176d991d2f1c1440d3a3ea29df96d572.ppt

- Количество слайдов: 29

e. Xtensible Business Reporting Language “XBRL” SEC Filings Using XBRL “A CFO’s Perspective” Greg Adams, CFO & COO EDGAR Online, Inc.

SEC Filings Using XBRL: Corporate Pressures SEC’s Voluntary Filing Program Financial Reporting Process & XBRL Sample Form 8 -K Filing Benefits of XBRL to Information Consumers

Financial Executives § Have a critical responsibility to communicate operational results to stakeholders § Are facing a growing demand for efficient delivery in an interactive medium § Need better tools for faster decision making § Want their internal control environment enhanced through less retyping, more system integration, etc.

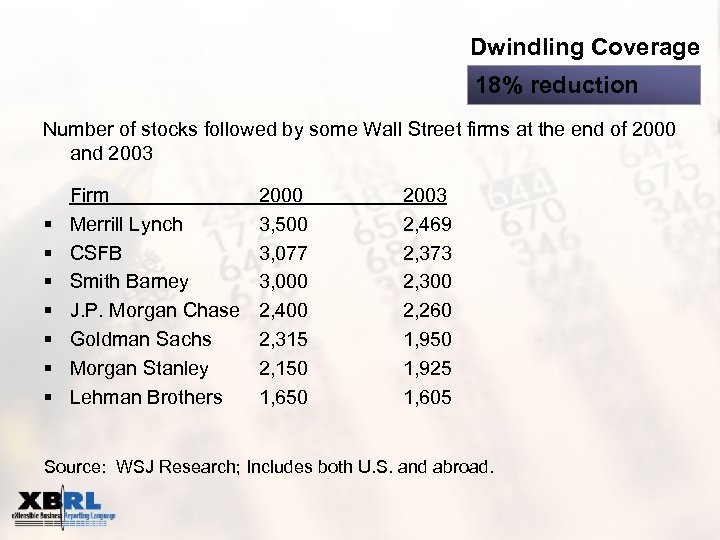

Dwindling Coverage 18% reduction Number of stocks followed by some Wall Street firms at the end of 2000 and 2003 § § § § Firm Merrill Lynch CSFB Smith Barney J. P. Morgan Chase Goldman Sachs Morgan Stanley Lehman Brothers 2000 3, 500 3, 077 3, 000 2, 400 2, 315 2, 150 1, 650 2003 2, 469 2, 373 2, 300 2, 260 1, 950 1, 925 1, 605 Source: WSJ Research; Includes both U. S. and abroad.

SEC Voluntary Reporting Program

“The annual report of the 21 st century will not be annual and it will not be a report: it will be an up to date, informative dialogue” - Alan Benjamin in the 21 st Century Annual Report

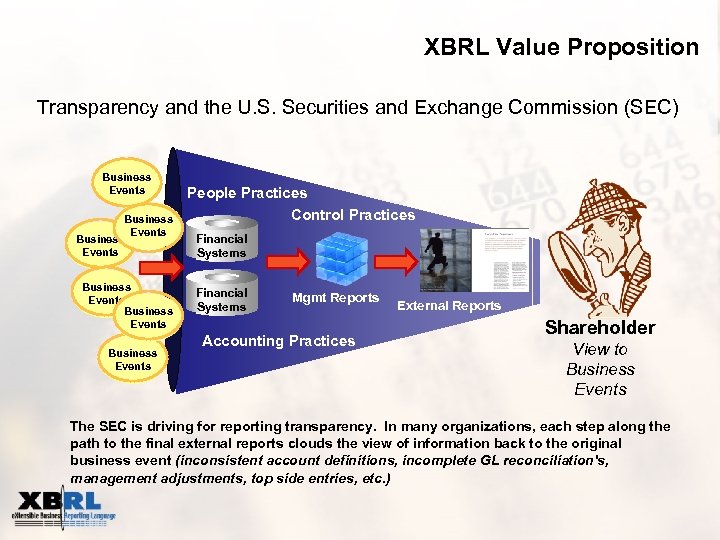

XBRL Value Proposition Transparency and the U. S. Securities and Exchange Commission (SEC) Business Events Business Events People Practices Control Practices Financial Systems Mgmt Reports Accounting Practices External Reports Shareholder View to Business Events The SEC is driving for reporting transparency. In many organizations, each step along the path to the final external reports clouds the view of information back to the original business event (inconsistent account definitions, incomplete GL reconciliation's, management adjustments, top side entries, etc. )

