afdbbf16d20063381c992231aba31e47.ppt

- Количество слайдов: 24

East Asian Equity Markets, Financial Crisis, and the Japanese Currency Stephen Yan-leung Cheung Professor of Finance (Chair) Department of Economics and Finance City University of Hong Kong July 24, 2002 Stephen Cheung East Asian Equity Markets, Financial Crisis and the Japanese Currency

East Asian Equity Markets, Financial Crisis, and the Japanese Currency Stephen Yan-leung Cheung Professor of Finance (Chair) Department of Economics and Finance City University of Hong Kong July 24, 2002 Stephen Cheung East Asian Equity Markets, Financial Crisis and the Japanese Currency

Agenda 1. Motivations 2. Objectives 3. Data 4. Methodology and Results 5. Conclusions East Asian Equity Markets, Financial Crisis and the Japanese Currency 2

Agenda 1. Motivations 2. Objectives 3. Data 4. Methodology and Results 5. Conclusions East Asian Equity Markets, Financial Crisis and the Japanese Currency 2

Motivations a. Yen/ US volatility • Yen/ US was very volatile during the last decade • From 80 Yen/US to 147 Yen/US • Yen’s depreciation reduce Asia’s trade deficit with Japan from an annual deficit of $59 billion in 1995 -97 to $ 19 billion in 2001 East Asian Equity Markets, Financial Crisis and the Japanese Currency 3

Motivations a. Yen/ US volatility • Yen/ US was very volatile during the last decade • From 80 Yen/US to 147 Yen/US • Yen’s depreciation reduce Asia’s trade deficit with Japan from an annual deficit of $59 billion in 1995 -97 to $ 19 billion in 2001 East Asian Equity Markets, Financial Crisis and the Japanese Currency 3

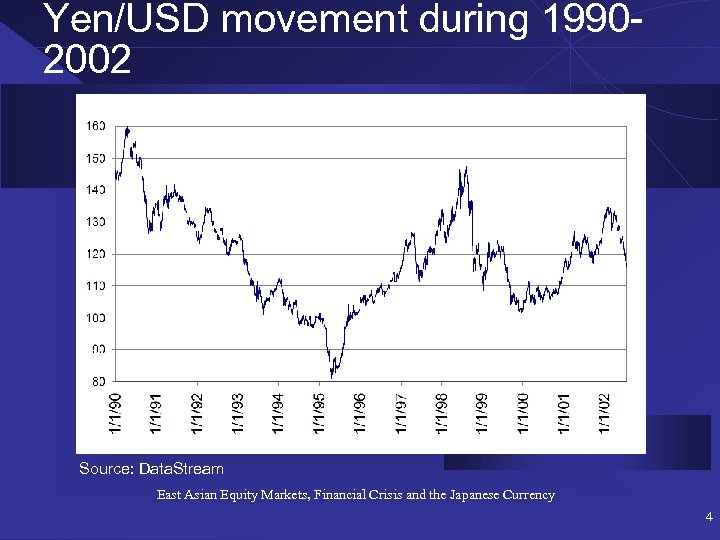

Yen/USD movement during 19902002 Source: Data. Stream East Asian Equity Markets, Financial Crisis and the Japanese Currency 4

Yen/USD movement during 19902002 Source: Data. Stream East Asian Equity Markets, Financial Crisis and the Japanese Currency 4

