ECON 308 Week 6 Chapter 6: Market Structure

ECON 308 Week 6 Chapter 6: Market Structure

Market structure: Objectives • Students should be able to • Differentiate among the four archetypal market structures • Distinguish between price takers and price searchers

Market structure: Objectives • Students should be able to • Differentiate among the four archetypal market structures • Distinguish between price takers and price searchers

Market structure • What is a market? • All firms and individuals willing and able to buy or sell a particular product • What is market structure? • Defined by attributes of the market environment

Market structure • What is a market? • All firms and individuals willing and able to buy or sell a particular product • What is market structure? • Defined by attributes of the market environment

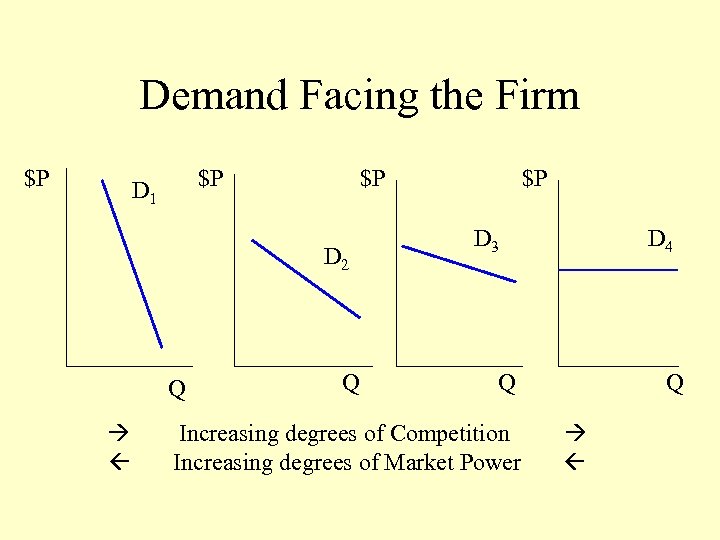

Demand Facing the Firm $P $P D 1 $P D 2 Q Q $P D 3 D 4 Q Increasing degrees of Competition Increasing degrees of Market Power Q

Demand Facing the Firm $P $P D 1 $P D 2 Q Q $P D 3 D 4 Q Increasing degrees of Competition Increasing degrees of Market Power Q

Market structure the archetypes • • Monopoly Oligopoly Monopolistic competition Perfect competition

Market structure the archetypes • • Monopoly Oligopoly Monopolistic competition Perfect competition

Alternative Market Structures The Most Competitive Case: The Price Taker Firm

Alternative Market Structures The Most Competitive Case: The Price Taker Firm

Perfect competition = Price Taker Characteristics • • Many buyers and sellers Product homogeneity Low cost and accurate information Free entry and exit • Best regarded as a benchmark

Perfect competition = Price Taker Characteristics • • Many buyers and sellers Product homogeneity Low cost and accurate information Free entry and exit • Best regarded as a benchmark

