8a8069690cde7cb1f1e302eafceed5cd.ppt

- Количество слайдов: 53

Economic and Commercial Real Estate Outlook By Lawrence Yun, Ph. D. Chief Economist National Association of REALTORS® May 14, 2015 Washington, D. C.

What’s the Market Like?

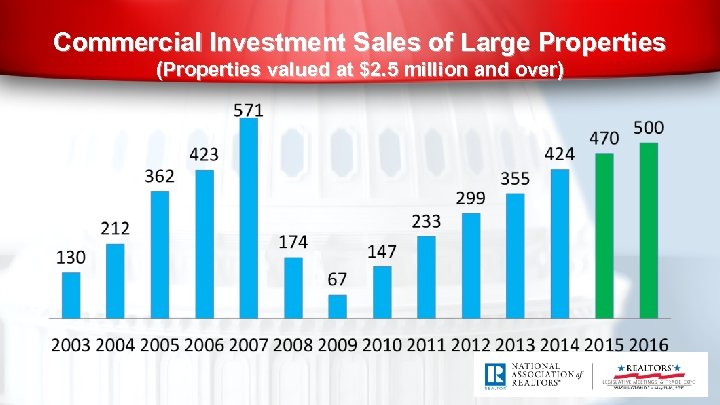

Commercial Investment Sales of Large Properties (Properties valued at $2. 5 million and over)

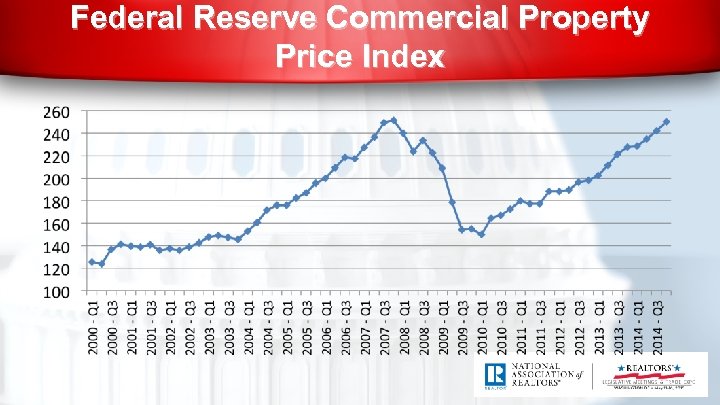

Federal Reserve Commercial Property Price Index

Green Street Price Index … 15% above past peak

REALTOR® Deal Size (Not $2. 5 million Properties)

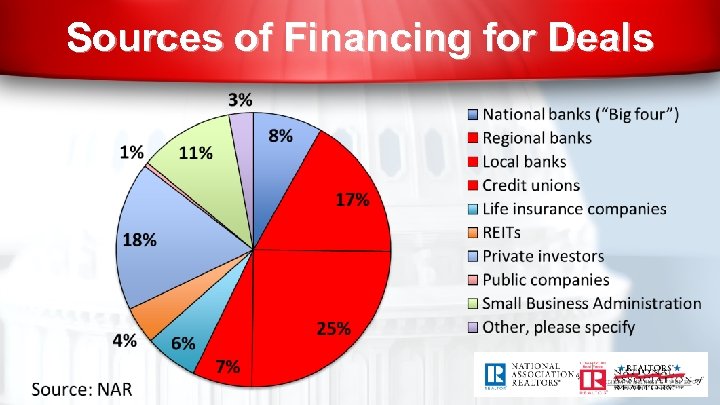

Sources of Financing for Deals

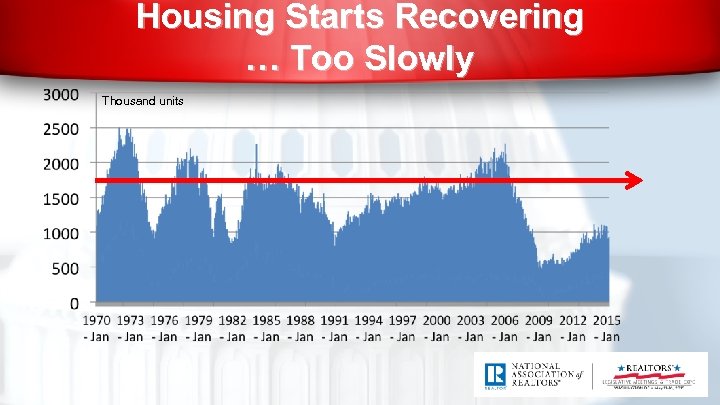

Housing Starts Recovering … Too Slowly Thousand units

Time to Sell a New Spec Home (in months)

Dodd-Frank? • Big homebuilders in the game • Small homebuilders not really in the game • Big commercial deals happening • Small commercial deals slowly happening

Stock Market S&P 500 Index

Corporate Profits Sky High $ billion

How’s the Economy?

