fc78c84e408811e56d0a8b5c171c04cf.ppt

- Количество слайдов: 22

Early Stage Investments The Israeli Perspective Yigal Erlich Founder & Managing Partner – The Yozma Group

Early Stage Investments The Israeli Perspective Yigal Erlich Founder & Managing Partner – The Yozma Group

The Yozma Group - Overview n Established: January 1993 n Founder of the Israeli Venture Capital Industry n $145 M Under Management (Yozma I, II & III) n 48 portfolio companies (16 Exits) n Early Stage Investor n 4 partners

The Yozma Group - Overview n Established: January 1993 n Founder of the Israeli Venture Capital Industry n $145 M Under Management (Yozma I, II & III) n 48 portfolio companies (16 Exits) n Early Stage Investor n 4 partners

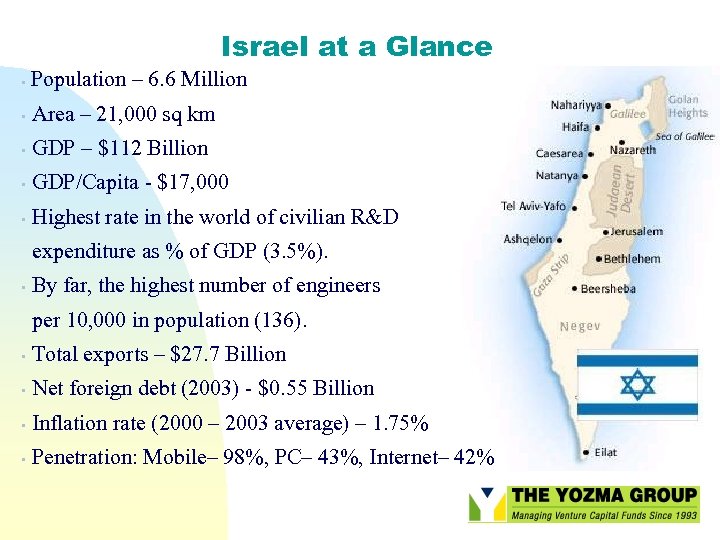

Israel at a Glance • Population – 6. 6 Million • Area – 21, 000 sq km • GDP – $112 Billion • GDP/Capita - $17, 000 • Highest rate in the world of civilian R&D expenditure as % of GDP (3. 5%). • By far, the highest number of engineers per 10, 000 in population (136). • Total exports – $27. 7 Billion • Net foreign debt (2003) - $0. 55 Billion • Inflation rate (2000 – 2003 average) – 1. 75% • Penetration: Mobile– 98%, PC– 43%, Internet– 42%

Israel at a Glance • Population – 6. 6 Million • Area – 21, 000 sq km • GDP – $112 Billion • GDP/Capita - $17, 000 • Highest rate in the world of civilian R&D expenditure as % of GDP (3. 5%). • By far, the highest number of engineers per 10, 000 in population (136). • Total exports – $27. 7 Billion • Net foreign debt (2003) - $0. 55 Billion • Inflation rate (2000 – 2003 average) – 1. 75% • Penetration: Mobile– 98%, PC– 43%, Internet– 42%

