a2e6145f8fcef7640802ca5031baa4a2.ppt

- Количество слайдов: 34

Economic Crisis: Technology is the answer Edward Tsang Centre For Computational Finance and Economics University of Essex IEEE Technical Committee on Finance and Economics

Economic Crisis: Technology is the answer Edward Tsang Centre For Computational Finance and Economics University of Essex IEEE Technical Committee on Finance and Economics

Motivation • Technology has changed every aspect of our lives • Why not economics!? • Do we understand the economy? • Very little! Hence the trouble. • Unique opportunities for computing

Motivation • Technology has changed every aspect of our lives • Why not economics!? • Do we understand the economy? • Very little! Hence the trouble. • Unique opportunities for computing

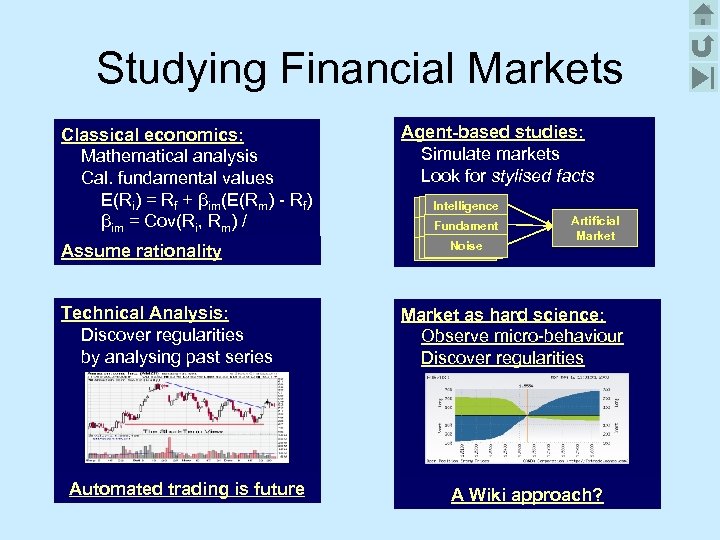

Studying Financial Markets Classical economics: Mathematical analysis Cal. fundamental values E(Ri) = Rf + βim(E(Rm) - Rf) βim = Cov(Ri, Rm) / Var(Rm) rationality Assume Agent-based studies: Simulate markets Look for stylised facts Technical Analysis: Discover regularities by analysing past series Market as hard science: Observe micro-behaviour Discover regularities Automated trading is future Intelligence EDDIE Fundament EDDIE al Noise EDDIE Artificial Market A Wiki approach?

Studying Financial Markets Classical economics: Mathematical analysis Cal. fundamental values E(Ri) = Rf + βim(E(Rm) - Rf) βim = Cov(Ri, Rm) / Var(Rm) rationality Assume Agent-based studies: Simulate markets Look for stylised facts Technical Analysis: Discover regularities by analysing past series Market as hard science: Observe micro-behaviour Discover regularities Automated trading is future Intelligence EDDIE Fundament EDDIE al Noise EDDIE Artificial Market A Wiki approach?

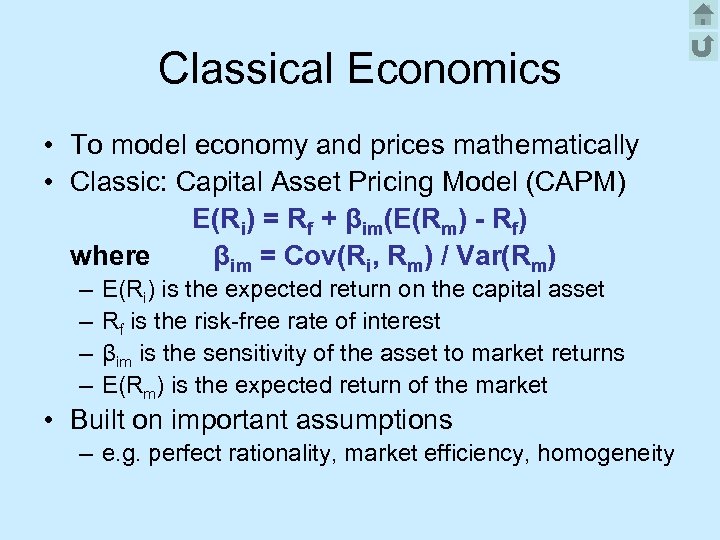

Classical Economics • To model economy and prices mathematically • Classic: Capital Asset Pricing Model (CAPM) E(Ri) = Rf + βim(E(Rm) - Rf) where βim = Cov(Ri, Rm) / Var(Rm) – – E(Ri) is the expected return on the capital asset Rf is the risk-free rate of interest βim is the sensitivity of the asset to market returns E(Rm) is the expected return of the market • Built on important assumptions – e. g. perfect rationality, market efficiency, homogeneity