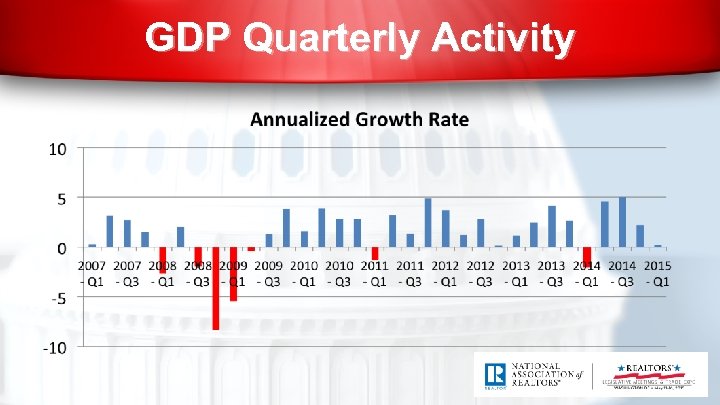

GDP Quarterly Activity

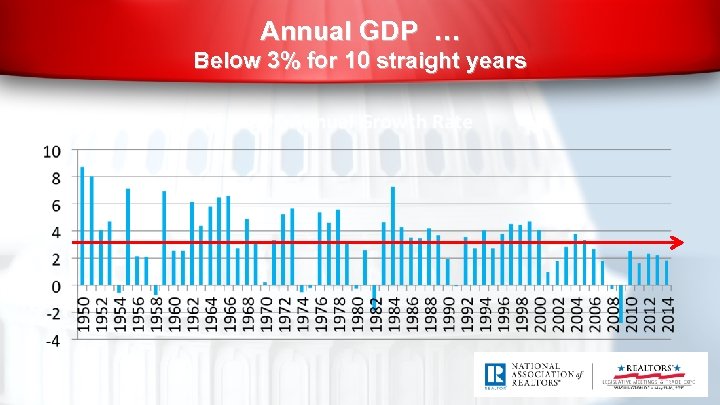

Annual GDP … Below 3% for 10 straight years

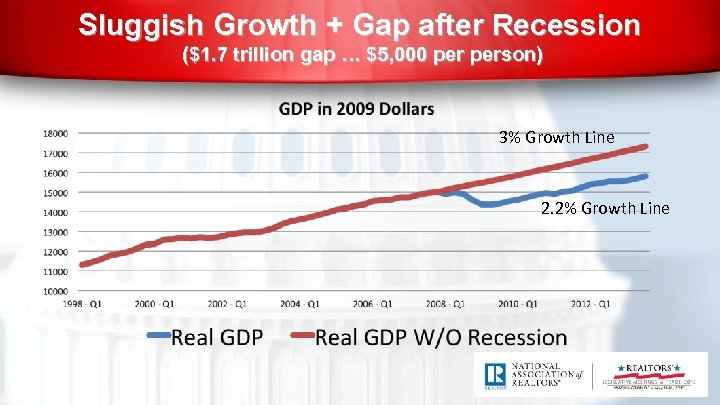

Sluggish Growth + Gap after Recession ($1. 7 trillion gap … $5, 000 person) 3% Growth Line 2. 2% Growth Line

