51a1ed72336b2bfa1cd03c0641a73f6a.ppt

- Количество слайдов: 34

ECON 339 X: Agricultural Marketing Chad Hart Assistant Professor/Grain Markets Specialist chart@iastate. edu 515 -294 -9911 Econ 339 X, Spring 2010

ECON 339 X: Agricultural Marketing Chad Hart Assistant Professor/Grain Markets Specialist chart@iastate. edu 515 -294 -9911 Econ 339 X, Spring 2010

Today’s Topic Risk Management Tools Price Risk Futures, Options Econ 339 X, Spring 2010

Today’s Topic Risk Management Tools Price Risk Futures, Options Econ 339 X, Spring 2010

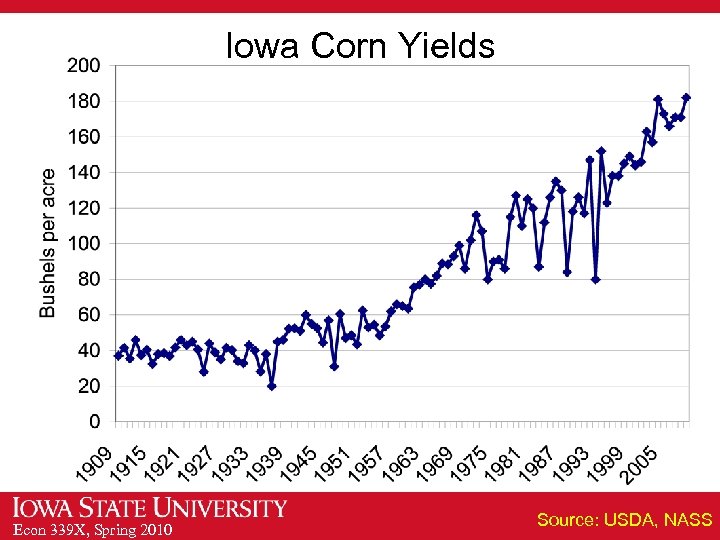

Iowa Corn Yields Econ 339 X, Spring 2010 Source: USDA, NASS

Iowa Corn Yields Econ 339 X, Spring 2010 Source: USDA, NASS

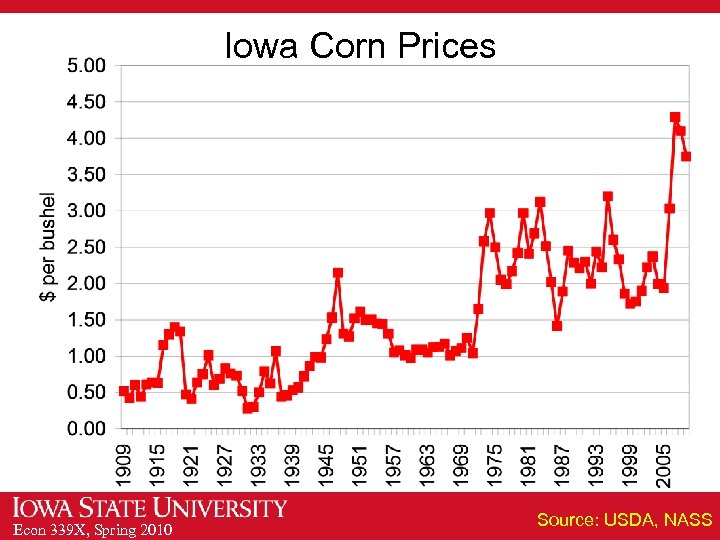

Iowa Corn Prices Econ 339 X, Spring 2010 Source: USDA, NASS

Iowa Corn Prices Econ 339 X, Spring 2010 Source: USDA, NASS

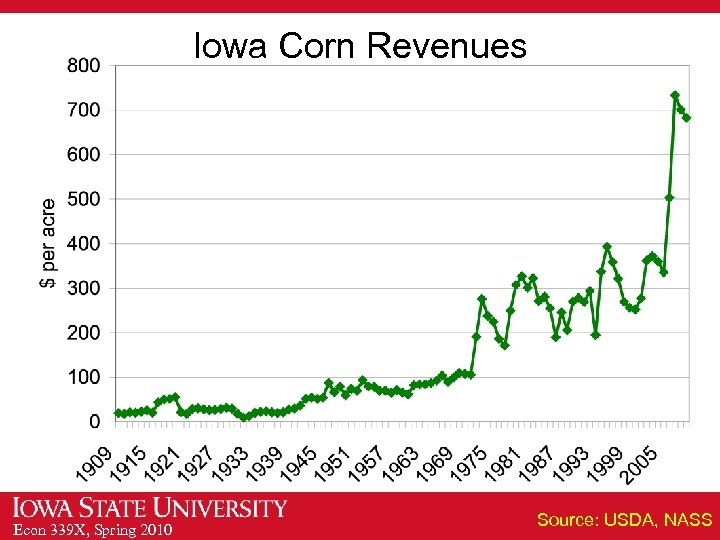

Iowa Corn Revenues Econ 339 X, Spring 2010 Source: USDA, NASS

