ae963597f5a15d45efd70ef1f483609c.ppt

- Количество слайдов: 119

Econ 1000 Lecture 6: Perfect Competition C. L. Mattoli (C) Red Hill Capital Corp. , Delaware, USA 2008 1

Econ 1000 Lecture 6: Perfect Competition C. L. Mattoli (C) Red Hill Capital Corp. , Delaware, USA 2008 1

Prologue n n n Businesses are stuck in the short run, although the length of the short run can vary depending on the business. The point is that, in most businesses it is not possible to change everything quickly. For example, if you own a store, it will not be easy to move the location. To move will require fitting out the new place, changing business cards, advertising the new location, etc. (C) Red Hill Capital Corp. , Delaware, USA 2008 2

Prologue n n n Businesses are stuck in the short run, although the length of the short run can vary depending on the business. The point is that, in most businesses it is not possible to change everything quickly. For example, if you own a store, it will not be easy to move the location. To move will require fitting out the new place, changing business cards, advertising the new location, etc. (C) Red Hill Capital Corp. , Delaware, USA 2008 2

Prologue n n Other changes for other businesses might be even longer. Thus, businesses will have some inputs that are fixed and others that can be more easily varied, like man (woman) hours. When we begin production and go from 0 units to the first, that will require adding some variable input, for example, labor, to the fixed. Given that, we can calculate the output per unit of the variable input, e. g. , labor. (C) Red Hill Capital Corp. , Delaware, USA 2008 3

Prologue n n Other changes for other businesses might be even longer. Thus, businesses will have some inputs that are fixed and others that can be more easily varied, like man (woman) hours. When we begin production and go from 0 units to the first, that will require adding some variable input, for example, labor, to the fixed. Given that, we can calculate the output per unit of the variable input, e. g. , labor. (C) Red Hill Capital Corp. , Delaware, USA 2008 3

Prologue n n n There is efficiency gained when you add, for example, a second unit of labor. Suppose that the company consists of 2 machines, fixed inputs. The first machine does the roughing out of the products and the second machine is a finishing machine. With one laborer she has to do the roughing out, then, move over to the other machine to finish the product. It is very inefficient. (C) Red Hill Capital Corp. , Delaware, USA 2008 4

Prologue n n n There is efficiency gained when you add, for example, a second unit of labor. Suppose that the company consists of 2 machines, fixed inputs. The first machine does the roughing out of the products and the second machine is a finishing machine. With one laborer she has to do the roughing out, then, move over to the other machine to finish the product. It is very inefficient. (C) Red Hill Capital Corp. , Delaware, USA 2008 4

Prologue n n n There is an efficiency gain, and the two can produce more than 2 times the output of one laborer. The marginal product is the change in output that occurs by adding one more unit of variable input. So it is a unit cost, specifically, for the next unit. As more units of input are added, there will continue to be efficiency gains, up to a point, then, efficiency begins to be lost. (C) Red Hill Capital Corp. , Delaware, USA 2008 5

Prologue n n n There is an efficiency gain, and the two can produce more than 2 times the output of one laborer. The marginal product is the change in output that occurs by adding one more unit of variable input. So it is a unit cost, specifically, for the next unit. As more units of input are added, there will continue to be efficiency gains, up to a point, then, efficiency begins to be lost. (C) Red Hill Capital Corp. , Delaware, USA 2008 5

Prologue n n As a result, the extra (marginal) output (product) increases, peaks, then, decreases. There is also an average output per unit of input. Using the average-marginal rule, the average output per unit of input will increase, as marginal product increases. Average variable cost per unit of output is inversely related to average output per unit variable input, i. e. , 1/[output/variable input] = variable input/output. (C) Red Hill Capital Corp. , Delaware, USA 2008 6

Prologue n n As a result, the extra (marginal) output (product) increases, peaks, then, decreases. There is also an average output per unit of input. Using the average-marginal rule, the average output per unit of input will increase, as marginal product increases. Average variable cost per unit of output is inversely related to average output per unit variable input, i. e. , 1/[output/variable input] = variable input/output. (C) Red Hill Capital Corp. , Delaware, USA 2008 6

Prologue n n n For example, 2 employees/2. 2 tons of grapes = 0. 91 employees/ton of grapes. So, it costs 0. 91 employees per unit of grapes. Thus, as MP increases, average cost decreases, and vice versa. As output increases, the fixed input is also spread over more units, so total cost per unit decreases, then increases. (C) Red Hill Capital Corp. , Delaware, USA 2008 7

Prologue n n n For example, 2 employees/2. 2 tons of grapes = 0. 91 employees/ton of grapes. So, it costs 0. 91 employees per unit of grapes. Thus, as MP increases, average cost decreases, and vice versa. As output increases, the fixed input is also spread over more units, so total cost per unit decreases, then increases. (C) Red Hill Capital Corp. , Delaware, USA 2008 7

Prologue MC will be inverse to MP, as the change in output per input increasing means the cost per new unit is decreasing. n Then, we can use the averagemarginal rule to look at cost curves. n We give a diagrammatic summary of the basic concepts in the next few slides. n (C) Red Hill Capital Corp. , Delaware, USA 2008 8

Prologue MC will be inverse to MP, as the change in output per input increasing means the cost per new unit is decreasing. n Then, we can use the averagemarginal rule to look at cost curves. n We give a diagrammatic summary of the basic concepts in the next few slides. n (C) Red Hill Capital Corp. , Delaware, USA 2008 8

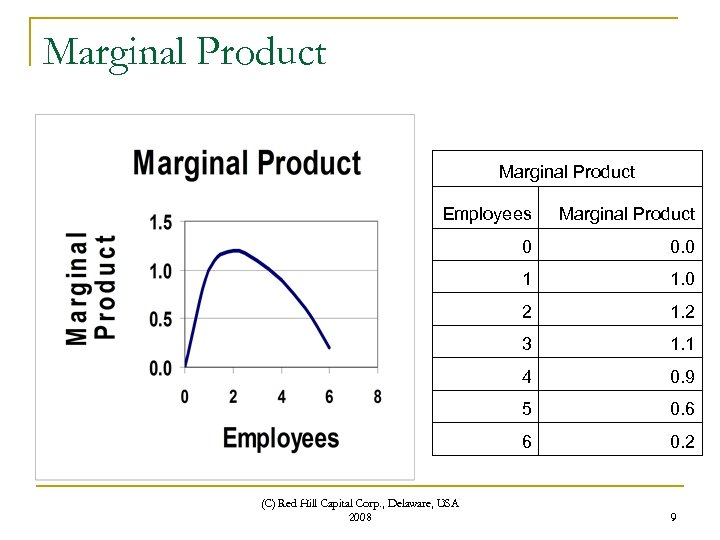

Marginal Product Employees Marginal Product 0 0. 0 1 1. 0 2 1. 2 3 1. 1 4 0. 9 5 0. 6 6 0. 2 (C) Red Hill Capital Corp. , Delaware, USA 2008 9

Marginal Product Employees Marginal Product 0 0. 0 1 1. 0 2 1. 2 3 1. 1 4 0. 9 5 0. 6 6 0. 2 (C) Red Hill Capital Corp. , Delaware, USA 2008 9

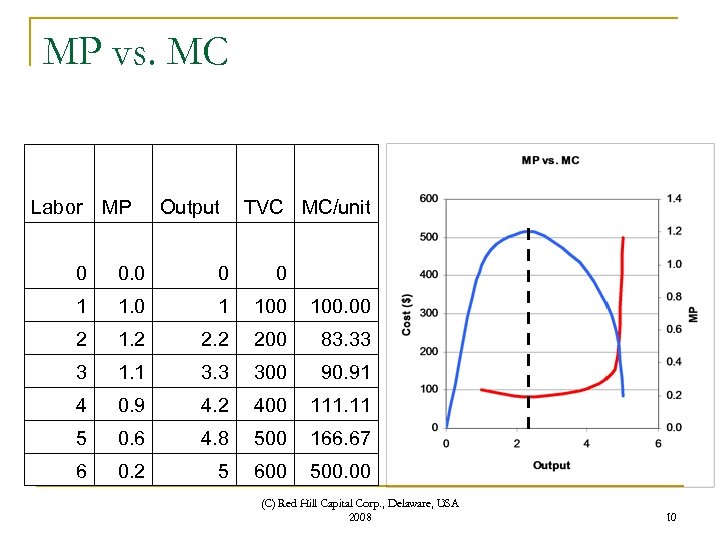

MP vs. MC Labor MP Output TVC MC/unit 0 0 0 1 100. 00 2 1. 2 200 83. 33 3 1. 1 3. 3 300 90. 91 4 0. 9 4. 2 400 111. 11 5 0. 6 4. 8 500 166. 67 6 0. 2 5 600 500. 00 (C) Red Hill Capital Corp. , Delaware, USA 2008 10

MP vs. MC Labor MP Output TVC MC/unit 0 0 0 1 100. 00 2 1. 2 200 83. 33 3 1. 1 3. 3 300 90. 91 4 0. 9 4. 2 400 111. 11 5 0. 6 4. 8 500 166. 67 6 0. 2 5 600 500. 00 (C) Red Hill Capital Corp. , Delaware, USA 2008 10

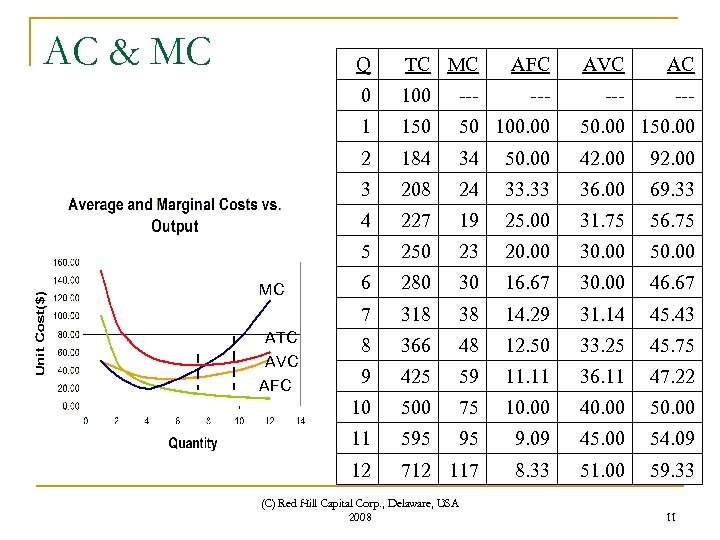

AC & MC Q 0 --- 150 50 100. 00 50. 00 150. 00 2 184 34 50. 00 42. 00 92. 00 3 208 24 33. 33 36. 00 69. 33 4 227 19 25. 00 31. 75 56. 75 5 250 23 20. 00 30. 00 50. 00 6 280 30 16. 67 30. 00 46. 67 7 318 38 14. 29 31. 14 45. 43 8 366 48 12. 50 33. 25 45. 75 9 425 59 11. 11 36. 11 47. 22 10 500 75 10. 00 40. 00 50. 00 11 595 95 9. 09 45. 00 54. 09 12 ATC AVC AFC 100 1 MC TC MC 712 117 8. 33 51. 00 59. 33 (C) Red Hill Capital Corp. , Delaware, USA 2008 AFC AVC AC --- --- 11

AC & MC Q 0 --- 150 50 100. 00 50. 00 150. 00 2 184 34 50. 00 42. 00 92. 00 3 208 24 33. 33 36. 00 69. 33 4 227 19 25. 00 31. 75 56. 75 5 250 23 20. 00 30. 00 50. 00 6 280 30 16. 67 30. 00 46. 67 7 318 38 14. 29 31. 14 45. 43 8 366 48 12. 50 33. 25 45. 75 9 425 59 11. 11 36. 11 47. 22 10 500 75 10. 00 40. 00 50. 00 11 595 95 9. 09 45. 00 54. 09 12 ATC AVC AFC 100 1 MC TC MC 712 117 8. 33 51. 00 59. 33 (C) Red Hill Capital Corp. , Delaware, USA 2008 AFC AVC AC --- --- 11

This week n n Chapter 7 Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 12

This week n n Chapter 7 Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 12

Objectives n n n We will describe market structure. We will finally get to a bottom line: profits. We will look at what it means for a market to be perfectly competitive. We will see why governments around the world promote market competition. We will examine how the internet is changing the structure of world markets (C) Red Hill Capital Corp. , Delaware, USA 2008 13

Objectives n n n We will describe market structure. We will finally get to a bottom line: profits. We will look at what it means for a market to be perfectly competitive. We will see why governments around the world promote market competition. We will examine how the internet is changing the structure of world markets (C) Red Hill Capital Corp. , Delaware, USA 2008 13

