0c282c44766c8fd0979e41a6bc5f09ae.ppt

- Количество слайдов: 18

e. PAYMENT - NEXT GENERATION E-BANKING Independent direct payments Online Betaal Congres 5 th of March 2009 Media Plaza Utrecht Mr. Andrea Anderheggen COO Payment Network AG Cooperating with leading Dutch Payment Service Providers Seite 1

e. PAYMENT - NEXT GENERATION The Company § Payment Network AG is a privately hold German limited corporation founded in December 2005. § The company’s objective is to market the innovative payment system based on Online Banking systems in Europe and worldwide. § A major investor of the company is the family office Reimann-Dubbers, § Reimann Investors Advisory Gmb. H, the family office of the Reimann-Dubbers family has invested in Payment Network AG early 2008. § Under the Reckitt Benckiser corporation Reimann has created world renowed brands: Key Facts § The company is managed by Mr. C. Klein (CEO), Mr. A Anderheggen (COO), Dr. J. Lütcke (CFO), R. Piater (CMO) and S. Krautkrämer (CTO) § We are generally bank independent although we work together with banks as marketing partner. § Today we employ 41 full time equivalents. § Since the official market launch of sofortüberweisung. de / DIRECTebanking. com in October 2006 over 11. 000 e. Commerce companies have registered. § We have already performed several million transactions mainly in Germany, Switzerland Austria and are live in the Netherlands since January 2009. § Our aim is to offer DIRECTebanking. com all over Europe within the next 12 to 18 months. Seite 2

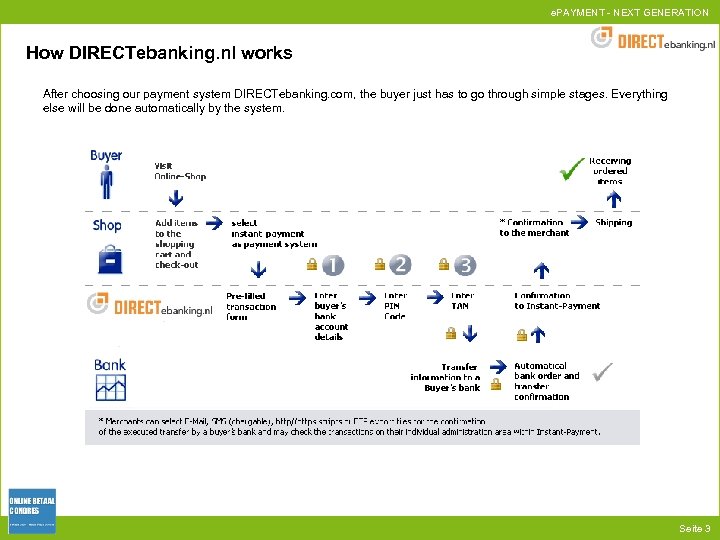

e. PAYMENT - NEXT GENERATION How DIRECTebanking. nl works After choosing our payment system DIRECTebanking. com, the buyer just has to go through simple stages. Everything else will be done automatically by the system. Seite 3

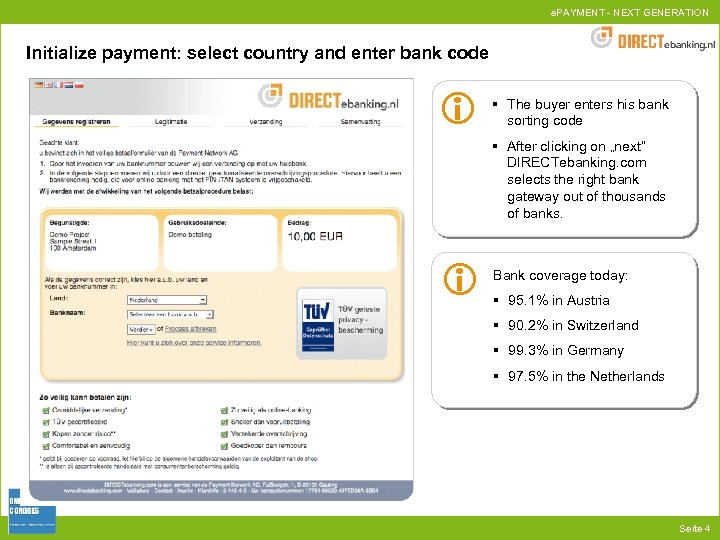

e. PAYMENT - NEXT GENERATION Initialize payment: select country and enter bank code § The buyer enters his bank sorting code § After clicking on „next“ DIRECTebanking. com selects the right bank gateway out of thousands of banks. Bank coverage today: § 95. 1% in Austria § 90. 2% in Switzerland § 99. 3% in Germany § 97. 5% in the Netherlands Seite 4

