5f7e5a30eb87e84578119208d1da253f.ppt

- Количество слайдов: 37

Economics for CED Spring 2004 Noémi Giszpenc Spring 2004 Lecture 7: Macro: Growth of the National Economy May 18, 2004 Economics for CED: Lecture 7, Noémi Giszpenc

Economics for CED Spring 2004 Noémi Giszpenc Spring 2004 Lecture 7: Macro: Growth of the National Economy May 18, 2004 Economics for CED: Lecture 7, Noémi Giszpenc

GNP changes over time • Value of GNP is measured in $, not stuff. – • Measured using prices of goods & services. Therefore GNP can go up in three ways: 1. More stuff produced 2. Prices rise with no change in quality 3. Prices rise with increase in quality Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 2

GNP changes over time • Value of GNP is measured in $, not stuff. – • Measured using prices of goods & services. Therefore GNP can go up in three ways: 1. More stuff produced 2. Prices rise with no change in quality 3. Prices rise with increase in quality Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 2

Changes in Price (not Quality) • Example: In 1993, pizza pies cost $10 and hamburgers cost $2. In 1994, pizza costs $9 and burgers $3 • 1993: John Deaux ate 15 pizzas and 20 burgers (cost: $190) 1994: 20 pizzas and 16 burgers ($228) • Did consumption increase or decrease? Is he better off or worse off? Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 3

Changes in Price (not Quality) • Example: In 1993, pizza pies cost $10 and hamburgers cost $2. In 1994, pizza costs $9 and burgers $3 • 1993: John Deaux ate 15 pizzas and 20 burgers (cost: $190) 1994: 20 pizzas and 16 burgers ($228) • Did consumption increase or decrease? Is he better off or worse off? Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 3

Example continued • John is at least as well off (if his tastes haven’t changed). Why? • 1993 consumption of 15 p. & 20 b. at 1994 prices = $195 < $228 --means that John could have afforded 1993 consumption but chose different combo (one he presumably likes better) • Follows that consumption increased Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 4

Example continued • John is at least as well off (if his tastes haven’t changed). Why? • 1993 consumption of 15 p. & 20 b. at 1994 prices = $195 < $228 --means that John could have afforded 1993 consumption but chose different combo (one he presumably likes better) • Follows that consumption increased Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 4

In general, if people… • have more than enough income to buy the same goods and services that they bought in an earlier period - • but they choose to buy a different assortment - • then we infer that on the whole, they are better off, • and production has increased. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 5

In general, if people… • have more than enough income to buy the same goods and services that they bought in an earlier period - • but they choose to buy a different assortment - • then we infer that on the whole, they are better off, • and production has increased. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 5

Making price level comparisons • Base Year: the year used as basis for a comparison of output or the price level (arbitrary). • Current Year: the year being compared to the base year (not “this” year). • “fixed weight price index” or Laspeyres’ Index – The cost of the base year assortment of goods at current prices divided by the cost of the base year assortment of goods at base year prices Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 6

Making price level comparisons • Base Year: the year used as basis for a comparison of output or the price level (arbitrary). • Current Year: the year being compared to the base year (not “this” year). • “fixed weight price index” or Laspeyres’ Index – The cost of the base year assortment of goods at current prices divided by the cost of the base year assortment of goods at base year prices Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 6

Another fixed-weight index • Paasche’s Index: – The cost of the current year assortment of goods at current prices divided by the cost of the current year assortment of goods at base year prices • Both indices assume unchanged consumption. – But consumers tend to buy more goods whose prices have risen less to achieve same levels of well-being. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 7

Another fixed-weight index • Paasche’s Index: – The cost of the current year assortment of goods at current prices divided by the cost of the current year assortment of goods at base year prices • Both indices assume unchanged consumption. – But consumers tend to buy more goods whose prices have risen less to achieve same levels of well-being. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 7

