2fc7b9159c12ca4d6de920ad406d2da6.ppt

- Количество слайдов: 19

e-freight Roadmap December 2012 GACAG e-Commerce Task Force 2012

Background Ö Through 2012, the GACAG e-Commerce Task Force (ECTF) has conducted a review of the e-freight initiative Ö The goal was to define a joint air cargo industry approach that GACAG members can consider adopting to drive implementation of paperless transportation processes in future Ö This document presents the new e-freight ‘Roadmap’ endorsed by each GACAG association memberships Ö It will form the basis for managing e-freight as an air cargo initiative moving forward 2 GACAG e-Commerce Task Force 2012

Contents Ö e-freight vision Ö Principles to support the vision Ö ‘Three Pillar’ Roadmap Approach Ö The Three Pillars Ö Proposed Targets Ö Roles Ö Items identified for GACAG collaboration (to date) Ö Governance Ö Next steps ALSO IN APPENDIX: Ö Current Status, Details on governance, Draft future scorecard, Scope of documents per Pillar, Details on targets (foot-notes), ‘What this roadmap aims to deliver’ (Text) 3 GACAG e-Commerce Task Force 2012

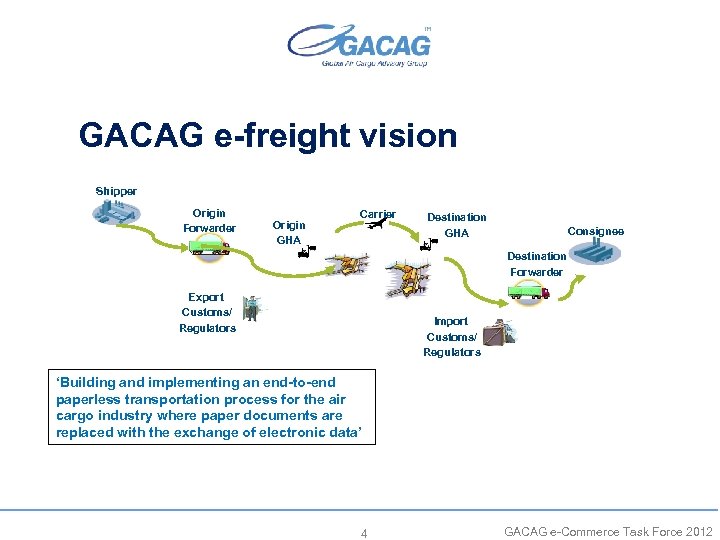

GACAG e-freight vision Shipper Origin Forwarder Origin GHA Carrier Destination GHA Consignee Destination Forwarder Export Customs/ Regulators Import Customs/ Regulators ‘Building and implementing an end-to-end paperless transportation process for the air cargo industry where paper documents are replaced with the exchange of electronic data’ 4 GACAG e-Commerce Task Force 2012

Principles (1/2) In support of the vision to build and implement an end-to-end paperless process for the air cargo industry, GACAG members have identified the following principles : The initiative shall: ÖAim to achieve data capture at source (to avoid re-keying) ÖAdopt end-to-end supply chain vision: shipper to consignee (to enable single data capture) ÖEncompass customs, security, transportation and other relevant documents that are part of the freight transportation process ÖInclude legal, regulatory, business and technology elements in the definition of paperless processes ÖRely on e-Document standards and common business processes (defined in e-freight Operating Procedures – e-FOP) that are aligned with international standard setting bodies (WCO, UNCEFACT, ICAO, etc. ) ÖAllow paper to still be present by exception as required by local processes and based on electronic source data (print-on-demand) 5 GACAG e-Commerce Task Force 2012

Principles (2/2) In support of the vision to build and implement an end-to-end paperless process for the air cargo industry, GACAG members have identified the following principles : The initiative shall: ÖNot rely on single industry technology platform: each participant remains responsible for managing their own data ÖUse existing industry EDI infrastructure where sufficient, but upgrade where relevant ÖDrive emergence of solutions that facilitate adoption by all parts of the supply chain, and all types of organizations (large and small) ÖIdentify workable migration paths from current paper based processes to paperless processes ÖDefine a roadmap towards 100% paperless that splits the vision in manageable components with specific deliverables over time 6 GACAG e-Commerce Task Force 2012

