7f3c2d2fe02eeef116b129d0c0427e06.ppt

- Количество слайдов: 30

ECON 4100: Industrial Organization Lecture 8 Commodity bundling and tie-in sales 1

Introduction • product tie-ins and commodity bundling • commodity bundling as a way to price discriminate • complementary goods and network externalities • Before we reach oligopoly: • http: //www. cbc. ca/news/canada/nova-scotia/class-actionlawsuits-manufacturing-refunds-cartels-1. 4354007 2 4 -1

Bundling • Firms sell goods as bundles (package-pricing) – selling two or more goods in a single package (complete stereo systems, fixed-price meals in restaurants, the whole car, not its parts) • Firms also use tie-in sales (requirements pricing): less restrictive than bundling – tie the sale of one good to the purchase of another (computer printers and printer cartridges; constraining the use of spare parts; car+financial services to pay for it) • Why? • Because it is profitable to do so! 3

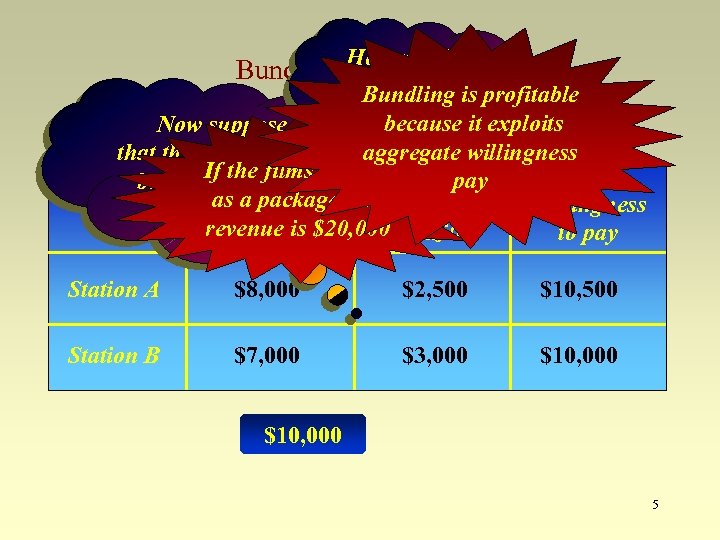

Bundling: an example How much can • Two television stations offered two old Hollywood films How much can be charged for – Casablanca and Son of Godzilla be If the films are sold charged for • Arbitrage is possible between the stations. Godzilla? separately total Casablanca? • Willingness revenue is $19, 000 to pay is: $7, 000 Willingness to pay for Casablanca Godzilla Station A $8, 000 $2, 500 Station B $7, 000 $2, 500 $3, 000 4

How much can be charged is profitable Bundling for thebecause it exploits package? Bundling: an example Now suppose aggregate willingness that the two films are If the sold Willingness to Total pay bundled and films are sold as pay for a package total pay for Willingness as a package revenue is $20, 000 Godzilla Casablanca to pay Station A $8, 000 $2, 500 $10, 500 Station B $7, 000 $3, 000 $10, 000 5

Bundling (cont. ) • Extend this example to allow for – costs – mixed bundling: offering products in a bundle and separately – But see examples at Rogers We will not cover these… Go to next page (tie-in sales) 6

