822bf102b5c53a8a0ecd825f5c1f1b24.ppt

- Количество слайдов: 31

Economic policy making: motives and driving forces in practice. Discussion … There ain't no such thing as a free lunch

Economic policy making: motives and driving forces in practice. Discussion … There ain't no such thing as a free lunch

Famous quotes: • “Economics is haunted by more fallacies than any other study known to man. ” Henry Hazlitt • Everyone wants to live at the expense of the state. They forget that the state wants to live at the expense of everyone. (Frederic Bastiat ) • The Great Depression, like most other periods of severe unemployment, was produced by government mismanagement rather than by any inherent instability of the private economy. (Milton Friedman )

Famous quotes: • “Economics is haunted by more fallacies than any other study known to man. ” Henry Hazlitt • Everyone wants to live at the expense of the state. They forget that the state wants to live at the expense of everyone. (Frederic Bastiat ) • The Great Depression, like most other periods of severe unemployment, was produced by government mismanagement rather than by any inherent instability of the private economy. (Milton Friedman )

Milton Friedman • If you put the federal government in charge of the Sahara Desert, in 5 years there'd be a shortage of sand • We have a system that increasingly taxes work and subsidizes nonwork • The government solution to a problem is usually as bad as the problem • Many people want the government to protect the consumer. A much more urgent problem is to protect the consumer from the government • Most of the energy of political work is devoted to correcting the effects of mismanagement of government

Milton Friedman • If you put the federal government in charge of the Sahara Desert, in 5 years there'd be a shortage of sand • We have a system that increasingly taxes work and subsidizes nonwork • The government solution to a problem is usually as bad as the problem • Many people want the government to protect the consumer. A much more urgent problem is to protect the consumer from the government • Most of the energy of political work is devoted to correcting the effects of mismanagement of government

Purpose of economic policies, as conventionally stated • macroeconomic intervention: anti-cyclical, stabilisation framework • implementing of government structural priorities • geo-political priorities • correcting market failures • promoting political priorities (social welfare etc) • combining, arbitrating or fine-tuning intervention instruments, held by various stakeholders (government, central bank, employers, trade-unions etc) • protect market environment (as perceived by political representation)

Purpose of economic policies, as conventionally stated • macroeconomic intervention: anti-cyclical, stabilisation framework • implementing of government structural priorities • geo-political priorities • correcting market failures • promoting political priorities (social welfare etc) • combining, arbitrating or fine-tuning intervention instruments, held by various stakeholders (government, central bank, employers, trade-unions etc) • protect market environment (as perceived by political representation)

Conventional wisdom • governments are there to intervene to stabilize the economy • governments are there to implement political priorities • governments are there to promote economic growth • governments are there to correct market failures

Conventional wisdom • governments are there to intervene to stabilize the economy • governments are there to implement political priorities • governments are there to promote economic growth • governments are there to correct market failures

Assumptions • As opposed to laissez-faire, economic policy is by definition about interventionism • There would be a great number of variants of the scope of intervention … • Resulting in a more or less defensive or proactive approach to exercising the policies (intervention power)

Assumptions • As opposed to laissez-faire, economic policy is by definition about interventionism • There would be a great number of variants of the scope of intervention … • Resulting in a more or less defensive or proactive approach to exercising the policies (intervention power)

Hazlitt: “Economics is haunted by more fallacies than any other study known to man… This is no accident…“ „ …The inherent difficulties of the subject would be great enough in any case, but they are multiplied a thousand fold by a factor that is insignificant in, say, physics, mathematics or medicine - the special pleading of selfish interests. “ ↓ Whether we like it or not, economic policy decision making is no different …

Hazlitt: “Economics is haunted by more fallacies than any other study known to man… This is no accident…“ „ …The inherent difficulties of the subject would be great enough in any case, but they are multiplied a thousand fold by a factor that is insignificant in, say, physics, mathematics or medicine - the special pleading of selfish interests. “ ↓ Whether we like it or not, economic policy decision making is no different …

Framing the subject of economic policies … Of course, the face value of stated intentions matters … and yet: • Economic policy is all about politics … • No one is owner of the only and full truth (truth is a very subjective and very political category) • „There ain't no such thing as a free lunch“ (who said that? ) • There are no anonymous resources • There are no magic boxes …

