b147d5c85458aa328d9fd9fba9c2a705.ppt

- Количество слайдов: 51

ECON 152 – PRINCIPLES OF MICROECONOMICS Chapter 24: Perfect Competition Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved.

ECON 152 – PRINCIPLES OF MICROECONOMICS Chapter 24: Perfect Competition Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved.

Characteristics of a Perfectly Competitive Market Structure n Perfect Competition ¨A market structure in which the decisions of individual buyers and sellers have no effect on market price n Perfectly Competitive Firm ¨A firm that is such a small part of the total industry that it cannot affect the price of the product or service that it sells 2

Characteristics of a Perfectly Competitive Market Structure n Perfect Competition ¨A market structure in which the decisions of individual buyers and sellers have no effect on market price n Perfectly Competitive Firm ¨A firm that is such a small part of the total industry that it cannot affect the price of the product or service that it sells 2

Characteristics of a Perfectly Competitive Market Structure n Price Taker ¨A competitive firm that must take the price of its product as given because the firm cannot influence its price 3

Characteristics of a Perfectly Competitive Market Structure n Price Taker ¨A competitive firm that must take the price of its product as given because the firm cannot influence its price 3

Characteristics of a Perfectly Competitive Market Structure n Price taker: ¨A firm can sell as much as wants at the going market price. ¨ There is no incentive to sell for a lower price. ¨ Attempts to charge a higher price will result in no sales. 4

Characteristics of a Perfectly Competitive Market Structure n Price taker: ¨A firm can sell as much as wants at the going market price. ¨ There is no incentive to sell for a lower price. ¨ Attempts to charge a higher price will result in no sales. 4

Characteristics of a Perfectly Competitive Market Structure n Characteristics of perfect competition ¨ Large number of buyers and sellers ¨ Homogenous products n When you buy a head of lettuce do you ask what farm it came from? ¨ No barriers to entry or exit ¨ Buyers and sellers have equal access to information 5

Characteristics of a Perfectly Competitive Market Structure n Characteristics of perfect competition ¨ Large number of buyers and sellers ¨ Homogenous products n When you buy a head of lettuce do you ask what farm it came from? ¨ No barriers to entry or exit ¨ Buyers and sellers have equal access to information 5

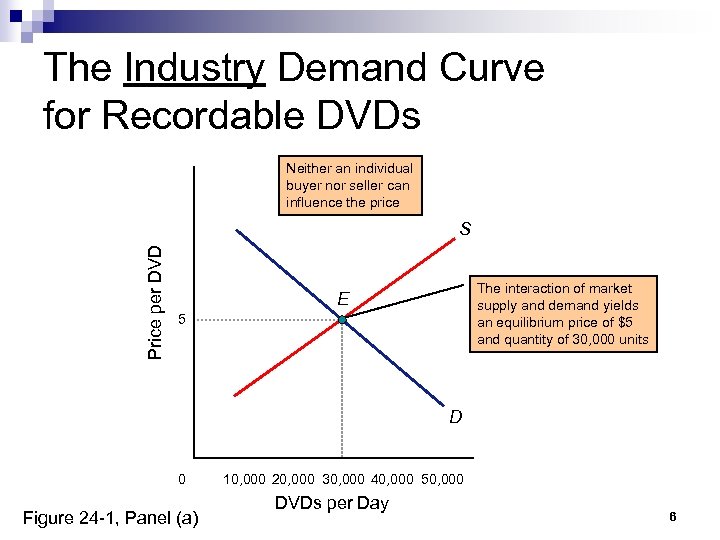

The Industry Demand Curve for Recordable DVDs Neither an individual buyer nor seller can influence the price Price per DVD S The interaction of market supply and demand yields an equilibrium price of $5 and quantity of 30, 000 units E 5 D 0 Figure 24 -1, Panel (a) 10, 000 20, 000 30, 000 40, 000 50, 000 DVDs per Day 6

The Industry Demand Curve for Recordable DVDs Neither an individual buyer nor seller can influence the price Price per DVD S The interaction of market supply and demand yields an equilibrium price of $5 and quantity of 30, 000 units E 5 D 0 Figure 24 -1, Panel (a) 10, 000 20, 000 30, 000 40, 000 50, 000 DVDs per Day 6

The Demand Curve of the Perfect Competitor n The perfectly competitive firm: ¨ ¨ Is a price taker (i. e. , must sell for $5) Will sell all units for $5 Will not be able to sell at a higher price Will not choose to sell more units at a lower price 7

The Demand Curve of the Perfect Competitor n The perfectly competitive firm: ¨ ¨ Is a price taker (i. e. , must sell for $5) Will sell all units for $5 Will not be able to sell at a higher price Will not choose to sell more units at a lower price 7

The Demand Curve Facing the Perfectly Competitive Firm Figure 24 -1, Panels (a) and (b) 8

The Demand Curve Facing the Perfectly Competitive Firm Figure 24 -1, Panels (a) and (b) 8

