1855fa13b3b3e5d021ee1950912908b8.ppt

- Количество слайдов: 19

Economics for CED Spring 2004 Noémi Giszpenc Spring 2004 Lecture 9: Macro: International Trade June 2, 2004 Economics for CED: Lecture 9, Noémi Giszpenc

Economics for CED Spring 2004 Noémi Giszpenc Spring 2004 Lecture 9: Macro: International Trade June 2, 2004 Economics for CED: Lecture 9, Noémi Giszpenc

Why trade among nations? • Why not practice self-sufficiency? • Mercantilists (17 th & 18 th C. ): if you can export more than you import, that – creates jobs in your country and – Gives you gold reserves to pay mercenaries • Free-traders (late 18 th & 19 th C. ): – Because trade is mutually beneficial: • Creates larger markets, which means more division of labor--more specialization--therefore more production, and higher real incomes. • David Ricardo: theory of comparative advantage Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 2

Why trade among nations? • Why not practice self-sufficiency? • Mercantilists (17 th & 18 th C. ): if you can export more than you import, that – creates jobs in your country and – Gives you gold reserves to pay mercenaries • Free-traders (late 18 th & 19 th C. ): – Because trade is mutually beneficial: • Creates larger markets, which means more division of labor--more specialization--therefore more production, and higher real incomes. • David Ricardo: theory of comparative advantage Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 2

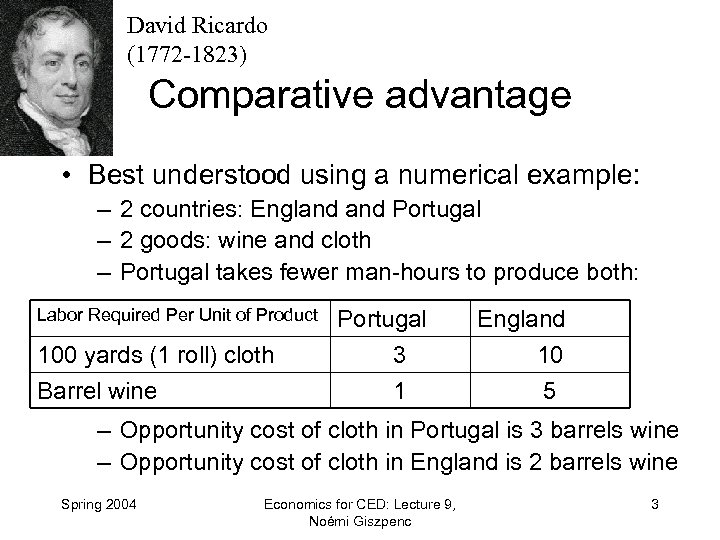

David Ricardo (1772 -1823) Comparative advantage • Best understood using a numerical example: – 2 countries: England Portugal – 2 goods: wine and cloth – Portugal takes fewer man-hours to produce both: Labor Required Per Unit of Product 100 yards (1 roll) cloth Barrel wine Portugal 3 1 England 10 5 – Opportunity cost of cloth in Portugal is 3 barrels wine – Opportunity cost of cloth in England is 2 barrels wine Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 3

David Ricardo (1772 -1823) Comparative advantage • Best understood using a numerical example: – 2 countries: England Portugal – 2 goods: wine and cloth – Portugal takes fewer man-hours to produce both: Labor Required Per Unit of Product 100 yards (1 roll) cloth Barrel wine Portugal 3 1 England 10 5 – Opportunity cost of cloth in Portugal is 3 barrels wine – Opportunity cost of cloth in England is 2 barrels wine Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 3

England Portugal trade • England exports cloth to Portugal: – At Portuguese prices, each roll of cloth buys 3 barrels of wine • In England a roll of cloth is worth only 2 barrels • Portugal exports wine to England: – At English prices, a barrel of wine buys half a roll of cloth • In Portugal a barrel is worth only 1/3 roll of cloth • Thus, Portuguese get cloth cheaper by producing wine to trade for cloth than by producing cloth at home – despite the fact that they can produce more cloth per unit of labor than the English can. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 4