Framing the subject of economic policies … Of course, the face value of stated intentions matters … and yet: • Economic policy is all about politics … • No one is owner of the only and full truth (truth is a very subjective and very political category) • „There ain't no such thing as a free lunch“ (who said that? ) • There are no anonymous resources • There are no magic boxes …

Framing the subject of economic policies … ctd • • • The world almost always behaves differently to wishes of politicians (and expectations of analysts …) The most important piece of information is available either late, or is often overlooked or misinterpreted Usually, traders will note the crucial information earlier than analysts, analysts earlier than managers and managers earlier than politicians … For some reason, misjudgements get to be particularly resilient … Views evolve substantially over time … Memories are surprisingly short … Policy mistakes are often reproduced (past lessons are often ignored – example: fiscal impulse to revitalize an economy is always paid hard by future generations, yet, governments keep having recourse to it …) The textbooks are right in stressing that the leading motive for policy makers is to get re-elected … Always do expect surprises … The risks of wishful thinking are not to be ignored … ctd

Framing the subject of economic policies … ctd • • • The world almost always behaves differently to wishes of politicians (and expectations of analysts …) The most important piece of information is available either late, or is often overlooked or misinterpreted Usually, traders will note the crucial information earlier than analysts, analysts earlier than managers and managers earlier than politicians … For some reason, misjudgements get to be particularly resilient … Views evolve substantially over time … Memories are surprisingly short … Policy mistakes are often reproduced (past lessons are often ignored – example: fiscal impulse to revitalize an economy is always paid hard by future generations, yet, governments keep having recourse to it …) The textbooks are right in stressing that the leading motive for policy makers is to get re-elected … Always do expect surprises … The risks of wishful thinking are not to be ignored … ctd

Example: the Euro – hopes and reality Yves Thibault de Silgy: „The Euro will provide a stable and sound macroeconomic framework“ … and the euro was expected to provide a growth impulse, promote further convergence inside the zone and to have a disciplining effect on economic policies Events since the euro introduction: - Speculative bubble on IT and CT markets 1999 -2000 - Economic recession (stagnation) 2001 -2004, implying … - An extreme loosening of ECB monetary policies … - Followed by a real estate bubble and excess credit supply … - Followed by a global financial and economic shock, implying. . - Series of conventional and unconventional actions of ECB monetary policies - Followed by a debt crisis, threatening the very foundations of the Eurozone - The convergence has taken place only to a limited extent (or not at all…) - For 8 years, the euro seemed to be a success story, ever since 2008 -2009 it is the main source of concern for the global economy

Example: the Euro – hopes and reality Yves Thibault de Silgy: „The Euro will provide a stable and sound macroeconomic framework“ … and the euro was expected to provide a growth impulse, promote further convergence inside the zone and to have a disciplining effect on economic policies Events since the euro introduction: - Speculative bubble on IT and CT markets 1999 -2000 - Economic recession (stagnation) 2001 -2004, implying … - An extreme loosening of ECB monetary policies … - Followed by a real estate bubble and excess credit supply … - Followed by a global financial and economic shock, implying. . - Series of conventional and unconventional actions of ECB monetary policies - Followed by a debt crisis, threatening the very foundations of the Eurozone - The convergence has taken place only to a limited extent (or not at all…) - For 8 years, the euro seemed to be a success story, ever since 2008 -2009 it is the main source of concern for the global economy

Example: the Euro – hopes and reality … questions Questions: - What were the benefits of the Eurozone creation, how were they distributed over time and over countries and are they still there? What were the costs and how were they distributed? - How much of the past and current trouble was actually imported and how much was fuelled by systemic (institutional) deficiencies of the Eurozone itself? - Has the Eurozone served as a protective shield or, rather, has it exposed further the structural weaknesses of its members? - Why is it that further convergence has not taken place? - Can the Eurozone ever survive without a European fiscal union?

Example: the Euro – hopes and reality … questions Questions: - What were the benefits of the Eurozone creation, how were they distributed over time and over countries and are they still there? What were the costs and how were they distributed? - How much of the past and current trouble was actually imported and how much was fuelled by systemic (institutional) deficiencies of the Eurozone itself? - Has the Eurozone served as a protective shield or, rather, has it exposed further the structural weaknesses of its members? - Why is it that further convergence has not taken place? - Can the Eurozone ever survive without a European fiscal union?