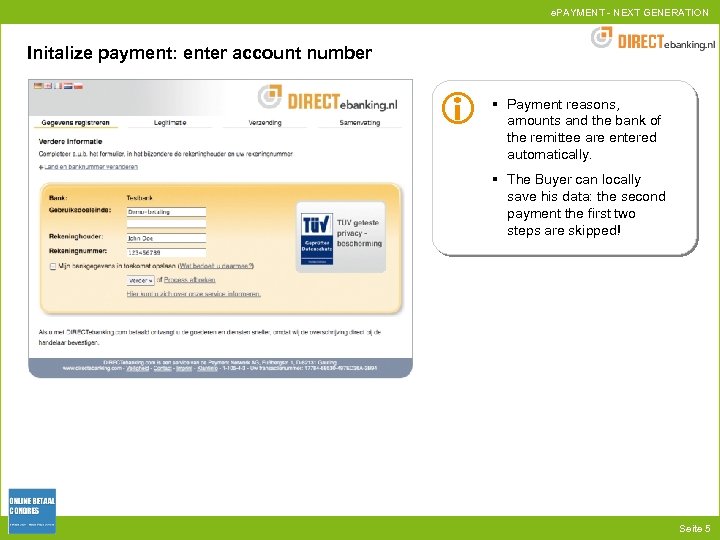

e. PAYMENT - NEXT GENERATION Initalize payment: enter account number § Payment reasons, amounts and the bank of the remittee are entered automatically. § The Buyer can locally save his data: the second payment the first two steps are skipped! Seite 5

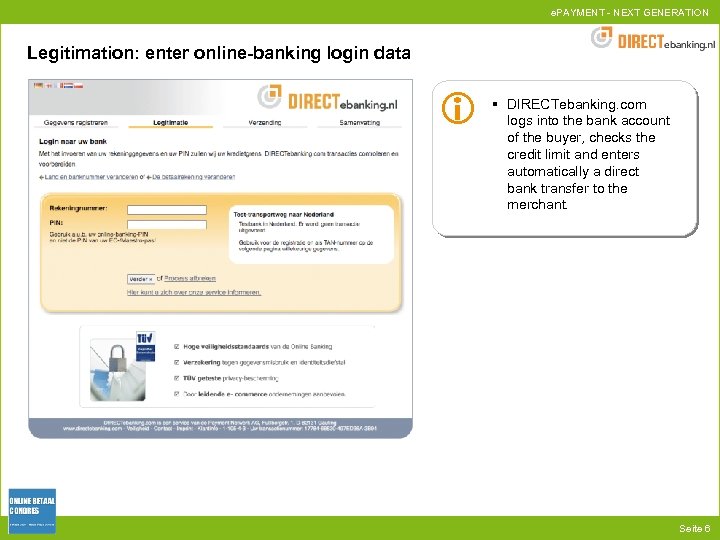

e. PAYMENT - NEXT GENERATION Legitimation: enter online-banking login data § DIRECTebanking. com logs into the bank account of the buyer, checks the credit limit and enters automatically a direct bank transfer to the merchant. Seite 6