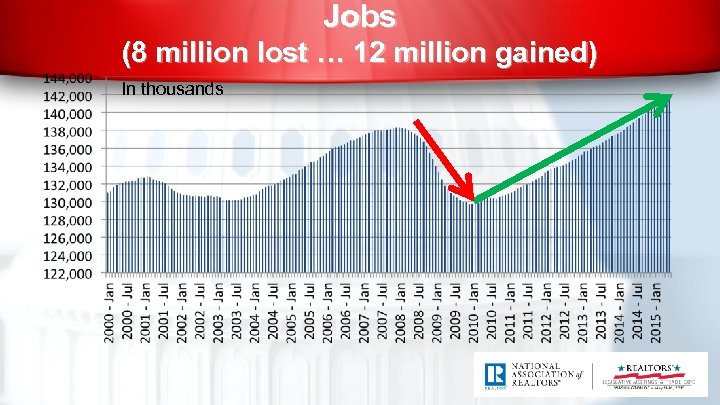

Jobs (8 million lost … 12 million gained) In thousands

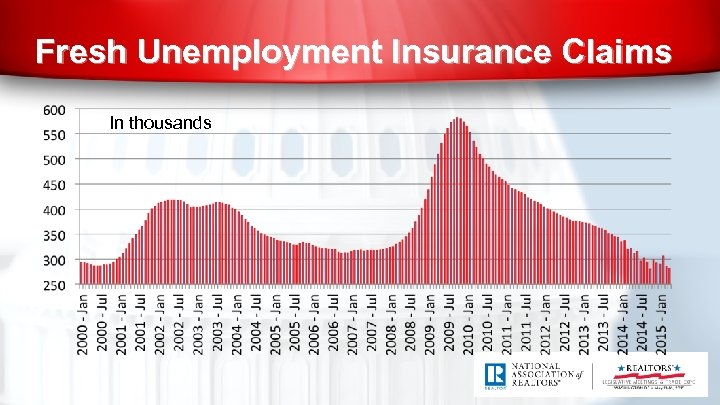

Fresh Unemployment Insurance Claims In thousands

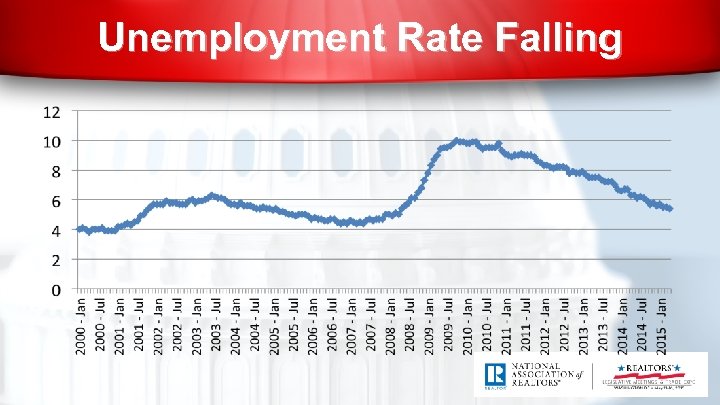

Unemployment Rate Falling

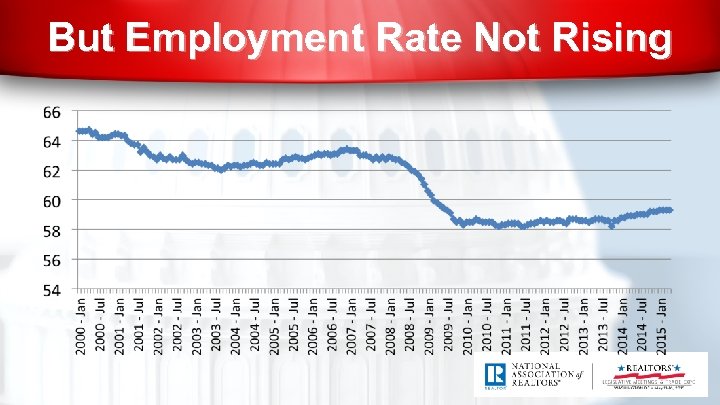

But Employment Rate Not Rising

Part-time Workers In thousands

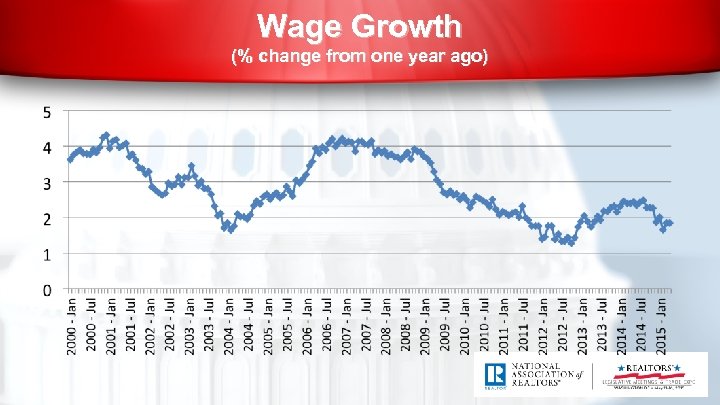

Wage Growth (% change from one year ago)

