d7a9160a3fdd538593a31d0a08ccfea8.ppt

- Количество слайдов: 33

ECON 4100: Industrial Organization Lecture 16 Vertical, Complementary, and Conglomerate Mergers

ECON 4100: Industrial Organization Lecture 16 Vertical, Complementary, and Conglomerate Mergers

Introduction • • • Conglomerates Vertical Mergers Complementary Mergers The problem of double marginalization Price discrimination

Introduction • • • Conglomerates Vertical Mergers Complementary Mergers The problem of double marginalization Price discrimination

Conglomerates (diversification) • Exploit economies of scope (remember that these often apply only at the plant level: you want to relocate plants, reorganize things to exploit economies of scope) • To grow without dominating your product’s market: diversify (you will avoid the regulatory watchdogs) • To protect yourself from the demand decline for your product • Diversify to spread risk (demand for your product might be OK now, but we do not know about the future, just in case: diversify!)

Conglomerates (diversification) • Exploit economies of scope (remember that these often apply only at the plant level: you want to relocate plants, reorganize things to exploit economies of scope) • To grow without dominating your product’s market: diversify (you will avoid the regulatory watchdogs) • To protect yourself from the demand decline for your product • Diversify to spread risk (demand for your product might be OK now, but we do not know about the future, just in case: diversify!)

Conglomerates (diversification) • Diversify to spread risk (demand for your product might be OK now, but we do not know about the future, just in case: diversify!) • But the shareholders do not need that diversification • They can diversify their own portfolio themselves! • This diversification logic is valid only for the manager

Conglomerates (diversification) • Diversify to spread risk (demand for your product might be OK now, but we do not know about the future, just in case: diversify!) • But the shareholders do not need that diversification • They can diversify their own portfolio themselves! • This diversification logic is valid only for the manager

Vertical Mergers • Now consider very different types of mergers – between firms at different stages in the production chain – also applies to suppliers of complementary products • These mergers turn out, in general, to be beneficial for everyone.

Vertical Mergers • Now consider very different types of mergers – between firms at different stages in the production chain – also applies to suppliers of complementary products • These mergers turn out, in general, to be beneficial for everyone.

Complementary Mergers • Take a simple example: – – – final production requires two inputs in fixed proportions one unit of each input is needed to make one unit of output input producers are monopolists final product producer is a monopolist demand for the final product is P = 140 - Q marginal costs of upstream producers and final producer (other than for the two inputs) normalized to zero. • What is the effect of merger between the two upstream producers?

Complementary Mergers • Take a simple example: – – – final production requires two inputs in fixed proportions one unit of each input is needed to make one unit of output input producers are monopolists final product producer is a monopolist demand for the final product is P = 140 - Q marginal costs of upstream producers and final producer (other than for the two inputs) normalized to zero. • What is the effect of merger between the two upstream producers?

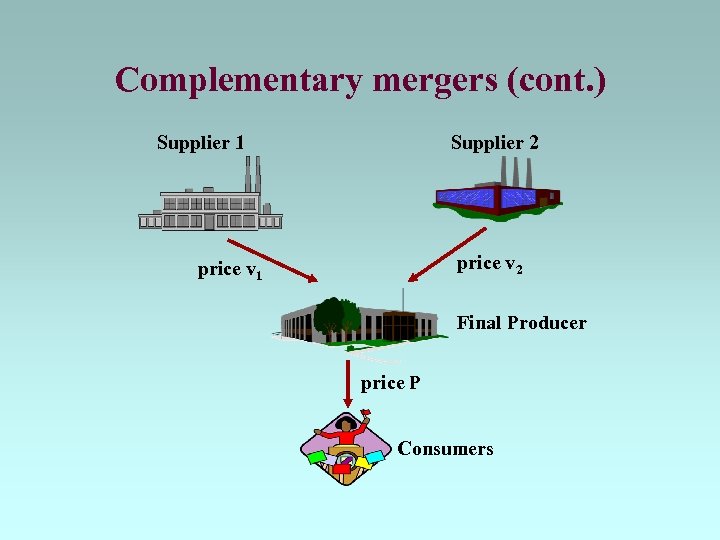

Complementary mergers (cont. ) Supplier 1 Supplier 2 price v 1 Final Producer price P Consumers

Complementary mergers (cont. ) Supplier 1 Supplier 2 price v 1 Final Producer price P Consumers

