9a761d15ff08f95f2c08b91cc4e691c5.ppt

- Количество слайдов: 23

ECON 337: Agricultural Marketing Lee Schulz Assistant Professor lschulz@iastate. edu 515 -294 -3356

ECON 337: Agricultural Marketing Lee Schulz Assistant Professor lschulz@iastate. edu 515 -294 -3356

Market Participants Ø Speculators have no use for the physical commodity ØThey buy or sell in an attempt to profit from price movements ØAdd liquidity to the market Ø May be part of the general public, professional traders or investment managers ØShort-term – “day traders” ØLong-term – buy or sell and hold

Market Participants Ø Speculators have no use for the physical commodity ØThey buy or sell in an attempt to profit from price movements ØAdd liquidity to the market Ø May be part of the general public, professional traders or investment managers ØShort-term – “day traders” ØLong-term – buy or sell and hold

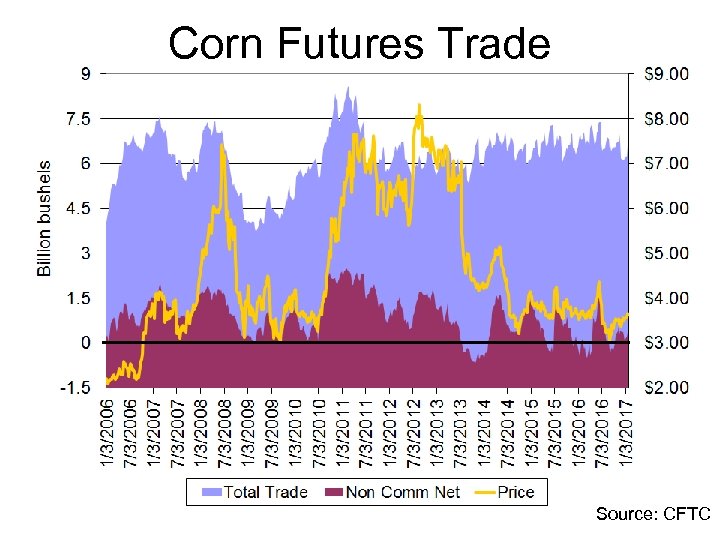

