04aef6ed48ea4aeebcf6c2939c9be272.ppt

- Количество слайдов: 32

Economic Modeling CSCI 1210 Spring 2004

Economic Modeling CSCI 1210 Spring 2004

“It’s the Economy, Stupid!” --Political consultant James Carville Ø What are the key economic issues? Ø Can we model the major influences on the economy? Ø How do policy choices affect these factors?

“It’s the Economy, Stupid!” --Political consultant James Carville Ø What are the key economic issues? Ø Can we model the major influences on the economy? Ø How do policy choices affect these factors?

Why Political Economics is Hard Ø Inherent complexity Ø Limitations of theory Ø Political spin doctoring Ø Deliberate obfuscation

Why Political Economics is Hard Ø Inherent complexity Ø Limitations of theory Ø Political spin doctoring Ø Deliberate obfuscation

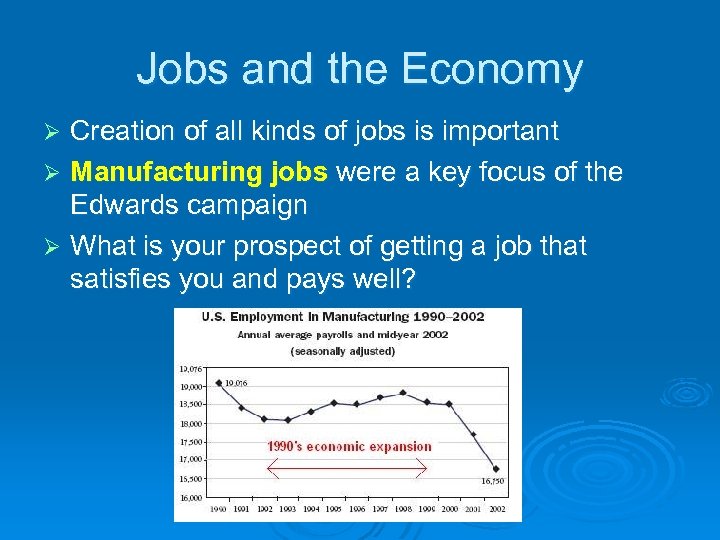

Jobs and the Economy Creation of all kinds of jobs is important Ø Manufacturing jobs were a key focus of the Edwards campaign Ø What is your prospect of getting a job that satisfies you and pays well? Ø

Jobs and the Economy Creation of all kinds of jobs is important Ø Manufacturing jobs were a key focus of the Edwards campaign Ø What is your prospect of getting a job that satisfies you and pays well? Ø