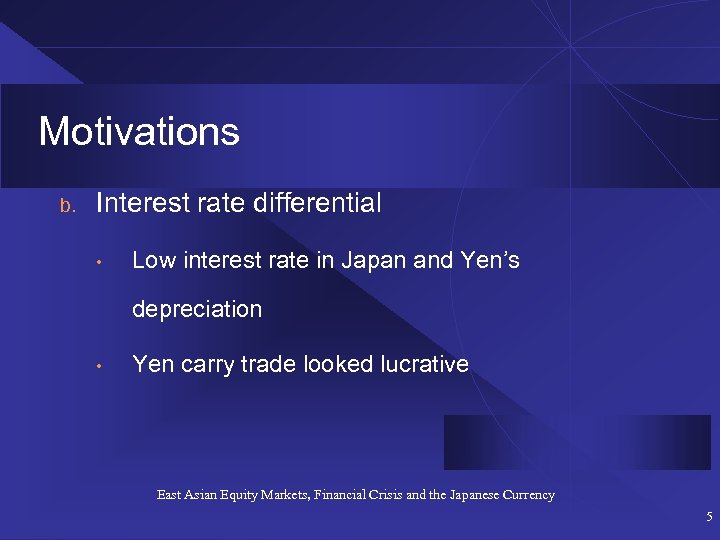

Motivations b. Interest rate differential • Low interest rate in Japan and Yen’s depreciation • Yen carry trade looked lucrative East Asian Equity Markets, Financial Crisis and the Japanese Currency 5

Motivations b. Interest rate differential • Low interest rate in Japan and Yen’s depreciation • Yen carry trade looked lucrative East Asian Equity Markets, Financial Crisis and the Japanese Currency 5

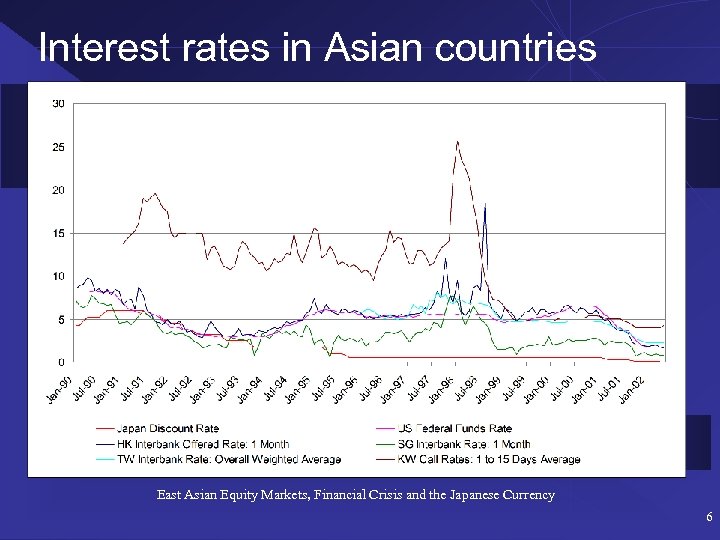

Interest rates in Asian countries East Asian Equity Markets, Financial Crisis and the Japanese Currency 6

Interest rates in Asian countries East Asian Equity Markets, Financial Crisis and the Japanese Currency 6

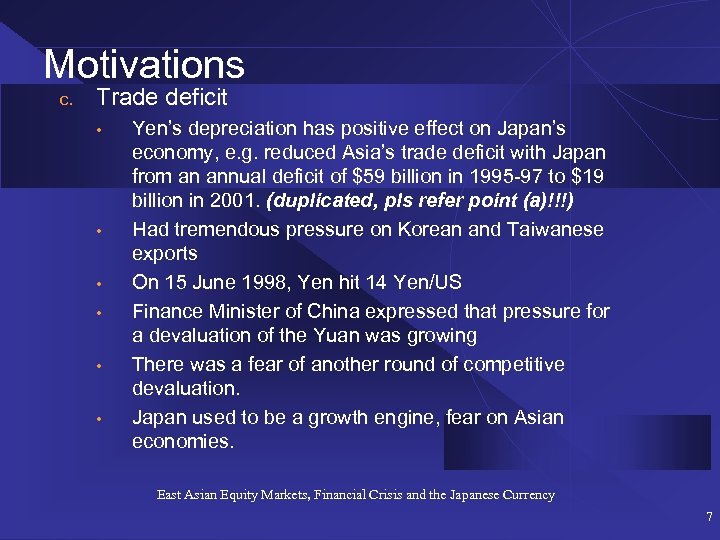

Motivations c. Trade deficit • • • Yen’s depreciation has positive effect on Japan’s economy, e. g. reduced Asia’s trade deficit with Japan from an annual deficit of $59 billion in 1995 -97 to $19 billion in 2001. (duplicated, pls refer point (a)!!!) Had tremendous pressure on Korean and Taiwanese exports On 15 June 1998, Yen hit 14 Yen/US Finance Minister of China expressed that pressure for a devaluation of the Yuan was growing There was a fear of another round of competitive devaluation. Japan used to be a growth engine, fear on Asian economies. East Asian Equity Markets, Financial Crisis and the Japanese Currency 7