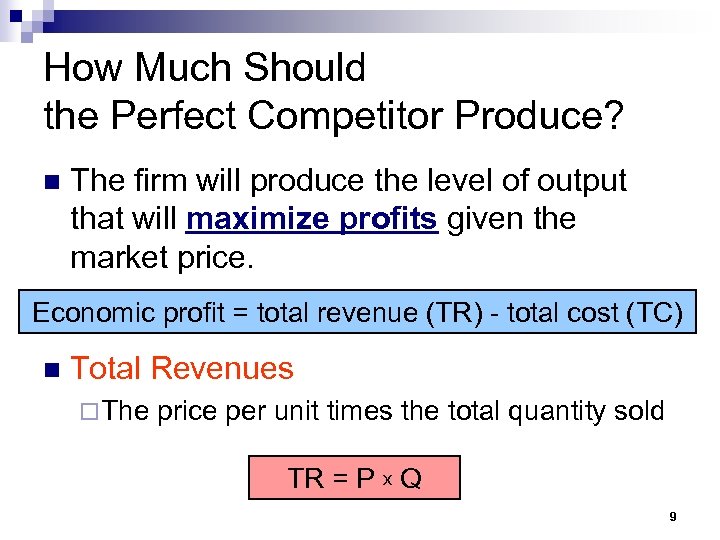

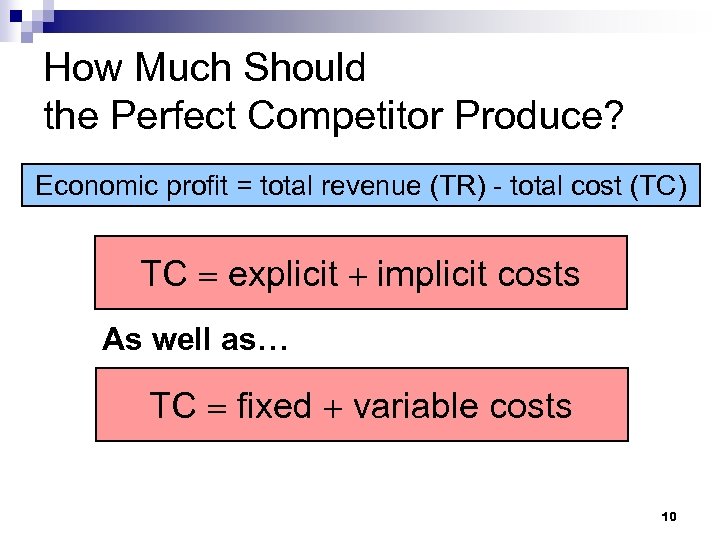

How Much Should the Perfect Competitor Produce? n The firm will produce the level of output that will maximize profits given the market price. Economic profit = total revenue (TR) - total cost (TC) n Total Revenues ¨ The price per unit times the total quantity sold TR = P x Q 9

How Much Should the Perfect Competitor Produce? n The firm will produce the level of output that will maximize profits given the market price. Economic profit = total revenue (TR) - total cost (TC) n Total Revenues ¨ The price per unit times the total quantity sold TR = P x Q 9

How Much Should the Perfect Competitor Produce? Economic profit = total revenue (TR) - total cost (TC) TC explicit + implicit costs As well as… TC fixed + variable costs 10

How Much Should the Perfect Competitor Produce? Economic profit = total revenue (TR) - total cost (TC) TC explicit + implicit costs As well as… TC fixed + variable costs 10

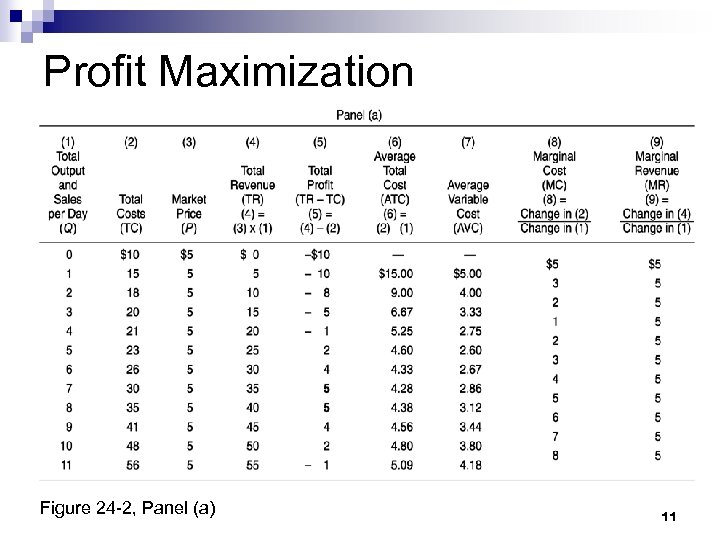

Profit Maximization Figure 24 -2, Panel (a) 11

Profit Maximization Figure 24 -2, Panel (a) 11

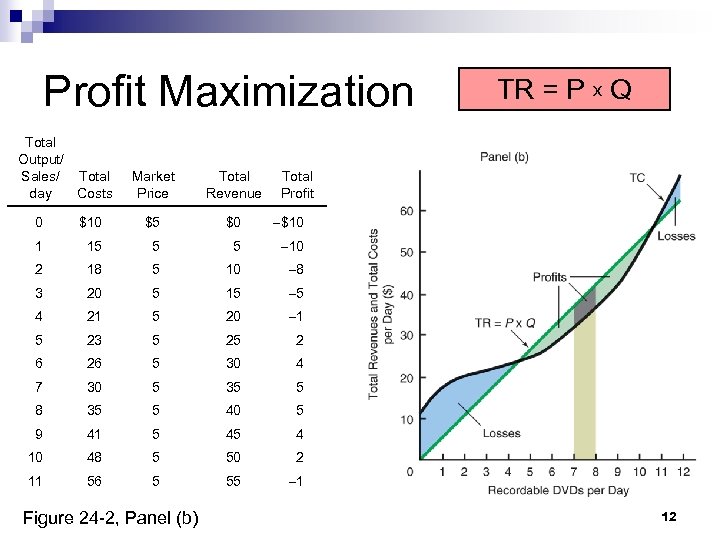

Profit Maximization Total Output/ Sales/ Total day Costs Market Price Total Revenue TR = P x Q Total Profit 0 $10 $5 $0 $10 1 15 5 5 10 2 18 5 10 8 3 20 5 15 5 4 21 5 20 1 5 23 5 25 2 6 26 5 30 4 7 30 5 35 5 8 35 5 40 5 9 41 5 45 4 10 48 5 50 2 11 56 5 55 1 Figure 24 -2, Panel (b) 12

Profit Maximization Total Output/ Sales/ Total day Costs Market Price Total Revenue TR = P x Q Total Profit 0 $10 $5 $0 $10 1 15 5 5 10 2 18 5 10 8 3 20 5 15 5 4 21 5 20 1 5 23 5 25 2 6 26 5 30 4 7 30 5 35 5 8 35 5 40 5 9 41 5 45 4 10 48 5 50 2 11 56 5 55 1 Figure 24 -2, Panel (b) 12