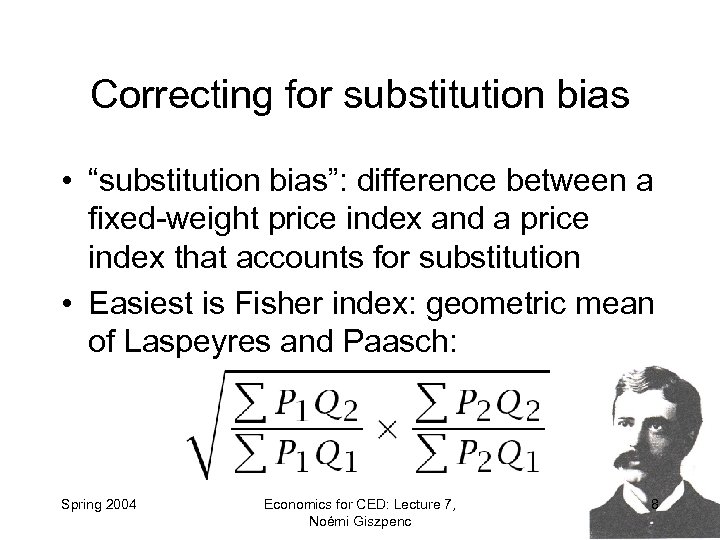

Correcting for substitution bias • “substitution bias”: difference between a fixed-weight price index and a price index that accounts for substitution • Easiest is Fisher index: geometric mean of Laspeyres and Paasch: Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 8

Correcting for substitution bias • “substitution bias”: difference between a fixed-weight price index and a price index that accounts for substitution • Easiest is Fisher index: geometric mean of Laspeyres and Paasch: Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 8

What happens with many years? • Two ways of handling multiple years: – Direct: always use same base year (I 87, 90) – Chained: multiplies consecutive indices that use consecutive years as base year. ‘ 87 to ‘ 90: (I 87, 87 x. I 87, 88 x. I 88, 89 x. I 89, 90) • Chain indexes are preferable for year-to-year or quarter-to-quarter comparisons. • Direct index preferable for longer term comparisons (1982 to 1987, or 1987 to 1990). – Most reasonable for up to 5 years--after more time, problematic to assume no changes in tastes, goods Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 9

What happens with many years? • Two ways of handling multiple years: – Direct: always use same base year (I 87, 90) – Chained: multiplies consecutive indices that use consecutive years as base year. ‘ 87 to ‘ 90: (I 87, 87 x. I 87, 88 x. I 88, 89 x. I 89, 90) • Chain indexes are preferable for year-to-year or quarter-to-quarter comparisons. • Direct index preferable for longer term comparisons (1982 to 1987, or 1987 to 1990). – Most reasonable for up to 5 years--after more time, problematic to assume no changes in tastes, goods Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 9

Back to John Deaux • Let 1993 be base year. • How much would it cost in 1994 prices to buy the goods and services John bought in 1993? $195. • In the base year, 1993, it had cost $190. • Using Laspeyres’ Index: the price level in 1994 (relative to a 1993 base year) is 195/190 = 1. 026 • The inflation from 1993 to 1994 is. 026=2. 6% Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 10

Back to John Deaux • Let 1993 be base year. • How much would it cost in 1994 prices to buy the goods and services John bought in 1993? $195. • In the base year, 1993, it had cost $190. • Using Laspeyres’ Index: the price level in 1994 (relative to a 1993 base year) is 195/190 = 1. 026 • The inflation from 1993 to 1994 is. 026=2. 6% Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 10

How much did consumption really increase? • 1993: John spent $190; 1994: $228 • This is a nominal (not adjusted) increase in spending of 20% = (228 -190)/190 • We know that 2. 6% was due to inflation (changes in prices) • Adjusting for inflation, John’s consumption has increased by 20% - 2. 6% = 17. 4%. – 17. 4% is John's increase in "real consumption. " • In this context, "real" means the same as "adjusted for inflation. " Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 11

How much did consumption really increase? • 1993: John spent $190; 1994: $228 • This is a nominal (not adjusted) increase in spending of 20% = (228 -190)/190 • We know that 2. 6% was due to inflation (changes in prices) • Adjusting for inflation, John’s consumption has increased by 20% - 2. 6% = 17. 4%. – 17. 4% is John's increase in "real consumption. " • In this context, "real" means the same as "adjusted for inflation. " Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 11

Applying measures to GNP: ‘ 92 & ’ 93 – Measure the outputs of various goods and services with 1992 prices for both years. – Thus, “real GDP” for 1993 is the sum of 1993 production of various goods and services valued at 1992 prices. • Could equally well do it the other way around -- both years in 1993 prices. – The two answers will not come out the same. Each is inaccurate -- biased -- and they are biased in opposite directions. – So the. Bureau of Economic Analysis (BEA) uses chained real dollars. • And also attempts to adjust for quality--if price went up but quality went up, too, then inflation was less. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 12