Where we are coming from We have studied the ideas of supply and demand, on their own, and examined the underlying motivations that lead to the general shapes of supply and demand curves. n Then, we looked at general interactions between supply and demand to get market equilibrium, and think about how changes in equilibrium might occur. n (C) Red Hill Capital Corp. , Delaware, USA 2008 14

Where we are coming from We have studied the ideas of supply and demand, on their own, and examined the underlying motivations that lead to the general shapes of supply and demand curves. n Then, we looked at general interactions between supply and demand to get market equilibrium, and think about how changes in equilibrium might occur. n (C) Red Hill Capital Corp. , Delaware, USA 2008 14

Where we are coming from n n n People are motivated by self-interest, but that self-interest leads to competition on both sides, supply and demand, in the end, self-interest serves society and results in positive benefits. On the demand side, self-interest is manifest in wants, desires, and needs, but it also tempers the price that they will pay for things. That puts limits on the supply side: they cannot simply charge whatever they want. (C) Red Hill Capital Corp. , Delaware, USA 2008 15

Where we are coming from n n n People are motivated by self-interest, but that self-interest leads to competition on both sides, supply and demand, in the end, self-interest serves society and results in positive benefits. On the demand side, self-interest is manifest in wants, desires, and needs, but it also tempers the price that they will pay for things. That puts limits on the supply side: they cannot simply charge whatever they want. (C) Red Hill Capital Corp. , Delaware, USA 2008 15

Where we are coming from n n What suppliers charge will affect not only how much they sell but also the total revenue that they will be able to take in. Last week we examined output, its motivations, and its limitations. Suppliers want to make profits but they have to face certain constraints. We saw that there is a short-run, in which only certain changes can be made to change the ability to supply, and a longer-run, in which more can be done to change supply. (C) Red Hill Capital Corp. , Delaware, USA 2008 16

Where we are coming from n n What suppliers charge will affect not only how much they sell but also the total revenue that they will be able to take in. Last week we examined output, its motivations, and its limitations. Suppliers want to make profits but they have to face certain constraints. We saw that there is a short-run, in which only certain changes can be made to change the ability to supply, and a longer-run, in which more can be done to change supply. (C) Red Hill Capital Corp. , Delaware, USA 2008 16

Where we are coming from n n n We examined the cost side and found that suppliers face diminishing returns to inputs. Diminishing returns means that suppliers will face changing unit costs, which will affect their eventual profitability. We also saw that they might face changing costs structures depending on their size, which are manifest in concepts of economies of scale: bigger, itself, might result in a longer -run way to reduce unit cost. (C) Red Hill Capital Corp. , Delaware, USA 2008 17

Where we are coming from n n n We examined the cost side and found that suppliers face diminishing returns to inputs. Diminishing returns means that suppliers will face changing unit costs, which will affect their eventual profitability. We also saw that they might face changing costs structures depending on their size, which are manifest in concepts of economies of scale: bigger, itself, might result in a longer -run way to reduce unit cost. (C) Red Hill Capital Corp. , Delaware, USA 2008 17

Where we are coming from n n n Suppliers, eventually, might also face diseconomies of scale because of the organizational structure of business, in general. In the end, that means that suppliers will, in most cases, always face a cost structure that will limit their ability to make profits. This week, we examine profitability in the case of perfectly competitive markets. (C) Red Hill Capital Corp. , Delaware, USA 2008 18

Where we are coming from n n n Suppliers, eventually, might also face diseconomies of scale because of the organizational structure of business, in general. In the end, that means that suppliers will, in most cases, always face a cost structure that will limit their ability to make profits. This week, we examine profitability in the case of perfectly competitive markets. (C) Red Hill Capital Corp. , Delaware, USA 2008 18

Market Structures (C) Red Hill Capital Corp. , Delaware, USA 2008 19

Market Structures (C) Red Hill Capital Corp. , Delaware, USA 2008 19

Market Structure n n n Firms sell things under a number of different sets of market conditions, which economists refer to as market structures. Economists then go on to identify several basic forms of market structure characterized by certain key features. The basic characteristics that shape market structure, include the number of firms in the industry, the differentiability of products, ease of entry and exit in the market, and availability and dissemination of information. (C) Red Hill Capital Corp. , Delaware, USA 2008 20

Market Structure n n n Firms sell things under a number of different sets of market conditions, which economists refer to as market structures. Economists then go on to identify several basic forms of market structure characterized by certain key features. The basic characteristics that shape market structure, include the number of firms in the industry, the differentiability of products, ease of entry and exit in the market, and availability and dissemination of information. (C) Red Hill Capital Corp. , Delaware, USA 2008 20

Market Structure n n Those characteristics are indicative of the degree of competition firms face in a market. If there are more firms, there are more places to buy something. If the products of those firms are more or less interchangeable, there is no reason to go to one firm than to another, except, perhaps for other reasons of convenience. If entry into the industry is easy, firms already in the industry will face threat of more competition. If it is difficult, they will face less of a threat. (C) Red Hill Capital Corp. , Delaware, USA 2008 21

Market Structure n n Those characteristics are indicative of the degree of competition firms face in a market. If there are more firms, there are more places to buy something. If the products of those firms are more or less interchangeable, there is no reason to go to one firm than to another, except, perhaps for other reasons of convenience. If entry into the industry is easy, firms already in the industry will face threat of more competition. If it is difficult, they will face less of a threat. (C) Red Hill Capital Corp. , Delaware, USA 2008 21

The Basic Market Structures Based on these simple parameters, there will be a range of competitiveness by firms in markets, ranging from none to a lot. n In a monopoly, there is one seller who dominates the market. n Then, there might be only a few large firms that dominate a market in an oligopoly. n (C) Red Hill Capital Corp. , Delaware, USA 2008 22

The Basic Market Structures Based on these simple parameters, there will be a range of competitiveness by firms in markets, ranging from none to a lot. n In a monopoly, there is one seller who dominates the market. n Then, there might be only a few large firms that dominate a market in an oligopoly. n (C) Red Hill Capital Corp. , Delaware, USA 2008 22

The Basic Market Structures After that, there might be monopolistic competition, in which products are differentiable, and there are many sellers, but monopolists compete to get people to like their product instead of the others. n Finally, there is perfect competition, which is the focus of this lecture. n We summarize features of the various market structures, in the next slide. n (C) Red Hill Capital Corp. , Delaware, USA 2008 23

The Basic Market Structures After that, there might be monopolistic competition, in which products are differentiable, and there are many sellers, but monopolists compete to get people to like their product instead of the others. n Finally, there is perfect competition, which is the focus of this lecture. n We summarize features of the various market structures, in the next slide. n (C) Red Hill Capital Corp. , Delaware, USA 2008 23

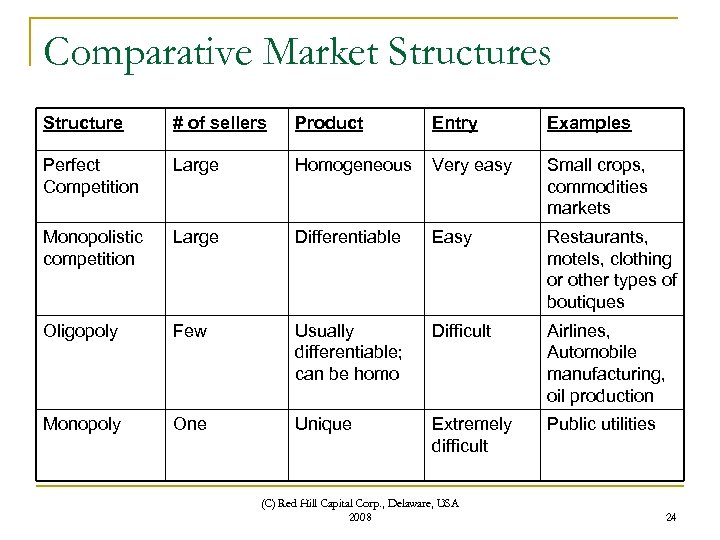

Comparative Market Structures Structure # of sellers Product Entry Examples Perfect Competition Large Homogeneous Very easy Small crops, commodities markets Monopolistic competition Large Differentiable Easy Restaurants, motels, clothing or other types of boutiques Oligopoly Few Usually differentiable; can be homo Difficult Airlines, Automobile manufacturing, oil production Monopoly One Unique Extremely difficult Public utilities (C) Red Hill Capital Corp. , Delaware, USA 2008 24

Comparative Market Structures Structure # of sellers Product Entry Examples Perfect Competition Large Homogeneous Very easy Small crops, commodities markets Monopolistic competition Large Differentiable Easy Restaurants, motels, clothing or other types of boutiques Oligopoly Few Usually differentiable; can be homo Difficult Airlines, Automobile manufacturing, oil production Monopoly One Unique Extremely difficult Public utilities (C) Red Hill Capital Corp. , Delaware, USA 2008 24

The Elements of Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 25

The Elements of Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 25

Perfect Competition n 1. Perfect competition means, basically, that no single firm can gain a competitive advantage over the others. That will be the case under a few rudimentary conditions. If there are many small firms, none of which has a large enough share of total output (total supply) that it can affect market price. (C) Red Hill Capital Corp. , Delaware, USA 2008 26

Perfect Competition n 1. Perfect competition means, basically, that no single firm can gain a competitive advantage over the others. That will be the case under a few rudimentary conditions. If there are many small firms, none of which has a large enough share of total output (total supply) that it can affect market price. (C) Red Hill Capital Corp. , Delaware, USA 2008 26

Perfect Competition Ø Ø In addition, it must be assumed that the suppliers do not collude but act independently. Example would be egg farmers. There are thousands of egg farmers. If one decides to raise his price, it will have no affect on the going market price for eggs. (C) Red Hill Capital Corp. , Delaware, USA 2008 27

Perfect Competition Ø Ø In addition, it must be assumed that the suppliers do not collude but act independently. Example would be egg farmers. There are thousands of egg farmers. If one decides to raise his price, it will have no affect on the going market price for eggs. (C) Red Hill Capital Corp. , Delaware, USA 2008 27

Perfect Competition 2. Ø Next, we assume the product is fungible (homogeneous, indistinguishable, standardized, all the same). That way, no single supplier is able to gain a competitive advantage through advertising, quality distinction, or even convenience of location. (C) Red Hill Capital Corp. , Delaware, USA 2008 28

Perfect Competition 2. Ø Next, we assume the product is fungible (homogeneous, indistinguishable, standardized, all the same). That way, no single supplier is able to gain a competitive advantage through advertising, quality distinction, or even convenience of location. (C) Red Hill Capital Corp. , Delaware, USA 2008 28

Perfect Competition Ø Ø Buyers are indifferent about which supplier they go to. There are no famous brand names. No one knows Coke and Pepsi. They just know cola. For example, fishmonger Ho’s lobster (long xia) is no better than fishmonger Chen’s lobster. They all come from the same sea. (C) Red Hill Capital Corp. , Delaware, USA 2008 29

Perfect Competition Ø Ø Buyers are indifferent about which supplier they go to. There are no famous brand names. No one knows Coke and Pepsi. They just know cola. For example, fishmonger Ho’s lobster (long xia) is no better than fishmonger Chen’s lobster. They all come from the same sea. (C) Red Hill Capital Corp. , Delaware, USA 2008 29

Perfect Competition 3. Ø Ø Ease of both entry and exit are part of the basis for perfect competition. That means, first, that there are no barriers to entry, like, startup cost (financial), technical, licensing, patent, permit, or government-imposed barriers. In that regard, anyone will be able to enter the market, on the one hand, and will not be discouraged by penalties, like investment, contractual, or legal reasons, to exit the business, on the other hand. (C) Red Hill Capital Corp. , Delaware, USA 2008 30

Perfect Competition 3. Ø Ø Ease of both entry and exit are part of the basis for perfect competition. That means, first, that there are no barriers to entry, like, startup cost (financial), technical, licensing, patent, permit, or government-imposed barriers. In that regard, anyone will be able to enter the market, on the one hand, and will not be discouraged by penalties, like investment, contractual, or legal reasons, to exit the business, on the other hand. (C) Red Hill Capital Corp. , Delaware, USA 2008 30

Perfect Competition Ø Ø Ø Resources are completely mobile to freely enter and exit the market. That is especially important in an industry in decline, in order for prices to adjust quickly. Easy entry assures that excess profits will not persist. Others seeing juicy profits will quickly enter the industry, and prices will be competitive. (C) Red Hill Capital Corp. , Delaware, USA 2008 31

Perfect Competition Ø Ø Ø Resources are completely mobile to freely enter and exit the market. That is especially important in an industry in decline, in order for prices to adjust quickly. Easy entry assures that excess profits will not persist. Others seeing juicy profits will quickly enter the industry, and prices will be competitive. (C) Red Hill Capital Corp. , Delaware, USA 2008 31

