4beed95bd47e576fdc6d7503c7a0568d.ppt

- Количество слайдов: 18

E-Payment, Issues and Challenges in N. W. F. P n n n According to EU directive document A payment that is initiated, processed and received electronically Components of e-payment system includes Money transfer applications, Network infrastructures Rules & procedures Major actors of e-payment includes n Payer n Payee n Banks n Trusted third Party

E-Payment, Issues and Challenges in N. W. F. P n n n According to EU directive document A payment that is initiated, processed and received electronically Components of e-payment system includes Money transfer applications, Network infrastructures Rules & procedures Major actors of e-payment includes n Payer n Payee n Banks n Trusted third Party

Types of e-payment system • Online credit card payment system 2. Electronic Payment based on Trusted Third Party (TTP) 3. Digital Cash 4. M-Payment Smart card based e-Payment system 5. Electronic billing presentment and payment • Electronic innovations over the past decade provided consumers a variety of financial instruments and channels to make payments. Adoption of each depends on many factors such as lifestyle choices, life priorities, access to technology and convenience. • The application of e-payments as the method for the receipt of revenues to government, including various forms of taxes, such as personal income, sales and excise and non-tax revenues such as fees, fines.

Types of e-payment system • Online credit card payment system 2. Electronic Payment based on Trusted Third Party (TTP) 3. Digital Cash 4. M-Payment Smart card based e-Payment system 5. Electronic billing presentment and payment • Electronic innovations over the past decade provided consumers a variety of financial instruments and channels to make payments. Adoption of each depends on many factors such as lifestyle choices, life priorities, access to technology and convenience. • The application of e-payments as the method for the receipt of revenues to government, including various forms of taxes, such as personal income, sales and excise and non-tax revenues such as fees, fines.

• A particular focus is on Governments in a traditional approach receive revenue in the form of a physical check, either through the mail or over the counter. Upon receipt of the payment a manual workflow is employed until the check is deposited and the accounting data is entered into a computer system due to which revenue payers the general public is not in a routine and recurring relationship with the government. • Point-of-sale systems allow the public to pay for goods and services with debit cards and credit cards, checks and cash over the counter at walk in service centers. This program will provide the public with a cost-effective convenient way to pay for government goods and services and allow for quick and efficient updates to citizens payment records. • An E- payment program will enable government to shift from traditional over-the-counter approach to epayment services where public can pay for goods and services over the Counter, Internet, and mobile. .

• A particular focus is on Governments in a traditional approach receive revenue in the form of a physical check, either through the mail or over the counter. Upon receipt of the payment a manual workflow is employed until the check is deposited and the accounting data is entered into a computer system due to which revenue payers the general public is not in a routine and recurring relationship with the government. • Point-of-sale systems allow the public to pay for goods and services with debit cards and credit cards, checks and cash over the counter at walk in service centers. This program will provide the public with a cost-effective convenient way to pay for government goods and services and allow for quick and efficient updates to citizens payment records. • An E- payment program will enable government to shift from traditional over-the-counter approach to epayment services where public can pay for goods and services over the Counter, Internet, and mobile. .

Challenges: Security challenges include • Disclosure of private information • Counterfeiting • Illegal alteration of payment data But, possible solutions are: SSL (Secure Socket Layer) SET (Secure Electronic Transaction) 3 D Secure Smart Card Security • Also Advancement in technology along with Encryption and validation technologies has made most transactions very secure which is more than enough to address the security issues. Problems related to infrastructure: • Frequent connectivity failure in telephone lines, • Unavailability of dedicated data service networks and closed financial networks • Frequent power interruption • No financial networks that links different banks, Automated clearing houses or ACH • Banks are not ready for e-payment, e-payment

Challenges: Security challenges include • Disclosure of private information • Counterfeiting • Illegal alteration of payment data But, possible solutions are: SSL (Secure Socket Layer) SET (Secure Electronic Transaction) 3 D Secure Smart Card Security • Also Advancement in technology along with Encryption and validation technologies has made most transactions very secure which is more than enough to address the security issues. Problems related to infrastructure: • Frequent connectivity failure in telephone lines, • Unavailability of dedicated data service networks and closed financial networks • Frequent power interruption • No financial networks that links different banks, Automated clearing houses or ACH • Banks are not ready for e-payment, e-payment

Legal Framework: • No legal and regulatory framework for e-commerce and e-payment due to: • Inexistence of large pool of e-commerce and epayment users group, • Lack of a Civil Code to address some of the issues with in electronic transactions for e. g. • Freedom of form of contracts • clearly stipulated privacy and data protection laws