Iowa Corn Revenues Econ 339 X, Spring 2010 Source: USDA, NASS

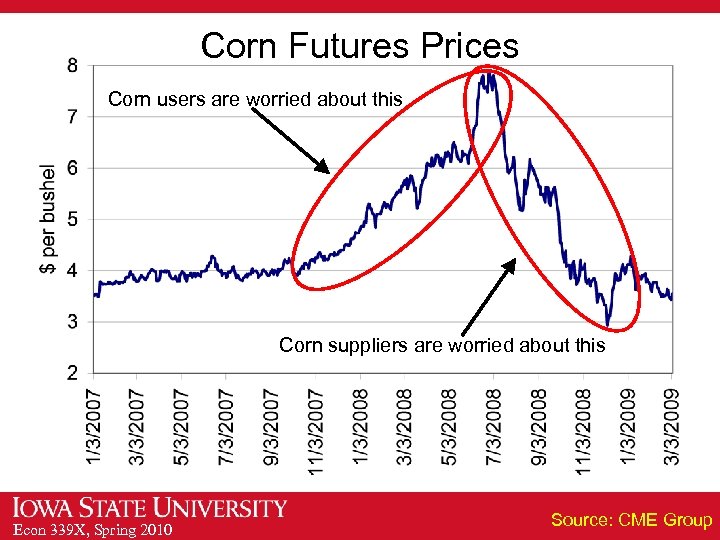

Corn Futures Prices Corn users are worried about this Corn suppliers are worried about this Econ 339 X, Spring 2010 Source: CME Group

Corn Futures Prices Corn users are worried about this Corn suppliers are worried about this Econ 339 X, Spring 2010 Source: CME Group

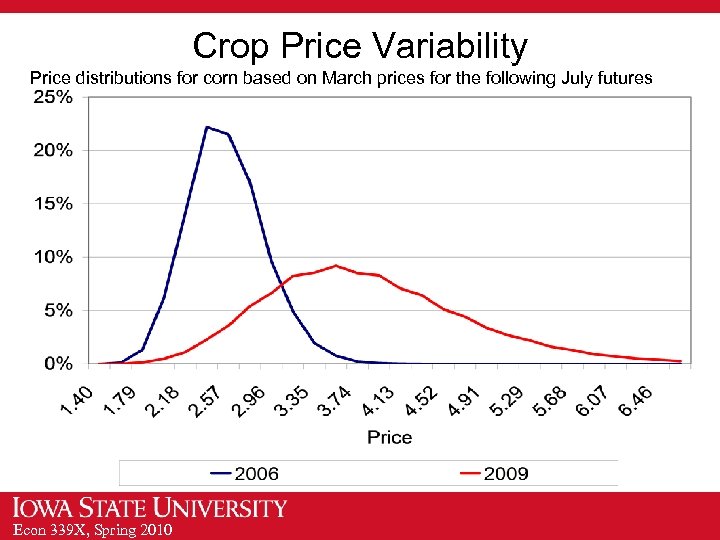

Crop Price Variability Price distributions for corn based on March prices for the following July futures Econ 339 X, Spring 2010

Crop Price Variability Price distributions for corn based on March prices for the following July futures Econ 339 X, Spring 2010

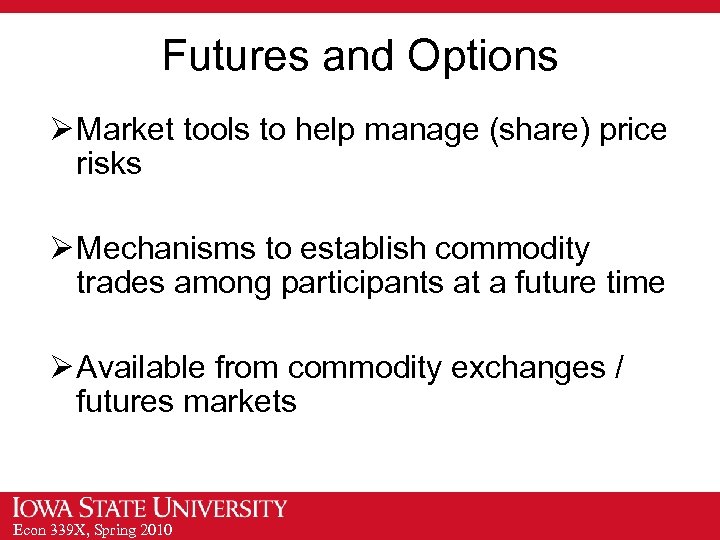

Futures and Options Ø Market tools to help manage (share) price risks Ø Mechanisms to establish commodity trades among participants at a future time Ø Available from commodity exchanges / futures markets Econ 339 X, Spring 2010