Classical Economics • To model economy and prices mathematically • Classic: Capital Asset Pricing Model (CAPM) E(Ri) = Rf + βim(E(Rm) - Rf) where βim = Cov(Ri, Rm) / Var(Rm) – – E(Ri) is the expected return on the capital asset Rf is the risk-free rate of interest βim is the sensitivity of the asset to market returns E(Rm) is the expected return of the market • Built on important assumptions – e. g. perfect rationality, market efficiency, homogeneity

CIDER: Computational Intelligence Determines Effective Rationality (1) • • You have a product to sell. One customer offers £ 10 Another offers £ 20 Who should you sell to? • Obvious choice for a rational seller 16 March 2018 All Rights Reserved, Edward Tsang

CIDER: Computational Intelligence Determines Effective Rationality (1) • • You have a product to sell. One customer offers £ 10 Another offers £ 20 Who should you sell to? • Obvious choice for a rational seller 16 March 2018 All Rights Reserved, Edward Tsang

CIDER: Computational Intelligence Determines Effective Rationality (2) • You are offered two choices: – to pay £ 100 now, or – to pay £ 10 per month for 12 months • Given cost of capital, and basic mathematical training • Not a difficult choice … 16 March 2018 All Rights Reserved, Edward Tsang

CIDER: Computational Intelligence Determines Effective Rationality (2) • You are offered two choices: – to pay £ 100 now, or – to pay £ 10 per month for 12 months • Given cost of capital, and basic mathematical training • Not a difficult choice … 16 March 2018 All Rights Reserved, Edward Tsang

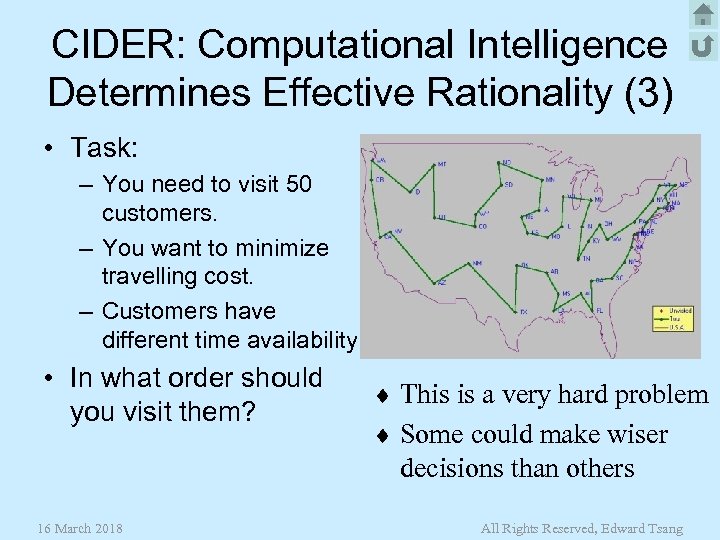

CIDER: Computational Intelligence Determines Effective Rationality (3) • Task: – You need to visit 50 customers. – You want to minimize travelling cost. – Customers have different time availability. • In what order should you visit them? ¨ This is a very hard problem ¨ Some could make wiser decisions than others 16 March 2018 All Rights Reserved, Edward Tsang

CIDER: Computational Intelligence Determines Effective Rationality (3) • Task: – You need to visit 50 customers. – You want to minimize travelling cost. – Customers have different time availability. • In what order should you visit them? ¨ This is a very hard problem ¨ Some could make wiser decisions than others 16 March 2018 All Rights Reserved, Edward Tsang

What is Rationality? • Are we all logical? • What if Computation is involved? • If we know P is true and P Q, then we know Q is true • We know all the rules in Chess, but not the optimal moves • “Rationality” depends on computation power! – Think faster “more rational” 16 March 2018 All Rights Reserved, Edward Tsang

What is Rationality? • Are we all logical? • What if Computation is involved? • If we know P is true and P Q, then we know Q is true • We know all the rules in Chess, but not the optimal moves • “Rationality” depends on computation power! – Think faster “more rational” 16 March 2018 All Rights Reserved, Edward Tsang

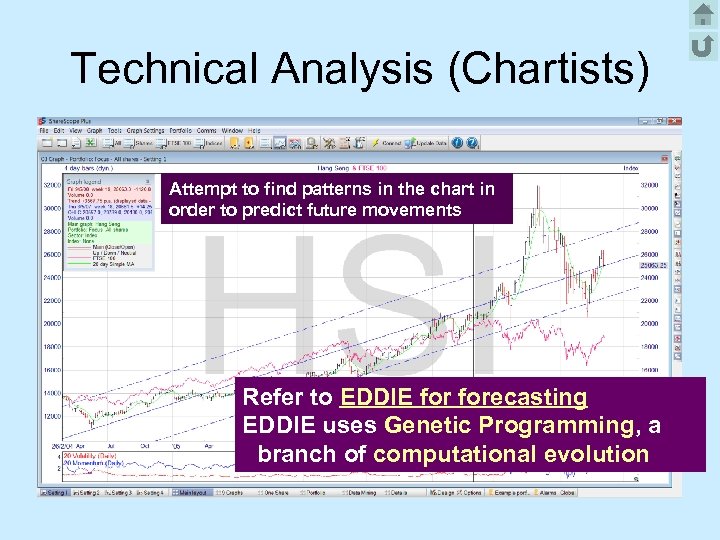

Technical Analysis (Chartists) Attempt to find patterns in the chart in order to predict future movements Refer to EDDIE forecasting EDDIE uses Genetic Programming, a branch of computational evolution