How linked to XBRL initiative? § Move towards transparency § If items were tagged and identified more information could be made available for investors and analysts to analyze in the manner that chose to do so § Enhances information acquisition, evaluation and combination § Improves transparency without additional disclosures § Newfound discovery capabilities § Can benefit nonprofessional users

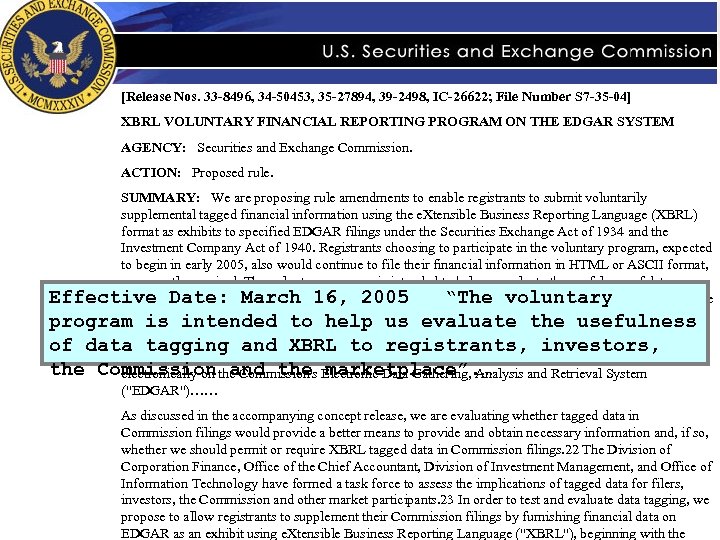

[Release Nos. 33 -8496, 34 -50453, 35 -27894, 39 -2498, IC-26622; File Number S 7 -35 -04] XBRL VOLUNTARY FINANCIAL REPORTING PROGRAM ON THE EDGAR SYSTEM AGENCY: Securities and Exchange Commission. ACTION: Proposed rule. SUMMARY: We are proposing rule amendments to enable registrants to submit voluntarily supplemental tagged financial information using the e. Xtensible Business Reporting Language (XBRL) format as exhibits to specified EDGAR filings under the Securities Exchange Act of 1934 and the Investment Company Act of 1940. Registrants choosing to participate in the voluntary program, expected to begin in early 2005, also would continue to file their financial information in HTML or ASCII format, as currently required. The voluntary program is intended to help us evaluate the usefulness of data tagging in general, and XBRL in particular, to registrants, investors, the Commission and the marketplace Effective Date: March 16, 2005 “The voluntary generally. A companion concept release also being issued today provides additional information on program is intended to help us evaluate the usefulness tagged data and solicits comment on the development of data tagging and XBRL to registrants, investors, BACKGROUND: All registrants who file with the Commission are now generally required to file the Commission and the marketplace”. … electronically on the Commission's Electronic Data Gathering, Analysis and Retrieval System ("EDGAR")…… As discussed in the accompanying concept release, we are evaluating whether tagged data in Commission filings would provide a better means to provide and obtain necessary information and, if so, whether we should permit or require XBRL tagged data in Commission filings. 22 The Division of Corporation Finance, Office of the Chief Accountant, Division of Investment Management, and Office of Information Technology have formed a task force to assess the implications of tagged data for filers, investors, the Commission and other market participants. 23 In order to test and evaluate data tagging, we propose to allow registrants to supplement their Commission filings by furnishing financial data on EDGAR as an exhibit using e. Xtensible Business Reporting Language ("XBRL"), beginning with the

XBRL Voluntary Filing and FAQs § SEC commenced the voluntary program for receiving financial information on EDGAR using XBRL in early April 2005 § Approved Taxonomies (classification systems) for commercial and industrial companies, banking and savings institutions, and insurance companies. § In August 2005, SEC Extends Voluntary Program to Investment Companies § The expansion will allow mutual funds to file exhibits to their annual report to shareholders (N-CSR) and quarterly statement of portfolio holdings (N-Q) in XBRL § SEC believes “tagged data will improved the quality of information and speed of its availability” § Will help the Commission determine whether these improvements will empower individual investors to get information faster and more conveniently and to choose more wisely by making better-informed comparisons.