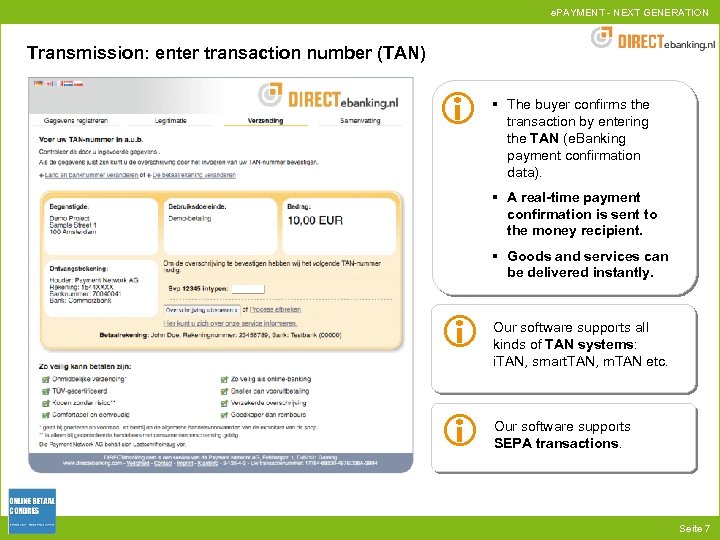

e. PAYMENT - NEXT GENERATION Transmission: enter transaction number (TAN) § The buyer confirms the transaction by entering the TAN (e. Banking payment confirmation data). § A real-time payment confirmation is sent to the money recipient. § Goods and services can be delivered instantly. Our software supports all kinds of TAN systems: i. TAN, smart. TAN, m. TAN etc. Our software supports SEPA transactions. Seite 7

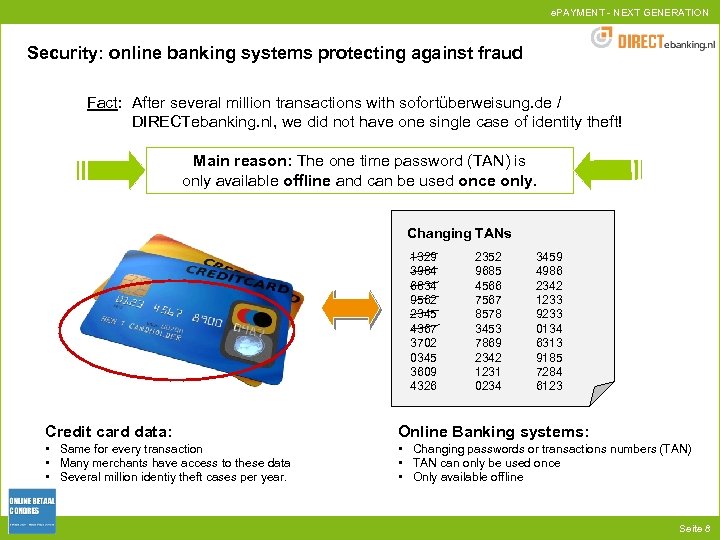

e. PAYMENT - NEXT GENERATION Security: online banking systems protecting against fraud Fact: After several million transactions with sofortüberweisung. de / DIRECTebanking. nl, we did not have one single case of identity theft! Main reason: The one time password (TAN) is only available offline and can be used once only. Changing TANs 1329 3984 6834 9562 2345 4367 3702 0345 3609 4326 2352 9685 4566 7567 8578 3453 7869 2342 1231 0234 3459 4986 2342 1233 9233 0134 6313 9185 7284 6123 Credit card data: Online Banking systems: • Same for every transaction • Many merchants have access to these data • Several million identiy theft cases per year. • Changing passwords or transactions numbers (TAN) • TAN can only be used once • Only available offline Seite 8

e. PAYMENT - NEXT GENERATION Security: TÜV certified data privacy § Based on BSI an ISO-2007 principles § Online-banking data (PIN/TAN) are not accessible to employees. § Transactions using DIRECTebanking. com can not be manipulated by Payment Network AG or third party staff. § Data transfers security based on secure Triple DES (168/112 bit) connections. § Banking data centers are certified according to industry best-practice online banking standards. § Users can check DIRECTebanking. com authenticity thanks to the certified 128 -bit SSL certificate. § Continous checks by the TÜV Seite 9

e. PAYMENT - NEXT GENERATION Security: insurance against identity theft § Insurance against data fraud and identity theft § The customer using DIRECTebanking. com is insured against online banking data fraud and identity theft cases. The insurance company is one of the largest German bank insurance corporations. § Buyers are insured up to 5. 000 EUR per individual case. 5. 000 EUR normally corresponds to the maximum amount transferable per transaction number (TAN). Seite 10