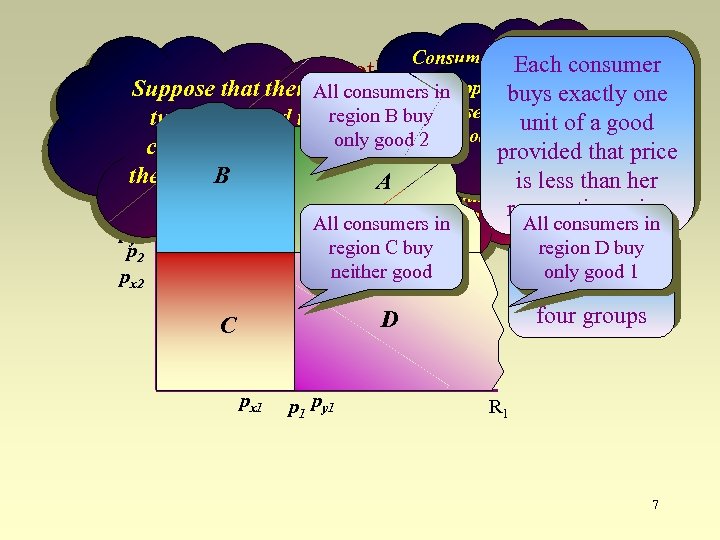

Consumer y Each consumer has Bundling: another example py 1 reservation price the firm Supposebuys exactly one that Suppose that there. All consumers in are for good 1 and consumers in sets All py 2 1 for price p region B buy two goods and that unit of p for good and price a good region A buy good 1 2 R 2 only good 2 2 consumers differ in Consumer x has good 2 that price provided for both goods reservation price px 1 less than her their reservation prices A B is for good 1 and px 2 for these goods reservation price for good Allyconsumers in 2 All consumers in py 2 region C buy region D buy p 2 Consumers x neither good only good 1 px 2 split into four groups D C px 1 py 1 R 1 7

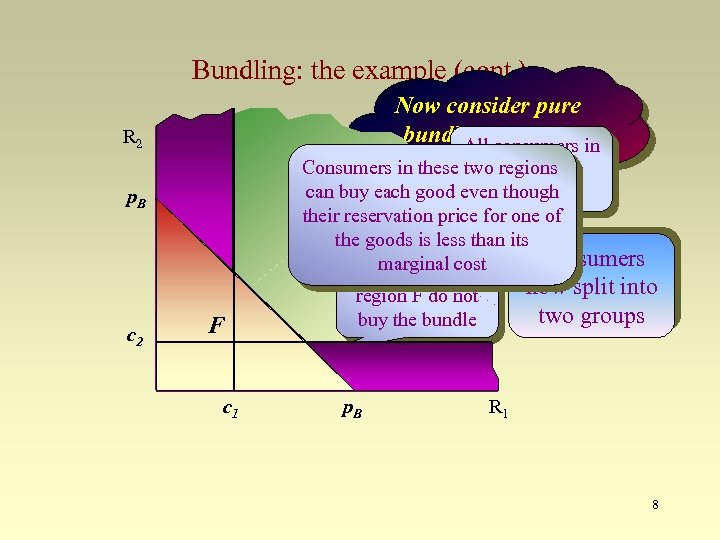

Bundling: the example (cont. ) Now consider pure bundling consumers in at some All price p. B E buy Consumers in these two regions region R 2 can buy each good even though the bundle their reservation price for one of Ethe goods is less than its Consumers All marginal cost consumers in p. B c 2 F c 1 now split into two groups region F do not buy the bundle p. B R 1 8