Framing further the subject of economic policies … • Economic policy decisions have no measurable alternatives: it is not possible to measure something that has not taken place … examples (following the euro case): – what would be the economic performance in the EU of the Euro was not introduced? ? ? – What would happen to economies in 2008 -2009 if fiscal stimulus was not provided by governments? – What would be our own situation in this country if we adopted the Euro in 2009 (as expected at one stage…) • • While it might be (and, actually, it is) possible to measure the benefit of a given decision to groups, sectors or interested parties, on the other hand it is not possible to conclude that a benefit has been provided to all Actually, speaking about the words „benefit to all“, it is not even clear what „benefit“ truly means (ex: is GDP the right indicator? )

Framing further the subject of economic policies … • Economic policy decisions have no measurable alternatives: it is not possible to measure something that has not taken place … examples (following the euro case): – what would be the economic performance in the EU of the Euro was not introduced? ? ? – What would happen to economies in 2008 -2009 if fiscal stimulus was not provided by governments? – What would be our own situation in this country if we adopted the Euro in 2009 (as expected at one stage…) • • While it might be (and, actually, it is) possible to measure the benefit of a given decision to groups, sectors or interested parties, on the other hand it is not possible to conclude that a benefit has been provided to all Actually, speaking about the words „benefit to all“, it is not even clear what „benefit“ truly means (ex: is GDP the right indicator? )

Framing further the subject of economic policies … • • It would be illusory to believe that a „win win“ solution to all can always be designed … in reality, it is more likely that the benefit of some will imply a loss (cost) to others (from the temporal or sectoral point of view, or both) „There ain't no such thing as a free lunch“ If „there ain´t no such thing as an objective truth“ then no solution/decision in economic policy can objectively be the best … … which is primarily about politics (classical example: left wing parties will promote that the budget deficit is covered by increased taxes, while right wing parties would rather prefer cutting budget expenditures Experiments rarely work, or their results are misinterpreted Miracle solutions happen only in fairy tales Models are a very useful tool helping to frame and discipline thinking, however, if overestimated, they may imply serious mistakes in economic policy decision making …

Framing further the subject of economic policies … • • It would be illusory to believe that a „win win“ solution to all can always be designed … in reality, it is more likely that the benefit of some will imply a loss (cost) to others (from the temporal or sectoral point of view, or both) „There ain't no such thing as a free lunch“ If „there ain´t no such thing as an objective truth“ then no solution/decision in economic policy can objectively be the best … … which is primarily about politics (classical example: left wing parties will promote that the budget deficit is covered by increased taxes, while right wing parties would rather prefer cutting budget expenditures Experiments rarely work, or their results are misinterpreted Miracle solutions happen only in fairy tales Models are a very useful tool helping to frame and discipline thinking, however, if overestimated, they may imply serious mistakes in economic policy decision making …

Framing further the subject of economic policies … • the issue of different time horizons (government, central banks, financial institutions, shareholders, consumers etc …) • carrying over costs … (has been dealt with already earlier today) • carrying over risks (let’s talk about the crisis and it’s underlying factors…) • the issue of information asymmetry (and uneven distribution and delays in delivery) • the issues of emotions vs. rationality • rent seeking • the power of expectations in economic life, their role in economic policies • the phenomenon of vested interests and hidden motives • the phenomenon of a “drop in the sea”

Framing further the subject of economic policies … • the issue of different time horizons (government, central banks, financial institutions, shareholders, consumers etc …) • carrying over costs … (has been dealt with already earlier today) • carrying over risks (let’s talk about the crisis and it’s underlying factors…) • the issue of information asymmetry (and uneven distribution and delays in delivery) • the issues of emotions vs. rationality • rent seeking • the power of expectations in economic life, their role in economic policies • the phenomenon of vested interests and hidden motives • the phenomenon of a “drop in the sea”