Perfect Competition Ø § For example, you go into the bicycle rental business. You buy a bicycle and a cell phone to start your business, and you can easily close the business any time. A further assumption is that market participants are well-informed and welleducated about the product, including knowledge of the product, its production costs, and prices. (C) Red Hill Capital Corp. , Delaware, USA 2008 32

Perfect Competition Ø § For example, you go into the bicycle rental business. You buy a bicycle and a cell phone to start your business, and you can easily close the business any time. A further assumption is that market participants are well-informed and welleducated about the product, including knowledge of the product, its production costs, and prices. (C) Red Hill Capital Corp. , Delaware, USA 2008 32

Perfect World (No one’s Perfect) The idea of perfect competition is a perfect world ideal. Models are not reality but only try to approximate it under simplified ideal conditions. n The world is not perfect and rational. There is no perfect information. There is convenience of going to a store one block from you instead of one mile. Selfinterest can lead to bad behavior. n (C) Red Hill Capital Corp. , Delaware, USA 2008 33

Perfect World (No one’s Perfect) The idea of perfect competition is a perfect world ideal. Models are not reality but only try to approximate it under simplified ideal conditions. n The world is not perfect and rational. There is no perfect information. There is convenience of going to a store one block from you instead of one mile. Selfinterest can lead to bad behavior. n (C) Red Hill Capital Corp. , Delaware, USA 2008 33

Perfect World (No one’s Perfect) However, we expect markets, like farm products, inter-city trucking, or housecleaning services, to be close to the competitive model. There are many sellers, and products are very similar. n Moreover, the model can provide a benchmark against which real-world market structure and performance can be judged. n (C) Red Hill Capital Corp. , Delaware, USA 2008 34

Perfect World (No one’s Perfect) However, we expect markets, like farm products, inter-city trucking, or housecleaning services, to be close to the competitive model. There are many sellers, and products are very similar. n Moreover, the model can provide a benchmark against which real-world market structure and performance can be judged. n (C) Red Hill Capital Corp. , Delaware, USA 2008 34

Competition and Policy n n n In chapter 4, we saw that lack of competition can lead to market failures that result in inefficient outcomes. On the other hand, perfectly competitive markets will lead to maximum efficiency. In that regard, governments around the world have devoted much regulation and legislation to promote efficiency by encouraging competition and to discourage anti-competitive behavior through legal and financial penalties. (C) Red Hill Capital Corp. , Delaware, USA 2008 35

Competition and Policy n n n In chapter 4, we saw that lack of competition can lead to market failures that result in inefficient outcomes. On the other hand, perfectly competitive markets will lead to maximum efficiency. In that regard, governments around the world have devoted much regulation and legislation to promote efficiency by encouraging competition and to discourage anti-competitive behavior through legal and financial penalties. (C) Red Hill Capital Corp. , Delaware, USA 2008 35

ACCC: Australia’s Competition Watchdog n n n In Australia, for example, The Australian Competition and Consumer Commission (ACCC) is the statutory authority charged with oversight and enforcement of the relevant Trade Practices Act that deal with competition. The objective of The Act is to enhance the welfare of Australians by promoting competition and fair trading and providing for consumer protection. The ACCC also administers the Price Surveillance Act. (C) Red Hill Capital Corp. , Delaware, USA 2008 36

ACCC: Australia’s Competition Watchdog n n n In Australia, for example, The Australian Competition and Consumer Commission (ACCC) is the statutory authority charged with oversight and enforcement of the relevant Trade Practices Act that deal with competition. The objective of The Act is to enhance the welfare of Australians by promoting competition and fair trading and providing for consumer protection. The ACCC also administers the Price Surveillance Act. (C) Red Hill Capital Corp. , Delaware, USA 2008 36

ACCC Objectives 1. 2. 3. 4. 5. Improve competition and efficiency in markets Foster fair trade practices in well-informed markets. Promote competitive pricing when possible and restrain prices in markets where competition is less than effective Inform and educate the community about the Trade Practices Act Use resources efficiently and effectively (C) Red Hill Capital Corp. , Delaware, USA 2008 37

ACCC Objectives 1. 2. 3. 4. 5. Improve competition and efficiency in markets Foster fair trade practices in well-informed markets. Promote competitive pricing when possible and restrain prices in markets where competition is less than effective Inform and educate the community about the Trade Practices Act Use resources efficiently and effectively (C) Red Hill Capital Corp. , Delaware, USA 2008 37

New Zealand Commerce Commission (NZCC) Goals 1. 2. 3. Dynamic markets and all goods and services produced at competitive prices Consumers confident of information they receive when making choices Regulated industries constrained from making excess profits, face incentives to invest, and share efficiency gains with consumers. (C) Red Hill Capital Corp. , Delaware, USA 2008 38

New Zealand Commerce Commission (NZCC) Goals 1. 2. 3. Dynamic markets and all goods and services produced at competitive prices Consumers confident of information they receive when making choices Regulated industries constrained from making excess profits, face incentives to invest, and share efficiency gains with consumers. (C) Red Hill Capital Corp. , Delaware, USA 2008 38

Policy Goals, Summarized n n n Even if not all industries are naturally competitive, government policies encourage efficiency by encouraging them to act as if they are competitive. Even though not all people practice enlightened self-interest, policy seeks to ban unethical behavior. Bad behaviors that governments seek to eliminate are: colluding to raise price/ profitability, exercising monopoly power at the expense of consumers, and misleading advertising. (C) Red Hill Capital Corp. , Delaware, USA 2008 39

Policy Goals, Summarized n n n Even if not all industries are naturally competitive, government policies encourage efficiency by encouraging them to act as if they are competitive. Even though not all people practice enlightened self-interest, policy seeks to ban unethical behavior. Bad behaviors that governments seek to eliminate are: colluding to raise price/ profitability, exercising monopoly power at the expense of consumers, and misleading advertising. (C) Red Hill Capital Corp. , Delaware, USA 2008 39

Policy Goals, Summarized n n n The authorities can order breakups of companies that have gained too much market power. They can disallow mergers that would result in too much market power residing in one company. They can disallow false advertising. They can impose price controls, like many countries do with public utility companies. They can impose fines and compensatory damages for bad behaviors, (C) Red Hill Capital Corp. , Delaware, USA 2008 40

Policy Goals, Summarized n n n The authorities can order breakups of companies that have gained too much market power. They can disallow mergers that would result in too much market power residing in one company. They can disallow false advertising. They can impose price controls, like many countries do with public utility companies. They can impose fines and compensatory damages for bad behaviors, (C) Red Hill Capital Corp. , Delaware, USA 2008 40

Information n Information is one of the most important things in business. Businesses need to keep some information secret, otherwise their competitors will gain advantage. The importance of information is highlighted by the large role that disclosure of information and its accuracy play in competition and securities laws around the world. (C) Red Hill Capital Corp. , Delaware, USA 2008 41

Information n Information is one of the most important things in business. Businesses need to keep some information secret, otherwise their competitors will gain advantage. The importance of information is highlighted by the large role that disclosure of information and its accuracy play in competition and securities laws around the world. (C) Red Hill Capital Corp. , Delaware, USA 2008 41

Consequences of Perfect Competition for Suppliers (C) Red Hill Capital Corp. , Delaware, USA 2008 42

Consequences of Perfect Competition for Suppliers (C) Red Hill Capital Corp. , Delaware, USA 2008 42

Price Taker, not Price Maker In a perfectly competitive market, market price is determined by aggregate supply and demand. n Moreover, consumers have perfect information about the actual market price. n The product is fungible, and the firm faces competition from inside the industry and the threat of others entering the industry. n (C) Red Hill Capital Corp. , Delaware, USA 2008 43

Price Taker, not Price Maker In a perfectly competitive market, market price is determined by aggregate supply and demand. n Moreover, consumers have perfect information about the actual market price. n The product is fungible, and the firm faces competition from inside the industry and the threat of others entering the industry. n (C) Red Hill Capital Corp. , Delaware, USA 2008 43

Price Taker, not Price Maker n n An individual firm is small and has no control to affect price (no market power), and if it tried to charge a higher-than-market price, informed consumers would not purchase from that firm because they can switch to another supplier with no effort, at all (he is right next door with the proper price). Thus, a firm is a price taker: it will necessarily have to sell at the going market price or sell nothing, at all. (C) Red Hill Capital Corp. , Delaware, USA 2008 44

Price Taker, not Price Maker n n An individual firm is small and has no control to affect price (no market power), and if it tried to charge a higher-than-market price, informed consumers would not purchase from that firm because they can switch to another supplier with no effort, at all (he is right next door with the proper price). Thus, a firm is a price taker: it will necessarily have to sell at the going market price or sell nothing, at all. (C) Red Hill Capital Corp. , Delaware, USA 2008 44

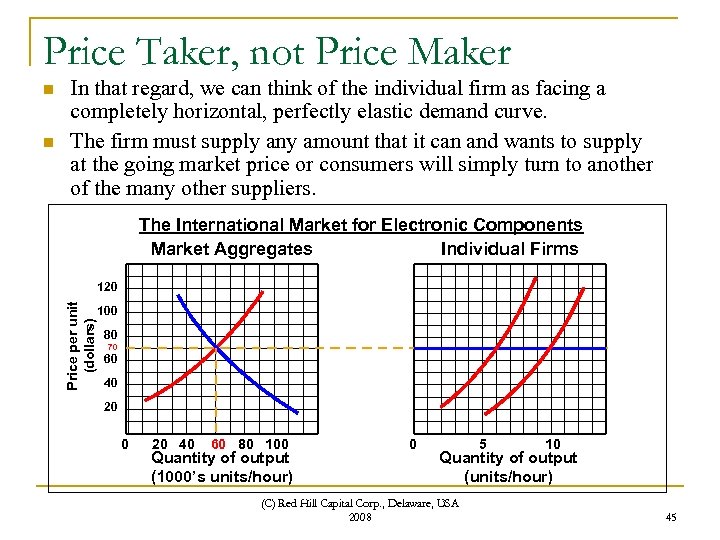

Price Taker, not Price Maker n In that regard, we can think of the individual firm as facing a completely horizontal, perfectly elastic demand curve. The firm must supply any amount that it can and wants to supply at the going market price or consumers will simply turn to another of the many other suppliers. The International Market for Electronic Components Market Aggregates Individual Firms 120 Price per unit (dollars) n 100 80 70 60 40 20 40 60 80 100 Quantity of output (1000’s units/hour) 0 5 10 Quantity of output (units/hour) (C) Red Hill Capital Corp. , Delaware, USA 2008 45

Price Taker, not Price Maker n In that regard, we can think of the individual firm as facing a completely horizontal, perfectly elastic demand curve. The firm must supply any amount that it can and wants to supply at the going market price or consumers will simply turn to another of the many other suppliers. The International Market for Electronic Components Market Aggregates Individual Firms 120 Price per unit (dollars) n 100 80 70 60 40 20 40 60 80 100 Quantity of output (1000’s units/hour) 0 5 10 Quantity of output (units/hour) (C) Red Hill Capital Corp. , Delaware, USA 2008 45

Each Firm Faces Perfect Elastic Demand In the above, graphical example, the individual firm’s output is several units per hour, while the industry output is an aggregate of 60, 000 units/hr. at equilibrium with total demand. n Equilibrium occurs at a price of $70/unit. n Therefore, a firm must take that price, no matter what it’s output. n (C) Red Hill Capital Corp. , Delaware, USA 2008 46

Each Firm Faces Perfect Elastic Demand In the above, graphical example, the individual firm’s output is several units per hour, while the industry output is an aggregate of 60, 000 units/hr. at equilibrium with total demand. n Equilibrium occurs at a price of $70/unit. n Therefore, a firm must take that price, no matter what it’s output. n (C) Red Hill Capital Corp. , Delaware, USA 2008 46

Each Firm Faces Perfect Elastic Demand It, effectively, faces horizontal demand, on its part, because no matter how much output it supplies, that is the price that people will be willing to pay for its product. n As we learned, when demand is horizontal, perfect elastic, a firm charging a higher price than that where supply intersects the demand curve will sell nothing. n (C) Red Hill Capital Corp. , Delaware, USA 2008 47

Each Firm Faces Perfect Elastic Demand It, effectively, faces horizontal demand, on its part, because no matter how much output it supplies, that is the price that people will be willing to pay for its product. n As we learned, when demand is horizontal, perfect elastic, a firm charging a higher price than that where supply intersects the demand curve will sell nothing. n (C) Red Hill Capital Corp. , Delaware, USA 2008 47

Each Firm Faces Perfect Elastic Demand On the other hand, selling at a price, below the one price in demand, would be stupid because he can sell the same amount at a higher price. n Moreover, a downward change in price would, in that case, also lead to a decrease in revenues because the firm will not be able to increase sales by decreasing price ([ΔQ/Q]/[ΔP/P] = ED = 0). n (C) Red Hill Capital Corp. , Delaware, USA 2008 48