Corn Futures Trade Source: CFTC

Corn Futures Trade Source: CFTC

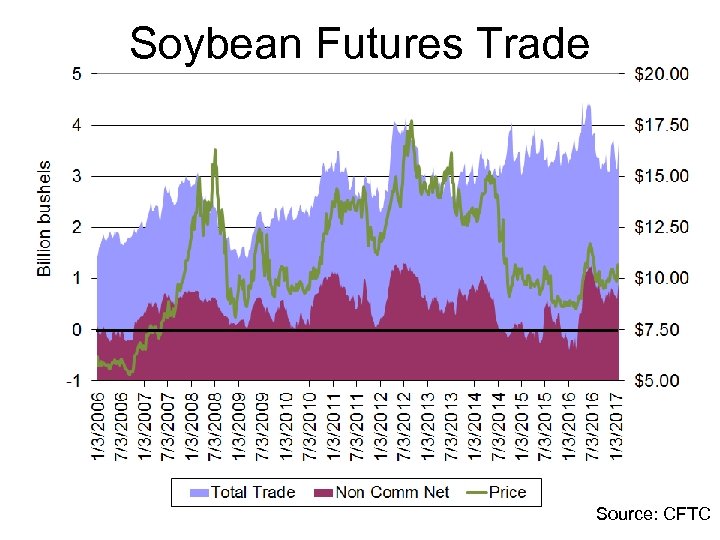

Soybean Futures Trade Source: CFTC

Soybean Futures Trade Source: CFTC

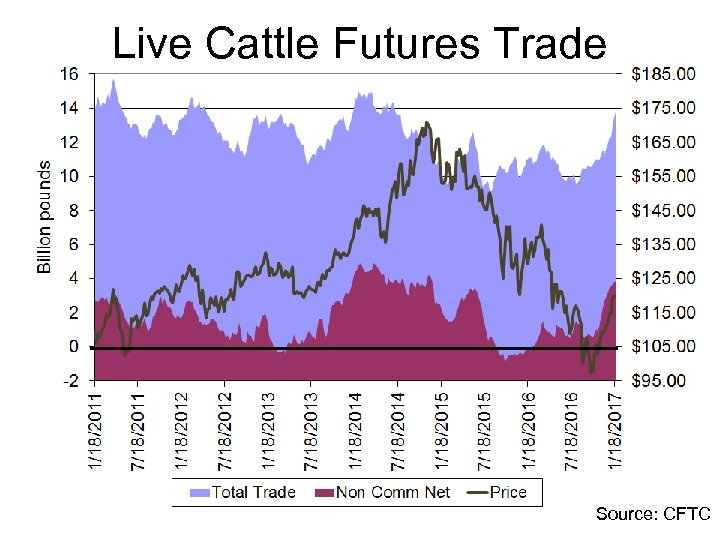

Live Cattle Futures Trade Source: CFTC

Live Cattle Futures Trade Source: CFTC

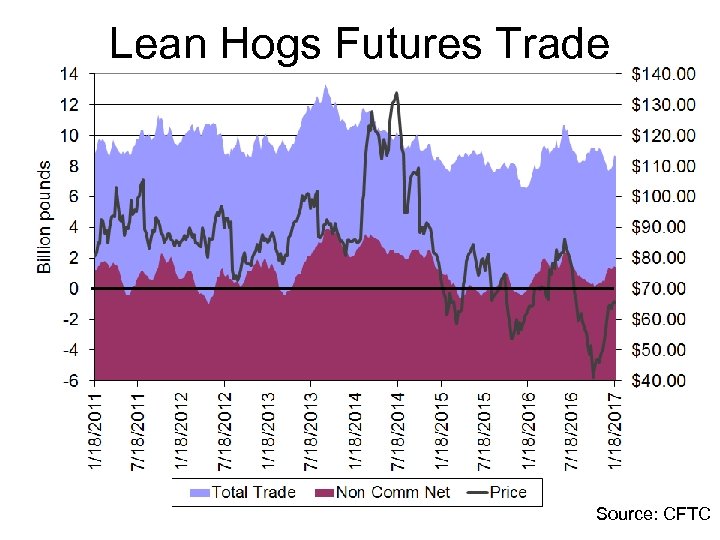

Lean Hogs Futures Trade Source: CFTC

Lean Hogs Futures Trade Source: CFTC

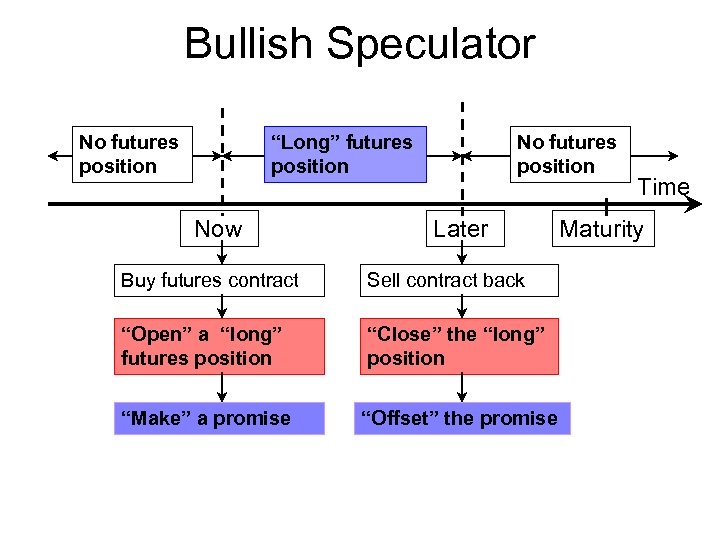

Bullish Speculator No futures position “Long” futures position Now No futures position Later Buy futures contract Sell contract back “Open” a “long” futures position “Close” the “long” position “Make” a promise “Offset” the promise Time Maturity

Bullish Speculator No futures position “Long” futures position Now No futures position Later Buy futures contract Sell contract back “Open” a “long” futures position “Close” the “long” position “Make” a promise “Offset” the promise Time Maturity