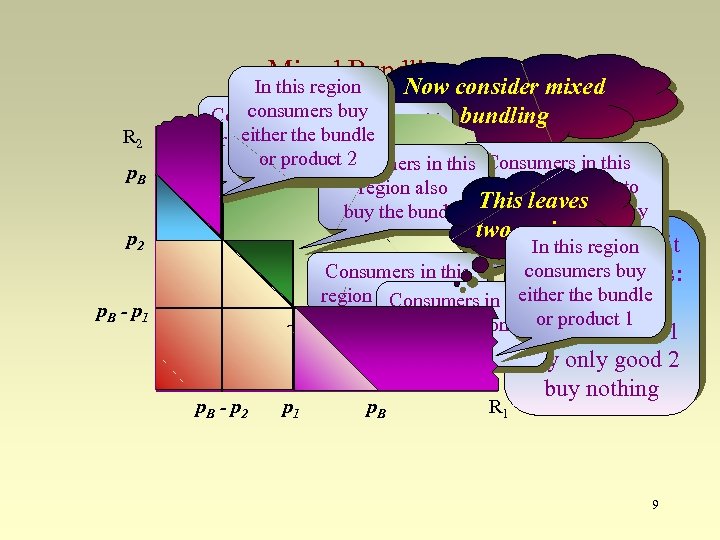

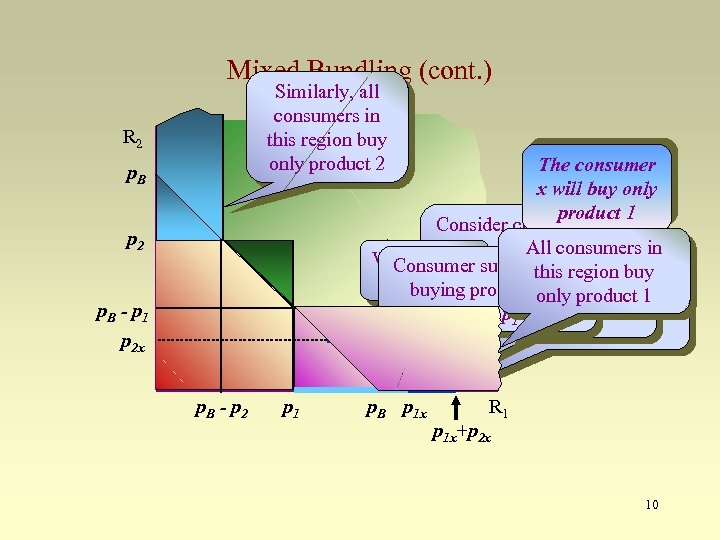

Mixed Bundling In this region R 2 p. B p 2 p. B - p 1 Now consider mixed consumers buy Consumers in Good 1 is sold bundling this either the bundle region buy only price p at 1 or product 2 good 2 Consumers in this 2 is sold Good Consumers in this region also at price p are willing to This 2 leaves buy the bundle buy both goods. They two regions buy the bundle Consumers split In this region consumers buy Consumers in this into four groups: either the bundle region buy nothing in thisbuy the bundle Consumers The bundle is sold region < p only or product 1 at price p. Bbuy 1 + pbuy only good 1 2 good 1 p. B - p 2 p 1 p. B R 1 buy only good 2 buy nothing 9

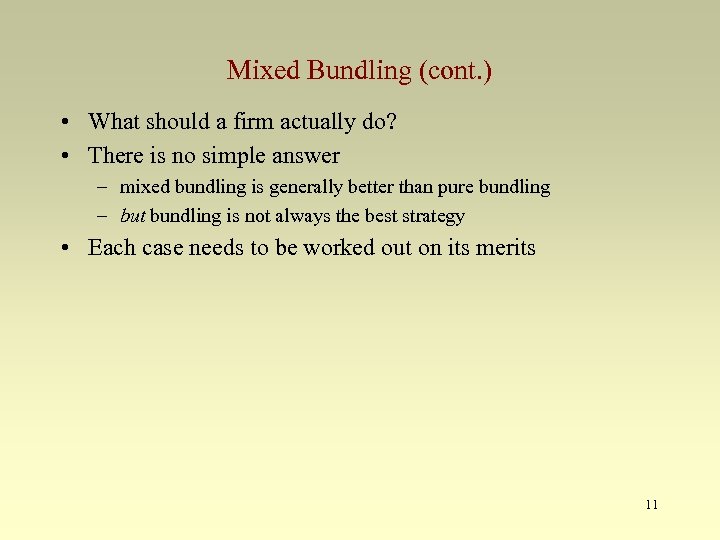

Mixed Bundling (cont. ) Similarly, all consumers in this region buy only product 2 R 2 The consumer x will buy only product 1 Consider consumer x with All consumers reservation prices p for in Which is this surplus from 1 x Consumerthis region buy surplus from product 1 and p 2 x for measure Her aggregate willingness buying theis 2 product 1 product only 1 bundle is product to pay for bundle is p 1 x -pp 1 + p thep - B 1 x 2 x p 1 x + p 2 x x p. B p 2 p. B - p 1 p 2 x p. B - p 2 p 1 p. B p 1 x R 1 p 1 x+p 2 x 10