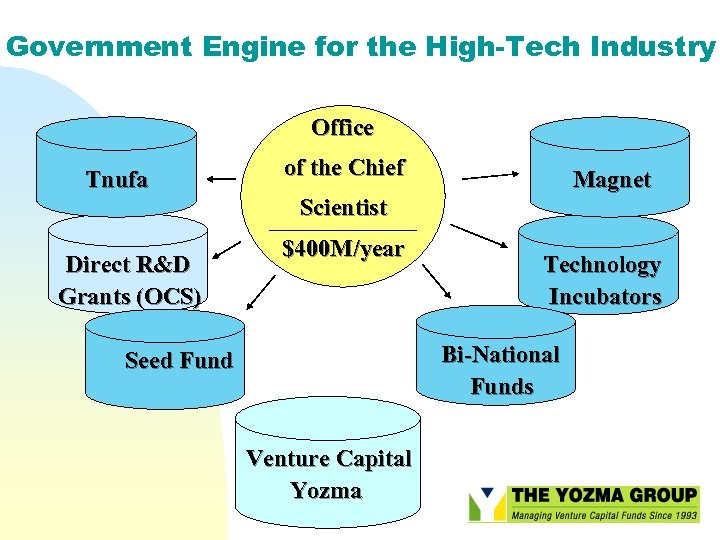

Government Engine for the High-Tech Industry Office Tnufa of the Chief Magnet Scientist Direct R&D Grants (OCS) $400 M/year Technology Incubators Bi-National Funds Seed Fund Venture Capital Yozma

Government Engine for the High-Tech Industry Office Tnufa of the Chief Magnet Scientist Direct R&D Grants (OCS) $400 M/year Technology Incubators Bi-National Funds Seed Fund Venture Capital Yozma

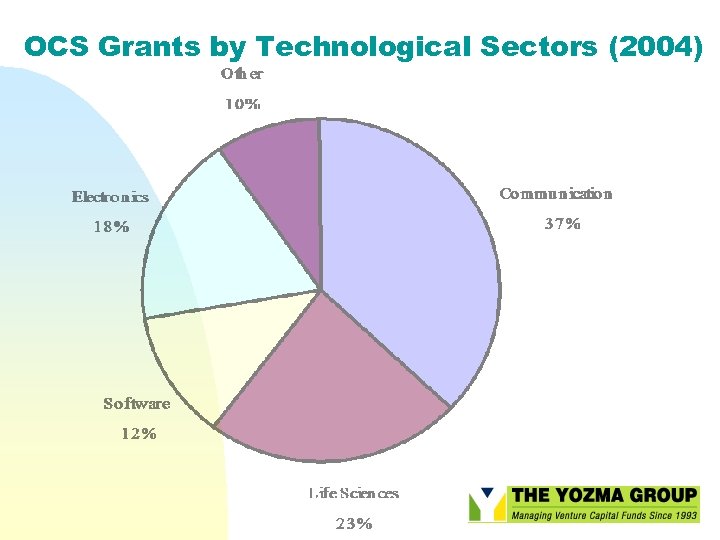

OCS Grants by Technological Sectors (2004)

OCS Grants by Technological Sectors (2004)

Technology Incubators – Background / Main Goals • Initiated in 1991 • Located all over Israel, including Periphery • Situated near Academic Institutes • Built an infrastructure to exploit entrepreneurial resources • $300 K for 2 years / project + $200 K/year for G&A support

Technology Incubators – Background / Main Goals • Initiated in 1991 • Located all over Israel, including Periphery • Situated near Academic Institutes • Built an infrastructure to exploit entrepreneurial resources • $300 K for 2 years / project + $200 K/year for G&A support

Current Status • 23 Technology incubators (best ones are privately owned) • 5 -6 Projects in each incubator per year • ~1, 000 Graduate Projects • Privatization: 30%

Current Status • 23 Technology incubators (best ones are privately owned) • 5 -6 Projects in each incubator per year • ~1, 000 Graduate Projects • Privatization: 30%

International Cooperation Bi-National Funds BIRDF - with U. S. A. SII-RD - with Singapore CIIRDF - with Canada BRITECH - with the UK KORIL-RDF - with S. Korea

International Cooperation Bi-National Funds BIRDF - with U. S. A. SII-RD - with Singapore CIIRDF - with Canada BRITECH - with the UK KORIL-RDF - with S. Korea