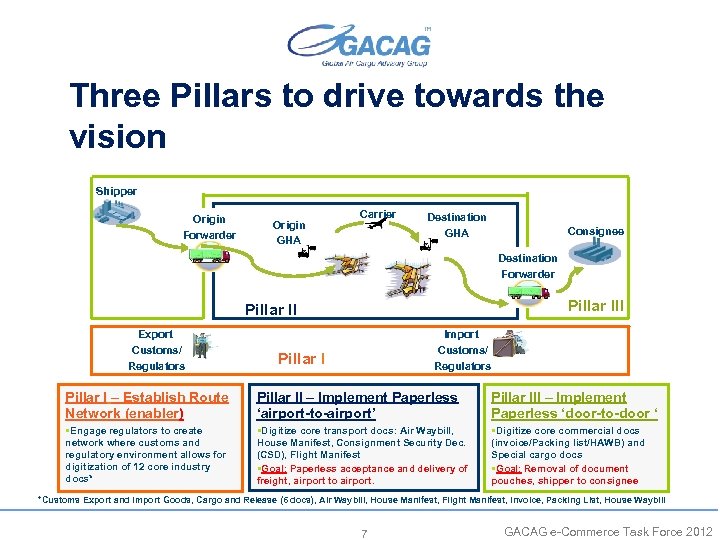

Three Pillars to drive towards the vision Shipper Origin Forwarder Origin GHA Carrier Destination GHA Consignee Destination Forwarder Pillar III Pillar II Export Customs/ Regulators Import Customs/ Regulators Pillar I – Establish Route Network (enabler) Pillar II – Implement Paperless ‘airport-to-airport’ Pillar III – Implement Paperless ‘door-to-door ‘ §Engage regulators to create network where customs and regulatory environment allows for digitization of 12 core industry docs* §Digitize core transport docs: Air Waybill, House Manifest, Consignment Security Dec. (CSD), Flight Manifest §Goal: Paperless acceptance and delivery of freight, airport to airport. §Digitize core commercial docs (invoice/Packing list/HAWB) and Special cargo docs §Goal: Removal of document pouches, shipper to consignee *Customs Export and Import Goods, Cargo and Release (6 docs), Air Waybill, House Manifest, Flight Manifest, Invoice, Packing List, House Waybill 7 GACAG e-Commerce Task Force 2012

