756308aa554477530a0ff36ab6843feb.ppt

- Количество слайдов: 126

Economic Development

Economic Development

Overview 2

Overview 2

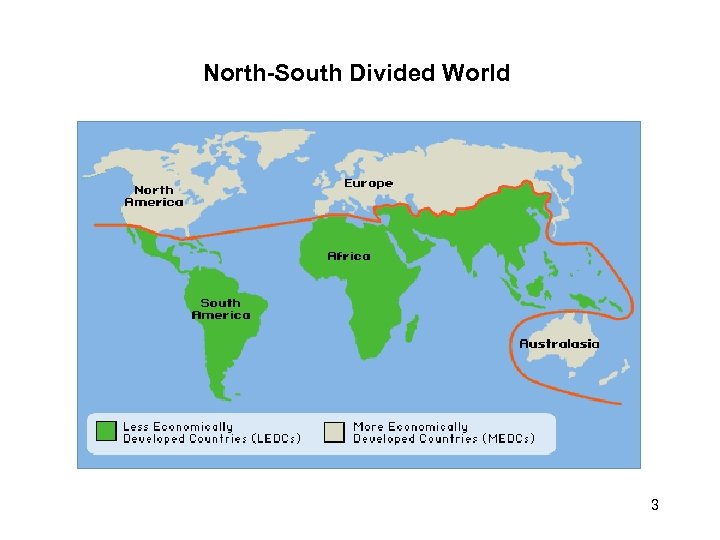

North-South Divided World 3

North-South Divided World 3

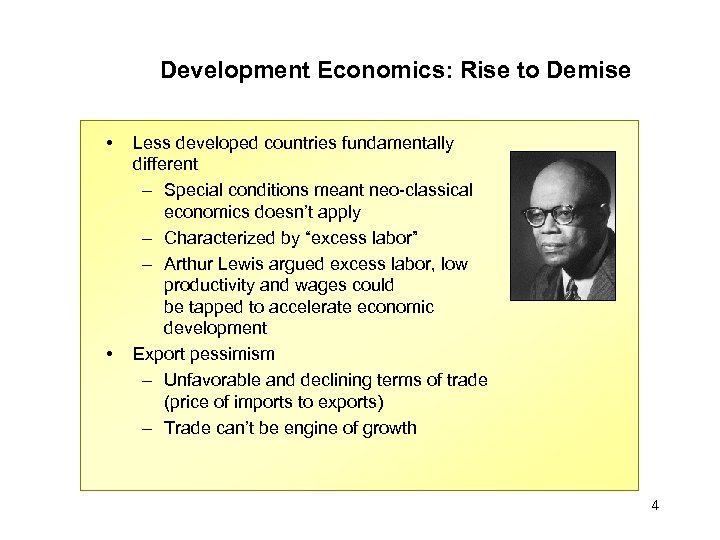

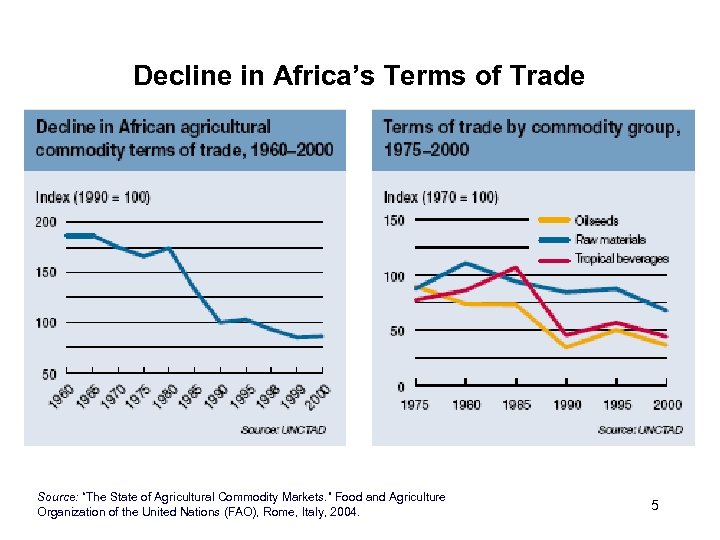

Development Economics: Rise to Demise • • Less developed countries fundamentally different – Special conditions meant neo-classical economics doesn’t apply – Characterized by “excess labor” – Arthur Lewis argued excess labor, low productivity and wages could be tapped to accelerate economic development Export pessimism – Unfavorable and declining terms of trade (price of imports to exports) – Trade can’t be engine of growth 4

Development Economics: Rise to Demise • • Less developed countries fundamentally different – Special conditions meant neo-classical economics doesn’t apply – Characterized by “excess labor” – Arthur Lewis argued excess labor, low productivity and wages could be tapped to accelerate economic development Export pessimism – Unfavorable and declining terms of trade (price of imports to exports) – Trade can’t be engine of growth 4

Decline in Africa’s Terms of Trade Source: “The State of Agricultural Commodity Markets. ” Food and Agriculture Organization of the United Nations (FAO), Rome, Italy, 2004. 5

Decline in Africa’s Terms of Trade Source: “The State of Agricultural Commodity Markets. ” Food and Agriculture Organization of the United Nations (FAO), Rome, Italy, 2004. 5

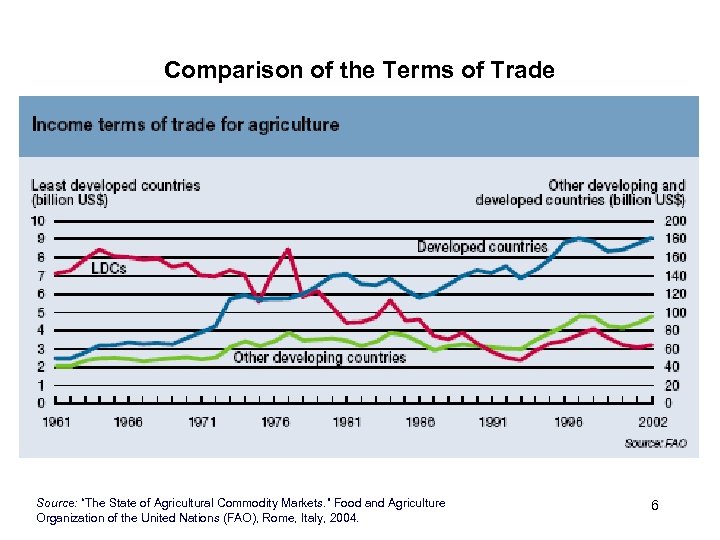

Comparison of the Terms of Trade Source: “The State of Agricultural Commodity Markets. ” Food and Agriculture Organization of the United Nations (FAO), Rome, Italy, 2004. 6

Comparison of the Terms of Trade Source: “The State of Agricultural Commodity Markets. ” Food and Agriculture Organization of the United Nations (FAO), Rome, Italy, 2004. 6

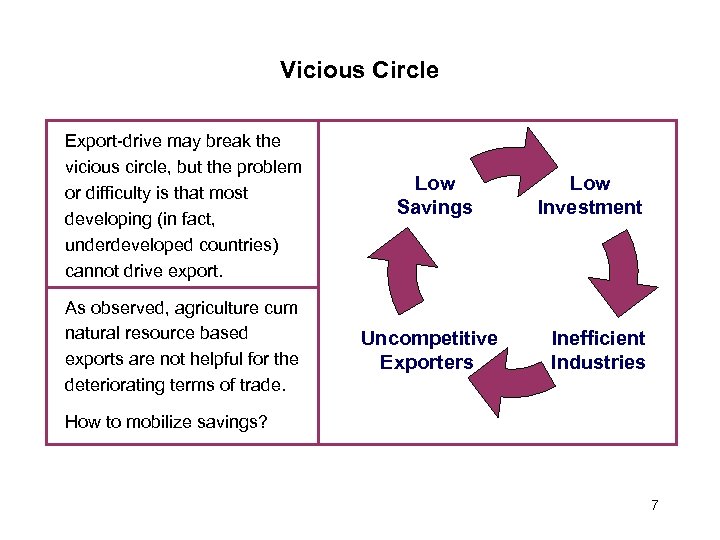

Vicious Circle Export-drive may break the vicious circle, but the problem or difficulty is that most developing (in fact, underdeveloped countries) cannot drive export. As observed, agriculture cum natural resource based exports are not helpful for the deteriorating terms of trade. Low Savings Uncompetitive Exporters Low Investment Inefficient Industries How to mobilize savings? 7

Vicious Circle Export-drive may break the vicious circle, but the problem or difficulty is that most developing (in fact, underdeveloped countries) cannot drive export. As observed, agriculture cum natural resource based exports are not helpful for the deteriorating terms of trade. Low Savings Uncompetitive Exporters Low Investment Inefficient Industries How to mobilize savings? 7

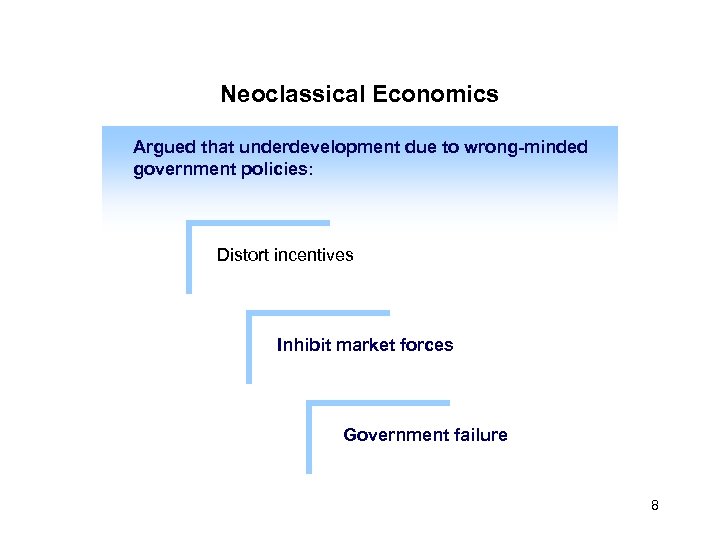

Neoclassical Economics Argued that underdevelopment due to wrong-minded government policies: Distort incentives Inhibit market forces Government failure 8

Neoclassical Economics Argued that underdevelopment due to wrong-minded government policies: Distort incentives Inhibit market forces Government failure 8

Government Failure • Not different economies in nature • Nor a “vicious cycle” • But government failure • Hence, – Market openness – Fiscal discipline – Wrong intervention Lead to growth 9

Government Failure • Not different economies in nature • Nor a “vicious cycle” • But government failure • Hence, – Market openness – Fiscal discipline – Wrong intervention Lead to growth 9

Neo-Liberal Explanation of East Asian Miracle South Korea, Taiwan, Hong Kong, Singapore (ANIEs-I or Four Asian dragons) “Market conforming” strategies Opened economies to the world, reduced the role of the state, pursued export-led strategies 10

Neo-Liberal Explanation of East Asian Miracle South Korea, Taiwan, Hong Kong, Singapore (ANIEs-I or Four Asian dragons) “Market conforming” strategies Opened economies to the world, reduced the role of the state, pursued export-led strategies 10

Washington Consensus “Broad agreement among government officials in both the industrial economies and international institutions on the importance of the neo liberal program for economic development and its emphasis on free markets, trade liberalization, and a greatly reduced role of the state in the economy. ” – Gilpin 11

Washington Consensus “Broad agreement among government officials in both the industrial economies and international institutions on the importance of the neo liberal program for economic development and its emphasis on free markets, trade liberalization, and a greatly reduced role of the state in the economy. ” – Gilpin 11

The State Needed to Initiate “Big Push” Overcome market failures – lack of entrepreneurship – low national savings – poor educational systems – little consensus on which industries to assist among economists or states 12

The State Needed to Initiate “Big Push” Overcome market failures – lack of entrepreneurship – low national savings – poor educational systems – little consensus on which industries to assist among economists or states 12

The Developmental State • Government incentives for private investment in strategic industries – Created an entrepreneurial class – Identified key industries – Exposed them to the global market • Concern of “late” industrialization • Market failure necessitating the state • Challenged neo-liberal consensus • Japan and East Asia – State governed / led the market 13

The Developmental State • Government incentives for private investment in strategic industries – Created an entrepreneurial class – Identified key industries – Exposed them to the global market • Concern of “late” industrialization • Market failure necessitating the state • Challenged neo-liberal consensus • Japan and East Asia – State governed / led the market 13

What to Do? How to Do? 14

What to Do? How to Do? 14

World Economy and Development Globalization of the world economy has changed the terms of development. It has transformed: - The nature of world markets and what it takes to be competitive in them - The nature of the national state and the relations between states and other levels of governance - The possible paths of development In terms of the factors promoting economic development globalization increases the importance of: - International trade (and thus the need for export-oriented economies) - Knowledge, skills and technology transfer for development in the global ‘knowledge economy’ - MNCs and FDI in knowledge and technology transfer - Education and skills (as argued in endogenous growth theory) 15

World Economy and Development Globalization of the world economy has changed the terms of development. It has transformed: - The nature of world markets and what it takes to be competitive in them - The nature of the national state and the relations between states and other levels of governance - The possible paths of development In terms of the factors promoting economic development globalization increases the importance of: - International trade (and thus the need for export-oriented economies) - Knowledge, skills and technology transfer for development in the global ‘knowledge economy’ - MNCs and FDI in knowledge and technology transfer - Education and skills (as argued in endogenous growth theory) 15