Motivations c. Trade deficit • • • Yen’s depreciation has positive effect on Japan’s economy, e. g. reduced Asia’s trade deficit with Japan from an annual deficit of $59 billion in 1995 -97 to $19 billion in 2001. (duplicated, pls refer point (a)!!!) Had tremendous pressure on Korean and Taiwanese exports On 15 June 1998, Yen hit 14 Yen/US Finance Minister of China expressed that pressure for a devaluation of the Yuan was growing There was a fear of another round of competitive devaluation. Japan used to be a growth engine, fear on Asian economies. East Asian Equity Markets, Financial Crisis and the Japanese Currency 7

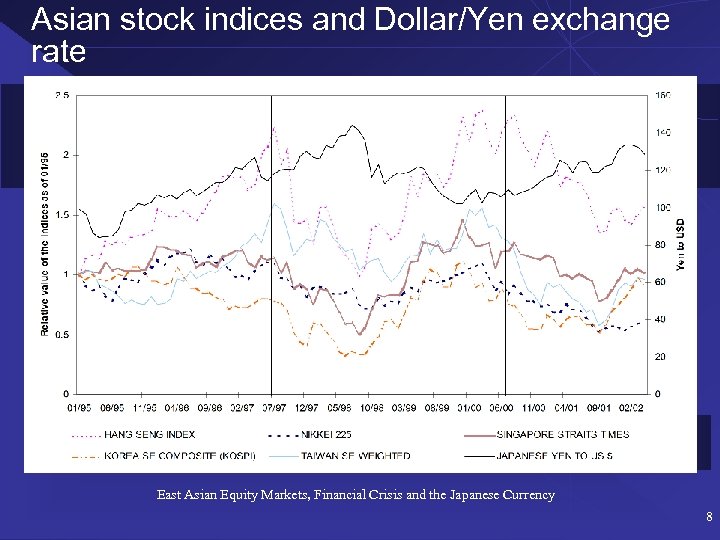

Asian stock indices and Dollar/Yen exchange rate East Asian Equity Markets, Financial Crisis and the Japanese Currency 8

Asian stock indices and Dollar/Yen exchange rate East Asian Equity Markets, Financial Crisis and the Japanese Currency 8

Motivations u Asian emerging markets, good investment opportunities before Asian Crisis (Levy and Sarnat, 1970; Solnik, 1974) u US market, the leading market (Cha and Cheung, 1998; Cheung and Ng, 1996) u The Change in information transmission mechanism after crisis (Cha and Cheung, 1998; Tuluca and Zwick, 2001) East Asian Equity Markets, Financial Crisis and the Japanese Currency 9

Motivations u Asian emerging markets, good investment opportunities before Asian Crisis (Levy and Sarnat, 1970; Solnik, 1974) u US market, the leading market (Cha and Cheung, 1998; Cheung and Ng, 1996) u The Change in information transmission mechanism after crisis (Cha and Cheung, 1998; Tuluca and Zwick, 2001) East Asian Equity Markets, Financial Crisis and the Japanese Currency 9

Objectives 1. Study the information structure changes between the equity markets in the US and four East Asian economies during the Asian crisis; and 2. Examine the impacts of Japanese currency movements on these four East Asian economies East Asian Equity Markets, Financial Crisis and the Japanese Currency 10

Objectives 1. Study the information structure changes between the equity markets in the US and four East Asian economies during the Asian crisis; and 2. Examine the impacts of Japanese currency movements on these four East Asian economies East Asian Equity Markets, Financial Crisis and the Japanese Currency 10

Data Daily logarithmic returns: u u u Hong Korea Singapore Taiwan US Sample period: u u u Pre-crisis period: January 1995 – June 1997 Crisis period: July 1997 – June 2000 Post-crisis period: July 2000 – July 2001 East Asian Equity Markets, Financial Crisis and the Japanese Currency 11