Each Firm Faces Perfect Elastic Demand On the other hand, selling at a price, below the one price in demand, would be stupid because he can sell the same amount at a higher price. n Moreover, a downward change in price would, in that case, also lead to a decrease in revenues because the firm will not be able to increase sales by decreasing price ([ΔQ/Q]/[ΔP/P] = ED = 0). n (C) Red Hill Capital Corp. , Delaware, USA 2008 48

Short-run Profit Maximization: Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 49

Short-run Profit Maximization: Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 49

The Framework n n At the beginning of module 3, we discussed how elasticity of demand puts a constraint on the supplier because changing price can have different affects on total revenues. In perfect competition, the constraint becomes one fixed price against which the supplier must judge his costs and ability to make a profit. (C) Red Hill Capital Corp. , Delaware, USA 2008 50

The Framework n n At the beginning of module 3, we discussed how elasticity of demand puts a constraint on the supplier because changing price can have different affects on total revenues. In perfect competition, the constraint becomes one fixed price against which the supplier must judge his costs and ability to make a profit. (C) Red Hill Capital Corp. , Delaware, USA 2008 50

The Framework n n n In the last lecture, we analyzed the elements of increasing and diminishing returns and cost constraints, which suppliers face. Now, we can put it all together and analyze profit. We saw how the unit cost curves were Ushaped with minimums due to a maximum in marginal product, which comes at the point of diminishing returns. (C) Red Hill Capital Corp. , Delaware, USA 2008 51

The Framework n n n In the last lecture, we analyzed the elements of increasing and diminishing returns and cost constraints, which suppliers face. Now, we can put it all together and analyze profit. We saw how the unit cost curves were Ushaped with minimums due to a maximum in marginal product, which comes at the point of diminishing returns. (C) Red Hill Capital Corp. , Delaware, USA 2008 51

The Framework n n Profits = revenues – costs. On supply and demand curves we show price per units, and the average cost figures show cost per unit. We shall look at two methods to determine maximum profits: the total revenue-total cost approach and the marginal revenue equals marginal cost method. We are in the short-run. (C) Red Hill Capital Corp. , Delaware, USA 2008 52

The Framework n n Profits = revenues – costs. On supply and demand curves we show price per units, and the average cost figures show cost per unit. We shall look at two methods to determine maximum profits: the total revenue-total cost approach and the marginal revenue equals marginal cost method. We are in the short-run. (C) Red Hill Capital Corp. , Delaware, USA 2008 52

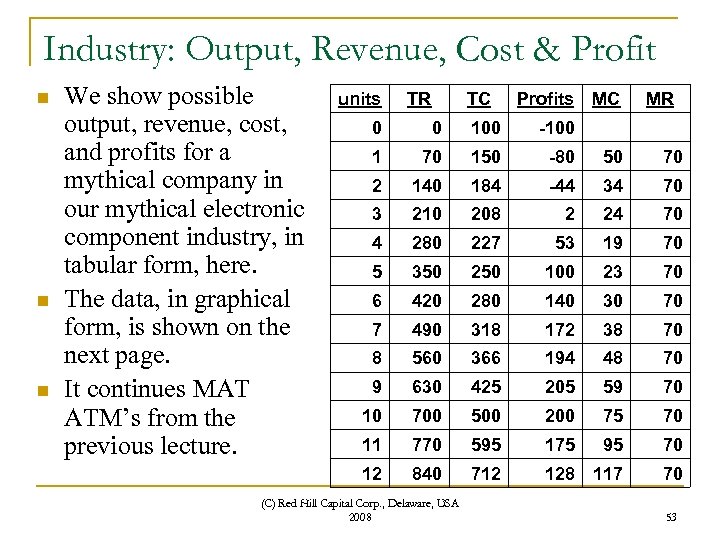

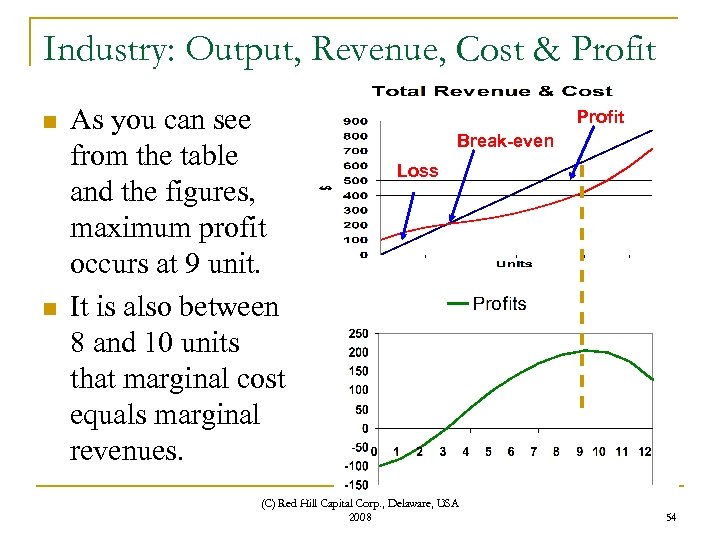

Industry: Output, Revenue, Cost & Profit n n n We show possible output, revenue, cost, and profits for a mythical company in our mythical electronic component industry, in tabular form, here. The data, in graphical form, is shown on the next page. It continues MAT ATM’s from the previous lecture. units TR TC Profits MC MR 0 0 100 -100 1 70 150 -80 50 70 2 140 184 -44 34 70 3 210 208 2 24 70 4 280 227 53 19 70 5 350 250 100 23 70 6 420 280 140 30 70 7 490 318 172 38 70 8 560 366 194 48 70 9 630 425 205 59 70 10 700 500 200 75 70 11 770 595 175 95 70 12 840 712 128 117 70 (C) Red Hill Capital Corp. , Delaware, USA 2008 53

Industry: Output, Revenue, Cost & Profit n n n We show possible output, revenue, cost, and profits for a mythical company in our mythical electronic component industry, in tabular form, here. The data, in graphical form, is shown on the next page. It continues MAT ATM’s from the previous lecture. units TR TC Profits MC MR 0 0 100 -100 1 70 150 -80 50 70 2 140 184 -44 34 70 3 210 208 2 24 70 4 280 227 53 19 70 5 350 250 100 23 70 6 420 280 140 30 70 7 490 318 172 38 70 8 560 366 194 48 70 9 630 425 205 59 70 10 700 500 200 75 70 11 770 595 175 95 70 12 840 712 128 117 70 (C) Red Hill Capital Corp. , Delaware, USA 2008 53

Industry: Output, Revenue, Cost & Profit n n As you can see from the table and the figures, maximum profit occurs at 9 unit. It is also between 8 and 10 units that marginal cost equals marginal revenues. Profit Break-even Loss (C) Red Hill Capital Corp. , Delaware, USA 2008 54

Industry: Output, Revenue, Cost & Profit n n As you can see from the table and the figures, maximum profit occurs at 9 unit. It is also between 8 and 10 units that marginal cost equals marginal revenues. Profit Break-even Loss (C) Red Hill Capital Corp. , Delaware, USA 2008 54

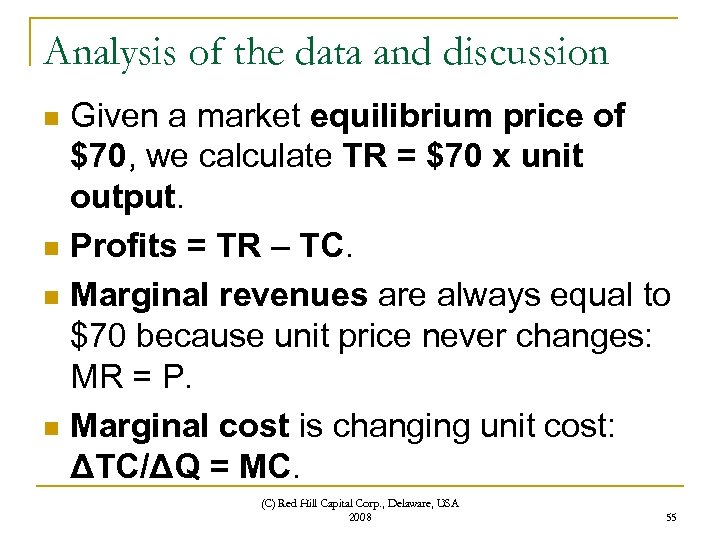

Analysis of the data and discussion Given a market equilibrium price of $70, we calculate TR = $70 x unit output. n Profits = TR – TC. n Marginal revenues are always equal to $70 because unit price never changes: MR = P. n Marginal cost is changing unit cost: ΔTC/ΔQ = MC. n (C) Red Hill Capital Corp. , Delaware, USA 2008 55

Analysis of the data and discussion Given a market equilibrium price of $70, we calculate TR = $70 x unit output. n Profits = TR – TC. n Marginal revenues are always equal to $70 because unit price never changes: MR = P. n Marginal cost is changing unit cost: ΔTC/ΔQ = MC. n (C) Red Hill Capital Corp. , Delaware, USA 2008 55

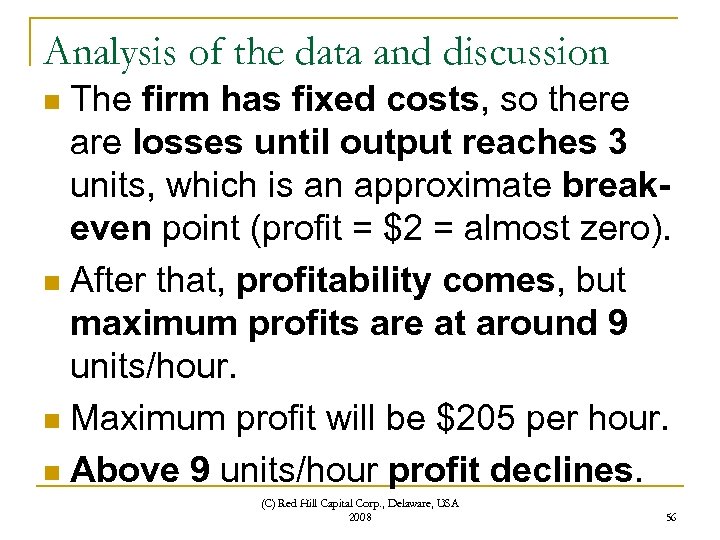

Analysis of the data and discussion The firm has fixed costs, so there are losses until output reaches 3 units, which is an approximate breakeven point (profit = $2 = almost zero). n After that, profitability comes, but maximum profits are at around 9 units/hour. n Maximum profit will be $205 per hour. n Above 9 units/hour profit declines. n (C) Red Hill Capital Corp. , Delaware, USA 2008 56

Analysis of the data and discussion The firm has fixed costs, so there are losses until output reaches 3 units, which is an approximate breakeven point (profit = $2 = almost zero). n After that, profitability comes, but maximum profits are at around 9 units/hour. n Maximum profit will be $205 per hour. n Above 9 units/hour profit declines. n (C) Red Hill Capital Corp. , Delaware, USA 2008 56

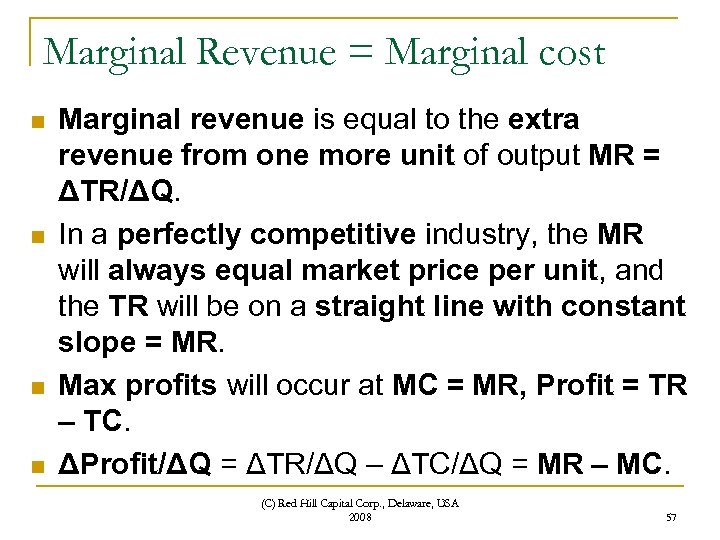

Marginal Revenue = Marginal cost n n Marginal revenue is equal to the extra revenue from one more unit of output MR = ΔTR/ΔQ. In a perfectly competitive industry, the MR will always equal market price per unit, and the TR will be on a straight line with constant slope = MR. Max profits will occur at MC = MR, Profit = TR – TC. ΔProfit/ΔQ = ΔTR/ΔQ – ΔTC/ΔQ = MR – MC. (C) Red Hill Capital Corp. , Delaware, USA 2008 57

