Economic Policy ***Tariffs***

Economic Policy ***Tariffs***

v Definition fee collected when goods or services cross the country’s borders v country’s geographical border may be different from its customs border v one of the oldest and most commonly used tools of trade policy.

v Definition fee collected when goods or services cross the country’s borders v country’s geographical border may be different from its customs border v one of the oldest and most commonly used tools of trade policy.

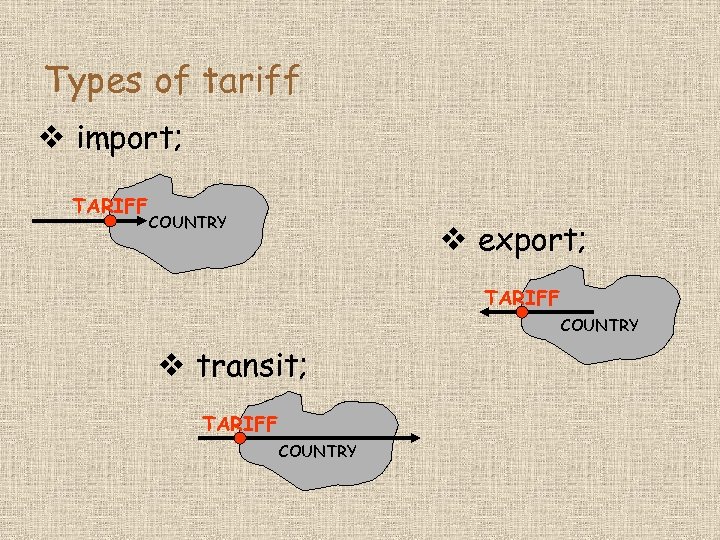

Types of tariff v import; TARIFF COUNTRY v export; TARIFF COUNTRY v transit; TARIFF COUNTRY

Types of tariff v import; TARIFF COUNTRY v export; TARIFF COUNTRY v transit; TARIFF COUNTRY

![Types of tariff [cont. ] v ad valorem; as a percentage of the value Types of tariff [cont. ] v ad valorem; as a percentage of the value](https://present5.com/presentation/bbb53c783eb1e2970281285d21a7f69f/image-4.jpg) Types of tariff [cont. ] v ad valorem; as a percentage of the value of the goods How to define this value? v ad spetiem (specific); fixed amount for a certain quantity of the goods , e. g. 10 EUR per 1 tone v compound; e. g. a percentage of the value but not less than a fixed amount for a certain quantity

Types of tariff [cont. ] v ad valorem; as a percentage of the value of the goods How to define this value? v ad spetiem (specific); fixed amount for a certain quantity of the goods , e. g. 10 EUR per 1 tone v compound; e. g. a percentage of the value but not less than a fixed amount for a certain quantity

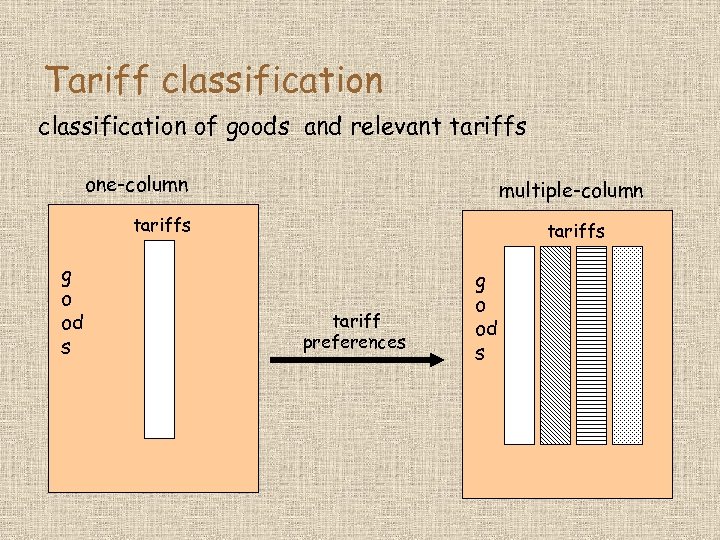

Tariff classification of goods and relevant tariffs one-column multiple-column tariffs g o od s tariff preferences g o od s