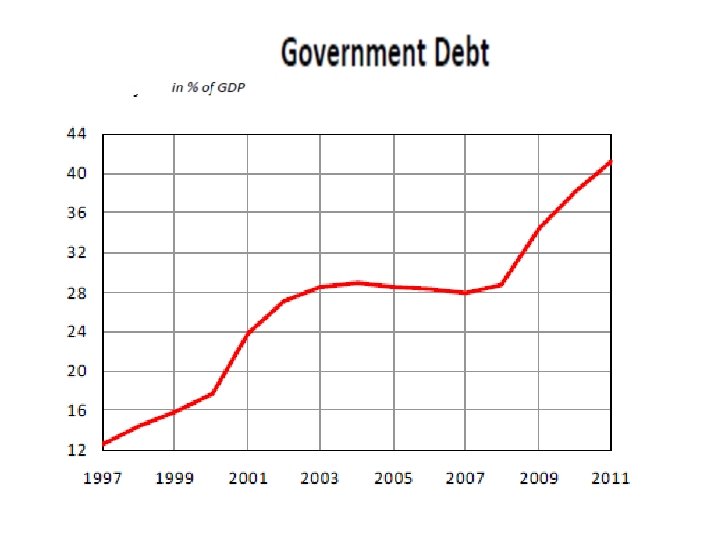

Examples of policy tricks • • Claiming de facto the anonymous feature of the budget resources („this is so important that is simply has to be paid by the state budget“) … … or the public debt („our current public debt to GDP ratio is 43 %, so we can afford to increase it since the Maastricht criterion is 60%“) Pushing the problems away (example: the debate about European bonds) Playing the game of inter-sectoral or inter-temporal distribution of costs of policy decisions (higher taxes or lower expenditure or higher deficit) Having recourse to old (and failed) solutions (printing money etc) • Recent examples: • • • – Taxing more financial institutions or distribution networks – Increasing the deposit insurance coverage will cost nothing to taxpayers …

Examples of policy tricks • • Claiming de facto the anonymous feature of the budget resources („this is so important that is simply has to be paid by the state budget“) … … or the public debt („our current public debt to GDP ratio is 43 %, so we can afford to increase it since the Maastricht criterion is 60%“) Pushing the problems away (example: the debate about European bonds) Playing the game of inter-sectoral or inter-temporal distribution of costs of policy decisions (higher taxes or lower expenditure or higher deficit) Having recourse to old (and failed) solutions (printing money etc) • Recent examples: • • • – Taxing more financial institutions or distribution networks – Increasing the deposit insurance coverage will cost nothing to taxpayers …

Possible implications of all that … • Unintended and unexpected distortions to markets (solar energy …) • Solving the current problems today we create new problems tomorrow (the financial – economic – debt crisis …) • Feeding corruption, erode credibility etc … So far, we have described quite a pesimistic vision of economic policies. However …

Possible implications of all that … • Unintended and unexpected distortions to markets (solar energy …) • Solving the current problems today we create new problems tomorrow (the financial – economic – debt crisis …) • Feeding corruption, erode credibility etc … So far, we have described quite a pesimistic vision of economic policies. However …

A balancing comment about the subject of economic policies … • • • Despite all the previous (and the fact that no government has ever found the solution to all deficiencies of a market economy) … … a market economy has no viable alternative, denying the market is not an option … we know something about it in our country Similarly, it is not a solution to take economic policies out of the hand of politicians (a propos: to whom would it be given? Technocrats tend to be no better …)

A balancing comment about the subject of economic policies … • • • Despite all the previous (and the fact that no government has ever found the solution to all deficiencies of a market economy) … … a market economy has no viable alternative, denying the market is not an option … we know something about it in our country Similarly, it is not a solution to take economic policies out of the hand of politicians (a propos: to whom would it be given? Technocrats tend to be no better …)

Examples for consideration 1 Scrappage schemes: • Purpose: increase demand for new cars: provide growth incentive to car industry • Assumption: segment of economy with lots of multiplication effects, large employer, get consumers go against the investment cycle (induced by crisis) • Description of scheme: subsidy from state budget paid on new car purchases • Who benefited: not only domestic, but also foreign car producers • Who suffered the costs: all taxpayers • Side effects: distortion to competitive environment, market signals Question for discussion: was that a useful scheme? Discuss the immediate effects, compared to systemic implications (costs).

Examples for consideration 1 Scrappage schemes: • Purpose: increase demand for new cars: provide growth incentive to car industry • Assumption: segment of economy with lots of multiplication effects, large employer, get consumers go against the investment cycle (induced by crisis) • Description of scheme: subsidy from state budget paid on new car purchases • Who benefited: not only domestic, but also foreign car producers • Who suffered the costs: all taxpayers • Side effects: distortion to competitive environment, market signals Question for discussion: was that a useful scheme? Discuss the immediate effects, compared to systemic implications (costs).