Marginal Revenue = Marginal cost n n Marginal revenue is equal to the extra revenue from one more unit of output MR = ΔTR/ΔQ. In a perfectly competitive industry, the MR will always equal market price per unit, and the TR will be on a straight line with constant slope = MR. Max profits will occur at MC = MR, Profit = TR – TC. ΔProfit/ΔQ = ΔTR/ΔQ – ΔTC/ΔQ = MR – MC. (C) Red Hill Capital Corp. , Delaware, USA 2008 57

Marginal Revenue = Marginal cost n n n That equation tells us that profit will increase (ΔProfit/ΔQ > 0; positive change in profit) if MR > MC. That simply says that the extra revenue you get from selling that one extra unit, MR, is greater than the extra cost that you take on to produce that extra unit, MC. Therefore, there will be an addition to profits. (C) Red Hill Capital Corp. , Delaware, USA 2008 58

Marginal Revenue = Marginal cost n n n That equation tells us that profit will increase (ΔProfit/ΔQ > 0; positive change in profit) if MR > MC. That simply says that the extra revenue you get from selling that one extra unit, MR, is greater than the extra cost that you take on to produce that extra unit, MC. Therefore, there will be an addition to profits. (C) Red Hill Capital Corp. , Delaware, USA 2008 58

Marginal Revenue = Marginal cost n n n Profit will stop increasing (ΔProfit/ΔQ = 0) when MR=MC. And profit will begin to decrease (ΔProfit/ΔQ < 0; negative change in profit) after that point when MC > MR. It is only logical that total profits should decline at that point since the extra revenue that you take in, MR, is less than the extra cost that you incur, MC. (C) Red Hill Capital Corp. , Delaware, USA 2008 59

Marginal Revenue = Marginal cost n n n Profit will stop increasing (ΔProfit/ΔQ = 0) when MR=MC. And profit will begin to decrease (ΔProfit/ΔQ < 0; negative change in profit) after that point when MC > MR. It is only logical that total profits should decline at that point since the extra revenue that you take in, MR, is less than the extra cost that you incur, MC. (C) Red Hill Capital Corp. , Delaware, USA 2008 59

Marginal Revenue = Marginal cost So you will actually be subtracting the difference, MC – MR, from profits that have already been booked. n Then, we have the MR=MC Rule which says that maximum profits or minimum loss will occur at the point where MR=MC. n (C) Red Hill Capital Corp. , Delaware, USA 2008 60

Marginal Revenue = Marginal cost So you will actually be subtracting the difference, MC – MR, from profits that have already been booked. n Then, we have the MR=MC Rule which says that maximum profits or minimum loss will occur at the point where MR=MC. n (C) Red Hill Capital Corp. , Delaware, USA 2008 60

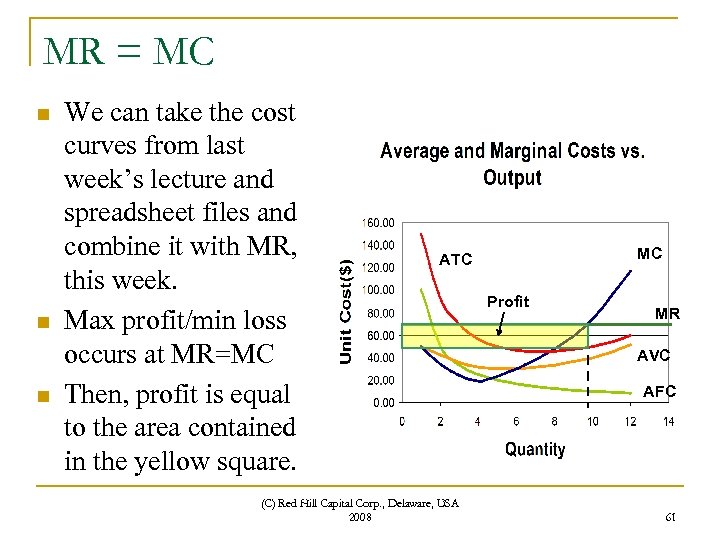

MR = MC n n n We can take the cost curves from last week’s lecture and spreadsheet files and combine it with MR, this week. Max profit/min loss occurs at MR=MC Then, profit is equal to the area contained in the yellow square. MC ATC (C) Red Hill Capital Corp. , Delaware, USA 2008 Profit MR AVC AFC 61

MR = MC n n n We can take the cost curves from last week’s lecture and spreadsheet files and combine it with MR, this week. Max profit/min loss occurs at MR=MC Then, profit is equal to the area contained in the yellow square. MC ATC (C) Red Hill Capital Corp. , Delaware, USA 2008 Profit MR AVC AFC 61

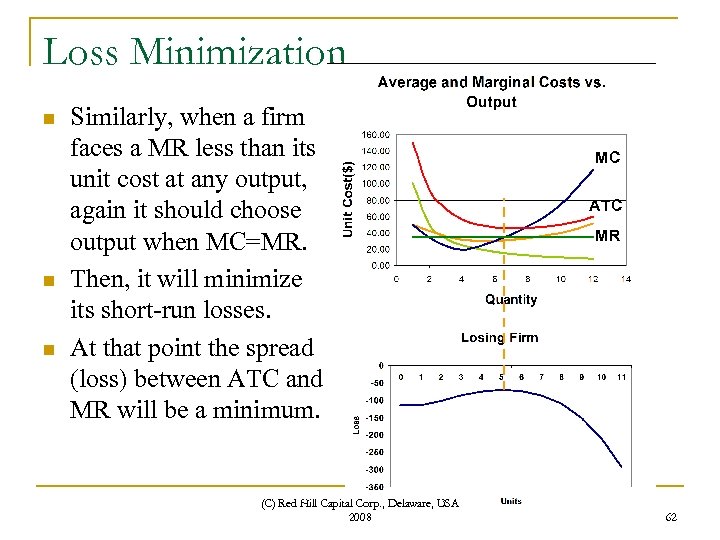

Loss Minimization n Similarly, when a firm faces a MR less than its unit cost at any output, again it should choose output when MC=MR. Then, it will minimize its short-run losses. At that point the spread (loss) between ATC and MR will be a minimum. (C) Red Hill Capital Corp. , Delaware, USA 2008 MC ATC MR 62

Loss Minimization n Similarly, when a firm faces a MR less than its unit cost at any output, again it should choose output when MC=MR. Then, it will minimize its short-run losses. At that point the spread (loss) between ATC and MR will be a minimum. (C) Red Hill Capital Corp. , Delaware, USA 2008 MC ATC MR 62

(C) Red Hill Capital Corp. , Delaware, USA 2008 63

(C) Red Hill Capital Corp. , Delaware, USA 2008 63

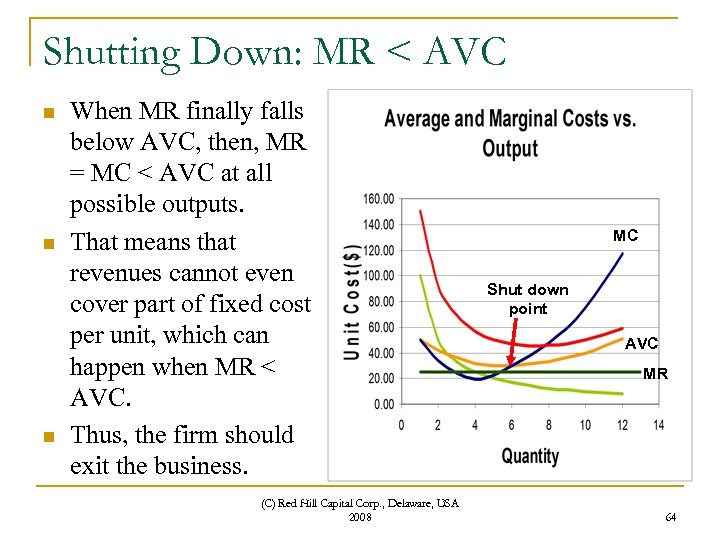

Shutting Down: MR < AVC n n n When MR finally falls below AVC, then, MR = MC < AVC at all possible outputs. That means that revenues cannot even cover part of fixed cost per unit, which can happen when MR < AVC. Thus, the firm should exit the business. (C) Red Hill Capital Corp. , Delaware, USA 2008 MC Shut down point AVC MR 64

Shutting Down: MR < AVC n n n When MR finally falls below AVC, then, MR = MC < AVC at all possible outputs. That means that revenues cannot even cover part of fixed cost per unit, which can happen when MR < AVC. Thus, the firm should exit the business. (C) Red Hill Capital Corp. , Delaware, USA 2008 MC Shut down point AVC MR 64

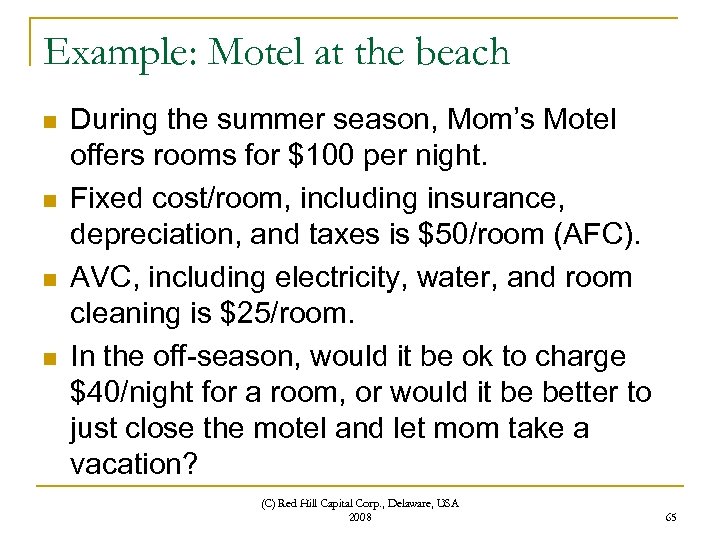

Example: Motel at the beach n n During the summer season, Mom’s Motel offers rooms for $100 per night. Fixed cost/room, including insurance, depreciation, and taxes is $50/room (AFC). AVC, including electricity, water, and room cleaning is $25/room. In the off-season, would it be ok to charge $40/night for a room, or would it be better to just close the motel and let mom take a vacation? (C) Red Hill Capital Corp. , Delaware, USA 2008 65

Example: Motel at the beach n n During the summer season, Mom’s Motel offers rooms for $100 per night. Fixed cost/room, including insurance, depreciation, and taxes is $50/room (AFC). AVC, including electricity, water, and room cleaning is $25/room. In the off-season, would it be ok to charge $40/night for a room, or would it be better to just close the motel and let mom take a vacation? (C) Red Hill Capital Corp. , Delaware, USA 2008 65

Example Analysis n n n Since AVC = $25, if the motel charges $40/night for a room, it will have $15 left over after pay for AFC/room. That leftover $15 of revenues, while not enough to actually recover all AFC per room, will at least go towards paying some of it. Since the AFC has to be paid whether or not the motel is open, it is better business sense to at least pay for some by charging only $40/night than to close down and not recover any at all. (C) Red Hill Capital Corp. , Delaware, USA 2008 66

Example Analysis n n n Since AVC = $25, if the motel charges $40/night for a room, it will have $15 left over after pay for AFC/room. That leftover $15 of revenues, while not enough to actually recover all AFC per room, will at least go towards paying some of it. Since the AFC has to be paid whether or not the motel is open, it is better business sense to at least pay for some by charging only $40/night than to close down and not recover any at all. (C) Red Hill Capital Corp. , Delaware, USA 2008 66

Break Time n Please take a 10 minute break (C) Red Hill Capital Corp. , Delaware, USA 2008 67

Break Time n Please take a 10 minute break (C) Red Hill Capital Corp. , Delaware, USA 2008 67

Short-run Supply Curves: Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 68

Short-run Supply Curves: Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 68

Individual Firm’s Possible Supply n n n We looked at costs interacting with revenues and discovered some general rules for a firm to remain in business. For it to make sense for a firm to remain in business, MR must be equal to or above the minimum variable cost, the point at which MC = AVC. Otherwise the firm cannot cover any FC, and it will go deeper and deeper into debt. (C) Red Hill Capital Corp. , Delaware, USA 2008 69

Individual Firm’s Possible Supply n n n We looked at costs interacting with revenues and discovered some general rules for a firm to remain in business. For it to make sense for a firm to remain in business, MR must be equal to or above the minimum variable cost, the point at which MC = AVC. Otherwise the firm cannot cover any FC, and it will go deeper and deeper into debt. (C) Red Hill Capital Corp. , Delaware, USA 2008 69