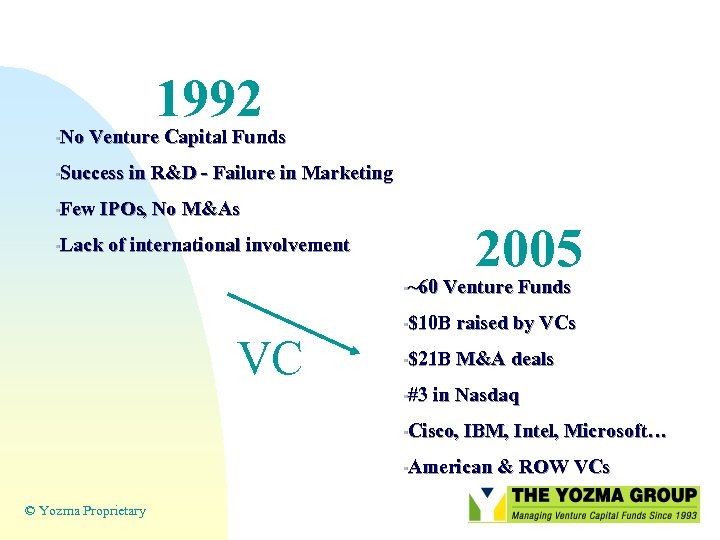

1992 No Venture Capital Funds • Success in R&D - Failure in Marketing • Few IPOs, No M&As • 2005 Lack of international involvement • ~60 Venture Funds • VC $10 B raised by VCs • $21 B M&A deals • #3 in Nasdaq • Cisco, IBM, Intel, Microsoft… • American & ROW VCs • © Yozma Proprietary

1992 No Venture Capital Funds • Success in R&D - Failure in Marketing • Few IPOs, No M&As • 2005 Lack of international involvement • ~60 Venture Funds • VC $10 B raised by VCs • $21 B M&A deals • #3 in Nasdaq • Cisco, IBM, Intel, Microsoft… • American & ROW VCs • © Yozma Proprietary

Yozma Venture Capital (1) Mission: • To create the venture capital market in Israel Method: • To entice the private sector and foreign investors to set up new VC funds • To participate in the inv. Committee in the new VC funds • To secure an obligation of the new VC funds to invest in startup companies in Israel Accomplished through: • Establishment of a $100 M investment company Use of proceeds: • Establishment of 10 drop down funds together with strategic partners. • 15 Direct investments © Yozma Proprietary

Yozma Venture Capital (1) Mission: • To create the venture capital market in Israel Method: • To entice the private sector and foreign investors to set up new VC funds • To participate in the inv. Committee in the new VC funds • To secure an obligation of the new VC funds to invest in startup companies in Israel Accomplished through: • Establishment of a $100 M investment company Use of proceeds: • Establishment of 10 drop down funds together with strategic partners. • 15 Direct investments © Yozma Proprietary

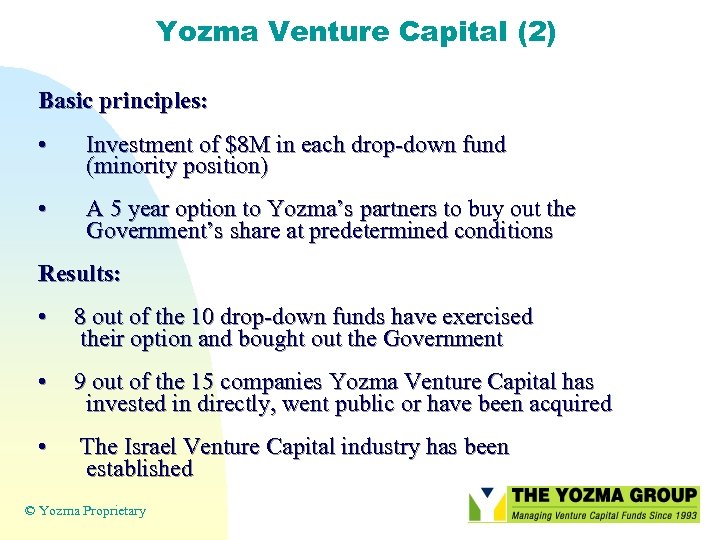

Yozma Venture Capital (2) Basic principles: • Investment of $8 M in each drop-down fund (minority position) • A 5 year option to Yozma’s partners to buy out the Government’s share at predetermined conditions Results: • 8 out of the 10 drop-down funds have exercised their option and bought out the Government • 9 out of the 15 companies Yozma Venture Capital has invested in directly, went public or have been acquired • The Israel Venture Capital industry has been established © Yozma Proprietary