Data Daily logarithmic returns: u u u Hong Korea Singapore Taiwan US Sample period: u u u Pre-crisis period: January 1995 – June 1997 Crisis period: July 1997 – June 2000 Post-crisis period: July 2000 – July 2001 East Asian Equity Markets, Financial Crisis and the Japanese Currency 11

Methodology and results Stationarity 1. Dickey-Fuller test: - all stock indices are I(1) processes 2. Johansen cointegration test on the indices of the US and four Asian economies : - Pre-crisis period: pairwise cointegrated Crisis and post-crisis period: no cointegration Action: include an error correction term for the precrisis period only East Asian Equity Markets, Financial Crisis and the Japanese Currency 12

Methodology and results Stationarity 1. Dickey-Fuller test: - all stock indices are I(1) processes 2. Johansen cointegration test on the indices of the US and four Asian economies : - Pre-crisis period: pairwise cointegrated Crisis and post-crisis period: no cointegration Action: include an error correction term for the precrisis period only East Asian Equity Markets, Financial Crisis and the Japanese Currency 12

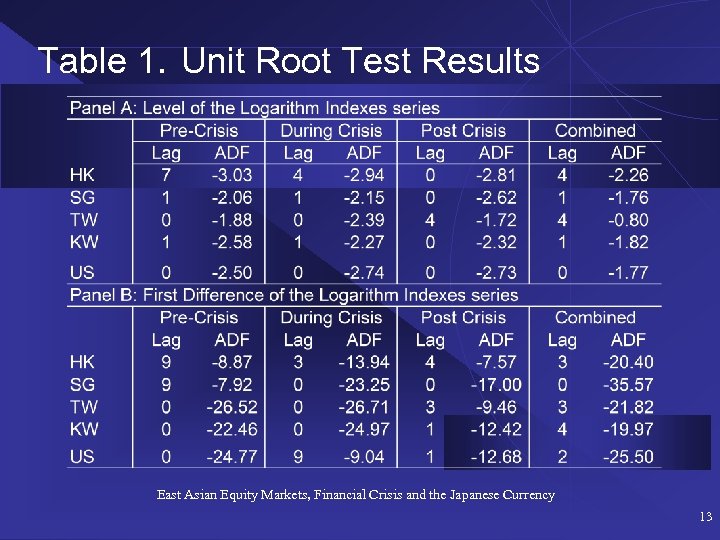

Table 1. Unit Root Test Results East Asian Equity Markets, Financial Crisis and the Japanese Currency 13

Table 1. Unit Root Test Results East Asian Equity Markets, Financial Crisis and the Japanese Currency 13

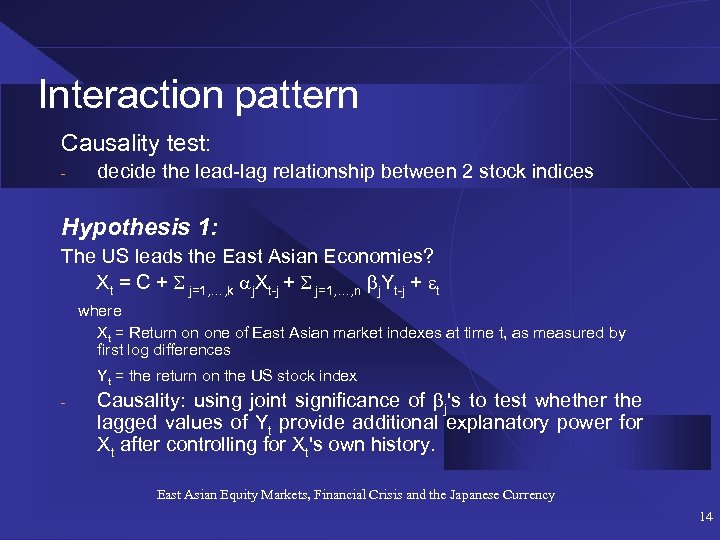

Interaction pattern Causality test: - decide the lead-lag relationship between 2 stock indices Hypothesis 1: The US leads the East Asian Economies? Xt = C + j=1, …, k j. Xt-j + j=1, …, n j. Yt-j + t where Xt = Return on one of East Asian market indexes at time t, as measured by first log differences Yt = the return on the US stock index - Causality: using joint significance of j's to test whether the lagged values of Yt provide additional explanatory power for Xt after controlling for Xt's own history. East Asian Equity Markets, Financial Crisis and the Japanese Currency 14

