77f5c2af071a140e3e9c080f56b23690.ppt

- Количество слайдов: 41

ECONOMICS, 5 e Roger Arnold CHAPTER 5 Macroeconomic Measurements, Part I: Prices and Unemployment

ECONOMICS, 5 e Roger Arnold CHAPTER 5 Macroeconomic Measurements, Part I: Prices and Unemployment

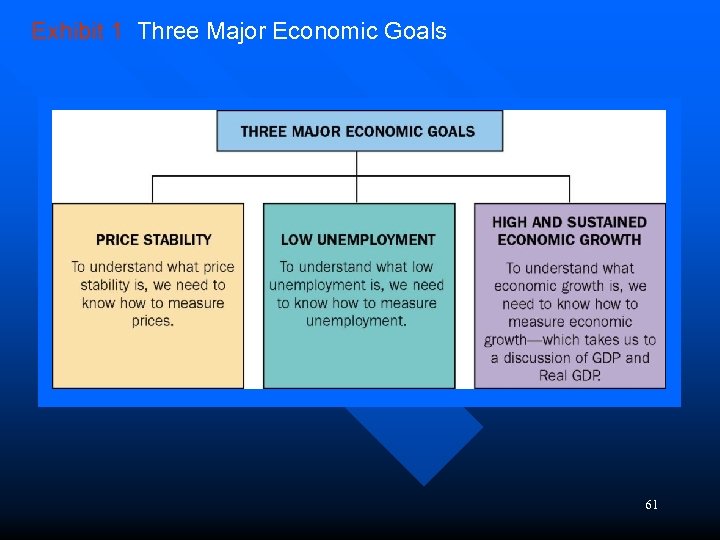

Exhibit 1 Three Major Economic Goals 61

Exhibit 1 Three Major Economic Goals 61

MACROECONOMIC VARIABLES n Price Levels – The economy's price level refers to a weighted average of the prices of its goods and services

MACROECONOMIC VARIABLES n Price Levels – The economy's price level refers to a weighted average of the prices of its goods and services

PRICE STABILITY INFLATION is an increase in the general price level over time n DEFLATION is a decrease in the general price level over time n

PRICE STABILITY INFLATION is an increase in the general price level over time n DEFLATION is a decrease in the general price level over time n

INFLATION AND PURCHASING POWER If prices on average rise n a given income buys fewer goods and services. n inflation decreases the purchasing power of the dollar. n

INFLATION AND PURCHASING POWER If prices on average rise n a given income buys fewer goods and services. n inflation decreases the purchasing power of the dollar. n

MEASURING THE PRICE LEVEL n Measures of the Price Level – The consumer price index measures the average nominal prices of goods and services that a typical family living in an urban area buys

MEASURING THE PRICE LEVEL n Measures of the Price Level – The consumer price index measures the average nominal prices of goods and services that a typical family living in an urban area buys

Consumer Price Index n n The CPI is calculated by the Bureau of Labor Statistics (BLS, http: //www. bls. gov). The representative group of goods chosen is called the Market Basket. To calculate the CPI we need the total dollar expenditure in the current year and the base year. The base year is a benchmark year that serves as that basis of comparison for prices in other years. 66

Consumer Price Index n n The CPI is calculated by the Bureau of Labor Statistics (BLS, http: //www. bls. gov). The representative group of goods chosen is called the Market Basket. To calculate the CPI we need the total dollar expenditure in the current year and the base year. The base year is a benchmark year that serves as that basis of comparison for prices in other years. 66

