b90db80d3237781b3e9be54db4cd783a.ppt

- Количество слайдов: 49

Economic and Fiscal Overview: the Good, the Bad and the Ugly Lansing Torch Club April 2012

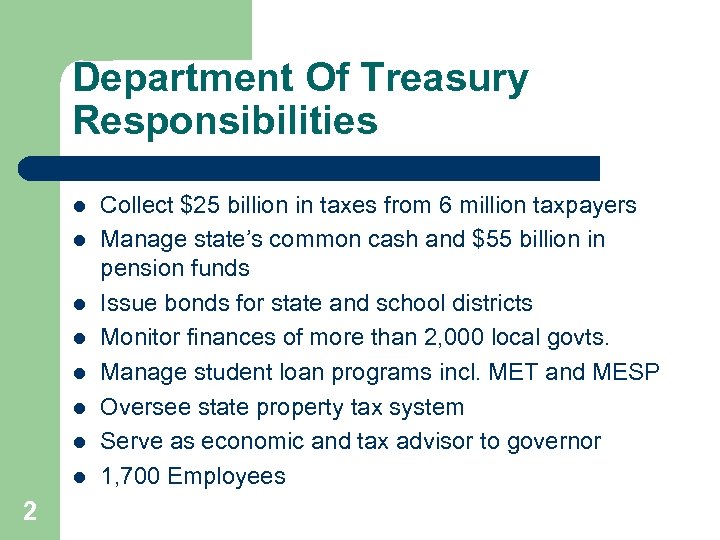

Department Of Treasury Responsibilities l l l l 2 Collect $25 billion in taxes from 6 million taxpayers Manage state’s common cash and $55 billion in pension funds Issue bonds for state and school districts Monitor finances of more than 2, 000 local govts. Manage student loan programs incl. MET and MESP Oversee state property tax system Serve as economic and tax advisor to governor 1, 700 Employees

The Ugly l l l 3 Worst recession since 1930 s Michigan employment declines for 10 straight years Stock market drops 55%

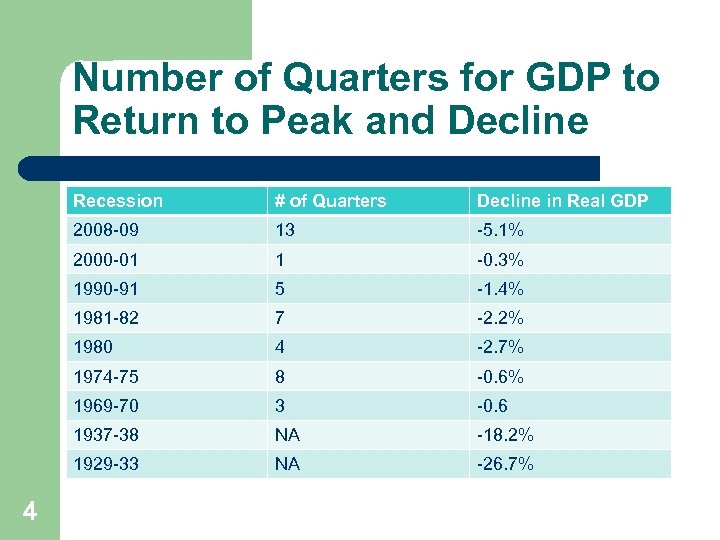

Number of Quarters for GDP to Return to Peak and Decline Recession Decline in Real GDP 2008 -09 13 -5. 1% 2000 -01 1 -0. 3% 1990 -91 5 -1. 4% 1981 -82 7 -2. 2% 1980 4 -2. 7% 1974 -75 8 -0. 6% 1969 -70 3 -0. 6 1937 -38 NA -18. 2% 1929 -33 4 # of Quarters NA -26. 7%

Sales and Big 3 Market Share Collapses 5 Source: Automotive News. Consensus Est.