Applying measures to GNP: ‘ 92 & ’ 93 – Measure the outputs of various goods and services with 1992 prices for both years. – Thus, “real GDP” for 1993 is the sum of 1993 production of various goods and services valued at 1992 prices. • Could equally well do it the other way around -- both years in 1993 prices. – The two answers will not come out the same. Each is inaccurate -- biased -- and they are biased in opposite directions. – So the. Bureau of Economic Analysis (BEA) uses chained real dollars. • And also attempts to adjust for quality--if price went up but quality went up, too, then inflation was less. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 12

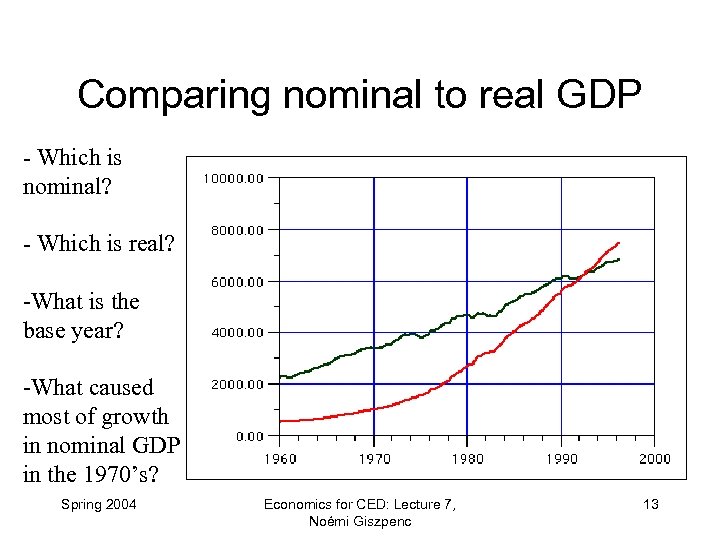

Comparing nominal to real GDP - Which is nominal? - Which is real? -What is the base year? -What caused most of growth in nominal GDP in the 1970’s? Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 13

Comparing nominal to real GDP - Which is nominal? - Which is real? -What is the base year? -What caused most of growth in nominal GDP in the 1970’s? Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 13

Problems with GDP as measure of national well-being • Population (see last lecture) • Undocumented transactions – An important component in production, especially in less developed countries. Official GDP figures might understate production growth to some extent. • Nonmarket gains and losses – Social changes; Environmental changes; Household production; Leisure time… Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 14

Problems with GDP as measure of national well-being • Population (see last lecture) • Undocumented transactions – An important component in production, especially in less developed countries. Official GDP figures might understate production growth to some extent. • Nonmarket gains and losses – Social changes; Environmental changes; Household production; Leisure time… Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 14

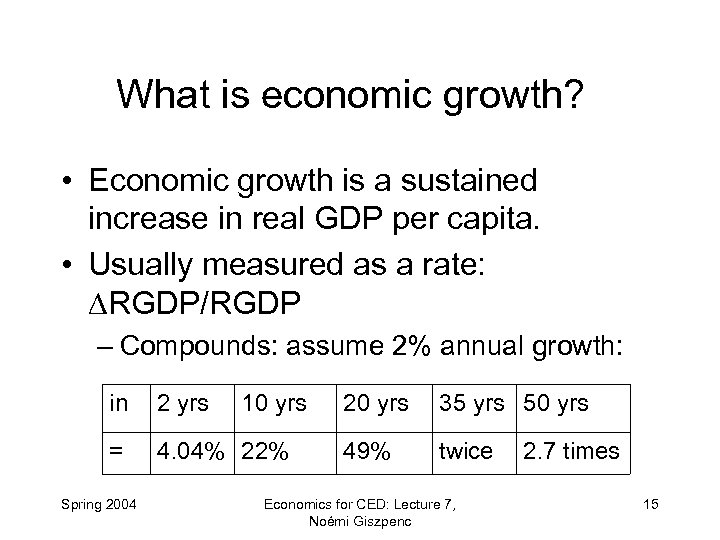

What is economic growth? • Economic growth is a sustained increase in real GDP per capita. • Usually measured as a rate: ∆RGDP/RGDP – Compounds: assume 2% annual growth: in 2 yrs = 4. 04% 22% Spring 2004 10 yrs 20 yrs 35 yrs 50 yrs 49% twice Economics for CED: Lecture 7, Noémi Giszpenc 2. 7 times 15