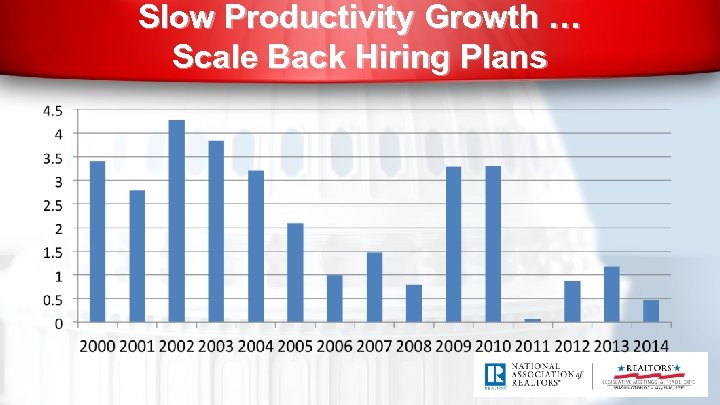

Slow Productivity Growth … Scale Back Hiring Plans

Top and Bottom States for Jobs The Best % Gain in 12 months The Worst % Gain in 12 months Utah 4. 0% West Virginia -0. 7% Florida 3. 8% Mississippi 0. 5% Oregon 3. 4% Maine 0. 5% Washington 3. 4% Montana 0. 6% California 3. 2% Alaska 0. 6% Georgia 3. 2% North Dakota 3. 2% Nevada 3. 0%