Futures and Options Ø Market tools to help manage (share) price risks Ø Mechanisms to establish commodity trades among participants at a future time Ø Available from commodity exchanges / futures markets Econ 339 X, Spring 2010

Futures Markets A market where contracts for physical commodities are traded, the contracts set the terms of quantity, quality, and delivery ØChicago: Corn, soybeans, wheat (soft red), oats, rice ØAlong with the livestock complex ØKansas City: Wheat (hard red winter) ØMinneapolis: Wheat (hard red spring) ØTokyo: Corn, soybeans, coffee, sugar ØHas a market for Non-GMO soybeans ØOther markets in Argentina, Brazil, China, and Europe Econ 339 X, Spring 2010

Futures Markets A market where contracts for physical commodities are traded, the contracts set the terms of quantity, quality, and delivery ØChicago: Corn, soybeans, wheat (soft red), oats, rice ØAlong with the livestock complex ØKansas City: Wheat (hard red winter) ØMinneapolis: Wheat (hard red spring) ØTokyo: Corn, soybeans, coffee, sugar ØHas a market for Non-GMO soybeans ØOther markets in Argentina, Brazil, China, and Europe Econ 339 X, Spring 2010

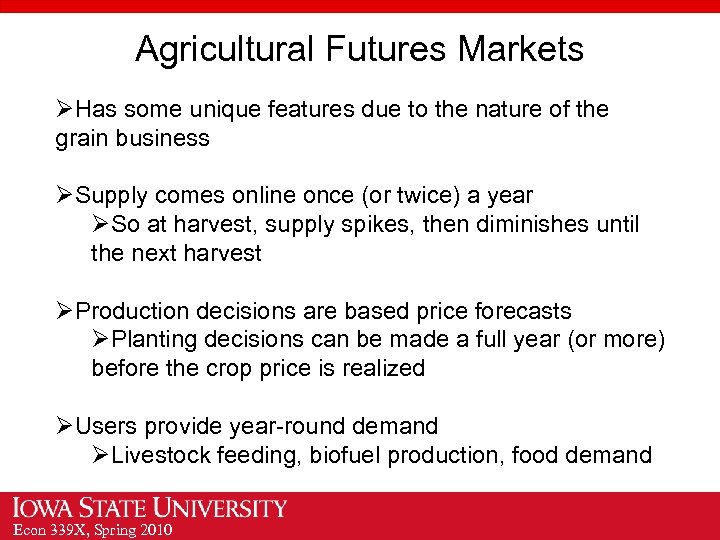

Agricultural Futures Markets ØHas some unique features due to the nature of the grain business ØSupply comes online once (or twice) a year ØSo at harvest, supply spikes, then diminishes until the next harvest ØProduction decisions are based price forecasts ØPlanting decisions can be made a full year (or more) before the crop price is realized ØUsers provide year-round demand ØLivestock feeding, biofuel production, food demand Econ 339 X, Spring 2010

Agricultural Futures Markets ØHas some unique features due to the nature of the grain business ØSupply comes online once (or twice) a year ØSo at harvest, supply spikes, then diminishes until the next harvest ØProduction decisions are based price forecasts ØPlanting decisions can be made a full year (or more) before the crop price is realized ØUsers provide year-round demand ØLivestock feeding, biofuel production, food demand Econ 339 X, Spring 2010

Futures Market Exchanges ØCompetitive markets ØOpen out-cry and electronic trading ØCentralized pricing ØBuyers and sellers are both in the market ØRelevant information is conveyed through the bids and offers for the trades ØBid = the price at which a trader would buy the commodity ØOffer = the price at which a trader would sell the commodity Econ 339 X, Spring 2010

Futures Market Exchanges ØCompetitive markets ØOpen out-cry and electronic trading ØCentralized pricing ØBuyers and sellers are both in the market ØRelevant information is conveyed through the bids and offers for the trades ØBid = the price at which a trader would buy the commodity ØOffer = the price at which a trader would sell the commodity Econ 339 X, Spring 2010

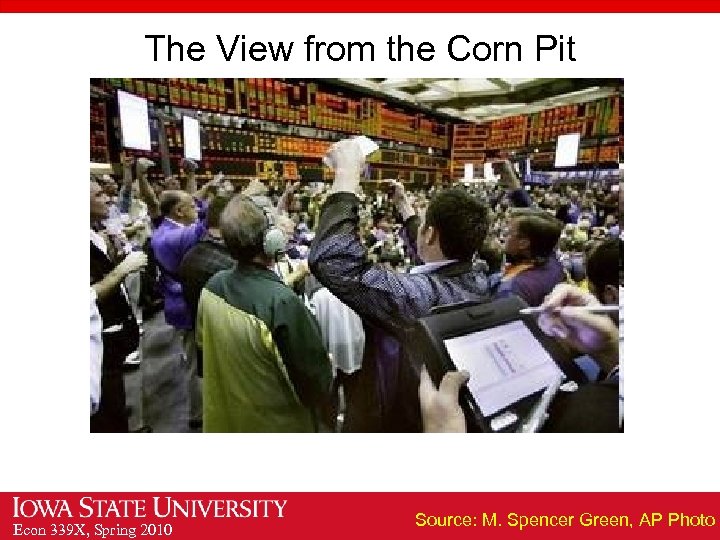

The View from the Corn Pit Econ 339 X, Spring 2010 Source: M. Spencer Green, AP Photo