Yozma Venture Capital (2) Basic principles: • Investment of $8 M in each drop-down fund (minority position) • A 5 year option to Yozma’s partners to buy out the Government’s share at predetermined conditions Results: • 8 out of the 10 drop-down funds have exercised their option and bought out the Government • 9 out of the 15 companies Yozma Venture Capital has invested in directly, went public or have been acquired • The Israel Venture Capital industry has been established © Yozma Proprietary

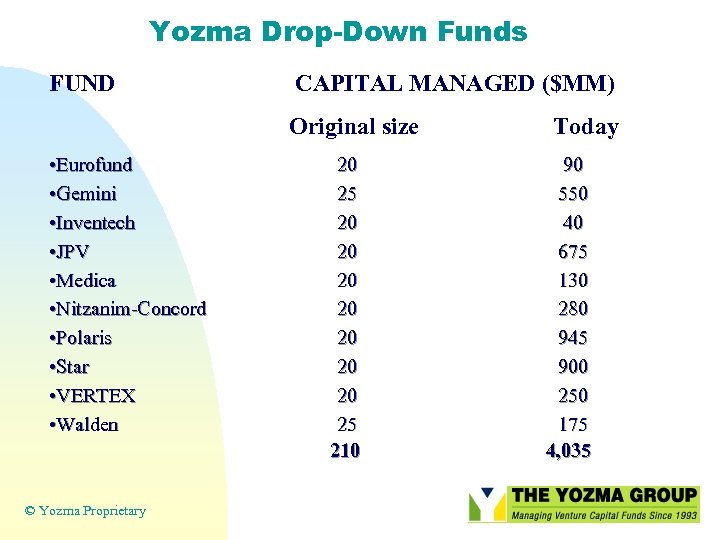

Yozma Drop-Down Funds FUND CAPITAL MANAGED ($MM) Original size • Eurofund • Gemini • Inventech • JPV • Medica • Nitzanim-Concord • Polaris • Star • VERTEX • Walden © Yozma Proprietary 20 25 20 20 25 210 Today 90 550 40 675 130 280 945 900 250 175 4, 035

Yozma Drop-Down Funds FUND CAPITAL MANAGED ($MM) Original size • Eurofund • Gemini • Inventech • JPV • Medica • Nitzanim-Concord • Polaris • Star • VERTEX • Walden © Yozma Proprietary 20 25 20 20 25 210 Today 90 550 40 675 130 280 945 900 250 175 4, 035

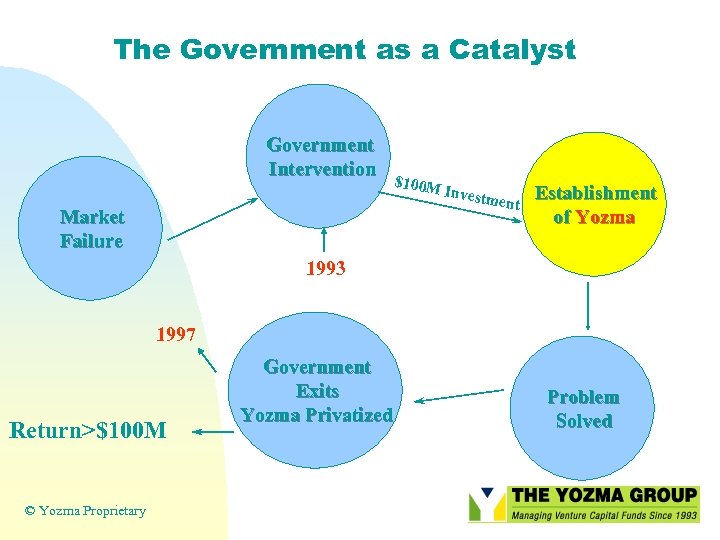

The Government as a Catalyst Government Intervention Market Failure $100 M Investm ent Establishment of Yozma 1993 1997 Return>$100 M © Yozma Proprietary Government Exits Yozma Privatized Problem Solved