Consumer Spending Impact

Oil Price

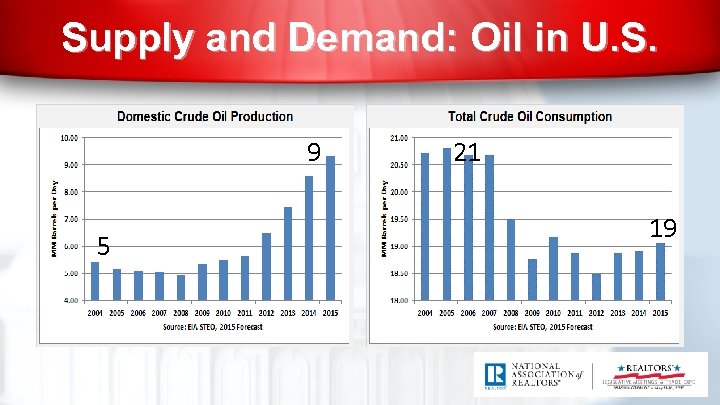

Supply and Demand: Oil in U. S. 9 5 21 19

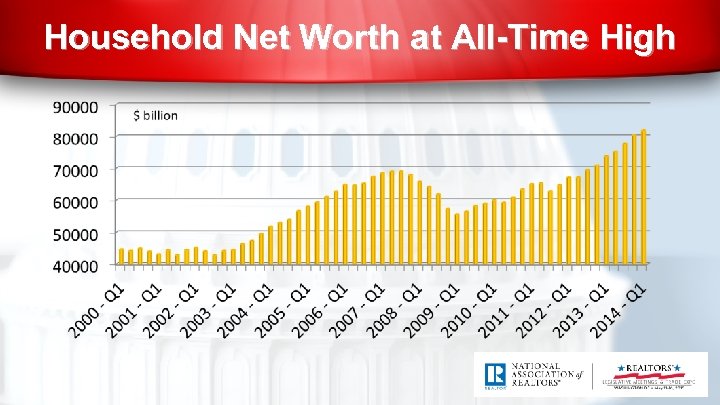

Household Net Worth at All-Time High

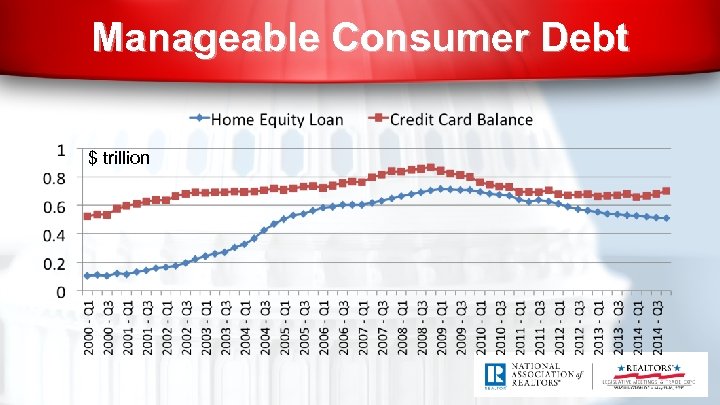

Manageable Consumer Debt $ trillion

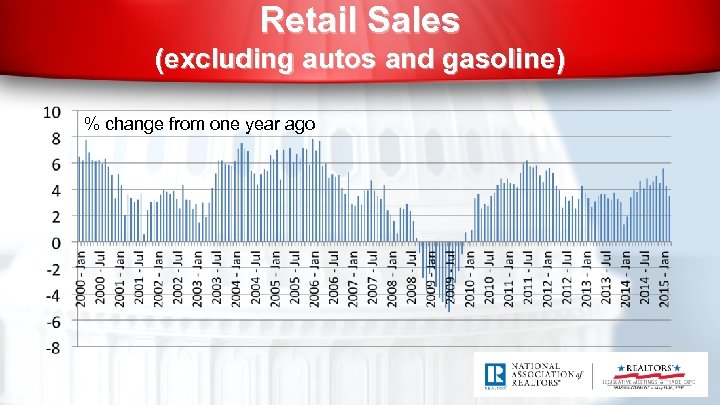

Retail Sales (excluding autos and gasoline) % change from one year ago

E-Commerce Retail Sales % change from one year ago

Jobs in Retail and Warehousing % change from one year ago

Strong Dollar Impact

U. S. Dollar – The Most Trusted

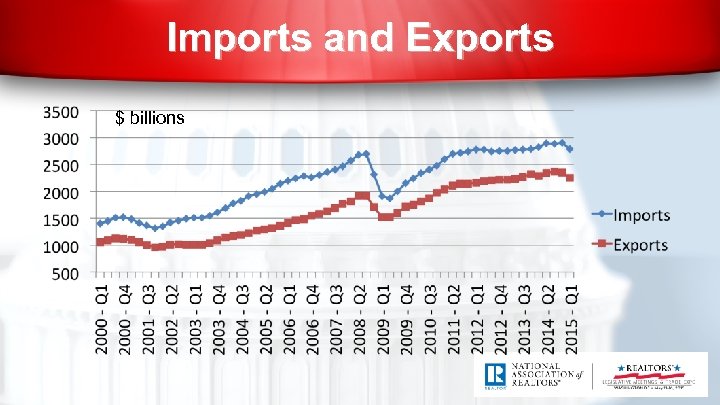

Imports and Exports $ billions

Who is Stalking the Dollar? (U. S. weakening against China)

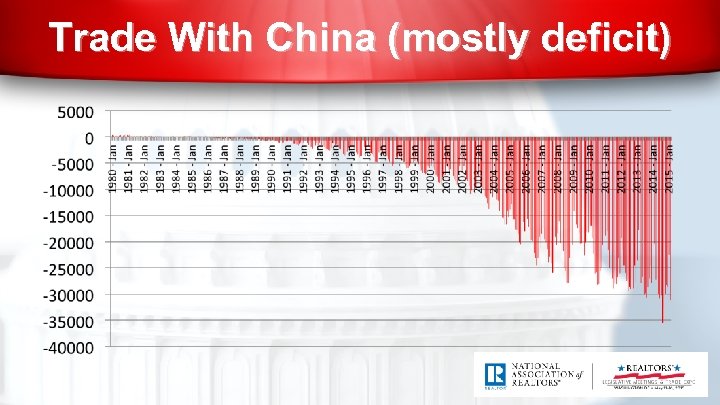

Trade With China (mostly deficit)

Jobs Impact on Office and Apartments

Jobs in Professional Business Service thousands

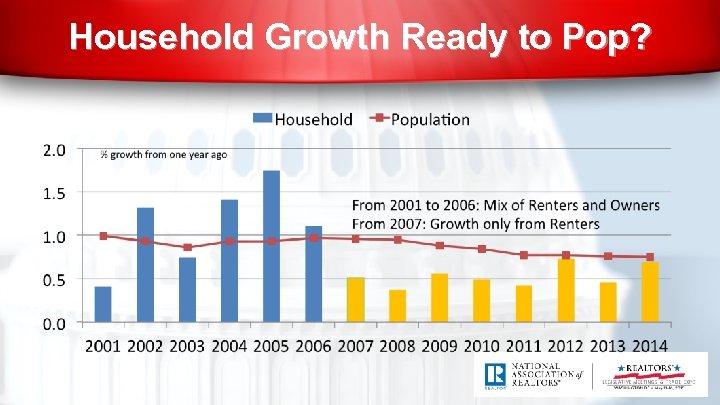

Household Growth Ready to Pop?