Examples for consideration 2 Investment incentives: • Purpose: promote investment, mostly (but not only) FDI, create jobs, instrument of „industrial“ policy (may also be calibrated regionally, sectorally …) • Assumption: important to actively promote competitivity of economy, use a lot by all countries • Description of scheme: various incentives provided to investor over a certain financial limit (tax holidays, subsidy to jobs created, providing all necessary infrastructure such as road, railway connection, water and electricity lines etc) • Who benefits: all investors eligible by financial criterion • Who suffers the costs: all taxpayers, non-eligible companies who are at clear market disadvantage, incidentally mostly domestic. • Side effects: to some extent it is a scheme killer of small domestic enterprises, in addition it distorts the structural balance in economies (Slovakia and Czechs excessively dependent on highly cyclical car industry) Question for discussion: is that a useful scheme? Discuss the immediate effects, compared to systemic implications (costs).

Examples for consideration 2 Investment incentives: • Purpose: promote investment, mostly (but not only) FDI, create jobs, instrument of „industrial“ policy (may also be calibrated regionally, sectorally …) • Assumption: important to actively promote competitivity of economy, use a lot by all countries • Description of scheme: various incentives provided to investor over a certain financial limit (tax holidays, subsidy to jobs created, providing all necessary infrastructure such as road, railway connection, water and electricity lines etc) • Who benefits: all investors eligible by financial criterion • Who suffers the costs: all taxpayers, non-eligible companies who are at clear market disadvantage, incidentally mostly domestic. • Side effects: to some extent it is a scheme killer of small domestic enterprises, in addition it distorts the structural balance in economies (Slovakia and Czechs excessively dependent on highly cyclical car industry) Question for discussion: is that a useful scheme? Discuss the immediate effects, compared to systemic implications (costs).

Examples for consideration 3 Fiscal stimuli • • • Purpose: compensate for output losses in crisis time Assumption: governments should actively play the anticyclical card of fiscal policies Description of scheme: implemented either through automatic fiscal stabilizers (what is that? ) or discretionary fiscal policies, most often both, in many ways quite similar to the previous two (actually both could be seen as part of it) Who benefits: may have short-term cascade effects on many segments of economy Who suffers the costs: all taxpayers (current – via deficit - and future – via debt), private sector (crowding-out and cost effect of public deficit/debt on private investment) Side effects: over time loss of credibility of fiscal policy, implied increased cost of borrowing and, most of all, future pro-cyclical feature of fiscal policy = fiscal consolidation in times of stagnation/recession (as seen currently) Question for discussion: is that a viable policy instrument? Discuss the short -term effects as opposed to the medium and long term ones ….

Examples for consideration 3 Fiscal stimuli • • • Purpose: compensate for output losses in crisis time Assumption: governments should actively play the anticyclical card of fiscal policies Description of scheme: implemented either through automatic fiscal stabilizers (what is that? ) or discretionary fiscal policies, most often both, in many ways quite similar to the previous two (actually both could be seen as part of it) Who benefits: may have short-term cascade effects on many segments of economy Who suffers the costs: all taxpayers (current – via deficit - and future – via debt), private sector (crowding-out and cost effect of public deficit/debt on private investment) Side effects: over time loss of credibility of fiscal policy, implied increased cost of borrowing and, most of all, future pro-cyclical feature of fiscal policy = fiscal consolidation in times of stagnation/recession (as seen currently) Question for discussion: is that a viable policy instrument? Discuss the short -term effects as opposed to the medium and long term ones ….