Legal Framework: • No legal and regulatory framework for e-commerce and e-payment due to: • Inexistence of large pool of e-commerce and epayment users group, • Lack of a Civil Code to address some of the issues with in electronic transactions for e. g. • Freedom of form of contracts • clearly stipulated privacy and data protection laws

ISSUES IN E-PAYMENT • Socio-cultural issues • Resistance to changes in technology among customers and staff due to: • Lack of awareness on the benefits of new technologies, • Fear of risk, • Lack of trained personnel in key organizations, • Tendency to be content with the existing structures, • People are resistant to new payment mechanisms

ISSUES IN E-PAYMENT • Socio-cultural issues • Resistance to changes in technology among customers and staff due to: • Lack of awareness on the benefits of new technologies, • Fear of risk, • Lack of trained personnel in key organizations, • Tendency to be content with the existing structures, • People are resistant to new payment mechanisms

Bureaucratic issues • An e-payment project can face several obstacles within a bureaucracy, at the political level or with outside entities. Some issues that may exist within a bureaucracy: for e. g. • Who takes ownership, responsibility and the lead in a project? • Keeping enthusiasm for the project. • Leadership continuity issues. Overcoming implementation difficulties regarding standard systems, Union, and middle management opposition. On the political level: • Inadequate funding or allocation of resources. • Legislative or regulatory constraints. • Political opposition. And Outside Entities such as: Gaining public.

Bureaucratic issues • An e-payment project can face several obstacles within a bureaucracy, at the political level or with outside entities. Some issues that may exist within a bureaucracy: for e. g. • Who takes ownership, responsibility and the lead in a project? • Keeping enthusiasm for the project. • Leadership continuity issues. Overcoming implementation difficulties regarding standard systems, Union, and middle management opposition. On the political level: • Inadequate funding or allocation of resources. • Legislative or regulatory constraints. • Political opposition. And Outside Entities such as: Gaining public.

POINTOF SALE TERMINAL Provide customized receipts with retailer name Offer advanced reporting tools for retailers through web-interface Terminal Benefits Offer a demo mode for training purposes Complete automatic updates of templates, products and services Provide retailer credit control through existing billing infrastructure available with the distributor/operator Two level security with supervisor and teller sign-in passwords Fast transaction times Robust inbuilt thermal printer Credit and debit card processing is provided as an option (subject to approval by banking acquirer) Can be made GPRS enabled (eliminating the requirement of a telephone line) Can perform both PIN based as well as PIN-less transactions

POINTOF SALE TERMINAL Provide customized receipts with retailer name Offer advanced reporting tools for retailers through web-interface Terminal Benefits Offer a demo mode for training purposes Complete automatic updates of templates, products and services Provide retailer credit control through existing billing infrastructure available with the distributor/operator Two level security with supervisor and teller sign-in passwords Fast transaction times Robust inbuilt thermal printer Credit and debit card processing is provided as an option (subject to approval by banking acquirer) Can be made GPRS enabled (eliminating the requirement of a telephone line) Can perform both PIN based as well as PIN-less transactions