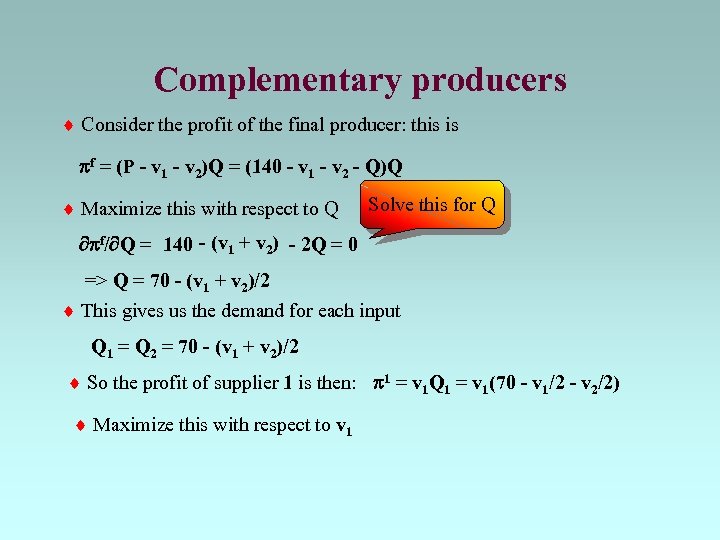

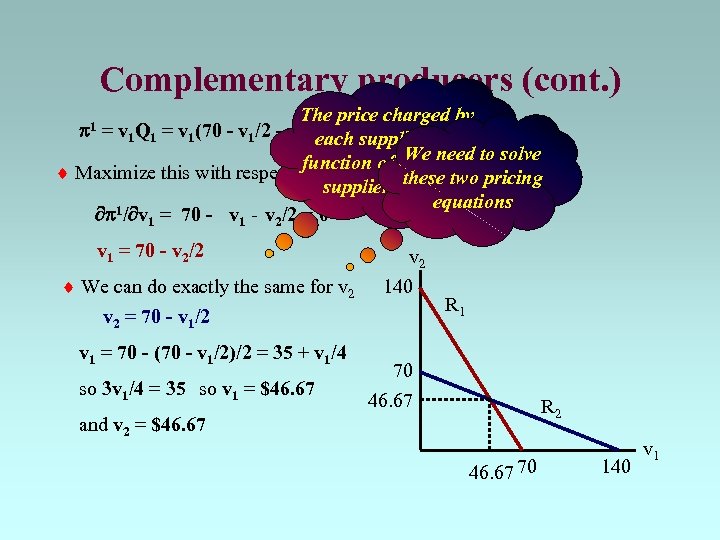

Complementary producers Consider the profit of the final producer: this is pf = (P - v 1 - v 2)Q = (140 - v 1 - v 2 - Q)Q Maximize this with respect to Q Solve this for Q pf/ Q = 140 - (v 1 + v 2) - 2 Q = 0 => Q = 70 - (v 1 + v 2)/2 This gives us the demand for each input Q 1 = Q 2 = 70 - (v 1 + v 2)/2 So the profit of supplier 1 is then: p 1 = v 1 Q 1 = v 1(70 - v 1/2 - v 2/2) Maximize this with respect to v 1

Complementary producers Consider the profit of the final producer: this is pf = (P - v 1 - v 2)Q = (140 - v 1 - v 2 - Q)Q Maximize this with respect to Q Solve this for Q pf/ Q = 140 - (v 1 + v 2) - 2 Q = 0 => Q = 70 - (v 1 + v 2)/2 This gives us the demand for each input Q 1 = Q 2 = 70 - (v 1 + v 2)/2 So the profit of supplier 1 is then: p 1 = v 1 Q 1 = v 1(70 - v 1/2 - v 2/2) Maximize this with respect to v 1

Complementary producers (cont. ) The price charged by = v 1 Q 1 = v 1(70 - v 1/2 - v 2/2) each supplier is a function of the other 1 solve Solve We need to this for v Maximize this with respect to v 1 supplier’sthese two pricing price equations p 1/ v 1 = 70 - v 1 - v 2/2 = 0 p 1 v 1 = 70 - v 2/2 We can do exactly the same for v 2 = 70 - v 1/2 v 1 = 70 - (70 - v 1/2)/2 = 35 + v 1/4 so 3 v 1/4 = 35 so v 1 = $46. 67 v 2 140 R 1 70 46. 67 R 2 and v 2 = $46. 67 70 140 v 1

Complementary producers (cont. ) The price charged by = v 1 Q 1 = v 1(70 - v 1/2 - v 2/2) each supplier is a function of the other 1 solve Solve We need to this for v Maximize this with respect to v 1 supplier’sthese two pricing price equations p 1/ v 1 = 70 - v 1 - v 2/2 = 0 p 1 v 1 = 70 - v 2/2 We can do exactly the same for v 2 = 70 - v 1/2 v 1 = 70 - (70 - v 1/2)/2 = 35 + v 1/4 so 3 v 1/4 = 35 so v 1 = $46. 67 v 2 140 R 1 70 46. 67 R 2 and v 2 = $46. 67 70 140 v 1

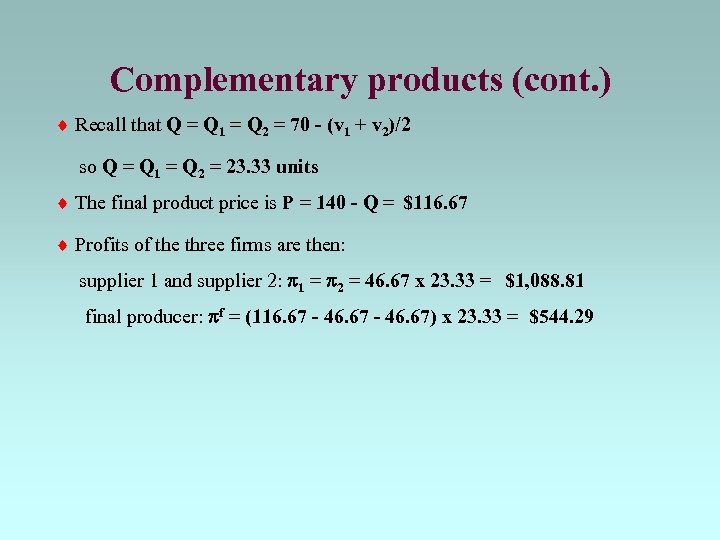

Complementary products (cont. ) Recall that Q = Q 1 = Q 2 = 70 - (v 1 + v 2)/2 so Q = Q 1 = Q 2 = 23. 33 units The final product price is P = 140 - Q = $116. 67 Profits of the three firms are then: supplier 1 and supplier 2: p 1 = p 2 = 46. 67 x 23. 33 = $1, 088. 81 final producer: pf = (116. 67 - 46. 67) x 23. 33 = $544. 29

Complementary products (cont. ) Recall that Q = Q 1 = Q 2 = 70 - (v 1 + v 2)/2 so Q = Q 1 = Q 2 = 23. 33 units The final product price is P = 140 - Q = $116. 67 Profits of the three firms are then: supplier 1 and supplier 2: p 1 = p 2 = 46. 67 x 23. 33 = $1, 088. 81 final producer: pf = (116. 67 - 46. 67) x 23. 33 = $544. 29