The View from the Corn Pit Econ 339 X, Spring 2010 Source: M. Spencer Green, AP Photo

Options Ø What are options? Ø An option is the right, but not the obligation, to buy or sell an item at a predetermined price within a specific time period. Ø Options on futures are the right to buy or sell a specific futures contract. Ø Option buyers pay a price (premium) for the rights contained in the option. Econ 339 X, Spring 2010

Options Ø What are options? Ø An option is the right, but not the obligation, to buy or sell an item at a predetermined price within a specific time period. Ø Options on futures are the right to buy or sell a specific futures contract. Ø Option buyers pay a price (premium) for the rights contained in the option. Econ 339 X, Spring 2010

Option Types Ø Two types of options: Puts and Calls Ø A put option contains the right to sell a futures contract. Ø A call option contains the right to buy a futures contract. Ø Puts and calls are not opposite positions in the same market. They do not offset each other. They are different markets. Econ 339 X, Spring 2010

Option Types Ø Two types of options: Puts and Calls Ø A put option contains the right to sell a futures contract. Ø A call option contains the right to buy a futures contract. Ø Puts and calls are not opposite positions in the same market. They do not offset each other. They are different markets. Econ 339 X, Spring 2010

Put Option Ø The Buyer pays the premium and has the right, but not the obligation, to sell a futures contract at the strike price. Ø The Seller receives the premium and is obligated to buy a futures contract at the strike price if the Buyer uses their right. Econ 339 X, Spring 2010

Put Option Ø The Buyer pays the premium and has the right, but not the obligation, to sell a futures contract at the strike price. Ø The Seller receives the premium and is obligated to buy a futures contract at the strike price if the Buyer uses their right. Econ 339 X, Spring 2010

Call Option Ø The Buyer pays a premium and has the right, but not the obligation, to buy a futures contract at the strike price. Ø The Seller receives the premium but is obligated to sell a futures contract at the strike price if the Buyer uses their right. Econ 339 X, Spring 2010

Call Option Ø The Buyer pays a premium and has the right, but not the obligation, to buy a futures contract at the strike price. Ø The Seller receives the premium but is obligated to sell a futures contract at the strike price if the Buyer uses their right. Econ 339 X, Spring 2010

Options as Price Insurance Ø The person wanting price protection (the buyer) pays the option premium. Ø If damage occurs (price moves in the wrong direction), the buyer is reimbursed for damages. Ø The seller keeps the premium, but must pay for damages. Econ 339 X, Spring 2010

Options as Price Insurance Ø The person wanting price protection (the buyer) pays the option premium. Ø If damage occurs (price moves in the wrong direction), the buyer is reimbursed for damages. Ø The seller keeps the premium, but must pay for damages. Econ 339 X, Spring 2010

Options as Price Insurance Ø The option buyer has unlimited upside and limited downside risk. ØIf prices moves in their favor, the option buyer can take full advantage. ØIf prices moves against them, the option seller compensates them. Ø The option seller has limited upside and unlimited downside risk. ØThe seller gets the option premium. Econ 339 X, Spring 2010

Options as Price Insurance Ø The option buyer has unlimited upside and limited downside risk. ØIf prices moves in their favor, the option buyer can take full advantage. ØIf prices moves against them, the option seller compensates them. Ø The option seller has limited upside and unlimited downside risk. ØThe seller gets the option premium. Econ 339 X, Spring 2010

Option Issues and Choices Ø The option may or may not have value at the end ØThe right to buy at $4. 00 has no value if the market is below $4. 00. Ø The buyer can choose to offset, exercise, or let the option expire. Ø The seller can only offset the option or wait for the buyer to choose. Econ 339 X, Spring 2010

Option Issues and Choices Ø The option may or may not have value at the end ØThe right to buy at $4. 00 has no value if the market is below $4. 00. Ø The buyer can choose to offset, exercise, or let the option expire. Ø The seller can only offset the option or wait for the buyer to choose. Econ 339 X, Spring 2010

Strike Prices Ø The predetermined prices for the trade of the futures in the options Ø They set the level of price insurance Ø Range of strike prices determined by the futures exchange Econ 339 X, Spring 2010

Strike Prices Ø The predetermined prices for the trade of the futures in the options Ø They set the level of price insurance Ø Range of strike prices determined by the futures exchange Econ 339 X, Spring 2010