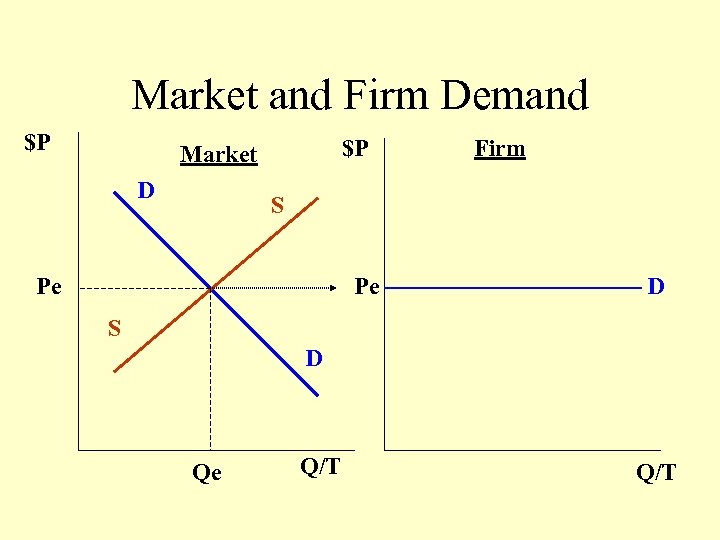

Market and Firm Demand $P $P Market D Firm S Pe Pe D S D Qe Q/T

Market and Firm Demand $P $P Market D Firm S Pe Pe D S D Qe Q/T

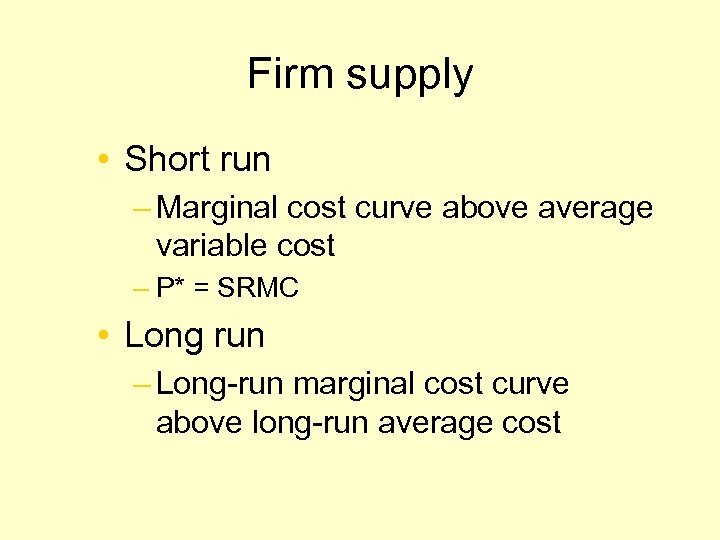

Firm supply • Short run – Marginal cost curve above average variable cost – P* = SRMC • Long run – Long-run marginal cost curve above long-run average cost

Firm supply • Short run – Marginal cost curve above average variable cost – P* = SRMC • Long run – Long-run marginal cost curve above long-run average cost

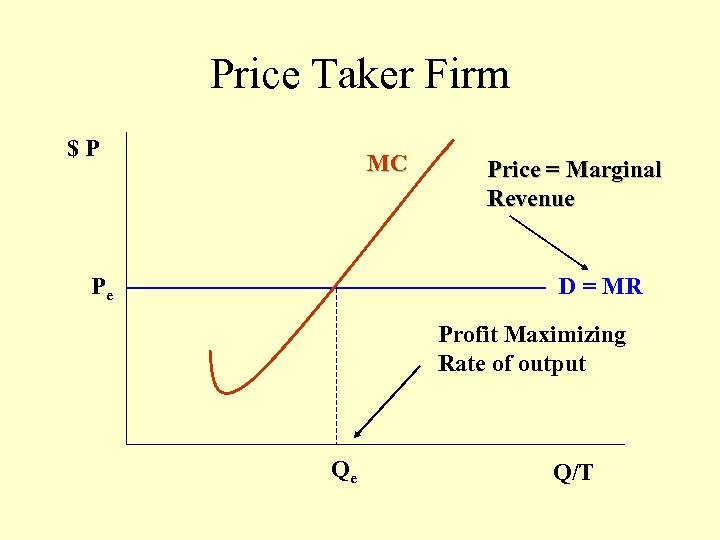

Price Taker Firm $P MC Pe Price = Marginal Revenue D = MR Profit Maximizing Rate of output Qe Q/T

Price Taker Firm $P MC Pe Price = Marginal Revenue D = MR Profit Maximizing Rate of output Qe Q/T