Complementary products (cont) Supplier 1 23. 33 units @ $46. 67 each Now suppose that the two suppliers merge Supplier 2 23. 33 units @ $46. 67 each Final Producer 23. 33 units @ $116. 67 each Consumers

Complementary products (cont) Supplier 1 23. 33 units @ $46. 67 each Now suppose that the two suppliers merge Supplier 2 23. 33 units @ $46. 67 each Final Producer 23. 33 units @ $116. 67 each Consumers

Complementary mergers (cont. ) Supplier 1 Supplier 2 price v The merger allows the two firms to coordinate their prices Final Producer price P Consumers

Complementary mergers (cont. ) Supplier 1 Supplier 2 price v The merger allows the two firms to coordinate their prices Final Producer price P Consumers

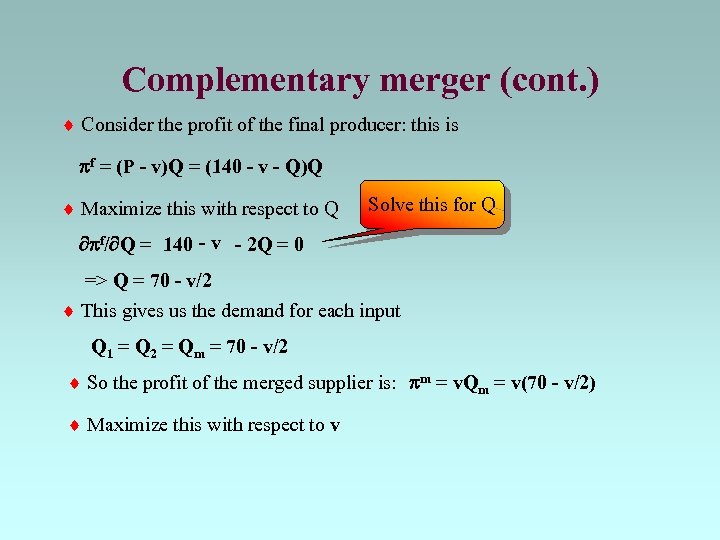

Complementary merger (cont. ) Consider the profit of the final producer: this is pf = (P - v)Q = (140 - v - Q)Q Maximize this with respect to Q Solve this for Q pf/ Q = 140 - v - 2 Q = 0 => Q = 70 - v/2 This gives us the demand for each input Q 1 = Q 2 = Qm = 70 - v/2 So the profit of the merged supplier is: pm = v. Qm = v(70 - v/2) Maximize this with respect to v

Complementary merger (cont. ) Consider the profit of the final producer: this is pf = (P - v)Q = (140 - v - Q)Q Maximize this with respect to Q Solve this for Q pf/ Q = 140 - v - 2 Q = 0 => Q = 70 - v/2 This gives us the demand for each input Q 1 = Q 2 = Qm = 70 - v/2 So the profit of the merged supplier is: pm = v. Qm = v(70 - v/2) Maximize this with respect to v

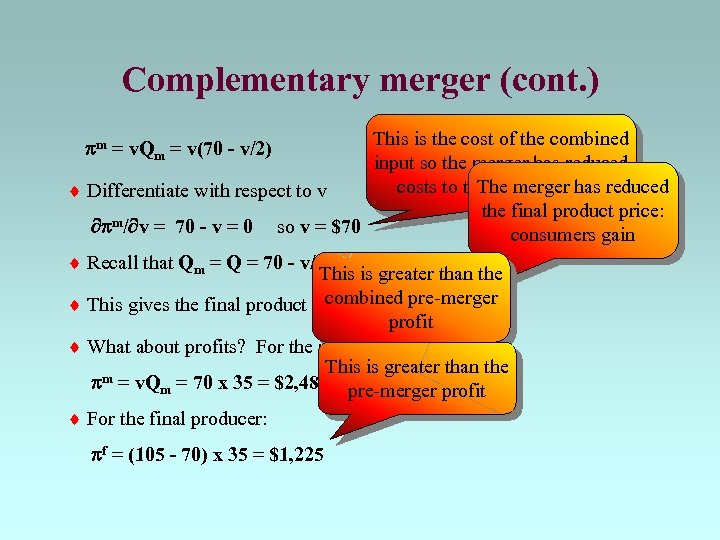

Complementary merger (cont. ) This is the cost of the combined input so the merger has reduced costs to the final producer reduced The merger has Differentiate with respect to v the final product price: m/ v = 70 - v = 0 p so v = $70 consumers gain Recall that Qm = Q = 70 - v/2 so Qm = Q = 35 units This is greater than the combined pre-merger This gives the final product price P = 140 - Q = $105 profit What about profits? For the merged upstream firm: This is greater than the m = v. Q = 70 x 35 = $2, 480 p m pre-merger profit For the final producer: pm = v. Qm = v(70 - v/2) pf = (105 - 70) x 35 = $1, 225

Complementary merger (cont. ) This is the cost of the combined input so the merger has reduced costs to the final producer reduced The merger has Differentiate with respect to v the final product price: m/ v = 70 - v = 0 p so v = $70 consumers gain Recall that Qm = Q = 70 - v/2 so Qm = Q = 35 units This is greater than the combined pre-merger This gives the final product price P = 140 - Q = $105 profit What about profits? For the merged upstream firm: This is greater than the m = v. Q = 70 x 35 = $2, 480 p m pre-merger profit For the final producer: pm = v. Qm = v(70 - v/2) pf = (105 - 70) x 35 = $1, 225