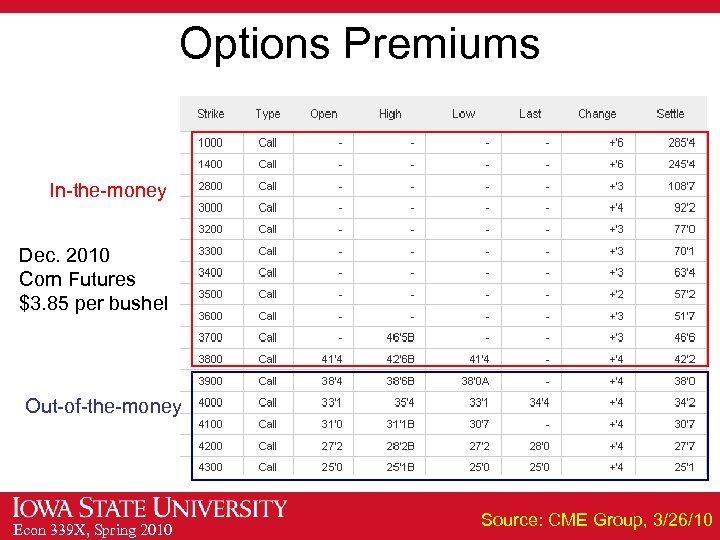

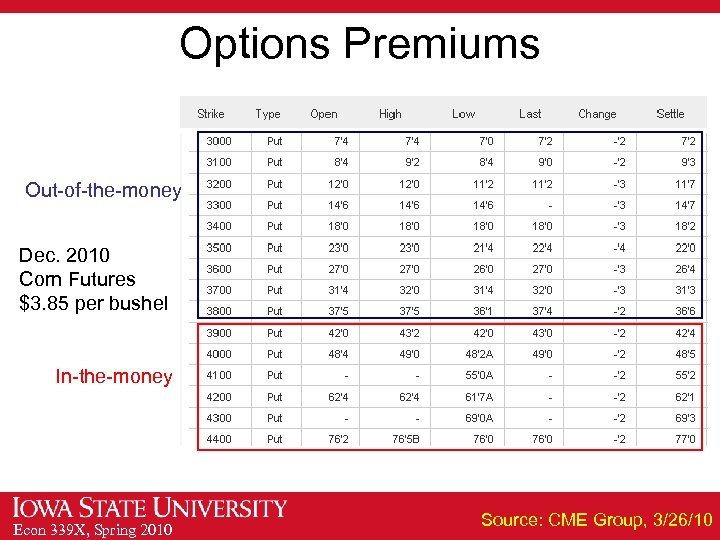

Options Premiums Ø Determined by trading in the marketplace Ø Different premiums Ø For puts and calls Ø For each contract month Ø For each strike price Ø Depends on five variables Ø Strike price Ø Price of underlying futures contract Ø Volatility of underlying futures Ø Time to maturity Ø Interest rate Econ 339 X, Spring 2010

Options Premiums Ø Determined by trading in the marketplace Ø Different premiums Ø For puts and calls Ø For each contract month Ø For each strike price Ø Depends on five variables Ø Strike price Ø Price of underlying futures contract Ø Volatility of underlying futures Ø Time to maturity Ø Interest rate Econ 339 X, Spring 2010

Option References Ø In-the-money Ø If the option expired today, it would have value Ø Put: futures price below strike price Ø Call: futures price above strike price Ø At-the-money Ø Options with strike prices nearest the future price Ø Out-of-the-money Ø If the option expired today, it would have no value Ø Put: futures price above strike price Ø Call: futures price below strike price Econ 339 X, Spring 2010

Option References Ø In-the-money Ø If the option expired today, it would have value Ø Put: futures price below strike price Ø Call: futures price above strike price Ø At-the-money Ø Options with strike prices nearest the future price Ø Out-of-the-money Ø If the option expired today, it would have no value Ø Put: futures price above strike price Ø Call: futures price below strike price Econ 339 X, Spring 2010

Options Premiums In-the-money Dec. 2010 Corn Futures $3. 85 per bushel Out-of-the-money Econ 339 X, Spring 2010 Source: CME Group, 3/26/10

Options Premiums In-the-money Dec. 2010 Corn Futures $3. 85 per bushel Out-of-the-money Econ 339 X, Spring 2010 Source: CME Group, 3/26/10

Options Premiums Out-of-the-money Dec. 2010 Corn Futures $3. 85 per bushel In-the-money Econ 339 X, Spring 2010 Source: CME Group, 3/26/10

Options Premiums Out-of-the-money Dec. 2010 Corn Futures $3. 85 per bushel In-the-money Econ 339 X, Spring 2010 Source: CME Group, 3/26/10