Examples for consideration 4 School fees for university education • • • Purpose: decrease the cost of university education to the state budget, other (but disputed) arguments: provide incentives to school and students Assumption (as officially stated): create a new financing stream to cover the needs and to improve the quality of education, create increased cost pressure on this segment of the educational system with the aim of increasing the quality, distribute more evenly the costs of getting university grades (“those who directly benefit should pay more”) – currently presumably distributed very unfairly Description of scheme: fees paid by students to cover a certain part (not all) of the costs of the education, technically various options exist … Who benefits: in the short run immediately taxpayers, in the longer run (perhaps) the entire society and economy (= benefits of better skilled population) Who suffers the costs: students Side effects: if not designed properly, may lead to various discriminatory distortions in access to education Question: what is your view of that? Do you find it fair to introduce school fees or do you stick to the assumption that education should be kept “free” (knowing however that “ there ain´t no such thing as a free lunch”

Examples for consideration 4 School fees for university education • • • Purpose: decrease the cost of university education to the state budget, other (but disputed) arguments: provide incentives to school and students Assumption (as officially stated): create a new financing stream to cover the needs and to improve the quality of education, create increased cost pressure on this segment of the educational system with the aim of increasing the quality, distribute more evenly the costs of getting university grades (“those who directly benefit should pay more”) – currently presumably distributed very unfairly Description of scheme: fees paid by students to cover a certain part (not all) of the costs of the education, technically various options exist … Who benefits: in the short run immediately taxpayers, in the longer run (perhaps) the entire society and economy (= benefits of better skilled population) Who suffers the costs: students Side effects: if not designed properly, may lead to various discriminatory distortions in access to education Question: what is your view of that? Do you find it fair to introduce school fees or do you stick to the assumption that education should be kept “free” (knowing however that “ there ain´t no such thing as a free lunch”

Examples for consideration 5 Deposit insurance schemes • • • Purpose: protect the savings of depositors (currently up to 100 k euros equivalent) in case of bankruptcy of financial institutions Assumption: costs of bankruptcy should be primarily covered by shareholders, depositors should get better treatment because of information asymmetry Description of scheme: covers most of the deposit instruments as offered by banks and other financial institutions Who benefits: depositors Who suffers the costs: all depositors of all institutions (contribution of institutions to the Deposit Insurance Fund, calculated as proportion of the deposits they administer): cost transferred to the depositors themselves via increased fees Side effects: moral hazard: depositors less vigilant to the institutional risk, the chose their institution solely by conditions on deposits it offers, also counterproductive on the institution´s side (aggressive market practices in search of new deposit client, in limit approaching the prudential principles) Question: what is your view of that? Is it correct that institutions (governments or Deposit Insurance Schemes) take away from customers/consumers (individuals) an ever increasing share of market risk? Why should consumers not be allowed to assume their part of risk?

Examples for consideration 5 Deposit insurance schemes • • • Purpose: protect the savings of depositors (currently up to 100 k euros equivalent) in case of bankruptcy of financial institutions Assumption: costs of bankruptcy should be primarily covered by shareholders, depositors should get better treatment because of information asymmetry Description of scheme: covers most of the deposit instruments as offered by banks and other financial institutions Who benefits: depositors Who suffers the costs: all depositors of all institutions (contribution of institutions to the Deposit Insurance Fund, calculated as proportion of the deposits they administer): cost transferred to the depositors themselves via increased fees Side effects: moral hazard: depositors less vigilant to the institutional risk, the chose their institution solely by conditions on deposits it offers, also counterproductive on the institution´s side (aggressive market practices in search of new deposit client, in limit approaching the prudential principles) Question: what is your view of that? Is it correct that institutions (governments or Deposit Insurance Schemes) take away from customers/consumers (individuals) an ever increasing share of market risk? Why should consumers not be allowed to assume their part of risk?

Choice of issues for discussion – Forex interventions by the central bank: when are they justified? – Should monetary policies consider asset price development and how? – How much (if at all) fiscal policy power should be taken away from governments in case of fiscal trouble? – Is a higher economic growth (higher GDP increase) a viable option to eliminate the accumulated fiscal debt? – How can a government support economic growth in a situation when the fiscal instrument is no more available (as it was so far)? – And, actually, should governments exercise growth policies at all? If not, what functions for governments do we see in the future? – When is a deficit of public budgets excessive, what are the criteria to evaluate it? Actually, is a deficit of public budgets an acceptable notion at all? – What needs to be done further to the pension systems (beyond what has been introduced already) to make them sustainable in the long run? – Optimal mix of fiscal reform elements (expenditure vs revenue) – Is a fiscal union a solution to the Eurozone trouble? – Is an early membership in the Eurozone still an option for us, given the structural weaknesses of our economy? Are there still benefits to be in? How do they compare to the benefits of remaining out? – Co-ordination of fiscal policies was embodied in the SGP – why has it failed? And is the current fiscal pact sufficient to keep deficits and debts under control