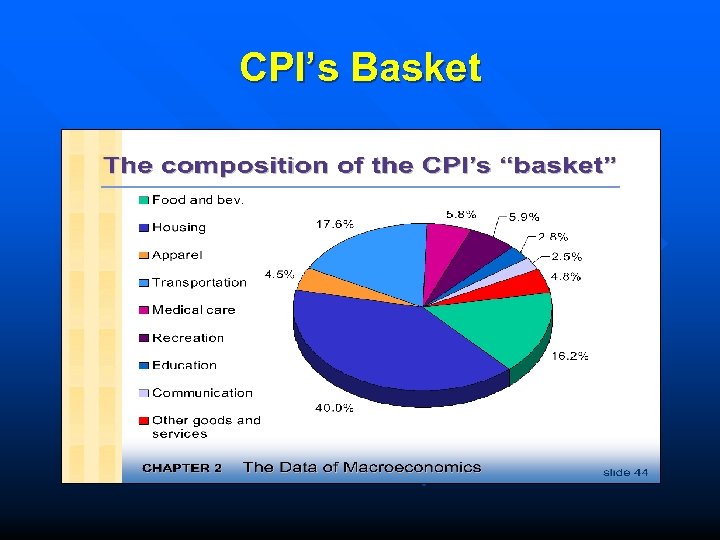

CPI’s Basket

CPI’s Basket

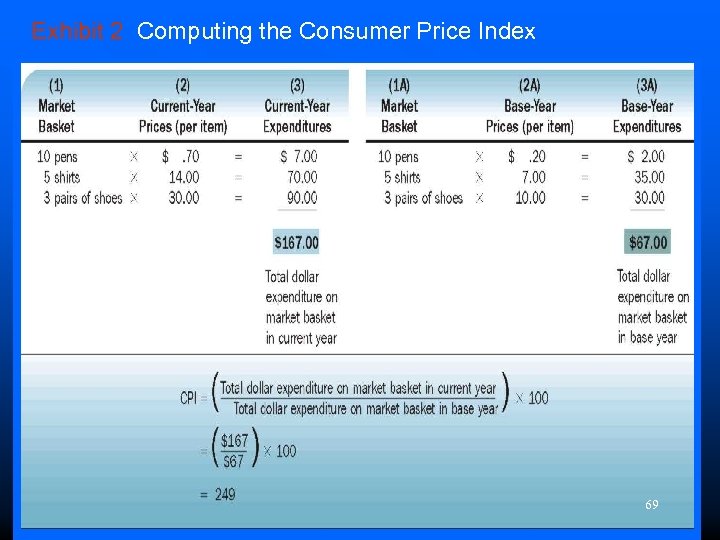

Calculating the CPI = (current expenditure/base expenditure) X 100 n Current expenditure = the total dollar expenditure on market basket in current year n Base expenditure = the total dollar expenditure on market basket in base year n 68

Calculating the CPI = (current expenditure/base expenditure) X 100 n Current expenditure = the total dollar expenditure on market basket in current year n Base expenditure = the total dollar expenditure on market basket in base year n 68

Exhibit 2 Computing the Consumer Price Index 69

Exhibit 2 Computing the Consumer Price Index 69

THE INFLATION RATE Inflation rate = {CPI (t) - CPI (t-1) } x 100 CPI (t-1)

THE INFLATION RATE Inflation rate = {CPI (t) - CPI (t-1) } x 100 CPI (t-1)