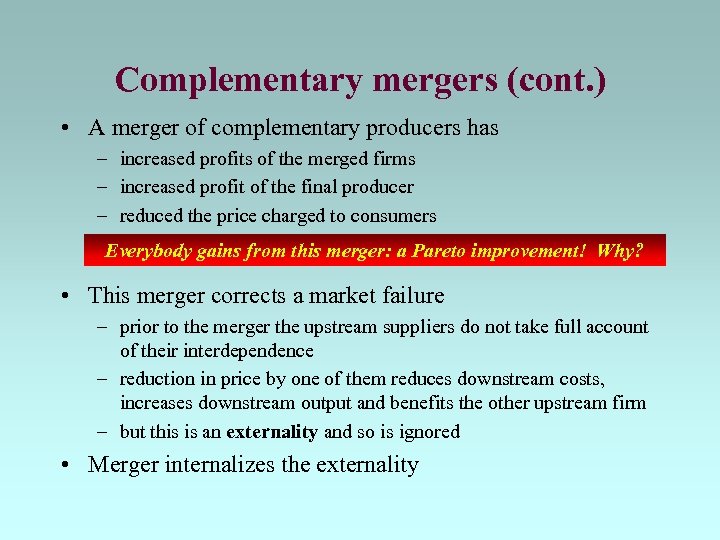

Complementary mergers (cont. ) • A merger of complementary producers has – increased profits of the merged firms – increased profit of the final producer – reduced the price charged to consumers Everybody gains from this merger: a Pareto improvement! Why? • This merger corrects a market failure – prior to the merger the upstream suppliers do not take full account of their interdependence – reduction in price by one of them reduces downstream costs, increases downstream output and benefits the other upstream firm – but this is an externality and so is ignored • Merger internalizes the externality

Complementary mergers (cont. ) • A merger of complementary producers has – increased profits of the merged firms – increased profit of the final producer – reduced the price charged to consumers Everybody gains from this merger: a Pareto improvement! Why? • This merger corrects a market failure – prior to the merger the upstream suppliers do not take full account of their interdependence – reduction in price by one of them reduces downstream costs, increases downstream output and benefits the other upstream firm – but this is an externality and so is ignored • Merger internalizes the externality

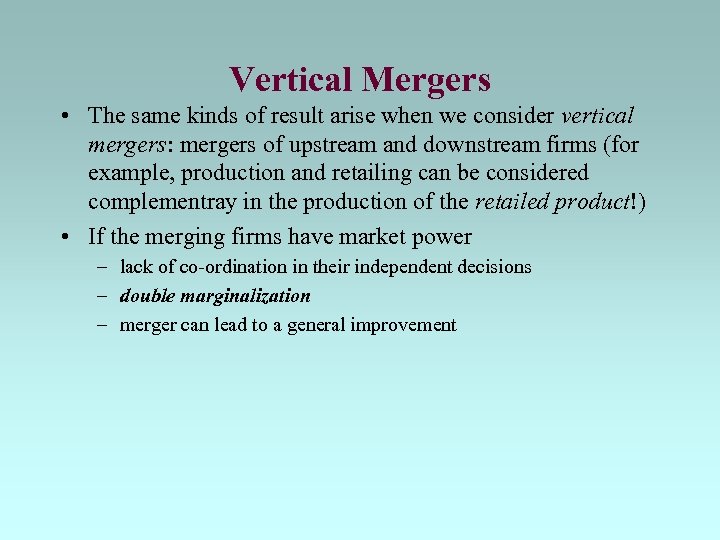

Vertical Mergers • The same kinds of result arise when we consider vertical mergers: mergers of upstream and downstream firms (for example, production and retailing can be considered complementray in the production of the retailed product!) • If the merging firms have market power – lack of co-ordination in their independent decisions – double marginalization – merger can lead to a general improvement

Vertical Mergers • The same kinds of result arise when we consider vertical mergers: mergers of upstream and downstream firms (for example, production and retailing can be considered complementray in the production of the retailed product!) • If the merging firms have market power – lack of co-ordination in their independent decisions – double marginalization – merger can lead to a general improvement

Vertical Mergers • We can illustrate this with a simple model – one upstream and one downstream monopolist (manufacturer and retailer for simplicity) – upstream firm has marginal costs $20 – sells product to the retailer at price r per unit – retailer has no other costs: one unit of input gives one unit of output – retail demand is P = 140 - Q

Vertical Mergers • We can illustrate this with a simple model – one upstream and one downstream monopolist (manufacturer and retailer for simplicity) – upstream firm has marginal costs $20 – sells product to the retailer at price r per unit – retailer has no other costs: one unit of input gives one unit of output – retail demand is P = 140 - Q

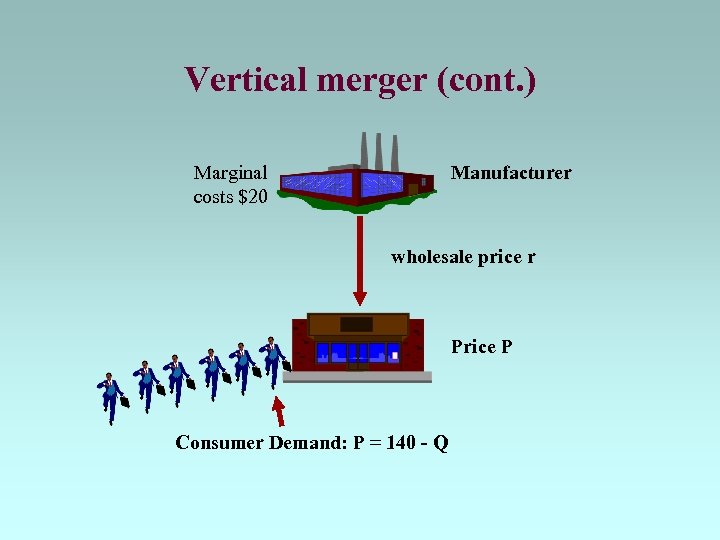

Vertical merger (cont. ) Marginal costs $20 Manufacturer wholesale price r Price P Consumer Demand: P = 140 - Q