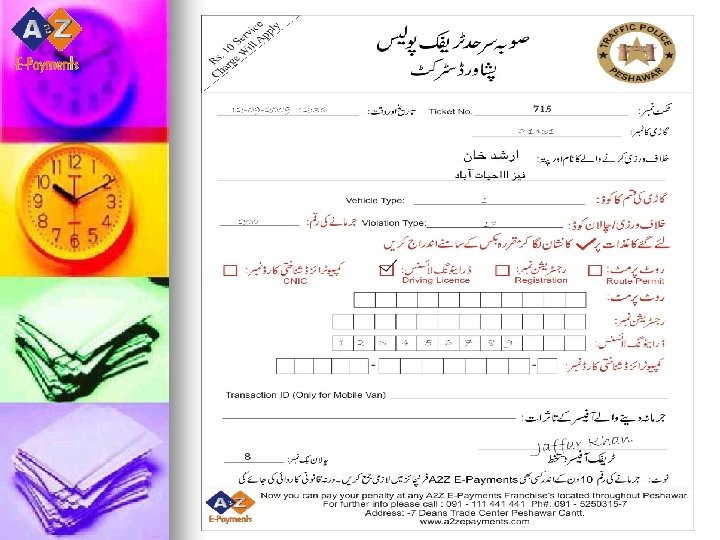

Front Side

Front Side

Back Side

Back Side

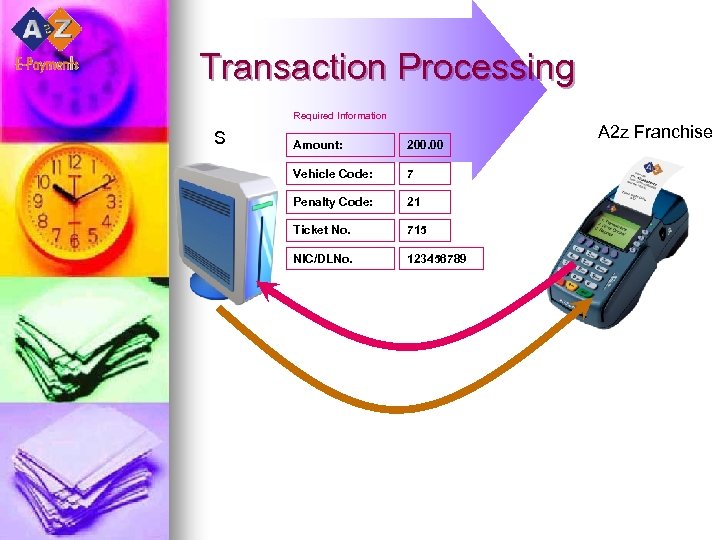

Transaction Processing Required Information S Amount: 200. 00 Vehicle Code: 7 Penalty Code: 21 Ticket No. 715 NIC/DLNo. 123456789 A 2 z Franchise

Transaction Processing Required Information S Amount: 200. 00 Vehicle Code: 7 Penalty Code: 21 Ticket No. 715 NIC/DLNo. 123456789 A 2 z Franchise

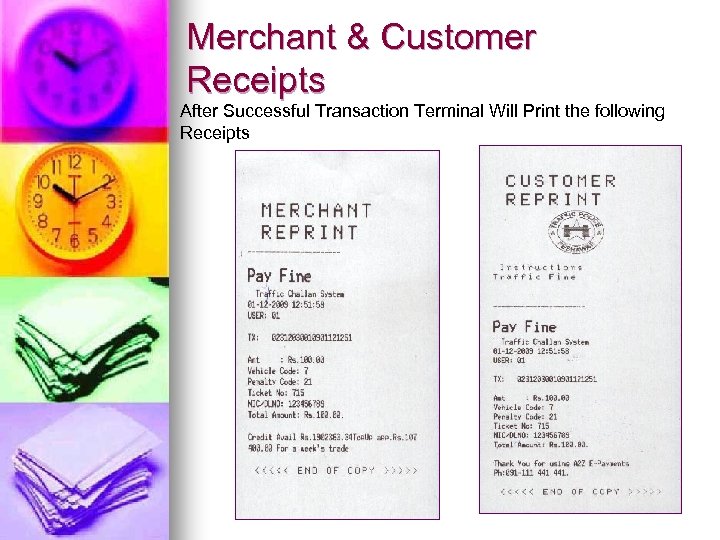

Merchant & Customer Receipts After Successful Transaction Terminal Will Print the following Receipts

Merchant & Customer Receipts After Successful Transaction Terminal Will Print the following Receipts