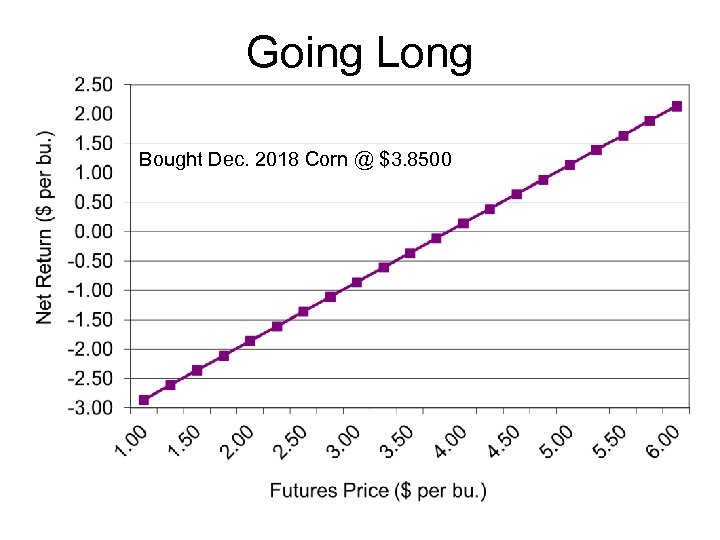

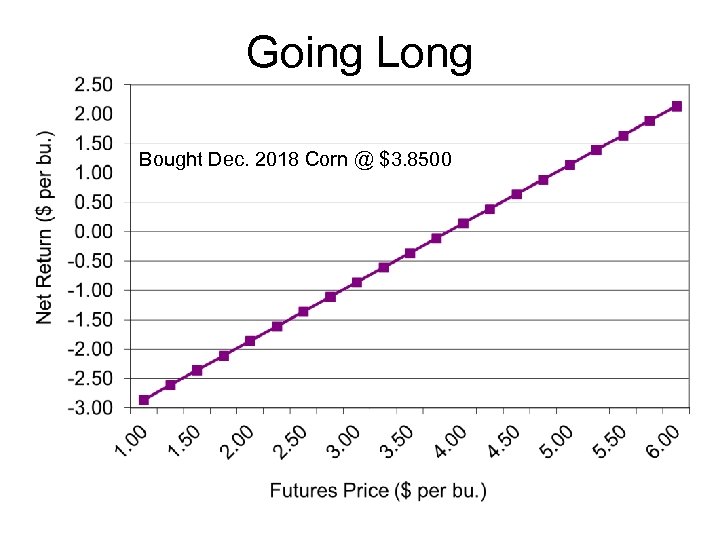

Going Long Bought Dec. 2018 Corn @ $3. 8500

Going Long Bought Dec. 2018 Corn @ $3. 8500

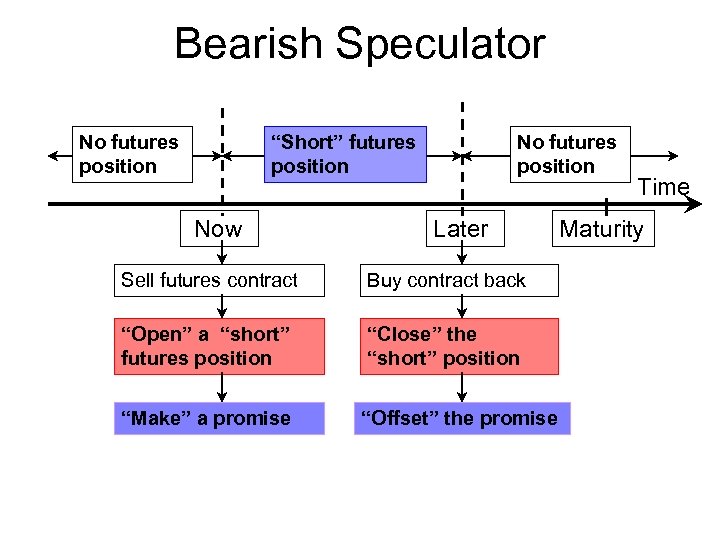

Bearish Speculator No futures position “Short” futures position Now No futures position Later Sell futures contract Buy contract back “Open” a “short” futures position “Close” the “short” position “Make” a promise “Offset” the promise Time Maturity

Bearish Speculator No futures position “Short” futures position Now No futures position Later Sell futures contract Buy contract back “Open” a “short” futures position “Close” the “short” position “Make” a promise “Offset” the promise Time Maturity