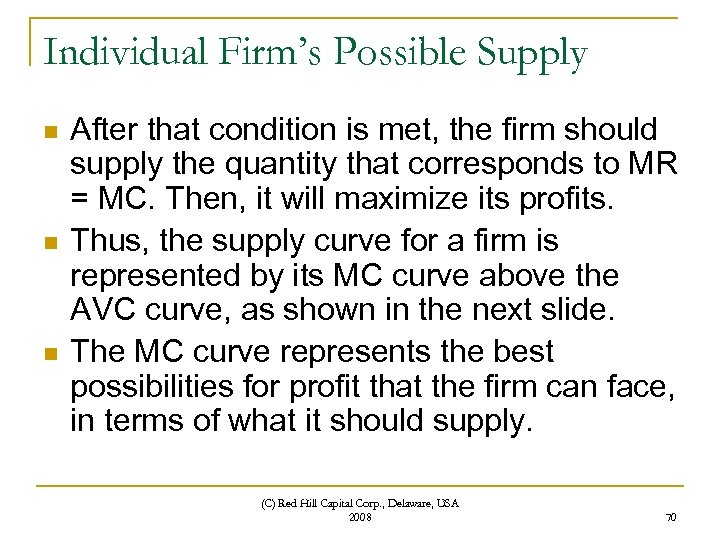

Individual Firm’s Possible Supply n n n After that condition is met, the firm should supply the quantity that corresponds to MR = MC. Then, it will maximize its profits. Thus, the supply curve for a firm is represented by its MC curve above the AVC curve, as shown in the next slide. The MC curve represents the best possibilities for profit that the firm can face, in terms of what it should supply. (C) Red Hill Capital Corp. , Delaware, USA 2008 70

Individual Firm’s Possible Supply n n n After that condition is met, the firm should supply the quantity that corresponds to MR = MC. Then, it will maximize its profits. Thus, the supply curve for a firm is represented by its MC curve above the AVC curve, as shown in the next slide. The MC curve represents the best possibilities for profit that the firm can face, in terms of what it should supply. (C) Red Hill Capital Corp. , Delaware, USA 2008 70

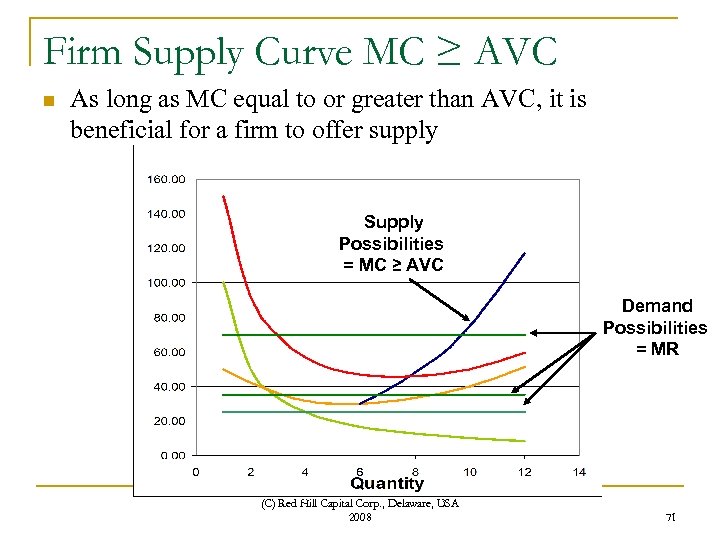

Firm Supply Curve MC ≥ AVC n As long as MC equal to or greater than AVC, it is beneficial for a firm to offer supply Supply Possibilities = MC ≥ AVC Demand Possibilities = MR (C) Red Hill Capital Corp. , Delaware, USA 2008 71

Firm Supply Curve MC ≥ AVC n As long as MC equal to or greater than AVC, it is beneficial for a firm to offer supply Supply Possibilities = MC ≥ AVC Demand Possibilities = MR (C) Red Hill Capital Corp. , Delaware, USA 2008 71

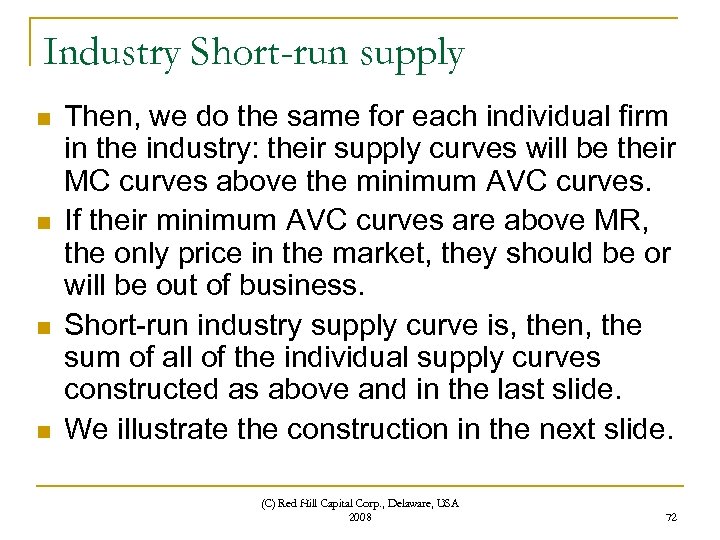

Industry Short-run supply n n Then, we do the same for each individual firm in the industry: their supply curves will be their MC curves above the minimum AVC curves. If their minimum AVC curves are above MR, the only price in the market, they should be or will be out of business. Short-run industry supply curve is, then, the sum of all of the individual supply curves constructed as above and in the last slide. We illustrate the construction in the next slide. (C) Red Hill Capital Corp. , Delaware, USA 2008 72

Industry Short-run supply n n Then, we do the same for each individual firm in the industry: their supply curves will be their MC curves above the minimum AVC curves. If their minimum AVC curves are above MR, the only price in the market, they should be or will be out of business. Short-run industry supply curve is, then, the sum of all of the individual supply curves constructed as above and in the last slide. We illustrate the construction in the next slide. (C) Red Hill Capital Corp. , Delaware, USA 2008 72

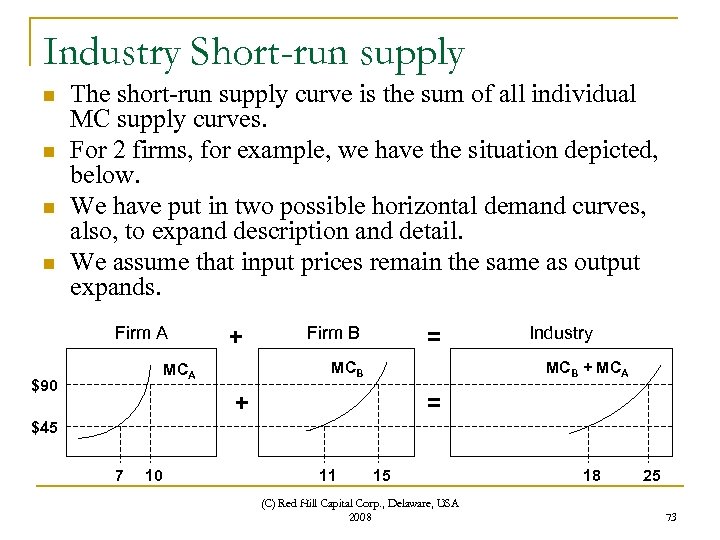

Industry Short-run supply n n The short-run supply curve is the sum of all individual MC supply curves. For 2 firms, for example, we have the situation depicted, below. We have put in two possible horizontal demand curves, also, to expand description and detail. We assume that input prices remain the same as output expands. Firm A + = MCB MCA $90 Firm B Industry MCB + MCA + = $45 7 10 11 15 (C) Red Hill Capital Corp. , Delaware, USA 2008 18 25 73

Industry Short-run supply n n The short-run supply curve is the sum of all individual MC supply curves. For 2 firms, for example, we have the situation depicted, below. We have put in two possible horizontal demand curves, also, to expand description and detail. We assume that input prices remain the same as output expands. Firm A + = MCB MCA $90 Firm B Industry MCB + MCA + = $45 7 10 11 15 (C) Red Hill Capital Corp. , Delaware, USA 2008 18 25 73

Short-run Equilibrium Adding in the an aggregate demand schedule gives an interaction to find market price and quantity in equilibrium. n Firms will earn a profit, as long as the MR = an equilibrium price is above, not only the AVC, but also the ATC. n Profit = Q P(=MR) – Q [AFC + AVC] n (C) Red Hill Capital Corp. , Delaware, USA 2008 74

Short-run Equilibrium Adding in the an aggregate demand schedule gives an interaction to find market price and quantity in equilibrium. n Firms will earn a profit, as long as the MR = an equilibrium price is above, not only the AVC, but also the ATC. n Profit = Q P(=MR) – Q [AFC + AVC] n (C) Red Hill Capital Corp. , Delaware, USA 2008 74

Short-run Equilibrium They will minimize loss by supplying on MC=MR, below ATC but above AVC. n Short-run equilibrium will retain until something happens that changes it. n We show the situation for an individual firm and the industry in the next slide. n (C) Red Hill Capital Corp. , Delaware, USA 2008 75

Short-run Equilibrium They will minimize loss by supplying on MC=MR, below ATC but above AVC. n Short-run equilibrium will retain until something happens that changes it. n We show the situation for an individual firm and the industry in the next slide. n (C) Red Hill Capital Corp. , Delaware, USA 2008 75

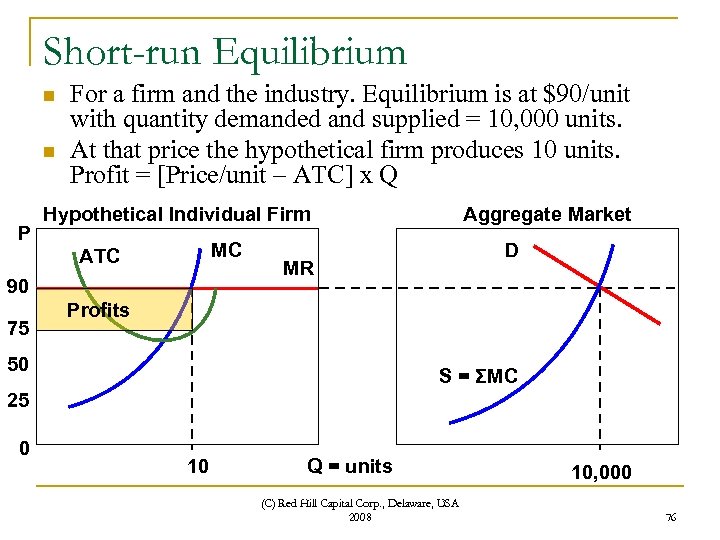

Short-run Equilibrium n n P For a firm and the industry. Equilibrium is at $90/unit with quantity demanded and supplied = 10, 000 units. At that price the hypothetical firm produces 10 units. Profit = [Price/unit – ATC] x Q Hypothetical Individual Firm MC ATC 90 75 Aggregate Market D MR Profits 50 S = ΣMC 25 0 10 Q = units (C) Red Hill Capital Corp. , Delaware, USA 2008 10, 000 76

Short-run Equilibrium n n P For a firm and the industry. Equilibrium is at $90/unit with quantity demanded and supplied = 10, 000 units. At that price the hypothetical firm produces 10 units. Profit = [Price/unit – ATC] x Q Hypothetical Individual Firm MC ATC 90 75 Aggregate Market D MR Profits 50 S = ΣMC 25 0 10 Q = units (C) Red Hill Capital Corp. , Delaware, USA 2008 10, 000 76

Long-run Supply Curves: Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 77

Long-run Supply Curves: Perfect Competition (C) Red Hill Capital Corp. , Delaware, USA 2008 77

The long-run n n In the long-run, all inputs become variable. Existing firms can react to opportunities for profits by expanding or down-sizing, buying or selling PP&E or other inputs that remain fixed in the short-run. Opportunities for profit will attract new firms, while losses will cause firms to exit the business. Free entry and exit are a crucial part of perfectly competitive markets. (C) Red Hill Capital Corp. , Delaware, USA 2008 78

The long-run n n In the long-run, all inputs become variable. Existing firms can react to opportunities for profits by expanding or down-sizing, buying or selling PP&E or other inputs that remain fixed in the short-run. Opportunities for profit will attract new firms, while losses will cause firms to exit the business. Free entry and exit are a crucial part of perfectly competitive markets. (C) Red Hill Capital Corp. , Delaware, USA 2008 78

Long-run Equilibrium Variability of all inputs means that a firm can decide to completely shut down, if it is earning less than normal profits (negative economic profits). n New firms will enter, if they see that existing firms are earning above normal profits. n Entry/exit of firms is the key factor in long-run market equilibrium. n (C) Red Hill Capital Corp. , Delaware, USA 2008 79

Long-run Equilibrium Variability of all inputs means that a firm can decide to completely shut down, if it is earning less than normal profits (negative economic profits). n New firms will enter, if they see that existing firms are earning above normal profits. n Entry/exit of firms is the key factor in long-run market equilibrium. n (C) Red Hill Capital Corp. , Delaware, USA 2008 79