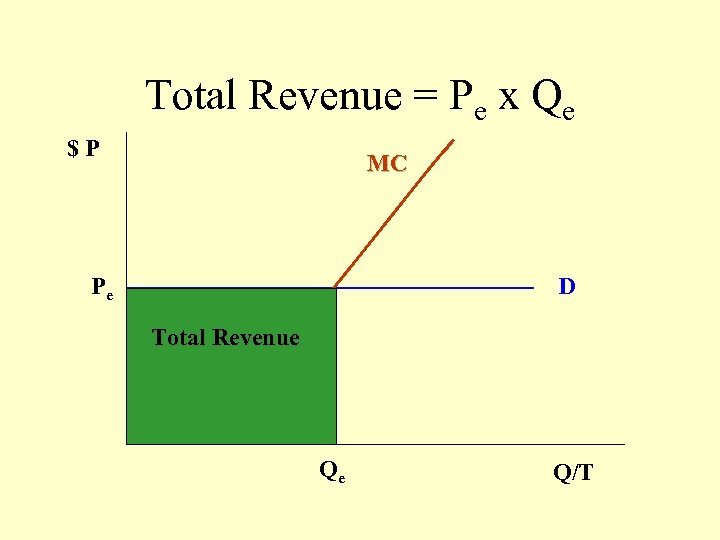

Total Revenue = Pe x Qe $P MC Pe D Total Revenue Qe Q/T

Total Revenue = Pe x Qe $P MC Pe D Total Revenue Qe Q/T

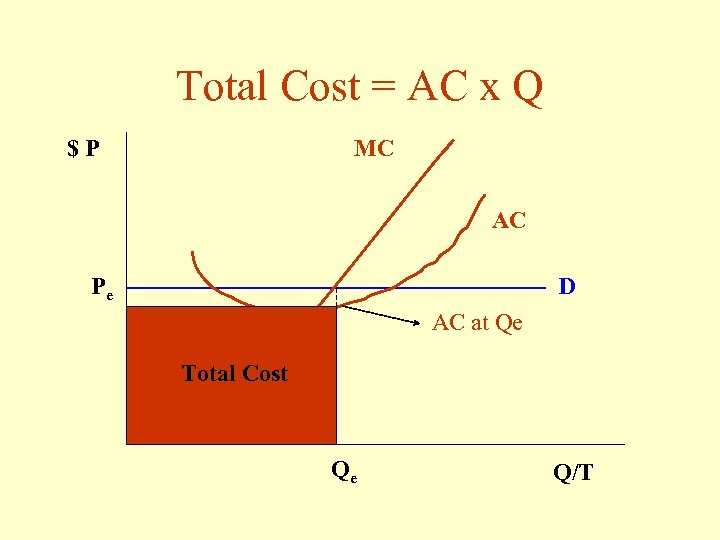

Total Cost = AC x Q $P MC AC Pe D AC at Qe Total Cost Qe Q/T

Total Cost = AC x Q $P MC AC Pe D AC at Qe Total Cost Qe Q/T

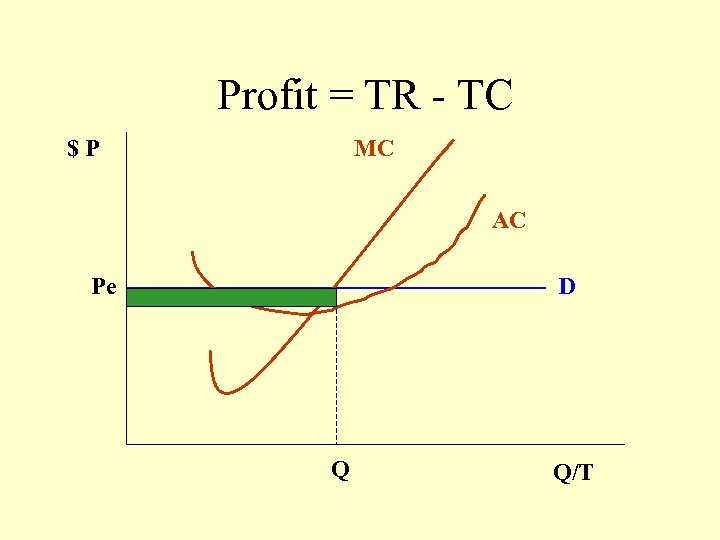

Profit = TR - TC $P MC AC Pe D Q Q/T

Profit = TR - TC $P MC AC Pe D Q Q/T

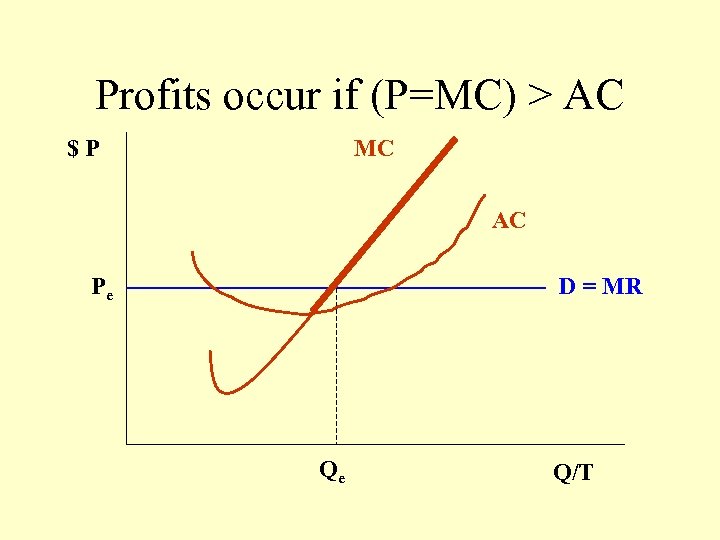

Profits occur if (P=MC) > AC $P MC AC Pe D = MR Qe Q/T

Profits occur if (P=MC) > AC $P MC AC Pe D = MR Qe Q/T