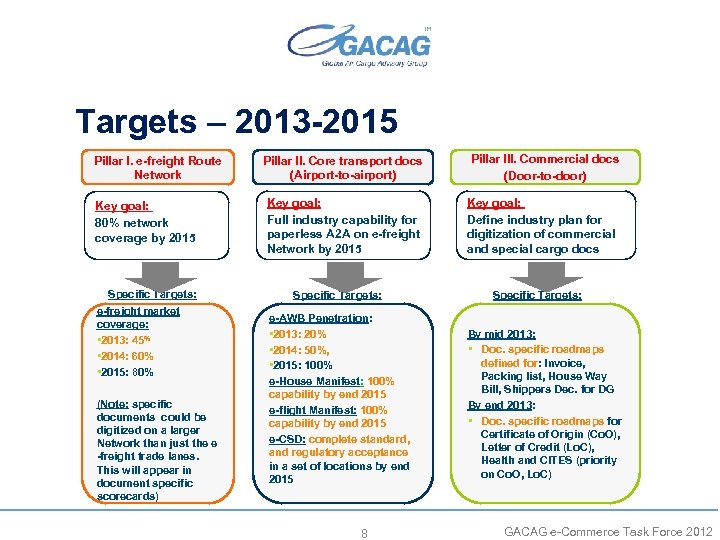

Targets – 2013 -2015 Pillar I. e-freight Route Network Key goal: 80% network coverage by 2015 Specific Targets: e-freight market coverage: • 2013: 45% • 2014: 60% • 2015: 80% (Note: specific documents could be digitized on a larger Network than just the e -freight trade lanes. This will appear in document specific scorecards) Pillar II. Core transport docs (Airport-to-airport) Key goal: Full industry capability for paperless A 2 A on e-freight Network by 2015 Specific Targets: e-AWB Penetration: • 2013: 20% • 2014: 50%, • 2015: 100% e-House Manifest: 100% capability by end 2015 e-flight Manifest: 100% capability by end 2015 e-CSD: complete standard, and regulatory acceptance in a set of locations by end 2015 8 Pillar III. Commercial docs (Door-to-door) Key goal: Define industry plan for digitization of commercial and special cargo docs Specific Targets: By mid 2013: • Doc. specific roadmaps defined for: Invoice, Packing list, House Way Bill, Shippers Dec. for DG By end 2013: • Doc. specific roadmaps for Certificate of Origin (Co. O), Letter of Credit (Lo. C), Health and CITES (priority on Co. O, Lo. C) GACAG e-Commerce Task Force 2012

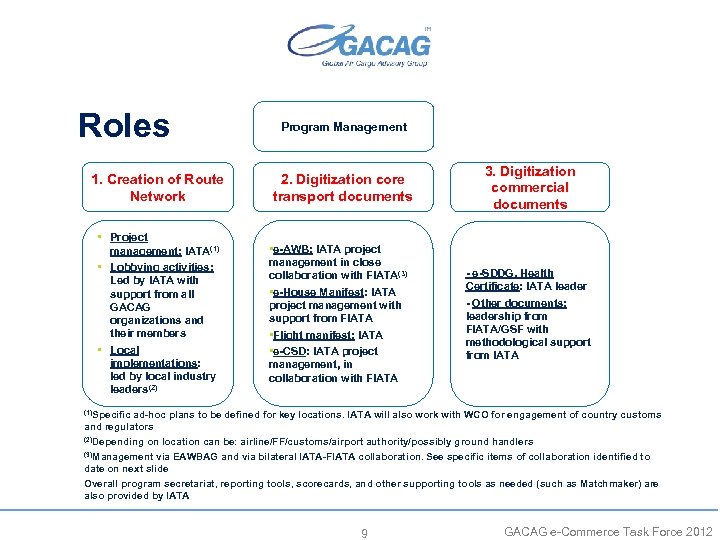

Roles 1. Creation of Route Network • Project management: IATA(1) • Lobbying activities: Led by IATA with support from all GACAG organizations and their members • Local implementations: led by local industry leaders(2) Program Management 2. Digitization core transport documents • e-AWB: IATA project management in close collaboration with FIATA(3) • e-House Manifest: IATA project management with support from FIATA • Flight manifest: IATA • e-CSD: IATA project management, in collaboration with FIATA 3. Digitization commercial documents - e-SDDG, Health Certificate: IATA leader - Other documents: leadership from FIATA/GSF with methodological support from IATA (1)Specific ad-hoc plans to be defined for key locations. IATA will also work with WCO for engagement of country customs and regulators (2)Depending on location can be: airline/FF/customs/airport authority/possibly ground handlers via EAWBAG and via bilateral IATA-FIATA collaboration. See specific items of collaboration identified to date on next slide Overall program secretariat, reporting tools, scorecards, and other supporting tools as needed (such as Matchmaker) are also provided by IATA (3)Management 9 GACAG e-Commerce Task Force 2012

