f1f58a4580771be917fed64c7de402ef.ppt

- Количество слайдов: 32

ECON 4100: Industrial Organization Lecture 13(III) Further issues on predatory conduct

ECON 4100: Industrial Organization Lecture 13(III) Further issues on predatory conduct

Introduction • Preemption as predation: A distinct but related issue is an incumbent investing early to prevent new entry • More examples of limit pricing • Predation under uncertainty • Long-Term Contracts as Entry Barriers

Introduction • Preemption as predation: A distinct but related issue is an incumbent investing early to prevent new entry • More examples of limit pricing • Predation under uncertainty • Long-Term Contracts as Entry Barriers

Preemption as predation • A distinct but related issue is an incumbent investing early to prevent new entry • Now we have an issue of timing • Is it in the interests of an incumbent to preempt by – building new plants prior to a rival’s entry – adding new products prior to a rival’s entry • Related to another issue – entrant may race to innovate to preempt entry • A simple model when we predict a sustained increase in demand • We do not cover the model but we think about the implications

Preemption as predation • A distinct but related issue is an incumbent investing early to prevent new entry • Now we have an issue of timing • Is it in the interests of an incumbent to preempt by – building new plants prior to a rival’s entry – adding new products prior to a rival’s entry • Related to another issue – entrant may race to innovate to preempt entry • A simple model when we predict a sustained increase in demand • We do not cover the model but we think about the implications

Market Preemption • Take a simple market with an incumbent and just two periods – current profit M ( $900 in our previous example with P = 120 - Q ) – market is expected to grow - demand is expected to double in the next period (e. g. , P = 120 – Q/2 M = $1800) – to meet the new demand requires additional capacity – the new capacity can be added: • In first period or in second period • By incumbent or by new entrant

Market Preemption • Take a simple market with an incumbent and just two periods – current profit M ( $900 in our previous example with P = 120 - Q ) – market is expected to grow - demand is expected to double in the next period (e. g. , P = 120 – Q/2 M = $1800) – to meet the new demand requires additional capacity – the new capacity can be added: • In first period or in second period • By incumbent or by new entrant

Market Preemption • Assumption 1: entrant must install new capacity before incumbent in order to be a viable competitor – If both install capacity in 1 st period or in 2 nd period, all consumers stick with the incumbent —Entrant earns non-positive profit – If incumbent installs capacity in 1 st period and entrant in 2 nd, entrant again earns non-positive profit – Only if entrant installs capacity in 1 st period and incumbent does not does entrant earn positive profit

Market Preemption • Assumption 1: entrant must install new capacity before incumbent in order to be a viable competitor – If both install capacity in 1 st period or in 2 nd period, all consumers stick with the incumbent —Entrant earns non-positive profit – If incumbent installs capacity in 1 st period and entrant in 2 nd, entrant again earns non-positive profit – Only if entrant installs capacity in 1 st period and incumbent does not does entrant earn positive profit

Market Preemption (cont. ) • Assumption 2: if entry occurs, competition is Cournot. Outcome in 2 nd period: q 1 = q 2 = 40; 1 = 2 = $800 • Incumbent timing of capacity expansion in absence of entry threat – 1 st period Present value of profit = ($900 – F) + $1800/(1+r). – 2 nd period Present value of profit = $900 + ($1800 – F)/(1+r). – In absence of entry threat, 2 nd period expansion is more profitable by amount r. F/(1+r). • Entrant: must enter in 1 st period to be viable – If incumbent sticks with 2 nd period expansion, entrant earns –F + $800/(1+r) – If incumbent changes to 1 st period expansion, entrant earns nonpositive profit

Market Preemption (cont. ) • Assumption 2: if entry occurs, competition is Cournot. Outcome in 2 nd period: q 1 = q 2 = 40; 1 = 2 = $800 • Incumbent timing of capacity expansion in absence of entry threat – 1 st period Present value of profit = ($900 – F) + $1800/(1+r). – 2 nd period Present value of profit = $900 + ($1800 – F)/(1+r). – In absence of entry threat, 2 nd period expansion is more profitable by amount r. F/(1+r). • Entrant: must enter in 1 st period to be viable – If incumbent sticks with 2 nd period expansion, entrant earns –F + $800/(1+r) – If incumbent changes to 1 st period expansion, entrant earns nonpositive profit