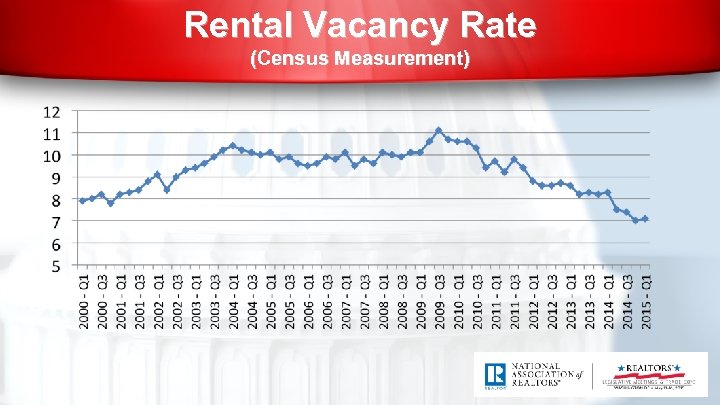

Rental Vacancy Rate (Census Measurement)

Rents Rising at 7 -year high

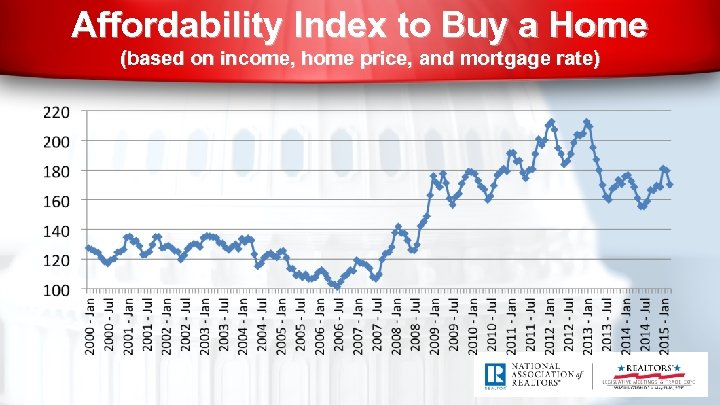

Affordability Index to Buy a Home (based on income, home price, and mortgage rate)