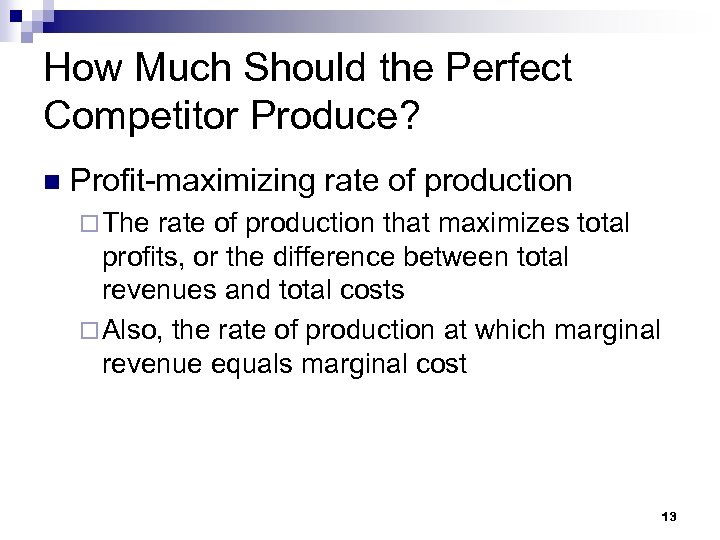

How Much Should the Perfect Competitor Produce? n Profit-maximizing rate of production ¨ The rate of production that maximizes total profits, or the difference between total revenues and total costs ¨ Also, the rate of production at which marginal revenue equals marginal cost 13

How Much Should the Perfect Competitor Produce? n Profit-maximizing rate of production ¨ The rate of production that maximizes total profits, or the difference between total revenues and total costs ¨ Also, the rate of production at which marginal revenue equals marginal cost 13

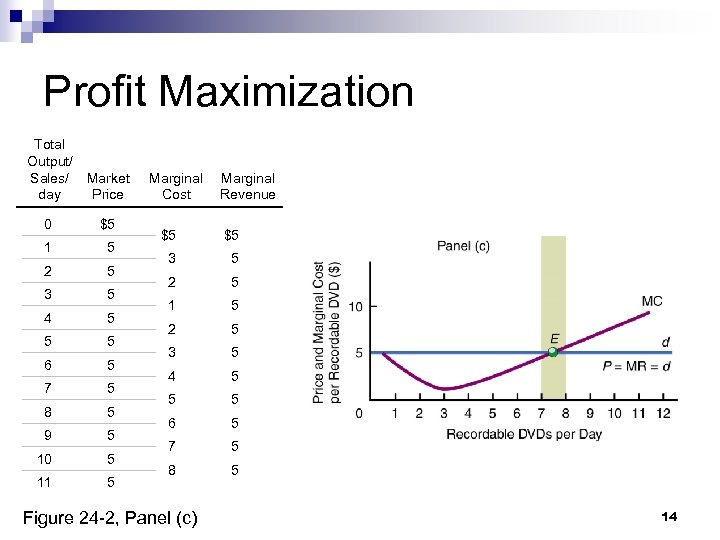

Profit Maximization Total Output/ Sales/ Market day Price 0 $5 1 5 2 5 3 5 4 5 5 5 6 5 7 5 8 5 9 5 10 5 11 5 Marginal Cost Marginal Revenue $5 $5 3 5 2 5 1 5 2 5 3 5 4 5 5 5 6 5 7 5 8 5 Figure 24 -2, Panel (c) 14

Profit Maximization Total Output/ Sales/ Market day Price 0 $5 1 5 2 5 3 5 4 5 5 5 6 5 7 5 8 5 9 5 10 5 11 5 Marginal Cost Marginal Revenue $5 $5 3 5 2 5 1 5 2 5 3 5 4 5 5 5 6 5 7 5 8 5 Figure 24 -2, Panel (c) 14

Using Marginal Analysis to Determine the Profit-Maximizing Rate of Production Marginal revenue is the change in total revenue divided by the change in output n Marginal cost is the change in total cost divided by the change in output n 15

Using Marginal Analysis to Determine the Profit-Maximizing Rate of Production Marginal revenue is the change in total revenue divided by the change in output n Marginal cost is the change in total cost divided by the change in output n 15

Using Marginal Analysis to Determine the Profit-Maximizing Rate of Production n Profit maximization ¨ Economic profits = TR TC ¨Profit-maximizing output occurs when MC = MR ¨ For a perfectly competitive firm, this is at the intersection of the firm’s demand curve and its marginal cost curve since price equals marginal revenue. 16

Using Marginal Analysis to Determine the Profit-Maximizing Rate of Production n Profit maximization ¨ Economic profits = TR TC ¨Profit-maximizing output occurs when MC = MR ¨ For a perfectly competitive firm, this is at the intersection of the firm’s demand curve and its marginal cost curve since price equals marginal revenue. 16

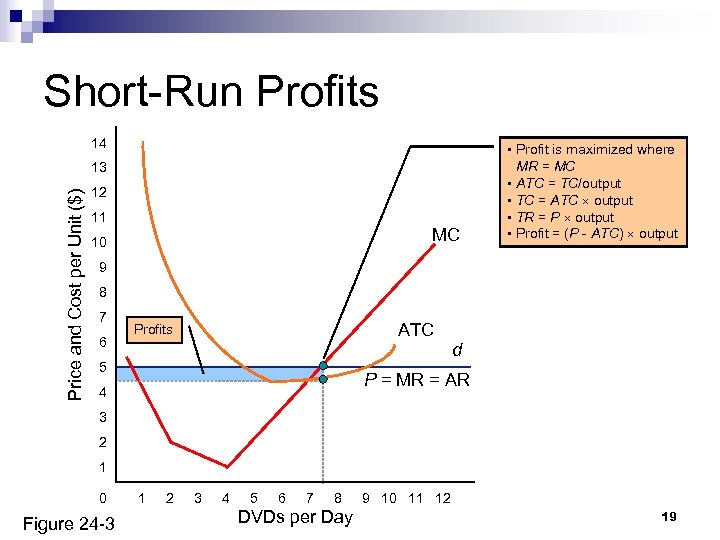

Short-Run Profits n To find out what our competitive individual DVD producer is making in terms of profits per unit produced in the short run, we have to determine the excess of price above average total cost. 17