Mixed Bundling (cont. ) • What should a firm actually do? • There is no simple answer – mixed bundling is generally better than pure bundling – but bundling is not always the best strategy • Each case needs to be worked out on its merits 11

Tie-in sales • Bundling does not always work • Requires that there are reasonably large differences in consumer valuations of the goods • It usually involves two complementary goods • What about tie-in sales? – “like” bundling but proportions vary (you do not have to buy the goods in the same proportions all the time) (also called “requirements” tie-in rather than package “tie-in”) – allows the monopolist to make supernormal profits on the tied good – different users charged different effective prices depending upon usage – facilitates price discrimination by making buyers reveal their demands 12

Tie-in sales • What about tie-in sales? – It is sometimes for efficiency reasons, some machines work better with their usable parts – Sometimes tie-in sales are used to evade regulations like priceceilings – It may be good to assure quality of the consuming experience – To work around problems of cartelization (you sell cheaper one of the goods to avoid detection of the discounting of the main good) 13

Tie-in Sales • Suppose that we sell a specialized product – a camera? – that uses highly specialized film • Then we effectively tie the sales of film cartridges to the purchase of the camera • It can be problematic for the regulator if it is used to affect the suppliers of film • This is what we call foreclosure 14

Tie-in Sales • How should we price the camera and film? – suppose that marginal costs of the film and of making the camera are zero (to keep things simple) – suppose also that there are two types of consumer: high-demand low-demand – Run the example yourselves 15

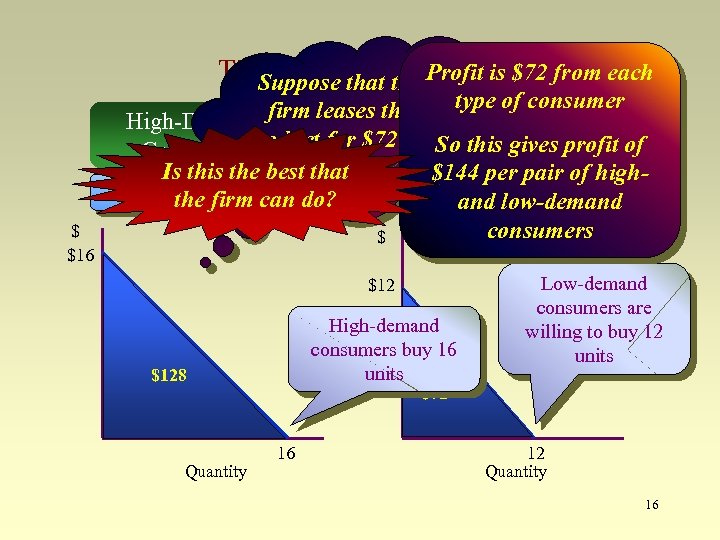

Tie-In Sales: anthe Profit is $72 from each Suppose that Example $ $16 type of consumer firm leases the Low-Demand High-Demand product for $72 per. So this gives profit of Consumers Is this the best period that $144 per pair of high. Demand: P firm-can do? Demand: low-demand the = 16 Q and P = 12 - Q consumers $ $12 High-demand consumers buy 16 units $128 Quantity Low-demand consumers are willing to buy 12 units $72 16 12 Quantity 16