Vertical merger (cont. ) Marginal costs $20 Manufacturer wholesale price r Price P Consumer Demand: P = 140 - Q

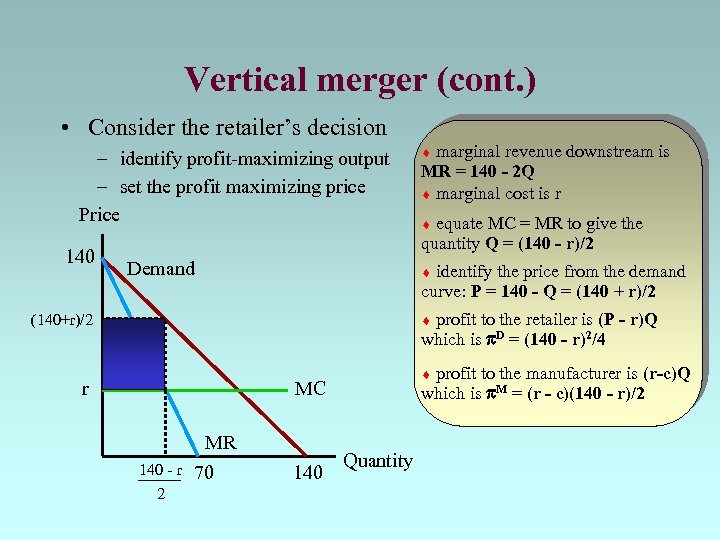

Vertical merger (cont. ) • Consider the retailer’s decision – identify profit-maximizing output – set the profit maximizing price Price 140 Demand marginal revenue downstream is MR = 140 - 2 Q marginal cost is r equate MC = MR to give the quantity Q = (140 - r)/2 identify the price from the demand curve: P = 140 - Q = (140 + r)/2 profit to the retailer is (P - r)Q which is p. D = (140 - r)2/4 (140+r)/2 r profit to the manufacturer is (r-c)Q which is p. M = (r - c)(140 - r)/2 MC 140 - r 2 MR 70 140 Quantity

Vertical merger (cont. ) • Consider the retailer’s decision – identify profit-maximizing output – set the profit maximizing price Price 140 Demand marginal revenue downstream is MR = 140 - 2 Q marginal cost is r equate MC = MR to give the quantity Q = (140 - r)/2 identify the price from the demand curve: P = 140 - Q = (140 + r)/2 profit to the retailer is (P - r)Q which is p. D = (140 - r)2/4 (140+r)/2 r profit to the manufacturer is (r-c)Q which is p. M = (r - c)(140 - r)/2 MC 140 - r 2 MR 70 140 Quantity

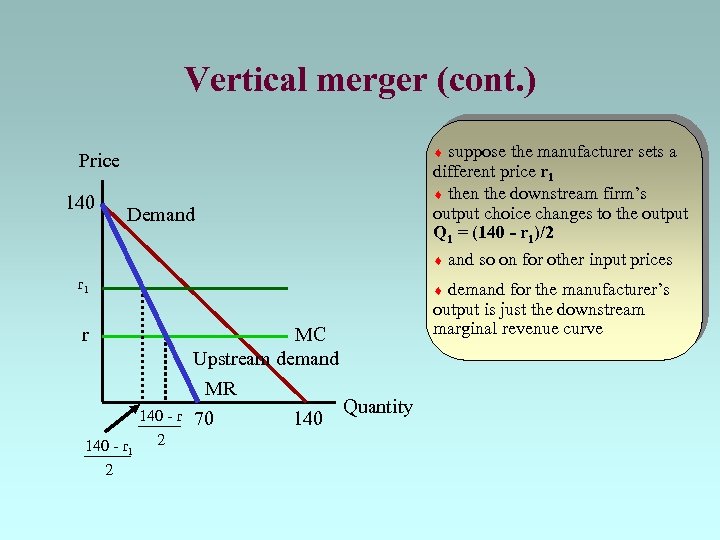

Vertical merger (cont. ) 140 suppose the manufacturer sets a different price r 1 then the downstream firm’s output choice changes to the output Q 1 = (140 - r 1)/2 Price Demand r 1 demand for the manufacturer’s output is just the downstream marginal revenue curve r 140 - r 1 2 2 MC Upstream demand MR Quantity 70 140 and so on for other input prices

Vertical merger (cont. ) 140 suppose the manufacturer sets a different price r 1 then the downstream firm’s output choice changes to the output Q 1 = (140 - r 1)/2 Price Demand r 1 demand for the manufacturer’s output is just the downstream marginal revenue curve r 140 - r 1 2 2 MC Upstream demand MR Quantity 70 140 and so on for other input prices

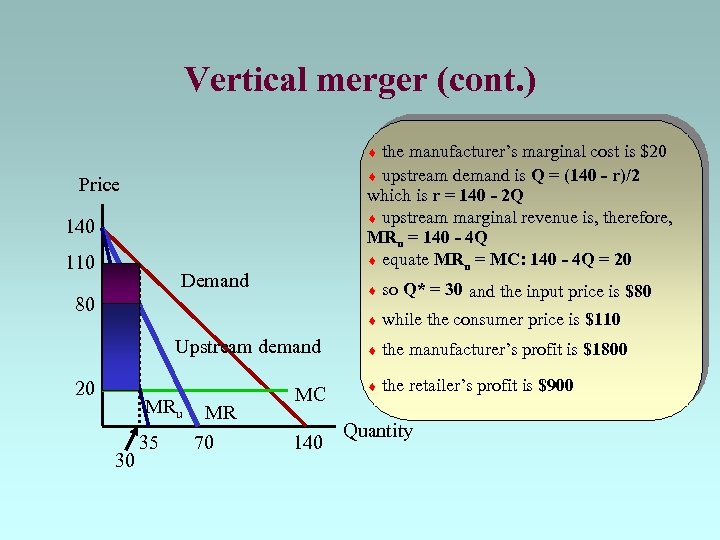

Vertical merger (cont. ) the manufacturer’s marginal cost is $20 upstream demand is Q = (140 - r)/2 which is r = 140 - 2 Q upstream marginal revenue is, therefore, MRu = 140 - 4 Q equate MRu = MC: 140 - 4 Q = 20 Price 140 110 Demand 80 Upstream demand 20 MRu 30 35 MR 70 MC 140 so Q* = 30 and the input price is $80 while the consumer price is $110 the manufacturer’s profit is $1800 the retailer’s profit is $900 Quantity