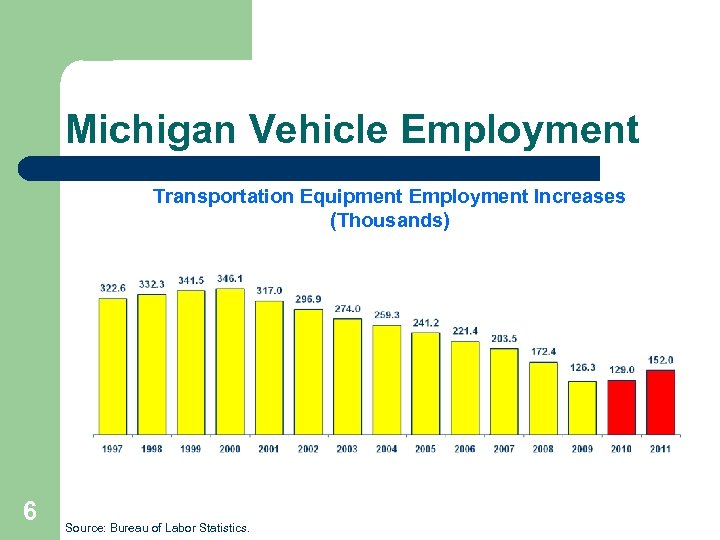

Michigan Vehicle Employment Transportation Equipment Employment Increases (Thousands) 6 Source: Bureau of Labor Statistics.

Michigan Payroll Employment and Vehicle Production 6 Month Moving Average – Year over Year Percent Change 7 Source: Bureau of Labor Statistics & Michigan Department of Treasury

Michigan Taxes Decline as a Percent of Personal Income Michigan State Tax Revenue as a Percent of Personal Income 8 Note: FY 2010 tax estimate based on May 2010 Consensus. FY 2010 personal income based on ORTA and consensus estimates May 2010.

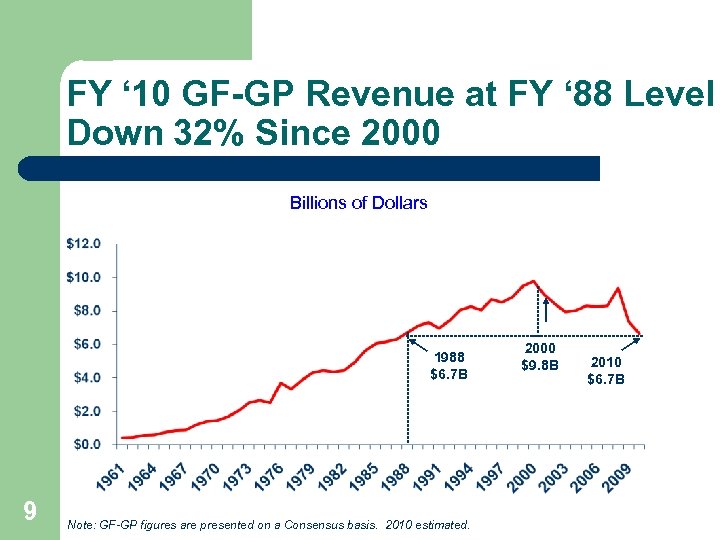

FY ‘ 10 GF-GP Revenue at FY ‘ 88 Level Down 32% Since 2000 Billions of Dollars 1988 $6. 7 B 9 Note: GF-GP figures are presented on a Consensus basis. 2010 estimated. 2000 $9. 8 B 2010 $6. 7 B

FY ’ 10 Inflation Adjusted GF-GP Lowest Since 1965 Billions of 2010$ 1999 $14. 3 B 1965 $6. 5 B 10 Note: GF-GP figures are presented on a Consensus basis and adjusted for inflation to 2010 dollars using the state and local government price deflator. FY 2010 is the May 2010 Consensus estimate. 2010 $6. 7 B

SAF Revenue Below FY 2005 Level 11 Consensus Estimate

FY ’ 11 Inflation Adjusted SAF Lowest Since Proposal A Adopted Billions of 2011$ 1995 $11. 6 B 12 2011 $10. 8 B Consensus Est. Note: SAF figures are presented on a Consensus basis and adjusted for inflation to 2011 dollars using the state and local government price deflator. FY 2010 & FY 2011 are the May 2010 Consensus estimates.