SEC Voluntary Reporting Program § Allows companies to “furnish” XBRL tagged financial statements § Added Rule 401 to Regulation S-T allowing filers to furnish supplemental information using XBRL § Allows for company flexibility in filing financial statements, with or without footnotes and MD&A § Can submit XBRL tagged document either with the official filing or as an amendment, however, there is no submission deadline § Must correlate to a standard GAAP Taxonomy § Relief for liability if error is not materially misleading or false

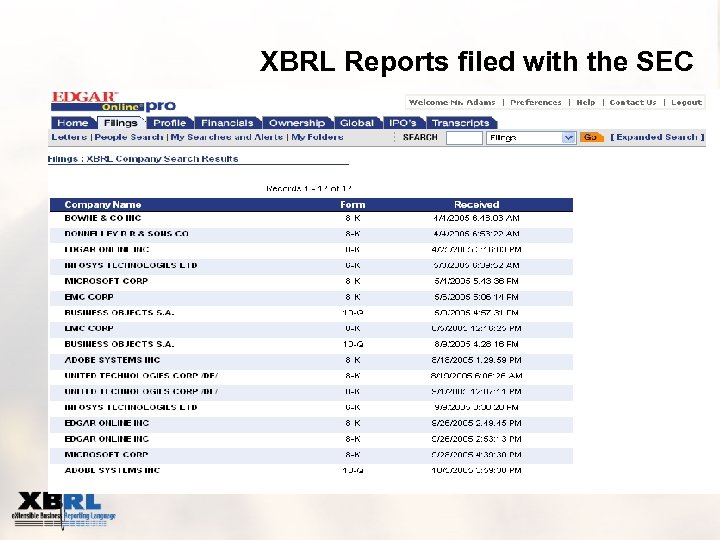

XBRL Reports filed with the SEC

SEC Proposed Rule – Voluntary Reporting SEC would like to study: § Search capability of EDGAR database § Capability to perform financial comparisons amongst registrants § Ability to perform financial analysis (ratios, etc. ) § Impact on staff’s ability to review filings more timely and efficiently § Use of tagged data for risk assessment § Compatibility of XBRL with other Commission requirements

Financial Reporting Process

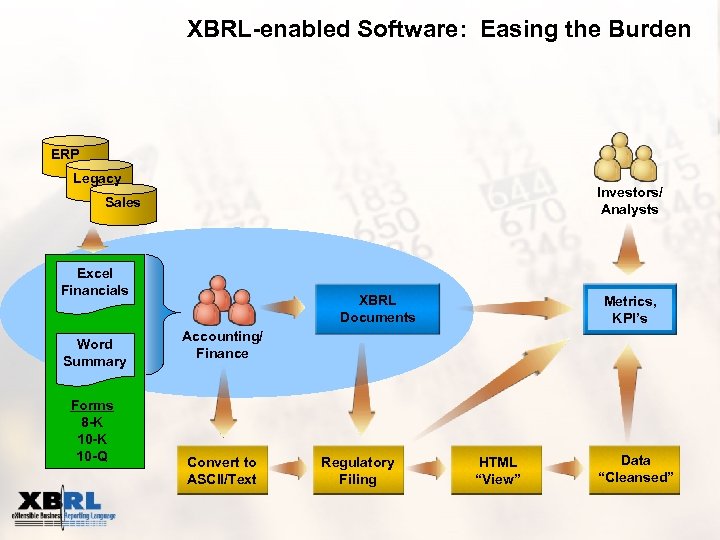

XBRL-enabled Software: Easing the Burden ERP Legacy Investors/ Analysts Sales Excel Financials Word Summary Forms 8 -K 10 -Q XBRL Documents Metrics, KPI’s Accounting/ Finance Convert to ASCII/Text Regulatory Filing HTML “View” Data “Cleansed”

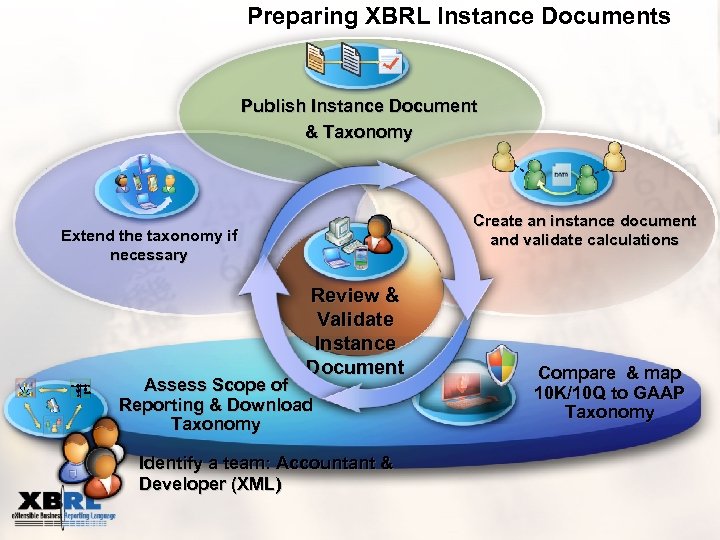

Preparing XBRL Instance Documents Publish Instance Document & Taxonomy Create an instance document and validate calculations Extend the taxonomy if necessary Review & Validate Instance Document Assess Scope of Reporting & Download Taxonomy Identify a team: Accountant & Developer (XML) Compare & map 10 K/10 Q to GAAP Taxonomy

Output looks like this…. .