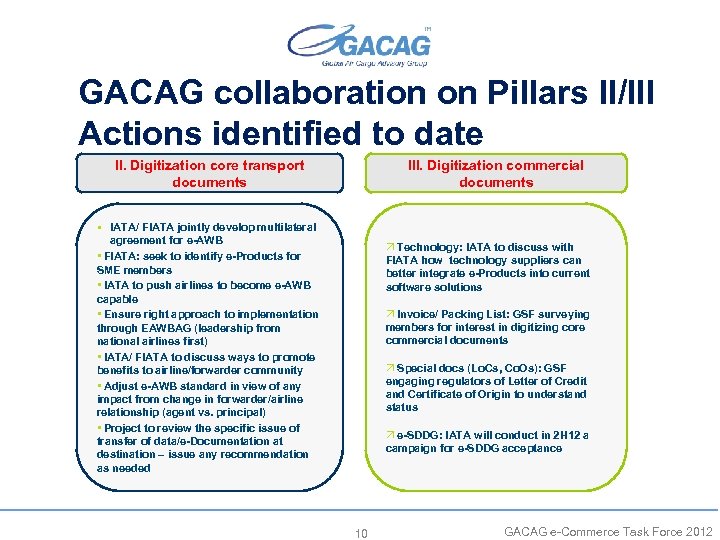

GACAG collaboration on Pillars II/III Actions identified to date II. Digitization core transport documents III. Digitization commercial documents § IATA/ FIATA jointly develop multilateral agreement for e-AWB • FIATA: seek to identify e-Products for SME members • IATA to push airlines to become e-AWB capable • Ensure right approach to implementation through EAWBAG (leadership from national airlines first) • IATA/ FIATA to discuss ways to promote benefits to airline/forwarder community • Adjust e-AWB standard in view of any impact from change in forwarder/airline relationship (agent vs. principal) • Project to review the specific issue of transfer of data/e-Documentation at destination – issue any recommendation as needed Ö Technology: IATA to discuss with FIATA how technology suppliers can better integrate e-Products into current software solutions Ö Invoice/ Packing List: GSF surveying members for interest in digitizing core commercial documents Ö Special docs (Lo. Cs, Co. Os): GSF engaging regulators of Letter of Credit and Certificate of Origin to understand status Ö e-SDDG: IATA will conduct in 2 H 12 a campaign for e-SDDG acceptance 10 GACAG e-Commerce Task Force 2012

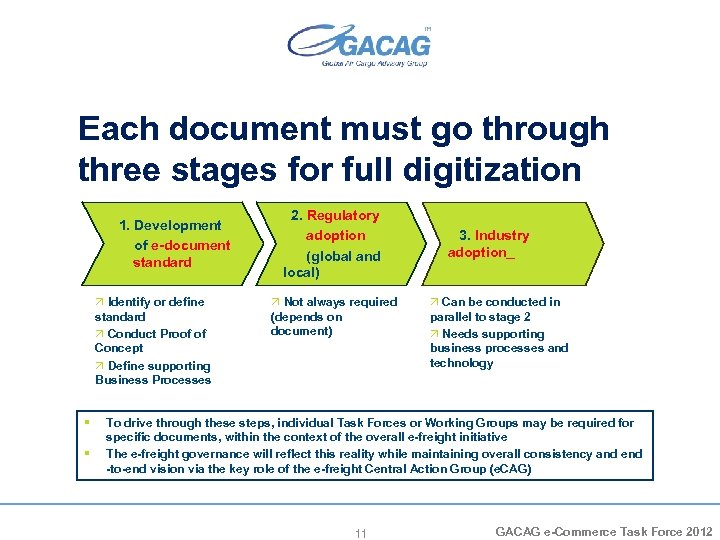

Each document must go through three stages for full digitization 1. Development of e-document standard Ö Identify or define standard Ö Conduct Proof of Concept Ö Define supporting Business Processes § § 2. Regulatory adoption (global and local) Ö Not always required (depends on document) 3. Industry adoption Ö Can be conducted in parallel to stage 2 Ö Needs supporting business processes and technology To drive through these steps, individual Task Forces or Working Groups may be required for specific documents, within the context of the overall e-freight initiative The e-freight governance will reflect this reality while maintaining overall consistency and end -to-end vision via the key role of the e-freight Central Action Group (e. CAG) 11 GACAG e-Commerce Task Force 2012