Value of State Pension Funds (billions) Period Dec. 2000 $51. 5 Dec. 2002 $40. 7 Dec. 2007 $61. 8 Dec. 2008 $44. 5 Dec. 2011 13 Value $48. 1

Actions to Balance Budget l l l l 14 l Cut spending- far more than any other state Raised taxes-$1. 3 billion Reduced public employee benefits Reduced state employment by 10, 000 Closed 8 prisons Expanded business tax incentives Federal Aid up sharply Left $1. 3 billion surplus

Federal Aid to Michigan (millions) Year % of Budget 2002 -03 $12, 227 30. 9% 2007 -08 $14, 669 33. 6% 2010 -11 $21, 314 44. 3% 2012 -03 15 Amount $19, 973 41. 6%

The Good l l 16 National economy recovering at modest pace Michigan recovery stronger than most states

Ten Quarters in a Row of GDP Growth Observed Real GDP Growth 3. 0% Growth 17 Figures are annualized percent change from preceding quarter in 2005 chained dollars. Source: Bureau of Economic Analysis. Forecast quarters in red are the September 2010 Global Insight forecast.

U. S. Has Gained Nearly 3. 6 Million Jobs Since February 2010 18 Source: U. S. Bureau of Labor Statistics, U. S. Department of Labor; 4/1/2012

Corporate Profits Up Sharply in 2009 and 2010 2011 Q 3: $1970. 1 19 Source: Bureau of Economic Analysis

Michigan’s 10 -year recession Comes to an End Michigan Wage and Salary Employment Year-Over-Year Change (In Thousands) Avg. 20 Cons. Forecast Note: Bureau of Labor Statistics. 2012 -2014 estimates are from the January 2012 Consensus Forecast.

Vehicle Sales Up, Big 3 Market Share Stabilizes 21 Source: Automotive News. Consensus Est.

Michigan Unemployment Rate, Monthly, 2008 -2011 22

State Budget l 23 The Good, the Bad, and the Ugly

State Budget Balances, FY 2011 FY 2013 (millions) FY 2011 FY 2012 FY 2013 GF/GP $568. 3 $627. 9 $656. 9 SAF $722. 6 $119. 3 $303. 0 Total $1, 290. 6 $747. 2 $959. 9 Bus. Tax Cut $0 -$552. 0 -$309. 0

Michigan Expenditure Growth Lowest Among States 25 Source: Office of Revenue and Tax Analysis, Michigan Dept. of Treasury, 07/27/10, based on NASBO State Expenditure Surveys 2001 and 2009.

Michigan State Government 10, 700 Fewer Employees than 2000 26 Source: Michigan Department of Treasury

Government Not Large Compared to Other States 27 Source: Bureau of the Census, 2008 State and Local Government Employment Survey

The Bad Taxes raised on the poor and seniors and education budgets cut to pay for business tax cuts 28

Summary of Tax Reform l l Reduce business taxes by $1. 7 billion by replacing MBT with 6% CIT, and make up lost revenue by raising personal income taxes. The number of businesses paying state business tax reduced by 70%. Taxes increases fall mainly on seniors, and low and middle-income families. The stated purpose is to improve the Michigan business climate and simplify the tax system.

Unnecessary Budget Changes l l 30 Cuts in K-12 and higher education budgets Cuts in revenue sharing Reduction in EITC from 20% to 6% Some personal income tax increases

A Better Approach l l Extend 6% corporate income tax to business income with a possible exemption of $250, 000 raises $550 -$700 million Retain a 0. 1% gross receipts tax on all businessraises $250 million Impose a tax on selected services such as sports tickets and service contracts Provide a $20, 000 pension exemption for individual returns and $40, 000 for joint returns, or at minimum phase out exemption

Proposed Changes (cont. ) l l Leave the income tax at 4. 35%- saves average taxpayer less than $1 a week- raises $165 million Retain or possibly reduce EITC to 10 or 15% for two years Use revenue in excess of estimates to restore revenue sharing cuts or cut in EITC- revenues likely to be at least $200 million higher in both FY 2011 and FY 2012 Add one tax credit for all charitable contributions$150/$300