Technical Analysis (Chartists) Attempt to find patterns in the chart in order to predict future movements Refer to EDDIE forecasting EDDIE uses Genetic Programming, a branch of computational evolution

Computer vs Human Traders • • Programs work day and night, humans can’t Programs react in miliseconds, humans can’t Programs can be fully audited, humans can’t When programs make mistakes, one can learn and change the culprit codes – Failed human traders simply change jobs • Expertise in computer programs accumulates – Human traders leave with his/her experience Not to mention costs, emotion, hidden agenda, etc. 16 March 2018 All Rights Reserved, Edward Tsang

Computer vs Human Traders • • Programs work day and night, humans can’t Programs react in miliseconds, humans can’t Programs can be fully audited, humans can’t When programs make mistakes, one can learn and change the culprit codes – Failed human traders simply change jobs • Expertise in computer programs accumulates – Human traders leave with his/her experience Not to mention costs, emotion, hidden agenda, etc. 16 March 2018 All Rights Reserved, Edward Tsang

Automated Trading is Future • Traders have to program Or work with programmers • Traders provide strategies • Programmers produce programs • Programs trade – Markets are 24 hours – Already true foreign exchange – No reason for markets to pause in weekends

Automated Trading is Future • Traders have to program Or work with programmers • Traders provide strategies • Programmers produce programs • Programs trade – Markets are 24 hours – Already true foreign exchange – No reason for markets to pause in weekends

FAQ in Automated Trading • Is the market predictable? – It doesn’t have to be: just code your own expertise – Market is not efficient anyway, herding has patterns • How can you predict exceptional events? – No, we can’t – Neither can human traders • How can you be sure that your program works? – – No, we can’t Neither were we sure about Nick Leeson at Barrings Codes are more auditable than humans If you can improve your odds from 50 -50 to 60 -40 in your favour, you should be happy 16 March 2018 All Rights Reserved, Edward Tsang

FAQ in Automated Trading • Is the market predictable? – It doesn’t have to be: just code your own expertise – Market is not efficient anyway, herding has patterns • How can you predict exceptional events? – No, we can’t – Neither can human traders • How can you be sure that your program works? – – No, we can’t Neither were we sure about Nick Leeson at Barrings Codes are more auditable than humans If you can improve your odds from 50 -50 to 60 -40 in your favour, you should be happy 16 March 2018 All Rights Reserved, Edward Tsang

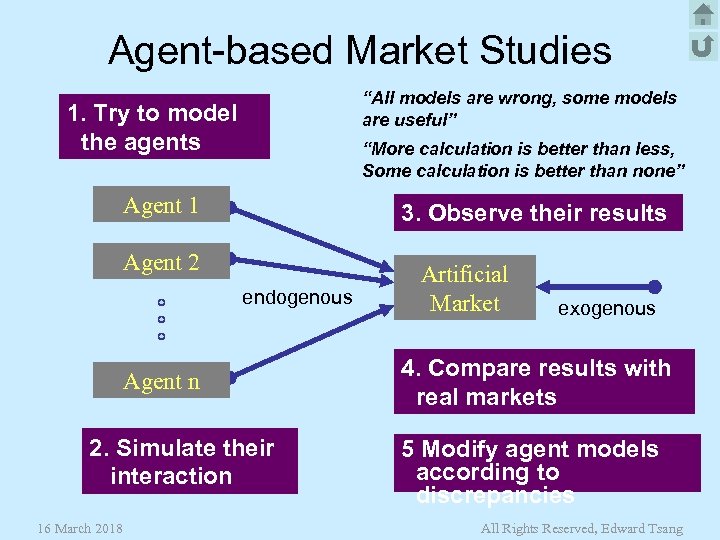

Agent-based Market Studies “All models are wrong, some models are useful” 1. Try to model the agents “More calculation is better than less, Some calculation is better than none” Agent 1 3. Observe their results Agent 2 endogenous Agent n 2. Simulate their interaction 16 March 2018 Artificial Market exogenous 4. Compare results with real markets 5 Modify agent models according to discrepancies All Rights Reserved, Edward Tsang

Agent-based Market Studies “All models are wrong, some models are useful” 1. Try to model the agents “More calculation is better than less, Some calculation is better than none” Agent 1 3. Observe their results Agent 2 endogenous Agent n 2. Simulate their interaction 16 March 2018 Artificial Market exogenous 4. Compare results with real markets 5 Modify agent models according to discrepancies All Rights Reserved, Edward Tsang

The Hard Science of Markets (Richard Olsen) • How is biology studied? – E. g. one observes the growth of plants – Measure certain chemical contents – Write down regularities – Generalize regularities if possible Richard Olsen Forex OANDA • Markets are results of micro-behaviour – Technical analysis only studies the results (prices) – Much deeper knowledge can be observed from studying micro-behaviour …