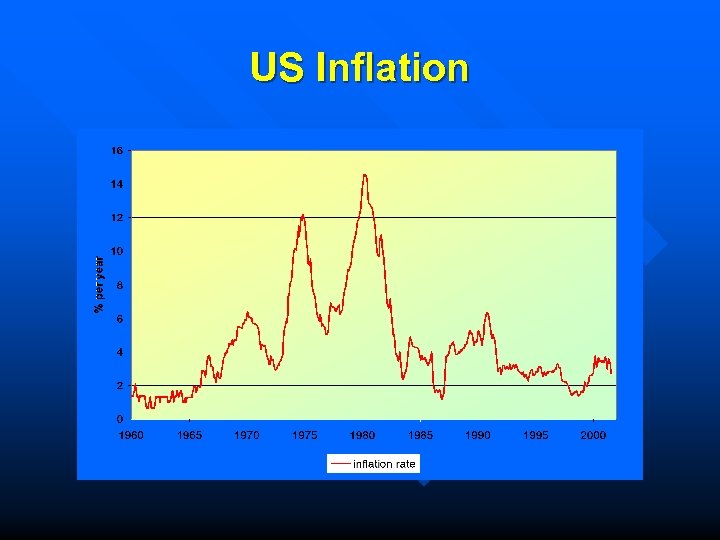

US Inflation

US Inflation

COMPUTE THE INFLATION RATE USING THE FOLLOWING: CPI 1997 = 159. 1 n CPI 1996 = 156. 9 n formula ({CPI 97 - CPI 96} / CPI 96) X 100 n 159. 1 -156. 9 / 156. 9 = 2. 2/156. 9 =. 014 n. 014 X 100 = 1. 4% n 72

COMPUTE THE INFLATION RATE USING THE FOLLOWING: CPI 1997 = 159. 1 n CPI 1996 = 156. 9 n formula ({CPI 97 - CPI 96} / CPI 96) X 100 n 159. 1 -156. 9 / 156. 9 = 2. 2/156. 9 =. 014 n. 014 X 100 = 1. 4% n 72

USING THE CPI: REAL vs. NOMINAL INCOME n NOMINAL INCOME - money income measured in current period dollars

USING THE CPI: REAL vs. NOMINAL INCOME n NOMINAL INCOME - money income measured in current period dollars

USING THE CPI: REAL vs. NOMINAL INCOME n REAL INCOME - money income adjusted for changes in the price level real Y = nominal Y x 100 n CPI (t) n

USING THE CPI: REAL vs. NOMINAL INCOME n REAL INCOME - money income adjusted for changes in the price level real Y = nominal Y x 100 n CPI (t) n

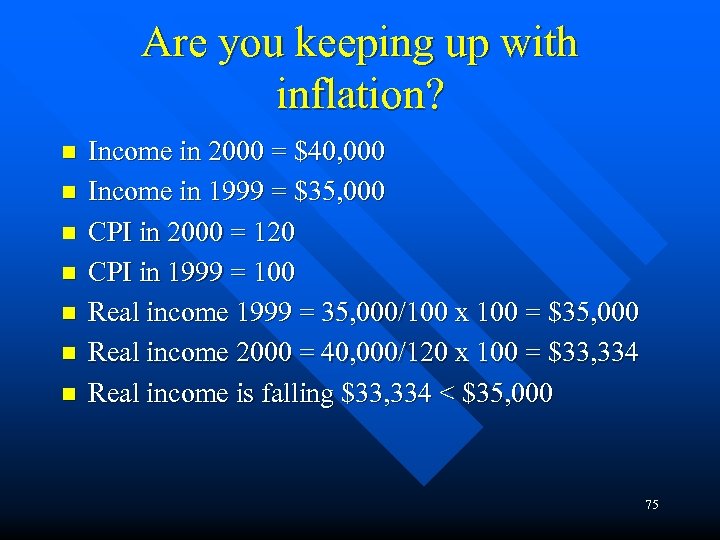

Are you keeping up with inflation? n n n n Income in 2000 = $40, 000 Income in 1999 = $35, 000 CPI in 2000 = 120 CPI in 1999 = 100 Real income 1999 = 35, 000/100 x 100 = $35, 000 Real income 2000 = 40, 000/120 x 100 = $33, 334 Real income is falling $33, 334 < $35, 000 75

Are you keeping up with inflation? n n n n Income in 2000 = $40, 000 Income in 1999 = $35, 000 CPI in 2000 = 120 CPI in 1999 = 100 Real income 1999 = 35, 000/100 x 100 = $35, 000 Real income 2000 = 40, 000/120 x 100 = $33, 334 Real income is falling $33, 334 < $35, 000 75