What is economic growth? • Economic growth is a sustained increase in real GDP per capita. • Usually measured as a rate: ∆RGDP/RGDP – Compounds: assume 2% annual growth: in 2 yrs = 4. 04% 22% Spring 2004 10 yrs 20 yrs 35 yrs 50 yrs 49% twice Economics for CED: Lecture 7, Noémi Giszpenc 2. 7 times 15

Some adjustments • Need to subtract population growth rate to get growth rate of real GDP per capita. • Labor productivity is the output person employed in the work force – Growth of labor productivity = growth of real GDP - growth of employed labor force Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 16

Some adjustments • Need to subtract population growth rate to get growth rate of real GDP per capita. • Labor productivity is the output person employed in the work force – Growth of labor productivity = growth of real GDP - growth of employed labor force Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 16

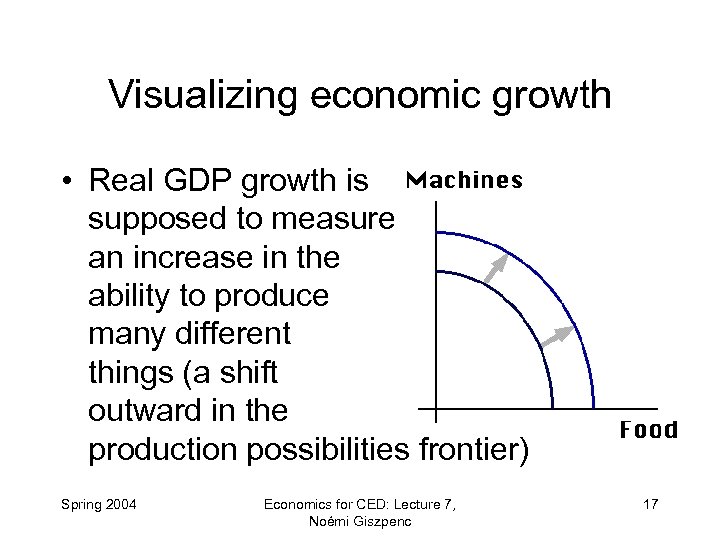

Visualizing economic growth • Real GDP growth is supposed to measure an increase in the ability to produce many different things (a shift outward in the production possibilities frontier) Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 17

Visualizing economic growth • Real GDP growth is supposed to measure an increase in the ability to produce many different things (a shift outward in the production possibilities frontier) Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 17

What is the opposite of growth? • Brief decline of economy = Recession – Two consecutive quarters (3 -month periods) of declining GDP – A period when business production, employment and earnings fall below levels that the economy is capable of achieving • Longer-term decline = Depression – Ordinarily occurring over several fiscal years – A long-term economic state characterized by high unemployment, low prices, low levels of trade and investment, restriction of credit, many bankruptcies Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 18

What is the opposite of growth? • Brief decline of economy = Recession – Two consecutive quarters (3 -month periods) of declining GDP – A period when business production, employment and earnings fall below levels that the economy is capable of achieving • Longer-term decline = Depression – Ordinarily occurring over several fiscal years – A long-term economic state characterized by high unemployment, low prices, low levels of trade and investment, restriction of credit, many bankruptcies Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 18

Now we know what it is & how to measure it--but what causes it? • The Mercantilists (16 th to 18 th C. Europe): – Economic power necessary for political power--and reverse is also true: power can increase wealth. • – Nations can conquer, colonize & regulate industry & trade Exports add more to national economy than imports-balance of trade & export support important. James Steuart: Free trade between unequal parties tends to increase inequalities – • • Spring 2004 Because of different bargaining power Thus free trade is rational for winners but not for everybody. Economics for CED: Lecture 7, Noémi Giszpenc 19

Now we know what it is & how to measure it--but what causes it? • The Mercantilists (16 th to 18 th C. Europe): – Economic power necessary for political power--and reverse is also true: power can increase wealth. • – Nations can conquer, colonize & regulate industry & trade Exports add more to national economy than imports-balance of trade & export support important. James Steuart: Free trade between unequal parties tends to increase inequalities – • • Spring 2004 Because of different bargaining power Thus free trade is rational for winners but not for everybody. Economics for CED: Lecture 7, Noémi Giszpenc 19

Problems with Mercantilism • Principles badly applied in practice – Gov’ts quick to introduce new trade restrictions and taxes but slow to dismantle outdated ones. • Conflict between national interest & particular business interests – Nation as whole paid for protection w/out receiving benefits of full employment or nat’l self-reliance • Chronic trade surpluses as bad as chronic deficits--beggars trading partners • In general too much emphasis on int’l trade. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 20