e. PAYMENT - NEXT GENERATION Security: money back guarantee for buyers § We closely work together with the European market leader of customer protection programs Trusted Shop § Therefore in many shops, buyers paying with DIRECTebanking. com are protected in case merchants do not deliver goods. § More information here: www. trustedshops. com Seite 11

e. PAYMENT - NEXT GENERATION European expansion plan (status 05. 03. 2009) Status Germany Live since 2005 Austria Live since 30. 11. 2007 Switzerland Live since 01. 08. 2008 Netherlands Live since 15. 01. 2009 * UK Going-Live: April / May 2009 * Belgium Going-Live: May / June 2009 * France Going-Live: July / August 2009 Poland Going-Live: September 2009 Nordics Going-Live: October 2009 Spain Going-Live: December 2009 USA Going-Live: 2010 vision Country One harmonized, international online banking transfer system offering a gateway to the local online bank account Seite 12

e. PAYMENT - NEXT GENERATION How are we entering the Dutch market? Work with existing e. Commerce customers from other countries. Best known in the Netherlands: (Live) Start cooperation with leading Dutch payment service providers to facilitate integration. Already live or signed: (Live) Seite 13

e. PAYMENT - NEXT GENERATION How are we entering the Dutch market? Open an office in the Netherlands (Amsterdam) with Dutch business development, customer care and integration support managers. Presentation of DIRECTebanking. nl in leading e. Commerce magazines, forum, blogs and on the most important e. Commerce events in the Netherlands. Direct approaches to Dutch merchants, payment service providers, banks and service companies within the Dutch e. Commerce industry. Seite 14

e. PAYMENT - NEXT GENERATION Benefits : why DIRECTebanking. nl? DIRECTebanking. nl costs less than competitors. Standard fees for Dutch retail merchants: • 1% or 50 Cent per transaction • • Save money! 39. 90 Euro setup fees 4. 90 Euro monthly maintenance fees No further costs Free support We award innovative partners helping us entering a new market More information on www. directebanking. nl/kosten Seite 15

e. PAYMENT - NEXT GENERATION Benefits : why DIRECTebanking. nl? DIRECTebanking. nl is easy to integrate. • We work together with leading payment service providers. • We offer standard plugins for over 80 shop systems such as: Easy integration More information on www. directebanking. nl/installatie Seite 16

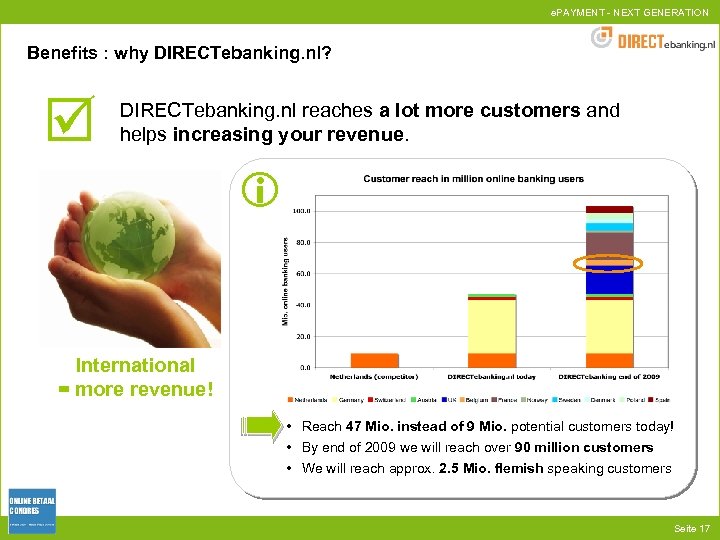

e. PAYMENT - NEXT GENERATION Benefits : why DIRECTebanking. nl? DIRECTebanking. nl reaches a lot more customers and helps increasing your revenue. International = more revenue! • Reach 47 Mio. instead of 9 Mio. potential customers today! • By end of 2009 we will reach over 90 million customers • We will reach approx. 2. 5 Mio. flemish speaking customers Seite 17

e. PAYMENT - NEXT GENERATION Thank you & QA Payment Network AG Fussbergstrasse 1 D - 82131 Gauting Andrea Anderheggen Chief Operating Officer Tel: +49 89 20 20 889 14 Email: aa@payment-network. com Seite 18

0c282c44766c8fd0979e41a6bc5f09ae.ppt