Market Preemption (cont. ) • Threat of entry changes incumbent’s calculation of timing of expansion – 1 st period expansion preserves monopoly Present value of profit = is still ($900 – F) + $1800/(1+r). – 2 nd period expansion permits entry Present value of profit is $900 + ($800 – F)/(1+r). – 1 st period expansion loses r. F/(1+r) but gains $1000/(1+r) by preserving monopoly. Incentive to expand in 1 st period is [$1000 – r. F]/(1+r). – Entrant’s incentive for 1 st period expansion is ]$800/(1+r)] - F – Incumbent’s incentive to expand in 1 st period exceeds that of the entrant’s. The incumbent is fighting to hang on to monopoly profit while the best that entrant can hope for is the Cournot profit of a typical industry firm

Market Preemption (cont. ) • Threat of entry changes incumbent’s calculation of timing of expansion – 1 st period expansion preserves monopoly Present value of profit = is still ($900 – F) + $1800/(1+r). – 2 nd period expansion permits entry Present value of profit is $900 + ($800 – F)/(1+r). – 1 st period expansion loses r. F/(1+r) but gains $1000/(1+r) by preserving monopoly. Incentive to expand in 1 st period is [$1000 – r. F]/(1+r). – Entrant’s incentive for 1 st period expansion is ]$800/(1+r)] - F – Incumbent’s incentive to expand in 1 st period exceeds that of the entrant’s. The incumbent is fighting to hang on to monopoly profit while the best that entrant can hope for is the Cournot profit of a typical industry firm

Limit Pricing Again • Often the incumbent’s incentive to expand capacity now exceeds that of the entrant’s • The incumbent is fighting to hang on to monopoly profit while the best that entrant can hope for is the Cournot profit of a typical industry firm • The capacity expansion and preemption games are ways of resolving the Chain-store paradox – indicate that it is rational for incumbents to deter entry – Indicate that entry deterrence efforts are not only rational but predatory in that they require investments that are not profitable unless they deter entry

Limit Pricing Again • Often the incumbent’s incentive to expand capacity now exceeds that of the entrant’s • The incumbent is fighting to hang on to monopoly profit while the best that entrant can hope for is the Cournot profit of a typical industry firm • The capacity expansion and preemption games are ways of resolving the Chain-store paradox – indicate that it is rational for incumbents to deter entry – Indicate that entry deterrence efforts are not only rational but predatory in that they require investments that are not profitable unless they deter entry

Limit Pricing Again • An alternative approach to predation: information structure – suppose that an entrant does not have perfect information about the incumbent’s costs • if the incumbent is low-cost, one should not enter • if the incumbent is high-cost, one should enter – does a high-cost incumbent have an incentive to pretend to be low-cost - to prevent entry, for example by pricing as a low-cost firm?

Limit Pricing Again • An alternative approach to predation: information structure – suppose that an entrant does not have perfect information about the incumbent’s costs • if the incumbent is low-cost, one should not enter • if the incumbent is high-cost, one should enter – does a high-cost incumbent have an incentive to pretend to be low-cost - to prevent entry, for example by pricing as a low-cost firm?

A (Simple) Example • • • Incumbent has a monopoly in period 1 Threat of entry in period 2 Market closes at the end of period 2 Entrant observes incumbent’s actions in period 1 These actions determine whether or not to enter in period 2 Incumbent is expected to be high-cost or low-cost – no direct information on incumbent’s costs – entrant knows that there is a probability that the incumbent is low -cost • Need to specify pay-offs in different situations

A (Simple) Example • • • Incumbent has a monopoly in period 1 Threat of entry in period 2 Market closes at the end of period 2 Entrant observes incumbent’s actions in period 1 These actions determine whether or not to enter in period 2 Incumbent is expected to be high-cost or low-cost – no direct information on incumbent’s costs – entrant knows that there is a probability that the incumbent is low -cost • Need to specify pay-offs in different situations