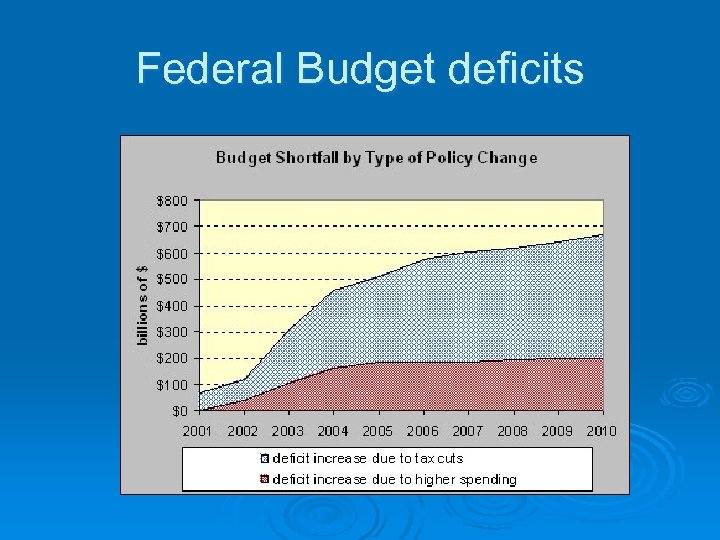

Federal Budget deficits

Federal Budget deficits

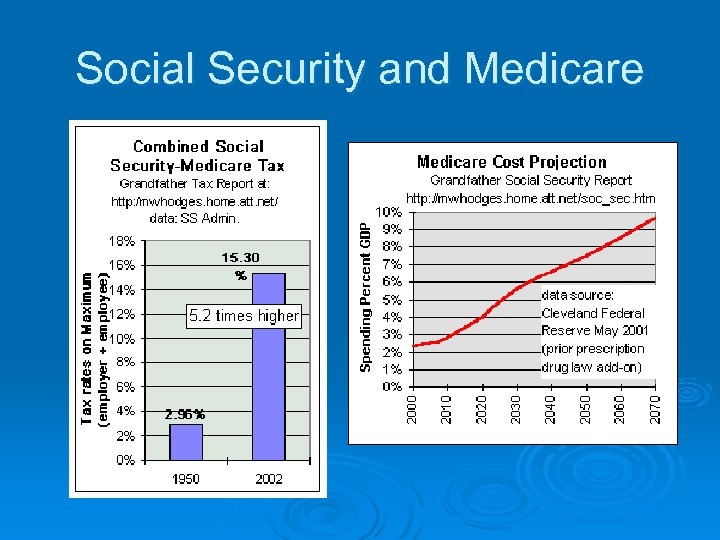

Social Security and Medicare

Social Security and Medicare

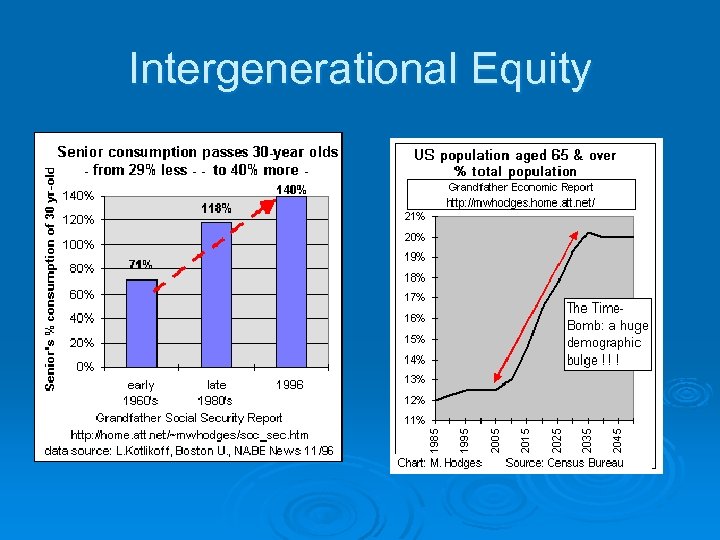

Intergenerational Equity

Intergenerational Equity

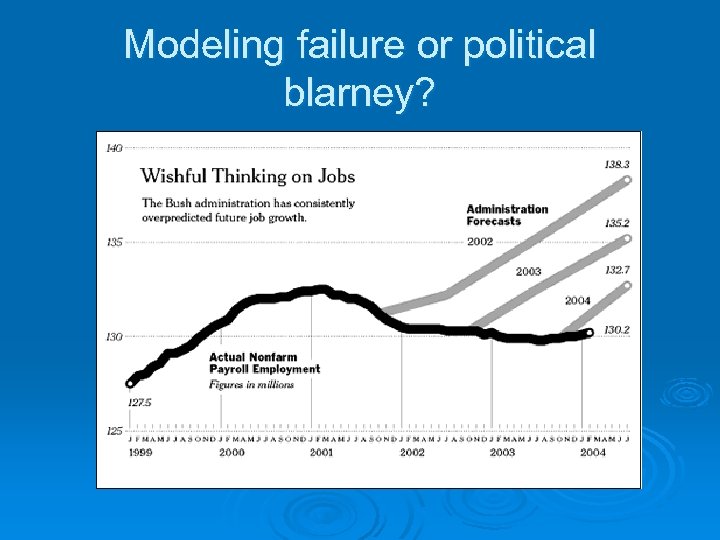

Modeling failure or political blarney?

Modeling failure or political blarney?

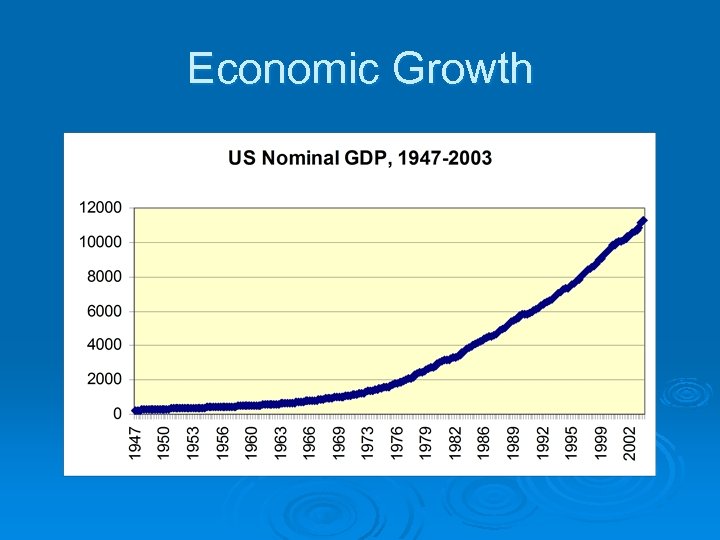

Economic Growth

Economic Growth

Economic growth and the Deficit “I owe $50, 000. Should I worry? ” Ø Answer: it depends on your projected future income! Ø Deficits are best measured as a percentage of Gross Domestic Product (GDP) Ø Budget deficit and trade deficit are both important