England Portugal trade • England exports cloth to Portugal: – At Portuguese prices, each roll of cloth buys 3 barrels of wine • In England a roll of cloth is worth only 2 barrels • Portugal exports wine to England: – At English prices, a barrel of wine buys half a roll of cloth • In Portugal a barrel is worth only 1/3 roll of cloth • Thus, Portuguese get cloth cheaper by producing wine to trade for cloth than by producing cloth at home – despite the fact that they can produce more cloth per unit of labor than the English can. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 4

Trade with comparative advantage • Prices will probably be somewhere between two extremes: say, 2. 5 rolls of cloth per barrel of wine – At these prices, both countries still better off with trade than without • Key point: England has a comparative advantage in cloth – Even though Portugal has the absolute advantage in both goods. – Relative price of cloth (in wine) is less in England. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 5

Trade with comparative advantage • Prices will probably be somewhere between two extremes: say, 2. 5 rolls of cloth per barrel of wine – At these prices, both countries still better off with trade than without • Key point: England has a comparative advantage in cloth – Even though Portugal has the absolute advantage in both goods. – Relative price of cloth (in wine) is less in England. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 5

Realistic qualifications • David Ricardo believed in the Labor Theory of Value--that “natural” prices derived from amount of labor. • Prices depend on at least 3 factors of production: land, labor, capital • Still, different countries have different resource endowments, so comparative advantage still holds. • As in other markets, prices determined largely by supply and demand. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 6

Realistic qualifications • David Ricardo believed in the Labor Theory of Value--that “natural” prices derived from amount of labor. • Prices depend on at least 3 factors of production: land, labor, capital • Still, different countries have different resource endowments, so comparative advantage still holds. • As in other markets, prices determined largely by supply and demand. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 6

Realistic qualifications (cont. ) • Most trade is multi-lateral (among many countries with many goods) not bilateral (2 countries) with only 2 goods – Doesn’t undermine idea of comparative advantage though • Some trade is in roughly similar products – “counter-trade”: Jaguars for Toyotas • Different tastes in different countries can lead to mutually beneficial trades Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 7

Realistic qualifications (cont. ) • Most trade is multi-lateral (among many countries with many goods) not bilateral (2 countries) with only 2 goods – Doesn’t undermine idea of comparative advantage though • Some trade is in roughly similar products – “counter-trade”: Jaguars for Toyotas • Different tastes in different countries can lead to mutually beneficial trades Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 7

Realistic qualifications (cont. ) • Monopoly power: – Could make both countries worse off. – Openness to trade could limit monopoly power. • Unemployment – Comparative advantage model assumes full employment – If mercantilist trade policies can promote more employment, policy makers face dilemma: • Will the country be better off with trade according to comparative advantage, which is efficient? • or are more, inefficient jobs better than no jobs at all? Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 8

Realistic qualifications (cont. ) • Monopoly power: – Could make both countries worse off. – Openness to trade could limit monopoly power. • Unemployment – Comparative advantage model assumes full employment – If mercantilist trade policies can promote more employment, policy makers face dilemma: • Will the country be better off with trade according to comparative advantage, which is efficient? • or are more, inefficient jobs better than no jobs at all? Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 8

Realistic qualifications (cont. ) • Static or dynamic? – In model, poorer country is better off from trade, but remains relatively poor – This is because improving productivity is outside of the model Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 9

Realistic qualifications (cont. ) • Static or dynamic? – In model, poorer country is better off from trade, but remains relatively poor – This is because improving productivity is outside of the model Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 9

What Herman Daly says • One of the unmentioned assumptions of the model is that both labor and capital are moored to their respective nations. • Under such conditions, comparative advantage takes over. • But with mobile capital, only absolute advantage matters. – Capital picks up and moves to more productive locale--in the example’s case, Portugal. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 10