Problems with Mercantilism • Principles badly applied in practice – Gov’ts quick to introduce new trade restrictions and taxes but slow to dismantle outdated ones. • Conflict between national interest & particular business interests – Nation as whole paid for protection w/out receiving benefits of full employment or nat’l self-reliance • Chronic trade surpluses as bad as chronic deficits--beggars trading partners • In general too much emphasis on int’l trade. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 20

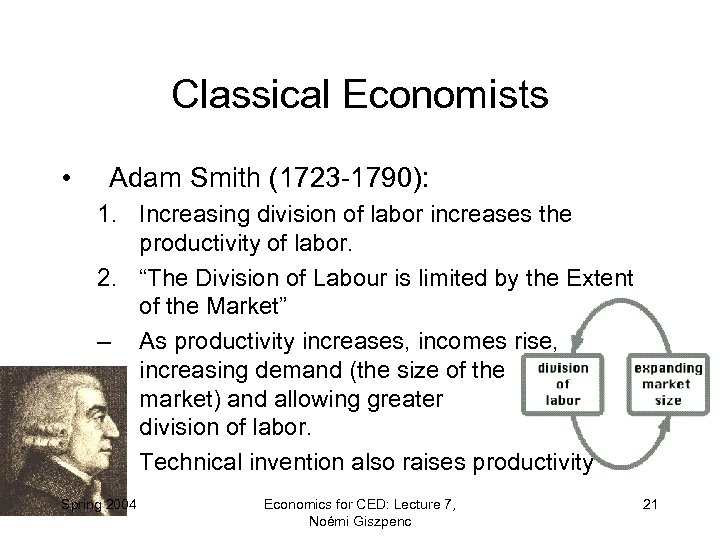

Classical Economists • Adam Smith (1723 -1790): 1. Increasing division of labor increases the productivity of labor. 2. “The Division of Labour is limited by the Extent of the Market” – As productivity increases, incomes rise, increasing demand (the size of the market) and allowing greater division of labor. – Technical invention also raises productivity Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 21

Classical Economists • Adam Smith (1723 -1790): 1. Increasing division of labor increases the productivity of labor. 2. “The Division of Labour is limited by the Extent of the Market” – As productivity increases, incomes rise, increasing demand (the size of the market) and allowing greater division of labor. – Technical invention also raises productivity Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 21

Adam Smith’s take continued • “Virtuous circle” not guaranteed. – Grinds to halt if market limited by gov’t • Ex: if gov’t creates monopolies, they would limit output to keep profits and prices up • Ex: if gov’t limits trade – Thus, role of gov’t is to maintain order and protect property and contracts, & otherwise stay out of market • Rising wages a sign of a healthy economy; more so than high profits. – But capitalists do turn profit into new investment (capital formation), increasing productivity & growth. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 22

Adam Smith’s take continued • “Virtuous circle” not guaranteed. – Grinds to halt if market limited by gov’t • Ex: if gov’t creates monopolies, they would limit output to keep profits and prices up • Ex: if gov’t limits trade – Thus, role of gov’t is to maintain order and protect property and contracts, & otherwise stay out of market • Rising wages a sign of a healthy economy; more so than high profits. – But capitalists do turn profit into new investment (capital formation), increasing productivity & growth. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 22

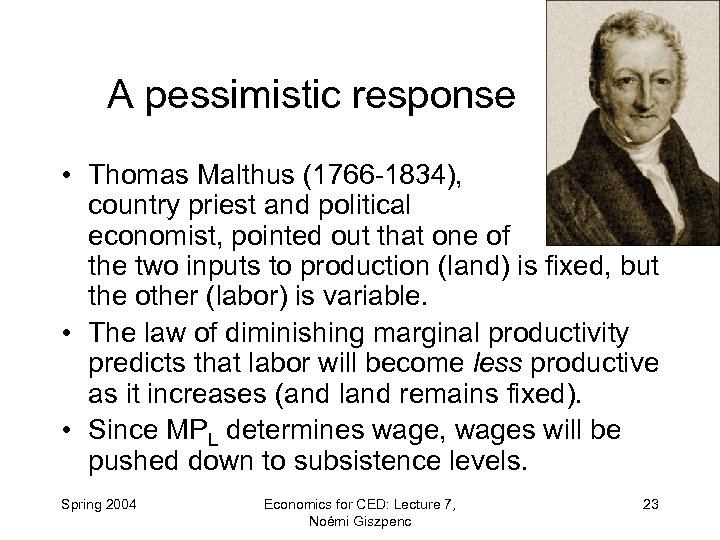

A pessimistic response • Thomas Malthus (1766 -1834), country priest and political economist, pointed out that one of the two inputs to production (land) is fixed, but the other (labor) is variable. • The law of diminishing marginal productivity predicts that labor will become less productive as it increases (and land remains fixed). • Since MPL determines wage, wages will be pushed down to subsistence levels. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 23