The Government as a Catalyst Government Intervention Market Failure $100 M Investm ent Establishment of Yozma 1993 1997 Return>$100 M © Yozma Proprietary Government Exits Yozma Privatized Problem Solved

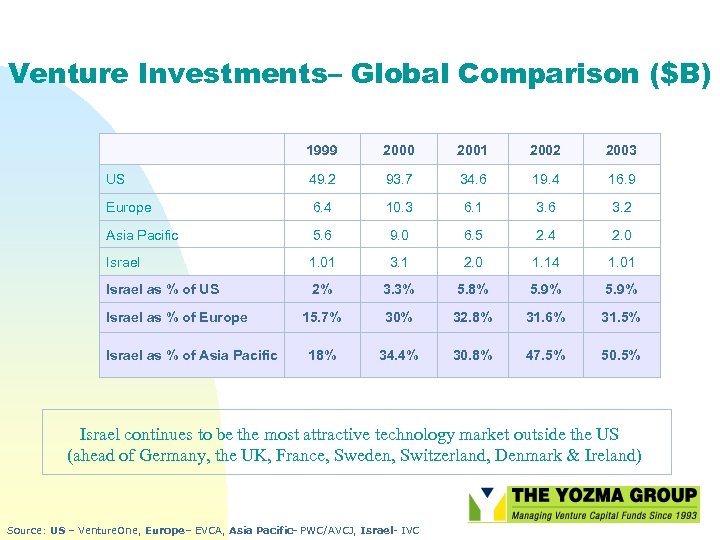

Venture Investments– Global Comparison ($B) 1999 2000 2001 2002 2003 US 49. 2 93. 7 34. 6 19. 4 16. 9 Europe 6. 4 10. 3 6. 1 3. 6 3. 2 Asia Pacific 5. 6 9. 0 6. 5 2. 4 2. 0 Israel 1. 01 3. 1 2. 0 1. 14 1. 01 Israel as % of US 2% 3. 3% 5. 8% 5. 9% 15. 7% 30% 32. 8% 31. 6% 31. 5% 18% 34. 4% 30. 8% 47. 5% 50. 5% Israel as % of Europe Israel as % of Asia Pacific Israel continues to be the most attractive technology market outside the US (ahead of Germany, the UK, France, Sweden, Switzerland, Denmark & Ireland) Source: US – Venture. One, Europe – EVCA, Asia Pacific PWC/AVCJ, Israel- IVC –

Venture Investments– Global Comparison ($B) 1999 2000 2001 2002 2003 US 49. 2 93. 7 34. 6 19. 4 16. 9 Europe 6. 4 10. 3 6. 1 3. 6 3. 2 Asia Pacific 5. 6 9. 0 6. 5 2. 4 2. 0 Israel 1. 01 3. 1 2. 0 1. 14 1. 01 Israel as % of US 2% 3. 3% 5. 8% 5. 9% 15. 7% 30% 32. 8% 31. 6% 31. 5% 18% 34. 4% 30. 8% 47. 5% 50. 5% Israel as % of Europe Israel as % of Asia Pacific Israel continues to be the most attractive technology market outside the US (ahead of Germany, the UK, France, Sweden, Switzerland, Denmark & Ireland) Source: US – Venture. One, Europe – EVCA, Asia Pacific PWC/AVCJ, Israel- IVC –