Short-Run Profits n To find out what our competitive individual DVD producer is making in terms of profits per unit produced in the short run, we have to determine the excess of price above average total cost. 17

Short-Run Profits 14 Price and Cost per Unit ($) 13 12 11 10 • Recall: Profits are maximized at 7. 5 units where MC = MR. • How do we measure profits? 9 8 7 6 5 4 3 2 1 0 1 2 3 4 5 6 7 8 DVDs per Day 9 10 11 12 18

Short-Run Profits 14 Price and Cost per Unit ($) 13 12 11 10 • Recall: Profits are maximized at 7. 5 units where MC = MR. • How do we measure profits? 9 8 7 6 5 4 3 2 1 0 1 2 3 4 5 6 7 8 DVDs per Day 9 10 11 12 18

Short-Run Profits 14 Price and Cost per Unit ($) 13 12 11 MC 10 • Profit is maximized where MR = MC • ATC = TC/output • TC = ATC output • TR = P output • Profit = (P - ATC) output 9 8 7 6 ATC Profits 5 d P = MR = AR 4 3 2 1 0 Figure 24 -3 1 2 3 4 5 6 7 8 DVDs per Day 9 10 11 12 19

Short-Run Profits 14 Price and Cost per Unit ($) 13 12 11 MC 10 • Profit is maximized where MR = MC • ATC = TC/output • TC = ATC output • TR = P output • Profit = (P - ATC) output 9 8 7 6 ATC Profits 5 d P = MR = AR 4 3 2 1 0 Figure 24 -3 1 2 3 4 5 6 7 8 DVDs per Day 9 10 11 12 19

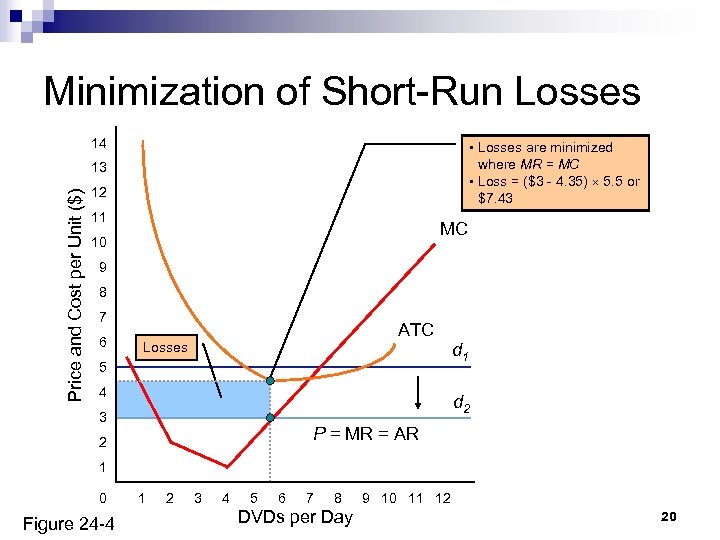

Minimization of Short-Run Losses 14 • Losses are minimized where MR = MC • Loss = ($3 - 4. 35) 5. 5 or $7. 43 Price and Cost per Unit ($) 13 12 11 MC 10 9 8 7 6 ATC Losses 5 4 d 1 d 2 3 P = MR = AR 2 1 0 Figure 24 -4 1 2 3 4 5 6 7 8 DVDs per Day 9 10 11 12 20

Minimization of Short-Run Losses 14 • Losses are minimized where MR = MC • Loss = ($3 - 4. 35) 5. 5 or $7. 43 Price and Cost per Unit ($) 13 12 11 MC 10 9 8 7 6 ATC Losses 5 4 d 1 d 2 3 P = MR = AR 2 1 0 Figure 24 -4 1 2 3 4 5 6 7 8 DVDs per Day 9 10 11 12 20

Short-Run Profits Short-run average profits or average losses are determined by comparing average total costs with price (average revenue) at the profit-maximizing rate of output. n In the short run, the perfectly competitive firm can make economic profits or economic losses. n 21

Short-Run Profits Short-run average profits or average losses are determined by comparing average total costs with price (average revenue) at the profit-maximizing rate of output. n In the short run, the perfectly competitive firm can make economic profits or economic losses. n 21

The Short-Run Shutdown Price n What do you think? ¨ Would you continue to produce if you were incurring a loss? In the short run? n In the long run? n 22

The Short-Run Shutdown Price n What do you think? ¨ Would you continue to produce if you were incurring a loss? In the short run? n In the long run? n 22

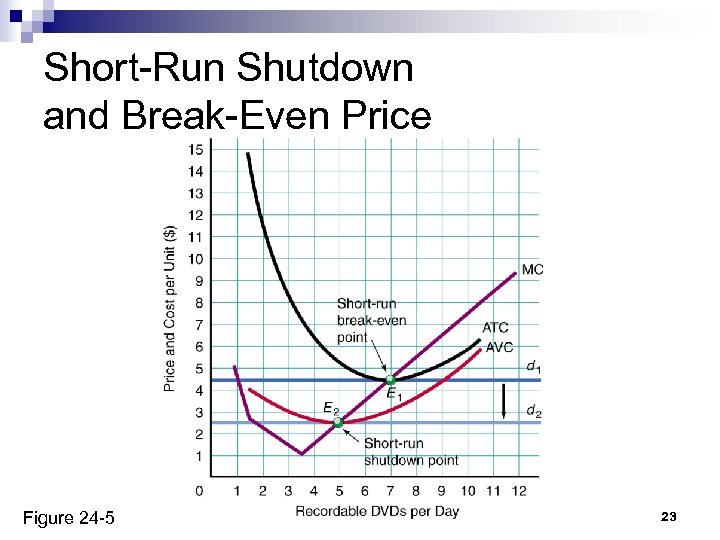

Short-Run Shutdown and Break-Even Price Figure 24 -5 23

Short-Run Shutdown and Break-Even Price Figure 24 -5 23

The Short-Run Shutdown Price n As long as the price per unit sold exceeds the average variable cost per unit produced, the firm will be covering at least part of the opportunity cost of the investment in the business—that is, part of its fixed costs. 24