A pessimistic response • Thomas Malthus (1766 -1834), country priest and political economist, pointed out that one of the two inputs to production (land) is fixed, but the other (labor) is variable. • The law of diminishing marginal productivity predicts that labor will become less productive as it increases (and land remains fixed). • Since MPL determines wage, wages will be pushed down to subsistence levels. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 23

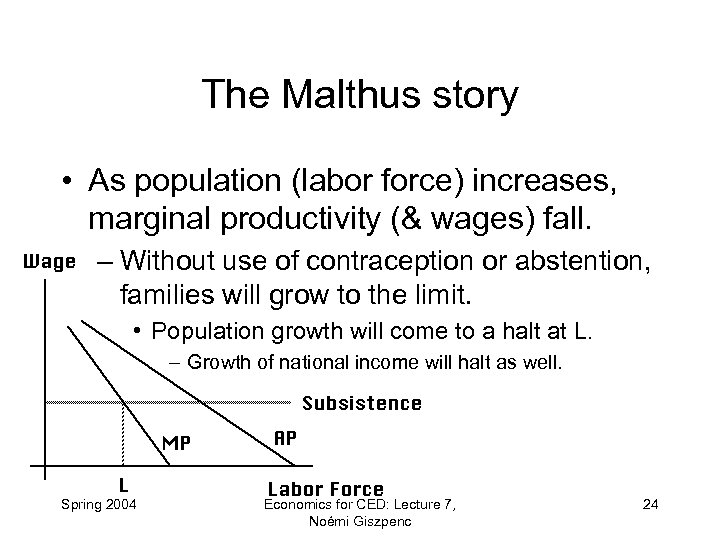

The Malthus story • As population (labor force) increases, marginal productivity (& wages) fall. – Without use of contraception or abstention, families will grow to the limit. • Population growth will come to a halt at L. – Growth of national income will halt as well. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 24

The Malthus story • As population (labor force) increases, marginal productivity (& wages) fall. – Without use of contraception or abstention, families will grow to the limit. • Population growth will come to a halt at L. – Growth of national income will halt as well. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 24

The controversy • Since Malthus wrote 200 years ago, population has continued to increase, as has agricultural and manufacturing productivity. • However, that could be a series of lucky accidents. There is no scientific reason to believe we will continue to be lucky. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 25

The controversy • Since Malthus wrote 200 years ago, population has continued to increase, as has agricultural and manufacturing productivity. • However, that could be a series of lucky accidents. There is no scientific reason to believe we will continue to be lucky. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 25

Enter Capital Nassau William Senior (1790 -1864) • Investment in capital raises labor productivity (& thus output). – So there is a demand for investment. Where does supply come from? • People prefer to have goods and services now rather than in the future. (BIG ASSUMPTION) • So people will supply investment funds only if they are rewarded by more goods and services in the future than they can get now. – Return on investment must overcome other preferences of lenders of capital. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 26

Enter Capital Nassau William Senior (1790 -1864) • Investment in capital raises labor productivity (& thus output). – So there is a demand for investment. Where does supply come from? • People prefer to have goods and services now rather than in the future. (BIG ASSUMPTION) • So people will supply investment funds only if they are rewarded by more goods and services in the future than they can get now. – Return on investment must overcome other preferences of lenders of capital. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 26

Marx (1818 -1883) • Prime mover of economic growth is human ingenuity, which leads to… • …changing means of production, that need appropriate forms of organization – I. e. , forces of production matched by relations of production • Relations of production full of conflict Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 27

Marx (1818 -1883) • Prime mover of economic growth is human ingenuity, which leads to… • …changing means of production, that need appropriate forms of organization – I. e. , forces of production matched by relations of production • Relations of production full of conflict Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 27