Vertical merger (cont. ) the manufacturer’s marginal cost is $20 upstream demand is Q = (140 - r)/2 which is r = 140 - 2 Q upstream marginal revenue is, therefore, MRu = 140 - 4 Q equate MRu = MC: 140 - 4 Q = 20 Price 140 110 Demand 80 Upstream demand 20 MRu 30 35 MR 70 MC 140 so Q* = 30 and the input price is $80 while the consumer price is $110 the manufacturer’s profit is $1800 the retailer’s profit is $900 Quantity

Vertical merger (cont. ) • Now suppose that the retailer and manufacturer merge – – manufacturer takes over the retail outlet retailer is now a downstream division of an integrated firm the integrated firm aims to maximize total profit Suppose the upstream division sets an internal (transfer) price of r for its product – Suppose that consumer demand is P = P(Q) The internal transfer – Total profit is: price nets out of the • upstream division: (r - c)Q • downstream division: (P(Q) - r)Q profit calculations • aggregate profit: (P(Q) - c)Q • Back to the example

Vertical merger (cont. ) • Now suppose that the retailer and manufacturer merge – – manufacturer takes over the retail outlet retailer is now a downstream division of an integrated firm the integrated firm aims to maximize total profit Suppose the upstream division sets an internal (transfer) price of r for its product – Suppose that consumer demand is P = P(Q) The internal transfer – Total profit is: price nets out of the • upstream division: (r - c)Q • downstream division: (P(Q) - r)Q profit calculations • aggregate profit: (P(Q) - c)Q • Back to the example

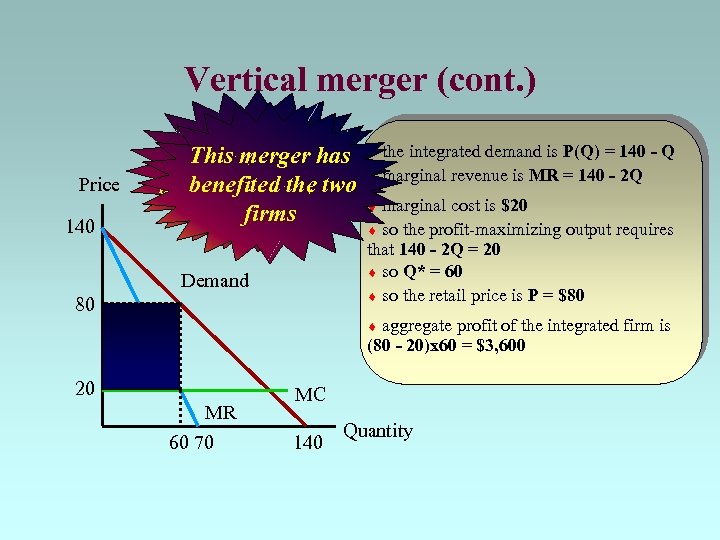

Vertical merger (cont. ) Price 140 This merger has the integrated demand is P(Q) = 140 - Q benefited the two marginal revenue is MR = 140 - 2 Q benefited consumers marginal cost is $20 firms so the profit-maximizing output requires that 140 - 2 Q = 20 so Q* = 60 so the retail price is P = $80 Demand 80 aggregate profit of the integrated firm is (80 - 20)x 60 = $3, 600 20 MR 60 70 MC 140 Quantity

Vertical merger (cont. ) Price 140 This merger has the integrated demand is P(Q) = 140 - Q benefited the two marginal revenue is MR = 140 - 2 Q benefited consumers marginal cost is $20 firms so the profit-maximizing output requires that 140 - 2 Q = 20 so Q* = 60 so the retail price is P = $80 Demand 80 aggregate profit of the integrated firm is (80 - 20)x 60 = $3, 600 20 MR 60 70 MC 140 Quantity

Vertical merger (cont. ) • Integration increases profits and consumer surplus • Why? – the firms have some degree of market power – so they price above marginal cost – so integration corrects a market failure: double marginalization • What if manufacture were competitive? – retailer plays off manufacturers against each other – so obtains input at marginal cost – gets the integrated profit without integration

Vertical merger (cont. ) • Integration increases profits and consumer surplus • Why? – the firms have some degree of market power – so they price above marginal cost – so integration corrects a market failure: double marginalization • What if manufacture were competitive? – retailer plays off manufacturers against each other – so obtains input at marginal cost – gets the integrated profit without integration

Vertical merger (cont. ) • Why worry about vertical integration? – two possible reasons • price discrimination • vertical foreclosure

Vertical merger (cont. ) • Why worry about vertical integration? – two possible reasons • price discrimination • vertical foreclosure