Neo-Liberal Development Theory and Policy The Washington Consensus model, prescribed by the international agencies, and backed by the most developed economies, has emphasized: - Minimal government intervention including through Industrial Policy - Free-trade (no tariffs, subsidies and free capital flows) - Structural adjustment policies to reduce state spending The policies are based on neo-liberal policies for economic development which go back to Adam Smith. As Ha-Joon Chang has argued, successful developing economies often have more to learn from Frederick List than Adam Smith. Liberal free trade policies have generally advantaged the already powerful economies. Advocacy of ‘free trade’ policies to poorer countries is often a case of rich countries tending to ‘kick away the ladder’ on which they ascended. 16

Neo-Liberal Development Theory and Policy The Washington Consensus model, prescribed by the international agencies, and backed by the most developed economies, has emphasized: - Minimal government intervention including through Industrial Policy - Free-trade (no tariffs, subsidies and free capital flows) - Structural adjustment policies to reduce state spending The policies are based on neo-liberal policies for economic development which go back to Adam Smith. As Ha-Joon Chang has argued, successful developing economies often have more to learn from Frederick List than Adam Smith. Liberal free trade policies have generally advantaged the already powerful economies. Advocacy of ‘free trade’ policies to poorer countries is often a case of rich countries tending to ‘kick away the ladder’ on which they ascended. 16

Role of the State in Development List criticised Smith for ignoring the historical evidence of how the rich countries had developed through harnessing the power of the state. He advocated using the power of the state to develop manufactures and to old in world trade through the nurturing and protection of infant industries and the use of mercantilist strategic trading policies. Late development theorists, from Alexander Gerschenkron to Alice Amsden, have built on List’s insights. They argued that nations that industrialized after Britain had to do it differently since technology was more advanced, and more easily transferred, and since industries were on a larger scale. Industrialization could happen more quickly - Required more state intervention - Relied heavily on skills and skills transfer 17

Role of the State in Development List criticised Smith for ignoring the historical evidence of how the rich countries had developed through harnessing the power of the state. He advocated using the power of the state to develop manufactures and to old in world trade through the nurturing and protection of infant industries and the use of mercantilist strategic trading policies. Late development theorists, from Alexander Gerschenkron to Alice Amsden, have built on List’s insights. They argued that nations that industrialized after Britain had to do it differently since technology was more advanced, and more easily transferred, and since industries were on a larger scale. Industrialization could happen more quickly - Required more state intervention - Relied heavily on skills and skills transfer 17

Problems of Liberal Development Theory Neo-liberal policies are based upon myths about how the now rich countries actually developed and there is little evidence that they work well now. Historically, most successful developing countries, including the recent cases in East Asia, have used substantial state intervention in industrial, trade and education policy and so on to assist development. The current world economic crisis is also reinforcing the need to reconsider dominant model of development. The crisis suggests that the neo-liberal model of finance-driven, debt-based capitalism in developed countries has serious problems and suggests that the neo-liberal model of development - encapsulated in the ‘Washington Consensus’ - may need to be re-thought. Many of those which grew fastest ignored liberal policies of the Washington Consensus. 18

Problems of Liberal Development Theory Neo-liberal policies are based upon myths about how the now rich countries actually developed and there is little evidence that they work well now. Historically, most successful developing countries, including the recent cases in East Asia, have used substantial state intervention in industrial, trade and education policy and so on to assist development. The current world economic crisis is also reinforcing the need to reconsider dominant model of development. The crisis suggests that the neo-liberal model of finance-driven, debt-based capitalism in developed countries has serious problems and suggests that the neo-liberal model of development - encapsulated in the ‘Washington Consensus’ - may need to be re-thought. Many of those which grew fastest ignored liberal policies of the Washington Consensus. 18

Growth, Distribution and Well Being - Between 1960 and 1998 real income pc in Japan and tigers increased x 4. - Life Expectancy in HPAEs grew from 56 years in 1960 to 71 in 1990. - Proportions living in absolute poverty declined between 1960 and 1990 from 58% to 17% in Indonesia and from 37% to 5% in Malaysia (compared with 54% to 43% in India) - HPEAs also achieved low and often declining levels of income inequality, particularly in Japan and Taiwan but also, until the 1980 s, in S. Korea and Singapore. 19

Growth, Distribution and Well Being - Between 1960 and 1998 real income pc in Japan and tigers increased x 4. - Life Expectancy in HPAEs grew from 56 years in 1960 to 71 in 1990. - Proportions living in absolute poverty declined between 1960 and 1990 from 58% to 17% in Indonesia and from 37% to 5% in Malaysia (compared with 54% to 43% in India) - HPEAs also achieved low and often declining levels of income inequality, particularly in Japan and Taiwan but also, until the 1980 s, in S. Korea and Singapore. 19

Role of Education in East Asia General view: Capital accumulation (savings) and education played major role in East Asian Miracle. According to WB: ‘far and away the major difference in predicted growth rates between HPAEs and sub-Saharan Africa derives from variations in primary school enrolment rates. ’ Investment focused initially on universalizing primary education which had highest rate of return. Secondary and higher education were developed sequentially when growth and higher rates of return to higher levels encouraged private investment. Growth, private investment and declining birth allowed increase in per capita spending and higher enrols in education without excessive public cost. Skills contributed significantly to productivity growth and technology transfer. 20

Role of Education in East Asia General view: Capital accumulation (savings) and education played major role in East Asian Miracle. According to WB: ‘far and away the major difference in predicted growth rates between HPAEs and sub-Saharan Africa derives from variations in primary school enrolment rates. ’ Investment focused initially on universalizing primary education which had highest rate of return. Secondary and higher education were developed sequentially when growth and higher rates of return to higher levels encouraged private investment. Growth, private investment and declining birth allowed increase in per capita spending and higher enrols in education without excessive public cost. Skills contributed significantly to productivity growth and technology transfer. 20

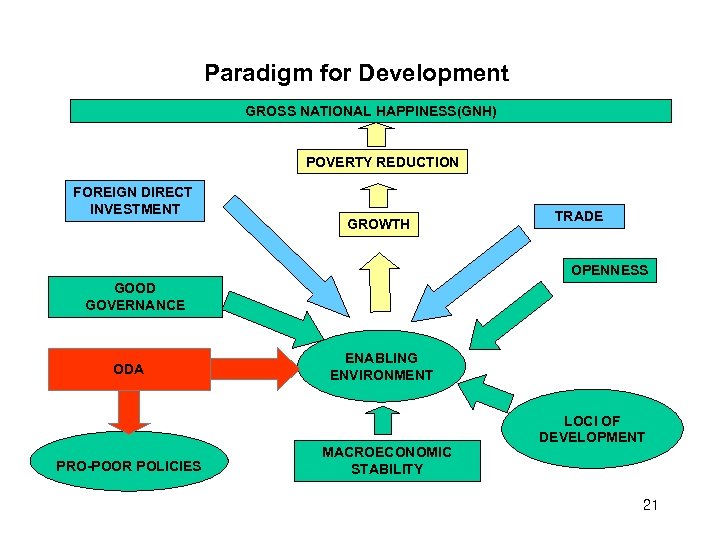

Paradigm for Development GROSS NATIONAL HAPPINESS(GNH) POVERTY REDUCTION FOREIGN DIRECT INVESTMENT GROWTH TRADE OPENNESS GOOD GOVERNANCE ODA PRO-POOR POLICIES ENABLING ENVIRONMENT MACROECONOMIC STABILITY LOCI OF DEVELOPMENT 21

Paradigm for Development GROSS NATIONAL HAPPINESS(GNH) POVERTY REDUCTION FOREIGN DIRECT INVESTMENT GROWTH TRADE OPENNESS GOOD GOVERNANCE ODA PRO-POOR POLICIES ENABLING ENVIRONMENT MACROECONOMIC STABILITY LOCI OF DEVELOPMENT 21

Fundamental Trade-offs in Development Strategies Radical vs. Gradual Balanced vs. Unbalanced Closed vs. Open Foreign Resources vs. Domestic Resources Government (planning) vs. Market Growth-first vs. Shared Growth Imitative vs. Innovative (Creative) Authoritarian vs. Democratic 22 22

Fundamental Trade-offs in Development Strategies Radical vs. Gradual Balanced vs. Unbalanced Closed vs. Open Foreign Resources vs. Domestic Resources Government (planning) vs. Market Growth-first vs. Shared Growth Imitative vs. Innovative (Creative) Authoritarian vs. Democratic 22 22

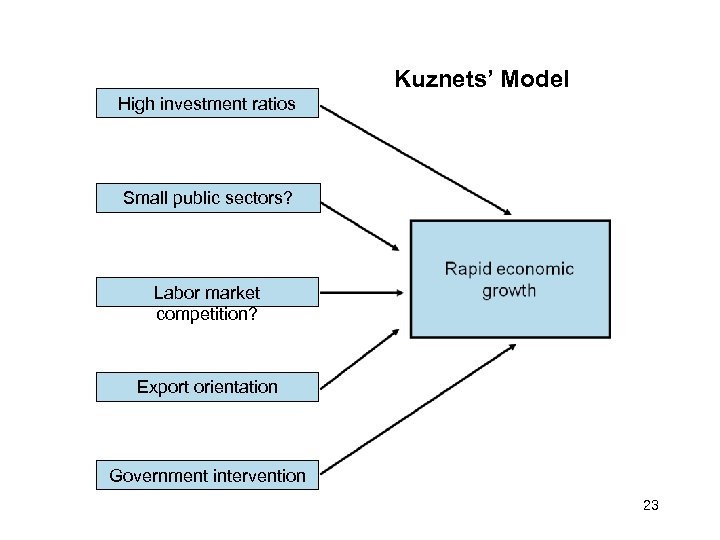

Kuznets’ Model High investment ratios Small public sectors? Labor market competition? Export orientation Government intervention 23

Kuznets’ Model High investment ratios Small public sectors? Labor market competition? Export orientation Government intervention 23

Substitution Strategy Concept by Gerscenkron Gerschenkronian Thesis - “The more backward a country’s economy, the greater was the part played by special institutional factors…(and) the more pronounced was the coerciveness and comprehensiveness of those factors. ” - The patterns of industrialization was a combined result of: ① The technological trends, ② Degrees of backwardness (=underdevelopment), ③ The necessity and will for latecomers to compete with forerunners. 24

Substitution Strategy Concept by Gerscenkron Gerschenkronian Thesis - “The more backward a country’s economy, the greater was the part played by special institutional factors…(and) the more pronounced was the coerciveness and comprehensiveness of those factors. ” - The patterns of industrialization was a combined result of: ① The technological trends, ② Degrees of backwardness (=underdevelopment), ③ The necessity and will for latecomers to compete with forerunners. 24

- “The more backward (underdeveloped) a country’s economy, the more pronounced was the stress…on bigness of both plant and enterprise. . (and) the greater was the stress upon producer’s goods as against consumer goods. ” - Different institutional patterns among country’s were a result of different catching-up strategy. Implications - A main driver in Gerschenkronian thesis is the competition among countries. - The different strategies and institutions adopted by latecomers were substitutes for the lack of ‘prerequisites’ of development such as capital, technologies or financial intermediaries. ⇒ a substitution strategy. 25

- “The more backward (underdeveloped) a country’s economy, the more pronounced was the stress…on bigness of both plant and enterprise. . (and) the greater was the stress upon producer’s goods as against consumer goods. ” - Different institutional patterns among country’s were a result of different catching-up strategy. Implications - A main driver in Gerschenkronian thesis is the competition among countries. - The different strategies and institutions adopted by latecomers were substitutes for the lack of ‘prerequisites’ of development such as capital, technologies or financial intermediaries. ⇒ a substitution strategy. 25

Gerschenkron’s Late-Comer’s Advantage Characteristics of late industrializing countries - Industrialization starts by sudden high growth - Preference for large-scale factories and firms - The capital-good sector is more emphasized than the consumptiongood sector. - There is a tendency to restrict people’s consumption - Utilization of centralized financial institutions Emphasis on diversification of growth types - Late industrializing countries do not necessarily follow the same stages of growth and trials and errors of developed countries. They have more opportunities in technology selection and learning, so that their growth can be faster and they can catch up with developed countries. The later starters should find more innovative or radical development strategies. 26

Gerschenkron’s Late-Comer’s Advantage Characteristics of late industrializing countries - Industrialization starts by sudden high growth - Preference for large-scale factories and firms - The capital-good sector is more emphasized than the consumptiongood sector. - There is a tendency to restrict people’s consumption - Utilization of centralized financial institutions Emphasis on diversification of growth types - Late industrializing countries do not necessarily follow the same stages of growth and trials and errors of developed countries. They have more opportunities in technology selection and learning, so that their growth can be faster and they can catch up with developed countries. The later starters should find more innovative or radical development strategies. 26