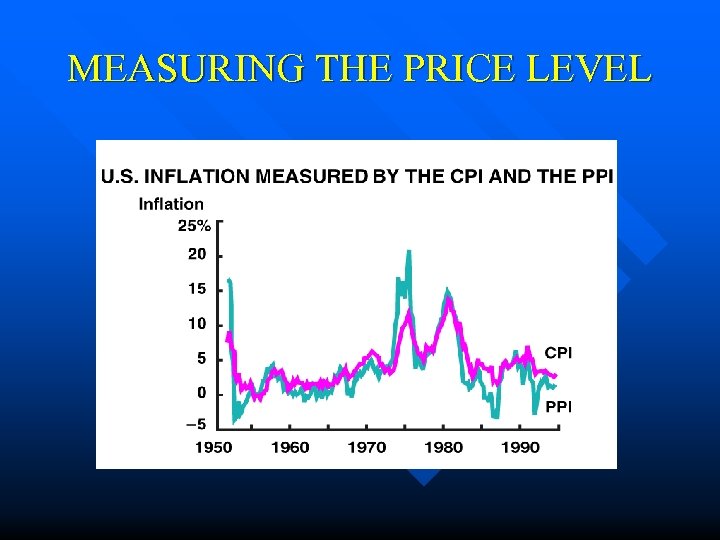

MEASURING THE PRICE LEVEL n Other Measures of the Price Level – The producer price index is a weighted average of the prices of inputs that producers buy to make final goods

MEASURING THE PRICE LEVEL n Other Measures of the Price Level – The producer price index is a weighted average of the prices of inputs that producers buy to make final goods

MEASURING THE PRICE LEVEL

MEASURING THE PRICE LEVEL

MACROECONOMIC VARIABLES n Price Levels – The GDP price deflator equals nominal GDP divided by real GDP – Nominal GDP measures the current dollar value of the economy – Real GDP measures output valued at constant prices – – Nominal GDP = Real GDP X GDP price deflator Real GDP = Nominal GDP / GDP price deflator

MACROECONOMIC VARIABLES n Price Levels – The GDP price deflator equals nominal GDP divided by real GDP – Nominal GDP measures the current dollar value of the economy – Real GDP measures output valued at constant prices – – Nominal GDP = Real GDP X GDP price deflator Real GDP = Nominal GDP / GDP price deflator

MEASURING THE PRICE LEVEL n Limitations of Price Indexes – Index and other measures are imperfect and have limitations » Ignores such things as changes in quality, technological advances, and other factors that alter results » People substitute other goods when prices rise

MEASURING THE PRICE LEVEL n Limitations of Price Indexes – Index and other measures are imperfect and have limitations » Ignores such things as changes in quality, technological advances, and other factors that alter results » People substitute other goods when prices rise

SUBSTITUTION BIAS To avoid a potential bias created by ignoring consumer substitutions the US moved to a CHAIN-WEIGHTED index in Dec. 1995

SUBSTITUTION BIAS To avoid a potential bias created by ignoring consumer substitutions the US moved to a CHAIN-WEIGHTED index in Dec. 1995