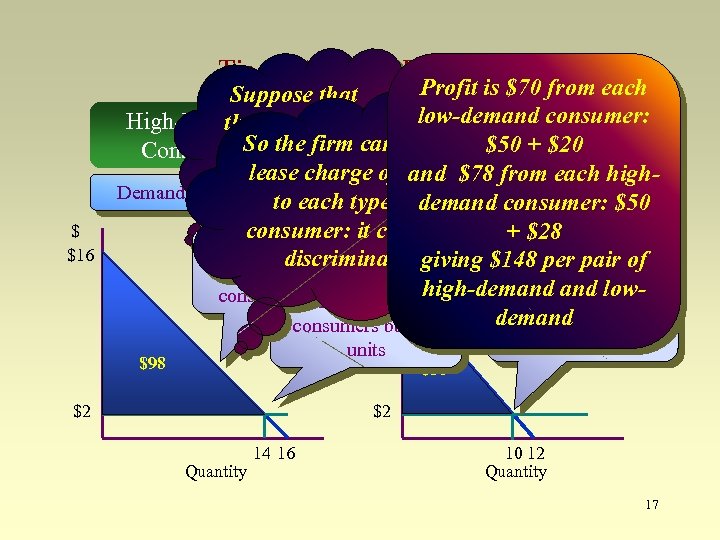

Tie-In Sales: an Example $ $16 Profit is $70 from each Suppose that low-demand consumer: High-Demandfirm sets a Low-Demand the So $50 + $20 Consumers the$2 per price of firm can set a Consumers lease charge of $50 $78 from each highand unit Demand: P = 16 - Q each type of Demand: P = 12 - Q Consumer surplus to demand consumer: $50 consumer: it cannot for low-demand + $28 $ Consumer surplus consumers is $50 discriminate giving $148 per pair of for high-demand $12 high-demand lowconsumers is $98 Low-demand High-demand buy 10 consumers buy 14 units $98 $2 units $50 $2 Quantity 14 16 10 12 Quantity 17

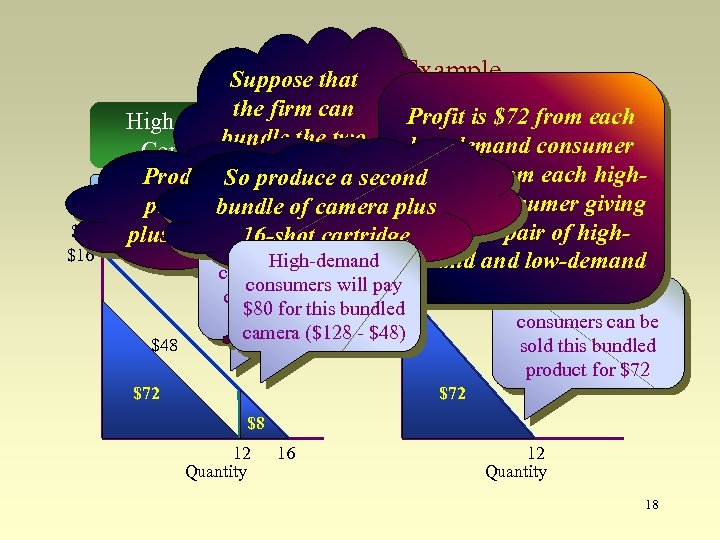

Tie-In Sales: an Example Suppose that $ $16 the firm can Profit is $72 from each High-Demand Low-Demand bundle the two low-demand consumer Consumers goods instead and Produce. Sobundled a second $80 from each higha produce Demand: P = 16 - Q them Demand: P = 12 of tieof camera plus demand consumer. Q giving product of camera bundle plus 12 -shot cartridge $ $150 per pair of high 16 -shot cartridge High-demand low-demand consumers get $48 consumers will$12 pay consumer surplus $80 for this bundled from buying it camera ($128 - $48) $72 Low-demand consumers can be sold this bundled product for $72 $8 12 Quantity 16 12 Quantity 18

Other types of price-discrimination • Quality differentiation (pay for the label) - Did you know that a Toyota Corolla and a Geo Prizm are the same car? And a Nissan Quest and a Mercury Villager? 19