Economic growth and the Deficit “I owe $50, 000. Should I worry? ” Ø Answer: it depends on your projected future income! Ø Deficits are best measured as a percentage of Gross Domestic Product (GDP) Ø Budget deficit and trade deficit are both important

Ways of measuring GDP Ø Nominal GDP: total dollar amount Ø Real GDP: adjusted for inflation Ø Per capita GDP: production person Ø Per capita real GDP See the “Economic growth” spreadsheet for examples

Ways of measuring GDP Ø Nominal GDP: total dollar amount Ø Real GDP: adjusted for inflation Ø Per capita GDP: production person Ø Per capita real GDP See the “Economic growth” spreadsheet for examples

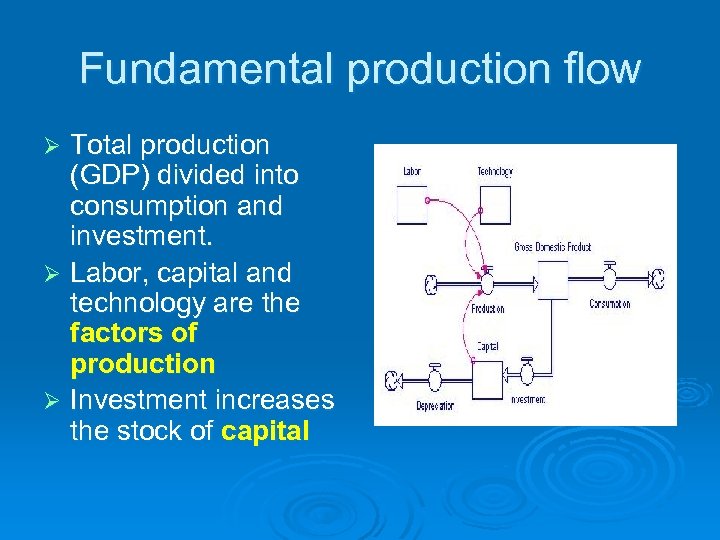

Fundamental production flow Total production (GDP) divided into consumption and investment. Ø Labor, capital and technology are the factors of production Ø Investment increases the stock of capital Ø

Fundamental production flow Total production (GDP) divided into consumption and investment. Ø Labor, capital and technology are the factors of production Ø Investment increases the stock of capital Ø

Fundamental production flow Ø Total production = Gross Domestic Product (GDP) Ø Production divided into consumption and investment Ø Investment adds to capital stock Ø Production investment more production: positive feedback loop!

Fundamental production flow Ø Total production = Gross Domestic Product (GDP) Ø Production divided into consumption and investment Ø Investment adds to capital stock Ø Production investment more production: positive feedback loop!

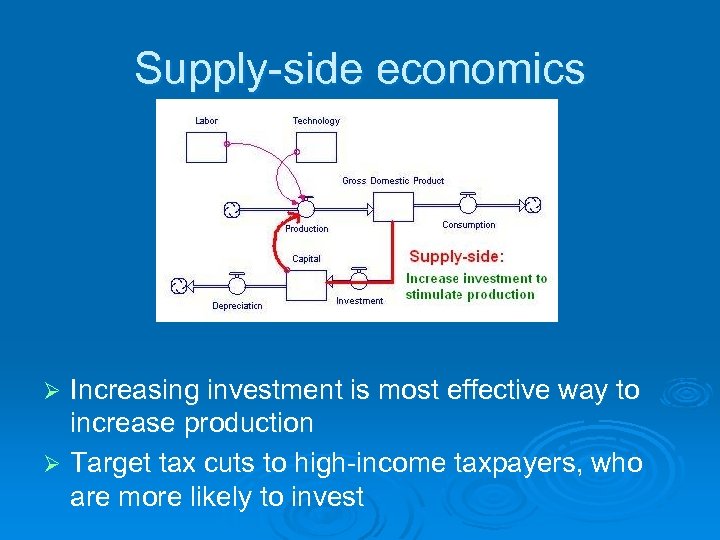

Supply-side economics Increasing investment is most effective way to increase production Ø Target tax cuts to high-income taxpayers, who are more likely to invest Ø

Supply-side economics Increasing investment is most effective way to increase production Ø Target tax cuts to high-income taxpayers, who are more likely to invest Ø