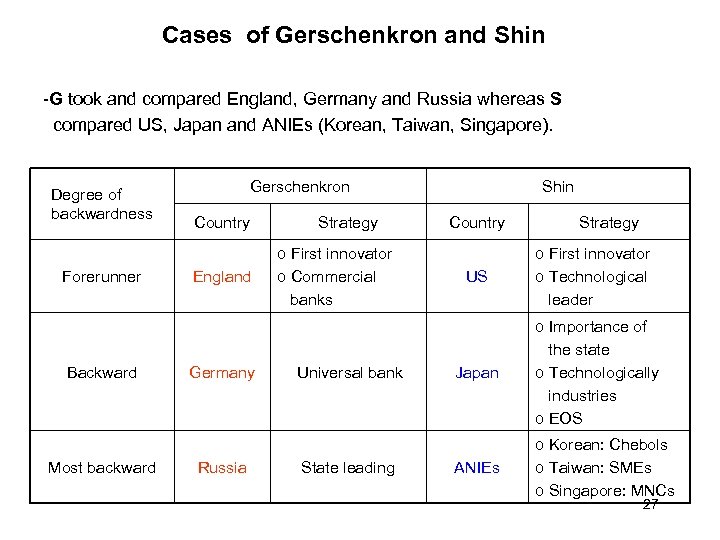

Cases of Gerschenkron and Shin -G took and compared England, Germany and Russia whereas S compared US, Japan and ANIEs (Korean, Taiwan, Singapore). Degree of backwardness Forerunner Backward Most backward Gerschenkron Country England Germany Russia Strategy o First innovator o Commercial banks Universal bank State leading Shin Country Strategy US o First innovator o Technological leader Japan o Importance of the state o Technologically industries o EOS ANIEs o Korean: Chebols o Taiwan: SMEs o Singapore: MNCs 27

Cases of Gerschenkron and Shin -G took and compared England, Germany and Russia whereas S compared US, Japan and ANIEs (Korean, Taiwan, Singapore). Degree of backwardness Forerunner Backward Most backward Gerschenkron Country England Germany Russia Strategy o First innovator o Commercial banks Universal bank State leading Shin Country Strategy US o First innovator o Technological leader Japan o Importance of the state o Technologically industries o EOS ANIEs o Korean: Chebols o Taiwan: SMEs o Singapore: MNCs 27

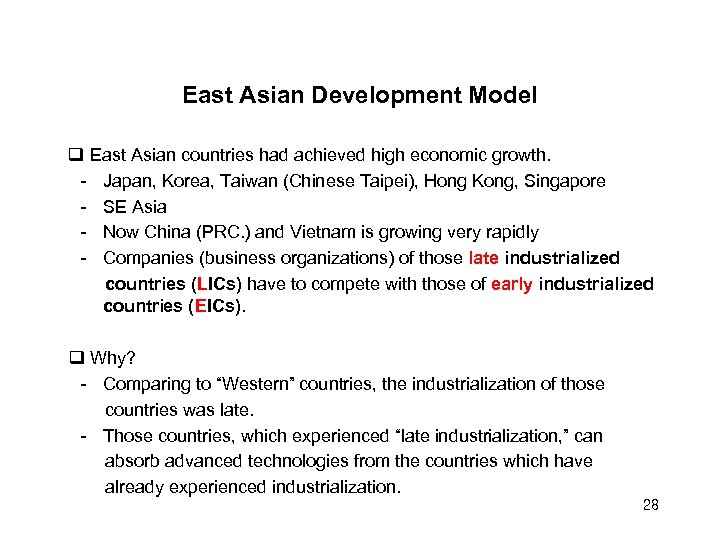

East Asian Development Model East Asian countries had achieved high economic growth. - Japan, Korea, Taiwan (Chinese Taipei), Hong Kong, Singapore - SE Asia - Now China (PRC. ) and Vietnam is growing very rapidly - Companies (business organizations) of those late industrialized countries (LICs) have to compete with those of early industrialized countries (EICs). Why? - Comparing to “Western” countries, the industrialization of those countries was late. - Those countries, which experienced “late industrialization, ” can absorb advanced technologies from the countries which have already experienced industrialization. 28

East Asian Development Model East Asian countries had achieved high economic growth. - Japan, Korea, Taiwan (Chinese Taipei), Hong Kong, Singapore - SE Asia - Now China (PRC. ) and Vietnam is growing very rapidly - Companies (business organizations) of those late industrialized countries (LICs) have to compete with those of early industrialized countries (EICs). Why? - Comparing to “Western” countries, the industrialization of those countries was late. - Those countries, which experienced “late industrialization, ” can absorb advanced technologies from the countries which have already experienced industrialization. 28

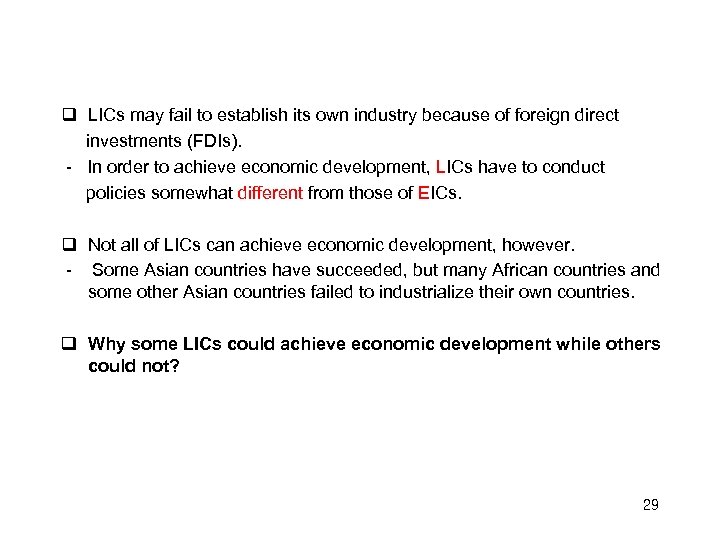

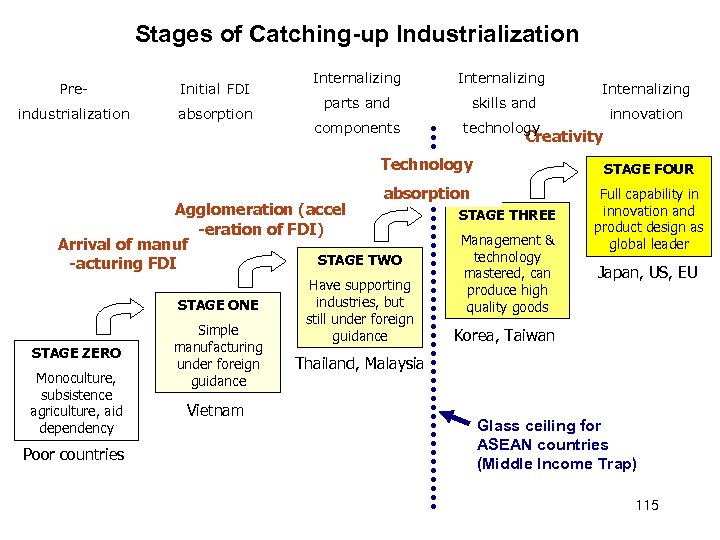

LICs may fail to establish its own industry because of foreign direct investments (FDIs). - In order to achieve economic development, LICs have to conduct policies somewhat different from those of EICs. Not all of LICs can achieve economic development, however. - Some Asian countries have succeeded, but many African countries and some other Asian countries failed to industrialize their own countries. Why some LICs could achieve economic development while others could not? 29

LICs may fail to establish its own industry because of foreign direct investments (FDIs). - In order to achieve economic development, LICs have to conduct policies somewhat different from those of EICs. Not all of LICs can achieve economic development, however. - Some Asian countries have succeeded, but many African countries and some other Asian countries failed to industrialize their own countries. Why some LICs could achieve economic development while others could not? 29

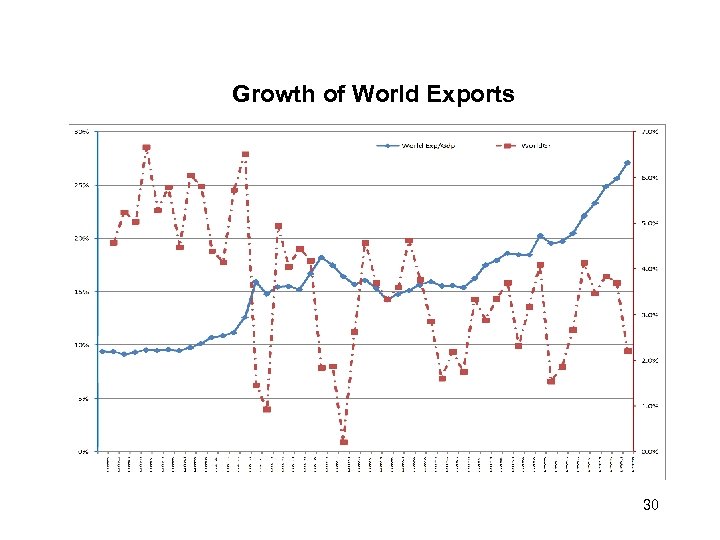

Growth of World Exports 30

Growth of World Exports 30

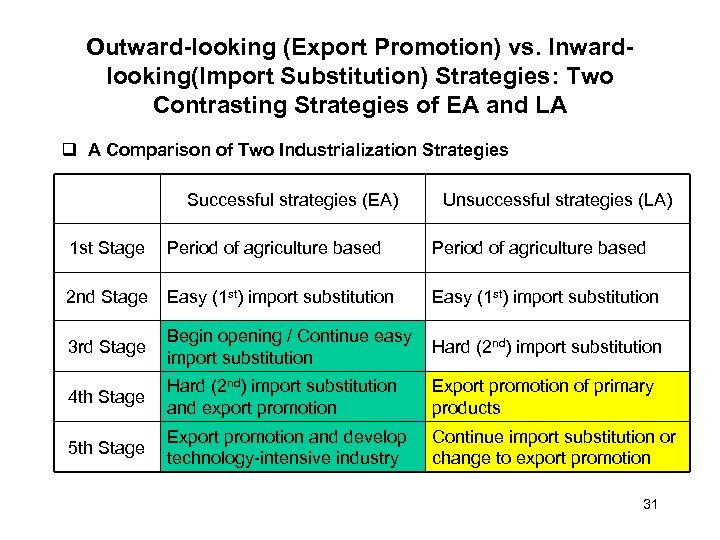

Outward-looking (Export Promotion) vs. Inwardlooking(Import Substitution) Strategies: Two Contrasting Strategies of EA and LA A Comparison of Two Industrialization Strategies Successful strategies (EA) Unsuccessful strategies (LA) 1 st Stage Period of agriculture based 2 nd Stage Easy (1 st) import substitution 3 rd Stage Begin opening / Continue easy import substitution Hard (2 nd) import substitution 4 th Stage Hard (2 nd) import substitution and export promotion Export promotion of primary products 5 th Stage Export promotion and develop technology-intensive industry Continue import substitution or change to export promotion 31

Outward-looking (Export Promotion) vs. Inwardlooking(Import Substitution) Strategies: Two Contrasting Strategies of EA and LA A Comparison of Two Industrialization Strategies Successful strategies (EA) Unsuccessful strategies (LA) 1 st Stage Period of agriculture based 2 nd Stage Easy (1 st) import substitution 3 rd Stage Begin opening / Continue easy import substitution Hard (2 nd) import substitution 4 th Stage Hard (2 nd) import substitution and export promotion Export promotion of primary products 5 th Stage Export promotion and develop technology-intensive industry Continue import substitution or change to export promotion 31

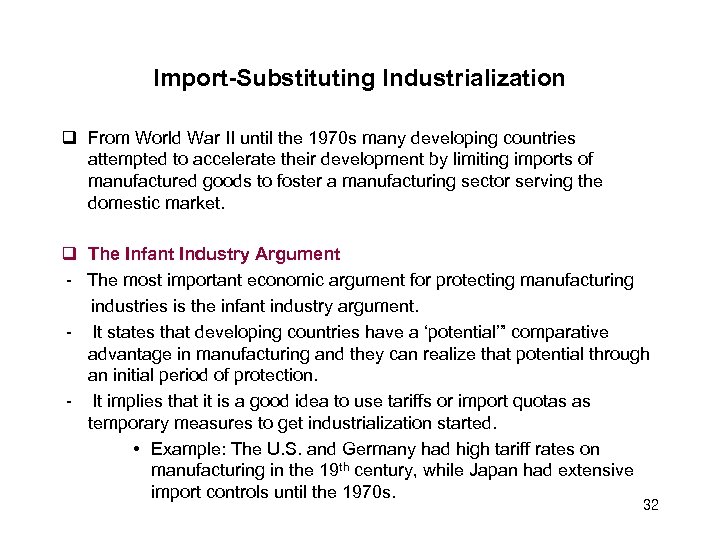

Import-Substituting Industrialization From World War II until the 1970 s many developing countries attempted to accelerate their development by limiting imports of manufactured goods to foster a manufacturing sector serving the domestic market. The Infant Industry Argument - The most important economic argument for protecting manufacturing industries is the infant industry argument. - It states that developing countries have a ‘potential’” comparative advantage in manufacturing and they can realize that potential through an initial period of protection. - It implies that it is a good idea to use tariffs or import quotas as temporary measures to get industrialization started. • Example: The U. S. and Germany had high tariff rates on manufacturing in the 19 th century, while Japan had extensive import controls until the 1970 s. 32