Interaction pattern Causality test: - decide the lead-lag relationship between 2 stock indices Hypothesis 1: The US leads the East Asian Economies? Xt = C + j=1, …, k j. Xt-j + j=1, …, n j. Yt-j + t where Xt = Return on one of East Asian market indexes at time t, as measured by first log differences Yt = the return on the US stock index - Causality: using joint significance of j's to test whether the lagged values of Yt provide additional explanatory power for Xt after controlling for Xt's own history. East Asian Equity Markets, Financial Crisis and the Japanese Currency 14

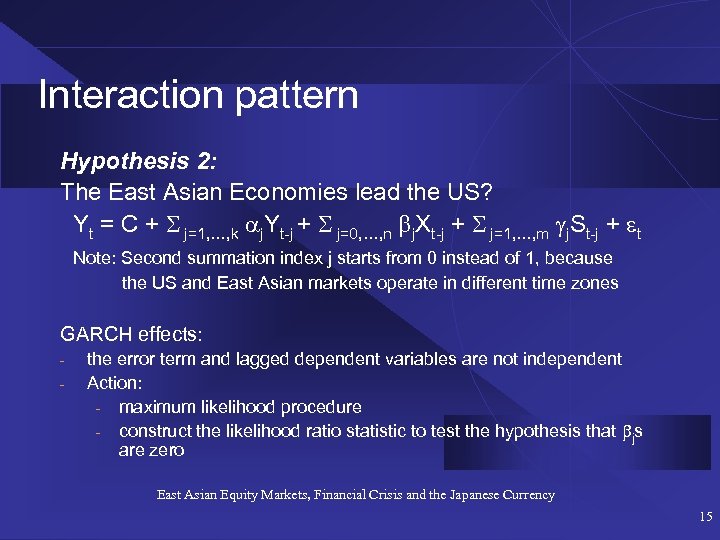

Interaction pattern Hypothesis 2: The East Asian Economies lead the US? Yt = C + j=1, …, k j. Yt-j + j=0, …, n j. Xt-j + j=1, …, m j. St-j + t Note: Second summation index j starts from 0 instead of 1, because the US and East Asian markets operate in different time zones GARCH effects: - the error term and lagged dependent variables are not independent Action: - maximum likelihood procedure - construct the likelihood ratio statistic to test the hypothesis that js are zero East Asian Equity Markets, Financial Crisis and the Japanese Currency 15

Interaction pattern Hypothesis 2: The East Asian Economies lead the US? Yt = C + j=1, …, k j. Yt-j + j=0, …, n j. Xt-j + j=1, …, m j. St-j + t Note: Second summation index j starts from 0 instead of 1, because the US and East Asian markets operate in different time zones GARCH effects: - the error term and lagged dependent variables are not independent Action: - maximum likelihood procedure - construct the likelihood ratio statistic to test the hypothesis that js are zero East Asian Equity Markets, Financial Crisis and the Japanese Currency 15