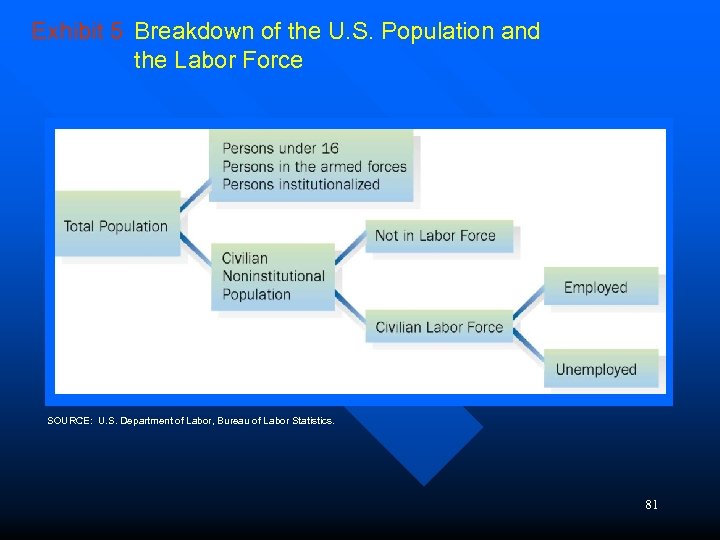

Exhibit 5 Breakdown of the U. S. Population and the Labor Force SOURCE: U. S. Department of Labor, Bureau of Labor Statistics. 81

Exhibit 5 Breakdown of the U. S. Population and the Labor Force SOURCE: U. S. Department of Labor, Bureau of Labor Statistics. 81

EMPLOYED Worked at least 1 hour in a wage/salary paying position n Owned his/her own business n Worked 15 hrs. per week in family business or farm as “unpaid” worker n absent due to illness, strike, or vacation n

EMPLOYED Worked at least 1 hour in a wage/salary paying position n Owned his/her own business n Worked 15 hrs. per week in family business or farm as “unpaid” worker n absent due to illness, strike, or vacation n

UNDEREMPLOYMENT Workers are classified as employed n If they worked as little as one hour for pay during the survey week and n Even if they are over qualified for the work n The reported rate of unemployment may be understated due to underemployment n

UNDEREMPLOYMENT Workers are classified as employed n If they worked as little as one hour for pay during the survey week and n Even if they are over qualified for the work n The reported rate of unemployment may be understated due to underemployment n

UNEMPLOYED Did not work in the survey week but willing and able to work and actively looked within the last 4 weeks. n Laid off and waiting to be called back n Waiting to report to a job within 30 days n

UNEMPLOYED Did not work in the survey week but willing and able to work and actively looked within the last 4 weeks. n Laid off and waiting to be called back n Waiting to report to a job within 30 days n

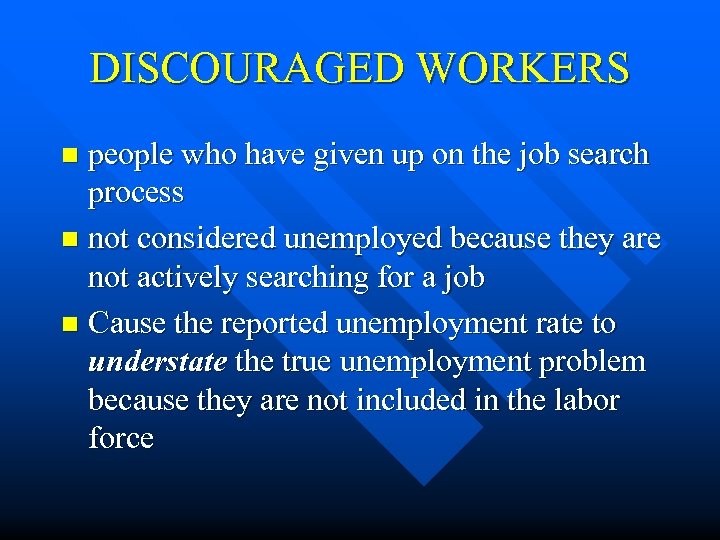

DISCOURAGED WORKERS people who have given up on the job search process n not considered unemployed because they are not actively searching for a job n Cause the reported unemployment rate to understate the true unemployment problem because they are not included in the labor force n

DISCOURAGED WORKERS people who have given up on the job search process n not considered unemployed because they are not actively searching for a job n Cause the reported unemployment rate to understate the true unemployment problem because they are not included in the labor force n