Other types of price-discrimination • [We will get back to these when dealing with cartels] • Basing-point pricing: prices are quoted as “free on board” plus delivery charge from a basing. Also known as Mill base pricing. A pricing system in which prices are quoted for delivery at the point of production with the buyer to pay freight from that point. • We saw before what happens when the seller absorbs transportation costs. • With FOB manufacturers can keep peace among distributors by requiring them to use this policy, so every distributor keeps its local geographic monopoly and stops competition from other (distant) distributors. The location of the mill and the location of the basin can be different, so that there could be a complex pricing scheme by combining them. 20

Other types of price-discrimination • Basing-point pricing: prices are quoted as “free on board” plus delivery charge from a basing. Also known as Mill base pricing. A pricing system in which prices are quoted for delivery at the point of production with the buyer to pay freight from that point. • Example: “Pittsburgh Plus freight” for steel in the US • A form of spatial price discrimination based on oligopolistic collusion. The mill price at one location determines the delivered price at all locations regardless of the location of the plant from which delivery is actually made. (was used in the marketing of steel in the United States) 21

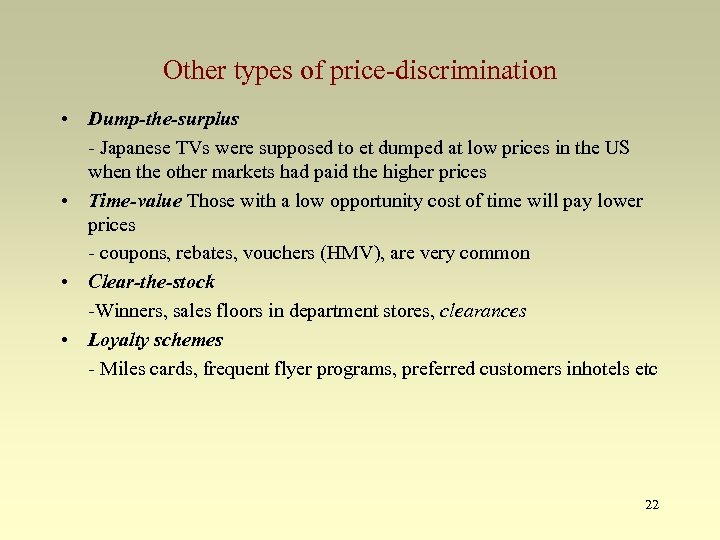

Other types of price-discrimination • Dump-the-surplus - Japanese TVs were supposed to et dumped at low prices in the US when the other markets had paid the higher prices • Time-value Those with a low opportunity cost of time will pay lower prices - coupons, rebates, vouchers (HMV), are very common • Clear-the-stock -Winners, sales floors in department stores, clearances • Loyalty schemes - Miles cards, frequent flyer programs, preferred customers inhotels etc 22

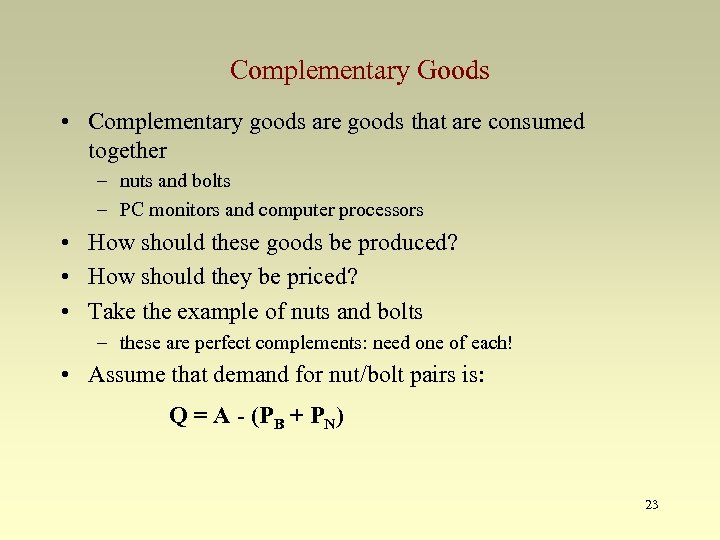

Complementary Goods • Complementary goods are goods that are consumed together – nuts and bolts – PC monitors and computer processors • How should these goods be produced? • How should they be priced? • Take the example of nuts and bolts – these are perfect complements: need one of each! • Assume that demand for nut/bolt pairs is: Q = A - (PB + PN) 23