The Short-Run Shutdown Price n As long as the price per unit sold exceeds the average variable cost per unit produced, the firm will be covering at least part of the opportunity cost of the investment in the business—that is, part of its fixed costs. 24

The Short-Run Shutdown Price n Short-Run Break-Even Price ¨ The price at which a firm’s total revenues equal its costs ¨ At the break-even price, the firm is just making a normal rate of return on its capital investment n Short-Run Shutdown Price ¨ The price that just covers average variable costs ¨ It occurs just below the intersection of the marginal cost curve and the average variable cost curve 25

The Short-Run Shutdown Price n Short-Run Break-Even Price ¨ The price at which a firm’s total revenues equal its costs ¨ At the break-even price, the firm is just making a normal rate of return on its capital investment n Short-Run Shutdown Price ¨ The price that just covers average variable costs ¨ It occurs just below the intersection of the marginal cost curve and the average variable cost curve 25

The Meaning of Zero Economic Profits Why produce if you are not making a profit? n Hint: n ¨ Distinguish between economic profits and accounting profits ¨ When economic profits are zero, accounting profits are positive 26

The Meaning of Zero Economic Profits Why produce if you are not making a profit? n Hint: n ¨ Distinguish between economic profits and accounting profits ¨ When economic profits are zero, accounting profits are positive 26

The Perfect Competitor’s Short-Run Supply Curve n Question ¨ What like? n does the supply curve for the individual firm look Answer ¨ The firm’s supply curve is the marginal cost curve above the short-run shutdown point. ¨ Thus, the competitive firm’s short-run supply curve is its marginal costs curve equal to and above the point of intersection with the average variable cost curve. 27

The Perfect Competitor’s Short-Run Supply Curve n Question ¨ What like? n does the supply curve for the individual firm look Answer ¨ The firm’s supply curve is the marginal cost curve above the short-run shutdown point. ¨ Thus, the competitive firm’s short-run supply curve is its marginal costs curve equal to and above the point of intersection with the average variable cost curve. 27

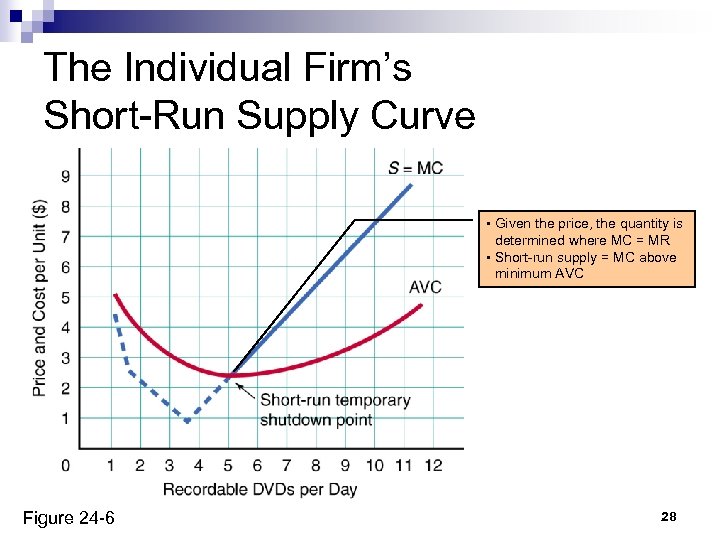

The Individual Firm’s Short-Run Supply Curve • Given the price, the quantity is determined where MC = MR • Short-run supply = MC above minimum AVC Figure 24 -6 28

The Individual Firm’s Short-Run Supply Curve • Given the price, the quantity is determined where MC = MR • Short-run supply = MC above minimum AVC Figure 24 -6 28

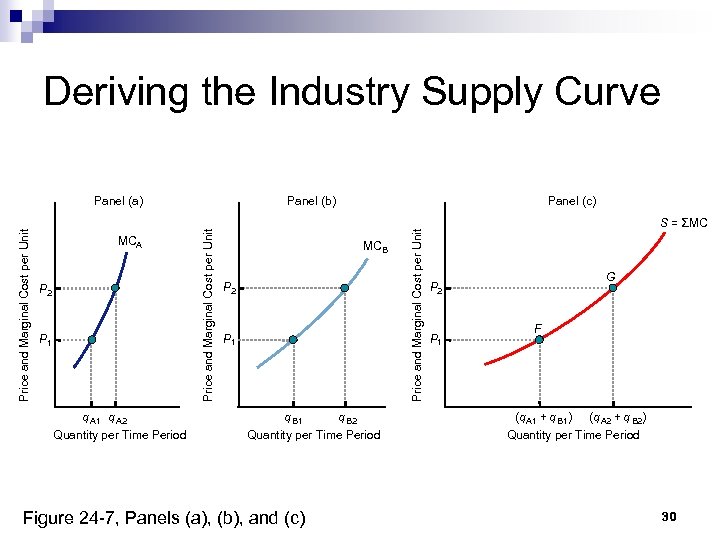

The Perfect Competitor’s Short-Run Supply Curve n The Industry Supply Curve ¨ The locus of points showing the minimum prices at which given quantities will be forthcoming 29

The Perfect Competitor’s Short-Run Supply Curve n The Industry Supply Curve ¨ The locus of points showing the minimum prices at which given quantities will be forthcoming 29