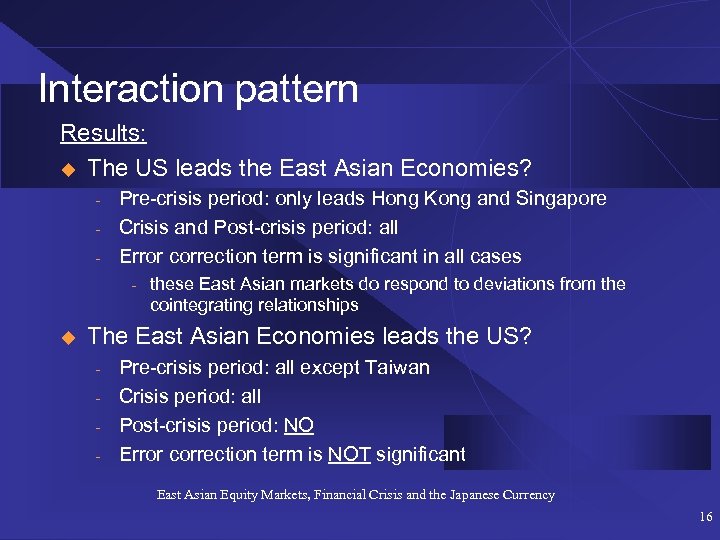

Interaction pattern Results: u The US leads the East Asian Economies? - Pre-crisis period: only leads Hong Kong and Singapore Crisis and Post-crisis period: all Error correction term is significant in all cases - u these East Asian markets do respond to deviations from the cointegrating relationships The East Asian Economies leads the US? - Pre-crisis period: all except Taiwan Crisis period: all Post-crisis period: NO Error correction term is NOT significant East Asian Equity Markets, Financial Crisis and the Japanese Currency 16

Interaction pattern Results: u The US leads the East Asian Economies? - Pre-crisis period: only leads Hong Kong and Singapore Crisis and Post-crisis period: all Error correction term is significant in all cases - u these East Asian markets do respond to deviations from the cointegrating relationships The East Asian Economies leads the US? - Pre-crisis period: all except Taiwan Crisis period: all Post-crisis period: NO Error correction term is NOT significant East Asian Equity Markets, Financial Crisis and the Japanese Currency 16

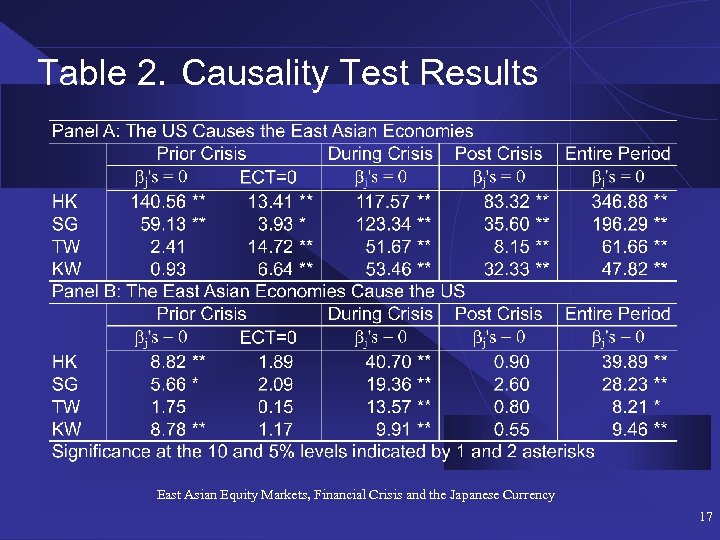

Table 2. Causality Test Results East Asian Equity Markets, Financial Crisis and the Japanese Currency 17

Table 2. Causality Test Results East Asian Equity Markets, Financial Crisis and the Japanese Currency 17

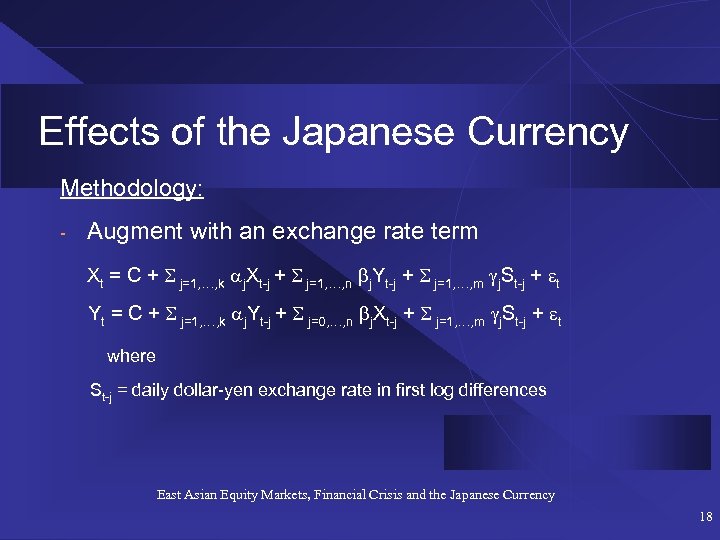

Effects of the Japanese Currency Methodology: - Augment with an exchange rate term Xt = C + j=1, …, k j. Xt-j + j=1, …, n j. Yt-j + j=1, …, m j. St-j + t Yt = C + j=1, …, k j. Yt-j + j=0, …, n j. Xt-j + j=1, …, m j. St-j + t where St-j = daily dollar-yen exchange rate in first log differences East Asian Equity Markets, Financial Crisis and the Japanese Currency 18