What Herman Daly says • One of the unmentioned assumptions of the model is that both labor and capital are moored to their respective nations. • Under such conditions, comparative advantage takes over. • But with mobile capital, only absolute advantage matters. – Capital picks up and moves to more productive locale--in the example’s case, Portugal. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 10

How does money flow? • Often needs to change from one monetary unit to another • Like other exchanges, the relative prices of national moneys are determined by supply and demand • People in one country demand units of foreign countries to buy foreign goods – (and to make gobs of money speculating) – So demand for currency is related to demand for real goods and services. • (and to different interest rates paid) Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 11

How does money flow? • Often needs to change from one monetary unit to another • Like other exchanges, the relative prices of national moneys are determined by supply and demand • People in one country demand units of foreign countries to buy foreign goods – (and to make gobs of money speculating) – So demand for currency is related to demand for real goods and services. • (and to different interest rates paid) Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 11

2 ways of determining FX rates • Purchasing Power Parity – Assumption: if goods cost different amounts in different countries, arbitrage will whittle down the differences • Interest Rate Parity – Assumption: if different currencies earn different rates of return, exchange rates will adjust to reflect differential demands Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 12

2 ways of determining FX rates • Purchasing Power Parity – Assumption: if goods cost different amounts in different countries, arbitrage will whittle down the differences • Interest Rate Parity – Assumption: if different currencies earn different rates of return, exchange rates will adjust to reflect differential demands Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 12

Purchasing Power Parity • Say basket of goods in country A costs p. Ay • Same basket of goods in country B costs p. By • So p. Ay/p. By = p. A/p. B should = EA/B – Say p. A goes up: EA/B goes up, meaning more A for every B: a devaluation of A relative to B. – What causes changes in p. A? • Inflation • Changes in productivity • Changes in E from other causes Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 13

Purchasing Power Parity • Say basket of goods in country A costs p. Ay • Same basket of goods in country B costs p. By • So p. Ay/p. By = p. A/p. B should = EA/B – Say p. A goes up: EA/B goes up, meaning more A for every B: a devaluation of A relative to B. – What causes changes in p. A? • Inflation • Changes in productivity • Changes in E from other causes Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 13

Problems with PPP theory • Transportation costs and trade restrictions • Costs of Non-Tradable Inputs – Such as rent • Perfect information – Needed for effective arbitrage • Other market participants – PPP is about goods. Total world trade is approx. $100 billion/day. Activity on the FX market is approx. $1 trillion/day. What else is going on? Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 14

Problems with PPP theory • Transportation costs and trade restrictions • Costs of Non-Tradable Inputs – Such as rent • Perfect information – Needed for effective arbitrage • Other market participants – PPP is about goods. Total world trade is approx. $100 billion/day. Activity on the FX market is approx. $1 trillion/day. What else is going on? Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 14

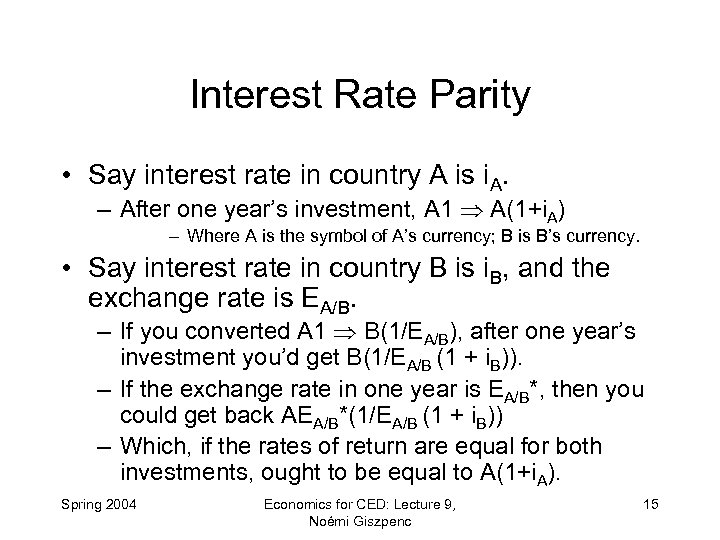

Interest Rate Parity • Say interest rate in country A is i. A. – After one year’s investment, A 1 A(1+i. A) – Where A is the symbol of A’s currency; B is B’s currency. • Say interest rate in country B is i. B, and the exchange rate is EA/B. – If you converted A 1 B(1/EA/B), after one year’s investment you’d get B(1/EA/B (1 + i. B)). – If the exchange rate in one year is EA/B*, then you could get back AEA/B*(1/EA/B (1 + i. B)) – Which, if the rates of return are equal for both investments, ought to be equal to A(1+i. A). Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 15