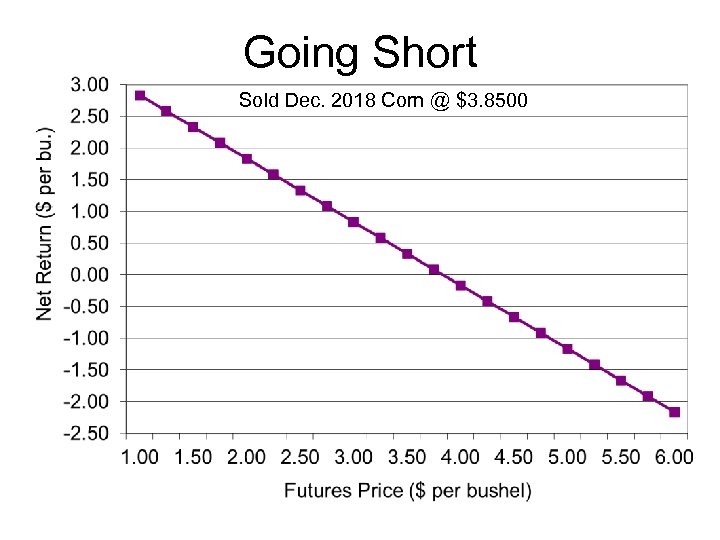

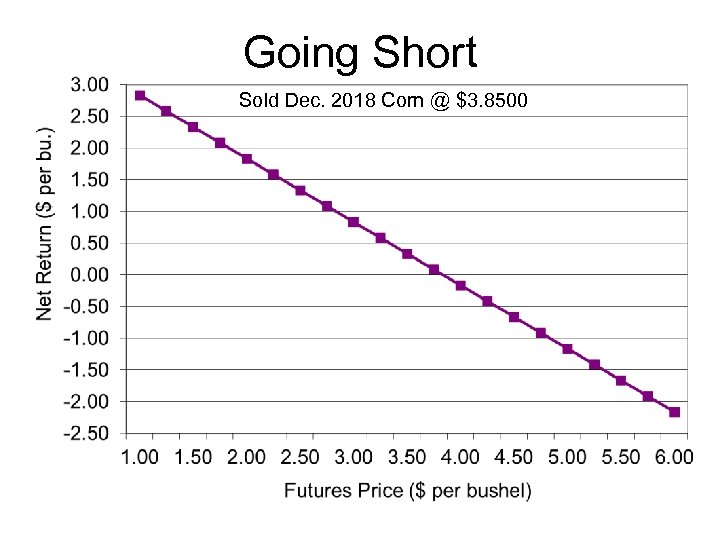

Going Short Sold Dec. 2018 Corn @ $3. 8500

Going Short Sold Dec. 2018 Corn @ $3. 8500

Speculators Ø Speculators: ØBuy or sell in an attempt to profit from favorable price movements ØFace the risk of losses from unfavorable price movements ØDo not produce or consume the commodity ØBenefit the market because they add liquidity ØOften trade the news of the day

Speculators Ø Speculators: ØBuy or sell in an attempt to profit from favorable price movements ØFace the risk of losses from unfavorable price movements ØDo not produce or consume the commodity ØBenefit the market because they add liquidity ØOften trade the news of the day

Why Speculators Like Futures Markets ØRelatively little capital required ØInitial margin, margin calls ØNo need to handle commodity (e. g. , transportation, storage, cleaning) ØEasy to speculate on either side of the market (Up or Down)

Why Speculators Like Futures Markets ØRelatively little capital required ØInitial margin, margin calls ØNo need to handle commodity (e. g. , transportation, storage, cleaning) ØEasy to speculate on either side of the market (Up or Down)

How Would You Speculate? Ø Flooding is projected for Iowa Ø Reports of a bumper crop in Brazilian soybeans Ø Rumors of foot and mouth disease in the U. S. Ø Inflation is projected to rise

How Would You Speculate? Ø Flooding is projected for Iowa Ø Reports of a bumper crop in Brazilian soybeans Ø Rumors of foot and mouth disease in the U. S. Ø Inflation is projected to rise

Day Traders Ø Looking for quick within-day price moves Ø Might be “long” today and “short” tomorrow Ø Limit the risk they face by limiting their amount of time in the market

Day Traders Ø Looking for quick within-day price moves Ø Might be “long” today and “short” tomorrow Ø Limit the risk they face by limiting their amount of time in the market