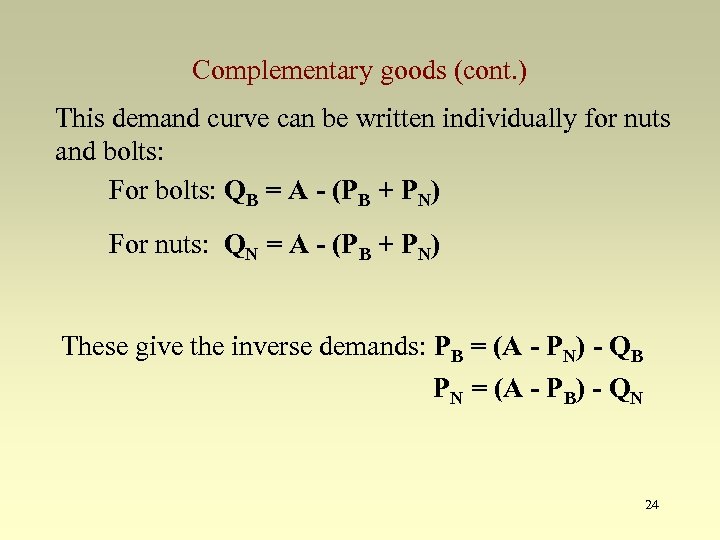

Complementary goods (cont. ) This demand curve can be written individually for nuts and bolts: For bolts: QB = A - (PB + PN) For nuts: QN = A - (PB + PN) These give the inverse demands: PB = (A - PN) - QB PN = (A - PB) - QN 24

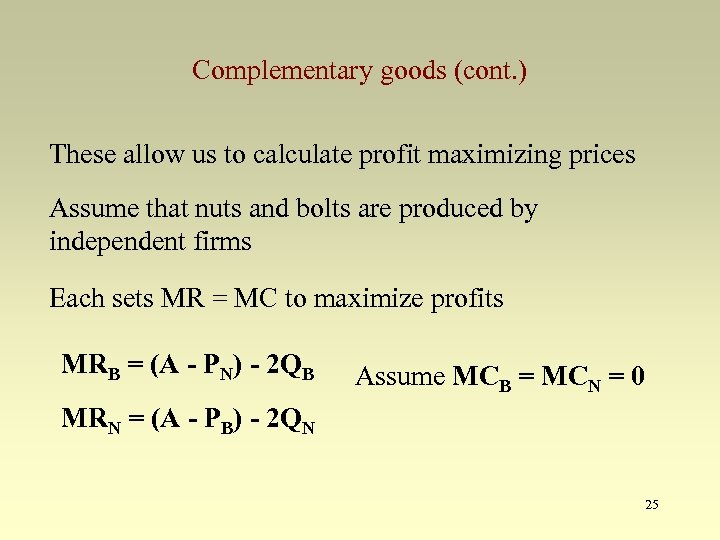

Complementary goods (cont. ) These allow us to calculate profit maximizing prices Assume that nuts and bolts are produced by independent firms Each sets MR = MC to maximize profits MRB = (A - PN) - 2 QB Assume MCB = MCN = 0 MRN = (A - PB) - 2 QN 25

Complementary goods (cont. ) Therefore QB = (A - PN)/2 and PB = (A - PN) - QB = (A - PN)/2 by a symmetric argument PN = (A - PB)/2 The price set by each firm is affected by the price set by the other firm (there is an externality) In equilibrium the price set by the two firms must be consistent 26