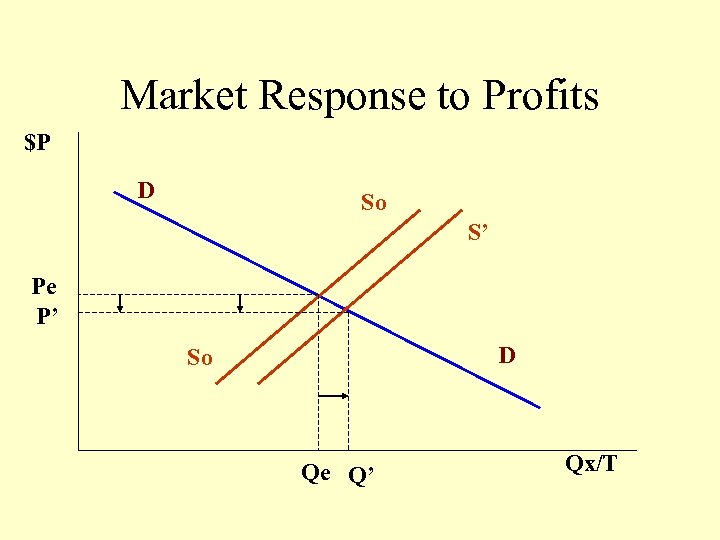

Market Response to Profits $P D So S’ Pe P’ D So Qe Q’ Qx/T

Market Response to Profits $P D So S’ Pe P’ D So Qe Q’ Qx/T

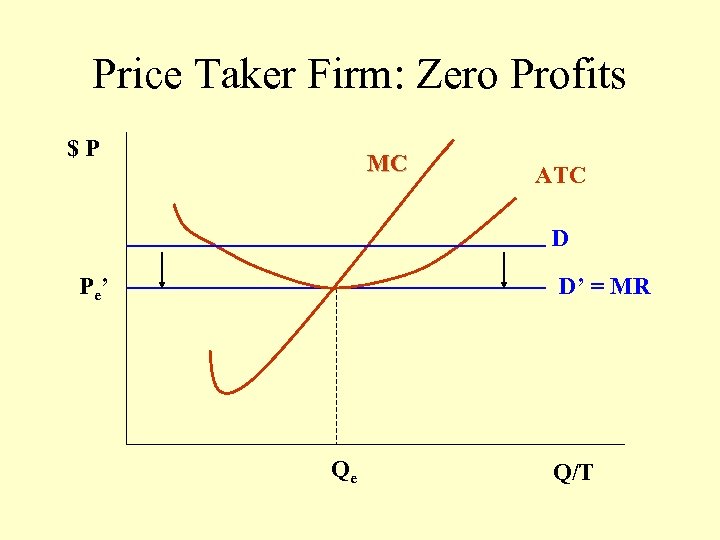

Price Taker Firm: Zero Profits $P MC ATC D P e’ D’ = MR Qe Q/T

Price Taker Firm: Zero Profits $P MC ATC D P e’ D’ = MR Qe Q/T

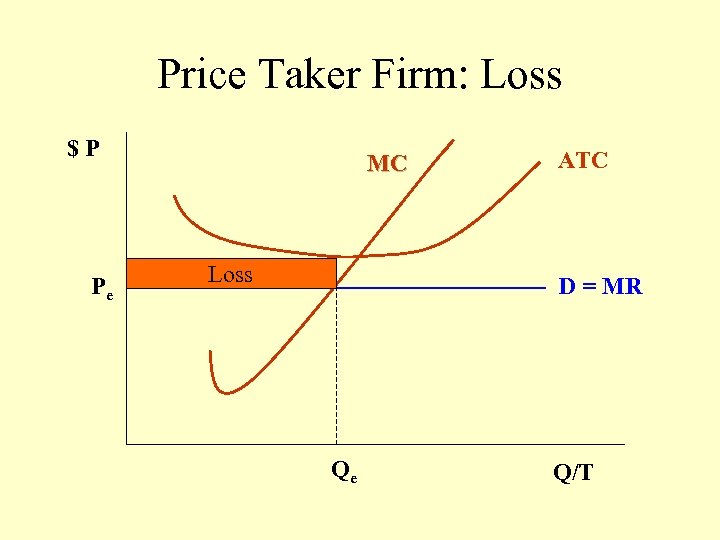

Price Taker Firm: Loss $P Pe MC Loss ATC D = MR Qe Q/T

Price Taker Firm: Loss $P Pe MC Loss ATC D = MR Qe Q/T

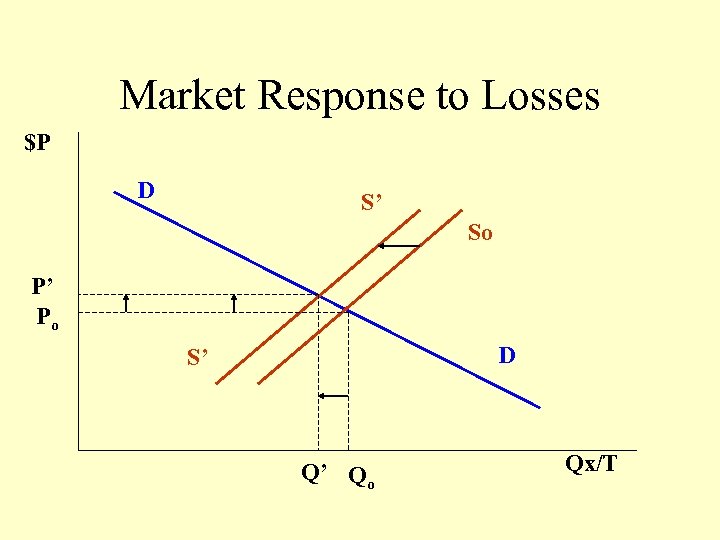