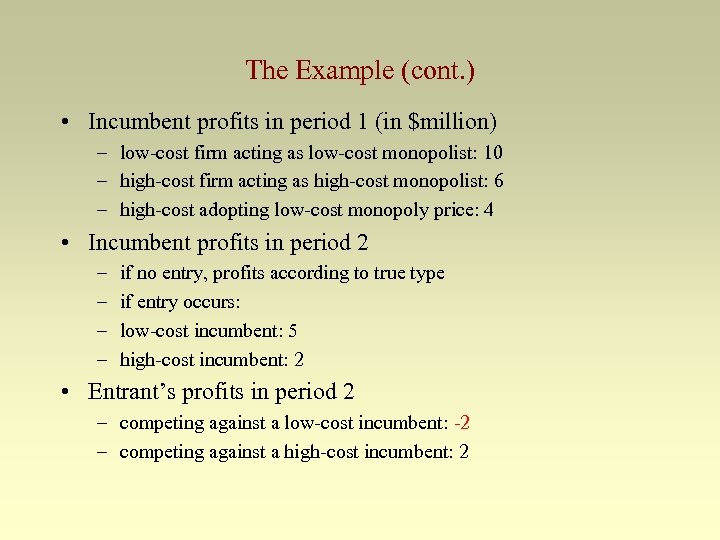

The Example (cont. ) • Incumbent profits in period 1 (in $million) – low-cost firm acting as low-cost monopolist: 10 – high-cost firm acting as high-cost monopolist: 6 – high-cost adopting low-cost monopoly price: 4 • Incumbent profits in period 2 – – if no entry, profits according to true type if entry occurs: low-cost incumbent: 5 high-cost incumbent: 2 • Entrant’s profits in period 2 – competing against a low-cost incumbent: -2 – competing against a high-cost incumbent: 2

The Example (cont. ) • Incumbent profits in period 1 (in $million) – low-cost firm acting as low-cost monopolist: 10 – high-cost firm acting as high-cost monopolist: 6 – high-cost adopting low-cost monopoly price: 4 • Incumbent profits in period 2 – – if no entry, profits according to true type if entry occurs: low-cost incumbent: 5 high-cost incumbent: 2 • Entrant’s profits in period 2 – competing against a low-cost incumbent: -2 – competing against a high-cost incumbent: 2