Import-Substituting Industrialization From World War II until the 1970 s many developing countries attempted to accelerate their development by limiting imports of manufactured goods to foster a manufacturing sector serving the domestic market. The Infant Industry Argument - The most important economic argument for protecting manufacturing industries is the infant industry argument. - It states that developing countries have a ‘potential’” comparative advantage in manufacturing and they can realize that potential through an initial period of protection. - It implies that it is a good idea to use tariffs or import quotas as temporary measures to get industrialization started. • Example: The U. S. and Germany had high tariff rates on manufacturing in the 19 th century, while Japan had extensive import controls until the 1970 s. 32

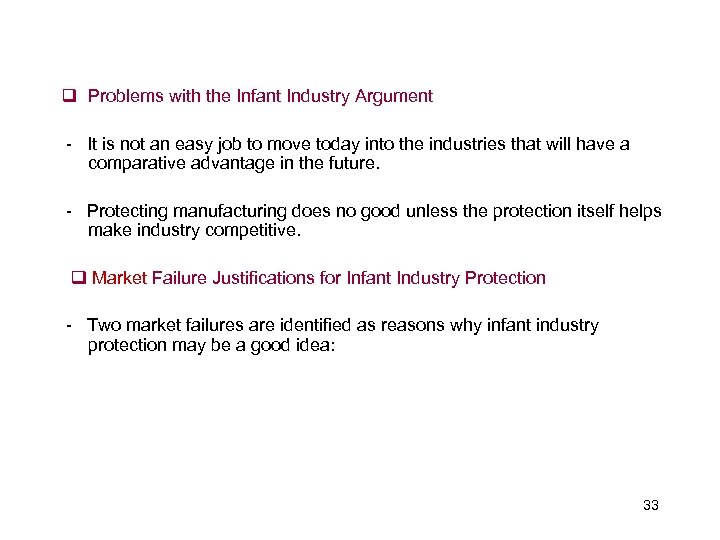

Problems with the Infant Industry Argument - It is not an easy job to move today into the industries that will have a comparative advantage in the future. - Protecting manufacturing does no good unless the protection itself helps make industry competitive. Market Failure Justifications for Infant Industry Protection - Two market failures are identified as reasons why infant industry protection may be a good idea: 33

Problems with the Infant Industry Argument - It is not an easy job to move today into the industries that will have a comparative advantage in the future. - Protecting manufacturing does no good unless the protection itself helps make industry competitive. Market Failure Justifications for Infant Industry Protection - Two market failures are identified as reasons why infant industry protection may be a good idea: 33

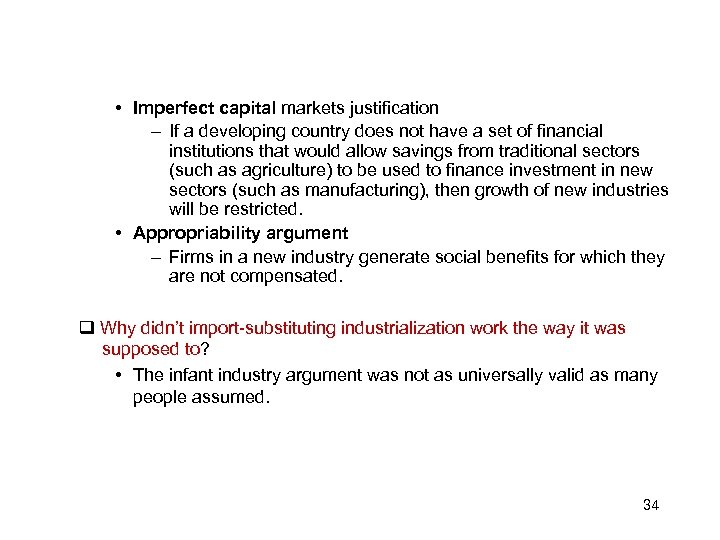

• Imperfect capital markets justification – If a developing country does not have a set of financial institutions that would allow savings from traditional sectors (such as agriculture) to be used to finance investment in new sectors (such as manufacturing), then growth of new industries will be restricted. • Appropriability argument – Firms in a new industry generate social benefits for which they are not compensated. Why didn’t import-substituting industrialization work the way it was supposed to? • The infant industry argument was not as universally valid as many people assumed. 34

• Imperfect capital markets justification – If a developing country does not have a set of financial institutions that would allow savings from traditional sectors (such as agriculture) to be used to finance investment in new sectors (such as manufacturing), then growth of new industries will be restricted. • Appropriability argument – Firms in a new industry generate social benefits for which they are not compensated. Why didn’t import-substituting industrialization work the way it was supposed to? • The infant industry argument was not as universally valid as many people assumed. 34

Import-substituting industrialization generated: High rates of effective protection Inefficient scale of production Higher income inequality and unemployment Implications - Outward-looking strategy should be implemented in parallel with infant industry protection and immediately after short period of import substitution. - Infant industry protection should be ended as soon as possible. (Under the WTO system, it is more difficult to protect infant industries. ) - Economic development requires a process of a certain period of protection → learning → catching up with developed countries by technological capability building - Government intervention should be based on clear performance criteria. 35

Import-substituting industrialization generated: High rates of effective protection Inefficient scale of production Higher income inequality and unemployment Implications - Outward-looking strategy should be implemented in parallel with infant industry protection and immediately after short period of import substitution. - Infant industry protection should be ended as soon as possible. (Under the WTO system, it is more difficult to protect infant industries. ) - Economic development requires a process of a certain period of protection → learning → catching up with developed countries by technological capability building - Government intervention should be based on clear performance criteria. 35

The Making of a Miracle (WB. 2003. “The East Asian Miracle”) High and Sustained Economic Growth - In 1965~1990, East Asian economies grew faster than all other regions of the world. - This is due to seemigly miraculous growth in 8 high-performing Asian economies including 4 tigers (Korea, Hong Kong, Taiwan, Singapore), 3 Southeast ANIEs(Malaysia, Thailand, Indonesia) and China. (Philippines was not good) - The HPAEs have grown more than twice as fast as the rest of East Asia; about three times as fast as LA and South Asia; and 25 times faster than Sub-Saharan Africa. - The growth of HPAEs was higher than developed countries and oil-producing Middle Asian countries. 36

The Making of a Miracle (WB. 2003. “The East Asian Miracle”) High and Sustained Economic Growth - In 1965~1990, East Asian economies grew faster than all other regions of the world. - This is due to seemigly miraculous growth in 8 high-performing Asian economies including 4 tigers (Korea, Hong Kong, Taiwan, Singapore), 3 Southeast ANIEs(Malaysia, Thailand, Indonesia) and China. (Philippines was not good) - The HPAEs have grown more than twice as fast as the rest of East Asia; about three times as fast as LA and South Asia; and 25 times faster than Sub-Saharan Africa. - The growth of HPAEs was higher than developed countries and oil-producing Middle Asian countries. 36

Rapid Growth with Equitable Income Distribution - HPAEs are unique in that they combined the rapid and sustained growth with higher equal income distributions. (‘Shared Growth’) Welfare Enhancement - The average life expectancy of HPAEs rapidly increased from 56 years in 1960 to 71 in 1990. - Reduction of the absolute poverty class Factors of the Success of HPAEs - “Getting the basis right”. (To be explained) o The principle engines of growth were private domestic investment and rapidly growing human capital. 37

Rapid Growth with Equitable Income Distribution - HPAEs are unique in that they combined the rapid and sustained growth with higher equal income distributions. (‘Shared Growth’) Welfare Enhancement - The average life expectancy of HPAEs rapidly increased from 56 years in 1960 to 71 in 1990. - Reduction of the absolute poverty class Factors of the Success of HPAEs - “Getting the basis right”. (To be explained) o The principle engines of growth were private domestic investment and rapidly growing human capital. 37

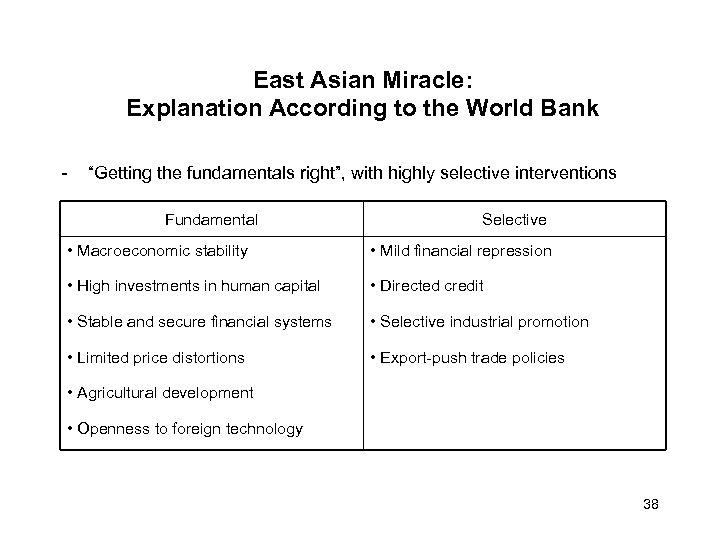

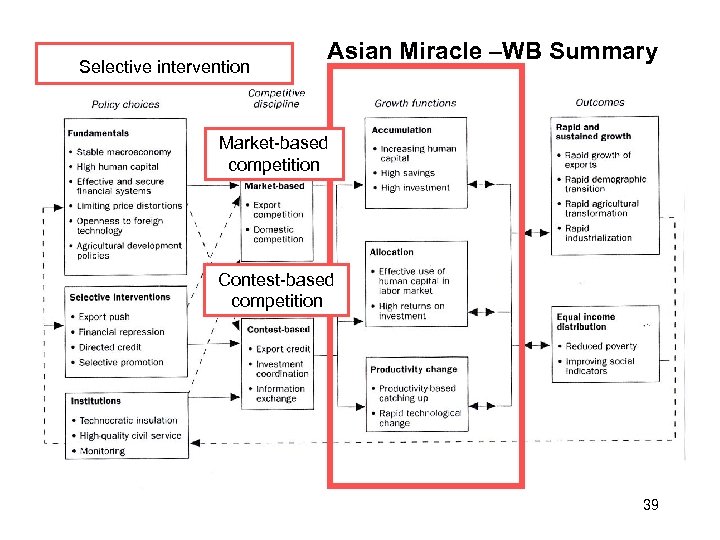

East Asian Miracle: Explanation According to the World Bank - “Getting the fundamentals right”, with highly selective interventions Fundamental Selective • Macroeconomic stability • Mild financial repression • High investments in human capital • Directed credit • Stable and secure financial systems • Selective industrial promotion • Limited price distortions • Export-push trade policies • Agricultural development • Openness to foreign technology 38

East Asian Miracle: Explanation According to the World Bank - “Getting the fundamentals right”, with highly selective interventions Fundamental Selective • Macroeconomic stability • Mild financial repression • High investments in human capital • Directed credit • Stable and secure financial systems • Selective industrial promotion • Limited price distortions • Export-push trade policies • Agricultural development • Openness to foreign technology 38

Selective intervention Asian Miracle –WB Summary Market-based competition Contest-based competition 39

Selective intervention Asian Miracle –WB Summary Market-based competition Contest-based competition 39

East Asia Growth: Why Is It an Economic Miracle? - Rapid growth, sustained over long periods– 30 years or more in some– unprecedented - Very low income inequality–unprecedented - Low endowment of natural resources - Lack Western-style democratic institutions - Strong intervention in markets - Defied received (western) wisdom, hence, a “miracle” 40

East Asia Growth: Why Is It an Economic Miracle? - Rapid growth, sustained over long periods– 30 years or more in some– unprecedented - Very low income inequality–unprecedented - Low endowment of natural resources - Lack Western-style democratic institutions - Strong intervention in markets - Defied received (western) wisdom, hence, a “miracle” 40

Implication of the East Asian Economic Development Lessons for Developing Countries (World Bank. 1993. The East Asian Miracle ) - Stable macroeconomic policy - Investment in education on the earlier development stage - Consideration of agricultural sector - Sound financial system - Open to foreign ideas and technology - Minimization of price distortions - Successful export push 41

Implication of the East Asian Economic Development Lessons for Developing Countries (World Bank. 1993. The East Asian Miracle ) - Stable macroeconomic policy - Investment in education on the earlier development stage - Consideration of agricultural sector - Sound financial system - Open to foreign ideas and technology - Minimization of price distortions - Successful export push 41

Things to Avoid: - Promoting specific industries or attempting to leapfrog stages of technological development - Negative interest rates of providing large subsidies to borrowers - Providing direct credit without adequate monitoring Three Factors of the East Asian miracle - Outward orientation - Macroeconomic stability - Investment in human capital 42

Things to Avoid: - Promoting specific industries or attempting to leapfrog stages of technological development - Negative interest rates of providing large subsidies to borrowers - Providing direct credit without adequate monitoring Three Factors of the East Asian miracle - Outward orientation - Macroeconomic stability - Investment in human capital 42