The Hard Science of Markets (Richard Olsen) • How is biology studied? – E. g. one observes the growth of plants – Measure certain chemical contents – Write down regularities – Generalize regularities if possible Richard Olsen Forex OANDA • Markets are results of micro-behaviour – Technical analysis only studies the results (prices) – Much deeper knowledge can be observed from studying micro-behaviour …

Agent-based Market Studies • If I can model every investor, I can predict the market • But I can’t accurately model investors • However, I know exactly what orders were placed • I know what happened after each order was placed – Whether it was transacted – Its immediate impact to prices – Price movements afterwards • Can’t we learn anything from these? – By recording details and looking for regularities – As we do in biology

Agent-based Market Studies • If I can model every investor, I can predict the market • But I can’t accurately model investors • However, I know exactly what orders were placed • I know what happened after each order was placed – Whether it was transacted – Its immediate impact to prices – Price movements afterwards • Can’t we learn anything from these? – By recording details and looking for regularities – As we do in biology

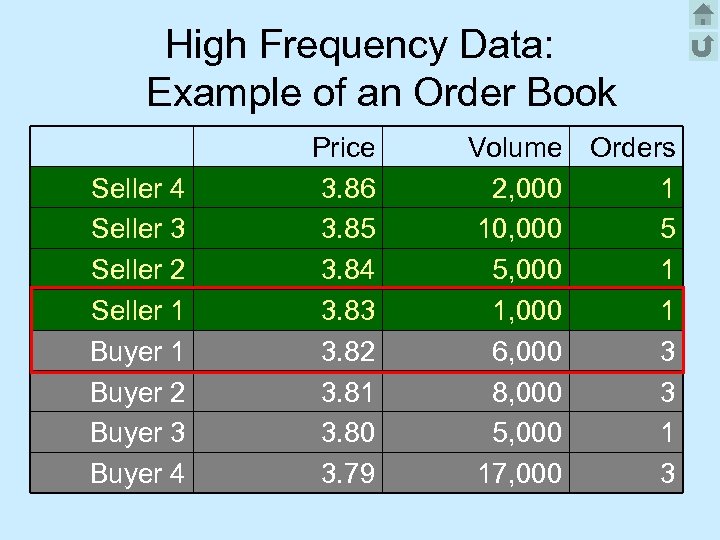

High Frequency Data: Example of an Order Book Seller 4 Seller 3 Seller 2 Seller 1 Buyer 2 Buyer 3 Buyer 4 Price 3. 86 3. 85 3. 84 3. 83 3. 82 3. 81 3. 80 3. 79 Volume Orders 2, 000 1 10, 000 5 5, 000 1 1, 000 1 6, 000 3 8, 000 3 5, 000 1 17, 000 3

High Frequency Data: Example of an Order Book Seller 4 Seller 3 Seller 2 Seller 1 Buyer 2 Buyer 3 Buyer 4 Price 3. 86 3. 85 3. 84 3. 83 3. 82 3. 81 3. 80 3. 79 Volume Orders 2, 000 1 10, 000 5 5, 000 1 1, 000 1 6, 000 3 8, 000 3 5, 000 1 17, 000 3

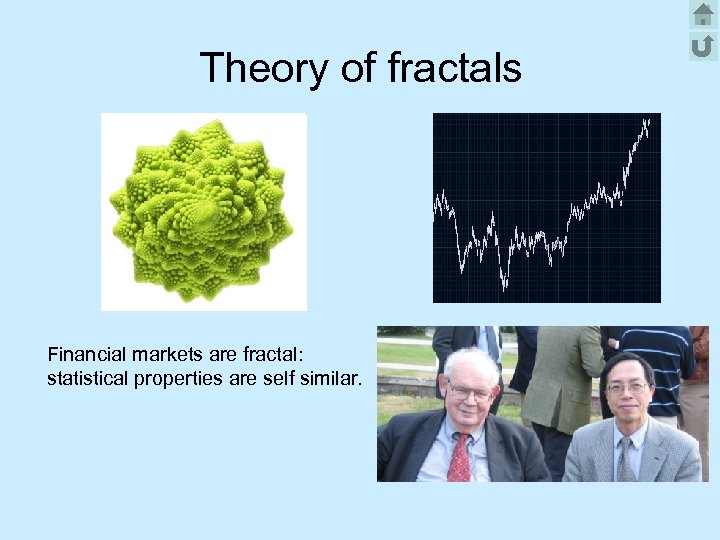

Theory of fractals Financial markets are fractal: statistical properties are self similar.

Theory of fractals Financial markets are fractal: statistical properties are self similar.