Keynesian economics Aggregate demand: total willingness of the economy to buy stuff Ø Government can influence aggregate demand by spending and tax policies Ø Aggregate demand is main control for production Ø

Keynesian economics Aggregate demand: total willingness of the economy to buy stuff Ø Government can influence aggregate demand by spending and tax policies Ø Aggregate demand is main control for production Ø

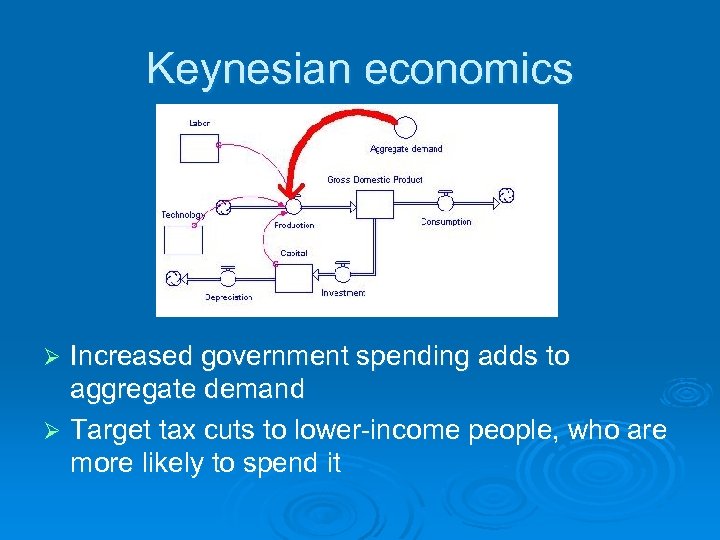

Keynesian economics Increased government spending adds to aggregate demand Ø Target tax cuts to lower-income people, who are more likely to spend it Ø

Keynesian economics Increased government spending adds to aggregate demand Ø Target tax cuts to lower-income people, who are more likely to spend it Ø

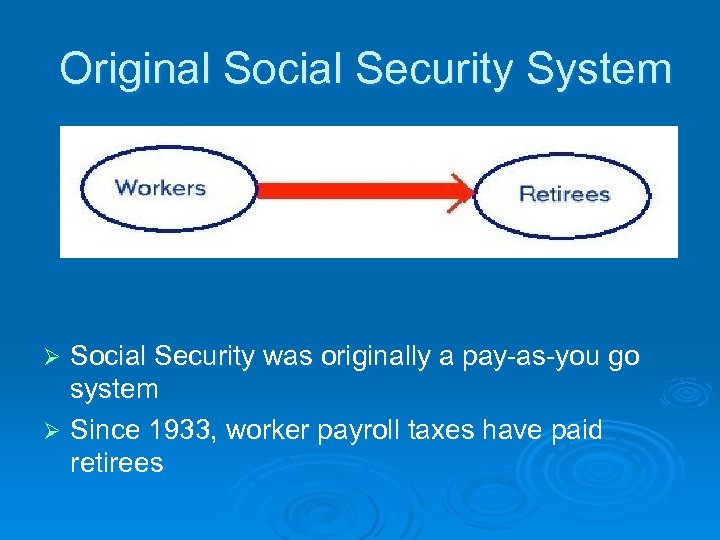

Original Social Security System Social Security was originally a pay-as-you go system Ø Since 1933, worker payroll taxes have paid retirees Ø

Original Social Security System Social Security was originally a pay-as-you go system Ø Since 1933, worker payroll taxes have paid retirees Ø

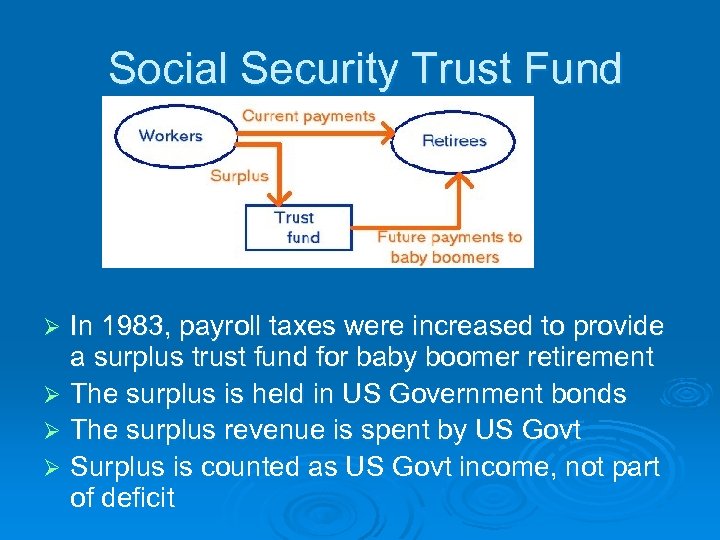

Social Security Trust Fund In 1983, payroll taxes were increased to provide a surplus trust fund for baby boomer retirement Ø The surplus is held in US Government bonds Ø The surplus revenue is spent by US Govt Ø Surplus is counted as US Govt income, not part of deficit Ø