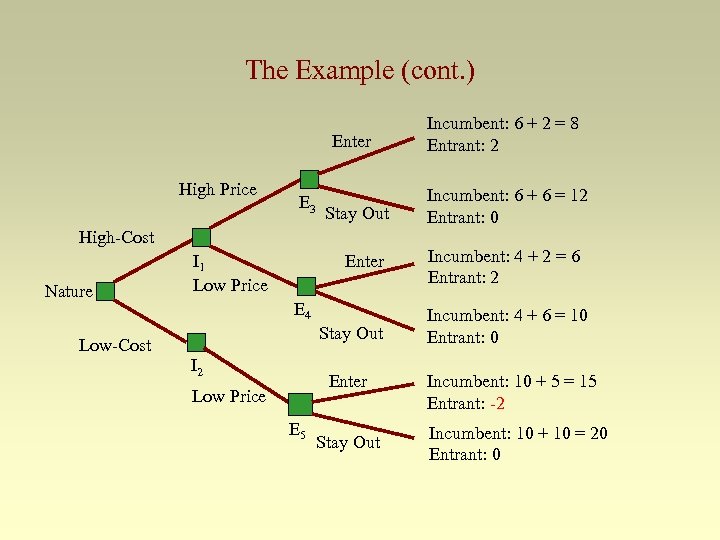

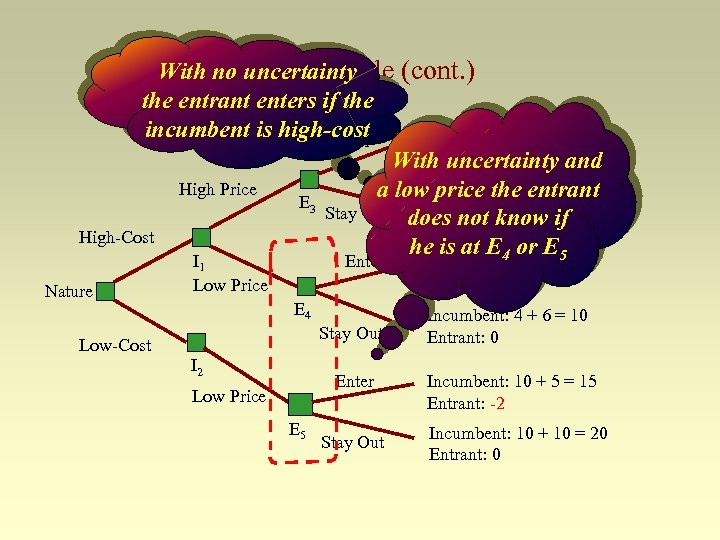

The Example (cont. ) Enter High Price E 3 Stay Out High-Cost Nature I 1 Low Price Enter E 4 Stay Out Low-Cost I 2 Enter Low Price E 5 Stay Out Incumbent: 6 + 2 = 8 Entrant: 2 Incumbent: 6 + 6 = 12 Entrant: 0 Incumbent: 4 + 2 = 6 Entrant: 2 Incumbent: 4 + 6 = 10 Entrant: 0 Incumbent: 10 + 5 = 15 Entrant: -2 Incumbent: 10 + 10 = 20 Entrant: 0

The Example (cont. ) Enter High Price E 3 Stay Out High-Cost Nature I 1 Low Price Enter E 4 Stay Out Low-Cost I 2 Enter Low Price E 5 Stay Out Incumbent: 6 + 2 = 8 Entrant: 2 Incumbent: 6 + 6 = 12 Entrant: 0 Incumbent: 4 + 2 = 6 Entrant: 2 Incumbent: 4 + 6 = 10 Entrant: 0 Incumbent: 10 + 5 = 15 Entrant: -2 Incumbent: 10 + 10 = 20 Entrant: 0

With no uncertainty The Example (cont. ) the entrant enters if the Incumbent: 6 + 2 = 8 incumbent is high-cost Enter Entrant: 2 With uncertainty and High Price a low. Incumbent: 6 + 6 = 12 price the entrant E 3 Stay Out does not 0 know if Entrant: High-Cost he is at E 4 4 + 2 = 6 Incumbent: or E 5 Nature I 1 Low Price Enter E 4 Stay Out Low-Cost I 2 Enter Low Price E 5 Stay Out Entrant: 2 Incumbent: 4 + 6 = 10 Entrant: 0 Incumbent: 10 + 5 = 15 Entrant: -2 Incumbent: 10 + 10 = 20 Entrant: 0

With no uncertainty The Example (cont. ) the entrant enters if the Incumbent: 6 + 2 = 8 incumbent is high-cost Enter Entrant: 2 With uncertainty and High Price a low. Incumbent: 6 + 6 = 12 price the entrant E 3 Stay Out does not 0 know if Entrant: High-Cost he is at E 4 4 + 2 = 6 Incumbent: or E 5 Nature I 1 Low Price Enter E 4 Stay Out Low-Cost I 2 Enter Low Price E 5 Stay Out Entrant: 2 Incumbent: 4 + 6 = 10 Entrant: 0 Incumbent: 10 + 5 = 15 Entrant: -2 Incumbent: 10 + 10 = 20 Entrant: 0

The Example (cont) • Consider a high-cost incumbent. It can – price high in period 1: entry will certainly occur, total profits are 8 – price low in period 1: • if no entry occurs, total profits are 10 • if entry occurs, total profits are 6

The Example (cont) • Consider a high-cost incumbent. It can – price high in period 1: entry will certainly occur, total profits are 8 – price low in period 1: • if no entry occurs, total profits are 10 • if entry occurs, total profits are 6

The Example (cont) • A high-cost incumbent has an incentive to pretend to be low-cost if by so doing it can deter entry • The entrant recognizes this incentive to masquerade as a low cost firm (formally “to pool”) • The issue is: what can the entrant infer from observing a low price knowing that this may be a deception? ? ? • In turn this depends on the probability that observing a low -price means that the incumbent is a low-cost firm

The Example (cont) • A high-cost incumbent has an incentive to pretend to be low-cost if by so doing it can deter entry • The entrant recognizes this incentive to masquerade as a low cost firm (formally “to pool”) • The issue is: what can the entrant infer from observing a low price knowing that this may be a deception? ? ? • In turn this depends on the probability that observing a low -price means that the incumbent is a low-cost firm

The Example (cont. ) • If the entrant observes the incumbent setting a low-price in period 1, it cannot tell whether the game is at node E 4 or E 5 • As a result, the entrant must rely on the unconditional probability that the incumbent is low-cost – the incumbent is low-cost with probability , in which case entry will lead to a profit of – 2 – The incumbent is high-cost with probability 1 - , in which case entry will lead to a profit of 2 – So the expected profit is 2(1 - ) - 2 = 2 - 4