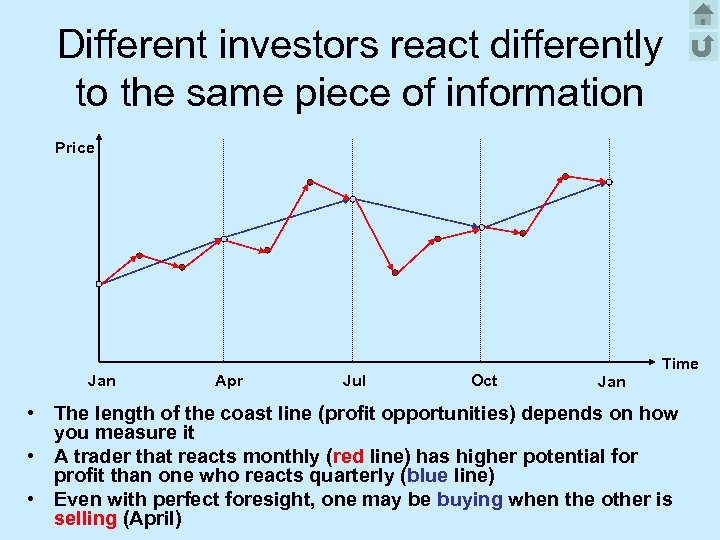

Different investors react differently to the same piece of information Price Jan Apr Jul Oct Time Jan • The length of the coast line (profit opportunities) depends on how you measure it • A trader that reacts monthly (red line) has higher potential for profit than one who reacts quarterly (blue line) • Even with perfect foresight, one may be buying when the other is selling (April)

Different investors react differently to the same piece of information Price Jan Apr Jul Oct Time Jan • The length of the coast line (profit opportunities) depends on how you measure it • A trader that reacts monthly (red line) has higher potential for profit than one who reacts quarterly (blue line) • Even with perfect foresight, one may be buying when the other is selling (April)

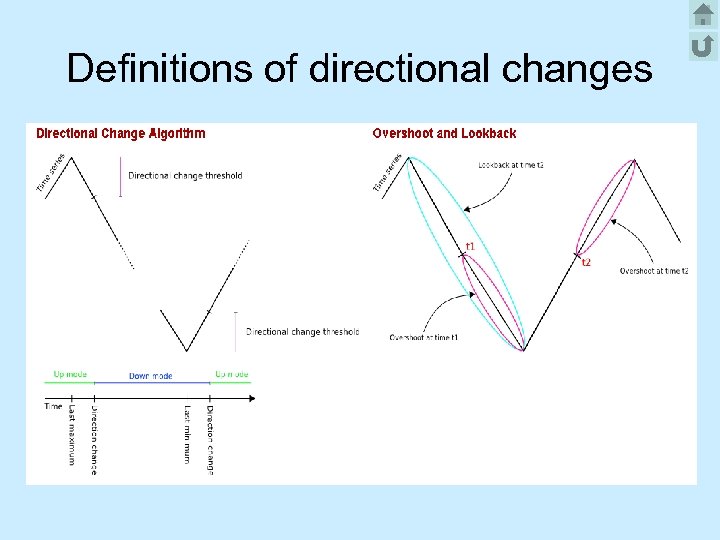

Definitions of directional changes

Definitions of directional changes

Directional Changes (DC) • A Directional Change Event can be a – Downturn Event or an – Upturn Event. • A Downward Run is a period between a Downturn Event and the next Upturn Event. • An Upward Run is a period between an Upturn Event and the next Downturn Event.

Directional Changes (DC) • A Directional Change Event can be a – Downturn Event or an – Upturn Event. • A Downward Run is a period between a Downturn Event and the next Upturn Event. • An Upward Run is a period between an Upturn Event and the next Downturn Event.

DC Definition (2) • In a Downward Run, a Last Low is constantly updated to the minimum of – (a) the current price and – (b) the Last Low. • In an Upward Run, a Last High is constantly updated to the maximum of – (a) the current price and – (b) the Last High.

DC Definition (2) • In a Downward Run, a Last Low is constantly updated to the minimum of – (a) the current price and – (b) the Last Low. • In an Upward Run, a Last High is constantly updated to the maximum of – (a) the current price and – (b) the Last High.

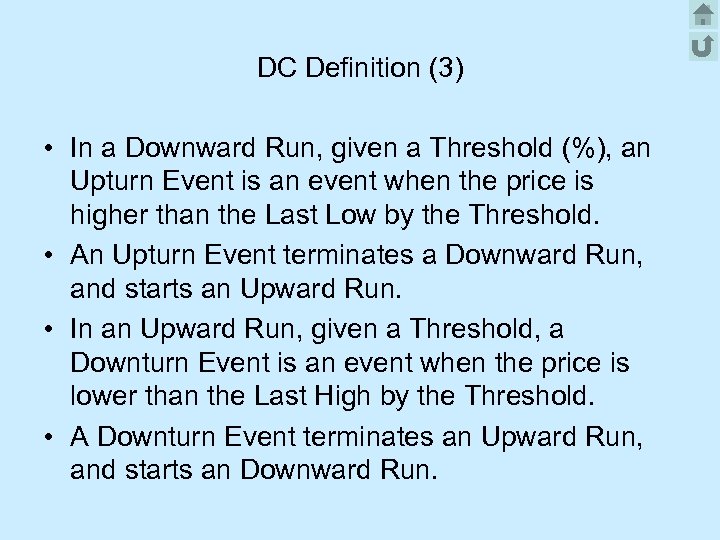

DC Definition (3) • In a Downward Run, given a Threshold (%), an Upturn Event is an event when the price is higher than the Last Low by the Threshold. • An Upturn Event terminates a Downward Run, and starts an Upward Run. • In an Upward Run, given a Threshold, a Downturn Event is an event when the price is lower than the Last High by the Threshold. • A Downturn Event terminates an Upward Run, and starts an Downward Run.