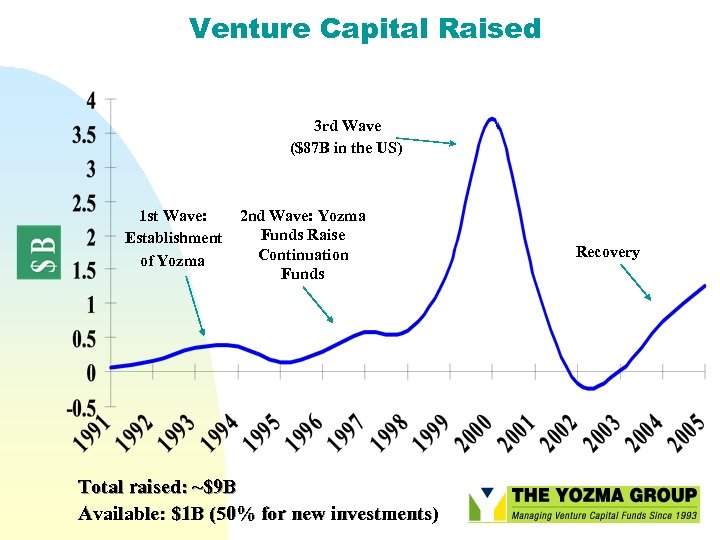

Venture Capital Raised 3 rd Wave ($87 B in the US) 1 st Wave: Establishment of Yozma 2 nd Wave: Yozma Funds Raise Continuation Funds Total raised: ~$9 B Available: $1 B (50% for new investments) Recovery

Venture Capital Raised 3 rd Wave ($87 B in the US) 1 st Wave: Establishment of Yozma 2 nd Wave: Yozma Funds Raise Continuation Funds Total raised: ~$9 B Available: $1 B (50% for new investments) Recovery

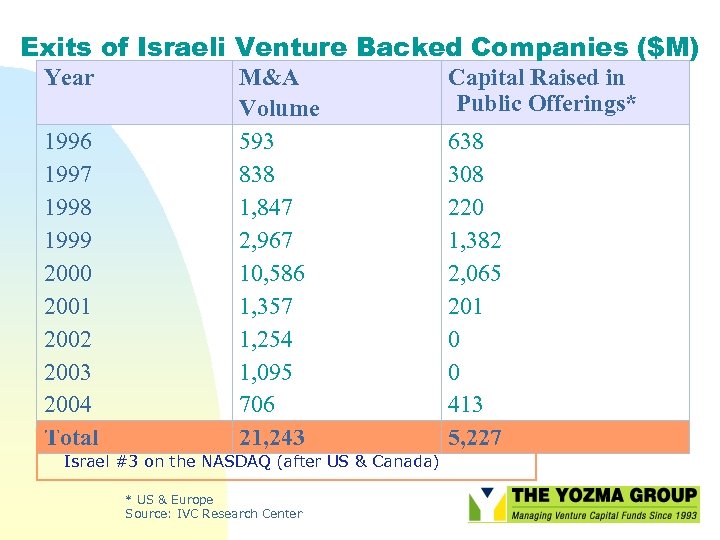

Exits of Israeli Venture Backed Companies ($M) Year 1996 1997 1998 1999 2000 2001 2002 2003 2004 Total M&A Volume 593 838 1, 847 2, 967 10, 586 1, 357 1, 254 1, 095 706 21, 243 Israel #3 on the NASDAQ (after US & Canada) * US & Europe Source: IVC Research Center Capital Raised in Public Offerings* 638 308 220 1, 382 2, 065 201 0 0 413 5, 227

Exits of Israeli Venture Backed Companies ($M) Year 1996 1997 1998 1999 2000 2001 2002 2003 2004 Total M&A Volume 593 838 1, 847 2, 967 10, 586 1, 357 1, 254 1, 095 706 21, 243 Israel #3 on the NASDAQ (after US & Canada) * US & Europe Source: IVC Research Center Capital Raised in Public Offerings* 638 308 220 1, 382 2, 065 201 0 0 413 5, 227