Effects of the Japanese Currency Methodology: - Augment with an exchange rate term Xt = C + j=1, …, k j. Xt-j + j=1, …, n j. Yt-j + j=1, …, m j. St-j + t Yt = C + j=1, …, k j. Yt-j + j=0, …, n j. Xt-j + j=1, …, m j. St-j + t where St-j = daily dollar-yen exchange rate in first log differences East Asian Equity Markets, Financial Crisis and the Japanese Currency 18

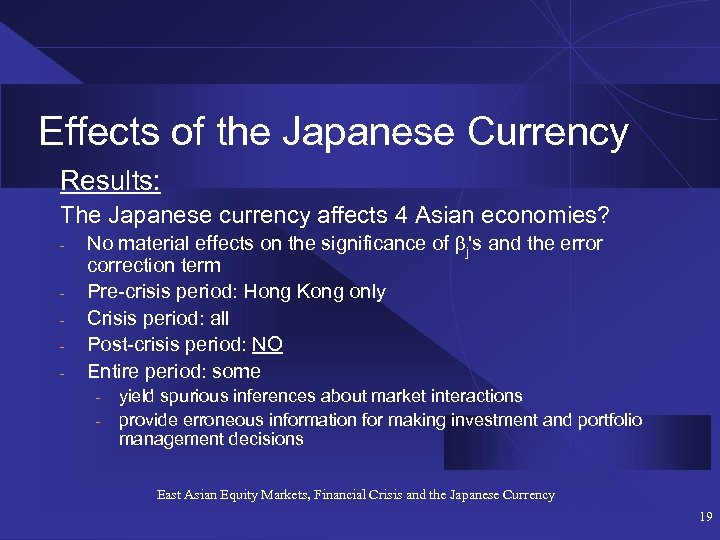

Effects of the Japanese Currency Results: The Japanese currency affects 4 Asian economies? - No material effects on the significance of j's and the error correction term Pre-crisis period: Hong Kong only Crisis period: all Post-crisis period: NO Entire period: some - yield spurious inferences about market interactions provide erroneous information for making investment and portfolio management decisions East Asian Equity Markets, Financial Crisis and the Japanese Currency 19

Effects of the Japanese Currency Results: The Japanese currency affects 4 Asian economies? - No material effects on the significance of j's and the error correction term Pre-crisis period: Hong Kong only Crisis period: all Post-crisis period: NO Entire period: some - yield spurious inferences about market interactions provide erroneous information for making investment and portfolio management decisions East Asian Equity Markets, Financial Crisis and the Japanese Currency 19