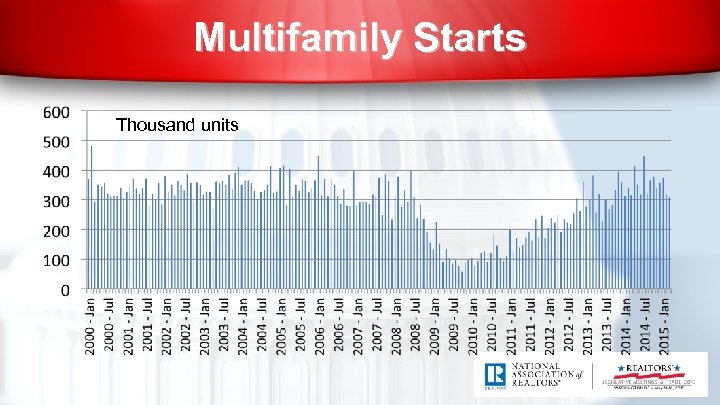

Multifamily Starts Thousand units

Monetary Policy and Forecast

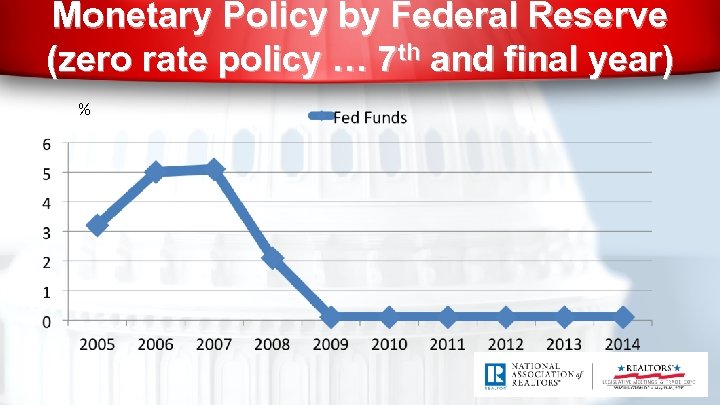

Monetary Policy by Federal Reserve (zero rate policy … 7 th and final year) %

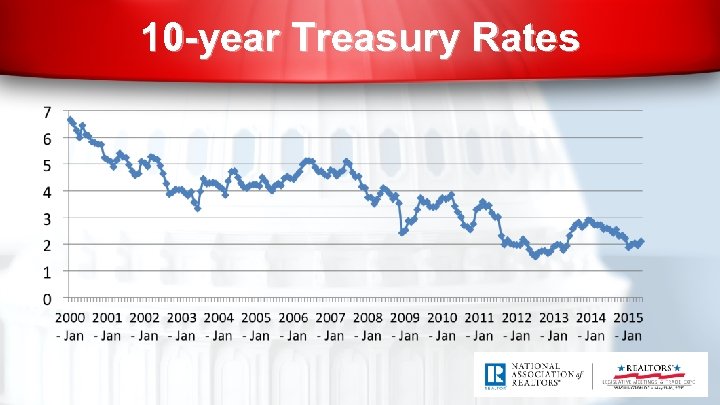

10 -year Treasury Rates

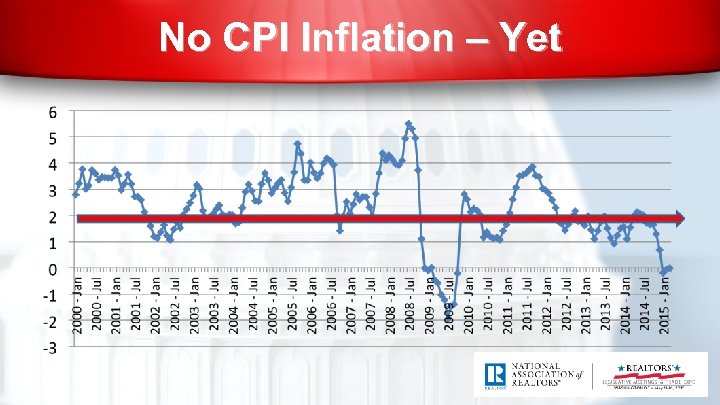

No CPI Inflation – Yet

Monetary Policy • Quantitative Easing … Finished • Fed Funds Rate hike … September 2015 • 10 -year Treasury reaching – 2. 5% by end of 2015 – 3. 5% by end of 2016

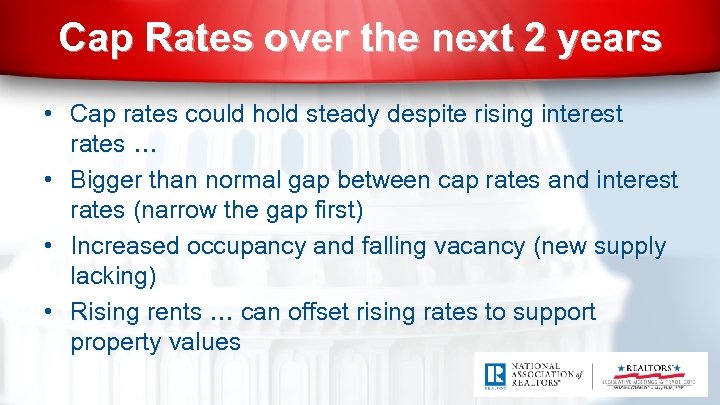

Cap Rates over the next 2 years • Cap rates could hold steady despite rising interest rates … • Bigger than normal gap between cap rates and interest rates (narrow the gap first) • Increased occupancy and falling vacancy (new supply lacking) • Rising rents … can offset rising rates to support property values

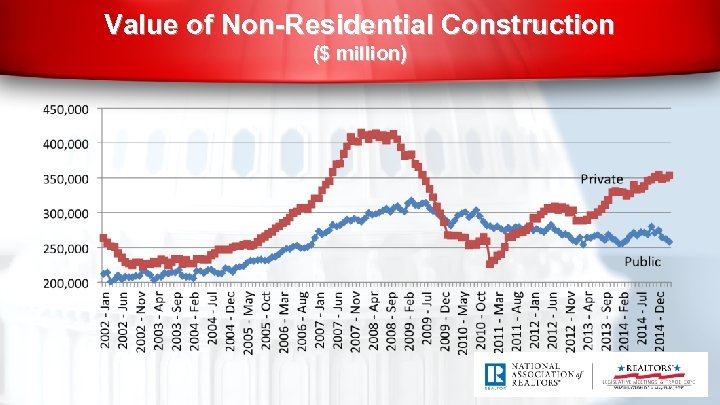

Value of Non-Residential Construction ($ million)