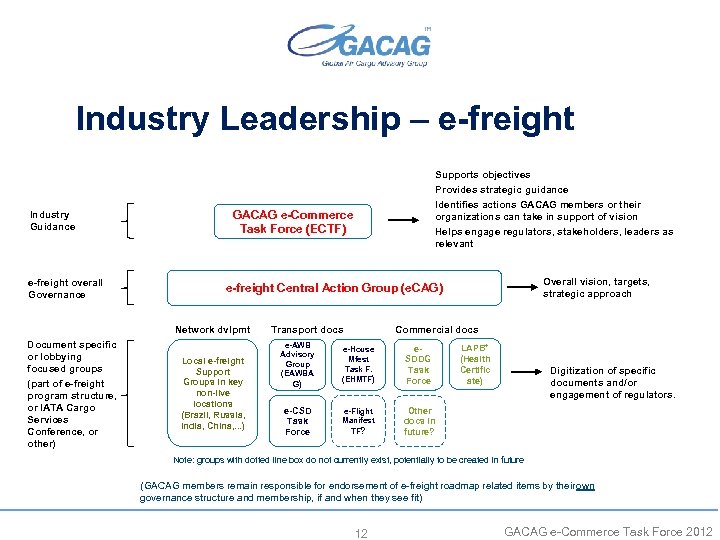

Industry Leadership – e-freight Supports objectives Provides strategic guidance Industry Guidance e-freight overall Governance Overall vision, targets, strategic approach e-freight Central Action Group (e. CAG) Network dvlpmt Document specific or lobbying focused groups (part of e-freight program structure, or IATA Cargo Services Conference, or other) Identifies actions GACAG members or their organizations can take in support of vision Helps engage regulators, stakeholders, leaders as relevant GACAG e-Commerce Task Force (ECTF) Local e-freight Support Groups in key non-live locations (Brazil, Russia, India, China, . . . ) Transport docs Commercial docs e-AWB Advisory Group (EAWBA G) e-House Mfest Task F. (EHMTF) e. SDDG Task Force e-CSD Task Force e-Flight Manifest TF? Other docs in future? LAPB* (Health Certific ate) Digitization of specific documents and/or engagement of regulators. Note: groups with dotted line box do not currently exist, potentially to be created in future (GACAG members remain responsible for endorsement of e-freight roadmap related items by their own governance structure and membership, if and when they see fit) 12 GACAG e-Commerce Task Force 2012

Appendix 13 GACAG e-Commerce Task Force 2012

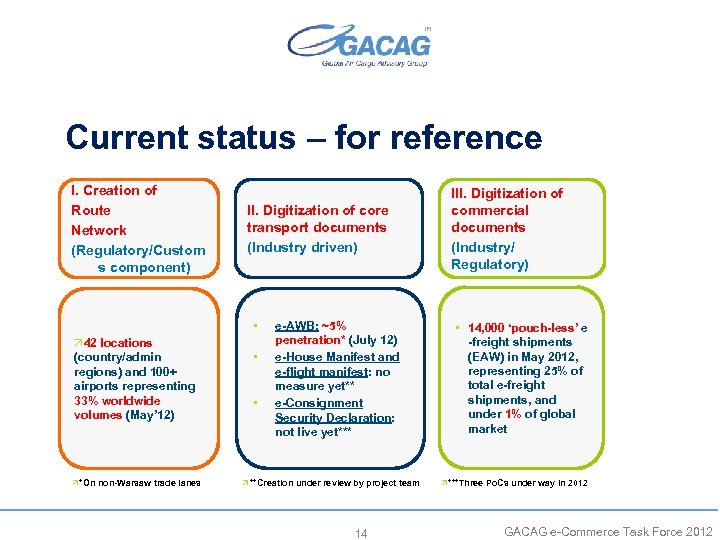

Current status – for reference I. Creation of Route Network (Regulatory/Custom s component) II. Digitization of core transport documents (Industry driven) • Ö 42 locations (country/admin regions) and 100+ airports representing 33% worldwide volumes (May’ 12) Ö*On non-Warsaw trade lanes • • e-AWB: ~5% penetration* (July 12) e-House Manifest and e-flight manifest: no measure yet** e-Consignment Security Declaration: not live yet*** Ö**Creation under review by project team 14 III. Digitization of commercial documents (Industry/ Regulatory) • 14, 000 ‘pouch-less’ e -freight shipments (EAW) in May 2012, representing 25% of total e-freight shipments, and under 1% of global market Ö***Three Po. Cs under way in 2012 GACAG e-Commerce Task Force 2012

