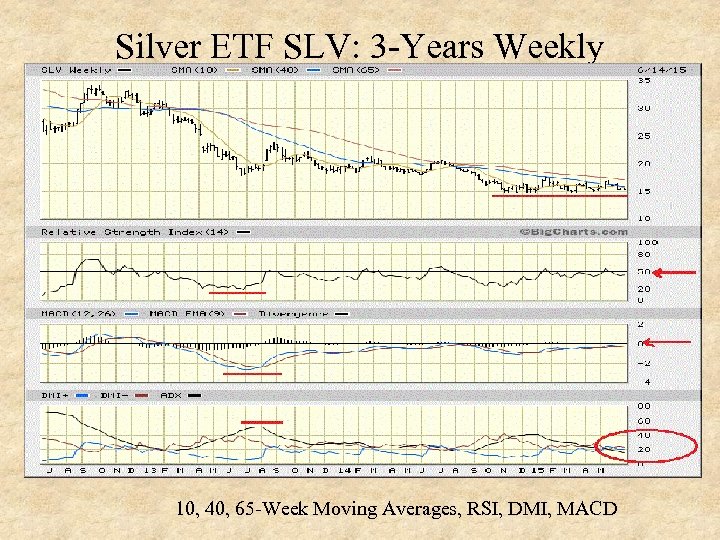

Silver ETF SLV: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

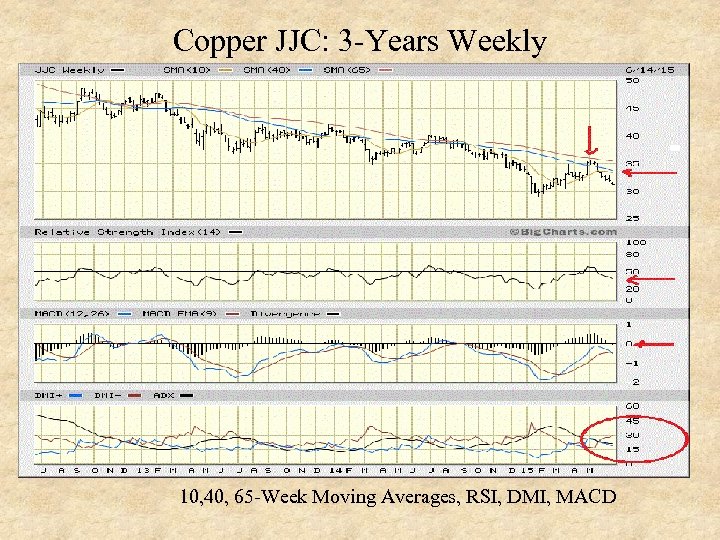

Copper JJC: 3 -Years Weekly 10, 40, 65 -Week Moving Averages, RSI, DMI, MACD

30 -Year Treasury Yield: 3 -Years Weekly 10, 40, 65 -Weekly Moving Averages, RSI, DMI, MACD

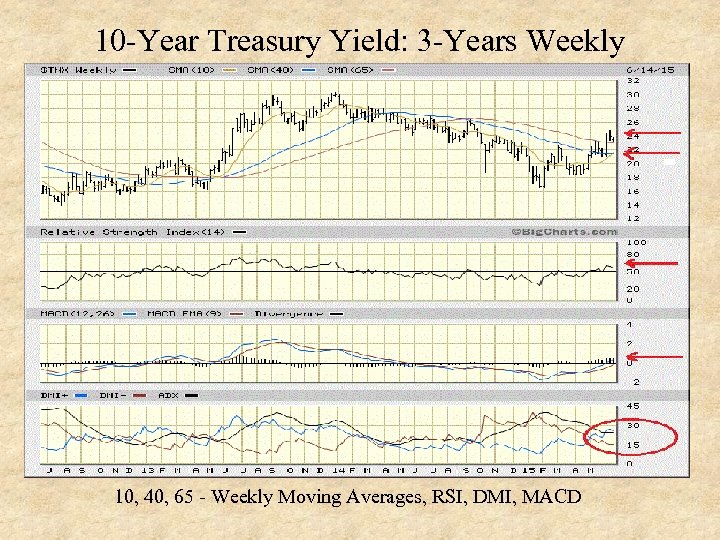

10 -Year Treasury Yield: 3 -Years Weekly 10, 40, 65 - Weekly Moving Averages, RSI, DMI, MACD

The End

96399609e7e6afc076dfb25444ab215d.ppt