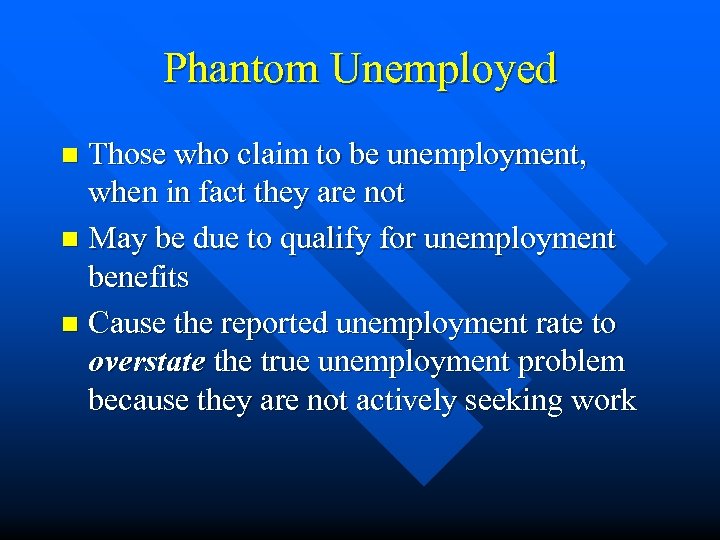

Phantom Unemployed Those who claim to be unemployment, when in fact they are not n May be due to qualify for unemployment benefits n Cause the reported unemployment rate to overstate the true unemployment problem because they are not actively seeking work n

Phantom Unemployed Those who claim to be unemployment, when in fact they are not n May be due to qualify for unemployment benefits n Cause the reported unemployment rate to overstate the true unemployment problem because they are not actively seeking work n

THE UNEMPLOYMENT RATE # people unemployed x 100 # people in labor force

THE UNEMPLOYMENT RATE # people unemployed x 100 # people in labor force

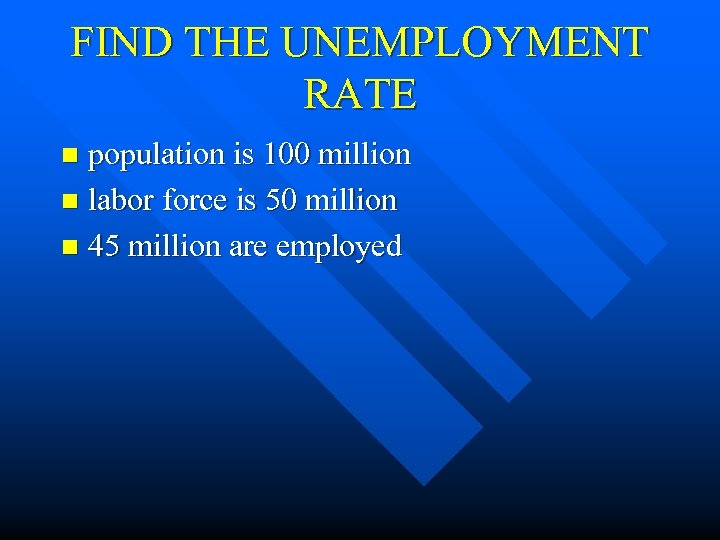

FIND THE UNEMPLOYMENT RATE population is 100 million n labor force is 50 million n 45 million are employed n

FIND THE UNEMPLOYMENT RATE population is 100 million n labor force is 50 million n 45 million are employed n

UNEMPLOYMENT RATE U = 5 m. /50 m. x 100 = 10%

UNEMPLOYMENT RATE U = 5 m. /50 m. x 100 = 10%

Types of Unemployment n Frictional

Types of Unemployment n Frictional

FRICTIONAL UNEMPLOYMENT people moving between jobs or into the labor force.

FRICTIONAL UNEMPLOYMENT people moving between jobs or into the labor force.