The Example (cont. ) • If the entrant observes the incumbent setting a low-price in period 1, it cannot tell whether the game is at node E 4 or E 5 • As a result, the entrant must rely on the unconditional probability that the incumbent is low-cost – the incumbent is low-cost with probability , in which case entry will lead to a profit of – 2 – The incumbent is high-cost with probability 1 - , in which case entry will lead to a profit of 2 – So the expected profit is 2(1 - ) - 2 = 2 - 4

The Example (cont. ) • This is negative if > ½. • If, absent any information other than the initial distribution of firm types, there is a “sufficiently high” probability that the incumbent is low cost, an incumbent can deter entry by setting a low price in period 1

The Example (cont. ) • This is negative if > ½. • If, absent any information other than the initial distribution of firm types, there is a “sufficiently high” probability that the incumbent is low cost, an incumbent can deter entry by setting a low price in period 1

Limit Pricing and Uncertainty • Note: the model shows how a high-cost firm can deter entry. • However, to do this it must set a low price. This is how it “fools” the would-be entrant. • Thus, the threat of entry forces the incumbent to price below the monopoly price it would otherwise set • This lower limit price therefore mitigates the resource misallocation effects of monopoly.

Limit Pricing and Uncertainty • Note: the model shows how a high-cost firm can deter entry. • However, to do this it must set a low price. This is how it “fools” the would-be entrant. • Thus, the threat of entry forces the incumbent to price below the monopoly price it would otherwise set • This lower limit price therefore mitigates the resource misallocation effects of monopoly.

Long-Term Contracts as Entry Barriers • Can an incumbent preclude entry by having customers signing long-term contracts that can only be broken with penalty? – Chicago School Answer: No. Buyer cannot be forced to sign a contract that is against its own best interest – Post Chicago School Answer: Yes. Incumbent can write a contract that makes it in the customer’s interest to keep out a lower cost entrant

Long-Term Contracts as Entry Barriers • Can an incumbent preclude entry by having customers signing long-term contracts that can only be broken with penalty? – Chicago School Answer: No. Buyer cannot be forced to sign a contract that is against its own best interest – Post Chicago School Answer: Yes. Incumbent can write a contract that makes it in the customer’s interest to keep out a lower cost entrant

Long-Term Contracts as Entry Barriers • Essence of the Post-Chicago argument – A new entrant will earn a lot of surplus – The long-term contract can be written so as to limit entry by making sure that much of any surplus generated by entry goes to the customer (We skip the example during class, but we will consider additional ways to deter entry)

Long-Term Contracts as Entry Barriers • Essence of the Post-Chicago argument – A new entrant will earn a lot of surplus – The long-term contract can be written so as to limit entry by making sure that much of any surplus generated by entry goes to the customer (We skip the example during class, but we will consider additional ways to deter entry)

An Example • The Setup: One seller (the incumbent), one buyer and one potential entrant—and two periods – Buyer is willing to pay $100 for a commodity – Incumbent has cost of $50 – Potential entrant with cost randomly distributed between 0 and $100 – Contract between buyer and seller written in first period but covers 2 nd period – Entrant decides whether or not to enter in 2 nd period

An Example • The Setup: One seller (the incumbent), one buyer and one potential entrant—and two periods – Buyer is willing to pay $100 for a commodity – Incumbent has cost of $50 – Potential entrant with cost randomly distributed between 0 and $100 – Contract between buyer and seller written in first period but covers 2 nd period – Entrant decides whether or not to enter in 2 nd period

An Example (cont. ) • Competition and entry without a Long-term Contract – In the absence of entry, the incumbent sells to the buyer at the buyer’s reservation price of $100 – The entrant’s cost per unit c is uniformly distributed between 0 and $100. Since the incumbent’s unit cost is $50, the entrant should be able to enter so long as its cost is less than $50, i. e. , about half the time – If c <$50, the entrant will enter. Competition between the entrant and the incumbent will mean the entrant cannot price above $50. But, importantly, there is no pressure for it to price below $50 either—even if c is very low – In this scenario, the buyer’s expected price is: – P = ½ x $100 + ½ x $50 = $75 Expected Surplus = $25