Deriving the Industry Supply Curve P 2 P 1 q A 2 Quantity per Time Period Panel (c) MCB P 2 P 1 q B 2 Quantity per Time Period Figure 24 -7, Panels (a), (b), and (c) Price and Marginal Cost per Unit MCA Panel (b) Price and Marginal Cost per Unit Panel (a) S = ΣMC G P 2 P 1 F (q A 1 + q B 1) (q A 2 + q B 2) Quantity per Time Period 30

Deriving the Industry Supply Curve P 2 P 1 q A 2 Quantity per Time Period Panel (c) MCB P 2 P 1 q B 2 Quantity per Time Period Figure 24 -7, Panels (a), (b), and (c) Price and Marginal Cost per Unit MCA Panel (b) Price and Marginal Cost per Unit Panel (a) S = ΣMC G P 2 P 1 F (q A 1 + q B 1) (q A 2 + q B 2) Quantity per Time Period 30

The Perfect Competitor’s Short-Run Supply Curve n Factors that influence the industry supply curve (determinants of supply) ¨ Firm’s productivity ¨ Factor costs ¨ Taxes and subsidies ¨ Number of firms 31

The Perfect Competitor’s Short-Run Supply Curve n Factors that influence the industry supply curve (determinants of supply) ¨ Firm’s productivity ¨ Factor costs ¨ Taxes and subsidies ¨ Number of firms 31

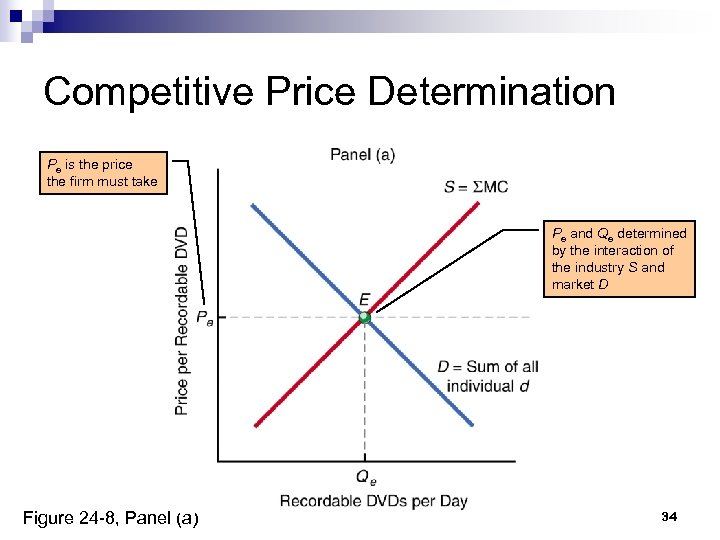

Competitive Price Determination n Question ¨ How is the market, or “going, ” price established in a competitive market? n Answer ¨ This price is established by the interaction of all the suppliers (firms) and all the demanders. 32

Competitive Price Determination n Question ¨ How is the market, or “going, ” price established in a competitive market? n Answer ¨ This price is established by the interaction of all the suppliers (firms) and all the demanders. 32

Competitive Price Determination n The competitive price is determined by the intersection of the market demand curve and the market supply curve ¨ The market supply curve is equal to the horizontal summation of the supply curves of the individual firms 33

Competitive Price Determination n The competitive price is determined by the intersection of the market demand curve and the market supply curve ¨ The market supply curve is equal to the horizontal summation of the supply curves of the individual firms 33

Competitive Price Determination Pe is the price the firm must take Pe and Qe determined by the interaction of the industry S and market D Figure 24 -8, Panel (a) 34

Competitive Price Determination Pe is the price the firm must take Pe and Qe determined by the interaction of the industry S and market D Figure 24 -8, Panel (a) 34

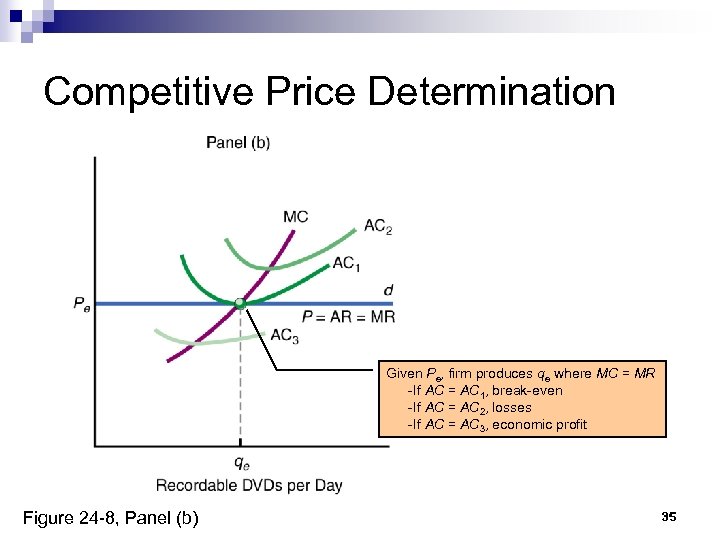

Competitive Price Determination Given Pe, firm produces qe where MC = MR -If AC = AC 1, break-even -If AC = AC 2, losses -If AC = AC 3, economic profit Figure 24 -8, Panel (b) 35

Competitive Price Determination Given Pe, firm produces qe where MC = MR -If AC = AC 1, break-even -If AC = AC 2, losses -If AC = AC 3, economic profit Figure 24 -8, Panel (b) 35

The Long-Run Industry Situation: Exit and Entry n Profits and losses act as signals for resources to enter an industry or to leave an industry. 36

The Long-Run Industry Situation: Exit and Entry n Profits and losses act as signals for resources to enter an industry or to leave an industry. 36

The Long-Run Industry Situation: Exit and Entry n Signals ¨ Compact ways of conveying to economic decision makers information needed to make decisions ¨ A true signal not only conveys information but also provides the incentive to react appropriately 37

The Long-Run Industry Situation: Exit and Entry n Signals ¨ Compact ways of conveying to economic decision makers information needed to make decisions ¨ A true signal not only conveys information but also provides the incentive to react appropriately 37