Choice of issues for discussion – Forex interventions by the central bank: when are they justified? – Should monetary policies consider asset price development and how? – How much (if at all) fiscal policy power should be taken away from governments in case of fiscal trouble? – Is a higher economic growth (higher GDP increase) a viable option to eliminate the accumulated fiscal debt? – How can a government support economic growth in a situation when the fiscal instrument is no more available (as it was so far)? – And, actually, should governments exercise growth policies at all? If not, what functions for governments do we see in the future? – When is a deficit of public budgets excessive, what are the criteria to evaluate it? Actually, is a deficit of public budgets an acceptable notion at all? – What needs to be done further to the pension systems (beyond what has been introduced already) to make them sustainable in the long run? – Optimal mix of fiscal reform elements (expenditure vs revenue) – Is a fiscal union a solution to the Eurozone trouble? – Is an early membership in the Eurozone still an option for us, given the structural weaknesses of our economy? Are there still benefits to be in? How do they compare to the benefits of remaining out? – Co-ordination of fiscal policies was embodied in the SGP – why has it failed? And is the current fiscal pact sufficient to keep deficits and debts under control

Choice of issues for discussion • • • Jak daleko má dnes eurozóna ke skutečné fiskální unii? Zamyšlení na současnou dluhovou krizí … Rozšiřování daňového základu a zjednodušování daňového systému omezováním zvláštních úprav a výjimek oslabuje účinnost hospodářské politiky: „pravda nebo mýtus“? „Tvrdíme, že národ, který se snaží , prodanit´ k prosperitě, je jako člověk, který stojí v kbelíku a snaží se sám sebe zvednoutza rukojeť“ (Winston Churchill) ¨Ničí progresivní daně hospodářský růst či nikoliv? Dluhy předlužených zemí: odpouštět či neodpouštět? Zlaté časy, kdy se jevilo že měnová politika našla recept na trvalý nízkoinflační růst s krizí zjevně skončily. . . kde se stala chyba? A dá se o chybě vůbec hovořit? Ekonomická transformace s sebou nese nevyhnutelné náklady . . . má smyslu tyto náklady rozkládat (třeba v čase) nebo je lepší nechat je na ekonomiku dopadnout jednorázově. . . úvaha. Ve většině zemí se veřejné rozpočty chronicky potýkají s deficitními tendenci – je to nevyhnutelné? Pokud ano, čím je to způsobené a jak by bylo možné tomuto jevu čelit? Je vůbec žádoucí tomuto jevu čelit? Může vnější fiskální pravidlo pomoci řešit intertemporální, resp. mezigenerační rozložení nákladů fiskální politiky? Pokud ne proč, pokud ano čím resp. jak?

Choice of issues for discussion • • • Jak daleko má dnes eurozóna ke skutečné fiskální unii? Zamyšlení na současnou dluhovou krizí … Rozšiřování daňového základu a zjednodušování daňového systému omezováním zvláštních úprav a výjimek oslabuje účinnost hospodářské politiky: „pravda nebo mýtus“? „Tvrdíme, že národ, který se snaží , prodanit´ k prosperitě, je jako člověk, který stojí v kbelíku a snaží se sám sebe zvednoutza rukojeť“ (Winston Churchill) ¨Ničí progresivní daně hospodářský růst či nikoliv? Dluhy předlužených zemí: odpouštět či neodpouštět? Zlaté časy, kdy se jevilo že měnová politika našla recept na trvalý nízkoinflační růst s krizí zjevně skončily. . . kde se stala chyba? A dá se o chybě vůbec hovořit? Ekonomická transformace s sebou nese nevyhnutelné náklady . . . má smyslu tyto náklady rozkládat (třeba v čase) nebo je lepší nechat je na ekonomiku dopadnout jednorázově. . . úvaha. Ve většině zemí se veřejné rozpočty chronicky potýkají s deficitními tendenci – je to nevyhnutelné? Pokud ano, čím je to způsobené a jak by bylo možné tomuto jevu čelit? Je vůbec žádoucí tomuto jevu čelit? Může vnější fiskální pravidlo pomoci řešit intertemporální, resp. mezigenerační rozložení nákladů fiskální politiky? Pokud ne proč, pokud ano čím resp. jak?