Going Short Sold Dec. 2018 Corn @ $3. 8500

Going Short Sold Dec. 2018 Corn @ $3. 8500

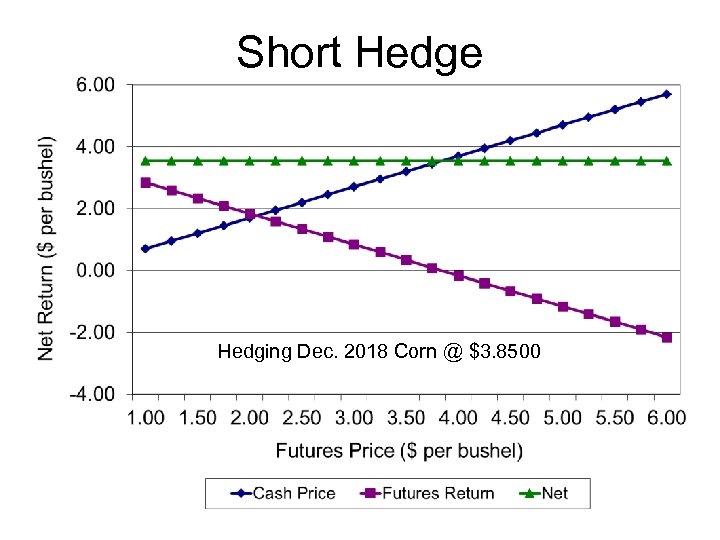

Short Hedge Hedging Dec. 2018 Corn @ $3. 8500

Short Hedge Hedging Dec. 2018 Corn @ $3. 8500

Going Long Bought Dec. 2018 Corn @ $3. 8500

Going Long Bought Dec. 2018 Corn @ $3. 8500

Long Hedge Hedging Dec. 2018 Corn @ $3. 8500

Long Hedge Hedging Dec. 2018 Corn @ $3. 8500

Cash Contracts Ø When we talk about a cash contract, it is an agreement between a seller and a buyer covering a quantity and quality of a product to be delivered at a specified location and time for a specific price Ø If the time is now, we call it a “cash” contract Ø If the time is sometime in the future, then it’s a “forward cash” contract

Cash Contracts Ø When we talk about a cash contract, it is an agreement between a seller and a buyer covering a quantity and quality of a product to be delivered at a specified location and time for a specific price Ø If the time is now, we call it a “cash” contract Ø If the time is sometime in the future, then it’s a “forward cash” contract

Cash Bids Key Coop http: //www. keycoop. com/cash-bids Heartland Coop https: //myaccount. heartlandcoop. com/bids. htm Cargill https: //www. cargillag. com/Local. Bids/Find. ALocation West Central Coop http: //www. west-central. com/grain/west-central-bids/default. aspx

Cash Bids Key Coop http: //www. keycoop. com/cash-bids Heartland Coop https: //myaccount. heartlandcoop. com/bids. htm Cargill https: //www. cargillag. com/Local. Bids/Find. ALocation West Central Coop http: //www. west-central. com/grain/west-central-bids/default. aspx

The Highest Cash Price Is … … Not always the highest return Need to think about transportation and storage costs Compare the cash prices we’ve seen today: Ø If storage is costing me 3 cents/bushel/month, do the May bids look better than the current cash price? Ø If transportation is costing me 0. 5 cents/bushel/mile, which is the better price? Boone (16 miles) Gilbert (8 miles) Nevada (10 miles) Alleman (16 miles) Eddyville (100 miles)

The Highest Cash Price Is … … Not always the highest return Need to think about transportation and storage costs Compare the cash prices we’ve seen today: Ø If storage is costing me 3 cents/bushel/month, do the May bids look better than the current cash price? Ø If transportation is costing me 0. 5 cents/bushel/mile, which is the better price? Boone (16 miles) Gilbert (8 miles) Nevada (10 miles) Alleman (16 miles) Eddyville (100 miles)

Cash vs. Futures Hedge Ø Cash Sales Ø Locks in full price and delivery terms Ø No margin requirements Ø Futures Hedge Ø Locks in futures price, but leaves basis open Ø Could see price improvement/loss Ø Can be easily offset if problems arise

Cash vs. Futures Hedge Ø Cash Sales Ø Locks in full price and delivery terms Ø No margin requirements Ø Futures Hedge Ø Locks in futures price, but leaves basis open Ø Could see price improvement/loss Ø Can be easily offset if problems arise

Class web site: http: //www 2. econ. iastate. edu/faculty/hart/Classes/eco n 337/Spring 2018/index. htm Have a great weekend!

Class web site: http: //www 2. econ. iastate. edu/faculty/hart/Classes/eco n 337/Spring 2018/index. htm Have a great weekend!