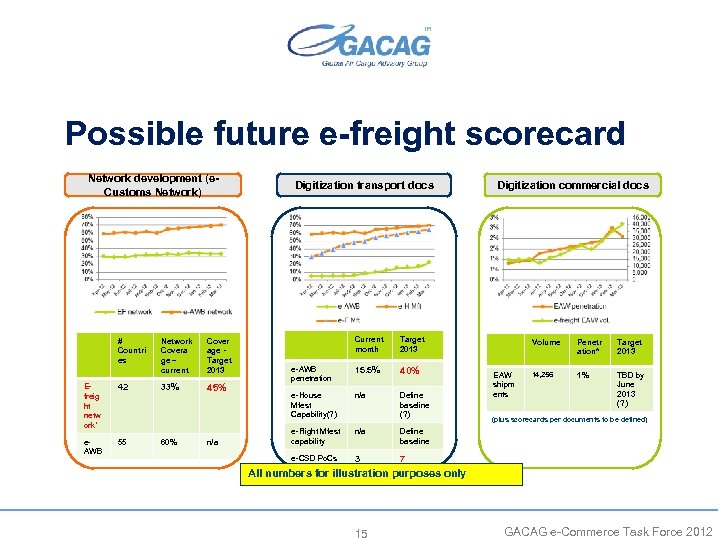

Possible future e-freight scorecard Network development (e. Customs Network) # Countri es Efreig ht netw ork* 42 e. AWB 55 Network Covera ge – current Cover age Target 2013 33% 45% 60% n/a Digitization transport docs Current month Target 2013 e-AWB penetration 15. 5% 40% e-House Mfest Capability(? ) n/a Define baseline (? ) e-Flight Mfest capability n/a Define baseline e-CSD Po. Cs 3 Digitization commercial docs 7 Volume EAW shipm ents Penetr ation* Target 2013 14, 256 1% TBD by June 2013 (? ) (plus scorecards per documents to be defined) All numbers for illustration purposes only 15 GACAG e-Commerce Task Force 2012

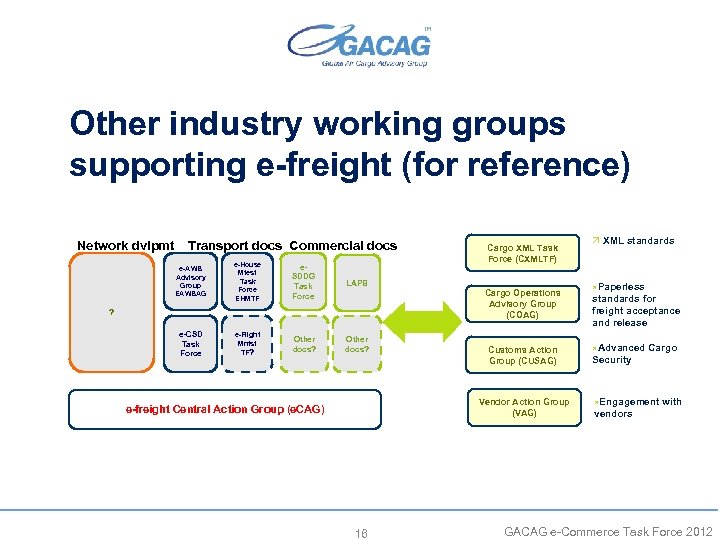

Other industry working groups supporting e-freight (for reference) Network dvlpmt Transport docs Commercial docs e-AWB Advisory Group EAWBAG e-House Mfest Task Force EHMTF e. SDDG Task Force LAPB e-CSD Task Force e-Flight Mnfst TF? Other docs? Cargo XML Task Force (CXMLTF) Cargo Operations Advisory Group (COAG) ? Customs Action Group (CUSAG) Vendor Action Group (VAG) e-freight Central Action Group (e. CAG) 16 Ö XML standards Paperless standards for freight acceptance and release Ö Advanced Cargo Security Ö Engagement with vendors Ö GACAG e-Commerce Task Force 2012