Four Key Factors for the East Asian Miracle - Sound macroeconomic policy. - An efficient bureaucracy that can implement long-term development policy. - Active government policies for industrialization and export promotion. - Flexible, pragmatic policy approach with error-correcting mechanism. 43

Four Key Factors for the East Asian Miracle - Sound macroeconomic policy. - An efficient bureaucracy that can implement long-term development policy. - Active government policies for industrialization and export promotion. - Flexible, pragmatic policy approach with error-correcting mechanism. 43

East Asian Miracle, Growth and Income Distribution - Economic growth in East Asia contributed to decrease absolute poverty in general, but the process did not necessarily improve income distribution. - The impact of growth on poverty reduction has not been uniform across the economies. It depends on the following. - Sources of growth: Internally generated or externally sustained by foreign trade and investment? - Composition of output: Main drivers was the agriculture or light manufacturing? - Labor market: restrictions and regulations of the labor market - Market and non-market institutions: How they generate growth? impulses 44

East Asian Miracle, Growth and Income Distribution - Economic growth in East Asia contributed to decrease absolute poverty in general, but the process did not necessarily improve income distribution. - The impact of growth on poverty reduction has not been uniform across the economies. It depends on the following. - Sources of growth: Internally generated or externally sustained by foreign trade and investment? - Composition of output: Main drivers was the agriculture or light manufacturing? - Labor market: restrictions and regulations of the labor market - Market and non-market institutions: How they generate growth? impulses 44

Key Factors - The most critical factor that underlay the miracle process, both growth and poverty reduction, was these countries’ openness to trade and technology. - Openness helped them overcome the limitations of domestic markets, provided new economic opportunities to exploit in international markets, created competitive pressures for the domestic economy, and allowed access to new technology through imports of new machinery and equipment. Supplementary Factors - Economic openness is largely unfruitful unless complemented by other factors, such as macroeconomic stability, labor market flexibility, and good economic governance. - These latter primary factors together helped to create a domestic economic environment that encouraged productive investment and production. 45

Key Factors - The most critical factor that underlay the miracle process, both growth and poverty reduction, was these countries’ openness to trade and technology. - Openness helped them overcome the limitations of domestic markets, provided new economic opportunities to exploit in international markets, created competitive pressures for the domestic economy, and allowed access to new technology through imports of new machinery and equipment. Supplementary Factors - Economic openness is largely unfruitful unless complemented by other factors, such as macroeconomic stability, labor market flexibility, and good economic governance. - These latter primary factors together helped to create a domestic economic environment that encouraged productive investment and production. 45

Virtuous Circle - The outward-oriented policies created a virtuous circle of accumulation and assimilation. - The rapid accumulation of capital and acquisition of new technology went hand in hand with the formation of new skills. - The new demand supply impulses that outward orientation helped to create facilitated the process of skills formation. - On the one hand, export-oriented policies helped to raise the economies’ income levels, which in turn increased both private and public investment in education. - The availability of new technology led to new pressures on the labor force to upgrade its skills to meet the evolving demands of the new range of equipment. 46

Virtuous Circle - The outward-oriented policies created a virtuous circle of accumulation and assimilation. - The rapid accumulation of capital and acquisition of new technology went hand in hand with the formation of new skills. - The new demand supply impulses that outward orientation helped to create facilitated the process of skills formation. - On the one hand, export-oriented policies helped to raise the economies’ income levels, which in turn increased both private and public investment in education. - The availability of new technology led to new pressures on the labor force to upgrade its skills to meet the evolving demands of the new range of equipment. 46

- In addition, the economic success of these economies led to rising expectations of international competitiveness that was accompanied by greater demands for new and sophisticated skills. □ Difference in the Initial Conditions - Favorable initial conditions, such as high educational attainment, equitable income and asset distribution, and a dynamic agriculture sector, did not exist in all the miracle economies to the same extent, nor did they all undergo a process of comprehensive land reform. - Thus these were not the primary factors hat initiated the miracle growth process, but to the extent that these favorable initial conditions existed, they might have helped make the growth process more equitable, or may even have enhanced it. 47

- In addition, the economic success of these economies led to rising expectations of international competitiveness that was accompanied by greater demands for new and sophisticated skills. □ Difference in the Initial Conditions - Favorable initial conditions, such as high educational attainment, equitable income and asset distribution, and a dynamic agriculture sector, did not exist in all the miracle economies to the same extent, nor did they all undergo a process of comprehensive land reform. - Thus these were not the primary factors hat initiated the miracle growth process, but to the extent that these favorable initial conditions existed, they might have helped make the growth process more equitable, or may even have enhanced it. 47

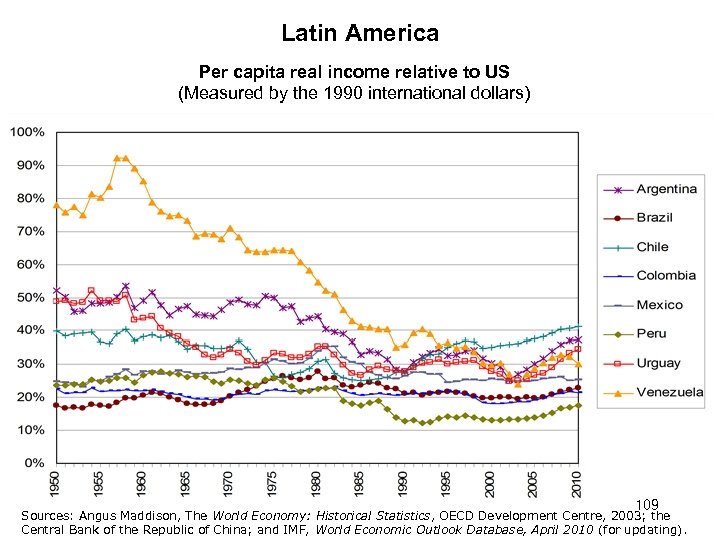

East Asia and Latin America Performance of LAC (Latin America and Carrebian) - Despite its lead in terms of industrial development (and its location advantages for export-proximity and historical links with US the largest market for developing world exports), LAC’s response has been much less vigorous than that of East Asia. - Export success in LAC has been highly concentrated, with a few major success combined with many others losing market shares. This suggests that it was not liberalization as such that drove its export acceleration but other, more country specific, factors. 48

East Asia and Latin America Performance of LAC (Latin America and Carrebian) - Despite its lead in terms of industrial development (and its location advantages for export-proximity and historical links with US the largest market for developing world exports), LAC’s response has been much less vigorous than that of East Asia. - Export success in LAC has been highly concentrated, with a few major success combined with many others losing market shares. This suggests that it was not liberalization as such that drove its export acceleration but other, more country specific, factors. 48

- The structure of exports in LAC is less conductive to long-term growth than in East Asia. Most of the growth was in resourcebased products, growing slowly in world trade. Success in dynamic high-tech products was confined to a tiny few. In fact, the integrated production systems that drove export growth in East Asia largely bypassed LAC, even of the served US markets. - The few outstanding success in LAC in manufactured exports face severe competitive challenges. Export activity is often delinked from local industry and capabilities, and the competitive base will be eroded unless these links are greatly strengthened. While this is also true of some East Asian countries, others have built impressive local capabilities and even the weaker ones are acutely conscious of the need to develop local capabilities and are investing in doing so more assiduously than the leaders in LAC. 49

- The structure of exports in LAC is less conductive to long-term growth than in East Asia. Most of the growth was in resourcebased products, growing slowly in world trade. Success in dynamic high-tech products was confined to a tiny few. In fact, the integrated production systems that drove export growth in East Asia largely bypassed LAC, even of the served US markets. - The few outstanding success in LAC in manufactured exports face severe competitive challenges. Export activity is often delinked from local industry and capabilities, and the competitive base will be eroded unless these links are greatly strengthened. While this is also true of some East Asian countries, others have built impressive local capabilities and even the weaker ones are acutely conscious of the need to develop local capabilities and are investing in doing so more assiduously than the leaders in LAC. 49

East Asia versus Latin America 50

East Asia versus Latin America 50

“Deep Determinants” of Economic Development • Geography: Natural Resources, Distance from Equator • Integration: Overall Participation with Global Economy • Institutions: Success of Public Institutions Indicators of Macroeconomic Performance • Domestic Savings • Investment • Trade Openness 51

“Deep Determinants” of Economic Development • Geography: Natural Resources, Distance from Equator • Integration: Overall Participation with Global Economy • Institutions: Success of Public Institutions Indicators of Macroeconomic Performance • Domestic Savings • Investment • Trade Openness 51

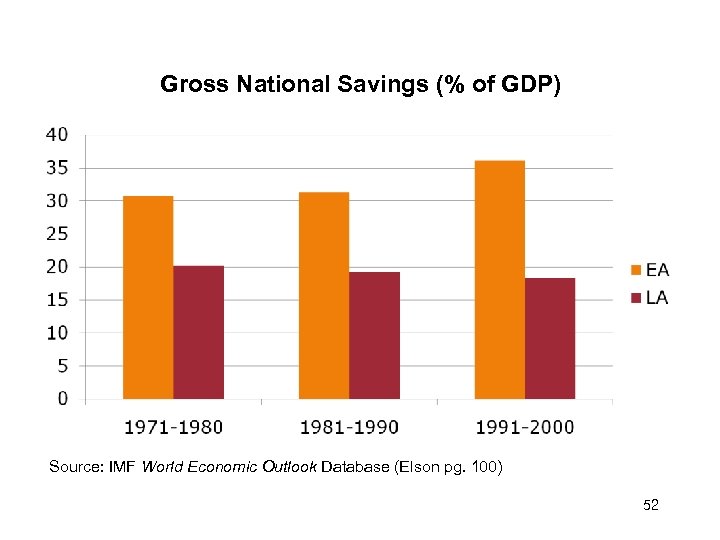

Gross National Savings (% of GDP) Source: IMF World Economic Outlook Database (Elson pg. 100) 52

Gross National Savings (% of GDP) Source: IMF World Economic Outlook Database (Elson pg. 100) 52

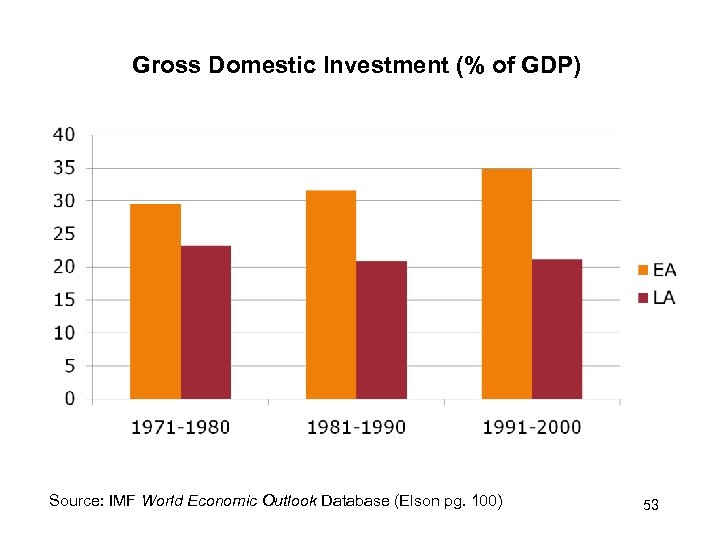

Gross Domestic Investment (% of GDP) Source: IMF World Economic Outlook Database (Elson pg. 100) 53

Gross Domestic Investment (% of GDP) Source: IMF World Economic Outlook Database (Elson pg. 100) 53

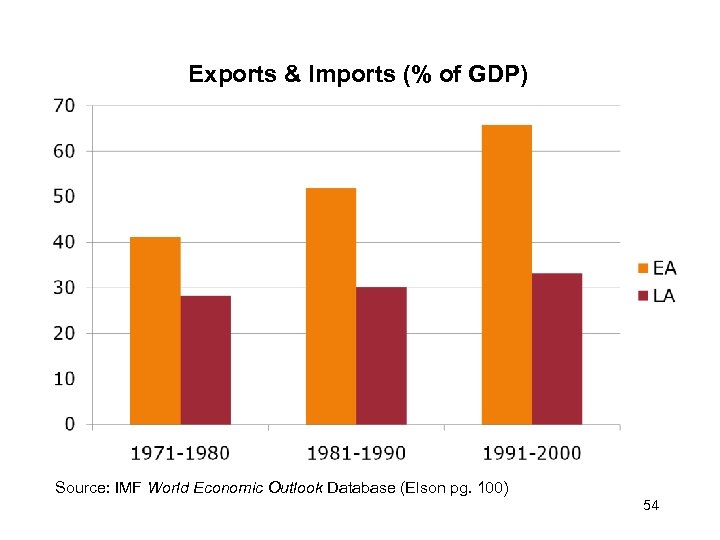

Exports & Imports (% of GDP) Source: IMF World Economic Outlook Database (Elson pg. 100) 54

Exports & Imports (% of GDP) Source: IMF World Economic Outlook Database (Elson pg. 100) 54

Factors Accounting for Latin American Stagnation • Persistent Macroeconomic Instability • Weak Integration Into Global Economy • Poor Public Institutions Causes of Macroeconomic Instability • Lack of Stable Policy Environment • High Levels of Inflation • Non-Competitive Exchange Rates • Zero to Negative Interest Rates 55