Interest Rate Parity • Say interest rate in country A is i. A. – After one year’s investment, A 1 A(1+i. A) – Where A is the symbol of A’s currency; B is B’s currency. • Say interest rate in country B is i. B, and the exchange rate is EA/B. – If you converted A 1 B(1/EA/B), after one year’s investment you’d get B(1/EA/B (1 + i. B)). – If the exchange rate in one year is EA/B*, then you could get back AEA/B*(1/EA/B (1 + i. B)) – Which, if the rates of return are equal for both investments, ought to be equal to A(1+i. A). Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 15

Rearranging… • You obtain: • Where i. A is rate of return on investment in country A; RHS is return on investment in B. • Shows that the expected rate of return on the asset from country B depends on two things: – interest rate in country B, and – the expected percentage change in the value of B • If B appreciates, rate of return is higher--so investors would be willing to accept a lower interest rate. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 16

Rearranging… • You obtain: • Where i. A is rate of return on investment in country A; RHS is return on investment in B. • Shows that the expected rate of return on the asset from country B depends on two things: – interest rate in country B, and – the expected percentage change in the value of B • If B appreciates, rate of return is higher--so investors would be willing to accept a lower interest rate. Spring 2004 Economics for CED: Lecture 9, Noémi Giszpenc 16

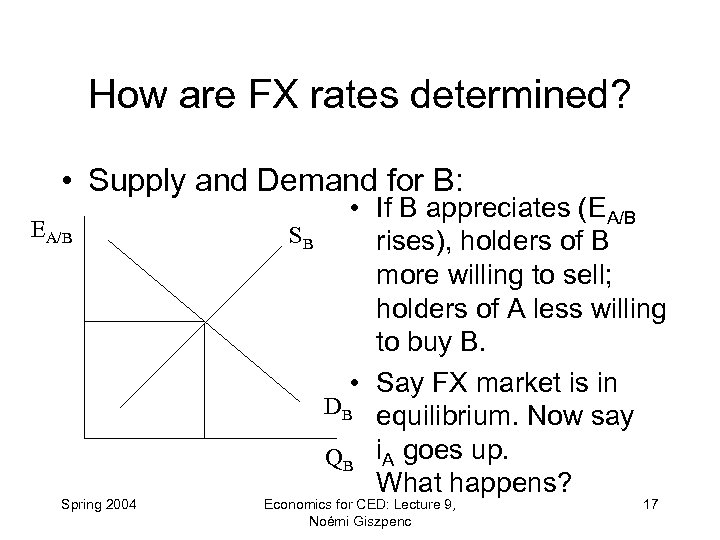

How are FX rates determined? • Supply and Demand for B: EA/B Spring 2004 • If B appreciates (EA/B SB rises), holders of B more willing to sell; holders of A less willing to buy B. • Say FX market is in DB equilibrium. Now say QB i. A goes up. What happens? Economics for CED: Lecture 9, Noémi Giszpenc 17

How are FX rates determined? • Supply and Demand for B: EA/B Spring 2004 • If B appreciates (EA/B SB rises), holders of B more willing to sell; holders of A less willing to buy B. • Say FX market is in DB equilibrium. Now say QB i. A goes up. What happens? Economics for CED: Lecture 9, Noémi Giszpenc 17