Social Security Trust Fund In 1983, payroll taxes were increased to provide a surplus trust fund for baby boomer retirement Ø The surplus is held in US Government bonds Ø The surplus revenue is spent by US Govt Ø Surplus is counted as US Govt income, not part of deficit Ø

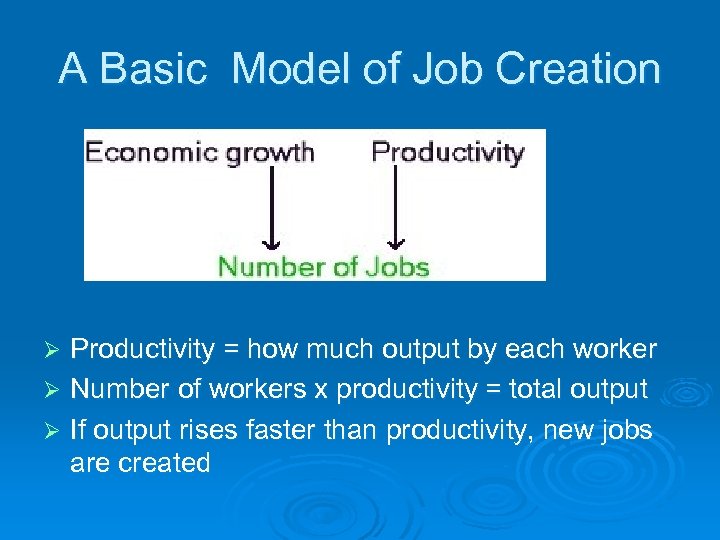

A Basic Model of Job Creation Productivity = how much output by each worker Ø Number of workers x productivity = total output Ø If output rises faster than productivity, new jobs are created Ø

A Basic Model of Job Creation Productivity = how much output by each worker Ø Number of workers x productivity = total output Ø If output rises faster than productivity, new jobs are created Ø

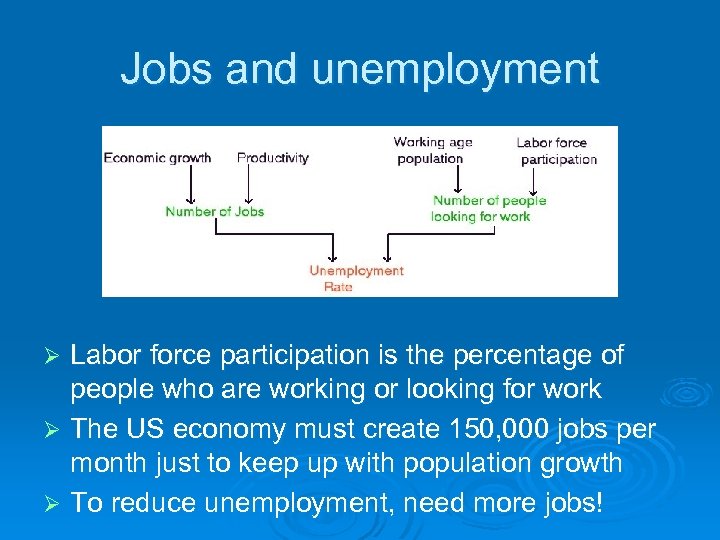

Jobs and unemployment Labor force participation is the percentage of people who are working or looking for work Ø The US economy must create 150, 000 jobs per month just to keep up with population growth Ø To reduce unemployment, need more jobs! Ø

Jobs and unemployment Labor force participation is the percentage of people who are working or looking for work Ø The US economy must create 150, 000 jobs per month just to keep up with population growth Ø To reduce unemployment, need more jobs! Ø