Factors Accounting for Latin American Stagnation • Persistent Macroeconomic Instability • Weak Integration Into Global Economy • Poor Public Institutions Causes of Macroeconomic Instability • Lack of Stable Policy Environment • High Levels of Inflation • Non-Competitive Exchange Rates • Zero to Negative Interest Rates 55

Regional Integration Into the Global Economy • No change in the rate of Total Global Exports of Latin America between 1980 and 2000 • East Asia experienced higher rates of global exports and higher rates of intra-industry trade • Between 1985 -2000 East Asia received twice the amount of FDI 56

Regional Integration Into the Global Economy • No change in the rate of Total Global Exports of Latin America between 1980 and 2000 • East Asia experienced higher rates of global exports and higher rates of intra-industry trade • Between 1985 -2000 East Asia received twice the amount of FDI 56

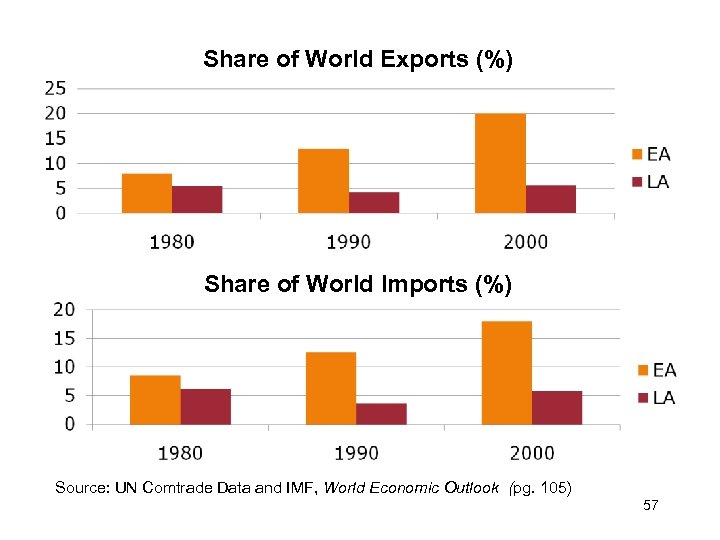

Share of World Exports (%) Share of World Imports (%) Source: UN Comtrade Data and IMF, World Economic Outlook (pg. 105) 57

Share of World Exports (%) Share of World Imports (%) Source: UN Comtrade Data and IMF, World Economic Outlook (pg. 105) 57

Quality of Public Institutions Surveys are used to measure institutional effectiveness: • Government effectiveness (EA 71. 3 vs. LA 50. 4) • Regulatory quality (EA 68. 5 vs. LA 59. 4) • Political stability (EA 59. 4 vs. LA 51. 2) • Democratic accountability (EA 6. 0 vs. LA 7. 8) • Bureaucratic quality (EA 7. 4 vs. LA 5. 1) 58

Quality of Public Institutions Surveys are used to measure institutional effectiveness: • Government effectiveness (EA 71. 3 vs. LA 50. 4) • Regulatory quality (EA 68. 5 vs. LA 59. 4) • Political stability (EA 59. 4 vs. LA 51. 2) • Democratic accountability (EA 6. 0 vs. LA 7. 8) • Bureaucratic quality (EA 7. 4 vs. LA 5. 1) 58

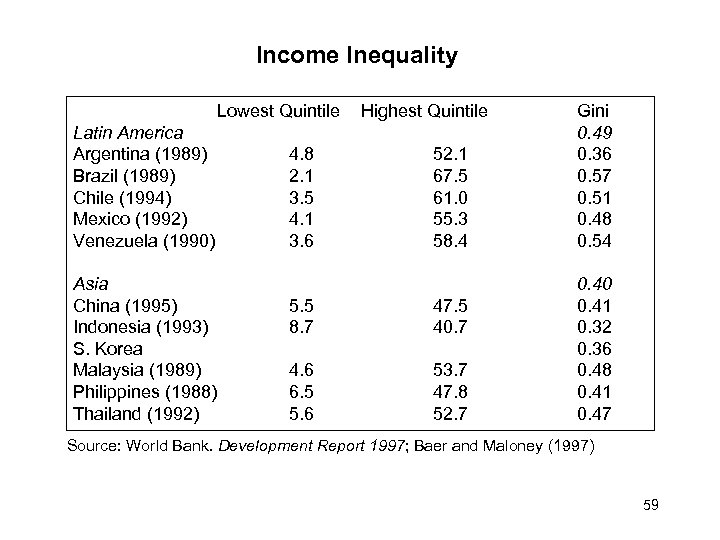

Income Inequality Lowest Quintile Latin America Argentina (1989) Brazil (1989) Chile (1994) Mexico (1992) Venezuela (1990) Asia China (1995) Indonesia (1993) S. Korea Malaysia (1989) Philippines (1988) Thailand (1992) 4. 8 2. 1 3. 5 4. 1 3. 6 Highest Quintile 52. 1 67. 5 61. 0 55. 3 58. 4 5. 5 8. 7 47. 5 40. 7 4. 6 6. 5 5. 6 53. 7 47. 8 52. 7 Gini 0. 49 0. 36 0. 57 0. 51 0. 48 0. 54 0. 40 0. 41 0. 32 0. 36 0. 48 0. 41 0. 47 Source: World Bank. Development Report 1997; Baer and Maloney (1997) 59

Income Inequality Lowest Quintile Latin America Argentina (1989) Brazil (1989) Chile (1994) Mexico (1992) Venezuela (1990) Asia China (1995) Indonesia (1993) S. Korea Malaysia (1989) Philippines (1988) Thailand (1992) 4. 8 2. 1 3. 5 4. 1 3. 6 Highest Quintile 52. 1 67. 5 61. 0 55. 3 58. 4 5. 5 8. 7 47. 5 40. 7 4. 6 6. 5 5. 6 53. 7 47. 8 52. 7 Gini 0. 49 0. 36 0. 57 0. 51 0. 48 0. 54 0. 40 0. 41 0. 32 0. 36 0. 48 0. 41 0. 47 Source: World Bank. Development Report 1997; Baer and Maloney (1997) 59

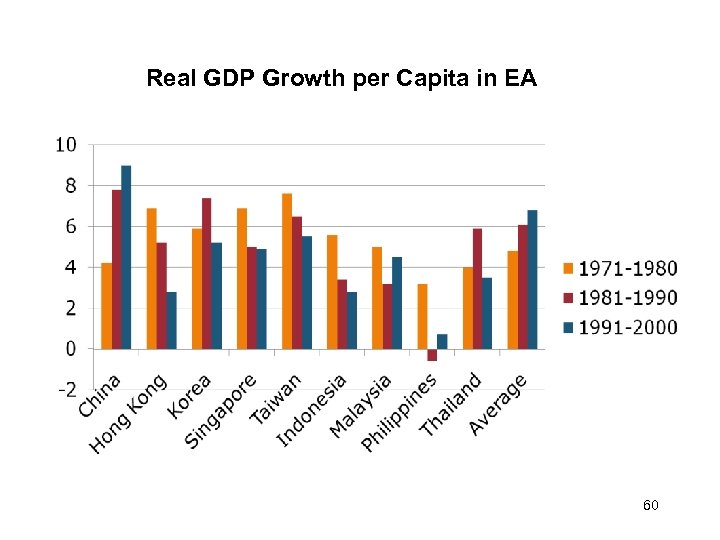

Real GDP Growth per Capita in EA 60

Real GDP Growth per Capita in EA 60

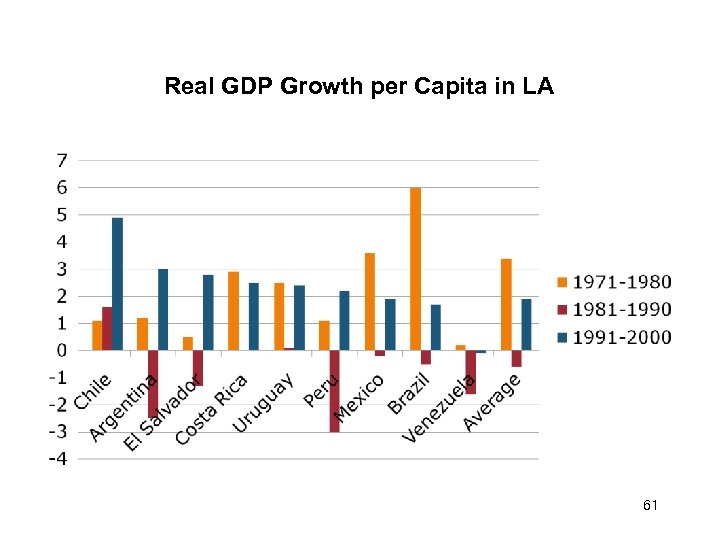

Real GDP Growth per Capita in LA 61

Real GDP Growth per Capita in LA 61

The Millennium Development Goals and Why They Matter We have the opportunity in the coming decade to cut world poverty by half. Billions more people could enjoy the fruits of the global economy. Tens of millions of lives can be saved. The practical solutions exist. The political framework is established. And for the first time, the cost is utterly affordable Whatever one’s motivation for attacking the crisis of extreme povertyhuman rights, religious values, security, fiscal prudence, ideology-the solutions are the same. All that is needed is ACTION. 62

The Millennium Development Goals and Why They Matter We have the opportunity in the coming decade to cut world poverty by half. Billions more people could enjoy the fruits of the global economy. Tens of millions of lives can be saved. The practical solutions exist. The political framework is established. And for the first time, the cost is utterly affordable Whatever one’s motivation for attacking the crisis of extreme povertyhuman rights, religious values, security, fiscal prudence, ideology-the solutions are the same. All that is needed is ACTION. 62

What are the Millennium Development Goals? The Millennium Development Goals are the world’s time–bound and quantified targets for addressing extreme poverty in its many dimensions-income poverty, hunger, disease, lack of adequate shelter, and exclusion-while promoting gender equality, education, and environmental sustainability. The Millennium Development Goals form a blueprint agreed to by all the world's countries and all the world's leading development institutions. They are goals and targets adopted by the UN in the year of 2000. Set in response to the world’s main development challenges, the MDGs range from halving extreme poverty to halting the spread of HIV/AIDS and providing universal primary education, all by the target date of 2015. 63

What are the Millennium Development Goals? The Millennium Development Goals are the world’s time–bound and quantified targets for addressing extreme poverty in its many dimensions-income poverty, hunger, disease, lack of adequate shelter, and exclusion-while promoting gender equality, education, and environmental sustainability. The Millennium Development Goals form a blueprint agreed to by all the world's countries and all the world's leading development institutions. They are goals and targets adopted by the UN in the year of 2000. Set in response to the world’s main development challenges, the MDGs range from halving extreme poverty to halting the spread of HIV/AIDS and providing universal primary education, all by the target date of 2015. 63

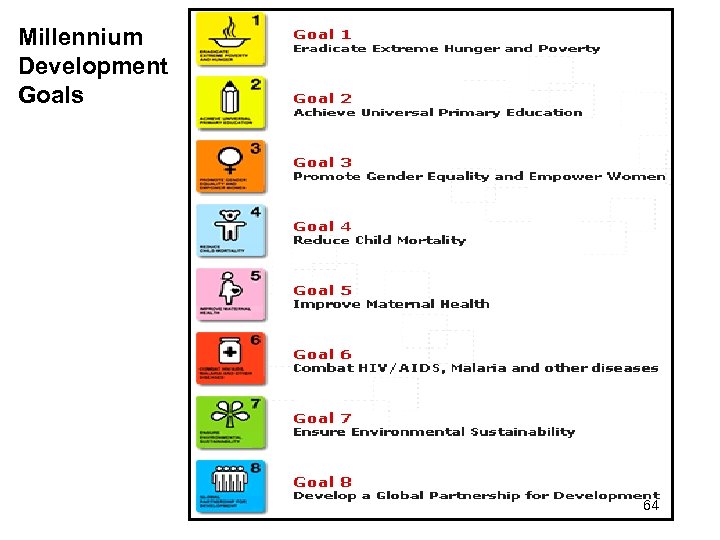

Millennium Development Goals 64

Millennium Development Goals 64

Millennium Development Goals Goal 1: Eradicate extreme poverty and hunger - Target 1 A: Halve the proportion of people living on less than $1 a day - Target 1 B: Achieve employment for women, and young people - Target 1 C: Halve the proportion of people who suffer from hunger Goal 2: Achieve universal primary education - Target 2 A: By 2015, all children can complete a full course of primary schooling, girls and boys Goal 3: Promote gender equality and empower women - Target 3 A: Eliminate gender disparity in primary and secondary education preferably by 2005, and at all levels by 2015 Goal 4: Reduce child mortality - Target 4 A: Reduce by two-thirds, between 1990 and 2015, the under-five mortality rate Goal 5: Improve maternal health - Target 5 A: Reduce by three quarters, between 1990 and 2015, the maternal mortality ratio - Target 5 B: Achieve, by 2015, universal access to reproductive health 65 65