Roy Harrod (1900 -1978) Evsey Domar (1914 -1997) Modern growth theories • Harrod-Domar growth model – Based on work by J. M. Keynes – Posits that the rate of economic growth depends on the growth of capital • and thus on the proportion of income saved and invested – Growth also depends on growth of labor supply and of labor productivity • necessary for demand to grow as fast as labor supply plus labor productivity to avoid growth of unemployment – If capital and labor out of balance problems. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 28

Roy Harrod (1900 -1978) Evsey Domar (1914 -1997) Modern growth theories • Harrod-Domar growth model – Based on work by J. M. Keynes – Posits that the rate of economic growth depends on the growth of capital • and thus on the proportion of income saved and invested – Growth also depends on growth of labor supply and of labor productivity • necessary for demand to grow as fast as labor supply plus labor productivity to avoid growth of unemployment – If capital and labor out of balance problems. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 28

Neoclassical Growth Theory • Of course capital and labor won’t be out of balance, though, silly! • Because of diminishing marginal productivity, capital and labor do not have independent productivities. • Holding one input fixed, adding more of the other will yield diminishing marginal returns. • If capital grows faster than labor then the ratio of capital to labor increases, so the profitability of investment decreases, and investment slows down. • This continues until an equilibrium is reached. – The equilibrium ratio of capital to labor is denoted k. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 29

Neoclassical Growth Theory • Of course capital and labor won’t be out of balance, though, silly! • Because of diminishing marginal productivity, capital and labor do not have independent productivities. • Holding one input fixed, adding more of the other will yield diminishing marginal returns. • If capital grows faster than labor then the ratio of capital to labor increases, so the profitability of investment decreases, and investment slows down. • This continues until an equilibrium is reached. – The equilibrium ratio of capital to labor is denoted k. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 29

Are things really that stable? • As described so far, neoclassical model predicts no growth in labor productivity. – Though the ideas were developed in 1950 s and 60 s, period of greatest increases in productivity • Innovation to the Rescue! • With innovation, marginal productivity of capital increases, so investment increases, so marginal productivity of labor increases too. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 30

Are things really that stable? • As described so far, neoclassical model predicts no growth in labor productivity. – Though the ideas were developed in 1950 s and 60 s, period of greatest increases in productivity • Innovation to the Rescue! • With innovation, marginal productivity of capital increases, so investment increases, so marginal productivity of labor increases too. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 30

What does growth bring? • First off, more growth often stimulates more invention (and education) – So innovation is “endogenous” to growth • Secondly, increasing all the factors of production may not be subject to diminishing returns – Choices are: increasing returns to scale, constant returns, or decreasing returns – Reasoning from Smith’s virtuous circle, Marshall, Pigou, and Kaldor said: increasing returns! • Beside greater ÷ of labor, gains from learning-by-doing Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 31

What does growth bring? • First off, more growth often stimulates more invention (and education) – So innovation is “endogenous” to growth • Secondly, increasing all the factors of production may not be subject to diminishing returns – Choices are: increasing returns to scale, constant returns, or decreasing returns – Reasoning from Smith’s virtuous circle, Marshall, Pigou, and Kaldor said: increasing returns! • Beside greater ÷ of labor, gains from learning-by-doing Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 31

What could slow or halt growth? • Infant Industry Problem – Profitable industries may not be able to get big enough or learn enough in time to survive • Spillover Problem – Benefits of innovation accrue to others, so why invest? • Big Business Problem – Companies can achieve economies of scale, too – Turn into monopolies, use power to push profits up instead of expanding production Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 32

What could slow or halt growth? • Infant Industry Problem – Profitable industries may not be able to get big enough or learn enough in time to survive • Spillover Problem – Benefits of innovation accrue to others, so why invest? • Big Business Problem – Companies can achieve economies of scale, too – Turn into monopolies, use power to push profits up instead of expanding production Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 32

A version of Harrod-Domar in practice • Used by international development economists throughout the 1950 s and 60 s The model said that the rate of growth should follow from: • 1. 2. – – – Spring 2004 The rate at which a nation saved, and The productivity of the capital provided by savings Proportion of income that nation saves (and invests): savings/income ratio Value of capital is related to value of goods produced per year with the capital/output ratio Annual rate of economic growth: first divided by second. Economics for CED: Lecture 7, Noémi Giszpenc 33

A version of Harrod-Domar in practice • Used by international development economists throughout the 1950 s and 60 s The model said that the rate of growth should follow from: • 1. 2. – – – Spring 2004 The rate at which a nation saved, and The productivity of the capital provided by savings Proportion of income that nation saves (and invests): savings/income ratio Value of capital is related to value of goods produced per year with the capital/output ratio Annual rate of economic growth: first divided by second. Economics for CED: Lecture 7, Noémi Giszpenc 33