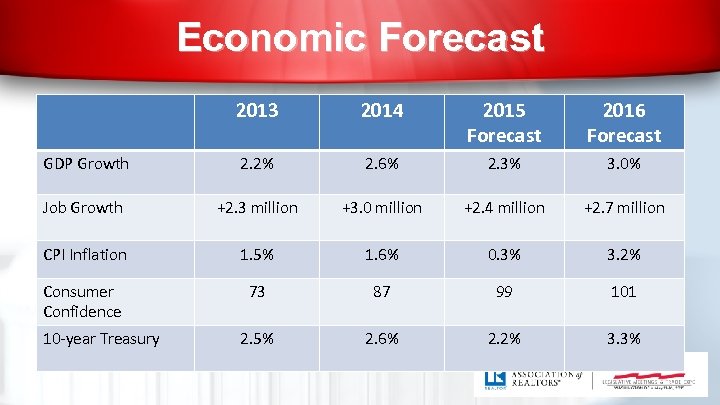

Economic Forecast 2013 2014 2015 Forecast 2016 Forecast GDP Growth 2. 2% 2. 6% 2. 3% 3. 0% Job Growth +2. 3 million +3. 0 million +2. 4 million +2. 7 million CPI Inflation 1. 5% 1. 6% 0. 3% 3. 2% Consumer Confidence 73 87 99 101 2. 5% 2. 6% 2. 2% 3. 3% 10 -year Treasury

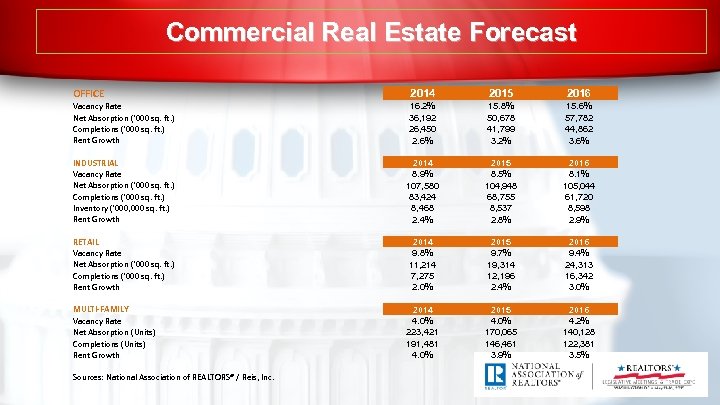

Commercial Real Estate Forecast OFFICE 2014 2015 2016 Vacancy Rate Net Absorption ('000 sq. ft. ) Completions ('000 sq. ft. ) Rent Growth 16. 2% 36, 192 26, 450 2. 6% 15. 8% 50, 678 41, 799 3. 2% 15. 6% 57, 782 44, 862 3. 6% 2014 8. 9% 107, 580 83, 424 8, 468 2. 4% 2015 8. 5% 104, 948 68, 755 8, 537 2. 8% 2016 8. 1% 105, 044 61, 720 8, 598 2. 9% 2014 9. 8% 11, 214 7, 275 2. 0% 2015 9. 7% 19, 314 12, 196 2. 4% 2016 9. 4% 24, 313 16, 342 3. 0% 2014 4. 0% 223, 421 191, 481 4. 0% 2015 4. 0% 170, 065 146, 461 3. 9% 2016 4. 2% 140, 128 122, 381 3. 5% INDUSTRIAL Vacancy Rate Net Absorption ('000 sq. ft. ) Completions ('000 sq. ft. ) Inventory ('000, 000 sq. ft. ) Rent Growth RETAIL Vacancy Rate Net Absorption ('000 sq. ft. ) Completions ('000 sq. ft. ) Rent Growth MULTI-FAMILY Vacancy Rate Net Absorption (Units) Completions (Units) Rent Growth Sources: National Association of REALTORS® / Reis, Inc.

8a8069690cde7cb1f1e302eafceed5cd.ppt