Federal Budget Issues l 33 The truth about the Federal budget

Federal Revenues and Expenditures as % of GDP, 19712012

Federal Spending Increases During Recessions Years 1971 -1973 16. 7% 1974 -1976 38. 0% 1980 -1982 26. 2% 1990 -1992 10. 2% 2000 -2002 12. 4% 2008 -2010 35 Expenditure Increase 15. 9%

Federal Government Spending – FY 2010 36 Source: Office of Management & Budget

Federal Budget: FY 2010 and FY 2020 Projection billions of dollars 37 Source: Congressional Budget Office

Total Tax Revenue as % of GDP, selected OECD Countries, 2009 Rank % of GDP 1 Denmark 48. 2% 2 Sweden 46. 4% 3 Italy 43. 5% 4 Belgium 43. 2% 5 Finland 43. 1% 20 Canada 31. 1% 31 United States 24. 0% 32 Chile 18. 2% 33 38 Country Mexico 17. 5%

Is it Possible to Cut $1 Trillion from Federal Budget in One Year? l l l l l Interest on the Debt- $264 B Social Security- $727 B Veterans Support- $63 B Military & Civ. Retirement- $141 B Medicare- $572 B Medicaid- $273 B Defense- $710 B Income Support- $343 B Rest of Budget- $563 B

Possible Budget Cuts l Medicare & Medicaid (10%)- $85 B Defense- $100 B Income Support (10%)- $34 B Rest of Budget (25%)- $140 B l Total- $359 B (9. 8%) l $1 Trillion cut would require 50% reduction in these programs l l l

Higher Income Groups Capture Most Income Gains 41

Index of Income Inequality, Selected Nations, (2000 -2008) Country Index Namibia 1 70. 7 South Africa 2 65. 0 Brazil 10 56. 7 Hong Kong 17 53. 3 Singapore 30 48. 1 Mexico 32 47. 9 China 36 45. 0 United States 44 45. 0 Iran 42 Rank 47 44. 5 Russia 56 41. 5

Index of Income Inequality, Selected Nations (cont. ) Country Index Japan 74 38. 1 United Kingdom 92 34 France 98 32. 7 Canada 100 32. 0 European Union 106 31. 0 Germany 123 27. 0 Norway 131 25. 0 Denmark 132 24. 0 Slovenia 43 Rank 133 24. 0 Sweden 134 23. 0

Average Annual Family Income, 2009 Percentile Top. 01 $27. 3 M Top-. 01 -1% $3. 2 M Top 1% $1. 1 M Top 1 -10% $164. 6 T Bottom 90% $31. 2 T Average 44 Average Income $52. 0 T

Income Inequality Louis Brandeis: "We can either have democracy in this country or we can have great wealth concentrated in the hands of a few, but we can't have both. "

History of Recessions # of Business Cycles Average Duration Average Expansion 1854 -1919 16 22 months 27 months 1919 -1945 6 18 months 35 months 1945 -2001 10 10 months 57 months Addendum: Duration Peak Unemployment GDP Decline Great Depression 43 months 35. 3% (1933) -26. 7% 18 months 10. 1% -5. 0% Great Recession 46

Key Income Tax Changes l l l Eliminate or reduce pension exemption Eliminate most credits- city income tax, contributions to universities and charities Freeze tax rate at 4. 35% until 1/1/2013 and then lower to 4. 25% (rate was scheduled to decline to 3. 9% by 2015). Exemption for interest, dividends, and capital gains repealed for people age 65 and 66; currently $10, 218/$20, 437 less pension exemption. Repeal $600 child care credit.

Key Income Tax Changes (cont. ) l l Homestead property tax credit reducedincome phase out now $41, 000/$50, 000 (from $73, 650/$82, 650); senior rebate reduced from 100% to 60% at incomes over $20, 000; TV cap of $135, 000 EITC reduced from 20% to 6%.

Pension Exemption Changes l l l Exemption eliminated for persons age 59 or lessat age 67 will receive $20, 000/$40, 000 exemption which covers both Soc. Sec. and pension. People 60 -66 in 2012 will receive $20, 000/$40, 000 exemption plus Soc. Sec. exemption. People 67 and older in 2012 will not be affected. Private pension exemption is $45, 842/$91, 680 and public pensions are exempt.

b90db80d3237781b3e9be54db4cd783a.ppt