DC Definition (3) • In a Downward Run, given a Threshold (%), an Upturn Event is an event when the price is higher than the Last Low by the Threshold. • An Upturn Event terminates a Downward Run, and starts an Upward Run. • In an Upward Run, given a Threshold, a Downturn Event is an event when the price is lower than the Last High by the Threshold. • A Downturn Event terminates an Upward Run, and starts an Downward Run.

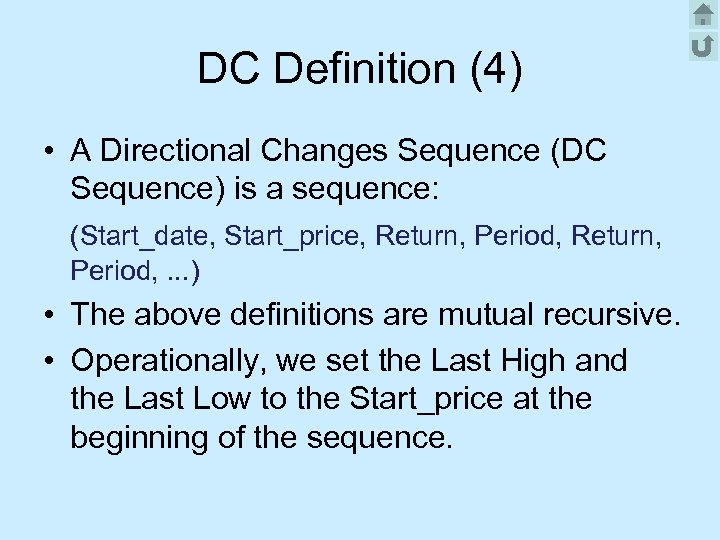

DC Definition (4) • A Directional Changes Sequence (DC Sequence) is a sequence: (Start_date, Start_price, Return, Period, . . . ) • The above definitions are mutual recursive. • Operationally, we set the Last High and the Last Low to the Start_price at the beginning of the sequence.

DC Definition (4) • A Directional Changes Sequence (DC Sequence) is a sequence: (Start_date, Start_price, Return, Period, . . . ) • The above definitions are mutual recursive. • Operationally, we set the Last High and the Last Low to the Start_price at the beginning of the sequence.

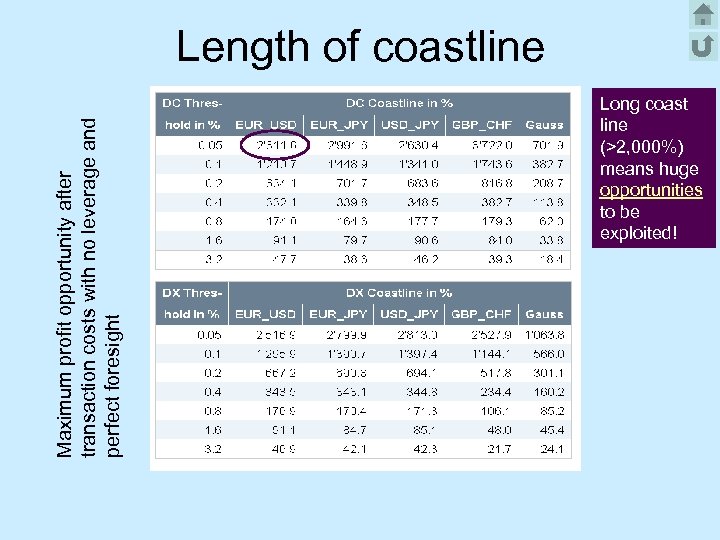

Maximum profit opportunity after transaction costs with no leverage and perfect foresight Length of coastline Long coast line (>2, 000%) means huge opportunities to be exploited!

Maximum profit opportunity after transaction costs with no leverage and perfect foresight Length of coastline Long coast line (>2, 000%) means huge opportunities to be exploited!