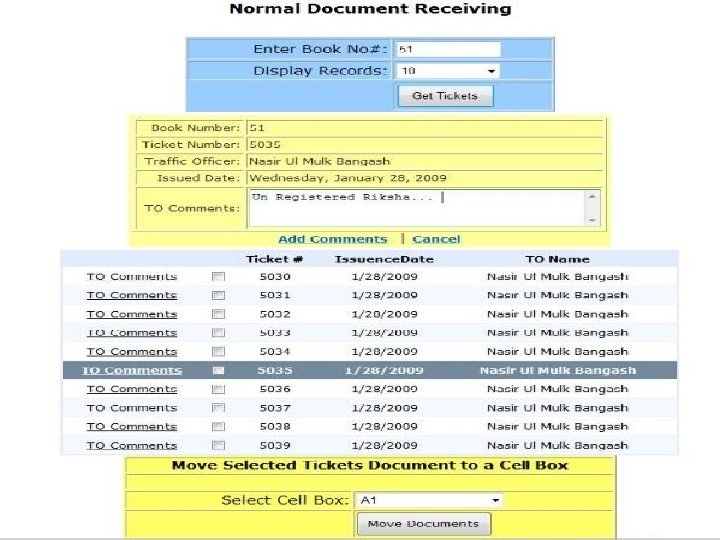

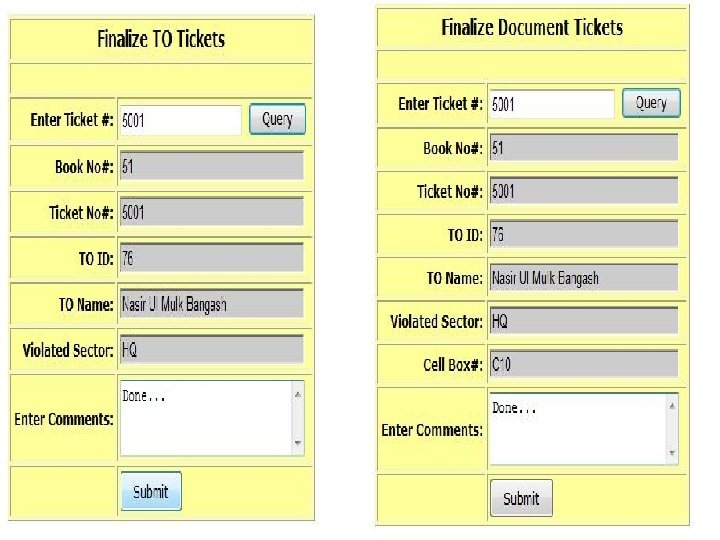

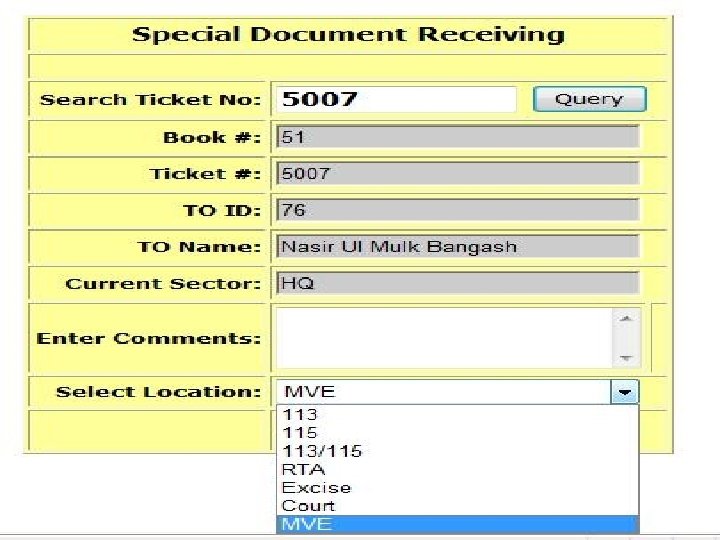

Document Cell

Document Cell

n Benefits to the Government n Improved cash flow n Reduced operating costs n Simplified payment and collection processes n Simplified record keeping n reliable and secure way to access and pay for government services. n Automation of government business processes.

n Benefits to the Government n Improved cash flow n Reduced operating costs n Simplified payment and collection processes n Simplified record keeping n reliable and secure way to access and pay for government services. n Automation of government business processes.

LAST NOTE • Addressing consumers ’ concerns about electronic payments comes down to a few basics. • First, the entity on the other side of the transaction (the government acting in the capacity of the merchant) must ensure • Tools they offer are easy to use, cleanly designed so that they are intuitive, very reliable and constructed and operated in such a way • that they offer secure and consistent service. • Second, the merchant must proactively market the fact that they offer e-payment alternatives. • Third, merchants must find ways to differentiate the e-payment options from other choices so that consumers want to use them.

LAST NOTE • Addressing consumers ’ concerns about electronic payments comes down to a few basics. • First, the entity on the other side of the transaction (the government acting in the capacity of the merchant) must ensure • Tools they offer are easy to use, cleanly designed so that they are intuitive, very reliable and constructed and operated in such a way • that they offer secure and consistent service. • Second, the merchant must proactively market the fact that they offer e-payment alternatives. • Third, merchants must find ways to differentiate the e-payment options from other choices so that consumers want to use them.

THANK YOU FOR YOUR PATIENCE YOU WERE LISTENING TO SHAKIR ULLAH CEO A 2 Z E-PAYMENTS - 7 DEANS TRADE CENTRE, PESHAWAR UAN-091 -111 -441

THANK YOU FOR YOUR PATIENCE YOU WERE LISTENING TO SHAKIR ULLAH CEO A 2 Z E-PAYMENTS - 7 DEANS TRADE CENTRE, PESHAWAR UAN-091 -111 -441