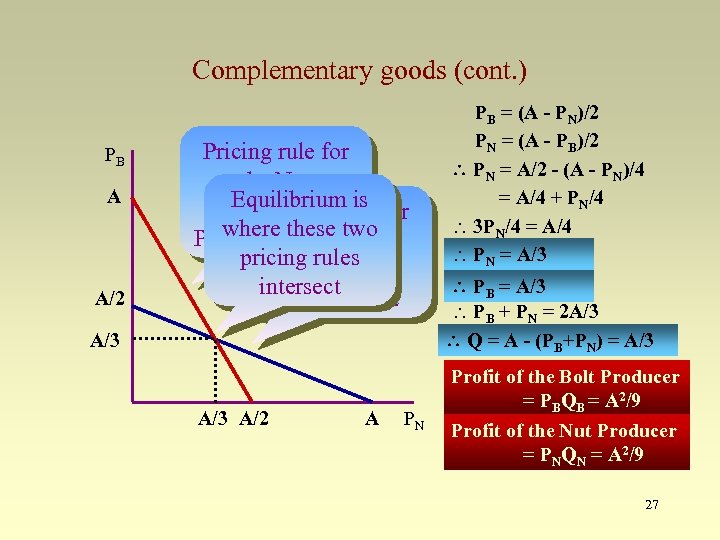

Complementary goods (cont. ) PB A A/2 Pricing rule for the Nut Equilibrium is Producer: rule for Pricing PN where these. Bolt = (A - PB)/2 two the pricing rules Producer: intersect PB = (A - PN)/2 A/3 A/2 A PN PB = (A - PN)/2 PN = (A - PB)/2 PN = A/2 - (A - PN)/4 = A/4 + PN/4 3 PN/4 = A/4 PN = A/3 PB + PN = 2 A/3 Q = A - (PB+PN) = A/3 Profit of the Bolt Producer = PBQB = A 2/9 Profit of the Nut Producer = PNQN = A 2/9 27

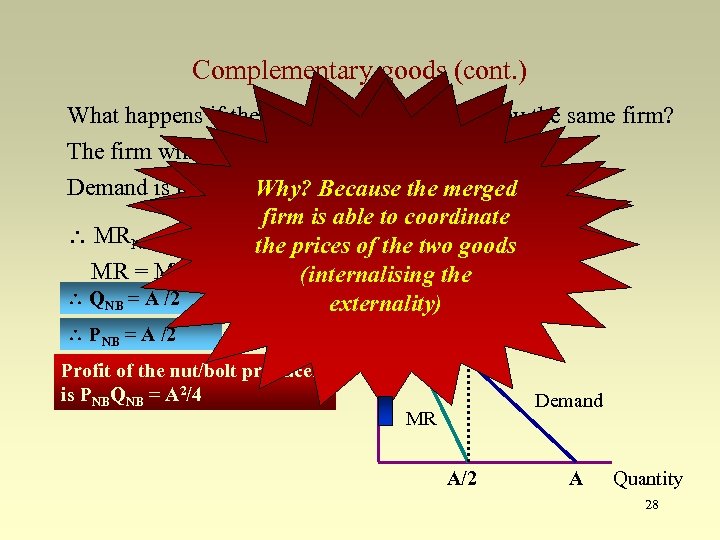

Complementary goods (cont. ) What happens if the two goods are produced by the same firm? Merger for a two firms The firm will set a price PNB of thenut/bolt pair. Demand is now QNB =results. NB so that PNB = A - QNB A P in consumers Why? -Because the merged firm being charged is able$to coordinate MRNB = A - 2 QNB prices of andtwo goods lower the prices the firm making greater profits MR = MC = 0 A (internalising the QNB = A /2 externality) PNB = A /2 Profit of the nut/bolt producer is PNBQNB = A 2/4 A/2 Demand MR A/2 A Quantity 28

• If one of the goods were sold competitively the price would be equal to MC (zero in this example) • The other good would be sold at the MR=MC price so at P= $A/2 • If both goods were sold competitively the price would be zero for both of course 29

• • Next Game Theory Static games and Cournot Competition Read Ch. 9 30

7f3c2d2fe02eeef116b129d0c0427e06.ppt