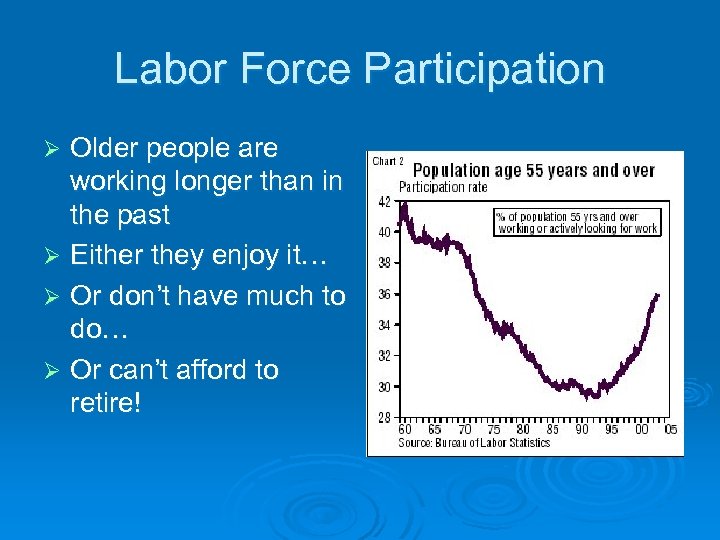

Labor Force Participation Older people are working longer than in the past Ø Either they enjoy it… Ø Or don’t have much to do… Ø Or can’t afford to retire! Ø

Labor Force Participation Older people are working longer than in the past Ø Either they enjoy it… Ø Or don’t have much to do… Ø Or can’t afford to retire! Ø

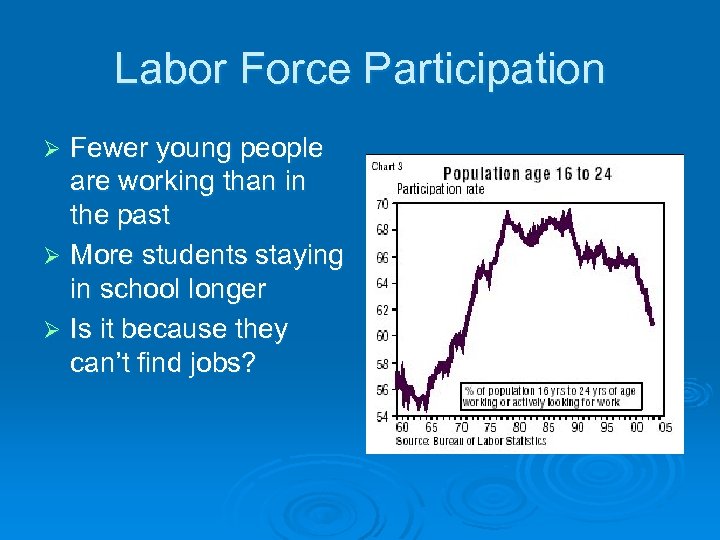

Labor Force Participation Fewer young people are working than in the past Ø More students staying in school longer Ø Is it because they can’t find jobs? Ø

Labor Force Participation Fewer young people are working than in the past Ø More students staying in school longer Ø Is it because they can’t find jobs? Ø

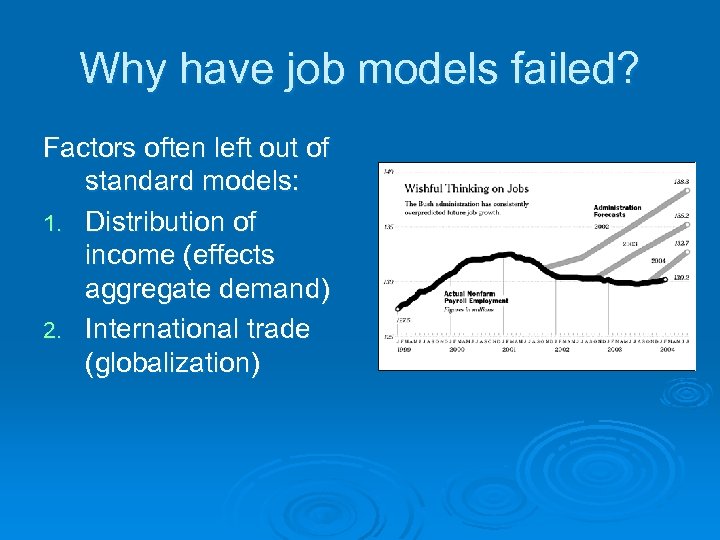

Why have job models failed? Factors often left out of standard models: 1. Distribution of income (effects aggregate demand) 2. International trade (globalization)

Why have job models failed? Factors often left out of standard models: 1. Distribution of income (effects aggregate demand) 2. International trade (globalization)