Striking observation • 17 scaling laws discovered so far, e. g. – When a directional change of r% occurs, it is followed by an overshoot of r% – The time for the overshoot to happen is also highly correlated to the time taken for the change of direction to happen! • Further observation and analysis needed • Machine learning needed for function fitting

Striking observation • 17 scaling laws discovered so far, e. g. – When a directional change of r% occurs, it is followed by an overshoot of r% – The time for the overshoot to happen is also highly correlated to the time taken for the change of direction to happen! • Further observation and analysis needed • Machine learning needed for function fitting

![Significance of HFF Average daily turnover : about US$3. 98 trillion [1] 2008 World Significance of HFF Average daily turnover : about US$3. 98 trillion [1] 2008 World](https://present5.com/presentation/a2e6145f8fcef7640802ca5031baa4a2/image-26.jpg) Significance of HFF Average daily turnover : about US$3. 98 trillion [1] 2008 World GDP [2]: World 1. US 2. Japan 3. China 4. Germany 5. France US$60. 69 trillion US$14. 26 trillion US$ 4. 92 trillion US$ 4. 40 trillion US$ 3. 67 trillion US$ 2. 87 trillion [1] 2009 estimation based on Bank for International Settlements, 2007 [2] International Monetary Fund, 2008

Significance of HFF Average daily turnover : about US$3. 98 trillion [1] 2008 World GDP [2]: World 1. US 2. Japan 3. China 4. Germany 5. France US$60. 69 trillion US$14. 26 trillion US$ 4. 92 trillion US$ 4. 40 trillion US$ 3. 67 trillion US$ 2. 87 trillion [1] 2009 estimation based on Bank for International Settlements, 2007 [2] International Monetary Fund, 2008

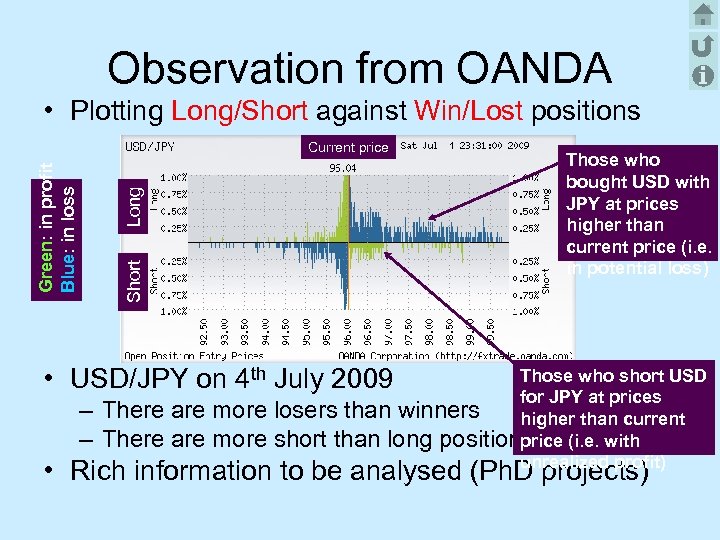

Observation from OANDA • Plotting Long/Short against Win/Lost positions Long Short Green: in profit Blue: in loss Current price Those who bought USD with JPY at prices higher than current price (i. e. in potential loss) • USD/JPY on 4 th July 2009 – There are more Those who short USD for JPY at prices losers than winners higher than current price short than long positions (i. e. with unrealized profit) • Rich information to be analysed (Ph. D projects)

Observation from OANDA • Plotting Long/Short against Win/Lost positions Long Short Green: in profit Blue: in loss Current price Those who bought USD with JPY at prices higher than current price (i. e. in potential loss) • USD/JPY on 4 th July 2009 – There are more Those who short USD for JPY at prices losers than winners higher than current price short than long positions (i. e. with unrealized profit) • Rich information to be analysed (Ph. D projects)

Micro behaviour analysis • Approach: – Modelling trading agents – Consequences analysis on big offers/bids – Finding patterns, such as scaling laws • Hope to explain market behaviour that conventional economics failed to explain – No perfect rationality – No homogeneous behaviour by traders • An exciting way forward

Micro behaviour analysis • Approach: – Modelling trading agents – Consequences analysis on big offers/bids – Finding patterns, such as scaling laws • Hope to explain market behaviour that conventional economics failed to explain – No perfect rationality – No homogeneous behaviour by traders • An exciting way forward

Proposal • Indonesian tsunami 2004 led to construction of early warning systems • Economic turmoil demands the same! • Banking sector lost in the crisis over US$1, 000 bn (779 bn Euro, £ 702 bn, 6, 529 bn KON) • Investing 2%, or US$2 bn is not too much – Richard Olsen, OANDA and CCFEA – Clive Cookson, Financial Times

Proposal • Indonesian tsunami 2004 led to construction of early warning systems • Economic turmoil demands the same! • Banking sector lost in the crisis over US$1, 000 bn (779 bn Euro, £ 702 bn, 6, 529 bn KON) • Investing 2%, or US$2 bn is not too much – Richard Olsen, OANDA and CCFEA – Clive Cookson, Financial Times