Long-run Equilibrium n n If new firms enter, supply is increased, price decreases for the interaction of the old demand curve with the new supply curve. The process will continue until there are no more above normal profits to be had. If firms exit, supply will shift left, price will increase, and a new equilibrium will come when economic profits get up to the zero level, above loss levels. In the next slide, we show a firm in long-run equilibrium. (C) Red Hill Capital Corp. , Delaware, USA 2008 80

Long-run Equilibrium n n If new firms enter, supply is increased, price decreases for the interaction of the old demand curve with the new supply curve. The process will continue until there are no more above normal profits to be had. If firms exit, supply will shift left, price will increase, and a new equilibrium will come when economic profits get up to the zero level, above loss levels. In the next slide, we show a firm in long-run equilibrium. (C) Red Hill Capital Corp. , Delaware, USA 2008 80

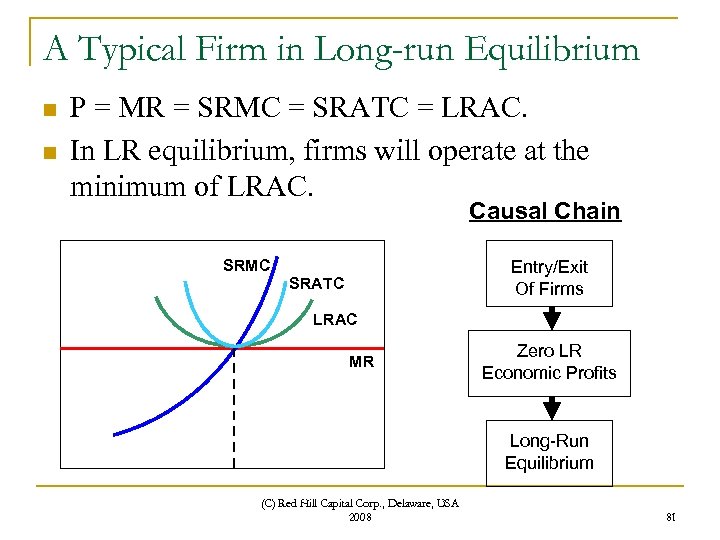

A Typical Firm in Long-run Equilibrium n n P = MR = SRMC = SRATC = LRAC. In LR equilibrium, firms will operate at the minimum of LRAC. Causal Chain SRMC Entry/Exit Of Firms SRATC LRAC MR Zero LR Economic Profits Long-Run Equilibrium (C) Red Hill Capital Corp. , Delaware, USA 2008 81

A Typical Firm in Long-run Equilibrium n n P = MR = SRMC = SRATC = LRAC. In LR equilibrium, firms will operate at the minimum of LRAC. Causal Chain SRMC Entry/Exit Of Firms SRATC LRAC MR Zero LR Economic Profits Long-Run Equilibrium (C) Red Hill Capital Corp. , Delaware, USA 2008 81

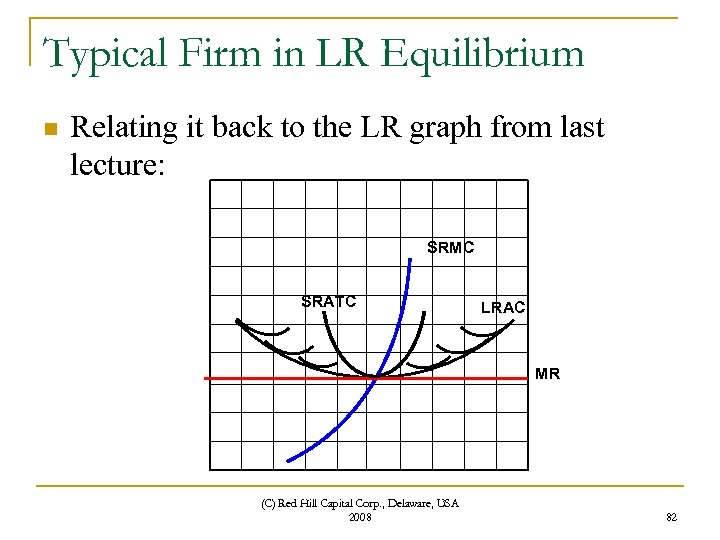

Typical Firm in LR Equilibrium n Relating it back to the LR graph from last lecture: SRMC SRATC LRAC MR (C) Red Hill Capital Corp. , Delaware, USA 2008 82

Typical Firm in LR Equilibrium n Relating it back to the LR graph from last lecture: SRMC SRATC LRAC MR (C) Red Hill Capital Corp. , Delaware, USA 2008 82

P = MR = SRMC = SRATC = LRAC n n n We have established the P = MR =SRMC concept, already. Also, SRMC = SRATC is the short run minimum level for profits to cover all costs. In the long-run, a firm will also want to be at the minimum in the LRAC curve, also, because larger or smaller operations will be on either side of that minimum will have higher average total costs. (C) Red Hill Capital Corp. , Delaware, USA 2008 83

P = MR = SRMC = SRATC = LRAC n n n We have established the P = MR =SRMC concept, already. Also, SRMC = SRATC is the short run minimum level for profits to cover all costs. In the long-run, a firm will also want to be at the minimum in the LRAC curve, also, because larger or smaller operations will be on either side of that minimum will have higher average total costs. (C) Red Hill Capital Corp. , Delaware, USA 2008 83

P = MR = SRMC = SRATC = LRAC n n n Thus, LR equilibrium can occur only after all firms have adjusted to that perfect minimal cost point. As long as no variables change, there is no reason for a firm to produce a new level of output. Everything is the best that it can be. There is no reason to change size of plant or anything else. (C) Red Hill Capital Corp. , Delaware, USA 2008 84

P = MR = SRMC = SRATC = LRAC n n n Thus, LR equilibrium can occur only after all firms have adjusted to that perfect minimal cost point. As long as no variables change, there is no reason for a firm to produce a new level of output. Everything is the best that it can be. There is no reason to change size of plant or anything else. (C) Red Hill Capital Corp. , Delaware, USA 2008 84

P = MR = SRMC = SRATC = LRAC Since all firms are happy where they are, the industry will be in equilibrium. n There is no extra profit to cause new entries and enough profit to keep all existing producers. n The price in the LR equilibrium is the best price that can be achieved. n (C) Red Hill Capital Corp. , Delaware, USA 2008 85

P = MR = SRMC = SRATC = LRAC Since all firms are happy where they are, the industry will be in equilibrium. n There is no extra profit to cause new entries and enough profit to keep all existing producers. n The price in the LR equilibrium is the best price that can be achieved. n (C) Red Hill Capital Corp. , Delaware, USA 2008 85

P = MR = SRMC = SRATC = LRAC The market is acting perfectly efficiently and consumer welfare is maximized. n Since things are constantly changing (even world population, for example), LR equilibrium will not often be achieved, and n Most of the time markets will just be moving in the direction of an apparent LR equilibrium state. n (C) Red Hill Capital Corp. , Delaware, USA 2008 86

P = MR = SRMC = SRATC = LRAC The market is acting perfectly efficiently and consumer welfare is maximized. n Since things are constantly changing (even world population, for example), LR equilibrium will not often be achieved, and n Most of the time markets will just be moving in the direction of an apparent LR equilibrium state. n (C) Red Hill Capital Corp. , Delaware, USA 2008 86

3 Types of Long-run Supply Curves (C) Red Hill Capital Corp. , Delaware, USA 2008 87

3 Types of Long-run Supply Curves (C) Red Hill Capital Corp. , Delaware, USA 2008 87

LR supply n n A perfect competitive industry’s LR supply curve shows the quantities that the industry will supply at various equilibrium prices after all entry and exit has been completed. The shape of the LR supply curve depends on the response of prices of inputs as new firms enter an industry. There are three possibilities, increasing, flat and decreasing costs. We look at each, in turn. (C) Red Hill Capital Corp. , Delaware, USA 2008 88

LR supply n n A perfect competitive industry’s LR supply curve shows the quantities that the industry will supply at various equilibrium prices after all entry and exit has been completed. The shape of the LR supply curve depends on the response of prices of inputs as new firms enter an industry. There are three possibilities, increasing, flat and decreasing costs. We look at each, in turn. (C) Red Hill Capital Corp. , Delaware, USA 2008 88

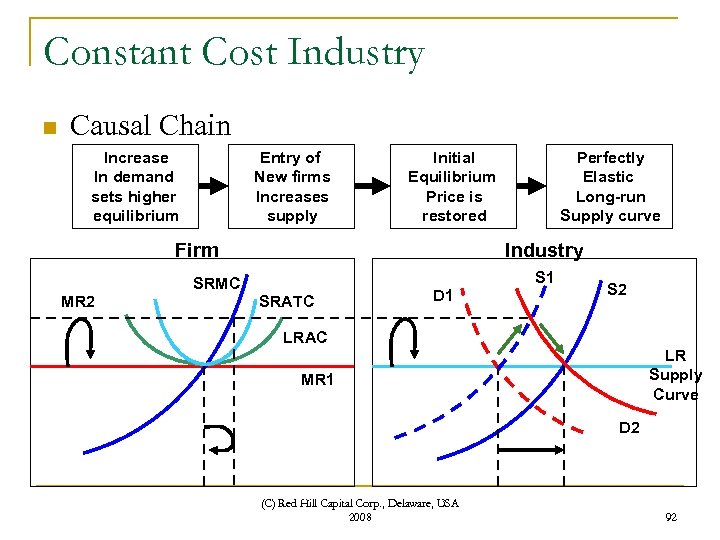

Constant Cost Industry A constant cost industry is one in which the expansion of output by entry of new firms into the industry has no affect on the firm’s cost curves. n Consider an upward shift in demand (see next slide). n In response to the demand shift, in the short run, price will rise along the supply curve to a new short-run equilibrium. n (C) Red Hill Capital Corp. , Delaware, USA 2008 89

Constant Cost Industry A constant cost industry is one in which the expansion of output by entry of new firms into the industry has no affect on the firm’s cost curves. n Consider an upward shift in demand (see next slide). n In response to the demand shift, in the short run, price will rise along the supply curve to a new short-run equilibrium. n (C) Red Hill Capital Corp. , Delaware, USA 2008 89

Constant Cost Industry n At that new equilibrium, existing firms will adjust output along their supply curves, and they will increase profits to above normal. As a result of excess profits, new firms will be induced to enter the industry. n Then, supply will increase until there are no abnormal profits. n (C) Red Hill Capital Corp. , Delaware, USA 2008 90

Constant Cost Industry n At that new equilibrium, existing firms will adjust output along their supply curves, and they will increase profits to above normal. As a result of excess profits, new firms will be induced to enter the industry. n Then, supply will increase until there are no abnormal profits. n (C) Red Hill Capital Corp. , Delaware, USA 2008 90

Constant Cost Industry n n n Old firms will adjust down their SRMC supply curves to the point that they were at before the change with the new equilibrium price of new demand met by new supply at an expanded quantity. Since we have no increases in costs at the expanded output, the new equilibrium price should be the same as the original equilibrium price before demand increased. In that regard, the change in equilibrium price traces out a straight line (see figure in next slide), and that is the long-term supply curve. (C) Red Hill Capital Corp. , Delaware, USA 2008 91

Constant Cost Industry n n n Old firms will adjust down their SRMC supply curves to the point that they were at before the change with the new equilibrium price of new demand met by new supply at an expanded quantity. Since we have no increases in costs at the expanded output, the new equilibrium price should be the same as the original equilibrium price before demand increased. In that regard, the change in equilibrium price traces out a straight line (see figure in next slide), and that is the long-term supply curve. (C) Red Hill Capital Corp. , Delaware, USA 2008 91

Constant Cost Industry n Causal Chain Increase In demand sets higher equilibrium Entry of New firms Increases supply Initial Equilibrium Price is restored Firm Industry S 1 SRMC MR 2 Perfectly Elastic Long-run Supply curve SRATC D 1 S 2 LRAC LR Supply Curve MR 1 D 2 (C) Red Hill Capital Corp. , Delaware, USA 2008 92

Constant Cost Industry n Causal Chain Increase In demand sets higher equilibrium Entry of New firms Increases supply Initial Equilibrium Price is restored Firm Industry S 1 SRMC MR 2 Perfectly Elastic Long-run Supply curve SRATC D 1 S 2 LRAC LR Supply Curve MR 1 D 2 (C) Red Hill Capital Corp. , Delaware, USA 2008 92

Constant Cost Industry n n If you imagine that the reverse situation happens and demand decreases: New SR equilibrium will be at a lower price. That means that firms are making less than normal profits. Thus, firms will exit the business, supply will decrease, and price will eventually be restored at the original equilibrium price with a lower quantity supplied. (C) Red Hill Capital Corp. , Delaware, USA 2008 93