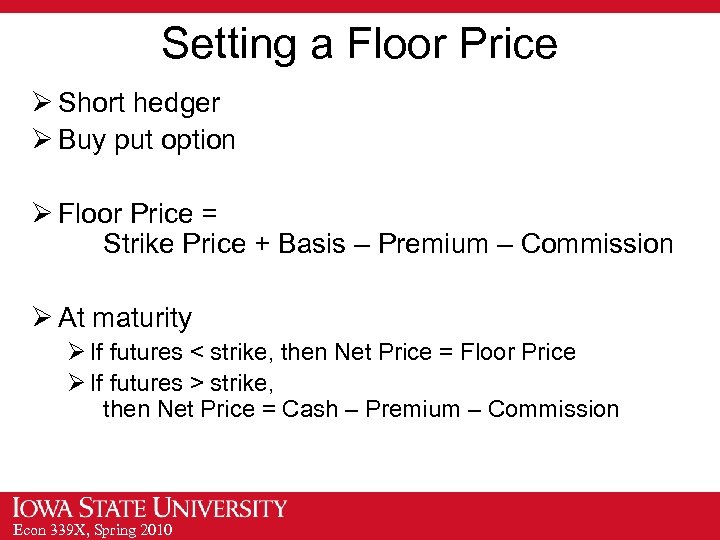

Setting a Floor Price Ø Short hedger Ø Buy put option Ø Floor Price = Strike Price + Basis – Premium – Commission Ø At maturity Ø If futures < strike, then Net Price = Floor Price Ø If futures > strike, then Net Price = Cash – Premium – Commission Econ 339 X, Spring 2010

Setting a Floor Price Ø Short hedger Ø Buy put option Ø Floor Price = Strike Price + Basis – Premium – Commission Ø At maturity Ø If futures < strike, then Net Price = Floor Price Ø If futures > strike, then Net Price = Cash – Premium – Commission Econ 339 X, Spring 2010

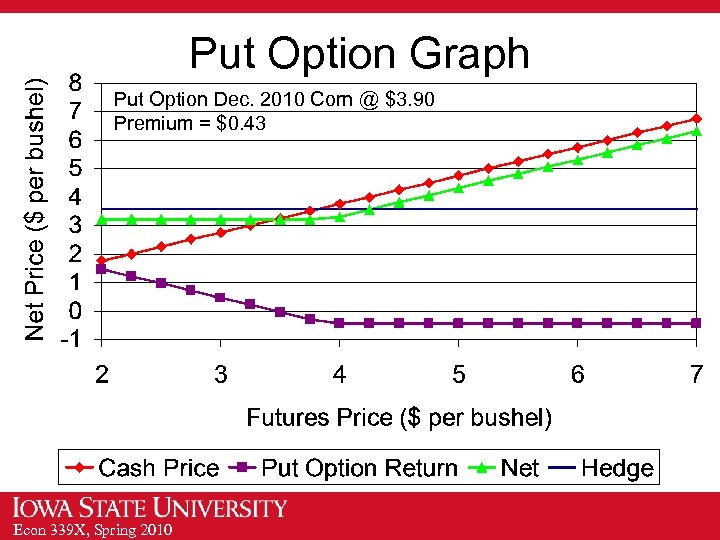

Put Option Graph Put Option Dec. 2010 Corn @ $3. 90 Premium = $0. 43 Econ 339 X, Spring 2010

Put Option Graph Put Option Dec. 2010 Corn @ $3. 90 Premium = $0. 43 Econ 339 X, Spring 2010

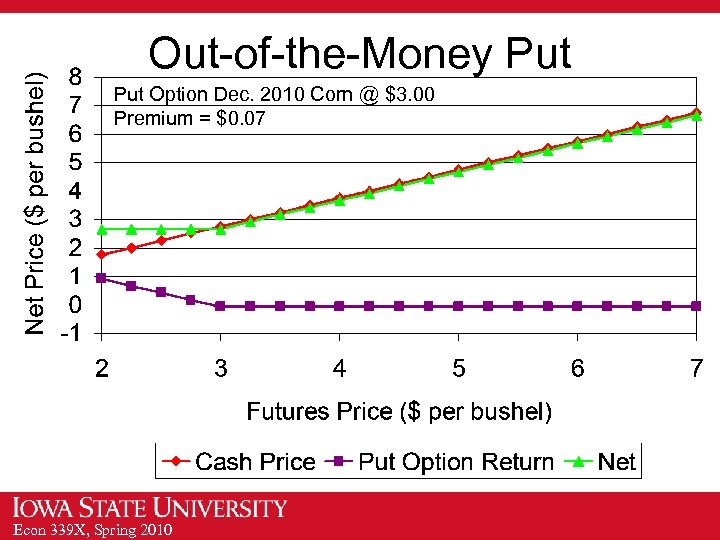

Out-of-the-Money Put Option Dec. 2010 Corn @ $3. 00 Premium = $0. 07 Econ 339 X, Spring 2010