Millennium Development Goals Goal 1: Eradicate extreme poverty and hunger - Target 1 A: Halve the proportion of people living on less than $1 a day - Target 1 B: Achieve employment for women, and young people - Target 1 C: Halve the proportion of people who suffer from hunger Goal 2: Achieve universal primary education - Target 2 A: By 2015, all children can complete a full course of primary schooling, girls and boys Goal 3: Promote gender equality and empower women - Target 3 A: Eliminate gender disparity in primary and secondary education preferably by 2005, and at all levels by 2015 Goal 4: Reduce child mortality - Target 4 A: Reduce by two-thirds, between 1990 and 2015, the under-five mortality rate Goal 5: Improve maternal health - Target 5 A: Reduce by three quarters, between 1990 and 2015, the maternal mortality ratio - Target 5 B: Achieve, by 2015, universal access to reproductive health 65 65

Goal 6: Combat HIV/AIDS, malaria, and other disease - Target 6 A: Have halted by 2015 and begun to reverse the spread of HIV/AIDS - Target 6 B: Achieve, by 2010, universal access to treatment for HIV/AIDS for all those who need it - Target 6 C: Have halted by 2015 and begun to reverse the incidence of malaria and other major diseases Goal 7: Ensure environmental sustainability - Target 7 A: Integrate the principles of sustainable development into country policies and programs and reverse the loss of environmental resources - Target 7 B: Halve, by 2015, the proportion of people without sustainable access to safe drinking water and basic sanitation - Target 7 C: Have achieved by 2020 a significant improvement in the lives of at least 100 million slum dwellers Goal 8: Develop a global partnership for development - Target 8 A: Develop further an open, rule-based, predictable, nondiscriminatory trading and financial system - Target 8 B: Address the special needs of the Least Developed Countries(LDC) - Target 8 C: Address the special needs of landlocked developing countries and small island developing states - Target 8 D: Deal comprehensively with the debt problems of developing countries through national and international measures in order to make debt sustainable in the long term - Target 8 E: In cooperation with pharmaceutical companies, provide access to affordable essential drugs in developing countries - Target 8 F: In cooperation with the private sector, make available the benefits of new technologies, especially information and communications technologies 66

Goal 6: Combat HIV/AIDS, malaria, and other disease - Target 6 A: Have halted by 2015 and begun to reverse the spread of HIV/AIDS - Target 6 B: Achieve, by 2010, universal access to treatment for HIV/AIDS for all those who need it - Target 6 C: Have halted by 2015 and begun to reverse the incidence of malaria and other major diseases Goal 7: Ensure environmental sustainability - Target 7 A: Integrate the principles of sustainable development into country policies and programs and reverse the loss of environmental resources - Target 7 B: Halve, by 2015, the proportion of people without sustainable access to safe drinking water and basic sanitation - Target 7 C: Have achieved by 2020 a significant improvement in the lives of at least 100 million slum dwellers Goal 8: Develop a global partnership for development - Target 8 A: Develop further an open, rule-based, predictable, nondiscriminatory trading and financial system - Target 8 B: Address the special needs of the Least Developed Countries(LDC) - Target 8 C: Address the special needs of landlocked developing countries and small island developing states - Target 8 D: Deal comprehensively with the debt problems of developing countries through national and international measures in order to make debt sustainable in the long term - Target 8 E: In cooperation with pharmaceutical companies, provide access to affordable essential drugs in developing countries - Target 8 F: In cooperation with the private sector, make available the benefits of new technologies, especially information and communications technologies 66

How will the world look in 2015, if the goals are achieved? - More than 500 million people will be lifted out of extreme poverty. More than 300 million will no longer suffer from hunger. There will also be dramatic progress in child health. Rather than die before reaching their fifth birthday, 30 million children will be save. So will the lives of more than 2 million others - Achieving the Goals will mean safe drinking water for another 350 million people, and the benefits of basic sanitation for 650 million, allowing them to lead healthier and more dignified lives. - Hundreds of millions more women and girls will lead their lives in freedom, with more security and more opportunity. Behind these large numbers are the lives and hopes of people seeking new opportunities to end the burden of grinding poverty. 67

How will the world look in 2015, if the goals are achieved? - More than 500 million people will be lifted out of extreme poverty. More than 300 million will no longer suffer from hunger. There will also be dramatic progress in child health. Rather than die before reaching their fifth birthday, 30 million children will be save. So will the lives of more than 2 million others - Achieving the Goals will mean safe drinking water for another 350 million people, and the benefits of basic sanitation for 650 million, allowing them to lead healthier and more dignified lives. - Hundreds of millions more women and girls will lead their lives in freedom, with more security and more opportunity. Behind these large numbers are the lives and hopes of people seeking new opportunities to end the burden of grinding poverty. 67

Why the Goals Are Important The fulcrum on which development policy of the international political system - The MDGs are the first international goals to recognize, at the highest political levels, that poverty in the poorest countries can be dramatically reduced only if developing countries put well designed and well implemented plans in place to reduce poverty and only if rich countries match their efforts with substantial increases in support. Means to a productive life - The goal is to combine the critical public investments in infrastructure and human capital with market-oriented economic policies to ensure the dynamism of private sector growth. As economies grow richer, the private sector can also provide an increasing share of core infrastructure services. 68

Why the Goals Are Important The fulcrum on which development policy of the international political system - The MDGs are the first international goals to recognize, at the highest political levels, that poverty in the poorest countries can be dramatically reduced only if developing countries put well designed and well implemented plans in place to reduce poverty and only if rich countries match their efforts with substantial increases in support. Means to a productive life - The goal is to combine the critical public investments in infrastructure and human capital with market-oriented economic policies to ensure the dynamism of private sector growth. As economies grow richer, the private sector can also provide an increasing share of core infrastructure services. 68

The quest for a more secure and peaceful world - The risk of civil conflict declines steadily as national incomes increase. Negative economic growth shocks increase the risk of civil conflict dramatically. The implications are twofold: investing in development is especially important to reduce the probabilities of conflict, and development strategies should take into consideration their possible effects on reducing (or inadvertently increasing) the risks of conflict. 69

The quest for a more secure and peaceful world - The risk of civil conflict declines steadily as national incomes increase. Negative economic growth shocks increase the risk of civil conflict dramatically. The implications are twofold: investing in development is especially important to reduce the probabilities of conflict, and development strategies should take into consideration their possible effects on reducing (or inadvertently increasing) the risks of conflict. 69

Only a Few Years Left for the Goal Achivements - Economic development lifted millions of people out of poverty in the last decade. While the population of developing countries rose from about 4 billion people to 5 billion, average per capita incomes rose by more than 21 percent - General developing world trends obscure vast differences across and within regions and countries. Some regions have made little progress or even experienced reversals in several areas. Many countries have seen economic growth while others have experienced stagnation. And many of the poorest countries have seen gradual economic growth, but at rates grossly inadequate to yield a dramatic reduction in poverty. 70

Only a Few Years Left for the Goal Achivements - Economic development lifted millions of people out of poverty in the last decade. While the population of developing countries rose from about 4 billion people to 5 billion, average per capita incomes rose by more than 21 percent - General developing world trends obscure vast differences across and within regions and countries. Some regions have made little progress or even experienced reversals in several areas. Many countries have seen economic growth while others have experienced stagnation. And many of the poorest countries have seen gradual economic growth, but at rates grossly inadequate to yield a dramatic reduction in poverty. 70

- There has been clear progress towards implementing the Millennium Development Goals. But their overall success is still far from assured, a progress report by the United Nations has found, and will depend in large part on whether developed countries make good on their aid commitments. - The world has been making progress toward the MDGs—but it is uneven and too slow. A large majority of nations will reach the MDGs only if they get substantial support - advocacy, expertise and resources - from outside. - The challenges for the global community, in both the developed and developing world, are to mobilize financial support and political will, reengage governments, re-orient development priorities and policies, build capacity and reach out to partners in civil society and the private sector. - It seems that another round of MDGs is inevitable. 71

- There has been clear progress towards implementing the Millennium Development Goals. But their overall success is still far from assured, a progress report by the United Nations has found, and will depend in large part on whether developed countries make good on their aid commitments. - The world has been making progress toward the MDGs—but it is uneven and too slow. A large majority of nations will reach the MDGs only if they get substantial support - advocacy, expertise and resources - from outside. - The challenges for the global community, in both the developed and developing world, are to mobilize financial support and political will, reengage governments, re-orient development priorities and policies, build capacity and reach out to partners in civil society and the private sector. - It seems that another round of MDGs is inevitable. 71

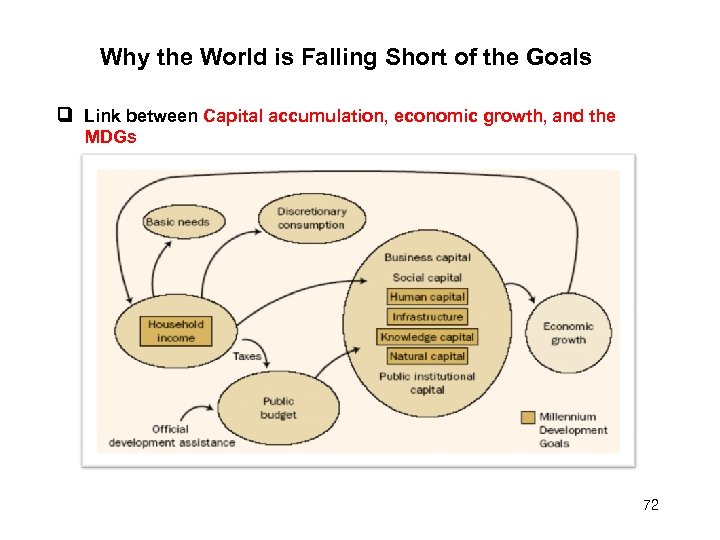

Why the World is Falling Short of the Goals Link between Capital accumulation, economic growth, and the MDGs 72

Why the World is Falling Short of the Goals Link between Capital accumulation, economic growth, and the MDGs 72

- Some important investments in human capital and infrastructure are not covered by the Goals but are crucial for achieving the Goals and for spurring economic growth - All forms of capital are required to support long-term economic growth. Capital grows as a product of investment, with investment coming from private household savings or from public investments drawn from government revenue, savings from abroad, and other sources of income. When the process of capital accumulation breaks down, economic growth and poverty reduction break down. 73

- Some important investments in human capital and infrastructure are not covered by the Goals but are crucial for achieving the Goals and for spurring economic growth - All forms of capital are required to support long-term economic growth. Capital grows as a product of investment, with investment coming from private household savings or from public investments drawn from government revenue, savings from abroad, and other sources of income. When the process of capital accumulation breaks down, economic growth and poverty reduction break down. 73

Reasons for Shortfalls in Achieving the Goals Governance Failures - Economic development stalls when governments do not uphold the rule of law, pursue sound economic policy, make appropriate public investments, manage a public administration, protect basic human rights, and support civil society organizations—including those representing poor people—in national decision making. Poverty Traps - Many reasonably well governed countries are too poor to make the investments. They lack the fiscal resources to invest in infrastructure, social services, and even the public administration necessary to improve governance. Without roads, transport, soil nutrients, electricity, safe cooking fuels, clinics, and schools, the populations are chronically hungry, disease-burdened, and unable to save. Without adequate public sector salaries and information technologies, public management is chronically weak. 74

Reasons for Shortfalls in Achieving the Goals Governance Failures - Economic development stalls when governments do not uphold the rule of law, pursue sound economic policy, make appropriate public investments, manage a public administration, protect basic human rights, and support civil society organizations—including those representing poor people—in national decision making. Poverty Traps - Many reasonably well governed countries are too poor to make the investments. They lack the fiscal resources to invest in infrastructure, social services, and even the public administration necessary to improve governance. Without roads, transport, soil nutrients, electricity, safe cooking fuels, clinics, and schools, the populations are chronically hungry, disease-burdened, and unable to save. Without adequate public sector salaries and information technologies, public management is chronically weak. 74

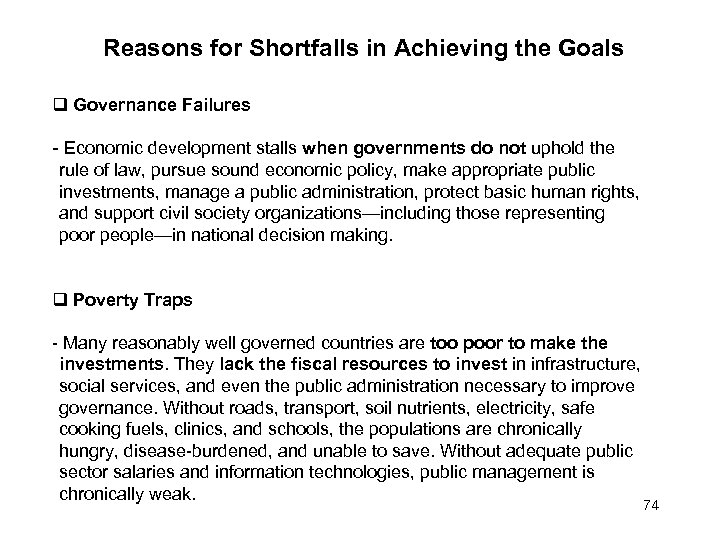

Poverty Traps: Why poverty traps happen - One of the many problems of being extremely poor is that almost all of a country’s income must be devoted to current income rather than saving. Each household has to spend its income on food, clothing, shelter, and other basic needs, with little or nothing left over to save for the future. - The situation with low savings is even worse than it looks, however, because the national income accounts data almost surely, and substantially, overestimate the true saving rate of the poorest countries. To a significant extent, these countries are living off their natural capital but counting resource depletion as income. 75