An Example (cont. ) • Competition and entry without a Long-term Contract – In the absence of entry, the incumbent sells to the buyer at the buyer’s reservation price of $100 – The entrant’s cost per unit c is uniformly distributed between 0 and $100. Since the incumbent’s unit cost is $50, the entrant should be able to enter so long as its cost is less than $50, i. e. , about half the time – If c <$50, the entrant will enter. Competition between the entrant and the incumbent will mean the entrant cannot price above $50. But, importantly, there is no pressure for it to price below $50 either—even if c is very low – In this scenario, the buyer’s expected price is: – P = ½ x $100 + ½ x $50 = $75 Expected Surplus = $25

The Example (cont. ) • Competition and entry with a long-term contract – Can the incumbent offer the buyer a contract that has at least as much expected surplus and makes entry less probable? Yes. – Consider the following contract (written in 1 st period): In 2 nd period, incumbent will sell to buyer at P = $75. Buyer must buy from incumbent unless the buyer pays a $50 breach of contract fee – Entrant can now enter only if c < $25, i. e. ¼ of the time. If it enters, it charges a price of $25. – Buyer: ¾ of the time, it stays with the contract and pays $75. ¼ of the time it breaks the contract, pays entrant $25 and pays incumbent $50 breach-of-contract fee for a total of $75. Buyer’s expected surplus is thus the same $25 with contract as it was without the contract.

The Example (cont. ) • Competition and entry with a long-term contract – Can the incumbent offer the buyer a contract that has at least as much expected surplus and makes entry less probable? Yes. – Consider the following contract (written in 1 st period): In 2 nd period, incumbent will sell to buyer at P = $75. Buyer must buy from incumbent unless the buyer pays a $50 breach of contract fee – Entrant can now enter only if c < $25, i. e. ¼ of the time. If it enters, it charges a price of $25. – Buyer: ¾ of the time, it stays with the contract and pays $75. ¼ of the time it breaks the contract, pays entrant $25 and pays incumbent $50 breach-of-contract fee for a total of $75. Buyer’s expected surplus is thus the same $25 with contract as it was without the contract.

The Example (cont. ) • Incumbent’s Incentive to Offer the contract: – Without the contract, incumbent will win the 2 nd period competition ½ the time. It will sell at P = $100 and incur cost of $50 for an expected profit of $25. – With the contract it will: • Win the 2 nd period competition ¾ of the time. It will sell at P = $75, incur a cost of $50 for an expected profit of 0. 75 x $25 = $16. 67 • Lose the 2 nd period competition ¼ of the time. It will then incur no cost but receive a $50 breach of contract payment. Its expected profit will be 0. 25 x $50 = $12. 50. – Overall, incumbent’s expected profit with the contract is $29. 17 > $25. The incumbent prefers the contract.

The Example (cont. ) • Incumbent’s Incentive to Offer the contract: – Without the contract, incumbent will win the 2 nd period competition ½ the time. It will sell at P = $100 and incur cost of $50 for an expected profit of $25. – With the contract it will: • Win the 2 nd period competition ¾ of the time. It will sell at P = $75, incur a cost of $50 for an expected profit of 0. 75 x $25 = $16. 67 • Lose the 2 nd period competition ¼ of the time. It will then incur no cost but receive a $50 breach of contract payment. Its expected profit will be 0. 25 x $50 = $12. 50. – Overall, incumbent’s expected profit with the contract is $29. 17 > $25. The incumbent prefers the contract.

The Experiment (cont. ) The contract offers a gain to the incumbent and no loss to the buyer, so it will be signed. Yet it reduces the probability of entry from ½ to ¼. This is inefficient. Without the contract, the expected surplus is ½ x (the profit of the incumbent with no entry) + ½ (the profit of the entrant and the buyer with entry) = ½ x $50 + ½ x $75 = $62. 50 With the contract, the expected total surplus is ¾ (the surplus of the buyer plus that of the incumbent without entry) plus ¼ (the surplus of the buyer, the entrant and the incumbent with entry) = ¾ x $50 + ¼ x ($25+$12. 5+$50)= $37. 50 + $21. 75 = $59. 25 NOTE: It was argued that Microsoft’s use of two-year contracts and contractual requirements to equipment manufacturers such as Compaq and Dell pay for a (very high) minimum number of computers shipped with MS-DOS or Windows deterred entry.