Out-of-the-Money Put Option Dec. 2010 Corn @ $3. 00 Premium = $0. 07 Econ 339 X, Spring 2010

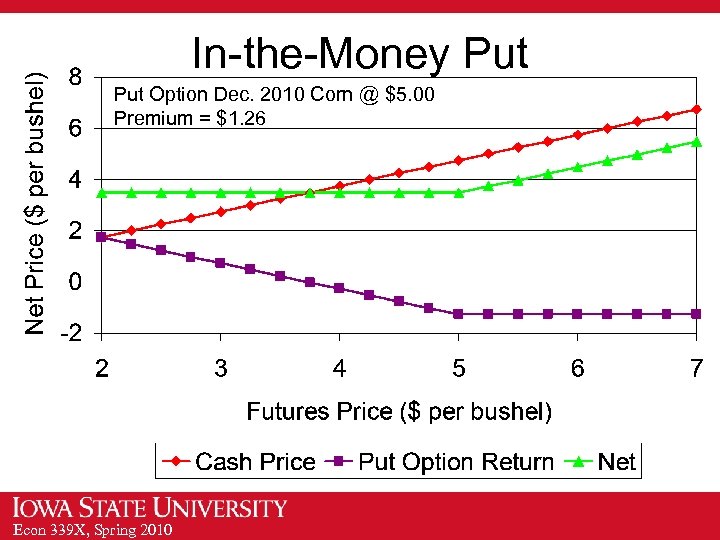

In-the-Money Put Option Dec. 2010 Corn @ $5. 00 Premium = $1. 26 Econ 339 X, Spring 2010

In-the-Money Put Option Dec. 2010 Corn @ $5. 00 Premium = $1. 26 Econ 339 X, Spring 2010

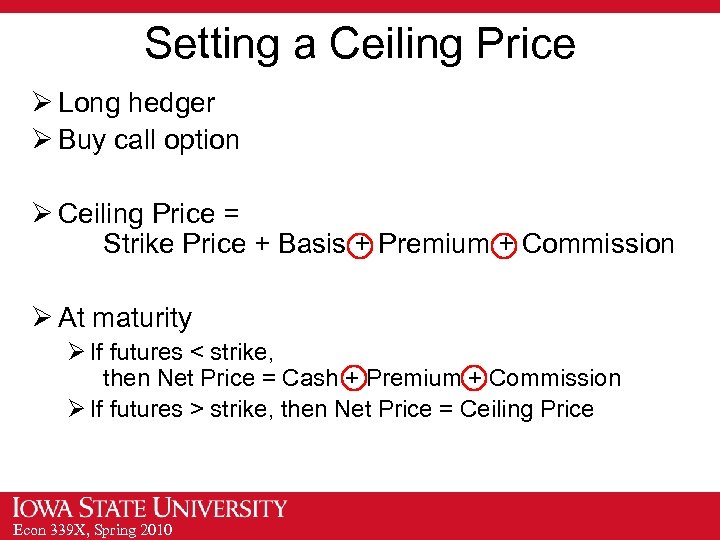

Setting a Ceiling Price Ø Long hedger Ø Buy call option Ø Ceiling Price = Strike Price + Basis + Premium + Commission Ø At maturity Ø If futures < strike, then Net Price = Cash + Premium + Commission Ø If futures > strike, then Net Price = Ceiling Price Econ 339 X, Spring 2010

Setting a Ceiling Price Ø Long hedger Ø Buy call option Ø Ceiling Price = Strike Price + Basis + Premium + Commission Ø At maturity Ø If futures < strike, then Net Price = Cash + Premium + Commission Ø If futures > strike, then Net Price = Ceiling Price Econ 339 X, Spring 2010

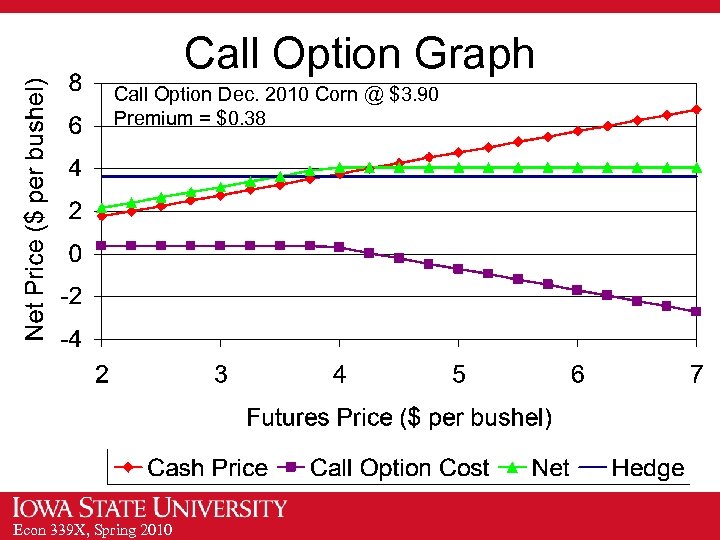

Call Option Graph Call Option Dec. 2010 Corn @ $3. 90 Premium = $0. 38 Econ 339 X, Spring 2010