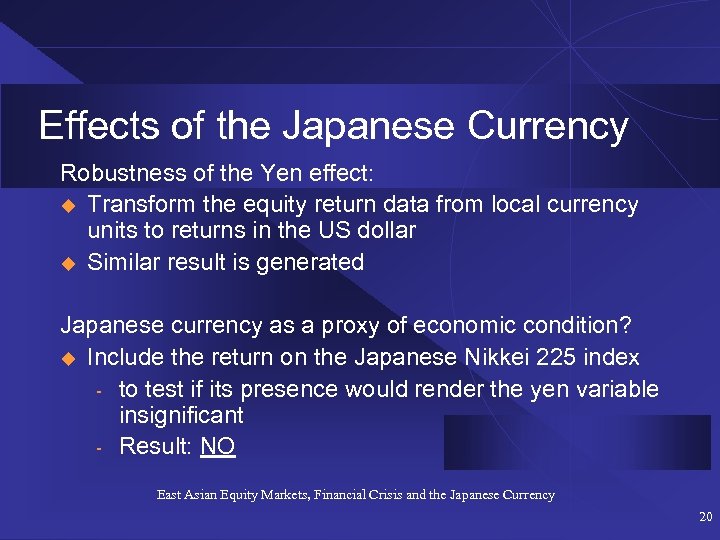

Effects of the Japanese Currency Robustness of the Yen effect: u Transform the equity return data from local currency units to returns in the US dollar u Similar result is generated Japanese currency as a proxy of economic condition? u Include the return on the Japanese Nikkei 225 index - to test if its presence would render the yen variable insignificant - Result: NO East Asian Equity Markets, Financial Crisis and the Japanese Currency 20

Effects of the Japanese Currency Robustness of the Yen effect: u Transform the equity return data from local currency units to returns in the US dollar u Similar result is generated Japanese currency as a proxy of economic condition? u Include the return on the Japanese Nikkei 225 index - to test if its presence would render the yen variable insignificant - Result: NO East Asian Equity Markets, Financial Crisis and the Japanese Currency 20

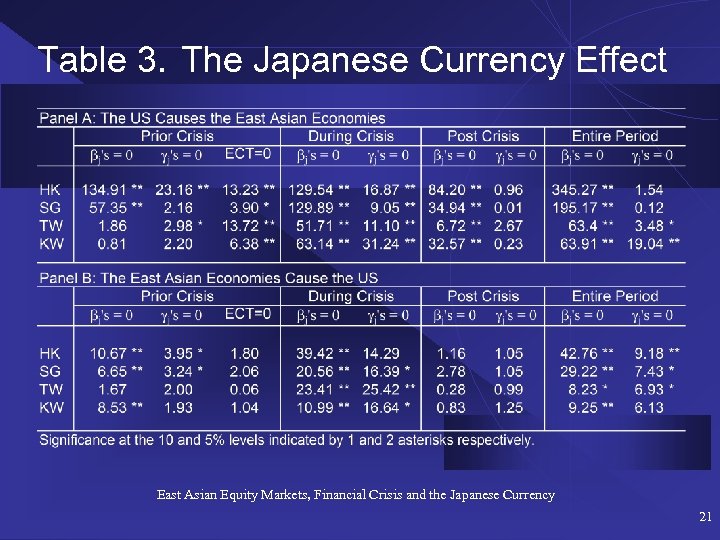

Table 3. The Japanese Currency Effect East Asian Equity Markets, Financial Crisis and the Japanese Currency 21

Table 3. The Japanese Currency Effect East Asian Equity Markets, Financial Crisis and the Japanese Currency 21

Conclusions u u u Confirms the dominant role of the US market in the East Asian equity markets Information structure during the crisis period is different from the non-crisis periods. The Japanese currency is found to affect these equity markets during the crisis period, but disappears in the post-crisis sample. East Asian Equity Markets, Financial Crisis and the Japanese Currency 22

Conclusions u u u Confirms the dominant role of the US market in the East Asian equity markets Information structure during the crisis period is different from the non-crisis periods. The Japanese currency is found to affect these equity markets during the crisis period, but disappears in the post-crisis sample. East Asian Equity Markets, Financial Crisis and the Japanese Currency 22

Conclusions Implications of the changing causal relationship : u Academia: - warrant a detailed study on information flow and propagation mechanisms under different market conditions u Investment community: - different investment strategies should be pursued under different market conditions - the use of long sample data may yield obscure and even erroneous information on market interactions. East Asian Equity Markets, Financial Crisis and the Japanese Currency 23

Conclusions Implications of the changing causal relationship : u Academia: - warrant a detailed study on information flow and propagation mechanisms under different market conditions u Investment community: - different investment strategies should be pursued under different market conditions - the use of long sample data may yield obscure and even erroneous information on market interactions. East Asian Equity Markets, Financial Crisis and the Japanese Currency 23

Thank You Stephen Cheung East Asian Equity Markets, Financial Crisis and the Japanese Currency

Thank You Stephen Cheung East Asian Equity Markets, Financial Crisis and the Japanese Currency