More Importantly XBRL Output looks like this…. .

Sample Form 8 -K

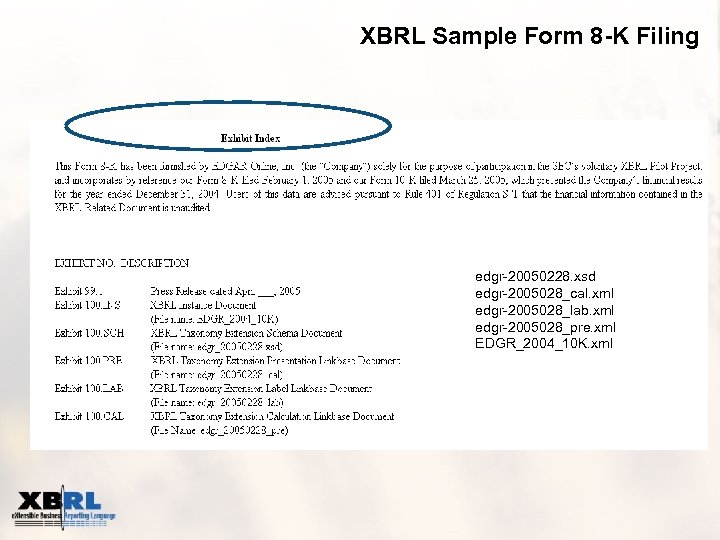

XBRL Sample Form 8 -K Filing edgr-20050228. xsd edgr-2005028_cal. xml edgr-2005028_lab. xml edgr-2005028_pre. xml EDGR_2004_10 K. xml

EDGAR Online Facts…. § Effort on Voluntary Filing Program § 160+ Hours for first effort § Over 200 discrete tagged items § Over 30 Taxonomy extensions § Instance document was reviewed 3 X by three different people § Used in-house conversion software to extend and tag plus 2 different tools to validate § Did not include auditors for review § Created I-Metrix Excel Add-in § Was one of the first companies to make XBRL tagged financials available in Excel (I-Metrix)

Internal Considerations ü Managing and maintaining XBRL taxonomies for internal/external reporting will require an ongoing effort ü Implementing will impact the internal business rules governing data and the people who use/process it ü Confusion over XBRL as an internal and/or external reporting solution ü Enabled software – many vendors have enabled software, but others are in development ü Existing business process will have to be re-examined as part of implementation for efficiencies and risk considerations

XBRL Taxonomy and Instance Document Applications

Benefits - How linked to XBRL initiative? § Timeliness § Capital markets rely on timely and reliable information for the allocation of capital resources § Comparability is enhanced across countries § Access information more quickly § Faster processing § Accelerated filing deadlines can be easier to accomplish

Benefits - How linked to XBRL initiative? § Section 404/internal controls (SOX) § A reporting format such as XBRL could enable easier documentation of internal controls – less manual intervention and massaging § Can enable the integration of disparate systems to optimize the internal control process § Can be a critical tool for enabling compliance with 404 – monitoring can occur real time

Benefits - How linked to XBRL initiative? § Fair value accounting § A lot of concern regarding the reliability (verifiability) of determining appropriate fair value – if assumption disclosures were tagged – management’s choices would be more transparent to users and easily compared with others § Principles-based accounting standards § If information is tagged – much easier to determine judgments made by management – analysts could easily adjust for their own analysis § Comparability is enhanced across companies – makes management’s financial reporting choices more transparent – search facilitating technology

Benefits - How linked to XBRL initiative? § International Convergence § May be less important in an XBRL environment. Could adapt to country reporting regimes much more easily § Comparability is enhanced § Complimentary toward objective of a single set of high quality, understandable and enforceable global accounting standards

Summary : Benefits of XBRL for Preparers § § Lower cost of producing information § Better tools for faster decision making § More timely accurate data § XBRL provides an immediate ROI for benchmarking Have a critical responsibility to communicate operational results to stakeholders § Expanded communication “reach” § Tell your own story to stakeholders (precise & clear) Better control environment – extension of SOX 404 § Utilized during risk assessment and planning phase § Facilitate the comparability and granularity of financial disclosure – comp analysis Accelerated adoption of reporting model changes

Questions?

176d991d2f1c1440d3a3ea29df96d572.ppt