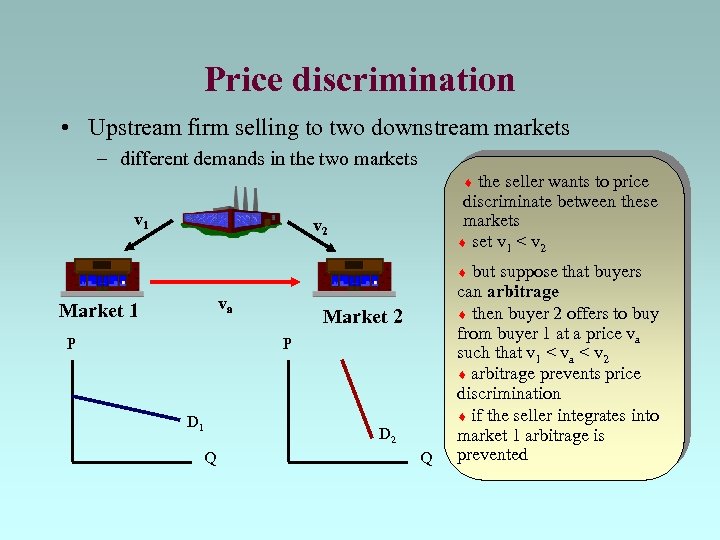

Price discrimination • Upstream firm selling to two downstream markets – different demands in the two markets the seller wants to price discriminate between these markets set v 1 < v 2 v 1 v 2 but suppose that buyers can arbitrage then buyer 2 offers to buy from buyer 1 at a price va such that v 1 < va < v 2 arbitrage prevents price discrimination if the seller integrates into market 1 arbitrage is prevented va Market 1 P Market 2 P D 1 D 2 Q Q

Price discrimination • Upstream firm selling to two downstream markets – different demands in the two markets the seller wants to price discriminate between these markets set v 1 < v 2 v 1 v 2 but suppose that buyers can arbitrage then buyer 2 offers to buy from buyer 1 at a price va such that v 1 < va < v 2 arbitrage prevents price discrimination if the seller integrates into market 1 arbitrage is prevented va Market 1 P Market 2 P D 1 D 2 Q Q

Price discrimination • With which downstream market would you want to merge first? ? ? • The one with most elastic demand of course!

Price discrimination • With which downstream market would you want to merge first? ? ? • The one with most elastic demand of course!

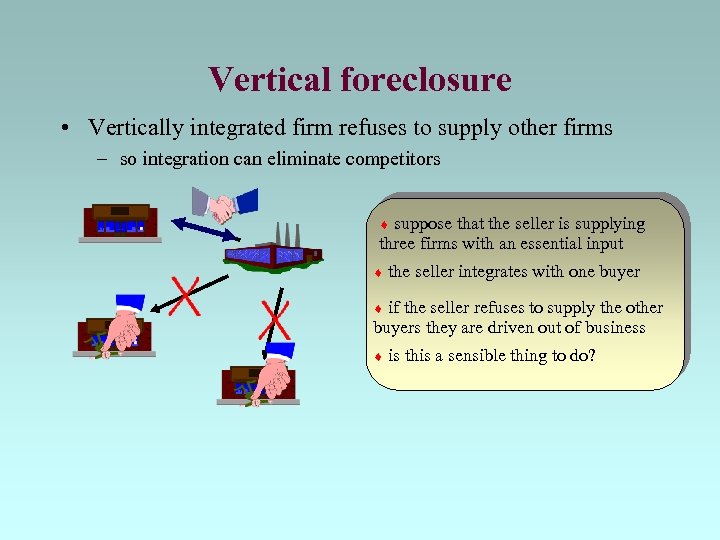

Vertical foreclosure • Vertically integrated firm refuses to supply other firms – so integration can eliminate competitors suppose that the seller is supplying three firms with an essential input the seller integrates with one buyer if the seller refuses to supply the other buyers they are driven out of business is this a sensible thing to do?

Vertical foreclosure • Vertically integrated firm refuses to supply other firms – so integration can eliminate competitors suppose that the seller is supplying three firms with an essential input the seller integrates with one buyer if the seller refuses to supply the other buyers they are driven out of business is this a sensible thing to do?

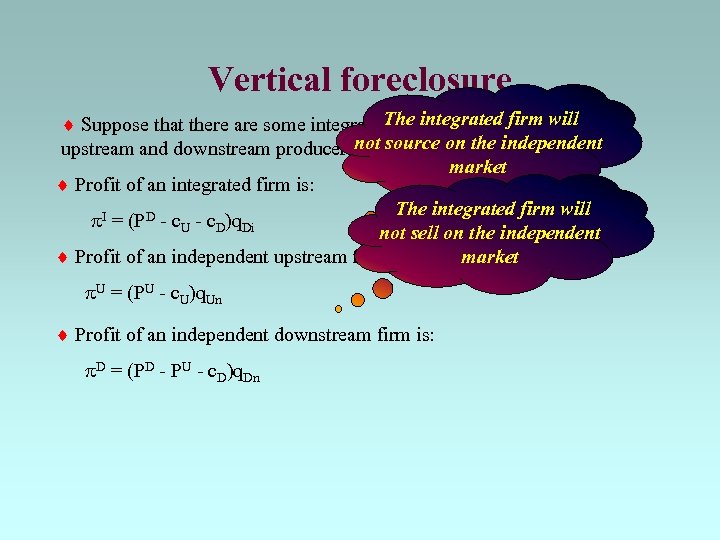

Vertical foreclosure The integrated firm will Suppose that there are some integrated firms and some independent upstream and downstream producersnot source on the independent market Profit of an integrated firm is: The integrated firm will p. I = (PD - c. U - c. D)q. Di not sell on the independent market Profit of an independent upstream firm is: p. U = (PU - c. U)q. Un Profit of an independent downstream firm is: p. D = (PD - PU - c. D)q. Dn

Vertical foreclosure The integrated firm will Suppose that there are some integrated firms and some independent upstream and downstream producersnot source on the independent market Profit of an integrated firm is: The integrated firm will p. I = (PD - c. U - c. D)q. Di not sell on the independent market Profit of an independent upstream firm is: p. U = (PU - c. U)q. Un Profit of an independent downstream firm is: p. D = (PD - PU - c. D)q. Dn