Types of Unemployment Frictional n Structural n

Types of Unemployment Frictional n Structural n

STRUCTURAL UNEMPLOYMENT skills and/or location of workers does not match available jobs

STRUCTURAL UNEMPLOYMENT skills and/or location of workers does not match available jobs

Types of Unemployment Frictional n Structural n Natural n

Types of Unemployment Frictional n Structural n Natural n

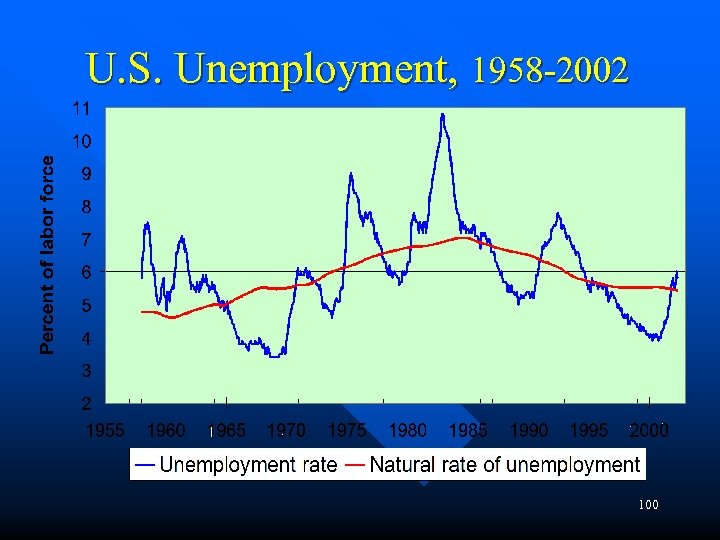

NATURAL UNEMPLOYMENT a certain level of frictional and structural unemployment that is considered natural in a changing economy (usually 4 -6. 5%)

NATURAL UNEMPLOYMENT a certain level of frictional and structural unemployment that is considered natural in a changing economy (usually 4 -6. 5%)

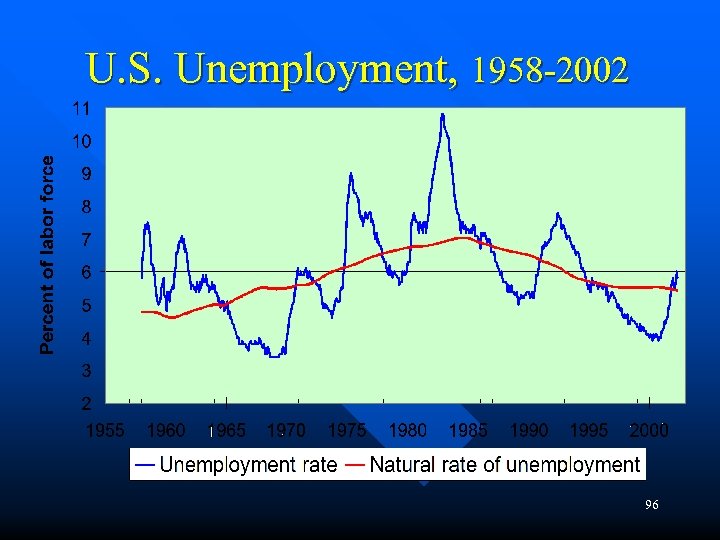

U. S. Unemployment, 1958 -2002 96

U. S. Unemployment, 1958 -2002 96

FULL EMPLOYMENT The full employment rate is when unemployment is at its natural rate (not zero).

FULL EMPLOYMENT The full employment rate is when unemployment is at its natural rate (not zero).

Types of Unemployment Frictional n Structural n Natural n Cyclical n

Types of Unemployment Frictional n Structural n Natural n Cyclical n

CYCLICAL UNEMPLOYMENT unemployment due to downturns in overall economic activity (recessions) The difference between the existing unemployment rate and the natural unemployment rate

CYCLICAL UNEMPLOYMENT unemployment due to downturns in overall economic activity (recessions) The difference between the existing unemployment rate and the natural unemployment rate

U. S. Unemployment, 1958 -2002 100

U. S. Unemployment, 1958 -2002 100