The Long-Run Industry Situation: Exit and Entry n Summary ¨ Economic n Signal resources to enter the market and the price falls to the break-even price ¨ Economic n profits losses Signal resources to exit the market and the price increases to the break-even level 38

The Long-Run Industry Situation: Exit and Entry n Summary ¨ Economic n Signal resources to enter the market and the price falls to the break-even price ¨ Economic n profits losses Signal resources to exit the market and the price increases to the break-even level 38

The Long-Run Industry Situation: Exit and Entry n Summary ¨ At n break-even Resources will not enter or exit because the market is yielding a normal rate of return ¨ In the long run, the perfectly competitive firm will make zero economic profits (a normal rate of return) 39

The Long-Run Industry Situation: Exit and Entry n Summary ¨ At n break-even Resources will not enter or exit because the market is yielding a normal rate of return ¨ In the long run, the perfectly competitive firm will make zero economic profits (a normal rate of return) 39

The Long-Run Industry Situation: Exit and Entry n Long-Run Industry Supply Curve ¨A market supply curve showing the relationship between price and quantities forthcoming after firms have been allowed time to enter or exit from an industry 40

The Long-Run Industry Situation: Exit and Entry n Long-Run Industry Supply Curve ¨A market supply curve showing the relationship between price and quantities forthcoming after firms have been allowed time to enter or exit from an industry 40

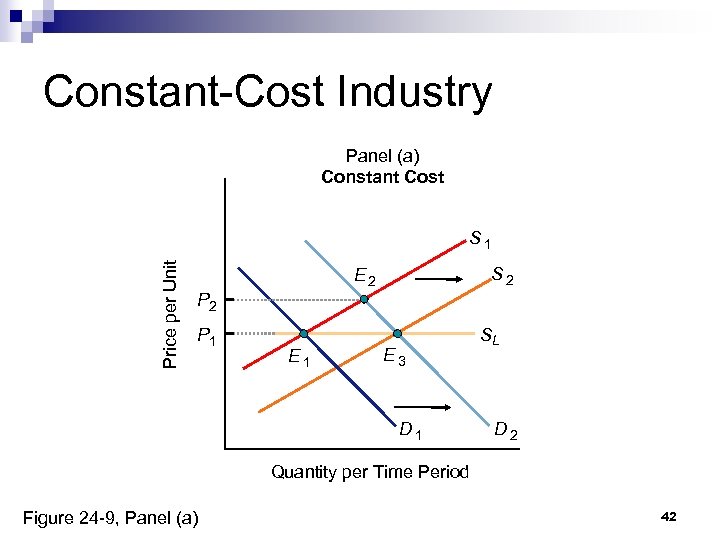

The Long-Run Industry Situation: Exit and Entry n Constant-Cost Industry ¨ An industry whose total output can be increased without an increase in long-run perunit costs 41

The Long-Run Industry Situation: Exit and Entry n Constant-Cost Industry ¨ An industry whose total output can be increased without an increase in long-run perunit costs 41

Constant-Cost Industry Panel (a) Constant Cost Price per Unit S 1 S 2 E 2 P 1 E 3 D 1 SL D 2 Quantity per Time Period Figure 24 -9, Panel (a) 42

Constant-Cost Industry Panel (a) Constant Cost Price per Unit S 1 S 2 E 2 P 1 E 3 D 1 SL D 2 Quantity per Time Period Figure 24 -9, Panel (a) 42

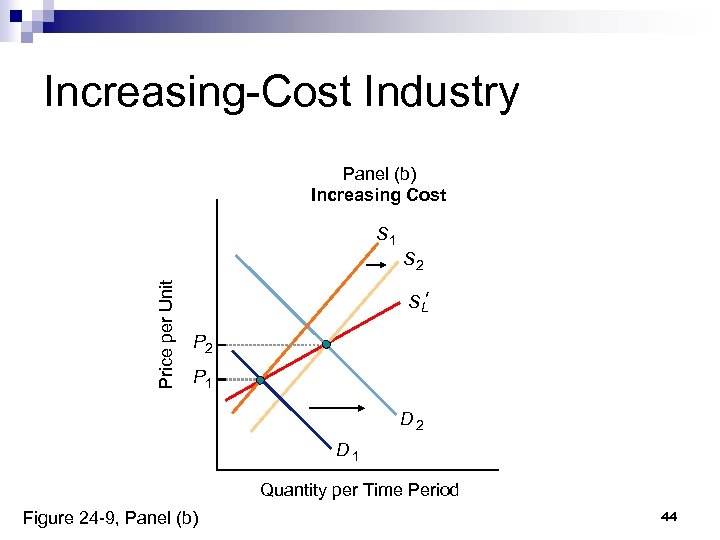

The Long-Run Industry Situation: Exit and Entry n Increasing-Cost Industry ¨ An industry in which an increase in industry output is accompanied by an increase in longrun per unit costs 43

The Long-Run Industry Situation: Exit and Entry n Increasing-Cost Industry ¨ An industry in which an increase in industry output is accompanied by an increase in longrun per unit costs 43

Increasing-Cost Industry Panel (b) Increasing Cost S 1 Price per Unit S 2 ' SL P 2 P 1 D 2 D 1 Quantity per Time Period Figure 24 -9, Panel (b) 44

Increasing-Cost Industry Panel (b) Increasing Cost S 1 Price per Unit S 2 ' SL P 2 P 1 D 2 D 1 Quantity per Time Period Figure 24 -9, Panel (b) 44