Did it work? • Governments were convinced that to grow they must increase saving, – chiefly by cutting the consumption by already-poor peasants, – and invest savings in industries with highest capital/output ratios: • heavy industry and large-scale farming • No. It did not work. – Industries complement and need each other – Poor can also save--and do so more readily if consumption is not cut. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 34

Did it work? • Governments were convinced that to grow they must increase saving, – chiefly by cutting the consumption by already-poor peasants, – and invest savings in industries with highest capital/output ratios: • heavy industry and large-scale farming • No. It did not work. – Industries complement and need each other – Poor can also save--and do so more readily if consumption is not cut. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 34

Another theory of growth: trade • The Economic Benefits of Trade (Bush) – – – • Expands and spurs growth in overseas markets for American goods and services; Creates higher-paying American jobs; Supports America's small- and medium-size businesses; Trade agreements like the NAFTA and the Uruguay Round have given American consumers greater choice and generated benefits for a typical family of $1, 300 to $2, 000 each year. Economists say that lowering barriers to trade by even one-third will boost the world economy by as much as $613 billion--and boost the U. S. economy by $177 billion a year. Is it really so? – Not really, say Francisco Rodríguez and Dani Rodrik • “We find little evidence that open trade policies–in the sense of lower tariff and non-tariff barriers to trade–are significantly associated with economic growth. ” – Thomas Balogh and other pragmatic institutional economists observed long ago that international trade & investment can increase inequalities--but doesn’t have to if done right. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 35

Another theory of growth: trade • The Economic Benefits of Trade (Bush) – – – • Expands and spurs growth in overseas markets for American goods and services; Creates higher-paying American jobs; Supports America's small- and medium-size businesses; Trade agreements like the NAFTA and the Uruguay Round have given American consumers greater choice and generated benefits for a typical family of $1, 300 to $2, 000 each year. Economists say that lowering barriers to trade by even one-third will boost the world economy by as much as $613 billion--and boost the U. S. economy by $177 billion a year. Is it really so? – Not really, say Francisco Rodríguez and Dani Rodrik • “We find little evidence that open trade policies–in the sense of lower tariff and non-tariff barriers to trade–are significantly associated with economic growth. ” – Thomas Balogh and other pragmatic institutional economists observed long ago that international trade & investment can increase inequalities--but doesn’t have to if done right. Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 35

What’s wrong with these theories? • All assume one or a few causes, abstracting from all the rest in ahistorical, faux-scientific fashion. • There is not one path to growth. • A country’s own path is rarely blocked by one barrier only. • Economic growth is likely to be affected by at least the following: – – – – Natural resources Appropriate government Education Health care Birth control Appropriate technology Appropriate skill & know-how Spring 2004 – – – – Entrepreneurship Tolerance of innovation Work culture Saving and investment Foreign exchange External markets and terms of trade Opportunity costs for the educated Economics for CED: Lecture 7, Noémi Giszpenc 36

What’s wrong with these theories? • All assume one or a few causes, abstracting from all the rest in ahistorical, faux-scientific fashion. • There is not one path to growth. • A country’s own path is rarely blocked by one barrier only. • Economic growth is likely to be affected by at least the following: – – – – Natural resources Appropriate government Education Health care Birth control Appropriate technology Appropriate skill & know-how Spring 2004 – – – – Entrepreneurship Tolerance of innovation Work culture Saving and investment Foreign exchange External markets and terms of trade Opportunity costs for the educated Economics for CED: Lecture 7, Noémi Giszpenc 36

Conclusions • Economic systems are neither mechanical nor organic – Growth is not a process by which a few specifiable inputs regularly produce predictable outputs, even given congenial conditions • Growth is history – “growth” is a misleading metaphor for economic development • It is complex, inventive, conflict-ridden, partly repetitive but partly different every time • Read “Cities and the Wealth of Nations” by Jane Jacobs Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 37

Conclusions • Economic systems are neither mechanical nor organic – Growth is not a process by which a few specifiable inputs regularly produce predictable outputs, even given congenial conditions • Growth is history – “growth” is a misleading metaphor for economic development • It is complex, inventive, conflict-ridden, partly repetitive but partly different every time • Read “Cities and the Wealth of Nations” by Jane Jacobs Spring 2004 Economics for CED: Lecture 7, Noémi Giszpenc 37