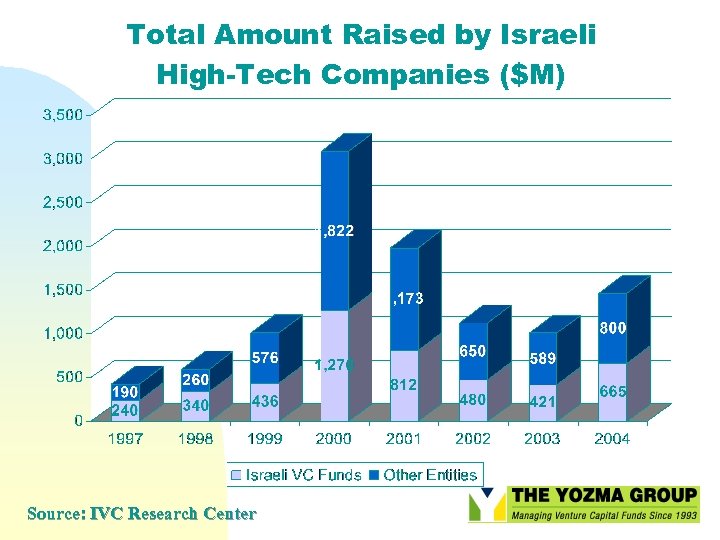

Total Amount Raised by Israeli High-Tech Companies ($M) Source: IVC Research Center

Total Amount Raised by Israeli High-Tech Companies ($M) Source: IVC Research Center

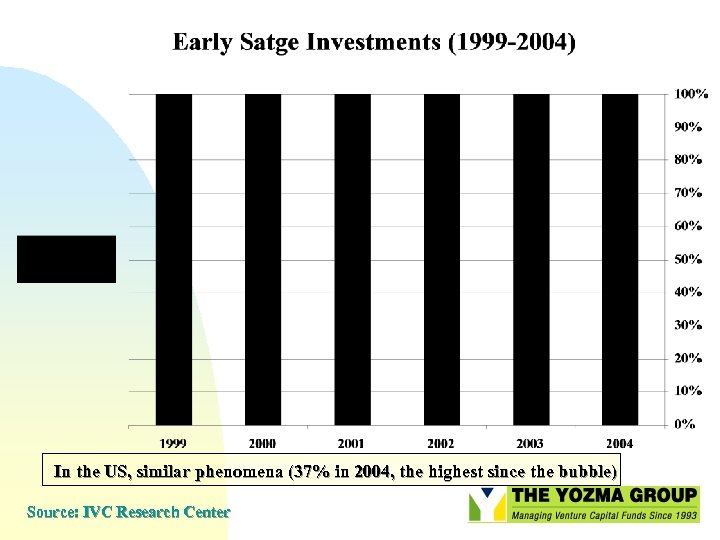

In the US, similar phenomena (37% in 2004, the highest since the bubble) Source: IVC Research Center

In the US, similar phenomena (37% in 2004, the highest since the bubble) Source: IVC Research Center

International companies in Israel 70’s , 80’s 90’s Business Opportunities Cheap labor Academic Institutes n n IBM Intel Motorola National Semiconductor (greater than the “country risk”) Skilled Workforce M&As n n n n IBM n Intel n Motorola n National Semi. n Compaq n Microsoft n Applied Mat. n 3 Com n Nortel n Samsung n TI n GE n SAP Hitachi Sun Cisco J&J Sun Lucent Toshiba AOL Alcatel SGI Acer HP Guidant n n n CA Infineon Marvell Avaya Vishay EMC Oracle Boston Sci. Siemens Broadcom KLA Qualcomm

International companies in Israel 70’s , 80’s 90’s Business Opportunities Cheap labor Academic Institutes n n IBM Intel Motorola National Semiconductor (greater than the “country risk”) Skilled Workforce M&As n n n n IBM n Intel n Motorola n National Semi. n Compaq n Microsoft n Applied Mat. n 3 Com n Nortel n Samsung n TI n GE n SAP Hitachi Sun Cisco J&J Sun Lucent Toshiba AOL Alcatel SGI Acer HP Guidant n n n CA Infineon Marvell Avaya Vishay EMC Oracle Boston Sci. Siemens Broadcom KLA Qualcomm