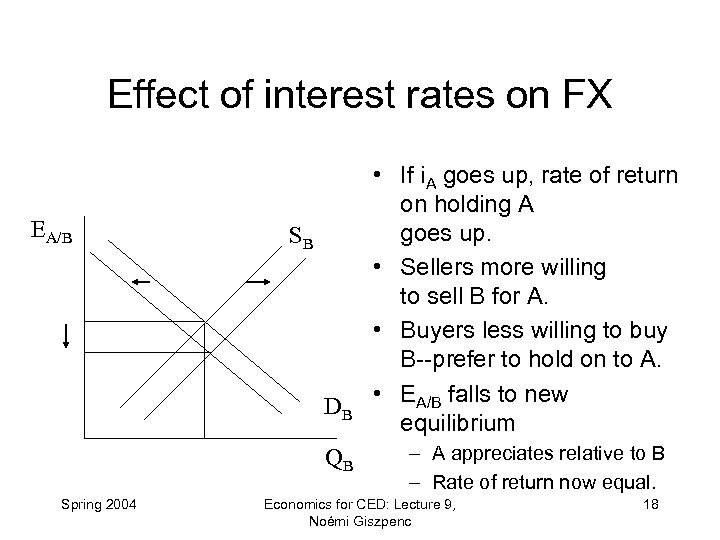

Effect of interest rates on FX EA/B SB DB QB Spring 2004 • If i. A goes up, rate of return on holding A goes up. • Sellers more willing to sell B for A. • Buyers less willing to buy B--prefer to hold on to A. • EA/B falls to new equilibrium – A appreciates relative to B – Rate of return now equal. Economics for CED: Lecture 9, Noémi Giszpenc 18

Effect of interest rates on FX EA/B SB DB QB Spring 2004 • If i. A goes up, rate of return on holding A goes up. • Sellers more willing to sell B for A. • Buyers less willing to buy B--prefer to hold on to A. • EA/B falls to new equilibrium – A appreciates relative to B – Rate of return now equal. Economics for CED: Lecture 9, Noémi Giszpenc 18

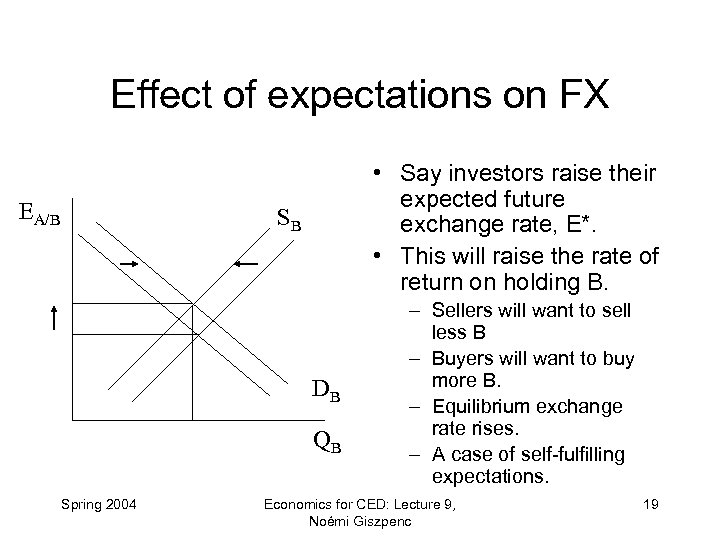

Effect of expectations on FX EA/B • Say investors raise their expected future exchange rate, E*. • This will raise the rate of return on holding B. SB DB QB Spring 2004 – Sellers will want to sell less B – Buyers will want to buy more B. – Equilibrium exchange rate rises. – A case of self-fulfilling expectations. Economics for CED: Lecture 9, Noémi Giszpenc 19

Effect of expectations on FX EA/B • Say investors raise their expected future exchange rate, E*. • This will raise the rate of return on holding B. SB DB QB Spring 2004 – Sellers will want to sell less B – Buyers will want to buy more B. – Equilibrium exchange rate rises. – A case of self-fulfilling expectations. Economics for CED: Lecture 9, Noémi Giszpenc 19