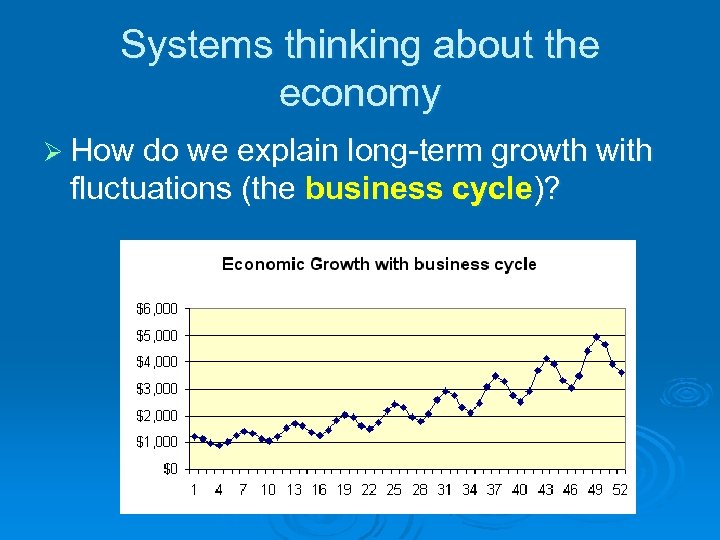

Systems thinking about the economy Ø How do we explain long-term growth with fluctuations (the business cycle)?

Systems thinking about the economy Ø How do we explain long-term growth with fluctuations (the business cycle)?

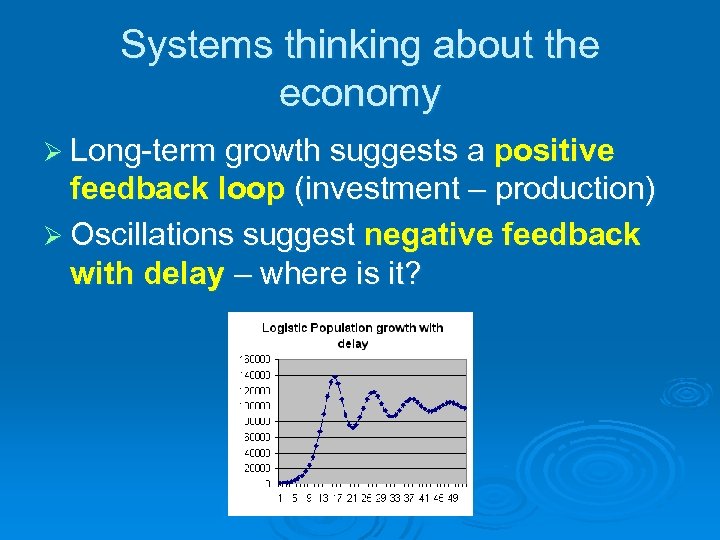

Systems thinking about the economy Ø Long-term growth suggests a positive feedback loop (investment – production) Ø Oscillations suggest negative feedback with delay – where is it?

Systems thinking about the economy Ø Long-term growth suggests a positive feedback loop (investment – production) Ø Oscillations suggest negative feedback with delay – where is it?

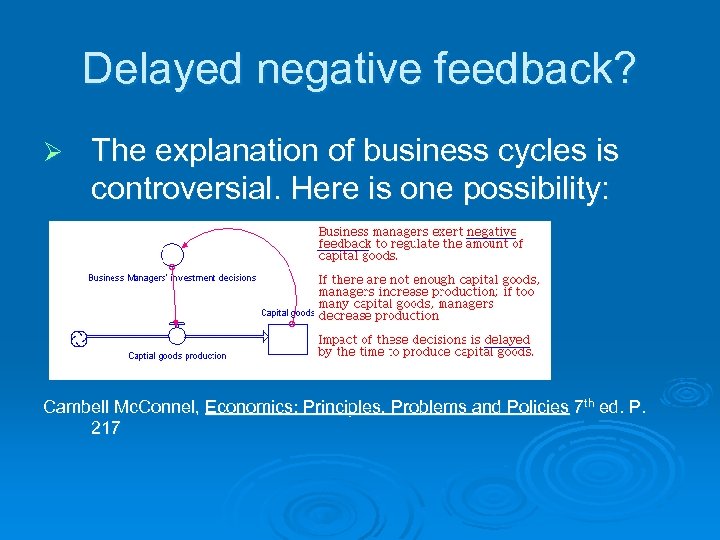

Delayed negative feedback? Ø The explanation of business cycles is controversial. Here is one possibility: Cambell Mc. Connel, Economics: Principles, Problems and Policies 7 th ed. P. 217

Delayed negative feedback? Ø The explanation of business cycles is controversial. Here is one possibility: Cambell Mc. Connel, Economics: Principles, Problems and Policies 7 th ed. P. 217

Delayed feedback example 1. 2. 3. 4. 5. 6. An entrepreneur opens a disco roller rink nightclub in Athens The club is a big hit! Three other local entrepreneurs plan disco roller rink nightclubs A few months later, there are 4 clubs All four clubs, sharing the market, lose $ A few months later, 2 clubs close