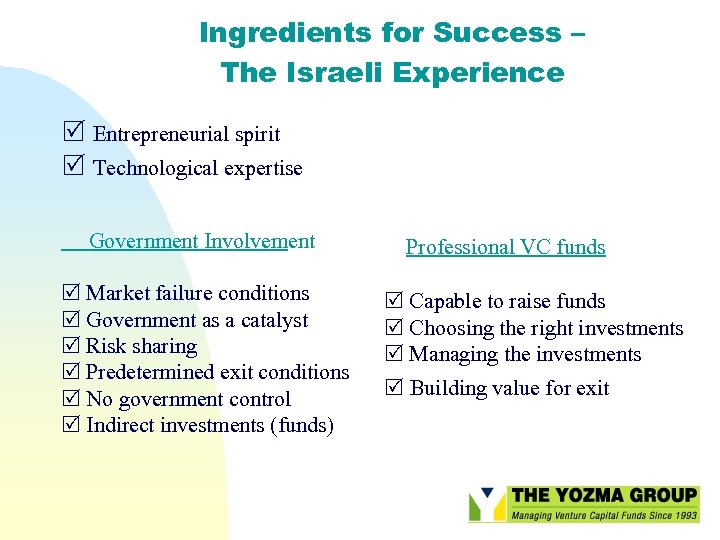

Ingredients for Success – The Israeli Experience Entrepreneurial spirit Technological expertise Government Involvement Market failure conditions Government as a catalyst Risk sharing Predetermined exit conditions No government control Indirect investments (funds) Professional VC funds Capable to raise funds Choosing the right investments Managing the investments Building value for exit

Ingredients for Success – The Israeli Experience Entrepreneurial spirit Technological expertise Government Involvement Market failure conditions Government as a catalyst Risk sharing Predetermined exit conditions No government control Indirect investments (funds) Professional VC funds Capable to raise funds Choosing the right investments Managing the investments Building value for exit

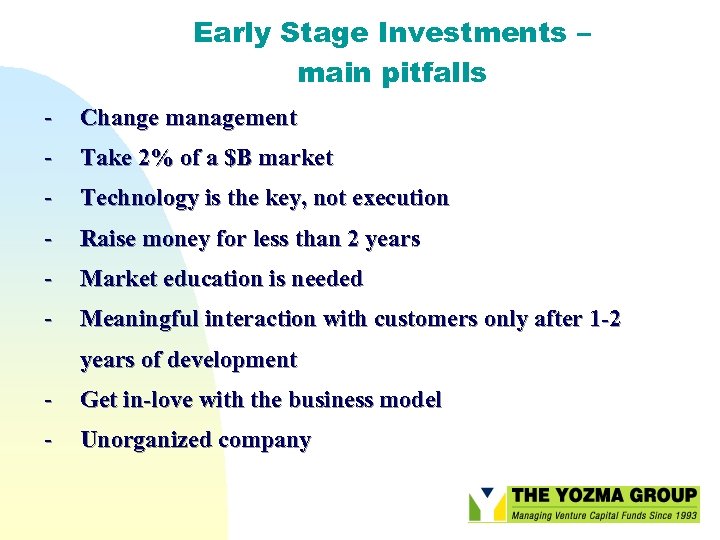

Early Stage Investments – main pitfalls - Change management - Take 2% of a $B market - Technology is the key, not execution - Raise money for less than 2 years - Market education is needed - Meaningful interaction with customers only after 1 -2 years of development - Get in-love with the business model - Unorganized company

Early Stage Investments – main pitfalls - Change management - Take 2% of a $B market - Technology is the key, not execution - Raise money for less than 2 years - Market education is needed - Meaningful interaction with customers only after 1 -2 years of development - Get in-love with the business model - Unorganized company

Thank You

Thank You