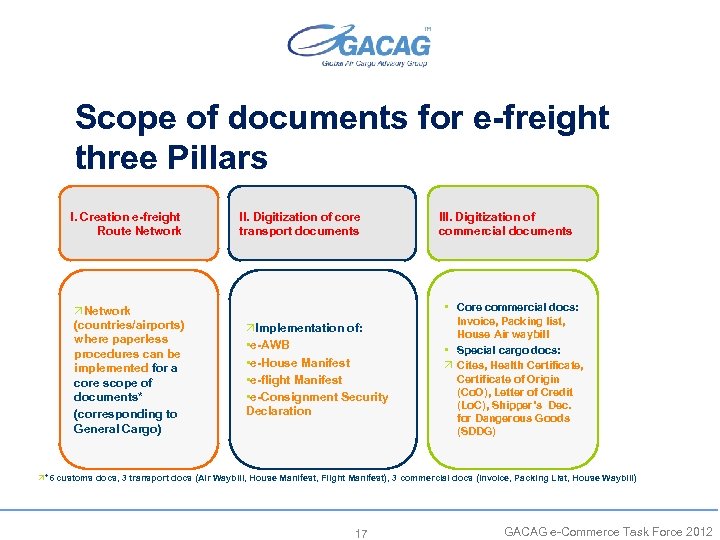

Scope of documents for e-freight three Pillars I. Creation e-freight Route Network ÖNetwork (countries/airports) where paperless procedures can be implemented for a core scope of documents* (corresponding to General Cargo) II. Digitization of core transport documents ÖImplementation of: • e-AWB • e-House Manifest • e-flight Manifest • e-Consignment Security Declaration III. Digitization of commercial documents • Core commercial docs: Invoice, Packing list, House Air waybill • Special cargo docs: Ö Cites, Health Certificate, Certificate of Origin (Co. O), Letter of Credit (Lo. C), Shipper’s Dec. for Dangerous Goods (SDDG) Ö*6 customs docs, 3 transport docs (Air Waybill, House Manifest, Flight Manifest), 3 commercial docs (Invoice, Packing List, House Waybill) 17 GACAG e-Commerce Task Force 2012