Tariff classification of goods and relevant tariffs one-column multiple-column tariffs g o od s tariff preferences g o od s

Effects of tariffs v redistribution – change of a consumer surplus (CS); a producer surplus (PS); a government surplus (GS) v fiscal – income to the state budget v protection – domestic producers against foreign competitors v consumption – consumers have to pay more => buy less

Effects of tariffs v redistribution – change of a consumer surplus (CS); a producer surplus (PS); a government surplus (GS) v fiscal – income to the state budget v protection – domestic producers against foreign competitors v consumption – consumers have to pay more => buy less

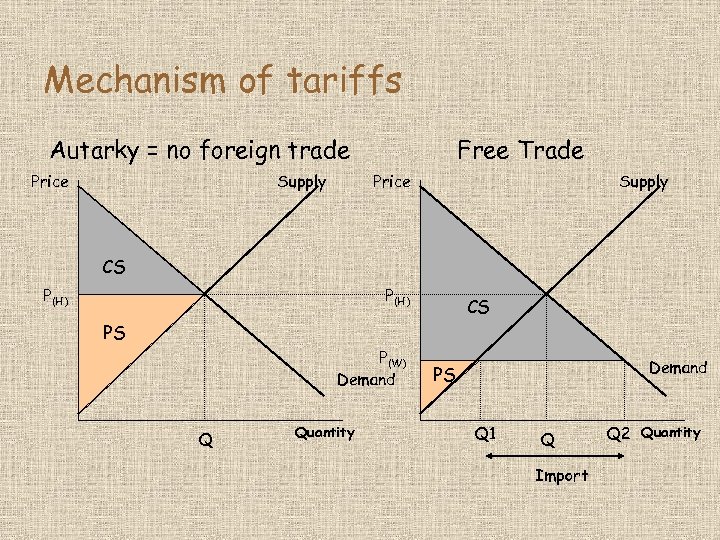

Mechanism of tariffs Autarky = no foreign trade Price Supply Free Trade Price Supply CS P(H) CS PS P(W) Demand Q Quantity Demand PS Q 1 Q Import Q 2 Quantity

Mechanism of tariffs Autarky = no foreign trade Price Supply Free Trade Price Supply CS P(H) CS PS P(W) Demand Q Quantity Demand PS Q 1 Q Import Q 2 Quantity

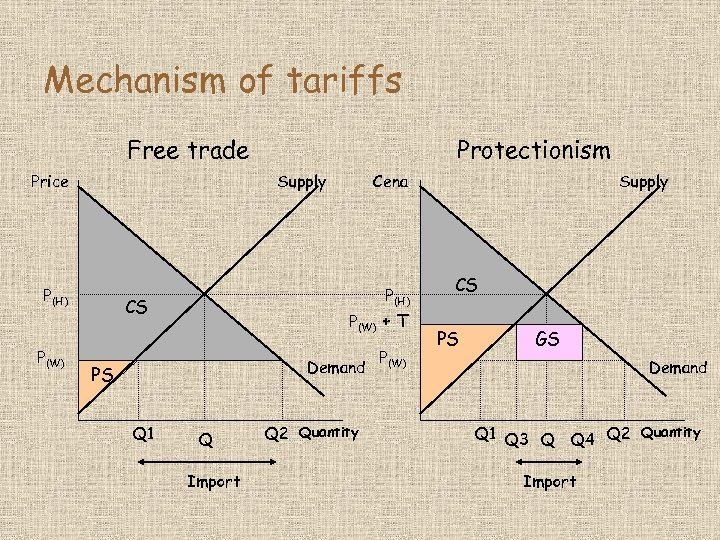

Mechanism of tariffs Free trade Price Supply P(H) P(W) Protectionism Cena P(H) CS P(W) + T Demand PS Q 1 Q Import Q 2 Quantity P(W) Supply CS PS GS Demand Q 1 Q 3 Q Q 4 Q 2 Quantity Import

Mechanism of tariffs Free trade Price Supply P(H) P(W) Protectionism Cena P(H) CS P(W) + T Demand PS Q 1 Q Import Q 2 Quantity P(W) Supply CS PS GS Demand Q 1 Q 3 Q Q 4 Q 2 Quantity Import