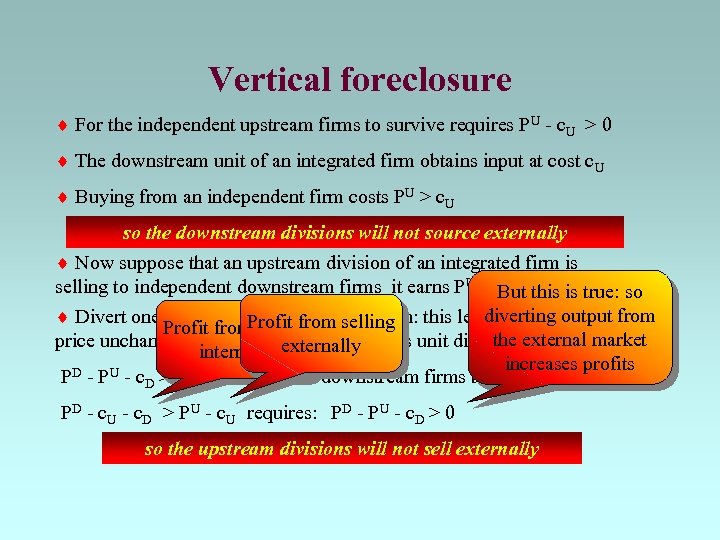

Vertical foreclosure For the independent upstream firms to survive requires PU - c. U > 0 The downstream unit of an integrated firm obtains input at cost c. U Buying from an independent firm costs PU > c. U so the downstream divisions will not source externally Now suppose that an upstream division of an integrated firm is selling to independent downstream firms it earns PU - c. But this is unit sold U on each true: so diverting output from Divert one unit to its downstreamselling this leaves the downstream Profit from division: Profit from selling the price unchanged: it earns PDexternallyon this unit diverted external market - c. U - c. D internally increases profits PD - PU - c. D > 0 for independent downstream firms to survive PD - c. U - c. D > PU - c. U requires: PD - PU - c. D > 0 so the upstream divisions will not sell externally

Vertical foreclosure For the independent upstream firms to survive requires PU - c. U > 0 The downstream unit of an integrated firm obtains input at cost c. U Buying from an independent firm costs PU > c. U so the downstream divisions will not source externally Now suppose that an upstream division of an integrated firm is selling to independent downstream firms it earns PU - c. But this is unit sold U on each true: so diverting output from Divert one unit to its downstreamselling this leaves the downstream Profit from division: Profit from selling the price unchanged: it earns PDexternallyon this unit diverted external market - c. U - c. D internally increases profits PD - PU - c. D > 0 for independent downstream firms to survive PD - c. U - c. D > PU - c. U requires: PD - PU - c. D > 0 so the upstream divisions will not sell externally

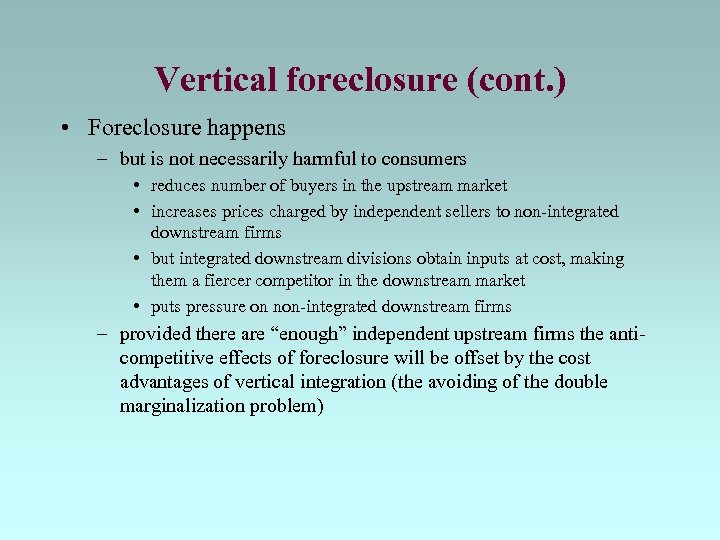

Vertical foreclosure (cont. ) • Foreclosure happens – but is not necessarily harmful to consumers • reduces number of buyers in the upstream market • increases prices charged by independent sellers to non-integrated downstream firms • but integrated downstream divisions obtain inputs at cost, making them a fiercer competitor in the downstream market • puts pressure on non-integrated downstream firms – provided there are “enough” independent upstream firms the anticompetitive effects of foreclosure will be offset by the cost advantages of vertical integration (the avoiding of the double marginalization problem)

Vertical foreclosure (cont. ) • Foreclosure happens – but is not necessarily harmful to consumers • reduces number of buyers in the upstream market • increases prices charged by independent sellers to non-integrated downstream firms • but integrated downstream divisions obtain inputs at cost, making them a fiercer competitor in the downstream market • puts pressure on non-integrated downstream firms – provided there are “enough” independent upstream firms the anticompetitive effects of foreclosure will be offset by the cost advantages of vertical integration (the avoiding of the double marginalization problem)

Vertical foreclosure (cont. ) • Foreclosure happens • Remember that foreclosure affects both the downstream market and the upstream one (the other upstream ones have no distributor for their product, the alternative distributor do not get to buy the inputs) • E. g. imagine that a car manufacturer merged with some steering wheel manufacturer. The car company would not buy form the alternative suppliers! • Also the steering wheel section of the firm does not sell to other car companies!

Vertical foreclosure (cont. ) • Foreclosure happens • Remember that foreclosure affects both the downstream market and the upstream one (the other upstream ones have no distributor for their product, the alternative distributor do not get to buy the inputs) • E. g. imagine that a car manufacturer merged with some steering wheel manufacturer. The car company would not buy form the alternative suppliers! • Also the steering wheel section of the firm does not sell to other car companies!

NEXT • Vertical relations and vertical restraints

NEXT • Vertical relations and vertical restraints