Market Response to Losses $P D S’ So P’ Po D S’ Q’ Qo Qx/T

Market Response to Losses $P D S’ So P’ Po D S’ Q’ Qo Qx/T

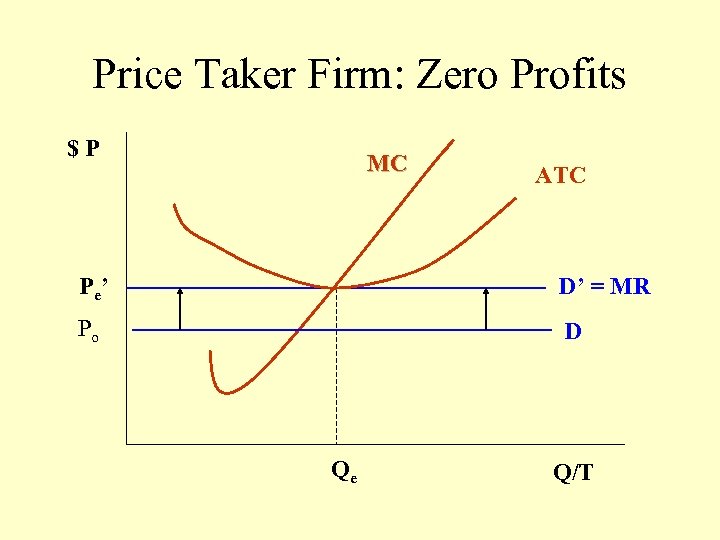

Price Taker Firm: Zero Profits $P MC ATC P e’ D’ = MR Po D Qe Q/T

Price Taker Firm: Zero Profits $P MC ATC P e’ D’ = MR Po D Qe Q/T

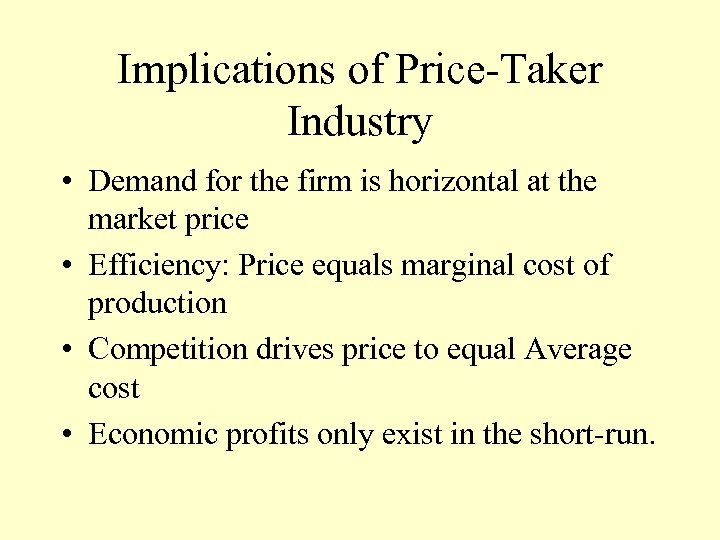

Implications of Price-Taker Industry • Demand for the firm is horizontal at the market price • Efficiency: Price equals marginal cost of production • Competition drives price to equal Average cost • Economic profits only exist in the short-run.