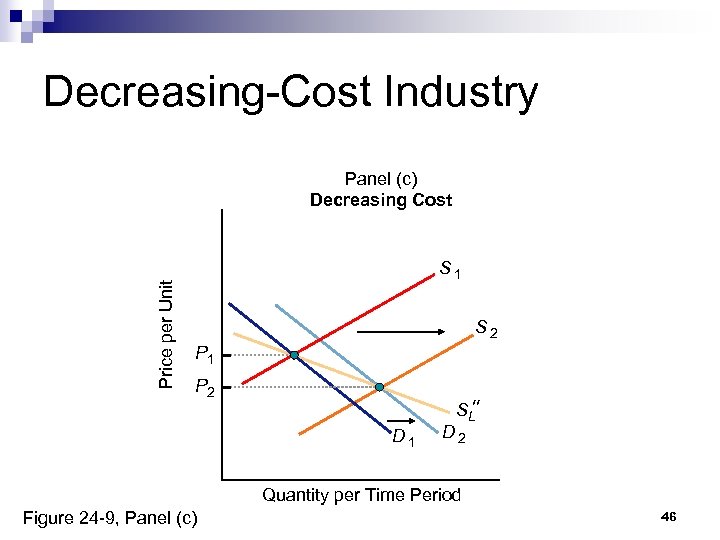

The Long-Run Industry Situation: Exit and Entry n Decreasing-Cost Industry ¨ An industry in which an increase in industry output leads to a reduction in long-run per-unit costs 45

The Long-Run Industry Situation: Exit and Entry n Decreasing-Cost Industry ¨ An industry in which an increase in industry output leads to a reduction in long-run per-unit costs 45

Decreasing-Cost Industry Price per Unit Panel (c) Decreasing Cost S 1 S 2 P 1 P 2 '' SL D 1 D 2 Quantity per Time Period Figure 24 -9, Panel (c) 46

Decreasing-Cost Industry Price per Unit Panel (c) Decreasing Cost S 1 S 2 P 1 P 2 '' SL D 1 D 2 Quantity per Time Period Figure 24 -9, Panel (c) 46

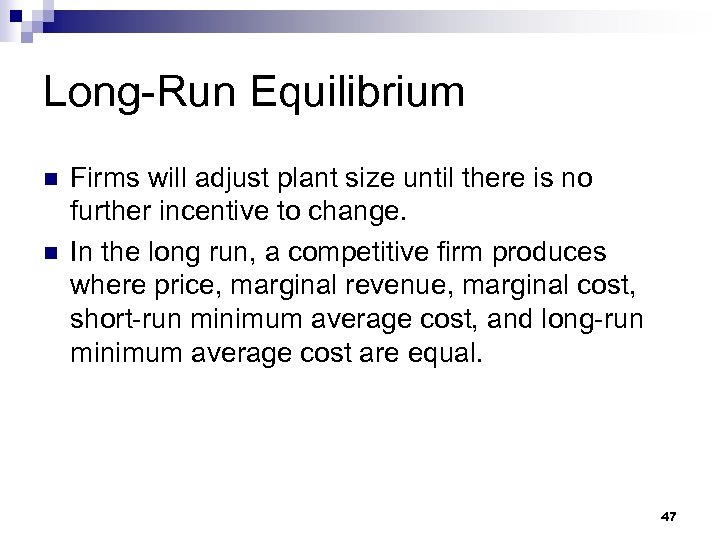

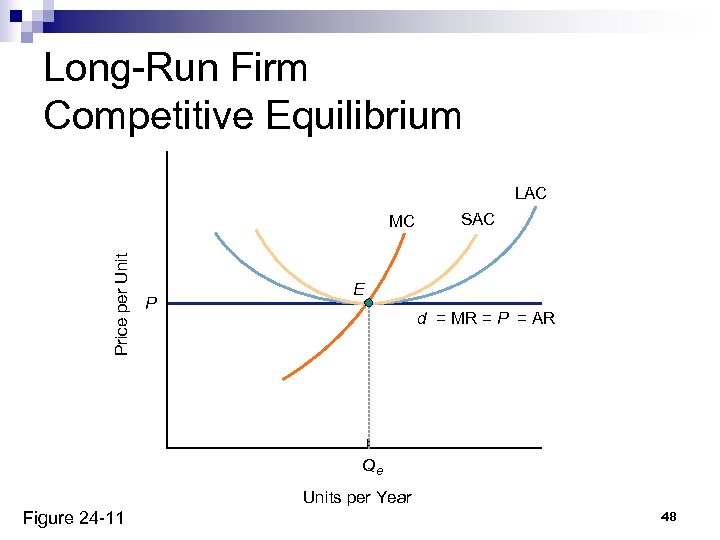

Long-Run Equilibrium n n Firms will adjust plant size until there is no further incentive to change. In the long run, a competitive firm produces where price, marginal revenue, marginal cost, short-run minimum average cost, and long-run minimum average cost are equal. 47

Long-Run Equilibrium n n Firms will adjust plant size until there is no further incentive to change. In the long run, a competitive firm produces where price, marginal revenue, marginal cost, short-run minimum average cost, and long-run minimum average cost are equal. 47

Long-Run Firm Competitive Equilibrium LAC Price per Unit MC P SAC E d = MR = P = AR Qe Units per Year Figure 24 -11 48

Long-Run Firm Competitive Equilibrium LAC Price per Unit MC P SAC E d = MR = P = AR Qe Units per Year Figure 24 -11 48

Competitive Pricing: Marginal Cost Pricing n Marginal Cost Pricing ¨A system of pricing in which the price charged is equal to the opportunity cost to society of producing one more unit of the good or service in question 49

Competitive Pricing: Marginal Cost Pricing n Marginal Cost Pricing ¨A system of pricing in which the price charged is equal to the opportunity cost to society of producing one more unit of the good or service in question 49

Competitive Pricing: Marginal Cost Pricing n Market Failure ¨A situation in which an unrestrained market operation leads to either too few or too many resources going to a specific economic activity 50

Competitive Pricing: Marginal Cost Pricing n Market Failure ¨A situation in which an unrestrained market operation leads to either too few or too many resources going to a specific economic activity 50

ECON 152 – PRINCIPLES OF MICROECONOMICS Chapter 24: Perfect Competition Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved.

ECON 152 – PRINCIPLES OF MICROECONOMICS Chapter 24: Perfect Competition Materials include content from Pearson Addison-Wesley which has been modified by the instructor and displayed with permission of the publisher. All rights reserved.