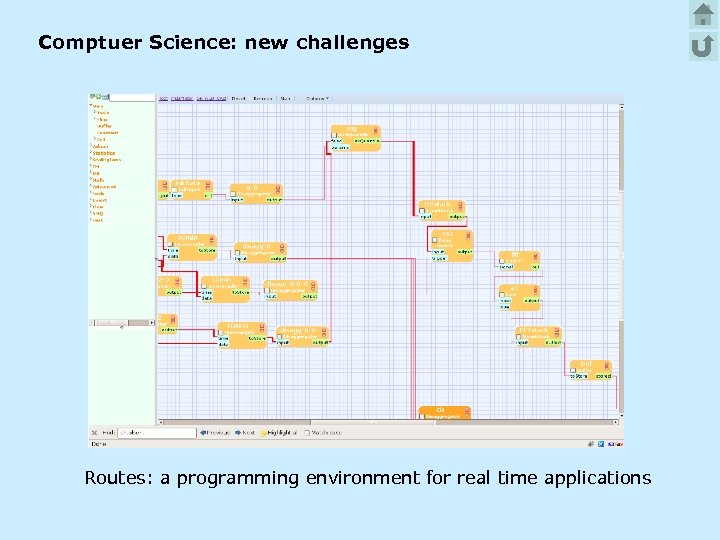

Comptuer Science: new challenges Routes: a programming environment for real time applications

Comptuer Science: new challenges Routes: a programming environment for real time applications

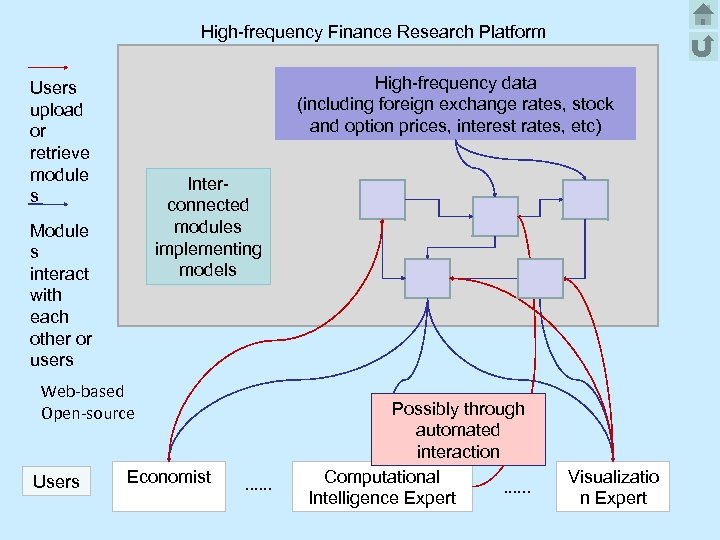

High-frequency Finance Research Platform High-frequency data (including foreign exchange rates, stock and option prices, interest rates, etc) Users upload or retrieve module s Interconnected modules implementing models Module s interact with each other or users Web-based Open-source Users Economist . . . Possibly through automated interaction Computational. . . Intelligence Expert Visualizatio n Expert

High-frequency Finance Research Platform High-frequency data (including foreign exchange rates, stock and option prices, interest rates, etc) Users upload or retrieve module s Interconnected modules implementing models Module s interact with each other or users Web-based Open-source Users Economist . . . Possibly through automated interaction Computational. . . Intelligence Expert Visualizatio n Expert

Concluding Summary • Classical economics build castles on sand • Technical analysis only scratches the surface • Agent-based help understand markets – Repeatable, enabling scientific studies • “Market science” looks into micro-behaviour – Chartists look at end results, why not look at causes!? – If chartists can make money, so can market scientists! – Exciting, uncharted area [demanding expertise!] • Technology will play a big part in economics!

Concluding Summary • Classical economics build castles on sand • Technical analysis only scratches the surface • Agent-based help understand markets – Repeatable, enabling scientific studies • “Market science” looks into micro-behaviour – Chartists look at end results, why not look at causes!? – If chartists can make money, so can market scientists! – Exciting, uncharted area [demanding expertise!] • Technology will play a big part in economics!

Reference • Richard Olsen & Clive Cookson, How science can prevent the next bubble, FT. com, 12 February 2009

Reference • Richard Olsen & Clive Cookson, How science can prevent the next bubble, FT. com, 12 February 2009

References http: //www. bracil. net/finance/papers. html • Martinez-Jaramillo, S. & Tsang, E. P. K. , An heterogeneous, endogenous and co-evolutionary GPbased financial market, IEEE Transactions on Evolutionary Computation, Vol. 13, No. 1, 2009, 33 -55 • Tsang, E. P. K. , Forecasting – where computational intelligence meets the stock market, Frontiers of Computer Science in China, Springer, Vol. 3, No. 1, March 2009, 53 -63 • Tsang, E. P. K. , Computational intelligence determines effective rationality, International Journal on Automation and Control, Vol. 5, No. 1, January 2008, 63 -66

References http: //www. bracil. net/finance/papers. html • Martinez-Jaramillo, S. & Tsang, E. P. K. , An heterogeneous, endogenous and co-evolutionary GPbased financial market, IEEE Transactions on Evolutionary Computation, Vol. 13, No. 1, 2009, 33 -55 • Tsang, E. P. K. , Forecasting – where computational intelligence meets the stock market, Frontiers of Computer Science in China, Springer, Vol. 3, No. 1, March 2009, 53 -63 • Tsang, E. P. K. , Computational intelligence determines effective rationality, International Journal on Automation and Control, Vol. 5, No. 1, January 2008, 63 -66