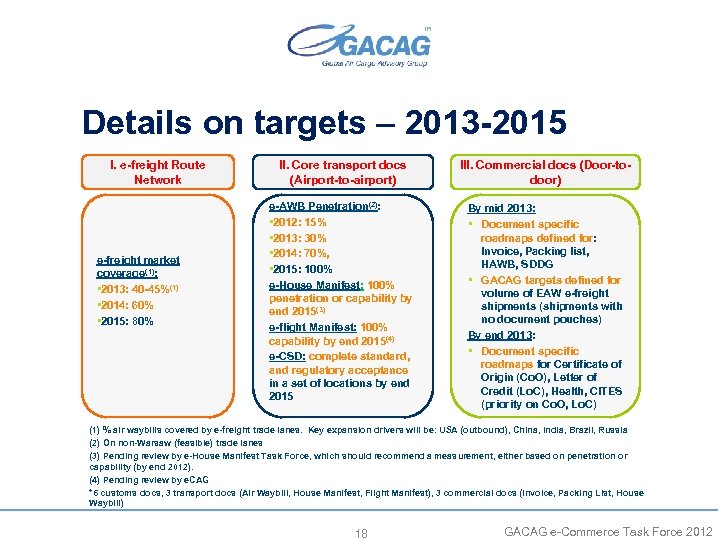

Details on targets – 2013 -2015 I. e-freight Route Network e-freight market coverage(1): • 2013: 40 -45%(1) • 2014: 60% • 2015: 80% II. Core transport docs (Airport-to-airport) III. Commercial docs (Door-todoor) e-AWB Penetration(2): • 2012: 15% • 2013: 30% • 2014: 70%, • 2015: 100% e-House Manifest: 100% penetration or capability by end 2015(3) e-flight Manifest: 100% capability by end 2015(4) e-CSD: complete standard, and regulatory acceptance in a set of locations by end 2015 By mid 2013: • Document specific roadmaps defined for: Invoice, Packing list, HAWB, SDDG • GACAG targets defined for volume of EAW e-freight shipments (shipments with no document pouches) By end 2013: • Document specific roadmaps for Certificate of Origin (Co. O), Letter of Credit (Lo. C), Health, CITES (priority on Co. O, Lo. C) (1) % air waybills covered by e-freight trade lanes. Key expansion drivers will be: USA (outbound), China, India, Brazil, Russia (2) On non-Warsaw (feasible) trade lanes (3) Pending review by e-House Manifest Task Force, which should recommend a measurement, either based on penetration or capability (by end 2012). (4) Pending review by e. CAG *6 customs docs, 3 transport docs (Air Waybill, House Manifest, Flight Manifest), 3 commercial docs (Invoice, Packing List, House Waybill) 18 GACAG e-Commerce Task Force 2012

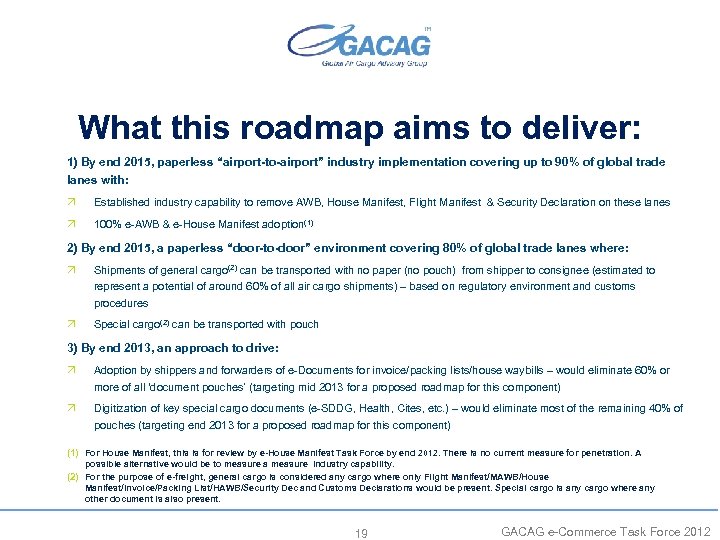

What this roadmap aims to deliver: 1) By end 2015, paperless “airport-to-airport” industry implementation covering up to 90% of global trade lanes with: Ö Established industry capability to remove AWB, House Manifest, Flight Manifest & Security Declaration on these lanes Ö 100% e-AWB & e-House Manifest adoption(1) 2) By end 2015, a paperless “door-to-door” environment covering 80% of global trade lanes where: Ö Shipments of general cargo(2) can be transported with no paper (no pouch) from shipper to consignee (estimated to represent a potential of around 60% of all air cargo shipments) – based on regulatory environment and customs procedures Ö Special cargo(2) can be transported with pouch 3) By end 2013, an approach to drive: Ö Adoption by shippers and forwarders of e-Documents for invoice/packing lists/house waybills – would eliminate 60% or more of all ‘document pouches’ (targeting mid 2013 for a proposed roadmap for this component) Ö Digitization of key special cargo documents (e-SDDG, Health, Cites, etc. ) – would eliminate most of the remaining 40% of pouches (targeting end 2013 for a proposed roadmap for this component) (1) For House Manifest, this is for review by e-House Manifest Task Force by end 2012. There is no current measure for penetration. A possible alternative would be to measure a measure industry capability. (2) For the purpose of e-freight, general cargo is considered any cargo where only Flight Manifest/MAWB/House Manifest/Invoice/Packing List/HAWB/Security Dec and Customs Declarations would be present. Special cargo is any cargo where any other document is also present. 19 GACAG e-Commerce Task Force 2012

2fc7b9159c12ca4d6de920ad406d2da6.ppt