Putting things into historical perspective • The world before Keynes – Fluctuations of the economic cycle are an “ct of Providence” – Government intervention is needed solely to ensure the basic state functions (yet, state budget were often in deficit) – There is no anti-cyclical fiscal policy – Generally, lower government intervention in economy allows for (significantly according to current standards) lower fiscal redistribution (lower expenditure and less taxes – but higher custom fees because of protectionist attitudes) – Money supply linked to gold, prices are remarkably stable over the long run – Forex rates are derived from gold, there are no exchange rate fluctuations, changes are decided administratively – Interest rates reflect the true content of there are – price of money, they are solely determined by the market as a result of demand supply for/of credit – Central banks (as understood today) did not exist

Putting things into historical perspective • The world before Keynes – Fluctuations of the economic cycle are an “ct of Providence” – Government intervention is needed solely to ensure the basic state functions (yet, state budget were often in deficit) – There is no anti-cyclical fiscal policy – Generally, lower government intervention in economy allows for (significantly according to current standards) lower fiscal redistribution (lower expenditure and less taxes – but higher custom fees because of protectionist attitudes) – Money supply linked to gold, prices are remarkably stable over the long run – Forex rates are derived from gold, there are no exchange rate fluctuations, changes are decided administratively – Interest rates reflect the true content of there are – price of money, they are solely determined by the market as a result of demand supply for/of credit – Central banks (as understood today) did not exist

Putting things into historical perspective ctd • The world according to Keynes … – The government’s primary role is to ensure that economic growth is stable. The government has the right and the obligation to make use, for that purpose, of both the fiscal and monetary policies – In case of economic decline, the government can and is supposed to increase spending (and run budget deficits) to stimulate the economy … – However, in case of the growth phase of the economic cycle, governments must run a budget surplus and repay debts, accumulated in the crisis time – The stability of domestic prices should get the priority to the stability of foreign exchange rate

Putting things into historical perspective ctd • The world according to Keynes … – The government’s primary role is to ensure that economic growth is stable. The government has the right and the obligation to make use, for that purpose, of both the fiscal and monetary policies – In case of economic decline, the government can and is supposed to increase spending (and run budget deficits) to stimulate the economy … – However, in case of the growth phase of the economic cycle, governments must run a budget surplus and repay debts, accumulated in the crisis time – The stability of domestic prices should get the priority to the stability of foreign exchange rate

Putting things into historical perspective ctd - you may actually run a budget deficit almost indefinitely, there almost not limits to government indebtedness – the public debt can be eroded by higher inflation (implying the need to have government influence – explicit or hidden – over central banks) – loss of credibility of both fiscal and monetary policies

Putting things into historical perspective ctd - you may actually run a budget deficit almost indefinitely, there almost not limits to government indebtedness – the public debt can be eroded by higher inflation (implying the need to have government influence – explicit or hidden – over central banks) – loss of credibility of both fiscal and monetary policies

A balancing comment about the subject of economic policies … • • • Despite all the previous (and the fact that no government has ever found the solution to all deficiencies of a market economy) … … a market economy has no viable alternative, denying the market is not an option … we know something about it in our country Similarly, it is not a solution to take economic policies out of the hand of politicians (a propos: to whom would it be given? Technocrats tend to be no better …)

A balancing comment about the subject of economic policies … • • • Despite all the previous (and the fact that no government has ever found the solution to all deficiencies of a market economy) … … a market economy has no viable alternative, denying the market is not an option … we know something about it in our country Similarly, it is not a solution to take economic policies out of the hand of politicians (a propos: to whom would it be given? Technocrats tend to be no better …)

Purpose of economic policies • macroeconomic intervention: anti-cyclical, stabilisation framework • implementing of government structural priorities • geo-political priorities • correcting market failures • promoting political priorities (social welfare etc) • combining, arbitrating or fine-tuning intervention instruments, held by various stakeholders (government, central bank, employers, trade-unions etc) • protect market environment (as perceived by political representation)

Purpose of economic policies • macroeconomic intervention: anti-cyclical, stabilisation framework • implementing of government structural priorities • geo-political priorities • correcting market failures • promoting political priorities (social welfare etc) • combining, arbitrating or fine-tuning intervention instruments, held by various stakeholders (government, central bank, employers, trade-unions etc) • protect market environment (as perceived by political representation)