Constant Cost Industry n n If you imagine that the reverse situation happens and demand decreases: New SR equilibrium will be at a lower price. That means that firms are making less than normal profits. Thus, firms will exit the business, supply will decrease, and price will eventually be restored at the original equilibrium price with a lower quantity supplied. (C) Red Hill Capital Corp. , Delaware, USA 2008 93

Decreasing Cost Industry As new firms enter a decreasing cost industry, input prices fall as total output expands. n A decreasing-cost industry is one in which expansion of industry output by the entry of new firms decreases firm’s costs. n Consider, for example, the computer market. n (C) Red Hill Capital Corp. , Delaware, USA 2008 94

Decreasing Cost Industry As new firms enter a decreasing cost industry, input prices fall as total output expands. n A decreasing-cost industry is one in which expansion of industry output by the entry of new firms decreases firm’s costs. n Consider, for example, the computer market. n (C) Red Hill Capital Corp. , Delaware, USA 2008 94

Decreasing Cost Industry n n n As output of computers increase, suppliers of computer chips might experience economies-of-scale cost decreases, themselves, and be able to supply a larger computer industry with cheaper chips. Thus, computer makers will be able to decrease their costs as a direct result of their industry expansion. Then (see slide below), an increase in demand will cause a temporary increase in price, resulting in expanded profits. (C) Red Hill Capital Corp. , Delaware, USA 2008 95

Decreasing Cost Industry n n n As output of computers increase, suppliers of computer chips might experience economies-of-scale cost decreases, themselves, and be able to supply a larger computer industry with cheaper chips. Thus, computer makers will be able to decrease their costs as a direct result of their industry expansion. Then (see slide below), an increase in demand will cause a temporary increase in price, resulting in expanded profits. (C) Red Hill Capital Corp. , Delaware, USA 2008 95

Decreasing Cost Industry n n As new entrants into the market a new supply curve will develop at which all suppliers have a new cost curve, below the original one. Tracing out the straight line between equilibrium prices is a downward sloping curve. Thus, the LR supply curve, in this case, is downward sloping. See the next slide for a graphical illustration for this case. (C) Red Hill Capital Corp. , Delaware, USA 2008 96

Decreasing Cost Industry n n As new entrants into the market a new supply curve will develop at which all suppliers have a new cost curve, below the original one. Tracing out the straight line between equilibrium prices is a downward sloping curve. Thus, the LR supply curve, in this case, is downward sloping. See the next slide for a graphical illustration for this case. (C) Red Hill Capital Corp. , Delaware, USA 2008 96

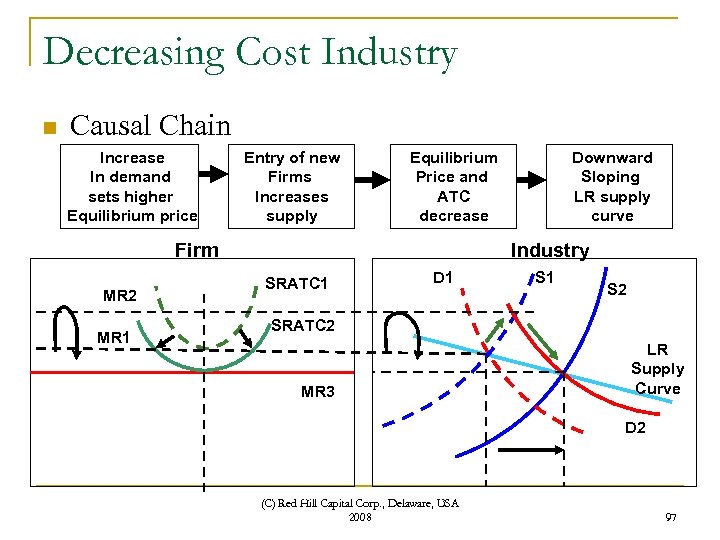

Decreasing Cost Industry n Causal Chain Increase In demand sets higher Equilibrium price Entry of new Firms Increases supply Equilibrium Price and ATC decrease Firm MR 2 MR 1 Downward Sloping LR supply curve Industry SRATC 1 D 1 S 2 SRATC 2 MR 3 LR Supply Curve D 2 (C) Red Hill Capital Corp. , Delaware, USA 2008 97

Decreasing Cost Industry n Causal Chain Increase In demand sets higher Equilibrium price Entry of new Firms Increases supply Equilibrium Price and ATC decrease Firm MR 2 MR 1 Downward Sloping LR supply curve Industry SRATC 1 D 1 S 2 SRATC 2 MR 3 LR Supply Curve D 2 (C) Red Hill Capital Corp. , Delaware, USA 2008 97

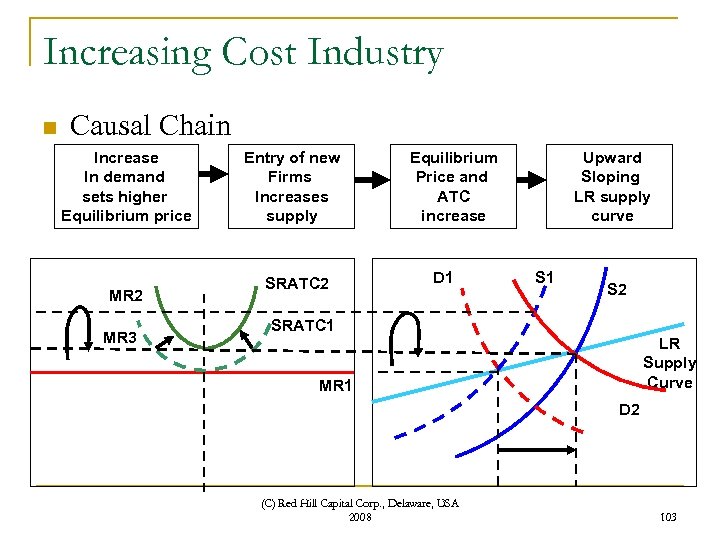

Increasing Cost Industry n As an increasing cost industry expands its output with the entry of new firms, prices of inputs rise. n As the industry uses more labor, land, machinery, and raw materials, the demand for greater quantities drives up some or all of their prices. (C) Red Hill Capital Corp. , Delaware, USA 2008 98

Increasing Cost Industry n As an increasing cost industry expands its output with the entry of new firms, prices of inputs rise. n As the industry uses more labor, land, machinery, and raw materials, the demand for greater quantities drives up some or all of their prices. (C) Red Hill Capital Corp. , Delaware, USA 2008 98

Increasing Cost Industry For example, suppose that the home electronics industry uses a significant percentage of electrical engineers, in the country, and it decides to expand. n Then, salaries of electrical engineers, who are in limited supply, will increase, and the cost of home electronics might increase. n (C) Red Hill Capital Corp. , Delaware, USA 2008 99

Increasing Cost Industry For example, suppose that the home electronics industry uses a significant percentage of electrical engineers, in the country, and it decides to expand. n Then, salaries of electrical engineers, who are in limited supply, will increase, and the cost of home electronics might increase. n (C) Red Hill Capital Corp. , Delaware, USA 2008 99

Increasing Cost Industry n n It is believed that most industries, in practice, are increasing-cost industries. As a result, the long-run supply curve of such industries is the usual upward-sloping supply curve that we are familiar with. We show what happens in such an increasing cost industry in the slide, below. Demand increases, causing a temporary increase in equilibrium price, up the old supply curve, and a chance to earn abnormal profits. (C) Red Hill Capital Corp. , Delaware, USA 2008 100

Increasing Cost Industry n n It is believed that most industries, in practice, are increasing-cost industries. As a result, the long-run supply curve of such industries is the usual upward-sloping supply curve that we are familiar with. We show what happens in such an increasing cost industry in the slide, below. Demand increases, causing a temporary increase in equilibrium price, up the old supply curve, and a chance to earn abnormal profits. (C) Red Hill Capital Corp. , Delaware, USA 2008 100

Increasing Cost Industry In response to this excess profit potential, new firms enter the industry, and supply expands. n As a result, price begins to decrease. n However, because of increasing costs for everyone in the industry, there is a new ATC cost structure curve which is shifted upward from the initial one. n (C) Red Hill Capital Corp. , Delaware, USA 2008 101

Increasing Cost Industry In response to this excess profit potential, new firms enter the industry, and supply expands. n As a result, price begins to decrease. n However, because of increasing costs for everyone in the industry, there is a new ATC cost structure curve which is shifted upward from the initial one. n (C) Red Hill Capital Corp. , Delaware, USA 2008 101

Increasing Cost Industry Then, the equilibrium price declines to a level, which is above the initial equilibrium price. n Thus, the LR supply curve traced out by the overall movement between initial and final market equilibriums is upward sloping. n See the figures for details. . n (C) Red Hill Capital Corp. , Delaware, USA 2008 102

Increasing Cost Industry Then, the equilibrium price declines to a level, which is above the initial equilibrium price. n Thus, the LR supply curve traced out by the overall movement between initial and final market equilibriums is upward sloping. n See the figures for details. . n (C) Red Hill Capital Corp. , Delaware, USA 2008 102

Increasing Cost Industry n Causal Chain Increase In demand sets higher Equilibrium price MR 2 MR 3 Entry of new Firms Increases supply SRATC 2 Equilibrium Price and ATC increase D 1 Upward Sloping LR supply curve S 1 S 2 SRATC 1 LR Supply Curve MR 1 D 2 (C) Red Hill Capital Corp. , Delaware, USA 2008 103

Increasing Cost Industry n Causal Chain Increase In demand sets higher Equilibrium price MR 2 MR 3 Entry of new Firms Increases supply SRATC 2 Equilibrium Price and ATC increase D 1 Upward Sloping LR supply curve S 1 S 2 SRATC 1 LR Supply Curve MR 1 D 2 (C) Red Hill Capital Corp. , Delaware, USA 2008 103

The Internet & Global Markets (C) Red Hill Capital Corp. , Delaware, USA 2008 104

The Internet & Global Markets (C) Red Hill Capital Corp. , Delaware, USA 2008 104

The Internet and the Global Marketplace The development of the internet has increased competition on a global basis. n With the existence of the internet, information is more readily available, and it is as easy to order a book or a new coat, on-line, as it is to make a phone call to your local book or clothing boutique. n (C) Red Hill Capital Corp. , Delaware, USA 2008 105

The Internet and the Global Marketplace The development of the internet has increased competition on a global basis. n With the existence of the internet, information is more readily available, and it is as easy to order a book or a new coat, on-line, as it is to make a phone call to your local book or clothing boutique. n (C) Red Hill Capital Corp. , Delaware, USA 2008 105

The Internet and the Global Marketplace Now, a girl with a bedroom full of books can market her books to people as easily as someone who has a book store. Both offer their own convenience. n The store has books on display that you can page through, the girl has excerpts of books on her website and you don’t even need to take a walk to the store. n (C) Red Hill Capital Corp. , Delaware, USA 2008 106

The Internet and the Global Marketplace Now, a girl with a bedroom full of books can market her books to people as easily as someone who has a book store. Both offer their own convenience. n The store has books on display that you can page through, the girl has excerpts of books on her website and you don’t even need to take a walk to the store. n (C) Red Hill Capital Corp. , Delaware, USA 2008 106

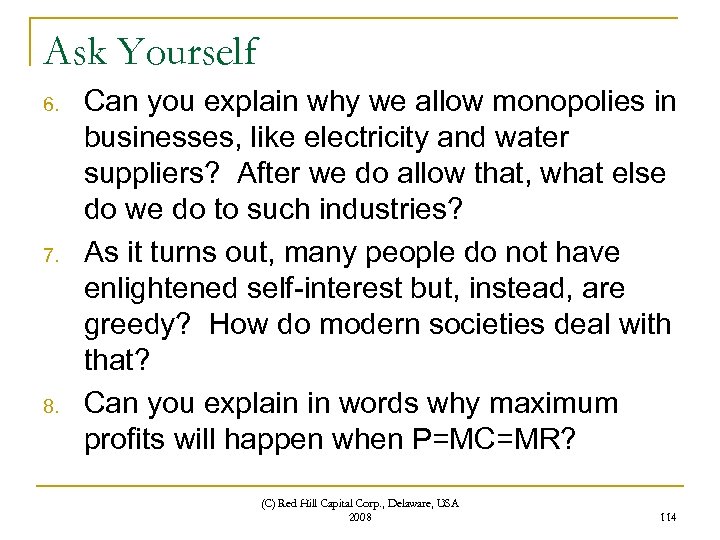

The Internet and the Global Marketplace n n n It also has done away with the monopolies that people have locally or geographically. Previously, one would have to invest in opening a local store. Now, a bookseller from a small town in Guangdong province can offer books to a person in New York City. In that regard, barriers to entry to many markets have been lowered by the internet and the ability to do browsing, buying and selling, on-line. (C) Red Hill Capital Corp. , Delaware, USA 2008 107