Poverty Traps: Why poverty traps happen - One of the many problems of being extremely poor is that almost all of a country’s income must be devoted to current income rather than saving. Each household has to spend its income on food, clothing, shelter, and other basic needs, with little or nothing left over to save for the future. - The situation with low savings is even worse than it looks, however, because the national income accounts data almost surely, and substantially, overestimate the true saving rate of the poorest countries. To a significant extent, these countries are living off their natural capital but counting resource depletion as income. 75

Breaking out of the poverty trap - The key to overcoming the poverty trap is to raise the economy’s capital stock—in infrastructure, human capital, and public administration—to the point where the downward spiral ends and self-sustaining economic growth takes over. - This requires a “big push” of basic investments between now and 2015 in key infrastructure (roads, electricity, ports, water and sanitation, accessible land for affordable housing, environmental management), human capital (nutrition, disease control, education), and public administration. - Goals create a solid framework for identifying investments that need to be made. They point to practical targets of public investment—water, sanitation, slum upgrading, education, health, environmental management, and basic infrastructure—that reduce income poverty and gender inequalities, improve human capital, and protect the environment. By achieving the Goals, poor countries will establish an adequate base of infrastructure and human capital that will enable them to escape from the poverty trap. 76

Breaking out of the poverty trap - The key to overcoming the poverty trap is to raise the economy’s capital stock—in infrastructure, human capital, and public administration—to the point where the downward spiral ends and self-sustaining economic growth takes over. - This requires a “big push” of basic investments between now and 2015 in key infrastructure (roads, electricity, ports, water and sanitation, accessible land for affordable housing, environmental management), human capital (nutrition, disease control, education), and public administration. - Goals create a solid framework for identifying investments that need to be made. They point to practical targets of public investment—water, sanitation, slum upgrading, education, health, environmental management, and basic infrastructure—that reduce income poverty and gender inequalities, improve human capital, and protect the environment. By achieving the Goals, poor countries will establish an adequate base of infrastructure and human capital that will enable them to escape from the poverty trap. 76

Pockets of Poverty - The next step of economic development occurs when countries have made the transition from subsistence agriculture to commercial agriculture and from commodity exports to urban-based exports, with a large proportion of the population living in urban areas. - The major policy implication for middle-income countries is to ensure that critical investments—in infrastructure, human capital, and public administration—get channeled to lagging regions, including slums, and to social groups excluded from the political process and economic benefits. - The investment strategies of middle-income countries need to focus on sophisticated infrastructure (such as state-of-the-art container ports and intermodal transport systems) and on innovation systems comprising national laboratories, research universities, and public-private R&D partnerships. 77

Pockets of Poverty - The next step of economic development occurs when countries have made the transition from subsistence agriculture to commercial agriculture and from commodity exports to urban-based exports, with a large proportion of the population living in urban areas. - The major policy implication for middle-income countries is to ensure that critical investments—in infrastructure, human capital, and public administration—get channeled to lagging regions, including slums, and to social groups excluded from the political process and economic benefits. - The investment strategies of middle-income countries need to focus on sophisticated infrastructure (such as state-of-the-art container ports and intermodal transport systems) and on innovation systems comprising national laboratories, research universities, and public-private R&D partnerships. 77

Areas of specific policy neglect - A fourth reason why some Goals are not being met is simply that policymakers are unaware of the challenges, unaware of what to do, or neglectful of core public issues. - Environmental policy is often grossly neglected because of politically weak environment ministries, even weaker law enforcement, and considerable deficiencies in information and in the capacity to act on that information. Few governments currently have the capacity to assess the deep links between ecosystem services (hydrology, biodiversity, natural hazard reduction) and poverty reduction. - Also common are gender biases in public investment and social and economic policies, maternal health, and sexual and reproductive health. Adolescents are also widely underserved for life skills, nutrition information, education and employment opportunities, and sexual and reproductive health information and services. Throughout the developing world and even in middle-income countries, maternal mortality ratios remain appallingly high. 78

Areas of specific policy neglect - A fourth reason why some Goals are not being met is simply that policymakers are unaware of the challenges, unaware of what to do, or neglectful of core public issues. - Environmental policy is often grossly neglected because of politically weak environment ministries, even weaker law enforcement, and considerable deficiencies in information and in the capacity to act on that information. Few governments currently have the capacity to assess the deep links between ecosystem services (hydrology, biodiversity, natural hazard reduction) and poverty reduction. - Also common are gender biases in public investment and social and economic policies, maternal health, and sexual and reproductive health. Adolescents are also widely underserved for life skills, nutrition information, education and employment opportunities, and sexual and reproductive health information and services. Throughout the developing world and even in middle-income countries, maternal mortality ratios remain appallingly high. 78

Private and Public Investments to Meet the MDGs The public and the private sectors both have a role in almost every form of investment needed for the Goals. In some areas the private sector is predominant—as for business growth, generating employment, raising incomes, and raising productivity. In others the government is predominant—as for governance and a regulatory framework to foster the private sector. In still others there is a mix of responsibilities—as for human capital, infrastructure, science and technology, and environmental sustainability. Public and private investments, when well designed, tend to be complementary, not rivals or substitutes. It is therefore a huge mistake to be dogmatic about public versus private investments. Both are needed. 79

Private and Public Investments to Meet the MDGs The public and the private sectors both have a role in almost every form of investment needed for the Goals. In some areas the private sector is predominant—as for business growth, generating employment, raising incomes, and raising productivity. In others the government is predominant—as for governance and a regulatory framework to foster the private sector. In still others there is a mix of responsibilities—as for human capital, infrastructure, science and technology, and environmental sustainability. Public and private investments, when well designed, tend to be complementary, not rivals or substitutes. It is therefore a huge mistake to be dogmatic about public versus private investments. Both are needed. 79

The limits to private investment - A common assessment for countries stuck in extreme poverty is that they simply need more private investment (including foreign capital inflows) to stimulate market growth. Too simplistic, this view mischaracterizes the challenges of promoting private investment in low-income countries. - Private investment in general, and foreign investment in particular, require that certain threshold conditions be met. When infrastructure and human capital are inadequate, potential investors will stay away completely. - One of the roles of the public sector is to ensure that infrastructure is adequate to push the economy across the threshold, so that private investors can earn at least the minimum return they need to invest. 80

The limits to private investment - A common assessment for countries stuck in extreme poverty is that they simply need more private investment (including foreign capital inflows) to stimulate market growth. Too simplistic, this view mischaracterizes the challenges of promoting private investment in low-income countries. - Private investment in general, and foreign investment in particular, require that certain threshold conditions be met. When infrastructure and human capital are inadequate, potential investors will stay away completely. - One of the roles of the public sector is to ensure that infrastructure is adequate to push the economy across the threshold, so that private investors can earn at least the minimum return they need to invest. 80

The need for public investment - Why not let the private sector simply take the lead in infrastructure, health, and education if those investments are indeed so important as preconditions for other kinds of private investment? • First, many of the key preconditions for growth—such as roads, infectious disease control, and education—are public goods, meaning in shorthand that the social returns to providing them are much higher than the private returns. • Second, even though these infrastructure and human capital investments are preconditions for long-term growth, the private rate of return on these investments is very low. • Third, some of the key investments—such as public health and primary education—are merit goods, meaning that universal access to such goods is a goal in itself. 81

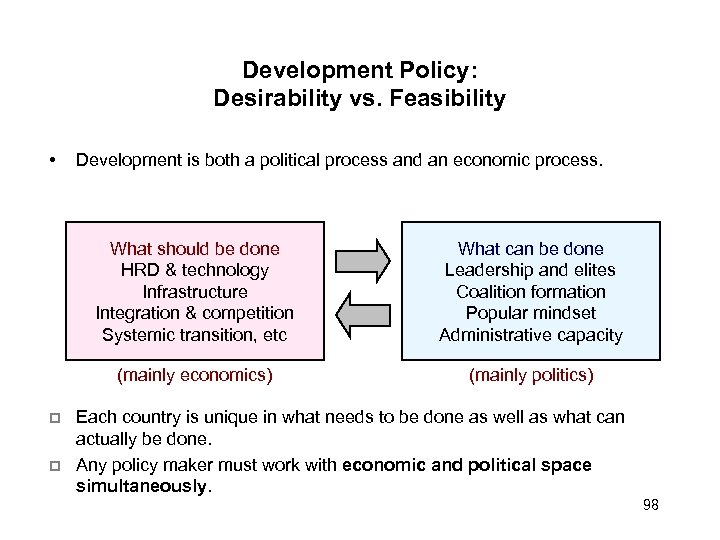

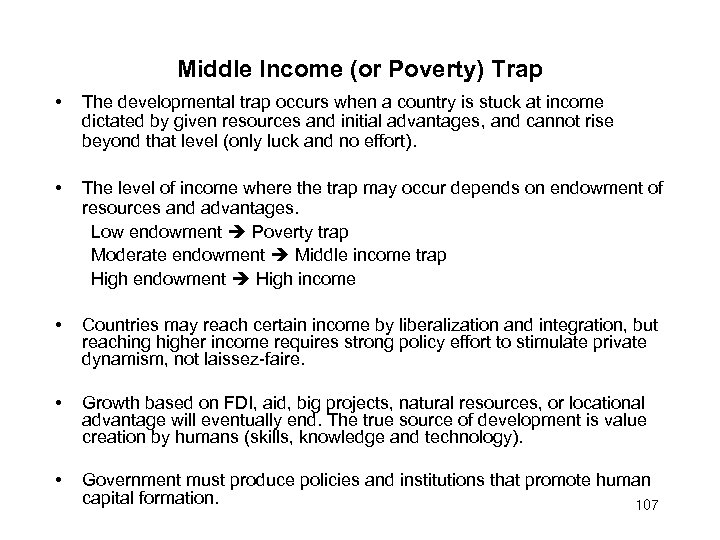

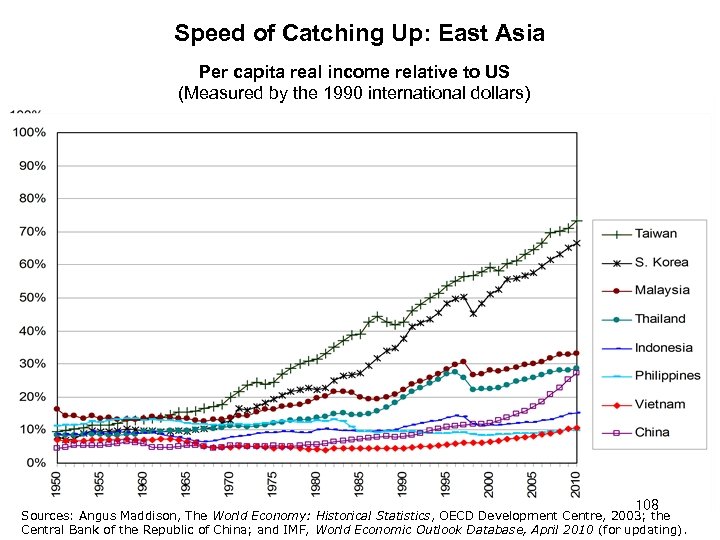

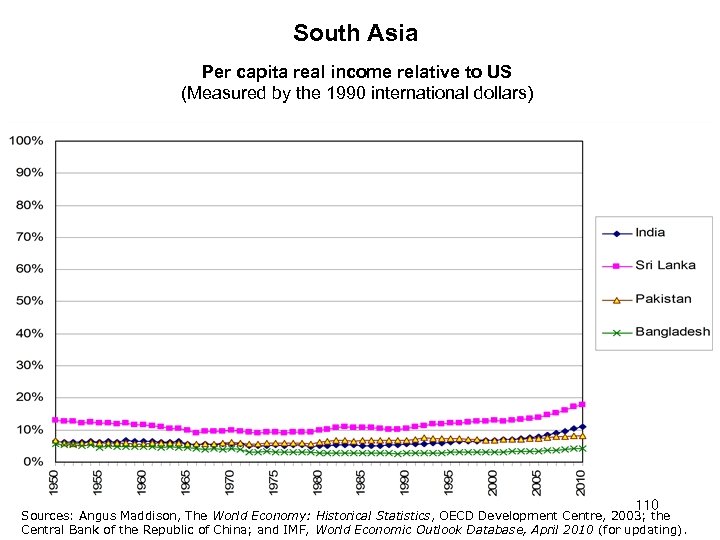

The need for public investment - Why not let the private sector simply take the lead in infrastructure, health, and education if those investments are indeed so important as preconditions for other kinds of private investment? • First, many of the key preconditions for growth—such as roads, infectious disease control, and education—are public goods, meaning in shorthand that the social returns to providing them are much higher than the private returns. • Second, even though these infrastructure and human capital investments are preconditions for long-term growth, the private rate of return on these investments is very low. • Third, some of the key investments—such as public health and primary education—are merit goods, meaning that universal access to such goods is a goal in itself. 81