The Experiment (cont. ) The contract offers a gain to the incumbent and no loss to the buyer, so it will be signed. Yet it reduces the probability of entry from ½ to ¼. This is inefficient. Without the contract, the expected surplus is ½ x (the profit of the incumbent with no entry) + ½ (the profit of the entrant and the buyer with entry) = ½ x $50 + ½ x $75 = $62. 50 With the contract, the expected total surplus is ¾ (the surplus of the buyer plus that of the incumbent without entry) plus ¼ (the surplus of the buyer, the entrant and the incumbent with entry) = ¾ x $50 + ¼ x ($25+$12. 5+$50)= $37. 50 + $21. 75 = $59. 25 NOTE: It was argued that Microsoft’s use of two-year contracts and contractual requirements to equipment manufacturers such as Compaq and Dell pay for a (very high) minimum number of computers shipped with MS-DOS or Windows deterred entry.

Other ways to deter entry (do unto others before they do unto you) Instead of decreasing prices, you may want to increase costs for your competitors There are legal ways and illegal ones of course… • All business sagacity reduces itself in the last analysis to a judicious use of sabotage Thorstein Veblen

Other ways to deter entry (do unto others before they do unto you) Instead of decreasing prices, you may want to increase costs for your competitors There are legal ways and illegal ones of course… • All business sagacity reduces itself in the last analysis to a judicious use of sabotage Thorstein Veblen

Other ways to deter entry You can interfere with others’ production. Apparently British Airways were doing this to Virgin Atlantic Airways The French government was spying on people traveling on Air France to steal commercial information You can also sabotage your competitor’s attempts to gather information about the market (if they conduct market research, try to distort the prices with special discounts etc. )

Other ways to deter entry You can interfere with others’ production. Apparently British Airways were doing this to Virgin Atlantic Airways The French government was spying on people traveling on Air France to steal commercial information You can also sabotage your competitor’s attempts to gather information about the market (if they conduct market research, try to distort the prices with special discounts etc. )

Other ways to deter entry Manipulate government regulations to favor yourself For example get the government to use a grandfathering system to distribute environmental permits Tell them that way the industry will remain small and the pollution overall will be less: you do not want to flood the market with polluting firms, right?

Other ways to deter entry Manipulate government regulations to favor yourself For example get the government to use a grandfathering system to distribute environmental permits Tell them that way the industry will remain small and the pollution overall will be less: you do not want to flood the market with polluting firms, right?

Other ways to deter entry Try to tie the product you sell to some complement you also sell and your competitor does not Or make it more difficult for your customer to combine your competitor’s products with those of other firms Raise switching costs for consumers (it used to be common practice that you had to change your phone number if you switched to a new cell-phone company right? Well that is now illegal, but it worked for years!!!)

Other ways to deter entry Try to tie the product you sell to some complement you also sell and your competitor does not Or make it more difficult for your customer to combine your competitor’s products with those of other firms Raise switching costs for consumers (it used to be common practice that you had to change your phone number if you switched to a new cell-phone company right? Well that is now illegal, but it worked for years!!!)

Other ways to deter entry If you are a less labor-intensive firm, make sure you increase wages, so that the other firms, who are more labor intensive are going to be worse-off (If you are Wal-Mart, get Sunday shopping in Antigonish!!!) Favor the unionization of your employees

Other ways to deter entry If you are a less labor-intensive firm, make sure you increase wages, so that the other firms, who are more labor intensive are going to be worse-off (If you are Wal-Mart, get Sunday shopping in Antigonish!!!) Favor the unionization of your employees

Other ways to deter entry Buy patents and keep them sleeping Hoard scarce resources Lobby to get legislation that increases everyone’s costs (get Sunday shopping, favor high health and safety standards, etc. ) Advertise, and advertise first!

Other ways to deter entry Buy patents and keep them sleeping Hoard scarce resources Lobby to get legislation that increases everyone’s costs (get Sunday shopping, favor high health and safety standards, etc. ) Advertise, and advertise first!

Next Remember that predation tactics can also come in the shape of new products, redesign of an old one, more publicity, more research and development, etc. Remember, then, how difficult it is to discern between the actions that are undertaken just to drive competition away so market performance is worse, and the actions that drive competitors away but increase welfare Collusion: read Chapter 14!!!

Next Remember that predation tactics can also come in the shape of new products, redesign of an old one, more publicity, more research and development, etc. Remember, then, how difficult it is to discern between the actions that are undertaken just to drive competition away so market performance is worse, and the actions that drive competitors away but increase welfare Collusion: read Chapter 14!!!