Delayed feedback example 1. 2. 3. 4. 5. 6. An entrepreneur opens a disco roller rink nightclub in Athens The club is a big hit! Three other local entrepreneurs plan disco roller rink nightclubs A few months later, there are 4 clubs All four clubs, sharing the market, lose $ A few months later, 2 clubs close

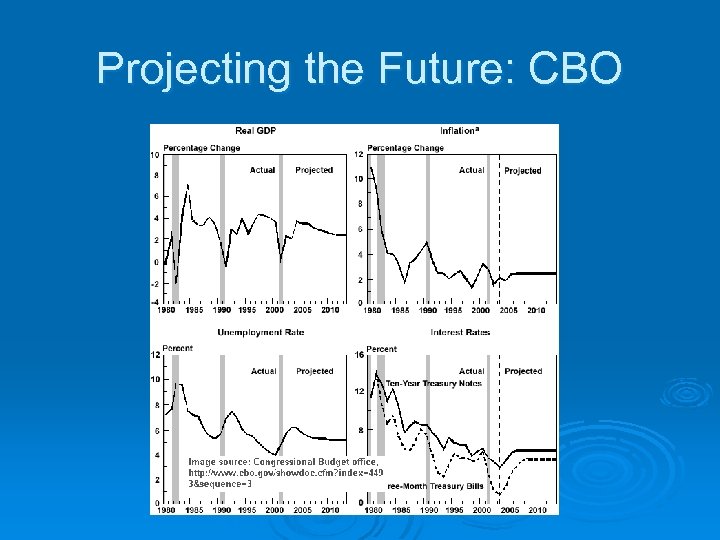

Projecting the Future: CBO

Projecting the Future: CBO

How to Lose $8 Trillion Ø Congressional Budget Office (CBO) predictions used to project Federal budget Ø Note curves ‘flatline’ out – they are guesses of average future values Ø Experiment: go back to spreadsheet, adjust GDP growth rate down 1%. What is total difference over 15 years?

How to Lose $8 Trillion Ø Congressional Budget Office (CBO) predictions used to project Federal budget Ø Note curves ‘flatline’ out – they are guesses of average future values Ø Experiment: go back to spreadsheet, adjust GDP growth rate down 1%. What is total difference over 15 years?

How to Lose $8 Trillion Ø Early 2001: Bush Administration projects a cumulative Federal budget surplus of $5. 6 trillion over 2001 -2011 time period Ø September 2003 – projected cumulative budget deficit of $2. 3 trillion over 20012011 time period Source: Dizzying Dive to Red Ink Poses Stark Choices for Washington by David Firestone. New York Times, Sept 14, 2003

How to Lose $8 Trillion Ø Early 2001: Bush Administration projects a cumulative Federal budget surplus of $5. 6 trillion over 2001 -2011 time period Ø September 2003 – projected cumulative budget deficit of $2. 3 trillion over 20012011 time period Source: Dizzying Dive to Red Ink Poses Stark Choices for Washington by David Firestone. New York Times, Sept 14, 2003

“A Fall Worthy of Milton” “It really was the perfect fiscal storm. ” – Joel Prakten, Macroeconomic Advisers Ø Ø Projected surplus was based on stock-market bubble Effects of recession Effects of 9/11 attacks Effects of tax cuts “[I]t was hard when staring at the surplus to argue that there shouldn't be a tax cut” -Robert D. Reischauer, former CBO director

“A Fall Worthy of Milton” “It really was the perfect fiscal storm. ” – Joel Prakten, Macroeconomic Advisers Ø Ø Projected surplus was based on stock-market bubble Effects of recession Effects of 9/11 attacks Effects of tax cuts “[I]t was hard when staring at the surplus to argue that there shouldn't be a tax cut” -Robert D. Reischauer, former CBO director

Acknowledgements Ø Ø Ø Tax revenue chart: http: //www. getamericaworking. org Budget deficit projections: http: //www. reachm. com/amstreet/archives/000120. html Social security charts: http: //mwhodges. home. att. net/soc_sec. htm Wishful thinking on jobs: http: //www. commondreams. org/views 04/0309 -08. htm John Maynard Keynes image: http: //www-groups. dcs. st-and. ac. uk/~history

Acknowledgements Ø Ø Ø Tax revenue chart: http: //www. getamericaworking. org Budget deficit projections: http: //www. reachm. com/amstreet/archives/000120. html Social security charts: http: //mwhodges. home. att. net/soc_sec. htm Wishful thinking on jobs: http: //www. commondreams. org/views 04/0309 -08. htm John Maynard Keynes image: http: //www-groups. dcs. st-and. ac. uk/~history