Call Option Graph Call Option Dec. 2010 Corn @ $3. 90 Premium = $0. 38 Econ 339 X, Spring 2010

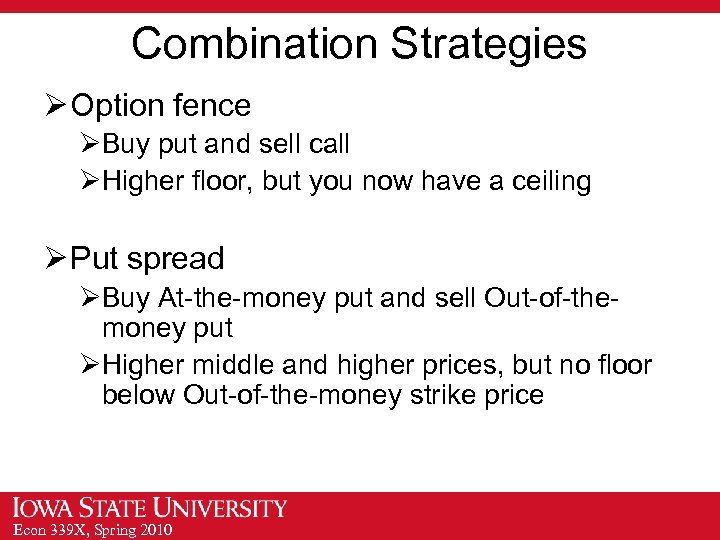

Combination Strategies Ø Option fence ØBuy put and sell call ØHigher floor, but you now have a ceiling Ø Put spread ØBuy At-the-money put and sell Out-of-themoney put ØHigher middle and higher prices, but no floor below Out-of-the-money strike price Econ 339 X, Spring 2010

Combination Strategies Ø Option fence ØBuy put and sell call ØHigher floor, but you now have a ceiling Ø Put spread ØBuy At-the-money put and sell Out-of-themoney put ØHigher middle and higher prices, but no floor below Out-of-the-money strike price Econ 339 X, Spring 2010

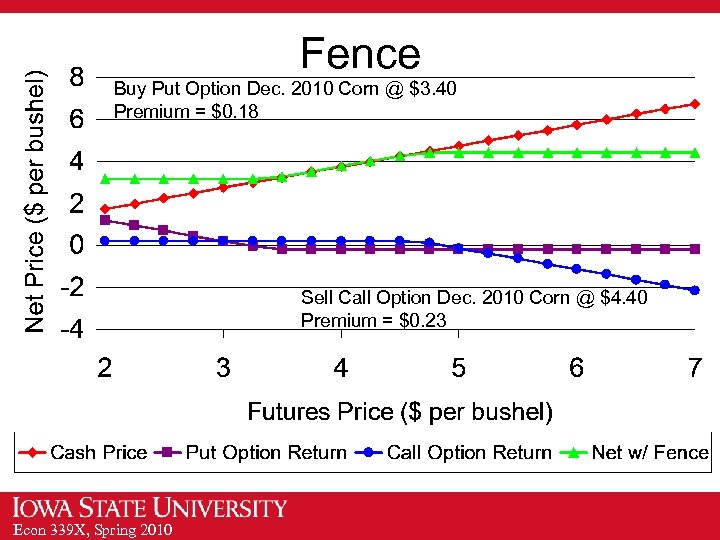

Fence Buy Put Option Dec. 2010 Corn @ $3. 40 Premium = $0. 18 Sell Call Option Dec. 2010 Corn @ $4. 40 Premium = $0. 23 Econ 339 X, Spring 2010

Fence Buy Put Option Dec. 2010 Corn @ $3. 40 Premium = $0. 18 Sell Call Option Dec. 2010 Corn @ $4. 40 Premium = $0. 23 Econ 339 X, Spring 2010

Summary on Options Ø Buyer ØPays premium, has limited risk and unlimited potential Ø Seller ØReceives premium, has limited potential and unlimited risk Ø Buying puts ØEstablish minimum prices Ø Buying calls ØEstablish maximum prices Econ 339 X, Spring 2010

Summary on Options Ø Buyer ØPays premium, has limited risk and unlimited potential Ø Seller ØReceives premium, has limited potential and unlimited risk Ø Buying puts ØEstablish minimum prices Ø Buying calls ØEstablish maximum prices Econ 339 X, Spring 2010

Class web site: http: //www. econ. iastate. edu/classes/econ 339/hartlawrence/ Econ 339 X, Spring 2010

Class web site: http: //www. econ. iastate. edu/classes/econ 339/hartlawrence/ Econ 339 X, Spring 2010