Implications of Price-Taker Industry • Demand for the firm is horizontal at the market price • Efficiency: Price equals marginal cost of production • Competition drives price to equal Average cost • Economic profits only exist in the short-run.

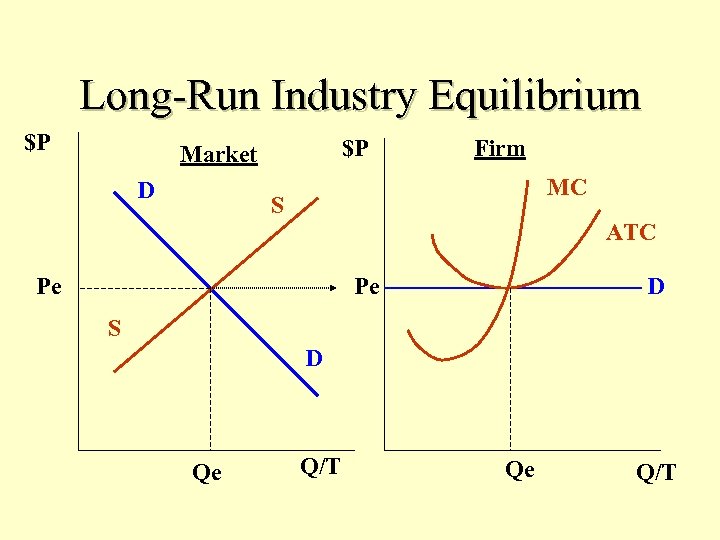

Long-Run Industry Equilibrium $P $P Market D Firm MC S ATC Pe Pe D S D Qe Q/T

Long-Run Industry Equilibrium $P $P Market D Firm MC S ATC Pe Pe D S D Qe Q/T

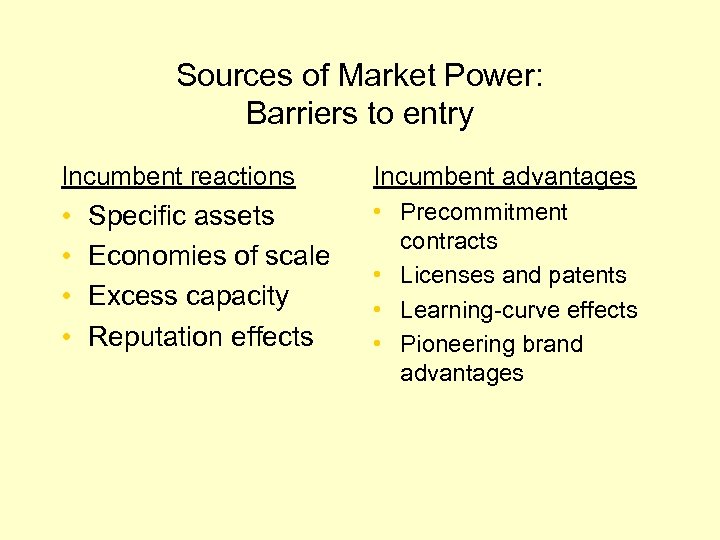

Sources of Market Power: Barriers to entry Incumbent reactions Incumbent advantages • • • Precommitment contracts • Licenses and patents • Learning-curve effects • Pioneering brand advantages Specific assets Economies of scale Excess capacity Reputation effects

Sources of Market Power: Barriers to entry Incumbent reactions Incumbent advantages • • • Precommitment contracts • Licenses and patents • Learning-curve effects • Pioneering brand advantages Specific assets Economies of scale Excess capacity Reputation effects

Monopoly • Strong barriers to entry single supplier • Profit maximization – faces market demand sets MR=MC • Unexploited gains from trade

Monopoly • Strong barriers to entry single supplier • Profit maximization – faces market demand sets MR=MC • Unexploited gains from trade

Oligopoly • A few firms produce most market output • Products may or may not be differentiated • Effective entry barriers protect firm profitability • Firm interdependence requires strategic thinking

Oligopoly • A few firms produce most market output • Products may or may not be differentiated • Effective entry barriers protect firm profitability • Firm interdependence requires strategic thinking

Monopolistic competition • • Multiple firms produce similar products Firms face downsloping demand curves Profit maximization occurs where MC=MR In the limit, firms compete away economic profits

Monopolistic competition • • Multiple firms produce similar products Firms face downsloping demand curves Profit maximization occurs where MC=MR In the limit, firms compete away economic profits